PQ APRIL (1)

-

Upload

imoustino-imo -

Category

Documents

-

view

21 -

download

0

description

Transcript of PQ APRIL (1)

-

PQmagazineApril 2015 www.pqmagazine.co.uk / www.pqjobs.co.uk

Learning conferenceWhat do ACCA examinerswant? We spill the beanson F1, F7, P1 and P2

BIG 4STUDENTAUTHORSTAKE AIM

The ICAEW is on the move. Recordstudent numbers and plans foralternative papers and the phasedmove towards CBE assessment wereall unveiled at the recent ACA tutorsconference.

Gavin Aspden, director, qualifications, andShaun Robertson, head of qualifications, toldconference delegates (on more than oneoccasion) that the changes being outlined werestill subject to full governance and approval from

ICAEW Council. But theyamount to a radical moveforward for the body thatfirst introduced objectivetesting to its syllabus in2002.

Robertson revealed thatin 2002 just over 3,000students were signed up toICAEW trainingagreements. Last year, a

massive 7,326 students joined the ICAEWtrainee ranks, beating the previous record set in1988 when student numbers topped 7,000 forthe first time in a single year. You can add tothat another 3,115 PQs who signed up to theCFAB qualification, a first step on the road to thefull qualification. These new records mean some22,000 students are currently studying towardsthe various stages of the ICAEW qualification.

Aspden revealed that, on top of bringing inCBE assessment to all levels, the institute is alsolooking to introduce alternative papers in two keyareas financial services and UK GAAP.

The education department is working onphasing in computer exams from 2016. There

will, however, be no change in the style orapproach of the exams.

Aspden said that the technology has to fitwhat the ICAEW wants to achieve, and not theother way around. The exams will also bemarked by a real person rather than by acomputer.

First to get the CBE treatment will be the TaxCompliance exams, kicking off in March 2016.The ICAEW believes this phased approach willallow it to manage the risks and ensure the

qualification isnt compromised.Interestingly, the ICAEW is adding long-form

questions to some of its OT papers at the firstlevel (Certificate). It has already done this to theAccounting module and now plans to do thesame for the Management Information andPrinciples of Taxation papers. We spoke to the ICAEWs executive director oflearning and professional development, MarkProtherough, about the proposed changes andmuch more. See page 14

BRIGHT FUTUREFOR ICAEW PQs

Institute announces record student intake for 2014 and a move to CBE testing from 2016

Some22,000students arecurrently studyingtowards thevarious stages ofthe ICAEWqualification

Agents of change: ShaunRobertson and Gavin Aspden

PQ april 15 p01 CCM.qxp_pq nov 11 p01,10 11/03/2015 11:43 Page 1

-

Coursesstart lateMarch

Guarantee yourexam success withKaplans Complete

CIMA Courses

+ Included in Classroom and Live Online OT tuition courses, plus Distance Learning Premier courses.

# To qualify for the Lifetime Pass Guarantee, certain criteria must be met. T&Cs apply. See www.kaplanfinancial.co.uk for details.

* Prizewinners from the November 2014 exams.

Complete Flexibility

Our classroom and

Live Online Objective Test

and Case Study courses

have regular start dates

scheduled across a

12 month timetable,

so theres complete

flexibility to support

your needs.

Complete Confidence

We are the only official

publisher of CIMA materials,

which means you can be sure

our study materials will cover

everything you need to know.

We are also the only training

provider to be able to include

CIMA approved e-learning

content in our courses.+

Complete Success

All our classroom and

Live Online complete

packages come with the

peace of mind of our

Lifetime Pass Guarantee,#

and with 7 out of 10 first

in world prizewinners* at

Kaplan you can be sure

youre in safe hands.

+44 (0)1908 540 069 [email protected]

www.kaplanfinancial.co.uk/cimacomplete

To find out more visit:

002_PQ 0415.qxp_PQ 1209 000 05/03/2015 10:58 Page 7

-

comment PQ

News08ACCA results Glitch see some

PQs get their marks upgraded10CIPFA exams Progression

rules dropped from this summer12Careers focus New Reed

survey outlines whats going onin the world of work

Features, etc06Mind your Ps&Qs Exams on

demand are nothing of the sort;and the best of social media

14Interview We speak to ICAEWchief Mark Protherough aboutthe institutes plans for the future

16Lets get technical We explainthe concept of accruals

18ACCA P6 Expert advice on howto pass this troublesome paper

20Essential economics OpenUniversity lecturer JonathanWinship looks at the concept ofeconomic and accounting profit

22Audit Three top De Montfortuni studentsexplain whatswrong withthe UKsaudit market

24Exam skills How keeping youranswers neat and tidy improvesyour chances of getting a pass

25ICAEW focus Improvingaccess to the qualification for allpart qualified students

26Throughput accounting Howto avoid the dreaded bottleneck

28ACCA learning providersconference The first in ourseries of reports about what theACCA examiners really want

30CIPFA spotlight Apprenticescheme nutures young talent

31The disposal of assets Get togrips with this important concept

32Careers Life at StockportCollege; building your network;and our Book Club review

38Fun time The lighter side ofaccountancy plus our giveaways

The columnistsRobert Bruce The etiquette ofboard meetings explained 8Prem Sikka Corporate governancecode cant stop the scandals 10Carl Lygo Students could hold keyto the general election 12

Subscribe to PQ magazineIts FREE see page 35 or go to

www.pqmagazine.co.ukABC July 2013June 2014

32,361

Publishers statement: We have adigital issue of the magazine which

is sent to 9,111 requested readers

Meet the examinersIs it me or are ACCA tutors getting softer? I can remember thedays when putting an examiner in a room full of lecturers was

the equivalent of throwing them into a bear pit. Perhaps in the pastthere was a lot of one-upmanship going on, but one wonders if passrates of 29% and 30% would have been tolerated as they are now. I canonly suppose that in those more confrontational days tutors felt that poorpass rates reflected on their ability to teach their subject. The ACCAlearning providers conference is still a fantastic opportunity to meet theexaminers every two years, and with so many changes going on it is avital communication forum. This years conference in London againshowed there is no substitute for meeting an examiner in the flesh. Itdefinitely makes them more human! We have two pages in this monthsissue on what the examiners want, with more to follow next month. Afterthe conference PQ spoke to the newly promoted Alan Hatfield hesnow an executive director and director of qualifications CatherineEdwards. Watch out for that interview in next months issue, too.

One thing we should say is that while the ACCA will be using PearsonVue software for its CBE exams it will be using its own network of examcentres. A student wrote to us concerned about exam capacity if ACCAand CIMA students were trying to book exams at Pearson Vue at thesame time (see our lead letter on page 6). Hopefully, we have put thatconcern to bed.

Sonny Sharma We were really saddened to hear that LCAs SonnySharma passed away recently. There arent many bigcharacters around these days, but it is fair to say thisman was one big personality. He will be missed by everyone who knewhim. A lawyer by trade, Sharma always put his students first, and hissmile and jovial character livened up our world.

Graham Hambly, PQ magazine editor ([email protected])

CONTENTS April 2015

+44 (0)113 243 0056 [email protected]

www.kaplanfinancial.co.uk/pqpremierFind out more about Distance Learning Premier:

Prepare for examsuccess with KaplansACCA DistanceLearning PremierKaplans Distance Learning Premier course is packed full of

innovative new features and technologies to help you to get the

most from your study time, whilst giving you the support you need.

Study with Distance Learning Premier to benefit from:

Kaplan Mobile Practice App

Online access to all of your course content for 5 years

Up to 16 hours of key syllabus area videos per paperand revision videos that focus on key topics

MyKaplan your personalised online study space

Paper specialist tutors, extensive question practice

and ACCA approved study materials included7KHFRQWHQWIRU\HDUVIHDWXUHLVEDVHGRQFRXUVHVSXUFKDVHGIURP-XQH7KLVIHDWXUHGRHVQRWDSSO\UHWURVSHFWLYHO\&RQWHQWIURPSDSHUVSXUFKDVHG

SUHYLRXVO\ZLOOQRWEHDYDLODEOHIRUD\HDUSHULRG6HHZHEVLWHIRU7&V

PQ apr 15 p3 ccm_pq aprl08 p04 10/03/2015 14:43 Page 1

-

ACCA

REVISION

CO

URSES

ONE-TO-ONE

COACHING

AWARD-WINNING

TUTORS

FREE BIG BOOK

OF ACCA EXAM TIPS

QUESTION BASED

DAYS ONLY 190

LIVE ONLINE

SESSIONS

YOURTOOLKIT FOR

EXAM SUCCESS

004-005_PQ 0415.qxp_PQ 1209 000 05/03/2015 10:59 Page 7

-

Register now, start in May

ALONG WITH YOUR

REVISION COURSE

YOULL GET:

QUESTION & ANSWER SESSIONS

EXAM QUESTION BANK

MOCK EXAM

www.LSBF.org.uk/ACCA

020 3535 1111

To learn more about our tutors visit www.lsbf.org.uk/meet-the-team*This oer is only applicable to ACCA revision papers from Skills, Essentials and Options levels purchased from 30th March until 13th April 2015. Eligible students may be entitled to the following: book 1 revision paper and 1 QBD for 60 o, book 2 revision papers and 2 QBDs for 75 o, book 3 revision papers and 3 QBDs for 90 o. For full Terms & Conditions please visit our website.

Early Bird oer: save up to 90 on your revision*

004-005_PQ 0415.qxp_PQ 1209 000 05/03/2015 10:59 Page 8

-

PQ have your say

www.LSBF.org.uk/SHOP

PART-TIME E-SHOP

Book ACCA & CIMA papers

in a few simple steps online

View timetables & tutor proles

Exclusive e-shop oers

PQ Magazine Fourth floor, Central House, 142 Central Street, London EC1V 8AR | Phone: 020 7216 6444 | Email: [email protected]: www.pqmagazine.co.uk | Editor/publisher: Graham Hambly [email protected] | Advertising manager: Polly Thrasivoulou [email protected]

Associate editor: Adam Riches | Art editor: Tim Parker | Subscriptions: [email protected] | Contributors: Robert Bruce, Prem Sikka, Carl Lygo, Tony Kelly, Phil Gammon, Jo Daley | Origination and print services by Classified Central Media

If you have any problems with delivery, or if you want to change your delivery address, please email [email protected] by PQ Publishing PQ Publishing 2015

Not really on demandPQ magazine says that ACCA willbe using Pearson Vue centresfrom late 2016 (March 2015issue). This is bad news for bothACCA and CIMA PQs alike! Im aCIMA student and today bookedmy OT under the new system.Available appointments are fewand far between at my three localcentres. The earliest one I couldbook was a month away.

Has anyone considered thecapacity of these centres when

they will be hosting bothsets of exams? My localcentre has 10 machinesand very little parking.

The exams are marketed as ondemand, but if I wanted to sit ata weekend I would have to waitfor more than six weeks from thetime I booked for a slot at any ofmy nearest three centres.

This could cause seriousproblems and will not lead to theeasy on demand booking wewere promised.Name and address suppliedThe editor says: Weve had itconfirmed by ACCA that they willbe using Pearson Vue software,but at the associations ownnetwork of centres. But we thinkthere still could be issues here watch this space.

The writer of the star letter each month wins a fantastic I PQ mug!

Hot & Tweet

email [email protected]

Pick the right optionI have just read your article onACCA pass rates, particularly for P4and P5 (PQ, March 2015). May Ijust say that all the options are setat a masters level all as difficultas each other in their own way. P6and P7 tend to have higher passrates, in my opinion, as these aretaken mainly by students who workfor the accountancy firms. Inaddition, my educated guess is thatthese papers attract a lot of UK-based candidates, especially P6.

P4 and P5 are popular papersglobally. I can say that fromteaching many P4 students, both inthe UK and abroad, the global passrates do not reflect the level ofperformance that I have seen. Youcan see the pass rates I haveachieved via my twitter feed andthese are consistently more thandouble the global average.

Simply put, students must pickthe option that suits them best, butthis also includes picking a tutorwho knows that paper inside out.Sunil Bhandari, ACCA tutor, by email

Glitch in the systemI was one of those students whocould access their ACCA examresults on Saturday night (PQmagazine, March 2015). This is notthe first time I have been able toget my results early. There seemsto be a glitch in the ACCAs systemthat happens every time they get

When PQ heard that some ACCA December exam resultshave been amended we went straight onto LinkedIn tosee what people thought. One correspondent said:Great, good on them. Others quickly confirmed thatthey had benefited; some marks were put up by twopercentage points, turning fails into passes. This got us

into another discussion about pass rates. There seems to be a rise in thenumber of PQs receiving 49%, which was something we understoodbodies with a 50% pass rates try to avoid. We also asked what youthought of the ACCAs new strapline Think Ahead. Youll have to waituntil next months issue to discover what came out of that. So if yourbody had a strapline what would it be? Tell us, but be nice please!

Weve been busytweeting thismonth, with manyof our tweets alerting readers tostories that have been postedon our website but didnt makeit into the magazine. We hadthe full story of HMRCs courtof appeal win against theEclipse Film Partnership(no35), which protects anestimated 635m in tax. Wealso covered the long-runningdebate on the discrepancy ofVAT rates between printedbooks and e-books that wentbefore the European Court. Andthere was a big piece oninnovating auditor reports fromthe FRC. You can find our takeon the story in the next issue ofNQ magazine, along with thestory of a new use for Facebook collaring bankrupts!

We also use tweets to highlightthe great jobs on offer on ourjobs board www.pqjobs.co.uk.There are hundreds of greatjobs aimed at PQs. Two wefeatured recently were for alegal credit controller inEdinburgh on a salary of up to19,000, and a post for a PQmanagement accountant inLuton with a pay packet of upto 33,000 up for grabs.

Follow us @PQmagazine.

the results ready to release. Likethe students you talked to lastmonth I am a little worried aboutthe security of the ACCA system.However, I read somewhere, I thinkon the ACCAs website, that theyare now ISO 22301 approved. Thismeans they can identify andmanage current threats to itsbusiness, and security of the examresults must be one of these. So wemust be safe!Name and address supplied

PQ apr 15 p6 ccm.qxp_pq aprl08 p04 11/03/2015 10:47 Page 1

-

To book your ACCA 2015 programme

visit bpp.com/acca or call 03331 221 573

The 96% is based on part time P3 students sitting in December 2013 at our Reading centre. *Full terms and conditions apply www.bpp.com/terms/l/lifetime-pass-assurance. The new Lifetime Pass Assurance

Scheme cannot be used in conjunction with any other ofer or promotion run by any BPP group company. No cash alternative available.

96%

ACCA

Pass Rates

ACCA start dates still available via Online Classroom Live and Online Classroom

Its not too late to book your ACCA Programme. Choose from one of our online learning

programmes, Online Classroom Live or Online Classroom and study ACCA wherever you

want. These programmes will provide you with everything you need to sit your exams

with condence.

Introducing BPP Momentum

Our 2015 ACCA programmes see the launch of BPP Momentum, our exciting approach

to learning that recognises that everyone, and the way they learn, is diferent. At the heart

of BPP Momentum is competency-based learning; it means you will learn by doing. By

progressively gaining knowledge, practising what you have learnt and testing as you go you

will build your competence gradually and be in the best position to pass your exams. To

discover more about BPP Momentum please visit bpp.com/moresuccess

It is not too late to book your ACCA programme

Visit bpp.com/accastarterpack for more details

Try ACCA for free

007_PQ 0415.qxp_PQ 1209 000 09/03/2015 16:34 Page 7

-

8 PQ Magazine April 2015

PQ news

Insolvency fees cappedThe government has said it

will impose a cap on fees chargedby administrators of collapsedcompanies. The move followsprotests from creditors overexcessive charges. Under rules laidbefore Parliament, administrators(and other practitioners) whooversee insolvencies will have toprovide upfront estimated costs.They will also have to providedetails of the work they propose tocarry out and say exactly how longthey expect it all to take.

Northern Ireland callingA call has gone out for

volunteers to help set up aNorthern Ireland AAT branch.Currently, both members andstudents in the province aremissing out on events as there isno point of contact. CIPFA has saidit would be prepared to provideassistance to anyone interested intaking on the role.

ACCA joins forces with US uniACCA and Pace University

have announced a landmark

partnership linking the ACCAqualification with graduate andundergraduate courses at theuniversity. Starting this autumn,both undergraduates andgraduates at Paces department ofaccounting will be able to qualifyfor specific exemptions from theACCAs 14 exams. The exemptionswill include four for graduate andfive for undergraduate courses.

CIPFA signs Sri Lanka MoUCIPFA and the Institute of

Chartered Accountants of Sri Lanka

have signed a Memorandum ofUnderstanding (MoU) to strengthenthe countrys public financialmanagement. The MoU outlines aframework for co-operationbetween the two institutes toimprove governance of publicfinance within the country and helpimprove training and developmentin the accountancy profession. Thecollaboration will open the doors tomembership for members of bothinstitutes and professionaldevelopment opportunities formembers of CA Sri Lanka.

In brief

I was talking recently about the abilityof cartoons to jab the unexpectedagainst the expected and so producea laugh. And I remembered a cartoonin the New Yorker magazine. Itshowed three men on stage wearingsuits and ties. Above them was a sign:Accounting Night at the Improv. Theyare saying: Now is the part of theshow where we ask the audience toshout out some random numbers.Cartoons shake up your assumptions,and this one crossed over the dividebetween work and fun. Accountantsup on stage? Perish the thought.

But it is important to apply whatyou would in your leisure life to thework environment. The consultantsIndependent Audit produce a regularnewsletter called The Effective Board,and a recent one dealt with thesimple practicalities of boardmeetings. The chairman shouldnt sitin the middle of the long side of thetable. A free-for-all in the seatingshouldnt be allowed. Break upgroups. Dont let cabals develop. Dontlet the company secretary sit at theother end to the chairman (the abilityto provide a subtle nudge will belost), and so on. The same rules applyat a dinner party. The person incommand of the cooking and servingshould be in subtle touch withwhoever is hosting. Dont let all themen sit at one end of the table. Movepeople around. Dont let the eveningbecome static.

Dinner parties dont have to dealwith recalcitrant finance directors orrogue non-executives. But theunderlying principles, like much inlife, are strikingly similar.

ROBERTBRUCE

Making ameal ofboardmeetings

Robert Bruce is an award-winning writer onaccountancy for The Times

ACCA amends exam scoresafter administrative reviewA small number of ACCA Decembersitters came in for a shock 11 daysafter they had received their exammarks their pass marks wereincreased! For many it meant abetter pass percentage, but forothers the 2% rise turned a failureinto a welcomed pass. As one F5sitter explained: My 48% has beenadjusted to 50% so no retake forme, thank goodness, so relieved.

Interestingly, PQ magazine hasheard the amendment applied inlots of papers F5, F6, F9, P1, P2,and P6.

Sitters in Nottingham wondered ifit was a centre issue, but manytrainees agreed is was all verystrange. As one student said: Icould maybe understand it if it wasjust happening in one exam, but it

seems very widespread.Students believe December

sitters deserve a proper explanationof what actually happened.

The ACCAs Director of Learning,

Alan Hatfield, said: We want toreassure students that this was aone-off processing issue and allaffected students have beennotified.

He added: There are manyquality assurance procedures andsafeguards built into the markingprocedure and the processing ofexam results to ensure that the finalresults issued to candidates arecorrect.

The notification emails alsoapologised for the error andpromised that the ACCA was takingany measures it can to ensure thatthis cannot happen again in thefuture. For reports from the ACCAslearning providers conference seepage 28

EY launches earn as you learn

Scaled scoresthe way ahead

EY has launched a new Assurance Scholarshipprogramme giving students the opportunity to study fora degree while receiving financial support and workexperience at the firm.

Building on an existing partnership with LancasterUniversity, EY is teaming up with the Bath and Warwickuniversities to offer the scholarship to 60 students.

Students studying certain degrees will be eligible toapply, with 5,000 a year on offer to help with theupfront costs of attending university. Students will alsobenefit from a paid summer work placement at one ofEYs UK offices in their second year and a year-longindustrial placement in their third year of study.

The first-ever CIMA case study exam results will hitinboxes in early April. The operational results will be first they will be released on Thursday 2 April, followed bythe management pass rates on Friday 10 April. Last outwill be the strategic results on 16 April.

Students (like PQ magazine) might be a littleconfused about what they are actually going to receive.Instead of percentages, candidates will be given ascaled score that will range from zero to 150.

As CIMA provides different versions of the exam overthe five-day exam window it believes scaled scores arenecessary so that scores reported are comparable nomatter what version a candidate sat. CIMA will bepublishing the five different exam questions set, sositters can judge which one was easier.

An institute insider explained that by converting rawscores it allows CIMA to eliminate differences indifficulty between forms and provides fair andcomparable results for candidates. Scaled scores alsomake it easier for candidates to compare theirperformances from one session to another.

Hatfield: aone-off issue

PQ Apr 15 p8 CCM.qxp_pq sept 12 p08 11/03/2015 11:45 Page 10

-

PLUS YOU GET MORE:

Personalised feedback on mock exams

2 complete Case Study mock exams

Bespoke course material to the relevant

Case Study sitting

One-to-one coaching

Register now

PREPARE FOR YOUR

CIMA CASE STUDY

EXAMS WITH

LSBF

BENEFIT FROM:

Up to date tips to maximise your score

Integrating the knowledge from the

Objective Tests into the Case Study

Specialist CIMA tutors

BIRMINGHAM

Start in May

0121 616 3370www.FBT-global.com/CIMA

MANCHESTER

Start in May

0161 669 4272www.LSBFmanchester.com/CIMA

LONDON

Start in April

020 3535 1111www.LSBF.org.uk/CIMA

CIMA courses specications vary depending on the campus

selected. Visit our websites for specic course information.

009_PQ 0415.qxp_PQ 1209 000 05/03/2015 15:09 Page 7

-

10 PQ Magazine April 2015

PQ news

The revelations that HSBC may havehelped its clients to evade taxes is thelatest corporate scandal. People areangry and the regulatory system hasfailed to check abuses. Internalcontrols at banks, utility companiesand big accountancy firms do notappear to be able to curb anti-socialpractices. No ethics committee, auditcommittee or external auditors havereported weaknesses or misconduct.

External regulation is based on avoluntaristic approach, typified by theCode of Corporate Governance. Thecomply-or-explain approach does notempower stakeholders to takedirectors to task. The interests ofconsumers, employees, taxpayers andsuppliers get virtually no mention inthe Code. And glossy words in annualreports are part of a cynicalimpression management exercise.

External regulators are ineffective.Some banks have been fined, but thisis now all part of the cost of trading,as executives rush to meet profittargets and maximise their bonuses.The usual predatory practices continueas the culprits are too big to shutdown and company directors are notheld personally liable. Externalregulators have little independence.They come from the very industry thatis to be regulated. Business executivesbecome regulators and then return tothe industry.

There is an urgent need to end thevoluntary approach to corporategovernance and make directorspersonally liable for corporatemisdemeanours.

PREMSIKKA

Corporategovernancecode cantstop thescandals

Prem Sikka is professor of accountancy at theUniversity of Essex

Progression rules droppedfrom CIPFAs June sittingCIPFA has changed its progressionrules. In the past, students couldnot sit the exam of either strategicstage module before successfullycompleting all other modules.

This rule no longer applies,although CIPFA is saying that giventheir nature it is still important thatPQs plan to sit the strategic stagemodules at the end of their studies.This all means that from the June2015 sitting students can sit anystrategic stage module as part oftheir last planned sitting ofProfessional Certificate orProfessional Diploma modules.

At the same time, the institutehas announced minor presentationchanges to the headers on the frontcover of the June 2015 exampapers. From this summer, therewill be no reference to the stage orthe title of the qualification andsome modules will be labelled UKversion or international version,depending on your choice of paper.

Another change unveiled recentlyis the embedding of the formulae inthe Management Accounting exam,either in the relevant question or atthe back of the exam paper. So thatspells the end of the separate

formulae sheet document. Thatsaid, separate formulae sheets willcontinue to be provided for theFinancial Management andStrategic Financial Managementexams.

Finally, in the FinancialAccounting paper, the cash flowstatement pro forma will beincluded as the last page of thepaper rather than being providedseparately (from June 2015).Candidates will be able to tear thisoff and use the page as a templatefor their exam answers if requiredby the exam.

CIMA has updated its code ofethics to ensure it remainsrelevant and reflects the changingdynamics and pressures of theprofession. While no changes havebeen made to the CIMA syllabus,the institute is still recommendingthat students familiarise themselveswith the new-look 2015 code as itwill help PQs answer specific

questions in theexam hall.

PQs should alsonote that CIMA hasupdated its studentethics support e-learning tool. Thishas been reviewed

and new questions from the2015 practice exams have beenadded.

The conflict of interest sectionin the newly updated code hasparticularly been beefed up thesix paragraphs on this area havebecome 14.

Know your code and pass the exam!

So what makes you happy at work?An AAT survey found having nicetoilets, music in theoffice and the abilityto take your shoes offare noticable plusses.Happiness can alsobe found in funcolleagues, a bit ofrespect and havingyour ideas listenedto. Interestingly, the first money-related option didnt appear untilnumber 11 on the list. That washaving a pay review scheme.

Asked how their year had gone,those surveyed gave a mixed

reaction. Some 20% saidthe past 12 months hadgone badly from aprofessional point of view.In all, 55% of thosesurveyed said they didntfeel appreciated and one infive plan to change bosses.

Top 10 factors for work happiness1) Respect for employees2) Flexible hours/understandingwhen child sick

3) Hard working colleagues4) Fun colleagues5) Being acknowledged for yourachievements6) Having ideas listened to7) Free parking/close to publictransport8) Regular thank yous9) Realistic deadlines10) Fast broadbandAlso on the list: nice toilets (number12); comfy chairs (20); music inoffice (28); freedom to take yourshoes off (33); and good stationery(35).

Top tax ideasA tax systemthat empowersregional citiesand encouragesbusinesses to

invest in people will boostemployment and drive the UKeconomy, according to the writersof the winning essays in a majorPwC student tax competition. Thetwo winning students, RichardCha and Jamie Parker, both fromthe University of Cambridge, eachwalked away with a 10,000 prize.Chas essay made the case for a

decentralised tax system, with thedevolution of tax and spendingpowers to cities. He argued that todrive the modern UK economy acompetitive country and not just asingle competitive city is essential.Parkers essay put the case forgreater decentralisation of taxesand establishing a more explicitlink between businesses thatinvest in human capital and therates they pay in taxation.

Salaries not so importantA large salary is no longer the toppriority for graduates when looking

for their first job, according to thelatest EY poll. When asked to rankthe most important considerationswhen choosing a future employeronly 11% of students said the sizeof the wage packet would be thekey factor. Salary and benefits fellto fifth place in the ranking overall,down from joint top position lastyear. Access to training anddevelopment opportunities toppedthe poll with 35% of the vote a15% percentage point hike on lastyear. EYs Julie Stanbridge said:Money clearly isnt king fortodays graduates.

Female CEO for Deloitte in the USDeloitte has chosen CathyEngelbert as its new chiefexecutive. This is a first among theBig 4 firms in the US. Engelbertreplaces Frank Friedman theinterim CEO. She has anaccounting degree from LehighUnivesity and joined Deloitte in1986. Engelbert is both chair andchief executive of Deloitte &Touche for the next four years.Meanwhile, in the UK, partners re-elected David Sproul as theirCEO. He begins his second termon 1 June 2015.

So are you happy at work?

pq apr 15 p10 CCM_pq sept 12 p08 10/03/2015 11:15 Page 10

-

Read our full Study InterActive Terms and Conditions at studyinteractive.org/terms-and-conditions

011_PQ 0415.qxp_PQ 1209 000 06/03/2015 09:24 Page 7

-

12 PQ Magazine April 2015

PQ news

The student vote could be the key todeciding the 2015 general election ifthe vote is as close as it is predictedto be. At the 2010 election the LiberalDemocrats were the top choice amongstudents but the opinion polls suggesttheir support has fallen away giventhe broken promise that led to atripling of tuition fees forundergraduate students. Labour haveput tuition fees at the centre of theirelection manifesto, promising toreduce fees to 6,000 a year, makingup the lost income for universities byincreasing taxation on more wealthypensioners.

Undergraduate students were askedhow they would vote in the Mayelection: the result was Labour 33%,Green 28%, Conservative 23%,Liberal Democrat 7%, SNP 4% andUKIP 2%. Research by the HigherEducation Policy Institute (Spring2015, Report 73) suggests there are10 swing seats where students couldimpact the result. This researchpredicts Labour may gain six seatsfrom the Conservatives and two fromthe Liberal Democrats, while theConservatives could gain two from theLiberal Democrats. All of this assumesstudents register to vote (the newvoter registration system haschanged) and turn out to vote.

What has been interesting for mehas been the student reaction toLabours proposed tuition fees cut.While the cut has been welcomedstudents have complained that notenough is being done to lend studentsenough money to cover maintenancecosts. Maintenance loans are meanstested and the maximum householdincome must be under 25,000 ayear to qualify for a full maintenanceloan.

CARLLYGO

Studentscould holdthe balanceof power

Professor Carl Lygo ischief executive of BPP

THE CAREER CAROUSEL

CFO NOT SO SUPERAT SUPERGROUP

Councils takes controlof 6bn health budget

ACCA is thinking aheadThe need for ACCA PQs to

think ahead has now beenincorporated in the ACCAs newstrapline. The director of strategyand brands, David Grint, tolddelegates at the global learningproviders conference that theACCAs new brand positioning aimsto reinforce its strategy to be theworlds most forward thinking

professional accountancy body.He explained for students thebrand has to tell a story. It meanssupporting them so they realisethose early dreams and hopes, hesaid. And he added that as theircareers evolve they know that theACCA will be constantly relevant towhatever they do. Grint has alsorefreshed the brand identity. Youcan expect to see the ACCA logo in

orange and green boxes, as well asthe traditional red one.

Even Einstein failed an examThe UK College of Business

and Computing took a novel andeye-catching approach in a recentonline advert. It explained that in1895 Einstein failed his exams, sofailure can happen even to a somevery clever people. For those who

dont know, a young Albert Einsteinfailed the entrance exam to aprestigious Polytechnic inSwitzerland. He passed the exam12 months later after studying for ayear at a local high school.

In brief

How many times do you expect tochange your employer during yourworking life? Well,the latest ReedAccountancy &Finance salaryguide found 27%of respondents had had seven or moreemployers. That said, accountancy and finance staffseem very happy bunnies. Awhopping 90% of those surveyedsaid they were satisfied with theircurrent role. This is perhaps

reflected in the fact that just overone in 10 (11%) said they will be

looking for a newjob in the next 12months.

With newvacancies startingto outstrip thenumber of activecandidates salary

expectations are starting to rise.The research also shows that

what accountants want mostchanges over their career. Betweenthe ages of 18 and 24, salary and

benefits is the priority (39%). Thischanges for those aged 25 to 34,when job satisfaction becomes thekey to a happy working life. From35 to 45 work-life balance is all-important. Finally, from 45 to 54salary and benefits again becomethe most important aspect of anaccountants working life thuscompleting the circle! Find out what you are worth byrequesting the Reed Accountancy& Finance 2015 Salary and MarketInsight report go towww.reedglobal.com/salaryguide

The CFO of SuperGroup (readSuperdry here), Shaun Wills,has been forced to quit afterbeing declared bankrupt.Accountant Wills was thesubject of a personalbankruptcy order on 10February after a petition fromHMRC. It is, of course, anoffence to be a director if youare an undischarged bankrupt'unless you have a leave ofcourt (Company DirectorsDisqualification Act 1986).

Eyebrows have been raisedover the two weeks it tookWills to inform the board. In astatement the firm said: This isa personal matter, on whichSuperGroup will not comment

further, and is wholly unrelatedto the financial position of thecompany.

Meanwhile, Paul Coyle, theformer group treasurer andhead of tax at Morrisons, hasbeen sentenced to a year inprison for insider trading. Thecase was brought by theFinancial Conduct Authorityafter it was discovered Coylehad bought and sold shares inOcado when it was in talks withMorrisons over a joint venture(worth 216m). Ex-KPMGemployee Coyle pleaded guiltyon both counts and on top ofhis time in prison has beenordered to pay 15,000 costs.He made 80,000 on the trade.

Well done to the Institute of Certified Bookeepers, named Best International Association at the Association Excellence Awards 2015

In whats been seen as a surprise move bysome commentators, 10 Manchester councilshave been given control of over 6bn of NHSspending.

CIPFAs CEO, Rob Whiteman, said hewelcomed any move that brings decisionmaking over health spending closer to localpeople, but added that we must make surethat all areas of the UK can benefit from anydevolution dividend.

Whiteman stressed that CIPFA will work tomake sure that any deal works for the peopleof Manchester and that the right governance,financial management and delivery systemsare in place.

Local government academic Tony Traversemphasised that this devolution was one ofthe most radical changes in healthcare sincethe NHS was created. He expected there tonow to be a queue of every city region in thecountry, including London, wanting to get inon this.

PQ apr 15 p12 ccm.qxp_pq sept 12 p08 11/03/2015 11:45 Page 8

-

013_PQ 0415.qxp_PQ 1209 000 10/03/2015 09:27 Page 7

-

Last year was a record one forstudents signing up with theICAEW, so PQ magazine wentalong to speak to executive director oflearning and professional development,Mark Protherough, about what sparkedthis rise. We also wanted to talk to himabout the proposed changes to theICAEW assessment process, unveiled atthe ACA tutor conference.

Protherough happily confirmed thatthe total number of students joiningICAEW training programme last year was7,326, a new high. You can also add afurther 3,115 to this, those starting theCFAB qualification. He was particularlypleased that the growth comes acrossthe board from the Big 4,internationally, in industry and the publicsector. The numbers signing up withsmaller and medium sized practices isalso the highest in 20 years.

Protherough believes that, to a certaindegree, the ICAEW is also taking marketshare from its competitors. Interestingly,the numbers were not impacted at all bythe Scottish referendum. However, ifthere had been a yes vote it might havebeen interesting to see what would havehappened, he ventured.

Along with the UK, the ICAEW isparticularly strong in Cyprus, the MiddleEast and Malaysia. It is also workingclosely with other professional bodies.Protherough cited the work the ICAEW iscurrently doing in Greece, Indonesia andBotswana as the way forward. It wontmean hundreds of new students but itcould lead to more small rises in studentnumbers.

Women on the up .The ICAEW doesnt directly recruit itsown students, but in recent years thereappears to have been a problem withrecruitment female trainees. At 41%, theICAEW attracts the lowest female intakeof any of the accountancy bodies.Protherough explained that traditionallythe ACA qualification attracted studentswith science degrees and male studentsdominate these courses. He felt manyfirms are making huge efforts withdiversity and with more school leaversbeing recruited this may help adjust the

balance. He pointed out that the ICAEWwould soon be unveiling its 2014 traineefemale intake, up 1% to 42% a movein the right direction.

Next on the agenda was the trainingcontract now called the trainingagreement. Protherough looked surprisedat our suggestion that it seemed oldfashioned. He sees it as unique atripartite agreement that protected boththe employer and student. He stressedthat the agreement says to employersthey have a duty of care for theirtrainees, but also outlines to PQs whatthey are expected to do in return. Weare saying that you are not just joiningKPMG or Deloitte, you are joining aprofession with ethical standards andindependence. So from the start, PQsunderstand this is not just about doingyour day job. And if a student oremployer has a problem they can go tothe ICAEW to get it resolved.

The future is CBEs .Turning to the move to CBE assessment,Protherough felt that technology seems tofinally be at a place where the ICAEWdoes not have to compromise itsstandards and rigour. That wasnt thecase even two years ago. The institutewill be announcing who has won thetender process to run the exams this

14 PQ Magazine April 2015

PQ interview

Along withthe UK, the ICAEW isparticularly strongin Cyprus, theMiddle East andMalaysia

April, but Protherough stressed it wouldhave to be the right testing package atthe right price that wins. He is also veryaware that he must get this right firsttime.

To this end, the ICAEW has opted for aphased approach. First up will be TaxCompliance, which will switch to a CBEformat in March 2016. He is reallyexcited about how the move couldtransform the exams. Instead of writingabout the theory of spreadsheets ICAEWswill be working on them! It will make theexams so much more real, he stressed.

Another major proposal is the offeringof alternative papers in two areas. Thefirst is financial services (banking andinsurance). Employers have told theICAEW their ACAs need these technicalskills. This module will be an alternativeto the existing Business Planning Taxmodule, be fully open-book, and run fortwo-and-a-half hours.

UK GAAP modules are also beingintroduced as an alternative on papersthat concentrate of IFRSs. With the vastmajority of PQs (90%) working on UKGAAP rather than IFRS this makespractical sense, say employers.

We asked Protherough if there mightbe more variants and he said yes.However, he also said he didnt want tocannibalise the market. Although he isnot looking at anything specific he didmention the public and charity sectors,but felt, ultimately, it will be the marketthat decides where the demand will be.Whatever happens there will be just onedesignation the ICAEW charteredaccountant ACA.

He also revealed that he has alreadytalked to the Student Council about someof these proposals. On balance, he feltthey gave him a green to amber light.There was still some concern about thespeed of typing needed and howspecialist modules might affect futurecareers, but the general consensus waspositive. Protherough promised to talk tostudents again at the end of April.

He and his team certainly have a busytime ahead! PQ

ICAEW PHASING TIMETABLE

A RECORD YEARPQ has a coffee and a chatwith the ICAEWs executivedirector of learning andprofessional development,Mark Protherough

January 2016: Accounting style long-form questions forManagement Information and Principles of Taxation

March 2016: Implement CBE for Tax Compliance

March 2017: Roll out CBE for Audit & Assurance,Financial Accounting & Reporting & Financial Management

2018: Implement CBE for Business Strategy, BusinessPlanning Taxation, Corporate Reporting, Strategic BusinessManagement & Case Study

Protherough: talking with PQsabout taking theinstitute forward

pq apr 15 p-14 CCM.qxp_Layout 1 12/03/2015 10:21 Page 23

-

EXC

CITING JOB OFFER

R IN MAURITIUS FOR HIGH CALIBRE

the

ES

nd

ford

ius to

RER

,

ABOUT

EXCITING

All levels

JOB OFFER IN MAURITIUS FOR HIGH CALIBRE

LECTURERS TO TEACH: ACCA, ICAEW & FINANCIAL COURS

BSP SCHOOL

BSP School of Accountancy and Management, was founded in June 2011 by Mr Sham Mathura, FCCA. The institution is already

largest accountancy college and the preferred choice in Mauritius. It is registered by the Teertiary T Education Commission (TEC) a

focuses on professional accountancy education, namely the ACCA, CFA, CIMA and Bsc in Applied Accounting programmes (Oxf

Brookes University). BSP has been awarded the ACCA Gold Status Partner by ACCA UK. BSP School is the only college in Mauriti

be ISO 9001:2008 certifed Quality Management Systems.

Please send your CV to [email protected]

VACANCY 1: FULL-TIME LECTURER

SALARY NEGOTIABLE DEPENDING ON

EXPERIENCE & PROVEN TRACK RECORD

t OTHER BENEFITS INCLUDE:

* CAR * BUNGALOW * INSURANCE COVER

t CONTRACT INNIMUMMI 3 YEARS

LYYAPPL NOW FOR LYYJUL 2015 INT AKE

VACANCY 2: P RTT-AR -TIME T / VISITING LECTUR

ATTE RA PER AYY DA APPROX. 550 GBP +

AIR TICKET ECONOMY CLASS, INSURANCE,

ATTION ACCOMMODA LOCAL TRANSPORT

PROVIDED

LYY APPL NOW FOR AY MA 2015 REVISION

COURSES, WORKSHOPS & CPDs

NOTE: Full-Time lecturer can also apply for vacancy 2 and will be paid separately.

BSP HANDLES ALL YOUR WORK PERMIT ATTIONS APPLICA FOR BOTH OFFERS

A

C

FAAll levelsin Applied AccountingBSc

ACCAAll papers - Full time & Part time Apply now

et leader in:arkM

el: 468 1777TTer 2, Ebene | woTTyber el 7, CveL

WORK AND LIVE IN PARADISE...ITS POSSIBLE

015_PQ 0415.qxp_PQ 1209 000 11/03/2015 11:52 Page 7

-

Iwas flicking through an old photoalbum with my wife at the weekendand she spotted a picture of mewith an ex-girlfriend. Why are you on ayacht with Julia Roberts? she asked.You dont need to worry, darling, it wasbefore I met you I tried to reassure her.I dont care you can sleep in thespare room tonight was her response.Thats a bit cruel, I thought!

And that got me to thinking about theaccruals concept, one of the keyunderlying principles in preparingaccounts.

The accruals concept is also called thematching concept because it involvesmaking sure that you matchtransactions to the period that they relateto. For example, if I make a sale inDecember but dont actually get paiduntil January, I will account for therevenue when the sale was actuallymade in December. When I get paidfor the sale is irrelevant to when Irecognise the income.

Applying the accruals concept to expensesWhen working out the expenses figure tobe recognised in the profit and lossaccount, the key thing is to ensure thatyou are recognising the correct numberof months of expense. In a three-monthaccounting period we need to recognisethree months of expense. In a 12-monthaccounting period we need to recognise12 months of expense.

Setting up an accrualLets say a business started on the 1 January 2015 and has a year-end of31 December. The first accountingperiod is therefore 12 months long. Letssay that during this year the businessreceived three 300 telephone bills, eachcovering a three-month period (so 100per month). By 31 December 2015 theywould have recognised 3 x 300 = 900of telephone expense (this would be adebit in the telephone expense account).This is only nine months of expense sowe are not matching enough expense tothe 12-month accounting period. We areshort by three months! The way werecognise the extra expense that isrequired is with an accrual. An accrual isa liability you owe to someone buthavent actually been invoiced for yet.

The reason this often happens is thatbills for many utilities are received inarrears, ie after the end of the periodthey relate to.

Lets say that the final 300 telephonebill of the year (covering October to

December) is actually received inJanuary 2016. Even though the bill isreceived in the following year we need tomatch this cost to the period that itrelates to, which is the year ended 31stDecember 2015 as this is when thetelephone was being used.

To set up the accrual the double entryis:Debit telephone expense 300, beingadded to the 900 already recognised.Credit accrual 300, which is theliability owed to the telephone company.

This means the telephone expense forthe year ended 31 December 2015 isnow 900 + 300 = 1,200, which is afull and correct 12 months of expense.

Dealing with the accrual in the nextaccounting periodAs the accrual account is a balancesheet item (it is a liability) it will becarried down at the start of the followingperiod as a credit balance in the accrualsledger account. Since the invoice that weaccrued for is now going to be actuallyreceived we need to reverse the accrualback out of the accounts. We do this byposting exactly the reverse double entryused to set it up:Debit accrual 300 to get rid of it, aswe will now receive and pay the bill.Credit telephone expense 300, as thebill being paid actually relates to the prior

16 PQ Magazine April 2015

PQ accruals

Gareth John explains the accruals concept, also called the matching concept and sets you a little exercise

LETS GET TECHNICAL

year not this one. We are thereforecancelling the debit entry that would beposted to the telephone expense accountfor the bill being paid.

Why dont you have a go at this example.When you have finished you can see metalk through my solution atwww.firstintuition.co.uk/category/aatFollowing on from the explanations abovethe business receives the followingtelephone bills in the year ended 31 December 2016:

In January 300 for the periodOctober to December 2015

In April 600 for the period Januaryto March 2016

In July 600 for the period April toJune 2016

In October 600 for the period Julyto September 2016

They then receive a 600 telephonebill for the period October to December2016 in January 2017.

Show the telephone expense andaccrual ledger accounts for the yearended 31st December 2016. Gareth John is a tutor/director withFirst Intuition and helps to managetheir AAT distancelearning programme. He was PQ MagazineAccountancy Lecturer of the Year in 2011

PQ

Are you thinking about accruals?

No dear,we are aperfectmatch!

PQ April 15 p16 ccm_Layout 1 10/03/2015 11:16 Page 23

-

Quality, Affordability, Employability

LCA Business School London, 19 Charterhouse Street, London EC1N 6RA

Tel: 020 7400 6772 Email: [email protected]

Speak to a personal

course advisor on

020 7400 6772

or enrol with us on-line

www.lca.anglia.ac.uk

P1 Rev

P1 Rev

F7-F9 P1-P3 P6-P7F4-F6

F5 Rev

F5 Rev

F6 Rev

F6 Rev

F4 Rev

F4 Rev

F8 Rev

F8 Rev

F9 Rev

F9 Rev

F7 Rev

F7 Rev

P3 Rev

P3 Rev

P2 Rev

P2 Rev

P6 Rev

P6 Rev

P7 Rev

P7 Rev

DateDay

Saturday

Saturday

Saturday

Sunday

Sunday

Sunday

09 May 2015

16 May 2015

23 May 2015

10 May 2015

17 May 2015

24 May 2015

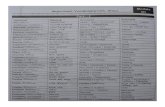

ACCA Revision Course | Timetable May 2015 Lecture Timing 9.30am to 4.30pm

017_PQ 0415.qxp_PQ 1209 000 05/03/2015 11:01 Page 7

-

Pass rate: 38% (December 2014) Technical difficulty: 9/10 Weighting of calculations: 40-50% Weighting of discursive elements:

60-50% Exam technique: 9/10

The syllabus .The P6 Advanced Taxation exam builds on F6and requires more in-depth study of areas seenpreviously. There is a strong emphasis onapplication of knowledge to real life scenarios, onthe interaction of taxes and tax planning.Communication of advice is also very important.

The P6 syllabus is broken down into four keyareas:

AApply further knowledge and understandingof the UK tax system through the study ofmore advanced topics within the taxes studiedpreviously and the study of stamp taxes: Althoughthere are some new topics introduced at P6, itwould be very hard to pass the exam based onthese alone. A thorough knowledge of the F6content is also vital. Students must have a soundunderstanding of the basics of income tax,corporation tax, capital gains tax, inheritance tax,VAT and national insurance. Questions ofteninvolve almost entirely F6 knowledge, but testedin a more advanced way.

Stamp taxes are the only new taxes introducedat the P6 level, but represent a very minor area.

There is no guidance provided by the ACCAon the weighting of different topics in the exam,except that every exam will include an ethicalcomponent for approximately five marks insection A. Breadth of study is, therefore, veryimportant.

BIdentify and evaluate the impact of relevanttaxes on various situations and courses ofaction, including the interaction of taxes: Mostquestions in the P6 exam involve more than onetax, often applied to the same transaction ortransactions. For example, the gift of an assetduring an individuals lifetime may haveimplications for both capital gains tax andinheritance tax. It is important that students candistinguish between the different taxes,particularly in relation to the reliefs andexemptions available.

Questions may also require comparison ofdifferent options, for example: employed versusself-employed; setting up as a sole trader or acompany; taking a company car or a cashalternative.

CProvide advice on minimising and/ordeferring tax liabilities by the use ofstandard tax planning measures: Tax planning isa key part of the P6 exam. Many questions willinvolve some sort of tax planning, especially thescenario questions in section A of the exam.

Popular tax planning areas include: planningfor groups of companies involving both lossesand gains; loss relief planning for sole traders;tax planning for married couples; inheritance taxplanning. Advice on tax efficient investmentssuch as the Enterprise Investment Scheme,Seed Enterprise Investment Scheme, venturecapital trusts and pensions is often required inthe exam.

DCommunicate with clients, HM Revenue andCustoms and other professionals in anappropriate manner: As well as the practicalapplication of tax rules to client scenarios,students are expected to produce professionaldocuments incorporating helpful, clear advice.Question 1 in section A will require the answer tobe presented in a particular format such as areport, memorandum or letter and will have fourmarks available in respect of professional skills.The use of headings and a clear, logical formatwill help to obtain those marks.

Sitting the P6 exam .The P6 exam requires a sound knowledge of thekey rules and principles of all of the taxes as well

as an ability to apply these rules to sometimesunfamiliar scenarios. Question practice is vital,as the application of the rules is a skill that isbest obtained by experiencing as manyscenarios as possible.

Good exam technique is essential .Generally, the technical content of thecompulsory questions in section A is morestraightforward than that of the section Bquestions. Although students may prefer to startwith the shorter section B questions, they mustensure that they leave enough time to fullyanswer section A, as this is often where theeasiest marks are to be found.

The P6 examiner has noted that students tendto spend longer on the first question and seemto lack a sense of urgency, often resulting inpoorer performance in later questions. Studentsshould try to maintain their level of effortthroughout the exam.

It is very important to read the requirementcarefully, and answer only the question set.Revisit the requirement often to make sure thatall parts have been attempted and nothing hasbeen left out.

Finally, although the P6 syllabus may seemdaunting, remember that only 50% is needed toobtain a pass. Helen Forster is a tax content specialist atKaplan Financial

PQ

18

PQ ACCA P6 paper

PQ Magazine April 2015

Helen Forster offers expert advice on passing P6 a tough nut to crack

TECHNIQUE IS CRUCIAL

pq apr 15 p18 CCM_Layout 1 09/03/2015 12:34 Page 14

-

019_PQ 0415.qxp_PQ 1209 000 11/03/2015 11:52 Page 7

-

20 PQ Magazine April 2015

PQ back to basics

Last month we learnt the importance ofknowing what is meant by economiccosts (also known as relevant costs) andwhat is meant by accounting costs. Accountantsuse economic costs for decision makingpurposes such as whether to buy a machine togenerate income but use accounting costs forthe bookkeeping records that underlie thepublished financial statements.

Accountants should also know the differencebetween economic profit and accounting profit.Even if we ignore purely accounting costs suchas depreciation, economic profit does not equalaccounting profit because, like economic cost,its calculation includes opportunity costs. Theeasiest way to understand economic profit, againignoring purely accounting costs such asdepreciation, is that it broadly equals accountingprofit less opportunity costs.

The next activity will help you understand thedifference between accounting profit andeconomic profit.

Activity Pat gives up her job and an annual salary of45,000 to start a new business in a verycompetitive industry. She draws 60,000 fromher savings account, giving up the opportunity toearn 3% annual interest, to start and operate thebusiness over its first year.

In the course of the first year the businessgenerates income of 85,000 and incursexpenses of 55,000.a) What is the accounting profit for Patsbusiness for the first year?b) What is the accounting rate of return for thefirst year on Pats outlay of 60,000?c) Why is the accounting rate of return verymisleading?d) What is the economic profit for Pats businessfor the first year?

Solution and feedbacka) The accounting profit is simply the income of85,000 expenses of 55,000 = 30,000.b) The accounting rate of return for the first yearis the profit of 30,000 as a percentage of theoutlay of 60,000 = 50% c) This high rate of return is very misleading asit ignores the opportunity costs involved in Patgiving up her job and the interest on her money.d) The economic profit is the accounting profitof 30,000 less all the opportunity costs involvedin generating such a profit. The opportunitycosts are the 45,000 salary and the 1,800interest (60,000 x 3%) given up. Economicprofit is thus 30,000 45,000 1,800 = -

16,800 i.e. a loss of 16,800.Pats accounting profit of 30,000 is actually

an economic loss of 16,800. This loss gives anindication of the real result of Pat giving up herjob and her savings to invest in the business. Itis only an indication because we need to takeinto account such factors as relevant taxes andfuture earnings and costs of the businessbeyond the first year. Nevertheless, the exampleabove shows the importance of includingopportunity cost in the real and relevant profit ofan investment.

The important final thing to remember is thatmainstream economics divides economic profitinto two types: normal profit and abnormal profit.Normal profits are the minimum profits thatcompetitive firms, such as Pats in our example,need to make to stay in their present line ofbusiness; namely, to cover their opportunitycosts, while abnormal profits are any profitsgreater than normal profits.

The idea in economic theory is that abnormalprofits should only be temporary, as anyabnormal profits in a perfectly competitiveindustry would soon attract new entrants. Newbusinesses would soon be attracted until pricesfell to the point at which no abnormal profits areleft.

Although the real world often does not behavelike economic theory all PQ accountants need toknow core economic concepts such asopportunity cost. When you are asked for thecost or profit of anything (be it an investment,project, activity or accounting period) alwaysremember if you need to supply the accountingcost or profit, or the economic one. Its notalways obvious! Jonathan Winship is a lecturer at The OpenUniversity Business School and one of theauthors of The Open University ProfessionalCertificate in Accounting

PQ

Essential economicsIn part two of his guide to essential economics, OU lecturer Jonathan Winship looks at economic profit andaccounting profit. Part one on accounting cost and economic cost was in Februarys issue of PQ magazine

Joseph Stiglitz, the American economist andprofessor at Columbia University. He is a recipient of the Nobel Prize in EconomicSciences (2001)

Ask yourself the followingquestions: How confident areyou? Are you sure about thetreatment of supplies,standard, exempt and zero-rated? Do not fall into the trapof thinking that a businessmaking wholly exemptsupplies can voluntarilyregister it cant. A businessmaking a mixture of suppliescan register, but may bepartially exempt, which affectsthe recovery of input tax.

Are you looking backwardsor forwards? There are two tests forcompulsory registration. The current VATregistration limit is 81,000, but applied in

two different ways. Dont think of81,000 as an annual limit but athreshold to be applied in twosituations. When looking at a growingbusiness, the taxable supplies of theprevious 12 months need to becompared with the VAT limit of81,000. This is not an annual test,but looks at a rolling total of taxablesupplies at the end of each month.When taxable supplies for the previous12 months exceed the limit of81,000, registration is compulsory.However, if the anticipated value oftaxable supplies for a business is

expected to exceed 81,000 in just the next30 days, then registration is compulsory. So81,000 is applied in two different ways.

When can a business charge VAT? Only aVAT registered business can charge VAT.However, that means output tax is charged onsales and on capital transactions. Thinkabout this if you are dealing withincorporation, although that might constitutea transfer of a going concern which is outsidethe scope of VAT.

When should a business stop chargingVAT? If anticipated supplies for the next 12months are less than 79,000, a businessmay deregister. On cessation of trading, abusiness must deregister. Cath Hall is an AIA Achieve e-tutor. The AIAAchieve team is producing a series of A QuickLook at articles throughout 2015. Morearticles can be found on the AIA website:www.aiaworldwide.com/a-quick-look-at

A QUICK LOOK AT... VAT REGISTRATION

pq april 15 p20 CCM_Layout 1 09/03/2015 12:32 Page 26

-

021_PQ 0415.qxp_PQ 1209 000 05/03/2015 11:03 Page 7

-

22

PQ De Montfort challenge

PQ Magazine April 2015

Lisa Wakefield, a senior accountancy lecturer at De Montfort University, challenged her students to write anarticle suitable for publication in PQ magazine. Here we publish an edited version of the winning entry byAhmed Dhada, Farhan Chohan and Amanveer Dhesi, who focused on problems within the world of audit

BE AUDIT YOU CAAs far as professions go, auditing has arelatively simple purpose. Auditors actas independent examiners on behalf ofthe shareholders and objectively assess whethera companys financial statements and accountshave been properly prepared. Audits serve afundamental purpose in promoting confidenceand reinforcing trust in financial information[and capital markets], according to the ICAEWsAgency Theory And The Role Of Audit report(2005), which is essential in a developedeconomy.

Recently, the auditing profession has comeunder much scrutiny. The financial crash of2007/08 raised questions on why the auditingprofession did not anticipate the possibility ofcollapse. None of the worlds recent largeaccounting scandals, like Tesco, Lets Gowexand Olympus, were uncovered by the auditorsdespite these scandals taking place overmultiple years and slipping past multiple audits.Lets Gowex was unique in that the fraud was

uncovered by Gotham City Research, anindependent analyst firm. So the question is:why have auditors become so inept?

One element of the profession criticised forleading it to its current state is the dominance ofthe Big 4 accounting firms and the oligopolythey hold. The firms are, in order of size,Deloitte, PricewaterhouseCoopers, Ernst &Young and KPMG. The Big 4 audits 99 of theFTSE-100 and 240 of the FTSE-250. BritishFirms on average stay with the same auditors for48 years. And some banks will only lend to firmsaudited by one of the Big 4. This has resulted ina lack of competition in the industry for the bigfirms, no incentive to improve services, a lack ofchoice and competitive pricing for thecustomers, and no opportunity for growth for anyaspiring audit firms offering services of highquality.

This has led to a decrease in the value of anaudit, increased audit costs and a cosyrelationship between big company boards and

the senior partners of major audit firms,according to Alan Millichamp and John Taylors2012 book Auditing, which might impede onthe objectivity and independence needed toproperly perform an audit.

The cosy relationship that hinders theauditors effectiveness is only amplified by theaudit firms ability to perform non-audit services.This only makes firms more familiar with theirclients, further impedes objectivity andindependence, creates a conflict of interest andleads to a neglect of audit duties. Whilecombined audit revenues have fallen by $5bnover the past five years, advisory fees havejumped by $16.1bn, with audit firmsincreasingly relying on consulting services fortheir bottom line. If an audit firm wanted to wina profitable, long-term consulting contract itwould become more hesitant to expose fraud ordo anything that would paint its client in anegative light, especially if they rely on thoseaudit fees. The Enron scandal highlighted this

The Institute of Certied Bookkeepers

I was a serving helicopter pilot

with the Army, but changed my

career and I am now an award

winning Certi ed Bookkeeper

Natalie Phillips MICB. CB. Dip

HRH Prince Michael of Kent GCVO

I am an award-winning Certi ed Bookkeeper

To nd out if you could become a bookkeeper call

0845 060 2345www.bookkeepers.org.uk/PQ

pq april 15 p22-23 ccm.qxp_Layout 1 11/03/2015 09:40 Page 14

-

PQ Magazine April 2015 23

De Montfort challenge PQ

AN BE!issue. Enron paid its auditors $52m a year, overhalf of which was for non-audit services.

Many pieces of legislation have been enactedor proposed to strengthen the independence ofauditors. In response to the Enron crisis, theSarbanes-Oxley Act overhauled the US auditinglandscape, disallowing non-audit services toaudit clients and forcing the mandatory rotationof audit partners every five years. In Britain, theFinancial Reporting Council encouraged firms toput their audits out to tender every 10 years orexplain why they did not. This regulatorypressure has had a moderately positive effect;33 FTSE-350 companies have put their auditsout to tender since the recommendation, and 50more are expected this year. The EuropeanCommission is currently drafting a law thatwould make EU companies change auditors atleast every 10 years, or 20 if the audit was put totender directly, after some auditors wereaccused of being asleep at the switch in thelead-up to the bank collapses of 2007-09 (EUdeal marks big step in auditor rotation reforms,Sam Fleming, 2013). While this extracompetition is good for the industry andincreases confidence in audits, it is not enoughthat firms simply rotate between the Big 4. ThePublic Company Accounting Oversight Board, aUS non-profit body dedicated to the oversight ofauditing, found deficiencies in 32% of Big 4audits in 2011, and 36% in 2012. This isespecially concerning considering that the Big 4audited companies that made up 97% of thevalue on the US stock market.

Stricter regulation .The current European proposals are quite weakin comparison to those originally mooted, whichwere to break up the Big 4, disallowsimultaneous audit and non-audit services, forcerotations more frequently and promote jointaudits. These were severely watered down afterthe Big 4 lobbied the European parliament. TheBig 4 seem to be using their dominance andinfluence to maintain control of the auditindustry. It must be wrested from them.

Regulators should be far stricter. For a start,they should disallow audit firms from providingnon-audit services to an audit client, this goeswithout saying. The rotation rules are a lottrickier. The rules we would propose would befocused on levelling the playing field andcreating real competition in the industry. Wesuggest that it should be made mandatory torotate audit firms after a much shorter period oftime, say four years, and not allow firms to revertto a previously appointed auditor until a fixedperiod of time expires since their last auditengagement (say 25 years). This will stop largecompanies from rotating between the Big 4 adinfinitum, force the larger firms to eventually usenon-Big 4 auditors, break the oligopoly andintroduce real competition into the industry.

The only concern with this approach is the

fact that in the short term the quality of auditsprovided by non-Big 4 firms to largecorporations might be inadequate and of poorquality due to the fact that they might not beproperly equipped nor have the experience toaudit larger more complex companies. Tomitigate this worry, joint audits between Big 4and non-Big 4 audit firms should be heavilypromoted and incentivised by regulators byallowing joint audit engagements to last longerthan the standard four years. This will greatlyhelp prepare non-Big 4 auditors to audit largecompanies.

The Big 4 have also argued that a closerelationship only increases the value of the auditbecause of the familiarity the audit team willhave with the client firm, but the evidence forthis is scant. There is also a case to make forthe idea that making audits non-mandatorywould increase their reliability and quality. Ifstakeholders begin to see audits no longer asunnecessary red tape and as a genuine valueadding activity that attracts shareholders andcreditors, companies may take their selection ofauditors and the quality of services they areproviding more seriously, while auditors will workharder to provide genuine value, knowing theirindustry is no longer government guaranteed.

The Big 4 will be the most opposed to theseproposals since they have the most to lose. Butthey are necessary to improve the quality of andtrust in the audit, and abate the criticisms thatare currently levied against the profession. Hadthe auditing industry been properly reformedearlier it is likely that some of the larger recentaccounting scandals would have been caughtearly or even prevented. The economicrecession, on the other hand, could not havebeen foreseen or prevented by the auditorssimply because it was not their duty to. Anauditors duty is to assure the shareholders that

the accounts have been prepared properly inaccordance to the relevant accountingstandards. This has caused much discussionabout expanding the auditors duties to increasethe value they offer, not just the shareholders,but to society at large.

The most discussed expansion would be toinclude a duty to detect fraud. As it stands,external auditors were only responsible for 4.6%of fraud detection in 2010 and 3.3% in 2012.The argument stands that auditors would morediligently look for fraud, and find it, whilepotential fraudsters would be encouraged toreconsider their folly, knowing they were morelikely to get caught. Another idea, put forward bythe ACCA, called for a widening of the scope ofthe audit [so that it includes] engaging withclients on issues such as risk management,corporate governance an organisationsbusiness model and its likely sustainability.

Consultancy role .While this would further serve the interests ofstakeholders at large, it would also push auditorsinto more of a consultancy role and lead to theaforesaid neglect of audit duties and destructionof independence that we are attempting tostrengthen and preserve. The Institute ofChartered Accountants of Scotland have gone inthe opposite direction. They recommend that theduty of the external audit should be vastlydiminished and outsourced to internal auditors.There seems to be no consensus on where theindustry should be going.

Whatever regulators choose to do, reformsmust be made. The fundamental purpose of anaudit is to provide independent assurance, andit currently is failing to do so. The reliability ofand trust in the audit must be improved,otherwise people will begin to ask: whats thepoint? PQ

Big 4 concerns: top De Montfort students Ahmed Dhada, Amanveer Dhesi and Farhan Chohan

Redpix P

hotography

pq april 15 p22-23 ccm.qxp_Layout 1 12/03/2015 10:22 Page 15

-

24

PQ exam skills

PQ Magazine April 2015

Improve your answer bookletCurrently, most accountancy exams apart from computer-based ones have to be answered in bookletswhich are then scanned and marked byhumans on a computer. Examiners andmarkers alike constantly criticise the layoutand quality of students scripts.

Accountancy exams are professional andtherefore answers need to look professional,but with time pressure in exam conditionsthis key requirement is often lost.

It is essential to follow a few easy ruleswhich will help the marker when markingyour script: Always use a black ballpoint pen. This isbecause all scripts are scanned and the bestcolour to show up is black. A number ofstudents insist on using gel pens but oncescanned the marks made by them cansmudge and even go through pages,affecting whats underneath. Never write in the margins. One side is cutoff by the scanning machine and the otherside is where the marker annotates theallocation of marks awarded. Abbreviations are totally acceptable inworkings, but workings themselves need tobe followed, so a little narrative is required tomake them logical. Ensure you space themout sufficiently, and all workings should be

numbered and answers crossed referenced tothem. If for some reason you have not left enoughspace for something, then help the marker bycross referencing to the page where you havecompleted the rest of the answer All questions should start on a new page andyou should aim to start each part of a questionor each issue (if applicable to the question) ona new page. Make use of subheadings. This makes youranswers automatically more logical and mucheasier to mark. If the requirement or thequestion numbers different parts, eg a), b) or(i), (ii) then use the same numbering in youranswer If your handwriting is small you need to aim towrite as large as you can. When your script isscanned it is reduced in size to accommodatethe marking package which takes up a third ofthe marking screen. Yes, the marker can zoomin, but then they are unable to view a completeline of text. If you know you have untidy handwriting thenwrite using double spacing (that is write onalternative lines).

The key to success in exams is to haveanswers that look professional that is includestructure, space and subheadings. Jenny Winstanley, Reed Business School

PQ

*Funding available for ACCA and CIMA fees for employees of UK charities. Prots are covenanted up to Reed Educational Trust Limited which is a registered charity. Reg. No. 328347

Optional full board residential facilities provided at very competitive rates.

Free lunch and parking for ALL students. ALL exam results published on our

website. Download our course brochures. Discounts apply, see website for details.

01608 674 224

The Manor, Little Compton, Nr Moreton-in-Marsh, Glos GL56 ORZ

www.reedbusinessschool.co.uk

Q Tutor marked scripts

Q Outstanding pass rates

Q ACCA Revision courses commencing from 13th April

Q Book Now for CIMA Integrated Case Study for May Sitting

Jenny Winstanley explains how makingyour answers neat and tidy can really

help you get that vital pass mark

No mark-er: ahighlighter is forrevision only use a black pen in the exam hall

PQ April 15 p24 CCM_Layout 1 09/03/2015 13:34 Page 14

-

ICAEW focus PQ

Like all assessment bodies, ICAEW isrequired to make reasonable adjustmentsfor students under the Equality Act 2010;we call these access arrangements and they arechanges to the way we deliver the exam or to theexam environment. Access arrangements ensureall students can demonstrate their knowledge,skills and experience on a level playing field.Access arrangements arise from physical ormental impairment that has a substantial andlong-term negative effect on your ability to donormal daily activities. This includes specificlearning difficulties such as dyslexia, and physicalimpairments that directly impact the ability towrite, for example. However, many people I talk toare surprised by the range of differentcircumstances and adjustments that come underaccess arrangements; I would encourage anyonewho thinks they might be eligible to get in touchwith us.

All the information you might need as astudent in relation to access arrangementrequirements is on our website; the guidanceand forms are available with embedded text-to-speech PDF functionality, and we have a teamwho can answer all your questions onarrangements [email protected]. We can alsooffer adjustments for some circumstances thatfall outside the Equality Act 2010; we do this tohelp students who have short-term issues thatmight otherwise stop them being able tocomplete their exams.

Case-by-case basis .At ICAEW we are proud of our inclusiveapproach and we deal with access arrangementson a case-by-case basis, so if you think you needarrangements it will be your specificcircumstances well consider, and we wontaward you something thats inappropriate justbecause it worked for another student. We mightlook at what your employer provides for you inyour job, because whats effective in supportingyou in the workplace is often the best approachfor an exam environment. Where thearrangements weve agreed are complex wellarrange to speak with you and your employeror tuition provider if needed to talk throughexactly how things will work on exam day.

The arrangements well agree to provide canvary according to the type of exam youre sitting;for example, some students might need acomputer when sitting the essay-basedexaminations, but dont need any adjustmentsfor the Certificate Level. The arrangements alsoneed to be reasonable and we need to ensurethat they are fair and that no student might havean advantage; our application process has roomfor dialogue to ensure weve fully understood

your circumstances, and this means that wetreat your application individually while ensuringany arrangements we agree will be in line withother students with comparable circumstances.