Millennials They like To Save Money Too! · time-poor shopper, other retailers adopted a pricing...

Transcript of Millennials They like To Save Money Too! · time-poor shopper, other retailers adopted a pricing...

MARCH 2017

WWW.THELOYALTYPOST.COM

Millennials They likeTo Save Money Too!

LOYALTY & MORESatisfying The Connected Customer

CONSUMER FOCUSCustomer - Loyalty : CustomerInsight Or Sales Promotion?

FUTURE TRENDSOmni Channel – More Than JustA Buzzword

SPECIAL FEATUREThe Persistent Paradox: To

Build Brand Loyalty – Or TenderLoyalty?

ANALYTICS & MOREFulfilling The Promise Of

Analytics

THE LOYALTY POST | MAR 2017

ContentsCONSUMER FOCUS

27 Customer - Loyalty: Customer insight or sales promotion?

MARKETING FEATURE

06 Four Steps for a Successful Multilingual Marketing Campaign

12 Win With Social Intelligence: Vital Tips for CMOs in 2016 and Beyond

33 How Can Brands Deal With This Digital Divide?

38 Know Your Digital Customer From Customer to Social To Digital MDM

FUTURE TRENDS

35 Omni Channel – more Than Just A Buzzword

INDUSTRY UPDATE

32 Germany: PAYBACK launches digital payments and loyalty card

26 Amazon India Scores Highest in User Loyalty, Says Study

COVER STORY

23 Millennials: They like to save money too!

SPECIAL FEATURE

43 The Persistent Paradox: To Build Brand Loyalty – or Tender Loyalty?

LOYALTY & MORE

03 Retail Pricing Strategies: Their impact on customer loyalty

40 Satisfying the Connected Customer

CUSTOMER EXPERIENCE

09 The Six Pillars of B2B Customer Experience Excellence

20 Four Ways to Create Personalised Customer Experiences in 2016

24 Why it’s time for customer service to go omnichannel

ANALYTICS & MORE

15 Fulfilling the promise of analytics

12

16

17

THE LOYALTY POST | MAR 2017

Speak to any average consumer and mention the names of some high quality, leading businesses. The chances are

high that one of the first words they will use is "expensive". Not "excellent service", "marvellous range" or even "helpful staff". Possibly "Expensive but worth it", or "You get what you pay for", but in the average consumer's mind, price is almost always a key factor.

DIFFERENTIATING ON PRICE - GOOD OR BAD MOVE?Let's take a quick look at popular traditional pricing strategies, as well as a new one - Access Pricing - that overcomes many of the challenges that we've have had to deal with in the past. Most pricing strategies clearly appeal to one category of shoppers but not to others. EDLP, for example, would appeal to time-poor/

money-poor shoppers who have little to spend and no time to shop around - it would make sense for them to choose a solid EDLP store and do all their shopping there. Hi-Lo pricing would appeal to cherry pickers - who fall into the time-rich/money-poor category. But Access pricing should appeal to all categories of shoppers - a significant advantage. But what exactly is 'access pricing'? Well, it's a loyalty-based pricing technique that allows a retailer to differentiate prices between regular customers and occasional shoppers in an open, transparent way. It's the ultimately fair tiered pricing system. Customers collect points on their purchases as usual - but throughout the store, key items are priced at two levels: the price that the item would normally sell for, and a very much lower price that's available in exchange for some of the customer's loyalty points.

Pricing strategy is a key feature of any business - it plays a key role in customers' perceptions of any business. Here we explore all the main options, and how they impact customer loyalty..

Retail Pricing Strategies: Their impact on customer loyalty

03| LOYALTY & MORE

THE LOYALTY POST | MAR 2017

Some thirty years ago, Hi-Lo pricing and EDLP were joined in the marketers'

armoury by a new weapon: Profit-up-front pricing. PUF pricing is seen in the warehouse club industry (for example, Costco, SAM's, and BJ's) where qualified customers pay for the privilege of buying items at bedrock prices which include extremely low profit margins. Usually, customers buy membership by paying an annual fee in advance. This admits them to the warehouse, where they can buy goods at 'wholesale' prices. The operator can sell goods at these low prices because the revenue from these up-front membership fees account for about half of its pre-tax profits.

Just lately, a fourth way, called 'Access Pricing' (brainchild of retail marketing guru

Brian Woolf) is making its appearance. Its unique feature is to differentiate prices on basic items between regular customers and occasional shoppers in an open, transparent way. up until now it's been very difficult to offer higher prices for casual customers and lower prices for regular customers within the same retail store, without offending some customers. In countries with a well-developed social conscience (the UK, for example) a policy of better prices for those who spend more can result in quite vociferous negative

THE FOUR KEY PRICING STRATEGIES

There was a time when manufacturers recommended a price for each item, and retailers simply charged that price. Any differentiation then was purely on convenience, ambience, product range and quality of service of the retailer. Let's look at the four key strategies:

In order to introduce another element of differentiation, some retailers started

reducing the prices of key products, in order to attract customers into their stores, where they would buy other products as well as the reduced-price products. Hi-Lo pricing was born, and fairly quickly became the norm. The retailer made little profit, or even a loss, on the price-reduced products, but recouped the revenue in the increased sales of other profitable lines. Hi-Lo pricing also introduced an element of excitement into shopping - shoppers felt good when they had bought an exceptional bargain, and this would tend to encourage them to return.

To appeal to the more 'no-nonsense' shopper, and to simplify shopping for the

time-poor shopper, other retailers adopted a pricing strategy whereby they charged a fair, but low-as-possible price for all products. While this is thought by some to be boring, it is very successful to this day. To those for whom shopping is a chore to be handled as painlessly and quickly as possible, EDLP is the perfect solution. No need to shop around, no need to clip coupons, no need to waste time, simply buy what you need from the same place every week and know that you're getting a square deal. However, EDLP presents a challenge to the retailer: in the absence of other differentiators any loyalty exhibited is to the prices charged, not to the business. EDLP shoppers will defect to a competitor who begins to charge slightly lower prices.

• HI-LO PRICING

• EDLP (Every Day Low Pricing)

• PUF (Profit Up Front)

• ACCESS PRICING

04 | LOYALTY & MORE04 | LOYALTY & MORE

THE LOYALTY POST | MAR 2017

publicity. "Why should the poor old pensioner pay more than the rich young businessman?" would be a frequent cry. But Access Pricing, using readily available technology and a points-based loyalty card programme now make it possible.

HOW ACCESS PRICING WORKS

Customers collect points on their purchases, using a seemingly standard points-based loyalty programme. There, the similarity ends. Throughout the store, key items are priced at two levels: the price that the item would normally cost, and a second price, very much lower, but supplemented by some of the buyer's loyalty points. For example, as expected, a product usually priced at US$9.99 could be bought off the shelf for US$9.99. But alternatively, it could be bought for US$3.99 plus 900 of the loyalty points that the customer has already collected. That US$6 discount was earned (at 10 points for US$1 spent) by spending US$90 - not counting bonus points; even then, it's a substantial reward. This means that the customers have control of the prices they pay, and how they spend their loyalty points. For loyalty programme operators this is excellent news: it maintains member interest, and gets customers interacting with the programme on a frequent basis - every time they go shopping. As Woolf says, it's effectively putting "Golden Handcuffs" on your best customers.

APART FROM RETAIL... where else is access pricing good?

Clearly, food retailers can use access pricing. But many other sectors of business can, too. For example, consider two disparate sectors: airlines and office supply stores. Airlines' frequent flyer programmes could use access pricing techniques to offer a ticket on any

domestic trip for, say, US$100 plus 10,000 miles (instead of 25,000 miles). That would inject much-needed cash into an airline's purse while providing a meaningful reason for travellers to fly on that airline, even if individual flights are not always the lowest priced. And office supply stores could use access pricing, neutralising and even bettering their warehouse club competitors by offering really low prices on key items that warehouse club competitors carry instead of thinly discounting everything else.This right pricing strategy is critical not only to the business model, but to the target audience, and it's essential to use the right combinations

to attract and reward the right customers. And it can be a mistake to think that only one strategy should be employed, too - it's could be an advantage to combine pricing techniques to suit market conditions, as well as customer attitudes and buying motivations.

WHERE TO FIND MORE DETAIL...

See The Loyalty Guide up-closeThe Loyalty Guide, our comprehensive guide to customer loyalty, explains every aspect of loyalty programmes, best practices, concepts, models and innovations, all backed up with case studies, original research, illustrations, charts, graphs, tables, and presentation material. Find out about the principles, practicalities, metrics, analysis, and bottom-line effects of loyalty, and gain the expert guidance of dozens of loyalty and relationship marketing thought-leaders, worldwide.

Author: By Peter Clark (author, The Loyalty Guide)

LOYALTY & MORE | 05LOYALTY & MORE | 05

THE LOYALTY POST | MAR 2017

For modern businesses, the key to being successful is to stay current. The advent and growth of the Internet and social

media have made the world a smaller and more connected place. We are seeing a transition from business-to-consumer and business-to-business to human-to-human. Marketing initiatives must adapt accordingly.

When developing a marketing campaign, you want it to evoke emotion with your customer base. So it's important to understand different types of consumers, their habits, and their culture.

Connected intimately to culture and identity is language. To better relate your product or service to consumers, try presenting those products and services in a way that identifies with consumers of a particular culture—via multilingual marketing.

A successful multilingual marketing campaign involves the following:

• Research• Planning• Execution• Distribution

As a marketer, you are familiar with planning and implementing a marketing campaign; through the following tips, we will talk about the best ways to research, plan, execute, and distribute a multilingual marketing campaign

Your company has decided to move into new markets. It's time to plan your marketing initiatives. Marketing research is essential in the modern global market. Start with a country assessment. Take a look at key factors: geographic, demographic, economic, cultural, legal, political, and infrastructure.

Your first goal is to find out more about your target consumer. What languages do they speak? What websites are they visiting? What social media outlets do they interact on? Do they shop frequently online?

Your second goal is to find out how well the way you market your product or service relates to those target consumers. Assess your current English-language or US-based marketing campaign. Look at the premise. Would it work for another culture? Why or why not?

When planning a multilingual marketing campaign, think about how you are going to tackle the language barrier. Free translation tools such as Google Translate may work for understanding the gist of an email, but it will not work in the context of marketing.

PLANNINGDISTRIBUTION

EXECUTION

1 Research: Knowing the Market

2Planning: How to Bridge the Language (and Culture) Barrier

06 | MARKETING FEATURE

THE LOYALTY POST | MAR 2017

Marketing content is supposed to have a human element, whereas machine-translated text can often sound unnatural and takes away from the native brand experience.

Bilingual employees are often considered a cost-effective option: They work within your organization, and they have good knowledge of the target language. However, bilingual employees may not have a marketing background. But such a background is important when considering translation of marketing materials or corporate communications. Bilingual employees may be more important as internal reviewers for translations to make sure the materials "speak the language" of your company (company-specific terms).

Choosing a reputable translator is an important part of the planning stage. The freelancer or translation agency you choose must have a good reputation. Qualifications should include the use of in-country, native-speaking linguists: They will know about cultural sensitivities, current events, and other nuances that will make translations relevant and engaging.

Word-for-translation will not always resonate, so take a look at firms who are adept at transcreation—translation plus creation. This approach takes translation to the next level: Marketing content is adapted so that the words and the meaning carry the same weight in different cultures.

Creating a style guide is also an important part of the planning stage. Your brand's source content has a distinct voice. You will want to make sure that your, voice carries over into multilingual markets. Your style guide should include any frequently used industry jargon, including acronyms and abbreviations as well as keywords related to your brand. Such guidelines will allow translators and content creators to make sure content maintains a consistency of voice and tone.

The planning phase involves a lot of assessing and choosing strategic partnerships. The execution phase is all about efficiency, timeliness, and communication. If you have chosen a partner to work with on your multilingual marketing campaign, communication is vital. First, confirm that the source content is final—so that you avoid a lot of back-and-forth issues. Also, to avoid delay, ensure the source content creator is available for any questions.

If you have elected to have translations or multilingual content reviewed (highly recommended that you do), then you should have the reviewers ready. As noted earlier, bilingual employees are often used to this end. Since they have other jobs, it is important to let them know when they will have to review content and establish deadlines. Set expectations for the translators, the reviewers, and yourself.

Also, plan for what happens when the translations or multilingual content are ready and final, at which point the next phase of the campaign comes into play.

3Execution: Putting Your Plan Into Practice

MARKETING FEATURE |07

THE LOYALTY POST | MAR 2017

A lot of time is spent on planning and creating content. In the case of multilingual marketing campaigns, a lot of time is spent preparing content for translation, translating the content, and then finalizing it. Just as important is spending time to think about distribution. Will the content be printed? Will it be provided online? Who is responsible for printing and posting the content?

When launching a project into multiple new markets, all translations must be ready so that they can be released simultaneously with the source language, if that is intended to be part of the marketing campaign.

For today's modern business, global customer engagement is paramount. Successful planning and implementation of a multilingual marketing campaign means huge potential for gains in company growth.

4Distribution: It's Not One-Size Fits All

Caitlin Nicholson is a business development specialist at LinguaLinx, a translation and global marketing service provider that works with thousands of clients and linguists around the world.

08 | MARKETING FEATURE

THE LOYALTY POST | MAR 2017

There is substantial evidence correlating positive customer experience with business growth.

Most customers spend more as a result of a positive customer experience, and more than half of customers who recommend a brand do so because of the customer experience (versus other factors, such as price or product), research has found.

However, many companies fail to deliver excellent customer experience.

Yet, poor customer experience drives brand switching—typically a key reason for three quarters of lost customers. And most customers who suffer a bad customer experience spread negative word-of-mouth.

Recent research* conducted by B2B International found that only 14% of large B2B organizations are truly customer-centric—i.e., the customer experience is ingrained in the fabric of the company.

That finding indicates that B2B companies have significant work to do to become more customer-focused, but it also suggests a huge opportunity for B2B firms to differentiate their brands by delivering a superior customer experience.

So, what do B2B firms need to do to deliver a differentiated customer experience?

The Six Pillars of B2B Customer Experience Excellence

CUSTOMER EXPERIENCE 09

THE LOYALTY POST | MAR 2017

In examining the customer experience of over 500 B2B brands, we identified the six pillars behind B2B customer experience excellence, and then we tested the performance of those pillars in a recent survey* of B2B marketers of large firms:

3) SEAMLESSNESS

A company may deliver valued products and services, but how does the customer perceive the entire journey, from registering the need to receiving the final deliverable?

Across hundreds of B2B brands, a key driver of overall satisfaction and loyalty is ease of doing business with the supplier. Whether it's a manufacturing company, a reseller or a financial services supplier, seamlessness is vital to a successful customer experience.

Seamlessness, therefore, makes it into the top six customer experience excellence pillars, but only 4 in 10 B2B firms perform well in this regard.

4) RESPONSIVENESS

Central to customer-centricity is making customers feel that they are the most important customer being served, and responsiveness goes a long way toward demonstrating to customers that they are valued.

Responsiveness is a critical customer experience excellence pillar that spans

1) COMMITMENT

The first step in customer experience excellence is to be committed to satisfying customers and making them feel valued. Without that commitment across the company, it is significantly more difficult to succeed on the remaining pillars of customer experience excellence.

Only around a half of B2B firms are committed—again, highlighting the opportunity for B2B companies to differentiate through customer-centricity.

2) FULFILLMENT

Many B2B firms are guilty of selling products and services that they want to sell, rather than what the customer really wants and values. Rightly, then, the next pillar of customer experience excellence relates to understanding and delivering on customer needs.

It is somewhat worrying that only 38% of B2B firms perform well on this important requirement, indicating a need for B2B companies to better align their offering with customer wants and desires.

10 CUSTOMER EXPERIENCE

THE LOYALTY POST | MAR 2017

touchpoints across the customer journey, such as communications, deliveries, and issue resolution.

Failing on this important requirement can increase customer defection, and so it is alarming that only 39% of B2B firms perform well on responsiveness.

5) PROACTIVITY

The more sophisticated customer-centric businesses are those that are proactive in delivering a superior customer experience. Such firms anticipate customer needs and desires, and strive to resolve issues before the customer feels pain. Doing so requires the supplier to walk in the customer's shoes to foresee potential customer needs and pain points and to be fully prepared for them. A mere quarter of B2B firms admit to performing well on proactivity.

6) EVOLUTION

The final pillar, evolution, describes the totally customer-centric firm that recognizing it must always make improvements to the customer experience because customer needs, attitudes, and behaviors change over time.

Just 27% of B2B firms say they perform well on this continual-improvement process; nearly three-fourths of B2B companies therefore acknowledge their weakness in not addressing the customer experience on an ongoing basis.

Interestingly, knowledge-based companies (such as those in IT, financial and professional services, healthcare, and education) tend to rate their customer experience performance higher than do companies in trade and services (such as wholesale, telecoms, and utilities) and companies in manufacturing and construction.

Knowledge-based companies entail more customer interaction and so there is arguably more opportunity to build strong customer relationships, which is essential in driving customer experience excellence in B2B markets.

*A survey of 266 B2B marketing professionals was conducted in the last quarter of 2015. The research spanned North America and Europe and surveyed large firms serving businesses (the average respondent business size was $6 billion in revenue).

Author - Julia Cupman is vice-president at global business-to-business market research agency B2B International, which serves a wide range of sectors, from traditional heavy industry to financial and business services. Reach her via +1-914-761-1909 or email: [email protected].

CUSTOMER EXPERIENCE 11

THE LOYALTY POST | MAR 2017

It's no secret that the marketing landscape continues to evolve, including the modern CMO's approach to accelerating his or her

organization's "buzz," lead generation, and content engagement efforts.

However, one additional crucial element of marketing that all CMOs need to be addressing right now is social listening and analytics.

Social data has the ability to transform and better inform the decisions CMOs make within their organizations every day, and it can heavily influence long-term marketing tactics.

Social intelligence can provide tremendous value, but if the modern CMOs don't start acknowledging (and acting on) the value social data provides—they risk losing brand relevancy and losing touch with their consumer base in a hurry.

So, how can CMOs begin to factor social intelligence into their business approach? What do they need to understand to fully take advantage of social data?

Here are some tips that can help CMOs take the first important steps toward factoring social listening into their overall agenda—and leap data-first into the future.

1) HIRING FOR SOCIAL DATA SUCCESS

First item on the CMO's agenda for 2016: hire data analysts within the marketing department. Creating and expanding a group of data analysts can only help deepen social insights throughout marketing (and companywide).

You need to have a set group of people who are constantly focused on social media monitoring for your brand. For example, data

Win With Social Intelligence: Vital Tips for CMOs in 2017 and Beyond

12 | MARKETING FEATURE

THE LOYALTY POST | MAR 2017

analysts will pay attention to your brand across all social platforms, able to capture brand mentions (or anything relevant—brand, topic, competitor, etc.) found online.

However, the real value of this work lies in how the information is used.

Social listening provides a CMO with a glimpse into what consumers are talking about and expose their sentiments regarding the brand's products and services. CMOs can learn where they need to improve to meet consumers' expectations.

Ultimately, when used properly, this data can guide CMOs toward more strategic decisions inside the boardroom.

2) IDENTIFYING BENEFITS OF SOCIAL

CMOs must understand how broad the benefits of social listening are, reaching beyond just the marketing and sales departments. CMOs need to be well versed on how social intelligence can influence all departments.

• Social listening can be used to find new hires, deal with customer service issues, and conne

• ct with key audiences to build deeper relationships. It truly allows for a communication line between a brand and its customers.

• Social listening can help brands craft social posts and other public statements in ways that move beyond simply promoting and pushing out the brand name to actually addressing consumers' concerns.

• It provides companies with the insights to influence the performance of core business operations, such as product development and customer service.

• Arming a company with knowledge about the topics consumers are tweeting about to the

media can also serve as a valuable precursor to topics that may end up in the actual news; that allows brands to better plan for or predict headline risk.

For all those reasons and more, social listening undoubtedly provides companywide value and insights—and why every CMO needs to understand and address it for his/her brand.

3) FINDING THE RIGHT AUDIENCES

CMOs need to understand HOW to start using insights collected from listening. It's not JUST meant to help people get to know their audience; it's about finding connections with them and gleaning insights about them, then targeting and personalizing future communication.

Marketers can pinpoint numerous attributes to each member of their consumer base to help them truly understand their audience better. For example, gender, interests, and professions of social audiences can be fairly critical information for any brand. That information can help brands create targeted content or products for those consumers.

Recognizing the demographic makeup of a social audience can provide value to an overall marketing strategy: Are there certain products or types of content that activate certain segments of a brand's audience on social? What are those products? And how are people talking about them? Knowing the answers to the questions can help CMOs better understand their own campaign efforts and help them strategize to reach specific audiences, depending on the brand goals.

MARKETING FEATURE |13

THE LOYALTY POST | MAR 2017

Beyond simply listening socially to an audience, there are resources available to CMOs that enable them to track instant social insights from their audiences—identifying trends and content in real time. With the right tools, CMOs can create and customize desired social audience segments, pinpoint influencers within those segments, and see what content is being shared by those influencers in real time.

Social listening is undoubtedly enhanced by technology, and CMOs should be aware that they have the access to help target their desired customers with the right content at the right time.

4) MEANINGFUL SOCIAL MEASUREMENT

CMOs must begin focusing on measuring meaningful ROI metrics during and at the end of campaigns. Meaningful ROI are the numbers that can follow you into the boardroom and to business end goals, exponentially increasing their value. Ultimately, though, it is nearly impossible to attribute hard numbers to the ROI of a social

listening campaign, so it's best to establish well-thought-out goals for the campaign and check to see whether they are achieved during and at the finish of the campaign.

It's ultimately every CMO for him/herself. But with social media platforms probing the world's largest focus group every second of every day, the modern CMO would be foolish to think he/she can maintain success without tuning into the social world—the desires expressed there, trends, popular stories, and what the collective social Web says and feels about their brands.

Author : Will McInnes is CMO of social intelligence platform Brandwatch. He's also a board member of the Big Boulder Initiative, the mission of which is to establish the foundation for the long-term success of the social data industry.

14 | MARKETING FEATURE

THE LOYALTY POST | MAR 2017

While data and analytics have been part of business for a long time, it’s only in recent years that the value

they provide has captured the attention of senior executives and managers. That is because there has been an explosion of systems and devices that generate data coupled with greatly reduced costs to collect, store and analyze that data. The result: big data.

Today, big data and analytics (BD&A) are changing the way decisions are made – from everyday business challenges to differentiating a company in an effort to gain competitive advantage. Decision-makers’ eyes and imaginations are now open to new opportunities that might have slipped under the radar in the past.

However, for all the benefits BD&A promises, it is disruptive. And like all disruptive concepts, it can turn any organization on its head. In fact, because of the disruptive nature of BD&A, many companies are struggling to

derive full value from their initiatives and capabilities. A recent EY and Forbes Insights survey of 564 executives in large global enterprises found that most organizations still do not have an effective and aligned business strategy for competing in a digital, analytics-enabled world. For many companies, the people- and process-related change management issues have prevented analytics from fully delivering on its potential.

Illustrating this challenge, the survey found that while 78 percent of organizations said data and analytics are changing the nature of competitive advantage, and despite the 66 percent who said they are investing $5 million or more in analytics, only 12 percent of organizations described themselves as analytics leaders. The reason so few companies class themselves as leaders, or are able to drive competitive differentiation, is because of the 89 percent that admitted that change management is the biggest barrier to realizing analytics’ value.

Fulfilling the promise

of

ANALYTICS & MORE 15

THE LOYALTY POST | MAR 2017

What separates these leaders in analytics excellence from those organizations still struggling with their programs?

Most organizations do not have an effective and aligned business strategy for competing in a digital, analytics-enabled world.

The EY-Forbes survey found that the most advanced companies – those within the top 10 percent in the survey results – use BD&A in their decision-making “all of the time” or “most of the time” and said they considered their organization as “advanced” or “leading” in applying BD&A to business issues and opportunities. Further, these companies reported a “significant” shift in their ability to meet competitive challenges.

In other words, the top 10 percent of companies are not just producing data and analytics, they use the analytics-driven insights at the point at which decisions are made. The ability of an organization to utilize, or as we refer to it, “consume,” analytics like this is not easy. Most companies have rich BD&A production strategies and processes in place – a topic that warrants another article for another day, but driving BD&A consumption throughout the organization has proven to be challenging.

For many companies, being able to consume analytics requires an entirely new mindset – moving from viewing BD&A as simply a technology issue to viewing it as a powerful business tool. To do this, companies must consider the human element of analytics.

The human element focuses on why, despite all the data available, analytics insights are not used. Are employees not aware of the data? Do they not understand it? Are they not trained on how to access it? Are the right analytics insights reaching the right people at the right time? Or, perhaps they are but the insights are dismissed because they tell an inconvenient or unbelievable truth.

Many companies are hitting the reset button on their BD&A initiatives to take the human element into account. But this is often easier said than done. To ensure that organizations receive the highest return on investment from their programs, three key areas should be considered:

STRATEGY: What strategy should an organization adopt in the face of disappointing returns on analytics investments? How does a company shift from analytics being a technical issue to a strategic business imperative?

LEADERSHIP: What leadership does a company need to have in place? Both at the senior level and at the operational level throughout the organization?

CONSUMPTION: How are analytics insights consumed, both at the individual and the organizational level?

Creating Strategy that can Win in a BD&A-enabled WorldWithout a strategic approach providing high-level guidance, analytics efforts are rudderless. The first step in steering the ship is to articulate a vision for the role of analytics.

Perhaps unsurprisingly, when we asked “what best describes the state of your organization’s overall strategy toward data and analytics?” we found that the most successful companies – the top 10 percent – say that analytics is central to their overall strategy. These organizations may have data scientists and analysts on staff, have identified targets for analysis and even talk about being

16 | ANALYTICS & MORE

THE LOYALTY POST | MAR 2017

an “analytics-driven enterprise” in their mission statements and annual reports. But enabling the organization to leverage analytics requires more than introducing technology or launching new programs. It is about having the organizational alignment, the governance and the culture to harness the transformative potential of analytics to guide the organization to success.

Organizations leading the way in this area are formulating and acting on their visions in a tangible way. The top 10 percent of companies, “the best” in the survey, scored an average of 22.6 out of a total score of 25, compared with 12.6 percent for “the rest.” Clearly, the ability of organizations to define themselves in terms of analytics capabilities ranges widely. The transformation to an analytics-driven enterprise requires the integration of many components and a common purpose and vision. This is where strong leadership can make a difference.

Analytics Leadership Requires a Renaissance ProfessionalWhen analytics needs to be at the heart of the business strategy, it’s logical that the analytics leader needs to be proficient in business as well as the technical aspects of analytics. While it might be logical, many organizations have struggled to install the right person at the head of their analytics programs. That’s in no small part too because it’s tough to find an individual with the rare blend of talents required.

An analytics leader must have sound knowledge of data management fundamentals

such as data extraction, data quality and developing data architecture. They must have an advanced understanding of the mathematic disciplines that underpin analytics as well as the enabling technologies. They must be able to effectively translate, using visualizations, what the data are saying into a compelling story that will create action among other senior leaders. And they must have an intimate knowledge of the business and the industry landscape, coupled with a hunger to innovate new products, process, or, in order to achieve competitive differentiation, an entirely new business strategy.

The survey results illustrate this need for a multi-talented individual, with the top 10 percent of firms listing new revenue streams, sector knowledge/experience, statistical proficiency, and data extraction and transformation as some of the most important things they look for in their analytics leader. Finding an individual with all the necessary skills (watch this video for more) is not easy.

That’s why those who do combine these skills are in high demand, with the corresponding high salaries.

ANALYTICS & MORE 17

THE LOYALTY POST | MAR 2017

Enhancing BD&A Consumption Across the EnterpriseAnalytics consumption takes place at two levels in an organization: senior-level executives and other decision-makers gain insights to help them understand their markets, product or service positioning and operations. Individual employees at all levels and locations throughout an enterprise can use analytics to help improve their own decision-making.

The top 10 percent of companies in the EY-Forbes survey scored an average of 77 percent for organizational consumption, with the rest of the companies scored an average of only 51 percent. As with strategy and leadership, the top companies are “getting it right” when it comes to data consumption, and this is reflected in their bottom lines. Industry

sectors leading the way in enabling analytics consumption organization-wide include technology and consumer products and retail.

But even for leaders, BD&A is as much an art as it is a science. A successful analytics environment does not depend on technology alone; it requires marshaling human capital to deliver the right insights at the right time. As noted earlier, any transformative initiative requires support from the top, but employees at all levels must also buy into the effort. They must also be trained so they can effectively understand and use analytics (see Figures 1 and 2 for how leading companies recognize, monitor and support their staff). The value of analytics comes from the behavioral alignment required to “consume” analytics in order to move from insights to action to creating value.

Figure 1: Based on a recent EY-Forbes study, for a majority of organizations the tools and technologies they employ to leverage data and analytics are either immature or have yet to

be standardized.

18 | ANALYTICS & MORE

THE LOYALTY POST | MAR 2017

A Brighter FutureCompetitive advantage over the coming years will depend on how well companies in all industries embed analytics into their enterprise-wide business strategy and decision-making. When a company puts analytics at its heart, seismic changes can take place.

The pace of that change in any given organization will depend on two factors: First, the sense of urgency with the organization, typically driven by how rapidly the competitive landscape of the organizations is changing. And second, having the right leader in place who can implement the right organizational structure and governance that will embed analytics at the point decisions are made. Only then can organizations finally realize the promise of BD&A and secure the competitive advantage they need to succeed.

Figure 2: Data and analytics skills are becoming essential to a myriad of jobs and business roles.

As EY’s (Ernst & Young) global chief analytics officer, Chris Mazzei leads the Global Analytics Center of Excellence that serves as a catalyst for transformation both internally, within EY, to embed analytics into its service offerings across all business lines, as well as externally for EY’s clients by delivering analytics offerings that help organizations grow, optimize and protect value. Author - By Chris Mazzei

ANALYTICS & MORE 19

THE LOYALTY POST | MAR 2017

To help cut through the noise in 2017, Neil Joyce, MD EMEA from marketing technology group Signal, zooms in on four problem areas of 2016 and the solutions that will make all the difference in 2017.

If last year taught marketers one thing, it’s that digital marketing is moving beyond cookies and browsers to deliver the

seamless, personalised experiences customers have come to expect.

Here are some “problematic” digital trends of 2017, followed by equally trendy pieces of advice that just might solve them.

Problem number 1

The limitations of walled gardens create challenges for advertisers. The three largest walled gardens (Facebook, Google and Twitter) promise a rich inventory of logged-in user data, allowing advertisers to target and reach consumers across their various devices. Advertisers are finding campaign success in these walled gardens, but are also feeling

Four Ways to Create Personalised

Customer Experiences

in 2017

20 CUSTOMER EXPERIENCE

THE LOYALTY POST | MAR 2017

the full effect of why they are called that: advertisers put their customer data in, but they do not get it back to build their profile data, close the loop on attribution, or create a true universal view of the customer journey.

Solution

Advertisers will join forces to scale first-party data and identity. 2017 is the year advertisers will start thinking about ways to work with trusted marketing partners to connect with always-on customers outside the constraints of walled gardens. This emerging model is called a cooperative identity network. Publishers and/or advertisers can form an identity network with trusted partners to share anonymised data in a secure and privacy-compliant way. This allows companies to work together to better match the scale of walled gardens, providing a more complete picture of their customers without having to surrender control of their data.

Problem number 2

Ad blocking goes from trend to widespread adoption. If 2016 was the year that ad blocking got its foothold, 2017 will be the year that everybody’s doing it.

‘Research from Adobe and PageFair found that ad blocking could cost publishers as much as $41.4 billion worldwide in 2017.’

These are still early days in the ad blocking battle: the landscape and technology is changing quickly on all sides. Publishers and advertisers will need to be ready to adapt to whatever happens next.

Solution

People-based advertising leads to more relevance and engagement. The entire ecosystem will get serious about addressing this issue, prompting publishers to seek to know

more about their customers and get smart about their data-driven offerings. Advertisers will also push for higher standards among themselves and their vendor partners on things like ad creative and precision targeting.

Problem number 3

The gains from programmatic advertising reach their ceiling. Programmatic media buying has exploded over the last six years due largely to the need for efficiency, and ultimately, reduced costs. The result? Lower ad rates, which almost 70% of advertisers agree is a top benefit of programmatic.

‘But the gains that can be extracted from workflow efficiency may soon hit their peak, leading advertisers to look for other ways to get more value for their digital ad spend.’

Solution

Advertisers shift focus to precise targeting of known audiences. The next great advertising efficiency to be gained is in reducing wasted ad spend on targeting unknown audiences. Advertisers will turn to the power of their own first-party data to fuel more precise targeting of customers they already know, and ultimately greater ROI.

To achieve improved targeting, marketers need to shift their understanding of first-party data usage away from cookie-based tactics to people-based strategies that require the ability to identify customers across devices and channels, and tie the data back to a user-level profile.

Problem number 4

The demand for data-driven c-suite roles increases. First-party data impacts a business

CUSTOMER EXPERIENCE 21

THE LOYALTY POST | MAR 2017

far beyond the marketing department. Amazon uses customer data to create original video programming. Samsung uses data to provide viewers with content recommendations on its smart TVs, and so on.

But along with the realisation of big data, there comes an increase in data-related business challenges. Fragmented ownership of data and varying data governance or data management practices can result in masses of messy data, information silos, and lost opportunities for the business.

Solution

The chief data strategist will rise to prominence.

In 2016, the first-party data revolution will be in full swing, and a new breed of data-driven leaders will emerge in the c-suite to help businesses leverage that data to drive more value across the enterprise. This leader will be a master of data science skills, hold a strategic function within the c-suite, and work across the organisation to impact marketing, product development, customer service, and more.

Author - Neil Joyce, MD EMEA, Signal

22 CUSTOMER EXPERIENCE

THE LOYALTY POST | MAR 2017

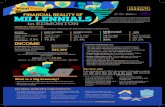

According to a new survey from Valassis, Millennials are just as likely as Gen-X or Baby Boomer consumers to use

print coupons. Millennials! They want want everything to be digital. Except when they don't.

The Valassis "2016 Coupon Intelligence Report: Savvy Shoppers Provide Reality Check” compares consumer buying behavior across generations. The report reveals that Millennials are not only using print coupons at similar rates as average consumers, but are also using them at rates that have increased more than any other generation in the last year.

When it comes to millennials’ shopping behavior, the report found:

Millennials are savers: 47% of millennials say they increased their use of coupons in the past year, a rate 14% higher than all respondents and 21% higher than baby boomers.

Millennials use print coupons: 85% use coupons delivered in the mail; 82% use coupons delivered from the newspaper coupon book; and 34% of millennials report an increase in mail coupon usage, significantly higher than gen X and baby boomers.

Millennials are digitally charged: Millennials actively download paperless discounts to their store ID/loyalty cards wherever they are - 75% before they enter and 73% in the store. This compares to 62% of all consumers who download savings before they enter the store and 55% while in the store; and 41% of millennials have increasingly gone to the Internet to find coupons compared to 29% of all consumers.

The Bullet Point: Millennials! They're just like us olds! Except when they aren't. Perhaps it's time we started to think of Millennials as a collection of individuals instead of a monolithic block of consumers who move in lockstep. Just a thought.

Millennials: They like to

save money too!

COVER STORY 23

THE LOYALTY POST | JAN 2016

THE LOYALTY POST | MAR 2017

It’s well recognised that consumers are increasingly choosing to use many different communication channels when transacting

with customers. A survey at the end of 2014 for CRM software specialists Zendesk of 7,000 consumers in 7 countries showed that 67% of online shoppers had made purchases that involved multiple channels in the previous six months. But of those, only 7% were extremely satisfied that brands provided a seamless, integrated and consistent customer service experience across channels. 87% of the sample said that brands must work harder to create a seamless omnichannel experience for customers and a surprisingly high 37% of respondents expected to be able to contact the same customer service rep, by name, regardless of the channel they used. How many companies are there where they can do that? Contacting the same person across all channels may seem like a big ask but it does emphasise how quickly customer expectations are going up. In the Zendesk research 69% of respondents said that they believed that customer service expectations are increasing every year.

Earlier this year American customer service technology firm [24]7 conducted similar research in the UK. Their Managing Director for European Operations, Nick Mitchell, takes up the story.

THE RESEARCHWorking as a customer service or customer insight manager must feel at times like a really tough job. We’ve recently conducted research with TLF Research into customer service in both the financial services and utility industries and some of the findings revealed a whole host of customer service ‘pet hates’ most or all of which likely apply to all industries. Some of these issues included; companies not knowing who a customer is, despite having interacted with them previously; uninformed customer service agents unable to tell people the required information and the old chestnut, being left hanging on the phone for too long.

CHANGING CUSTOMER SERVICE EXPECTATIONSBut our most recent survey of more than 2,000 UK consumers about utility customer service also showed that customer service expectations are changing and that utilities are starting to meet those changing demands. The new Omnichannel customer service - defined as predictive experiences across channels, devices, location and time - is already starting to take hold. In the UK, 92% of UK consumers are using a variety of different channels, from voice to chat to online and mobile, to communicate with their utility provider’s customer service departments.

Why it’s time for customer service to go

omnichannel

24 CUSTOMER EXPERIENCE

THE LOYALTY POST | MAR 2017

According to Google research in August 2012, 90% of customers cross devices in pursuit of a single goal like shopping, managing finances, and planning travel whilst two-thirds of consumers surveyed by Google reported using smartphones and laptops simultaneously.So it is time for brands regardless of industry to take the next step on the omnichannel journey. They must make sure that consumers get the same quality of service every time they connect, irrespective of the channel they use. Businesses must also use the data they hold on their customers to predict intent and maintain the context of the situation so that customers can continue their interactions in a different channel, device, at a later time.

THE MOST POPULAR WAYS TO INTERACT WITH CUSTOMER SERVICEPicking up the phone to speak to a utility provider was the most popular way to interact with customer service. But new channels are starting to grow in popularity and brands should be mindful of the requirement to maintain the context of the customer’s situation and deliver the same standard of customer service as they move to a different channel.Figure 1: The most popular ways to interact with customer service

SOCIAL MEDIASocial media is actually the fastest growing medium for customer service, especially amongst younger consumers. The figures for using Facebook and Twitter especially amongst 18-34 year olds, suggest that social media is a customer service channel that should not be ignored. Despite on-going media hype about apps and despite many utilities offering apps for customer service, only 5.6 per cent of those surveyed regularly used a downloaded customer service app on a smartphone or tablet.

USING BIG DATA TO MAINTAIN THE CUSTOMER'S CONTEXTWhat was particularly interesting about the research was the fact that around one in five people admitted to getting frustrated when their utility firms do not know who they are or what the context of their situation is, despite having communicated via another channel previously. Now if someone interacts over the phone to complete a goal, for example, make a change to their account, and the customer then goes online and there is no recognition of the previous call, no wonder people get frustrated. You can imagine that this issue isn’t limited to any single industry.Another one in five would expect utility firms to know what they want based on previous contact they have had with them. Data is an incredibly powerful tool for any organisation to utilise and there is no question that most firms hold enough data on their customers to understand and predict intent and enable them to move seamlessly across a variety of channels, should they wish to do so. Simply put, customers today expect a seamless, intuitive experience – one that maintains continuity, connectivity and context across all channels to simplify their lives. That applies to pretty much every industry, not just the utility and financial services industries we focused our research on. It’s more than just offering your services over multiple channels. The differences between being a multichannel and omnichannel company are significant and apply to all of the components of your business. It’s not just a matter of semantics but an adjustment in capabilities, business strategy and philosophy. It’s about connecting the interactions across these channels to improve customer service.The repercussions of not doing so could be severe. Consumers are becoming less inert about changing providers and suppliers, so getting omnichannel right should be a priority for all businesses.

In Person – 10% Landline – 66% Facebook – 7%Online – 50%Live Chat – 15%Mobile – 22%

Customer Service App – 5%

Author - Nick Mitchell is the Managing Director, EMEA at intuitive customer experience company, [24]7.

CUSTOMER EXPERIENCE 25

THE LOYALTY POST | MAR 2017

Amazon India Scores Highest in User Loyalty, Says Study

their shopping experience as four or five on a scale of one to five, minus the percentage of customers who rated their experience as one or two. Without giving the actual figures, Amazon put its overall growth in 2015 at 250 per cent growth. This year so far, the growth is pegged at 150 per cent.

“My impression about Amazon is that they stuck to the basics. They do in the US, with certain tweaks for the Indian market. They have not done any major acquisition as a Flipkart buying Myntra or Snapdeal acquiring Freecharge,” said Amarjeet Singh, partner – tax, KPMG in India.

Singh added that Amazon’s interaction with vendors is a lot more sophisticated. “At a corporate level after they lost out on China, they have put in a lot of investment and efforts behind Amazon India and their international network has supported them.”

What might have helped is that Amazon’s biggest rival in India, Flipkart, has had to face challenges. On Friday, Morgan Stanley, a minority but a significant investor in Flipkart, marked down the value of its holding in the company for a second time in three months. With the latest mark-down of 15.5 per cent, the total value of Flipkart has dipped to $9.4 billion, from a high of $15.2 bn a few months earlier.

AMAZON’S ATTRACTIONS

• The company tries to ensure their call centers pick up calls on a single ring• Average time allotted for a customer query is a minute • Usage of predictive analysis to study consumer behavior

E-commerce platform Flipkart’s co-founder and chief executive officer, Binny Bansal, recently made news when he introduced net promoter score (NPS) as their new metric. Thereby, keeping aside the other popular e-commerce benchmark, gross merchandise value (GMV) of products sold on a platform.

However, a study shows Amazon India is already a market leader in this space. NPS is an index that measures users’ readiness to recommend to others a company’ s products or services. So, NPS translates into customer loyalty and retention.

According to a study conducted by RedSeer Consulting, a research and advisory firm that works closely with start – ups, Amazon India already has the highest NPS among all online marketplace majors. The findings are a result of studying 1,800-odd online shoppers across India.

“We conclude that customers’ overall satisfaction level is highest for Amazon, followed very closely by Flipkart, while Snapdeal ranks third,” said Mrigank Gutgutia, Engagement Manager at RedSeer.

The Indian operation of the Jeff Bezos-led e-commerce major had around 88 per cent NPS, compared to Flipkart’s 85 per cent. Snapdeal, which in the past few months has taken a number of steps, including relying heavily on precision analytics to satisfy customers, was third at 69 per cent.

RedSeer said the satisfaction score was equal to the percentage of customers who rated

26 INDUSTRY UPDATE

THE LOYALTY POST | MAR 2017

In November 2004, Hurricane Frances was rushing towards the Florida coastline. Some residents were already in their

cars heading inland. Much further inland in Bentonville, Arkansas, there was also much activity in the Wal-Mart office as CIO Linda Dillman encouraged staff to take advantage of the company’s ‘predictive technology’. With almost 4,000 stores in the US and around 100 million customers every week, Wal-Mart is continuously gathering, storing and processing billions of pieces of data about customers’ needs and spending habits by store, by region, at different times of year, in changing weather conditions and during major events. So what do they buy when a hurricane’s on its way? Not what you might expect. Torches, batteries and bottled gas isn’t too surprising, nor maybe that beer sales showed the biggest increase. But what about strawberry pop tarts? Sales increase seven-fold on average in areas with a hurricane alert!

Based on these consumer behavior insights, Wal-Mart trucks were soon heading for Florida with emergency supplies of pop-tarts and six-packs. And they all sold well. So Wal-Mart uses its massive database and software expertise at macro level to minimise stock-outs and maximise sales. As well as hurricanes, it knows what sells when the Super Bowl final’s on TV, when there’s a heat wave or a flu epidemic. (Apparently, during a flu epidemic you get them in with a price promotion on Lem-Sips and make big profits on other products like fresh orange juice without any price cutting.) But Wal- Mart doesn’t use its data at micro level. It doesn’t know what will make Mrs Smith buy more orange juice or what might incentivise Mr Jones to trade up to a higher margin beer. For that you need data from a loyalty scheme. And that adds far too much cost for a discounter like Wal- Mart. In the last few weeks it’s added a lot more cost for Tesco. .

Customer - Loyalty: Customer insight or sales promotion?

CUSTOMER EXPERIENCE 27

THE LOYALTY POST | MAR 2017

CLUBCARD POINTS DOUBLED

On August 17th, Tesco hit the headlines in the business pages when it doubled the points earned on Tesco Clubcard to 2 points for every £1 spent, equivalent to a 2% discount. This followed an earlier initiative in May allowing customers to double the value of their Clubcard vouchers by spending them on high margin products such as health, beauty and clothing. Marketing Director, Carolyn Bradley refused to reveal the cost of the new scheme but some analysts estimated it would reduce the company’s profits by £400 million per annum. Others thought it smacked of desperation following Tesco’s unaccustomed loss of market share during the recession. But the doubling of Clubcard points only equals the discount provided by Sainsbury’s Nectar card and still lags way behind the most generous scheme – the 4 points per £1 offered by Boots Advantage card. Others don’t offer any points or loyalty schemes. ASDA promotes ‘everyday low prices’ and works very hard to be at the top of Big Four price comparison tables. Morrisons has also been dismissive of loyalty schemes, preferring in-store promotions such as ‘bogofs’ – buy one get one free. But is this rewarding loyalty or disloyalty? Many traditional sales promotions are an attempt to “buy” market share. Most supermarkets worldwide (Wal-Mart’s “everyday low prices” strategy is an exception) use the sales promotion budget to reward disloyal customers using a “hi-lo” principle. Deep discounts on some popular items attract customers to the store and sales increase, at least in the short term. But what kind of customers has it attracted? Almost certainly the switchers, continually looking for the best deals and happy to cherry pick from whichever company currently offers the lowest price. Tesco’s “core purpose,” printed on the back of the business cards of many of its executives, is “to earn the lifetime loyalty of our customers”, but is a loyalty card the way to achieve this? Has any loyalty scheme ever earned customers’ lifetime loyalty?

SUCCESSFUL LOYALTY SCHEMES

Some loyalty schemes have been very popular. Air Miles was created during the mid 1980s by Alan Deller, Commercial Director of British Caledonian Airways and the partners of advertising agency Mills, Smith & Partners. Together they formed the Air Miles Travel Promotions Company Limited in 1986 and sold 51% of the UK operation to British Airways soon after. They attracted three million collectors in the first three months. Sainsbury’s was Air Miles first supermarket partner in the UK, but when it replaced its Reward Card with membership of the Nectar scheme, Sainsbury’s customers were no longer able to collect Air Miles. This was an unfortunate decision for both sides since almost 25% of the 1 billion air miles issued in 2001 had gone to Sainsbury’s shoppers, but it was an opportunity for Tesco. When Tesco launched its new partnership with Air Miles in March 2002, searches online for the nearest Tesco store jumped 450% and Sainsbury’s lost an estimated 1% of its sales and 60,000 customers to Tesco. And they weren’t just any old customers. They tended to be affluent, mature, confident people who organised their own travel and were prepared to change supermarkets to earn their miles. Perhaps Sainsbury’s should have anticipated this because Tesco was the big winner. Air Miles now has 8 million customers and 200 partners in the UK.

Air Miles soon became a generic with most of the world’s airlines launching copycat schemes. But did it drive customer loyalty? Certainly Air Miles built a very loyal customer base with some people zealously, perhaps irrationally, going out of their way to chase miles wherever possible. Air Miles, and copycat schemes, also increased repeat purchase for airlines as customers put up with inconvenience, poor service and even higher prices (especially if the company was paying for business trips) in order to collect those last few miles for the family holiday. But they didn’t increase the loyalty of Sainsbury’s customers, nor did they increase most

28 CUSTOMER EXPERIENCE

THE LOYALTY POST | MAR 2017

collectors’ loyalty to the airline as opposed to Air Miles. In fact, some airlines’ biggest detractors were committed members of their ‘loyalty’ schemes.

Air Canada’s Aeroplan frequent flyer programme was so successful that its parent spun the scheme off into a stand-alone loyalty business in 2005. The Aeroplan programme was initially valued at US$2 billion, significantly more than Air Canada! Today, Aeroplan has a valuation of US$2.8 billion against Air Canada’s US$0.5 billion and Aeroplan’s loyalty business has expanded into a loyalty portal, offering a vast market of products members can ‘earn and burn’ points on or simply buy.

LOYAL TO THE SCHEME NOT THE COMPANY

In Canada, extremely large percentages of consumers are members of loyalty programmes. Loyalty publisher Colloquy recently released the results of a survey of 2500 Canadian consumers, 87% of whom were active participants in at least one loyalty programme. (85% in the UK possess at least one loyalty card.) Nearly 50% of loyalty programme members said that special treatment is important to them, yet only 7% said that they get special treatment from their loyalty programmes. Research results such as these indicate that many consumers perceive value in loyalty programmes and use them often to earn rewards, but have less attachment to the company, Air Canada and Aeroplan being a good example. If so, loyalty schemes are driving short-term behaviour, not loyalty. Most customers are in it for the points and the rewards that come with

them, not because they hold the company in high regard. The special treatment that customers crave and that they don’t feel they get from most loyalty programmes has to come from a visible effort by the company to treat customers well, to demonstrate its interest in them – in fact to build its entire business model around meeting customers’ needs.

EARNING THE LIFETIME LOYALTY OF OUR CUSTOMERS

So, back to Tesco Clubcard. Is it the same as all the other loyalty schemes? Or is it building the lifetime loyalty of Tesco customers? Many people highlight Clubcard as the main driver behind Tesco’s huge increase in market share since its introduction in 1995. So lets have a brief look at its history.

Clubcard was introduced after a trial at three Tesco stores (Sidcup, Wisbech and the Dartford Tunnel) ended so successfully that boss, Lord MacLaurin, told the Clubcard team: “What scares me about this, is that you know more about my customers in three months than I know in 30 years”. He was right to give the go-ahead. Just one year later Clubcard holders were spending 28% more at Tesco and 16% less at Sainsbury’s.

CUSTOMER EXPERIENCE 29

THE LOYALTY POST | MAR 2017

From the outset, Tesco saw the card more as a thank you than a sales promotion tool and this genuine philosophy of rewarding customers’ loyalty has been the key to its success, allied to some other very clever decisions based on analysis of facts rather than gut feel:

• Applications were maximised by making the process as quick and simple as possible and by really educating staff about Clubcard so that they sold it enthusiastically in store.

• Clubcard was not advertised as a ‘loyalty’ card. The words ‘thank you’, ‘reward’, ‘every little helps’ etc were used but never the word loyalty. Being loyal to a supermarket is not a selling point for customers, being thanked and getting rewards are.

• One of the best decisions, and one that still differentiates Clubcard from most other reward schemes, was the quarterly mailing. Instead of allowing customers to cash in their points at the checkout whenever they wanted, Tesco decided to incur the massive cost of sending a quarterly statement with cash vouchers for the value of points earned in the period. This has been very effective for three main reasons:

1. Customers place more value on the rewards because the physical vouchers are like being sent a gift of money. When customers habitually cash in points at the checkout to reduce their shopping bill they tend to take the reward for granted.

2. Behaviourally, spending vouchers is very different from using the card to reduce your shopping bill. The latter does not change behaviour. It just reduces the retailer ’s profit. The evidence from Tesco’s trials was that if customers had cash vouchers, many would use them for special treats rather than reducing the cost of their existing shopping. Moreover, Tesco can proactively encourage this behaviour by adding promotional coupons to the quarterly mailing for higher margin products that fit the customer’s basket history or lifestyle profile.

3. Clubcard holders have an incentive to inform Tesco of address changes. If customers can cash in rewards on demand they often don’t bother, so the database decays.

One of the main things that has distinguished Clubcard from other loyalty schemes is the depth of its data analysis. This has enabled Tesco to do things like target lapsed shoppers, customers who ignore certain departments, customers who are clearly using competitors more than Tesco etc. It also shows that 88% of Tesco’s revenue comes from the most loyal 40% of customers. Using Clubcard data has enabled Tesco to concentrate promotions on those high value customers and the products they buy, attempting to deepen the most profitable relationships rather than indiscriminately recruiting new customers.

Tesco believes that marketing strategy should be simple. At its core, an equally simple idea that’s written into its marketing manuals – ‘reward the behaviour you seek’. As Clubcard built Tesco’s understanding of where its profits were coming from, the company increasingly focused on long-term customer loyalty as its main objective, especially the most loyal 40%. Up to 2003, Tesco had spent over £200 million of its sales promotion budget on incentives for “opportunity” customers. By 2004, after using its loyalty card data to predict customer loyalty and sales growth long term, Tesco switched almost the entire budget to rewarding long-term loyal customers.

ARE LOYALTY SCHEMES WORTH IT?

Given the very high cost of in-house loyalty schemes (in Tesco’s case vouchers worth around £400m each year, 11p on each physical card and 15 million letters to Clubcard members four times a year), are schemes like Clubcard and Advantage worth the investment? Many loyalty experts and business leaders say that loyalty schemes encourage repeat purchase, but that’s not the same as loyalty. It’s still just a transactional relationship not an emotional one, and true loyalty has to encompass the emotional dimension.

30 CUSTOMER EXPERIENCE

THE LOYALTY POST | MAR 2017

Harvard Business School summarises customer loyalty in terms of the 3Rs:

• Retention• Related sales• Referrals

Clearly there’s sometimes, but not always, an emotional element in recommendation, although customers do often rationally recommend a good deal as well as the more emotional memory of a great experience. The Leadership Factor has always maintained that satisfaction is an attitude but loyalty is a behaviour. Tesco, very sensibly, doesn’t get hung up on esoteric debates about whether loyalty is emotional or rational, it just focuses on why it wants its best customers to be loyal. Because it wants them to spend more, especially on higher margin products (and services like Tesco Personal Finance). How does that happen? By customers visiting Tesco more often, using competitors less often, buying a wider range of products in Tesco and, icing on the cake, becoming less price-sensitive and upgrading to higher quality, higher margin options. All behaviours. Tesco uses Clubcard to ‘reward the behaviours it seeks’. If customers feel satisfied with the value they’ve had from Tesco or, less likely, if they’ve had some great emotional experience from a really helpful member of staff, they may recommend the company to friends. But the lion’s share of what Tesco wants is in those behaviours. So who cares if it’s real loyalty or not? The end result is the same.

And there’s another massive and growing advantage of loyalty schemes, especially inhouse ones where the company owns all the data.

ANALYTICS AND COMPUTING POWER

Some people now argue that the real value of a loyalty scheme is linked to our increasing ability to crunch vast volumes of demographic, situational and transactional data, which is leading to a new analyticallydriven era. A Boots Advantage card application form asks customers for their employment status, number of children, spectacles or contact lens usage and, i they are pregnant, when their baby is due. The Clubcard form does put its questions about dietary preferences and who you live with in an “optional” information box, but most people fill it in. This computing power allied with the vast amount of data collected over the years allows Tesco and Boots to make insightful, personalised recommendations to move very specific customer behaviours closer to their objectives. For example, Tesco found that bird feeders were bought by a high concentration of serious organic shoppers. “The sales data would make you believe there is only a tiny market [for bird seed and feeders], whereas Clubcard data implied that, actually, there was a big potential market,” says Crawford Davidson, now Marketing Director of Tesco Personal Finance but previously involved with Clubcard. “If we stocked them more and told customers about them, would they buy them? The answer is yes, and, in fact, you can sell more elaborate bird feeders and bigger bags of bird seed.”

In December 2006 Tesco offered 80,000 customers up to one-third off their Christmas shop, sending them a £5 gift card and a voucher offering them a further £18 off if they spent £70. Competitors described the offer as ‘madness’. But was it? Tesco was using Clubcard data to target customers who, despite being regular

THE LOYALTY POST | JAN 2016

CUSTOMER EXPERIENCE 31

THE LOYALTY POST | MAR 2017

Tesco shoppers, obviously did their main Christmas shop elsewhere. The offer illustrates Tesco’s increasingly sophisticated use of Clubcard data, enabling it to specifically target and incentivise people who are clearly using competitors more often or for specific purposes – something that’s impossible for rivals without a loyalty scheme to do. Tesco can analyse when individual customers shop, how they pay and even how many calories they consume. If customers buy less than a week’s worth of calories they must also be shopping with a rival. If they shop at an out-of-town store late at night they almost certainly own a car. The data can be used for tailored promotions and to sell relevant new products and financial services to specific customers. Tesco’s list of company values starts with the goal to ‘understand customers better than anyone’. That might explain a lot about their success.

STOP PRESS

At the end of September, Sainsbury’s announced a multimillion pound investment over five years in a coupon-based loyalty scheme, giving customers money-off coupons at the till for hundreds of branded and own label products in what will be its biggest investment in customer loyalty since it launched its Nectar card in 2002. Coupons will be generated on the spot through stand-alone printers installed in all of Sainsbury's 535 supermarkets. Over 60 leading brands including Unilever, Proctor & Gamble and Heinz have signed up to the scheme. Clearly a response to Tesco increasing the value of its Clubcard points over the summer, it seems to be another escalation in loyalty card wars – great for customers but maybe not so good for suppliers’ profits.

Germany: PAYBACK launches digital payments and loyalty card

News from the EHI conference in Bonn: German coalition loyalty programme PAYBACK CEO Dominik Dommick and digital services director Philipp Blome announced the launch a new mobile loyalty card in June for its 28 million members. The latest enhancement to the successful PAYBACK app combines points collection, payment, coupon redemption and personalised offers for the first time. A pilot phase due to start in June will give customers the opportunity to collect points from major PAYBACK partners on their smartphones.

During the pilot, customers will also be able to pay with their phones at DM-Dogerie Market. The retail chain Real- will introduce the smartphone payment option in July, and partners including Aral, GALERIA Kaufhof, REWE and Alnatura will be equipped for mobile payments in autumn. The solution is based on QR code and NFC technology; the sum of money due is paid by direct debit. Money quote from Philipp Blome:

“Customers are demanding more and more mobile services. Therefore, it is very important to achieve the best possible integration between the PAYBACK app and the partners’ apps. Our service package composed of coupons, loyalty and payment makes us more relevant compared to large payment providers as they only offer one payment function. By ensuring the mutual integration of our mobile offers, it doesn’t matter where or how users begin their mobile shopping trip. With this feature the app has great potential."

PAYBACK is a leading multi-partner loyalty programme internationally with 28 million members collecting points from 650 partner companies. They can then redeem these points for vouchers, rewards or Lufthansa miles, or they can donate them to charity. Around 95% of all the points collected are redeemed by customers. In 2014, the value of the total points collected was EUR 275 million.

32 INDUSTRY UPDATE

THE LOYALTY POST | MAR 2017

media channels and engage them with the brand.”

He adds, “While the segments have similar pattern of consuming traditional media, it is the watching online video on which these segments differ significantly.”

This dual pace in consumer adoption rates is creating a growing ‘digital divide’ that is most evident in Western markets, particularly the US, UK, Germany and France, leaving many businesses struggling with how they can tailor content for different audiences.

Barclays is one example of a company that is successfully bridging this gap, reaching young people through social media and instant messaging, while targeting ‘silver surfers’ through bespoke training courses and downloadable guides to help them with online banking and other digital platforms.

Joseph Webb, Global Director of Connected Life, said: “Brands need to be wary of making sweeping assumptions about the digital habits of different age groups. While millennial’s are clearly an important demographic, Generation X (aged 31-45) and the baby boomers (aged 46-65) generally have higher disposable incomes, established buying patterns and are spending increasingly more time online. Brands are

How Can Brands Deal With This

Digital Divide?Looking across the globe, the average millennial (aged 16 – 30) with Internet access spends 3.2 hours a day on their mobile devices – the equivalent of 22.4 hours – almost a whole day – every week. That’s 1,168 hours or 49 days over the course of a year.

In India it is 2.2 hours a day, where digital access is becoming mobile – driven; 85% of the weekly internet millennial population

in india now own a smartphone, according to connected life, a study of over 60,000 internet users worldwide from global research consultancy TNS.

Millennial’s prioritize social over other forms of media, with 43 per cent using social media daily, or watching online video (42 per cent). This age group are also the most likely to adopt new buying methods such as mobile payments (11 per cent of millennial’s in India do this weekly).

However, focusing on how to use new channels to engage millennial’s can be an expensive distraction. By constantly trying to keep up with the most digitally advanced consumers, brands risk leaving behind other consumers who are also shifting their patterns of behavior, albeit at a slower pace.