Rate Structure Design: Setting Rates for a Pay-As-You ... · Rate Structure Design Setting Rates...

Transcript of Rate Structure Design: Setting Rates for a Pay-As-You ... · Rate Structure Design Setting Rates...

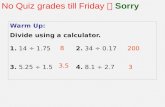

United States Solid Waste and EPA530-R-99-006Environmental Protection Emergency Response January 1999Agency (5305W) www.epa.gov/payt

1EPA Rate Structure Design

Setting Rates for aPay-As-You-Throw Program

PPaayy--AAss--YYoouu--TThhrroowwPPrroodduuccttss aanndd TToooollss

EPA has developed a series of products that can help you learnmore about PAYT and the rate-setting process:

Pay-As-You-Throw: Lessons Learned About Unit Pricing, a complete guide to PAYT.

Pay-As-You-Throw SuccessStories, a collection of communitytestimonials.

The Pay-As-You-Throw Tool Kit,which includes guidebooks, aworkbook, software, and a videotape to help communitiesimplement PAYT.

A series of fact sheets for differentstakeholders is also available. To geta copy of any of these products, call

the EPA Pay-As You-ThrowHelpline toll free at 1-888-EPA-PAYT, or find themonline atwwwwww..eeppaa..ggoovv//ppaayytt..

2 Printed on paper that contains at least 20 percent postconsumer fiber.

cover4.qxd 2/9/99 11:43 AM Page 1

Rate Structure DesignSetting Rates for a

Pay-As-You-Throw Program

Prepared by

Janice L. Canterbury and Gordon Hui

U.S. EPA Office of Solid Waste

Acknowledgments

Paul Baily

Sharon Dickerson

George Garland

John Gibson

Angie Leith

Paul Ligon

Terry Martin

Jim Morris

Ellen Ryan

Pat Vieira

rsdfinalmock.qxd 2/9/99 11:27 AM Page 1

1

Introduction ............................................................................................................................................3

I. Maximizing the Power of Economic Incentives to Achieve Municipal Solid Waste (MSW) Goals .......5

Benefits of Using Economic Incentives and Price Responsiveness .......................................................5

Establishing Community MSW Goals ................................................................................................6

Basic Methods of Rate Structure Design .............................................................................................6

Common Pricing Systems for Pay-As-You-Throw (PAYT) ..................................................................7

II. First Method of Setting PAYT Rates: Drawing From Comparable Communities ...............................9

III. Second Method of Setting PAYT Rates: Using the Six-Step Rate Structure Design (RSD) Process...12

1. Forecast Residential MSW Amounts.............................................................................................14

2. Determine the Types of MSW Services To Be Provided ................................................................16

3. Estimate Net Costs of MSW.........................................................................................................17

4. Determine PAYT Revenues and MSW Program Cost Coverage ...................................................19

5. Calculate PAYT Rates ...................................................................................................................19

6. Adjust MSW Services and PAYT Rate Structure...........................................................................24

IV. Refinements in Setting PAYT Rates .................................................................................................25

Direct and Indirect Costs ..................................................................................................................25

Other Factors to Consider in Setting PAYT Rates.............................................................................27

Case Studies..............................................................................................................................................28

Glossary ....................................................................................................................................................34

Contents

rsdfinalmock.qxd 2/9/99 11:27 AM Page 1

3

Overview

The purpose of this booklet is to provide community planners and officials with an overview of twobasic methods for setting rates within a Pay-As-You-Throw (PAYT) program. The booklet introducesand explains both conceptual and practical considerations for setting PAYT rates. It draws largelyfrom the experience of many PAYT communities that are satisfied with their approach to rate struc-

ture design. This booklet does not provide a formula or recipe for rate setting but, instead, discusses the keysteps and points to consider as you develop a rate structure that can best support your own community’sgoals.

What Is PAYT? PAYT is an economic incentive that encourages citizens to reduce waste. Unlike traditional municipal

solid waste (MSW) management systems, where residents pay for waste services through taxes or a flat fee,under PAYT systems, residents are charged for MSW services based on the amount of trash they discard.More than 4,000 communities across the country have implemented PAYT programs. These programsrepresent a concrete step that local officials can take to make their MSW management efforts more eco-nomically and environmentally sustainable.

What Are the 3-E’ Benefits of PAYT? PAYT offers three key benefits that can help communities move toward greater sustainability:

• Environmental Sustainability. PAYT helps protect the environment. Charging residents a fee for eachbag or can of trash generated gives them an incentive to discard less waste. The typical result is a signif-icant increase in waste prevention and recycling.

• Economic Sustainability. PAYT is economically viable for a broad range of communities. In fact, mostcommunities considering PAYT focus first on the economics. Well-designed programs enable commu-nities to generate the revenues they need to cover MSW program costs.

• Equity. PAYT is widely seen as a more equitable arrangement. Under PAYT, community residents whothrow away less pay less.

Introduction

‘

rsdfinalmock.qxd 2/9/99 11:28 AM Page 3

4

What Is Rate Structure Design?Rate structure design (RSD) is determining the price you charge per unit of solid waste set out for col-

lection, processing, and/or disposal. All decisions about your program—from choosing a container type tomaximizing resident participation—eventually feed into your rate structure. An effective rate structureshould generate the revenues needed to cover the costs of service. By providing an economic incentive forresidents to reduce their waste, an effective rate structure can also reduce those costs.

This booklet provides RSD information from a national perspective. It is important to remember thatthere are no ‘cookie cutters’ for PAYT; no two MSW programs share the same bottom line. Communitieswith successful PAYT programs base the fees they charge on their own unique goals and circumstances.This is one reason why PAYT rates vary widely among programs. The tools and information in this book-let will help you design a PAYT rate structure that works for your community.

This booklet also provides a collection of rate-setting success stories from five communities. These testi-monials are presented in the words of the officials who developed the programs. They offer real-worldexamples of how different communities have approached the challenge of arriving at PAYT rates that areconsistent with their own community’s goals.

iinn

ttrr

oodd

uucc

ttii

oonn

rsdfinalmock.qxd 2/9/99 11:28 AM Page 4

5

Maximizing the Power of Economic Incentivesto Achieve MSW Goals

II

Traditionally, communities have raised the rev-enues to cover MSW program costs in waysthat are entirely disconnected from the amountof MSW services used by residents in their

jurisdictions. Most U.S. communities, for example,charge for MSW services by either levying a proper-ty tax or billing all residents an equal amount.Residents in these communities usually lack infor-mation on the costs of the MSW services they use.As a result, citizens often act as if MSW services arefree. No matter how much or how little these individuals use the services, they incur no financialconsequence and reap no financial benefit. Peopletypically respond to (apparently) free services byoverusing them. In most communities, this resultsin unnecessarily large amounts of garbage withexcessive costs for which the local citizens mustthen pay.

In contrast, PAYT introduces price incentives,based on market values, into individuals’ decisions,which then collectively determine a community’spattern of generation, collection, processing, anddisposal of MSW. It does this by pricing MSW pro-gram services in a way that reflects the resources(e.g., labor, equipment, fuel, and land) needed to

dispose of household materials that are no longeruseful—regardless of whether they were purchased(e.g., leftover food, discarded packaging, or brokenproducts) or grown (e.g., grass clippings and treetrimmings).

This price signal gives residents information todecide on the actions they should take to set outless trash and more recyclables. Pricing MSW ser-vices also provides individuals with the opportunityto take actions that can make a financial difference.Both aspects of price—the information it providesand the opportunity it provides residents to reducetheir MSW service expenses—cause individuals inPAYT communities to conserve on MSW servicesjust as they conserve on any other service or prod-uct that has a price. PAYT provides a continuingmotivation to residents to reduce their expenses forMSW services by managing their waste materials ina more environmentally sustainable fashion.

Many PAYT communities have demonstratedthe power of economic incentives; they have sharplylowered the amounts of trash they dispose of andalso significantly increased recycling rates. Price signals can steer residents to engage in a variety ofwaste reduction activities. Residents, for example,

Benefits of Using Economic Incentives and Price Responsiveness

The power of PAYT to reduce waste is contained in the rate structure of a program. The process ofdesigning a rate structure, therefore, is critical in maximizing this power. This section explains howPAYT’s economic power works and provides an overview of the two basic methods for designing a ratestructure. This section also helps you choose a pricing system for your PAYT program—a key step in

the rate structure design (RSD) process.

rsdfinalmock.qxd 2/9/99 11:28 AM Page 5

might be motivated to reduce the amount ofexcess packaging of products they buy, reuse prod-ucts or packaging materials, share magazine sub-scriptions, donate used clothing or furniture tocharities, recycle more materials, and compost andgrasscycle organics.

Under PAYT, all of these waste reduction activ-ities can provide an economic advantage to the resident. In serving as a continuing reminder toreduce waste, PAYT serves as a powerful educa-tional tool supplementing the efforts of MSWplanners, recycling coordinators, and environmen-tal organizations striving to enhance waste reduc-tion activities within a community.

Growing numbers of communities are turningto PAYT and thereby shifting toward managingMSW services as they would any other utility. Theaggregate result is a significant reduction in waste.Collectively, PAYT programs are succeeding inaligning millions of citizens’ efforts to conservetheir own financial resources with the overall goalof conserving the nation’s natural resources.

Establishing Community MSW Goals

An effective RSD aligns the power of economic incentives with a community’sspecific MSW goals. It is essential, therefore,to clearly define those goals in advance of

implementing PAYT. Clear goals can help youdetermine your approach to the RSD process; yourpricing system, container types, and billing system;your public education techniques; and other keyaspects of your PAYT program.

Examples of MSW goals in PAYT communities include:

• Reducing MSW amounts.

• Increasing recycling rates.

• Increasing composting rates.

• Reducing the total cost of the MSW program.

• Increasing equity among citizens.

• Generating revenues to cover MSW costs.

Basic Methods of Rate StructureDesign

Once you establish your community’s MSWgoals, the next step in implementing PAYT isto choose a pricing system (see pages 7-8)and establish the rates. As PAYT programs

have spread across the country, communities haveacquired valuable experience about determining anappropriate price to charge per container. Plannersuse a wide variety of methods to arrive at a price.The method you choose will depend on yourcommunity’s goals and resources and the size andthe complexity of your MSW program.

This booklet describes two general approachesthat encompass most of the methods used: usingdata from comparable communities, and buildingfrom your own community’s data using a six-stepprocess. These approaches to RSD are described indetail in Sections II and III, respectively.

In calculating an appropriate unit price fortheir program, some municipalities conduct an in-depth analysis of costs. Performing this detailedlevel of analysis requires a greater amount of staffexpertise. Some communities use accountantsskilled in utility rate setting for this work. Formore information about initiating a comprehen-sive cost analysis for the RSD process, see SectionIV.

6

ssee

cctt

iioo

nn

II

rsdfinalmock.qxd 2/9/99 11:28 AM Page 6

Advantages

• Provides a strong waste reduction incentive.Since residents must pay for the collection ofeach bag they place at the curb, they have astrong incentive to reduce waste and increaserecycling and composting. (It should be notedthat each of these PAYT pricing systems willlikely provide a waste reduction incentive, butproportional pricing tends to give the strongestrelative price signal for citizens to reduce waste.)

• Potentially lowers MSW program costs and issimple to manage. Residents typically purchasebags directly from the municipality or fromlocal retail outlets. Compared with options thatrequire a billing mechanism, this system canresult in lower administrative costs.

Disadvantages

• Not a cost-based pricing system. Most costs forMSW services (e.g., costs of labor, equipment,and fuel associated with collection) are directlybuilt into a community’s overall MSW systemrather than the per container costs tied tochanges in quantities of trash discarded.Proportional rates do not reflect the cost struc-ture of most MSW programs.

• Potential revenue uncertainty. Since propor-tional pricing links all revenues to residents’trash set outs, a proportional system exposes allrevenues to the uncertainty of residents’responses to the introduction of price signals.This can lead to significant over- or under-recovery of needed MSW revenues. In addition,for bag programs, residents might buy and storemany bags at once to use them over time. Thissurplus buying may create revenue fluctuationsfor the MSW agency.

7

Common Pricing Systems for Pay-As-You-Throw

Each of the two methods of RSD are compatible with the following commonly used pricing systems(or combinations of systems) that have been successfully implemented in communities across thecountry.

Communities commonly choose among three basic types of PAYT pricing systems: proportional, vari-able, or multi-tiered, or a combination of these. Each system has its own advantages and disadvantages.One pricing system, for example, offers greater revenue stability while another creates a stronger wastereduction incentive to residents.

To decide which pricing system is best for your community, consider your community’s MSW pro-gram goals (e.g., increasing recycling or keeping administrative costs low). After familiarizing yourself withthe tradeoffs associated with each price system, determine which is most likely to meet your goals.

ProportionalProportional systems create the most direct relationship between trash amounts and price. Residents

are charged the same amount of money for each unit of waste they set out for collection (e.g., $1.50 foreach 30-gallon bag). The price is based upon the number of bags, tags, or stickers (usually sold at localretail stores or municipal offices) a resident uses.

ssee

cctt

iioo

nn

II

rsdfinalmock.qxd 2/9/99 11:28 AM Page 7

Advantage

• Increased control over the waste reductionincentive. MSW authorities can charge aprice for additional containers that is higherthan the subscription-level price if their goalis to create a strong incentive to reduce andrecycle. Some MSW departments, however,are concerned that residents might disposeof their waste in undesirable ways if they feelthe pricing system is unfair. To avoid this,additional containers can be charged at alower price than the subscription-level price.

Disadvantage

• Potentially higher costs. Communities mustoffer residents a choice of subscription levels,provide them with containers in varyingsizes, and bill accordingly. Haulers may needto count set outs during collection. As aresult, these systems might be more expen-sive to implement and administer (especiallyduring the startup phase).

Variable RateVariable rate pricing means charging different amounts per unit of garbage. Residents subscribe

to one of several different container size options (typically, these are 32- to 64-gallon sizes, althoughthey can range from 10 to 96 gallons in capacity). The community bills residents based on theirsubscription level. For the garbage that residents discard above their subscription level, they mustpay an additional fee.

Under a variable rate system, the price charged for subsequent containers may increase ordecrease, depending on the community’s PAYT program goals. A household that pays $1.50 perweek for a 32-gallon can subscription level, for example, might be charged either $1.00 or $2.00 foreach additional 32-gallon can it sets out in weekly collections.

In addition, container sizes used for set outs above the subscription level can be varied. Somecommunities offer only one container size for additional set outs. Others ask residents to use con-tainers that are larger or smaller than their subscription-level container size. Residents pay the feefor extra garbage by purchasing specially marked or colored bags (or tags/stickers that can be affixedto the bags), or the trash collectors can count the additional set outs at the time of collection andbill residents accordingly.

Two-Tiered or Multi-TieredTwo-tiered or multi-tiered systems help communities achieve revenue stability. Similar to the

billing systems used by telephone and water utilities, residents subscribe to a base level of service,for which they pay a flat fee. These ‘first-tier’ fees can be assessed through local taxes or through amonthly or quarterly charge, often included in a utility or other municipal bill. These fees can beused to cover the fixed portion of a community’s solid waste program costs (e.g., accounting, per-sonnel, purchasing, and executive oversight). Residents then pay a ‘second-tier’ fee based on theamount of waste they set out. Second-tier fees can be either variable rate or proportional. These feesare often used to cover variable costs (e.g., collection, transport, and disposal).

Advantage

• Provides revenue stability. Multi-tiered systems allow communities to ensure that the program’s fixed costs will be covered, nomatter how much residents reduce waste andincrease recycling (and thereby decreasePAYT revenues).

Disadvantage

• Potentially generates a lower waste reduc-tion incentive. The total cost of trash servicesmight not be apparent to residents when partof the program cost (first-tier fee) is chargedat a flat rate or hidden in taxes. This maylessen the incentive for residents to reduceand recycle.

ssee

cctt

iioo

nn

II

8

rsdfinalmock.qxd 2/9/99 11:28 AM Page 8

9

some communities start the rate structure design (RSD) process by examining programs in success-ful PAYT cities or towns with similar MSW programs, services, and/or demographic profiles. Inthis case, it may be particularly useful to look at communities with comparable disposal costs andtipping fees, complementary programs, and pickup frequencies. After learning what size containers

these communities use and the price they charge for each, you can adjust your rates to fit your com-munity’s goals. You also might simply use other communities’ rates as a starting point for your own,more extensive calculations (see Section III).

The map on pages 10-11 offers a sample of PAYT rate structures across the country in 1998. Thecommunities shown have implemented many different program variations, from variable rate systemsusing a combination of bags and cans to proportional systems based on the sale of tags or stickers. Allof these communities have set rates that allow them to meet their unique program goals. Use this mapto learn more about rates and PAYT program variations in use today. (For a more comprehensivematrix of PAYT communities, check EPA’s Web site at <www.epa.gov/payt>.)

Starting with rates used by comparable communities might initially be the simplest approach toRSD. Eventually, though, you might need to revise your community’s rates to more reliably covercosts, more effectively encourage waste reduction, or more vigorously achieve other community goals.

First Method of Setting PAYT RatesDrawing From Comparable Communities

IIII

rsdfinalmock.qxd 2/9/99 11:29 AM Page 9

10

NNuummbbeerr ooff ccoommmmuunniittiieess wwiitthh PPAAYYTT

AAuubbuurrnn,, WWAA

Population: 3366,,000000Start Date: 11996688Price per Container:$$88..8877 per month for one 30-gal-lon can per week; oorr $$1199..6600 permonth for one 60-gallon can perweek

PPiittttssbbuurrgg,, CCAA

Population: 4488,,000000Start Date: pprree--11999900Price per Container:$$1188 per month for one 32-gallon bag per week;oorr $$2211 per month forone 96-gallon can perweek

IImmppeerriiaall ,, NNEE

Population: 22,,000000Start Date: 11999922Price per Container:$$22..0000 per 30-gallonbag; $$66..0000 per 90-gallon can

PPllaannoo,, TTXX

Population: 112299,,000000Start Date: 11999911Price per Container:$$1111..1155 per month for one95-gallon can;$$1122..5500 per month for eachadditional 95-gallon can

SStt.. CClloouudd,, MMNN

Population: 4499,,000000Start Date: 11999911Price per Container:$$22..0000 per 32-gallon bag

PPeennddlleettoonn,, OORR

Population: 1155,,000000Start Date: 11993355Price per Container:$$1122..3355 per month for one32-gallon bag per week;oorr $$2255 per month for one 90-gallon can per week

AAnnttiiggoo,, WWII

Population: 88,,000000Start Date: 11999900Price per Container:$$11..5500 per sticker (30 gallons)

RR AA TT EE SS TT RR UU CC TT UU RR EE DD EE SS II

GGlleennddaallee,, CCAA

Population: 118800,,000000Start Date: 11999900Price per Container:$$66..4455 per month for one64-gallon can per week; oorr$$1100..1100 per month for one100-gallon can per week

1111--2255

00

11--1100

2266--5500

5511--1100

550000++

110011--550000

rsdfinalmock.qxd 2/9/99 11:29 AM Page 10

OOccoonneeee CCoouunnttyy,, GGAA

Population: 2255,,000000Start Date: 11999944Price per Container:$$11..5500 per 32-gallon bag

AAbbeerrddeeeenn,, MMDD

Population: 1133,,000000Start Date: 11999933Price per Container:4400¢¢ per sticker (20gallons); 8800¢¢ persticker (32 gallons)

WWiillmmiinnggttoonn,, NNCC

Population: 6622,,000000Start Date: 11999922Price per Container:$$1122..1100 per month forone 40-gallon can perweek; oorr $$1155..1100 permonth for one 90-galloncan per week

BBoorroouugghh ooff WWooooddssttoowwnn,,NNJJ

Population: 33,,000000Start Date: 11999922Price per Container:9900¢¢ per 15-gallon bag;$$11..8800 per 30-gallon bag

SSttoonniinnggttoonn,, CCTT

Population: 11,,000000Price per Container:8855¢¢ per 20-gallonbag; $$11..5500 per 34-gallon bag

WWoorrcceesstteerr,, MMAA

Population: 117700,,000000Start Date: 11999922Price per Container:2255¢¢ per 15-gallonbag; 5500¢¢ per 30-gallon bag

FFrryyeebbuurrgg,, MMEE

Population: 33,,550000Start Date: 11999933Price per Container:$$11..0000 per sticker(30 lb. maximum)

UUttiiccaa,, NNYY

Population: 6699,,000000Start Date: 11998899Price per Container:8855¢¢ per 16-gallon bag;$$11..4400 per 32-gallonbag

LLaannssiinngg,, MMII

Population: 113300,,000000Start Date: 11997766Price per Container:$$11..5500 per 30-gallonbag

AAuurroorraa,, IILL

Population: 111199,,000000Start Date: 11999911Price per Container:6677¢¢ per 14-gallonbag; $$11..3355 per sticker (32 gallons)

DDaarriieenn,, IILL

Population: 1188,,000000Start Date: 11999900Price per Container:$$11..5500 per bag(60 lb. maximum)

0000009900ainer:ker

DD EE SS II GG NN :: SS AA MM PP LL EE RR AA TT EE SS

11

rsdfinalmock.qxd 2/9/99 11:30 AM Page 11

12

Asecond method of rate structure design (RSD) is to review data on your community’s waste gener-ation, program costs, and other relevant factors to arrive at your own PAYT rates. These calcula-tions can be simple or complex, depending on the kinds of data and the amount of expertise youhave available. You will need to estimate the amounts of solid waste generated under PAYT, the

types of MSW services that will be provided, and the net costs of MSW services. To help develop theseestimates, communities often use simple worksheets or more complex tools such as computer software.While this method takes some time and effort, it may produce a rate structure in which you have greaterconfidence. The method has six basic steps as outlined below.

IIIIIISecond Method of Setting PAYT Rates

Using the Six-Step RSD Process

Forecast residential MSW amounts. Forecast the annual tonnage of MSW youexpect to collect once PAYT has been implemented.

Determine the types of MSW services to be provided. Determine the types of MSWservices that will be provided to residents (e.g., collection of trash, recyclables, and com-postables) and the types of containers and billing options to be used under PAYT.

Estimate net costs of MSW. Estimate your net costs using the information developedabove on forecasted amounts of MSW and the types of services that will be provided.Net MSW costs incorporate MSW costs less any revenues from complementary pro-grams (e.g., sale of recyclables, composting, and trash or bulky waste pickup).

Determine PAYT revenues and MSW program cost coverage. Based on MSW costsand your coverage objectives, calculate the estimated revenues you need to generate.This may be more or less than net MSW costs, depending on your community’s othergoals and financial resources.

1

3

2

4

RSDchp3.qxd 2/9/99 11:36 AM Page 12

13

se

ct

io

n

III

Calculate PAYT rates. Select a pricing system that is appropriate for your communityafter considering the pros and cons of the alternative systems (see pages 7-8). Based onthe pricing system you select and the forecasted amounts and costs of MSW you expectunder PAYT, calculate the price level necessary to pay for your program.

Adjust MSW services and PAYT rate structure. If the PAYT price level seems toohigh, consider less costly or more efficient MSW services and/or choose a PAYT pricingsystem that encourages greater reduction in your community’s solid waste (and henceMSW costs). Then recompute the PAYT price level. Continue making adjustmentsuntil all of your community’s objectives are met by the PAYT rate structure.

The six-step RSD process is detailed in this section using the example of a hypothetical communitynamed ‘Midtown.’ Midtown is establishing a PAYT rate structure. It has a population of 35,000 (17,500households). A task force comprised of diverse community stakeholders determined the town’s MSWgoals, which are:

• To encourage waste prevention

• To increase composting and recycling

• To maintain MSW revenue stability

Midtown currently has a curbside recycling program for collecting glass, aluminum, and newspaper. It will add collection of plastics, mixed paper, and steel cans. The city also decided to launch an aggres-sive education and outreach program on backyard composting and grasscycling in order to reduce theorganics in its waste stream.

The example of Midtown is intended to help explain the basic RSD concepts. We encourage you toapply this six-step process to your own community’s specific needs as you explore MSW program optionsand their implications for reduced solid waste tonnage, increased recycling, and PAYT revenues. Thisexample is not intended to be a precise formula—there are no cookie cutter recipes for RSD! Rather, it isa methodology; a step-by-step analysis of the factors to consider when designing your own rates. Keep inmind your own community’s goals, MSW services, costs, and revenue needs—which could differ greatlyfrom this example—and be sure to use your own community’s data when applying this approach.

To gather the necessary information, you might need to consult your community’s MSW programrecords or the finance office in your town, city, or county government. You can base your estimates oncommunity demographic and waste generation data. Other useful sources of information include localprivate haulers or the MSW offices of nearby PAYT communities.

Key terms and concepts used in this section of the booklet are listed on the following page. Refer tothis list, as necessary, as you work through the six-step process outlined in this section; additional usefulterms are referenced in the glossary on page 34.

5

6

RSDchp3.qxd 2/9/99 11:36 AM Page 13

14

se

ct

io

n

III

Forecast Residential MSW Amounts

The first step involves estimating the amount ofwaste you will collect from the residents inyour community during the base year andprojection year. To obtain accurate calcula-

tions, you will need to isolate residential wastesfrom commercial wastes. Including commercialwaste inflates both the total weight of MSW andthe costs to be covered by the PAYT program. Thiswill lead to inaccurate PAYT rate calculations. (Ifyour community intends to collect commercialwaste as part of your PAYT program, you will needto design a separate rate structure based upondumpster size and collection frequency.)

A. MSW collected in the projection year, withoutPAYT.

Estimate the MSW tonnage you currently col-lect per household in a year. Adjust this amountfor any likely changes in your community’s pop-ulation in the projection year.

B. MSW collected in the projection year, withPAYT.

Make a preliminary estimate of how much theresidents in your community will increase theirwaste reduction efforts in response to PAYT.Successful PAYT communities recommend thatit is better to overestimate reductions in trashset outs rather than to underestimate wastereduction efforts. This will ensure a sufficientrevenue flow. (You can later revise this wastereduction estimate once you have developedmore information such as the types of MSWservices that will be provided, the pricing systemthat is best for your community, and the level ofPAYT rates; see Section IV for more informa-tion.) Based on this estimate, calculate theMSW tonnage per household you expect to col-lect in the projection year under PAYT.

Table 1 on page 15 illustrates how Midtowncalculated its residential MSW amounts in the pro-jection year with and without PAYT.

BBaassee yyeeaarr:: The year prior to implementation ofPAYT, which can be used as a baseline againstwhich potential PAYT impacts are measured.

PPrroojjeeccttiioonn yyeeaarr:: The year during which PAYT hasbeen implemented and resident response hasleveled out in response to the price incentives(e.g., through reduced waste generation andincreased recycling).

CCoommpplleemmeennttaarryy pprrooggrraammss:: MSW services (e.g.,curbside/drop-off recycling, composting, andbulky waste pickup) that supplement basictrash collection and disposal.

WWaassttee rreedduuccttiioonn:: The combined reduction inMSW that is discarded, resulting from greaterwaste prevention, increased reuse and recy-cling, and more backyard and municipal com-posting.

DDiirreecctt ccoossttss:: These costs are readily assignable toa particular MSW activity such as collection,processing, or disposal.

•• CCoolllleeccttiioonn aanndd ttrraannssppoorrttaattiioonn ccoossttss:: Directcosts for trash and recyclables pickup, trans-portation, and temporary storage in transferstations. These costs usually rise (or fall) as thelevel of MSW activity changes, although notalways in exact proportion, and sometimeswith a time lag. Major components includecosts of labor, equipment, and/or contractpayments.

•• PPrroocceessssiinngg ccoossttss:: Processing costs of recy-clables and other direct costs related to thepostcollection management of recyclables.

•• DDiissppoossaall ccoossttss:: Landfill tipping fees, incineratorcosts, and disposal costs for residuals.

IInnddiirreecctt ((oovveerrhheeaadd)) ccoossttss:: The management andsupport costs of operating the MSW program(including any indirect costs from centralizedlocal government functions that are allocatedto the MSW program’s budget). These costssupport the entire MSW system and are oftenrelatively fixed costs, but they must be allocat-ed among services and their associated rateson some basis (e.g., tonnage, full-time equiva-lents required, etc.).

Key Terms and Concepts 1

RSDchp3.qxd 2/9/99 11:36 AM Page 14

15

se

ct

io

n

III

Table 1. Calculating MSW Tonnages

* Since Midtown will expand its recycling program and plans to offer an aggressive education and out-reach program on backyard composting and grasscycling, it estimates a 30 percent reduction in trashtonnage and a 40 percent rise in recyclables with PAYT. Midtown expects total MSW tonnage to drop byabout 16 percent with PAYT.

A national study reports a 1144-- ttoo 2277--ppeerrcceenntt rreedduuccttiioonn in trash (by weight) in PAYT communities thathad nnoo rreeccyycclliinngg pprrooggrraamm oorr tthhaatt ssiimmppllyy rreettaaiinneedd tthheeiirr eexxiissttiinngg rreeccyycclliinngg pprrooggrraamm.. Communities thatadopted PAYT in combination with new or expanded recycling programs achieved even higher percent-age reductions in trash. Cities that did not change their recycling program with the introduction of PAYTtypically experienced iinnccrreeaasseess ooff 3322 ttoo 5599 ppeerrcceenntt iinn tthhee wweeiigghhtt ooff mmaatteerriiaallss rreeccyycclleedd.. (Unit Pricing ofResidential solid Waste: A Preliminary Analysis of 212 U.S. Communities by Marie Lynn Miranda andSharon LaPalme, June 4, 1997, Nicholas School of the Environment, Duke University.)

The percentage of waste reduction your community can anticipate will also be significantly influ-enced by such factors as the extent of your public outreach, the range of complementary programsoffered, and the expected rate of resident participation.

Weighing the Difference With PAYT

Midtown

MSW in Projection Year, Without PAYT Trash Recyclables Total MSW

Tons of MSW collected in base year 28,000 7,000 35,000

÷ Number of households (17,500) in base year

= Tons per household per year 1.60 0.40 2.00

× Number of households (18,750) in projection year

= Tons of MSW in projection year without PAYT 30,000 7,500 37,500

MSW in Projection Year, With PAYT

Tons in projection year without PAYT 30,000 7,500

× MSW multipliers from PAYT*:

(1.00 - 0.30 drop in trash) ×0.70

(1.00 + 0.40 rise in recyclables) × 1.40

= Tons of MSW in projection year with PAYT 21,000 10,500 31,500

Percent drop in MSW due to PAYT, projection year: - 30% + 40% - 16%

RSDchp3.qxd 2/9/99 11:36 AM Page 15

16

se

ct

io

n

III

Determine the Typesof MSW Services To BeProvided

Next, you will determine the collectionoptions, the types of MSW services to beprovided to residents, the customers to beincluded, and the container type to use.

A. Collection optionsExamples include collection of trash, recy-clables, compostables, and/or bulky items.

B. Type and frequency of serviceSome examples are backyard pickup, curbsidepickup, or rural drop-off. Collection frequenciesinclude semiweekly, weekly, biweekly, andmonthly.

C. Customers to be covered by PAYT programExamples include single-family housing, smallmultifamily housing units, and large multi-family housing units.

D. Container type and capacitySelect the container type and size (volume) youplan to use in your PAYT program. Typicalcontainer types are:

• Bags. Trash bags, usually 20 to 30 gallons incapacity, are often used in PAYT programs.Residents purchase the specially marked bagsfrom municipal offices or retail stores.

• Cans. Some communities use cans, rangingfrom 10 to 96 gallons in capacity. These sys-tems often operate on a subscription basisunder which residents choose the can sizethey wish to use.

• Stickers or tags. Some communities sell resi-dents stickers or tags to affix to each containerof trash they generate. Containers must notexceed prescribed volume or weight limits.

• Compost bins. Some communities providebins to residents for backyard composting.

After you have chosen a container type, esti-mate its average weight. There are several ways todo this. The most accurate method for estimatingthe weight of the (filled) containers is to conduct awaste audit. Obtain samples of filled trash contain-ers from representative households in your com-munity. Sample from large households, one- ortwo-person house-holds, and elderly residents inthe proportions they occur in your community.Weigh the samples to derive volume-to-weightconversions for your community.

You can also estimate the weight of containersusing local or national data, although the averageweight of a container of garbage can vary from onecommunity to another (e.g., a filled 30-gallon bagmay weigh 24 to 48 pounds). In addition, youmight want to adjust expected weights upward toaccount for the tendency of residents to compactmore trash under PAYT. Table 2 on page 17 showsMidtown’s container selection and estimatedweight under its PAYT program.

For tag or sticker systems, decide on the vol-ume and weight of containers your program willpermit. Keep in mind that some communities havereaped an unexpected windfall because residents setout less trash than is permitted by the sticker orbag. If residents set out only 25 pounds in a bagpriced to allow 30 pounds, for example, the com-munity retains the difference, which can quicklyadd up to a substantial surplus.

If you plan to use more than one container size,identify the volume and weight per container foreach container size. Offering more than one con-tainer size (or smaller containers) offers customersseveral advantages, especially those residentsalready producing small amounts of trash, such assingles, childless couples, and retirees. These indi-viduals can reduce waste only slightly and still see adrop in costs. If only 30-gallon containers areoffered, for example, a resident that normally pro-duces 60 gallons of trash per month would onlysee savings by cutting waste in half (to 30 gallons amonth). If 20- and 30-gallon containers areoffered, however, the resident could reduce wasteto 40 or 50 gallons per month and still pay less.

2

RSDchp3.qxd 2/9/99 11:37 AM Page 16

17

se

ct

io

n

III

Table 2. Selection of Container andVolume-to-Weight Conversion

* Midtown’s residents currently set out 30-gallon bags that average 27 pounds. Midtown estimates thatthe weight of the bags is likely to increase by about 10 percent under PAYT, to 30 pounds per bag.

Estimate Net Costs of MSW

Next, you will identify the cost components ofyour solid waste program. Since no two com-munities record and report their cost infor-mation in the same way, this discussion is

intended to provide only general guidance andshould be customized to reflect information avail-able in your community. Whenever possible, try toisolate MSW program costs from other public ser-vice or utility costs in your community’s budget(see Section IV for further discussion). One of themost important steps in planning for PAYT is toidentify where and why MSW activities (and theircosts) will shift when you implement PAYT.

Under PAYT programs, there can be one-timestartup costs (e.g., capital investment for garbagecarts or compost bins, or costs for an educationand outreach campaign). Some new costs can beongoing costs (e.g., administration and staffingcosts associated with billing residents for services).But most of the cost changes with PAYT involvecost shifting and, usually, a reduction in overallongoing costs as total MSW amounts fall.

For each of the following categories, considerwhich costs, if any, could increase temporarilyduring the transition to the PAYT program orshift permanently to a higher or lower levelunder PAYT.

A. Direct costs

Itemize your MSW program’s current directcosts for collecting trash, recyclables, and com-postable materials; processing recyclables and com-postables; and disposing of trash and residuals.These costs must then be allocated to the MSWpathways available (see Section IV for a discussionof pathways; for Midtown, trash or recyclables arethe available MSW pathways). Then identify if anyof these costs increase temporarily or shift perma-nently under PAYT. Direct labor, fuel, and equip-ment costs could be less under PAYT than under atraditional program, for example, particularly if thereduced amount of waste results in less frequentMSW collection. Do not include the costs associ-ated with operating a municipally owned landfillor materials recovery facility under disposal andprocessing costs if they are already included inyour indirect costs.

The cost of processing recyclable and com-postable materials might rise as more citizens usethese service options rather than the trash service.Disposal costs usually decrease under PAYT sincethere tends to be less waste for disposal.

B. Indirect (overhead) costs

Itemize the current indirect costs of your MSWprogram. Then identify which, if any, of theseindirect costs might increase temporarily or shiftpermanently under PAYT. Introducing PAYT can

3

Container Type Volume Weight With PAYT(gallons) (pounds)

Cans

Bags ✓ 30 30*

Stickers

Midtown

RSDchp3.qxd 2/9/99 11:37 AM Page 17

18

se

ct

io

n

III

* Midtown has decided to fund PAYT startup costs from a separate fund, so as not to distort the initial PAYTrates it sets.

lead to temporary increases in the costs of somestaffing positions, such as MSW public outreachspecialists and customer service representatives.These individuals are responsible for educating res-idents and responding to questions, which are farmore numerous at the beginning of the new PAYTprogram.

C. Net costs

Add together all of the estimated ongoing costs(direct and indirect) of your MSW program underPAYT. Subtract any net revenues from comple-mentary programs to arrive at your MSW programnet costs. Compare the projected year costs underyour current program with those under PAYT.

Separately consider one-time startup costs. Decidewhether to fund these from other sources or fromPAYT fees.

Midtown’s net costs in the projection year areillustrated above in Table 3.

Table 3. MSW Net Costs in Projection Year (in thousands of dollars)

More detailed information on MSW costs isprovided in Section IV of this booklet. You canalso consult the U.S. Environmental ProtectionAgency’s (EPA’s) Full Cost Accounting forMunicipal Solid Waste Management: A Hand-book, EPA530-R-95-041, September 1997, orEPA’s Full Cost Accounting Web site at<www.epa.gov/fullcost>.

MSW Cost Resources

Midtown

Without PAYT Trash Recyclables Total MSWDirect Costs

Collection $900 $390 $1,290

Transport and storage 200 100 300

Disposal/processing 900 135 1,035

+ Indirect Costs 400 200 600

= MSW Gross Costs 2,400 825 3,225

- Recyclable Revenues 0 225 225

= MSW Net Costs Without PAYT $2,400 $600 $3,000

With PAYT

Direct Costs*

Collection $760 515 1,275

Transport and storage 190 135 325

Disposal/Processing 630 190 820

+ Indirect Costs 320 245 565

= MSW Gross Costs 1,900 1,085 2,985

- Recyclable Revenues 0 315 315

= MSW Net Costs With PAYT $1,900 $770 $2,670

Percent change in MSW net costs in projection year, due to PAYT -11%

RSDchp3.qxd 2/9/99 11:37 AM Page 18

19

se

ct

io

n

III

Determine PAYT Revenuesand MSW Program CostCoverage

In the previous step, you calculated the MSWnet costs in the projection year with PAYT. Nowyou must determine the level of revenues thePAYT program must generate to achieve your

community’s goals. Depending on your goals, youmay want PAYT fees to cover all or part of yourMSW program costs, or you may want the PAYTfees to generate revenues that exceed your MSWprogram net costs. Consider the following:

• You might decide to cover less than 100 percentof current MSW program costs if your PAYTprogram exempts residents living in multi-family housing units and your communitydraws from other revenue sources to cover thecosts of those MSW services.

• You might decide to cover 100 percent of cur-rent MSW program costs if you operate yourMSW program as an enterprise fund.

• You might decide to cover more than 100 per-cent of current MSW program costs if you usePAYT fees to cover current MSW programcosts and pay for other MSW costs (e.g., land-fill closure or siting) and/or cover a budgetshortfall for non-MSW expenses (e.g., publiceducation).

Calculate PAYT Rates

PAYT rates can provide clear price signals toencourage residents to engage in specificwaste reduction activities. Now that you haveforecasted MSW tonnage with PAYT, deter-

mined the MSW service costs to be covered byPAYT, and chosen a container size and estimatedits average weight, you are ready to choose a PAYTpricing system and calculate your rates. Refer topages 7-8 in Section I to compare the pros and

cons of commonly used PAYT pricing systems(i.e., proportional, variable, or two-tier). Choosethe one that is most consistent with your commu-nity’s goals. This section shows how to calculateyour initial (provisional) rates under each of thesethree systems.

A. Proportional Rates

A proportional pricing system is the simplesttype of system for which to calculate a rate. Underthis pricing system, each container is the same sizeand the same price.

Number of containers

First, you will need to estimate the number ofcontainers you expect will be set out each year.Convert your forecasted annual trash tonnageunder a PAYT program into pounds of trash peryear (i.e., multiply the number of tons by 2,000).Divide that number by the average weight (inpounds) of the trash container you have selected.The result is the estimated total number of con-tainers of trash the residents in your communitywill generate each year under PAYT.

To develop a proportional rate, divide theMSW program costs to be covered by PAYT rev-enues by the number of containers of trash youexpect with a PAYT program in place. The result is the initial (provisional) price per container eachhousehold will pay under a proportional PAYT system.

Midtown calculated a rate under a proportionalpricing system (Table 4) and established a price of$1.90 per bag. If municipal officials in Midtowndetermine that $1.90 per bag is too high and resi-dents resort to undesirable methods of waste dis-posal, other pricing options include two-tieredpricing (see page 21), covering less than 100 per-cent of solid waste costs with PAYT revenues (i.e.,using tax revenues to help defray solid waste costs),or charging separately for recycling and waste dis-posal.

4

5

RSDchp3.qxd 2/9/99 11:37 AM Page 19

20

se

ct

io

n

III

Table 4. Calculating Proportional PAYT Rates

* In this example, Midtown operates its MSW program as an enterprise fund and plans to fully coverongoing MSW net costs with its PAYT revenues (and generate a small buffer fund to cover the uncertainties in the estimates). Assuming Midtown provides free recycling services, the price per bag is rounded to $1.90.

If Midtown decided to charge a separate fee forrecyclables to cover its net cost, for example, itcould apply this same proportional rate approachto both trash and recyclables. In this case,Midtown might charge $41 per household per yearto cover net costs of recycling services (i.e., netrecyclable costs of $770,000 divided by the num-ber of households (18,750) = $41.07) and $1.40per bag (i.e., costs of trash services ($1,900,000)divided by the number of bags with PAYT(1,400,000) = $1.36) to cover net costs of trashservices.

B. Variable Rates

Variable rate pricing is the most flexible pricingsystem, but it can also be the most complex. Withvariable rates, the per-gallon price differs by thesize of container set out by the resident. In somecommunities, containers are all the same size. Inother communities, containers can be differentsizes.

Number of containers

After selecting the container sizes, you mustestimate the weight of each filled container. Inaddition, you must estimate the percentage of yourcommunity’s trash you expect will be set out ineach container size. (This estimate can be devel-oped during the same trash container samplingexercise you carry out to estimate volume-to-weight conversions by container size.)

Multiply the total number of pounds of trashyou expect with PAYT times the percentage oftrash you expect will be set out in the first contain-er size. Then divide the result by the expected aver-age weight this container size will be when set outunder a PAYT program. The result is the estimatednumber of containers of this size you can expectunder PAYT. Next, repeat this calculation todevelop estimated numbers for each of the othercontainer sizes you permit under the PAYT pro-gram. Table 5 shows Midtown’s container selec-tions and estimated weight per container filled.

PAYT Proportional Rate Calculation Example from Midtown

Tons of trash in projection year (with PAYT) 21,000

× 2,000 pounds per ton = Pounds of trash 42,000,000

÷ 30 pounds (Average weight per 30-gallon bag)

= Number of 30-gallon bags per year with PAYT 1,400,000

MSW costs to be covered by PAYT revenues $2,670,000

÷ 1,400,000 (number of 30-gallon bags

per year with PAYT) = PAYT rate $1.90*

Midtown

RSDchp3.qxd 2/9/99 11:37 AM Page 20

21

se

ct

io

n

III

Allocating MSW net costs

To calculate a variable rate structure, you mustalso determine the proportion of MSW net coststhat will be covered by the revenues from eachcontainer size. As discussed in Section I, you maydecide to charge higher per-gallon rates for largeror additional containers (to encourage waste pre-vention) or lower per-gallon rates for larger oradditional containers (to reflect the cost structurewhere there are significant fixed costs). Table 6 onpage 22 shows how Midtown calculated a variablerate structure for 32- and 64-gallon cans covering40 percent of its MSW costs with the small canand 60 percent of its costs with the large can.

Alternatively, if Midtown decided to charge aseparate fee for recyclables to cover its net costs, itcould apply this approach to both trash and recy-clables. In this example, it might charge $41 perhousehold per year (as in the preceding propor-tional rates example). Midtown might charge$1.60 per 32-gallon can (i.e., 40 percent of trashcosts (0.40 x $1,900,000) divided by the numberof 32-gallon cans (480,000) = $1.58) and $2.50per 64-gallon can (i.e., 60 percent of trash costs(0.60 x $1,900,000) divided by the number of64-gallon cans (458,182) = $2.49). This wouldgenerate sufficient revenues to cover total MSWnet costs plus a small buffer fund to cover uncer-tainties in the estimates.

C. Two-Tier Rates

Under a two-tier pricing system, residents sub-scribe to a base level of service for which they paya flat fee (first-tier fee) that may be assessedthrough local taxes or through direct billing.Second-tier fees, on the other hand, are based onthe amount of waste that residents throw away.Many communities use the simplest version, atwo-tier pricing system with a proportional sec-ond-tier rate. Some communities, however, usemore complicated rate structures. The most com-plex are multi-tier pricing systems with variablerate pricing for the second and higher tiers.

Number of containers

Estimate the number of containers set out peryear with PAYT. If you plan to use only one con-tainer size, follow the approach in the proportionalrates section (page 19); if you plan to use severalcontainer sizes, follow the approach in the variablerates section (page 20-21).

Cost basis per tier

Some communities use revenues from the first-tier fees to cover fixed costs and revenues from thesecond tier to cover direct collection and disposalcosts. Other communities use revenues from thefirst tier to cover direct and indirect collectioncosts, and revenues from the second tier to cover

Table 5. Selection of Container andVolume-to-Weight Conversion

* Midtown’s PAYT Task Force projects more trash compaction in the smaller, 32-gallon cans.

Container Type Volume Weight With PAYT* Percent of (gallons) (pounds) Trash by

Container Size

Cans ✓ 32 35 40%

Cans ✓ 64 55 60%

Bags

Tags/Stickers

Midtown

RSDchp3.qxd 2/9/99 11:37 AM Page 21

22

se

ct

io

n

III

* In this example, Midtown operates its MSW program as an enterprise fund and plans to fully coverongoing MSW costs with its PAYT revenues. It has decided to cover 40 percent of MSW costs with therevenues from 32-gallon cans and 60 percent of MSW costs with the revenues from 64-gallon cans.Midtown has chosen a variable rate structure it believes will achieve its goal of encouraging wastereduction while taking into account the cost concerns of large families. Based on this calculation, it plansto charge $2.25 per 32-gallon can and $3.50 per 64-gallon can.

Table 6. Calculating a Variable Rate Structure

PAYT Variable Rate Calculation Example from Midtown

Tons of trash in projection year (with PAYT) 21,000

× 2,000 pounds per ton

= Pounds of trash with PAYT 42,000,000

32-gallon cans

Pounds of trash × 0.40 (Portion of trash in 32-gallon cans)

= Pounds of trash in 32-gallon cans with PAYT 16,800,000

÷ 35 (Average pounds per 32-gallon can)

= Number of 32-gallon cans per year with PAYT 480,000

MSW program costs to be covered by PAYT $2,670,000

× 0.40 (Portion of costs to be covered by

revenues from 32-gallon cans) $1,068,000

÷ 480,000 (Number of 32-gallon cans set out with PAYT)

= Price per 32-gallon can with PAYT $2.23*

64-gallon cans

Pounds of trash × 0.60 (Portion of trash in 64-gallon cans)

= Pounds of trash per year in 64-gallon cans with PAYT 25,200,000

÷ 55 (Average pounds per 64-gallon can) = Number of 64-gallon cans per year with PAYT 458,182

MSW program costs to be covered by PAYT $2,670,000

× 0.60 (Portion of costs covered by revenues

from 64-gallon cans) $1,602,000

÷ 458,182 (Number of 64-gallon cans set out with PAYT)

= Price per 64-gallon can with PAYT $3.50*

Midtown

RSDchp3.qxd 2/9/99 11:37 AM Page 22

23

se

ct

io

n

III

* In this example, Midtown operates its MSW program as an enterprise fund and decides to fully coverongoing MSW net costs with its PAYT revenues. It has chosen a two-tier rate structure it believes willstrongly encourage waste reduction. It has decided to cover fixed costs for trash, plus net costs of recy-clables ($320,000 + $770,000 = $1,090,000), with revenues from the first-tier billing. The remainingdirect costs for trash are covered by second-tier fees per bag. Based on this calculation, Midtown roundsoff the calculated figures and provisionally plans to charge households $14.50 per quarter and $1.15per bag.

Table 7. Calculating a Two-Tier Rate Structure

direct disposal costs only. As discussed in Section I,the greater the costs to be covered by first-tier fees,the more stable the PAYT revenue stream; thegreater the costs to be covered by second-tier fees,the greater are the community’s waste reductionand recycling incentives.

Two-tier price

Once you decide which costs will be covered bythe revenues from each pricing tier, calculate theamount each household is billed each year by the

first-tier fee by dividing first-tier costs by the number of households. (Divide the result by four to develop quarterly billings per household.)Calculate the second-tier charge per container bydividing the second-tier costs by the number ofcontainers set out per year, if you are using proportional second-tier pricing. (If you are usingvariable second-tier pricing, follow the approachshown in the variable rates section.) Table 7 showshow Midtown calculated a two-tier rate.

PAYT Two-Tier Rate Calculation Example From Midtown

Portion of MSW net costs to be covered by first-tier fees $1,090,000

+ Portion of MSW net costs covered by second-tier fees $1,580,000

= Total MSW net costs to be covered by PAYT revenues $2,670,000

First-Tier Rate

Portion of MSW net costs to be covered by first-tier fees $1,090,000

÷ 18,750 (Number of households)*

= Annual MSW net costs per household $58.13

÷ 4 quarters = Quarterly PAYT bill per household $14.53

Second-Tier Rate

Portion of MSW net costs covered by second-tier fees $1,580,000

÷ 1,400,000 (Number of 32-gallon bags per year)

= Price per 32-gallon bag $1.13*

Midtown

RSDchp3.qxd 2/9/99 11:37 AM Page 23

24

se

ct

io

n

III

Adjust MSW Services andPAYT Rate Structure

By now, you have developed a PAYT ratestructure that reduces trash, increases recy-cling, and generates revenues sufficient tocover your designated costs of MSW services.

At this point, these are still provisional rates. It isimportant to know where your estimated costs andrevenues are most sensitive to the underlyingassumptions. It is also important to be sure yourassumptions on some steps (such as percentagereduction in trash or increase in recyclables) areconsistent with your assumptions on other steps(such as types of MSW services provided, effortdevoted to public education and outreach, orPAYT rate and pricing system). This review maycause you to raise or lower your provisional rates tosome degree.

To gain some confidence in your rate structuredesign—or to be aware of where you need toimprove the quality of your underlying data—goback to the key decision points to see how higheror lower estimates would affect the final outcome.

If you must avoid a shortfall in revenues, con-sider using more conservative estimates. Assumethat residents will aggressively reduce waste, forexample, or that community population might notgrow as rapidly as expected. These conservativeassumptions result in lower levels of estimatedwaste and, therefore, higher expected PAYT rev-enues. Alternatively, you could simply acknowledgethe need for a safe margin of revenues and thenraise rates accordingly, without making assump-tions about population or waste reduction changes.

Below are several key points to keep inmind as you consider your provisional ratesand make adjustments.

• FFoorreeccaassttiinngg rreessiiddeennttiiaall MMSSWW aammoouunnttss.. InStep 1, you estimated the number ofhouseholds in the projection year.Consider the impact on your rate structureof greater or lesser population levels inthe projection year.

•• EExxppeecctteedd wwaassttee rreedduuccttiioonn iimmppaacctt ooff PPAAYYTT..In Step 1, you estimated the levels ofreduced trash, increased trash com-paction, and increased recycling resultingfrom residents’ responses to PAYT priceincentives. Reconsider the strength of resi-dents’ responses in light of the type ofpricing system you have chosen and thelevel of your provisional PAYT rates.Calculate alternative rate structures afterassuming greater or lesser responsivenessfrom residents. Consider expanding edu-cation and outreach activities to ensurehigh rates of participation.

• EEssttiimmaatteedd wweeiigghhtt ooff ttrraasshh ccoonnttaaiinneerrss.Consider the impact on your unit price ifthe actual average weight of filled trashcontainers is higher or lower than yourestimate.

• MMSSWW ccoossttss.. Vary these to see how reason-able variations above or below your bestestimate could affect the unit price need-ed. Consider raising the rate structure toensure your MSW net program costs arecovered and then lower them later if yougenerate excess revenues.

This kind of analysis can be done onworksheets (e.g., paper and pencil or electronic) or through specialized computerprograms designed to apply sensitivity analy-sis and iteratively develop a PAYT rate structure that is based on internally consistentassumptions and that best meets your community’s needs.

Key Decision Points6

RSDchp3.qxd 2/9/99 11:37 AM Page 24

25

Refinements in Setting PAYT Rates

IIVV

Your community may decide to include in the PAYT rate all the direct and fixed costs of the activitiesneeded to support each of the MSW services available to residents. This section provides a moredetailed discussion of MSW costs, their allocation among MSW pathways and activities, and relatedissues a community might wish to consider when calculating PAYT rates.

Direct and Indirect Costs

Residents often have many choices for recover-ing or discarding materials. They may be ableto set out trash, recyclables, and compostablematerials at the curb. They also may be able

to take items to drop-off centers, or a transfer sta-tion or landfill. Local governments that provideMSW services send a message to residents throughthe fees they charge for each of these services. Amajor factor in deciding what to charge for MSWservices should be the cost of each service. Thefollowing discussion can help you determine theseservice costs.

A. MSW pathways and activities

Pathways for MSW choices track the activitiesthrough which each type of material proceeds.MSW pathways (see page 26) include recycling,composting, waste-to-energy, and landfilling.MSW activities include waste collection, operationof transfer stations, transportation of waste, wasteprocessing and disposal, and sale of byproducts.After being picked up at a residence, for example,trash may be taken to a transfer station and thenhauled to a landfill and buried. Some activitiesmay serve more than one pathway. The landfill inthis system, for example, is part of the pathway fortrash collection, recyclables collection, yard trim-mings collection, and drop-offs by residents.

B. Direct costs

Costs directly attributable to an activity aresometimes relatively easy to allocate. If differenttrucks provide collection and transport for differ-ent types of MSW services, for example, you canallocate the cost of each truck to the appropriateservice. If the same trucks are used for collecting

trash as well as recyclables or yard trimmings, how-ever, you should allocate those costs on some rea-sonable basis, such as the time a truck is used foreach service. Similarly, landfill costs must be allo-cated to each pathway that uses the landfill. Sincelandfill tipping fees are usually based on weight,the weight of MSW dumped at the landfill mightbe an appropriate basis for allocating landfill costsamong the MSW activities. In sum, it is importantto develop a reasonable way to identify the costsassociated with providing each MSW service toresidents and then a way to allocate them amongactivities.

C. Indirect costs

Indirect MSW costs are usually spread over sev-eral MSW activities. A greater effort is required toidentify the costs and to allocate them to theappropriate activity. The general manager of theMSW program, for example, is a necessary part ofall MSW services. A person answering the tele-phone to take questions or complaints from resi-dents is also essential for the smooth operation ofthe entire MSW program, as are the staff who billfor MSW services or handle MSW payables. All ofthese indirect costs must be identified and allocat-ed on a fair basis.

One simple approach to allocating indirectcosts is to estimate the tonnage of waste that eachMSW service processes. Then the indirect cost canbe allocated to each MSW service in proportion tothe amount of waste it processes. Some communi-ties may want (or need) to make even more preciseallocations. Whatever allocation method is used,however, it is important that the allocation of indi-rect costs should be seen as fair by those who arecharged for MSW services.

rsdfinalmock.qxd 2/9/99 11:30 AM Page 25

ssee

cctt

iioo

nn

IIVV

26

Figure 1: MSW Pathways and Activities

CollectionActivity

TransferStationActivity

TransportActivity

SolidWasteFacilityActivity

SalesActivity

TransferStation

Mixed WasteCollection

RecyclablesCollection

Yard TrimmingsCollection

TransferStation

TransportTransport

TransferStation

Transport

Waste-to-Energy

LandfillMaterial

Recovery FacilityComposting

Facility

Sale ofCompost

Sale ofRecyclables

Sale ofEnergy

Sale ofEnergy

Solid Waste – Generic Flow Chart

rsdfinalmock.qxd 2/9/99 11:30 AM Page 26

ssee

cctt

iioo

nn

IIVV

27

Other Factors to Consider inSetting PAYT Rates

Setting rates on the basis of the full costs of eachMSW service can generate sufficient revenuesto cover MSW costs. Yet there may be otherpublic policy considerations that could suggest

higher or lower PAYT rates as described below.

A. Front- and back-end costs

The costs discussed so far occur at the sametime as service delivery. Other costs are incurredbefore or after service delivery, however, and mustalso be included to have a full picture of theresources being used to provide MSW services.Front-end costs for a landfill, for example, mayinclude site preparation, liners, monitoring wells,and the costs of holding public meetings to obtainsite approval. Back-end costs include landfill clo-sure as well as postclosure monitoring and maintenance. Even though these costs occur beforeor after the actual provision of service, they are anessential part of the job and should be included inthe basis for calculating PAYT rates.

B. Policy considerations

Your community may have MSW prioritiesbased on other policy considerations. A local gov-ernment, for example, may want to encouragematerials recovery and composting but discouragelandfilling. It may decide to charge less than fullcost for options that it considers ‘desirable’ andmore than full cost for options that are ‘undesir-able.’

C. Pricing complementary services

Many PAYT communities motivate wastereduction behavior by charging only for trash ser-vices and then collect and process recyclables andcompostables for free. To some, this approachappears to most directly meet public policy objec-tives. Other communities charge for certain com-plementary services, however. These charges reflectthe economic resources expended in recyclingactivities and, at the same time, may encourage residents to make greater efforts in waste preven-tion, reuse, and backyard composting activities.

D. Revenue stability

One of the most common goals of MSW agen-cies is to guarantee revenue stability. To achieve thisgoal, many communities use a two-tiered rate. Thiskind of pricing system recognizes that some costsare fixed and others are variable. PAYT rates can beset so that revenues cover designated costs in thefirst tier despite the reduction in MSW amounts.An MSW billing system, for example, may use thesame resources regardless of how much MSW thecommunity discards each month.

On the other hand, given that residents typical-ly respond to PAYT rates by generating less waste,the second-tier rates can cover the costs for thereduced amounts of waste that are discarded. Also,costs for the landfill (such as expenses for equip-ment and operators) will eventually drop if thelandfill receives less waste each month. The num-ber of operators could be reduced through attritionor transfers to another activity. These lower costscan be covered by the second-tier fees. Direct costsand the revenues from second-tier fees tend to riseand fall by similar amounts as MSW amountsincrease and decrease. (Discussed in Overview onpage 3, and in the Midtown example.)

To further assist your own community’s RSDefforts, you might attend workshops or choose asoftware program to calculate more advanced ratestructures. Additionally, EPA offers severalresources on PAYT, rate setting, and full costaccounting as described in the box below.

For updated information on rate setting andpricing and other available resources, visit EPA’sPAYT Web site at <www.epa.gov/payt> and theFull Cost Accounting Web site at<www.epa.gov/fullcost>. Two useful resources onthese Web sites are Pay As You Throw: LessonsLearned About Unit Pricing, EPA530-R-94-004,April 1994, and Full Cost Accounting forMunicipal Solid Waste Management: A Handbook,EPA530-R-95-041, September 1997. These doc-uments can also be ordered at no charge fromEPA’s RCRA hotline at 800 424-9346 (TDD800 553-7672).

Resources

rsdfinalmock.qxd 2/9/99 11:30 AM Page 27

28

Case Studies

Every community approaches the process of designing a rate structure for its PAYT program different-ly. In this section you will learn how five communities met this challenge. These case studies repre-sent a range of different pricing systems, container choices, and population sizes. The stories werewritten by the local officials who initiated or now run their community’s PAYT program.

Program success is the thread that runs through each of the stories. As the following testimonials illus-trate, there is no one correct price or approach to pricing that will make PAYT a success. There are manydifferent paths local officials can take. Review the stories to learn more about rate structure design (RSD)and how you might set appropriate prices for your program.

rsdfinalmock.qxd 2/9/99 11:31 AM Page 28

ccaa

ssee

ss

ttuu

ddii

eess

29

Oconee is a fast-growing, semirural countycovering 186 square miles with a popula-tion of 25,000. The major portion of thepopulation is located in the northern end

of the county with more than 160 subdivisions.The southern portion is primarily rural.

The county started its PAYT program inMay 1994 as a result of the necessary closing ofour landfill (rather than meeting Subtitle Dlandfill requirements). We began by developinga comprehensive understanding of the areas wewere presently serving and planned to servewith the new system. After privatization wasdiscussed and rejected, we contracted with aneighboring county with an approved landfill.

Residents are offered the choice of contract-ing with a private collector or using the coun-ty’s volume-based Blue Bag program. Residentsthat use the program buy the blue bags fromretail outlets and haul their garbage to one ofthe county drop centers, where there aredumpsters for source-separated recyclablesand blue bags. Residents are not charged forrecycling.

The bag is 32 gallons in size and costs citi-zens $1.50 at retail outlets. The price of thebag was determined through bid prices fromvendors and included a 10-cent profit forretailers. Tipping fees and hauling costs werealso considered in determining this price.

A $1.50 per-bag price was determined to bethe maximum amount that would ensure pub-lic cooperation in this new program, though itdoes not reflect the cost of the program to thepenny. Other counties were charging $1.50and, based on the cost of operating the dropcenters and disposing of the trash, that wasabout as high as we thought we could go(although the actual cost is slightly less thanthat).

All county officials and a Citizen’s SolidWaste Task Force were involved in detailed pre-planning of the new system. It was decided thechangeover would be made as rapidly as possi-ble rather than doing it in stages. Once inplace, total recycling tonnage increased 36 tonsover the previous fiscal year, and this equates toapproximately $26,000 in cost avoidance oftipping fees. We have a workable program,acceptable to the public, and one that is notincurring additional excessive expenses in viewof the rapid population growth of the county.

Other counties were charging $1.50and, based on the cost of operatingthe drop centers and disposing of thetrash, that was about as high as wethought we could go.

Population: 25,000

Start date: 1994

Rate structure: Proportional

Price: $1.50 per 32-gallon bag

Oconee County, Georgia

rsdfinalmock.qxd 2/9/99 11:31 AM Page 29

ccaa

ssee

ss

ttuu

ddii

eess

30

Trinity County began a PAYT incentive pro-gram in September 1996. The county isspread out over about 3,100 square mileswith only 13,000 residents. We offer a com-

bined drop-off and curbside collection program.

Before we considered the program, wedecided it was necessary to do some kind of arevenue increase. The County Board decidedthat rather than raise the benefit assessmentacross the board, it would institute tipping feescharged per household. That way, those peoplewho are recycling heavily or are a single personin a household and don’t generate very muchgarbage are getting a break for not creatingwaste.

Under our program, residents are charged$5.00 per cubic yard for disposal at the county’sdrop-off transfer station and landfill. Residentswho have refuse pickup are charged $1.00 foreach 33-gallon can, which is based on the coun-ty’s estimate that there are approximately six cansin a cubic yard. The $5.00 per cubic yard fee isbased on the county’s cost for landfilling MSW.

Other costs are covered under a ‘benefitassessment,’ the first tier of our multi-tieredsystem. Each household unit is charged $100

per year, which covers administration, somemaintenance of the landfill, and other costs.The combination of the benefit assessment andtipping fees covers what it costs to maintain thelandfill and transfer sites, all administrative fees,and everything else that is involved in solidwaste. It also includes long-term care of thelandfill and operation of recycling drop-offcenters at two of the eight transfer stations.

We also encourage participation in recyclingby adding an additional incentive through ben-efit assessment discounts. Residents who bringin recyclable materials are given a discount($0.025 per pound of the weight of the recy-clables they bring in) off their benefit assess-ment, with a ceiling of 40 percent of theirannual assessment. Businesses are limited to a25 percent discount. The program has beenvery successful for us, and hopefully morecommunities will institute these types of pro-grams—helping us reach goals of 50 percentreduction in waste or more!

Population: 13,000

Start date: 1996

Rate structure: Multi-Tier

Price: $100 per year for first-tier fee; $5.00

per cubic yard or $1.00 per 33-gallon

can for second-tier fee

Trinity County, California

The $5.00 per cubic yard fee is basedon the county’s cost for landfilling theMSW. Other costs are covered under a‘benefit assessment,’ the first tier of ourmulti-tiered system. Each householdunit is charged $100 per year, whichcovers administration, some mainte-nance of the landfill, and other costs.

rsdfinalmock.qxd 2/9/99 11:31 AM Page 30

ccaa

ssee

ss

ttuu

ddii

eess

31

The city of Platteville is a small universitycommunity in southwest Wisconsin, homeof the University of Wisconsin-Platteville.The current Platteville recycling and solid

waste program began on March 5, 1990. Theintent of the program is to encourage recyclingthrough a PAYT program. All single andduplex residential units in Platteville areallowed one 35-gallon clear bag or garbage canup to 50 pounds per week per residence. Thecity provides a bin for recycling, which is col-lected curbside on the same day as the garbagepickup. This is paid through the city taxes.

Any solid waste beyond the 35-gallon bagor garbage can must go in a special plastic bagthat citizens can purchase for $1.00. The citysells these bags at City Hall and has workedwith local supermarkets and convenience storesto sell the bags. The $1.00 fee takes intoaccount the cost of the bag, the incentive forstores to carry the bags (stores are charged 90cents for the $1.00 bags), and administrativecosts (including a portion of salaries and otherline items).

The price also includes 40 to 50 cents perbag for collection, hauling, and tipping fees.Costs to collect yard trimmings and operate thecompost pile are also included. In addition, weconsidered the potential for people to surrepti-tiously dump garbage: if the price is too high,people will find ways to illegally dump garbage.Based on these factors, we determined the bestrate to be $1.00.

These efforts are encouraged by state law inWisconsin. Beginning in 1997, all responsibleunits (a municipality or group of municipali-ties) must develop a volume-based fee systemsuch as PAYT, unless the responsible unitdiverts for recycling at least 25 percent (byvolume or weight) of the solid waste collected.Through its PAYT program, the city ofPlatteville has surpassed this goal.

Platteville, Wisconsin