RealPoint CMBS Delinquency Report July 2009

Transcript of RealPoint CMBS Delinquency Report July 2009

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

1/15

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

2/15

August 2009

Page 2 of 15

0.472% 0.543%0.631%

0.828%

1.025%

1.281%

1.431%

1.664%

2.066%

2.275%

3.505%

3.135%

0.000%

0.500%

1.000%

1.500%

2.000%

2.500%

3.000%

3.500%

4.000%

P e r c e n

t a g e

Aug -08 Sep- 08 O ct-08 No v- 08 De c-08 Ja n-09 Fe b-0 9 Mar-09 Apr-09 M ay-0 9 Jun -09 Ju l-09Month

Note: Even if the $4.8 billion of GGP-sponsored loans that returned to current payment status in July were omitted from the reported delinquency stats in June (effectively ignored for delinquency reporting purposes), the monthly trend of growth for CMBS delinquency would have continued. Specifically, after removing these loans, CMBS delinquency still increased from $18.78 billion in May 2009 (2.275%) up to a hypothetical $23.85 billion in June 2009 (2.92%), and then to 25.68 billion in July (3.135%).

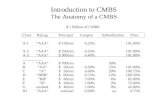

The resultant delinquency ratio for July 2009 of 3.14% (down slightly from the 3.5% reported one month

prior) is now over six times the 0.49% reported one-year prior in July 2008 and over 11 times theRealpoint recorded low point of 0.283% from June 2007. The increase in both delinquent unpaid balanceand delinquency ratio over this time horizon reflects a steady increase from historic lows in mid-2007.

An additional $152.4 million in loan workouts and liquidations were reported for July 2009 across 34 loansat an average loss severity of 31.3%. Fifteen of these loans, however, at $87.62 million experienced aloss severity near or below 1%, most likely related to workout fees, while the other 19 loans at $64.8million experienced an average loss severity near 55%. As additional pressures are placed on specialservicers to maximize returns in todays credit market, true loss severities are expected to be high whileliquidation activity is expected to slow as fewer transactions occur. This would be the result of reduced ordistressed asset pricing, lower availability of take-out financing, and increased extensions of balloondefaults through 2009 and 2010.

Forecasted Delinquency by Balance and Percentage Scenario AnalysisOverall, following the correction of the GGP-sponsored loans in July, we now expect the delinquentunpaid CMBS balance to continue along its current trend and grow towards $50 billion before the end of2009. Based upon an updated trend analysis, we project the delinquency percentage to grow in excess of 6% before year-end 2009 (potentially approaching and surpassing 8% under more heavily stressed scenarios). This outlook is mostly due to the reporting of several large loans fromrecent vintage transactions that continue to show signs of stress and default, along with continued balloonmaturity defaults from more seasoned vintage transactions. In addition, while we maintain our negativeoutlook for both the retail and hotel sectors for 2009, we are closely monitoring the negative trendssurrounding several large struggling multifamily loans in the New York MSA that have near-term defaultrisk, and the lack of new issuance to offset the continued increases in delinquent unpaid balance.

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

3/15

August 2009

Page 3 of 15

Year I ssued # o f Loans Current Ba lance2007 66 4,627,226,962.92$2006 50 943,418,490.99$2005 43 825,828,288.59$2004 34 685,220,196.41$2003 10 59,890,210.70$2002 3 20,354,138.41$2001 9 123,212,550.35$2000 12 67,351,065.05$1999 60 255,918,408.60$1998 5 35,478,842.64$1997 3 3,407,319.37$

Totals 295 7,647,306,474.03$

Table 2: Monthly Special Servicing TransfersJuly 2009

Our historical scenario and trend analysis regarding recent default activity and the potential for futuredelinquency growth ( affected somewhat by the delinquency fluctuation of the previously mentioned GGP- sponsored specially-serviced loans) presents the following:

Scenario 1 (Six-Month Historical Assumptions):

Over the past six months, delinquency growth by unpaid balance has averaged roughly $2.5billion per month, while the outstanding universe of CMBS under review has decreased onaverage by $3.94 billion per month from pay-down and liquidation activity.

If such delinquency average were increased by an additional 25% growth rate, and then carriedthrough the end of 2009, the delinquent unpaid balance would reach $41 billion and reflect adelinquency percentage near 5.05% by December 2009.

In addition to this growth scenario, if we add-in the potential default of two very large high riskCMBS loans under review by Realpoint (namely the $3 billion Peter Cooper Village / StuyvesantTown loan spread through multiple CMBS deals via a pari passu structure, and the $4.1 billionExtended Stay Hotel loan in the WBC07ESH pool which was recently transferred to the special servicer in July following the Chapter 11 bankruptcy protection filing of Extended Stay and the potential for CMBS debt restructuring ), the delinquent unpaid balance would top $48 billion

and reflect a delinquency percentage over 6% by December 2009.

Scenario 2 (Three-Month Historical Assumptions):

Over the past three months, delinquency growth by unpaid balance has averaged roughly $2.85billion per month, while the outstanding universe of CMBS under review has decreased onaverage by $3.7 billion per month from pay-down and liquidation activity.

If such delinquency average were again increased by an additional 25% growth rate, and thencarried through the end of 2009, the delinquent unpaid balance would reach $44 billion andreflect a delinquency percentage slightly above 5.3% by December 2009.

In addition to this growth scenario, if we again add-in the potential default of the $3 billion PeterCooper Village / Stuyvesant Town loan and the $4.1 billion Extended Stay Hotel loan, thedelinquent unpaid balance would reach $51 billion and reflect a delinquency percentage

above 6.3% by December 2009.

Special Servicing Exposure and Other TrendsSpecial servicing exposure continues to rise dramatically on a monthly basis, having increased for the15 th straight month through July 2009. The unpaid balance for specially serviced CMBS increased on a

net basis by $7.34 billion in July 2009, up to a trailing 12-month high of $47.87 billion from $40.53 billion in June andonly $37.05 billion in May. In addition, newly transferredspecially-serviced loans totaled 295 at $7.65 billion in July2009, as shown in Table 2. Worth noting is that anadditional 159 loans at $6.396 billion of such balance (84%of newly transferred balance) were issued from 2005through 2007. Our default risk concerns for the 2005 to

2007 vintage transactions relative to underlying collateralperformance and payment ability are more evident on amonthly basis. Both the volume and unpaid balance ofCMBS loans transferred to special servicing on a monthlybasis continues to raise questions about underlying creditstability in todays market climate for these more recentvintage CMBS deals.

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

4/15

August 2009

Page 4 of 15

As a result of the recent transfer activity, the corresponding percentage of loans in special servicingincreased to 5.84% of all CMBS by unpaid balance in July 2009, up from 4.96% a month prior. Theoverall trend of special servicing since January 2005, by both unpaid balance and percentage, ispresented in Charts 3 and 4 below.

Charts 3 and 4 Special Servicing Exposure: Balance vs. Percentage (source: Realpoint)

Special Servicing Exposure by Unpaid Balance ($BB): January 2005 through July 2009

Jul-09, $47.87

Jan-08, $4.53

Jan-09, $14.38

Jan-07, $3.74

Jan-06, $5.57Jan-05, $8.55

$0.00

$10.00

$20.00

$30.00

$40.00

$50.00

$60.00

J a n - 0

5

A p r - 0

5 J u

l - 0 5

O c t - 0

5

J a n - 0

6

A p r - 0

6 J u

l - 0 6

O c t - 0

6

J a n - 0

7

A p r - 0

7 J u

l - 0 7

O c t - 0

7

J a n - 0

8

A p r - 0

8 J u

l - 0 8

O c t - 0

8

J a n - 0

9

A p r - 0

9

Special Servcing Exposure as % of Outstanding CMBS: January 2005 through July 2009

Jul-09, 5.84%

Jan-09, 1.71%

Jan-08, 0.52%

Jan-07, 0.52%

Jan-06, 1.00%

Jan-05, 1.95%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

J a n - 0

5

A p r - 0

5 J u

l - 0 5

O c t - 0

5

J a n - 0

6

A p r - 0

6 J u

l - 0 6

O c t - 0

6

J a n - 0

7

A p r - 0

7 J u

l - 0 7

O c t - 0

7

J a n - 0

8

A p r - 0

8 J u

l - 0 8

O c t - 0

8

J a n - 0

9

A p r - 0

9

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

5/15

August 2009

Page 5 of 15

Furthermore, nearly 54% of delinquent unpaid balance through July 2009 came from transactions issuedin 2006 and 2007, with over 28% of all delinquency found in 2006-issued transactions. When we extendour review to include the 2005 vintage, an additional 16% of total delinquency is found; thus over 70% ofCMBS delinquency comes from 2005 to 2007 vintage transactions.

Chart 5 below shows the increased delinquent unpaid balance relative to these three vintages over thepast six months, clearly reflecting the increasing trends we have highlighted in recent months.

Chart 5 Monthly Delinquent Unpaid Balance for 2005, 2006 and 2007 Vintage Transactions

$-

$1,000,000,000

$2,000,000,000

$3,000,000,000

$4,000,000,000

$5,000,000,000

$6,000,000,000

$7,000,000,000

$8,000,000,000

Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09Month

2005 2006 2007

Throughout 2009, we expect to see continued high delinquency by unpaid balance for these threevintages due to aggressive lending practices prevalent in such years. We also expect to see some loansfrom the 2008 vintage to show signs of distress and default in cases where pro-forma underwritingassumptions fail to be realized.

Otherwise, when focusing on deals seasoned for at least one year, our investigation reveals the following: Deals seasoned at least a year have a total unpaid balance of $815.9 billion, with $25.68 billion

delinquent a 3.15% rate (up from only 1.27% six months prior).

When agency CMBS deals are removed from the equation, deals seasoned at least a year have atotal unpaid balance of $785.52 billion, with $25.602 billion delinquent a 3.26% rate (up from only1.32% six months prior).

Conduit and fusion deals seasoned at least a year have a total unpaid balance of $693.62 billion, with$24.26 billion delinquent a 3.498% rate (up from only 1.38% six months prior).

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

6/15

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

7/15

August 2009

Page 7 of 15

Through July 2009, another $152.4 million in CMBS loan workouts and liquidations were reported at anoverall average loss severity of 31.3% (shown in Table 3). We highlight, however, that 15 of these loansat $87.62 million experienced a loss severity near or below 1%, most likely related to special servicingworkout fees, while the remaining 19 loans at $64.8 million experienced an average loss severity near55% - a clearer reflection of true loss severity. We expect higher levels of loss severity to be the norm in2009 for those loans that experience a term default where cash flow from operations is not sufficient tosupport in-place debt obligations (i.e. DSCR below break-even).

Table 3 Liquidations for July 2009: Material Loss vs. Workout Fees, etc. (source: Realpoint)

Deal ID Pros ID Loan Name Prop Type Balance Before Loss Loss Amount Loss % Loss Date City StateBACM0605 69.000 Woodside Center Office 8,150,000.00$ 2,882,419.87$ 35.4% 7/16/2009 Alpharetta GABOFC00C1 8218094696-18 Blockbuster Strip Center Retail 636,778.55$ 32,135.48$ 5.0% 7/20/2009 NORTH CANTON OHBSC07P17 59.000 PGA Professional Center Office 12,387,102.67$ 3,028,606.77$ 24.4% 7/30/2009 Palm Beach Gardens FLCBAC0401 800000689 03FIXED/VARIABLE Multi-family 121,605.40$ 121,605.40$ 100.0% 7/27/2009 SCRANTON PACBAC0401 800000917 05FIXED/VARIABLE Multi-family 352,412.55$ 30,454.99$ 8.6% 7/15/2009 PHOENIX AZCBAC0501 2005100625 02FIXED/VARIABLE Multi-family 262,443.85$ 262,443.85$ 100.0% 7/3/2009 CENTRAL FALLS RICBAC0501 2005100614 02FIXED/VARIABLE Other 174,672.07$ 99,620.88$ 57.0% 7/1/2009 FALL RIVER MACCSC00C2 57 Pike Plaza III Retail 1,194,577.91$ 1,194,577.91$ 100.0% 7/9/2009 INDIANAPOLIS INCCSC00C2 56 Pike Plaza II Retail 8,700,725.58$ 8,672,587.22$ 99.7% 7/9/2009 INDIANAPOLIS INCMAC98C2 000WMFG172 Circuit City Houston Retail 2,515,256.98$ 2,025,960.13$ 80.5% 7/16/2009 HOUSTON TX

CMAC98C2 000MLMI037 Comp-USA Retail 1,751,735.71$ 966,502.52$ 55.2% 7/16/2009 WICHITA KSCSF02CK1 000050 Kimball Square Apartments Multi-family 4,257,529.28$ 2,205,663.89$ 51.8% 7/17/2009 Dallas TXCSF05C04 117.000 Seven Oaks Apartments Multi-family 2,411,545.62$ 1,311,971.93$ 54.4% 7/31/2009 HENDERSON KYCSM08C01 56.000 Peoria Strip Center Retail 1,652,950.62$ 1,028,478.25$ 62.2% 7/10/2009 GLENDALE AZFUBA01C1 000026 Foxfire Apartments Multi-family 12,261,172.81$ 4,524,485.21$ 36.9% 7/31/2009 DURHAM NCFUNB02C1 000086 Western Heights Multi-family 1,896,283.52$ 1,896,283.52$ 100.0% 7/31/2009 DETROIT MIGSM204G2 000133 237 West Northfield Boulevard Office 2,387,698.99$ 1,100,042.70$ 46.1% 7/1/2009 NULL TNLBC99C01 185 Lincoln Park Mobile Home Village Multi-family 839,609.38$ 112,841.04$ 13.4% 7/8/2009 LINCOLN PARK MIMSDW00PR 000065 Circuit City Stores Retail 2,849,793.82$ 522,243.22$ 18.3% 7/10/2009 PORTLAND OR

Sub-Totals 64,803,895.31$ 32,018,924.78$ 5 5.2 % Av g Se verit y

Deal ID Pros ID Loan Name Prop Type Balance Before Loss Loss Amount Loss % Loss Date City StateBACM0001 51513 Balcones Apartments Multi-family 1,239,067.35$ 12,604.99$ 1.0% 7/8/2009 COLLEGE STATION TXBACM0001 51511 Casa Verde Apartments Multi-family 2,292,430.34$ 23,310.93$ 1.0% 7/8/2009 COLLEGE STATION TXBSC99WF2 17154 521-527 & 529-535 West 20th Street Industrial 5,686,272.07$ 57,271.67$ 1.0% 7/2/2009 New York NYCSF99C01 99-04862 Mid-Towne Mobile Terrace Multi-family 1,904,682.98$ 19,260.00$ 1.0% 7/1/2009 SALINAS CADLJ99CG2 000152 Hampton Inn - Louisville Hotel 2,794,288.11$ 33,106.85$ 1.2% 7/1/2009 LOUISVILLE CODLJ99CG2 000040 Knollwood Estates Mobile Home Park (1F) Multi-family 2,431,262.18$ 22,971.91$ 0.9% 7/2/2009 ALLENDALE MIDLJ99CG2 000039 River Haven Mobile Home Park (1F) Multi-family 8,752,100.35$ 82,653.51$ 0.9% 7/2/2009 GRAND HAVEN MIFUNB99C2 000103 Delmont Village Shopping Center Retail 3,146,069.57$ 64,279.68$ 2.0% 7/1/2009 BATON ROUGE LA

LBC99C01 115 1200 Route 9 Retail 2,653,494.76$ 27,482.49$ 1.0% 7/1/2009 WOODBRIDGE NJLBUB04C1 76 Kenneth Court Multi-family 2,655,449.53$ 1,792.40$ 0.1% 7/13/2009 TAMPA FLLBUB05C1 73 Auburn Place & College Point I & II Apartments Multi-family 2,820,026.83$ 24,613.03$ 0.9% 7/13/2009 STEPHENVILLE TXMSDW01IQ 000100 Fullerton Industrial Industrial 2,263,559.94$ 22,777.18$ 1.0% 7/1/2009 FULLERTON CAMSDW01IQ 000099 Cerritos Industrial Industrial 2,358,758.10$ 23,734.99$ 1.0% 7/1/2009 Cerritos CAMSDW01IQ 000001 Town Center Plaza Retail 45,701,561.41$ 459,807.58$ 1.0% 7/7/2009 LEAWOOD KSPNC00C02 000174 Briarwood Apartments Multi-family 919,767.75$ 7,278.67$ 0.8% 7/31/2009 Pueblo CO

Sub-Totals 87,618,791.27$ 882,945.88$ 1.0 % Avg Se verit y

Aggregate T otal 152,422,686.58$ 32,901,870.66$ 3 1.3 % Av g Se verit y

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

8/15

August 2009

Page 8 of 15

Table 4 Monthly CMBS Liquidations and Average Loss Severity, January 2008 to July 2009 (source: Realpoint)

Totals Balance Before Loss Loss Amount Avg. Loss %

Jul-09 152,422,686.58$ 32,901,870.66$ 31.3%

Jun-09 104,612,935.29$ 27,604,887.58$ 39.6%May-09 83,774,841.23$ 33,562,306.32$ 35.2%Apr-09 65,890,685.28$ 13,820,841.89$ 31.1%

Mar-09 157,538,109.76$ 38,348,045.97$ 50.7%Feb-09 53,881,344.45$ 21,297,774.64$ 23.6%Jan-09 127,512,771.20$ 42,220,021.31$ 37.1%

Dec-08 119,798,193.52$ 53,191,551.67$ 42.0%

Nov-08 134,819,667.87$ 25,028,932.54$ 27.6%Oct-08 93,685,039.57$ 8,286,575.46$ 13.5%Sep-08 78,271,654.89$ 6,971,767.96$ 17.0%

Aug-08 70,664,692.73$ 12,174,288.96$ 20.0%Jul-08 201,914,661.89$ 56,467,662.03$ 30.4%Jun-08 158,520,022.07$ 31,146,059.73$ 24.9%

May-08 81,930,650.64$ 19,632,531.51$ 16.5%Apr-08 115,172,947.71$ 62,227,934.35$ 29.4%Mar-08 97,384,008.72$ 21,385,223.39$ 19.6%

Feb-08 86,972,409.26$ 19,949,191.89$ 20.3%

Jan-08 58,557,636.99$ 18,181,773.24$ 32.1%

Table 5 Average Loss Severities by Property Type for 2009: All Liquidated Loans (source: Realpoint)

Prop Type Balance Before Loss Loss Amount Loss % # of LoansHealthcare Average 4,380,823.18$ 2,055,986.84$ 46.9% 1Hotel Average 61,165,149.89$ 9,754,846.64$ 31.0% 6Industrial Average 30,590,102.65$ 6,858,983.98$ 16.9% 8Multi-family Average 223,688,022.68$ 104,372,343.95$ 40.7% 83Office Average 218,309,114.24$ 36,346,072.99$ 23.8% 26Other Average 1,445,959.51$ 1,060,467.14$ 68.8% 7Retail Average 206,054,201.64$ 49,307,046.83$ 32.6% 47Grand Average 745,633,373.79$ 209,755,748.37$ 35.8% 178

Table 6 Average Loss Severities by Property Type for 2009: Loans wi th Material Loss Severity Above 2% (source: Realpoint)

Prop Type Balance Before Loss Loss Amount Loss % # of LoansHealthcare Average 4,380,823.18$ 2,055,986.84$ 46.9% 1Hotel Average 11,380,566.84$ 9,669,504.99$ 91.2% 2Industrial Average 12,162,351.66$ 6,671,344.27$ 64.6% 2Multi-family Average 164,207,145.03$ 103,803,031.92$ 59.9% 56Office Average 68,378,267.21$ 35,163,713.03$ 55.0% 11Other Average 1,297,901.49$ 1,058,899.60$ 80.0% 6Retail Average 76,920,502.01$ 48,019,077.67$ 56.0% 27Grand Average 338,727,557.42$ 206,441,558.32$ 60.1% 105

Table 7 Average Loss Severities by Property Type for 2009: Loans with Loss Severity Below 2%, including AssumedSpecial Servicing Workout Fees (source: Realpoint)

Prop Type Balance Before Loss Loss Amount Loss % # of LoansHotel Average 49,784,583.05$ 85,341.65$ 0.8% 4Industrial Average 18,427,750.99$ 187,639.71$ 1.0% 6Multi-family Average 59,480,877.65$ 569,312.03$ 1.0% 27Office Average 149,930,847.03$ 1,182,359.96$ 0.9% 15Other Average 148,058.02$ 1,567.54$ 1.1% 1Retail Average 129,133,699.63$ 1,287,969.16$ 1.1% 20Grand Average 406,905,816.37$ 3,314,190.05$ 1.0% 73

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

9/15

August 2009

Page 9 of 15

For comparison by property type: The highest loss severities in 2006 were found in healthcare (55%) and industrial (34.5%)

collateral; multifamily collateral remained highest by balance before liquidation ($606.7 million),but reported the lowest severity (24.5%).

The highest loss severities in 2007 were found in industrial (50%) and healthcare collateral(44%); multifamily collateral was again the highest by balance before liquidation ($356 million),but reported the fourth lowest severity (32.5%).

The highest loss severities in 2008 were found in mixed-use / other (36%) and multifamilycollateral (31%); multifamily collateral was again the highest by balance before liquidation($576.97 million).

Future Workouts Delinquency CategoriesThe total balance of loans in Foreclosure and REO increased for the 21 st straight month to $5.26 billion inJuly 2009 from $4.77 billion in June and only $3.91 billion in May, despite ongoing liquidation activity.The chart below also shows the rapid growth of loans reflecting 30-day delinquency in the past sixmonths, transitioning swiftly into more distressed levels on a monthly basis in 2009, thus supporting ouruse of 30-day defaults as an early indicator of workouts to come for 2009-2010.

Chart 6 Monthly Delinquency Categories (source: Realpoint)

$-

$2,000,000,000

$4,000,000,000

$6,000,000,000

$8,000,000,000

$10,000,000,000

$12,000,000,000

$ D e

l i n q .

Aug-08 Sep-08 Oct-08 Nov-08 Dec-08 Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09Month

30-Day 60-Day 90+-Day Foreclosure REO

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

10/15

August 2009

Page 10 of 15

Property Type In July 2009, retail loans remained the greatest contributor to overall CMBS delinquency, at 1.06% of

the CMBS universe, over 33% of total delinquency, and a 3.8% delinquency rate. Retail surpassed multifamily in May 2009 as the highest CMBS default contributor, for the first time since May 2004.

Following a slight decline in May 2009 (the first decline since August 2008), multifamily loans remaineda poor performer in June and July 2009, with a delinquency rate over 4%. By dollar amount, multifamilyloan delinquency is now up by an astounding $5.95 billion since a low point of only $903.3 million inJuly 2007.

As shown in Chart 7 below, multifamily, retail, office and hotel collateral loan delinquency as apercentage of the CMBS universe have clearly trended upward since mid-2008.

Only nine healthcare loans at 0.019% of the CMBS universe were delinquent in July 2009, but suchdelinquent unpaid balance reflects nearly 7% all healthcare collateral in CMBS.

As a percentage of total unpaid balance, month-over-month delinquencies for only two of sevencategories increased by double digits or more from June to July 2009 (hotel and industrial).

In 2009 we expect retail delinquency to continue its increase as consumer spending suffers from theoverall weakness of the U.S. economy. We also anticipate store closings and retailer bankruptcies tocontinue throughout the year, along with the uncertainty regarding GGP bankruptcy loan defaults.

In addition, the hotel sector will likely experience a significant increase in delinquency as both businessand leisure travel slows further, resulting in further declines in occupancy, REVPAR and ADR.

Table 8 Monthly Delinquency by Property Type (source: Realpoint)

Prop.Type Cu rrent Balance Loan Co unt % of CMBS Universe % of CMBS Delinq. % o f Property TypeHealthcare Total 152,717,601.12$ 9 0.019% 0.595% 6.985%Hotel Total 3,487,307,082.21$ 187 0.426% 13.579% 4.682%Industrial Total 868,274,196.85$ 127 0.106% 3.381% 2.413%Multi-family Total 6,851,062,405.82$ 772 0.836% 26.676% 4.215%Office Total 4,203,041,121.62$ 394 0.513% 16.366% 1.832%Retail Total 8,692,065,992.50$ 768 1.061% 33.845% 3.819%Other Total 1,427,808,214.78$ 211 0.174% 5.560% 1.642%Grand Total 25,682,276,614.90$ 2,468 3.135% 100.000%

Chart 7 Trailing Twelve Month Delinquency by Property Type (source: Realpoint)

Property Type Monthly Delinquency: as Percentage ofCMBS Universe

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

A u g - 0 8 S e p - 0 8

O c t - 0 8 N o v - 0 8

D e c - 0 8 J a n - 0 9

F e b - 0 9 M a r - 0 9

A p r - 0 9 M a y - 0 9

J u n - 0 9 J u l - 0 9

Month

P e r c e n

t a g e

Healthcare Hote l Indus tri al Multi -f amily Offi ce Re ta il Other

Table 9 Trailing Twelve Month Delinquency by Property Type: as % of Outstanding Property Type Balance (source: Realpoint)

Property Typ e Aug- 08 Sep- 08 Oct-08 No v-08 D ec-08 Jan -09 Feb-09 Mar-09 Apr-09 M ay-09 Jun- 09 Jul-09Healthcare 4.4% 4.2% 4.4% 5.0% 5.2% 5.9% 5.8% 5.6% 6.0% 5.5% 6.3% 7.0%Hotel 0.3% 0.3% 0.5% 0.7% 1.1% 1.5% 1.8% 2.0% 2.2% 2.8% 4.2% 4.7%Industrial 0.3% 0.4% 0.6% 0.6% 0.9% 1.0% 1.1% 1.3% 1.5% 1.6% 1.9% 2.4%Multi-family 1.1% 1.3% 1.4% 1.9% 2.0% 2.4% 2.6% 2.8% 3.7% 3.4% 4.0% 4.2%Office 0.3% 0.3% 0.3% 0.4% 0.5% 0.7% 0.8% 1.1% 1.2% 1.5% 1.8% 1.8%Retail 0.3% 0.4% 0.6% 0.8% 1.1% 1.3% 1.6% 1.8% 2.3% 2.6% 5.2% 3.8%Other 0.2% 0.3% 0.2% 0.3% 0.3% 0.5% 0.4% 0.7% 0.9% 1.1% 2.6% 1.6%

Trailing Twelve Month Property Type Delinquency: as % of Outstanding Property Type Balance

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

11/15

August 2009

Page 11 of 15

Special Servicing Special servicing exposure increased for the 15 th straight month to $47.87 billion in July 2009 from

$40.53 billion in June and only $37.05 billion in May. For the 20 th straight month, the total unpaid principal balance for specially-serviced CMBS when

compared to 12 months prior increased, by a high $41.4 billion since July 2008. Such exposure is upover 642% in the trailing-12 months.

Conversely, for historical reference, special servicing exposure was also below $4 billion for 11 straightmonths through October 2007.

With the May 2009 transfer of nearly $7.33 billion of GGP related SPE borrower loans to specialservicing, exposure by property type is now heavily weighted towards retail collateral at 37%, followedby multifamily at 21% and other at 16%.

Unpaid principal balance noted as current but specially-serviced decreased to a low of $1.44 billion inJuly 2007, but has since increased to $25.3 billion in July 2009. This figure is inflated by the GGP-sponsored loans paying interest-only at the non-default rate of interest (despite some requiring principaland interest from amortization prior to transfer in May).

Within the 3.08% of CMBS current but specially-serviced, we found 242 loans at $21.23 billion with anunpaid principal balance over $20 million, up from 176 loans at $12.1 billion a month prior.

Unpaid principal balance exceeded $50 million for 135 current but specially-serviced loans in July 2009,and exceeded $100 million for 75 loans. Such loans are now highlighted by the various Extended StayHotel loan notes found in the WBC07ESH transaction.

Table 10 Trailing Twelve Month Special Servicing Exposure (source: Realpoint)

Month UPB* % of CMBS UPB % of CMBS UPB % of CMBS SSJul-09 $47.87 5.84% $25.26 3.08% $22.61 47.2%Jun-09 $40.53 4.96% $15.76 1.93% $24.77 61.1%May-09 $37.05 4.49% $21.23 2.57% $15.82 42.7%Apr-09 $24.52 2.95% $10.35 1.25% $14.16 57.8%Mar-09 $20.30 2.43% $8.39 1.01% $11.91 58.7%Feb-09 $17.11 2.04% $7.14 0.85% $9.96 58.2%

Jan-09 $14.38 1.71% $5.87 0.70% $8.51 59.2%Dec-08 $12.78 1.51% $5.77 0.68% $7.01 54.9%Nov-08 $10.14 1.20% $4.31 0.51% $5.83 57.5%Oct-08 $8.32 0.97% $3.97 0.46% $4.35 52.3%Sep-08 $7.23 0.85% $3.50 0.41% $3.73 51.6%Aug-08 $6.88 0.80% $3.50 0.41% $3.38 49.1%Jul-08 $6.45 0.75% $3.01 0.35% $3.44 53.3%

* Figures in b illions

Delinquent andAll Specially Serviced Loans curren t but wit h

the Special Servicer Specially Serviced

Chart 8 Special Servicing Exposure by Property Type (source: Realpoint)

Property Type Stratification - Specially Serviced Assets

Hotel Total9.8%

Office Total14.2%

Other Total15.6%

Retail Total36.9%

Healthcare Total0.3%

Multi-family Total20.8%

Industrial Total2.3%

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

12/15

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

13/15

August 2009

Page 13 of 15

Issuance In July 2009, over 96% of CMBS delinquency by deal type was found in fusion and conduit deals. Of note by deal type is the 21% kickout loan transaction delinquencies. The 2006 and 2007 vintage transactions topped the list when delinquency is ranked by year of

issuance, accounting for over 53% of total delinquency. Both vintage years had an individualdelinquency rate for their respective outstanding balance above the overall rate of 3.14%.

Deals issued from 2005 through 2007 now contribute over 70% of total delinquency, 2.2% of all CMBS.We feel this is a result of current market conditions and aggressive underwriting, and will lead to furtherspecial servicing exposure and ultimate liquidation activity.

Deals issued in 1998 through 2001 contribute over 11% of the total delinquency, 0.35% of all CMBS.

Table 13 - Delinquency by Deal Type (source: Realpoint)

Deal Type Current Balance Loan Count % of CMBS Universe % of CMBS Delinq. % of Deal TypeFusion Total 23,330,581,302.77$ 1,993 2.848% 90.843% 3.619%Unknown Total 1,380,407,383.93$ 255 0.169% 5.375% 1.506%Conduit Total 930,296,024.65$ 215 0.114% 3.622% 1.900%Kickout Total 40,991,903.55$ 5 0.005% 0.160% 21.186%Grand Total 25,682,276,614.90$ 2,468 3.135% 100.000%

Note: Kickout Deal Type added to database in May 2008

Table 14 - Delinquency by Year of Issuance (source: Realpoint)

Year Total Year Loan Count % of CMBS Universe % of CMBS Delinq. % of Year Balance2006 Total 7,211,163,838.10$ 606 0.880% 28.078% 3.632%2007 Total 6,626,970,534.89$ 434 0.809% 25.804% 3.197%2005 Total 4,180,747,608.71$ 401 0.510% 16.279% 2.709%2004 Total 2,489,649,671.29$ 216 0.304% 9.694% 3.308%2003 Total 1,105,263,532.53$ 116 0.135% 4.304% 2.217%2001 Total 867,981,496.32$ 133 0.106% 3.380% 2.222%1998 Total 707,611,810.67$ 139 0.086% 2.755% 6.241%1999 Total 663,547,853.59$ 130 0.081% 2.584% 6.066%2000 Total 607,263,747.45$ 100 0.074% 2.365% 2.449%2002 Total 560,741,720.63$ 83 0.068% 2.183% 1.664%Top 10 To tals 25,020,941,814.18$ 2,358 3.054% 97.425%

Chart 9 - Delinquency by Year of Issuance: As % of Outstanding Vintage Balance (source: Realpoint)

CMBS Delinquency Exposure by Vintage: As % of Outstanding VintageBalance

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Vintage Year

D e l i n q u e n c y

%

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

14/15

August 2009

Page 14 of 15

Franchise Transactions The delinquency rate for Franchise transactions remains erratic on a monthly basis (as reflected in the

chart below). Delinquency grew to 14.6% in December 2008, the highest it has been over the trailing-12 months, but

fell to only 9.05% in June 2009 a low for the trailing-12 months. Franchise delinquency has averaged 12.6% over the trailing-12 months. 502 franchise loans at $269.4 million have been liquidated since January 2006 at an average severity

of 78%. This includes 76 loans at $31.5 million in 2007, 69 loans at $52.3 million in 2008, and 269loans at $102.5 million to date in 2009.

Chart 10 Franchise Deal Delinquency (source: Realpoint)

14.119% 14.394% 14.442%

13.341%

14.582% 14.147% 14.096%

9.391%

11.284%

9.324%

9.045%

13.172%

0.000%

2.000%

4.000%

6.000%

8.000%

10.000%

12.000%

14.000%

16.000%

Percentage

Aug-08 Sep-08 Oct-08 Nov-08 Dec-08 Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09Month

-

8/14/2019 RealPoint CMBS Delinquency Report July 2009

15/15

August 2009 Note:

Realpoint has been tracking monthly commercial mortgage-backed securitization delinquency trends across various categories since January 2001. This report includes monthly breakdowns of delinquency for the entire Realpoint CMBS portfolio by delinquency category (30-day, 60-day, 90+-day, foreclosure,and real estate owned) along with exposure across each of the seven primary property types (healthcare,hotels, industrial, multifamily, office, retail, and other).

Realpoint LLC

Frank A. InnauratoManaging Director267-960-6002

Robert DobilasPresident / CEO267-960-6001_________________________________________________________________________________

Copyright 2009 Realpoint LLC

The material contained herein (the Material) is being distributed in the United States by Realpoint LLC (Realpoint). Realpoint makes no representation asto its accuracy, timeliness or completeness and does not undertake to update any information or opinions contained in the Material. The Material is publishedsolely for information purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or derivative. The Material is not to beconstrued as providing investment services in any state, country or jurisdiction. From time to time, Realpoint, its affiliates and subsidiaries and/or their officersand employees may perform other services for companies mentioned in the Material. Opinions expressed herein may differ from the opinions expressed byother divisions of Realpoint, its affiliates and subsidiaries.

The Material has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of the Material andinvestments discussed may not be suitable for all investors. Investors should seek financial advice regarding the suitability of investing in any securities orfollowing any investment strategies discussed in the Material. Past performance is not indicative of future returns. Certain assumptions may have been made inpreparing the Material that has resulted in certain returns detailed herein and any changes thereto may have a material impact on any returns detailed. Norepresentation is made that any returns detailed herein will be achieved. If an investment is denominated in a currency other than the investor's currency,changes in the rates of exchange may have an adverse effect on value, price or income.

Realpoint LLC, 410 Horsham Road, Suite A., Horsham, PA 19044 (800) 299-1665