PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIESassets to offset liabilities makes these countries more...

Transcript of PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIESassets to offset liabilities makes these countries more...

PRIVATE CAPITAL FLOWS TO

LOW INCOME COUNTRIES:

Perception and Reality

Matthew Martinwith Cleo Rose-Innes

INVE$TING in poor countries: Who benefits?

29

Introduction

Low-income countries, particularlythose in sub-Saharan Africa, have longbeen perceived as aid-dependent,receiving virtually no private foreigncapital. The future for such alleged“basket cases” was judged bleak. Yetmany low-income countries have longknown the reality: private foreigncapital (PFC) flows are significant. That reality was reflected in severalstudies in the mid-1990s.1

Low-income countries have veryrudimentary systems for monitoringprivate capital, resulting in vastlyunderestimated and underreporteddata to international institutions.Reported data is usually based onestimates which bear little relationshipto actual flows. Based on surveys ofsuppliers of private foreign capitalflows, the true data indicates that low-income countries with stableeconomies and open investmentpolicies attract extremely large flowsin relation to GDP or othereconomic variables.

As a result, these large flows haveprovoked currency crises and macro-economic instability in low-income

countries. Although these have beencomparable in magnitude to the majorcrises in emerging market economies(Argentina, Brazil, Russia, Turkey,and East Asia), they have remainedlargely unnoticed by the internationalcommunity.

This chapter looks at the reality oflarge private foreign capital flows tolow-income countries. It is based onprojects executed by DevelopmentFinance International (DFI) incollaboration with 18 countries,funded by the participating govern-ments themselves, and by thegovernments of Denmark, Sweden,Switzerland, and the United Kingdom.These research projects analyzed thecontrast between the perception andreality of flows to low-income coun-tries. Subsequent project stages havemoved on to assisting countriesimprove their monitoring of foreignprivate capital, and conductingdetailed surveys of foreign assetsand liabilities (FAL) and of investorperceptions2 in seven low-incomecountries. The project is designedto build sustainable governmentcapacity to conduct their ownsuch analyses.

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES:

Perception and RealityMatthew Martin

with Cleo Rose-Innes

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

30

BOX 1

The Foreign Private Capital Capacity-Building Project

The goal of the Foreign Private Capital-Capacity Building Project (FPC-CBP) is todevelop independent and sustainable capacity within participating countries tomonitor and analyze the effects of foreign private capital on their economies.

The project is run by Development Finance International (a UK non-profit)in partnership with regional organizations to ensure that capacity to assistcountries is decentralized.

These partner organizations are :

• Banque Centrale des États de l’Afrique de l’Ouest (BCEAO) in FrancophoneAfrica;

• Centro de Estudios Monetarios Latino-Americanos (CEMLA) in Latin America;

• Macro-Economic and Financial Management Institute of Eastern andSouthern Africa (MEFMI) in Eastern and Southern Africa; and

• West African Institute for Financial and Economic Management (WAIFEM) inAnglophone West Africa.

The data used in this study is taken from seven low-income countries currentlyparticipating in the FPC-CBP.

The latest published survey data covers Tanzania (1999); The Gambia, Ghana,Malawi and Uganda (2000); and Guyana and Zambia (2001). Flows are for thatyear, and the stock data is the closing stock at the end of that year. Data for 2000and 2001 has been surveyed and is currently being processed for publication.

For this study on low-income countries, in-country analytical teams providedDFI with their latest finalized survey data. This information is in the publicdomain, as survey countries disseminate their analytical reports in print, andwhere possible, posting their reports on Central Bank and InvestmentPromotion Agency websites at the end of each project cycle.

Participating countries have also committed themselves to reinforcing theirlegal and institutional structures, human resources, management and supervi-sion procedures and working environments, to give greater political priority tothe issues, to increase the transparency of analysis to civil society, and toincrease their financial contributions over time to these exercises.

Each country project is structured in the following way:

• Participant countries request a DFI/CEMLA/MEFMI/WAIFEM DemandAssessment Mission where conditions are assessed, a coordination structurebetween government agencies and other stakeholders established, and amethodology and budget finalized.

INVE$TING in poor countries: Who benefits?

31

This approach encourages cooperation and cohesion among governmentagencies, saves donor money, and reduces the number of questionnairesreceived by the private sector, again increasing responses. In Uganda, forexample, government questionnaires in this area have been reduced fromthree to one by close cooperation between the Bank of Uganda, the UgandaInvestment Authority, and the Uganda Bureau of Statistics.

• Prior to the survey launch, members of the private sector are invited to anopening conference where these and related macroeconomic issues arediscussed, raising awareness of the survey process and improving public-private sector dialogue.

• A survey sample targeting key investors is identified and the final surveyquestionnaire is tailored to country need by the in-country team.

The survey is (usually) divided into three sections:

— Foreign Liabilities: equity (stocks and flows of both direct and portfolioinvestment); retained earnings of FDI; borrowing from non-residents (bydebt type and maturity)

— Foreign Assets: equity (stocks and flows of both direct and portfolioinvestment); profit data; lending to non-residents (by debt type andmaturity)

— Investor Perceptions: the detailed questionnaire includes questions oneconomic and financial factors; political and governance factors; theefficiency and cost of services; labour, health and environmental factors;pull factors of initial investment; intentions over the medium-term; theutility of information sources for investment decision-making, and desiredaggregate information from government.

Data quality is assessed and when satisfactory (this may require follow-up withrespondents), output tables are produced for analytical purposes. The in-country teams finalize a report on their findings, which is disseminated at aclosing conference.

The integration of balance-of-payments and perceptions questionnairesencourages a much higher private sector response rate. Countries that haveincluded both elements of the questionnaire have increased their responserates by 20-30 per cent, producing a 75-80 per cent average response rateamong the seven countries. The data used here is drawn from a total of 2,196processed returns: Ghana, 255; Guyana, 33; Malawi, 155; Tanzania, 900; TheGambia, 204; Uganda, 326; and Zambia, 323.

• Country teams receive additional training on interview techniques, non-survey methodology, and data enumeration. As returns are collected fromrespondents the data is checked and entered into a database.

The remainder of the chapter isbased on the work of DFI and teamsof government officials in sevendeveloping countries: The Gambia,Ghana, Guyana, Malawi, Tanzania,Uganda, and Zambia.3 It examines inturn the current reality; the signifi-cance of private foreign capital flows;implications for government policy inlow-income countries; and the needfor building low-income countries’capacity to monitor and analyzeforeign private capital.

The current reality

The scale of stocks and flows

In the mid-1990s, international datasources were reporting that flows ofprivate capital to low-income coun-tries were insignificant. However, assome countries improved theirmonitoring, it became obvious thatthese flows were very important.While international organizationswere still relying on outdated data ongross inflows, inflows tracked by thecountries themselves were double ortriple the levels of internationallypublished figures.4 This alternate“reality” occurred because theexchange control or foreign invest-ment monitoring systems in manylow-income countries did not havethe capacity to record such items asretained earnings, intracompany debttransactions, and “offshore” borrowing(borrowing occurring outside therecipient country) .5

However, countries are now usingsurvey techniques which furtherimprove the coverage of inflowsand that stress reporting returns onforeign private capital inflows (profitremittances and loan repayments), andon the outflows related to outwardinvestment from low-income coun-tries. Especially in periods of negativeeconomic development, outflows arenow seen to be much higher and netinflows considerably lower than previ-ously published (for example, Ghanain 2000), due to large outflows for onecompany and ripple effects on newinvestment by others. On the otherhand, dramatic improvements in therecording of private sector debt havepushed up flows and stocks in thisarea dramatically.6

Figures 1 and 2 examine the scaleof gross foreign private capital inflowsand accumulated stocks in relation toGDP in the seven project countries.

Figure 3 shows that there are alsolarge outflows of profits, dividends,and debt service. These have averaged59 per cent of the inflows (39 per centexcluding Ghana). These outflowsdemonstrate the high rate of returnwhich can be achieved on foreign pri-vate capital in low-income countries.

On the other hand, outflows alsodemonstrate the vulnerability of low-income economies to net-flowreversals in the event of changes inthe economic environment. Ghanaexperienced this vulnerability in 2000,when its outflows were almost twiceas high as inflows that year. Thisreversal, precipitated by a crisis facedby the large investment company

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

32

Ashanti Goldfields—which was widelyreported in the international press—caused a collapse in the currency andnational foreign exchange reserves.

As a result, net flows average only3.5 per cent of GDP a year across theproject countries. The high level ofinflows and outflows related to thelow-income countries’ economiesshows the potential major impact oneconomic stability and the need forlow-income country governments topay close attention to policies whichcan stabilize these flows or swiftlyadjust to changes.

On the other hand, there is littleoutward investment from most ofthese economies. The stocks of suchassets are less than 2 per cent of GDP,and less than 7 per cent of the stocksof liabilities. Nearly all (70-80 percent) are bank loans rather thanequity. As most countries have norestrictions on outward flows, this issurprising—it may reflect the lack ofknowledge in their private sectors ofalternative investment opportunities todiversify their portfolios. The lack ofassets to offset liabilities makes thesecountries more vulnerable to crisescaused by PFC.

Composition of stocks and flows

Another problem with previoussystems for monitoring private foreigncapital flows is that they have tendedto assume that almost all flows areForeign Direct Equity Investment(FDEI). This is because they have beenbased on asking Investment PromotionAgencies (IPAs) how much “invest-

INVE$TING in poor countries: Who benefits?

33

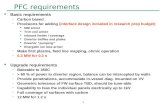

0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%

Malawi

Ghana

The Gambia

Uganda

Zambia

Tanzania

Guyana

Figure 1

Private foreign capital inflows (% GDP)

Figure 2

Private foreign capital stock (% GDP)

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50%

The Gambia

Uganda

Malawi

Tanzania

Zambia

Ghana

Figure 3

Inflows and outflows (% of GDP)

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

Ghana Guyana Malawi Tanzania The Gambia

Uganda Zambia

inflow

outflow

ment” they have approved, and thenestimating that a certain percentagemight have turned into actual invest-ment. Yet virtually no IPAs askinvestors how they are going to fundtheir investment, even though differentfunding methods have dramaticallyvarying implications for the sustain-ability of private flows.

Foreign private capital can bedivided into four main types of flows:

• Foreign Direct Equity Investment—divided in turn into new directequity and earnings from existingequity which are reinvested in thecompany rather than expatriated

• Foreign Portfolio EquityInvestment—new equity (or rein-vested earnings on existing equity)which is less than 10 per cent of theequity value of a company

• Foreign Direct Non-EquityInvestment—loans provided byrelated (parent or affiliated)companies to a recipient countrycompany

• Other Investment—represents loansfrom unrelated companies and lessformalized short-term credit tocompanies for trade and servicespayments

Recent country data has revealedsome surprising new findings, shownin Figure 4, about the averagecomposition of flows to the seven low-income countries studied:

• on average, new direct equityinvestment (including reinvestedearnings, which were previously notrecorded) represent 32 per cent ofthe total

• portfolio investment is very low, atonly 2 per cent, but there continueto be large gaps in reporting theseflows, especially by the many non-resident investors who put moneyinto treasury bill or bond marketsvia nominee local companies

• intracompany loans are a crucialsource of funding for equityinvestors, and are higher than totalequity flows at 41 per cent

• debt to/credit from unrelated com-panies is also important at 25 percent of flows

• total private sector debt flows arevery high, averaging 66 per cent(though two-thirds come fromrelated companies, and 82 per centare long-term)

Figure 5, however, reveals widedifferences among countries withequity representing only 19 per centof total flows to Guyana, and 45 percent for The Gambia. Even within debt

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

34

Figure 4

Composition of foreign private capital flows

Long-term Internal Loans(37%)

Direct Equity(28%)

Long-term External Loan(17%)

Trade Credit (7%)

Reinvested Earnings (4%)

Short-term Internal Loans (4%)Portfolio (2%)Short-term External Loans (1%)

flows, related debt is much moresignificant than unrelated debt forMalawi, Tanzania, and Zambia, andmuch less significant for The Gambia.

For many countries the debt:equityratio is around 1:5 and the leverageratio (debt as a percentage of totalliabilities) is around 60 per cent. Thisis relatively high and comparable torecent debt:equity ratios for the EastAsian and Pacific countries,7 andexplains why companies are sovulnerable to market shocks.

In order to understand compositionof flows, it is necessary to look at theindividual sectors where investmentis taking place and at key companies.In several countries, individual sectorshave very high debt:equity ratios. Ingeneral, countries where resourceextraction sectors and projects (espe-cially mining and petroleum) areimportant have a much higherdebt:equity ratio, and debt financetends to be much more available totransnational corporations.

Overall, high debt:equity ratiosalso lead to a rapidly growing privatesector debt burden, as Figure 6 shows.Though they represent on averageonly around 15 per cent of totalnational external debt, in countriessuch as Ghana and Mozambique, thenumbers are closer to 30 per cent.With the reduction of public sectordebt under the HIPC Initiative and therapid accumulation of private sectordebt (66 per cent of new inflows), thisis set to become a key element ofnational debt burdens. HIPC FinanceMinisters have demanded more atten-tion be paid to this issue.8

The composition of flows isimportant because it determines thevolatility of the flows and the rate ofreturn. Typically, the international liter-ature on private flows to developingcountries has assumed a hierarchy ofdesirability of private capital flows,starting with the least volatile with

INVE$TING in poor countries: Who benefits?

35

Figure 5

Composition of private capital inflows

0%

10%

20%30%

40%

50%

60%

70%80%

90%

100%

Ghana Guyana Malawi Tanzania The Gambia

Uganda Zambia

EquityInvestment

IntercompanyBorrowing

OtherBorrowing

Figure 6

Private sector external debt (PSED) stocks by type (% of GDP)

0%

5%

10%

15%

20%

25%

30%

35%

Ghana Malawi Tanzania The Gambia

Uganda Zambia

Other Borrowing Intracompany Borrowing

the lowest return, and descendingto the most volatile demanding thehighest return.9

The most desirable flows have,therefore, been assumed to be ForeignDirect Investment (FDI), which isbelieved to be less volatile and morelong-term because it consists of fixedcapital investment and is difficult toexpatriate. However, detailed studiesof low-income countries indicate thatthis is not true. As Figure 7 shows,such investment demands andachieves very high returns (muchhigher than those of debt discussedbelow), averaging 14.8 per cent butexceeding 20 per cent in The Gambiaand Malawi. Of course, many of thesecompanies are foreign-local jointventures and generate large profitsfor local investors.

However, of this amount, around75 per cent is repatriated as remit-tances, exceeding 10 per cent of capi-tal each year. These figures far exceedprevious International Monetary Fund(IMF) balance-of-payments estimates

which averaged only 65 per cent ofremittances (of much lower stock esti-mates). There is also strong evidencethat in periods of crisis in a recipienteconomy, equity investors increasedividend repatriation and repaymentof intracompany loans, implying thatflows vary procyclically, exacerbatingtrends in the wider economy.

The profitability of equity variesenormously by sector in differentcountries, but construction oftenproduces rates of 70 per cent or more.Both agriculture and finance haveaverage profits around 20-25 per cent,and manufacturing averages rates of15 per cent. The wholesale and retailtrade, and accommodation andtourism appear to be the least prof-itable sectors at an average 5 per cent.

The next most desirable flows,according to international studies,have been long-term loans, followedby short-term loans and portfolioequity flows. However, the evidencefrom low-income countries argues fora much more nuanced analysis of thestability and return on such flows.

In particular, it is vital to distinguishbetween loans from institutions linkedto investors, and those from unrelatedinstitutions as they have fundamentallydifferent purposes and rates of return.Related parent companies of multi-national investors often provide largeintracompany loans to supportworking capital or imports of capitalgoods. Typically, these loans have lowor zero interest rates and short (oneyear) or undefined repayment dates.Subsidiaries prefer these funds, largelybecause they cannot access interna-tional bank loans at such low interest

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

36

Figure 7

Profitability of equity capital

0%

5%

10%

15%

20%

25%

Zambia Uganda TheGhana

Malawi Ghana

Profits RemittedProfits Attributable to FDI

rates, and because intracompany loansprovide flexible repayment schedules.Often, these parent companies are thesole source of “cheap” loans forsubsidiaries; their large “float” can bewithdrawn quickly if there is any signof economic, political, or commodityprice instability in the recipientcountry. Indeed, these flows representa large proportion (20-40 per cent) oftotal foreign capital flows to low-income countries.

Loans from unrelated institutionsare a different matter. They may helpto finance trade credit or workingcapital but are more often used tofinance capital goods for major invest-ment projects with a longer repaymenthorizon. They usually have clearlydefined repayment dates and higherinterest rates, related closely tocommercial lending rates in theirhome countries. Nevertheless, multi-nationals with access to such interna-tional finance appear to be efficient atmobilizing such capital at low interestrates, around international commercialrates for the borrowing currency, plusa spread of about 2 per cent. For thosecompanies borrowing in US dollars,this meant rates of around 6 per centin 2000. This fell to 3-4 per cent in2001-02. Companies borrowing inSouth African rand were less fortu-nate, as rates were 15 per cent on acurrency which was appreciating atthe time.

Overall, these results somewhatcontradict the traditional hierarchy ofdesirability of flows. FDI can be anextremely expensive (and thereforeimplicitly volatile) form of foreigncapital but, while intracompany andunrelated debt can also be procycli-

cally volatile, their costs in normalyears are much lower than thoseof equity.10

The results for balance-of-paymentsand economic stability are shown inFigure 8. Most net inflows areaccounted for by debt in the bulk ofcountries but, in difficult years, bothdebt (Ghana) and equity (Malawi) canlead to net outflows.

Direction of stocks and flows

Source countriesMost low-income countries’ IPAshave until recently focused the bulkof their investment promotion effortson Europe and North America. Yetevidence from the countries we havestudied reveals this focus is rapidlybecoming less appropriate. At theend of 2001, accumulated historicalinvestment stocks stood at 65 per centfrom Europe and North America.However, 35 per cent of stocks werefrom other regions of the world,including intra-African and intra-

INVE$TING in poor countries: Who benefits?

37

Figure 8

Net equity and debt flows as a % of GDP

-4%

-2%

0%

2%

4%

6%

8%

10%

Ghana Guyana Malawi Tanzania The Gambia

Uganda Zambia

DebtEquity

Caribbean flows, and flows fromAsia and Australasia. Of these, asurprisingly high 5 per cent camefrom offshore tax havens such asBermuda, the British Virgin Islands,the Isle of Man, Panama, and theTurks and Caicos.

Three further data elements rein-force this conclusion:

• Investments by such companies asSouth African Breweries or AngloAmerican and Old Mutual are iden-tified by their place of registration(i.e., the Netherlands and the UK)rather than their place of operation.When adjustments are made toreflect the true country whereinvestment promotion efforts mightinfluence decisions, the percentageof intra-African investment stock isestimated to rise to 25.5 per cent.

• There is strong evidence that invest-ment from offshore havens repre-sents investors based in Africancountries deciding to park funds inthese havens in order to minimize

risk, until they are ready to bringthem in as FDI.11 This would pushthe percentage of intra-Africaninvestment to over 30 per cent.

• Flow data indicates that in recentyears diversification has beenaccelerating.

Individual countries show sharpvariations. While 87 per cent of invest-ment stock in Ghana is from Europeand North America, it falls to around60 per cent for Guyana and Malawi,and around 40 per cent for Tanzania,Uganda, and Zambia. Intra-Africaninvestment is high in Zambia (40 percent), Malawi, Tanzania, and Uganda(all at 30 per cent), but much lower inGhana (5 per cent). Investment fromAsia and the Caribbean accounts for30 per cent of investment in Guyana.Offshore haven investment is highestin Uganda (21 per cent).

Recipient sectors In international investment forums, itis often suggested that most foreigninvestment in low-income countriesgoes into mining and petroleum.However, the evidence from theproject countries belies this (seeFigure 10). Only in Tanzania andZambia is mining the largest sector,accounting for more than a quarter ofthe stock of foreign equity investment(though, for example, in Zambia,mining accounts for 51 per cent oftotal foreign private capital stock dueto high debt levels). Manufacturing isthe most important sector in Malawi,Uganda, and Ghana, reaching half ofequity stock in the first two. Financeand tourism dominate The Gambia.Finance is also important in Zambia,as is tourism in Malawi. Even agricul-

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

38

Figure 9

Sources of foreign direct investment

Europe(38%)

North America(27%)

Africa(15%)

Other(11%)

Tax Havens (5%)

Asia (4%)

ture receives 5-10 per cent of invest-ment in most countries, though itremains the poor relation and itsshare of investment is way below itsshare of GDP. Flows data alsoindicates that diversification isaccelerating, with even higher propor-tions of recent flows than total stocksin manufacturing and services.

Recipient regionsInvestment remains concentrated inone or two regions in most coun-tries— generally those with stronginfrastructure (e.g., where governmentand business centres are located),human capital, and natural resources.Poorer regions tend to lag behind—which is of major concern for policy-makers trying to foster more regionallybalanced development under theirnational poverty reduction strategies.Even when poorer regions receivemassive investment, this may consistof one or two massive enclaveprojects, making these regions highlydependent on the project’s success.

The significance ofprivate capital flows

One reason for private foreign capital’smajor significance in the project coun-tries is profitability. The 2,200 interna-tional and domestic investors surveyedindicated a high level of confidence inthe future prospects of their enterprises:60 per cent said they had plans forfurther expansion (only 10 per centplanned reductions) and more than65 per cent anticipated increasedturnover and profitability in the nextthree to four years, despite the fact

that a number of the economiessurveyed had recently experiencedsignificant macroeconomic shocks.This suggests that investors in theseeconomies are resilient and haveidentified techniques to cope withshocks to the wider economy, notablyrelying on intracompany borrowing asa more flexible form of financing.

A second key reason is that theseinvestors do not share (or even takenotice of) the continuing negativeperception of Africa as a “basket case”promising high risks and low returns,a perception which fuels the attitudesof many transnational corporate head-quarters, the international media, andsome rating agencies.12

Investors ignored these perceptionsin determining risks, and based theirdecisions on their experience, usingthe actual information available.When asked which sources informedtheir investment decisions, theystressed the views of business associ-

INVE$TING in poor countries: Who benefits?

39

Figure 10

Foreign direct equity investment (FDEI) stocks by sector

0%

20%

40%

60%

80%

100%

Zambia Tanzania Ghana Malawi Uganda The Gambia

Guyana

Service

Utilities

Wholesale and Retail Manufacturing

Mining

Agriculture

ates and the local and regional media,and attached the lowest value tointernational media and donor andinternational publications.

A third reason for the high flows isthe positive perception of the businessenvironment by investors. Their initialdecisions to invest were motivated byseveral positive pull factors.

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

40

Figure 11

Rating information sources for investment decision-making

0%

10%20%30%40%50%60%70%80%90%

100%

Businessassociates

Local andregional media

Internet Word ofmouth

Governmentpublications

Internationalmedia

Donor andinternationalpublications

Very useful Quite useful Useless

Figure 12

Pull factors motivating initial investment

Freq

uen

cy o

f re

spo

nse

fro

m h

igh

est

(10)

to lo

wes

t (0

)

0

1

2

3

4

5

6

7

8

9

10

Domesticeconomicsituation/

market size

Economicpolicies

Regionaleconomicsituation/

market size

Investmentincentives

Exchangecontrol

Taxincentives

Exchangerate

Tradepolicy

Interest rate

Availability of finance

The most important factors weredomestic economic and politicalstability, access to domestic markets,regional economic and politicalstability, access to regional markets,and economic policy. Investmentincentives (i.e., liberalization and one-stop facilitation) ranked fourth, andtax incentives sixth. Privatizationdid not feature at all, except for thefew investors who had acquiredprivatized companies.

Asked what supported their positiveoutlook, investors emphasized nation-al economic stability and marketaccess through regional integrationand trade policy. Those who benefitedfrom investment and tax incentivesvalued these elements highly. A majornew factor is growing labour skillsand productivity. Trade policy is alsosurfacing because it guaranteesregional market access. High ratingsfor political stability in Malawi andZambia were offset by negativeratings for political instability inneighbouring Zimbabwe.

Negative factors affecting invest-ment are rooted in investors’ realexperiences, especially the constraintsplaced on their business activities.Principal among these is the cost ofdomestic finance (through bothinterest rates and the cost of bankingservices), which contrasts with pre-investment perceptions of low costsand easy access, and has been thebiggest shock for investors. This partlyexplains why they have turned somuch to external debt financing.

Other key factors are economicvolatility—notably inflation andcurrency depreciation—the high cost

and inefficiency of utilities (especiallyelectricity) and weak infrastructure(especially transport). Investors arealso increasingly concerned about theeffect of HIV/AIDS on their ability tomaintain a stable and skilled work-force, and corruption.

Country-level analysis revealedinteresting results. For example, themost negative scores are for HIV/AIDsin Malawi and Zambia, demonstratinghow in touch investors are with thekey problems facing their societies. Inaddition, there is a marked variation in

INVE$TING in poor countries: Who benefits?

41

Figure 13

Current investment influences

Cost of domestic finance

Inflation

Electricity

Currency depreciation

HIV/Aids

Corruption

Transport

Drought

Floods

Monetary policy

Land issues

Political stability

Tax incentives

Trade policy

Labour

Investment incentives

Market access

Economic stability

country scores, with Tanzania and TheGambia only marginally negativeoverall across the range, and Malawiand Zambia much more negative. Thisis broadly in line with investor futureintentions, where the percentageintending to expand investment inTanzania and The Gambia is muchhigher. It is also obvious from thecountry scores that investors’ percep-tions are not always in accord withthose of international or donor institu-tions: for example, what interestsinvestors most is not the principle of apolicy (e.g., liberalization), but thepractical result (e.g., devaluation).

The surveys also included theperceptions of resident investors andtouched on policy measures neededto promote domestic investment andsavings. They differ on several issuesfrom foreign investors. Whereasforeign investors (dependent on therelative balance between imports and

export earnings) are happy withexchange rate depreciation, domesticinvestors (often import dependent)place a high premium on exchangerate stability. Similarly, foreigninvestors with access to offshorefinance, are not as concerned asdomestic investors by the high interestcosts or lack of access to domesticfinance. Thirdly, domestic investorsare much less concerned with (orinformed about) investment andtax incentives.

Investors’ positive expectations forthe future affect how they intend tospend their future investment.Priorities include developing theskills of their workforce, investing intechnology, and recruiting moreworkers. In addition, investorsalso indicated their intentions toincrease imports and exports in themedium term.

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

42

Figure 14

Key aims of future investment

0

1

2

3

4

5

6

7

Staff Training

Investing inTechnology

Recruitment Increased Imports

Increased Exports

Diversification R&D

Freq

uen

cy o

f re

spo

nse

fro

m h

igh

est

(7)

to lo

wes

t (0

)

On the other hand, investorsawarded lower priority to diversifyingtheir activities. This suggests both thatthey do not feel pressured by competi-tors, and that they lack access tocapital which would enable them todiversify. Nor do they intend to devoteresources to in-house research anddevelopment (as opposed to investingin technology supplied by others).These cautious strategies may limitnational economic growth in thatthey make the economy lessdiversified and more dependent onimported technology, but are typicalin low-income countries.

Implications for government policy

Macroeconomic effects

Until this new data emerged, countrieshad little idea of the state of theirbalance-of-payments, let alone theimpact of foreign private capital onthe wider economy. While the newdata series is not yet long enough toallow reliable econometric analysis,the findings of the country studiesconfirm and deepen those of earlierwork on the same economies:13

• Flows appear to be increasinglycorrelating with higher privatesector investment, indicating thedevelopment of greater linkagesbetween foreign and domesticinvestors. The causality of this rela-tionship is unclear—it may be thatcountry circumstances favour alltypes of investment. However, thegrowing number of joint venturesand knowledge of supplier-clientrelationships between foreign and

local investors indicates that therelationship between foreign anddomestic investment can bemutually reinforcing.

• There is also positive evidence ofsectoral diversification, technologyimprovement, skills transfer, value-added from commodityprocessing, and increased employ-ment from projects and sectors insome countries.

• However, too many large projectsremain virtual enclaves, conductingmost of their business and financingoffshore, and paying virtually no taxdue to incentives, as a resultdramatically reducing any positivecontribution to the economy.

• In addition, the high rate of divi-dends remitted by some sectorsindicates a worrying short-termattitude, with companies looking fora quick return rather than opportu-nities for long-term reinvestment.Similarly, many companies are toodependent on finance linked tocommodity production. Theresulting volatility of flows inconditions of commodity price orwider macroeconomic instabilityrenders flows highly procyclical,exacerbating the effects ofeconomic booms or slumps, andan unreliable financing source forlong-term sustainable development.

• Many low-income countries havesuffered as a result of foreign privatecapital crises caused by the with-drawal of key investors or thegeneral reaction of investors towider national or internationalfactors. Some (fewer) countrieshave also faced problems caused byexcesses of foreign private capital.

INVE$TING in poor countries: Who benefits?

43

Such crises, which can have muchmore dramatic negative impacts inundiversified low-income countries,underline the vital role of counter-cyclical, rapidly mobilized officialflows in preserving economicstability and avoiding privatecapital crises. It is a role they arefailing to play.

Potential policy responses

Low-income countries have limitedtools to respond to these effects:

• Macroeconomic and policy stabilityappear to be the most reliabletools—though investors are anxiousthat stability not target low inflationlevels at the expense of growth.

• Foreign exchange interventionhas—in the last few years—becomea relatively frequently used tool insome countries. But it is effectiveonly in smoothing minor currencyfluctuations and when notperceived by the markets (whichwill speculate against it). Given thelow foreign exchange reserves inmost low-income countries, it canprovide only a first line of defence.

• Many low-income countries rapidlyliberalized their financial flows inthe 1990s, partly under pressurefrom the IMF and partly becausethey realized that capital controlshad little effect on the massiveamounts of private capital entering(and more usually leaving as capitalflight) the country. Research hasalways indicated that capital (nowknown as financial) account liberal-ization should be gradual and care-

fully sequenced, and that countriesshould retain means of monitoringand analyzing flows after liberaliza-tion. Yet, even after several crises,and its acceptance among the G-8,very few countries benefit from thisgeneral consensus for gradualism.

• Trying to control booms and bustsof foreign private capital throughmonetary measures does not workvery well in OECD economies andsucceeds even less in low-incomecountries with their underdevelopedmonetary markets and poorly per-forming transmission mechanisms.Measures which have worked betterin low-income countries—andwhich have been used more oftenin recent years—have included non-market mechanisms such asshifting government deposits fromcommercial to central banks, andvarying reserve requirements on different types of foreign private capital.

• Most low-income countries havehad to rely on fiscal policy toadjust to foreign private capitalcrises, with disastrous results. Boomand bust procyclical fiscal policy(i.e., increasing expenditures duringbooms and reducing them duringbusts) is highly undesirable andruins long-term fiscal and povertyreduction expenditure plans.Instead, a contracyclical fiscalpolicy would be preferable, whetherthis means using tight fiscal policyto reduce booms caused by toomuch PFC, or increasing expendi-tures to make up for shortfalls inprivate investment.

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

44

• The low level of portfolio flows inalmost all countries is not expectedto be reversed in the short-term. Inmost small low-income economiesthere are few assets which can beprivatized with sufficient profit to befloated on the stock exchange, andinternational investment funds are(with a few pioneering exceptions)relatively uninterested. Given theinstability of portfolio flows in otherregions, countries should focusmost of their efforts on encouraginggreenfield direct investment.

National policy measures canachieve little: if the internationalcommunity is serious about low-income countries reaching theMillennium Development Goals, itmust pay more attention to the effectsof foreign private capital on theireconomies, and provide much greateramounts of official capital to promoteeconomic stability, in order to allowpoverty reduction expenditure andgrowth plans to proceed on schedule.

Policy implications ofinvestor perceptions

Data on investor perception shouldnot be used in a knee-jerk reaction toinfluence policy. Data must be disag-gregated and compared witheconomic reality. For example, ifdomestic investors are complainingabout exchange rate depreciation, butgovernment analyses determine suchdepreciation necessary for an export-led development strategy, then policy-makers must better explain anddiscuss such measures with the invest-ment community, and perhapsconsider compensatory measures suchas import duty/VAT drawbacks, rather

than change the exchange rate policy.Similarly, government needs tocounter investors’ low regard for thehealth of their labour force as a keyissue, illustrating why it is a keyconstraint to success and growth.

However, sound surveys whichcapture the opinions of 70-80 percent of investors provide a muchbetter basis for action than many ofthe public-private forums of recentyears, where analysis is sometimesreplaced by grandstanding or lobbyingon behalf of special interests. They arealso more reliable (and more positive)than many internationally-basedmedia and ratings agency analyses ofinvestment climates, because theyrepresent the experiences of actualinvestors rather than the fears ofpotential investors. It is vital forgovernments to transmit these resultsto the international media and donororganizations, and to use them as partof their investment promotion drives.

The principal lessons from theinvestor perceptions survey are:

• Investors intend to increase theirinvestment. Future surveys willprovide more detail on the scale ofsuch increases, as well as verifyingif investors met their (probably)optimistic projections. However, theevidence is strong enough so thatcountries can forecast increases inforeign private capital in theirmacroeconomic projections.

• The most important positive factorsin investment decisions are domes-tic economic growth and politicalstability, access to regional markets,and debt reduction. This impliesthat efforts to maintain high growth,

INVE$TING in poor countries: Who benefits?

45

low inflation, and stable exchangerates, and to accelerate regionalintegration and cancel debt for thepoorest countries, are top prioritiesfor investment promotion.

• Incentives are also an importantfactor in investment decisions, justas bureaucracy is a strong negativefactor. Efforts to streamline invest-ment procedures should be rein-forced wherever possible.

• Availability of skilled local staff isalso vital. The current focus onprimary education in nationalpoverty reduction strategies islaudable, but also underlines theneed for expanding priorities toinclude secondary and vocationaleducation.

• Tax incentives are of little impor-tance in investment decisions. Thisis consistent with other findingswhich indicate that tax incentivesaffect neither the overall amount ofFDI to developing countries, nor itsdistribution among them (except asa marginal factor in choosingbetween two countries which areotherwise virtually comparable intheir attractiveness to investors).High tax burdens can deterinvestors.14 This implies thatcountries need to move away fromblanket tax holidays for foreigninvestors, where major investorsreceive five-to-10-year tax holidaysfrom corporate and profit taxes,and in some cases even fromstaff income and indirect taxes.Countries should move towardmore targeted tax allowances orcredits for capital investment ortraining, as part of creating a levelplaying field with a relatively lowcorporate tax rate for foreign anddomestic companies.

• Investors’ intended targets for futureinvestment fit well with this morenuanced approach. Staff trainingand upgrading technology are theirtop priorities and could benefit fromincentives (though they may not benecessary if companies are alreadymotivated). On the other hand,encouraging diversification,research and development, andpromoting linkages betweendomestic and foreign investors,looks to be more difficult and willrequire more analysis and carefullytargeted incentives.

• It is also essential to combat thosenegative factors which discourageinvestors from expanding theirbusinesses. Given that utilities,infrastructure, and health (especiallymalaria and HIV/AIDs) issues havebeen identified as important priori-ties, it is encouraging to note thesteps outlined in the NewPartnership for Africa’sDevelopment (NEPAD) and othernational poverty reduction strategiesto overcome these problems.NEPAD’s governance peer reviewmechanisms should reduce corrup-tion and political instability overtime.

• The lack of domestic financing isthe major constraint to business.Given that commercial banks areunable to supply loans to business-es effectively (even in the mostdeveloped countries’ financialsystems), diversification of thefinancial sector beyond commercialbanks to investment banks, venturecapital, leasing, and micro-creditmust top the list of policy reforms.15

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

46

INVE$TING in poor countries: Who benefits?

47

Box 2Monitoring Foreign Private Capital in Africa and Latin America

Developing country governments in Africa and Latin America have requestedassistance in improving strategies for monitoring foreign private capital. Inparticular, countries require assistance:

• to move rapidly forward to meet international data dissemination standardsfor balance-of-payments flows and International Investment Position stocks,such as the Global Data Dissemination Standard and the Special DataDissemination System

• to collect not just balance-of-payments data, but also other elements suchas source countries, recipient sectors and regions, and terms of theflows/stocks

• to collect data on investor perceptions and intentions which go beyondsimple analysis of motivations to invest and analyze investor policies,especially corporate social responsibility issues

• to be trained in how to use such information to refine macroeconomic andinvestment promotion policies

• to conduct more detailed analysis of long-term sustainability and volatilityof flows, and the returns demanded on investment, and to integrate suchanalysis with their analysis of public sector debt sustainability andfinancing prospects

• to analyze in more detail the actual macroeconomic effects of foreign private capital, and simulate potential future effects and necessary policyresponses, through scenario and risk analysis

• to analyze for themselves (as opposed to consuming analysis conducted by donor agencies) the actual and potential contributions of foreign private capital to poverty reduction, including via corporate social responsibility policies1

• to collect and analyze all of this information through an integrated nationalprogram run by a task force composed of all relevant government andprivate sector agencies, to build their own capacity rather than relying onexternal consultants or international agencies.

1 See Bhindi, 2002.

Capacity-buildingneeds

Though the current projects areunearthing an enormous amount ofadditional information about privateforeign capital in developingcountries, the perceptions and inten-tions of investors, and the policyimplications for recipient countries,there is a demand on the part of coun-tries for more intensive assistance inthis field. Despite the progress theyhave made in data collection andbasic analysis, there is still a need forfurther work on non-survey reportingmethods and more advanced analysis.

In addition, there are at least 50developing countries which are notconducting these types of exercises atall, relying instead on estimates frominvestment promotion agencies, orsurveys of a few large companies. As aresult, 63 developing country govern-ments in Africa and Latin Americahave requested further assistance inthis field (See Box 2 - MonitoringForeign Private Capital in Africa andLatin America).

As a result, the governments ofDenmark, Sweden, Switzerland, andthe UK are jointly financing the exten-sion of the one-year, eight-countrypilot Foreign Private Capital Capacity-Building Project into a three-yearprogram which will help 63 govern-ments (12 targeted for intensivecapacity-building, with the otherssharing information on best practice atregional and inter-regional seminars)to reinforce their capacity on thesekey development issues.

Biographies

Matthew Martin is Director of theDevelopment Finance InternationalGroup, a not-for-profit corporationwhich is based in London and fundedby donor governments and inter-national organizations. The DFI Groupis currently building capacity in42 developing countries to analyzehow to finance their development andto change policy at a the national andinternational levels.

The DFI Group works closelywith partner institutions run by theministries of finance and central banksof developing country governmentsthemselves, to which it is transferringits responsibility for execution ofprogrammes.

The two main DFI Programmes are:

• Debt Relief International (DRI),which is assisting 34 countries toanalyse the sustainability and con-tribution to poverty reduction oftheir debt (external and domestic)and their new official financing, tonegotiate the best possible financ-ing and debt relief terms, and toadvocate changes to the interna-tional system for debt management.

• Development Finance International(DFI), which is assisting 18 coun-tries to monitor and analyse thesustainability and contribution topoverty reduction of their interna-tional private capital flows(including foreign direct invest-ment, portfolio investment andprivate sector debt).

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

48

Cleo Rose-Innes is the researcher atDevelopment Finance International.She researches methodology, draftspublications and edits DFI documen-tation. She also liases with countryteams to assist on PCF databases,review data quality and comment oncountry reports. She has an MSc inFinance for Development fromLondon University (SOAS).

References

African Economic ResearchConsortium, (AERC). “Financial SectorReform in Africa.” Special Edition,African Development Review,Abidjan, 1998.

Baball, Balliram. Monitoring PrivateSector External Debt: Key Issues andChallenges. London: Debt ReliefInternational, March, 2002.

Bergsman, Joel. Advice on Taxationand Tax Incentives for Foreign DirectInvestment. Washington, DC: WorldBank, May 1999.

Bhinda, Nils; with Griffith-Jones,Stephany; Leape, Jonathan; Martin,Matthew; and others. Private CapitalFlows to Africa: Perception andReality. London: DevelopmentFinance International, 1999.

“Private Capital Flows, CorporateSocial Responsibility and GlobalPoverty Reduction.” London:Development Finance International,March, 2002, mimeo.

Government of The Gambia. ForeignPrivate Capital Flows in The Gambia.Banjul, August 2002.

Government of Ghana. Foreign Assetsand Liabilities and Investor Perceptionin Ghana. Accra, May 2003.

Government of Guyana. PrivateCapital Flows Study. Dar es Salaam,March 2002.

Government of Malawi. PrivateCapital Stocks Survey. Lilongwe,September 2002.

Government of Tanzania. Report onthe Study of Foreign Private CapitalFlows in Mainland Tanzania. Dar esSalaam, December 2001.

Government of Uganda. PrivateCapital Flows Survey 2001 Report.Kampala, July 2002.

Government of Zambia. Foreign Assetsand Liabilities and Investor PerceptionSurvey Report. Lusaka, October 2003.

HIPC Ministerial Forum. Declarationof 8th HIPC Ministerial Meeting.Kigali, April 2003.

Martin, Matthew. Financing Africa’sDevelopment in the 21st Century. TheGilman Rutihinda Memorial Lecture,Bank of Tanzania, June 1999.

Financing Poverty Reduction in HIPCs.London: Debt Relief International,2002a.

“Analysing the Sustainability of PrivateCapital Flows.” London: DevelopmentFinance International, March 2002b,mimeo.

UNCTAD, World Investment Report(2000-2002 editions), Geneva.

INVE$TING in poor countries: Who benefits?

49

Wells, Louis; Allen, Nancy; Morisset,Jacques; and Pirnia, Neda. Using TaxIncentives to Compete for ForeignInvestment: Are They Worth the Costs? FIAS Occasional Paper 15.Washington, DC: World Bank,September 2001.

World Bank, Global DevelopmentFinance (2000-2003 editions),Washington, DC.

Footnotes

1 For example, Nils Bhinda, et al.,Private Capital Flows to Africa:Perception and Reality (London:Development FinanceInternational:1999).

2 Previous surveys of FAL and investorperceptions were often conductedseparately, overburdening the privatesector with repetitive surveys.

3 I am most grateful to Nils Bhinda andHendrie Scheun of DFI for commentson the draft of this paper, and toMomodou Ceesay (The Gambia),Kassim Yahya and Addomah-Gyabaah(Ghana), Gobind Ganga (Guyana),Paul Mamba and Lizzie Chikoti(Malawi), Peter Noni (Tanzania),Muwanga Zake and David Behena(Uganda), and Denny Kalyalya(Zambia), for leading country teams in the projects.

4 See Nils Bhinda, et al., 1999 andMatthew Martin, “Financing Africa’sDevelopment in the 21st Century.”The Gilman Rutihinda MemorialLecture, June 1999.

5 IFC studies of India indicate flows 3-4 times as high as recordedamounts, due to the same factors.

6 See Balliram Baball, MonitoringPrivate Sector External Debt: KeyIssues and Challenges (London: DebtRelief International: 2002).

7 World Bank, Global DevelopmentFinance, Washington, DC: 2003.

8 HIPC Ministerial Forum, Declarationof 8th HIPC Ministerial Meeting,Kigali, April 2003.

9 See also Matthew Martin, FinancingPoverty Reduction in HIPCs (London:Debt Relief International: 2002a)

10 See also Matthew Martin, “Analysingthe Sustainability of Private CapitalFlows” (London: DFI, 2002b), mimeo.

11 It is not clear how much of this isinvestment from one African countryto another and how much represents“round-tripping” (funds taken out ofthe host country and brought back inagain via offshore havens) whichshould be excluded from FDI as it isinvestment by residents of the country.

12 For more details of this attitude seeBhinda et al.

13 See Bhinda et al., Private CapitalFlows to Africa: Perception andReality, 1999.

14 See Joel Bergsman, Advice onTaxation and Tax Incentives forForeign Direct Investment(Washington, DC: World Bank, May1999); Matthew Martin, FinancingAfrica’s Development in the 21stCentury; and Louis Wells et al., UsingTax Incentives to Compete for ForeignInvestment: Are They Worth the Costs?FIAS Occasional Paper 15(Washington, DC: World Bank:September 2001).

15 See African Economic ResearchConsortium (AERC), “Financial SectorReform in Africa.” Special Edition,African Development Review,Abidjan, 1998.

PRIVATE CAPITAL FLOWS TO LOW INCOME COUNTRIES: Perception and Reality

50