r t g go Return of Organization Exempt From Income...

Transcript of r t g go Return of Organization Exempt From Income...

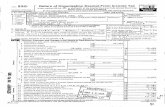

Return of Organization Exempt From Income Tax Form

g go Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung

benetft trust or private foundation) LOOL

Department of the Treasury Internal Revenue Service 0, The organization may have to use a copy of this return to satisfy state reporting requirements A For the 2002 calendar year, or tax year period beginning JUN 1 2002 and ending MAY 31 2003 B Check If Plane C Name of organization applicable

use IRS Addms label or

~change print or TEPHENS COLLEGE =

Name Number and street (or P 0 . box if mad is not delivered to street address) Initial Specific .0 . BOX 2006 change See

DInsWo-

D~m m ~mm aons City or town, state or country, and ZIP + 4 =Amended e"°°° OLUMBIA MO 65215

D Employer Identification number

43-0670936 Room/suite E Telephone number

573-876-7105

Other (specify)

~d~ 9uon * Section 501(c)l3) organizations and 4947ja)(1 ) nonexempt veritable trusts must attach a completed Schedule A (Form 990 or 990-EZ~

H and I are not applicable to section 527 organizations . . H(a) Is this a group return for affiliates? D Yes ~ No

G Web site:lWWW . STEPHENS . EDU H(b) It 'Yes,* enter number of affiliates J Organization type (ChECkOnIyOnE) "X 501(c)(3 )" cn58rtno104947(a)(1)or= 527 H(c)Areallaffiliates mcluded? N/A DYes ONo K Check here " = if the organization's gross receipts are normally not more than $25,000 . The In-No,- attach a list )

H(d) Is this a separate return filed by an or- organization need not file a return with the IRS, but if the organization received a Form 990 Package anization covered b y a g rou p rulin g ? Yes No m the mad, it should file a return without financial data . Some states require a complete return . I Enter 4-di it GEN 10,

M Check " = if the organization is not required to attach ass receipts Add lines 6b, 8b, 9b, and 10b to line 12 . 18 , 006 , 756 . Sch e (Form 990, 990-EZ, or 990-PF) t I Revenue Expenses, and Changes in Net Assets or Fund Balances

1 Contnbutions, gifts, grants, and similar amounts received a Direct pubic support la 3 , 169 , 822 . b Indirect public support 1 b c Government contributions (grants) 1c 124 655 . d Total (add lines t a through 1c) (cash $ 2 , 3 2 3 , 3 51 . noncash $ 971,126 . E 1 d 3 , 294,477 .

2 Program service revenue including government fees and contracts (from Part VII, line 93) 2 10 , 401 , 450 .

3 Membership dues and assessments 3 4 Interest on savings and temporary cash investments 4 9 1 277 . 5 Dividends and interest from securities 5 196 , 209 . 6 a Gross rents SEE STATEMENT 2 6a 686 743 .

b Less rental expenses 6b c Net rental income or (loss) (subtract line 6b from line 6a) 6c 686 , 743 .

7 Other investment income (descnbe " CHANGE IN SPLIT-INTEREST GIFTS 7 <21 689 .> 8 a Gross amount from sale of assets other A Securities B Other

than inventory 3 , 397 , 204 . 8a 31 , 516 . b Hess cost or other basis and saes expenses 3 , 507 , 725 . 8b 42 , 762 . c Gain or (loss) (attach schedule) < 110 5 21 . 8c < 11 2 4 6 . d Net gam or (loss) (combine line 8c, columns (A) and (B)) STMT 3 STMT 4 8d < 12 1 7 6 7 . >

9 Special events and activities (attach schedule) a Gross revenue (not including $ of contributions

reported on line 1a) 9a b Less' direct e raisin ex arises 9b c Net income o (loss) btract If e 9b from line 9a) 9c

10 a Gross sales o inv w rice 10a b Less cost of s sold ~ Cam) 106 c Gross profit r`~fi s)~'~i~al~ d14t*k ( ~ schedule) (subtract line 10b from line 10a) 10c

11 Other revenu (fir , FC&I 11 11 , 569 .

dl 7 c d

d

17 17 445 940 . 18 <2 , 989 , 671 .> 19 33 264 513 . 20 <104F940 .> 21 30 169 902 .

Form 990 (2002) `n

18 Excess or (deficit) for the year (subtract line 17 from line 12) 19 Net assets or fund balances at beginning of year (from line 73, column (A)) 20 Other changes m net assets or fund balances (attach explanation) SEE STATEMENT 5 21 Net assets or fund balances at end of year (combine lines 18, 19, and 20)

p LHA For Paperwork Reduction Act Notice, see the separate instructions .

r t

L

12 Total revenu add n -5 ,~W% Sd 9

13 Program ser4ses#~r~J~ea4a cnluFnn 19'1 N

14 Management and general (from line 44, column (C))

15 Fundraising (from line 44, column (D))

16 Payments to affiliates (attach schedule)

12 14,456 269 . 13 14 893 021 . L41 1 0` 73 5 849 . 1s 817,070 .

t

. , STEPHENS COLLEGE Statement of All organizations must complete column

~~ Functional Expenses and (4) organizations and section 4947( Do not include amounts reported on line

Rh Rh Oh 1/1h �. ,a � f c°.# 1 (A) Total (D) Fundraising

22 Grants and allocations (attach schedule) Cash $ 3764402 . � o� casr,$ 22 3 r 764 , 402 . 3 764 402 . TaTRMENT $

23 Specific assistance to individuals (attach schedule) 23 24 Benefits paid to or for members (attach schedule) 24 25 Compensation of officers, directors, etc 25 421 , 488 . 0 . 421 , 488 . 26 Other salaries and wages 26 4 , 411 , 464 . 3 , 865 , 404 . 177 , 458 . 368 , 27 Pension plan contributions 27 28 other employee benefits 281 , 095 , 064 . 837 1 972 . 163 , 478 . 93 , 29 Payroll taxes 29 30 Professional fundraising fees 30 31 Accounting fees 31 32 Legal fees 32 33 Supplies 33 687 669 . 545 383 . 135 708 . 6 34 Telephone 34 7 2 2 4 4 . 12 1 967 . 57 , 761 . 1 35 Postage and shipping 35 226 , 873 . 171 , 560 . 8 , 644 . 46 , 36 Occupancy 36 2 , 494 , 073 . 2 , 331 , 577 . 152 364 . 10 37 Equipment rental and maintenance 37 217 , 887 . 112 , 200 . 8 6 442 . 19 38 Printing and publications 38 85 r 698 . 5 173 . 860 . 79 , 39 Travel 39 347 552 . 135 670 . 156 799 . 55 40 Conferences, conventions, and meetings 40 41 interest 41 418 555 . 340 455 . 53 104 . 24 42 Depreciation, depletion, etc . (attach schedule) 42 1 329 , 253 . 1 , 242 , 648 . 81 , 205 . 5 43 Other expenses not covered above (itemize)

a 43a b 43b c 43c d 43d e SEE STATEMENT 6 43e 1 , 873 , 718 . 1 , 5 27 , 610 . 1 240 538 . 105

anizat~on4s comp l np expenses

( }{u~ ~~ym~ i9th 0f lines 13-1s 44 17,4 4 5 , 9 4 0 . 14 , 8 9 3 , 0 21 . 1,735,849 . 817, as ~ 43 Joint Costs . Check " = rtyou are following SOP 98-2 Are any joint costs from a combined educational campaign and fundraising solicitation reported in (8) Program services? r t ~ Yes M Nc If 'Yes," enter (I) the aggregate amount of these joint costs $ ; (i1) the amount allocated to Program services $ (iii) the amount allocated to Management and general $ , and (Iv) the amount allocated to Fundraising $

570 . 070 .

part II Statement of Program Service Accomplishments What is the organization's primary exempt purposes 1 SEE STATEMENT 7

Program Service

All organizations must describe their exempt purpose achievements m a clear end concise manner State the number of clients served, publications Issued, etc Discuss ~xp BflSBS (Required for 501(c)(3) and

achievements that ere not measurable (Section 501(c)(3) and (4) organizations and 49470(1) nonexempt charitable trash must also enter we amount of grants and (q) orps ., end 4947(a(1) allocations W others 1 trusts, but optional for others

a INSTRUCTION & RELATED EDUCATIONAL & GENERAL EXPENSES OF MORE THAN 400 FULL-TIME & PART-TIME STUDENTS .

(Grants and allocations $ ) b

(Grants and allocations $ 1 C

(Grants and allocations $ ) d

(Grants and allocations $ ) e Other program services (attach schedule) - (Grants and allocations $

14,893,021 .

f Total 01 Program Service Expenses (should equal line 44, column (8), Program services) t 14 , ti 9 .3 , U 11 . 223011 01-22-03 Form 990 (2002)

43-0670936 Columns (B), (C), and (D) are required for section 501(c)(3) Page 2

1) nonexempt charitable trusts but optional for others

0 . 2 .

614 .

578 . 516 .

132 . 245 . 665 . 083 .

996 . 400 .

9,218,510 .1 ss 1 14,406,726 . Organizations that follow SFAS 117, check here 1 U and complete tines 67 through

69 and lines 73 and 74 67 Unrestricted 11 , 354 0 0 4 . 67 8 , 874, 2 4 0 . 68 Temporarily restricted 4 , 289 , 867 . 68 3 , 491 , 877 .

m 69 Permanently restricted 17 , 620 , 642 . 69 17 , 803 , 785 . Organizations that do not follow SFAS 117, check here 1 ~ and complete lines

70 through 74 70 Capital stock, trust principal, or current funds 70 .. 71 Paid-in or capital surplus, or land, building, and equipment fund 71 72 Retained earnings, endowment, accumulated income, or other funds 72 73 Total net assets or fund balances (add lines 67 through 69 or lines 70 through 72,

. column (A) must equal line 19, column (e) must equal line 21) 33 , 264 , 513 . 73 30 , 169 , 902 74 Total liabilities and net assets /fund balances (add lines 66 and 73) ~ 42,483,023 . ~ 74 ~ 44,576,628 .

Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular organization How the public perceives an organization in such cases may be determined by the information presented on its return . Therefore, please make sure the return is complete and accurate and fully describes, m Part III, the organization's programs and accomplishments

223021 01 .22-03

t

Form 990 (2002) STEPHENS COLLEGE 43-0670936 Page 3

P~ ~V Balance Sheets

Note : Where required, attached schedules and amounts within the description column (A) (B) should be for end-of-year amounts only. Beginning of year End of year

45 Cash - non-interest-bearing 67 , 493 . 45 <41 , 389 .> 46 Savings and temporary cash investments ~ 3 , 360 , 912 . 46 432,257 .

47 a Accounts receivable 47a 500 , 658 . b Hess allowance fordoubtful accounts 47b 98 , 784 . 380 9 4 1 . a7c 401 ,. 874 .

48 a Pledges receivable 48a 1 122 , 3 4 9 . b Hess allowance for doubtful accounts a8b 2 , 563 , 441 . 48c 1 122 , 349 .

49 Grants receivable 48 , 722 . 49 134 , 505 . 50 Recewables from officers, directors, trustees,

and key employees 50 N d 51 a Other notes and roans receivable STMT 9 51a 1 , 099 , 575 . N

b Less~allowance fordoubtful accounts 51b 962 , 801 . 51 c 1 , 099 , 575 . 52 Inventories for sage or use 217 , 811 . 52 188 , 280 . 53 Prepaid expenses and deferred charges 115 765 . 53 107 , 136 . 54 Investments -securities STMT 10 " E:1 Cost OX FMV 16 , 919 , 806 . 54 21 , 550 , 893 . 55 a Investments - land, buildings, and

. equipment basis 55a 227 , 851

b Hess accumulated depreciation STMT 11 55b 93 , 379 . 136 , 164 . 55c 134 , 472 . 56 Investments-other SEE STATEMENT 12 84 , 113 . 56 94 , 023 . 57 a Land, buildings, and equipment basis 57a 44 , 268 , 125 .

b Hess accumulated depreciation STMT 13 57b 27 , 508 r 420 . 17 , 476 , 608 . 57c 16 , 759 , 705 . 58 Other assets (describe " SEE STATEMENT 14 ) 148 , 446 . 58 2 , 592 , 948 .

59 Total assets add pines 45 throu g h 58 must e q ual pine 74 ) 42 , 483 , 023 . 59 44 , 576 , 628 . 60 Accounts payable and accrued expenses 1 420 , 994 . 60 921 619 . 61 Grants payable 915 , 224 . 61 931 , 539 . 62 Deferred revenue 1 , 090 , 135 . 62 559 , 746 .

N d 63 Loans from officers, directors, trustees, and key employees 63 a 64 a Tax-exempt bond liabilities 64a

b Mortgages and other notes payable STMT 15 5 , 730 , 201 . 1 Gab 11 , 925 , 715 . 65 Other liabilities (describe ~ SEE STATEMENT 16 ) I 61,956 .1 65 1 68,107 .

i

2 HR/WK 1 0 .1 0 .1 0 . --------------------------------- ---------------------------------

--------------------------------- ---------------------------------

--------------------------------- ---------------------------------

75 Did any officer, director, trustee, or key employee receive aggregate compensation of more than $100,000 from your organization and all related organizations, of which more than $10,000 was provided by the related organizations If 'Yes,' attach schedu l e 1 [::] Yes [K] No Form 990 (2002)

223031 01-22-03

1

Form 990 2002 STEPHENS COLLEGE 11f-A Reconciliation of Revenue per Audited

Financial Statements with Revenue per Return

a Total revenue, gains, and other support per audited financial statements " a 10 , 586 , 927 .

b Amounts included on line a but not on line 12, Form 990 :

(1) Net unrealized gams on investments $ <104,940 .

(2) Donated services and use of facilities $

(3) Recoveries of prior year grants S

(4) Other(specify) S

Add amounts on lines (1) through (4) " b <104 , 940 .. c dine a minus line b " c 10 6 91 8 6 7 .

d Amounts included on tine 12, Form 990 but not on line a :

(1) Investment expenses not included on line 6b, Form 990 $

(2) Other (specify) STMT 17 : 3,764,402 .

Add amounts on lines (1) and (2) 10- d 764,402 . e Total revenue per line 12, Form 990

line c pus line d " e 14 , 456 , 269 . Part Y List of Officers, Directors, Trustees, and Key I

(A) Name and address

MARCIA KIERSCHT 1200 E . BROADWAY COLUMBIA, MO 65215 ROBERT BADAL 817 ELMWOOD PLACE SE JAMESTOWN, ND 58401 CAROL JULIAN 1507 E . BROADWAY #102 COLUMBIA, MO 65201 JOAN RINES WALNUT CREST, P .O . BOX 7405 COLUMBIA, MO 65201 ----------------- TIM KLOCKO 5 MUMFORD DRIVE COLUMBIA, F46-6-6-06-37 SEE ATTACHED LIST ---------------------------------

43-0670936 Pag e a P$rt tV=13Reconciliation of Expenses per Audited

Financial Statements with Expenses per Return

a Total expenses and losses per audited financial statements " a 113 , 681 , 538 .

b Amounts included on line a but not on line 17, Form 990 :

(1) Donated services and use of facilities

(2) Prior year adjustments reported on line 20, Form 990 $

(3) Losses reported on line 20, Form 990 i

(4) Other (specify) S

' Add amounts on lines (1) through (4) " b 0 . c dine a minus line b " c 13 681 538 . d Amounts included on line 17, Form

990 but not on line a :

(1) Investment expenses not included on line 6b, Form 990 $

(2) Other (specify) STMT 18 : 3,764,402 .

3 7 6 4 4 0 2 . Add amounts on lines (1) and (2) "

-117 , 445 , 940 . e Total expenses per line 17, Form 990

pine c pus line d " 71plOyeeS (List each one even if not compensated )

'~nt+~buGons to (E) (8) Title and average hours C) Compensation (D xpense ~ E employee benefit per week devoted to 'fl not p p i , enter ,9 a der~� ~a account and p osition -0- . coin ensation other allowances

?RESIDENT

0 HRS/WK 1182,832 .E 19,993 .E 0 . ROVOST

0 HRS/WK 1 19,563 .E 2,484 .E 0 . P FOR ADVANCEMENT

0 HRS/WK 1 79,929 .E 10,457 .E 0 . P STUDENT A AIRS

0 HRS/WK 64 , 164 . 0 . 0 . P OF BUSINESS AND FINANCE

0 HRS/WK 75,000 . 11,012 . 0 .

b It 'Yes ; you may indicate the value of these items here Do not include this amount as revenue m Part I or as an expense m Part II (See instructions m Part III ) 82b N/A

83 a Did the organization comply with the public inspection requirements for returns and exemption applications 83a K b Did the organization comply with the disclosure requirements relating to quid pro quo contributions? 83b X

84 a Did the organization solicit any contributions or gifts that were not tax deductibles N/A 84a b If 'Yes,* did the organization include with every solicitation an express statement that such contributions or gifts were not

tax deductible? N/A 84b

85 501(c)(4), (5), or (6) organizations. a Were substantially all dues nondeductible by members N/A 85a b Did the organization make only in-house lobbying expenditures of $2,000 or less N/A 85b

It 'Yes' was answered to either SSa or 85b, do not complete 85c through 85h below unless the organization received a waiver for proxy tax owed for the prior year .

c Dues, assessments, and similar amounts from members 85c N/A d Section 162(e) lobbying and political expenditures 85d N/A

e Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices 85e N/A

1 Taxable amount of lobbying and political expenditures (line 85d less 85e) 851 N/A

g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f? N/A

h If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85f to its reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the following tax year? N/A

501(c)(7) organizations. Enter a Initiation fees and capital contributions included on line 12 86a N/A

b Gross receipts, included on line 12, for public use of club facilities 86b N/A

501(c)(12) organizations. Enter . a Gross income from members or shareholders 87a N/A

b Gross income from other sources . (Do not net amounts due or paid to other sources

86

87

88 against amounts due or received from them ) 87b N/A

At any time during the year, did the organization own a 50% or greater interest m a taxable corporation or partnership, or an entity disregarded as separate from the organization under Regulations sections 301 .7701-2 and 3017701-39 If 'Yes,* complete Part IX 88 X

501(c)(3) organizations. Enter . Amount of tax imposed on the organization during the year under section 4911 0, 0 " , section 4912 . 0 . , section 4955 . 0 .

501(c)(3) and 501(c)(4) organizations. Did the organization engage in any section 4958 excess benefit transaction during the year or did it become aware of an excess benefit transaction from a prior year?

89 a

It 'Yes,' attach a statement explaining each transaction I 89b ~ ~ X

c Enter . Amount of tax imposed on the organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 . 0

d Enter : Amount of tax on line 89c, above, reimbursed by the organization " 0 . 90 a List the states with which a copy of this return is filed lo- NONE

b Number of employees employed m the pay period that includes March 12, 2002 ~ 90b ~ 383

91 The books are in care of " STEPHENS COLLEGE -- Telephone no " 573-876-7105

ziP+4 10,- 65215 Locatedat " 1200 EAST BROADWAY COLUMBIA, MO

92 Section 49470(1) nonexempt charitable trusts filing Form 990 in lieu of Form 1041- Check here 1 D and enter the amount of tax-exempt interest received or accrued during the tax year " 1 92 ~ N/A

223041 Form 990 2002 o1-zz-ai

Form 990 (2002) STEPHENS COLLEGE 43-0670936 Page NA yi Other Information Yes No 76 Did the organization engage in any activity not previously reported to the IRS If 'Yes,* attach a detailed description of each activity 76 X 77 Were any changes made in the organizing or governing documents but not reported to the IRS? 77 X

If 'Yes,' attach a conformed copy of the changes . 78 a Did the organization have unrelated business gross income of $1,000 or more during the year covered by this returns 78a X

b If 'Yes,* has d flied a tax return on Form 990-T for this year? N/A 78b 79 Was there a liquidation, dissolution, termination, or substantial contraction during the year? 79 X

If "Yes," attach a statement 80 a Is the organization related (other than by association with a statewide or nationwide organization) through common membership,

governing bodies, trustees, officers, etc., to any other exempt or nonexempt organization? 80a K b If 'Yes,* enter the name of the organization

and check whether d is 0 exempt or E] nonexempt 81 a Enter direct or indirect political expenditures . See line 81 instructions 81a 0 .

b Did the organization file Form 1120-POL for this year? 81b X

82 a Did the organization receive donated services or the use of materials, equipment, or facilities at no charge or at substantially less than fair rental values 82a I ~ X

Z

Form 990 (2002) STEPHENS COLLEGE p~ Vii Analysis of Income-Producing Activities (see page

Note: Enter gross amounts unless otherwise Unrelated busmi

indicated. (A) Business 93 Program service revenue . code

a TUITION & FEES b BOOKSHELF SALES c RESIDENCE HALL FEES d FOOD SERVICE INCOME e OTHER PROGRAM RELATED f Medicare/Medicaid payments p Fees and contracts from government agencies

94 Membership dues and assessments 95 Interest on savings and temporary cash investments 96 Dividends and interest from securities 97 Net rental income or (loss) from real estate

a debt-financed property 6 not debt-financed property

98 Net rental income or (loss) from personal property 99 Other investment income 100 Gain or (loss) from sales of assets

other than inventory 101 Net income or (loss) from special events 102 Gross profit or (loss) from sales of inventory 103 Other revenue

ROYALTIES b c d

-- 10e Subtotal (add columns (B), (D), and (E)) 105 Total (add line 104, columns (B), (D), and (E)) Note : Line 105 plus line 1d, Part I should equal the amount on line 12. Part l.

131 of the instructions ) ss income Excluded b section sit, si

C mount E"` A !~ (D S,e� Amount

or 51 4 (E) Related or exempt function income 7 , 693 , 457 .

338 318 . 1 , 009 , 818 .

886 464 . 473,393 .

0 .1 1 760,342 .E 10,401,450 . 1111. 11,161,792 .

pWr" VlllRelationship of Activities to the Accomp (See page 32 of the instructions .) ment of

1 Park X I Information Regarding Transfers Associated (a) Did the organization, during the year, receive any funds, directly or indirectly, (b) Did the organization, during the year, pay premiums, directly or indirectly, on Note : I/ "Yes" to ( b) , file Form 8 O,and Form 4720 see instructions).

Under penalties of penury that I h e ex In is retain, including acco Please cortec d co a oycAp"Tep r e fficer) Is based on all in

Sign

Here ' Signatur of o er D e

Paid Preparer's' signature

Preparer's Fi � ,;9name (o, WILLIAMS-KEEPERS LLC Use Only yours it

self-employed), '105 EAST ASH STREET 223161 address, end o,_~,j_rn zJP+o COLUMBIA MO 65203

43-0670936 Page B

9,277 . 6,209 .

743 .

<11 .6t39 .

181 <121,767 .

151 11,569 .

Line No . Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment of the organization's exempt purposes (other than by providing funds for such purposes)

SEE STATEMENT 19

p~ jX Information Regarding Taxable Subsidiaries and Disregarded Entities (see page 32 of the instructions) A) B C

Name, address, andEIN of corporation, Percentage of Nature of)activities Tota(0) inome End-op-year

p artnershi p, or disre ardedenti ownership interest assets

N/A

STAMATS COMMUNICATIONS PRINTING/GRAPHIC

615 EAST 5TH ST CEDAR RAPIDS IA 52406 DESIGN 165 748 . Total number of others receiving over $50,000 for professional services " 1 223101101-22-03 LHA For Paperwork Reduction Act Notice, see the Instructions tar Form 990 and Form 990-EZ . Schedule A (Farm 990 or 990-EZ) 2002

L

SCWEDULt a Organization Exempt Under Section 501(c)(3) OMB No 1545-0047

(Form 990 or 990-EZ) (Except Private Foundation) and Section 501(e), 501(f), 501(k), 501(n), or Section 4947(a)(1) Nonexempt Charitable Trust '00

Department ollheTreasury Supplementary Information-(See separate instructions.) Internal Revenue service lim. MUST be completed by the above organizations and attached to their Form 990 or 990-EZ Name of the organization Employer identification number

STEPHENS COLLEGE 1 43 0670936 Part I Compensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees

(See page 1 of the instructions. List each one. If there are none, enter 'None.') (a) Name and address of each employee paid (b) Title and average hours (d) Contributions ~o (e) Expense

more than $50,0 00 per week devoted to (c) Compensation emplo

plan98 yee

deferredbenerc account and other

pOSItI0f1 compensation allowances

LOIS BICHLER TL SCI CHAIR

4734 LAKE VALLEY COLUMBIA MO 65203 40 HRS WK 56 , 792 . 5 . .67

GREG BIER PROF BUS ADM

6580 S . SABINE . COLUMBIA . MO 65203 40 HRS/WK 54 .683 . 5 .46

Total number of other employees paid over $50 ,000 . 0 Part II Compensation of the Five Highest Paid Independent Contractors for Professional Services

(See page 2 of the instructions. List each one (whether individuals or firms) . If there are none, enter *None.*)

(a) Name and address of each independent contractor paid more than $50,000 (b) Type of service (c) Compensation

ASBESTOS REMOVAL SERVICES

v n nnv inqlal .T~s~~FUCnu rTmv urn r1q1 1 n_~,)Q,7

BON APPETIT MGT . CO .

1 .787 .

SODEXHO MARRIOTT SERVICES PLANT MAINTENANCE

P .O . BOX 70060 CHICAGO IL 60673-0060 OPERATIONS 1262898 .

RUFFALO CODY AND ASSOCIATES

P .O . BOX 3018 . CEDAR RAPIDS . IA 52406 ELEMARKETING 57,286 .

43-0670936 Pa9e2 Schedule A (Form 990 or 990-EZ) 2002 STEPHENS COLLEGE

X

X

X

X

X e Transfer of any part of its income or assets 1 2e

Status (See pages 3 through 5 of the instructions .)

13 D An organization that is not controlled by any disqualified persons (other than foundation managers) and supports organizations described in* (1) lines 5 through 12 above, or (2) section 501(c)(4), (5), or (6), if they meet the test of section 509(a)(2) (See section 509(a)(3) )

Provide the followmp information about the supported orpamzations . (See gape 5 of the instructions ) (b) Line number

from above (a) Name(s) of supported organization(s)

14 n An ornanization organized and ouerated to test for public safety Section 509(a)(4) (See aaae 5 of the instructions Schedule A (Form 990 or 990-EZ) 2002

223111 01-22-03

T

Statements About Activities (See page 2 of the instructions)

1 During the year, has the organization attempted to influence national, state, or local legislation, including any attempt to influence public opinion on a legislative matter or referendum? If'Yes ; enter the total expenses paid or incurred in connection with the lobbying activities 1 $ $ (Must equal amounts on line 38, Part VI-A, or line i of Part VI-B ) 1 Organizations that made an election under section 501(h) by filing Form 5768 must complete Part VI-A Other organizations checking 'Yes,' must complete Part VI-B AND attach a statement giving a detailed description of the lobbying activities .

2 During the year, has the organization, either directly or indirectly, engaged m any of the following acts with any substantial contributors, trustees, directors, officers, creators, key employees, or members of their families, or with any taxable organization with which any such person is affiliated as an officer, director, trustee, majority owner, or principal beneficiary? (if the answer to any question is "Yes," attach a detailed statement explaining the transactions.)

a Sale, exchange, or leasing of property? 2a

b Lending of money or other extension of credit

c Furnishing of goods, services, or facilities

d Payment of compensation (or payment or reimbursement of expenses rf more than $1,000) SEE PART V, FORM 990

No

X

3 Does the organization make grants for scholarships, fellowships, student loans, etc ? (See Note below ) 3 X 4 Do you have a section 403(b) annuity plan for your employees? 4 X Note : Attach a statement to explain how the organization determines that individuals or organizations receiving grants or loans from it in furtherance of it charitable programs "qualify" to receive payments. SEE STATEMENT 2 0

The organization is not a private foundation because it is- (Please check only ONE applicable box.) 5 0 A church, convention of churches, or association of churches Section 170(b)(1)(A)(i) 6 0 A school Section 170(b)(1)(A)(ii) (Also complete Part V ) 7 0 A hospital or a cooperative hospital service organization . Section 170(b)(1)(A)(ui) . 8 D A Federal, state, or local government or governmental unit Section 170(b)(1)(A)(v) 9 E] A medical research organization operated in conjunction with a hospital . Section 170(b)(1)(A)(uQ Enteritis hospital's name, city,

and state 10, 10 0 An organization operated for the benefit of a college or university owned or operated by a governmental unit Section 170(b)(1)(A)(iv)

(Also complete the Support Schedule in Part IV-A .) 11a 0 An organization that normally receives a substantial part of its support from a governmental unit or from the general public .

Section 170(b)(1)(A)(vQ (Also complete the Support Schedule m Part IV-A ) 11b o A community trust Section 170(b)(1)(A)(vi) (Also complete the Support Schedule m Part IV-A ) 12 0 An organization that normally receives . (1) more than 331/3% of its support from contributions, membership fees, and gross

receipts from activities related to its charitable, etc , functions - subject to certain exceptions, and (2) no more than 331% of its support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30, 1975 See section 509(a)(2) (Also complete the Support Schedule m Part IV-A )

d Add . Line 27a total and line 27b total f 27d N/A e Public support (line 27c total minus line 27d total) " 27e N/A f Total support for section 509(a)(2) test Enter amount on line 23, column (e) 1 27f N/A g Public support percentage (line 27e (numerator) divided by line 27f (denominator) 1 r27 N/A h Investment income percentage (line 18, column (e) (numerator) divided by line 27f (denominator) 11 27h ~ N/A

28 Unusual Grants : For an organization described m line 10, 11, or 12 that received any unusual grants during 1998 through 2001, prepare a list for y our records to show, for each year, the name of the contributor, the date and amount of the grant, and a brief description of the nature of the grant . Do not 111e this list with your return . Do not include these grants in line 15

223121 01-22-03 Schedule A (Forth 990 or 990-EA 2002

Schedule A (Form 990 or 990-EZ) 2002 STEPHENS COLLEGE 43-0670936 Page 3 Support Schedule (Complete only if you checked a box on line 10, 11, or 12 .) Use cash method of accounting. N/A Note : You ma use the worksheet m the instructions /or convertin from the accrual to the cash method of accounting .

Calendar year (ortiscalyear be g in nln in " (a) 2001 (b) 2000 (c) 1999 (d) 1998 (e) Total 15 Gifts, grants, and contributions

received . (Do not include unusual rants See line 28

18 Membership fees received 17 Gross receipts from admissions,

merchandise sold or services performed, or furnishing of facilities m any activity that is related to the organization's chantable, etc , purpose

18 Gross income from interest, dividends, amounts received from payments on securities loans (sec- tion 512(a)(5)), rents, royalties, and unrelated business taxable income (less section 511 taxes) from businesses acquired by the organization after June 30, 1975

19 Net income from unrelated business activities not included in line 18

Zp Tax revenues levied for the organization's benefit and ether paid to it or expended on its behalf

21 The value of services or facilities furnished to the organization by a governmental unit without charge Do not include the value of services or facilities generally furnished to the public without charge

22 Other income . Attach a schedule Do not include gain or (loss) from sale of capital assets

23 Total of lines 15 through 22 0 . 0 . 0 . 0 . 0 . 24 Line 23 minus line 17 25 Enter 1 % of line 23 26 Organizations described on lines 10 or 11 : a Enter 2% of amount in column (e), line 24 0- 25a N/A

b Prepare a list for your records to show the name of and amount contributed by each person (other than a governmental unit or publicly supported organization) whose total gifts for 1998 through 2001 exceeded the amount shown m line 26a 0o not file this list with your return . Enter the sum of all these excess amounts 1 26b N/A

c Total support for section 509(a)(1) test Enter line 24, column (e) 1 26c N/A d Add . Amounts from column (e) for lines . 18 19

22 26b 1 26d N/A

e Public support (line 26c minus line 26d total) _ 1 26e N/A f Public support percentage (line 26e (numerator) divided by line 26c (denominator)) 1 261 N/A

27 Organizations described on line 12 : a For amounts included m lines 15, 16, and 17 that were received from a 'disqualified person ; prepare a list for your records to show the name of, and total amounts received m each year from, each 'disqualified person! Do not file this list with your return . Enter the sum of such amounts for each year (2001) (2000) (1999) (1998)

b For any amount included in line 17 that was received from each person (other than 'disqualified persons'), prepare a list for your records to show the name of, and amount received for each year, that was more than the larger of (1) the amount on line 25 for the year or (2) $5,000 (Include in the list organizations described in lines 5 through 11, as well as individuals ) Do not file this list with your return . After computing the difference between the amount received and the larger amount described m (1) or (2), enter the sum of these differences (the excess amounts) for each year (2001) (2000) (1999) (1998)

c Add . Amounts from column (e) for lines 15 16 17 20 21 " ~ 27c ~ N/A

223131 01-22-03

Schedule A (Form 990 or 990-EZ) 2002 STEPHENS COLLEGE 43-0670936 Page 4 pg~ y Private School Questionnaire (See page 7 of the instructions .)

(To be completed ONLY by schools that checked the box on line 6 in Part IV)

29 Does the organization have a racially nondiscriminatory policy toward students by statement in its charter, bylaws, other governing Yes No

instrument, or m a resolution of its governing body 29 K 30 Does the organization include a statement of its racially nondiscriminatory policy toward students m all its brochures, catalogues,

and other written communications with the public dealing with student admissions, programs, and scholarships? 30 X 31 Has the organization publicized its racially nondiscriminatory policy through newspaper or broadcast media during the period of

solicitation for students, or during the registration period rf it has no solicitation program, m a way that makes the policy known to all parts of the general community d serves? 31 X If 'Yes ; please describe, if "No,' please explain . (If you need more space, attach a separate statement ) THE POLICY STATES IN PART THAT STEPHENS COLLEGE DOES NOT DIS- CRIMINATE ON THE BASIS OF RACE, RELIGION, GEOGRAPHIC ORIGIN OR HANDICAP IN THE ADMINISTRATION OF ITS EDUCATIONAL & ADMISSION POLICIES, SCHOLARSHIPS & LOANS, & OTHER COLLEGE PROGRAMS .

32 Does the organization maintain the following a Records indicating the racial composition of the student body, faculty, and administrative staffs 32a X b Records documenting that scholarships and other financial assistance are awarded on a racially nondiscriminatory basis? 32b X

c Copies of all catalogues, brochures, announcements, and other written communications to the public dealing with student admissions, programs, and scholarships 32c X

d Copies of all material used by the organization or on its behalf to solicit contributions? 32d X If you answered 'NO'to any of the above, please explain . (If you need more space, attach a separate statement )

33 Does the organization discriminate by race in any way with respect to' a Students' rights or privileges? 33a K b Admissions policies? 33b K s Employment of faculty or administrative staff? 33c K d Scholarships or other financial assistance 33d K e Educational policies 33e X 1 Use of faalities9 331 X g Athletic programs 33 X

h Other extracurricular activities? 33h X

If you answered 'Yes'to any of the above, please explain (If you need more space, attach a separate statement )

34 a Does the organization receive any financial aid or assistance from a governmental agency 34a X b Has the organization's right to such aid ever been revoked or suspended 34b X

If you answered 'Yes'to either 34a or b, please explain using an attached statement. 35 Does the organization certify that it has complied with the applicable requirements of sections 4 01 through 4 05 of Rev . Proc 75-50,

1975-2 C 8 587, covering racial nondiscrimination'? If'No ; attach an explanation 35 X Schedule A (Form 990 or 990-EZ) 2002

4-Year Averaging Period Under Section 501(h) (Some organizations that made a section 501(h) election do not have to complete all of the five columns

below See the instructions for lines 45 through 50 on page 11 of the instructions )

Lobbying Expenditures During 4-Year Averaging Period N/A

Calendar year (or (a) (b) W (d) (e) fiscal year beginning In) 1 2002 2001 2000 1999 Total

45 Lobbying nontaxable 0 . amount

46 Lobbying ceding amount 150% of line 45( e)) 0

47 Total lobbying ex penditures 0

48 Grassroots nontaxable 0 . amount

49 Grassroots ceding amount 150% of line 48( e)) 0

50 Grassroots lobbying ex penditures 0

Pates VI-B Lobbying Activity by Nonelecting Public Charities (For reporting only by organizations that did not complete Part VI-A) (See page 11 of the instructions ) N/A

During the year, did the organization attempt to influence national, state or local legislation, including any attempt to Yes No Amount influence public opinion on a legislative matter or referendum, through the use of a Volunteers b Paid staff or management (Include compensation in expenses reported on lines c through h .) c Media advertisements d Mailings to members, legislators, or the public e Publications, or published or broadcast statements f Grants to other organizations for lobbying purposes g Direct contact with legislators, their staffs, government officials, or a legislative body h Rallies, demonstrations, seminars, conventions, speeches, lectures, or any other means I Total lobbying expenditures (Add Boast through h .) t ~ 0

It 'Yes'to any of the above, also attach a statement giving a detailed description of the lobbying activities 223141 01-22-03 Schedule A (Form 990 or 990-EZ) 2002

Schedule A (Form 990 or 990-EZ) 2002 STEPHENS COLLEGE 43-0670936 Page 5 Path VI-A Lobbying Expenditures by Electing Public Charities (See page 9 of the instructions .) N/A

(To be completed ONLY by an eligible organization that filed Form 5768)

Check " a D if the organization belongs to an affiliated rou Check " b D if you checked °a° and 'limited control' p rovisions a

Limits on Lobbying Expenditures Affiliated,group To be completed for ALL term expenditures' means amounts paid or incurred .) totals electing organizations

N/A 36 Total lobbying expenditures to influence public opinion (grassroots lobbying) 36

37 Total lobbying expenditures to influence a legislative body (direct lobbying) 37

38 Total lobbying expenditures (add lines 36 and 37) 38

39 Other exempt purpose expenditures 39

40 Total exempt purpose expenditures (add lines 38 and 39) 40

41 Lobbying nontaxable amount Enter the amount from the following table

If the amount on line 40 Is - The lobbying nontaxable amount Is -

Not over $500.000 20% of the amount on line 40

Over $500,000 but not over $7,000,000 $100,000 plus 15% of the excess over $500,000

Over $1,W0,000 but not over $1,500,000 $175,000 plus 10% of the excess over $1,000,000 41

Over $1,500,000 but not over $17,000,000 $225,000 plus 5% of the excess over $1,500,000

Over $77,000,000 $1,000,000

42 Grassroots nontaxable amount (enter 25% of line 41)

r4

43 Subtract line 42 from line 36 Enter-0- if line 42 is more than line 36

44 Subtract line 41 from line 38 . Enter-0- if line 41 is more than line 38

Caution : If there is an amount on either line 43 or line 44, you must file Form 4720.

Schedule A (Form 990 or 990-EZ) 2002 STEPHENS COLLEGE 43-0670936 Page 6 Pifrt Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations (See page 12 of the instructions ) 51 Did the reporting organization directly or indirectly engage m any of the following with any other organization described in section

501(c) of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations? a Transfers from the reporting organization to a nonchantable exempt organization of : Yes No

(I) Sales or exchanges of assets with a nonchantable exempt organization (i1) Purchases of assets from a nonchantable exempt organization (III) Rental of facilities, equipment, or other assets (Iv) Reimbursement arrangements (v) Loans or loan guarantees (vi) Performance of services or membership or fundraising solicitations Sharing of facilities, equipment, mailing lists, other assets, or paid employees If the answer to any of the above is 'Yes,' complete the following schedule Column (b) should always show the fair market value of the goods, other assets, or services given by the reporting organization If the organization received less than fair market value in any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or services received N/A

lal I (b) I l~) (d) Line no Amount involved Name of nonchantable exempt organization Description of transfers, transactions, and sharing arrangements

52 a Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described in section 501(c) of the

Code (other than section 501(c)(3)) or in section 527? " ~ Yes ~ No

(I) Cash (II) Other assets

b Other transactions :

51a(1) X a(II) X

b(l) X b(11) X b(III) X b(Iv) X b(v) X b(vi) X c X

r 0 r 0 r 0 s 0 ~ 0 a . r p M ~ 00 w4 0 M 01 Q O 0 00 L+,1 N o ~ o, tyyt:~ Ln "~ ,--l rt oh Lta Ln

~ t0 ~O 0~ ~N ~ ~ LC) Lam' o ̀

~-1 a o

v u) i~ ~o M ~ M fn 01 'k! [- N ~? M M

0 a

~re~ O

Uy m

~ .~

*

V 1G l~ +C~ N t71 rl ~El N L"+ I~ `y

o o Oh t"- %O ('fit %O t-t O) 1+°! M E l~ I~ i'~! 01 iy3 01 Ltt ~ CS O ~E

E L) ~? ~ S~ 01 CJ n r1 In 41j [- N 01 tT 1G OD 00 °' C~ r1 a 0D Gf] 0D l0 ~-I N N

M G!1 d~ En F''k 4l~ ko

d! N t+FY O GfI 00 Si7 ~ 00 O N 00 v d~ o a° m "-I M I11 0 <-i l . lo 01 Qt M r-f r-1 ~ A CJ 10 M !"1 r-( O 01 r1 L- O N 01 ON 01

0 [- fn OD t`" O w O 0 r--4 M d~ u7 ~o to °° o H r1 G~ 10 l''l~ \O t4 N f"'? OD tr %O to %0

v»1 ~-1 tn 0 3 N ko .1 t-( S'r? ~ ~ ::r c " o

C y ~.

UA °° U

oc

o Vx

m

~ f ~ ;

N fit O ~ oo tD ~ OD O N 00 ~ C~ y ~? -4 m Ll1 0 ON r-f I- W 01 01 M r»(

~m N ko m M r1 O G1 r-4 C'+ O ~1 01 Vh 01

4'k l- [it 00 !'- O 4o O in ~-4 M TV to to p ~ o ~»1 r-1 0 %C C- lG C- N OD C+- l0 lo 1G O. v ri '-1 t!'~ ~--1 p N ~G r1 r1 C~ r1 +CM d~

a> M j Z ~D %O kD ko to 10 VJ k0

ri r1 r~ r-1 r~ r-1 rl ri O O 4~ C.~ O O ¢ O Q O Q O 0

" " O p O . O O O Q " + " Q O O

I~ " M

0 0 5

a a ~ a ~ a

d °'~ ~ H i~{ H Yet H Y~{ H }»~ H Yi H OCr a ~r, w

W W }~~1 rx x a

~r w cn E~-q H ~aC o

w z

W z H 9

~ D W o

~n H ~~ a > ~ n w w ~ ~ ~ > ~ a o a ~ > ~s c~ x H

° cWn ~ cn °a ~ z ~ ¬ A W ~ u1 h ~ ~~r1 E°+ a v) xuw w 4 w to o ~ ~ H ~ v ~ = H~ ~ ca

al ~

o ~ H ~ A'~..~ ~ p wrn A+~

~ ¬~ W ~l H 6 N Rr? d' t!! ko r- CD Ot O P-4 N

mNN

Nb

N

G~1 C7 a 0

01

O w

O ON Oh

43-0670936 STEPHENS COLLEGE

STATEMENT 1 FOOTNOTES

STATEMENT S) 1

PART II, LINE 22 GRANTS AND ALLOCATION A LIST OF RECIPIENTS OF SCHOLARSHIPS AND OTHER FINANCIAL AID IS AVAILABLE ON REQUEST . ALTHOUGH THERE MAY BE RECIPIENTS WHO ARE RELATED TO PERSONS HAVING AN INTEREST IN THE INSTITUTION, SUCH RECIPIENTS ARE SELECTED ON AN EQUAL, OBJECTIVELY DETERMINABLE BASIS WITH OTHER SUCH RECIPIENTS . THAT IS, ALL STUDENTS RECEIVING SCHOLARSHIPS ARE JUDGED WORTHY BY THE INSTITUTION'S ASSESSMENT ON THE BASIS OF ACADEMIC ACHIEVEMENT, FINANCIAL NEED, AND OTHER SIMILAR STANDARDS .

SCHEDULE A, PART V, QUESTION 34A THE INSTITUTION RECEIVES FEDERAL ASSISTANCE FROM THE U .S . DEPARTMENT OF EDUCATION FOR STUDENT FINANCIAL AID UNDER THE PELL GRANT, SUPPLEMENTARY EDUCATIONAL OPPORTUNITY GRANT,

STATEMENT S) 2, 3

STEPHENS COLLEGE 43-0670936

FORM 990 RENTAL INCOME STATEMENT 2

ACTIVITY GROSS KIND AND LOCATION OF PROPERTY NUMBER RENTAL INCOME

HILLCREST HALL, CHAPEL, OTHER REAL ESTATE 1 679,824 . RESIDENTIAL REAL ESTATE 2 6,919 .

TOTAL TO FORM 990, PART I, LINE 6A 686,743 .

FORM 990 GAIN (LOSS) FROM PUBLICLY TRADED SECURITIES STATEMENT 3

GROSS COST OR EXPENSE NET GAIN DESCRIPTION SALES PRICE OTHER BASIS OF SALE OR (LOSS)

SALE OF PUBLICLY TRADED SECURITIES 3,397,204 . 3,507,725 . 0 . <110,521 .>

TO FORM 990, PART I, LINE 8 3,397,204 . 3,507,725 . 0 . <110,521 .>

STEPHENS COLLEGE 43-0670936

FORM 990 GAIN (LOSS) FROM SALE OF OTHER ASSETS STATEMENT 4

METHOD ACQUIRED

DONATED

DATE ACQUIRED

VARIOUS VARIOUS SALE OF HORSES

STATEMENT S) 4, 5, 6

DESCRIPTION DATE SOLD

GROSS COST OR EXPENSE NET GAIN NAME OF BUYER SALES PRICE OTHER BASIS OF SALE DEPREC OR (LOSS)

31,516 . 42,762 . 0 . 0 . <11,246 .>

TO FM 990, PART I, LN 8 31,516 . 42,762 . 0 . 0 . <11,246 .>

FORM 990 OTHER CHANGES IN NET ASSETS OR FUND BALANCES STATEMENT 5

DESCRIPTION AMOUNT

UNREALIZED GAIN (LOSS) ON INVESTMENTS <104,940 .>

TOTAL TO FORM 990, PART I, LINE 20 <104,940 .>

FORM 990 OTHER EXPENSES STATEMENT 6

(A) (B) (C) (D) PROGRAM MANAGEMENT

DESCRIPTION TOTAL SERVICES AND GENERAL FUNDRAISING

UTILITIES 170,707 . 14,615 . 156,092 . ADVERTISING/PROMO 216,174 . 210,527 . 5,647 . CONTRACTED SERVICES 987,252 . 922,328 . 64,924 . RETAIL SUPPLIES 247,153 . 247,153 . MISCELLANEOUS 154,983 . 109,836 . 14,658 . 30,489 . MANAGEMENT FEES ON INVESTMENTS 58,789 . 58,789 . BANK CHARGES 6,422 . 2,794 . 3,628 . MEMBERSHIPS 18,203 . 6,322 . 10,999 . 882 . MUSIC PROGRAMMING 14,035 . 14,035 .

TOTAL TO FM 990, LN 43 1,873,718 . 1,527,610 . 240,538 . 105,570 .

I

STEPHEN~S COLLEGE 43-0670936

STATEMENT S) 7, 8

FORM 990 STATEMENT OF ORGANIZATION'S PRIMARY EXEMPT PURPOSE STATEMENT 7 PART III

EXPLANATION

PROVIDE THE OPPORTUNITY FOR BOTH TRADITIONAL & NONTRADITIONAL STUDENTS TO STUDY AND EARN UNDERGRADUATE DEGREES IN THE LIBERAL ARTS .

FORM 990 CASH GRANTS AND ALLOCATIONS STATEMENT 8

DONEE'S CLASSIFICATION DONEE'S NAME DONEE'S ADDRESS RELATIONSHIP AMOUNT

SCHOLARSHIPS SEE STATEMENT 2 NONE 3764402 .

TOTAL INCLUDED ON FORM 990, PART II, LINE 22 3764402 .

0 . 1,099,575 .

0 . 1,099,575 . TOTALS INCLUDED ON FORM 990, PART IV, LINE 51

FORM 990 NON-GOVERNMENT SECURITIES STATEMENT 10

TO 990, LN 54 COL B

STATEMENT S) 9, 10

r

STEPHEN~S COLLEGE 43-0670936

FORM 990 OTHER NOTES AND LOANS REPORTED SEPARATELY STATEMENT 9

BORROWER'S NAME TERMS OF REPAYMENT

LOANS TO STUDENTS UNDER PERKINS & OTHER LOAN PROGRAMS

DATE OF MATURITY ORIGINAL INTEREST FMV OF NOTE DATE LOAN AMOUNT RATE CONSIDERATION

0 . .00$ 0 .

SECURITY PROVIDED BY BORROWER PURPOSE OF LOAN

DESCRIPTION OF DOUBTFUL ACCT RELATIONSHIP OF BORROWER CONSIDERATION ALLOWANCE BALANCE DUE

SECURITY DESCRIPTION

EQUITY SECURITIES OTHER DEBT SECURITIES MUTUAL FUND DEBT SECURITIES

OTHER PUBLICLY TOTAL

CORPORATE CORPORATE TRADED OTHER NON-GOV'T STOCKS BONDS SECURITIES SECURITIES SECURITIES

8,844,082 . 8,844,082 .

11688192 . 11,688,192 .

1,018,619 . 1,018,619 .

8,844,082 . 1,018,619 . 11688192 . 21,550,893 .

STEPHENS COLLEGE 43-0670936

FORM 990 DEPRECIATION OF ASSETS HELD FOR INVESTMENT STATEMENT 11

COST OR ACCUMULATED OTHER BASIS DEPRECIATION

110,239 . 0 . 117,612 . 93,379 .

227,851 . 93,379 .

DESCRIPTION

LAND - INVESTMENT BUILDINGS - INVESTMENT

TOTAL TO FORM 990, PART IV, LN 55

FORM 990 OTHER INVESTMENTS

VALUATION DESCRIPTION METHOD

CSV LIFE INSURANCE MARKET VALUE

TOTAL TO FORM 990, PART IV, LINE 56, COLUMN B

FORM 990 DEPRECIATION OF ASSETS NOT HELD FOR INVESTMENT

ACCUMULATED DEPRECIATION

0 . 407,695 .

19,688,135 . 663,112 .

5,849,772 . 96,480 .

803,226 . 0 . 0 .

27,508,420 .

COST OR OTHER BASIS

505,335 . 1,687,350 .

30,771,105 . 2,606,098 . 6,767,916 .

120,171 . 1,355,768 .

81,090 . 373,292 .

44,268,125 .

BOOK VALUE

505,335 . 1,279,655 .

11,082,970 . 1,942,986 . 918,144 . 23,691 .

552,542 . 81,090 .

373,292 .

16,759,705 .

LAND LAND IMPROVEMENTS BUILDINGS FURNISHING & FIXTURES EQUIPMENT & FURNISHING VEHICLES LIBRARY BOOKS GIFT HORSES CONSTRUCTION IN PROGRESSS

TOTAL TO FORM 990, PART IV, LN 57

STATEMENT S) 11, 12, 13

DESCRIPTION

BOOK VALUE

110,239 . 24,233 .

134,472 .

STATEMENT 12

AMOUNT

94,023 .

94,023 .

STATEMENT 13

STEPHENS COLLEGE 43-0670936

FORM 990 OTHER ASSETS STATEMENT 14

TOTAL TO FORM 990, PART IV, LINE 58, COLUMN B

STATEMENT S) 14

DESCRIPTION

LOAN FUNDS HELD BY TRUSTEE BOND COSTS

AMOUNT

2,450,000 . 142,948 .

2,592,948 .

NONE FMV OF

CONSIDERATION

0 .

DESCRIPTION OF CONSIDERATION

STATEMENT S) 15

STEPHENS COLLEGE 43-0670936

FORM 990 OTHER NOTES AND LOANS PAYABLE STATEMENT 15

LENDER'S NAME TERMS OF REPAYMENT

MOHEFA-BONDS SERIES 1999 BIANNUALLY

DATE OF MATURITY ORIGINAL INTEREST NOTE DATE LOAN AMOUNT RATE

12/ /99 06/01/29 4,500,000 . .60$

SECURITY PROVIDED BY BORROWER PURPOSE OF LOAN

DEED OF TRUST CAPITAL IMPROVEMENTS

RELATIONSHIP OF LENDER

FMV OF DESCRIPTION OF CONSIDERATION CONSIDERATION BALANCE DUE

0 . 4,183,940 .

LENDER'S NAME TERMS OF REPAYMENT

FIRSTAR - VEHICLE LOAN MONTHLY

DATE OF MATURITY ORIGINAL INTEREST NOTE DATE LOAN AMOUNT RATE

04/30/01 04/30/06 17,790 . 8 .99

SECURITY PROVIDED BY BORROWER PURPOSE OF LOAN

VEHICLE TITLE PURCHASE VEHICLE

RELATIONSHIP OF LENDER

BALANCE DUE

11,628 .

43-0670936

LENDER'S NAME

BANK OF THE WEST

TERMS OF REPAYMENT

MONTHLY

DATE OF MATURITY ORIGINAL INTEREST NOTE DATE LOAN AMOUNT RATE

03/15/02 02/19/07 13,553 . 10 .75

SECURITY PROVIDED BY BORROWER PURPOSE OF LOAN

PURCHASE EQUIPMENT EQUIPMENT

RELATIONSHIP OF LENDER

STATEMENT S) 15

STEPHENS COLLEGE

NONE FMV OF

DESCRIPTION OF CONSIDERATION CONSIDERATION BALANCE DUE

0 . 10,591 .

LENDER'S NAME TERMS OF REPAYMENT

BOONE COUNTY NATIONAL INT ONLY BANK

DATE OF MATURITY ORIGINAL INTEREST NOTE DATE LOAN AMOUNT RATE

7,294,556 . 4 .75$

SECURITY PROVIDED BY BORROWER PURPOSE OF LOAN

PLAYHOUSE PROPERTY OPERATING CAPITAL

RELATIONSHIP OF LENDER

NONE FMV OF

DESCRIPTION OF CONSIDERATION CONSIDERATION BALANCE DUE

0 . 4,619,556 .

43-0670936

RELATIONSHIP OF LENDER

NONE FMV OF

DESCRIPTION OF CONSIDERATION CONSIDERATION BALANCE DUE

0 . 3,100,000 .

TOTAL INCLUDED ON FORM 990, PART IV, LINE 64, COLUMN B 11,925,715 .

FORM 990 OTHER REVENUE INCLUDED ON FORM 990 STATEMENT 17

DESCRIPTION

FINANCIAL AID/SCHOLARSHIPS

TOTAL TO FORM 990, PART IV-A

STATEMENT S) 15, 16, 17

I 1 1

STEPHENS COLLEGE

LENDER'S NAME TERMS OF REPAYMENT

MOHEFA - REVENUE ANTICIPATION NOTES SERIES 2003

DATE OF MATURITY ORIGINAL INTEREST NOTE DATE LOAN AMOUNT RATE

/ /03 3,100,000 . 2 .25$

SECURITY PROVIDED BY BORROWER PURPOSE OF LOAN

DEED OF TRUST CAPITAL IMPROVEMENTS

FORM 990 OTHER LIABILITIES STATEMENT 16

DESCRIPTION AMOUNT

ANNUITY AND LIFE INCOME OBLIGATIONS 68,107 .

TOTAL TO FORM 990, PART IV, LINE 65, COLUMN B 68,107 .

AMOUNT

3,764,402 .

3,764,402 .

STEPHENS COLLEGE 43-0670936

FORM 990 OTHER EXPENSES INCLUDED ON FORM 990 STATEMENT 18

3,764,402 . TOTAL TO FORM 990, PART IV-B

STATEMENT S) 18, 19, 20

DESCRIPTION

FINANCIAL AID/SCHOLARSHIPS

AMOUNT

3,764,402 .

FORM 990 PART VIII - RELATIONSHIP OF ACTIVITIES TO STATEMENT 19 ACCOMPLISHMENT OF EXEMPT PURPOSES

LINE EXPLANATION OF RELATIONSHIP OF ACTIVITIES

93A TUITION & FEES RECEIVED IN EXCHANGE FOR PROVIDING LIBERAL ARTS EDUCATION TO STUDENTS .

93B SALES OF BOOKS & OTHER ITEMS SOLD TO STUDENTS, FACULTY, & STAFF . 93C FEES RECEIVED IN EXCHANGE FOR PROVIDING RESIDENT LIVING TO STUDENTS . 93D FEED RECEIVED IN EXCHANGE FOR PROVIDING FOOD SERVICE TO STUDENTS 93E FINANCE CHARGES ON LOAN FUNDS, THEATRE TICKET SALES FOR STUDENT

PROGRAMS, BILLING SERVICE FEES, LIBRARY & REGISTER FINES & FEES, & MISCELLANEOUS SERVICE INCOME FROM STUDENTS .

SCHEDULE A EXPLANATION OF QUALIFICATIONS TO RECEIVE PAYMENTS STATEMENT 20 PART III, LINE 3

STUDENT AID IS BASED ON THE FACTORS OF FINANCIAL NEED AND ACADEMIC POTENTIAL

. A

STEPHENS COLLEGE ORM 990 PAGE 2 43-0670936

j Election To Expense Certain Tangible Property Under Section 179 Note : If you have an listed property, complete Part V before you complete Part I .

1 Maximum amount . See instructions for a higher limit for certain businesses 1 24,000 .

2 Total cost of section 179 property placed in service (see instructions)

3 Threshold cost of section 179 property before reduction in limitation 3 $200,000

4 Reduction in limitation . Subtract line 3 from line 2. If zero or less, enter ~0 .

5 Dollar limitation for tax ear Subtract line 4 from line 1 If zero or less enter -0~ If married filin g separate ly, sea Inshudions (e) Description of property (b) Cost (business use only) (c) Elected cost

7 Listed property . Enter amount from line 29 7

8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 8

9 Tentative deduction. Enter the smaller of line 5 or line 8 9

10 Carryover of disallowed deduction from line 13 of your 2001 Form 4562 10

11 Business income limitation . Enter the smaller of business income (not less than zero) or line 5 11

12 Section 179 expense deduction. Add lines 9 and 10, but do not enter more than line 11 12

13 Carryover of disallowed deduction to 2003 . Add fines 9 and 10, less fine 12 1111- F1 3 Note: Do not use Pert 11 or Part 111 below for listed property. Instead, use Part V.

11special Depreciation Allowance and Other Depreciation Do not include listed property.)

14 Special depreciation allowance for qualified property (other than listed property) placed In service during the tax year (see Instructions) 14

15 Property subject to section 1680(1) election (see instructions) 15

18 Other depreciation (including ACRS see instructions 18 1 - 329 , 254 .

J1JI MACRS Depreciation (Do not include listed property .) (See instructions .)

Section A

17 MACRS deductions for assets placed in service in tax years beginning before 2002 17

18 If you are electing under section 168()(4) to group any assets placed in service during the tax

ear into one or more general asset accounts check here

Section B - Assets Placed in Service During 2002 Tax Year Usin the General De reciation System (b) Month end (c) Basis for degradation (d) Recovery (e) Classification of property year placed (business/Investment use period (e) Convention (~ Method (~ Depreciation deduction

in service only - sea Instructions)

19a 3-year property

b 5-year property

c 7-year property

d 1 0-year property

0 15-year property

f 20-year property

25-year property 25 yrs . S/L

/ h Residential rental property

27.5 yrs . MM S/L

/ 27.5 yrs . MM S/L

i Nonresidential real property ~ 39 yrs . MM S/L

MM S/L Section C - Assets Placed in Service During 2002 Tax Year Using the Alternative Depreciation System

b 1 c 4

12 y rs . S/L 40 vrs . MM S/L

J pI$A Summary (See instructions.) 21 Listed property . Enter amount from line 28 22 Total . Add amounts from line 12, lines 14 through 17, lines 19 and 20 m column (g), and line 21 .

Enter here and on the appropriate lines of your return . Partnerships and S corporations - see ins 23 For assets shown above and placed in service during the current year, enter the

portion of the basis attributable to section 263A costs I 23 216251 10-25-o2 LHA For Paperwork Reduction Act Notice, see separate instructions.

21

Form 4562 (2002)

OMB No

20 1545-017

Forth 4562 2

Depreciation and Amortization 990 Department ofthaTreasury (Including Information on Listed Property) Attachment Internal Revenue service 1 See separate instructions . 1 Attach to your tax return . Sequence No 87 Name(s) shown on return Business or activity to which this forth relates Identifying number

1,329,254 .

Form 4562 (2002) Page 2 pIV Listed Property (Include automobiles, certain other vehicles, cellular telephones, certain computers, and property used for entertainment,

recreation, or amusement .) Note : For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c) of Section A, all of Section 8, and Section C if applicable .

Section A - Depreciation and Other Information (Caution : See instructions for limits forpassenger automobiles.)

24a Do you have evidence to suooort the business/investment use claimed n Yes n No 24b If 'Yes .' is the evidence written? D Yes 0 No 1 (d) (e)

(11 (e) (n)

Type of property Date Business/ Cost or Basis for depreciation Recovery Method/ Depreciation Elected (list vehicles first ) placed m investment cbu9in«snnv~~,ent section 179

service use percentage other basis use only) period Convention deduction cost

25 Special depreciation allowance for qualified listed property placed in service during the tax vear and used more than 50% in a aualifed business use

business use :

% S/L I %I S/L %S/L -

28 Add amounts in column (h), lines 25 through 27 . Enter here and on line 21, page 1 28 29 Add amounts in column (i), line 26 . Enter here and on line 7, page 1 ~ 29

Section B - Information on Use of Vehicles Complete this section for vehicles used by a sole proprietor, partner, or other 'more than 5% owner," or related person . If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles .

(a) (b) I (c) Idl I (e) I M hicte Vehicle Vehicle Vehicle Vehicle VehG 30 Total businesslnvestment miles driven during the

year (do not include commuting miles) 31 Total commuting miles driven during the year 32 Total other personal (noncommuting) miles

driven 33 Total miles driven during the year.

Add lines 30 through 32 34 Was the vehicle available for personal use

during off-duty hours? _ 35 Was the vehicle used primarily by a more

than 5% owner or related person? 38 Is another vehicle available for personal

use?

Yes I No I Yes I No I Yes I No

Amortization

o I u I ~cde amomuno nnon Amortization ahon section period or percentage for this year

as 5 r 498 . ~ 44 ~ 5-14-9-8-,

Form 4582 (2002)

(a) I (b) k) Description of cosh Data amor67a6on Amortlzabla

beans amount

21625211a25-02

27 Property used

Section C - Questions for Employers Who Provide Vehicles for Use by Their Employees Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who are not more than 5°.6 owners or related arsons . 37 Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, by your Yes

employees? 38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your

employees? See instructions for vehicles used by corporate officers, directors, or 1 % or more owners 39 Do you treat all use of vehicles by employees as personal use? 40 Do you provide more than five vehicles to your employees, obtain information from your employees about

the use of the vehicles, and retain the information received? 41 Do you meet the requirements concerning qualified automobile demonstration use?

Note : If your answer to 37, 38, 39, 40, or 41 is "Yes, " do not complete Section B for the covered vehicles.

42 Amortization of costs that begins du

43 Amortization of costs that began before your 2002 tax year 44 Total . Add amounts in column (0 . See instructions for where to

STEPHENS COLLEGE Board of Trustees May 31, 2003

Virginia Simmons-4965 Dallas, TX 75225

r"~ r

Patricia Barry-19?? Los Angeles, CA 90049

Gayle Bentsen--1967 Houston, TX 77019

Mary Bitzer Columbia, MO 65201

Dale Creach Vice Chair-Administration & Finance Secretary & Treasurer Columbia, MO 65201-6344

Bruce Crittenden St. Louis, MO 63128

Katherine Dietzen-1986 New York, NY 10019

George Ann Handing-1958 Vice Chair-Board Affairs Denver, CO 80224

Charles Johnson Shawnee Mission, KS 66208-1954

Gretchen Kimball-1957 Chair Board of Trustees Belvedere, CA 94920

Teresa Maledy--1978 Columbia, MO 65203

Dr . Lenard Politte, Vice Chair-Academic & Student Affairs Columbia, MO 65201

Christy Powell-1968 Coral Gables, FL 33156-2326

Mary Silverthorne--1955 Vice Chair-Advancement Dallas, TX 75229

8y . Date Director

Alternate Mailing Address - Enter the address if you want the copy of this application for an additional 3-month extension returned to an address different than the one entered above .

Name WILLIAMS KEEPERS, LLC

Type 1105 Number and street (include suite, room, or apt . no .) Or a P.O. box number

or print E . ASH STREET City or town, province or state, and country (including postal or ZIP code) COLUMBIA, MO 65203

Form 8868 (12-2000)

Form 8868(12-2000) Page 2

0 If you are filing for an Additional (not automatic) 3-Month Extension, complete only Part II and check this box Note : Only complete Part II if you have already been granted an automatic 3-month extension on a previously tiled Form 8888 . 0 If you are filing for an Automatic 3-Month Extension, complete only Part I (on page 1) .

pmt 11 Additional not automatic 3-Month Extension of Time - Must file Original and One Co

Name of Exempt Organization Employer identification number Type or print. STEPHENS COLLEGE 43-0670936 Fi° by me extended Number, street, and room or suite no. If a P.O . box, see instructions . For IRS use only due date (or .O . BOX 2006 filing the Mnm See City, town or post office, state, and ZIP code. For a foreign address, see instructions. instructions C OLUMBIA , MO 65215

Check type of return to be filed (File a separate application for each return) : D Form 990 D Form 990~EZ D Form 990~T (sec . 401(a) or 408(a) trust) EJ Form 1041-A D Form 5227 0 Form 8870

Form 990-BL D Form 990~PF D Form 990-T (trust other than above) D Form 4720 ~ Form 6069

STOP: Do not complete Part II if you were not already granted an automatic 3-month extension on a previously fil ed Form 8888 .

" If the organization does not have an office or place of business in the United States, check this box " D " Ii this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN) . If this is for the whole group, check this box " = . If it is for part of the group, check this box " = and attach a list with the names and ESNs of all members the extension is for .

4 I request an additional 3-month extension of time until APRIL 15 , 2004

5 For calendar year , or other tax year beginning JUN 1, 2002 . and ending MAY 31, 2003 8 If this tax year is for less than 12 months, check reason : 0 Initial return D Final return ~ Change in accounting period 7 State in detail why you need the extension

ADDITIONAL TIME IS NECESSARY TO FILE A COMPLETE AND ACCURATE RETURN .

8a If this application is for Form 990-BL, 990-PF, 990~T, 4720, or 6069, enter the tentative tax, less any nonrefundable credits . See instructions

b If this application is for Form 990~PF, 990-T, 4720, or 6069, enter any refundable credits and estimated tax payments made . Include any pnor year overpayment allowed as a credit and any amount paid previously with Form 8868

c Balance Due . Subtract line 8b from line 8a. Include your payment with this form, or, if required, deposit with FTD coupon or, if required, by using EFfPS (Electronic Federal Tax Payment System). See instructions $ N/A

Signature and Verification Under penalties of perjury, I dgc~ re t I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and ccro~1at I am a0honzed to prepare this form .

Notice to Applicant - To Be Completed by the IRS 0 We have approved this application . Please attach this form to the organization's return .

We have not approved this application . However, we have granted a 10-day grace period from the later of the date shown below or the due

date of the organization's return Including any prior extensions) . This grace period is considered to be a valid extension of time for elections otherwise required to be made on a timely return . Please attach this form to the organization's return .

We have not approved this application . After considering the reasons stated in item 7, we cannot grant your request for an extension of time to

file . We are not granting the 10day grace period. We cannot consider this application because it was filed after the due date of the return for which an extension was requested .

Other

Alternate Mailing Address - Enter the address if you want the copy of this application for an additional 3-month ~~~pnto an address different than the one entered above . ~'� ` ~+ ~~

~ U u9

Name WILLIAMS KEEPERS, LLC LINDA WE15ilvr r , r i_L� vin[l:l OR,

Type I Number and street Include suite, room, or apt. no .) Or a P.O . box number or print 105 E . ASH STREET

City or town, province or state, and country Including postal or ZIP code) COLUMBIA . MO 65203

Form 8868 (12-2000)

0 If you are filing for an Additional (not automatic) 3-Month Extension, complete only Part 11 and check this box . . . . . . . " 0 Note: Only complete Part II if you have already been granted an automatic 3-month extension on a previously filed Form 8868. 0 K you are filing for an Automatic 3-Month Extension, complete only Part 1 (on page 1) . Part 0 Additional not automatic 3-Month Extension of Time - Must file Original and One Co

Name of Exempt Organization Employer identification number Type or print . TEPHENS COLLEGE 43-0670936 File by the extended Number, street, and room or suite no . If a P.O. box, see instructions . For IRS use only due date for P .O . BOX 2006 filing we return see City, town or post office, state, and ZIP code . For a foreign address, see instructions . '"'`"ct'°"' OLUMB IA, MO 65215 Check type of return to be filed (Fle a separate application for each return):

Form 990 [--1 Form 990~EZ FlForm 990~T (sec. 401(a) or 408(a) trust) D Form 1041 ~A ED Form 5227 EJ Form 8870 Form 990-BL [-1 Form 990-PF 0 Form 990~T (trust other than above) 0 Form 4720 El Form 6069

STOP: Do not complete Part II if you were not already granted an automatic 3-month extension on a previously filed Form 8888.

" If the organization does not have an office or place of business in the United States, check this box . . . . . . . . . , , . ., . . . , , . . . . . " If this is !or a Grove Return, enter the organization's four digit Group Exemp?i~.r. Number !GE .KQ . If this is for the whole group, check this box " 0 . If it is for part of the group, check this box " D and attach a list with the names and EINs of all members the extension is for .

4 I request an additional 3-month extension of time until APRIL 15, 2004 5 For calendar year_, or other tax year beginning JUN 1, 2002 . and ending MAY 31, 2003 8 If this tax year is for less than 12 months, check reason : 0Initial return 0 Final return E:1 Change in accounting period 7 State in detail why you need the extension

ADDITIONAL TIME IS NECESSARY TO FILE A COMPLETE AND ACCURATE RETURN .

8a If this application is for Form 990-8L, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any nonrefundable credits . See instructions , _ .__ ., . . . . . . . . . . . . . , . . . . _ . . . ._ . . . __

b If this application is for Form 990~PF, 990-T, 4720, or 6069, enter any refundable credits and estimated tax payments made . Include any prior year overpayment allowed as a credit and any amount paid previously with Form 8868 . $

c Balance Due . Subtract line 8b from line 8a. Include your payment with this form, or, if required, deposit with F7D coupon or, if required, by using EFTPS (Electronic Federal Tax Payment System). See instructions . . . . . . _ $ N/A

Signature and Verification Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that I am authorized to prepare this form .

Signature " A . ~ Tile " CPA A ^1 Date " II Notice to Applicant - To Be Completed by the IRS

We have approved this application . Please attach this form to the organization's return . We have not approved this application . However, we have granted a 10~day grace period from the later of the date shown below or the due date of the organization's return (including any prior extensions) . This grace period is considered to be a valid extension of time for elections otherwise required to be made on a timely return . Please attach this form to the organization's return . We have not approved this application . After considering the reasons stated in item 7, we cannot grant your request for an extension of time to file . We are not granting the 10~day grace period . We cannot consider this application because it was filed after the due date of the return for which an extension was requested . Other

EXTENSION APPROVED Director Date