Pytheas Montenegro Report 2011

-

Upload

daptrading -

Category

Documents

-

view

1.166 -

download

3

description

Transcript of Pytheas Montenegro Report 2011

1Copyright © 2011 Pytheas Limited July 2011

Investing in Montenegro,

the pearl of the Adriatic.

July 2011

Version 04

2Copyright © 2011 Pytheas Limited July 2011

“At the moment of the creation of our planet, the most beautiful

merging of land and sea occurred at the Montenegrin seaside...

when the pearls of nature were sworn, an abundance of them were

strewn all over this area…”

Lord Byron

From the top of Mount Lovćen: “Am I in Paradise or on the Moon?!”

Bernard Shaw

3Copyright © 2011 Pytheas Limited July 2011

4Copyright © 2011 Pytheas Limited July 2011

Map of Montenegro

5Copyright © 2011 Pytheas Limited July 2011

Location & National Symbols

Coat of Arms

Flag

6Copyright © 2011 Pytheas Limited July 2011

It is Pytheas opinion that Montenegro could become the business

bridge of Europe across the Adriatic, both a business hub and an

economic gateway; an exclusive destination for Europeans and

other nationals that seek to invest in a holiday, a retirement home or

an investment home!

7Copyright © 2011 Pytheas Limited July 2011

Why Montenegro

■ At the borders of the old and new Europe;

■ An EU candidate state;

■ The Euro (€) has been its official currency since 2001;

■ Political stability;

■ Reformed according to the EU legal framework for investment;

■ Relatively developed telecommunication infrastructure;

■ One of the most competitive corporate tax regimes in Europe;

■ No restrictions on profit, dividend or interest;

■ Significant tax reliefs and concessions;

■ Liberal trade regime;

■ Customs exemptions for investments in goods imported as investors’ deposits;

■ Free access to EU markets;

■ FTA zones and also to the Russian market (only 1% of the custom evidence);

■ The quality and diversity of its natural and anthropological values, makes it a most attractive tourist and permanent living destination;

■ Land laws that give foreign investors equal status with local ones, i.e. with full deeds and titles to land and real estate.

8Copyright © 2011 Pytheas Limited July 2011

Slide(s)About Montenegro

Geography 9 - 10

Demographics 11 - 12

Government 13 - 14

Climate 15

Ports 16

Yachting Marinas 17

Nature beyond conception 18 - 33

History and culture 34 - 42

9Copyright © 2011 Pytheas Limited July 2011

■ Montenegro is a smaller, predominantly mountainous state in southwest Balkans (Southeastern Europe).

■ It borders Croatia and Bosnia and Herzegovina to the northwest, Serbia to the northeast, Albania to the south and the Adriatic Sea (across Italy) to the west.

■ The length of its borders are 614 km; with, Croatia 14 km, Bosnia and Herzegovina 225 km, Serbia 203 km and Albania 172 km.

■ The length of the coastline is 293,5 km with 56.9 km of beaches and 16.1 km of island coast.

Geography

10Copyright © 2011 Pytheas Limited July 2011

Geography (continued)

■ Its surface area is 13,812 km² (Sicily is 25,460 km² and Cyprus is 9,251 km²).

■ By its geographical position, it belongs to Southern Europe.

■ The two furthermost points of the country are only 190 km apart in a straight line, but between them the northbound air streams of Africa meet the southbound from the Polar circle.

■ The distance between capital Podgorica and Rome is around 500 km by air, from Paris and Berlin it is around 1,500 km, from Moscow almost 2,000 km, and 7,500 km from New York.

Hotel Sveti Stefan, Sveti Stefan

11Copyright © 2011 Pytheas Limited July 2011

■ The population of Montenegro is 620,029 (2011 census).

■ The capital is Podgorica (formerly Titograd) with 185,937inhabitants, Nikšić 72,443, Bijelo Polje 46,051, Bar 42,048, Berane 33,970, Pljevlia 30,786, Herceg Novi 30,864 (2011 census) .

■ Ethnic groups: Montenegrin 45%, Serbian 29%, Bosniak 9%, Albanian 5%, other (Muslims, Croats, Roma) 12% (2011 census).

■ Population growth rate: - 0.777% (2010 est.)

■ Birth rate: 11.09 births/1,000 population (2010 est.)

Demographics

Montenegrins in national costumes

12Copyright © 2011 Pytheas Limited July 2011

■ Urban population: 63% of total population (2011).

■ Rate of urbanization: - 0.8% annual rate of change (2005-10 est.).

■ The official language of Montenegro is Montenegrin. It became the official language in October of 2007.

■ Standard Serbian, Bosnian, Albanian, and Croatian are also spoken and are officially recognized languages.

■ It is a multi-ethnic and multi-confessional community (vast majority Christian orthodox, the rest are Islamic, Roman Catholic, Jewish, Protestant and other).

.

Demographics (continued)

Majorettes in the old city of Kotor

13Copyright © 2011 Pytheas Limited July 2011

■ Montenegro is a parliamentary representative democratic republic whereby the Prime Minister is the head of the government.

■ Executive Power Government;

The Government is appointed by majority vote of the Parliament;

The Prime Minister submits to the Parliament the Government's Program including a list of proposed ministers – the resignation of the Prime Minister will cause the fall of the Government.

■ Legislative Power Parliament (4-year term) and Government.

■ Judicial Power Independent of Executive and Legislative;

It includes a constitutional court composed of five judges with nine-year terms and a supreme court with justices that have life terms.

■ The President (5-year term) is the head of state. The President performs some executive and legislative functions in addition

to ceremonial duties.

Government

14Copyright © 2011 Pytheas Limited July 2011

■ Igor Lukšić is the current Prime Minister of Montenegro and Head of Government. The current members of the cabinet were elected on 29 December 2010; and supported by a ruling coalition of DPS, SDP, DUA, HGI and BS.

■ Montenegro’s local government has 21 municipalities. The municipal authorities are the

Municipal Assembly and the Mayor;

The Municipal Assembly (4-year tem) is the representative body of the citizens of the Municipality;

The Mayor (4-year term) is the executive body of the municipality.

Government (continued)

Map of Montenegro municipalities

15Copyright © 2011 Pytheas Limited July 2011

Climate

■ Montenegro has a rather diverse climate, The South part is characterized

by Mediterranean climate with long, hot and dry summers, and gentle rainy winters.

The Central and northern part is characterized by mountain climate, and

The utmost North part by continental climate, with small, considerably equilibrated quantities of rainfalls, and great daily and yearly amplitudes of temperature.

■ Average temperature of the air is 27.4°C in the summer and 13.4°C in the winter; 180 average sunny days per year. At Rafailovići, Budva

16Copyright © 2011 Pytheas Limited July 2011

Ports

■ International Seaports Bar;

Kotor;

Herceg Novi;

Tivat;

Zelenika.

■ International Airports Podgorica;

Tivat.

Port of Bar, a view

17Copyright © 2011 Pytheas Limited July 2011

Yachting Marinas

■ Yachting Marinas Ulcinj;

Sveti Nikola, Bar;

Budva;

Herceg Novi;

Kaliman, Tivat;

Kotor;

Meljine;

Kordić, Prčanj;

Risan;

Zelenika.

Mega-yacht marina (under construction), Tivat

18Copyright © 2011 Pytheas Limited July 2011

Nature beyond conception

■ Although small in area, nature has produced here unique contrasts that is truly beyond conception.

■ The diversity of its, geological background, areas, climate and landscape, as well as the position of Montenegro in the Balkans and on the Adriatic, provide conditions of very high biological diversity, making Montenegro one of the hot spots of European and world biodiversity.

■ The Parliament of Montenegro, in 1991, adopted the Declaration whereby Montenegro got proclaimed the first ecological state in the world.

Ada Bojana beach, Ulcinj

19Copyright © 2011 Pytheas Limited July 2011

■ Over a span of only 100 km in a straight line, three natural environments are distinguishable: the seaside, the Karstic field zone and the high mountain region.

■ A most attractive resource is the 313 km long coastline with 117 natural sandy and rocky beaches and 8 small islands – The longest beach is at Ulcinj (12 km) also the longest natural sandy beach on the Mediterranean.

■ The seaside is a very narrow strip of land (2 to 10 km wide), separated from the inland by high and steep dolomite mountains of Rumija, Sutorman, Orjen, and Lovćen.

Mogren beach, Budva

Nature beyond conception (continued)

20Copyright © 2011 Pytheas Limited July 2011

■ The abundance of underwater caves, shipwrecks, cliffs and rich marine life make Montenegro a scuba diving heaven.

■ The fauna of the Montenegro sea (although not yet fully investigated) includes over 300 species of algae, 40 species of sponges, 150 species of crustaceans, 340 species of mollusks, and almost 400 species of fish, with 3 species of marine turtles and 4 species of dolphins, the economically important Norway lobster and petrified sponge. Several species of whales are also occasional visitors. Shipwreck at the area of Ţanijce

Nature beyond conception (continued)

21Copyright © 2011 Pytheas Limited July 2011

■ With the longest fiord of South Europe, Fiord Kotor (Boka Kotorska), which is 28 km long and 30 meters deep, surrounded by mountains which are 1.900 meters above sea level – a stunning dolomite rock walled chasm with its entrance in the town of Herceg Novi, decorated with small fishing shelters, picturesque villages and islands all the way to Kotor, one of the prettiest, unspoiled existing medieval towns; founded by the ancient Greeks (named Kattaro), fortified by the Byzantines (named Askrivion), later ruled by the Venetians and today a UNESCO world heritage site.

Fiord Kotor, a view

Nature beyond conception (continued)

22Copyright © 2011 Pytheas Limited July 2011

■ Numerous caves and sinkholes, some of which are particularly beautiful (cave Lipska, cave Đalovića), while others are among the deepest in the Balkans (sink holes at Vjetrena brda in Durmitor, Duboki do in Lovćen) – characterized by an exceptionally complex and rich fauna, with many endemic and relict forms.

■ There are 40 lakes in Montenegro and its rivers have still remained the purest of Europe's.

■ Lake Skadar, (also called Lake Scutari) can vary between 370 km2 and 530 km2, of which 2/3 is in Montenegro and 1/3 in

Cave Lipska, Cetinje

Nature beyond conception (continued)

23Copyright © 2011 Pytheas Limited July 2011

Albania. Declared a national park in 1983, is one of the largest bird reserves in Europe, having 271 bird species, among which are some of the last curly pelicans in Europe.

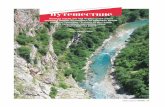

■ The Tara is the longest river in Montenegro (150 km). The canyon of the river is about 80 km long cut between the mountains of Sinjajevina and Durmitor, the average depth is about 1,000 meters, and reaches a maximum depth of 1,600 meters which makes it the deepest and longest canyon of the world after the Grand Canyon. Lake Skadar, a view

Nature beyond conception (continued)

24Copyright © 2011 Pytheas Limited July 2011

■ Additional canyons include that of Morača and Cijevna rivers, Piva, Mrtvica and Komarnica and gorges such are Ibarska, Tifranska and Đalovića.

■ Eighty percent of the territory of Montenegro is comprised of forests, natural pasturelands and meadows. Notably there are more than 54 peaks higher than 1,900 meters (two at 2,522 m).

■ A total of 2,833 plant species (3,650 including subspecies), many of them unique, grow in Montenegro which makes up nearly a quarter of the entire European flora! All that in a mere 0.14% of the continents territory.Edraianthus montenegrinus, Durmitor

Nature beyond conception (continued)

25Copyright © 2011 Pytheas Limited July 2011

■ Characteristic flora includes, the Alpine flower Edelweiss, the endemic Edraianthus montenegrinus, Edraianthus glisichi, Edraianthus pulevici, Wulfenia blecicii, Durmitor mullein, Potentilla montenegrina, Draba betriscea, and many relict glacial species.

■ There are 305 protected bird species in Montenegro. Some of the rarest nesting birds include the Dalmatian Pelican, Ferruginous Duck , White Eyed Pochard, Scops owl, the Black Crowned Night Heron and the European nightjar.

Potentilla montenegrina, Durmitor

Nature beyond conception (continued)

26Copyright © 2011 Pytheas Limited July 2011

■ Other characteristic bird fauna includes, Pyrhocorax graculus, Antus pratensis, Prunella collaris, Phoenicurus ochruros, Golden Eagle, Griffon Vulture, Wall Creeper. There are also a number of glacial relicts among the bird fauna, including Snow Finch, Horned Lark and Alpine Accentor.

■ With its 271 bird species, Lake Skadar is a real attraction for birdwatchers and nature lovers –since 1995 it has been a designated Wetland of International Importance by the Ramsar Convention as a habitat for water birds. Grey Heron, Lake Skadar

Nature beyond conception (continued)

27Copyright © 2011 Pytheas Limited July 2011

■ Especially interesting bird species at Lake Skadar are the, Dalmatian Pelican colonies, Pygmy Cormorant (the biggest world colony of approximately 2,000 bird pairs), Whiskered Tern, Great Cormorant, Ferruginous Duck, White-tailed Eagle, Grey Heron.

■ There are five ornithological reserves at Lake Skadar (at, Manastirska tapija, Grmozur, Omerova gorica, Crni zar, Pančevo oko), four bird-watching towers (at, Stanaj, Radus, Plavnica and Zabljacke) and several organized bird-watching tours offered by the Lake Skadar National Park.

Pygmy Cormorants at Lake Skadar

Nature beyond conception (continued)

28Copyright © 2011 Pytheas Limited July 2011

■ Mountain forests occupy 54% of the territory, with natural forests covering about 45% of the land, making Montenegro one of the most forested countries in Europe.

■ Fir Abies alba, Spruce Picea excelsa and Mugho Pine Pinus mugo, Abieto-Picetum, Picetum abieti montenegrinum, Heldreich (Whitebark) Pine, Pine Pinus peuce are some of the coniferous species.

■ Beech Fagetum forests, Chestnut forests, Macquis and Evergreen Oak, Mountain Maple Acer heldreichii are only some of the species. At Mrtvica Canyon

Nature beyond conception (continued)

29Copyright © 2011 Pytheas Limited July 2011

■ There is maybe no other country in Europe where the nature lover can enjoy so many activities (rafting, freshwater and deep sea fishing, climbing, hunting, hiking, caving, skiing, etc.) within a most diverse morphological environment, in an easily accessible area in terms of distance; four national parks and a number of other places of unique flora and fauna, some of which protected by UNESCO.

■ The five national parks are Lake Skadar National Park, Lovćen National Park, Durmitor National Park, Biogradska Gora National Park and National Park Prokletije. Tara Canyon, a view

Nature beyond conception (continued)

30Copyright © 2011 Pytheas Limited July 2011

■ National Park Biogradska Gora, a 5,650 ha area reserve, in the municipality of Kolašin, contains 26 different habitats of plants with 220 different plants, 150 kinds of birds and 10 kinds of mammals and 86 kinds of trees some more that 500 years old. In the waters of the Park exist three kinds of trout and 350 kinds of insects. Also large mountain slopes and tops, glacier lakes at altitude of 1,820 meters, forests, all in a most unique and complex geological and morphological environment.

Biogradsko Lake, National Park Biogradska Gora

Nature beyond conception (continued)

31Copyright © 2011 Pytheas Limited July 2011

■ National Park Durmitor is in the Northwest of Montenegro, in the municipality of Ţabljak, limited by rivers Piva and Tara between which there are 23 mountain tops over 2,300 meters of altitude; a 39,00 ha area reserve. It includes part of Tara Canyon which is 1,600 meters above river level, dense forests, 17 glacier lakes and the highest peak in the country, Bobotov Kuk at 2,522 m. Durmitor National Park boasts 1,500 kinds of flora, 314 protected animals including 163 kinds of birds.

Crno Jezero (Black Lake), Durmitor

Nature beyond conception (continued)

32Copyright © 2011 Pytheas Limited July 2011

■ National Park Lovćen is in the Southwest of Montenegro in the cliff area of Dinara Alps, a 6,220 ha area reserve. Due to the influence of two extreme climatic zones in a rather small area, Mediterranean and Continental, nature here formed a unique habitat. There are 1,158 plant species out of which four are endemic and 200 bird species. The park is dominated by mountain Lovćen and by the mausoleum of Petar II Petrović Njegoš. It has two mountain peaks, Štirovnik (1,749 m) and Jezerski Vrh (1,657 m).

View of the Bay of Kotor from National Park Lovćen

Nature beyond conception (continued)

33Copyright © 2011 Pytheas Limited July 2011

Nature beyond conception (continued)

■ National Park Prokletije is in the Southeast of Montenegro. Most of the 1,052 ha reserve is within the territories of Plav and Roţajewith glacial lakes (Hridsko, Visitorsko, Ropojansko, Tatarijsko, Bjelajsko, the Vizier), larger and smaller streams, springs and rivers, underground aquifers and mountain ponds(Treskavac, Koljindarsko). There are also numerous hills, ravines, steep slopes, river valleys, alpine type and numerous peaks over 2,000 meters above sea level (at Carnation-Bjelički).

Lake Hridsko, National Park Prokletije

34Copyright © 2011 Pytheas Limited July 2011

History and culture

■ Montenegrins have accumulated a rich cultural and historical heritage, which dates from the pre-Romanesque, Gothic and Baroque periods.

■ Montenegro has been influenced by both eastern and western civilizations – whether these were Greeks, Illyrians, or Romans, Byzantines, Venetian, Slavs, Austro-Hungarians or Ottomans, they all left their mark forming a most interesting multicultural society.

■ The historical roots of Montenegro lie long before the arrival of the Slavs in the Balkans in the 6th and 7th century AD.

Ancient city of Dioclea, Podgorica

35Copyright © 2011 Pytheas Limited July 2011

History and culture (continued)

■ The first recorded settlers of present-day Montenegro were Illyrians; the Illyrian Kingdom emerged during the 3rd century BC with its capital at Skadar, named Docleata.

■ Prior, during the 6th and 7th

centuries BC substantial Greek colonies were established on the Montenegrin coast (Apollonia, Epidamnus, Lissus, Kattaro).

■ Celts are also known to have settled there in the 4th century BC.

■ In 9 AD the Romans (and Byzantines) conquered the region.

Roman mosaics (4th century BC), Risan

36Copyright © 2011 Pytheas Limited July 2011

■ Slavs colonized the area after the 6th century AD, forming a semi-independent principality called Doclea, that was involved in Balkan medieval politics with ties to Rascia (Raška) and Byzantium and to a lesser extent Bulgaria.

■ Doclea (or Duklja) gained its independence from the Byzantine Empire in 1042 – the Byzantine influence in art and architecture is especially felt in continental part of Montenegro.

■ Over the next few decades, it expanded its territory to neighboring Rascia and Bosnia and also became recognized as a kingdom.

Reţevići Monastery, Petrovac

History and culture (continued)

37Copyright © 2011 Pytheas Limited July 2011

■ Its power started declining at the end of the 11th century and by 1186, it was conquered by Stefan Nemanja and incorporated into Serbian realm.

■ The newly acquired land, then called Zeta, was governed by the Serbian Nemanjić dynasty.

■ After the Serbian Empire collapsed in the second half of the 14th century, another family, the Balšićs, came to prominence.

■ Coastal Montenegro from 1420 to 1797 was a province of the Venetian Republic. The Venetian territory was then centered around the area of the Bay of Kotor, and included the towns of

Ostrog Monastery, Nikšić

History and culture (continued)

38Copyright © 2011 Pytheas Limited July 2011

Kotor, Risan, Perast, Tivat, Herceg Novi, Budva, and Sutomore.

■ The Montenegrin coastal region is especially known for its cultural monuments, such as the Cathedral of St. Tryphon, the basilica of St. Lucas (over 800 years), Our Lady of the Rock (Scrpjelo), the Savina Monastery and many others.

■ The name "Montenegro" meaning Black Mountain was first mentioned in the 15th

century.

■ Montenegro's resistance to Ottoman attacks (15th century), which in the end resulted in Kotor Venetian Walls, a view

History and culture (continued)

39Copyright © 2011 Pytheas Limited July 2011

strengthening its statehood, marks this time period.

■ Renowned about their bravery Montenegrins forced Giuseppe Garibaldi to state: “Montenegro undoubtedly takes one of the first places; the legendary heroism of its people brings honor to mankind”.

■ The printed word in Montenegro goes way back in history. Thirty-eight years after the Gutenberg's Bible, in 1494 the first book was printed in the Crnojević printing press in Cetinje – “Oktoih”, a precondition for the future development of literature in Montenegro. First book published in the Balkans,

Cetinje (1494)

History and culture (continued)

40Copyright © 2011 Pytheas Limited July 2011

■ In the 15th century it remained the only officially unconquered and free oasis, surrounded by the powerful Ottoman empire and the Venetians.

■ Montenegro was internationally recognized as a state in 1878. Its capital at the time was Cetinje.

■ On 1 August 1910 during the reign of King Nikola I of the Petrović Dynasty was declared a Kingdom.

■ From 1918 to 1941 it was part of the Kingdom of Yugoslavia.

■ After World War II, it became one of the six republics of the Socialist Federal Republic of Yugoslavia.

Hussein Pasha Mosque, Pljevlja

History and culture (continued)

41Copyright © 2011 Pytheas Limited July 2011

■ In 1992, after the breakup of Communist Yugoslavia and the introduction of a multi-party political system, it became part of the Federal Republic of Yugoslavia (FRY).

■ In 2003 the FRY was renamed to Serbia and Montenegro and officially reconstituted as a loose union.

■ At a referendum held on 21 May 2006, the majority of its citizensvoted for its independence.

■ Today it is an independent state internationally recognized.

■ UN received Montenegro as the 192nd country member on 27 July 2006.

Church Gospa od Skrpjela, Perast

History and culture (continued)

42Copyright © 2011 Pytheas Limited July 2011

■ The culture of present-day Montenegro is as pluralistic and diverse as its history and geographical position would suggest.

■ A very important dimension of Montenegrin culture is the ethical ideal of “Čojstvo i Junaštvo”, roughly translated as "Humanity and Bravery“ – another result of its centuries long warrior history, it is the unwritten code of chivalry that stipulates what is required to deserve a true respect of the people. Amongst other, in the old days of battle, it resulted in Montenegrins fighting to the death as being captured was considered the greatest shame.

Montenegrins in national costumes, Cetinje

History and culture (continued)

43Copyright © 2011 Pytheas Limited July 2011

Slide(s)

The Economy –

General 44 - 57

The Economy – Sectors & Bodies

Banking 58 - 66

Insurance 67 - 71

Capital Market 72 - 75

Foreign Trade 76 - 82

Hospitality & Tourism 83 - 94

Real Estate & Construction 95 - 104

Industrial 105 - 112

Slide(s)

Minerals & Mining 113 - 119

Agriculture & Forestry 120 - 123

Transport &

Communications 124 - 129

Education 130 - 133

Healthcare 134 - 137

Environment 138 - 141

44Copyright © 2011 Pytheas Limited July 2011

The Economy – General

■ Montenegro is a small, open, middle-income economy. Despite a medium level of wealth, the country's economic strength is limited by the small size and concentrated nature of its economy.

■ Notably, Montenegro does not issue its own currency, but has been using the Euro as legal tender since 2002 and maintains an exchange system free of restrictions on the making of payments and transfers for current international transactions.

■ As with other smaller economies, the crisis reached the countryRiver Tara, a view

45Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

with a lag, only starting to be felt in the last quarter of 2008. Officially the crisis fully hit Montenegro during 2009. As a result the GDP growth rate in 2009 was -5.7%.

■ Previously, in 2006 and 2007 the country achieved GDP growth rates of 8.6% and 10.7% respectively which continued strongly into 2008 with 6.9% growth.

■ In 2007, Montenegro achieved a record fiscal surplus of more than 6% of GDP, which remained at 1% of GDP in 2008 – positioning it at the time as one of the fastest growing European countries.

Montenegro Real GDP Growth

Year %

2005 4.2

2006 8.6

2007 10.7

2008 6.9

2009 -5.7

2010 1.1

2011 2.0*

Source: IMF, Pytheas Emerging Markets Research * Estimate

46Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

■ Since its independence in 2006, Montenegro has experienced an economic and financial roller coaster ride. The country’s abundant potential attracted large capital inflows, an increasing share of which were debt creating.

■ Wealth effects made real estate lending and absorption booms mutually reinforcing, and overstretched the nascent financial sector’s ability to guard against risks. The economy began to overheat and then, as elsewhere, the inflows juddered to a halt. The result was a sharp decline in output. Šareni Pasovi, National Park Durmitor

47Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

# Montenegro Macroeconomic Indicators, selected 2009 2010 2011

1 Nominal GDP (€ million) 2,981 3,023 3,111

2 GDP real growth rate (%) -5.7 1.1 2.0

3 Inflation (%) 3.4 0.5 4.0

4 Unemployment rate (%) 11.5 12.2 12.0

5 Current account balance (€ million) -896 -775 -761

6 Current account balance as % of GDP (%) -26.2 -25.6 -24.5

7 External debt (€ million) 2,781 3,000 3,089

8 External debt as % of GDP (%) 93.3 98.9 99.3

9 Net FDI, in current prices as % of GDP (%) 35.8 17.9 15.4

10 Net FDI, in current prices (€ million) 1,066 542 480

11 Gross domestic savings as % of GDP (%) -6.2 -6.7 -4.7

12 Gross national savings as % of GDP (%) -3.1 -3.6 -2.5

Source: Montenegro Ministry of Finance, CBME, MONSTAT, IMF, EUROSTAT, Pytheas Emerging Markets Research2010 = Estimate 2011 = Projections

48Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

■ Huge vulnerabilities were accumulated during the boom when the authorities did not take the opportunity to sufficiently strengthen policy buffers. With policy space exhausted at the beginning of the crisis, the authorities were forced to adopt unconventional policies to mitigate its effects.

■ During the boom the Central Bank of Montenegro raised the cost of credit through higher reserve requirements and tightened supervisory and prudential standards, but credit growth was hardly dented. In the Fall of 2008, banks suffered from a simultaneous run on deposits, loss of access to financing, and deterioration in asset quality.

■ The early surpluses largely reflected temporarily buoyant tax collections from high imports. Initially, they were placed in the domestic banking system, thereby enabling further credit extension. Then at the peak of the boom period, the fiscal stance relaxed (through tax cuts and public sector wage increases), leading to a structural fiscal deficit of some 6% of GDP in 2008.

■ The remaining fiscal buffers were quickly exhausted in the crisis, while large loan guarantees to the aluminum and steel companies created

49Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

substantial new contingent liabilities. By 2009 public and publicly guaranteed debt had risen to nearly 55% of GDP.

■ Excessively restrictive employment protections and an unduly rigid centralized collective bargaining system remained in place contributing to fast wage growth, limiting the flexibility of the corporate sector, and stifling new hiring, thus raising unemployment.

■ Privatization occurred later than elsewhere in Eastern Europe, and in consequence the interest of bidders was more limited.

Katun Gudţaljine on Bjelasica mountain

50Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

■ Privatization – The responsible body to manage, control and supply the privatization process implementation as well as to propose and coordinate all activities necessary for the capital projects application in Montenegro is the Montenegro Privatization and Capital Investment Council. Progress in large-scale privatization has been so far mixed: The tender for the sale of a 54% stake and a 30-year concession in the port

operator, Marina Bar, was concluded successfully in early 2010.

A tender for acquiring a long-term concession on the Bijela port infrastructure and the area surrounding the Bijela shipyard was launched in June 2010.

The government has also issued a tender for the privatization of the Railways Cargo Company (MonteCargo).

However, the tender for the sale of the majority stake in the port operator, Kontejnerski Terminal, failed.

Furthermore, the partial re-nationalization of the aluminum conglomerate KAP became effective in November 2009 with the state acquiring a 29% stake in the plant and a 31% stake in the related Nikšić Bauxite mine in exchange for a guarantee worth €135 million.

51Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

HTP “Budvanska Riviera“ AD Budva, In September 2009 the Government transferred an 18.3% stake in EPCG, the state-owned vertically integrated power utility, to Italy’s AZA. The Government also signed a €720 million agreement for the construction of an undersea power transmission line with Italy. The project, which is expected to make Montenegro an important node in the regional power market, will be implemented jointly by the Italian company Terna and the recently unbundled Montenegrin transmission system operator, Prenos.

The concession agreement to construct the Bar-Boljare motorway, signed in 2009, has not yet closed and construction has been severely delayed, mainly attributed to the failure of the first-ranked bidder to provide all the required documents and the length of the negotiations.

■ As per the relevant Government plan, the following companies are to be privatized within 2011: “Montepranzo“ Boka – Produkt AD Tivat,

“Montenegro Airlines” AD Podgorica, and

“Institute Dr. Simo Milošević” AD Igalo .

52Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

■ Additional tenders (date has not yet been defined) shall be also published for: Railway Transport of Montenegro AD Podgorica,

Railway infrastructure of Montenegro AD Podgorica,

Adriatic Shipyard AD Bijela,

Port of Bar AD Bar,

“Pobjeda“ AD,

“Zora” AD Berane,

HTP “Ulcinjska Riviera” AD Ulcinj,

Ferrous Metallurgy Institute AD Nikšić,

“Barska plovidba” AD Bar, and

Montenegrobonus LLC Cetinje.

■ Also within the privatization process through Public Private Partnership, investors shall be selected for the following tourism and hospitality projects: (a) Ada Bojana, (b) Velika Plaţa, (c) Njivice, (d) Utjeha, (e) Buljarica, and (f) Jaz. The same with the real property belonged to the military: (a) “Mediteran” Zabljak, (b) “Bigovo – Traste” Kotor, (c) Mamula, (d) Rakite, and (e) Kumbor.

53Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

■ The large industrial sector legacy enterprises were sold to smaller investors who lost access to new financing during the global crisis, forcing the government to retake a significant equity stake in the aluminum plant in exchange for extending loan guarantees.

■ In addition to the deposit run, the sudden stop in capital inflows also dried up financing for corporates just as the prices of their key export products began to fall sharply. With the very large contractions in industry, the decline in GDP (6%) would have been even worse but for the ability of the tourism sector to mostly withstand the downturn.

The old town of Budva

54Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

■ A tentative recovery is taking hold, following the global crisis that exerted heavy blows upon the economy. In 2010, a good tourism season was followed by resumed metal production, while heavy rains in the region boosted electricity production and exports. After contracting for almost two years, industry began to grow again in the second half of 2010. Nevertheless, industrial production at end-2010 was still considerably below its pre-crisis peak. Expected large-scale infrastructure foreign direct investment has so far not materialized and construction activity remains depressed. Overall 2010 GDP growth is estimated at 1.1%, keeping output below its 2008 level.

■ The needed rebalancing of the economy has begun. Inflation and wage growth decelerated sharply and the current account deficit halved to around 26% of GDP in 2010. While most of the improvement was due to a weather related boost in electricity exports and rebounding metals production, the nascent adjustment in costs has also improved competitiveness. The improved fundamentals have also contributed to the September 2010 debut Eurobond issuance of €200 million, subsequent spread tightening, and a further €180 million issuance in April 2011.

55Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

■ Fiscal consolidation has commenced. Reflecting mainly significant capital expenditure cuts, the 2010 fiscal deficit is estimated to have declined by 1.5% of GDP to 3.9%, though, loan guarantees of 3.6% were extended to industrial companies. Going forward, the authorities aim at balancing the budget in 2012 and achieving a sizeable surplus thereafter in order to bolster sustainability, lower financing risk, and boost the economy’s resilience to shocks. A durable fiscal adjustment should encompass both revenue and expenditure measures, especially steps to curb the public sector wage bill. An early implementation of pension reform would also strengthen the public finances, as would further efforts to avoid expenditure arrears and direct budget support to private companies.

■ In the banking sector, confidence has begun to return, as evidenced by increasing deposits, though they are still below their levels in the third quarter of 2007. However, non-performing loans have not yet leveled off – stagnant lending at the current juncture primarily reflects the dearth of creditworthy projects.

56Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

■ In an effort to prevent and mitigate systemic risks in the financial system in the future and to ensure its preservation, improvement, control and stability but also for better promotion of coordination and exchange of information between authorities in the financial sector, amongst other, the Montenegrin Government established the Financial Stability Board and the European Systemic Risk Board. Along the same lines the Financial Stability Council Law was adopted.

At Rijeka Crnojevića

57Copyright © 2011 Pytheas Limited July 2011

The Economy – General (continued)

■ Although the recovery is gaining momentum, limited policy space and incomplete reforms pose risks to the outlook. Montenegro must step up efforts to reconstitute fiscal, external, and financial buffers and to address rigidities in product and labor markets.

■ Noting the importance of strengthened competitiveness for securing external stability, structural reforms remain a top policy priority.

■ Greater flexibility in wage setting and employment protection would support job creation in the private sector, while addressing unemployment and poverty traps would boost labor participation and market attachment.

■ Improvements in the business environment and investment climate are also part of the unfinished agenda.

58Copyright © 2011 Pytheas Limited July 2011

■ The banking system comprises of the Central Bank of Montenegro (Centralna Banke Crne Gora), which is the regulatory and supervisory authority for the banking institutions – the banks, and the Micro-Credit Financial Institutions (MFIs).

■ According to the relevant law the main objective of the Central Bank of Montenegro is to establish and maintain a sound banking system and monetary policy, including safe and efficient payment systems.

The Millenium Bridge, Podgorica

Banking

59Copyright © 2011 Pytheas Limited July 2011

■ The Banking sector in Montenegro is completely privatized. There are eleven banks operating in the country, and all of them are in private ownership with the share of foreign capital exceeding 80%; three are locally-owned while the other eight are part of international banks and other entities, corporate and private.

■ The Montenegrin banking sector was severely hit by the global financial crisis. As a result non-performing loans as a percent of gross loans increased from 3.2% at end-2007 to 21% at end-2010.

Montenegro Banks – Ranking by Total Assets (2009)

# NameTotal

Assets%

1 Crnogorska Komercijalna Banka 840,732 27.8

2 NLB Montenegrobanka 515,213 17.0

3 Hypo-Alpe Adria Bank 507,189 16.8

4 Prva Banka Crne Gora 367,222 12.1

5 Podgorička Banka 240,234 7.9

6 Erste Bank 181,911 6.0

7 Atlas Banka 160,123 5.3

8 Hipotekarna Banka 100,103 3.3

9 Komercijalna Banka 71,799 2.4

10 Invest Banka Montenegro 24,250 0.8

11 First Financial Bank 16,457 0.5

Total 3,025,233 100.0

Source: Central Bank of Montenegro, Pytheas Emerging Markets

Banking (continued)

60Copyright © 2011 Pytheas Limited July 2011

Banking (continued)

Source: Central Bank of Montenegro, Pytheas Emerging Markets Research

Montenegro Banks – General, Year 2009 (€000)

# Name Total Assets

Total Liabilities

NetProfit Est. Foreign Ownership

1 Atlas Banka 160,123 131,319 1,161 2002 Local (IBM Atlas Group)

2 Crnogorska Komercijalna Banka 840,732 781, 637 -11,834 1997 OTP Bank (Hungary)

3 Erste Bank 181,911 159,074 195 2009 Erste Bank (Austria)

4 First Financial Bank 16,457 11,157 -1,706 2008 Restis Group (Greece)

5 Hipotekarna Banka 100,103 79,257 1,571 1991 Foreign & local entities

6 Hypo-Alpe Adria Bank 507,189 447,970 -18,315 2006 Bayern LB (Germany)

7 Invest Banka Montenegro 24,250 8,758 303 1961 Local (IMB Atlas Group)

8 Komercijalna Banka 71,799 50,642 1,159 2003 Komercijalna Banka (Serbia)

9 NLB Montenegrobanka 515,213 479,104 1,401 1995 NLB Group (Slovenia)

10 Podgorička Banka 240,234 209,525 -1,903 1906 Societe Generale (France)

11 Prva Banka Crne Gora 367,222 335,054 6,339 1901 Local

61Copyright © 2011 Pytheas Limited July 2011

■ During the boom the Central Bank of Montenegro raised the cost of credit through higher reserve requirements and tightened supervisory and prudential standards, but credit growth was hardly dented. In the Fall of 2008, banks suffered from a simultaneous run on deposits, loss of access to financing, and deterioration in asset quality.

■ The authorities implemented several measures to stabilize the banking system, including a law authorizing the government to provide direct support to banks in the form of credit lines and re-capitalization.

Banking (continued)

Montenegro Banking Sector – Distribution of Bank Credit by Borrower (%)

# Borrower 2007 2008 2009 2010

1 Private companies 60.6 59.2 56.4 54.8

2 Citizens 34.5 35.8 36.6 37.1

3 Government 1.4 1.0 1.3 2.1

4 State-owned cos 1.0 1.0 1.9 2.7

5 Funds 0.6 0.4 1.2 0.1

6 Banks 0.2 0.1 0.0 0.0

7 Financial Institutions 0.9 0.8 0.3 0.4

8 Credit cards 0.9 1.3 1.7 2.2

9 Other 0.0 0.4 0.6 0.6

Source: Central Bank of Montenegro, IMF

62Copyright © 2011 Pytheas Limited July 2011

■ The government provided such support in two cases: (a) a loan of €44 million for the

financially troubled Prva Banka, and

(b) a guarantee of €150 million to cover KfW Bankgruppe’s and European Investment Bank’s. loans to Montenegrin banks used for providing finance to small and medium-sized enterprises (SMEs).

■ A package of laws in the financial sector was approved in July 2010, including a new law on the central bank and a new deposit protection law.

Banking (continued)

Source: Central Bank of Montenegro, IMF

Montenegro Banking Sector – Distribution of Bank Credit by Economic Sector (%)

# Sector 2007 2008 2009 2010

1 Households 35.1 36.4 38.3 39.3

2 Trade 26.1 22.6 22.8 22.9

3 Construction 9.0 7.2 7.8 8.1

4 Services, Tourism, etc. 8.6 7.7 5.9 7.4

5 Agriculture, Hunting, Fishing 1.0 0.6 0.3 0.4

6 Mining, Energy 1.0 1.6 2.2 2.5

7 Transport, communications 3.6 3.1 2.6 3.0

8 Finance 2.8 2.5 2.4 1.7

9 Real Estate 3.6 4.2 4.4 3.0

10 Public services 2.9 2.0 2.6 3.1

11 Other 6.3 12.1 9.1 9.0

63Copyright © 2011 Pytheas Limited July 2011

■ Stress testing results of the banking system sensitivity to crisis showed that four banks needed to provide additional capital. Another two banks performed recapitalization, although the diagnostic assessment findings and stress testing results did not point to the recapitalization need.

■ Total non-performing assets of banks amounted to €509.3 million at end-2010 and made up 17.3% of total assets; showed a year-on-year increase of €164.6 million or 47.7%. Simultaneously, the share of non-performing assets to total assets grew by 5.91%.

■ Liquidity of the banking sector in 2010 was satisfactory which was largely contributed to the conservative lending policy.

■ Banks’ liquid assets amounted to €562.7 million at end-2010; showed an increase in one year period of €101 million or 21.92%. Liquid assets to total assets ratio amounted to 19.11% (15.26% at end-2009).

■ Liquid assets to short-term liabilities grew in 2010; attributed to a significantly faster increase in liquid assets as compared to short-term liabilities of banks. Simultaneously, short-term loans to short-term liabilities ratio declined and it was 48.44% on aggregate level due to decrease in loan portfolio in the previous year.

Banking (continued)

64Copyright © 2011 Pytheas Limited July 2011

Banking (continued)

# Montenegro Banking Sector – Selected Financial Ratios (%) 2007 2008 2009 2010

CAPITAL ADEQUACY

1 Regulatory capital as % of risk-weighted assets 17.1 15.0 15.7 15.9

2 Capital as % of assets 8.0 8.4 11.0 10.6ASSET QUALITY

3 NPLs in % of gross loans 3.2 7.2 13.5 21.04 Provisions, in % of NPLs 73.6 55.6 46.3 30.75 Provisions, in % of total loans 2.3 4.0 6.3 6.46 NPLs net of provisions, in % of capital 7.9 32.0 52.5 102.8

EARNINGS AND PROFITABILITY7 Gross profits ROAA 0.8 -0.6 -0.6 -2.78 Gross profits ROAE 10.5 -6.6 -6.9 -27.09 Net interest margin 3.0 3.8 4.9 4.910 Gross income, in % of average assets 7.0 5.1 5.3 5.4

LIQUIDITY11 Liquid assets, in % of total assets 18.1 11.2 15.3 19.112 Liquid assets, in % of short-term liabilities 32.0 20.9 25.8 32.913 Deposits, in % of assets 70.3 60.1 60.3 60.814 Loans, in % of deposits 107.4 140.5 131.4 122.9

Source: Central Bank of Montenegro, IMF

65Copyright © 2011 Pytheas Limited July 2011

■ Total MFIs assets and liabilities amounted to €58.7 million in December 2010 – same level as it was at the beginning of 2008; annual decline in MFIs assets amounted to 22.1%.

■ At 2010 year-end, total MFI loans amounted to €43.5 million which represented a year-on-year decline of 33.9%.

■ MFI granted loans for start-up of small entrepreneurial programs but under very unfavorable conditions – MFI average weighted effective interest rates reached 28.0% in December 2010, while nominal interest rates amounted to 19.2%.

Banking (continued)

Source: Central Bank of Montenegro

Montenegro Micro-Credit Financial Institutions –General, Year 2009 (€000)

# Name TotalAssets

TotalLiabilities

NetProfit

1 Agroinvest VFI 52,212 40,151 73

2 Alter Modus 16,493 11,487 289

3 Klikloan 1,745 598 -117

4 Montenegro Investments 3,194 1,908 256

5 Ozmont 1,786 1,192 143

66Copyright © 2011 Pytheas Limited July 2011

■ Useful links (alphabetically):

► Association of Montenegrin Banks

► Chamber of Economy of Montenegro

► Central Bank of Montenegro

► MONSTAT

► Montenegrin Employers Federation

► Montenegro Deposit Protection Fund

► Montenegro Ministry of Economy

► Montenegro Ministry of Finance

► Securities & Exchange Commission

Montenegro

Fortress Lessendro, Lake Skadar National Park

Banking (continued)

67Copyright © 2011 Pytheas Limited July 2011

■ The institution responsible for supervision and control of insurance in the country is the Insurance Supervision Agency of Montenegro (ISA), which is independent of any other governmental body.

■ The ISA supervises performance of affairs from the area of insurance, aimed at encouraging the insurance market development and ensuring adequate protection of the insured. Its basic goals are to protect the interests of the insured and related beneficiaries, and increase sustainability and reliability of the insurance market.

Old town of Kotor, a view

Insurance

68Copyright © 2011 Pytheas Limited July 2011

Montenegro Insurance Sector – Gross Premium by Company (May 2011)

Non Life Insurance Life Insurance Total

# Name Amount (€) % Amount (€) % Amount (€) %

1 Swiss Insurance 95,699.78 2.13 95,699.78 1.81

2 Lovćen Insurance 2,391,662.46 53.20 2,391,662.46 45.32

3 Sava Montenegro 847,464.76 18.85 847,464.76 16.06

4 Uniqa Non-Life Insurance 544,156.27 12.10 544,156.27 10.31

5 Delta Generali Insurance 616,665.87 13.72 616,665.87 11.68

6 Lovćen Life Insurance 99,291.67 12.70 99,291.67 1.88

7 Wiener Staedticshe Life Insurance 77,470.69 9.91 77,470.69 1.47

8 Uniqa Life Insurance 143,664.96 18.37 143,664.96 2.72

9 Merkur Insurance 49,655.12 6.35 49,655.12 0.94

10 Grawe Insurance 384,418.59 49.16 384,418.59 7.28

11 Atlas Life 9,444.76 1.21 9,444.76 0.18

12 Delta Generali Life Insurance 17,995.20 2.30 17,995.20 0.34

Total 4,495,649.14 100.00 781,941.99 100.00 5,277,591.13 100.00

Source: Insurance Supervision Agency of Montenegro

Insurance (continued)

69Copyright © 2011 Pytheas Limited July 2011

■ The insurance sector in 2010 in comparison with the previous year had shrunk. However, liquidity and solvency of insurance companies are characterized as satisfactory.

■ Gross insurance premium amounted to €62.8 million at end-2010 ; a 4.4% annual decline. Non-life insurance premiums were still dominant (86.5%) with a declining trend, result of non-life insurance gross premiums decline (5.4%).

■ Insurance companies faced the problem of aggravated collection during this period resulting to, the reversal of a number of insurance policies, an increase in requests for insurance surrenders and a decline in the number of active insurance policies.

■ Moreover, increase in competition in the insurance market during 2010 influenced a decline in concentration. Notably, three insurance companies with the highest insurance premiums had a market share of 77.5% at end-2010, a 1.4%dicline since the previous year.

■ Total share capital of insurance companies amounted to €39.2 million at end-2010, an increase of 13.1% since end-2009.

Insurance (continued)

70Copyright © 2011 Pytheas Limited July 2011

■ There was an increase of foreign capital share by 1% at end-2010 compared to the previous year.

■ At end-2010, the solvency margin of insurance companies amounted to €21.8 million and guarantee reserves to €23.9 million. The guarantee reserve to solvency margin ratio amounted to 109.4% at end-2010 indicating a satisfactory solvency

■ Liquidity ratio at end-2010 was to 3.5 and thus indicated that liquid funds of insurance companies were 3.5 times higher to their short term liabilities.

Old town of Bar, a view

Insurance (continued)

71Copyright © 2011 Pytheas Limited July 2011

■ Useful links (alphabetically):

► Insurance Supervision Agency of

Montenegro

► MONSTAT

► Montenegro Ministry of Finance

► National Bureau of Insurers of

Montenegro

Town of Cetinje, a view

Insurance (continued)

72Copyright © 2011 Pytheas Limited July 2011

■ The Montenegro Stock Exchange or Montenegroberza(MNSE) was founded in 1993, and is a member of the WFE, FESE and FEAS. It is the sole stock exchange in Montenegro, following the merger with the NEX Stock Exchange.

■ Trading on the MNSE consists of short and long term securities, six investment funds, bonds, and shares from government funds portfolios. The MONEX20 nadMONEXPIF are the principal stock indices of the Montenegro Stock Exchange.

Capital Market – Indices Growth Rates (%)

Year Moste Nex 20 Nex PIF

2004 -12.3 106.9 42.9

2005 302.2 287.7 404.9

2006 98.4 84.5 119.4

2007 77.1 89.3 120.8

2008 -71.2 -70.7 -85.1

2009 36.1 45.9 20.1

2010 -18.0 -0.5 -3.5

Source: Montenegro Stock Exchange

Capital Market

73Copyright © 2011 Pytheas Limited July 2011

■ Year 2010 was characterized by a decline of indices; the Montenegro Stock Exchange had its lowest turnover since 2004.

■ Privatization and recapitalization of the Montenegrin Electric Enterprise (EPCG) led to a short-term recovery of the capital market. However, negative trends were also evident in 2010 which reflected in a further decline in the value of indices and significantly lower turnover and number of transactions; indicating that negative effects of the crisis at the Montenegrin capital market were still present.

■ In addition, the highest decline in turnover in the region in 2010 was reported at the Montenegrin Stock Exchange.

■ During 2010, there was a turnover of €54.8 million by all Montenegrin stock exchanges achieved through 19.8 thousand transactions. Compared to end-2009, the turnover declined by 86.5% or €351 million, while the number of deals performed declined by 66.3%.

■ The average monthly turnover at end-2010 amounted to a mere €4.6 million, a significant decline compared to €33.8 million at end-2009. The largest portion of turnover was through secondary trade, while only 4.1% of turnover was reported through primary trade.

Capital Market (continued)

74Copyright © 2011 Pytheas Limited July 2011

■ In trade structure, the highest turnover in 2010 was from trade with company shares (61.4%), various types of bonds (25.2%), while the participation of mutual investment funds’ share in total turnover was 13.5%.

Capital Market (continued)

Town of Ulcinj

75Copyright © 2011 Pytheas Limited July 2011

■ Useful links (alphabetically):

► Central Depository Agency of

Montenegro

► MONSTAT

► Montenegro Ministry of Finance

► Montenegro Stock Exchange

► Montenegro Ministry of Finance

► NEX Montenegro

► Securities & Exchange Commission

Montenegro

Perast, a view

Capital Market (continued)

76Copyright © 2011 Pytheas Limited July 2011

It is Pytheas opinion that Montenegro could become the trading

gateway of the Western Balkans; with duties lower than the regional

average and an economy which is amongst the most liberal of

Europe and Central Asia.

77Copyright © 2011 Pytheas Limited July 2011

■ While continuing its pursuit of WTO accession, Montenegro retains an open trade regime with low duties. Today, based on its 5% simple average MFN applied tariff, Montenegro’s economy is among the more liberal ones in Europe and Central Asia (ECA). Based on the latest MFN applied tariff, it ranks 18th out of 181 countries (where 1st is least restrictive). Similar to the majority of other countries in its comparator groups, Montenegro is more protective of its agricultural goods (11.1% tariff) than of its non-agricultural goods (4% tariff). Montenegro’s maximum MFN applied tariff, excluding alcohol and tobacco, is 79.9% which is much lower than the regional average of 159.7%. However, only 5% of its tariff lines have zero MFN duties, which again it is much lower than the regional average of 28.2%.

■ Based on Montenegro’s simple average overall rest of the world tariff (including preferences) of 10.6%, the country’s exports face a less favorable trading environment than the average ECA country (9.7%). As is the case for most countries, Montenegro’s non-agricultural exports have better access to international markets (9.7% tariff) than its agricultural products (16.3% tariff).

Foreign Trade

78Copyright © 2011 Pytheas Limited July 2011

■ Due to its undiversified export structure (aluminum, steel, and fuel products compromise about 60% of the country’s export receipts with aluminum alone accounting to about 1/3 of the total, Montenegro is very vulnerable to swings in commodity prices.

■ It’s imports are more diversified than its exports. However, oil accounts for about 8% of total imports, and machinery and motor vehicles are also significant items in the import bill. Thus, due to high fuel prices and the need to upgrade its capital stock, Montenegro has run a high import bill in recent years.

Foreign Trade (continued)

A view of Alipašini izvori, Plav

79Copyright © 2011 Pytheas Limited July 2011

■ Total foreign trade for 2010 was €1,987.7 million, a 2.9% increase from the previous year. Exports corresponded to €330.4 million (a 19.3% increase compared to 2009) and imports to €1,657.3 million (a 0.2% increase from the previous year). Non-ferrous metals (€130.8 million) and iron and steel (€19.4 million) together represented more than 45% of exports, while machinery and transport equipment (€340.6 million) and food and live animals (€324.2 million) together represented more than 40% of imports.

Foreign Trade (continued)

Montenegro – Main Trade Partners (2010)

# Partners € million %

World 978,6 100

1 EU27 727,4 74,3

2 China 61,1 6,2

3 Brazil 54,2 5,5

4 Russia 50,9 5,2

5 Turkey 27,4 2,8

6 USA 15,0 1,5

7 Switzerland 11,0 1,1

8 Egypt 8,7 0,9

9 Albania 6,5 0,7

10 Japan 3,4 0,3

Source: MONSTAT

80Copyright © 2011 Pytheas Limited July 2011

■ In exports, main foreign trade partners were, Serbia (€74.9.million),

Greece (€56.4 million), and

Italy (€ 48.8 million).

■ In imports, Serbia (€432.6 million),

Bosnia and Herzegovina (€432.6 million), and

Germany (€117.1 million).

■ Main regional foreign trade partners were countries members of CEFTA and the EU.

Foreign Trade (continued)

Ţabljak in winter, a view

81Copyright © 2011 Pytheas Limited July 2011

■ Montenegro has A CEFTA and a Free Trade

agreement with Russia;

A Trade agreement with EU countries under the Autonomous Trade Preferences;

A Stabilization and Association agreement with the EU;

A Trade agreement with EFTA countries (Switzerland, Norway, Iceland, Lichtenstein);

Free Trade agreements with Albania, Serbia, Bosnia and Herzegovina, Bulgaria, Croatia, F. Y. R. Macedonia, Moldova, and Romania;

An asymmetric Free Trade agreement with Turkey.

Foreign Trade (continued)

Mausoleum of Petar II Petrović Njegoš, Lovćen

82Copyright © 2011 Pytheas Limited July 2011

■ Useful links (alphabetically):

► MONSTAT

► Montenegro Chamber of Economy

► Montenegro Customs Administration

► Montenegro Investment Promotion

Agency

► Montenegro Ministry of Economy

► Union of Free Trade Unions of

Montenegro

Town of Herzeg Novi, a view

Foreign Trade (continued)

83Copyright © 2011 Pytheas Limited July 2011

As per the latest economic impact research study from the World

Travel & Tourism Council and Oxford Economics, Montenegro will be

the fastest growing Hospitality & Tourism economy in the world over

the next ten years with regard to Hospitality & Tourism’s contribution

to GDP and employment.

84Copyright © 2011 Pytheas Limited July 2011

■ Hospitality and Tourism is accorded the highest development priority of all industries and represents one of the most important branches of the Montenegrin economy, generating multiple effects.

■ Montenegro is small in area, but its comparative natural advantages, its richness in cultural and historical sights and others features, make it one of the most attractive receptive tourist destinations.

■ Against a backdrop of global tourism decline, Montenegro’s tourism sector continued to expand in 2009 and 2010.

Hospitality & Tourism

Old city of Kotor, a view

85Copyright © 2011 Pytheas Limited July 2011

■ Montenegro will be the fastest growing Hospitality & Tourism economy in the world over the next ten years with regard to Hospitality & Tourism’s contribution to GDP and employment, according to the latest economic impact research from the World Travel & Tourism Council (WTTC) and Oxford Economics.

■ The WTTC/ Oxford Economics forecasts also rank Montenegro as being the fastest growing destination worldwide for Hospitality & Tourism investment growth, as well as placing Montenegro in 2nd place (behind Brazil) for visitor export growth.

Winter sunset at Hotel Sveti Stefan, Sveti Stefan

Hospitality & Tourism (continued)

86Copyright © 2011 Pytheas Limited July 2011

■ In 2010, Hospitality & Tourism’s total contribution to GDP, including its indirect and induced impacts, was 15.7%. This share is projected to rise to 17.2% in 2011 and to 36.3% by 2021 – an increase of 12.4% per annum over the next ten years. This will take Travel & Tourism’s total contribution to GDP to €1.9 billion a year by 2021 (a forecast based on constant 2011 prices and exchange rates) – up from an estimated €593.8 million in 2011.

■ The direct industry alone is projected to grow its share of GDP from 8.1% in 2011 to 14.8% in 2021 – an annual growth of 10.9% – with the actual contribution rising to €782.1 million over the ten-year period from 278.3 million in 2011.

■ The trend is also expected to be similar for Hospitality & Tourism’s total contribution to employment, estimated at 13.9% in 2010, and which is set to increase to 15.1% this year – accounting for some 26,000 jobs across the Montenegrin economy. By 2021, Travel & Tourism is expected to be supporting as many as 62,000 jobs – one in every three jobs – representing a growth of 9.4% a year over the coming decade

Hospitality & Tourism (continued)

87Copyright © 2011 Pytheas Limited July 2011

Hospitality & Tourism (continued)

#Montenegro Hospitality & Tourism contribution to the Economy –Average Real Growth per Annum 2011 - 2021

Growth (%)

1GDP: Direct ContributionThe direct contribution to GDP is expected to be €278.3mn (8.1% of total GDP) in 2011, rising by 10.9% p.a. to €782.1mn (14.8%) in 2021 (in constant 2011 prices).

10.9

2GDP: Total ContributionThe total contribution, including its wider economic impacts, is forecast to rise by 12.4% p.a. from €593.8mn (17.2% of GDP) in 2011 to €1,915.1mn (36.3%) by 2021.

12.4

3Employment: Direct ContributionHospitality & Tourism is expected to support directly 12,000 jobs (6.9% of total employment) in 2011, rising by 8.0% p.a. to 25,000 jobs (13.3%) by 2021.

8.0

4Employment: Total ContributionTotal contribution to employment is forecast to rise by 9.4% p.a. from 26,000 jobs (15.1% of total employment) in 2011 to 62,000 jobs (33.2%) by 2021.

9.4

5Visitor ExportsVisitor exports are expected to generate €633.8mn (44.8% of total exports) in 2011, growing by 12.4% pa (in nominal terms) to €1,558.8mn (46.3%) in 2021.

9.4

6InvestmentRelated investment is estimated at €192.1mn or 33.4% of total investment in 2011. It should rise by 16.4% p.a. to reach €876.4mn (or 50.8%) of total investment in 2021.

16.4

Source: World Travel & Tourism Council

88Copyright © 2011 Pytheas Limited July 2011

■ The coastal region of Montenegro accounts for about 96% of the total accommodation capacity; this region comprises of Herceg Novi (20.4%), Kotor (5.2%), Tivat (3.3%), Budva (43.3%), Bar (11.8%) and Ulcinj (12.3%).

■ Single villages of municipality of Budva, such as Bečići, Miločer and Sveti Stefan, Petrovac, concentrate the largest numbers of accommodation facilities. However, when it comes to their structure and level of accommodation facilities in this particular territory is below satisfactory to bad, as it is

Hospitality & Tourism (continued)

Montenegro Tourism Seasonality (2009)

# Month Overnights %

1 July 1,974,061 26.1

2 August 2,934,772 38.9

3 Year Total 7,552,006 100.0

Montenegro Tourism Regional Distribution and Accommodation (2009)

# Region Beds Overnights

1 Coastal 167,394 7,244,830

2 Central 3,575 207,676

3 Mountain 2,663 99,500

Source: MONSTAT

Source: MONSTAT

89Copyright © 2011 Pytheas Limited July 2011

dominated by complementary accommodation facilities (76%), i.e. private houses and rooms for rent. Organized licensed hotels are only about 19% of this region. The same picture is more or less repeated for the rest of the coastal region.

■ The central region accounts for 2.1% of the total accommodation; Podgorica (0.8%), Cetinje (0.3%), Nikšić (0.3%), other (0.7%). Their level again with a few exceptions is poor.

■ The mountain region accounts for 1.5% of Montenegro’s total accommodation; Ţabljak (0.6%),

Hospitality & Tourism (continued)

Splendid Hotel & Casino, Bečići

90Copyright © 2011 Pytheas Limited July 2011

Kolašin (0.5%), Plav (0.2%), other (0.2%). Despite the fact that this region has immense tourist reception potential, paradoxically, it represents the least developed area – the tourist product is poor and insufficiently attractive, without associated tourist infrastructure to match its rich natural attractions .

■ Pytheas Hospitality & Tourism conservatively estimates that Montenegro could accommodate more than 350,000 beds. The coastal region will continue to maintain its distinctive dominance in the future but with emphasis placed on quality rather than quantity.

Hospitality & Tourism (continued)

Ţabljak ski resort, a view

91Copyright © 2011 Pytheas Limited July 2011

Hospitality & Tourism (continued)

Montenegro Hotel Capacity by Category (2009)

# Category Hotels % Rooms % Beds %

1 L/5-star 4 1.6 370 2.6 1,075 3.3

2 A/4-star 67 26.4 3,604 25.3 8,391 25.6

3 B/3-star 85 33.5 3,883 27.2 8,921 27.3

4 C/2-star 78 30.7 5,091 35.7 11,629 35.5

5 D/1-star 20 7.9 1,303 9.1 2,708 8.3

Total 254 14,251 32,724

Source: MONSTAT, Pytheas Emerging Markets Research

3.3%

25.6%

27.3%

35.5%

8.3%

Montenegro Hotel Beds by Category (2009)

L/5-star

A/4-star

B/3-star

C/2-star

D/1-star

92Copyright © 2011 Pytheas Limited July 2011

■ In 2010, the number of tourists visiting Montenegro amounted to 1,263,000 or 4.6% more than in 2009. The number of tourist overnights amounted to 7,964,900 or 5.5% more than in the previous year. The number of domestic tourists’ overnights increased by 15.3%, while foreign tourists accounted for 6,977,900 overnights, or 4.2% more than in 2009.

■ The majority of overnight stays was in seaside resorts (96%), followed by mountain resorts (1.5%), the capital city (1.4%) and other tourist resorts (1.1%).

Hospitality & Tourism (continued)

Hotel Avala, Budva

93Copyright © 2011 Pytheas Limited July 2011

Hospitality & Tourism, Opinion

It is Pytheas’ opinion that Montenegro has the potential to become one of the world’s exclusive tourist destinations – there are just a

few places in the world where the eternal struggle of natural elements has shaped the face of the earth with such passion and fascination thus alone providing an unparalleled tourism product.

The quality of capacity must be however raised, tourist attractions developed, a new image created and distribution and training

reinforced!

Additionally, infrastructure related issues such are, direct flights, road improvement, water supply and waste management, require

immediate upgrading…

94Copyright © 2011 Pytheas Limited July 2011

■ Useful links (alphabetically):

► Budva Tourism Organization

► MONSTAT

► Montenegro Airlines

► Montenegro Ministry of Sustainable

Development and Tourism

► Montenegro Tribune

► National Tourism Organisation of

Montenegro

► Strategic Framework for Developing

Sustainable Tourism in Northern &

Central Montenegro

► Tourism Master Plan of Montenegro

► Visit Montenegro

Bianca Spa & Resort, Kolašin

Hospitality & Tourism (continued)

95Copyright © 2011 Pytheas Limited July 2011

■ Real Estate & Construction is a most significant industry. Analysis of historical data of real estate prices for the Montenegrin coast shows that immediately after independence, in relation to 2005, real estate prices grew by about 130% on average m² (for residential and commercial).

■ Rising overseas interest in Montenegro’s real property market especially between end-2006 and end-2008 has sparked a boom in the sale of real property for residential and hotel development; although it subsided in the past two years largely because of the global financial crisis.

Real Estate & Construction

Astra Montenegro, Budva

96Copyright © 2011 Pytheas Limited July 2011

■ Montenegro boasts a mix of historic properties full of local charm and character, and increasingly, a range of modern new build resort schemes targeting international holiday home buyers.

■ With the country in transition, many of these projects have been slow in coming to fruition. Indeed, until recently, Montenegro has remained an undeveloped market in respect of international standards of resort development.

■ Some of these proposed schemes comprise significant scope in terms of scale ofPorto Montenegro (mock-up), Tivat

Real Estate & Construction (continued)

97Copyright © 2011 Pytheas Limited July 2011

development and proposed amenities. They include branded hotel operations, an extensive range of high end facilities for guests and prospective home owners, with services and leisure amenities such as marinas, spas, retail areas, restaurants and bars, beach access, golf courses and casinos.

■ Montenegro’s hospitality sector is gradually attracting international brands, with Aman resorts already operational in Montenegro and hotels brands Hilton, Marriott, Banyan Tree and Kempinski reportedly entering the market. Atlas Capital Centre, Podgorica

Real Estate & Construction (continued)

98Copyright © 2011 Pytheas Limited July 2011

■ Given the rapid increase in land value in recent years with the exception of the past two years, special attention should be given by jurisdictional government ministries and municipalities to reduce complicated and drawn-�out procedures when purchasing land and when building new structures.

■ Lengthy and complex bureaucratic procedures and delays in rendering permit decisions are reported to be among the most significant problems in the area of real estate and construction.

■ While bureaucratic processes are an issue with almost every aspect of government administration, it affects the real estate and construction sectors perhaps more than any other business sector. Slow government administration can cause construction projects to be delayed or abandoned altogether. Bureaucracy can also have a detrimental affect on property values and discourage current and future investors.

■ There is an immediate need to improve coordination between individual government agencies, municipalities, and the central government authority in all phases of the permitting process.

Real Estate & Construction (continued)

99Copyright © 2011 Pytheas Limited July 2011

■ The absence of, incomplete, or slow adaptation of zoning laws and detailed urban plans on the municipal level cause confusion and make it difficult, or even impossible, to understand the parameters which investors/developers require to work on a given development project –uncertainty about what can and cannot be built on a certain parcel of land can lead to widespread confusion and inconsistency in the development of certain areas of Montenegro, particularly along the coast. Greater transparency in this area is necessary to inhibit corruption.

■ Additionally, there are frequent problems with the slow speed at which municipalities provide the necessary services and infrastructure (i.e. roads, sewer and water connections) for new construction projects. Also the level of professionalism and ability of the administrative staff of the local municipalities to work with large, international investors needs to be improved.

■ Finally, there is lack of correct and/or updated information within the Land Registry, which provides access to important information about land ownership and history of ownership to owners and potential buyers.

Real Estate & Construction (continued)

100Copyright © 2011 Pytheas Limited July 2011

■ Despite the recent expansion of the real estate sector foreigners own only 1.39% land in Montenegro. If we excludeowners from the former republics of Yugoslavia this percentage is only 0.05.

■ In 2010, construction cost of new dwellings increased by 1.8% in relation to 2009; a 9% increase in the sales price of land and a 0.1% increase in constructions costs were also observed during this same period, all others costs decreased by 2.0%. The number of sold dwellings of new construction increased by 5.5% in comparison to 2009.

Real Estate & Construction (continued)

Tre Canne (artist’s impression), Budva

101Copyright © 2011 Pytheas Limited July 2011

Real Estate & Construction (continued)

Montenegro Construction Sector – Main Cities General Data (2010)

# CityNumber of dwellings

Covered area (m²)

Total cost per m² (€)

Out of which

Land per m² (€)

Construction cost per m² (€)

Other costs per m² (€)

1 Podgorica 714 40,882 1,137 247 776 114

2 Bar 37 2,576 1,479 443 769 267

3 Budva 46 2,475 1,714 346 1,220 148

4 Nikšic 144 9,238 752 114 558 80

5 Other 74 4,543 1,296 299 861 136

Total 1,015 59,714 1,272 291 835 146

Source: MONSTAT

102Copyright © 2011 Pytheas Limited July 2011

Real Estate & Construction (continued)

Montenegro, Main Real Estate Development Projects (Alphabetically)

# Name Location Description Developer/ Owner Status

1 Astra Montenegro BudvaHotel, marina, casino, sports and leisure, residential. Project website

Mirax GroupUnder construction

2 Atlas Capital Centre PodgoricaCommercial, leisure, residential. Project website

JV Atlasgroup & Capital Investment

Under construction

3Luštica Development

LusticaHotels, golf, marina, sports and leisure, residential. Project website

JV Orascom Development & Government of Montenegro

Under study

4 Porto Montenegro TivatHotels, conferencing, marina, golf, sports and leisure, residential. Project website

J. and N. Rothschild, B. Arnault and O. Deripaska

Under construction

5 Sveti Marko island Kotor BayHotel, spa, marina, casino, sports and leisure, residential. Project website

Metropol Development Under study

6 The Adriatic Fair BudvaHotel, convention center and exhibition hall, commercial, leisure, residential.

Jadranski Sajam Budva Under study

7 The Adriatic Project BudvaHotel, residential, conferencing, commercial, sports and leisure. Project website

Orion Real Estate Partners Under study

8 TQ Plaza BudvaCommercial and leisure facilities, residential. Project website

TradeuniqueUnder construction

9 Tre Canne BudvaHotel apartments, commercial and leisure facilities, residential. Project website

Fab LiveUnder construction

10 Velika Plaţa UlcinjHotel, sports and leisure, residential. Project website

Government of MontenegroUnder tender

Source: Pytheas Emerging Markets Research

103Copyright © 2011 Pytheas Limited July 2011

Despite the acknowledged efforts of the Government of Montenegro to promote and place special emphasis on sustainable development, architectural monstrosities both in terms of zoning and architectural

design that are completely alien to the Montenegrin environment and heritage have been observed in several occurrences in the name of

profit maximization and ignorance.

Implementing and adhering to well‐devised zoning codes at the governmental and municipal level is critical to ensure future

investments and prosperity in this most beautiful country.

Architectural monstrosity should be eliminated!Architectural uniformity in all areas has to become a way of life!

Tradition and heritage has to be protected at all cost!

Real Estate & Construction – Remark

104Copyright © 2011 Pytheas Limited July 2011

■ Useful links (alphabetically):

► Architectural Atlas of Montenegro

► Contemporary Expression of

Traditional Houses in Montenegro

► ECO Lodge concept for Montenegro

► MONSTAT

► Montenegro Ministry of Sustainable

Development and Tourism

► Montenegro Investments

► Montenegro Investment

Opportunities Guide

The Adriatic Fair (artist’s impression), Budva

Real Estate & Construction (continued)

105Copyright © 2011 Pytheas Limited July 2011

Industrial sector

■ Over the last 50 years, the Manufacturing and Mining sectors have been the chief carriers of the economic development of Montenegro. During this period, the growth of the power industry, metallurgy (steel and aluminum), and transportation infrastructure became the basis for the overall development.

■ The three major industrial sectors are the manufacturingsector, the utilities sector (electricity, gas and water), and the mining sector.

Ţeljezara (steel factory) Nikšić, Nikšić

106Copyright © 2011 Pytheas Limited July 2011

■ Industries in Montenegro include metal processing, engineering, wood-processing, textile manufacture, chemicals, leather and footwear, apparel, household appliances, construction, and machinery. Production within the “manufacturing sector” represents 76.4%23 of the total industrial production.

■ Montenegro processes and finishes agricultural products. The country has fish-processing plants, flour mills, dairies, slaughterhouses, bakeries, breweries, juice factories, fruit processing factories, wineries, medicinal herb processing plants and other.

■ Electricity is mainly produced at, Pljevlja Thermo Power Plant, Perućica Hydro-power Plant and Piva Hydro-power Plant.

■ Industrial output in Montenegro grew by 17.5% in 2010, thus stopping the 2008 and 2009 declining trend and consequently contributing to Montenegro’s economy gradually exiting recession. The respective increases in mining and quarrying and electricity, gas and water supply amounted to 58.7% and 51.1%, while manufacturing industry recorded a 3% decline.

Industrial sector (continued)

107Copyright © 2011 Pytheas Limited July 2011

■ The highest increase was recorded in the extraction of energy producing materials (96.1%), manufacturing of machinery and equipment (53%) and electricity, gas and water supply (51%). The branches severely affected by the crisis were the manufacturing of leather and leather products with a decline in production of 76.9%, as well as the manufacturing of rubber and plastic products (-40.4%), the manufacturing of transport equipment (-20.3%) and the manufacturing of textile and textile products (-14.8%). Moreover, there is a significant decline (-14.7%) in the manufacturing of basic metals and metal products.

■ Industry was the sector of the economy that was most severely hit by the global financial crisis. Its output decline in 2009 exceeded 30%. The crisis strongly hit the Montenegrin metal industry, as well as the related mining industry. In addition to the inherited problems, these particular branches have faced the additional problem of placing their products in international markets.

Industrial sector (continued)

108Copyright © 2011 Pytheas Limited July 2011

■ Coal has been the most significant energy resource inMontenegro. The Pljevlja and Berane basins have confirmed reserves of 185 million and 158 million tons respectively.