Over 50 Life Insurance

Transcript of Over 50 Life Insurance

Over 50 Life Insurance

# Over 50 Life Insurance

Over 50 life insurance is available for you. It will help you to decide the best plans for your

old life. You can choose the best insurance for your life. Over 50 life insurance can you

buy and you should choose the best insurance in the old age. You may need the

insurance in this age because you consider about the cost in the old life will need much

cost. There are much insurance that offers the good over 50 life insurance, but you should

choose the best insurance with the good policy. If you want to but the insurance, you can

find them from your friend and the internet as the reference, you also need to ask the

expert about the best insurance or you can make consultation with your family members.

The benefit of the over 50 life insurance

The over 50 life insurance will be the good thing because it will help you to get the cost in

the funeral and the benefit after the death. The policy from the one insurance and the

other insurance will be difference. If you get the premature death you may not get the

mortgage payment. You should make the good plan when you want to but the life

insurance in the old age, because the premium for the over 50’s life insurance may more

expensive.

Not all insurance will give you the good offer. There is only the selected insurance that

will give you the conventional life offer for the old buyer. You can get the insurance from

the specialist as the provider and you can buy the plans in the age of 50-80. The insurance

can give you the cover and the guarantee after you reach 90 years old. You will not need

to pay the monthly payment after this age.

The benefit of the over 50 insurance that will be got by you will be different from ne to

another. You are recommended to make the comparation to get the best price of the

insurance. There is the cheaper price of the insurance if you can find the best insurance

from the high consideration. The consideration of the price will help you to make the plan

for your old life. You should choose the cheaper over 50’s life insurance which has the

good benefit.

There are many things that you should consider in finding the best over 50 life insurance.

There are the types of the insurance that will help you to get the best plan for your old

life. There are the types of the insurance such as the whole life insurance that will give

the money after your death, the level term that will give you the fixed payment but you

should agree the policy, decreasing term as the insurance with the lower price. You can

choose the best over 50 life insurance that you need.

There are much insurance that offer the good policy, but it will be the good thing if you

make the comparation from the one insurance to another insurance. You can find the

lower price of the insurance that will give you much benefit. Over 50 life insurance is the

good thing because it will help you to make the good plan in the old life. You can choose

the best and you should make the consultation with your family.

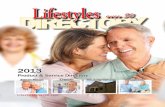

# Over 60 Life Insurance

Over 60 life insurance is needed to buy because there are many benefits from the

coverage that are offered. You should know the tips before buying this life insurance.

Insurance is very important to have. There are many kinds of insurance. Considering the

coverage, the most important insurance that you should have is life insurance. People

buy life insurance in different ages. The older they buy it, the higher the prices. Even

more, it will be very expensive if you buy this insurance over 60. Some insurance

companies do not offer life insurance to cover at this age. However, some companies

offer it. Anyway, it is needed for you to buy over 60 life insurance. If you are interested in

it, you need to follow this article.

Why Should You Buy Life Insurance at Over 60?

If you are over 60 years old, you still need to buy life insurance because of some reasons.

It is because at these ages, you will be easy to get illness or even dead. So, buying life

insurance will provide the financial support for your family. One of the benefits is related

to the dependent spouse. In fact, the death will cause devastating. It will also relate to the

financial support that will be used for survival. That is why you need to buy life insurance.

Besides that, life insurance for over 60 will also be useful especially for you who have

children. If your spouse does not have income and you have children, life insurance will

be very helpful for your children for their financial support. In fact, they have various needs

such as educational needs. So, if you have life insurance, you do not need to worry with

your children’s future if you die.

Then, you should also need to think about a legacy. It is a common tradition that people

who die will leave a legacy either for their spouse or their children. If you still have a

spouse, you need to leave the legacy for your spouse. However, if your spouse has dead,

the legacy will be for your children. Even though it will not be able to help them in long

terms, the legacy from your life insurance will be able to help them survive and find the

new income for themselves.

Types of Life Insurance for Over 60

As it is mentioned before that people who are over 60 are allowed to buy life insurance.

There are three over 60 life insurance types. So, you have to buy it depending on your

needs. You can also consider buying all the types of coverage. One of the types is life

cover. So, this coverage will focus on the life cover. This coverage is allowed to be bought

until you are 90 years old. Besides that, you do not need to buy the premium one.

The next type of life insurance coverage is trauma insurance. It will relate to your trauma

or other illness that may happen to you at your old ages. In fact, older people are easier

to get diseases. However, you are only allowed to buy this life insurance until you are 65

years old. Then, this coverage will be expired after you are 70 years old. However, it is

needed to buy.

The last type of life insurance for over 60 years old is funeral insurance. It is a kind of life

insurance that is bought by those who are over 60 years old and cover the funeral. So, if

you buy this life insurance and you die after buying this insurance, your family does not

need to be confused to think about the funeral cost. This life insurance will cover the cost

of your funeral. Considering the importance of life insurance, you need to buy over 60 life

insurance. So, you will spend the rest of your life in peace. In addition, it will be better if

you buy all those life insurance types above because it gives the complete coverage.

Is over 60 Life Insurance Expensive?

Life insurance is the most important insurance but also the most expensive insurance.

Even more, it will be much more expensive if you are older. Over 60 life insurance

certainly will be much more expensive compared to life insurance for those who are under

60 or even under 50. However, the price is more likely determined by the coverage. If you

buy the premium life insurance, of course, it will be much more expensive. However, you

will get the complete coverage. So, you have to decide it based on your needs.

The Tips to Buy Life Insurance for Over 60

If you are interested in life insurance while you are over 60, you need to know the tips to

buy it. There are many things that you have to pay attention. For example, you have to

decide the payment option. You can choose to pay it per month. However, this option is

very rare to take. Besides that, there is also an option where you can pay it per quarter

year or a half year. However, the most common option to take is per year payment.

Then, you should also pay attention to the insurance company where you buy the life

insurance. In this case, you have to make sure that the company has “A” rating. It means

that they have a good reputation.

Lastly, you need to pay attention to the policy. Different companies have different policies.

The policy can relate to various aspects such as requirements, payment, coverage, etc.

Anyway, you have to choose the easiest policy. That is all about life insurance that you

should buy after you are over 60 years old. If you are interested in over 60 life insurance,

you need to pay attention to the tips above. Hopefully this will be a useful reference for

you to buy life insurance at your older ages.

# Over 50 Life Insurance Comparison

Over 50 life insurance comparison is needed for choosing the appropriate insurance

service. The comparison is possible to be done easily nowadays through the official site

help. One common fact must be understood from nowadays life is that there are so many

types of the life insurance services can be found. The variations of the services offered

may create the confused situation for some people. Based on that reason, it becomes

important for you to have enough knowledge about the comparison. The extreme type of

over 50 life insurance comparison for example can be suggested for making sure that you

are choosing the appropriate type of the service nowadays.

The next question is where will you find the over 50 life insurance comparison nowadays?

That is actually something easy to be answered. Before you compose the idea about

taking the specific service of life insurance you may compose the specific plan about your

needed service. When you have the simple business for example you will need the

insurance for making the balance of your profit. That can be helped by getting the

insurance service since that can be used during your bad time of business. There is

always the risk of facing the problem when you have the modern business nowadays.

By proposing over 50 life insurance comparison you also may get the deep understanding

about some types of the benefits may be gained from every life insurance company. From

one company you for example may get the whole life insurance while from other

companies you may get the type of the captive insurance. Understanding all details about

the services and the companies can make your decision as the best one to be composed.

The Brief Explanation about the Life Insurance

There are actually some benefits may be gained from the over 50 life insurance

comparison. One of them for example is the information about the details of the claims.

When you have a business for example, there are some problems may be faced relate to

your business. That can be connected for example into your tax of business or even your

composition of balanced profit. All of these aspects must be included into the

consideration before you choose one company available in your location.

There is actually one benefit may be gained from the over 50 life insurance comparison

in nowadays time. The benefit can be connected into the easiness of accessing all

information needed from online site. Every company of insurance nowadays may have

the official site where you may find all information needed. The idea of choosing one

service from the appropriate company may create the great result.

The act of taking over 50 life insurance comparison also may be directed into the act of

getting the information about what kind of insurance type may be chosen. For your

business health you also may compose the idea about asset insurance or property

insurance. The idea for choosing the specific type of insurance must be supported by

some acts too. Without the supporting points proposed it will be hard to gain the benefits

from it. That is the first concept must be understood that can make sure that you have the

guarantee about getting the help during your problem appearance.

# Over 50 Life Insurance Plans

Over 50 life insurance plans can give so many benefits for your old age time. It for

example can give you the peaceful mind without thinking about the financial problem at

the time. Some people commonly feel confused when they are choosing one type of the

available over 50 insurances. That is caused commonly because they do not understand

about the specifications of the over 50 life insurance plans. The knowledge about that

whereas is the important thing to be reached when you want to choose the appropriate

option since the act of choosing the insurance must be directed into the need too. The

appropriateness between them is the condition must be achieved for making sure that

you may get the help from the insurance type chosen.

It is actually easy for finding the over 50 life insurance plans information nowadays. The

information for example can be gained from the people around you who have taken one

type of insurance. Besides, the over 50 life insurance plan information also can be found

by looking for it from the internet. That is the possible source to be gained when you

cannot compose the earlier idea because of some reasons. However, when you take this

way it must be sure from the beginning that the source used is the most trusted source.

That can keep the information gained as the most updated one.

The Benefits of having Over 50 Life Insurance

There are some benefits may be gained when you are choosing one of the available over

50 life insurance plans nowadays. One of them for example is the independence. When

you have the insurance you then may live in independence way without needing the help

from other sources. The insurance is the investment type in the simple way. So, you can

keep enjoy your life even if you do not work anyway because of the degradation of your

body health. The independence like that will be interesting for people who have the great

desire of having the pleasant life in their end time based on the simple preparation.

The over 50 life insurance plans commonly offer the benefit of getting the guarantee about

your children in the future. That also can be connected into your beloved people. By

choosing the insurance you then may make the protection for your family after your death.

Besides, the insurance also can help you for paying the complete ceremony of your death

like your burial payment, your medical bill, and some other aspects relating to your

financial need. That can help your family too to face the possibility of getting the financial

problems after your leave.

Choosing the over 50 life insurance plans also can give you more peace in your old age.

You do not need to think about your financial income because you have the guarantee

about that from your insurance. You also can use the insurance for paying the complete

financial need relating to your home like for paying your servant for cleaning your house

or for cooking and washing.

The Thought of having Over 50 Life Insurance

When you know about the available over 50 life insurance plans and you want to get it,

you must prepare your thought at first. The first consideration about that may be directed

into your goal. Choosing the over 50 life insurance service without understanding about

your goal may bring into the bad final result in the end. It becomes important for you to

have the specific goal for example to make sure that you have the easiness of paying the

complete payments after you death like the funeral cost for example. You also can refer

the goal into your desire of keeping your life style even in your old age.

Then, you also must propose some other considerations about the over 50 life insurance

company. Since nowadays you can find so many companies offer the type of the

insurance like this one you then must be more careful when you are considering of

choosing one of them. The over 50 life insurance plans are something important for your

life and so you must take the service from the trusted company only. Some characteristics

may be noticed to make a decision about the company as the trusted one or not. By

looking into the history of company you can detect its characteristics

The first aspect to be noticed from the company is its strength relating to its financial

aspect. Then, the long history of the company also can be considered too because that

connects into the trustworthy aspect of the company. Then, the specific characteristics of

the over 50 life insurance plans offered by the company also can be valued. That relates

into the guarantee about life time service offered or the limited one. The specification of

the service like its covering medication process also must be checked for making sure

that your choice is the best one.

More Details about the Over 50 Life Insurance

The idea about composing the over 50 life insurance plans actually is the idea based on

the desire for having the better future. That especially relates into the financial benefit

may be gained through the insurance. The old age actually is the moment for taking rest

and so having the insurance like this one may help you to deal with that. Nowadays you

actually may find so many companies that offer the different variations of the plans. The

act of selecting one of them may be done based on the consideration about the

appropriateness between it and your goal.

Nowadays you also can find the special type of the over 50 life insurance plans. It may

be found in the form of the insurance service without exam proposal. While the common

insurance services can be gained only after you take the physical exam as one condition

must be achieved, when you choose this one you do not need to do that. You just need

to take the internet connection, applying the application and proposing your proposal and

then you may get the chance for getting the service. If you like to get the service from the

simple process, taking this one is the better option for you.

The more details information about over 50 life insurance plans may be gained from any

sources. Since the different type of company commonly offers the service based on the

different terms and policies, you then need to know too that it is impossible for you to get

the service when you do not know exactly about some specifications from the chosen

company. So, you must get the deeper information about its specifications for example

by visiting its official website. That can really help you to make sure that you understand

all of its offerings.

# Over 50 Life Insurance Quotes

Over 50 life insurance quotes are the forms of the offerings from company insurances.

Some variations and some details must be understood before people make a decision.

There are some important details must be understood from the whole over 50 life

insurance quotes offered nowadays. You must know about the details to make sure that

there is the appropriateness between the insurance type and the desired type of the

insurance. By understanding the over 50 life insurance quotes details you also may know

about the limit of the service offered by the insurance type chosen. So, you can use the

insurance for getting the benefit at the time without the possibility of the wrong choice.

The details are relatively easy to be understood. Even if you are the beginner in proposing

the proposal about that, you can understand it fast because nowadays you also can find

any sources for it easily. So, you can look for the information about that completely without

having the hard way for getting its source. That relates into the fact that nowadays is the

information technology era where you may find the information about everything easily

from any trusted sources. The trusted source always gives the useful information for

everyone.

The Variations of the Over 50 Life Insurance Quotes

The over 50 life insurance quotes information is important because from the information

you then may get the better consideration about the insurance itself. The over 50 life

insurance quotes nowadays are offered in some variations depended on the company

itself. So many companies are possible to be found nowadays and so you can choose

one of them based on the consideration about its appropriateness with your desired goal.

When you are composing the idea of choosing one of them, it will be better for you to

know at first about the variations too.

The over 50 life insurance quotes commonly are offered for people between 50 and 80.

You actually can get the offering for the older age than that under some conditions. It is

possible for example to increase the limit into 90 old ages. The choice of the offering may

be appropriated with your need and your desire. Composing the idea about choosing one

of them is easy to be done based on the concept of the age limitation proposed. It is one

aspect that can be assumed as easier to be noticed than some other measures. The

easier is the way taken, the more pleasant is the process completed.

The variations of the over 50 life insurance quotes also can be referred into the variations

of the payment must be paid monthly. That can be found for example in the form of the

classification between the premium and the standard one. The premium level of the

insurance needs the higher monthly payment and that must be included into the

consideration. It is better for you to choose the most appropriate one based on the

consideration about its appropriateness with your capability too, especially the capability

of covering the monthly payment of the insurance. That is needed for avoiding the

possibility of the problem appearance in the end.

There are two aspects that can make the differences too between one and another

insurance service. The aspects are the aspect of the healthy and the age. The bad life

history like the experience with drug and alcohol sometimes influence the acceptance of

the proposal. Understanding the details of the over 50 life insurance quotes becomes the

point that can help the process of asking for the service. The terms and the policies

offered also can be depended on the specification of the company itself. Choosing the

prominent company will help you to get the better result with your desired service.

The aspect about how long you will get the insurance also becomes the important

variation aspect of the over 50 life insurance quotes needed to be considered. So many

choices from one year, five years, until thirty years, they become the important part too

to be considered. The quotes are actually the complete points must be understood

because they are the forms of the offerings may be gained from the service. Since

considering choosing one insurance type is something important, some companies then

commonly offer the time for people to think about that for example in thirty days.

The Deeper Information about Over 50 Life Insurance Quotes

The common over 50 life insurance services can be gained only by proposing the medical

check at first. That sometimes becomes something complex for some people. So, the

special offering of the over 50 life insurance quotes sometimes is needed too as the more

interesting option. The special offering may be gained in the form of the insurance service

without medication exam. That will be more interesting because that is simpler and easier

to be completed. If you are the modern people who like so much the simplicity, choosing

this one may be assumed as the best one instead of some other options available.

The over 50 life insurance quotes are possible to be considered based on some aspects.

The most important aspects are the aspect of the application characteristic and the aspect

of the age when you propose it. In the past time, the aspect of the gender even can be

counted but that is not useful any more since the end of 2012. Then, the consideration

about your smoking or not also is considered by some companies because that can

influence the medication aspect included into the insurance terms and policies.

When you choose to get one type of the over 50 life insurance quotes, you must be sure

that you have the complete data needed for getting the accepted proposal. The details of

the data also must be understood too. You for example cannot use your nickname and

you just possible to get it by using your real name only. It is actually the simple thing but

when you do not give enough attention into it you cannot get the best result relating to

the insurance service. So, you must give enough attention into the details like it from the

beginning.

The limitation of the age also becomes the important part of the over 50 life insurance

quotes. You can get the cheap offering of the insurance when you are between 50 and

86 old ages. It can give you the benefit for proposing the insurance proposal at the time.

For more details about the specification offered by the certain companies, it will be better

for you to use the service of insurance agent at the time. That can make the easier

process for proposing the proposal itself. The agent can make the easier process of

proposing it completely.

# Over 50 Life Insurance No Medical Exam

Over 50 life insurance no medical exam is simple to be proceeded. People can get some

benefits include its easiness and its cheap cost for being accepted. Nowadays, some

variations of over 50 life insurances can be found easily. When you want to make a pact

and getting the benefit from the insurance, you must be sure that you choose the most

appropriate one among some available options. Choosing the appropriate one is possible

to be completed when you understand the available options in details. One of them that

can be considered nowadays is the type of the over 50 life insurance no medical exam.

This one is relatively the standard type of life insurance.

The concept used for the over 50 life insurance no medical exam is the modern concept

connected into some aspects in life without medical exam. So, when you choose this one

you must be sure that the insurance type needed is the easy way to be taken. People

who have the bad history with their condition can choose this one based on the same

consideration. Based on that reason too this type is possible to be categorized as the type

of the popular insurance taken nowadays. The hard way for proposing the proposal in

some other types of insurance can be solved by choosing this type.

The Way for getting The Insurance

The type of insurance in the form of the over 50 life insurance no medical exam is possible

to be gained nowadays because of the help from the development of technology. The

over 50 life insurance no medical exam service is done by using internet service. At first

you may get the whole information about it and then you must answer the question asked

relating to your health and then when the answer is in line with the policy decided by the

insurance company you then can get the service directly.

The long distance healthy question proposed through internet connection helps you to

avoid the physical exam as it is suggested commonly by the common types of insurance.

The over 50 life insurance no medical exam is possible to be chosen when you do not

like to wait for a long time for example for 2 month minimally as the minimum time needed

for processing your proposal to get the common insurance. The reduction of time offered

by this way is possible because the process includes the process of paying it also can be

done in transfer model.

The time needed by the company for checking all information and all answer proposed

by you is only a short time. The standard time needed before you can get a decision from

the company about the over 50 life insurance no medical exam service is only fifteen

minutes. When your proposal is accepted, you just need to continue into the next step

including the step of understanding the policy and the terms suggested by the company.

Nowadays, so many companies offer this type of insurance with some variations of the

terms and policies.

The type of the over 50 life insurance no medical exam is limited only for people up to 65

years old. It means that after the age you cannot get the service any more especially

because of the possibility of your decreasing body healthy after the age. Since the

insurance is offered for people between 50 and 65 years old, it will be bad for you to wait

for a long time for getting the insurance. The insurance type then offers the simple way

of proposing it only by using the online process. The limitation like it must be understood

from the beginning.

The over 50 life insurance no medical exam also can be chosen when you are the type

of people who have the great progress in taking some business trips. By taking this

insurance you do not need to spend your time while you are in the condition of having no

time to process and wait for a long time. You just need to propose your proposal and

application in online way and then you may get the decision about its accepted value by

waiting only a short time. This type of insurance also can be proposed easily by people

even when they have the problem with their health and the age since the variations of

age group also can be found from some insurance companies.

The Benefits of the Insurance Type

There are some benefits may be gained from choosing the over 50 life insurance no

medical exam. The first one of course is the easiness of getting the service. People

commonly do not like to take the medical exam because of the long process must be

done while sometimes they just have the short time for that. So, choosing this type may

help them completely because they even do not need to visit the insurance company to

get its service. They just need the connection into the internet and the service will be

reached.

Since you just need the internet connection for proposing the proposal for the over 50 life

insurance no medical exam, you do not need to prepare the great budgets for it then. In

other words, you do not need to pay the great cost for the operational cost of getting the

insurance. It gives you the benefit relating to the time and the price must be paid. For

most of modern people, the simple process of proposing the proposal like this one

becomes the interesting one especially because they can save their time and money at

the same time.

Most of the modern people like to get all of their need from online process. That is caused

by the easiness of accessing it everywhere without the limitation of time and place. Based

on that reason, it becomes more pleasant too for you as modern people to take this

process because the process is done completely through the online way. The online way

offered by the over 50 life insurance no medical exam is the closest way to be understood

by modern people today.

Through all of its benefits, you actually can get the over 50 life insurance no medical exam

under the limitation too. The limitation is found primarily in the amount of money gained

through the over 50 life insurance without medical exam. You can get it in $ 25000 until

$ 250000. That can be assumed as the standard amount of the financial benefit may be

gained from the insurance. Actually that is enough for helping you at the time especially

when you count the easiness of processing the insurance itself when you compare it with

some other types of insurance nowadays.

# Over 50 Term Life Insurance

Over 50 term life insurance is different in one and other insurance company. By

considering the terms you can choose the appropriate insurance type. It is important

when you live in this modern time to have the life insurance. The reason is because you

can get so many benefits from having a life insurance. By having life insurance for

example you can have minimally the needed help when one time you need the direct

great amount of money while at the same time you do not have enough income to create

that. The need is increased more too when you have the older ages. So, you can need

for example the over 50 life insurance type and to get it easily you also must know about

the over 50 term life insurance.

There are of course some differences can be found between the over 50 term life

insurance and the terms of some other insurance types. Making sure that you know about

the differences can help you for choosing the most appropriate one in line with your need.

Besides, understanding some available types of insurance over 50 also can give you the

easiness for making a decision about choosing. The appropriate decision makes the

guarantee about the possibility of getting the maximum benefit from insurance service at

the time you need it.

Most of the over 50 term life insurance offers the low cost must be paid monthly for getting

its service. That can be included into the reason for needing it and choosing one common

type available nowadays. You actually are lucky to live nowadays since so many

insurance companies offer the variations of the services like this one and they also offer

the different terms and policies. You can choose one of them based on the

appropriateness with your nowadays condition like the consideration about your budgets

for that.

The Consideration for choosing the Life Insurance Easily

The over 50 term life insurance commonly is different in some details from the common

insurance terms. Because of that, you need to read all terms offered relating to the

insurance. The terms have the significant role for making sure that you may get the

desired type of insurance. It is possible for you to consider of choosing one of them based

on the knowledge about the differences from the common insurances. That is caused by

the fact that the insurance can be the useful thing only when it is practiced in line with

your need. The different people with different condition will need the different type too of

the insurance.

Understanding the over 50 term life insurance actually becomes the part of the steps can

be followed when you want to get the insurance service. The terms relate into some

condition must be achieved and of course you will not get the service without completing

all of it. Through the terms you also may know about the type of insurance covering. Just

make sure that the covering is in line with your need. The appropriateness between them

can make sure that the insurance is the useful one for you.

Besides of understanding the over 50 term life insurance, you then also must know about

your goal. The goal of different type of the insurance may be different especially when

that is offered by the different companies. The different company commonly has the

different terms and the different type of its services too. So, the next step is considering

about your goal and then chooses the appropriate one based on it and the company’s

offering. When it can be appropriated, the whole composition of the insurance will be the

best one to be chosen.

The information about the over 50 term life insurance also can be connected into the

information about the cost needed to be paid for the coverage. The difference may be

found relating to the different type of insurance level. When you take the premium level

for example, the amount of money must be paid of course is higher too than if you just

choose the common level of the insurance. The idea of choosing one of them must be

done based on the consideration of your capability for paying the coverage based on your

income.

The Functions of the Life Insurance Over 50

Some people may ask about the function of over 50 life insurance. The function is really

simple that is for making sure about the great life in your old age. Understanding the over

50 term life insurance may bring you into the easiness of getting the insurance itself. So,

from the beginning of composing the idea about getting the insurance you must make

sure about your knowledge about it. The knowledge is the basic condition must be

achieved by you especially when you do not want to get the problem during the time of

accessing it.

Getting the benefits from the life insurance then is possible only based on the

understanding about the over 50 term life insurance. The understanding is absolutely

needed for choosing the appropriate choice too of the insurance offering. Nowadays you

can find so many offerings from the available company. Some of them offer the premium

level of the insurance too. It actually will be better for you to choose this one when you

want the higher guarantee about your pleasant life over 50. The premium level of course

needs the higher preparation too relating to the cost must be paid for getting its service.

The function of the insurance for over 50 also can be connected into the act of keeping

your healthy condition. It is the common fact that the old age of people commonly brings

into some degradation of their healthy condition. Because of that, choosing the

appropriate insurance model is the important thing to be gained. When you have made a

decision about it you then must start it by trying to understand about the over 50 term life

insurance. The information about that is relatively easy too to be found from any sources

like from the online source.

The information about the over 50 term life insurance also can give you more knowledge

about the function of the insurance. Based on some terms offered you then may know

that the insurance can be functioned as such kind of investment. Even when you have

the rich children that can spend their time for caring your need but having the insurance

can give more pleasant financial condition for you. You can get the investment in the last

time of your life even when you actually do not have the great income any more. That will

be really pleasant especially because the way for getting it is relatively simple too.

# Over 50 Health Insurance

Over 50 health insurance will be a nice choice when you want to prepare the better life in

your old age. Having the health insurance maybe will be a nice choice for you. Well, it is

because the health insurance will prepare the better life especially in your old life. We

know, there are some kinds of the health insurance as your choice. Here, we will focus in

over 50 health insurance. This kind of the health insurance will help you to have the calm

day in your old time. Let us see some details of it. There are some matters, which you

need to know. I hope it will be useful for you all. See the details of it below.

Why you need to have insurance

People maybe want to know the reason why they need to have the insurance in their

health. Well, some people think that choosing the over 50 health insurance will make they

have the harder life. Here, we will talk about some facts about it. Why do you need to

choose the over 50 health insurance ideas? The fact says that the number of the

uninsured adults in 50 or over ages continues to rise. It shows that the adult people have

some problems in their old people. With the insurance, you will have something to hand

your problem.

In other hand, we know people in age 50 or over do not productive anymore. It means

they cannot do the hard work as when they are young. In other word, the 50 age or over

is the time for the people to enjoy their time without the job. It will be no problem when

the old people are jobless. Well, because their power sinks in their age. Here, the over

50 health insurance offers the hand to help the old people. With the insurance, the health

and the need of the old people will be handed and guaranteed.

The over 50 health insurance here also will be useful when people want to check their

health. We all know people with the 50 age or over will have more risk to be infected by

the virus or the sickness. In this case, the 50 health insurance will be the agent in the way

to help them. The insurance not only will help about the cost in paying the service of the

hospital but also will give the hand to throw away the sickness. By that fact, I think this

insurance idea will be an important matter for you all.

The way to choose the insurance agent

The insurance will be dealt with the function of the agent. Here, agent has the important

role in the way to hand your need. Here, before choosing the kinds, as you want, you

need to be selective in choosing the agent. We know, people want to have the benefit

agent in choosing the 50 health insura nce. Well, by this reason, you need to pay attention

with the details of it. I have some ways in order to find the best agent to help you in the

insurance. See the idea below.

Talking about the agent of over 50 health insurance, the first matter that you need to pay

attention is the service of it. Well, the kinds of the services will be the important matter

why you need to join with them. You can see the list of the service before you join with

them. In common, the agent will offer some services to you. Make some comparisons

with several agents. The more complete services can be the idea for you. In other hand,

you also need to know the consequences of the services.

Another matter that you need to know here is the rule of the agent. As I have said in the

paragraph before, you need to know the consequences in choosing the agent of the over

50 health insurance. One of the consequences here is the rule of the agent. Sometimes,

you will find the different rule in one agent and others. In common, the different rule here

happens because of the packet of the services. We know, the services will work with the

payment. The more complete services will need the higher payment. You need to make

sure about the payment here!

The best insurance for you

After talking about some details of the insurance matter, let us see about the examples

of the insurance. Knowing some kinds of the insurance here is important in the way to

have the best type as you want. Many insurances are available as your choices with its

own services and rules. I have some kinds of it below. You may see the kinds of it with

seeing the details of the services. By making some comparisons, I believe that you will

find the best insurance, as you want.

APRIL UK Health Insurance

The first kind of the over 50 health insurance here that can be your consideration is the

APRIL UK health Insurance. Well, for the people, it can be a nice option by the complete

service inside it. This insurance agent has the standard hospital option. You will have the

great service when you stay in the hospital. Talking about the cover option it is nice to

have the treatment. For the kind of sickness, this insurance will give the mid-range option.

Inside the insurance, you will have cashback when you find any problem there. Write it

on your list!

Aviva Health Insurance

For you who want to have the great insurance in the way to have the better life in your

old, the Aviva health can be the answer. Well, it is kind of the great type of over 50 health

insurance. This insurance agent will pleasant you with the kinds of its service. In the

hospital option, you will get the limited standard. The limited standard here will be a nice

option to give you better service to treat your sickness. In other hand, when you find any

problem there, the agent will give you cashback until 75%. Then, they also will offer some

discounts for you all.

Based on the explanation above, you can see some matters inside the over 50 health

insurance. The kinds of the insurance will be the great choice by its services. In this case,

it is important for you to be the good ember of it. How to be the good member? The first

matter is seeing the time of the payment. The payment is the basic how to feel the great

services there. Call your friend when you need some helps. I hope it will be useful for you

all.

Learn More about Life Insurance at http://scrappytv.com/.