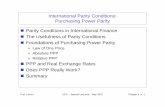

Parity in professional sports when revenues are maximized

Transcript of Parity in professional sports when revenues are maximized

Economic Modelling 40 (2014) 12–20

Contents lists available at ScienceDirect

Economic Modelling

j ourna l homepage: www.e lsev ie r .com/ locate /ecmod

Parity in professional sports when revenues are maximized☆

Burhan BinerDePaul University, Department of Economics, 1 East Jackson Boulevard, Suite 6200, Chicago, IL 60604, United States

☆ I would like to thank Ryan Rebholz of Pro Football Hallcrucial TV data.

E-mail address: [email protected].

http://dx.doi.org/10.1016/j.econmod.2014.03.0020264-9993/© 2014 Elsevier B.V. All rights reserved.

a b s t r a c t

a r t i c l e i n f oArticle history:Accepted 4 March 2014Available online xxxx

JEL classification:C13C23C34L52L83

Keywords:Dominant teamCartelsCensored regressionHeckman selection modelRandom coefficients model

There are two major hypotheses regarding the talent distribution among the teams that would maximize thetotal revenues in a sports league; dominant teams versus parity. This paper examines the revenue structure ofNational Football League and proposes policy recommendations regarding talent distribution among theteams. By using a unique, rich data set on game day stadium attendance and TV ratings we are able to measurethe total demand as a function of involved teams' talent levels. Reduced form regression results indicate that TVviewers are more interested in close games, on the other hand stadium attendees are more interested in hometeam's dominance, in other words stadium demand and TV demand work against each other. We thereforepropose a policy that promotes slight parity among the teams where big market teams have a slight advantageover the others. Total revenues of the league are maximized under such policy.

© 2014 Elsevier B.V. All rights reserved.

1. Introduction

Professional sports leagues in North America are good examples ofcartels. Most of them have some sort of exemption status from thelaws of commerce that the rest of the economy has to abide by. Theyhave a league governing body formed by the owners and players thatplan and take care of the problems of the league. The league generatesrevenue through games and the revenue is shared between teamowners and players. They aremostly free to adopt policies on governingthe league as theywish. The league primarily wants to increase the totalrevenuemade throughout the league in order to increase the salaries forplayers and profits for team owners. There are various actions availableto the league including imposing a salary cap or revenue sharing.

There are two major hypotheses regarding how leagues use relativestrength of teams to increase total revenues, player salaries and fan util-ity. The first is to follow the dominant team rule. Pick a few teams thathave a revenue making advantage over the others and make sure thatthey have a stronger team ensuring that their fans will generate higherrevenue. Major League Baseball, to some extent follows this, New YorkYankees, Boston Red Sox, New York Mets and Chicago Cubs have clearadvantage in revenue generation over other teams since they are inbigger cities. The second hypothesis is to distribute talent among the

of Fame for helpingme find the

teams “evenly”, ensuring a high level of competition and therebyattracting higher demand for the game.

In this paper we are going to empirically assess the superiority ofthese two hypotheses over each other for the National Football League.

Among all professional sports leagues theNational Football League isby far the most lucrative sports league. In 2007, the NFL's annual reve-nues exceeded $7 billion. In 2010, the NFL's TV deals were $4 billion.In contrast, Major League Baseball generated revenues of just over$6 billion. Basketball and hockey lag far behind. The National BasketballAssociations annual revenues stand at $3.3 billion. Bringing up the rearamong the Big Four team sports leagues, the National Hockey League'srevenues reach $2 billion annually. There are clearly certain thingsgoing right with the NFL. Popularity of the game has been increasingevery passing year along with its revenue making potential. Clearlytheir policies are working for the league. They have been employing asalary cap rule alongwith revenue sharing due to a collective bargainingwith the NFL Players Association since 1994. However, starting in 2010some of the policies in the league has changed. The league started tobring back the freemarket rules to change the outlook in the game. Pro-ponents of this idea claim that with free market rules, talent should beable to receive their worth even though there are opponents claimingthat it may actually work the opposite.

This paper argues that in the NFL, TV audience in general likes towatch somewhat close games while fans attending the games like tosee their teams dominate the other team.On average 66–70% of a team'srevenue comes from national media deals. Since most of the revenue

1 Players have a union and one of the objectives of the union is tomake sure every play-er is employed. Teams have to have number of players in their rosters to make sure thatthey can field a team for every game during the season. Every player that's in the pool atthe beginning of the season will be allocated to a team.

13B. Biner / Economic Modelling 40 (2014) 12–20

comes from themedia it's best to have a policy that advocates parity, yetfavoring big market teams slightly more.

There is a rich literature in sports economics. In the first mathemat-ical model of a professional sports league, El-Hodiri and Quirk,(1971),examine whether the current organization of professional team sportswill lead to equalization of playing strengths. They develop a dynamicmodel involving thewages, revenues, trades, draft, skill level, and prob-ability of winning a game. Profitmaximization is not consistentwith theequalization of playing strengths unless all teams are affected equally bya change in strength of one team in terms of gate receipts, or if the hometeam receives at least half of the gate receipts and all teams have thesame revenue function. Additionally, to ensure equalization, theremust be a constant supply of new playing skill and no cash sales.Equal strengths will converge regardless of the initial allocation oftalent. Fewer teams and a quicker depreciation of talent will speed upthe convergence process.

Biner (2013) argues that if one team acquires too much talent thenthat may impact the quality of the competition negatively and then de-velops a simple theoreticalmodel to capture the effect of this externalityon the revenue levels and wages when local fans care about winningonly. He finds that due to externalities competitive market allocationis too equal compared to SPP allocation. He then shows that whenlocal audience ismainly interested in seeing their local teamdominatingthe visiting team and national audience only interested in watching aclose game on TV, the only way in the model for it ever to be efficientto enforce parity is if we introduce a national TVmarket into the analy-sis. For the national TV market, parity is going to lead to a wider TVaudience. The greater theweight on this revenue stream, themore like-ly it is a parity policy can increase league revenues.

Empirical papers in Sports Economics are mostly done with very lim-ited data. This is usually due to a lack of useful team level game day data.Most of the empirical analysis is done for aggregate level data instead andusually done for a few years. The biggest problem is we don't have indi-vidual level data on consumers. The big elephant in the room is unob-served heterogeneity that's hard to touch due to lack of data at theindividual level. Specifically it's hard to measure the “fanness” of con-sumers. In European sports leagues, people are more attached to theirteams, in some cases cult like cultures exist. This is not really the case intheUS.However,we still see that type of behavior for certain teams. DetroitLions have been a losing team for quite some time, yet they have beenplaying to almost full stadium for most of their games. Whether this isdue to fans' connection to their teamsor someother reason is hard to guess.

Welki and Zlatoper (1994, 1999) analyzes the game day stadiumattendance inNFL for 1991 season. In their paper they analyze the atten-dance in terms of ticket price, home team record, visiting team record,income level of home team population, temperature and some otherdummy variables. Their Tobit analysis finds a clear bias for home teamrecord which supports our hypothesis for game day attendance. How-ever, their data is only for one season which raises doubts about thevalidity of the results. In their (1999) paper they analyze the gamesfor 1986 and 1987 seasons. In that paper they use betting lines to mea-sure how close a game is expected to be by the general audience. Theyfind that fans do care about closeness of games and quality of theplaying teams, especially home team.

Carney and Fenn (2004), on the other hand analyzes the TV ratingsfor NFL games in 2000 and 2001 seasons. In their analysis they findthat closeness of the games matter by using winning records of oppos-ing teams. Their results suggest evidence of race of coach, team success,and closeness of the contest as significant determinants of TV viewer-ship. However their analysis relies on local TV ratings which is a rela-tively minor consideration for the general discussion since most of therevenue comes from national media deals.

There is no research done on NFL for the entire revenue scheme. Ouranalysis is done for both TV ratings and stadium attendance making itpossible for us to come up with a better policy analysis. That's themain contribution of our paper to the literature along with optimal

talent level recommendations that generates the maximum demandfor the league. The TV rating data we use is at national level and gameday attendance data is a very rich panel data that spans 14 years.

The rest of the paper proceeds as follows. Section 2 introduces thetheoretical model. Section 3 describes the data used in the paper. InSection 4, we use reduced form regressions and random coefficientmodels for both sets of data to estimate demand and discuss the results.Section 5 concludes.

2. Model

This section first presents a simple theoretical model for sports de-mand both in terms of stadium attendance and TV ratings. The modelwe describewill be the actual demand equationwewill use to estimate.

In general the audience cares about a game's potential characteris-tics such as how close the gamewill be, likelihood of their teamwinningthe game, theweek the game is played and other factors.We can repre-sent the first two characteristics in terms of the talent levels of theteams. Let t1 be the home team's talent level and t2 be the visiting team'stalent level. Probability of home team winning has to be positively cor-relatedwith home team's talent level.Without loss of generality assumethat

Win1;2 ¼ t1t1 þ t2

� �αð1Þ

where 0 bα b 1. This assures us that probability ofwinning is an increas-ing and concave function of t1. Probability of winning for the visitingteam is defined similarly.

Closeness of the game has to be correlated with the talent differenceof the teams. Without loss of generality assume that

Close1;2 ¼ eβ t1−t2j j ð2Þ

where −1 ≤ β b 0.The TV ratings for a particular game will be the product of winning

probability and closeness. Similarly, stadium attendance will be a prod-uct of winning probability and closeness. Here, α is the elasticity ofdemand with respect to winning probability, and β is the elasticity ofdemand with respect to closeness.

We assume that there are two types of cities, big cities and small cit-ies. In an environment like this it's normal to assume that team types arealso correlated with the city types. Teams in big cities should be able tobring more demand and more revenue. Therefore we are going to as-sume that big city teams will have t1 talent and small city teams havet2 talent. This model is equivalent to the model where there is one bigcity team and one small city team facing each other certain percentagesof times in each other's stadium. Without loss of generality we canassume that they face each other ω1 times at the big city team's turf,and ω2 times at the small city team's turf. We can assume that ω1 +ω2 = 1, moreover we will normalize the total talent to 1, t1 + t2 = 1.Even though total talent used by the league can be less than 1 we willassume that it will be binding. In other words, everyone in the talentpool will be employed.1 Let the size of the big city be n1 and the sizeof the small city be n2.

Under these assumptions total demand for stadium attendance willbe the sum of demand from small cities and large cities:

Att ¼ n1ω1t1

t1 þ t2

� �α1 t2t1 þ t2

� �α2

eβ1 t1−t2j j þ n2ω2t1

t1 þ t2

� �α3 t2t1 þ t2

� �α4

eβ2 t1−t2j j:

ð3Þ

2 This is especially important for open air stadiums. Bookies follow the game dayweath-er report a few days before the game and put that into their formulas.

14 B. Biner / Economic Modelling 40 (2014) 12–20

We will however estimate the demand for the following generaldemand for stadium attendance

Att ¼ nωt1

t1 þ t2

� �α1 t2t1 þ t2

� �α2

eβ1 t1−t2j j: ð4Þ

We are assuming that elasticities of winning probabilities and close-ness are different for each city. On the other hand TV ratings will be

Rating ¼ n1ω1t1

t1 þ t2

� �α5 t2t1 þ t2

� �α6

eβ3 t1−t2j j þ n2ω2t1

t1 þ t2

� �α7 t2t1 þ t2

� �α8

eβ4 t1−t2j j:

ð5Þ

Sincewe are only looking at national level TVdata, for ratingswe canassume that elasticities of winning and closeness are the same through-out the league. We have no way of seeing which city watched whichgame in the data. Total demand for the game will be the sum of Attand Rating.

Under these assumptions we expect that the optimal talent alloca-tion among teams should be done in a more equal way as in Biner(2013).

3. Data

The first part of this section discusses data sources on TV data andprovides some description. The second part does the same for atten-dance data. Third section presents descriptive evidence that shedslight on the plausibility of our thesis.

3.1. TV data

Since almost 70% of operating income of every team under thecurrent revenue sharing rule comes from media deals, it's only fittingto first analyze TV ratings. Our TV rating data comes from Football Hallof Fame archives in Akron, Ohio. Data spans nationally televisedgames for 1972–1978 and 1981 and 1983. Data includes preseasongames, regular games and playoff games. Almost all of the preseasongames have ratings available, however there are no betting lines quotedfor them. Not all of the regular games have been nationally televised.Monday night, Thursday, Friday and Saturday games are usually nation-ally televised. On Sundays, usually one or two games are picked andtelevised by national stations. Even though there are 1943 games inthis period we have only 491 games with ratings.

In order to analyze the effect of close games on TV ratings we havecollected Las Vegas Betting line data for the corresponding gamesusing Washington Post archives. Sports books have been part of LasVegas gambling revenues for a very long time, accounting for a bitmore than 1% of the total. In the old days betting lines were usuallyfound by bookies who were collecting as much data as possible aboutthe games and the market and determining the risk averse lines. Lately,betting lines are becoming quite sophisticated just like in Wall Streetwith electronic betting and derivatives for hedging risk. Lines are quot-ed as one single number representing which team is favored by howmany points. It represents public's perception of an upcoming game.It's a good candidate for measuring how close a gamewill be if it's mea-sured around zero. If betting line between Vikings playing at Green Bayis reported as−5, this means that Green Bay is favored by 5 points. Themore negative the betting lines are, themore the home team is favored.If betting lines are quoted as positive that means visiting team is fa-vored. Clearly a betting line close to zero means that game is perceivedto be tight. Bookies who publish betting lines usually have their ownformulas. In order to do a consistent estimation, it's important to findconsistent betting lines. This is especially important since we usebetting lines for different periods, 1970's and 1994–2007 period. Ourcomparison shows that they are following the same line. Bookies in gen-eral use win ratios, streaks of teams involved in the upcoming game in

their formulas. Correlation between visiting teamwin ratio and bettinglines for the TV data is about 0.47; correlation between home teamwinratio and betting lines is about−0.46which is a clear indication of theirformula effecting the betting lines. Correlations with the win–lossstreaks are 0.38 and −0.38 respectively. They also use game specificinformation such as the place of the game, weather conditions duringthe game2 and team specific information such as injuries. We will de-note these information as Σ. Therefore, betting line between team iand team j at time t can theoretically be formulated as

Betijt ¼ E Pointi;t−Point j;t jWinrati;t−1;Winrat j;t−1; Streaki;t−1; Streakj;t−1;Σh i

:

ð6Þ

Here Pointi,t and Pointj,t are the number of points team i and team jwill score at the game respectively.

A single national rating point represents 1% of the total number oftelevision households. Since they are normalized with respect to thenumber of households with TV for that year it's a good measure forthe TV demand for the game. There is quite a bit variation in the ratingdata to explain. The lowest ratingwe have was recorded on a game thatcoincided with a World series game. The highest was recorded on aSuper Bowl game. Standard error for playoff games is about 7.6;standard error for regular games is 3.8. Viswinper and Homwinper arewinning percentages of visiting and home teams prior to every gamerespectively. Betting lines only measure how close a game is expectedto be, in other words they measure the relative perceived strength ofthe opposing teams; they do not measure individual qualities of theteams. We use winning percentages for this purpose. Win–loss streaksof opposing teams going into each game measure the order of wins.The order of wins is clearly important for our analysis as well sincewin percentages are not a good measure of how teams are doinggoing into a specific game. After four games, if a team has two winsand two losses clearly when those games are won make a difference.If they won the last two games, they go into next games on a winningspree and usually audience respond positively to that. If they win onan alternating schedule then the effect of the last win is not as much.Homebase measures the possible population who would be interestedin watching home team's game; visbase is similarly defined. It's calcu-lated by using team's division city populations. The rest of the variablesare dummyvariables describing the game day.Worldseries correspondsto the games coincidingwith theMLB playoff games, Doubleheader cor-responds to games that are televised consecutively on the same day. Onthe other hand, weekcount measures the week the game is played, asthe season progresses we see increased attention towards the game.Since betting lines show winning bias, we also include the absolutevalue of the betting lines, we only care how close a game is perceivedto be not who is likely to win, absline measures this. By using absolutevalue of betting lines we introduce nonlinearity into our estimation,however at the same time we lose the directional information that bet-ting lines bring into the table.

Summary description of the data is given in Table 1 in the appendix.However, Tables 2–5 show us a much better picture. We can see thatwhen absolute value of betting lines is smaller, ratings on average 1.2are higher, specifically when absolute value of betting lines is less than5 the mean rating is 20.072 compared to 18.855 when absolute valueof betting lines is higher than 5. We see the same picture consistentlyfor regular and playoff games separately as well. We give a muchdetailed analysis of this data in Section 3.3.

Table 1Summary statistics for TV ratings.

Class Variable Definition Mean Std. dev. Min. Max. N

Measure Rating TV ratings 18.273 6.44 5.9 49.1 491Share Share of the ratings 37.35 11.454 11 78 491

Closeness Lines Betting lines −2.102 7.704 −43 20 1843Absline Absolute value of betting lines 5.732 3.709 0 43 1843

Quality Viswinper Visiting team win percentage before game 0.608 0.246 0 1 414Homwinper Home team win percentage before game 0.627 0.247 0 1 414Visstreak Visiting team's win–loss streak before the game 1.072 2.821 −13 15 414Homestreak Home team's win–loss streak before the game 1.056 3.044 −14 16 414

Game day 1 PM 1 if game started at 1 PM ET 0.025 0.156 0 1 19344 PM 1 if game started at 4 PM ET 0.117 0.321 0 1 1934Evening 1 if game is played on an evening 0.108 0.311 0 1 1934Friday 1 if game is played on Friday 0.008 0.088 0 1 1934Thursday 1 if game is played on Thursday 0.016 0.126 0 1 1934Thanksgiving 1 if game is played on Thanksgiving 0.009 0.096 0 1 1934Saturday 1 if game is played on Saturday 0.046 0.21 0 1 1934Doubleheader 1 if game is a doubleheader 0.142 0.349 0 1 1934Worldseries 1 if game day coincides with World series 0.011 0.104 0 1 1934Monday 1 if game is played on Monday 0.069 0.253 0 1 1934Playoff 1 if it's a playoff game 0.036 0.186 0 1 1934Superbowl 1 if it's a superbowl game 0.005 0.068 0 1 1934Preseason 1 if it's a preseason game 0.038 0.191 0 1 1934Weekcount Week the game played 8.199 4.528 1 20 1861

Population Visbase Population of visiting team's division MSAs (millions) 3.415 0.642 2.11 5 1934Homebase Population of home team's division MSAs (millions) 3.409 0.645 2.11 5 1934Totbase Sum of visbase and homebase 6.824 1.037 4.3 9.810 1934

15B. Biner / Economic Modelling 40 (2014) 12–20

3.2. Stadium data

This section presents descriptive evidence that sheds light onthe plausibility of our thesis on stadium attendance. Our stadiumdata covers the games between 1994 and 2007. We collected atten-dance data for every regular game using various web sites. We thencollected betting lines corresponding to these games fromMrnfl.com. Mrnfl.com reports the betting lines published on Wash-ington Post, therefore it matches the betting lines we used for TVratings.

Some of the variables here are same as what we used for TV rat-ings. We include stadium size, stadium cost adjusted for 1938 prices,stadium age, attendance normalized by stadium size, MetropolitanStatistical Area (MSA) population, MSA income per capita, differencebetween attendance and stadium size, and average season price ad-justed for 1994 prices. Unfortunately at the panel level some ofthese variables are useless. Price is seasonal therefore has no effecton game by game estimation, stcost on the other hand is constantand in the usual reduced regression it has negative coefficient. Difmeasures the difference between attendance and stadium size, anddifrat is the normalized difference ratio. We have to use difrat forcensored regression model. Stadium size here is not a hard upperbound for attendance. Most of the time it's a binding constraint butin some cases some teams can add a few more seats to their stadi-ums. This is especially true for warm climate teams such as TampaBay. Nevertheless, the stadium sizes listed on team web sites aremostly observed; there are only 382 cases out of 3448 games thatsomehow teamsmanaged to post attendance higher than their stadi-um size.

Table 2Summary statistics of main variables of all games for TV ratings.

Variable Absline b 5 Absline ≥ 5

Mean Std. dev. N Mean Std. dev N

Rating 20.072 6.891 198 18.855 5.532 216Homwinper 0.659 0.231 198 0.562 0.25 216Viswinper 0.627 0.226 198 0.627 0.265 216Visstreak 1.672 2.871 198 0.523 2.666 216Homestreak 1.071 2.725 198 1.042 3.315 216

Summary of the data is given in Table 7 in the appendix. However,Table 8 shows us a much better picture. We can see that when bettinglines are smaller, stadium attendance ratio is quite high. If bettinglines are less than −13 then on average 95% of the stadium is filled.The lower the betting lines the more home team is favored over thevisiting team. When betting lines are less than −5, attendance ratio isabout 94.5%, but when betting lines are between −5 and 5 we seethat this rate goes down to 91%. When betting lines are higher than 5,meaning visiting team is considered to be significantly favored overthe home team we see that this rate slump to 89.8%. Difference maynot look too much but considering that most of the tickets are soldeven before the start of the season this definitely amounts to a bigdecrease. Unfortunately our data includes some white noise for theseseason ticket holders. We give a much detailed analysis of this data inSection 3.3.

3.3. Some descriptive results

This section provides some evidence on the possibility of our thesisthat TV watchers like to see close games and stadium attendees like tosee their team winning.

In Table 2, we look at all of the games broadcasted on TV in terms ofcloseness. We divide the games by absolute value of betting lines. Wecall games that have absolute value of betting lines less than 5 as closegames and the rest as not close games. We see that the average ratingfor close games is 20.072 and average rating for not close games is18.855. The difference of the means is statistically significant as the dif-ference of themeans statistic is equal to 1.9889829which is higher thant412, 0.975 = 1.9657386. In other words, we reject the hypothesis that

Table 3Summary statistics of main variables of regular games for TV ratings.

Absline b 5 Absline ≥ 5

Variable Mean Std. dev. N Mean Std. dev N

Rating 18.011 3.727 166 17.207 3.88 179Homwinper 0.641 0.245 166 0.539 0.266 179Viswinper 0.598 0.231 166 0.589 0.274 179Visstreak 1.247 2.5 166 0.156 2.585 179Homestreak 0.572 2.127 166 0.564 3.081 179

Table 4Summary statistics of main variables of playoff games for TV ratings.

Absline b 5 Absline ≥ 5

Variable Mean Std. dev. N Mean Std. dev N

Rating 30.763 9.335 32 26.827 5.434 37Homwinper 0.751 0.096 32 0.671 0.081 37Viswinperc 0.779 0.104 32 0.808 0.085 37Visstreak 3.875 3.626 32 2.297 2.344 37Homestreak 3.656 3.857 32 3.351 3.474 37

Table 6Summary statistics of main variables when |homwinper–viswinper| ≥0.2 for TV ratings.

Variable Mean Std. dev. Min. Max. N

Rating 17.419 4.485 5.9 32.7 197Absline 7.102 4.263 0 20 197Visstreak 0.513 2.666 −8 10 197Homestreak 0.523 3.189 −12 14 197

16 B. Biner / Economic Modelling 40 (2014) 12–20

themeans of the groups are equal at the 5% significance level. Moreover,we accept the hypothesis that mean of close games are higher than themean of not close games at the 3% significance level.

On the other handwe see from Table 3 that the mean rating for reg-ular close games is 18.011 and not close games is 17.207. Difference isagain statistically significant and higher for close games. For playoffgames we see that the difference becomes much more significant.Table 4 shows that for close playoff games mean rating is 30.763 andfor not close playoff games it is 26.827. Difference is again very muchstatistically significant.

Tables 5 and 6 show the ratings when the absolute value of differ-ence between winning percentages of home teams and visiting teamsis less than 0.2 and higher than 0.2. This difference can also be used asa proxy to measure perceived closeness of a game. We again see thatthe difference in mean ratings is very significant and people wouldlike to watch close games based on this measure as well.

All this is a pretty good indication that people would like to watchclose games more rather than the blowout games on TV. We will useabsolute value of betting lines to estimate this effect.

For fans who go andwatch the game in the stadium, we see a differ-ent pattern. Table 8 summarizes the main variables when the hometeam is favored, for close games and for games when the visiting teamis favored. When betting lines are less than −5 meaning that hometeam is heavily favored average attendance ratio is almost 95%. Whenbetting lines are between −5 and 5 meaning that they are perceivedto be close games we see that average attendance ratio falls to about91%. When visiting team is favored the average attendance ratio fallsto about 90%. The difference in the means is again statistically signifi-cant. We accept the hypothesis that fans would like to see their teamwin easily at the 5% significance level.

We will again use win percentages for home teams and visitingteams for this purpose. However these percentages, especially hometeam's winning percentage will serve us the purpose of identifyingwhich team fans would like it to win. In other words, if the coefficientof home team's winning percentage comes up high means that fanswould like their team to win rather than the opposing team.

4. Estimation

This section estimates the demand using various methods. The firstsubsection considers the TV demand. The next subsection estimatesthe stadium attendance.

Table 5Summary statistics of main variables when |homwinper–viswinper| b0.2 for TV ratings.

Variable Mean Std. dev. Min. Max. N

Rating 21.269 7.01 6.4 49.1 217Absline 4.488 2.558 0 14 217Visstreak 1.581 2.868 −4 15 217Homestreak 1.539 2.827 −5 16 217

4.1. TV demand

The most important aspect of our TV Data is that we observe thatgames expected to be close bring higher ratings. Our hypothesis isthat TV audience has a somewhat different utility function than the typ-ical fan. Our main purpose is to measure the fans' preferences for thegame, especially fans who watch the game on TV. Currently, most ofthe revenue comes from media deals. Hence, it's important for us togauge TV demand. The time period in where the TV demand is mea-sured does not make any difference, we are only interested in howcloseness of a game effects the TV demand and we are able to measurethat robustly using older data. In terms of the model we introduced,elasticity of winning probability for TV audience is very close to zero.Instead of going through the hassles of driving, waiting for the queues,bathrooms, parking, and dealing with the rowdy fans they'd like to sitat the comfort of their house and watch a nice game. An average gamewatcher on TV ismostly interested in games that are competitive ratherthan his team definitely winning. Let (t1,t2) be the talent level of both ofthe teams. Utility function of TV audience has to be a decreasing func-tion of |t1− t2|, increasing function of win records of both teams. Utilitymaximization of TV audience problem gives us a plausible demandfunction. It simply leads to the following assumption for TV ratings:We assume that the TV ratings are a production of betting lines, hometeam'swin percentage, visiting team'swin percentage and othermarketand game specific variables. This is along the lines of the model weintroduced in Section 2.

We use various estimation methods to estimate the problem. Inorder to account for the negative values that win–loss streaks andbetting lines take we will use the following log-linear modeling:

Ratingijt ¼ A � eα�abslineijt � eβ�homwinpert � eγ�viswinpert � eΩ ð7Þ

where Ω = {homestreak, visstreak, homebase, visbase, totbase,dummyvariables}, i denotes the home team, and j denotes visitingteam. We do expect the coefficient for absline to be negative and coeffi-cients ofwin percentages of both teams to be positive of closemagnitudewhen we log-linearize the production function for ratings. In the log-linear model ln(y) = β1 + β2x, one-unit increase in x leads to 100 ×β2% change in y.

Here we use win percentages of home team and visiting team toproxy for talent level of corresponding teams in Eq. (5). We will dothis for Eq. (3) as well. We can model the win percentage of a teamgoing into a game as

w ið Þ ¼ f ti; t−i; ξið Þ

where t−i is the talent level of other teams and ξi is just general errorterm. Note, that it is impossible to identify individual team talent levelsfrom betting lines since we have one equation and two variables butmore importantly betting lines carry some additional informationother than just talent difference. We can in general assume that f is anincreasing function of ti and decreasing function of t−i. Keeping t−i

fixed we can assume that ti can be approximated by f−1(w(i)). Inother words,

ti ≈ f−1 w ið Þð Þ þ ψi:

Table 7Summary statistics for game day attendance.

Class Variable Definition Mean Std. dev. Min. Max. N

Measure Line Betting lines −2.55 5.874 −24 20 3448Att Attendance 64520.151 10313.258 15131 90910 3433Viswinrat Visiting team win ratio before the game 0.502 0.262 0 1 3448Homwinrat Home team win ratio before the game 0.499 0.262 0 1 3448Attratio Attendance normalized by stadium size 0.92 0.123 0.242 1.235 3433Difrat Attendance difference normalized by stadium size −0.08 0.123 −0.758 0.235 3433Dif Difference between attendance and stadium size −5701.219 8804.909 −57010 14856 3433Visteamstreak Visiting team win–loss streak before the game 0.158 2.61 −12 15 3448Homteamstreak Home team win–loss streak before the game −0.125 2.656 −14 14 3448Absline Absolute value of betting lines 5.406 3.431 0 24 3448

Game day Week Week the game played 9.144 4.968 1 17 3448Weekdate Week day the game played 6.494 1.554 1 7 3448Yearweek Year of the game 2000.668 3.994 1994 2007 3448Monday 1 if game is played on Monday 0.068 0.252 0 1 3448Thursday 1 if game is played on Thursday 0.019 0.135 0 1 3448Friday 1 if game is played on Friday 0.009 0.093 0 1 3448Saturday 1 if game is played on Saturday 0.026 0.159 0 1 3448Sunday 1 if game is played on Sunday 0.879 0.326 0 1 3448

Stadium Stdsize Stadium size 70210.216 6969.578 41203 91665 3448Demographics Population Population of home team MSA 4155653.971 4132625.006 260000 18959938 3448

Income Income level of home team MSA 28241.209 4440.646 20645 43841.078 3448

17B. Biner / Economic Modelling 40 (2014) 12–20

We could have used just winning percentages for talent differencesas well but the winning percentages we have here are much cruder es-timates of talent and it doesn't take into account any game day specificinformation unlike betting lines. Betting lines carry farmore superior in-formationwhen it comes to talent differences. So it makes perfect senseto use betting lines for talent difference part of the Eq. (5) and winpercentages to use for the individual talent part of the Eq. (5).

Essentially what we are doing here is that we are using absolutevalue of betting lines as a proxy to estimate |t1 − t2|, in other wordsabsline = λ|t1 − t2|. We are using home team's win percentages toestimate t1 and visiting team's win percentages to estimate t2, Wini =γti. In other words, we are looking at the following regression equation

Rating ¼ αjt1−t2j þ β1t1 þ β2t2 þ ϵ:

This equation is identified since we have 3 variables to estimate 3parameters and it doesn't suffer from collinearity problem. We arelooking at a select number of games, as a result win ratios we areusing don't always add up to a constant number.

One of the problems with the estimation of TV ratings is that ourdata has sample selection issues. Scheduling of most of the games isdone before the season starts. Monday night games are scheduled thisway just as Thanksgiving day games at Detroit and Dallas. RegularSunday games and some Saturday games on the other hand are selectedby the broadcast company a week prior to the game. They tend to pickcompetitive games in general. My data includes playoff games as wellbut they are in general quite competitive and fit the selection criteria.In order to correct for selection we use the Heckman probit model. Se-lection equation is determined by homewinper, viswinper, homestreak,and visstreak. In order to use Heckman selection model we need exclu-sion restriction variables. Betting lines are determined to some extent

Table 8Summary statistics of main variables for Stadium Attendance.

Line b −5 −5 ≥ line ≥ 5

Variable Mean Std. dev. N Mean

Attratio 0.945 0.086 1187 0.909Att 65452.239 8221.093 1187 64216.219Viswinrat 0.487 0.261 1191 0.506Homwinrat 0.604 0.242 1191 0.461Visstreak −0.528 2.648 1191 0.319Homestreak 0.654 2.55 1191 −0.39

using these variables but the correlation is not that much. Especially,correlation between betting lines and win–loss streaks is very low. Weuse the type II Tobit model:

y1 ¼ x1β1 þ u1 ð8Þ

y2 ¼ 1 xδ2þυ2 N0½ �: ð9Þ

The second equation is the selection equation. y2 and x are alwaysobserved, y1 is observed only when y2 = 1. We have observations forhomewinper, viswinper, homestreak, and visstreak on every game. Thefact that win–loss streak can be negative and we look at games whereteams are more likely to be in equal strengths ensures that y2 can be0. For those gameswe don't have any ratings. With further assumptionsthat (u1,v2) is independent of x with zero mean, v2 ~ N(0,1) andE(u1|υ2) = γ1v2 we can estimate this model. A little bit manipulationgives us the following:

E y1jx; y2 ¼ 1ð Þ ¼ x1β1 þ γ1λ xδ2ð Þ ð10Þ

where λ is the inverse Mills ratio. We can estimate this model using theHeckit procedure:

We first obtain the probit estimate δ̂2 from the model

P yi2 ¼ 1jxið Þ ¼ Φ xiδ2ð Þ ð11Þ

using all observations. Then, obtain the estimated inverse Mills ratios

λ̂i2 ¼ λ xiδ̂2� �

. Then, we obtain β̂1 and γ̂1 from OLS regression on the

selected sample, yi1 on xi1, λ̂i2.

Line N 5

Std. dev N Mean Std. dev N

0.136 1897 0.898 0.141 34911324.751 1897 63002.011 10681.993 349

0.261 1905 0.535 0.263 3520.256 1905 0.345 0.23 3522.366 1905 1.608 2.985 3522.558 1905 −1.327 2.802 352

Table 9Reduced regressions on log ratings.

All games Regular games Playoff games

Variable Coefficient (Std. err.) Coefficient (Std. error) Coefficient (Std. error)

Absline −0.067† (0.039) −0.068† (0.038) −0.212 (0.179)Homewinpercentage 2.376⁎⁎ (0.711) 2.602⁎⁎ (0.685) 8.730 (7.356)Visitingwinpercentage 1.771⁎ (0.710) 1.522⁎ (0.694) 16.569⁎⁎ (5.972)1 PM −0.207 (1.187) 0.134 (1.223)4 PM 0.225 (1.073) 0.718 (0.999) 1.400 (0.881)Evening 1.357 (1.204) 0.370 (1.132)Friday −5.832⁎ (2.887) −5.341⁎ (2.705)Thursday 0.489 (1.381) 0.641 (1.367)Thanksgiving 1.933 (1.561) 2.300 (1.552)Saturday −3.654⁎⁎ (0.474) −2.044⁎⁎ (0.607) −4.402⁎⁎ (0.958)Doubleheader 0.066 (1.008) −1.450 (1.117) 4.073 (2.628)Worldseries −4.522⁎⁎ (0.664) −4.450⁎⁎ (0.611)Monday 3.356⁎⁎ (0.927) 3.549⁎⁎ (1.003) 2.957 (2.336)Playoff 8.077⁎⁎ (0.563)Superbowl 15.895⁎⁎ (1.452) 16.069⁎⁎ (3.134)Weekcount 0.232⁎⁎ (0.037) 0.185⁎⁎ (0.036) 1.381⁎⁎ (0.343)Visstreak 0.126⁎ (0.062) 0.092 (0.067) 0.054 (0.164)Homestreak 0.094 (0.060) 0.109 (0.067) −0.189 (0.141)Visbase −0.089 (0.211) −0.093 (0.215) −0.137 (0.686)Homebase 0.517⁎ (0.221) 0.539⁎ (0.228) 0.077 (0.714)Intercept 10.525⁎⁎ (1.778) 11.698⁎⁎ (1.774) −17.003 (10.954)N 414 345 69R2 0.820 0.598 0.865F 89.595 26.956 27.21

† Significant at the 10% level.⁎ Significant at the 5% level.⁎⁎ Significant at the 1% level.

18 B. Biner / Economic Modelling 40 (2014) 12–20

Results of reduced form regressions and Heckman probit selectionmodel are shown in Tables 9–10. Results are corroborating our hypoth-esis. TV audience cares more about how close the games are. Clearly thenegative coefficient on the absolute value of betting lines shows thatpeople care more about close games, it's statistically significant at thelevel of 10%. For every one unit difference in team talent ratings

Table 10Heckman selection model results for TV ratings.

Variable Coefficient (Std. err.)

Dependent variable: ratingAbsline −0.077⁎ (0.036)1 PM −0.688 (1.164)4 PM −0.237 (1.059)Evening 0.689 (1.181)Friday −6.042⁎ (2.749)Thursday 0.628 (1.351)Thanksgiving 1.805 (1.529)Saturday −3.611⁎⁎ (0.468)Doubleheader −0.048 (1.014)Worldseries −4.108⁎⁎ (0.644)Monday 3.452⁎⁎ (0.928)Playoff 8.418⁎⁎ (0.533)Superbowl 15.678⁎⁎ (1.496)Weekcount 0.230⁎⁎ (0.036)Visbase −0.144 (0.206)Homebase 0.499⁎ (0.214)Intercept 17.629⁎⁎ (1.795)

Selection equationHomewinpercentage 0.957⁎⁎ (0.146)Visitingwinpercentage 0.954⁎⁎ (0.150)Visstreak 0.040⁎⁎ (0.014)Homestreak 0.041⁎⁎ (0.014)Intercept −1.825⁎⁎ (0.122)N 1857Log-likelihood −1877.62χ(16)2 1415.189

† Significant at the 10% level.⁎ Significant at the 5% level.⁎⁎ Significant at the 1% level.

decrease by 6.7%. This is a significant effect on the ratings. Home team'swinning percentage is favored a little more than the visiting teamwin-ning percentage. Even when corrected for selection we see that close-ness of the games is significantly important.

Linear regression unfortunately gives us only a general idea abouthow the audience is reacting to games on TV. It averages out quite abit of information and doesn't use any possible nonlinearity the datahas. Graph of the data shows that ratings are very nonlinear in termsof betting lines, win percentages. In order to account for nonlinearityin the model we use one other specifications to model the TV demand.The other specification for TV ratings as a function of explanatory vari-ables we use is

LogRatingijt ¼ α þ β � abslineγijt þ τhomwinperηijt þ ψviswinperκijt þ…:

ð12Þ

The other variables are in linear form. Nonlinear estimation of thisspecification is reported in Table 11. Even when accounted for nonline-arity we see that absline has negative coefficient albeit it's statisticalsignificance is not much. The power of absline, γ, comes out 1.655.This supports the linear regression model we estimated earlier. Thecoefficients and powers ofwin ratios are quite significant and again sup-port our results from linear regression.

Throughout all thesemodels one other common result we see is thatpopulation base of a team is also very important. In other words teamsthat play in big cities or big markets tend to draw more audience to TV,this is of course expected but as a possible policy we can see that bigmarket teams should have better teams in order to maximize the reve-nues. This is especially true for home teams that have a large audience.It's better to televise games that are played on a big city team turf.

4.2. Stadium attendance demand

For the stadium case we are going to report linear fixed effect esti-mation results along with random effects Tobit results for panel datain Tables 12–13. Results are pooled. In the following linear fixed effect

Table 11Nonlinear least squares regression of log ratings on the explanatory variables.

Variable Coefficient (Std. err.)

α 2.474⁎⁎ (0.107)β −0.001 (0.003)γ 1.655 (1.357)τ 0.124⁎⁎ (0.042)η 1.494 (1.038)κ 0.082⁎ (0.042)ψ 1.300 (1.309)Visstreak 0.006† (0.004)Homestreak 0.005 (0.004)1 pm 0.018 (0.069)4 pm 0.042 (0.063)Evening 0.083 (0.070)Friday −0.358⁎ (0.168)Thursday 0.007 (0.081)Thanksgiving 0.155† (0.092)Saturday −0.169⁎⁎ (0.028)Doubleheader −0.032 (0.059)Worldseries −0.361⁎⁎ (0.039)Monday 0.185⁎⁎ (0.054)Playoff 0.374⁎⁎ (0.033)Superbowl 0.372⁎⁎ (0.085)Weekcount 0.013⁎⁎ (0.002)Totbase 0.014† (0.008)N 414R2 0.742

† Significant at the 10% level.⁎ Significant at the 5% level.⁎⁎ Significant at the 1% level.

Table 13RandomEffects Censored Regression StadiumAttendanceModelwith dependent variabledifrat.

Variable Model I Model II

Coefficient (Std. err.) Coefficient (Std. error)

Absline 0.002⁎⁎ (0.001)Line −0.00006 (0.0003)Homwinrat 0.057⁎⁎ (0.008) 0.059⁎⁎ (0.008)Viswinrat 0.002 (0.007) 0.002 (0.007)Visstreak 0.003⁎⁎ (0.001) 0.002⁎⁎ (0.001)Homstreak 0.004⁎⁎ (0.001) 0.005⁎⁎ (0.001)Week −0.002⁎⁎ (0.000) −0.002⁎⁎ (0.000)Monday 0.049⁎⁎ (0.008) 0.049⁎⁎ (0.008)Thursday 0.033⁎ (0.015) 0.032⁎ (0.015)Saturday −0.008 (0.012) −0.008 (0.012)Friday −0.015 (0.021) −0.015 (0.021)Intercept −0.096⁎⁎ (0.014) −0.088⁎⁎ (0.014)N 3433 3433Log-likelihood 1952.545 1948.085χ2 206.555 197.237

† Significant at the 10% level.⁎ Significant at the 5% level.⁎⁎ Significant at the 1% level.

19B. Biner / Economic Modelling 40 (2014) 12–20

model, xijt includes absline, homwinrat, viswinrat, homstreak, visstreakand other dummy variables. One of the problems with using absline asexplanatory variables here is that we lose quite a bit of information bydoing that. We are losing the directional interpretation of bettinglines, in other words which team is favored. If the coefficient of abslinecomes up as negative the interpretation is straightforward, fans likegames that are close. If it comes up as positive interpretation is vague,it most probably means they like blow-out games but since abslinedoesn't tell us which team is favored we have to use other variables tocome up with that result. The first model is usual fixed effects paneldata OLS estimation:

Attijt ¼ α þ x0ijtβ þ ϵijt : ð13Þ

Attendance is limited by number of seats available to fans, thereforeit's important take this censoring into account. As we pointed out in

Table 12Fixed effects panel estimation for attendance ratio.

Variable Coefficient (Std. err.)

Absline 0.0014⁎⁎ (0.0005)Week −0.002⁎⁎ (0.000)Homwinrat 0.049⁎⁎ (0.007)Viswinrat 0.002 (0.006)Visstreak 0.002⁎⁎ (0.001)Homstreak 0.004⁎⁎ (0.001)Monday 0.044⁎⁎ (0.007)Thursday 0.027⁎ (0.012)Friday 0.005 (0.018)Saturday −0.003 (0.011)Population 0.000⁎⁎ (0.000)Income 0.000⁎⁎ (0.000)Intercept 0.317⁎⁎ (0.028)N 3433R2 0.169F(43,3389) 57.623

† Significant at the 10% level.⁎ Significant at the 5% level.⁎⁎ Significant at the 1% level.

Section 3, censoring is not observed for every game. For some games,some teamsmanage to post attendancemore than stadium size, never-theless this is not a big problem since we censor any attendance overthe stadium size and use the stadium size as attendance for that partic-ular game.

Att⋆ijt ¼ α þ x0ijtβ þ ϵijt ; ϵijt∼N 0;σ2i

� �ð14Þ

where Attijt = Attijt∗ if Attijt∗ b stdsizei and Attijt = stdsizei otherwise.

Clearly, fans in this case care much more about their own team'sstrength since the coefficient of home team's winning percentage isvery high compared to visiting team winning percentage. Moreover,the coefficient on betting lines show a small bias towards home team'srelative strengthwhen it's donewith betting lines only rather than abso-lute value of the lines. Aswe pointed out before, the interpretation of ab-solute value of betting lines is problematic, we do get that it is positiveand people care about a blow out result. The fact that coefficient ofhomwinrat is significantly bigger than the coefficient of viswinrat tellsus that the blow out should be done by home team. If the home teamgoes into game as a clear favorite, for every 1 unit advantage over the vis-iting team the attendance is likely to increase by 6% of the stadium size.Censored regression on betting lines itself gives us a better interpreta-tion. In Table 13,we see that coefficient of betting lines is negative, show-ing bias towards home team. Once again homwinrat and viswinrat aremuch better indicators corroborating our previous result. Stadium at-tendees care more about their home team winning. We can assumethat elasticity of closeness for stadium attendees is almost zero.

If we however do the estimation team by team we see the effect oflines varying quite a bit. In some cases such as in Arizona, fans aremore interested in the visiting team rather than the home team. Whendone with absolute values however we expect the coefficient to be neg-ative, we are not getting that but the coefficient is very close to zero.Team records aremuch better predictions of the expectations of the fans.

It's natural to think that consumers in different cities have differentpreferences, therefore different coefficients for different games andgames in general. For example, people in New York might care aboutPhiladelphia games more than Arizona games.

A parsimoniousmodel for the relationships between attendance andbetting lines can be obtained by specifying a team-specific randomintercept ζ1j and a team-specific random slope ζ2j for (xij):

yij ¼ β1 þ β2xij þ ζ1 j þ ζ2 jxij þ ϵij ð15Þ

Table 14Random coefficients stadium attendance model with dependent variable attratio.

Model I Model II

Variable Coefficient (Std. err.) Coefficient (Std. error)

Absline 0.002† (0.001)Line −0.000048 (0.001)Homwinrat 0.060⁎ (0.007) 0.051⁎ (0.013)Viswinrat 0.004 (0.007) 0.005 (0.008)Visstreak 0.002⁎ (0.001)Homstreak 0.004⁎ (0.001)Week −0.002⁎ (0.000)Monday 0.041⁎ (0.007)Thursday 0.027† (0.013)Saturday −0.008 (0.011)Friday −0.012 (0.018)Intercept 0.880⁎ (0.013) 0.905⁎ (0.015)N 3433 3433Log-likelihood 2863.799 2918.139χ2 81.549 137.599

† Significant at the 10% level.⁎ Significant at the 5% level.

⁎⁎ Significant at the 1% level.

20 B. Biner / Economic Modelling 40 (2014) 12–20

¼ β1 þ ζ1 j

� �þ β2 þ ζ2 j

� �xij þ ϵij: ð16Þ

We assume that the covariate xij is exogenous with E(ζ1j|xij) = 0,E(ζ2j|xij) = 0, and E(ϵij|xij,ζ1j,ζ2j) = 0.

We will, as is usually done, assume that, given xij, the random inter-cept and random slope have a bivariate normal distribution with zeromean and covariance matrix Σ.

Following Rossi et al. (2005), we use a hierarchical Bayesian modelwith a mixture of four normal priors to account for the random coeffi-cients. We use EM algorithm to estimate the game day attendance.Table 14 shows the results.3

Results are again as we predicted. Coefficient of betting lines is neg-ative albeit very small. Howeverwin ratio of home teamagain has a veryhigh coefficient compared to win ratio of visiting team. If we make thehome team's talent increase by 1 unit relative to visiting teams, wesee that the attendance increase only by 0.00048%. On the other handif we increase home team's win record by one unit (hypothetically),attendance increases by 5%. This clearly shows that home team's recordis much more important for fans to attend. Home team fans would liketo see their team going dominant into the game.

5. Conclusion

This paper develops amodel to analyze demand in National FootballLeague and estimates it. The paper uses a combination of ratings and

3 For this estimation we didn't include all the variables in ratings data set due tononconvergence of EM algorithm.

stadium attendance data to estimate the parameters of the model. Theestimatedmodel fits the observed behavior of the consumers very well.

The estimation results in Section 4 clearly show that TV viewers andstadiumattendees display different type of preferences for the game. TVratings are determined mostly by close games with possibly strongteams playing each other. Moreover, big city teams are drawing biggeraudiences to their games. Coupled with this fact, it's better to have asmany close games and these games should be played among teamsthat has larger fan base.

On the other hand stadium attendance is determined by hometeam's dominance. In a city, fans are much more likely to attend agame if they think their team is more likely to win. Therefore, it's betterto give some bias in the distribution of talent to big city teams. Never-theless, since most of the revenue is obtained through media deals wesuggest that talent distribution among the teams should be more to-wards an even distribution. It's imperative that there should be somebias towards teams that have bigger fan base. Of course, this is a policythat should be adopted if there is a sensible revenue sharing policythroughout the league. Herewe are assuming that theNFL Commission-er acts as a Social Planner and has themeans to redistribute the revenuegenerated by this cartel. With a policy of this sort, it's pretty easy toincrease the size of the total revenue league makes and increase the in-dividual teams' share. Under this regime players on average are morelikely to see their salaries go up as well since the total revenue madewill increase considerably thereby increasing team owners' shares andplayers' wages. If there is no redistribution of revenue in place then apolicy that favors big city teams even a little bit is bound to backfire inthe future since small city teams will get weaker considerably in time.Big city teams will likely use the revenues they make to attract bettertalent and get stronger as time progresses. This should have adverse ef-fects on player salaries on average even though a few high talent playerswill likely see their wages go up much higher.

For future research, a structural demand estimation for both TV andstadium demand would be a good direction to take. A policy analysisbased on such estimation should give more robust results.

References

Biner, Burhan, 2013. Is parity good? Externalities in professional sports leagues. Econ.Model. 30, 715–720 (January).

Carney, Shannon, Fenn, Aju, 2004. The determinants of NFL viewership: evidence fromNielsen ratings. Colorado College Working Paper (October).

El Hodiri, Mohamed, Quirk, James, 1971. An economic model of a professional sportsleague. J. Polit. Econ. vol. 79, 1302–1319 (November/December).

Rossi, P., Allenby, G., Mcculloch, R., 2005. Bayesian Statistics and Marketing. John Wileyand Sons.

Welki, Andrew, Zlatoper, Thomas, 1994. US professional football: the demand for game-day attendance in 1991. Manag. Decis. Econ. 15, 489–495.

Welki, Andrew, Zlatoper, Thomas, 1999. US professional football game-day attendance.Am. Econ. J. 27 (3), 285–298.