Reliance Small Cap Fund Presentation Final

-

Upload

sonicstage -

Category

Documents

-

view

62 -

download

4

Transcript of Reliance Small Cap Fund Presentation Final

A R������� C������ �������

Table Of ContentsTable Of ContentsIndia Opportunity

Why Invest in Small Caps

Investment Case for Small Caps

Success Essentials and Reliance Mutual Fund Advantage

Reliance Small Cap Fund

Investment Strategy

Positioning

Product Features

India Moving Towards Higher Growth TrajectoryIndia Moving Towards Higher Growth Trajectory

...despite concerns of coalition politics, bureaucracy & poor infrastructure

Estimated for 2009-2011Source: CIEC, RCAM Estimates

India India -- The Next Trillion Dollar OpportunityThe Next Trillion Dollar Opportunity

INDIA’S GDP IN USD TRILLION

India took 60 years to get to its first USD 1 Trillion GDP in FY08 but the move to USD 2India took 60 years to get to its first USD 1 Trillion GDP in FY08, but the move to USD 2Trillion GDP will be in next 5-6 years, similar to that of ChinaDue to the huge consumption and savings/investment boom, USD 2 Trillion GDP is not adestination, but a milestone in India’s ongoing journey towards USD 4 Trillion GDP in the

Estimated for 2010-2014Source: CMIE, MOSL, RCAM Estimates

g g j ysubsequent 5-7 years, and so on

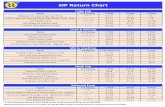

Emerging Markets To Attract Higher InflowsEmerging Markets To Attract Higher InflowsPeriod 1995-99 2000-04 2005-09 2009

Avg. World GDP $Bn 30,292 35,291 53,583 57,228Proportion of the World Average GDP level (%)

DM countries 80.4 79.5 72.2 69.3US 27.6 30.5 25.7 24.9

Growing size of EM economy andfading distinction between EMand DM economies should lead toincreased capital allocation to EMUS 27.6 30.5 25.7 24.9

UK 4.4 4.9 4.6 3.8Euro area 23.2 21.4 22.1 21.5Japan 14.8 12.2 8.7 8.8EM countries 19.6 20.5 27.8 30.7Brazil 2.6 1.7 2.4 2.6

increased capital allocation to EMeconomies

Period 1995-99 2000-04 2005-09 2009Avg.World M-Cap 14,047,039 17,734,308 25,689,296 24,630,640

Proportion of the Average World M-Cap (%)

Presently EM economies hold over 30%

Russia 1.0 1.1 2.2 2.2India 2.2 1.5 1.9 2.2China 3.1 4.3 6.5 8.3South Africa 0.5 0.4 0.5 0.5

Proportion of the Average World M-Cap (%)DM markets 94.1 95.3 90.1 86.8United States 46.6 51.9 44.3 42.5United Kingdom 9.7 10.4 9.6 9.0Europe (ex-EM) 30.0 29.1 29.0 27.3Japan 13.8 9.0 9.5 8.6Presently, EM economies hold over 30%

share in Global GDP, while their share inGlobal market cap is only 13%

EM markets 5.9 4.7 9.9 13.2Brazil 0.7 0.4 1.3 2.2Russia 0.2 0.2 0.8 0.8India 0.4 0.3 0.7 1.0China 0.0 0.3 1.5 2.4K 0 6 0 8 1 4 1 7

Source: IMF GDP data, MSCI m-cap data, RCAM Estimates, DM : Developed Markets, EM: Emerging Markets

Korea 0.6 0.8 1.4 1.7MSCI Indices used as proxy for market-cap data (Units: USD million)

Investments Will Flow To IndiaInvestments Will Flow To IndiaUSD (Trillion) CY2008 CY2014

BRICGDP 8.29 16.36Market Cap 5.61 16.36FII Investments* 1.00 ??USGDP 14 20 16 47

In 2014 BRIC’s combined GDP will be equal to US GDP

GDP 14.20 16.47Market Cap 12.09 16.47FII Investments* 10.64 ??

In 2014, BRIC s combined GDP will be equal to US GDPAt Market Cap GDP ratio of 1, BRIC countries will have a market cap of USD 16.36TrillionSignificant FII money will flow into the BRIC markets – India will gets its share ofSignificant FII money will flow into the BRIC markets India will gets its share ofinvestments

Source - RCAM Estimates, *FII numbers are approximations, BRIC – Brazil, Russia, India, China

Investment OutlookInvestment OutlookCurrently market is evenly poised with positive bias

India has emerged stronger from the global slump and is back on track to grow in excessof 7-8% per annum

For a sustained long term growth, the 3 growth drivers are in place:

Savings – Domestic savings are among the highest in the world

C ti S t t l dConsumption – Set to explode

Investments – At 34% of the GDP, again among the highest in the world

Policy announcements will have significant impact on the direction of the markety g p

Themes for the coming year

Big valuation disparity among large, mid caps & small caps. Opportunity for alphacreationcreation

Stock selection will be the keySource: Bloomberg, RCAM Estimates

Why Invest In Small Caps?Why Invest In Small Caps?

Key Benefits Of Investing In Small CapsKey Benefits Of Investing In Small Caps

Emergence Of Small Caps To Large CapsEmergence Of Small Caps To Large Caps

Today’s SmallToday’s Small …Are Tomorrow’s Potential…Are Tomorrow’s PotentialToday s Small Today s Small Caps ….Caps ….

…Are Tomorrow s Potential …Are Tomorrow s Potential Mid Caps, Mid Caps,

Which May Eventually Which May Eventually Become Large CapsBecome Large Caps

Small CapsSmall Caps Mid CapsMid Caps Large CapsLarge Caps

Re Re –– Rating Potential For Small CapsRating Potential For Small Caps

Small CapSmall CapSmall Cap Mid CapMid CapMid Cap Large CapLarge CapLarge Cap

Research AvailableResearch AvailableResearch Available Limited Moderate Widely

Very Limited Moderate Large

Institutional OwnershipInstitutional OwnershipInstitutional Ownership

Low Moderate FairValuation MultipleValuation MultipleValuation Multiple Low Moderate Fairppp

Entrepreneurial PassionEntrepreneurial PassionIndian entrepreneurial skills / mindset / spirit has been globally acknowledged over a

period of time

E d f Li R j h d b i t iti f tEnd of License Raj has opened many business opportunities for entrepreneur

Multiple sources of fund raising at various stage of business has been of tremendous

helpp

Competitive talent is being attracted & retained by rewarding performance linked

incentives, ESOPs, etc

In today’s economic environment, individuals with entrepreneurial mindset are exploring

new business opportunities that will not only survive in a recession but will also thrive

Th E i I di i ff i i th t iti t t b it fi tThus, Emerging India is offering various growth opportunities to entrepreneurs, be it first

generation entrepreneur or otherwise

Emerging Sectors Offer Opportunities For GrowthEmerging Sectors Offer Opportunities For Growth

In a developing economy like India, multiple sectors provide opportunities for growth

Example: Retailing, Food Processing, Pharmaceuticals, Media & Entertainment,

Real Estate, Education, Hospitality etcy

Once established and successful, ramp up can be rapid

Thus, emerging sectors are true reflection of entrepreneurial spirit, new opportunities

and creation of global behemothsand creation of global behemoths

Dynamics Of Multi Dynamics Of Multi -- BaggersBaggersMarket Capitalization = Net Profits X Perception

Market Price = EPS X PE

High Growth Potential / Scalability

Differentiated Business Model

Under Ownership, Under

Researched & Under CoveredDifferentiated Business Model

Emergence of Educated &

Passionate Management

Understanding Value of Market Cap

Various Modes of Fund Raising

Niche focus & ability to attract talent

in form of Quasi Entrepreneurs &

Emerging Sectors start small –

Technology, Retail, Real Estate,

Stock Options Insurance etc

This simultaneous impact on both EPS & PE creates a MULTI BAGGER

How Small Caps Are Classified ? How Small Caps Are Classified ? There is no scientific methodology to classify Large Caps, Mid Caps and Small Caps

but there are pre-defined indices on BSE & NSE

Mentioned below is the categorization of the same on the basis of market capitalization

as on August 2010

Indices Categorization No. Of Companies

Index Market Cap Range

(Rs. Crs)

Total Market Cap approx

(Rs Crs)

BSE SENSEX Large Cap 30 15,300 – 329,400 2,761,687g p , , , ,

BSE Mid Cap Mid Cap 273 1000 – 12,350 1,078,821

BSE Small Cap Small Cap 534 170 – 2300 351,840

Source: www.bseindia.com, 5th August 2010 , Index Market Cap Range given implies companies with the smallest market cap and largest market cap in that particularindices respectively as on August 5, 2010. Small Cap stocks for the purpose of the Reliance Small Cap Fund are stocks whose market capitalization is in between thehighest and lowest market capitalization of companies on BSE Small Cap Index

The Indian Small Cap OpportunityThe Indian Small Cap Opportunity

4300+ Cos. listed on Bombay Stock Exchange

1383 Cos. with Market Capitalization of over Rs 100 Cr

1065 Cos. with Market Capitalization of over Rs 200 Cr

664 Cos. with a Sales Turnover of over Rs. 200 Cr

613 Cos. with an Operating Profits over Rs 25 Cr

548 Cos. with net profits of over Rs 10 Cr

Source : www.bseindia.com, Capitaline Neo as on 6th August 2010

p

Investment Case For Small CapsInvestment Case For Small Caps

Performance Over The Last 2 Years (31st July 08 - 30th July 10)Outperformance of

Valuation As On 31st July 2010

I d P/E P i T B k V lIndex CAGR (%)

Outperformance of BSE SMALL CAP

Relative To Indices

S&P CNX Nifty 11.32 5.00

BSE SENSEX 11.58 4.74

Index P/E Price To Book Value

S&P CNX Nifty 22.31 3.78

BSE SENSEX 21.20 3.40

BSE MIDCAP 19.24 2.90

Small Caps are still available at better valuations compared to Large Caps

BSE MIDCAP 15.37 0.95

BSE SMALL CAP 16.32

BSE SMALL CAP 15.66 2.34

Source : www.bseindia.com, Capitaline Neo as on 6th August 2010

E l f h S ll C i h dE l f h S ll C i h dExamples of how Small Cap companies have emerged Examples of how Small Cap companies have emerged as Large Cap companies over a period of time as Large Cap companies over a period of time

creating wealth for the shareholderscreating wealth for the shareholderscreating wealth for the shareholderscreating wealth for the shareholders

The companies chosen herein are purely for illustrative purpose onlyReliance Mutual Fund or Reliance Small Cap Fund may or may not invest in the shares of these companiesThe investment decision of Reliance Mutual Fund to invest in any company is based on several factors includingThe investment decision of Reliance Mutual Fund to invest in any company is based on several factors includingresearch, market potential, future outlook etc

RetailingRetailing

Company Name

Market Capitalization (July 30th 2001)

Market Capitalization (July 30th 2010) Outperformance relative to

BSESENSEX (July 30th 2001- July 30th 2010)(Rs. Cr) (Rs. Cr)

P l R il (I di ) 19 98 9457 13 19 316%Pantaloon Retail (India) 19.98 9457.13 19,316%

PAT Rs.140.58 Crs

(30th June 2009)

PAT Rs.6.40 Crs(30th J 2001)(30th June 2001)

Source as on 31st July 2010, Capitaline Neo

Realty Realty -- ConstructionConstruction

Company Name

Market Capitalization (July 31st 2003)

Market Capitalization (July 30th 2010) Outperformance relative to

BSESENSEX (July 31st 2003- July 30th 2010)(Rs. Cr) (Rs. Cr)

U i h 72 44 20 457 53 17 550%

PAT Rs.1,195.53 Crs

(31st M h 2009)

Unitech 72.44 20,457.53 17,550%

(31st March 2009)

PAT Rs.13.57 Crs(31 t M h 2003)(31st March 2003)

Source as on 31st July 2010, Capitaline Neo

Computers Computers -- EducationEducation

Company Name

Market Capitalization (Jan 31st 2006)

Market Capitalization (July 30th 2010) Outperformance relative to

BSESENSEX (Jan 31st 2006- July 30th 2010)(Rs. Cr) (Rs. Cr)

Ed S l i 447 20 5 797 46 904%

PAT Rs.140.33 Crs(31st March 2009)

Educomp Solutions 447.20 5,797.46 904%

PAT Rs.14.00 Crs(31st March 2006)

Source as on 31st July 2010, Capitaline Neo

HealthcareHealthcare

Company Name

Market Capitalization (Jan 31st 2001)

Market Capitalization (July 30th 2010) Outperformance relative to

BSESENSEX (Jan 31st 2001- July 30th 2010)(Rs. Cr) (Rs. Cr)

A ll H i l 715 31 4 841 08 20%

PAT Rs.130.03 Crs(31st March 2010)

Apollo Hospitals 715.31 4,841.08 20%

PAT Rs.30.92 Crs(31st March 2002)

Source as on 31st July 2010, Capitaline Neo

FMCG FMCG –– Food & Dairy ProductsFood & Dairy Products

Company Name

Market Capitalization (July 1st 2003)

Market Capitalization (July 30th 2010) Outperformance relative to

BSESENSEX (July 01st 2003- July 30th 2010)(Rs. Cr) (Rs. Cr)

Z d W ll 2 31 2 015 23 9 924%

PAT Rs.46.71 Crs

Zydus Wellness 2.31 2,015.23 9,924%

Rs.46.71 Crs(31st March 2010)

PAT Rs.0.94 Crs

(31 t M h 2003)(31st March 2003)

Source as on 31st July 2010, Capitaline Neo

Dynamics Of Successful Small Cap InvestingDynamics Of Successful Small Cap InvestingStock Selection

Small Cap investing is all about stock selection rather than asset allocation

Stock selection based onSize of opportunity

Possible higher growth and its sustainability

Emerging theme / sector (Example: real estate retail food processing etc)Emerging theme / sector (Example: real estate, retail, food processing etc)

Zeal of management to scale and grow

Stock price movement tend to be more volatileLimited research

Lesser/negligible institutional ownership

However the sharp volatility subsides over a longer period and makes way forHowever the sharp volatility subsides over a longer period and makes way forhigher profitability

Reliance Mutual Fund AdvantageReliance Mutual Fund AdvantageOur Expertise

Bottom up approach has been strongly advocated as the key investment strategy of

Reliance Mutual FundReliance Mutual Fund.

Well-experienced team of investment professionals having

Collective experience of over 150 years in Indian equities

Most members individually tracking Indian equity markets for well over 15 years

In depth research capabilities to identify small caps with huge growth potential

Our research capability empowers the Fund Manager to be BOLD in identifying highOur research capability empowers the Fund Manager to be BOLD in identifying high

growth potential stocks & manage the RISK associated with it

Only fund in RMF’s product basket with a pre-dominant investment focus on small

cap companies where stock selection would play a key rolePast Performance may or may not be sustained in future

Reliance Mutual FundReliance Mutual FundReliance Mutual Fund Reliance Mutual Fund PresentsPresents

Reliance Small Cap Fund Reliance Small Cap Fund A Fund With A Fund With

A Very Aggressive Investment StyleA Very Aggressive Investment Style

Investment PhilosophyInvestment PhilosophyWith an endeavor to maximize returns & minimize risks by reasonable diversification ,

primary focus would be on small cap stocks

Investment in Equities of Small Cap Companies : 65%-100%*

Investment in Equities of any other Companies : 0%-35%*

I t t i D bt & M M k t S iti 0% 35%*Investment in Debt & Money Market Securities : 0% - 35%*

Small cap stocks, for the purpose of the fund are defined as stocks whose market

capitalization is in between the highest & lowest market capitalization of companiesp g p p

on BSE Small Cap Index

Investment with a longer term horizon

* Please refer detailed asset allocation on slide no 29. Market Capitalization: Market value of the listed company, which iscalculated by multiplying its current market price by number of its shares outstanding

Positioning Of Reliance Small Cap FundPositioning Of Reliance Small Cap Fund

Ri k

Returns

High Medium Low

High Reliance Small C F dRisk High Cap Fund

Medium

Low

A very aggressive small cap oriented fund

A relatively high risk/high return oriented fund characterized by volatility which will get

smoothened out over long term investment horizon

Reliance Small Cap Fund will be a vital part of an investor’s core portfolio that aims to

create an alpha for their investmentscreate an alpha for their investments

Scheme FeaturesScheme Features

Investment ObjectiveThe primary investment objective of the scheme is to generate long term capitalappreciation by investing predominantly in equity and equity related instrumentsof small cap companies and the secondary objective is to generate consistentreturns by investing in debt and money market securities

Equity & equity related securities of small cap companies including derivatives# 65% 100%

BSE Small Cap IndexBenchmark

- 65%-100%Equity & equity related securities of any other companies including derivatives#

- 0%-35%Debt & Money Market Securities **(including investments in securitised debt)

- 0% - 35%

Proposed Asset Allocation

** including securitised debt up to 30%# The Scheme proposes to invest at least 65% of the corpus in Equity & equity related instruments of small capcompanies which may go upto 100% of the corpus. The investment in Equity & equity related instruments ofany other companies other than small cap companies will be in the range of 0-35% of the corpus

F d MFund Manager Sunil Singhania

New Fund Offer Price: Rs.10/- per unit

Scheme FeaturesScheme FeaturesLoad Structure : During New Fund Offer &

Continuous Offer including SIP Installments

E t L d Nil

Choice of Plans/Options

Growth Plan: Growth & Bonus Option Entry Load: Nil

Exit Load:• 2% If redeemed or switched out on or before completion of

12 months from the date of allotment of units

Growth & Bonus Option Dividend Plan :

Dividend Payout OptionDividend Reinvestment Option

Minimum Application Amount• 1% If redeemed or switched out after 12 months but on or

before completion of 24 months from the date of allotmentof unitsNil If d d it h d t ft th l ti f 24

Minimum Application Amount

Rs.5000 & in multiples of Re. 1 thereafter

Additional Purchase Amount• Nil If redeemed or switched out after the completion of 24

months from the date of allotment of unitsIn accordance with the requirements specified by the SEBI circular no. SEBI/IMD/CIRNo.4/168230/09 dated June 30, 2009 no entry load will be charged for purchase / additionalpurchase / switch-in accepted by the Fund. Upfront commission shall be paid directly by theinvestor to the AMFI Registered Distributor based on the investor’s assessment of various

Rs.1000 (plus in the multiple of Re.1)

SIPinvestor to the AMFI Registered Distributor based on the investor’s assessment of variousfactors including the services rendered by the AMFI Registered Distributor.Mode of Payment : Auto Debit/ECS

DisclaimersDisclaimersThe views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the readers. This information ismeant for general reading purpose only and is not meant to serve as a professional guide for the readers. This document has been prepared on the basis of publicly availableinformation, internally developed data and other sources believed to be reliable. The Sponsor, The Investment Manager, The Trustee or any of their respective directors,employees, affiliates or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Whilst noaction has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and opinions given fair and reasonable.This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Recipients of this information should rely oninformation/data arising out of their own investigations. Readers are advised to seek independent professional advice and arrive at an informed investment decision beforemaking any investments. None of The Sponsor, The Investment Manager, The Trustee, their respective directors, employees, affiliates or representatives shall be liable forany direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material.The Sponsor, The Investment Manager, The Trustee, any of their respective directors, employees including the fund managers, affiliates, representatives including personsinvolved in the preparation or issuance of this material may from time to time, have long or short positions in, and buy or sell the securities thereof, of company(ies) / specificsectors mentioned herein.Terms of issue and mode of sale and redemption of units: The Scheme will offer for Subscription/ Switch-in and Redemption / Switch-out of Units on every Business Dayon an ongoing basis, within five business days of allotment. The redemption or repurchase proceeds shall be dispatched to the unitholders within 10 Business Days from thed t f d ti hdate of redemption or repurchase.Investor benefits and general services offered: The Scheme offers Systematic Investment Plan, Auto Switch facility, Online Transactions and Reliance Any Time MoneyCard during the NFO period. The NAV of Scheme shall be published on a daily basis by the Mutual Fund at least in two daily newspapers and will also uploaded on the AMFIsite www.amfiindia.com and Reliance Mutual Fund site i.e. www.reliancemutual.com.Statutory Details: Reliance Mutual Fund has been constituted as a trust in accordance with the provisions of the Indian Trusts Act, 1882. Sponsor: Reliance Capital Limited.Trustee: Reliance Capital Trustee Company Limited. Investment Manager: Reliance Capital Asset Management Limited (Registered Office of Trustee & InvestmentManager: “Reliance House” Nr. Mardia Plaza, Off. C.G. Road, Ahmedabad 380 006). The Sponsor, the Trustee and the Investment Manager are incorporated under theCompanies Act 1956 The Sponsor is not responsible or liable for any loss resulting from the operation of the Scheme beyond their initial contribution of Rs 1 lakh towards theCompanies Act 1956. The Sponsor is not responsible or liable for any loss resulting from the operation of the Scheme beyond their initial contribution of Rs.1 lakh towards thesetting up of the Mutual Fund and such other accretions and additions to the corpus.Risk Factors: Mutual Funds and securities investments are subject to market risks, and there is no assurance or guarantee that the objectives of the Scheme willbe achieved. As with any investment in securities, the NAV of the Units issued under the Scheme can go up or down depending on the factors and forcesaffecting the securities market. Reliance Small Cap Fund is only the name of the Scheme and does not in any manner indicates either the quality of the Scheme;its future prospects or returns. Past performance of the Sponsor/AMC/Mutual Fund is not indicative of the future performance of the Scheme. The NAV of the Scheme maybe affected, interalia, by changes in the market conditions, interest rates, trading volumes, settlement periods and transfer procedures. There are various risks associated withinvesting in Equities Bonds Foreign Securities investing and use of Derivatives Securitised Debt and Short Selling & Securities Lending For Scheme specific risk factorsinvesting in Equities, Bonds, Foreign Securities, investing and use of Derivatives, Securitised Debt and Short Selling & Securities Lending. For Scheme specific risk factorsand more details, please refer to the Scheme Information Document & Key Information Memorandum, which is available at all the DISC, Distributors andwww.reliancemutual.com. Investors can also call at our call centre 1800-300-11111 (toll free) for more details. Please read the Scheme Information Document andStatement of Additional Information carefully before investing.

Thank YouThank You

A R������� C������ �������