A study on new ULIP guidelines and comparative analysis on new ULIP vis-a-vis Mutual Funds.

Mutual Fund vs Ulip

-

Upload

pinkyjimiwal -

Category

Documents

-

view

227 -

download

0

Transcript of Mutual Fund vs Ulip

-

8/4/2019 Mutual Fund vs Ulip

1/37

PROJECT REPORT

On

MUTUAL FUND v/s ULIP

(In Partial Fulfillment of Master of Business Administration)

AT

RELIANCE LIFE INSURANCE COMPANY

LTD

NEW DELHI

(18.05.2009 TO 17.07.2009)

SUBMITTED BY:

RAKHI AGGARWAL

M08028

MBA (INSURANCE)

AMITY SCHOOL OF INSURANCE &

ACTUARIAL SCIENCE

AMITY UNIVERSITY-NOIDA

-

8/4/2019 Mutual Fund vs Ulip

2/37

Acknowledgement

The Project Title Comparison between Ulip and Mutual Fund has been

conducted by me during 18/05/09 to 17/07/09 at Reliance Life Insurance

Co. Ltd. I have completed this project, based on the primary research, under

the guidance of Mr. Srijit Upadhyay, (Sr. sales manager).

I owe enormous intellectual debt towards my guide Mr. Srijit Upadhyay,

who has augmented my knowledge in the field of Insurance management.

He has helped me learn about the process and giving me valuable insight

into the insurance business.

I am sincerely thankful to Mr. Abhay Gera (Trainer), for all his concern andthroughout guidance during the two months of my internship.

I am equally thankful to Mr. R.R Grover and Prof. I.J.Jain for his guidance

and enriching my thoughts in his field from different perspectives.

I would like to thank all the respondents without whose cooperation any

study/project would not have been possible.

Last but not the least, I feel indebted to all those people who have helped

directly or indirectly in successful completion of this study.

July 17,2009 Rakhi Aggarwal

2

-

8/4/2019 Mutual Fund vs Ulip

3/37

Preface

The project entitled to compare ULIP (Unit linked insurance plan) with the

mutual fund with respect to flexibility, liquidity, tax benefit , returns and soon.

To find and suggest which one is better to invest.

To sell the agency and ULIP products.

The project and accompanied training at Reliance Life Insurance Co. Pvt.

Ltd. gave me thorough insight of practical world of insurance business,

working and role of ULIP and Mutual Fund industry in India, apart it was

beneficial in part of exposure that we got, being the part of one of thesuccessfully operating private insurance companies.

3

-

8/4/2019 Mutual Fund vs Ulip

4/37

Certificate

This is to certify that Rakhi Aggarwal, a student of MBA (Insurance),

Amity School of Insurance and Actuarial Sciences, Amity University,bearing AUUP Enrollment No: A2801508081 has undertaken the summer

internship training at Reliance Life Insurance Co. Ltd. during 18.05.09 to

17.07.09.

She has worked under my guidance for the project- to study the ULIP and

mutual fund.

This project report is prepared in partial fulfillment of Master of Business

Administration (MBA) to be awarded by Amity University, Uttar Pradesh.

To the best of my knowledge, the piece of work is original and no part ofthis report has been submitted by the student to any other

institute/university earlier.

Prof.I.J Jain

(ASIAS)

4

-

8/4/2019 Mutual Fund vs Ulip

5/37

Executive Summary

I did my summer internship from Reliance Life Insurance Pvt Co Ltd. The

basic objective of doing this project was to study the ULIP products andcomparing them with the Mutual Funds.

To find which one is a better option available and what are the benefits

/loopholes of the two investment tools.

And lastly to sell the products/plans and agency in the market.

5

-

8/4/2019 Mutual Fund vs Ulip

6/37

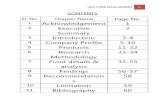

Table of contents

About Organization 7-8

About Insurance 9-11

ULIP 12-13

Mutual Fund 14-19

ULIP v/s Mutual Fund 20-21

ULIP v/s ELSS 22

ULIP v/s ELSS + Term Plan 23-24

Analysis 25

Conclusion 26

Recommendation 27

Bibliography 28

Annexure 29-36

6

-

8/4/2019 Mutual Fund vs Ulip

7/37

About the Organization

Reliance Life Insurance is an associate company of Reliance Capital Ltd, a

part of Reliance-Anil Dhirubhai Ambani Group.

Reliance Capital Businesses:

Reliance Mutual Fund:- Indias biggestMutual Fund.

Reliance General Insurance:- One of the Indias fastest growing GeneralInsurance Co. and among the top three private sector insurers.

Reliance Money:- leading retail brokerage houses and distributors offinancial products in India with 3 million customers.

Reliance Asset Reconstruction:- leading player in the healthy and robustfinancial market place.

Reliance Life Insurance:

Reliance life insurance started in Oct 2006. It took over AMP SANMAR,

(Chennai based insurance company) at 100 crores, which was under heavylosses. It was positioned at 18th rank in Oct 2006 among the total cos. Of

20.

Reliance life insurance has a pan India presence with a wide range of products catering to individuals and corporate needs. Reliance lifeinsurance have nearly 1,145 branches, nearly 1, 50,000 agents and 35

products covering saving, protection and investment requirements.

7

-

8/4/2019 Mutual Fund vs Ulip

8/37

Vision and mission:

Emerge as transnational Life Insurer of global scale and standard.

Create best value for Customers, Shareholders and all Stake holders

Achievements:

Closed last financial year with the new business premium of 3,513

crores.

Achieved growth rate of 28% in the last financial year against a

market growth of -6%.

In individual business segment, the co. achieved a growth rate of59% in terms of WRP against the pvt. Industry growth of 1 %.

Fastest gainer of market share growing from 1.9% amongst pvt.

Players in March 06 to 10.3% as of march 09, stood at 4th largest pvt.

Player in just 2 years starting at position of 11. Fastest co. to reach the 3 million policies mark and was the 3rd

largest pvt. Insurer in terms of policy count in 08-09.

Among the foremost life insurer companies in India to be certified

ISO 9001; 2000 for all the processes.

Awarded with Jamnalal Bajaj Uchit Vyavahar Vuruskar 2007.

It has also won the DL Shah Quality council of India commendation

award in Feb08 for promoting self help channels for service.

8

-

8/4/2019 Mutual Fund vs Ulip

9/37

Introduction

INSURANCE DEFINED Insurance is a provision for thedistribution of risks; that is to say, it is a financial provision against loss

from unavoidable disasters. The protection which it affords takes the form

of a guaranty to indemnify the insured if certain specified losses occur. The

principle of insurance, so far as the under-taking of the obligation is

concerned, is that for the payment of a certain sum the guaranty will be

given to reimburse the insured. The insurer, in accepting risks, so

distributes them that the sum total of all the amounts paid for this insurance

protection will be sufficient to meet the losses that occur.

Insurance in its basic form is defined as A contract between two parties

whereby one party called insurer undertakes in exchange for a fixed sumcalled premiums, to pay the other party called insured a fixed amount ofmoney on the happening of a certain event.

In simple terms it is a contract between the person who buys Insurance and

an Insurance company who sold the Policy. By entering into contract the

Insurance Company agrees to pay the Policy holder or his family members

a predetermined sum of money in case of any unfortunate event for a

predetermined fixed sum payable which is in normal term called Insurance

Premiums.

Insurance is basically a protection against a financial loss which can arise

on the happening of an unexpected event. Insurance companies collect

premiums to provide for this protection. By paying a very small sum ofmoney a person can safeguard himself and his family financially from an

unfortunate event.

For Exampleif a person buys a Life Insurance Policy by paying apremium to the Insurance company , the family members of insured person

receive a fixed compensation in case of any unfortunate event like death.

9

http://www.ndtvprofit.com/2008/01/16195839/What-is-Insurance.htmlhttp://www.ndtvprofit.com/2008/01/16195839/What-is-Insurance.htmlhttp://www.ndtvprofit.com/2008/01/16195839/What-is-Insurance.htmlhttp://www.ndtvprofit.com/2008/01/16195839/What-is-Insurance.html -

8/4/2019 Mutual Fund vs Ulip

10/37

Branches of insurance

General insurance in India

General Insurance provides much-needed protection against unforeseen

events such as accidents, illness, fire, burglary etc. Unlike Life Insurance,

General Insurance is not meant to offer returns but is a protection against

contingencies. Almost everything that has a financial value in life and has a

probability of getting lost, stolen or damaged, can be covered through

General Insurance policy

Major insurance policies that are covered under general insurance are:

Home insurance Health insurance

Motor insurance

Travel insurance

Marine insurance

Fire insurance

10

-

8/4/2019 Mutual Fund vs Ulip

11/37

Life insurance in India

LIFE INSURANCE-It is a contract providing for payment of a sum ofmoney to the person assured or, following him to the person entitled to

receive the same, on the happening of a certain event. It is a good method

to protect your family financially, in case of death, by providing funds forthe loss of income.

Types of life insurance policies;-

Term life insurance

Whole life insurance

Endowment policies

Money back policies

Annuity/pension policies/funds

ULIP

11

-

8/4/2019 Mutual Fund vs Ulip

12/37

Introduction:

ULIP- Unit Linked Insurance Plan. It is a category of goal-based financial

solutions that combine the safety of insurance protection with wealthcreation opportunities.

ULIP are market linked insurance plans where the risk is borne by the

policy holders. In ULIPS, a part of the investment goes towards providing

life cover. The residual portion of the ULIP is invested in a fund which in

turn invests in stocks or bonds. The value of investment alters with the

performance of the underlying fund.

Regulatory authority;-

IRDA- Insurance Regulatory and Development Authority.

Major Distribution channels;-

Agency

Brokerage firm

Banc assurance

Corporate Agent

Working of ULIP:

12

-

8/4/2019 Mutual Fund vs Ulip

13/37

Amount of premium to be paid and the amount of life cover is decided by

the policyholder. The insurer deducts some portion of the ULIP premium,

known as thePremium Allocation Charge, which varies from product to

product. The rest of the premium is invested in the fund or mixture of funds

like equity or debt or combination of two.

The fund value on a given date will reflect the performance of the

underlying assets classes. Apart, from the premium allocation charges,

there are mortality charges and ULIP administration charges which are

deducted on a periodic (mostly monthly) basis by cancellation of units.Whereas the fund management charges are adjusted from NAV on daily

basis.

Mutual funds

13

-

8/4/2019 Mutual Fund vs Ulip

14/37

Introduction:

A mutual fund is a collective investment that allows many investors, with acommon objective, to pool individual investments and give to a

professional manager who in turn would invest these monies in line with

the common objective.

Characteristics of Mutual Funds:

Investors own the mutual fund.

Professional managers (AMC) manage the fund for a small fee.

Fees charged are specified by SEBI and is expressed as a percentage

of assets managed.

The funds are invested in a portfolio of marketable securitiesin

accordance with the investment objective.

Value of the portfolio and investors holdings, alters with change inthe market value of investments.

14

-

8/4/2019 Mutual Fund vs Ulip

15/37

Mutual Funds:A Packaged Product

ProfessionalManagement

Convenience

INVESTINGTOOL

Liquidity

Diversification

15

-

8/4/2019 Mutual Fund vs Ulip

16/37

Classification of Mutual Funds

The classifications of Mutual fund are as follows:

Open-ended funds

Closed-ended funds

Load fund

No load fund

Equity fund

Debt fund

Balanced fund

Fund of funds

Open-ended vs. Closed-ended Funds:

OPEN-ENDED

No fixed maturity

Variable Corpus

Not Listed

Buy from and sell to the Fund

Entry/Exit at NAV related prices

CLOSED-ENDED Fixed Maturity

Fixed Corpus

Generally Listed

Buy and sell in the Stock Exchanges

Entry/Exit at the market prices

16

-

8/4/2019 Mutual Fund vs Ulip

17/37

Risk Return Trade-off

Risk

Potential

forreturn

Liquid Funds

Debt

Funds

Growth FundsAggressive, Value,

Growth

Balanced Funds

Sectoral Funds

Gilt Funds, BondFunds, High

Yield Funds

Ratio of Debt : Equity

Hedge Funds

17

-

8/4/2019 Mutual Fund vs Ulip

18/37

Mutual Fund Framework in India

Fund

Management

Registrar Custody

MarketingOperations

Distribution

Trustee Company

Sponsor

Asset Management Company

Fiduciary

responsibility to

the

Investors

Bank

Brokers

Markets

18

-

8/4/2019 Mutual Fund vs Ulip

19/37

Legal & Regulatory Environment:

SEBI - Capital Markets Regulator RBI - Money Markets Regulator

MOF - Policies

CLB, DCA, ROC

Stock Exchanges

Office of the Public Trustee.

Who can invest?

Resident Indian Individuals/HUF

Indian Companies/Partnership Firms

Trusts / charitable institutions / Puffs

Banks/ Fish / Nifco

Insurance Companies

Norris/ Fijis

Partnership firms etc.

Distribution Channels:

Individual Agents Distribution Companies

Banks and Nifco

Direct marketing channels

19

-

8/4/2019 Mutual Fund vs Ulip

20/37

ULIP v/s MUTUAL FUND

BASIS ULIP MUTUAL FUNDLife cover Yes No

Tax effectiveness

during investment

Are exempt under

section 80c.

Only ELSS (equity

linked saving scheme)

is exempt under section

80c.

Tax effectiveness

during maturity

Surrender/maturity

proceeds/death benefits

with bonus (if any) aretax free under section80 10(10D).

Long term capital gains

(more than 1 year) are

tax free. Short termcapital gains (less thanone year) are taxed at

11.22 %

Charges/expenses No upper limit, charges

determined by

insurance co.

High initial charges,

generally (5%-50%)

Tapers down sharply.

Fund mgt. chargesaround -1.50%

Limit set by SEBI

Initial charges-6%

Fund mgt. chargesaround:-2-2.5% .

Additional charges Administration charges

Mortality charges

Entry and Exit load- 2.5

%( max.)

Modifying asset

allocation

Switching allowed

between equity and

debt and back to equity

any no. of times at zero

or nominal cost without

moving out of scheme.

To switch b/w equity

and debt. Investor has

to exit and re-enter and

pay exit and entry load

every time.

Switchingmeansmoving out of current

scheme.

Maximizing returns Due to nominal

switching charges

maximizing returns

become cheaper

Due to entry and exit

load and STCG (short

term capital gain) tax,

maximizing returns

becomes expensive.

20

-

8/4/2019 Mutual Fund vs Ulip

21/37

Lock in period 3 years ELSS- 3 years

All other Mutual Fund-

0 years.

Liquidity Low, as lock in period

of 3 years.

High, can redeem

anytime if moneyneeded or invest inother scheme if fund

not performing well.

In general we can say that the ULIP has an edge over mutual fund in

terms of:-

Life cover

Tax benefit

Modifying Asset Allocation (easy and cheap) and maximizingreturns.

In general we can also say that Mutual Fund has an edge over Ulip in terms

of:-

Charges

Lock in period

21

-

8/4/2019 Mutual Fund vs Ulip

22/37

-

8/4/2019 Mutual Fund vs Ulip

23/37

ULIP v/s ELSS + Term Plan

ULIP

Age Term Premium

paying

term

Sum

assured

Annual

premium

Maturity

amount

30 10 10 10,00,000 1,00,000 15,20,375

Assumed returns at 10% CAGR.(Compounded Annual Growth Rate).

10% not calculated on 1, 00,000 but on less amount because ULIP NAVsare not net of expenses.

Net returns- 7.50%

ELSS+TERM PLAN

Premium paid towards term plan - 3600

Annual installment towards ELSS - 96400

Total -100,000

Term Plan

Age Sum Assured Annual

premium

Tenure Death

Benefit

30 15,00,000 3600 10 15,00,000

23

-

8/4/2019 Mutual Fund vs Ulip

24/37

Systematic Investment Plan (SIP)

Amt.

invested per

month

Amt.

invested per

year

Investment

term

Assumed

returns

Maturity

value

8033 96,400 10 8 14,56,247

8033 96,400 10 9 15,34,993

8033 96,400 10 10 16,18,308

Assumed returns at 10% CAGR

Net returns- 8-9%

Because mutual funds NAVS is usually net of expenses.

ULIP v/s ELSS + Term Plan (at a glance)

Basis ULIP ELSS+ Term Plan

Sum

assured

10,00,000 15,00,000

Death

benefit

during

the term

Higher of

sum

assured/fund

value

Sum assured (15,

00,000) + fund

value of ELSS.

Maturity

benefit

Fund value-

15,20,375

Fund value-

15,34,993

From the above example we can say its always better to buyELSS + TERM PLAN than buying ULIP.

24

-

8/4/2019 Mutual Fund vs Ulip

25/37

-

8/4/2019 Mutual Fund vs Ulip

26/37

Conclusion

Mutual fund and ulip both work in more or less the same way. The

major differences lies with respect to life cover, tax benefit, charges,

asset allocation and lock in period.

ULIP:

ULIP provides both life cover and investment opportunities to the

investors. It has tax benefit under section 80c. And benefits more to

them who have good market knowledge.

ULIP have high initial charges which make them less attractive in the

short run and they give less in the short run.

Whereas in the long run ULIP are always the winner and give good

and higher returns than mutual fund (ULIP have low fund

management charges) and the initial charges get compensated in the

long run. Therefore ULIP a better investment for long run

Mutual fund:-

Mutual fund, on the other hand gives only investment opportunities to

the investors with no life cover. Only equity linked saving schemes

have tax benefit under section 80c.An incentive for capital

appreciation proves to be costly as there are entry and exit load.

But despite of all these drawbacks mutual fund prove to be good in

the short run because of low initial charges. But they give less return

in long run due to high fund management charges. Therefore mutualfunds a better option in short runs.

26

-

8/4/2019 Mutual Fund vs Ulip

27/37

Recommendations

Investors with short term goals ,who like playing with stock market,wants more liquidity, cannot pay fixed installments for a long period,

who likes taking risk, whose investment varies from time to time and

last but not the least who are hard core interested in investment and

more equity exposures must go for mutual fund.

On the other hand investors who are quite conservative, have long

term goals (marriage, child, pension, etc), fixed regular income, quite

risk averse, can pay regular premium and wait for long and last but

not the least those who are interested in both life cover with

investment and availing tax benefit must go for ULIP plans.

Apart from these two there is a third category who wants both, good

returns in say 5-10 years along with tax benefit and life cover ,.they

must go for ELSS (mutual fund) plus Term plan.

27

-

8/4/2019 Mutual Fund vs Ulip

28/37

Bibliography

www.google.comwww.wikipedia.com

ICFAI Mutual Fund Book

NSE- AMFI Book

28

http://www.google.com/http://www.wikipedia.com/http://www.google.com/http://www.wikipedia.com/ -

8/4/2019 Mutual Fund vs Ulip

29/37

ANNEXURE

Computation of NAV

Example of ULIP v/s Mutual Fund

29

-

8/4/2019 Mutual Fund vs Ulip

30/37

NAV - COMPUTATION

NAV = Net assets of scheme / No of units Outstanding

I.e. Market value of investments+ Receivables +Other accrued income+

other assets - accrued expenses- Other Payables- Other liabilities

No. of units outstanding as at the NAV date

Imp :

Day of NAV Calculation is known as valuation day

NAV is computed for each business day

HOW NAV IS COMPUTED

Market value of Equities - Rs.100 core - AssetMarket value of Debentures - Rs.50 core - Asset

Dividends Accrued - Rs.1 core -Income

Interest Accrued - Rs.2 core - Income

Ongoing Fee payable - Rs.0.5 core - Liability

Amount payable on shares purchased -Rs.4.5 core - Liability

No. of units held in the Fund: 10 core units

NAV per unit = [(100+50+1+2)-(0.5+4.5)]/10

= [153-5]/10

= Rest. 14.80

Nave is influenced by:

Purchase and sale of Investment

Valuation of Investment

Other assets and Liabilities

Units sold or redeemed.

30

-

8/4/2019 Mutual Fund vs Ulip

31/37

CHANGE IN NAV FORMULA:

For NAV change in absolute terms =

(NAV at end of period - NAV at beginning of period) * 100

NAV at beginning of period

For NAV change in annualised terms =

(NAV change in % in absolute terms) * (365 / No. of days)

Investors Needs

Protection Need Investment Need

To protect living financial needs served

Standards, current and through investments

Survival requirements and savings

- Regular Income - Children education

- Retirement Income - Housing

- Insurance Cover - Children professional growth

Strategy To Smart Investing

Identify Objective

Start early

Focus long-term and stay invested

Beware of the effects of inflation & taxes

31

-

8/4/2019 Mutual Fund vs Ulip

32/37

Key points to remember before investing:

1. Investment decision are long term decision.

2. 1% Superior Return Can Make 20% difference in 25 Years.

3. Understand the virtues of rupee Cost averaging

4. Discipline is more important than intelligence.

Age Group

(Years)

Gr

(Eq

25- 40 75

41- 50 50

51- 60 35

Above 60 25

Need Based Investment Strategy

32

-

8/4/2019 Mutual Fund vs Ulip

33/37

ULIP v/s Mutual Fund

ULIP

Age Sum

assured

Term

of thepolicy

Premium

payingterm

Annual

premium

Premium

allocation charge

Administration

charge

Mortality

charge

Fund

managementcharge

30 20,00,00

0

20 20 1,00,000

1st year-

40% ofA.P.

2nd year

onwards-5% of

A.P.

In lumsum-5,000 in 1st year

only.

As pertable

given

below.

1.5%

Calculation of theFund value in 20 years @ 10 % CAGR:

r Age Mortalitycharges

rate per

1000 S.A

Annualpremium

Premiumallocation

charge

Mortalitycharge

Invest ableamount

Fundmgt.

charges

Finalinvestment

10% rateof return

Fund vat the

the ye

30 1.29 1,00,000 40,000

+5,000(admin

charge)

2,,580 52,420 786.30 51,633.70 5,163.37 56,797

31 1.30 1,00,000 5,000 2,600 1,49,197.07 2,237.95 1,46,959.12 14,695.91 1,61,632 1.35 1,00,000 5,000 2,700 2,53,955.03 3,809.32 2,50,145.71 25,014.57 2,75,1

33 1.40 1,00,000 5,000 2,800 3,67,360.28 5,510.40 3,61,849.88 36,184.98 3,98,0

34 1.48 1,00,000 5,000 2,960 4,90,074.86 7,351.12 4,82,723.74 48,272.37 5,30,9

35 1.58 1,00,000 5,000 3,160 6,22,836.11 9,342.54 6,13,493.57 61,349.35 6,74,8

36 1.69 1,00,000 5,000 3,380 7,66,462.92 11,496.9

4

7,54,965.98 75,496.59 8,30,4

37 1.82 1,00,000 5,000 3,640 9,21,822.57 13,827.3

3

90,7,995.24 90,799.52 9,98,7

38 1.97 1,00,000 5,000 3,940 10,89,854.7

6

16,347.8

2

10,73,506.9

4

10,7350.69 11,80

39 2.15 1,00,000 5,000 4,300 12,71,557.6

3

19,073.3

6

12,52,484.2

9

1,25,248.4

2

13,77

40 2.37 1,00,000 5,000 4,740 14,67,992.69

22,099.89

14,45,972.80

1,44,597.28

15,90

41 2.57 1,00,000 5,000 5,140 16,80,430.0

8

25,206.4

5

16,55,223.6

3

1,65,522.3

6

18,20

42 2.76 1,00,000 5,000 5,520 19,10,225.9

9

28,653.3

8

18,81,572.6

1

1,88,157.2

6

20,69

43 2.99 1,00,000 5,000 5,980 21,58,749.8 32,381.2 21,26,368.6 2,12,636.8 23,39,

33

-

8/4/2019 Mutual Fund vs Ulip

34/37

7 4 3 6

44 3.27 1,00,000 5,000 6,540 24,27,465.4

9

36,411.9

8

23,91,053.5

1

2,39,105.3

5

26,30

45 3.60 1,00,000 5,000 7,200 27,17,958.8

6

40,769.3

8

26,77,189.4

8

2,67,718.9

4

29,44

46 3.99 1,00,000 5,000 7,980 30,31,928.4

2

45,478.9

2

29,86,449.5

0

2,98,644.9

5

32,85

47 4.43 1,00,000 5,000 8,860 33,71,234.4

5

50,568.5

1

33,20,665.9

4

3,32,066.5

9

36,52

48 4.93 1,00,000 5,000 9,860 37,37,872.5

3

56,068.0

8

36,81,804.4

5

3,68,180.4

4

40,49

49 5.48 1,00,000 5,000 10,960 41,34,024.8

9

62,010.3

7

40,72,014.5

2

4,07,201.4

5

44,79

As we see from the above calculation that ULIP gives a negative growth till

4th year but it start giving returns from 5th year onwards.

From 10th

year onwards ULIP gives good returns as in long run, the highinitial charges are spread off and the charges reduce there on giving high

returns.

Therefore, ULIP are for long term investors and not good for short term

investors.

34

-

8/4/2019 Mutual Fund vs Ulip

35/37

Mutual fund

Term Annualinstallment

Rate of return Entry load Fund mgt.

charge

20 1,00,000 10%(CAGR) 2.5% 2.5%

Calculation of the Fund value in 20 years @ 10% CAGR.

Year Annual

installment

Entry

load

Investable

amount

Fund mgt.

charges

Final

investment

10% rate of

return

Fund value at

the end of the

year.

1,00,000 2,500 97,500.00 2,437.00 95,062.50 9,506.25 1,04,568.75

2 1,00,000 2,500 2,02,068.75 5,051.71 197,017.04 19,701.70 2,16,718.74

1,00,000 2,500 3,14,218.74 7,855.46 3,06,363.28 30,636.32 3,36,999.60

4 1,00,000 2,500 4,34,499.60 10,862.49 4,23,637.11 42,363.71 4,66,000.82

5 1,00,000 2,500 5,63,500.82 14,087.52 5,49,413.30 54,941.33 6,04,354.63

6 1,00,000 2,500 7,01,854.63 17,546.36 6,84,308.27 68,430.82 7,52,739.09

7 1,00,000 2,500 8,50,239.09 21,255.97 8,28,983.12 82,898.31 9,11,881.43

8 1,00,000 2,500 10,09,381.43 25,234.53 9,84,146.90 98,414.69 10,82,561.59

9 1,00,000 2,500 11,80,061.59 29,501.53 11,50,560.06 1,15,056.00 12,65,616.06

0 1,00,000 2,500 13,63,116.06 34,077.90 13,29,038.16 1,32,903.81 14,61,941.97

1 1,00,000 2,500 15,59,441.97 38,986.04 15,20,455.93 1,52,045.59 16,72,501.52

2 1,00,000 2,500 17,70,001.52 44,250.03 17,25,751.49 1,72,575.14 18,98,326.63

3 1,00,000 2,500 19,95,826.63 49,895.66 19,45,930.97 1,94,593.09 21,40,524.06

4 1,00,000 2,500 21,50,224.06 53,755.60 20,96,468.46 2,09,646.84 23,06,115.30

5 1,00,000 2,500 24,03,615.30 60,090.38 23,43,524.92 2,34,352.49 25,77,877.41

6 1,00,000 2,500 26,75,377.41 66,884.43 26,08,492.98 2,60,849.29 28,69,342.27

35

-

8/4/2019 Mutual Fund vs Ulip

36/37

7 1,00,000 2,500 29,66,842.27 74,171.05 28,92,671.22 2,89,267.12 31,81,938.34

8 1,00,000 2,500 32,79,438.34 81,985.95 31,97,452.39 3,19,745.23 35,17,197.62

9 1,00,000 2,500 36,14,697.62 90,367.44 35,24,330.18 3,52,433.01 38,76,763.19

20 1,00,000 2,500 39,74,263.19 99,356.57 38,749,06.62 3,87,490.66 42,62,397.28

Analysis

Years ULIP Returns Mutual Fund

Returns

0-4 Negative Positive but low

4-10 Recovering Good

10-15 Positive Increases at

diminishing rate

15-20 Increase greater than

M.F

Sluggish and less than

ULIP

With the above mention analysis, outcome is:

Till 13th year Mutual Fund is giving more returns than ULIP plan

but 14th year onwards ULIP is giving better return than mutual fund.

This implies that mutual fund are better in short term say for

around 10 years whereas ulip are and has always been the

winner in the long run say for investment for more than 10

years..

This is because in long run the high initial charges in ULIP are

compensated and it starts giving good returns.

In the long run the returns of mutual fund become sluggish becauseofhigh fund management charges. As the fund management charges

are deducted from the invest able amount, it comes out to be very

high in long run when the invest able amount becomes high in the

long run.

36

-

8/4/2019 Mutual Fund vs Ulip

37/37

Just 1% difference in the fund management charges of ULIP (1.5%)and Mutual Fund (2.5%) makes ULIP give better return in the long

run.

Therefore ULIP is always a winner in the long run.