REALITIES OF INCOME PLANNING IN RETIREMENT · 2016-07-05 · 1 Gallup Poll, Allyssa Brown, May 15,...

Transcript of REALITIES OF INCOME PLANNING IN RETIREMENT · 2016-07-05 · 1 Gallup Poll, Allyssa Brown, May 15,...

TOPICS

2 Introduction

3 Managing costs of living

4 Getting organized

6 Tax matters in retirement

7 Asset diversification

9 Creating a retirement paycheck

10 Income Source 1: Retirement Resources

16 Income Source 2: Earnings and Income

17 Income Source 3: Asset and Investment Drawdown

19 Income Source 4: Legacy Assets

22 Developing the REAL income plan

REALITIES OF INCOME PLANNING IN RETIREMENTIndividuals who want to realize their vision for retirement need a comprehensive income plan. This report provides planning insights and guidance that may help you create reliable income in retirement.

Income: A Guide to Planning for Income in Retirement

Income: A Guide to Planning for Income in Retirement

2 U.S. BANCORP INVESTMENTS | U.S. BANK

Investment and Insurance products and services are:

This material is based on data obtained from sources we consider to be reliable. It is not guaranteed as to accuracy and does not purport to be complete. This information is not intended to be used as the primary basis of investment decisions. Because

of individual client requirements, it should not be construed as advice designed to meet the particular investment needs of any investor. It is not a representation by us or an offer or the solicitation of an offer to sell or buy any security. Further, a security described in this publication may not be eligible for solicitation in the states in which the client resides.

Asset allocation and diversification does not ensure a profit or protect against a loss. Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted and you may have a gain or loss when you sell. Non-qualified withdrawals are subject to all applicable federal and state income taxes, and may be subject to a 10 percent federal penalty. There is no additional tax benefit for annuity contracts purchased in an IRA or other tax-qualified plan, since these are already afforded tax-deferred status. Thus, an annuity should be purchased in an IRA or qualified plan only if the client values some of the other features of the annuity and is willing to incur any additional costs associated with the annuity to receive such benefits.

U.S. Bank, U.S. Bancorp Investments, and their representatives do not provide tax or legal advice. Each individual’s tax and financial situation is unique. You should consult your tax or legal advisor for advice and information concerning your particular situation.

Insurance guarantees are backed by the claims-paying ability of the issuing insurance company.

For U.S. Bank: U.S. Bank is not responsible for and does not guarantee the products, services or performance of U.S. Bancorp Investments.

Credit products are offered by U.S. Bank National Association and subject to normal credit approval. Deposit products are offered by U.S. Bank National Association. Member FDIC.

For U.S. Bancorp Investments: Investment products and services are available through U.S. Bancorp Investments, the marketing name for U.S. Bancorp Investments, Inc., member FINRA and SIPC, an investment advisor and a brokerage subsidiary of U.S. Bancorp and affiliate of U.S. Bank.

Insurance products are available through various affiliated non-bank insurance agencies, which are U.S. Bancorp subsidiaries. Products may not be available in all states. CA Insurance License# OE24641.

RealSteps>Retirement® is a registered trademark of U.S. Bancorp.

Not a Deposit Not FDIC Insured Not Guaranteed by the Bank

May Lose Value Not Insured by Any Federal Government Agency

2U.S. BANCORP INVESTMENTS | U.S. BANK1 Gallup Poll, Allyssa Brown, May 15, 2013.

Income: A Guide to Planning for Income in Retirement

Americans’ biggest financial concern is funding their retirement, with 61 percent saying they are worried about having enough money for it.1

One rule of thumb suggests planning for 70–80 percent of current income to fund both essential and non-essential expenses in retirement. The actual amount may vary, making it critical to review the income plan on a regular basis.

Introduction

Retirement is the ultimate financial goal for most Americans, the reward for years of hard work, planning, saving and investing. However, maximizing this phase of life depends on developing a reliable income stream during retirement. Previous generations spent fewer years in retirement and often counted on a combination of employer pension and Social Security to provide a regular

“paycheck.” Today, funding a reliable income stream is substantially more challenging, given less workforce stability and increasing longevity, with the potential for living 20 or 30 years past one’s earning years. A strong income plan includes:

Determining expenses in retirement and timing of those expenses.

Distinguishing between essential expenses for meeting daily living needs and discretionary or non-essential expenses.

Identifying potential income sources and understanding tax implications of accessing various assets.

Prioritizing assets that may need to be liquidated over time when existing income sources are not sufficient to cover expenses.

Addressing risk factors that impact retirement income, including inflation, market volatility and longevity.

Monitoring your income strategy on an annual basis and making adjustments as needed.

This paper outlines a comprehensive process for creating a plan that may provide reliable income in retirement.

Income: A Guide to Planning for Income in Retirement

3 U.S. BANCORP INVESTMENTS | U.S. BANK

Life after the earning years: Managing costs of living

To build a retirement income plan, start by assessing likely expenses in retirement. These may vary over time. Some retirees spend more in the early retirement years when they are healthier and more active. Later on, some expenses may slow as lifestyles become less ambitious, but other costs such as health care will likely increase. The following factors will probably continue to impact overall cost of living.

Housing costs: Even those who own their homes outright continue to face expenses for upkeep, taxes and insurance. Different housing arrangements may become necessary later in life.

Taxes: Tax payments are a continuing reality for most retirees.

Health care: Health-related expenses, including unexpected events and the possible need for long-term care services will continue and may increase over time. It is important to understand what Medicare does and does not cover.

Large, one-time expenses: These may include purchasing a new car, a major home renovation or supporting a loved one financially.

Market volatility: Changes in investment values early in retirement can be more difficult to overcome when money is being withdrawn from savings and investments.

Inflation: Even with a moderate annual inflation rate of 3 percent, basic cost of living expenses will double over 24 years.

1 Mercer. (2013). Workers shy from savings amid retirement health worries. This study shows 23 percent of respondents say retirement health care expenses are their biggest worry. 22 percent said saving enough for retirement is their top concern. 2 Source: Merrill Lynch. (2013). Family & retirement: The elephant in the room. U. S.: Bank of America.

Health care expenses in retirement represent the most significant financial concern for older working-age Americans (age 50-64).1

62 percent of people 50 and older say they provide support for their parents or adult children.2

RealSteps>Retirement: A Guide to Realities of Health Care in Retirement is an additional educational resource available that provides insights and guidance on the impact of health care and long-term care on retirement plans. Ask your financial professional for a copy.

4U.S. BANCORP INVESTMENTS | U.S. BANK

Expenses in retirement Some expenses in retirement are fairly predictable, like housing and transportation, while others are likely to vary over the years. Spending for personal health care rises dramatically as individuals grow older, even doubling, after age 85.4

1 HealthView Services, 2015 Retirement Health Care Costs Data Report. This figure includes dental, vision, hearing and medical expenses and other out-of-pocket expenses. 2 Fidelity Retiree Health Care Costs Estimate, 2014. 3 United States Department of Labor, Bureau of Labor Statistics, Consumer Expenditure Survey. 4 Centers for Medicare and Medicaid Services, Office of the Actuary, National Health Statistics Group. Data is for 2010.

Housing costs, utilities, home

maintenance, etc.

Apparel

Food

Health care

Transportation (auto)

Entertainment contributions,

misc.

RETIREMENT INCOME Average spending for ages 65–74 3

No expense in retirement is more unpredictable than health care.

Getting organized: Understanding expenses

Once expenses are identified, breaking the expenses into these three categories will help prioritize spending in retirement.

Essential expenses: The foundation of any income plan is sufficient funds for necessities. These are the rock-bottom costs of day-to-day life, including food, housing, transportation, utilities, health care and taxes.

Non-essential expenses: Discretionary items may include ongoing and one-time expenses. These may include: purchasing a car, a vacation, or financing a hobby, helping with a grandchild’s college tuition, etc. Gifting plans or charitable contributions also fall in this category.

Unforeseen expenses: Typically, this category includes costs related to unexpected health care events and/or long-term care. Other unanticipated expenses include helping out an elderly parent or adult child. An emergency fund or certain types of insurance can help to protect against the impact of these expenses.

It is estimated that a 65-year-old couple retiring in 2015 will need $395,000, on average, to cover overall health care expenses throughout retirement.1 Yet a survey of pre-retirees, ages 55-64, finds that 48 percent believe they will need only $50,000 to cover health care expenses in retirement.2

Income: A Guide to Planning for Income in Retirement

5 U.S. BANCORP INVESTMENTS | U.S. BANK

Getting organized: Understanding income sources

Once expense allocations are determined, the next step is to identify sources of income and understand the tax implications of where your assets are held. Typically, assets invested for retirement are placed in three types of accounts with different tax treatments: taxable or tax-preferred, tax-deferred and tax-free. Through “asset location”—placing specific assets in different types of accounts and withdrawing funds strategically—your goal is to maximize savings and investments, while minimizing taxes.

Savings accounts cash reserve

Mutual funds

Stocks

Taxable bonds

Real estate

Trust assets

Tax-exempt municipal

bonds

Roth IRA

Life insurance cash values

Health Savings Account

IRA

401(k)

403(b)

Pensions

Deferred compensation

Annuities

Tax-deferredTaxable or Tax-preferred

During Accumulation:

During Distribution:

Tax-freeAsset Location It may be most effective to hold assets subject to higher tax rates in a tax-deferred account such as an IRA. This includes fixed-income funds, hedge funds and mutual funds that typically have high annual distributions. Generally, taxable accounts should be used for lower-tax investments like index mutual funds, exchange traded funds (ETFs) and funds with low turnover rates.

For example, under current tax law, U.S. stocks that pay dividends receive more favorable tax treatment (tax-preferred) than other forms of income generated by investments, such as interest. That means you owe less tax on income derived from dividend stocks placed in a taxable account than if you placed interest-paying bonds in the same account.

TAX TREATMENT OF EARNINGS FROM VARIOUS ASSETS

TaxableTaxable or Tax-preferred

Tax-free

Retirement may be a good time to start consolidating your accounts. Taking withdrawals from a single institution is less cumbersome and monitoring assets becomes easier.

6U.S. BANCORP INVESTMENTS | U.S. BANK 6

THE MULTIFACETED TAX SYSTEM

Tax matters in retirement: Details and considerations

It’s essential to understand the role that taxes play in retirement income distribution. The level of income you have in retirement affects your tax liability, and if you meet certain income thresholds, you may face other taxes.

Consult a qualified tax professional for guidance in dealing with the complexities of current law. Some federal tax system basics:

Ordinary income tax rate: Tax brackets vary based on income, ranging from 10 percent to 39.6 percent. Sources of retirement income that are taxed at ordinary income tax rates include:

Interest from savings accounts, CDs and bonds

The portion of distributions from traditional IRAs that represent earnings and pre-tax contributions

Distributions from pre-tax workplace retirement plans, such as 401(k)s, 403(b)s, etc.

All distributions from deductible IRAs

A portion of the income from annuities

Alternative Minimum Tax (AMT): Individuals who reach certain income levels may be subject to AMT. This tax is calculated by eliminating certain deductions that typically are allowed under standard tax calculations.

Tax-preferred treatment— Long-term capital gains/ qualified dividends tax rate: A more favorable rate applies on long-term capital gains distributions and qualified dividends, generally, from U.S.-based stocks. Those in the lowest tax brackets may be able to qualify for a 0 percent tax rate on long-term capital gains and qualified dividends. For most, these gains or dividends will be taxed at a 15 percent rate. Those in the 39.6 percent tax bracket may be required to pay a 20 percent capital gains/qualified dividend tax rate. Most states also apply taxes.

3.8 percent Medicare surtax on net investment income: Married individuals filing a joint return with income above $250,000 and single filers with income of $200,000 or more may be subject to a 3.8 percent tax on net investment income. The tax can be applied to interest, dividends, capital gains, rental and royalty income, and non-qualified annuities that exceed the threshold amounts.

Unlike the working years, when taxes are generally withheld from paychecks, retirees need to develop a different strategy to cover their tax liability. Typically, this means making quarterly estimated tax payments. Note that in many states, state income taxes also apply.

Other taxes to consider when calculating retirement income needs are residential property taxes and special property assessments that can occur.

Income: A Guide to Planning for Income in Retirement

7 U.S. BANCORP INVESTMENTS | U.S. BANK

Asset diversification: Reallocating your portfolio

As you approach retirement, it’s important to reposition investment assets to align with changing financial and income goals. Your plan should mitigate effects of market fluctuation while still meeting income needs over your lifetime. How this is handled depends on the composition of your current portfolio, your appetite for risk and the overall status of your retirement funding.

In most cases, it’s wise to position a portion of your assets in a lower-risk portfolio to meet near-term needs, with an offsetting portion invested in growth strategies for longevity needs. Again, matching specific assets to various types of accounts (taxable or tax-preferred, tax-deferred, tax-free) can help reduce the impact of taxes.

REALLOCATE YOUR PORTFOLIO AS LIFE CHANGES

Balancing act Balancing investment risk, income timing, taxes and longevity is a dynamic process, and it’s wise to revisit your plan on an annual basis. A financial professional can provide guidance about repositioning your portfolio and managing the process successfully.

RISK TIMING TAXES LONGEVITY

Strategy

Creating a plan that includes some guaranteed income is particularly important if you happen to retire when the markets are down. The earlier a market downturn happens in retirement, the greater the effect on your portfolio.

8U.S. BANCORP INVESTMENTS | U.S. BANK

Cash reserve, or cash alternatives A good rule of thumb is to maintain one-to-two years of estimated income needs in a cash reserve, or cash alternatives to cover expenses that would otherwise be met by liquidating assets.

Roth Individual Retirement Account (IRA) Consider rolling 401(k) or Traditional IRA funds into a Roth IRA. Taxes are due at the time of conversion, but once converted, earnings are tax-deferred and qualified withdrawals are tax-free. Also, there are no Required Minimum Distributions. Consult your tax advisor for specifics.

Health Savings Account (HSA) HSAs can be an important tool to supplement retirement income needs, given that health care is a key expense category for most retirees, and funds for the account are sheltered from taxes.

Annuities Annuities can be a flexible tool for retirement planning, due to the various options they offer for creating reliable income. They are the only financial instruments capable of producing a guaranteed stream of income that an individual can’t outlive.

Life insurance Cash value from life insurance may provide a tax-favorable way to supplement your retirement income. Life insurance may provide a death benefit in the short- or long-term and may fund a surviving spouse’s retirement plan in case of an untimely death.

Health Savings Accounts (HSA): An HSA is a savings account funded with pre-tax dollars and earmarked to pay health care-related expenses tax-free. Funds accumulated in an HSA can continue to accrue in the account and be used to help meet health care expenses in retirement. This includes premiums for Medicare coverage and Medicare supplement insurance, as well as any other out-of-pocket medical costs.

Note that distributions can be taken from an HSA after age 65 for non-medical reasons, but taxes will be due on the distribution.

There are eligibility and contribution limits to fund an HSA account during your earnings years.

Asset diversification: Supplemental strategies

In some situations, supplementing your portfolio with new strategies helps further reduce the risk of your overall retirement plan. This is especially important if there’s risk in your overall funding level, compared with your likely longevity.

For example, by putting some money in products or vehicles that guarantee income now or in the future, you diversify your portfolio and may create reliable income sources with less risk.

INCOME SOURCES TO CONSIDER ADDING TO RETIREMENT PORTFOLIOS:

Income: A Guide to Planning for Income in Retirement

9 U.S. BANCORP INVESTMENTS | U.S. BANK

REAL income plan Creating a retirement income plan is a complex process. Pages 10–21 describe the details of U.S. Bank’s REAL retirement income approach. Our financial professionals can work with you to develop a personalized, comprehensive plan for creating your retirement paycheck.

Comprehensive income plan: Creating a retirement paycheck

An effective retirement income plan strives to identify and utilize available sources of income and assets as efficiently as possible, to potentially create a reliable retirement paycheck. The plan must also anticipate the effects of longevity and usually incorporates four broad categories of income sources. These are typically implemented in the order below:

DEVELOPING A REAL RETIREMENT INCOME PLAN

1 Collinson, C. (2014). The retirement readiness of three unique generations: Baby boomers, generation X, and millennials. US: Transamerican Center for Retirement Studies.

Retirement Resources These are the most predictable sources of income, such as Social Security, pensions, annuities and Required Minimum Distributions (RMDs).

Earnings and Income Existing investments can help fund retirement through dividends, interest, rental income, earnings from part-time work, farm payments, royalties, trusts, partnerships or S Corp (k1).

Asset and Investment Drawdown Bridge income gaps by building a tax-advantaged strategy to draw down assets such as investments, distribution from cash-value life insurance, annuities or real estate.

Legacy Assets The desire to transfer wealth to future generations or favored charities will affect an income strategy plan. Tax-advantaged gifting strategies should be considered to ensure the smooth transition of assets to beneficiaries before and after death.

Income Source 1

Income Source 2

Income Source 3

Income Source 4

58 percent of workers expect their primary source of income in retirement to be self-funded through retirement accounts or other savings and investments. Younger generations in particular say they will be less dependent on retirement sources like Social Security.1

10U.S. BANCORP INVESTMENTS | U.S. BANK

An ideal plan Your plan should aim to cover at least 80 percent, ideally 100 percent, of your essential expenses with predictable retirement resources (Source 1) such as Social Security, pension payments and RMDs. If a gap is identified, you may want to consider purchasing an income-producing annuity or segregating a specific pool of assets for systematic drawdowns over time.

Income Source 1 Retirement Resources

To fund retirement, first start by defining income sources that are predictable and certain. These income sources may include:

Social Security

Pension payments

Annuity payments

Required minimum distributions (RMDs) from workplace savings such as 401(k) and 403(b) plans and traditional IRAs

These sources should serve as the foundation of any retirement income plan and should be earmarked for essential expenses. Determining the timing and distribution amount related to these retirement benefits is an important next step. There are a number of factors to consider, and the following pages present key considerations for each income source.

PLAN FOR EXPENSES TO MEET THE ESSENTIALS AND BEYOND

Essential Expenses

Non-Essential and Unforeseen Expenses

Income Source 1

Income Source 2

Income Source 3

Income Source 4

Gifting

The risk of outliving assets in retirement has increased, given the longer life expectancies Americans now enjoy. One strategy for addressing this concern is to purchase an annuity that will provide a regular stream of income throughout the life of an individual or the lives of a couple.

Income: A Guide to Planning for Income in Retirement

11 U.S. BANCORP INVESTMENTS | U.S. BANK

62 63 64 65 66 67 68 69 70

$750 $800 $867 $933 $1,000 $1,080 $1,160 $1,240 $1,320

First eligible for Social Security

benefits

BENEFITS INCREASE 57 PERCENT FROM AGE 62, UNTIL AGE 70

Full retirement age* Age at which benefits no

longer increase

Timing of benefits. Benefit payments increase 8 percent every year that benefits are delayed, until age 70. The chart to the right shows how the benefits increase over time for an individual who qualifies for a monthly benefit of $1,000 at the “full retirement age” of 66.

Income Source 1 Retirement Resources: Social Security

Timing is everything

The decision of when to begin collecting Social Security is different for every person with a number of factors to consider. Most people qualify to begin taking Social Security benefits on their 62nd birthday but have the option to delay taking benefits as late as their 70th birthday. The main advantage of delaying the start date is that each month of delay increases the monthly benefits and can have a substantial positive impact on monthly income, often a wise choice for individuals who continue to generate income or have other resources to fund early retirement years. For individuals with limited assets or health risks, it may make sense to take Social Security benefits early.

*Assumes age 66 full retirement individual benefit is $1,000.

”Full retirement age” as defined by Social Security administration is the age at which a person becomes entitled to full retirement benefits. It currently stands at 66, however, it will continue to rise to 67 depending on birth year. Visit ssa.gov for more information.

+

Full retirement ageBirth year

66+2 months+4 months+6 months+8 months+10 months 67

1943–54195519561957195819591960

12U.S. BANCORP INVESTMENTS | U.S. BANK

DETERMINING TIMING OF BENEFITS

Factors to consider

Start benefits early or at “full retirement age”

Delay benefits

Health issues or family history could reduce life expectancy X

A high likelihood of living into your mid-80s or beyond X

Limited resources available to fund essential expenses prior to age 70 X

Other assets available to fund income needs prior to age 70 X

A primary concern is having sufficient income available for a surviving spouse for years to come

X

Recipient will continue to work and earn an income X

Superior returns (in excess of 8 percent) can be earned in other investments X

8 percent increase in Social Security benefits (after full retirement age) is likely to be superior to return on other investments

X

Income Source 1 Retirement Resources: Social Security

A variety of factors may inform the decision of when to begin collecting Social Security.

TAX DETAILS & CONSIDERATIONS

Social Security: A portion of Social Security benefits may be subject to tax for those with “provisional income” of at least $25,000 for single tax filers and $32,000 for married couples filing a joint return. Provisional income is determined by combining Adjusted Gross Income (not including Social Security), tax-free interest from municipal bonds and 50 percent of the value of Social Security benefits earned in a given year.

If you work while receiving Social Security benefits, the benefit amount will be reduced until you reach full retirement age. $1 in benefits will be deducted for each $2 earned above the annual limit.

Married couples should discuss their planned retirement ages and Social Security options. A spouse who has limited earnings or did not work outside the home can claim a spousal benefit, generally this amounts to half the benefit received by the spouse who claims a primary benefit.

A divorced individual may qualify for one-half of the ex-spouse’s benefit if they were married to that spouse for at least 10 years and are currently not re-married.

Income: A Guide to Planning for Income in Retirement

13 U.S. BANCORP INVESTMENTS | U.S. BANK

Income Source 1 Retirement Resources: Pension Plans

Strategizing pension payouts

Those Americans lucky enough to still have a pension plan will probably have to make choices about their payout options. This includes the ability to take one large lump sum payout or a defined percentage of the whole, including a choice about benefits for the surviving spouse. The larger the benefit left to the survivor, the smaller the monthly benefit when the payout begins.

Some pension plans allow the participant to roll a lump sum into an IRA in lieu of a monthly income stream. The viability of this option depends on the family circumstances and other funding sources. The decision might make sense when the income is not needed, and the assets are earmarked for the next generation.

Options for pension payments may include:

Single Life:

Provides the highest monthly payout, but does not provide any income to the surviving spouse.2

Joint and Survivor Options:

100 percent: Provides the surviving spouse the same monthly payment received by the participant.

75 percent: Provides the surviving spouse 75 percent of what the participant’s payment was during the participant’s life.

50 percent: Provides the surviving spouse one-half of the benefit the participant received during life.

1 Economic Policy Institute, “Retirement Inequality Chartbook,” September 2013. 2 Note, certain pension options may require spousal approval at time of election.

Between 1990 and 2010, the share of Americans who received traditional pension plans fell by nearly half, from 42 to 22 percent.1

14U.S. BANCORP INVESTMENTS | U.S. BANK

Stabilizing income through an annuity Annuities, which are insurance products, are the only financial instruments capable of producing a guaranteed stream of income that an individual can’t outlive. Annuities are often used to supplement retirement income by helping ensure a minimum level of reliable income to meet essential expenses or protect against market volatility or health care events.

A single lump sum and/or a series of payments can fund an annuity. In return, the insurance company makes scheduled payments to you. The payment amount depends on the product, contract terms, and factors such as age, variable or fixed payment, and single or joint income needs.

Consider an annuity for these needs:

Income Source 1 Retirement Resources: Annuities

For creating reliable income in lieu of a defined benefit pension plan, consider diversifying your assets by converting some retirement savings into an annuity. This provides a reliable future income stream that can’t be outlived, reducing the overall risk of your retirement assets.

Essential expenses: To provide supplemental, guaranteed income.

Longevity insurance: To protect you and/or your spouse from outliving assets by using a deferred-income annuity.

Income gap: To bridge an income gap if you retire earlier than the age at which you plan to initiate Social Security payments.

Health event: To cover unexpected health care costs.

Market volatility: To maintain a consistent income level or provide a minimum death benefit by utilizing market volatility protection features.

Income: A Guide to Planning for Income in Retirement

15 U.S. BANCORP INVESTMENTS | U.S. BANK

Managing RMD drawdowns

Required minimum distributions (RMDs) affect those who hold money in traditional IRAs or workplace savings plans, such as 401(k), 403(b) and other qualified accounts. After turning 70½, owners must withdraw a portion of the account annually, calculated as a percentage of the account’s value, based on life expectancy factors established by the Internal Revenue Service. Failure to comply can result in a significant penalty.

The amount withdrawn as an RMD becomes fully taxable income. For some, these withdrawals form an additional income stream. However, in many cases, the money isn’t needed to cover current expenses. If you don’t need your RMDs for income, you may want to consider tax-advantaged strategies to benefit charities or future generations. (See more information under legacy planning.)

In some circumstances, it may make sense to take distributions from IRAs and workplace plans, prior to age 70½. For instance, taking distributions may make it feasible to delay initiating Social Security benefits, resulting in greater monthly income later in retirement. In addition, taking distributions earlier could minimize the RMDs at age 70½, potentially resulting in lower taxes later. These are factors to consider when evaluating income sources in retirement.

For clients who may be looking to defer RMDs to a future date, Qualifying Longevity Annuity Contracts (QLACs) may be an option to consider. QLACs allow you to use 25 percent of your IRA, or $125,000, whichever is less, to fund a QLAC. The dollar amount is excluded from the RMD calculation, which could potentially lower your taxes.

Income Source 1 Retirement Resources: RMDs

The IRS requires you to begin withdrawing money from most types of retirement accounts at age 70½, regardless of income needs and possible negative tax consequences. Seek the help of a financial professional to create an appropriate plan.

If an account owner fails to withdraw a RMD, fails to withdraw the full amount of the RMD, or fails to withdraw the RMD by the applicable deadline, the amount not withdrawn is taxed at an additional 50 percent.

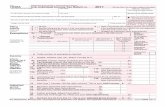

The account owner should file Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, with his or her federal tax return for the year in which the full amount of the RMD was not taken.

16U.S. BANCORP INVESTMENTS | U.S. BANK

Income Source 2 Earnings and Income

Tapping other sources of income After utilizing available retirement resources for your retirement needs, the next source of income that should be used are earnings and income. These earnings may include interest from bonds, dividends from stocks, capital gain distributions from mutual funds, as well as income from part-time work, a business or rental properties.

Ideally, you should access such income for retirement only after your retirement resources, such as social security, pensions, RMDs, and annuities, are exhausted. However, if income from these sources isn’t needed to meet basic expenses, the money can be retained, reinvested or used to fund other priorities.

Keep in mind that earnings from taxable accounts may increase the possibility of reaching a higher income threshold, resulting in more significant tax liability. The earnings from tax-deferred accounts can be reinvested without triggering current tax implications.

As a result, you typically want to place income-producing assets in retirement accounts, such as 401(k)s or IRAs, and place lower-tax investments, such as index funds and exchange traded funds (ETFs), in taxable accounts.

As discussed on page 6, the taxes you owe on investment earnings can vary, depending on the type of asset held or the source of earnings. Some income is subject to tax at ordinary income tax rates, while other income is subject to the more favorable long-term capital gains/qualified dividends rate.

Income: A Guide to Planning for Income in Retirement

17 U.S. BANCORP INVESTMENTS | U.S. BANK

Managing taxes An individual in the 33 percent tax bracket who needs $80,000 of after-tax income would require a distribution of $120,000 before federal income taxes. If, instead, assets can be liquidated from taxable accounts where only capital gains taxes would be due at the 15 percent level, only $94,000 in distributions would be required to net $80,000 on an after-tax basis.

Income Source 3 Asset and Investment Drawdown

Bridging income gaps with tax-advantaged liquidation When other income sources are exhausted, and additional income is needed for retirement expenses, it may be necessary to liquidate assets. The goal is to meet income needs, while keeping the drawdown as tax efficient as possible. As discussed on page 5, assets fall into three categories in terms of tax treatment during accumulation: taxable or tax-preferred, tax-deferred and tax-free. Typically, this is the recommended order for making drawdowns, and with each category, there are different factors to consider.

Taxable accounts

Generally, assets taken from taxable accounts have been taxed already, or if taxes are due, they’ll typically be taxed at the more favorable long-term capital gains rate. Ideally, it’s best to have the flexibility to sell assets with a higher cost basis—the price originally paid for the asset—since this will lead to a smaller capital gain and reduced tax. Another tactic is to offset capital gains by selling assets that may result in a capital loss.

Taxable accounts should include a cash reserve allocation (short-term, cash equivalents), which provides a ready source of funds for near-term expenses, typically 1–2 years of expenses. Having adequate cash reserves during down periods in the market gives investments time to recover ground, instead of forcing a sale when their value is depressed.

Requires $94,000 withdrawal

Requires $120,000 withdrawal

After-tax income needed:

$80,000

Option A: Liquidate assets subject to ordinary income tax at 33 percent

Option B: Liquidate assets subject to capital gains taxes at 15 percent

The size of a cash reserve may vary, but try to maintain one-to-two years of income needs in cash or cash alternatives to cover expenses that would otherwise be met by liquidating assets.

18U.S. BANCORP INVESTMENTS | U.S. BANK

Tax-deferred accounts Tax-deferred accounts (IRA, 401(k)) are taxable at the time the assets are withdrawn. When withdrawn, the amount of the withdrawal is taxed at ordinary income tax rates. Typically, these assets are accessed after taxable accounts to allow the tax deferral advantage to continue and delay paying taxes at the ordinary income tax rates.

Possible exceptions are when the individual anticipates the ordinary income tax bracket to be similar to the capital gain tax rate, or when individuals anticipate being in a higher tax bracket in the future. In these cases, it may make sense to take distributions from tax-deferred accounts prior to taxable accounts. Keep in mind that assets held in workplace plans and traditional IRAs are subject to required minimum distribution rules after reaching age 70½.

Another consideration relates to legacy planning. It may be logical to spend down tax-deferred accounts first, in order to preserve more funds in taxable and tax-free accounts that can be passed on to heirs in a more tax-advantaged way. (See page 19 for additional legacy planning information.)

Tax-free accounts Usually, the last assets to be tapped are tax-free accounts such as Roth IRAs, HSAs and certain withdrawals and loans from cash-value life insurance. Tax-free assets provide greater flexibility throughout retirement, allowing individuals to “top off” income needs by utilizing tax-free assets while avoiding crossing the threshold into a higher tax bracket.

Income Source 3 Asset and Investment Drawdown

TAX DETAILS AND CONSIDERATIONS

Phase out of itemized deductions or exemptions: This is another factor for high-income taxpayers to consider when assessing income tax. Adjusted gross income (AGI) thresholds in 2016 are $311,300 for married couples and $259,400 for single tax filers. Itemized deductions are reduced by 3 percent of the income level above those thresholds, while personal exemptions are reduced by 2 percent for each $2,500 above the threshold amounts.

Health Savings Accounts (HSAs): Although HSAs are tax-free, there are limitations on how the funds can be utilized. See page 8 for more information about HSAs.

Income: A Guide to Planning for Income in Retirement

19 U.S. BANCORP INVESTMENTS | U.S. BANK

Income Source 4 Legacy Assets

Managing personal legacy wishes Many individuals expect to transfer a portion of their wealth to future generations or favored charities. It’s important to spell out a clear direction about your personal legacy wishes. These choices can affect tax planning strategies in retirement, as well as impact retirement income. Similarly, an untimely death could have a dramatic effect on an otherwise sound plan.

When developing your estate plan give careful consideration to these key questions:

Who are you responsible for financially?

Who do you want to benefit from your assets?

Are there minor children in need of a guardian?

When and how do you want your heirs to receive the assets?

What are the potential estate costs, including estate taxes, probate costs, and administrative costs?

TAX DETAILS & CONSIDERATIONS

Exemption thresholds: The federal estate tax exemption has increased dramatically in recent years, to more than $5 million for an individual. Portability laws effectively make the exemption approximately $11 million for a married couple.

Some states impose an inheritance or estate tax, which is often lower than the federal exemptions.

89 percent of families are happier and more satisfied when parents include heirs in the planning.1

1UBS Investor Watch, “Begin before the end,” 2014.

20U.S. BANCORP INVESTMENTS | U.S. BANK

Gifting assets during your lifetime

In some situations, it may be a good idea to make gifts during one’s lifetime in order to decrease the size of an estate and minimize estate taxes after death. Decisions about when to make a gift depend on the federal estate exemption threshold and state estate tax laws.

If you’d like to benefit a charity and don’t need your RMDs for retirement income, a qualified charitable distribution from your IRA may make sense. Charitably inclined taxpayers who are 70½ and older may take a distribution of up to $100,000 from their IRA for charitable giving purposes. For this qualified charitable contribution rule to apply, the IRA distribution must be transferred directly from the IRA account to the qualified charity, by the IRA trustee or custodian, without passing through the account holder’s hands. This type of distribution can satisfy the taxpayer’s RMD requirement; however, such a distribution is not subject to income tax and would not be eligible for an income tax deduction for charitable giving purposes.

Every person’s situation is unique—it’s important to consult with your tax and legal advisor before making decisions.

Income Source 4 Legacy Assets

1 Accenture. The “Greater” Wealth Transfer: Capitalizing on the Intergenerational Shift in Wealth. 2012. 2 Women to Benefit From $22 Trillion in Wealth Transfer by 2020. www.thestreet.com.

Over the next 30 to 40 years, $30 trillion in assets is expected to pass from Boomers to their heirs in North America.1

By 2020, approximately $22 trillion in assets are expected to shift to women, based on trends in workforce advancement, and statistics that show women outlive spouses or partners, inheriting the largest share of family wealth.2

Income: A Guide to Planning for Income in Retirement

21 U.S. BANCORP INVESTMENTS | U.S. BANK

Income Source 4 Legacy assets

Transferring assets upon death When someone dies and passes on an asset held in a taxable account, the price originally paid for the investment, known as the

“cost basis,” is adjusted to its value at the time of death. This can significantly lower the taxes the beneficiary pays when the inherited asset is later sold, known as a “step-up in cost basis.”

By contrast, beneficiaries who receive gifted assets during the grantor’s lifetime won’t benefit from a step-up in cost basis after the grantor’s death. If the estate isn’t big enough to trigger a state or federal estate tax, there won’t be estate tax savings, and taxes paid by the beneficiary on the sale of an asset will be based on the original cost basis.

For some retirees, income needs are met from sources other than IRAs, allowing some or all IRA dollars to be earmarked for their beneficiaries. Unfortunately, RMDs decrease the IRA balance, leaving less to pass onto beneficiaries. Additionally, IRA balances are also subject to taxes upon inheritance, since all untaxed contributions and gains are taxed as ordinary income.

To maximize your IRA gift, consider purchasing a life insurance policy with your RMDs. After taxes are paid on the RMD withdrawal, use net proceeds to pay annual premiums on the largest possible guaranteed death benefit life insurance policy. If you start the process before you reach the age when RMDs are required, you may create a larger legacy since you’ll be younger, perhaps healthier, and insurance benefits are dependent on health at the time of underwriting. It’s important to name your beneficiary for both the life insurance policy and the IRA. The life insurance death benefit is paid to your beneficiary without tax liability.

Always discuss the potential tax impact with a tax advisor or estate attorney before finalizing plans.

Life insurance is a strategy that can protect survivors when someone dies. When structured as a tax-free exclusion, the benefits can be used to replace lost income, pay off remaining debt or fund an education savings plan for children and grandchildren.

Another strategy for passing on wealth is a “stretch IRA.” Annual distributions of an inherited IRA are based on the beneficiaries’ own life expectancies, instead of the grantors. That way, the tax-deferral benefits of the IRA can be stretched well beyond the life of the original account owner.

22U.S. BANCORP INVESTMENTS | U.S. BANK

Confidence and clarity: Developing the REAL income plan

Given the many challenges today’s retirees face, including unpredictable markets, changing tax laws and longer life expectancies, it’s wise to put a personal retirement income plan in place and review it annually. This plan should provide clarity about funding various expenses in retirement, the impact of taxes and protection against risks that could derail your expectations.

Utilizing U.S. Bank’s REAL income process, your financial professional will work closely with you to develop a comprehensive retirement income plan designed specifically for your needs. We take a holistic approach, matching expense needs with income sources in a tax-efficient manner, while continually adjusting for risk, and guiding you through the timing and order in which you access various sources of income. Developing a REAL retirement income plan is an essential part of our comprehensive approach designed to help bring clarity and confidence to your retirement.

OUR REAL APPROACH TO DEVELOPING YOUR RETIREMENT INCOME PLAN

Work one-on-one with a dedicated Financial Advisor.

For assistance with retirement planning, contact your U.S. Bancorp Investments Financial Advisor.

If you don’t currently have a Financial Advisor, talk to your U.S. Bank Relationship Manager or visit www.usbank.com/investments-wealth-management to find an advisor in your area.

R AE LRetirement resources The foundation for meeting basic expenses in retirement.

Assets that can be liquidated to supplement income needs.

Earnings and income from investments and other assets and part-time work.

Legacy assets designated for future generations and favorite charities.

RealSteps>Retirement educational materials and resources are available to keep you up-to-date on issues that affect your retirement.

Topics that may be of interest:

Social Security

Long-term Care Insurance

Medicare

Inherited Retirement Accounts

Navigating the Financial Aspects of Losing a Spouse

Estate Planning

Retirement Realities of Health Care

Retirement Realities for Women

Required Minimum Distributions (RMDs)

Taxes in Retirement

USBI-LIT-30279 (06/16)

RealSteps>Retirement® is a comprehensive retirement planning process designed to help our clients navigate the complexities of retirement. Through our RealSteps> approach, we seek to bring clarity and confidence to retirement planning, helping you move closer to your goals—step-by-step.

Real Understanding® Your plan starts with gathering information, identifying goals and concerns, and uncovering gaps and challenges.

Real AnswersTM Together we build a comprehensive financial plan for you, based on strategies around helping to generate cash flow, striving to grow and protect assets, and establish a legacy.

Real Progress® Once your plan is in place, we continue to work with you, maintaining its dynamism to help keep pace with life’s changes.