r Sized by Peak IP30 boe/d Austin Chalk Wells Since 2015 · GPOR 21% Ascent 12% AR 7% MR 4% CNX 3%...

Transcript of r Sized by Peak IP30 boe/d Austin Chalk Wells Since 2015 · GPOR 21% Ascent 12% AR 7% MR 4% CNX 3%...

1

Virginia

Butler

Indiana

Somerset

Stark

Randolph

Fayette

Garrett

Hardy

Grant

Preston

Clarion

Wayne

Mercer

Greene

Cambria

Allegheny

Washington

Meigs

Roane

Athens

Westmoreland

Lorain

Jefferson

Elk

PerryNoble

Pendleton

Lewis

Braxton

Ritchie

Belmont

Mason

Wood

Armstrong

Portage

Clearfield

Tucker

Beaver

Carroll

Monroe

Trumbull

Muskingum

Gallia

Wirt

Medina

Jackson

Bedford

Holmes

Morgan

Summit

Washington

Guernsey

Tyler

Coshocton

Wetzel

Gilmer

Harrison

Upshur

Harrison

Tuscarawas

Rockingham

Ashland

Marion

Jefferson

Columbiana

Mineral

Mahoning

Barbour

Knox

Venango

Webster

Lawrence

Marshall

Hampshire

Allegany

Clay

Calhoun

Monongalia

Doddridge

Licking

Taylor

Putnam

Cuyahoga

Ohio

Pocahontas

Shenandoah

Kanawha

Vinton

Geauga

Pleasants

Hocking

Brooke

Blair

CabellHighland

Nicholas

Forest

Legend

Hancock

Austin Chalk Wells Since 2015Sized by Peak IP30 boe/d

Siltstone Footprint

Drilling Rigs

PENNSYLVANIA

WEST VIRGINIA

OHIO

1

2

3

4

5

Elk

Erie

York

Tioga

Erie

Potter

Steuben

Centre

Oneida

Berks

Butler

Bradford

Kent

Lycoming

Bedford

Clinton

McKeanWarren

Clearfield

Augusta

Allegany

Blair

Indiana

Crawford

Luzerne

Somerset

Stark

Otsego

Wayne

Cattaraugus

Randolph

Bath

Fayette

Perry

Lancaster

Hardy

Mercer

Kanawha

Franklin

Chester

Garrett

Sussex

Cayuga

Tioga Delaware

Oswego

Broome

Ontario

Knox

Wayne

Chautauqua

Monroe

Chenango

Grant

Clarion

Preston

Schuylkill

Gallia

Cambria

Wayne

Monroe

Herkimer

Pike

Pocahontas

Lorain

Madison

Huntingdon

Onondaga

Venango

Greene

Perry

Clay

Nicholas

Allegheny

Adams

Fauquier

Trumbull

Washington

Meigs

Roane

Athens

Westmoreland

Cecil

Jefferson

Ashtabula

Frederick

Mifflin

Fulton

Rockingham

Licking

Noble

Pendleton

Carroll

Louisa

Yates

Fayette

Lewis

Wayne

Forest

Niagara

Webster

Braxton

Dauphin

Ritchie

Belmont

Mason

Wyoming

Wood

Armstrong

Portage

Baltimore

Livingston

Tucker

Beaver

Caroline

Lincoln

Albemarle

Carroll

Monroe

Boone

Susquehanna

Fairfax

Loudoun

Page

Hampshire

Cortland

Charles

Kent

Harford

Muskingum

Wirt

Medina

Sullivan

Jackson

Holmes

Morgan

Bucks

Summit

Washington

Guernsey

Genesee

Juniata

Union

Tyler

Carbon

Coshocton

Wetzel

Ashland

Greenbrier

Columbia

Tompkins

Lehigh

Gilmer

Geauga

Dorchester

Orleans

Vinton

Harrison

Upshur

Allegany

Harrison

Salem

Lake

Tuscarawas

Highland

Snyder

Orange

Frederick

Marion

Putnam

Cuyahoga

Cumberland

Jefferson

Columbiana

Cabell

Mineral

Wyoming

Cameron

Mahoning

Barbour

Culpeper

Chemung

Lebanon

Huron

Montgomery

Washington

Schuyler

Hocking

Wicomico

Essex

Lawrence

Marshall

Berkeley

Montgomery

Stafford

Howard

Monongalia

Morgan

Warren

Taylor

Clarke

Erie

Ohio

Doddridge

Ohio

Pennsylvania

New York

Virginia

West Virginia Maryland

Elk

Erie

Tioga

Potter

Steuben

Centre

Berks

Bradford

Lycoming

Clinton

McKean

Clearfield

Allegany

Luzerne

Cattaraugus

Blair

Wayne

Perry

Tioga

Broome

Ontario

Chenango

Schuylkill

Cayuga

Madison

Otsego

Monroe

Onondaga

Mifflin

Indiana

Cambria

Yates

Wayne

Monroe

WyomingLivingston

Susquehanna

Cortland

Dauphin

Sullivan

Jefferson

Genesee

Delaware

Juniata

Union

Carbon

Huntingdon

Columbia

Tompkins

Niagara

Lehigh

Seneca

Oneida

Snyder

Wyoming

Cameron

Chemung

Lebanon

Schuyler

Lackawanna

Northumberland

Orleans

Warren

Pike

Herkimer

Montgomery

Northampton

Bucks

Montour

Forest

Lancaster

Erie

Chester

PENNSYLVANIA

Opportunity to acquire a substantial portfolio of mineral and royalty assets in the core of the Utica, Marcellus, and Upper Devonian

52,406 net royalty acres(1), 1,771 ORRI acres(1), and 1,930 additional leased working interest acres

Low concentration risk, with interest in >625 currently producing wells across 20 counties in OH, PA, and WV

March 2019 production of 16.2 net mmcfe/d (90% gas) with drilling inventory consisting of >5,000 locations

LTM cash flow of ~$30 million

Well-distributed acreage provides high-confidence upside exposure across the tri-state region

Seller has exposure to >50% of the future development locations in core Utica

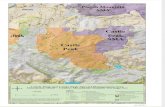

Asset Overview

Siltstone 2019 Appalachia Divestiture

Siltstone Resources and its affiliates (collectively, “Seller”) are offering for sale certain mineral and royalty interests in Appalachia (the

“Properties”). BMO Capital Markets has been retained as exclusive financial advisor to Seller.

Asset Map

OH29,173 PA

13,785

WV9,448

1. Net royalty acres normalized to 1/8th royalty.

2. March 2019 daily production. Upper Devonian production represents <1% of total production.

Key InformationNet Royalty Acres

by State(1)

Production by Formation

TBU

52% in

Belmont and

Jefferson, OH

42% in

Washington and

Greene, PA

Annual On-Acreage Wells TIL

TBU

OH86%

PA9%

WV5%

EQT23%

Encino22%

GPOR22%

Ascent12%

AR7%

CNX3%

MR3%

SWN2%

Other6%

Production

by Formation(2)

Production

by Operator(2)

Production

by State(2)

TBU

Utica87%

Marcellus13%

Strong Historical Activity

0

20

40

60

80

100

120

140

2014 2015 2016 2017 2018

Including Asset

Sales

$

27,085,019

Concentrated in most

economic and actively

developed areas

EQT23%

Encino22%

GPOR21%

Ascent12%

AR7%

MR4%

CNX3% SWN

2%

Other6%

Utica Marcellus Other

Pad / Well Name OperatorAvg. Peak

(mmcfe/d)

Jack Hamilton E SMF JF Ascent 29.1

Bounty Hunter EQT 21.7

Cosgray EQT 22.0

Quarto Mining Co. CNX 20.9

Coastal Forest Res. Co. Antero 22.3

My TB Investments 25H Shell 16.3

1

2

3

4

5

6

6

2

Key Investment Highlights

Process Overview

VDR available Mid August 2019

Data Room presentations begin in Late August 2019

Contact Sandra Ramsey at

[email protected] or 713-518-1187 for a

Confidentiality Agreement, access to the VDR, and/or to

request a data room presentation

NOTE: All or part of the Siltstone 2019 Appalachia Divestiture is subject to prior sale at any time and any dates are subject to revisions at any time, at the sole discretion of Seller and BMO Capital

Markets Corp. (“BMOCMC”). Please do not contact Seller directly. Direct all inquiries to the BMO Capital Markets Corp. (“BMOCMC”) personnel listed above.

DISCLAIMER: No representation or warranty, express; statutory; or implied, is given as to the achievement, completeness, accuracy or reasonableness of any information, data, projection, forecast, or other forward-looking

statement (including, but not limited to, with respect to future production and the cash flows to be derived therefrom) contained in this presentation or otherwise, all of which (i) reflect various assumptions made by, and

significant elements of judgment of, Seller and its management and (ii) are subject to business, economic and competitive uncertainties and contingencies. Neither Seller, nor any of its directors, officers, employees,

affiliates, consultants, representatives or agents, including, but not limited to, BMOCMC, (i) assumes any responsibility or duty to update or revise this information, or to inform any prospective purchaser(s) of any matter of

which any of them becomes aware that may affect any matter referred to in this information, (ii) accepts responsibility for any errors and omissions which may be contained herein or in any materials, statements, or

information otherwise provided by such persons or (iii) accepts any liability whatsoever for any loss (whether direct or consequential) arising from any use of or reliance on this information. In all cases, interested parties

should conduct their own investigation and analysis of the Properties, in consultation with their own legal, technical, financial, accounting and other advisors. The presentation of this information does not constitute an offer

that can be accepted to form a binding contract or deemed a basis for contract by estoppel or otherwise, and no prospective purchaser may rely on this information as a basis for incurring any costs, undertaking any

obligation or foregoing any opportunity. Seller reserves the right, at any time, to terminate any ongoing discussions with any prospective purchaser and to modify any procedures without giving advance notice or providing

any reason therefor to such prospective purchasers, and the act of providing this information shall not be construed, interpreted or implied to obligate Seller to furnish any additional information or to compel Seller to

negotiate or consummate a transaction with respect to all or any portion of the Properties described herein. No legal relationship shall be created between Seller and the recipient by virtue of the provision of this information

by Seller or by virtue of any discussion or communications in connection herewith. Seller further reserves the right to take any action with respect to the Properties, whether within or outside the ordinary course of business.

This document is not to be construed as an offer or solicitation to buy or sell any security.

BMO Capital Markets | 700 Louisiana Street | Suite 2100 | Houston, Texas 77002 | http://datarooms.bmo.com

Acreage concentrated in the core of the play

Exposure to premier acreage within portfolios of major Appalachian operators including Antero, Ascent, Encino, EQT, and

Gulfport, plus well-capitalized operators including Chevron, ExxonMobil, and Shell

Increasing development activity due to unrestricted market access following recent midstream de-bottlenecking efforts

Substantial free cash flow generation

LTM cash flow of ~$30 million

Lease extensions and renewals provide additional revenue source

Significant potential upside

Portfolio contains repeatable drilling inventory of highly economic locations with line of sight to >175 DUCs/PUDs

Wells spud on Seller acreage increasing annually

Comprehensive land and title documentation (both digital and hard copy)

1. Peer group includes Antero, Ascent, Chevron, CNX, Encino, EQT, ExxonMobil, Gulfport, and Montage.

Rob Priske MD / Transaction Mgr.

713-546-9727 [email protected]

Michael Hackett Commercial Manager

Bob Maurer Geoscientist

Emrys McMahon, PE Engineer

Jonathan Kalkan Engineering Tech.

Marian Yu Associate

Robust Production Growth

Contacts

(1)

0%

50%

100%

150%

200%

250%

300%

350%

1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19

Uti

ca D

ail

y P

rod

ucti

on

Gro

wth

Peer Group Siltstone