The Polar Prediction Workshop, Oslo, Norway, 6-8 October 2010

PetroChallenge Norway 2010

-

Upload

meghanclark -

Category

Education

-

view

215 -

download

1

Transcript of PetroChallenge Norway 2010

Xplore Petroleum Exploration Business Simulation

PetroChallenge Norway 2010

1Welcome to OilSim Exploration, the petroleum exploration business simulation.

This Powerpoint presentation is an introduction to OilSim, intended for those that are going to participate in an OilSim Exploration event.PurposeYou are an exploration team in charge of a new petroleum province.

Multidisciplinary challenge: Enhance your overall understanding of petroleum exploration and field development.

Create a Return on Investment

2The purpose of OilSim is to improve your overall understanding of the oil and gas exploration industry.

OilSim is an online business simulation, and it encompasses several if not all the disciplines that comprise the exploration industry.

In OilSim, you work together with others in a team.

Your team competes and collaborates with other teams that participate in the simulation.

Your team has been sent out by an energy company to a new and promising new oil and gas area, and your task is to maximize the value compared to the money you receive from the parent company

This measurement is also known as ROI, or Return On Investment.Money/CPsYou start with $200 millionCreate valueNet value of the oil and gas discovered MINUS all costs involved

Credibility points awardedSensible decisions and correct answersCPs are a measure of ability and credibilityConsidered when bidding for blocksUsed when applying for funds 3In order for your team to be able to start exploring, the headquarters have provided you with 200 million US dollars in virtual money. You can spend this money on acquiring surveys, bidding for licenses, investing in other teams licenses, and drilling wells.

Your aim is create value for your company and a Return on Investment (ROI), which is calculated as the value divided by the funds that you receive from the headquarters, so the more money you get, the harder it is to have a high ROI.

The value is calculated as the net present value of all the oil and gas fields that your team owns a share of minus everything you spend.

Later on if you run out of money, it is possible to apply for more money from the headquarters.

You will learnWhere and how to find hydrocarbons Corporate Social ResponsibilityLicensing rounds Farm-in and Partnerships negotiationsDrilling rigs Sub-contractorsEnvironmental issuesEconomically viable volumesTeam work, Critical decision making 4OilSim is a business simulation designed to give you an overview of the petroleum exploration industry.

The key learning points include:how you find oil and gas, which surveys are used for what, the importance of having good information, Corporate social responsibility of oil and gas companies how licenses are awarded, how energy companies spread the risk by going into partnerships, how drilling is done using rigs and sub-contractors, how environmental issues are addressed, how testing and appraisal wells reduce uncertainty, and finally the whole concept of economically viable volumes, to find out when do you move beyond exploration and start producing the oil or gas.

OilGasOil and Gas Value ChainThe long and bumpy road for oil from the underground to your tank, is called the oil and gas industry value chain.

The value chain is divided further into these parts:Upstream is about getting the hydrocarbons up from the ground, and comprises of activities related to exploration, field development, construction, production and abandonment. By its nature, the exploration phase is common for both oil and gas, but soon afterwards, the oil and gas value chain will segregate into two parallel value chains.Midstream is about transportation and storage, as well as oil refining and gas processing.Downstream is about distribution and retail sales of gas, fuels and lubricants, plastics and other hydrocarbon derivatives to industrial and consumer markets.

OilSim Exploration is all about the exploration part of the oil and gas industry. Exploration is about finding the hydrocarbons and proving that they are in sufficient quantities to start producing.

OilSim Field development and Production is about actually taking the oil or gas out of the subsurface. 5Loginwww.oilsim.com

6This is how the screen looks like when you browse to the www.oilsim.com web site.

To enter the system, you need to enter your user name and your password, and then press the Return key on the keyboard.

You will get the user name and password from your teacher/facilitator.Loginwww.oilsim.com

7This is how the screen looks like when you browse to the www.oilsim.com web site.

To enter the system, you need to enter your user name and your password, and then press the Return key on the keyboard.

You will get the user name and password from your teacher/facilitator.Main screen

8Main screen overviewIn the middle you can see the map again with a legend below. Later in the simulation the blocks in the map will have different colour codes depending on for example whether it is currently on offer or whether there has been found oil or gas there. You can click on any block on the map and get more information about that block. There is not much information in these block pages early in the simulation session, but these pages that describe each of the blocks become increasingly complex and comprehensive towards the end of the simulation.In the middle of this page you can see a description of the current task with six fields to fill out before the deadline passes.In the left hand side there is first a summary of the current standings. This includes your total value, the capital you have received from headquarters, the cash you have left, your return on investment, your rank among all the players in this simulation reality, and the credibility points that you have accumulated.Credibility points are awarded based on how well you solve the tasks within OilSim, and can be used when you ask for more money from the headquarters. By clicking More you can review the accounts with all financial transactions. Below the summary is a brief status, including the deadline for this task. Below the status are a number of simulation options, of which the first one (Home) is the most frequently used.In the Mailbox you can read and send messages from and to your rivals, as well your headquarters and the ministry who awards the licenses.When you click Home you get back to the first page of OilSim, and it is a good advice to go back to the home page frequently.You can also send applications to the headquarters for new funds for your exploration, but be prepared to answer some questions before you can get them to release the funds.By clicking Teams you can see how the other teams are doing, and by clicking Credibility you can get a list of the times you have gained or lost credibility points.Below this there are a number of helpful texts for you, including a brief description of the simulation concept, the geology, partnerships, and a glossary.The general structure of this page remains the same throughout the simulation.

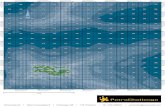

MapColumns e.g C1 to C112 Rows e.g. R1 to R144Block

Blocks are divided into 64 smaller cellse g. R52C1109This is an example of a map, used in OilSim.

Maps like these are normally handed out to all participants for reference. You can see that there is land to the left and increasing depths of sea to the right. All exploration in OilSim is done offshore in the area to the right.

The water depth runs from 0 meters to 1000 meters, and it must be said right away that oil and gas fields in shallower water are always cheaper to explore and easier to make commercial viable.

This map is divided into 252 square license blocks, each identified by a number between 501 and 752.

Each license block is 8x8 cells big, and each cell is 2km x 2km.

First taskChallenge: Find three sedimentary basins

Procedure: Buy and study magnetic and gravimetric surveys Submit the coordinates for each centreColumn and row number for each basin centre10Your first task is to identify the three basins that are in the area.

A basin is an region in the deep subsurface with a high accumulation of sedimentary rocks.

These sediments in general contain dead plants and animals also known as organic material that were deposited million of years ago.

Some of the organic material has been put under enough pressure and been exposed to high enough temperatures to be converted into hydrocarbons, including oil and gas.

This oil and gas has since migrated from the basins, but we will get back to that later. For the time being, you are being asked to identify the basins in the area, so that you know where the oil and gas came from.

The way you do it is through buying and studying of magnetic and gravimetric surveys.

When you think you have identified where the three basins are, you enter three different coordinates one column and row for each basin centre on the form on the home page.

It should be noted that you shall enter coordinates and not blocks and that the coordinates you enter here are only the basin centres and not the place you will search for oil and gas in.Gravimetric surveys

Gravimetric surveys indicate changes in the gravitational pull of the Earth in different areas of the sub-surface. Lower gravitational fields indicates likelihood of low density rocks Sedimentary rocks, porous and hopefully containing hydrocarbons

Here is a real example of a gravimetric survey from a Finnish field in Europe.

Gravimetric surveys show how the gravitational pull of the Earth differs over the area. , and are as the magnetic surveys carried out by aeroplanes with sensitive measuring devices.

The reason gravity is not the same all over is that the rocks in the subsurface are not the same.

Different types of rocks give different gravity pulls, and more specifically the sedimentary rocks in basins are not so dense as the surrounding crystalline rocks.

Therefore, the lower the gravity pull, the higher the probability that there is a basin below, and vice versa.

The red areas have the lowest gravitational pull. Thus the probability of finding hydrocarbons here is relatively high.The yellow areas have low-to-medium gravitational pull. Thus the probability of finding hydrocarbons here is relatively high.The green areas have medium gravitational pull. Thus the probability of finding hydrocarbons here is relatively medium.The light blue areas have medium-to-high gravitational pull. Thus the probability of finding hydrocarbons here is relatively low.The dark blue areas have highest gravitational pull. Thus the probability of finding hydrocarbons here is relatively low.

11

Surveys in Oilsim

Survey shopGravimetric survey of North-west areaIn OilSim surveys can be purchased from the survey shop. There are 4 quadrants and together they show the whole area of the OilSim map.

Open all four quadrant survey, and place the surveys next to each other, in order to see the full map context.

12Magnetic surveysMagnetic surveys show anomalies in in the expected magnetic field of the Earth in particular areas. Sedimentary rocks in the basins have a lower concentration of magnetic materials and lower magnetic field than the surrounding crystalline rocks.

This is an example of a real magnetic survey for the Finnish field shown earlier.

Magnetic surveys show differences in the expected magnetic fields for particular areas, which can be caused by different geological structures. The sedimentary rocks in the basins have a lower concentration of magnetic materials than the surrounding crystalline rocks. Thus the sedimentary basins are the areas with the lowest magnetic field. In the real magnetic surveys The purple areas have the lowest magnetic pull. Thus the probability of finding hydrocarbons here is relatively high.The yellow areas have medium magnetic pull. Thus the probability of finding hydrocarbons here is relatively medium.The light blue areas have highest magnetic pull. Thus the probability of finding hydrocarbons here is relatively low.

13Survey in OilSimMagnetic survey:North-west quadrant

Again in OilSim, magnetic surveys for four quadrants can be bought.14Survey in OilSimAll four quadrant surveys in map context

15Finding the Midpoint

So this is what it looks like when you are trying to find the midpoints for the 3 basin centres. 16Survey analysisLocate edges of the continous basin structure

Locate the diagonals and thus basin centre

To identify the centre of the basin, you shall identify the coordinates of the extreme points of the continuous basin structure.

The basin structure is coloured in red, orange and yellow. Extreme points are the most eastern, western, northern and southern points of the basin structure.

When the extreme point are identified, you shall make diagonals, in order to identify the centre of the basin. The centre lies where in the diagonals intersect with each other.

Identify the row number and column number of the centre.17

Centre may not be the sameExample:Top basin on both maps Calculate the midpoint between the gravimetric and magnetic centres found= C55 and R105C50R100C60R110Due to the natural variation between the magnetic and gravimetric characteristics of the structure, the centre location may vary.

The task is then to identify the average centre, by interpolation of the different centres.

Calculate the average centre, as the average centre between the gravimetric and magnetic centre:

Average Row no = Row no of magnetic + Row no of gravimetric, divided by 2

Average Column no = Column no of magnetic + Column no of gravimetric, divided by 2

The average centre will then show in the middle.18Centre Midpoint calculation3 centres one Centre midpoint for each basinExample: C55, R105Solve before deadline. All submissions are evaluated after the deadline (and not before).You may get 0-100 CPs. All three centres must be located to get full knowledge points.

When you have found out where you think the basin centres are, you enter your centre coordinates into the form on the home page.

When you press Submit, the simulation receives your guesses.

If there is a green line across the right hand side of the page when you have submitted, the coordinates have been registered in the system.

You can change your mind as long as the deadline has not passed and enter altered coordinates and press the Update button below the form.19Task 1 solvedMessage in Inbox: Shows resultsAnswers submittedCPs awarded

20Once the simulation has been unpaused, you will receive a Notification in your mailbox, on the left-handside of the homepage.

In the notification, you can see the basin coordinates chosen by each team and the number of credibility points awarded to each team, based upon their submitted answers.

If you look at the cell coordinates of one of the teams that was awarded close to 100 points, then you can see what the correct answers were.

Task 2 license roundThe government has decided to put the blocks in one of the basins on offer.

ChallengeDetermine 3 best blocks to bid forInitiate Corporate Social Responsibility projectsCommit to Exploration drilling programme

Licensing areaThe next step is the First licensing round, where exploration licenses for blocks situated in one of these basins are being offered by the Government. Each team will be able to make bids for particular blocks.

A block is a geographically two-dimensionally delimited area of the earths surface, assigned by the government. Your task now is to identify three blocks that your team believes to have the best prospects and submit license bids to the Government for them.

To evaluate the blocks potential, you must identify if it has any pockets of hydrocarbons, and determine if there are any circumstances that would prohibit or limit the possibilities of exploration of the blocks resources.

21Part 1 Choosing blocksAny restrictions involved? - Spawning groundsWhat are we looking for? - ProspectsWhere do we find prospects? In basins, where hydrocarbons have been 1) are produced and 2) trappedHow do I find them? - Geoscientific analysisCommon Risk Segment maps, 2D seismic

To determine which blocks are likely to offer the greatest return on investment, an analysis of data is needed. This analysis can be split into 3 parts:Finding out where you are not allowed to explore, areas that are environmentally sensitive this means researching the Spawning grounds surveyFinding out where geologists have identified subsurface structures that indicate higher probabilities of hydrocarbons. These structures are called Risk Segments. All the risk segments are combined into a common survey, the Common Risk Segment map (CRS map) which shows areas of high and low probability of hydrocarbons. Finding out where the hydrocarbons are trapped using the 2D seismic surveys

The combination of this analysis will help you decide which blocks are the most likely to have the best potential hydrocarbon reserves and therefore be the blocks you should be submitting bids for.

22

Source and migration1. SOURCE ROCKwhere organic material is put under sufficient pressure

2. MIGRATION ROCKwhere hydrocarbons are driven through3. CAP ROCKImpermeable rock that stops migration of hydrocarbons

4. PROSPECT23This slide illustrates the relationship between the sedimentary basins you identified in the first task and the prospects which you will encounter in the second task.

Oil and gas form as the result of a precise sequence of environmental conditions: The presence of organic material like plants, algae and bacteria Organic remains being trapped and preserved in sediment The material is buried deeply and then slowly "cooked" by increased temperature and pressure. Rocks containing sufficient organic substances to generate oil and gas in this way are known as source rocks.

Once it has formed, oil and gas moves away (migrates) from the source rock. This movement happens for two reasons. First the oil and gas expand to take up more room than the original organic matter therefore their pressure on the rock increases and they try to escape. Second, being less dense than the surrounding rock and water, they tend to rise upwards. The oil is held in pores of the rock and continue to rise upwards until it reaches the surface or a layer of impermeable rock (cap rock) and is trapped.

A prospect is a subsurface structure that is likely to contain hydrocarbons, whereThere is a source rock , where the original oil or gas was generated.Porous migration rock allowing the hydrocarbons to move into the prospectA porous reservoir rock in which the oil and gas is held and An impermeable cap rock that traps the oil and gas in place

Traps

(c) OLFAnticline trapFault trapStratigraphic trapSalt dome trapGeological pockets, that might contain hydrocarbons.There are many types of traps formed by rock formations:The most common type of trap and the ones found in OilSim are Four-Way Closure Trap, a type of anticline trap that occur within the same layer which has been pushed up into an arch but where the hydrocarbons are stopped from migrating further upwards due to the cap rock. Fault traps are created where layers of rock slide up against each other and contain permeable and impermeable rock. The oil migrating through the impermeable rock is cut off by an impermeable layer and trapped against the fault. Stratigraphic traps keep hydrocarbons in place due to changes in the rock type or sedimentary features of the area and an uneven distribution of formations. Salt Dome traps enable hydrocarbons to aggregate into pockets on both sides of the dome as stratigraphic traps, as well as above the dome as an anticline s trap.

24Red areasYou will not be awarded blocks that contain any red spots (spawning grounds)Blue areasBlocks in area may be awarded

Environmentally Sensitive areas25Over the years governments, organisations and the Oil and Gas companies have become aware of the impact exploration and production can have on the environment. Policies are now in place during the licensing rounds to limit or even prohibit drilling in particular areas, this can include areas of special natural characteristics, areas populated by particular species or protected habitats.

Spawning grounds are fish breeding grounds, and therefore very sensitive to any pollution, derived from oil and gas exploration and production.

In the real world, licenses are still offered where spawning grounds exist, but exploration and production activities are limited to times of the year when the fish are not breeding. However, in the OilSim simulation the Spawning Ground Survey covers the whole map and the red areas are spawning grounds and licenses WILL NOT be awarded for blocks that contain a red area. Even if a block contains only a very small red area the license will not be awarded. So looking at this map, if you submitted blocks 88 and 102 as 2 of your choices, neither of this blocks would be awarded licenses.

Common Risk Segment

Layer 3 Eocene1500m below the seabedLayer 2 Paleocene2500m below the seabedLayer 1 Cretaceous3500m below the seabed

CRS. Common Risk Segment surveys tell you about the probability of a structure in the block/cell containing oil or gasSurfaceIn real life to assess the exploration risks and prospects on a bain scale, geologists use Basin and Play Fairway Analysis and is conducted using special GIS software and other specialist programmes. In OilSim this analysis has been simplified into one Common risk segment map to show the probability of hydrocarbons in an area.

The geologists ask a number of questions to determine the probability of finding oil or gas, including:Is there a sedimentary basin and a migration route into the prospects in the area?Is there porous reservoir rock so that the oil or gas can be stored?Is there a sealing rock, so that the oil and gas can be trapped?

The CRS map helps to answer these questions by combining a number of maps, surveys, charts and data analysis into one map and represents the probability of finding oil and gas in a particular geological layer or horizon.If the answers to all 3 questions mentioned are YES, then the area is shown as green a high likelihood of finding hydrocardonsIf one is negative, then the area is shown in orange with a medium probabilty of hydrocardonsIf the answers to 2 or 3 questions are NO- then the area is red and has a low probability of containing oil or gas.

Since the CRS show the probabilities of prospects in only one particular horizon or layer, it is necessary to purchase the CRS for all 3 layers so that you can determine which area within the licensing area contains the highest probability of containing oil and gas. So on the CRS maps shown here the area circled in black on the OilSim map and each of the CRS shows that the area in question is within the licensing area and is green on all three CRS layers, indicating high probability of oil and gas on all 3 layers within the same area or blocks. Potentially an area that requires further investigation for individual prospects.262D Seismic surveysTraps can be found with seismic surveys and sound waves bouncing off structures 2D seismic survey is a vertical cross section of the geological layers along either a column or a row

27Geophysicists use the physical characteristics of rocks, their magnetic and gravitational properties and how sound waves travel through different kinds of rocks to help understand the structures below the Earth's surface. Survey ships and aircraft collect data and produce gravimetric, magnetic and 2d seismic surveys. Using different techniques allows scientists to locate particular rock formations that might contain trapped oil, including the 2d seismic which can help locate the traps.

2d seismic surveys in real life are available in rows and columns within a geographical area, following the path travelled by the ship or aircraft collecting the data. In OilSim the seismic information also follows the rows and columns, but is only available for every second row and column.

A seismic source, like a sledgehammer is used to generate seismic or sound waves, which are sensed by receivers and recorded on a seismograph. . Each type of seismic survey utilizes a specific type of wave (for example, reflected waves for reflection survey) and its specific arrival pattern on a multichannel record (Fig. 3). Seismic waves for the survey can be generated in two ways: actively or passively. They can be generated actively by using an impact source like a sledgehammer or passively by natural (for example, tidal motion and thunder) and cultural (for example, traffic) activities. Most of the seismic surveys historically implemented have been the active type. Seismic waves propagating within the vertical plane holding both source and receivers are also called inline waves, whereas those coming off the plane are called offline waves

Real Seismic

Seismic surveys are made from sound waves that are sent into the subsurface, reflected, and measured when they get back to the surface.

This slide shows an example of a real seismic line. It shows a cross-section of the subsurface with the blue and red lines indicating changes in velocity of the wave and therefore changes in geological structures in the subsurface.

The black, red, and green lines are lines added as interpretation of the data by geologists.black lines are so-called faults, which have happened for instance after earth quakes or other dramatic geological events.green lines are where geologists think the reservoir rock beginsred lines are where the geologists think the sealing rock begins

In this particular case there is a prospect indicated under the orange arrow, within the grey triangle.282DSeismic in OilSim

UnprocessedProcessed

InterpretedRed is top of the sealing rock

Green is top of the reservoir rock

There are 3 types of data available when you order Seismic surveys in OilSim. Unprocessed data, is the raw data that is available fairly soon after the seismic providors have done the surveysProcessed data gives you more information about the geological layers in the groundInterpreted date has been interpreted by geologists. These surveys identify the sealing and reservoir rocks, and possible fault lines in the geological structure.

The traps in OilSim are either:anticlinal fault traps

29Order Seismic

What type of data do you want?Columns or RowsUnprocessed or processed dataInterpreted or not

Only buy maximum of 1 block of data at a time to speed up processingTo buy surveys, click on survey tab and then order the Seismic surveys from the survey shop.After youve clicked buy this screen will appear. The yellow box over the map allows you to buy all the seismic data for those particular blocks. So click and hold and move the box to the area you wish to purchase. Choose what area you want to buy. Decide if you want columns or rowsChoose if you want processed or unprocessed surveys. Processed data takes more of your time, but you get better dataChoose interpreted or uninterpreted data. Intrpretede data takes more of your time, but you get better data. Then order batch, The price of the order will change depending upon your requests and the data type you want.30Processing Seismic

It takes time to process your requestCreated to order Moves to surveys once processed

it does take time to process your order and this can be seen in the top right hand corner.However, whilst this is processing: You can solve other assignments within OilSimyou can drag the orange square anywhere on the map, to make sure you get the area you are interested in. The time it takes to process the data, depends upon the amount and type of data requested. When the batch process has reached 100% the process is finished. 31View the Seismic

Red circles navigate through the 2D seismic

Yellow square Row 1 from Column 1-56

When the batch process has reached 100% the process is finished. Youll then be able to view the batch you bought in the centre of the page.

The red circles on this slide are navigation buttons and allow you to see all your 2D seismic in small icons. To focus on one specific 2D seismic, click on that icon. 32Anticlinal traps

Try and find at least 5 prospects in the block that you are going to bid for.In this example the yellow circles show prospects for block 547. The reason that 4 areas have been marked is that the green line (reservoir rock) makes a peak and there is a sealing rock (the red line) above them making sure that the oil and/or gas doesnt migrate to an other area. 33Fault traps

Leakage?In this scenario we can see a fault line go through the geological layer. There are 2 prospects are located right beside the fault line, but because the red line (sealing rock) is on both sides of the fault line the oil/gas cant migrate and is trapped. The other potential prospect actually has had leakage because the reservoir rock (the green line) is above the sealing rock, which allows the oil/gas to migrate. 34Leakage?

Leakage?Here the area between the reservoir and the sealant rock has been shaded in to show you whether you still have a seal at the fault or a gap where leakage could occur.35Cross-sectionsColumnRowProspect, ReservoirBasin,Source36However, you must remember that you are looking for the four-way trap, so you need to ensure that the peaks or bumps line up on both the column and row, where they intersect.

In this slide you can see that a 2D seismic survey for a Column and also one for a Row. Now where they cross, or intersect there needs to be peaks, it is only then that there is likely to be a trap. Intersecting 2D

When collecting 2D seismic for an area, the data is collected for both the rows and columns.

Now when you are looking for a trap, you first find your sedimentary basin.

CLICK

Lets use a cake as an example. You want to choose the piece of cake that has the most cream or jelly, make sure your slice will have the most. How can you do this?

CLICK

Well if you cut the cake in half you can see if any part appears to have more cream or jelly in the layer, but how do you know that the cream or jelly is thicker in the whole slice?

CLICK

The only way to find out is to make another intersecting cut, or make a slice and see if the cream or jam continues to be thicker in a particular part the whole way through. 37 Part 2 - CSRCorporate Social ResponsibilityAffects a companys reputation and their credibility Increase Credibility by initiating CSR projectsCSR points considered when bidding for a blockCommit to work programme, as part of licensing programme State how many exploration wells you promise to drill.Bids are evaluated based on work programme and team credibility

Corporate social responsibility is the term used for explaining how companies impact the environment, consumers, employees, communities, stakeholders and all other members of the public sphere in the areas in which they operate. The attitude and behaviour of a company affects their reputation, the manner in which it is seen as an employer, its credibility in the market place and wider world and therefore, has a direct affect on its share price.

Oil and gas companies are no different to any other large organisation that need to consider their actions on the world stage. The reasons for doing this are debatable, for example:Tax advantagesConsideration in licensing roundsBe seen in a better public lightBe seen as a considerate employer Being clear on responsibilities to the public/government

Whatever the reasons for having a CSR programme, there can be a wide number of benefits for a variety of groups. In OilSim, before each licensing round, companies are going to be able to participate in CSR projects which will enable them to earn additional credibility points, that are looked after during the license bidding process.

Also, just like in Norway in real life, the responsibility of a company to commit to a well drilling programme, to ensure that the government and the wider public will benefit from the oil and gas exploration process, companies will have to set a work programme as part of their licence bid.

This means that when a team chooses which block it wants to be awarded a licence for, it will promise to drill a certain number of wells in an attempt to find the oil and gas in the block. 38CSR tab updated

CSR summarySo after completing each project, your company will need to decide, whether it wishes to complete any more before concentrating on the remainder of the licensing round bidding process. You do not have to spend all the $30million open to CSR projects, in fact, on the CSR page, you can see how much of your budget you have spent on CSR, how much is remaining of this particular budget and how many points you have earnt in total on CSR. CSR funds that you dont spend in one round are transferred to the next one.

If you wish to continue and complete more some projects, just review the suggested CSR projects and initiate the ones you are interested in.

39CSR projectsSport sponsorshipGeoscience InstituteBriberyOrphanageBusiness developmentWind millUniversity exchange programmeSafety training centerFact finding missionProcurement trainingParkEnvironmental assessmentPrimary school computersWave energy plantAdvertisementsSocial welfare studyTV documentaryAirline frequencyBusiness simulationSupport singerNow there are a number of suggested projects, some more worthwhile than others, depending upon the priorities and interests of the people working in each company.

CSR is about caring for the local society and making a difference for the people living where you operateNot all projects are soundBribery does not paySome projects cost a lot, but do not give so much returnSome projects are riskier than others

40CSR tabMax Round spend: $30M on CSR projectsEach project:Financial cost and CPsProjects in grey: not enough cash or CPs to doOutcome: Positive/negative CPs earnt on completion

Before each licensing round, a team is able to spend up to $30 million on CSR projects that will earn them more credibility points. However, the $30million comes from the whole company budget and so companies will need to decide on what is more important, cash or credibility points and try and find a balance their teams are happy with.

So to determine what companies should spend their CSR budget on, click on the CSR tab. Here a number of projects are listed.

Some are grayed out, because the team does not have enough CP, enough CSR budget, or enough cash to do themEach has a cost, and a number of possible outcomes - Each outcome has a probability and either negative or positive CPIn the CSR tab you can see the minimum and maximum CP you can get, as well as the probability for getting the maximum CP41Project example

Teams can increase their competitive position by initiating CSR projectsSo in this example, a company is able to set up a Geoscience Institute with a local university and there is no requirement for them to already have CPs- it shows as zero.

The project will cost $8million but might also help provide the company with a pool of geologists, geophysicists it can employ in the future. So if the plans for the Institute go well, the company will earn itself 40 Credibility points. Now because of project planning, local politics and building regulations etc, there is probability that the project will be completed and successful of 60%, so a 40% chance of something not working out and the institute not being established.

So, if everything goes to plan the company will earn 40CPs and be well known for being involved in the new Geoscience Institute, and be well worth the $8million investment.

But if it goes wrong, they will still have to pay $8million, but will be awarded 0 CPs.

If you decide this is the project you want to invest in then click on the Initiate button.

You cannot initiate a project if it has the potential to make your CPs go into negativeYou cannot initiate a project if you dont have the cash for itEach project can only be run once per team

42Confirmation box

A pop up box appears to check that you definitely want to spend your money, once you click OK you cannot get your money back.

If you realise you chose the wrong project, click on cancel to take you back to the previous screen. 43CSR Project Result

Completed projects Credibility Point pageOnce intiated, you will immediately be informed whether the project was a Success or Failure as the project moves to the top of the CSR page, under Completed CSR projects.

Also, on the Credibility page, you are able to see all the Credibility points that a team has been awarded and the reasons why, throughout all the challenges in OilSim, including the CSR projects. 44Part 3 Well programmesChoose 3 blocks with good prospectsCommit to a number of exploration wellsBids evaluated using the following formula:Each well is worth 100 Credibility PointsBidding points = CP + 100 * No. of wells committedIf 2 teams choose the same block and same no. Of wells the team with the highest CPs will be awarded the blockGovernment awards one block per team

- You can get extra CP for doing CSR projects

Teams choose 3 blocks to try and increase the chances of getting a block they think has good prospects, but once all the bids are in and the government has evaluated the bids, each team will be awarded one block.

License bids are evaluated according to the following formula: CP (from 1st challenge and CSR) + 100 * wells committed

45Part 3 Well programmeSelect number of exploration wells that are to be drilled1-4 wellsTeams first choice block = block with most committed wellsPenalties:Bid disregarded if overcommit no of exploration wellsMinus 10 credibility points for each bid where the number of committed wells is higher than the number of prospects

So teams select the blocks they want and submit bids in order of preference. The block with the most Wells committed is considered to be the preferred block, even if not entered into first Block.

A team can promise to drill between 1 to 4 wells. The Bid is disregarded if a team commits to more wells than there are prospects

When deciding who gets which blocks, OilSim looks at the accumulated credibility points and adds 100 points for each well committed. The accumulated points at this point include credibility points from the find basin task and credibility points from completed CSR projects, but does NOT include any credibility points for choosing good blocks.AFTER deciding who gets which blocks, each team gets additional credibility points based on how good the blocks you bid for were. The maximum here is 300 credibility points.46Exploration wells

So when deciding how many exploration wells are needed for the well programme, you need to determin how many initial wells should you drill to find all the prospects in your block. On this example, based on the 2d seismic, you can see that by drilling 2 wells through the Eocene and Palocene you can reach 4 prospects. So we would commit to 2 exploration wells. 47Exploration wells

Leakage?In this example, you are able to drill one exploration well, since the drill can deviate by one cell as it progresses through the geological layers. So you can reach the prospect in R37 in the Paelocene and in R38 in the Cretaceous. 48Recap on Task 2Environmentally sensitive areas blocks to avoid Common Risk Segment surveys areas of higher probability of prospects 2D seismic blocks with most structures

Final tip - Check water depth - shallow water blocks

49So lets recap on the things you need to do to solve this task wisely and give you the highest probability finding prospects. First buy and review the ESA map to check which blocks you should completely avoidSecondly - buy all three CRS surveys and study these closely to find out which blocks have the highest probability of prospectsThirdly Buy and assess lots of 2D seismic surveys in order to identify particular blocks where there appear to be four-way traps and therefore the highest number of prospects.Finally consider your preferences and reviewing the water depths of the blocks, since those with shallow water will be cheaper to drill in and therefore more economically viable in the long run from a production point of view.Task 2 solvedMessage sent to all Results and CPsOne license per team

50When the deadline has passed each team has one exploration teams.

You can see a summary of the licensing round in a message in the Mailbox.

There you can see who got which blocks for what amount, which blocks all the teams bid for, and how many knowledge points each team gotBid Evaluation message

Bidding points are used to evaluate the licence.

CPs awarded are based upon how good the blocks are.

Remember a bid is disregarded if a team commits to more initial exploration wells than are needed to reach all prospects.

When deciding who gets which blocks, OilSim looks at the accumulated credibility points and adds 100 points for each well committed. The accumulated points at this point include credibility points from the find basin task and credibility points from completed CSR projects, but does NOT include any credibility points for choosing good blocks.AFTER deciding who gets which blocks, each team gets additional credibility points based on how good the blocks you bid for were. The maximum here is 300 credibility points.51Task 3 Exploration DrillingThe headquarters of your company has evaluated the license that you were awarded.Although the possibility of finding oil is fair, the costs involved are large. Thus the headquarters want you to spread the risk. Challenge: You shall farm-out minimum 20% from your license and farm-in as much as you can in other good licenses.

Gentlemen, hold your horses!

Exploration Drilling is not about going drilling into the ground. It is about careful planning the drilling operation , and foremost to spread the costs and risks involved upon many shoulders.Thus farm-outs are imperative activities before drilling itself can be conducted.52Task 3a PartnershipsAcquire 3D Seismic interpretations for the block you operate, and study the results from the licensing roundFarm-out: Get others to invest 20% or more in your license you can send them surveysFarm-in: Send offers to other teams to buy shares in their viable licenses. Submit an offer for each viable license, with amount offered and share wanted in whole %.53First you must get other teams to invest at least 20% of your license. This means that you need to convince others to invest in you.

The procedure for farming in is similar to the procedure in tasks 1 and 2. First you buy and study 3D seismic surveys for the blocks that you are the operator of.

Then you negotiate either in person or by sending messages. Then you submit one offer for each license that you would like to own a share in.

You submit the amount that you offer and the share that you want for that amount.Real 3D SeismicShows the subsurface structure in a cube.

54You need to buy and study 3D seismic interpretation in order to find out where to drill.

Each 3D seismic interpretation shows the geological structure for one horizon of one of the license blocks.

What you should look out for is four-way closure structural traps, as these are the only traps in OilSim.3D Seismicin OilSimLayer 1 CretaceousLayer 2 PaleoceneLayer 3 EoceneProspects are no guarantee of oil or gas

Your primary target is to find the limits of each prospects, not just plounge the drill string into the middle of each reservoir.

Thus you shall drill into the periphery of each prospect, not in the middle.

55PartnershipsSpread the risk: e.g Investing in other blocks divides the risks amongst all partners, much more preferable than keeping 100% of one field and all the risk.Increase probability of profit: investment in only 1 field which could be a dry prospect is possible, whereas the likelihood of investing in 5 fields which are all dry is unlikely.56Farm-in and out is about spreading the risk, thus basic risk management must be applied: Risk Sharing.Licences

Farm-inEither accept the amount or % the license owner requests, or amend the amounts to your own offerAdd a message to the sellerPress Send offerMinimum of $100000 per %When reviewing a farm-out offer you can either accept the amount or % the license owner requests, or amend the amounts to your own offer. Add a message to the seller explaining why they should choose your team and press Send offer 58

Farm-inWhen a team receives a Farm-In offer to appears under Financing. This is where a team can receive finance or money for a % of their own blocks Financing Is where a team is able to accept offers, and therefore receive money or finance for a % of their own blocks When a team receives a Farm-In offer it appears under financing on the right hand side of the homepage

59

Farm-inlicense OWNER decides whether to ACCEPT or REJECT the offerPartnerships established every time a license owner accepts an offer.Overview: On the main page, you can see all licenses. 1) licenses you operate, 2) licenses you have invested in, and other licenses.60By clicking on this offer the team can then accept or reject the offer.

A partnership is established every time a license owner accepts an offer.

You can farm in and farm out at any time from now on, but you need to sell at least 20% to be allowed to start drilling in the block that you operate.

Note, that you on the license tab can get an overview of the licenses that you operate, the licenses that you have invested in, and all the other licenses.You are not allowed to drill before at least 20% of your license has been farmed out.

Farm-in

All your farm-in offers to other teams are shown under Investing on the right-hand side of the homepage . This is where a team offers investments to other teams for a % of their blocksAll your farm-in offers to other teams are shown under Investing on the right-hand side of the homepage . This is where a team offers investments to other teams for a % of their blocks

Remember you must have farmed-out 20% of your own block before you can drill.61Take back offers

If you decide you no longer want to make an offer to a team, or you realise that an offer is not going to be accepted by another team. You need to take the offer back so that the money you were going to invest in that team, does not sit with the bank, but is returned to you.

To do this click on the Review Farm in button, next to the licence, for which you want to take the offer back. 62Take back offers

Then click on Take Back and the money, in this case $1,000,000 will be returned to you.

63Partners pay a proportional share of all future costsPartners receive a proportional share of the net proceeds from oil and gasThe operator team makes all decisions regarding drillingTeams can farm-out up to 70% of licenceOperators must keep 30% of licence

Partnerships64When you have entered a partnership, you will pay your share of all future costs in the license.

This includes your share of all exploration wells that are drilled.

On the other hand, you will receive your share of the net value of any oil or gas that is found in the license.

If you own 20% of a license you pay 20% of all costs, and you receive 20% of all license values.

Even if there are other owners, it is the operator team that takes all decisions regarding acquirement of 3D seismic, drilling of wells, and testing of wells.

When you are a partner in a license block, you get all information about the discovered oil and gas fields

A team can farm-out up to 70% of each licence, but must keep 30%.Water depth

Before choosing a rig, you need to check your water depth Find this at the bottom of the BLOCK pageBefore you begin to drill you need to know the water depth so that you choose the right type of rig. You can find this information by clicking on your block and scrolling to the bottom of the screen where a map of the whole blocks water depths are shown. By scrolling over each cell you can see the water depth for each particular cell.65Choose RigChoose the right rigs for your water depthsJack-up rigs for shallow waters

Semi-submersible rigs for middle waters

Drillships for the deepest waters

Rig cost = drilling days * day rate

The next task is to choose which rig to use to drill the exploration well, but you will need to know how deep the water is in the area you wish to drill, so check out the water depths under your block information.

There are three types of rigs: jack-up rigs for shallow waters, semi-submersible rigs for middle waters and drillships for the deepest waters. When choosing the rig ,, and.

The rigs have different costs per day, and the drilling days depend on how deep you drill into the subsurface and which service providers you choose

66RigsFew: limited number of rigs available.If you get one: start using it within 20 minutes.If you dont: wait in a queue, if another team is using the rig.Price can change: rig day rates are dynamic.In most cases there are fewer rigs than teams, so you need to be fast to get good and cheap rigs for your wells.

When you order a rig you need to start using it within 20 minutes.

If you do not use it within the 20 minutes, you will pay for 20 days of use.

You can release a rig that you have ordered on the home page.

The rig rates are dynamic, so that popular rigs tend to have increasing prices, while less popular rigs become cheaper.67Service ProvidersUpto 9 Star quality-Good: normally costs moreBad: cheaper, but reliability is low, so you risk extra drilling time and extra costs

Rig service providers are needed to operate the rig properly. Analysis, Shore base, Vessels, Well Services, Airways

High-star-providers are expensive, but you may be more sure that the operation wil be smooth. Avoid though to use expensive providers everytime, as you will run out of money too soon.Medium-star-providers are medium-priced, as the risk involved are a bit higher than with the expensive ones.Few-star-providers are low-priced, and may be a good choice when you shall drill many and non-critical wells.68Drill PositionEIA: enviromental impact analysis shows where not to drill.

Place your mouse where to drill

Before you choose where to drill you should buy an Environmental Impact Assessment (EIA) survey to get more knowledge about the area. This appears in the drilling guide.

The benefit of an EIA survey is that you will be prepared for any environmental challenges you might encounter when drilling. With an EIA survey you will have lesser probability for drilling problems, and the extra costs will be less.

Also, in the EIA survey you can see which drilling locations you might want to avoid where possible, this can be because of strong currents, adverse conditions on the seabed or other local conditions.

When you drill in those locations your costs go up 20%. You can see these locations in the EIA survey.

You only have to buy one EIA survey for each license that you operate. 69Penalties & FinesCertain problems can occur if Service Provider Selection is poor qualityOther penalties can occur if you drill in areas indicated as problematic in the Environmental Impact AssessmentAs in real life, problems can occur randomly and these are also applied with fines levied accordingly.70Service Providers are as good and bad as any providers in the real world. You may end up paying a higher bill, than originally anticipated.

You must watch out for red cells in the EIA, as you will be fined if you drill into protected cells.Drilling Position

Layer 1 CretaceousLayer 2 PaleoceneLayer 3 EoceneAs this figure illustrates, you can drill through all three horizons in one well.

You can even drill a deviated well, so that the position is not exactly the same in all horizons.

The deviation can be 1 cell for each horizon.

When we get to the drilling phase and we get to drill exploration wells, the wells can go through all three horizons.

If you choose to drill to the bottom most horizon, whatever is in the horizons above will be discovered as well.

Only one in five prospects actually contain oil or gas, so you will encounter a lot of dry prospects.

Thus, it makes sense to look out for prospects that are on top of each other in the 2D seismic surveys, as this increases your chances in finding something.

71Drilling Days

To determine how long it will probably take to complete drilling, check out the drilling Information tab.

The water depth is the distance from the water line to the seabed.

Layer 3 is approximately 1500 meters below the seabed, layer 2 is 1000 meters further down, and layer 1 is 3500 meters below seabed.

72Estimated cost

Earn extra CPs by calculating the estimated drilling cost Oil Spill control/Gas Blow outInputting estimated cost of drilling gives you credibility points, since you are keeping an eye on your accounts. You need to add all the costs of the rig and the service providers together and multiply this by the number of days you think it will take you to drill.

The oil spill control is voluntary but costs 5% of the drilling amount per day but will earn you more knowledge points and cost you less to clear an oil spill if it happens.

73Drilling Result

Drilling is instantaneous in OilSim and this is an example of how the drilling results might look like:

In this particular case the well was drilled through all three layers (horizons).

Gas was found in the deepest layers, while no prospect was found in the topmost and middle layers.The area of the gas find is estimated to be between 1 and 9.4 square kilometers.The thickness of the field is estimated to be between 103 and 290 meters.The quality on a scale from 0 to 10 is estimated to be between 1.8 and 6.1.These three variables area, thickness, and quality together give a volume range of between 8 million and 674 million barrels of oil equivalent, MBOE.The 674 MBOE is what is possible with 10% probability, while the 8 MBOE is what is PROVEN.It is only the proven volume of 8 MBOE that we can use in the calculations of economic viability.

74

Drilling ResultProven volume (MBOE) countsTest may increase proven volumeRemember to tick the boxes!

Drilling is instantaneous in OilSim and this is an example of how the drilling results might look like:

In this particular case the well was drilled through all three layers (horizons).

Gas was found in the deepest layers, while no prospect was found in the topmost and middle layers.The area of the gas find is estimated to be between 1 and 9.4 square kilometers.The thickness of the field is estimated to be between 103 and 290 meters.The quality on a scale from 0 to 10 is estimated to be between 1.8 and 6.1.These three variables area, thickness, and quality together give a volume range of between 8 million and 674 million barrels of oil equivalent, MBOE.The 674 MBOE is what is possible with 10% probability, while the 8 MBOE is what is PROVEN.It is only the proven volume of 8 MBOE that we can use in the calculations of economic viability.

75TestingOnly if you discover a field find Oil or GasYou decide whether you want more information about that fieldMore information by doing a production test (and other tests)Tests costs: Tests take 10 days per field. Tests have the same day-rate as the drilling if you use the same providers.When you have discovered a field the first decision you need to make is whether you want more information about that field right away and BEFORE you drill another exploration well.

You can get more information by doing a production test, which is a process in which you try to produce oil or gas from the field.

In OilSim production tests take 10 days per oil and gas field and you use the same providers as before.76Discovered prospects

77Assumptions

78Value calcuation

25% of 8 MBOE @ $5012% $39.9MExpected costs ifyou developed thefield (capex) andproducedthe oil (opex)If total expenses arehigher than the salesvalue, the value of thelicense is zeroAppraisalFrom Probable volume to proven reserves

However, if you can get the proven volume up, the block might become economically viable.

This is done through

production testing, and appraisal wells

When you have drilled the first well, you only have a small sample of the new-found oil or gas field. This is evident by the wide ranges of the area, thickness, quality, and volume variables. These wide ranges tell you that you actually do not know much about the field.

After drilling and testing, your next step therefore is to drill another well and test it. This is called an appraisal well.

Normally it takes at least three or four wells into a field before the license block becomes economically viable.

Sometimes it takes much more, and therefore you should not give up if the first wells into a field do not give any license value.

However, you should give up if the upper boundaries of the field become so low that there is no chance that it becomes economically viable. This is often the case in deep-water blocks, where the CAPEX are very high.

80Value and ROI

81Narrowing rangesExploration well:0 to 1572 MBOE (after drilling)11 to 1266 MBOE (after testing)First appraisal well:25 to 1033 MBOE (after drilling)34 to 910 MBOE (after testing)Second appraisal well:65 to 850 MBOE (after drilling)101 to 752 MBOE (after testing)Only proven MBOE counts82Here you can see an example of how the volume range narrows for each test and each wellCash and Value

Cash : Initial $200million investment

Funds from partnerships

Funds from the bank

Value:Valuation of licences (operators and partners) based on oil and gas found less expected costs if these licences were to be developedApply For More FundsClick on Apply for More Funds Tab. 1 CP for each $100,000 applied for.Answer the questions: All correct gives cash and you can keep CPs. One wrong gives cash and you keep of your CPs. Two wrong gives cash and you lose all CPs. All wrong, you get no cash and lose all CPs.Expensive money if less than 10 credibility points: Apply for cash and be fined $5million for each $20million requested.

84If you run out of cash, you can apply for more money from the headquarters. This is done through Apply for more funds on the menu to the left.Continue...Narrow uncertainty: Drill appraisal wells to get proven volumesDrill into other prospects to find more proven volumes.Farm-in and -out: Get into other good blocks.Two additional licensing rounds: Repeat the processes.Money: Apply for more money, if you run out of cash.85When you have drilled and tested a couple of wells to narrow the uncertainties in the first field(s), you can start drilling into other prospects in your license block to see if they might make the block economically viable.

You should follow what happens in the blocks you have farmed into, as well as keep an eye on new opportunities to invest.

You will have the chance to get new and maybe better license blocks in the additional licensing round(s).

If you run out of cash, you can apply for more money from the headquarters. This is done through Apply for more funds on the menu to the left.

The winner is the team that has the highest ROI (return on investment) when the simulation stops.