Nike Inc. Analyst Report

-

Upload

chad-de-gannes -

Category

Documents

-

view

85 -

download

1

Transcript of Nike Inc. Analyst Report

Consumer Discretionary

Chad de Gannes

October 14th, 2016

Tear Sheet

Investment Case

The Investment Case for Nike Inc. can be summarized as follows:

Competitive Advantage: First and foremost, Nike Inc. is the world’s number one shoemaker. They are very innovative with their products, in terms of reaching out to many athletics and sports including baseball, golf, volleyball, tennis, basketball and football. Nike operates Nike Town shoe and sportswear stores, Nike factory outlets and Nike women shops. Nike Inc. sells its products throughout the United States of America and in more than one hundred and eighty countries. Nike is a global brand and is recognized throughout the world from its famous “Swoosh” logo.

Opportunities: Nike is very powerful right now due to the fact that it is capable of making use of the opportunities which lie ahead. A huge opportunity for Nike right now, is within the Chinese Market. Nike is one of the few brands which are succeeding within the Asian market. Nike’s revenue in Greater China has been steadily increasing over the past few years. Their revenue in 2015 was $3.07 billion USD while currently in 2016, the revenue is roughly $3.78 billion USD, with the majority of the revenue coming from Nike’s footwear segment. Also, Nike has a signed a deal with the National Basketball Association (NBA) for Nike to be the official provider of NBA apparel. This eight-year deal was signed last year and will take effect for the 2017-2018 NBA season.

Long-Term Growth Revenue: Nike has said that by the year 2020, they will hit $50 billion in sales. With Nike’s double digit average annual growth rate for the next five years of 13.07%, it is realistic to think that this footwear company can meet and surpass those expectations. For the fiscal year 2015, Nike’s revenue was over $30 billion, up 10% from the year prior. If they continue forward with a 10% compound annual growth rate, Nike will hit their $50 billion target for 2020.

Segmentation: Within the next four years, Nike will target to produce around eleven billion in revenues by improving its focus on the women’s business segment. The Company has already introduced a few women’s only stores in Shanghai, London and also California. They are looking to have a thousand authentic spaces within the owned stores and stores also operated by sporting goods retailers. Nike wants these spaces to be done by the fiscal year 2020. There is huge growth within this segment since fitness is becoming a very attractive and popular lifestyle. This can be a revenue driver for this company in the future.

Valuation: Nike Inc.’s brand has a lot of impact on the valuation and also growth of the company. Nike currently employs more than sixty thousand people around the globe and its stock is now reaching the highest levels in history. The Market Cap of this organization is now equal to approximately $112 billion. This makes it very attractive to investors and also allows the company the chance to invest in further innovation and research.

Company Overview

NIKE, Inc., incorporated on September 8, 1969, is engaged in the design, development, marketing and selling of athletic footwear, apparel, equipment, accessories and services. The Company's operating segments include North America, Western Europe, Central & Eastern Europe, Greater China, Japan and Emerging Markets. The Company's portfolio brands include the NIKE Brand, Jordan Brand, Hurley and Converse. The Company sells its products to retail accounts, through its retail stores and Internet Websites, and through a mix of independent distributors and licensees across the world. The Company's products are manufactured by independent contractors.

As of May 31, 2016, the Company focused its NIKE brand product offerings in nine categories: Running, NIKE Basketball, the Jordan Brand, Football (Soccer), Men's Training, Women's Training, Action Sports, Sportswear (its sports-inspired lifestyle products) and Golf. Men's Training includes its baseball and American football product offerings. The Company also markets products designed for kids, as well as for other athletic and recreational uses, such as cricket, lacrosse, tennis, volleyball, wrestling, walking and outdoor activities. The Company's athletic footwear products are designed primarily for specific athletic use. Its products are also worn for casual or leisure purposes.

The Company also sells sports apparel. The Company also markets apparel with licensed college and professional team and league logos. The Company sells a range of performance equipment and accessories under the NIKE Brand name, including bags, socks, sport balls, eyewear, timepieces, digital devices, bats, gloves, protective equipment, golf clubs and other equipment designed for sports activities. The Company also sells a range of plastic products to other manufacturers through its subsidiary, NIKE IHM, Inc. NIKE IHM, Inc. manufactures Air-Sole cushioning components at the Company-owned facilities located near Beaverton, Oregon and in St. Charles, Missouri. The Company's Jordan Brand designs, distributes and licenses athletic and casual footwear, apparel and accessories focused on basketball using the Jumpman trademark. The Company's Hurley brand designs and distributes a range of action sports and youth lifestyle apparel and accessories under the Hurley trademark. The Company's brand, Converse, designs, distributes and licenses casual sneakers, apparel and accessories under the Converse, Chuck Taylor, All Star, One Star, Star Chevron and Jack Purcell trademarks. Converse Direct to Consumer operations include e-commerce business.

Financial Analysis

Liquidity Ratios

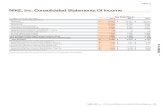

Analyzing Nike Inc.’s financials, one can notice that its Total Revenue growth over the prior year, has grown at 5.8%, indicating more sales had occurred for the period of May, 2016 than the previous year. The company has increased its sales and net income during the past fiscal year. Net income has increased by $487 million over the past year and also sales have increased by $1,775 million. Nike’s current Quick Ratio stands at 1.81 for the quarter ending August 2016. This indicates generally, a good short term health. During the past 13 years, Nike Inc.’s highest Quick Ratio was 2.73 and their lowest was 1.00.

This graph shows how Nike stacks up against some of its competitors in the industry in terms of Quick Ratio to Markey Cap. You can clearly see that Nike is dominating with their much higher market cap than other companies while maintaining above the industry median (1.26) for the Quick Ratio. Nike’s Quick Ratio is ranked higher than 75% of the 664 companies in the Global Footwear & Accessories industry.

Nike’s current ratio or the quarter ended in August, 2016 was 2.72. It is ranked higher than 72% of the other companies within the Global Footwear & Accessories industry. This is a very acceptable ratio and shows that Nike Inc. is a healthy business, being able to pay back its short-term liabilities. Over the past ten years, Nike has had a minimum current ratio of 1.68 and a

maximum of 3.54. Nike’s current ratio for the quarter ended August is just below the median current ratio for the past ten years of 2.83.

Asset Management Ratios

The inventory turnover measures how fast the company turns over its inventory within a year. It is calculated as cost of goods sold divided by average inventory. Nike Inc.’s cost of goods sold for the three months ended in August 2016 was $4,938 Mil. Nike Inc.’s average inventory for the quarter that ended in Aug. 2016 was $4,867 Mil. Therefore, Nike Inc.’s inventory turnover for the quarter that ended in Aug. 2016 was 1.01. This lower ended ratio can indicate that possibly Nike may have excess inventory because they do not have low sales.Nike Inc.’s account receivable for the three months ended in August 2016 was $3,526 Mil. Nike Inc.’s revenue for the three months ended in Aug. 2016 was $9,061 Mil. Hence, Nike Inc.’s days sales outstanding for the three months ended in Aug. 2016 was 35.51. This is the average amount of days that this company takes to collect revenue after the sale has been made. Nike is below the industry’s median of 46.17 and they are also doing better than 61% of companies in this industry. The quicker Nike can collect its outstanding receivables, the better.

Nike’s asset turnover ratio has been steady over the past few years, with an average of 1.51. Currently, there asset turnover ratio lies at 0.43 for the quarter ended August, 2016 but it was up to 1.51 when the quarter ended May, 2016. The sales for the quarter ending August 2016 declined a lot and hence why there was such a huge drop in the turnover ratio. This can be a warning sign since the assets have grown faster than the sales for this quarter but there is no doubt that with Nike’s plans and focus on innovation will definitely boost the turnover within the next quarter.

Debt Management Ratios

This graph here represents Nike’s Debt to Equity ratio over the past few years. As you can see, Nike has hit a high of 0.169. Nike’s debt to equity ratio improved from 2014 to 2015 but then shot up a lot within the 2016 financial year. Nike will need to find a way to pay off some of its debt for this ratio to decrease over the next few years, but with the anticipated revenue build up, this will not be a problem for this company.

Nike Inc.'s Operating Income for the three months ended in August 2016 was $1,226 Mil. Nike Inc.'s Interest Expense for the three months ended in Aug. 2016 was $-7 Mil. Nike Inc.'s interest coverage for the quarter that ended in Aug. 2016 was 175.14. Nike Inc. has enough cash to cover all of its debt and its current financial position is very stable.

Profitability Ratios

Operating margin is calculated as operating income divided by its revenue. Nike Inc.'s operating income for the three months ended in Aug. 2016 was $1,226 Mil. Nike Inc.'s revenue for the three months ended in August 2016 was $9,061 Mil. Therefore, Nike Inc.'s operating margin for the quarter that ended in August 2016 was 13.53%. Nike Inc.’s operating margin is expanding. Margin expansion is a good sign. Nike Inc.’s 5-Year Average operating margin Growth Rate was 0.20% per year. While on the other hand, Nike’s Gross Margin is calculated by dividing the gross profit by the revenue. Nike Inc.'s gross profit for the three months ended in Aug. 2016 was $4,123 Mil. Nike Inc.'s revenue for the three months ended in Aug. 2016 was $9,061 Mil. Therefore, Nike Inc.'s Gross Margin for the quarter that ended in Aug. 2016 was 45.50%. During the past 13 years, the highest Gross Margin of Nike Inc was 46.28%. The lowest was 43.50%. And the median was 44.95%. Nike has a durable competitive average with this ratio.

Nike Inc. yielded Return on Asset in I. Quarter above company average, at 17.79 %. ROA improved compare to previous quarter, due to net income growth. Within Consumer Discretionary sector Nike Inc. achieved highest return on assets. While Return on assets total ranking has improved so far to 2, from total ranking in previous quarter at 194.

The ROE however, or the quarter that ended in August 2016 was 40.91%. During the past 13 years, Nike Inc.'s highest Return on Equity (ROE) was 30.39%. The lowest was 18.00%. And the median was 22.73%. ROE improved compare to previous quarter, due to net income growth. Within Consumer Discretionary sector only one company achieved higher return on equity. While Return on equity total ranking has improved so far to 7, from total ranking in previous quarter at 351.

Market Value Ratios

As of today, Nike Inc.'s share price is $51.62. Nike Inc.'s earnings per share without non-recurring items for the trailing twelve months (TTM) ended in Aug. 2016 was $2.22. Therefore, Nike Inc.'s P/E (NRI) ratio for today is 23.25. During the past 13 years, Nike Inc.'s highest P/E (NRI) Ratio was 33.09. The lowest was 11.89. And the median was 2017. So basically, it takes Nike 23.25 years to pay back the share price of $51.62, assuming the earnings stay constant over the next 23.25 years.

PEG is defined as the P/E (NRI) Ratio divided by the growth ratio. The growth rate we use is the 5-year average EBITDA growth rate. Nike Inc.'s P/E (NRI) Ratio is 23.25. Nike Inc.'s 5-year average EBITDA growth rate is 12.90%. Therefore, Nike Inc.'s PEG for today is 1.80. A company with a P/E ratio similar to its growth rate is fairly valued. Nike may be overvalued in this instant since its P/E ratio is almost double its growth rate.

As you can see from this chart, Nike’s PEG ratio hit a high of 4.12 in the year 2010 but has decreased down to 1.91 in May, 2016. Its P/E ratio was much higher in the year 2010 but is slowly decreasing to a fairly valued company.

The Price to book ratio is used to contrast a company’s book value to its current market price. For Nike, it currently has a Price to book ratio of 7.071 for 14th Oct, 2016. This is ranked lower than 87% of the companies in this industry.

Key Sector/Industry Information

The major competitors in the global athletic footwear market are Nike Inc., Adidas Group, PUMA, and ASICS Corporation. These four company together account for approximately 80% of the market share of the global athletic footwear market. The global athletic footwear market is segmented into men, women and kids. Amongst these segments, the men’s footwear section dominates this footwear market, with approximately 60% share. The women’s section accompanies about 25-30% share and the rest is occupied by children. By retail distribution, this market can be classified into store based and non-store based distribution.

In terms of geographic, the Asia-Pacific is dominating the global athletic footwear and apparel market. This region has about nearly 40% share. The main reasons why this region is dominating is due to the fact that there is a lot of cheap labor within this region. Also there is heavy concentration of leading footwear manufacturers and the availability of cheap raw materials. The reason why this market has grown so much over the past few years is because of the growing popularity of living and maintaining a healthy active lifestyle. This escalates the demand for innovative footwear and hence increases in the seasonal sales. Although this is a growing market, the market in North America is anticipated to grow at a much slower pace since there is high material costs, high labor costs and also more increased competition within North America. Europe is forecasted to remain at a considerable regional industry in the next few years.

The major driving growth factors are the increase disposable income in developing economies, growing global population of the market, the rapidly spreading awareness of health and fitness and of course the corresponding ride in demand for innovative, affordable and agreeable products. Running, basketball and casual are the three main categories in the athletic footwear industry. The running category comprises of an estimated 35% of the market share. The basketball category is growing at the highest rate. In September 2013, the basketball category gained approximately 2.9% points of market share over the same month of the prior year. Also, the rising attraction of sports events, for example, The Olympics, FIFA World Cup and ICC World Cup etc. These events have accelerated the athletic footwear market. Along the lines of attraction and popularity, Athlete sponsorships play a big role in driving demand for athletic products. Athletic footwear companies sponsor star players to market products to millions of sports fans around the world. For example, some famous Nike-sponsored athletes include soccer star Cristiano Ronaldo, tennis star Roger Federer and basketball legend, Michael Jordan.

Risk and Rewards

The biggest threat to Nike’s stock lay in the areas of, if athletic wear goes out of fashion, if competitors such as Adidas and Under Armour keep growing and possibly capture more of the market share and also if the introduction within the Chinese market fails. If consumers start to shift to a more casual and formal look, then the popularity of athletic wear will die down a bit. This is something to consider since consumers are very mind sensitive on what is popular these days in terms of the industry and also because of the uncertainty. Behind Nike, Under Armour is the second largest US sportswear company. They produced almost $3 billion revenue for the year 2014. Under Armour has teamed up with NBA superstar and reigning MVP in order to help break into the Asia region of the global footwear industry. If Under Armour continues to make savvy partnerships with more popular athletes, this can show as a threat to Nike’s business. In China, the rising middle class social regions are increasing their athletic apparel demand. China can be a huge growth opportunity for Nike but yet the market is still unstable. Since the GDP per capita keeps rising, then there is more consumer discretionary income to spend. The only problem with infiltrating this region, is that Chinese consumers can be unpredictable.

On the upside, the rewards from infiltrating the Asia market can be great. With Nike breaking into this new segment, with competition from Under Armour, Nike can see great gains in their revenue and overall growth. Also, the high revenue which will continue for the year 2017-2018 from the NBA partnership deal will reveal huge gains for Nike. As basketball one of the more popular sports in the US, Nike will be able to make a lot of Revenue from apparel prices. Another growth driver for this company, will be the company’s “Integrated Marketplace”. This will drive in the future where the revenues will be expected to be operated by e-commerce sales and are also projected to to raise to around $7 billion in the next 4 and a half years. The company has already taken steps to improve its mobile commerce experience by adding style guides, broadened assortments and improved performance. It now aims to serve its customers wherever, whenever and however they want by providing easy access to Nike products, services and environments. With the introduction to the women’s segment, revenues can reach around $11 billion by the financial year 2020.

Summary

Overall, Nike Inc. is a great company in terms of their financials, innovation and development. Their revenues are certain to grow within the next few years due to their growth and introduction into emerging markets. Even with competitors such as Under Armour and Adidas who are Nike’s biggest competition currently, Nike still has made future deals, for example, the NBA deal which will reduce Adidas’ revenue and boost Nike’s own. Also, the celebrities which are signed to Nike, such as Michael Jordan and Cristiano Ronaldo are a big increase in attraction to consumers who also follow these athletes. With their incredible range of consumer goods which deal directly to the global athletic footwear market, they will most likely make their mark of their total revenue of $50 billion in sales by the year 2020. As stated before, the greater risks lie within if the Chinese Market segment is unstable and not what Nike expected and hence they lose revenue within that segment. Also, of course competition is a great threat since Adidas and Under Armour are also rising to take over some of Nike’s market share, especially Under Armour with the Asian Market. Holding Nike as a stock and possibly buying more shares in this company can be very beneficial. The revenue targets for Nike are very high and they can possibly rule this industry within the next 20 years. Also, not mentioned above, Nike has also partnered with Apple to create the Apple Watch Nike +. This watch can be used within the global athletic footwear industry. As Apple is one of the greater innovative companies who specialize in creating products that catch the viewer’s eye. Using this as an example in terms of how Nike will grow its revenue due to partnerships, Nike will become more innovative and be able to break into different segment of customers.

In the near future, one can see Nike as a definite buy as its stock price should increase due to all these new ideas and revenue builders. As Nike continues to pursue partnerships in order to create more unique and innovative products, its customer segments will grow and also will revenues. I do not expect the trend of being ‘healthy and fit’ to die out anytime soon, so only great things can come for Nike in the next coming years.

Appendix

Works Cited

Lutz, Ashley. "Nike Faces 3 Obstacles That Could Threaten Its Global Domination."

Business Insider. Business Insider, Inc, 29 June 2015. Web. 14 Oct. 2016.

"Nike Inc (NKE) Stock Analysis - GuruFocus.com." Nike Inc (NKE) Stock Analysis -

GuruFocus.com. N.p., n.d. Web. 14 Oct. 2016.

Forbes. Forbes Magazine, n.d. Web. 14 Oct. 2016.

"Footwear Market Trends." Footwear Market Trends. N.p., n.d. Web. 14 Oct. 2016.

@digitaltrends. "NBA Commissioner Says Nike’s Tech Will Take League to a Level

Adidas Never Reached." Digital Trends. Digital Trends, 22 Apr. 2016. Web. 14 Oct. 2016.