Mvat Act Doc

-

Upload

timothy-brown -

Category

Documents

-

view

227 -

download

0

Transcript of Mvat Act Doc

-

8/17/2019 Mvat Act Doc

1/28

MVAT - Maharashtra Value Added Tax.

INTRODUCTION

MVAT Act, 2002, has been introduced in the state of Maharashtra

w.e.f. 01‐04‐2005.As the name suggests, VAT i.e. Value Added Tax is atax uon e!er" !alue addition. #rior to 01‐04‐2005, Maharashtra had first

stage single‐ oint le!" s"stem of taxation imlemented through the

$omba" %ales Tax Act, 1&5&. 'nder that s"stem, onl" manufacturers and

imorters were re(uired to a" the tax on the first sale ta)ing lace in the

state. As against this, VAT s"stem contemlates tax at e!er" stage in the

entire chain of transactions relating to the same goods. The concet has become (uite familiar with our fellow brothers and need not be exlained

further with the hel of examles etc. %uffice it to sa", VAT is le!iable on

each sale haening in resect of the same goods.

A (uestion fre(uentl" is as)ed whether ositi!e !alue addition at

e!er" stage is necessaril" re(uired under VAT. The scheme of MVAT Act,

2002, does not re(uire such !alue addition at e!er" stage. *!en if the

seller sells the goods at cost rice, without adding an" margin for his

exenses or rofit etc., VAT is le!iable on that sale. Value addition also

does not mean enhancement of the intrinsic !alue of the goods. To gi!e

an examle, +A urchases motor car and fits accessories therein li)e air

conditioner, music s"stem etc. -n this case, there is ositi!e !alue addition

to the intrinsic !alue of the goods and VAT is certainl" alicable on the

sale of such motor car.

-n another case, +A urchases the said motor car and sells in the

same condition without an" refurbishment. -n that case too, VAT is

a"able on the sale of such car although there is no !alue addition made

b" the seller therein.

1

-

8/17/2019 Mvat Act Doc

2/28

MVAT - Maharashtra Value Added Tax.

Value addition can also be in the nature of exenses incurred on the

rocurement of the goods and mar)eting thereof without adding an"thing

into the intrinsic !alue of the goods such as selling exenses, ad!ertising

exenses, transort etc. *!en in such cases, VAT is alicable on the sale

of such goods. Another fre(uent (uer" is in resect of the case where

goods are sold at a loss. -n that case too, VAT is alicable on the sale

rice although offsetting the urchase tax against such sales tax ma"

result into a refund. There is no exress rohibition under MVAT Act to

claim refund in such cases.

2

-

8/17/2019 Mvat Act Doc

3/28

MVAT - Maharashtra Value Added Tax.

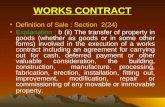

The MVAT Act, 2002.

Introduction of MVAT Act, 2002:

The Maharashtra Value Added Tax 2002 /erein after called as MVAT

Act has relaced the $omba" %ales Tax Act, 1&5& on w. e. f. 1st Aril

2005 and now the sales tax is collected b" the Maharashtra go!ernment

under MVAT Act, 2002.

hen the sales tax was collected under The $. %. T. Act, 1&5&,

hat was the reason to introduce the new MVAT Act, 20023

hat is the difference between the two Acts3

h" the go!ernment felt the need to relace the $. %. T. Act3

The basic difference is the charging of sales tax. 'nder the $.%.T. Act,

1&5& it was a single oint le!" of tax i.e. tax collection was at first

stage and other stages are allowed as resales and no tax a"able on

subse(uent stages.

/owe!er to increase the re!enue, the o!t. of Maharashtra in the $%T

regime.

-ntroduced resale tax which was maximum at 0.5 ercent on

sales. 'nder the MVAT Act, 2002 the concet of collection of sales tax

has changed and now the sales tax is collected at e!er" stage of !alue

addition till the goods reaches to the end user or consumer.

3

-

8/17/2019 Mvat Act Doc

4/28

MVAT - Maharashtra Value Added Tax.

Scope Of MVAT.

The MVAT Act, 2002 deals with the law relating to the le!" of tax

on the sale or urchase of certain goods in the %tate of Maharashtra. The

word %tate6 where!er used in the MVAT Act means the %tate of

Maharashtra.

Registration Liai!it"#

%ection 7 4 rescribes the limits of turno!er of sales for the

urose of attracting registration liabilit". -t must be borne in mind that it

is onl" the turno!er of sales which has to be comuted for this urose

and not the turno!er of urchases. The said limits are as under8

Categor" Of Dea!er Li$it Of T%rno&er Of Sa!es

Other Con'itions

-morter 9s. 1,00,000:‐ Value of taxable goods sold or urchased during

the "ear is not less than 9s. 10,000:‐ ;thers 9s. 10,00,000:‐ Value of

taxable goods sold or urchased during the "ear is not less than 9s.

10,000:‐

-morter, here, means as defined u:s. 217 and is a dealer who

brings an" goods into the state or to whom an" goods are disatched from

an" lace outside the state. Thus, he can be a dealer who recei!es the

goods from other states either b" wa" of stoc) transfers or b" wa" of

interstate urchases or b" imorting the goods from a foreign countr".

The condition of minimum !alue of imorted goods is consicuousl"

absent in this section as comared to the corresonding section under the

$%T Act. Therefore, a dealer who is an imorter in the sense described

abo!e, e!en for a negligible amount, would be liable for registration if his

turno!er of sales exceeds 9s. 1,00,000:‐.

4

-

8/17/2019 Mvat Act Doc

5/28

MVAT - Maharashtra Value Added Tax.

INCID(NC( O) TA*

The charging section is contained in section 4 which reads as

under8 %ub

-

8/17/2019 Mvat Act Doc

6/28

MVAT - Maharashtra Value Added Tax.

SC+(DUL(S AND RAT( O) TA*

• All the goods are classified under %chedules A to *.

• Sche'%!e A co!ers goods, which are generall" necessities of life.

oods co!ered b" %chedule A are free from tax. %ome of the items

co!ered b" %chedule A are agricultural imlements, cattle feed, boo)s,

bread, fresh !egetables, mil), sugar, fabrics, lain water, etc.

• Sche'%!e co!ers .

• All items which are not co!ered in an" of the abo!e %chedules are

automaticall" co!ered in residuar" Sche'%!e (. oods co!ered b"

%chedule * are sub.

VI. (*(M-TIONS

Collowing sales transactions are exemt from a"ment of tax under

MVAT Act8

6

-

8/17/2019 Mvat Act Doc

7/28

MVAT - Maharashtra Value Added Tax.

• -nterstate sale is exemt from a"ment of sales tax and it ma" be

liable to tax under @.%.T. Act. D%ection E1F

• %ales ta)ing lace outside the state as determined under %ection 4

of the @.%.T. Act. D%ection E1F

• %ales in the course of imort or exort D%ection E1F

• %ales of fuels and lubricants to foreign aircrafts. D%ection E2F

• -nter se sales between %ecial *conomic Gones, de!eloers of

%*G, 100> *;', %oftware Technolog" #ar)s and *lectronic /ardwareTechnolog" #ar) 'nits sub

-

8/17/2019 Mvat Act Doc

8/28

MVAT - Maharashtra Value Added Tax.

• As er %ection E5, the %tate o!ernment ma", b" general or

secial order, exemt full" or artiall" sales to secific categor" of

dealers mentioned in this sub %ection. $" Iotification dated 1&4200J

concessional rate of tax ? 4> is ro!ided for sale to secified *lectric

#ower enerating and Histribution @omanies, MTIK, $%IK, other

secified telehone ser!ice ro!iders and telecom infrastructure

ro!iders.

• ;ne more notification dated 2&th Bune, 200& is issued b" the %tate

o!ernment u:s. E5 b" which sale of certain secific goods for

satellite launch s"stem to the Heartment of %aceL o!ernment of

-ndia is exemted from a"ment of tax with effect from 1st Bul", 200&.

• The %tate o!ernment ma" issue the notification to grant refund of

an" tax le!ied on and collected from an" class or classes of dealers or

ersons or as the case ma" be, charged on the urchases or sales made

b" such class or classes of dealers or ersons. %ection 41. At resentthis notification is issued for grant of refund in case of @onsulate and

Hilomat authorities.

• As er %ection 414b read with notification dated 7011200E

issued under the said section, the sale of motor sirit at retail outlets is

exemted from tax, if the retail outlet urchases the same from

registered dealer.

VII. S(TO)) /IN-UT TA* CR(DIT

%ection 4E of the MVAT Act ro!ides for grant of inut tax credit to an"

registered dealer in resect of an" tax aid on his urchases sub

-

8/17/2019 Mvat Act Doc

9/28

MVAT - Maharashtra Value Added Tax.

to 55 of the MVAT 9ules, 2005. There are changes in rules from time to

time. The udated osition of setoff 9ules as on 01.0J.200& can be

summaried as under.

I$portant con'itions#

1. To be eligible for set off, a dealer must be registered under MVAT

Act at the time of urchase of goods, excet as ro!ided in 9ule

551a.

2. As er rule 52 set off is a!ailable on 9H urchases of goods being

caital assets and goods, the urchases of which are debited to #rofit

and Koss Account or Trading A:c.

7. Collowing sums are eligible for set off8

i Tax aid searatel" on urchases effected within the %tate and

suorted b" +Tax -n!oice+. *ntr" tax aid under Maharashtra *ntr" Tax

on oods Act as well as Maharashtra *ntr" Tax on Motor Vehicles Act.

9

-

8/17/2019 Mvat Act Doc

10/28

MVAT - Maharashtra Value Added Tax.

Registration Un'er MVAT Act

1+ TO OTAIN R(3ISTRATION C(RTI)ICAT(4

1 ‐ ;btaining of registration certificate is statutor" obligation of e!er"

dealer, who is liable to a" tax under the Act.

2 ‐ -t emowers the dealer to collect tax.

7 ‐ A registered dealer gets the benefits of set off inut tax credit

4 ‐ $usiness without registration in!ites enalt":rosecution.

5 ‐ Iobod" would li)e to bu" goods from unregistered dealer.

1ho sho%!' app!" for the registration4

The dealer who attains or crosses rescribed turno!er of urchase or sale

should al" for registration under VAT Act within 70 da"s from the date

on which turno!er crossed the rescribed limit.

Iote8 ;nce a dealer exceeds the rescribed turno!er and fulfils the

conditions as mentioned in table below, then the liabilit" to a" taxes

under the Act commences from the time of transaction b" which the

turno!er exceeds the rescribed limit.

1hat happens if not app!ie' in ti$e for registration4

hen a dealer does not al" within 70: =0 da"s from the date of

exceeding the rescribed turno!er of urchases or sales than certificate of

registration will be issued with effect from the date of uloading of the

alication. Therefore, from the date of starting of business till the date of

uloading of the alication, the dealer will be treated as unregistered.

-ro&isions of -ena!t" for %nregistere' 'ea!ers#

-f dealer does not al" in time and remains unregistered, it is an offence

under the Act.

10

-

8/17/2019 Mvat Act Doc

11/28

MVAT - Maharashtra Value Added Tax.

enefits of Registration#

i. /e can claim set off of tax aid on the urchase if eligible to get an".

ii. /e can issue !arious declarations rescribed @.%.T. Acts li)e Corm @

etc.

iii. 9egistered dealers are referred while awarding the go!ernment

contracts. The abo!e mentioned benefits are denied to an unregistered

dealer.

Disa'&antages of non registration#

5 'nregistered dealer is liable to a" tax on the sales affected b" him but

he cannot collect tax.

2 /e cannot claim an" set off or refund of the tax aid b" him.

6 #urchases at concessional rate of tax not a!ailable to him. /e cannot

issue forms or declarations li)e Corm @ etc.

7 Io authenticit" in the mar)et as ma

-

8/17/2019 Mvat Act Doc

12/28

MVAT - Maharashtra Value Added Tax.

Ne: Co$position sche$e for MVAT

Dea!er ; Its App!icai!it"

Heut" @hief Minister of the Maharashtra state announced the newcomosition scheme for retailers in his budget seech. The sales tax

deartment comes with the trade circular Io. VAT:AMH:2014:E:AHME

dated 20:0&:2014 regarding the new retailers comosition scheme. The

old comosition scheme is exired with effect from 70th%etember 2014.

The new comosition scheme will be effecti!e from 1st ;ctober 2014.

ho is the eligible dealer for the new comosition scheme3

Collowing is the list of the conditions for the eligible dealer for

comosition scheme.

1. The dealer should be register under MVAT act 2002

2. Alicant dealer should be a retailer, as exlain in section 42 1 b of

MVAT Act. At least &0> of sales should be to the end user i.e. to the

erson who is not dealer

7. The alicant dealer should not be a manufacture or an imorter.

4. The turno!er of sales of goods should not exceed ruees fift" lac) in

the re!ious "ear in which new comosition scheme is alied. hile

calculation the turno!er the turno!er of sales of goods, turno!er of sale of

high seed diesel or an" other )ind of motor srit co!ered b" entr" 5 and

10 of the %@/*H'K* H of the MVAT act and furnishing fabric co!ered

b" entr" 101 of %@/*H'K* @ of MVAT act is not considered.

5. The goods should be urchase from register dealer. /owe!er, this

condition is not alicable to the taxfree goods, ac)ing material used

for ac)ing of the goods, resold b" him.

=. The dealer who is ot comosition scheme from 1st ;ctober 2014

should be liable to file six monthl" returns during the "ear 20142015.

12

-

8/17/2019 Mvat Act Doc

13/28

MVAT - Maharashtra Value Added Tax.

The dealer who is liable to file monthl" or (uarterl" return during the

"ear 201415 shall not eligible to ot comosition scheme.

hat is the rate of @omosition amount3

There are two otions ro!ided for a"ment of comosition mone".

;tion 1N -f dealer ot to a" comosition amount on total turno!er of

sales, then he shall a" 1> on entire turno!er of sales including tax Nfree

goods.

;tion 2 N -f dealer ot to a" comosition amount on turno!er of sales

of taxable goods onl", then he shall a" 1.5> on such turno!er of sales.

hat are the conse(uences after alication of comosition scheme3

1. @omosition amount or tax shall not be collected searatel" b"

comosition dealer

2. @omosition dealer cannot issue the tax in!oice. /owe!er, he can

issue the cash memo, sales bill, etc. if !alue of goods sold exceeds 9s.

fift".

7. @omosition dealer shall not eligible to claim setoff under MVAT

rule 2005 in resect of urchase of goods, for which comosition has

been a!ailed. %etoff of ac)ing material used for ac)ing of the goods

for which comosition scheme is alied is not a!ailable. /owe!er, it is

clarified that dealer can claim setoff on urchase of caital assets,for

which benefit of comosition is not a!ailed.

4. A dealer oting for comosition scheme is not eligible for set off.Therefore, dealer oting for comosition scheme shall be re(uired to

re!erse the set off, alread" claimed, on the urchase of the goods held in

stoc) on the da" of oting for new comosition scheme. Cor examle, is

there is a closing stoc) of 9s. 5 lac)s and set off of 9s. 25000. The dealer

is re(uired to a" 9s.25000 in addition to comosition amount in his first

comosition return. The re!ersal of the setoff is re(uired to show in the

13

-

8/17/2019 Mvat Act Doc

14/28

MVAT - Maharashtra Value Added Tax.

row e of box 14 of the returns in Corm 272 or row e of box 17 of the

returns in Corm 277, as the case ma" be.

5. The comosition dealer is re(uired to file six monthl" return.

hen and how dealer can

-

8/17/2019 Mvat Act Doc

15/28

MVAT - Maharashtra Value Added Tax.

Co$positing 1or

-

8/17/2019 Mvat Act Doc

16/28

MVAT - Maharashtra Value Added Tax.

xi. 9ail trac)s,

xii. @ausewa"s, %ubwa"s, %illwa"s,

xiii. ater sul" schemes,

xi!. %ewerage wor)s,

x!. Hrainage,

x!i. %wimming ools,

x!ii. ater #urification lants and

x!iii. Bett"s

$ An" wor)s contract incidental or ancillar" to the contracts mentioned

in aragrah A abo!e, if such wor) contracts are awarded and executed

before the comletion of the said contracts.

-f the dealer ots for 5> comosition scheme, inut credit in excess of

4> of urchase rice can be a!ailed i.e. there will 4> retention in setoff

according to 9ule 574b of MVAT 9ules

and balance setoff can be a!ailed.

2. Co$position for a!! t"pes of 1or= Co$position

Sche$e

/ere, dealer ma" choose to a" VAT ?E> on total contract !alue less the

amount aid towards wor)s contract executed b" a registered sub

contractor. -n case dealer ots for E>

comosition scheme, 7=> ercent of total setoff amount is disallowed

and balance =4> setoff can be a!ailed as er 9ule 574a of MVAT

9ules.

16

-

8/17/2019 Mvat Act Doc

17/28

MVAT - Maharashtra Value Added Tax.

6. Co$position sche$e for %i!'ers an' De&e!opers# /5=

Co$position Sche$e

'nder this scheme, registered dealers underta)ing construction of flats,

dwellings or buildings or remises ma" choose to a" VAT ?1> of the

agreement amount secified in the agreement or agreement !alue adoted

for stam dut" uroses whiche!er is higher. -f he chooses to ot for this

scheme, he cannot a!ail an" inut tax credit in resect of urchases

effected b" him. Curther, he is not allowed to ma)e an" urchase against

+@ form. Also, he cannot issue tax in!oice and also not eligible for to

issue Corm Io. 40& to the subcontractor.

Works Contract TDS:

As er ro!isions of 9ule 40 of MVAT 9ules, notified emlo"ers are

re(uired to deduct TH%, )nown as wor)s contract TH% or @T TH%

from the amount a"able to the contractor. The rate of TH% shall be 2> if

the contractor is a registered dealer. -f the contractor is unregistered, rate

of tax deduction shall be 5>. The deductor needs to file @T TH% return

in form Io. 424 before 70th Bune e!er" "ear.

17

-

8/17/2019 Mvat Act Doc

18/28

MVAT - Maharashtra Value Added Tax.

Co$position Sche$e for a

-

8/17/2019 Mvat Act Doc

19/28

MVAT - Maharashtra Value Added Tax.

7. who urchases an" goods from a registered dealer whose sales of the

said goods are not liable to tax b" !irtue of the ro!isions contained

in subsection 1 of section E or

4. who sells at retail li(uor including li(uor imorted from out of -ndia,

-ndian Made Coreign Ki(uor or @ountr" Ki(uor excet as ro!ided

in subsection 2

Sche$e as App!ica!e to a of the first Cift" Ka)h ruee of the total turno!er of sales of

goods referred abo!e in a goods imorted out of Maharashtra

%tate, if an", including bread in loaf, rolls, or in slices, toasted or

otherwise,

2. in the case of a registered dealer and = er cent. of the first Cift"

Ka)h ruee of the total turno!er of sales of goods referred to in a

abo!e and goods imorted out of Maharashtra %tate, if an"

including bread in loaf, rolls, or in slices, toasted or otherwise

(c) Conditions in which this scheme will be applicable to retailers

i. The claimant dealer shall be certified b" the Boint @ommissioner

for the urose of claiming benefit under this entr",

ii. The claimant dealer shall not be entitled to claim an" set off under

the MVAT 9ules, in resect of the urchases corresonding to an"

goods which are sold or resold or used in ac)ing of goods referred

in a abo!e,

19

http://www.blogger.com/blogger.g?blogID=4953048163586243270http://www.blogger.com/blogger.g?blogID=4953048163586243270

-

8/17/2019 Mvat Act Doc

20/28

MVAT - Maharashtra Value Added Tax.

iii. The turno!er of sales of ba)er" roducts including bread has not

exceeded ruees Cift" Ka)h in the "ear re!ious to which the

comosition is a!ailed and if the dealer was not liable for

registration under the $%T Act, 1&5& or under MVAT Act, 2002, in

the immediatel" receding "ear, then he shall be entitled to claim

the benefit of the scheme in resect of the first Cift" Ka)h ruees of

the total turno!er of sales in the current "ear,

i!. The claimant dealer shall al" in the +Corm7 aended to this

notification to Boint @ommissioner of %ales Tax 9egistration in

case of dealers in Mumbai and in other @ases with Boint

@ommissioner of %ales Tax VAT Administration,

!. The to

-

8/17/2019 Mvat Act Doc

21/28

MVAT - Maharashtra Value Added Tax.

ix. %ub

-

8/17/2019 Mvat Act Doc

22/28

MVAT - Maharashtra Value Added Tax.

1. 9estaurants, *ating /ouse, 9efreshment 9oom, $oarding

*stablishment, Cactor" @anteen, @lubs, /otels and @aterers

2. $a)ers

7. 9etailers

4. Healers in %econdhand Motor Vehicles

Co$position Sche$e %n'er section 72/5 sha!! not app!" to a 'ea!er

1. who is a manufacturer or

2. who is an imorter or

7. who urchases an" goods from a registered dealer whose sales of

the said goods are not liable to tax b" !irtue of the ro!isions

contained in subsection 1 of section E or

4. who sells at retail li(uor including li(uor imorted from out of

-ndia, -ndian Made Coreign Ki(uor or @ountr" Ki(uor excet as

ro!ided in subsection 2

Sche$e App!ica!e to Retai!ers

ho is dealer engaged in 9etailing 3

Cor the urose of comosition scheme for retailers, a dealer shall be

considered to be engaged in the business of selling at retail if &:10th of

his turno!er of sales consists of sales made to ersons who are not

dealers. -n case of an" (uestion arises to determine whether an" articular

dealer is a retailer or not, then the (uestion shall be referred to the Boint

@ommissioner, who shall after hearing the dealer, if necessar", decide the

(uestion. The order made b" the Boint @ommissioner shall be final.

22

http://cakamalg.blogspot.com/2012/01/composition-scheme-for-bakers-under.htmlhttp://www.blogger.com/blogger.g?blogID=4953048163586243270http://cakamalg.blogspot.com/2012/01/composition-scheme-for-bakers-under.htmlhttp://www.blogger.com/blogger.g?blogID=4953048163586243270

-

8/17/2019 Mvat Act Doc

23/28

MVAT - Maharashtra Value Added Tax.

hat are class of sales and urchases which are eligible for enabling

benefit under this scheme 3

The scheme shall be alicable to total turno!er of sales made b"

a registered dealer , who is a retailer as ro!ided in section 41 and

exlained abo!e, of an" goods excluding the turno!er of resales if an",

effected b" him, of the following goods8

1. Coreign li(uor, as defined in rule 7=1 of the $omba" Coreign

Ki(uor 9ules, 1&57.

2. @ountr" li(uor, as defined in Maharashtra @ountr" Ki(uor 9ules,

1&J7.

7. Ki(uor imorted from an" lace outside the territor" of -ndia as

defined, from time to time, in rule 74 of the Maharashtra Coreign

Ki(uor -mort and *xort 9ules,1&=7.

4. Hrugs co!ered b" the entr" 2& of the %chedule @ aended to the

Act.

5. Motor %irits notified b" the %tate o!ernment under subsection

4 of section 41 of the Act.

Co$position A$o%nt /Ta? pa"a!e

The comosition amount shall be, calculated on the,

• *xcess, if an", of the total turno!er of sales, including turno!er of

sales of tax free goods but excluding li(uor, Hrugs, and Motor

%irits referred abo!e, in resect of an" six monthl" eriod

•

o!er the turno!er of urchases including turno!er of urchases of tax free goods, but excluding li(uor, Hrugs, Motor %irits referred

23

-

8/17/2019 Mvat Act Doc

24/28

MVAT - Maharashtra Value Added Tax.

to in column 7 of this entr" , in resect of the said six month

eriod.

•

The turno!er of urchases shall be increased b" the amount of taxcollected b" the !endor of the retailer searatel" from the retailer.

The Tax a"able on amount so calculated abo!e is

• 1 at the rate of " per cent for the retailers whose aggregate of the

turno!er of sales of goods, co!ered b" schedule A and goods

taxable at the rate of 4 er cent., if an", is more than 50 er cent. of

the total turno!er of salesL excluding the turno!ers of li(uor, drugs

and motor sirits referred to columns 7 of this entr"

• 2 at the rate of # per cent$ in an" other case.

Con'itions in :hich this sche$e :i!! e app!ica!e to retai!ers

i. The selling dealer does not collect tax searatel" in resect of the

sales secified abo!e.

ii. The claimant dealer shall not be entitled to claim an" set off under

the Maharashtra Value Added Tax 9ules, 2005, in resect of the

urchases corresonding to an" goods which are sold or resold or

used in ac)ing of such goods sold.

iii. The turno!er of sales of such goods does not exceeded rupees fifty

la%h in the "ear re!ious to which the comosition is a!ailed of

and if the dealer was not liable for registration, in the immediatel"

receding "ear, then he shall be entitled to claim the benefit of the

24

-

8/17/2019 Mvat Act Doc

25/28

MVAT - Maharashtra Value Added Tax.

scheme in resect of the first fift" la)h ruees of the total turno!er

of sales in the current "ear

i!. The turno!er of urchases referred to abo!e shall be reduced b" theamount of e!er" credit of an" t"e recei!ed b" the selling dealer

from an" of his !endors whether or not such credit is in resect of

an" goods urchased b" the selling dealer from the said !endor.

!. -n resect of the six monthl" eriod starting on the 1st Aril 2005,

for calculating the excess, 5:=th of the turno!er of sales of the six

monthl" eriod is to be considered instead of the entire turno!er of

sales for that eriod.

!i. The claimant dealer shall al" in the +Corm4 aended to the

notification for exercising the otion to a" tax under the

comosition scheme. The alication should be made to the

assessing authorit" who was in charge of the case on the 71st

March 2005 before the 15th Bune 2005 or as the case ma" be, to the

registering authorit" at the time of alication for 9egistration

@ertificate under the Act.

!ii. %ub

-

8/17/2019 Mvat Act Doc

26/28

MVAT - Maharashtra Value Added Tax.

xi. #urchases of tax free goods ma" be from registered dealers as well

as from unregistered dealers.

xii. An" other urchases from unregistered dealers are meant onl" for ac)ing of goods resold.

26

-

8/17/2019 Mvat Act Doc

27/28

MVAT - Maharashtra Value Added Tax.

Conc!%sion

-n nutshell, it can be stated that a erson effecting sales has to

ascertain that whether he is doing so in the caacit" of a dealer ha!ing

regard to the fre(uenc", continuit", regularit", !olume etc. of the

transactions. 9efer %ureme @ourt

-

8/17/2019 Mvat Act Doc

28/28

MVAT - Maharashtra Value Added Tax.

1e!iograph"

www.finance.indiamart.com

www.caclubindia.com

www.ser!icetax.go!.in

www.management aradise.com

www.tax4india.com

www.wisegee).com

www.wi)iedia.com

http://www.caclubindia.com/http://www.servicetax.gov.in/http://www.tax4india.com/http://www.wisegeek.com/http://www.wikipedia.com/http://www.caclubindia.com/http://www.servicetax.gov.in/http://www.tax4india.com/http://www.wisegeek.com/http://www.wikipedia.com/