April 2016 - ctconline.org · TITLE CODE :- MAHENG13836 ... Indirect Taxes Workshop On MVAT Act,...

Transcript of April 2016 - ctconline.org · TITLE CODE :- MAHENG13836 ... Indirect Taxes Workshop On MVAT Act,...

1April 2016 • THE CTC NEWSwww.ctconline.org

Helpdesk : (1) Events: Mr. Anand / Ms. S. Aarti • E-mail : [email protected] (2) Accounts & Membership : Ms. Manisha / Ms. Yogita E-mail : [email protected] (3) Administration : Mr. Hitesh Shah • E-mail : [email protected]

Cheque payments for all events are accepted at CTC JT Bandra Library at C-11, Bandra Kurla Complex, IT Office, Ground Floor, Bandra (E), Mumbai – 400 051

3, Rewa Chambers, Ground Floor, 31, New Marine Lines, Mumbai–400 020 Tel.: 2200 1787 / 2209 0423 • Fax: 2200 2455 E-mail: [email protected] • Website: www.ctconline.org

LECTURE MEETINGSSTUDENT & IT COMMITTEEThursday, 21st April, 2016

6.00 p.m. to 8.00 p.m. Provisions related to TDS &

Questions & Answers CA Mahendra Sanghvi Maheshwari Bhavan,

1st Floor, Marine Lines, Mumbai – 400 002

ALLIED LAWS COMMITTEEWednesday, 27th April, 2016

6.00 p.m. to 8.30 p.m. Real Estate (Regulation and

Development Act, 2016) (Passed by Lok Sabha and Rajya Sabha)

Shri K. K. Ramani, Advocate & Past President & CA Ramesh Prabhu A. V. Centre Hall, 4th Floor, Jai Hind

College, Churchgate, Mumbai – 400 020

RRC & SD COMMITTEEWednesday, 20th April, 2016

6.15 p.m. to 8.00 p.m. Achieve More With Less

– Make Every Moment Count Shri Arvind Khinvesra

Founder Achieve ThySelf CTC Conference Hall,

3, Rewa Chambers, Ground Floor, 31, New Marine Lines, Mumbai – 400 020.

Restricted to 25 members

TITLE CODE :- MAHENG13836

A Monthly Newsletter of The Chamber of Tax Consultants

President : Mr. Avinash Lalwani (Tel.: 23865363) | Vice President : Mr. Hitesh R. Shah (Tel.: 22001436)Hon Jt. Secretaries Mr. Ajay Singh (Tel.: 22013242) Mr. Ashok Manghnani (Tel.: 26774463) | Hon. Treasurer Mr. Hinesh Doshi (Tel.: 24132475)

April 2016

Vol. I Issue 11 | Total Pages - 16

Sr. No. Date Committee Nature of Programme Programmes Description Venue Pg.

No.1 5-4-2016 Allied Laws Study Circle Meeting On Drafting of Documents Relating to Family

Arrangement & PartitionCTC Conference Room 9

2 9-4-2016 Student & IT Connect Practical Workshop On Effective Email Management CTC Conference Room 23 10-4-2016 Indirect Taxes Half Day Workshop

(Jointly) On Service Tax WIRC Branch Auditorium,

Ahmedabad8

4 12-4-2016 Indirect Taxes Study Circle Meeting On Service exporters under the Foreign Trade Policy Babubhai Chinai Room, IMC 115 16-4-2016 Direct Taxes Full Day Seminar On Appellate Proceedings, DRP and AAR West End Hotel, Mumbai 46 17-19-4-2016 Student & IT Connect RRC (Jointly) Youth Residential Refresher Course Dew Drops Boutique, Igatpuri 27 18-4-2016 Direct Taxes Intensive Study Group

Meeting On Direct Taxes CTC Conference Room 12

8 20-4-2016 RRC & SD Lecture Meeting On Achieve More with Less – Make Every Moment Count

CTC Conference Room 7

9 21-4-2016 Student and IT Connect Lecture Meeting On Provisions related to TDS & Q & A Maheshwari Bhavan, Chira Bazar 1010 22, 23 & 29,

30-4-2016International Taxation Full Day Workshop

(4 Days)Advanced Workshop on Principles of Transfer Pricing West End Hotel, Mumbai 5

11 23-4-2016 Delhi Chapter Full Day Seminar On Start Up – Understanding, Funding India International Centre – Delhi 1212 23-4-2016 Membership & Public Relations Full Day Seminar (Jointly) On Direct Tax Jamnagar 1013 24-4-2016 Membership & Public Relations Full Day Seminar (Jointly) On Various Laws & Procedures related to Individuals Jamnagar 1014 25-4-2016 Study Circle & Study Group Study Circle Meeting “On Concept of Capital Value vis-a-vis- Property

Taxes charges by Local Authority & On Issues in Reassessment Proceedings Under IT Act, 1961 (Part- II)”

Babubhai Chinai Room, IMC 11

15 26-4-2016 Membership & Public Relations Self Awareness Series On Leadership Sutras from Bhagavad Gita CTC Conference Room 1116 27-4-2016 Allied Laws Lecture Meeting On Real Estate (Regulation and Development

Act, 2016)A.V. Centre Hall, Jaihind College 9

17 28-4-2016 Study Circle & Study Group Study Group Meeting On Recent Judgments under Direct Taxes Babubhai Chinai Room, IMC 1118 29-30-4-2016 Allied Laws Education Course On Capital Market West End Hotel, Mumbai, &

Conference Room, Consultair Investment Pvt. Ltd.

3

19 3 & 4-6-2016 Allied Laws Two Half Day Series On Auditing – A Way Forward – SME Perspective CTC Conference Room 920 11-6-2016 Direct Taxes Full Day Seminar On ICDS To be announced 821 23-26-6-2016 International Taxation 10th Residential

Refresher ConferenceOn International Taxation Rhythm Resort, Lonavala 6-7

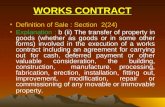

22 16, 30-4-2016 7-5-2016

Indirect Taxes Workshop On MVAT Act, Service Tax and Allied Laws STPAM Library, Mazgaon –

23 Law & Representation Suggestions for Post Budget Memorandum — 1224 — — — Renewal Notice 2016-17 — 1325 — — — Unreported Decisions (Direct Taxes & Indirect Taxes) — 14-1626 Additions to J.R. Shah Library 427 Publication for Sale 428 — — — Quotations — 16

POST BUDGET SUGGESTIONS

L & R COMMITTEEREQUEST FOR SUGGESTIONS ON POST

BUDGET MEMORANDUM 2016

Like every year, this year also The Chamber intends to make exhaustive

Post Budget Representation 2016. Members are requested to send their

suggestions by email on [email protected]. by 5-4-2016

2April 2016 • THE CTC NEWSwww.ctconline.org

Interested members may download the “Form” from The Chamber’s website www.ctconline.org or may collect it from The Chamber’s office and send it along with the cheque in favour of “The Chamber of Tax Consultants” Outstation Members are requested to send the DD/at Par cheque. Visit www.ctconline.org to avail the facility of ONLINE PAYMENT.

The ObjectiveObjective of workshop is to understand and effectively manage e-mails in an organisation. After this workshop, one will be able to under-stand e-mails from management, security, regulatory and legal perspectives.Session 1 : E-mail Management : Fundamentals, Tips and TechniquesSession 2 : Practical Hands on Demo on important tools & techniques and Mini Session 3: Overview of Perspective on e-mails from Security, Regulatory and Legal Perspective

Who should attend?Tax professionals, CA, CS, Office Managers who want to manage e-mail effectively

Programme DetailsDay, Date & Time : Saturday, 9th April, 2016; 10 a.m. to 2 p.m.Venue : CTC Conference Room, 3 Rewa Chambers, Ground Floor, 31, New Marine Lines, Mumbai – 400 020.

Sr. No.

Sessions / Topic Speakers

1. E-mail Management : Fundamentals, Tips and Techniques CA Uday Shah 2. Practical Hands on Demo CA Maitri Savla 3. Overview of Perspective on e-mails from Security, Regulatory and Legal Perspective CA Maitri Savla (15 mins)

Fees : Members Non-Members` 400/- + 14.5% ST ` 58/- = ` 458/- ` 600/- + 14.5 ST ` 87/- = ` 687/-

PRACTICAL WORKSHOP ON EFFECTIVE E-MAIL MANAGEMENT

Chairman : Parimal Parikh Vice Chairmen : Aalok Mehta, Dinesh Tejwani Convenors : Ashok Mehta, Bhavik Shah, Maitri Savla, Mitesh Katira Advisors : A. S. Merchant, Ninad Karpe

STUDENT AND IT CONNECT COMMITTEE

YOUTH RRC We are pleased to announce that Student & IT Connect Committee of Chamber jointly with Bombay Chartered Accountants Society is organising YOUTH RRC.Who should attend?Chartered Accountants, CS, Corporate Members, Student Members and Tax Professionals under 40 years of age.Days, Dates & Time : Sunday, Monday, Tuesday, 17th to 19th April, 2016 Venue : Dew Drops Boutique Retreat, Plot No. 105, Old Agra Road, Titoli Village, Igatpuri, Nashik – 422 403

Sr. No. Topics Speakers1 Key Note Address

Start-up India - Beginners Guide for setting up, Funding, working with start-ups & CA Entrepreneurship

Eminent Faculty CA Nitin Shingala

2 E- Commerce Modules, Direct & Indirect Tax Issues CA Sunil Gabhawalla

3 Studies on International Tax w.r.t. Start-ups Funding and Transactions CA T. P. Ostwal

4 Conducting an Audit in today’s scenario CA Himanshu Kishnadwala

5 Forensic Audit CA Chetan Dalal

6 Personality Enhancement Mr. Jagdish Shenoy

7 Practice vs. Industry vs. Entrepreneurship Moderator CA Bhavna Doshi

Registration Fees : Up to 4-4-2016 – ` 7,000/- + ` 1,015/- (14.5% S. Tax) = ` 8,015/-

After 4-4-2016 – ` 8,000/- + ` 1,160/- (14.5% S. Tax) = ` 9,160/-

For further details kindly contact: Mr. Hitesh Shah, Manager – CTC Office- 9821889249

3April 2016 • THE CTC NEWSwww.ctconline.org

Chairman : Kamal Dhanuka Vice Chairperson : Priti SavlaConvenors : Anil Sharma, Manish Dedhia Advisor : Pravin Veera

ALLIED LAWS COMMITTEE

Allied Laws Committee of The Chamber of Tax Consultants is pleased to announce Two Days Education Course on “Capital Market”.

The Objective of the Course Regulatory Compliances with respect to capital market is increasing day-by-day not only by SEBI but also by Revenue Department. This has cast additional burden on the entities related to Share Market as well as on professionals who are actually complying for them. The Education Course is proposed to give insight to the related person about various Regulatory Compliances sought by the Government and Regulators.

Who Should Attend? The Education Course is beneficial to all professionals and persons, students, articled clerks and upcoming professionals related to share market or doing share business, their employees and professionals complying for such persons.

The relevant details of the workshop are as under:

Days & Dates : Friday & Saturday, 29th & 30th April, 2016

Time : 9.30 am to 5.30 pm, 9.15 am to 10.00 am (Registration & Snacks)Venue : 29th April, 2016 - West End Hotel, Near Bombay Hospital, New Marine Lines, Mumbai – 400 020 30th April, 2016 - Conference Room, Consultair Investments Pvt. Ltd., 20 Down Town, Cambata

Bldg., 2nd Floor, S/W Wing, Eros Theatre Building, 42, M. Karve Road, Churchgate, Mumbai – 400 020.Fees : Up to 15th April, 2016 - Members - ` 2,750/- + ` 399/- Service tax = ` 3,149/-

Non-Members – ` 3,500/- + ` 508/- Service Tax = ` 4,008/- After 15th April, 2016 - Members ` 3,250/- + ` 471/- Service tax = ` 3,721/- Non-Members ` 4,000/- + ` 580/- Service tax = ` 4,580/-. (Includes Breakfast, Lunch, Tea/Coffee and Course Material)

Topics & Speakers

Topics Speakers

Friday, 29th April, 2016

1) Overview of Capital Market – (Knowledge, Concept, Growth, Strategy) CA S. P. Tulsian

2) Fundamental Analysis Mr. Nipun Mehta

3) Auditors – Role, Responsibility and Reporting – in relation to – Tax, Statutory, SEBI Exchange – In Relation to Share Broker and persons doing share business

CA Sandeep Maheshwari

4) Compliances applicable to Stock Brokers, Commodity Brokers and Depository Participants CA Kinjal Shah

5) Technical Analysis of Stock Trends – An Overview (Basic Principles, Philosophy and Techniques of reading chart like patterns, momentum indicators and Japanese candlestick)

CA Manish Chokshi

Saturday, 30th April, 2016

6) Understanding of Derivatives – (Future, Option, Call, Put) Shri Sidharth Bhamre

7) Regulators Compliance (Insider Trading, FII, Portfolio investment, Takeover) Shri S. D. Israni, Advocate

8) Direct tax vis-a-vis Capital Market – (Capital gain vs. Business Income, Tax treatment of derivatives transactions, 14A, Other Source)

CA Gautam Nayak

9) Professional Opportunities in Capital Market CA Bhavesh Vora

10) Issues on taxation of capital gains and other incomes earned by non-residents CA Rutvik Sanghvi

11) Service tax – Issues and Compliance for Capital Market CA Manish Gadia

Certification of Participation will be given to delegatesAll members are requested to enrol for this course at the earliest so as to avoid disappointment

Interested members may download the “Form” from The Chamber’s website www.ctconline.org or may collect it from The Chamber’s office and send it along with the cheque in favour of “The Chamber of Tax Consultants” Outstation Members are requested to send the DD/at Par cheque. Visit www.ctconline.org to avail the facility of ONLINE PAYMENT.

EDUCATION COURSE ON CAPITAL MARKET

4April 2016 • THE CTC NEWSwww.ctconline.org

Chairman : Ketan Vajani Vice Chairman : Mandar Vaidya Convenors : Dinesh Poddar, Rahul Sarda Advisor : K. Gopal

DIRECT TAXES COMMITTEE

Objective of appeal is a very valuable right under any statute, specially, under taxation statutes. This right enables citizens to redress their grievances against the revenue authorities. Various appellate authorities are listed in the Income-tax Act and the assessees can approach higher authorities in case he is aggrieved. Over the period of years, a new institution in the form of Dispute Resolution Panel has also been formed for deciding the matters arising out of Transfer Pricing Disputes. The scope of Authority for Advance Ruling has also been enlarged over the years. The right of appeal is a valuable statutory right but at the same time it is not an inherent right. The right has to be exercised as provided in Law. Accordingly, it is very much necessary for a tax professional to understand various legal and procedural issues that arise in the appellate proceedings. With a view to cater to the need of the professionals in this area, the Direct Tax Committee of The Chamber of Tax Consultants has organised a Full Day Seminar on Appellate Proceedings, DRP and AAR. The Seminar has been designed in a manner so as to cover the entire gamut of the subject and cover all the litigation forums including CIT(A), ITAT, DRP and AAR. The discussion at the Seminar will be in-depth and is aimed at better equipping a tax professional in this area of tax practice. Eminent tax professionals having years of experience will address the Seminar.

The Session-wise details of the Seminar are as under :Day & Date : Saturday, 16th April, 2016Time : 9.30 a.m. to 5.30 p.m. Venue : Hotel West End, Near Bombay Hospital, New Marine Lines, Mumbai – 400 020. Topics SpeakersKeynote Address ITAT Member / Senior

Revenue Authorities (to be confirmed)

Appeal Proceedings before CIT(A) including Drafting of Grounds of Appeal and Statement of Facts, Limitation Rules, Filing of of CIT(A) etc.

Shri Ajay Singh, Advocate

Appeal Proceedings before ITAT including Appealable and Non-appealable orders, Grounds before ITAT, Limitation Rules, Cross Appeals and Cross Objections, Relevant ITAT Rules dealing with various procedures, Art of Pleading, Powers of ITAT, Stay Petitions and Miscellaneous Petitions, Circumstances leading to constitution of Special Bench and Third Member Bench etc.

Shri B. V. Jhaveri, Advocate

Proceedings before Dispute Resolution Panel including provisions of Section 144C, Procedures to be followed, Income-tax (Dispute Resolution Panel) Rules, 2009 and various issues faced in DRP proceedings etc.

CA Karishma Phatarphekar

Proceedings before Authority for Advance Ruling including who can be an applicant, Application before AAR, Rulings of AAR and effect thereof, Real-life Issues faced before AAR etc.

Ms. Arati Sathe, Advocate

Fees : Members Up to 10-4-2016 : ` 1,500/- + ` 218/- Service Tax = ` 1,718/

After 10-4-2016 : ` 1,650/- + ` 239/- Service Tax = ` 1,889/- For Non-Members ` 1,800/- + ` 261/- Service Tax = ` 2,061/-

Enrolments restricted to First 80 participants. Members are requested to enroll at the earliest so as to avoid disappointment.

FULL DAY SEMINAR ON APPELLATE PROCEEDINGS, DRP AND AAR

Sr. No.

Subject Authors Publishers Edition

1. Yearly Tax Digest & Referencer – Vol. – 1 & 2 Taxmann Taxmann 2016 2. NGO Avdesh Ojha Tax Publisher 20163. The Taxmann Yearly Digest 2016 Taxmann Taxmann 20164. Law & Practice Conveyance M. J. Tijoriwala Snow white 20165. Combinations under the Competition Law CS Surendra Kanstiya Corporate Law Advisor 20156. E-Book on Budget – 2016 – on website www.ctconline.org

Additions to J. R. Shah Library, Room No. 462, Aayakar Bhawan, Mumbai-400 020 Tel: 022-2200 1215/16 (Ext.: 2462)

Library Timing : Monday to Friday : 10.00 a.m. to 6.00 p.m. Librarian : Mr. Rajan Gadshi (Mobile: 7045078260)

Sr. No. Subject Price Courier Charges Publisher Edition

1 Study Material of 39th Residential Refresher Course held at Lavasa in February 2016

` 300/- ` 56/- CTC 2016

- -

6

NGO ----

Law & Practive COnveyance 2016

6

Publication for Sale

5April 2016 • THE CTC NEWSwww.ctconline.org

INTERNATIONAL TAXATION COMMITTEEChairman : Naresh Ajwani Vice Chairman : Ramesh Iyer

Convenors : Ganesh Rajgopalan, Varsha Galvankar, Kartik Badiani

ADVANCED WORKSHOP ON PRINCIPLES OF TRANSFER PRICING (4 DAYS)International Taxation Committee is pleased to announce the Advanced Workshop on Principles of Transfer Pricing for the benefit of practitioners and professionals in industry. With the growing importance of Transfer Pricing – both International and Domestic – and increasing litigation, the course will provide 4 days of advanced training on topics which can be useful for understanding the practical issues that arise in carrying out transfer pricing analysis and during assessments. The course is designed for professionals, who aspire to practice in this area and also for those who will be faced with this law in their career.The sessions have been designed to have interaction with the learned Speakers having wide experience in Transfer Pricing and to bring out the nuances of the subject by way of live case studies. The proposed dates of the workshop are –Days & Dates : 22nd and 23rd April, 2016 (Friday & Saturday) 29th and 30th April, 2016 (Friday & Saturday)Time : 10.00 a.m. to 5.00 p.m. (Opening day starts at 9.45 a.m. Last day closes at 5.30 p.m.) Venue : Hotel West End, New Marine Lines, Opp. Bombay Hospital, Mumbai.

Fees Up to 10th April, 2016 From 11th April, 2016

For Members ` 7,000/- + Ser. Tax ` 1,015/- = ` 8,015/- ` 8,000/- + Ser. Tax ` 1,160/- = ` 9,160/-

For Non-Members ` 8,000/- + Ser. Tax ` 1,160/- = ` 9,160/- ` 9,000/- + Ser. Tax ` 1,305/- = ` 10,305/-

(Includes Tea, Snacks, Lunch & Study Material, if any)

Topics SpeakersA Introductory SessionB Fundamental Principles of Transfer Pricing• Introduction, Fundamental concepts and interpretation of basic Mr. Vispi T. Patel principles of Transfer Pricing Regulations, covering the nuances with regards to application of TP, associated enterprises, international transaction, reference made to TPO (i.e. basic legal framework) with case studies on debatable issues.

C Practical aspects of documentation, benchmarking and transfer pricing analysis • Information Technology/Information Technology Enabled Services, Engineering, Mr. Sanjay Kapadia KPO services, etc. • Manufacturing Mr. Sanjay Tolia• Royalty agreements, intra-group/management services, intangibles etc. o Legal Issues Mr. Freddy Daruwala, Advocate o Benchmarking and Documentation Issues Mr. Samir Gandhi• Financial Transactions comprising interest-free loans, trade credit facility, Eminent Faculty guarantees, etc.

D Practice Areas• Case studies on Domestic Transfer pricing (including basic legal framework and Mr. Nihar Jambusaria nuances thereof)with reference to sec.40A(2)• Case studies on Domestic Transfer pricing (including basic legal framework and Mr. Yogesh Thar nuances thereof)with reference to sec.80A/80IA/10AA• Exceptional Issues in Transfer Pricing, like those surrounding Mr. Ajit Kumar Jain re-characterisation of transactions into an international transaction on the perspective of it being a deemed service to AE, etc., incurrence of Advertising and Marketing Expenses. Other critical issues like Valuation, Issue of shares, Locational Savings etc. based on jurisprudence and practical experiences• How to prepare for TP Litigation [viz., Transfer Pricing Ms. Karishma Phatarphekar Assessments, Dispute Resolution Panel, Commissioner of Income-tax (Appeals) and Income-tax Appellate Tribunal], including standard defence strategies, penalties, etc.• Developments and experience in APAs in India Ms. Alpana Saxena• International developments, BEPS Report of OECD, Mr. T. P. Ostwal* GAAR and their inter-play with transfer pricing.

E Closing Session *Subject to confirmation

Interested Members may download the “Form” from The Chamber’s website www.ctconline.org or may collect it from The Chamber’s office and send it along with the cheque in favour of “The Chamber of Tax Consultants.” Outstation members are requested to send the DD/At Par cheque. Visit www.ctconline.org to avail the facility of ONLINE PAYMENT

6April 2016 • THE CTC NEWSwww.ctconline.org

INTERNATIONAL TAXATION COMMITTEEChairman : Naresh Ajwani Vice Chairman : Ramesh Iyer

Convenors : Ganesh Rajgopalan, Varsha Galvankar, Kartik Badiani Co-ordinators : Jimit Devani, Kartik Badiani

10TH RESIDENTIAL REFRESHER CONFERENCE ON INTERNATIONAL TAXATION, 2016Days & Dates : 23rd June, 2016 to 26th June, 2016 (Thursday to Sunday)

Venue : Rhythm Resorts, LonavalaIts monsoon, It’s Lonavala, it’s an all-suite resort and it’ll be packed with India’s International Tax Experts – do you need anything else!!!The International Taxation Committee is pleased to announce its 10th Annual Residential Refresher Conference on International Taxation to focus on practical and upcoming issues from 23rd June to 26th June, 2016 at the beautiful monsoon destination - Lonavala. The Conference will be held at RHYTHM RESORTS, LONAVALA. The ConferenceWe have seen many developments in the field of International Taxation globally during last one year. With OECD’s BEPS initiative and recently released draft POEM guidelines, the practice of International Taxation is undergoing qualitative change. There are many issues on cross-border taxation which one will have to be abreast of. The Venue RHYTHM, LONAVALA is an unique all-suite resort. The property nestles between unabashed indulgence and a sense of oneness with nature amidst the imposing Sahyadri mountains. Designed in traditional low rise Asian-Colonial style, the Resort is an epitome of elegance and comfort paired with tranquillity. The property has been built around a family of trees that are over 70 years old.The technical content of the Conference is as under:

Group Discussion Papers Faculty

Permanent Establishment (Issues in the context of BEPS measures and recent judicial pronouncements)

CA Shefali Goradia

Structuring of Outbound Investments (including aspects on POEM, FEMA) CA Vishal Gada

Exit Strategies for a Foreign Investor – Tax and Regulatory Implications CA Anup Shah

Papers for Presentation Faculty

Recent Experience on APAs and Way Forward

Minimising Risk in Current Era of Global Transparency

Presenters Mr. Sanjeev Sharma* Commissioner of Income Tax – APA 2 and Mr. Rahul Navin*, - CIT (TP)-(1)

Transfer Pricing – BEPS Initiative and Recent Developments CA Ajit Kumar Jain

Equalisation Levy CA Rashmin Sanghvi

Panel Discussion Faculty

Case studies on International Taxation Chairman: CA Pinakin Desai

Panellists: Mr. Sunil Moti Lala, Advocate & CA Vishal J. Shah

*Subject to confirmationFor Cypress Suites (Studio Suites) (subject to availability)

Date For Members of CTC For Non-Members of CTCOn or before 30th April, 2016 ` 15,500 + ` 2,248 (S. Tax) = ` 17,748/- ` 17,000 + ` 2,465 (S. Tax) = ` 19,465/-After 30th April, 2016 ` 17,500 + ` 2,538 (S. Tax) = ` 20,038/- ` 19,000 + ` 2,755 (S. Tax) = ` 21,755/-

For Banyan Suites (subject to availability)Date For Members of CTC For Non-Members of CTCOn or before 30th April, 2016 ` 16,750 + ` 2,429 (S. Tax) = ` 19,179/- ` 18,250 + ` 2,646 (S. Tax) = ` 20,896/-After 30th April, 2016 ` 18,750 + ` 2,719 (S. Tax) = ` 21,469/- ` 20,250 + ` 2,936 (S. Tax) = ` 23,186/-

Notes: 1. Conference will start at 2.30 pm on 23rd June preceded by lunch from 12.30 pm onwards. It will end on 26th June by 2.00 pm

followed by lunch. Pune Airport is about 2 hours from the Hotel. Mumbai Airport is about 2 hours 30 mins from the Hotel. There is no availability of Pickup & Drop facility from/to Airport/Railway station. Participants are requested to plan their travel accordingly. The hotel can arrange for pick up at additional cost.

2. Conference fee is inclusive of 3 Nights–4 Days accommodation on double-occupancy basis in Cypress / Banyan Suites, including meals for all 4 days, course material, and use of certain hotel facilities on complementary basis.

7April 2016 • THE CTC NEWSwww.ctconline.org

3. If the participant has identified their room partner, request you to co-ordinate with your room-partner and fill up the form on the same day (else it will be difficult for us to guarantee you the same suite).

4. In case of cancellation, no refund request shall be entertained, except under genuine unavoidable circumstances, subject to the approval of the International Tax Committee.

5. For enrolment please contact: Mr. Hitesh Shah at the CITC Office at 91-22-2200 1787 / 2209 0423.

Interested members may download form from the Chamber’s Website www.ctconline.org or may collect it from the Chamber’s office and send it along with the cheque in favour of “The Chamber of Tax Consultants.” Outstation members are requested to make the payment online or send DD/”At par” cheque.

RESIDENTIAL REFRESHER COURSE & SKILL DEVELOPMENT COMMITTEEChairman : Shailesh Bandi Vice Chairperson : Charu Ved

Convenors : Mehul Sheth, Pranav Jhaveri Advisor : Kishor Vanjara

LECTURE MEETINGThe Residential Refresher Course & Skill Development Committee is pleased to announce interactive Lecture meeting for all the members on Time Management.“Personal development is your springboard to success”. Inspite of knowing this very well, we seldom find time to invest in our development. Jump start your personal development with a programme that enables you to find time for it - Achieve More with Less. Free up your time to achieve balance in your life. Realize the difference between what you are doing and what you need to be doing. Identify your time wasters and get set to take a leap into personal development leading to professional development.”

Day & Date : Wednesday, 20th April, 2016Time : 05:45 p.m. to 06:15 p.m. fellowship & 06:15 p.m. to 08:00 p.m.

Lecture meetingSubject : “ACHIEVE MORE WITH LESS” – “MAKE EVERY MOMENT COUNT”Speaker : Arvind Khinvesra – Founder Achieve ThySelfVenue : CTC Conference Hall, 3, Rewa Chambers, Ground Floor,

31, New Marine Lines, Mumbai – 400 020.Fees : NILRestricted to 25 members first come first served basis

FORMAT OF ENROLMENT FORM10TH RESIDENTIAL REFRESHER CONFERENCE ON INTERNATIONAL TAXATION, 2016

At Rhythm Resorts, Lonavala 23rd June, 2016 TO 26th June, 2016

(Please use BLOCK letters, preferably typewritten and fill complete details)

Name*:........................................................................................................... Age*: .....................................Company/Firm Name: ..................................................................... Designation: .............................................Mailing address*: ............................................................................................................................................City*: ............................................... State*: .................................... Pincode*: .............................................CTC Membership No.: ................................... Tel.: (O) .................................. (R) ..............................................Fax ..................................... Mobile*................................. E-mail ID* .............................................................(Major communication will be by e-mail and SMS. Kindly fill in mobile No. & E-mail address carefully and in legible writing to enable us to send messages and forward soft copy of the Conference material.)Choice of Room Partner 1) .......................................................................................................................... or(We will try our best to accommodate your request)

Choice of Food*: Veg./Jain/Non-Veg. (*Marked fields are mandatory)I would like to lead the group discussion for the paper on:

Sr. No.

Topic (Please tick √)

1. Permanent Establishment (Issues in the context of BEPS measures and recent judicial pronouncements)2. Structuring of Outbound Investments (including aspects on POEM, FEMA)3. Exit Strategies for a Foreign Investor – Tax and Regulatory Implications

Details of Payment:Draft/Cheque No. ............................. dated…………… drawn on ……….………………………............………bank for ` ……….....……..[…………………………………………......................................……………………………..] (in words)

8April 2016 • THE CTC NEWSwww.ctconline.org

DIRECT TAXES COMMITTEEChairman : Ketan Vajani Vice Chairman : Mandar Vaidya

Convenors : Dinesh Poddar, Rahul Sarda Advisor : K. Gopal

FULL DAY SEMINAR ON INCOME COMPUTATION AND DISCLOSURE STANDARDS (ICDS) The Income Computation and Disclosure Standards notified on 31st March, 2015 are applicable with effect from A.Y. 2016-17. The Returns of Income to be filed for A.Y. 2016-17 will have to have various adjustments on account of ICDS while computing the total income for the year. The standards have generated lot of controversies and there are sufficient doubts prevalent on the subject as regards the interpretation and implementation of the ICDS. The Easwar Committee had recommended that the implementation of the standards should be postponed by a year. However, unfortunately the Finance Bill 2016 had no announcement to the effect of postponement of the standards. Accordingly, one will have to live with the ICDS on and from A.Y. 2016-17.

With a view to understand various issues arising on the subject and also to find a probable solution, the Direct Tax Committee of The Chamber of Tax Consultants is organising a Full Day Seminar on ICDS as per the details hereunder:

Day & Date Saturday, 11th June, 2016

Time 9.30 a.m. to 5.30 p.m.

Venue, Fees and Faculties To be finalised soon and will be intimated in due course.

Eminent faculties (to be finalised soon) will be addressing the Seminar. All the ICDS notified by the CBDT and the issues arising from the same will be dealt with. The detailed announcement including Venue, Faculties and Participation Fees will be made in due course of time. In the meantime, members are requested to kindly block their diaries for this very important and useful Seminar.

Block Your Diary for Saturday

11th June 2016

HALF DAY WORKSHOP ON SERVICE TAXHon’ble Finance Minister vide The Finance Bill, 2016 has proposed several changes in Indirect Taxes, especially service tax, which will have far reaching impact on construction industry, logistics industry etc. Besides there are quite a few amendments in CENVAT credit Rules, Point of Taxation Rules, Interest & penal provisions. With a view to have a threadbare analysis of these amendments & understand issues arising therefrom, half day seminar is organised by The Chamber of Tax Consultants, Mumbai, with the sup-port of Ahmedabad Branch of WIRC.

The details are as under:

Day & Date : Sunday, 10th April, 2016

Time : 9.30 a.m. to 1.00 p.m.

Venue : Auditorium, Ahmedabad Branch of WIRC, Ahemadabad

Topic SpeakersAmendments & Issues in construction Industry CA Naresh Sheth

Amendments & Issues in CENVAT, Interest, Penal provisions CA Rajiv Luthia

INDIRECT TAXES COMMITTEEChairman : Rajiv Luthia Vice Chairman : Vikram Mehta

Advisor : A. R. Krishnan Convenors : Akhil Kedia, Narendra Soni, Atul Mehta

Hearty CongratulationsHearty Congratulations to the newly elected office bearers of The Institute of Chartered Accountant of India for the period 2016-17.

CA. M. Devaraja Reddy President, ICAI

CA. Nilesh Shivji Vikamsey Vice-President, ICAI

CA. V. Sagar Secretary, ICAI

We recognise our old & continuing relationship with ICAI Vice President, CA. Nilesh Shivji Vikamsey, he was part of CTC family as Managing Council Member as well as Chairman, Corporate Members Committee for the year 2007-08 and afterwards he is continuing as Core Group Member of the Chamber of Tax Consultants.

9April 2016 • THE CTC NEWSwww.ctconline.org

Chairman : Kamal Dhanuka Vice Chairperson : Priti SavlaConvenors : Anil Sharma, Manish Dedhia Advisor : Pravin Veera

ALLIED LAWS COMMITTEE

Day & Date : Tuesday, 5th April, 2016

Time : 5.30 p.m. to 6.00 p.m. (Snacks), 6.00 p.m. to 8.00 p.m. (Meeting)

Topic & Speaker:

Topic Speaker

Drafting of Documents Relating to Family Arrangement & Partition Mr. Pravin N. Veera, Solicitor Venue : CTC Conference Hall, 3, Rewa Chambers, Ground Floor, 31, New Marine Lines, Mumbai-400 020

ALLIED LAWS STUDY CIRCLE MEETING (ONLY FOR ALC SC MEMBERS)

LECTURE MEETING ON REAL ESTATE (REGULATION AND DEVELOPMENT Act 2016)(Passed by Lok Sabha and Rajya Sabha)

The Real Estate (Regulation and Development) Act, 2016 has opened up a number of professional opportunities like Project Registration, Compliances, Quarterly return filings, Project Audit and the representation before the regulatory Authority and Appellate Tribunal. The Act is enacted to establish the Real Estate Regulatory Authority for regulation and promotion of the real estate sector and to ensure sale of plot, apartment of building, as the case may be, or sale of real estate project, in an efficient and transparent manner and to protect the interest of consumers in the real estate sector and to establish an adjudicating mechanism for speedy dispute redressal and also to establish the Appellate Tribunal to hear appeals from the decisions, directions or orders of the Real Estate Regulatory Authority and the adjudicating officer and for matters connected therewith or incidental thereto.To know all the details of the latest regulator in the real estate, this conference is arranged. We are pleased to announce Lecture Meeting on “Real Estate (Regulation and Development Act 2016), passed by Lok Sabha and Rajya Sabha. The speakers will enlighten the participants in a simplistic way, various issues pertains to new Real Estate Regulations:

Day & Date : Wednesday, 27th April, 2016

Time : 6.00 p.m. to 8.30 p.m.

Venue : A. V. Centre Hall, 4th Floor, Jai Hind College, Churchgate, Mumbai – 400 020

Topics and Speakers : Real Estate (Regulation and Development ) – 2016 (Passed by Lok Sabha and Rajya Sabha)

Shri K. K. Ramani, Advocate & Past President CA Ramesh Prabhu

All Members, Students and their associates are cordially invited to attend the meeting.

AUDITING – A WAY FORWARD – SME PERSPECTIVE(Two Half Day Series)

Audit for the year 2016-17 has started, to gear up our staff, students, articled clerks and ourselves, the Allied Laws Committee has organised a programme on “Auditing – A way forward – Small Medium Enterprises (SME) Perspective” on 3rd & 4th June, 2016.

Days, Dates & Time : Friday, 3rd June, 2016- 5.00 p.m. to 8.30 p.m. (Evening) Saturday, 4th June, 2016 – 9.30 a.m. to 2.30 p.m. (Morning)

Venue : CTC Conference Room, 3 Rewa Chambers, Gr. Floor, 31, New Marine Lines, Mumbai- 400 020Fees : For Members ` 1,000/- + Service Tax ` 145/- = ` 1,145/-

For Non Members ` 1,250/- + Service Tax ` 181/- = ` 1,431/-Course Fees includes cost of Study Material if any, and refreshments Enrolment limited to 25 members, first come first served basis.

Session Dates TOPICS FACULTIES1 3-6-2016 Overview of Select Indian Accounting Standards – “SME Perspec-

tive”CA Sanjeev Maheshwari

2 3-6-2016 Accounting Standard and Impact on Tax Assessment CA Jayant Gokhale3 4-6-2016 Audit & Documentation through Tally Mr. Anand Paurana4 4-6-2016 Issues Under Finalisation of Accounts and Audit Under Compa-

nies Act, 2013CA Abhay Mehta

5 4-6-2016 Practical Approach to Ind-AS CA Anand Banka

10April 2016 • THE CTC NEWSwww.ctconline.org

MEMBERSHIP & PUBLIC RELATIONS COMMITTEEChairman : Hemant Parab Vice Chairman : Abhay Arolkar

Convenors : Natwar Trivedi, Lalit Panchal Advisor : Parimal Parikh

FULL DAY SEMINAR ON DIRECT TAX - TAXMINT 2016We are pleased to announce Full Day Seminar on Direct Tax as ‘TAXMINT 2016’ with support of The Jamnagar Branch of WIRC of ICAI.

Relevant details of the seminar are as under:

Day & Date : Saturday, 23rd April, 2016

Time : 8.30 a.m. to 6.00 p.m.

Venue : Jamnagar Chamber of Commerce & Industry, Dhirubhai Ambani Vanijaya Bhavan, Near Subhash Bridge, Jamnagar – Rajkot Highway, Jamnagar – 361001 (Gujarat)

Co-ordinator : CA Sanjay Zala (Jamnagar) – Mobile No. 09974012301

Sr. No. Subjects Speakers1 Issues Under Secs. 56 to 58 and 68 CA Reepal Tralshawala

2 Issues Under Capital Gain CA Ashok Sharma

3 Reassessment and Revision CA Ketan Vajani

4 Landmark Judgments under Income-tax Act, 1961 CA Devendra Jain

* For registration please contact co-ordinator of programme

FULL DAY SEMINAR ON VARIOUS LAWS AND PROCEDURES RELATED TO INDIVIDUALS We are pleased to announce Full Day Seminar on Real Estate Planning, documentation with family trust, personal taxation and start-up India jointly with The Jamnagar Rotary Club.

Relevant details of the seminar are as under:

Day & Date : Sunday, 24th April , 2016

Time : 9.00 am to 5.30 pm

Venue : Gujarat Ayurvedic University Auditorium, DKV College Circle, Jamnagar

Co-ordinator : CA Kamlesh Rathod (Jamnagar) – Mobile No. 9898093552

Sr. No. Subject Speakers1 Drafting of Deed-including Family Trust Mr. Nirav C. Jani, Advocate

2 Personal Taxation and Business Deduction CA. Ashok Mehta

3 Estate Planning Mr. Priyahas A. Jani, Advocate & Solicitor

4 Start-up India Eminent Speaker

* For registration Please contact co-ordinator of programme

LECTURE MEETING ON PROVISIONS RELATED TO TDS & QUESTIONS & ANSWERSThe Student and IT Connect Committee has organised a Lecture Meeting with a view to update the Students, Articled Clerks, Audit Staff and Members on the above subject. All are cordially invited to attend the meeting.Day, Date & Time : Thursday, 21st April, 2016; 6.00 p.m. to 8.00 p.m.Venue : 1st Floor, Maheshwari Bhawan, 603, Jagannath Shankar Sheth Raod, Princess Street, Chira Bazar, Mumbai – 400 002.

Sr. No.

Subject Speaker

1 Lecture Meeting on provisions related to TDS & Questions & Answers CA Mahendra Sanghvi

Chairman : Parimal Parikh Vice Chairmen : Aalok Mehta, Dinesh Tejwani Convenors : Ashok Mehta, Bhavik Shah, Maitri Savla, Mitesh Katira Advisors : A. S. Merchant, Ninad Karpe

STUDENT AND IT CONNECT COMMITTEE

11April 2016 • THE CTC NEWSwww.ctconline.org

STUDY CIRCLE & STUDY GROUP COMMITTEEChairman : Ashok Sharma Vice Chairman : Dilip Sanghvi

Convenors : Dinesh R. Shah, Shreyas N. Shah, Sanjay Chokshi Advisor : Mahendra B. Sanghvi

STUDY CIRCLE MEETING (ONLY FOR STUDY CIRCLE MEMBERS)

Day & Date : Monday, 25th April, 2016

Time : 6.15 p.m. to 6.45 p.m. 6.45 p.m. to 8.00 p.m.

Subject : (A) Concept of Capital Value Vis-a-Vis Property Taxes charges by Local Authority

(B) Issues in Re-Assessment Proceedings under IT Act, 1961 (Part-II)

Group Leader : CA. H. M. Suthar CA Mahendra Sanghvi

Venue : 2nd Floor, Babubhai Chinai Committee Room, IMC, Churchgate, Mumbai – 400 020.

STUDY GROUP MEETING (ONLY FOR STUDY GROUP MEMBERS)

Day & Date : Thursday, 28th April, 2016

Time : 6.15 p.m. to 8.00 p.m.

Subject : Recent Judgments under Direct Taxes

Group Leader : Mr. Nitesh Joshi, Advocate

Venue : 2nd Floor, Babubhai Chinai Committee Room, IMC, Churchgate, Mumbai – 400 020.

INDIRECT TAX STUDY CIRCLE MEETING (FOR IDT STUDY CIRCLE MEMBERS ONLY)

Day & Date : Tuesday, 12th April, 2016

Time : 6.00 p.m. to 8.00 p.m.

Speaker : CA Amit Bothra

Chairman : Mr. Prasad Paranjpe, Advocate

Topic : Incentives for service exporters under the Foreign Trade Policy 2015-2020 – Policy, procedures and issues

Venue : Babubhai Chinoy Committee Room, 2nd Floor, IMC Churchgate, Mumbai - 400 020

INDIRECT TAXES COMMITTEEChairman : Rajiv Luthia Vice Chairman : Vikram Mehta

Advisor : A. R. Krishnan Convenors : Akhil Kedia, Narendra Soni, Atul Mehta

SELF AWARENESS SERIESThe Membership & Public Relations Committee is pleased to announce the First Meeting of SAS for the year 2016-17 on Leadership Sutras from Bhagavad Gita.

This meeting makes the timeless wisdom of the philosophical classic, the Bhagavad Gita, accessible to the contemporary mind. Condensing the relevant principles from the Gita into sutra-like statements, it brings a richer, more spiritual appreciation of life, work and success. It provides principles and practices addressing daily concerns such as :

Managing Stress – Be concerned, not disturbed

Team building – Words shape worlds; watch your words

Facing reversals – Life determines our problems; we determine their size.

To make awareness about effective Leadership sutras from Bhagavad Gita paves the way toward stronger commitment, greater achievement and deeper fulfilment, we have organise the SAS meeting for the benefit of members

Day & Date : Tuesday, 26th April, 2016

Time : 5.45 p.m. to 6.00 p.m. (Fellowship & Snacks) 6.00 p.m. to 8.00 p.m.

Subject : “LEADERSHIP SUTRAS FROM BHAGAVAD GITA” (Followed by question & answers)

Speaker : Shri Hare Krsna Das (A monk and spiritual Leader from ISKCON )

Venue : CTC Conference Room, 3 Rewa Chambers, Ground Floor, 31, New Marine Lines, Mumbai – 400 020.

MEMBERSHIP & PUBLIC RELATIONS COMMITTEEChairman : Hemant Parab Vice Chairman : Abhay Arolkar

Convenors : Natwar Trivedi, Lalit Panchal Advisor : Parimal Parikh

12April 2016 • THE CTC NEWSwww.ctconline.org

FULL DAY SEMINAR ON ‘START-UPS - UNDERSTANDING FUNDING, REGULATORY & TAXATION ASPECTS’The Objective:

To impart knowledge on Start-Ups – Understanding Funding, Regulatory & Taxation Aspects

Who should attend?

Chartered Accountants, CFOs, Senior Executives handling Finance and Tax functions, Corporate/General/In-house Counsel, Company Secretaries, Cost Accountants, Professional Advisors, Law Firms & Consultants, Tax Professionals

Day & Date : Saturday, 23rd April 2016

Time : 09.30 a.m. to 5.00 p.m.

Venue : India International Centre, Lecture Room I, Annexe Building, Dr. K. K. Birla Lane, Max Mueller Marg, Lodhi Estate, New Delhi – 110 003

Sr. No.

Speakers

1 CA Amithraj A.N.

2 Mr. Ramanuj Gopalan, Saif Partners**

3 Mr. Sujit Ghosh, Partner & National Head, Tax Litigation & Controversies (IDT) Advaita Legal

4 Mr. Arijit Chakravarty, Senior Principal, Advaita Legal

** Confirmation awaited

Fees Members: ` 1,100/- (Fee ` 961/- + Ser. Tax ` 134/- + Swachh Bharat Cess ` 5/-)

Non-Members: ` 1,500/- (Fee ` 1,310/- + Ser. Tax ` 183/- + Swachh Bharat Cess ` 7/-)

Students: ` 750/- (Fee ` 655/- + Ser. Tax ` 92/- + Swachh Bharat Cess ` 3/-)

(Fees includes Tea, Snacks and Lunch)

DELHI CHAPTER OF CTCChairman : R. P. Garg Vice Chairman : Suhit Aggarwal

Advisor : V. P. Verma Hon. Jt. Secretaries : Vijay Gupta & Sapna Gupta (Ms.) Hon. Treasurer : Gaurav Garg

INTENSIVE STUDY GROUP (DIRECT TAX) MEETING (FOR ISG (DT) MEMBERS ONLY)Day & Date : Monday, 18th April, 2016

Time : 6.00 p.m. to 8.00 p.m.

Group Leader : CA Mahendra Sanghvi

Topic : Recent Important Decisions under Direct Taxes

Venue : The Chamber’s Conference Room, 3, Rewa Chambers, Ground Floor, 31, New Marine Lines, Mumbai-400 020

DIRECT TAXES COMMITTEE

LAW & REPRESENTATION COMMITTEE

Chairman : Ketan Vajani Vice Chairman : Mandar Vaidya Convenors : Dinesh Poddar, Rahul Sarda Advisor : K. Gopal

Chairman : Vipul Joshi Co-Chairman : Mahendra Sanghvi Vice-Chairman : Krish Desai Convenors : Amrit Porwal, Devendra Jain, Nishtha Pandya Advisor : Y. P. Trivedi

REQUEST FOR SUGGESTIONS ON POST BUDGET MEMORANDUMLike every year, this year also The Chamber intends to make exhaustive Post Budget Representation. Members are requested to send their suggestions by email on [email protected]. by 5-4-2016.

13April 2016 • THE CTC NEWSwww.ctconline.org

RENEWAL NOTICE – 2016-171st March, 2016

Dear Members, SUB: PAYMENT OF ANNUAL MEMBERSHIP FEES FOR 2016-17

It’s our privilege to have been of service to you over the years. We truly appreciate and value your association. It’s time to renew annual membership and subscription of The Chamber’s Journal, Study Group and Study Circle Meetings and other subscription of The Chamber of Tax Consultants (“The Chamber”). The renewal fees for Annual Membership, Study Group and Study Circle and other Subscription for the financial year 2016-17 falls due for payment on 1st April, 2016. We thank you for your subscription. Your involvement is important and very much appreciated. We hope you will always continue to support the Chamber in its activities and growth as done in the past.

Thanking You, For the Chamber of Tax Consultants

CA Hinesh R. Doshi Hon. Treasurer

Sr. No.

Particulars Fees `

Service Tax 14%

S.B.C. 0.50%

Total `

1 Ordinary Membership Fees (Applicable to Ordinary Members only) 1,900 266 10 2,176

2 The Chamber’s Journal Subscription (Applicable to Life Members only) 900 0 0 900

3 The Chamber’s Journal Subscription (Applicable to Non Members only) 1,800 0 0 1,800

4 Associates Membership (Applicable to Associate Members only) 5,000 700 25 5,725

5 Student Membership (Applicable to Student Members only) 250 35 1 286

6 The Chamber’s Journal Subscription (Applicable to Student Members only) 700 0 0 700

7 Study Group (Direct Taxes) 2,200 308 11 2,519

8 Study Circle (Direct Taxes) 1,750 245 9 2,004

9 Study Circle (Indirect Taxes ) 1,500 210 8 1,718

10 Study Circle (International Taxation) 1,500 210 8 1,718

11 Study Circle (Allied Laws) 1,500 210 8 1,718

12 Self Awareness Series 600 84 3 687

13 Intensive Study Group On Direct Tax 1,500 210 8 1,718

14 Intensive Study Group On International Taxation 1,500 210 8 1,718

15 Fema Study Circle 1,500 210 8 1,718

16 Transfer Pricing Study Circle 1,500 210 8 1,718

Note: Members enrolling for Study Circle & Study Groups (Sr. Nos. 7 to 16 only) for 3 and above are entitled for 10% discount on gross fees.

Notes: 1. Payments should be made by Account Payee Cheque/Demand Draft in favour of “THE CHAMBER OF TAX CONSULTANTS”. Outstation

members are requested to send payments only by “Demand Draft or At Par Cheque”. 2. A consolidated Cheque/Draft may be sent for all payments. 3. Please also update your Mobile number & e-mail address to ensure receipt of regular updates on activities of the

Chamber. 4. Please send the below perforated portion duly filled with latest details along with payment. 5. Please write your full name on the reverse of Cheque/DD. 6. Kindly pay your membership fees by 30th April, 2016 for uninterrupted service of the Chamber’s Journal. 7. Subscribers opting to make payment through NEFT, are requested to e-mail the acknowledge copy of payment made

together with their name, mobile numbers to the Chamber’s office, so as to give correct credit to subscribers account. 8. Members are requested to download the Renewal Form from Chamber’s website www.ctconline.org. 9. Renewal Notices are also sent separately and members are requested to fill up the same and send it to the Chamber’s

office along with the cheque.10. Renewal Notice contains entire information of members as per CTC database. In case of any change in information of

Member as shown in form, kindly provide updated information along with the form.The details of NEFT payment are as under:

In Favour of : The Chamber of Tax Consultants Name of the Bank : Axis Bank, New Marine Lines Branch, Mumbai-400 020 A/c No. : 233010100194495 IFSC Code : UTIB0000233 Account Type : Saving Account

Members are requested to visit the website www.ctconline.org for online payment.

In Favour of : The Chamber of Tax Consultants Name of the Bank : IDBI Bank, Nana Chowk Branch, Mumbai-400 007.A/c No. : 0166104000060738 IFSC Code : IBKL0000166Account Type : Saving Account

14April 2016 • THE CTC NEWSwww.ctconline.org

UNREPORTED DECISIONS (Direct Taxes)By Ajay R. Singh & Rahul R. Sarda, Advocates

1. Section 14A – Judicial discipline in following higher authority’s orders Assessee, engaged in the business of share trading earned ` 12.04 lakh as exempt dividend income. The AO made a disallowance

of ` 46,89,748/- u/s 14A r.w. Rule 8D. Before the CIT(A), the assessee stated that the Tribunal in assessee’s own case for AY 2010-11 has held that no disallowance u/s. 14A r.w. Rule 8D can be made on dividend income from shares held as stock-in-trade. However, the CIT(A), disregarding the order of Tribunal passed in assessee’s own case, followed the decision of Mumbai Bench of the Tribunal in the case of HDFC Bank Ltd. vs. DCIT in ITA No. 374/Mum/2012 decided on 23-9-2015 and rejected the appeal.

Before the Tribunal, submitted that the order of the Tribunal in the case of HDFC Bank Ltd. (supra) on which the CIT had placed reliance had been reversed by the Hon’ble Bombay High Court in Writ Petition No. 1753 of 2016 decided on 25-2-2016. Held, CIT(A) erred in not following the order of Tribunal in assessee’s own case. The Bombay High Court in the case of CIT vs. India Advantage Securities Ltd. (supra) has confirmed the order of Tribunal wherein it was held that no disallowance u/s. 14A r.w. Rule 8D can be made on shares held as stock-in-trade. The Tribunal further observed that the CIT(A) should have maintained ‘Judicial Propriety’ in following the order of Appellate Authority. However, it restrained from commenting on the judicial indiscipline committed by the CIT(A) and expected that the CIT(A) concerned shall be more careful in future in honouring the orders of the higher Appellate Authorities.

Paresh Pritamlal Mehta vs. ITO, ITA No. 1715/PN/2015 dt. 18-3-2016, AY 2012-13 (ITAT Mumbai) 2. Section 73 – Explanation – Composite business of trading in shares & F&O transactions – Section 43(5) – Consistency

in other years The assessee was a member of two recognised Stock Exchanges – BSE & NSE. Both Exchanges had two separate segments i.e.

Capital Market Segment and Derivative Segment. In Capital market segment, assessee made trading of equity shares whereas in Derivative segment, future and options. The AO held that the transactions done by the assessee which were not covered u/s. 43(5) shall be hit by Explanation to section 73 and shall be treated as speculative in nature and accordingly he disallowed a sum of ` 56,94,166/- as deemed speculative loss, applying explanation to section 73. CIT(A) held that derivative transactions were covered by sec. 43(5)(d) and therefore, could not be held as speculative transactions. On the other hand, share trading done in the cash market is hit by explanation to section 73, and therefore, any loss/profit arising therefrom shall be deemed to be speculative, and could only be set off against income of subsequent years.

Held, by the Tribunal, where the assessee is a dealer in shares, the entire business consists in sale purchase of shares, then, it should be treated as composite business. Also, assessee’s stand of treating the whole business as composite business has always been accepted by the revenue in earlier as well as subsequent years. Accordingly, whole of assessee’s business was treated as speculative and loss of current year was allowed to be set off against profits of the current year.

J.G.A. Shah Share Brokers P. Ltd. vs. DCIT, ITA No. 4053/M/2013 dated 16-3-2016 (ITAT Mumbai) 3. Section 147 – Reassessment – Reopening pursuant to audit objection – AO objecting to audit objection – Reassessment

not valid The AO recorded reasons pursuant to an audit objection and reopened assessee’s assessment. However, the AO replied to the audit

objection stating that the issue was debatable in nature. The AO replied that in principle the objections raised by the audit are not acceptable. However, still the AO proceeded to reopen the assessment. The Tribunal held that once the AO himself disagreed with the audit objections, reopening could not be done. The requirement of law for reopening of the case is that the AO should be in a position to form a belief about escapement of income. Although, it is true that at the stage of reopening, the belief need not be conclusive, but it is equally expected that the position of law should be clear in the mind of the AO, at least prima–facie. The belief need not be conclusive but it should be firm and clear. No belief can be formed out of confusion and doubtful thoughts.

Sunil Gavaskar vs. ITO, ITA Nos. 3970-91/M/2010 dt. 16-3-2016 (ITAT Mumbai) 4. Sec. 263 – Revision of assessment – Detailed enquiry during assessment proceedings – Two views possible The assessee, was a step-down subsidiary of Zenith Sports Pvt. Ltd. which was a subsidiary of Nimbus Communications Ltd. (NCL)

and the group was engaged in the business of broadcasting through two channels namely Neo Cricket and Neo Sports. NCL has acquired the telecast rights from BCCI in respect of cricket matches played in India for which as per terms of agreement between BCCI and NCL, NCL was under obligation to provide for the Bank Guarantee to BCCI for ` 2000 crore. To secure this, NCL has been paying Bank Guarantee Commission to various banks year after year as per agreed terms. NCL has entered into another agreement with the assessee for telecast of the cricket matches for which NCL has set a condition that 80% of the BGC has to be reimbursed to it by the assessee. Accordingly during the F.Y. 2009-10 relevant to A.Y. 2010-11 the assessee reimbursed ` 21,31,28,582/- to NCL without deduction of tax at source. In order passed u/s. 201(1)/201(1A) dt. 18-3-2012, ITO(TDS)-2(4) treated that these payments are subject to TDS u/s. 194C and passed order accordingly.

However, the CIT did not accept the provisions of Section 194C invoked by the AO and held that payment of bank guarantee commission was in the nature of interest (sec. 194A) thereby invoking his powers u/s 263. Held, by the Tribunal that in the original assessment proceedings, the AO had analysed the payment in detail and then concluded that the provisions of sec. 194C are applicable. Also, not two but three views were possible viz. (i) TDS u/s 194H which was discussed by the AO in original order; (ii) TDS u/s. 194C which was upheld by AO; and (iii) sec. 194A now sought to be taken by CIT. Since three views were possible, revision was not permissible. Furthermore, even on merits, it was held that view of the CIT was not correct because there was no money borrowed or debt incurred, and hence, payment made to NCL was not “income by way of interest”.

Neo Sports Broadcast Pvt. Ltd. vs. CIT (TDS), ITA Nos. 4010-11/M/2014 dt. 19-2-2016, (ITAT Mumbai) NOTE: Whole decisions can be downloaded from CTC’s website www.ctconline.org under Knowledge Centre.

15April 2016 • THE CTC NEWSwww.ctconline.org

UNREPORTED DECISIONS ON SERVICE TAXBy CA. Vinay Jain

1. Whether any service tax Applicable Service Tax on reimbursements made to Overseas Branch Office by the Head Office in India? Whether branch can be treated as distinct entity rendering services to the Head office in India?

Tech Mahindra Ltd. provides Information Technology Software Services to its overseas clients. These services are rendered through ‘on-site’ and ‘off-shore’ operations. Tech Mahindra deputes the employees from India for providing the onsite services abroad. Further, M/s. Tech Mahindra has also established branches outside India which help Tech Mahindra to provide the onsite services.

The Branches of Tech Mahindra act as a salary disburser for the staff from India to the client locations besides carrying out other assigned activities. The salaries so disbursed as well as other expenses of running the branch, are reimbursed by Tech Mahindra from India.

The Revenue sought to charge service tax on these reimbursements made by Tech Mahindra from India to its overseas branches under ‘reverse charge’ on the ground that Head office and branch office are distinct entities in view of the provisions of section 66A(2)/66B(44). The revenue also sought to tax the said reimbursement for the period post introduction of Negative List.

Extensive arguments were made from both the sides and after considering all the submission, the Hon’ble CESTAT allowed the appeal filed by the appellants holding that no service tax would be applicable on the amount reimbursed to the branches. The relevant observations of the CESTAT are as under:-

• Section 66A (2) has limited coverage to tax the transactions and it is not elastic enough to govern the corporate intercourse and commercial indivisibility of a headquarters and its branches. Therefore, any service rendered to other contracting party by a branch as a branch of the service provider would not be within the scope of Section 66A.

• Mere identification of service and legal fiction of separate establishment is not sufficient to tax the activities of the branch. The services have to be received by a recipient located in India for use in relation to business or commerce.

• An exporter who operates through branches is clearly not the target of the legal fiction of branches being distinct from head office.

• When the transactions between the Branch and Head office located in the domestic territory are not taxable, the similar transactions cannot be taxed under Section 66A in case Branch and Head offices are located in two different tax jurisdictions.

• The transaction between the Branch and the Head office in India can be taxed under Section 66A if the services of the branch are used for the domestic operation by the Head office in India. In other words, the provisions of Section 66A cannot be applied to tax the export transactions of the Head office in India.

• The legal fiction created in Section 66A to treat the overseas Branch and Head office as two different persons was intended to prevent escapement from tax on the domestic services received by the primary establishment in India which could otherwise be deliberately routed through an overseas branch.

• The branch by its very nature cannot survive without resources assigned by the Head office. The activities of the head office and branch are thus inextricably enmeshed. Its employees are the employees of the overseas branch as a business. The economic survival of the Branch is entirely dependent on finances provided by the Head office. Its mortality is entirely contingent upon the will and pleasure of the Head office.

• The transfer of funds by gross outflow or by netted outflow is therefore, nothing but reimbursements and taxing such reimbursements would amount to taxing of transfer of funds which is not contemplated by Finance Act, 1994 whether before 1-7-2012 or after.

Impact of the decision

This decision has brought huge relief to the IT and Pharma Sector in India. By virtue of this decision, the reimbursements made by Head office in India to the overseas branch offices for the activities done by the branch offices abroad would not be liable to tax in India under reverse charge mechanism. The legal fiction created under Section 66A or 65B(44) of the Finance Act is only limited to tax those activities of Branch which are related to the local commercial or business activities of the head office in India.

M/s. Tech Mahindra Ltd. & others vs. Commissioner of Central Excise, Pune-I, CESTAT Mumbai, decision dated 15-3-2016 in Appeal No. ST/86066/15

2. Cargo Handling Service-Reference to Larger Bench of the CESTAT by the Supreme Court – Status update

A reference in relation to demand of service tax on cargo handling services was ordered by the Hon’ble Supreme Court in Civil Appeal No. 6028 of 2007 to the larger bench of the CESTAT. The said reference was made in pursuance of the conflicting decisions on the interpretation of the taxable entry of “Cargo Handling Service”.

The matter went on for two days before the CESTAT and extensive arguments were made from both the sides inter-alia on the scope and coverage of the taxable entry of “Cargo Handling Service”.

16April 2016 • THE CTC NEWSwww.ctconline.org

Follow us on:

Posted at Mumbai Patrika Channel Sorting Office – Mumbai 400 001.

Date of Publishing 1st of Every Month Date of Posting : 1st & 2nd April, 2016

If undelivered, please return to :

Non-receipt of the CTC News must be notified within one month from the date of publication, which is 1st of Every Month.

Printed by Shri Kishor Dwarkadas Vanjara and published by him on behalf of The Chamber of Tax Consultants (owners), 3, Rewa Chambers, Ground Floor, 31, New Marine Lines, Mumbai 400 020 and Printed at The Great Art Printers, 25, S. A. Brelvi Road, Unique House Opp, Apurva Restaurant, Next to Poddar Chambers, Ground Floor, Fort, Mumbai-400 001. and published at The Chamber of Tax Consultants (owners), 3, Rewa Chambers, 31, New Marine Lines, Mumbai 400 020.

Editor : Shri Kishor Dwarkadas Vanjara

Book Post

To

3, Rewa Chambers, Ground Floor, 31, New Marine Lines, Mumbai–400 020

Tel.: 2200 1787 / 2209 0423 • Fax: 2200 2455 E-mail: [email protected] • Website: www.ctconline.org

THE CHAMBER OF TAX CONSULTANTS

In this regard, Larger Bench, CESTAT passed an order on 2-3-2016 inter alia directing the parties to approach the Supreme Court to seek guidelines in relation to the scope of the reference. The Bench is of the view that the correct facts were not presented before the Hon’ble Supreme Court.

As far as matters of Coal Handling companies (Coal Carrier, Gajanand, SSV, Shreem, etc.) are concerned the Bench is of the view that there were no conflicting decisions. The Orissa High Court in case of Coal carrier -2011 (24) STR -395 and Mumbai Tribunal in cases of SSV and Shreem coal 2015 (37) STR 1067 had taken the same view. Hence, Larger Bench is of the view that these matters are not referred to them.

Further, in case of packing companies (ITW) also Bench is of the view that there were no contradictory CESTAT decisions as mentioned in the Supreme Court order as well. The appeals before the Supreme Court in case of ITW were against the decisions of the Kolkata CESTAT and the Andhra Pradesh High Court. In other words, there was no conflict between two CESTAT decisions.

Accordingly, the Hon’ble Bench adjourned the matter with a direction that the contesting parties may seek guidance from the Hon’ble Supreme Court regarding the scope of reference.

SSV Coal Carrier vs. CCE Nagpur - CESTAT Mumbai decision dated 2-3-2016 in Appeal No. ST116/08

Note: Whole decisions can be downloaded from CTC’s website www.ctconline.org under Knowledge Centre.

QUOTES FROM THE BOOK TOP PERFORMANCE BY ZIG ZIGLAR published by Embassy Books

1. Co-operation, like leadership, is not getting the other fellow to do what you want. Rather, it means getting him to want to do what you want.

2. Leadership is the art of getting someone else to do something that you want done because he wants to do it. – Dwight D. Eisenhower

3. How far you go in life depends on your being tender with the young, compassionate with the aged, sympathetic with the striving, and tolerant of the weak and the strong. Because someday in life you will have been all of these. – George Washington Carver

4. If you want to get the best out of a man, you must look for the best that is in him. – Bernard Haldane5. If you can’t measure it, you can’t manage it.6. An ounce of loyalty is worth a pound of cleverness. – Elbert Hubbard7. One learns people through the heart, not the eyes or the intellect. – Mark Twain8. People don’t care how much you know, until they know how much you care . . . about them.9. The greatest humiliation in life is to work hard on something from which you expect great appreciation, and then fail to get it. –

Edgar Watson Howe10. The primary skill of a manager consists of knowing how to make assignments and picking the right people to carry out those

assignments. – Lee Iacocca 11. You can’t sweep people off their feet if you can’t be swept off your own. – Clarence Day12. The great truths in life are the simple ones. You don’t need three moving parts or four syllables for something to be significant. –

Dr. Steve Franklin