Property & Wealth Dec Jan 2013 14

-

Upload

property-wealth -

Category

Documents

-

view

242 -

download

4

description

Transcript of Property & Wealth Dec Jan 2013 14

`17.55 Lacs*

News & Events 19

Hotspots 25

REIT- sides & the flip 30

Retail In Asia - Different

Strokes For Different Folks 34

Delayed Projects Plague NCR’s Residential Market 36

Top realty destinations to

invest in near metro cities 38

Home Loans Check List 41

Most Expensive Streets across

the World (2013) 42

Indian office space –a

subdued sentiment 44

Real Estate Investment Advice: Bungalows Versus Flats 46

Care Rates Iscon Platinum

by JP Iscon Limited 49

19propertywise

BADAL ENVISIONS PUNJAB AS THE COUNTRY’S MOST PREFERRED INVESTMENT DESTINATION

10COVER STORY

04

contents

Punjab - a new realityTOP BUSINESS HONCHOS FIRM UP INVESTMENT WORTH RS 55000 CRORE IN THE STATE

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Be a Prosperity Seeker 52

Premium Pools In Hot

Demand For Luxury Homes 56

Home of the Rich & Famous 58

Amazing Buildings 60 Amazing Gadgets 62

Dynamics of Luxury

Living in India 64

Eyecatchers 66

Amazing Getaways 68

Amazing Sites 70

Planetsavers 73

Bookshelf 75

Combination of Vastu,

Fengshui and Interior

can turn your house in a

true home 76

Healthy Living 78

Softcorner 80

52prosperityseek

05

contents

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

3rd Year of Publication ...... Download or browse any of the archive issues at www.propertyandwealth.in

www.facebook.com/propertyandwealth

Jasmeet Dhamija Editor-in-Chief

from the about this issue

08

“Think Big, Achieve Big”, and “Money follows ideas” slogan by Deputy CM,

Punjab evoked instant response by leading industrialists at the Progressive

Punjab Investment Summit held at Indian School of Business, Mohali on 9

– 10th Dec 2013. Deputy CM Sukhbir Singh Badal made an elaborate and

fact based presentation on what he called “a new reality about Punjab,” the

business honchos responded by pledging up investment worth Rs. 55000

crore in the state. Probably to ensure that industry leaders do not back

out from the promises made on dais, Chief Minister Prakash Singh Badal

wittingly quoted that, ‘in PUNJAB we call, promise breaker – a shoe maker’.

If investments actually come through, it will certainly be ‘a new reality about

Punjab’, but for that to happen, promises will have to be kept on both sides.

Read all about the summit as also Deputy CM Sukhbir Singh Badal’s call for

Investment In Infrastructure, Realty, Housing And Power Sector.

In the news section, the big news is that Coldwell Banker Real Estate LLC

has announced the signing of a master franchise agreement with Coldwell

Realty Private Ltd. to affiliate and service Coldwell Banker® and Coldwell

Banker Commercial® franchises in India. The firm will operate as Coldwell

Banker India.

Read on page 30 all about Real Estate Investments Trusts (REITs) and its

scope & advantages in the Indian environment and how it can help a sagging

commercial real estate.

In prosperity seeker this month, say goodbye to Sachin Tendulkar as he ends

his cricket innings, meet the Indian techie who got richer by Rs. 1240 crores

following a takeover by APPLE computers, welcome The Bonneville in INDIA,

the legendary motorcycle from the British motorcycle maker -Triumph and

appreciate the work done by Shabana Azmi, film actress turned social activist.

Our eye catcher this month is Google Boy - Kautilya Pandit, a child prodigy

from Haryana. In book review, learn about ‘Working the Law of Tenfold

Return’, Seed Money In Action, a book by Jon P. Speller, D.D.

Turn your house into home with a combination of Vastu, Fengshui and

Interior, read all about it in our regular feature by Vaastu Shree, Vaastu

Visharad Shri Naresh Singal.

Health comes first. Do not miss out on healthy living columns this month

and it’s all about Walnuts as a healthy snack. A Walnut a day, keeps heart

surgeons away. We now meet on 1st Feb 2014, so wishing you a healthy &

prosperous 2014.

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

….sustained hopes - 2014!!

It’s a magic movement when something small gathers steam and

gains critical mass - could be new fashion trend, a social behavior or

even an epidemic. A lot of it has to do with the kind of people involved,

the stickiness of the concept and a social context.

As debutant AAP (Aaam Aadmi Party) cements its place as a major

player in the Capital of one of the largest democracies, the world

watches over this turn around in common man’s exhausted patience,

intuitive sensibility, the ‘try new’ attitude & more so the always

sustained hopes.

It has become evident that the mantle of leadership is no longer

reserve only for a chosen few. Be it Politics or Economics!

The sheer complexity of modern business, its volatile & global nature,

a desperate necessity for innovation, and unprecedented rapidity of

change has all created a clamor for more and better leadership. Has

a new era begun, is India or more so Bharat story back with a bang!

Is this the real catalyst for change.. will the souring growth numbers

upscale! Will the politico change bring out the desired economic

dynamics?

As we ponder upon these long-term issues… the basic derivation

remains “Change” seemingly has been the order of the year.Be it

bidding farewell to the master blaster for a new rising in Brand Sachin

or may be the passing of Nelson Mandela, which leaves awaning

number of global figures representing freedom and resilience.

…we still have sustained hopes for the New Year 2014!!

Charu RSEditor

editorial

Publisher & Editor-in-ChiefJasmeet [email protected]

Editor Charu [email protected]

Feature Writers Satpal Kataria, K.Singh, Rupinder PD, Sheetal Singh

Art Director & VisualiserRajesh Bhardwaj

Graphics TeamAntima, Sunil, Mohinder

Advertisement & SalesDirector Marketing: Sandeep Kapoor (M) 9818510511 [email protected]

SubscriptionAjay Gupta

Photography Rohit Bhatia

Pre Press Team: GopalProduction Team: Vikas, Vijay

Advisory BoardHarpreet Pooja & Associates Architects Rajiv Gupta & Associates Chartered Accountant Vikas Chatrath, Advocate

Printed & Published by Jasmeet Singh at Plot No. 437-A, Industrial Area Phase-2, Chandigarh.Owned by Jasmeet Singh, 220, Sector 19-A, Chandigarh & Printed at Savitar Press, Plot No. 820, Ind. Area Ph-2, Chandigarh.

Print Production

CONTRIBUTORS AND ASSOCIATES

09PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Punjab - a new reality BADAL ENVISIONS PUNJAB AS THE COUNTRY’S MOST PREFERRED INVESTMENT DESTINATION

TOP BUSINESS HONCHOS FIRM UP INVESTMENT WORTH RS 55000 CRORE IN THE STATE

cover story

10

Punjab Chief Minister Mr. Parkash Singh Badal addressing the leading Industrialists of the country during Progressive Punjab Investors Summit-2013 at SAS Nagar (Mohali)

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Business and industry

in the country gave a

forceful endorsement to

the new investment policy

orientation of Punjab

at the two day Progressive Punjab

Investment Summit began at the ISB

campus on 9th Dec. 2013.

With some of the top names with global

profiles, like Mr. Mukesh Ambani

(Reliance), Mr. LN Mittal (Arcelor-Mittal),

Mr. Sunil Bharti Mittal (Bharti Airtel),

Mr. Sunil Munjal (Hero Honda), Mr.

YC Deveshwar (ITC), Mr. Onkar Singh

Kanwar (Apollo), Mr. Malwinder Mohan

Singh (Fortis) among others, flanking

Chief Minister Parkash Singh Badal and

Deputy Chief Minister Sukhbir Singh

Badal on the stage, this was quite easily

the biggest day for investment promotion

for Punjab and for show-casing the state

as the most preferred investment

destination in the country.

As Deputy CM Sukhbir Singh Badal

finished his elaborate and fact based

presentation on what he called “a new

reality about Punjab,” the industry

responded by giving him and the Punjab

government a full-throated testimonial,

with LN Mittal going the extent

of declaring that Punjab was the quickest

in responding to business requests. The

Deputy Chief Minister positioned himself

as the CEO of the state when it came to

business and industrial investment, and

speaker after speaker got up to give him

the thumbs up.

It was clearly from the whole hearted

response of the tycoons of business

and industry that the Deputy CM had

done his home work well and had succeeded and projecting

his government as the most business friendly government

in the country. Not just the commitments of Rs 55000

crores of investments but even the words in the speeches

that accompanied these decisions proved that Mr. Sukhbir

Singh Badal had been received an overwhelming mandate in

his favour from the captains of business, trade and industry.

His “Think Big, Achieve Big”, and “Money follows ideas”

slogans evoked instant response.

The comfort level of the business and industry tycoons with

the organisers carried a message of its own as it revealed that

they had chosen to place their trust in the present dispensation

in Punjab.

11

Deputy Chief Minister Punjab Mr. Sukhbir Singh Badal addressing the Captains of the Indian Industry during Progressive Punjab Investors Summit-2013 at SAS Nagar (Mohali)

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Sensing the mood of the summit, the Chief Mr. Parkash Singh

Badal deviated from his prepared speech and delivered what

could only be a called a “statesman’s futuristic message for

carrying the fruits of development, growth and prosperity to the

poorest of the poor.” Having seen that the leaders of business

and industry no longer needed any persuading to invest in

Punjab, the Chief Minister dwelled elaborately on the goals of

development, mixing it with traditional Punjabi warmth and

humour, even having delicious and light-hearted jibes at his

“good son for leaving nothing for me to speak.”

While the Deputy CM focused on “walking the talk” and

elaborated the path-breaking steps already taken by his

government to cut red tape through a regime of governance

reforms, the Chief Minister envisioned Punjab as the most

preferred investment destination in the country.

The Chief Minister envisioned Punjab as the most preferred

investment destination with firming up of total investment to

the tune of Rs 55000 crore on the first day of Progressive

Punjab Investors summit, where eminent industrialists and

entrepreneurs from the country and across the globe evinced

keen interest to set up their ventures in varied fields.

Addressing the galaxy of captains of industry and noted

entrepreneurs on the inauguration of two days summit here at

Indian School of Business (ISB), the Chief Minister said that

the vision and dynamism of Deputy Chief Minister Mr. Sukhbir

Singh Badal to put Punjab as the frontrunner state on the

Industrial map of the country, has finally bore fruits with his

unique effort to organize this mega event for the first time ever

organized during his political career spanning over more six

decades. He said that the recent path breaking initiatives by

giving lucrative incentives in terms of VAT retention, exemption

of stamp duty besides establishing Punjab Industrial Promotion

Bureau headed by him with Deputy Chief Minister as its co-

chairman and Mr. Anirudh Tiwari appointed as its Chief Executive

Officer to give clearances in fast mode to the entrepreneurs

would be instrumental in reposing their confidence and trust

in the investor friendly policies of the state government. Mr.

Badal pointed that earlier single window service was merely

a sham devoid of any meaningful purpose, which not only

demoralized the potential investors but also hampered the

industrial development of the state. The Chief Minister said

that the complete communal harmony, peace and amity was

mainly responsible for overall development and prosperity in

the state and urged the industrialists to make optimum use of

this congenial atmosphere backed by excellent infra structure,

surplus power, skilled human resources and best industrial

and work culture, for which the Reserve Bank of India has even

cover story

12

Punjab Chief Minister Mr. Parkash Singh Badal & Deputy Chief Minister Mr. Sukhbir Singh Badal and sitting on the dias the leading industrialists of the country during Progressive Punjab Investors Summit 2013 at SAS Nagar (Mohali)

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

rated Punjab amongst the three best investment destinations

across the country.

The Chief Minister said that Punjab’s economy was

predominantly an agrarian economy which has already

reached a plateau and now we were left with only option to

go for industrialization in a big way and today’s summit was a

step towards this direction. He announced to convene a much

bigger summit on agriculture in February next year thereby

inviting the key players in agro processing and stakeholders

related to agriculture not only from the country but abroad

also to further consolidate the agrarian base of our economy

with a focus on marketing besides food processing as a value

addition to the agriculture produce to benefit the farmers

enormously. Mr. Badal impressed upon the leading players of

the industry to attend that Agriculture summit also with same

enthusiasm so that pro-farmer policies could be chalked out

to help our beleaguered peasantry especially the small and

marginal farmers.

Buoyed over the whopping investments coming forth in today’s

summit, the Chief Minister in a lighter vein asked the Deputy

Chief Minister to closely follow up the MoUs signed between

the state government and the various industrial houses so that

these investments should not merely remain on paper but

should actually come on the ground. He urged the Industrialists

to be humane in their approach and contribute a significant

portion of their wealth for the philanthropic causes under

the Corporate Social Responsibility. Mr. Badal appreciated

Reliance and Bharti groups for doing exceptionally well for the

welfare of poor and disadvantaged sections of society. He said

the spirit of charity and doing good to poor was an inherent

character of the Punjabis as they have derived this inspiration

from the great Sikh Gurus, who called upon them to contribute

atleast 10% of their wealth (Dasvandh) adding that in the spirit

he asked the industrialists to donate generously for the well

being of needy because magnanimity for such humanitarian

acts never goes unrewarded rather their wealth would be

multiplied manifold.

The Chief Minister said that he had prioritized the Health

and Education sector by launching unique schemes so that

these core sectors should not be ignored at any cost. He said

that the state government has started Dr Hargobind Khurana

Post Matric scholarship scheme to give scholarship to the poor

but bright students securing more than 80% marks in Matric

class. Likewise Mr. Badal said that six special schools were

being set up by the state government to provide free education

to meritorious students of the rural areas adding that these

schools would provide free boarding and lodging facilities to

13

Punjab Chief Minister Mr. Parkash Singh Badal shacking hand with Mr. Mukesh Ambani Chairman Reliance Industries during Progressive Punjab Inves-tors Summit 2013 at SAS Nagar (Mohali) on Monday. Dy. CM Mr. Sukhbir Singh Badal and Industry Minister Punjab Mr. Madan Mohan Mittal are also seen in the picture.

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

the students at par with the private schools.

The Chief Minister urged the Industrialists to open Skill centers

to train the unemployed youth to enable them to be gainfully

employed besides catering to the needs of local industry. He

also asked the major captains of the Industry to focus their

attention on the welfare and prosperity of the economically

weaker sections as a part of ‘inclusive development’ otherwise

any deviation from this path could lead to a dangerous trend of

Naxalism, which was spreading its wings swiftly across several

parts of the country.

Slamming the Union government for ignoring the common man,

the Chief Minister said that the Congress has to pay heavy price

for its anti-people policies as it has been routed from the four

states during the recently concluded assembly polls whereas a

novice Aam Aadmi Party has registered impressive gains only

due to its concern shown for the poor and common people. He

said that Punjab which contributes 60% of the food grains in

national kitty despite of its 1.5% of country’s total area besides

enormous contribution of Punjabis in national freedom struggle

and safeguarding the borders from our hostile neighbor has

never been acknowledged by the Centre.

Earlier in his power point presentation Deputy Chief Minister

Mr. Sukhbir Singh Badal, while declaring Punjab as a power

surplus state, said that the power would be available here at

cheaper rates as compared to other states. Citing the CRISIL

rating of High prosperity and Equality, he said that the state

was having the best infra structure which was a basic catalyst

of industrial growth. The Deputy Chief Minister said that due to

the concerted efforts of the state government Ludhiana city has

been declared best investment destination by the world bank

adding that the RBI has also adjudged the state as one of the

top three investment destinations of the country.

The Deputy Chief Minister said that Punjab would be only state

with best air connectivity having three international airports at

Mohali, Amritsar and upcoming at Macchiwara besides three

domestic terminals at Bathinda, Ludhiana and Pathankot. He

further said that Punjab was having the finest road network

having four/ six lanes roads throughout the state which

connected all the cities and towns of the state. The Deputy Chief

Minister said that the state government has embarked a major

scheme for the comprehensive planning and development of

urban and rural areas across the state thereby equipping them

with 100% water supply and sewerage facility.

Underscoring the need of growth with equity, the Deputy Chief

Minister said that he was a firm believer that ideas were far more

important than the resources and to think big for achieving big

was his motto for success. He said not only the key players in

cover story

14

FLOW OF INVESTMENTS

Reliance Industries (RIL) chairman Mukesh Ambani on

Monday announced the possibility of a "collaborative

venture" with Bharti Airtel in setting up digital infrastructure

in the country.

Speaking at the Progressive Punjab Summit in Mohali,

Ambani announced an investment of Rs 2,500 crore

for setting up digital infrastructure for the 4G network.

Ambani also announced that Reliance Foundation

will partner with Punjab in promoting sports, specially

basketball in schools.

Bharti Airtel chairman Sunil Bharti Mittal, also announced

an investment of Rs 4,000 crore to set up digital

infrastructure in Punjab.

During the summit, Arcelor Mittal chairman Lakshmi

Mittal announced that his company will expand Bathinda

refinery project by at least 25 per cent with additional

investment of Rs 20,000 crore.

While ITC chairman Y C Deweshwar declared that the

company will set up its "showcase" food processing

industry either in Ludhiana or Jalandhar, Bicon chief

Kiran Majumdar Shaw said her company is taking Punjab

"very seriously" for investment.

The summit kicked off with many important

announcements expected to be made during the course

of the two-day event. More than 20 memoranda of

understanding are scheduled to be signed between

the government and top industrial houses promising

investment worth Rs 25,000 crore.

This includes a Rs 900-crore investment by Medanta

in a 25-acre Medicity in Mohali. This will be their

second venture in the country. Max Healthcare

and Fortis Healthcare Ltd will also set up hospitals in

Medicity. Ranbaxy is also expected to announce the

launch of another pharmaceutical unit in Punjab.

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

industry from India but abroad like CTCI Taiwan, USA’s leading

Mall Company Gumberg have already landed in the state. The

Deputy Chief Minister reiterated that conducive atmosphere

coupled with peace and harmony and enterprising skill of

Punjabis was a major factor to boost investment sentiment in

Punjab adding he said strikes and labour unrest were words

unheard of in the state.

The Deputy Chief Minister said that the establishment of

PBIP would facilitate the investors in securing clearances in a

hassle free manner under one roof and CEO has been made

accountable to give sanctions with regards to ten departments.

He said that the lucrative concessions given to industry had

further rejuvenated confidence amongst the industrialists

besides scaling down the corruption at the cutting edge

considerably through bringing out of box governance reforms

which were guaranteed to eliminate the interface between the

public and government officials.

Earlier the Chief Secretary Mr. Rakesh Singh welcomed the

esteemed gathering whereas Cabinet Minister Mr. Madan

Mohan Mittal proposed the vote of thanks. Principal Secretary

Industries Mr. Karan Avtar Singh conducted the proceedings

of the state.

Prominent amongst those present on the occasion Cabinet

Ministers Mr. Bikram Singh Majithia, Mr. Janmeja Singh

Sekhon, Mr. Sarwan Singh Phillaur, Mr. Sikander Singh

Maluka, Mr. Sharanjeet Singh Dhillon, Advisor to Chief

Minister on Media and National Affairs Mr. Harcharan Bains,

Media Advisor to Deputy Chief Minister Mr. Jangveer Singh,

Assistant Media Advisor to Deputy Chief Minister Mr. Harjinder

Sidhu, State BJP President Mr. Kamal Sharma, Financial

Commissioner Revenue Mr. NS Kang, Financial Commissioner

Development Mr. Suresh Kumar, Principal Secretary to Chief

Minister Mr. SK Sandhu, Special Principal Secretaries to Chief

Minister Mr. Gaggandip Singh Brar and Mr. KJS Cheema.

Punjab Chief Minister Mr. Parkash Singh Badal addressing the leading Industrialists of the country during Progressive Punjab Investors Summit-2013 at SAS Nagar (Mohali)

15PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

• UNVEILSNEWINVESTORFRIENDLYHOUSINGANDURBAN

DEVELOPMENT POLICY-2013

• FOCUSONHOLISTICINFRASTRUCTUREDEVELOPMENT

Punjab Deputy Chief Minister Mr. Sukhbir Singh Badal today

sought private investment in infrastructure, housing and

urban development, logistic and warehousing, power and

renewable energy sectors while unveiling new Housing and

Urban Development Policy-2013, Renewable Energy Policy,

offering best incentives in the country.

Inaugurating the first session ‘Propelling Sustainable

Infrastructure’ focused on housing infrastructure and

renewable energy sectors on the first day of Progressive Punjab

Investors Summit here today, the Deputy Chief Minister said

that Punjab is the first state in the country that has unveiled

holistic infrastructure development model under which a

single agency would be responsible for providing all urban

civic amenities including water, sewerage, street lightning,

solid waste management, sewerage treatment plant and would

be collecting user charges from the consumers. He said that

Punjab Government believes in handing over the development

of Housing Infrastructure and Urban development totally to

the private players and with government acting as facilitator.

He said that Punjab was focusing on overall development of

147 cities and there was investment potential of Rs. 2280

crore in water supply and sewerage sectors besides Rs. 732 in

8 clusters of Punjab for Solid Waste Management. Mr. Badal

said Punjab was focusing on providing world class citizen

services and was looking for private players for establishment

of data center, disaster recovery center, GIS Database and

Data digitalization of records of urban properties and there

was a potential business of hundreds of crores in this sector.

Unveiling the new Housing and Urban Development Policy

2013, Mr. Badal said this policy has been framed after

extensive consultation with stake holders has salient features

like common building rules, rationalization of potential zones

for CLU, EDC and other charges, incentives for green building,

public private partnership in urban development and provides

incentives for affordable housing. Mr. Badal said that in the

new policy floor area ratio has been upgraded from 1:1:75

to 1:30 and density per gross acre norm has been increased

from 175 PPA to 300 PPA for general housing and 400 for

EWS houses to provide more housing stock in the market. He

said that Punjab is the torchbearer in having Land Pooling

Policy and has already unveiled a new policy for mega and

super mega projects.

Showcasing the potential investment opportunities in Punjab,

Mr. Badal said that upcoming New Chandigarh in the Greater

Mohali Area is all set to give to new impetus to economic growth

and development. He said there are number of opportunities

in Medicity to be constructed on 424 acres of land, Educity

on 1700 acres, IT City on 1688 acres. He said investment

opportunities in the proposed financial district and Downtown

Mohali and Downtown Ludhiana would put development

model of Dubai in a shade.

Speaking about the investment opportunities in the Renewable

Energy Sector, the Deputy Chief Minister said there was great

scope of investment in the clean energy sectors of solar and

biomass power. He said Punjab is targeting to operationalise

200 MW solar power and 1000 MW biomass power in next

three years.

Earlier Mr. A. Venu Prasad, Secretary Housing and Urban

Development, Mr. Anurag Aggarwal, MD PIDB and TRANSCO

gave a detailed presentation on urban development, renewable

energy policies of the state and answered the queries of

investors from all over the country regarding various policies.

The panel discussion that was chaired by Mr. Mohit Gujral, Vice

Chairman, DLF, Mr. Pradeep Singh, CEO ISB, Mr. SK Roongta,

Chairman Power Business Group Vedanta, Mr. Ravi Khanna

CEO Aditya Birla Solar, Mr. Krishna Ram Bhupal, Director

GVK Power and was moderated by Mr. Arvind Mahajan, head

Infrastructure and Governance Services, KPMG India.

Sukhbir Seeks Investment In Infrastructure, Realty, Housing And Power Sectors

cover story

16 PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Mr. Mukesh Ambani Chairman Reliance Industries sharing viewpoint with Punjab Chief Minister Mr. Parkash Singh Badal during Progressive Punjab Investors Summit 2013 at SAS Nagar (Mohali)

Deputy Chief Minister Punjab Mr. Sukhbir Singh Badal exchanging MoU documents with the respective Chief of the company during Progressive Punjab Investors Summit 2013 at SAS Nagar (Mohali)

Authorized Sales Partner:

M: + 91 - 8699 842 416E: [email protected]

Life is all about Right Choices…Make the Best Choice

Ireo Water Front, Ludhiana - Integrated Township

Ireo Five Rivers, Panchkula - Integrated Township

Ireo Rise, Sector 99, Mohali - Residential Apartments

Ireo Hamlet, Sector 98, Mohali - Residential Plots & Villas

Ireo Hub, Sector 98, Mohali - Commercial Open Plaza

Visit & Explore : www.ireoworld.com

PROJECTS:

news & eventsREALESTATE&INFRASTRUCTURENEWS

EVENTSROUNDUP

2 Mn.Sq.Ft.LandParcelAcquiredByAlchemistTownshipIndia

Limited BiggestEverForEasternMetropolis

Delhi-based real estate developers Alchemist Township

India Limited have purchased 2 million square feet of prime

residential land from Highland Group at Kolkata Riverside,

a satellite township development encompassing 262 acres

being developed on the banks of the Hooghly River.

Altogether, Alchemist Township India Limited has earmarked

approximately Rs. 600 crore for this project. Jones Lang

LaSalle India was transaction partner for both the firms in this

deal.

Mayank Saksena, Managing Director - Land Services, Jones

Lang LaSalle India says, "Kolkata Riverside is a prime township

project that incorporates the latest features in environment-

friendly urban planning. It also has a very healthy mix of

market drivers, including a 25-acre IT Park created entirely

on sustainable development parameters, various commercial

establishments catering to the services sector, world-class

physical infrastructure and advanced lifestyle features such

JLL Closes Largest-Ever Land Deal In KolkataKolkata

Property & Investment Fair 2013Venue: Rotary Club, LudhianaDate: 21-22nd Dec 2013

forthcoming events

Ludhiana

Gurgaon Rapid Metro Begins Gurgaon

20

news&events

Rapid Metro-Gurgaon, the country’s first privately financed metro

rail service, is now opened to commuters. An announcement to

this effect was made by Sanjiv Rai, MD & CEO, IL&FS Rail Ltd.

Rapid Metro Gurgaon line will be opened to commuters from

6:05 am till 12:20 (midnight). Five fully automated trains with

a frequency of 4 minutes would run between six (currently five)

stations.

The launch of Rapid Metro Gurgaon is likely to boost connectivity

within the cyber city. It is expected that about 30 per cent of the

existing road traffic will move to Rapid Metro, thereby reducing

travel time and traffic jams for commuters on the NH-8, Gurgaon

and Delhi. Company officials said Phase I of Rapid Metro had

entailed a cost of Rs 1,088 crore.

as a golf course. Alchemist Township India Limited have made a

very astute choice in terms of location and land parcel magnitude,

allowing them to fully capitalize on this township's residential real

estate potential."

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

September 30, 2013 – Coldwell Banker Real Estate LLC

announced the signing of a master franchise agreement with

Coldwell Realty Private Ltd. to affiliate and service Coldwell

Banker® and Coldwell Banker Commercial® franchises in

India. The firm will operate as Coldwell Banker India. Coldwell

Realty Private, Ltd. is a privately held firm led by Ramnik

Chopra and a seasoned management team that has extensive

experience in commercial and residential real estate, along

with professional and financial services and marketing. The

company will be headquartered in Mumbai. Chopra earned

an electrical engineering degree in India. He then worked for

several technology companies in India and the United States,

before starting his own real estate marketing services company

to assist reputable Indian real estate developers in marketing to

people of Indian origin living overseas.

“India has risen dramatically in its wealth and its consumer

affinity for quality brands, while preserving traditional values

and culture," said Budge Coldwell Banker India will focus on

building the brand in the nation of 1.2 billion, the most populated

democratic nation in the world, concentrating its initial efforts

in major metropolitan areas, including Mumbai and New Dehli.

“The time is right for the Coldwell Banker brand to succeed

in India,” said Chopra. “We have the world’s fastest growing

middle class where homeownership remains aspirational and

homeownership rates are rising as personal wealth increases.

There is also a great opportunity to reach our affluent population

through the Coldwell Banker Previews International® program

and provide the outstanding service this market expects. The

century-old success of the Coldwell Banker brand, showcased

by the brand’s professionalism, strong consumer-service and

belief in ethical behavior are qualities that will resonate with

the Indian consumer. The proliferation of foreign investment in

Indian manufacturing, consumer services and retail also give us

an opportunity to succeed on the commercial real estate sector.”

Coldwell Banker Real Estate Announces Master Franchise Agreement for India

65th Fiabci World Congress Venue: LuxembourgDate: 17-22nd May 2014

Luxembourg

forthcoming events

21

news&events

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

news&events

22

Pimpri-Chinchwad Municipal Corporation, Pune's thriving

sister city, is all set to throw the doors of its first full-fledged mall

open to the public. City One Mall, a joint undertaking by PCMC's

leading development companies Rama Group and Pharande

Spaces, is being exclusively leased by out Jones Lang LaSalle

India.

Jeetu Panjabi, Director - Rama Group says, "The one missing

link on PCMC's well-meshed real estate market has been

organized retail. With City One Mall, the gap is finally being

bridged. This mall brings the best of brands under one roof to

create a unique shopping experience. The Pimpri-Chinchwad

Municipal Corporation now has a distinct cosmopolitan profile,

and lifestyle aspirations are at an all-time high."

Strategically located close to the Pimpri-Chinchwad Municipal

Corporation Building, City One has four levels of retail spaces

and will provide an international shopping experience, an

exclusive Entertainment City, alfresco cafes and global dining

options to PCMC's residents.

Anil Pharande, Chairman - Pharande Spaces says,

"PCMC has always been a promising catchment for retail

developments. The region's versatile population profile

has already spelled success for major local category

players like Jai-Hind, Ranka Jewellers, Silver Leaf,

Krishna Rajaram Ashtekar, Vama, Hastakala Sarees,

PNG, Bafna Jewellers and Chandukaka Saraf. Nevertheless,

PCMC has not had the benefit of a full-fledged mall development

to cater to its highly aspirational and rapidly growing shopper

catchment."

The PCMC region has seen a quantum leap in retail viability,

driven by the high purchasing power of employees from its

automobile and other manufacturing industries as well as

massive trading community. The potential for organized retail

in Pimpri-Chinchwad was waiting to be tapped, and Jones

Lang LaSalle's retail team confirms that the demand for space

at City One has been nothing short of spectacular.

So far, organized retail has had a very limited presence in

the PCMC belt. The opportunity for retailer to capture the

full potential of this market is much greater as compared to

many other locations. The massive residential development

happening in and around PCMC is creating considerable

inherent retail demand. National hypermarket chains such

as Big Bazaar, Star Bazaar and D Mart and organised retail

chains like E Zone, Croma, Vijay Sales, McDonald, Just In

Time, World of Titan, Tanishq and FabIndia already exist in

stand-alone stores. Now, City One Mall at is all set to offer all

the major brands under a single roof.

City One Mall's total development size is 3,33,000 square feet

of built-up area, consisting of two buildings, both equipped

with four levels of retail spaces and two levels of parking

space. In the first building, which has a total area of 1,12,000

square feet, Central has already snapped up 81,000 square

feet across the ground, first and second floors and is gearing

up for a grand launch of Pimpri Central by the end of 2013.

The remaining 21,000 square feet have been leased to Men's

Avenue - a leading Pune-based apparel retailer which has also

taken up space for their 'Kajree' saree section on the second

floor.

The second building in City One Mall, with 2,21,000 square

feet, has been allocated to the mall's multiplex, another anchor

as well as restaurants and vanilla retail stores. Mainland China

and Global Grill have already taken up 11,000 square feet

on the second floor and are operational. The 5-screen PVR

multiplex is scheduled to open up in the first quarter of 2014.

Pune’s Sister city, PCMC's First Full-Fledged Mall

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Globally renowned German bath fittings

Brand KLUDI announced their future

expansion plans in the Indian Market. Kludi

GMBH (Germany) - a 170 Million USD

parent company of KLUDIRAK India has

acquired majority stakes in the KLUDIRAK

with quantum infusion of equity. Strategically,

this is an extremely significant step not only

from resource mobilization standpoint, but

also in terms of the strengthening the brand

awareness of KLUDI in India. Consequently,

beginning 2014, KLUDIRAK India Pvt. Ltd.

will be re-named as KLUDI India Pvt. Ltd.

KLUDI India Pvt. Ltd. will invest 1.50 million

USD in India to support the expansion plan.

This strategic move is the clear reflection of

the importance that KLUDI accords India

in its global expansion plans. The press

conference today was addressed by; Mr.

Janusz Palarczyk, Group CEO – KLUDI,

Mr. Bernd Neidhardt, Managing Director

- KLUDIRAK India Pvt. Ltd. and Mr. Sanjay

Bankeshwar – Vice-President (Sales &

Marketing) KLUDIRAK India Pvt. Ltd.

Commenting on the occasion Mr. Janusz

Palarczyk, Group CEO – KLUDI said, “KLUDI

is targeting a market share on a 5-year

perspective of around 18-20% of the high-end

segment of the Indian market by 2018. The

high-end and luxury segment of the market

comprises approximately 5% of the overall

organized market of INR 4Bn. KLUDI India’s

revenue expectations would be exceeding

USD 5 million annually by 2018, growing at

35-40% year on year beginning 2014. In keeping with its core philosophy of quality sales rather than mass selling, KLUDI targets

to operate at healthy sustainable gross profits.”

Segment-wise, high-end retail is the focal point of KLUDI’s strategy and activity. The high-end hospitality segment too will be a

major focus that will be pursued aggressively by KLUDI in India. An additional advantage for KLUDI in India is the establishment

of a full-fledged sales office in Singapore, which is expected to support and complement the efforts of KLUDI India in high-end

projects. The role of Singapore-based consultants in brand specifications in many high-end institutional projects in India is

decisive and KLUDI Singapore office is expected to play a key support role in this endeavor of KLUDI India.

KLUDI - The German bath fittings major and leading European brand announces India expansion plans.

23

L to R - Mr. Janusz Palarczyk, Group CEO – KLUDI & Mr. Bernd Neidhardt, Managing Director - KLUDIRAK India Pvt. Ltd.jpg

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

About 200 real estate developers, investors and lenders attended the event.

Review

The Eighth Annual India Global Real Institute - 2013 meeting was held in Mumbai on October 3 and 4. The real estate investment event brought together the international players and national decision makers driving the real estate business in India. Even though the attendance at 8th GRI was lowest if compared to previous editions still the event gave excellent networking opportunity to about 200 real estate developers, investors and lenders who attended the event. Informal discussions were conducted about the issues related to realty business, such as Investing in India, Hospitality Developments, Private Equity, Townships vs. Smart Cities, Domestic Fundraising, Structured Debt Funding, Luxury Housing, Financing, Residential Developments, Shopping Malls, Affordable Housing, IT Parks, Land Acquisition, SEZs, Infrastructure, Logistics, and many more.

24

news&events

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

CHANDIGARHCAPITALREGIONPROPERTYHOTSPOTSZIRAKPURRZONE1

ZIRAKPURRZONE2

MULLANPUR-NEWCHANDIGARH

KANSAL

AEROCITY

MIXEDLANDUSE&INDUSTRIALSECTORS82,66,66A,66B

LANDRAN-BANURROAD(RIGHTSIDE)

LANDRAN-BANURROAD(LEFTSIDE)

KHARARLANDRAN-ROAD

BALONGI-KHARARROAD

MIXEDLANDUSE&INDUSTRIALSECTORS82,66,66A,66B+

WEEKENDHOMES

FOCUSTHISMONT H

26

HOT SPOT IN FOCUS

Falc

on

Vie

w

GURUDWARA SINGH

SHAHEEDAN

TR

IBU

NE

CH

OW

K

IT C

ity

IT C

ity

IT C

ity

200 ft. InternationalAirport Road

TO

PA

TIA

LA

TO

DE

LH

I

*Ma

p n

ot

to s

cale

Sig

natu

re

Tow

ers

Beste

ch

Square

JLP

L

Industr

ial P

lots

Disclaimer:Mapisnottoscaleandpurelyforillustrativepurpose.Accuracyofthemapisnotguaranteed.

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

27

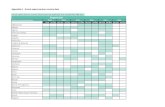

DISCLAIMER: Features, information & Budget Planner given above are indicative only. Please contact respective builder for more specific & accurate information. Property & Wealth is not responsible for any decisions taken through use of above information.

HOT SPOT IN FOCUS - MIXED LAND USE & INDUSTRIAL SECTORS 82, 66, 66A, 66B

DISCLAIMER: Features, information & Budget Planner given above are indicative only. Please contact respective builder for more specific & accurate information. Property & Wealth is not responsible for any decisions taken through use of above information.

Location: Sector 66A MohaliHighlights: Read to possess plots

with all infrastructure in place. Also

offering builtup industrial Plots.

Options: 500 sq yards or more for

Industrial Plots, 250 sq yds built

up industrial plot with or without

basement.

Janta Industrial

BudgetPlanner

0 10 20 30 40 50 60 70 80 90 100 150 >200

ZigmaWealth8146992437

Location: JLPL Eco City, Sector 66B, MohaliHighlights:Gated complex secured with a multi-tiered security system, Jogging track & landscaped lawns, Club house,Swimming Pool.Options: 4 BHK 3500 Sq. Ft.

Signature Towers

BudgetPlanner

0 10 20 30 40 50 60 70 80 90 100 150 >200

SalesOrganisers/Dealers:Call9216841278toAdveristeinthisspace

Location: Sector 66-A, SAS Nagar(Mohali),Highlights:The ultimate office spaces with futuristic designs, state-of-the-art facilities and relaxing environment strike the right balance between modernity and functionalityOptions: Office Spaces

Janta Twin Towers

BudgetPlanner

0 10 20 30 40 50 60 70 80 90 100 150 >200

SalesOrganisers/Dealers:Call9216841278toAdveristeinthisspace

SalesOrganisers/Dealers:Call9216841278toAdveristeinthisspace

Location: IT City Sector 82(A) 83(A), 101A

Highlights:Out of total area of 1685 acres, net area of about 400 acres will be used for allotment. The balance area will be used for residential, parks, green belts, institutional, commercial and road network.Options: 0.5 acre to 25 acres

IT/ Knowledge Industry Plots

BudgetPlanner

0 02 05 100 125 150

RatePerAcre:2.75CR(25acresite)upto5CR(1/2acresite)

Location: Sector 66, Mohali (adjoining Chandigarh)Highlights: Most Prime Location in Mohali adjoining Chandigarh Options: Office Spaces2BHK & 3BHK Flats

BestechSquareSector66Mohali

BudgetPlanner

Location: Sector 66-A, Near International Airport, MohaliHighlights:Excellent Location on 200’ Airport Express Highway with 17 ACRES of Lush Green ParkOptions: 3BHK (2480 SqFt), 4BHK (3007 SqFt) Flats.@ INR 3,790/- per sqft.

JLPL Falcon View

BudgetPlanner

MaKaanSearch8437002002,9872588555

0 10 20 30 40 50 60 70 80 90 100 150 >200

0 10 20 30 40 50 60 70 80 90 100 150 >200` inLakh

` inLakh

` inCrores

` inLakh

` inLakh

` inLakh

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

WEEKEND/HOLIDAY HOMES

Location: 3km from Solan on Solan Sabathu Road.Highlights: Registry for built up area for built area Even for non Himachlis. Enjoyable weather round the yearOptions: 1 BHK 671 sq feet, 2 BHK 111 sq feet and 4BHK duplex cottages 2475 sq feet.

AmravatiHills

BudgetPlanner

0 10 20 30 40 50 60 70 80 90 100 150 >200

Location: Kasauli Hills at 5000 feet, nearly 15kms from Kasauli amidst pristine environment.Highlights:Each Villa & Apartment providing a panoramic view of Mountains. Landscaped Gardens, Swimming Pool & Gym. International 5 star Hotel Options: Villas and Apartments

DLF Samavana

BudgetPlanner

0 10 20 30 40 50 60 70 80 90 100 150 >200

Location: Dagshai HillsHighlights: Situated at height of 5500 sq feet. its un spoilt nature at its best with Villas, plots, 5 star resorts.Options: Luxurious independent villas, residential plots

Pine Wood Resorts

BudgetPlanner

0 10 20 30 40 50 60 70 80 90 100 150 >200

Location: Dharampur Sapatu Road 2 kms from Hotel Victoria IntercontinentalHighlights: Panoramic View of the valley. Non Himachalis can buy in their own name. Specially imported pre fabricated apartments.Options: 1BHK/2BHK on 400 sq yard Plot

HillFarms

BudgetPlanner

0 10 20 30 40 50 60 70 80 90 100 150 >200

Location: Kais Village, KulluHighlights:First of its kind group housing in HP, Unique terraced landscaping all around.Options: Exclusive low rise designer apartments and Luxurious villas

Kaisville

BudgetPlanner

0 10 20 30 40 50 60 70 80 90 100 150 >200

Location: Solan Simla Old Road, Kumar hattiHighlights: Beautiful fully furnished apartment With un spoilt view of the mountains.An ideal hill farm house.Options: 2BHK and 3 BHK

Pine Wood Cottages

BudgetPlanner

0 10 20 30 40 50 60 70 80 90 100 150 >200

DISCLAIMER: Features, information & Budget Planner given above are indicative only. Please contact respective builder for more specific & accurate information. Property & Wealth is not responsible for any decisions taken through use of above information.

SalesOrganisers/Dealers:Call9216841278toAdvertiseinthisspace ZigmaWealth:8146992437

SalesOrganisers/Dealers:Call9872635220toAdvertiseinthisspace MegaMarketing:9815740230

SSAssociates:9876500036 Call9815601347

` inLakh

` inLakh

` inLakh

` inLakh

` inLakh

` inLakh

28 PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Zigma Wealth Corporate Office:-

REIT- sides & the flipREIT buys real estate assets which are income providing

property wise

30

At a time when the real estate sector is reeling

under liquidity crunch and poor sales, the

Securities and Exchange Board of India (Sebi)

has re-initiated the process of introducing real

estate investment trusts (Reits) in the country.

As planned way back in 2008, Sebi has finally released

a consultative paper and the proposed SEBI (Real Estate

Investment Trusts) Regulations for comments. Funds through

follow-on offers as well. This marks a key step in bringing

greater transparency and professionalism in the industry.

According to the proposed regulations, REITs will be registered

as trusts with SEBI. These trusts will not be allowed to launch

any scheme. Reits, which will raise funds through initial offers,

will have to list their units on exchanges for trade.

Knowing REITs

REIT is like a company that raises the capital required through

an IPO and then sells its shares to its investors. With the

capital raised, REIT buys real estate assets which are income

providing. Some forms of REIT generate income by renting out

the properties, while some others generate income by lending

money to other real estate investors.

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

31

The income generated from such type of activities is

distributed back to the investors in the form of dividends year

after year. REITs present a less risky option to investing in

under-construction properties and are well suited for investors

seeking a regular income.

REIT was first introduced back in 1962 in the United States of

America and ever since then the idea of REITs have spread all

over the world through Japan, Singapore and So on.

Key highlights of the draft guidelines

• REITs would be able to raise money from investors,

resident or foreign. However, at the start units would be offered

only to high net worth individuals (HNI) and institutions.

• A REIT would have to be set up as a trust which is allowed

and registered with SEBI before it can offer units to the

public and have its units listed in a fashion similar to an initial

public offering of equity shares. A REIT would have a trustee,

sponsor, manager and principal valuer before it can apply for

registration with the regulator. According to SEBI, a REIT once

listed may raise funds through follow-on offers. Moreover,

listing of units will be mandatory.

• The minimum size of investment that the REIT can

hold would be Rs 1,000 crore and the listing of units will be

mandatory. The minimum initial offer size would be Rs 250

crore and the minimum public float 25%. To avoid excessive

leverage, the consolidated borrowings and deferred payments

of the REIT have been capped at 50% of the value of its assets.

If the leverage exceeds 25%, the REIT would require credit

rating and approval of the majority of investors.

• The minimum subscription per investor would be Rs 2

lakh with every unit valued at Rs 1 lakh.

• 90% of the investment would have to be made in

“completed” revenue-generating properties; the remaining

10% could be invested in other assets as deemed fit by the

REIT manager

• Full valuation including a physical inspection of the

properties would be made at least once a year and be updated

every six-months. Accordingly, the net asset value of REIT

units would be declared at least twice a year.

The action taken by SEBI through issuing these draft guidelines

is an encouraging step and will help enhance liquidity position

of developers and make the realty sector more transparent

and accountable. When REITs come into being these would

stimulate substantial investor interest from domestic and

global investors in India, currently a passive real estate market.

REITs are expected to bring in globally recognized practices to

real estate funding and renew the interest of both global and

domestic investors in this sector. With REIT, one can expect

large-scale investor participation in the real estate sector.

What is in store for Indian real estate sector?

Reits have been on the wishlist of the Indian real estate sector

for long. It is expected to bring in globally-accepted practices

to real estate funding and revive the interest of both global and

domestic investors in the sector.

According to Cushman & Wakefield, around 57 million square

feet of office space is vacant in India and over 200 million

square feet of investible 'Grade A' leased offices are unsold.

These properties can be used by Reits to generate rental

incomes. The residential segment, where annual rental yield

is low (2-5%), will be better suited for capital appreciation.

"Allowing Reits will be a sign of the maturity of the Indian

real estate market. Reits reduce individual speculation in

real estate assets and allow for more professional investment

and management in the sector," says Sanjay Dutt, executive

managing director, South Asia, Cushman & Wakefield, a real

estate consultancy.

"If implemented, the timing of Reits will be great as many

developers are faced with liquidity issues as they have large

amounts of capital locked in commercial assets and are finding

it difficult to sell due to the large ticket sizes. Investments by

Reits will also indirectly reduce the exposure of banks to risky

assets as they have provided construction finances to many

projects," he adds.

"The decision to allow listing of Reits in India as an investment

product will boost the liquidity situation of cash-starved

developers, which are struggling to find funds for their

construction activities. This will also boost the subdued investor

sentiment in the country and will provide an investment avenue

which is less risky than under-construction properties, as well

as easier exit routes along with regular income " says Sachin

Sandhir, managing director, RICS (Royal Institute of Chartered

Surveyors) South Asia.

It’s the non- clarity on on stamp duty and taxation is what

worries some. "Reits will enable developers sitting on assets

to both unlock value and create liquidity. Due to global

acceptance offshore investors had already begun looking at

core opportunities in India. However, there is no clarity on

stamp duty and taxation yet, which will play an important

role in the success of Reits," says Khushru Jijina, managing

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

property wise

32

director, India Reit Fund Advisors, a real estate fund.

Experts say the Indian government and the market regulator

will need to move quickly to ensure that the momentum built

by Sebi's move remains. They say the process of allowing Reits

will have to be expedited to bring in institutional funding and

liquidity in the real estate sector quickly.

Howithelpinvestors&developers

REITs are beneficial to both investors and the real estate

industry. On the one hand, it provides an exit route for

the developer/industry; on the other, it offers investment

opportunities in property for retail and high net worth investors.

REIT sponsors, usually developers or private equity funds,

allow developers to gain liquidity by passing on ownership to

unit holders. “This is a welcome move. Once in place it will

provide an additional exit route for investors and enable retail

money to be channelised into India’s realty sector through a

regulated network,” says Anshuman Magazine, chairman and

managing director of CBRE South Asia.

According to the investment bank, DLF, Phoenix, Unitech and

Raheja are the largest rental asset owners and likely to be

the key beneficiaries. “Given DLF’s high leverage and limited

success in monetising its non-core assets, REITs could provide

new avenues to raise funding to help it reduce debt.

According to Morgan Stanley, India has 400 million sq ft of

office and mall properties valued at $60 billion (Rs 3.72 lakh

crore).

“It is definitely of interest to us and we would like to float a

Reit like many others,” said V Hari Krishna, director at Kotak

Realty Fund, which has a little over $100 million of investment

in commercial assets. “You get to play the property market

without development risks; Reits offer high liquidity which is

not there in the real estate markets and offer an income-play

like bonds.”

Tata Sons-owned TRIL, an advisor to realty fund Tata Realty

Initiatives Fund (TRIF-1), is also looking at floating a Reit here,

as well as in Singapore, over a period of time.

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

33

“The legislation (on Reits) offers good options for developers

like us who have large income-generating assets. It is a good

platform for exits. We believe Reits will be realty in India in

the next one year, when we will list our own Reit here,” TRIL

managing director Sanjay Ubale had told Business Standard

recently.

“Three-four years down the line, we will look at floating a Reit

in Singapore,” he had said.

TRIF-1 has a corpus of $750 million and owns around 90 per

cent stakes in the company’s mall projects in Amritsar and

Nagpur, among others.

According to sources, US-based Blackstone has also started

doing the spadework to launch Reits here. Blackstone is the

most-aggressive investor in commercial properties in India. It

has invested about $1 billion in Indian commercial properties,

mostly in IT parks and special economic zones, since 2011.

Some of its major investments include a $149-million

investment in DLF Akruti Info Parks in Pune and $200 million

in the properties of Embassy Property Developments.

Theflipside

Going by the pragmatic approach, SEBI has given a lot of

emphasis on transparency and disclosures According to

Bhairav Dalal, associate director, PwC India, “The good news

is that the regulator has clearly expressed its willingness to

kick-start REITs in India at the earliest. The cautious approach

adopted by Sebi during this initial period is acceptable and

appreciable. One concern is with regards to the strengthening

of our legal framework surrounding real estate in India, which

is a pre-requisite for REITs to thrive here. One of the basic

premises of the draft Reit regulations is the need to provide

an exit avenue and liquidity. However, the definition of "real

estate" seems rather constricted. The definition of "real estate"

or "property" should be broadened to include all commercial

and residential property and completed infrastructure assets

such as roads and highways that have a regular income flow.

The Real Estate Regulatory Bill, which was approved by the

Union Cabinet in June 2013, was therefore a move in the right

direction,” said Anuj Puri, Chairman & Country Head, Jones

Lang LaSalle India.

Unveiling the underlying policy marshland for REITs, Geeta

Dhania, Managing associate, Luthra & Luthra Law Offices, says

the sponsor eligibility condition of five years' experience in the

real estate industry on an individual basis should be widened

to enable non-core real estate players likehotels, hospitals and

other corporate houses with real estate to participate in Reits

as well.

Talking on the commercial viability, of the premise that the draft

Reit regulations provides that a Reit cannot undertake an initial

public offer without the prescribed minimum asset value, she

says, Our lawmakers should amend this requirement and may

consider a requirement to have the initial portfolio identified

and tied in by way of definitive documents prior to the initial

public offer and offering proceeds can be utilised to purchase

the assets.

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Retail In Asia - Different Strokes For Different FolksConsumers in India, China and other emerging nations are curious and want to explore new brands

property wise

34

Different Asian countries are at different stages

of development of infrastructure, logistics

capability and general real estate market

development. Retailers are prevailed upon to

tailor their local market strategies according to

factors such as real estate locations, price points and available

logistics. Such issues do not, as a rule, exist in developed

world.

The characteristics of Asian consumers that make them

different from consumers in developed markets are also

noteworthy. To begin with, most Asian populations are

witnessing rising incomes. This makes them prone to higher

spending impulses than consumers in the West, who are

currently in belt-tightening mode.

Also, consumers in India, China and other emerging nations

are curious and want to explore new brands. Consumption of

high-value items and luxury products is rising. Simultaneously,

the Asian consumer at all times keeps an eye on the affordability

of products.

This is a seemingly paradoxical approach for retail brands

that are used to the blacks and whites of spending patterns in

developed countries. They are often not sure how to position

themselves in markets where domestic alternatives to their

luxury items are available and also accepted.

Some interesting variants to the retail story in Asia:

• LocalPartnerSelection: International retailers are deploying

a variety of strategies when entering Asian markets. These

strategies range from emphasis on Internet marketing and

sales to adapting stores and specific products to fit in with local

cultures. Local, home-grown luxury brands seek international

capital and expertise, while global luxury brands are keen to

appeal to local tastes. Thus, partnerships between the two

become common.

• LocalStrategy: In order to be effective in Asia, international

retail strategies require to be customized to the nuances of the

local market. There are a number of nuances to be accounted

for, including the securing of top real estate locations at

accurate price points and good supply chain management.

• Product Lines: Product lines are more or less the same,

considering the inherent clout many well-known brands wield

in their particular segments. What differ are the finer elements

of product – product superiority (in the case of electronic

gadgets), product size (in the case of apparels and accessories,

depending upon the average build of people in a specific

geography), product pricing (depending upon cost structure in

the local markets and other business risks involved), product

choices specific to specific climatic conditions, and so on.

• Product Differentiation: In Asian countries, international

retailers that have displayed little or no disparity in price,

product and service from country to country have outperformed

peers that lack that same consistency. Zara and H&M are

good examples of such retailers, and they do very well. They

have a high luxury brand presence internationally, and the fact

that there is little brand dilution when going cross-border has

proved to be a winning strategy for them.

Anuj Puri, Chairman & Country Head, Jones Lang LaSalle India

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

35

• Brand Awareness And Recognition: The success of

international retail and restaurant-chain expansion often

depends on brand recognition. For instance, in Singapore

there is high recognition of American and Japanese brands

due to education, travel and popular culture. In countries

such as China, the upper-middle income group is showing an

increasing preference for popular Western brands.

• Curiosity: It would not be inappropriate to say that Chinese

and Indian consumers display an almost child-like eagerness

to try new things and explore new facets of their identities.

Therefore, they are low on brand loyalty. This is good news for

several domestic and international retailers who want to set up

base in these countries. However, several international retailers

also have to grapple with this limited brand-consciousness in

countries such as India, and could only hope that the trend

changes in their favour over time.

• Entry& LocationStrategy: In the West, entry and location

strategy is more oriented towards establishing the suitability

of the product to a particular population at a certain location.

This is possible because demographic data and digitized

real estate landscaping is readily available in developed

markets. Emerging markets are less organised, and

therefore international retailers need to begin by studying the

demographics of each market cluster separately. The rising

importance of focusing on the correct residential cluster to

target cannot be underestimated - there is a deep requirement

of adequate market research at the core.

•StoreSizes: Depending upon the depth of product offerings

for a particular market, store sizes also differ. For instance,

Marks & Spencer would probably need a 20,000 sq. ft. space

in the UK at a minimum, as it offers diverse product categories

in that market. However, in Asian countries where it will

invariably carry a more limited range of product offerings, it

would not need more than approximately 5000-6000 sq. ft.

of space.

• Operational Efficiency Vs. Omni-Presence: The Big Bang

expansion plans of international retailers into fast-growing

emerging markets may not fructify at this moment because

of investment capital constraints (as is to be expected in a

scenario wherein business in home country is weak). Wal-

Mart, for instance, said in 2012 that it will slow down launches

of new stores in China and other Asian markets, thereby

indicating a greater focus on operational efficiency.

• InnovativeStrategies: Fashion apparel is one of the segments

that is witnessing enormous growth in Asian markets. It is

geared towards a young population with rising incomes, yet

a determined focus on affordability. Thus, many international

and domestic retailers have come up with 'fast fashion' to

bring affordably-priced apparel to the market in quick cycles.

These retailers are also facing stiff competition from Asia’s

local players, who have long-standing strength in textiles, an

understanding of local tastes and established local distribution

networks.

• PrivateLabelsGoods: In India, big retailers have been active

in introducing private label products, which now account for

20-25% of the profits for most. To cater to needs of value-

conscious consumers, private labels can also fill a void in

markets such as India where many categories of goods are

still under-developed. Private labels have a much lower share

of supermarkets sales in Asia than in developed countries,

ranging from less than 1% in Indonesia to between 1.5%-30%

in Thailand, Hong Kong, Malaysia, South Korea, Singapore

and Taiwan (as per L.E.K. Consulting). Euromonitor research

shows that in India, this share is close to 11% and 4% in China.

Initially, some consumers show suspicion while buying private

labels. To overcome this suspicion, retailers are resorting to

upgrading packaging, competitive pricing and promoting their

international affiliation. All in all, private labels have a bright

future in India. According to AC Nielsen, private labels will sell

around 5 times more in India by 2015 as against the annual

USD 100 million turnover being seen today.

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Delayed Projects Plague NCR’s Residential Market

property wise

36

Santhosh Kumar, CEO - Operations, Jones Lang LaSalle India

PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Delayed delivery of residential projects has

become a significant issue on the real estate

market, leading to high levels of ire among

customers. In terms of the average delay in

delivering residential projects across India,

more than 25% of the committed supply has not been able to

hit the market as per schedule. The National Capital Region’s

performance in terms of delivery of residential supply due in

2013 has been the worst across all the major Indian cities.

In Gurgaon, only one-third of the total committed supply for

2013 has been delivered so far. The situation has been even

more alarming in other NCR regions such as Noida, where

only about one-fifth of the residential supply committed for

delivery in 2013 has been delivered so far.

In the West, Pune and Mumbai have shown a much better

performance in terms of project completions - these cities

could deliver more than 40% of the committed supply of 2013

as per scheduled delivery.

With delivery delays, inventory levels across India have risen

significantly. The Pan India inventory of residential stock is

now well above the comfort level of 14-15 months. Mumbai

has an inventory of close to 48 months, Delhi of 23 months

and Bangalore of 25 months. These are close to the levels

of 2007, when the residential real estate market's inventories

were at an all-time high.

Why Project Delays Occur

The issues leading to residential project delivery delays are

manifold. Poor project management is often one of them,

but this is not essentially the prime reason. In fact, it is the

current economic scenario - defined by high levels of inflation

and escalating construction costs - that is the leading reason

for delayed projects. Developers are facing a severe liquidity

crisis and do not have the capital to complete their projects.

However, there are also other factors at play.

One of these often is nothing more than a lack of commitment

to timely completion and delivery on the part of a developer.

We are currently looking at an environment wherein developers

are obsessed with launching new projects rather than making

the completion of existing projects a priority. There have been

many instances where funds that were raised for a particular

project were diverted for uses other than expediting the

completion of projects under construction.

Delay in regulatory clearances is another critical reason for

delays in project deliveries. In many cases of delayed projects in

Delhi NCR, the water and sand crises as well as environmental

regulations which developers have not been able to meet have

played a role. In quite a few projects, the lag caused by various

bureaucratic processes has also been an operative factor in

delayed project clearances.

There is no doubt that the new regulations pertaining to land

acquisition have thrown a rather massive spanner in the

works. In the NCR region, a significant number of residential

projects in areas such as Noida have been delayed because of

disputes with regards to land acquisition.

Advice For Property Buyers

In the current scenario, the secondary market seems to be

a more promising avenue for end-user buyers, as they can

get better price points there. However, transactions on the

secondary market often require buyers to have higher initial

liquidity so as to be able to meet the immediate capital

requirements. Also, in many of the projects, developers have

put in prohibitive measures such as high transfer charges

before the completion of the project. In such cases, the

valuation might also not be very attractive at all.

Nevertheless, developers are feeling lot of financial pain and

are now offering attractive construction-linked and payment

plans, with the bulk of the payment phased towards the time

of possession. These plans allow buyers with limited liquidity

to proceed with the purchase. Also, CLPs mean that buyers

have reduced exposure to the risk of delays.

We expect that in the ensuing two quarters, developers will

come out with more incentives and discounts to attract buyers.

In other words, the primary market will continue to maintain

its appeal. Buyers are, as always, advised to do a complete

and thorough due diligence of the credibility of any developer

they seek to deal with. Especially in the current scenario, the

delivery track record for previous projects is a vitally important

guideline for investment in the primary market.

37PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

Top realty destinations to invest in near metro cities

Buy a home for yourself this year. That's the

message of Union Budget 2013-14. The Budget

has announced an additional tax deduction of

Rs 1 lakh for those taking a loan up to Rs 25

lakh to buy their first home this financial year.

If you find the bait attractive enough, the Rs 25-lakh loan cap

and high property prices mean you have limited options if you

cannot make a big down-payment. One option is buying a

house at places not far from metro cities where prices are on

the lower side. Even if you don't want to move away from the

main city, the high returns that some of these new locations

promise means the house can be used as a bridge to the one

that you want to live in.

THEALTERNATIVES

With improving connectivity, expanding cities and rising

property prices, more and more home buyers are looking at

places close to metro cities. Developers are also betting big on

such locations.

Some emerging locations are Manesar (Haryana), Neemrana

property wise

38 PROPERTY & WEALTH VOL 3, ISSUE 03, Dec-Jan 2013-14

With improving connectivity, expanding cities and rising property prices, more and more home buyers are looking at places close to metro cities. Developers are also betting big on such locations.

(Rajasthan), Narela (Delhi), Dharuhera (Haryana), Bhiwadi

(Rajasthan), Yelahanka (Karnataka) and Ranjanapada

(Maharashtra). Knight Frank India, a property consultancy,

listed Manesar, Neemrana, Narela, Yelahanka and

Ranjanapada as "hidden gems" in a report released towards

the end of last year.

"Buying property in a location that is well-connected and an

upcoming industrial hub is apt not only from the end-user

point of view but also from the investment point of view,"

says PS Jayakumar, managing director of Value and Budget

Housing Corporation (VBHC), a Bangalorebased developer

with focus on low-cost homes.

"The Delhi-National Capital Region (Delhi-NCR) should be a

good bet, but buyers need to be aware of two situations-one,

economic development in the area and, two, rise in inventory

with a large number of new properties getting ready," says

Ankur Gupta, joint managing director of Delhi-based Ashiana

Housing.

To attract both investors and first-time buyers, developers are

offering properties in a number of destinations close to metro

cities. Some of these are likely to give good returns over the

years .

BHIWADI&DHARUHERA

Bhiwadi and Dharuhera are well-connected with Gurgaon and

Delhi through National Highway 8. These are at a distance of

around six km from each other.

"I will take Bhiwadi and Dharuhera as one region. These have

become industry hubs on the Delhi-Mumbai Industrial Corridor

(DMIC). Companies such as Honda, Gillette and Lafarge have

set up plants there and many others are considering expansion

(there). Infrastructure such as schools, malls and hospitals is

coming up in a big way and will make life easier," says Gupta.

The DMIC project aims to create new industrial centres in

seven states-Delhi, Uttar Pradesh, Haryana, Rajasthan,

Madhya Pradesh, Gujarat and Maharashtra-through better rail

and road connectivity. It is aligned with a proposed rail freight

corridor between Delhi and Mumbai. In this year's Union

Budget, the government has expressed willingness to provide

additional funds for the project. The first phase is slated for

completion in 2018.

"Bhiwadi has properties priced between Rs 15 and Rs 70

lakh while properties in Dharuhera start from Rs 15 lakh and