Microfinance in Iran with a glance at South Korea'sconf.mbri.ac.ir/akes/userfiles/file/مقالات...

Transcript of Microfinance in Iran with a glance at South Korea'sconf.mbri.ac.ir/akes/userfiles/file/مقالات...

١

Microfinance in Iran with a glance at South Korea's

Arghavan Farzin Motamed Manager of International cooperation department of Agriculture Bank of Iran

E-mail: [email protected]

Abstract In this paper, the microfinance in Korea and Iran is compared. For this goal, at

first, the history of microfinance in the world and in two countries is survived;

concern to the important role of the banks in microfinance, the role of

performance of banks is analyzed in this study.

As the required data about the Korean performance in this field was not

available, the microfinance in South Korea has been reviewed by applying the

existent researches.

For analyzing the microfinance in Iran, as the Agriculture bank of Iran is the

most important bank offering this service, the performance of the bank is

introduced and the impact assessment of microfinance services has been

analyzed.

Finally, concern to the results of the study some proposes has been presented

for the best performance in this field.

Key words: microfinance, banks, Bank Keshavarzi, South Korea, Iran

JEL classification: G21

٢

Introduction

Development is one of the most important goals of all countries. All countries of the world

wanted to create welfare for the people, decrease the poverty, diseases', and have economic

growth beside of the social development.

The importance of this goal has been distinguished in the Millennium Development Goals of the

united nation organization which all country members have obligated to try to reach to the goals

by 2015.

One of the tools to reach to a country without poverty, is microfinance, this kind of finance which

has been used for a long time in the world is recognized by Mohammad Younus from Bangladesh

.He used this method in Grameen bank and succeeded to decrease the poverty. There are many

countries in the world which using this tools to financing the small businesses.

In this article, the microfinance in Iran and South Korea has been surveyed and compared. By

reviewing the microfinance in these two countries the study tried to proposed some new

approaches in this field.

٣

II .literature of review

What is microfinance? "Microfinance according to the Robinson (2001,p 9) refers to small-scale financial services-

primarily credit and savings- provided to people who farm or fish or herd; who operate small

enterprises or microenterprises where goods are produced, recycled, repaired, or sold; who

provide services; who work for wages or commissions; who gain income from renting out small

amounts of land, vehicles, draft animals, or machinery and tools; and to other individuals and

groups at the local levels of developing countries, both rural and urban. Many such households

have multiple sources of income."

What is microcredit? A small financial loan made to poverty-stricken individuals seeking to start their own business.

This type of loan typically does not exceed a couple hundred dollars, so an impoverished

individual can not solely depend on this type of loan to fund their business. P0F

1

What are the differences between microfinance and microcredit? The terms microcredit and microfinance are often used interchangeably, but there are some

differences between them. The definition of microcredit and microfinance is defined above but

there are some differences between these two concepts which are presented below:

"Microcredit refers to very small loans for unsalaried borrowers with little or no collateral,

provided by legally registered institutions. Currently, consumer credit provided to salaried

workers based on automated credit scoring is usually not included in the definition of microcredit,

although this may change.

Microfinance typically refers to a range of financial services including credit, savings, insurance,

money transfers, and other financial products provided by different service providers, targeted at

poor and low-income people".1F2

By the way the most important point in the microfinance and microcredit is that this kind of

financial services should help people to create job or small business and help them to reach to a

financial independence.

١ . http://www.businessdictionary.com/definition/microcredit.html ٢ ) http://www.microfinancegateway.org/p/site/m/template.rc/1.26.12263/#2

۴

Microcredit V. Microfinance

Reference: Peter Nkamura, 2009:p4

As we can understand the microcredit is a part of microfinance. It means that the microfinance

involved the small loans with complementary services to empowering people and creating small

businesses.

The history of microfinance in the world Some of the most important factors for economic growth and development are the financial and

human resources. All of the potential human capital even poor people could have serious role in

the economic growth if they have the initial required capital to create job and produce goods and

services. So the idea of financing the poor people is shaped for decades. In this part of the article,

the history of microfinance is presented by introducing some of the important Microfinance

Institutions 2F3

One of the earlier and longer-lived micro credit organizations providing small loans to rural poor

with no collateral was the Irish Loan Fund system, initiated in the early 1700s by the author and

nationalist Jonathan Swift. Swift's idea began slowly but by the 1840s had become a widespread

institution of about 300 funds all over Ireland. Their principal purpose was making small loans

with interest for short periods. At their peak they were making loans to 20% of all Irish

households annually

and ://www.globalenvision.org/library/4/1051httpinformation is gathered from is part thmost of . ٣

microfinance -of-http://www.aboutmicrofinance.com/topics/history

Microfinance:

Money transfer services, Insurance, Saving

Microcredit:

Loans

۵

In the 1800s, various types of larger and more formal savings and credit institutions began to

emerge in Europe, organized primarily among the rural and urban poor. These institutions were

known as People's Banks, Credit Unions, and Savings and Credit Co-operatives.

The concept of the credit union was developed by Friedrich Wilhelm Raiffeisen and his

supporters. Their altruistic action was motivated by concern to assist the rural population to break

out of their dependence on moneylenders and to improve their welfare. From 1870, the unions

expanded rapidly over a large sector of the Rhine Province and other regions of the German

States. The cooperative movement quickly spread to other countries in Europe and North

America, and eventually, supported by the cooperative movement in developed countries and

donors, also to developing countries.

In Indonesia, the Indonesian People's Credit Banks (BPR) or The Bank Perkreditan Rakyat

opened in 1895. The BPR became the largest microfinance system in Indonesia with close to

9,000 units.

In the early 1900s, various adaptations of these models began to appear in parts of rural Latin

America. While the goal of such rural finance interventions was usually defined in terms of

modernizing the agricultural sector, they usually had two specific objectives: increased

commercialization of the rural sector, by mobilizing "idle" savings and increasing investment

through credit, and reducing oppressive feudal relations that were enforced through indebtedness.

In most cases, these new banks for the poor were not owned by the poor themselves, as they had

been in Europe, but by government agencies or private banks. Over the years, these institutions

became inefficient and at times, abusive.

Between the 1930s and 1970s, governments and donors focused on providing agricultural credit

to small and marginal farmers, in hopes of raising productivity and incomes.

In 1933, an Agriculture Bank under the name of Bank Keshavarzi was established in Iran. The

objective of the bank was financing the rural people by some small loans to improve the

agriculture production and the rural people life.

۶

In 1961, ACCION International was founded in Venezuela with $90,000, raised from private

companies by Joseph Blatchford. Initially the funding was used to build schools and water

systems, before turning to microcredit in 1973.

Starting in the 1970s, experimental programs in Bangladesh, Brazil, and a few other countries

extended tiny loans to groups of poor women to invest in micro-businesses. This type of

microenterprise credit was based on solidarity group lending in which every member of a group

guaranteed the repayment of all members.3F4

In 1971, Opportunity International, founded by Al Whittaker and David Bussau, lend to micro

entrepreneurs in Indonesia and Columbia. In 1979 they expand across Southeast Asia and South

America.

In 1972 the Self Employed Women's Association (SEWA) was registered as a trade union in

Gujarat (India), with the main objective of "strengthening its members' bargaining power to

improve income, employment and access to social security." In 1973, to address their lack of

access to financial services, the members of SEWA decided to found "a bank of their own". Four

thousand women contributed share capital to establish the Mahila SEWA Co-operative Bank.

Since then it has been providing banking services to poor, illiterate, self-employed women and

has become a viable financial venture with today around 30,000 active clients

Prof. Yunus creates Grameen Bank in 1983. To date, Grameen has lent more than $6 billion (to

7.4 million Bangladeshis). Its methods have become the basis for modern microfinance that

includes group lending, women-focused, and good repayment rates.

Another flagship of the microfinance movement is the village banking unit system of the Bank

Rakyat Indonesia (BRI). The micro banks of BRI are the product of a successful transformation

by the state of a state-owned agricultural bank during the mid-1980s.

In 1992, ACCION helps found BancoSol, a microfinance institution in Bolivia as a nonprofit

organization.

The National Microfinance Bank in Tanzania (NMB) was created in 1997. Meanwhile, Deutsche

Bank enters microfinance as part of its drive to embrace social investing. And, Grameen

Foundation is founded in the US.

٤ http://www.globalenvision.org/library/4/1051

٧

The Microenterprise Access to Banking Services initiative in the Philippines helps integrate rural

banks’ microfinance loan clients into the credit system in 2001.

In 2005, The UN called the year," International Year of Microcredit". Citibank opens Citi

Microfinance, based in London, New York, India and Colombia to broaden the reach of its

financial services.

As we reviewed above, since 1800 many institutions have established and worked to empowering

poor people.

After 2000, the microfinance has recognized as one of the most important tools to financing the

poor people to reach Millennium Development Goals (MDGs).

"Microfinance is one of the practical development strategies and approaches that should be

implemented and supported to attain the bold ambition of reducing world poverty by half." 4F5

Microfinance is interwoven into many of the recommended strategies to achieve the Millennium

Development Goals.

This method has used in many countries such in all over the world. This paper tries to have

studied and analyzed the microfinance in Iran by focusing in the role of Banks and having a

review of microfinance condition in South Korea.

III. Methodology As the goal of this study is to survey the microfinance in South Korea and Iran by focusing on the

role of banks in this kind of financing, and because the required data for quantitative analysis in

South Korea was not available, for the part of Korea analysis, the researches in this field which

were available in the websites were used. Besides that, some researches results under the shape of

reports and books were applied too. By this way, the situation of microfinance in Korea, history

of it and its impact on the economic indexes, presented.

To doing the same analysis in Iran, as there were more available data and information about the

microfinance, after the review of microfinance situation and the role of agriculture bank of Iran as

the most important bank in this kind of finance, for the impact analysis of the microfinance on

economic indexes, some econometrics model is estimated and some researches results in this area

is analyzed.

5 Microfinance and the Millennium Development Goals A reader’s guide to the Millennium Project Reports and other UN documents .2005

٨

Economy

Banks

Income

Productions

Income

Productions

Deposits

Finally the study is tried to use the gap analysis for this kind of finance in two countries and

compare the countries in this field.

Economic methodology

One of the most important factors of the economic growth and development is capital.

Concerning to the economic theories, the capital divide to human and financial, has the key role

on improving the production, income, consumption, GDP and the other economic indexes. These

two kinds of capitals are complete. The poor people are potential capitals in the economy, but

most of the time, they didn’t have enough financial resources to create a business. Microfinance

is a tool to finance these groups by the goal of increasing their role in the economy and getting

them out from the cycle of the poverty.

If the poor people can receive financial services, they can create business and produce goods and

services. By this way, they can have key role to increasing the GDP, National Income and the

other economic indexes. So, this tool can have the positive impact on the households and firms.

In other word, it has effect on microeconomic and macroeconomic together.

The approach of this study is to surviving the effect of the microfinance in the micro and

macroeconomic.

Conceptual model of the microfinance effect on economy is presented as bellow:

Producers

Small producers/businesses

Big producers/businesses

Consumers

Poor consumers

Reach and welfare consumers

Government

Microfinance

Labor market

Goods and services

k t

٩

As it is presented above the microfinance as a financial tool can effects on both players of the economy- producers and consumers- and it seems that it can be the appropriate tools for improving the small entrepreneurs and decreasing the poverty.

This study tries to analyze the microfinance in South Korea and Iran by this approach.

IV. Data and Data Transformation

Data which is used in this article for microfinance analysis in Iran is the microcredit data of Agriculture Bank of Iran, the data of value added in agriculture sector and the data of labor force in the sector.

The required data of South Korea is delivered from MixMarket website and the data in exiting studies of South Korean microfinance.

In the study, an econometric model base on panel data has estimated. Moreover, the results of the other researches about the impact of microfinance in Agriculture bank of Iran used.

Because of the lack of required data, the results of researches in this field are applied for microfinance analyzing in South Korea.

V. Results

The history of microfinance in Korea

The history of microfinance is not so long in Korea. Maybe around 10 years, it has started. One of

the reasons which the microfinance has started later than the other countries in Korea is some

Korean approaches to reducing the poverty such as Saemaul Undong movement which mainly

focused on an agricultural development project, and labor intensive industrialization from 1970 ~

1985

Saemaul Undong Movement was a movement seeking community development and

modernization. Of all things, it was a movement to escape from poverty. This ideal is not

limited to individual lifestyles and living conditions, but encompasses the whole community.

By this movement Korean people believe that:

" It means not working for only myself, but for my village and for my country; not

depending upon somebody else for help nor dreaming of a lucky fortune, but doing things with

our own hands in the right ways.

١٠

It cannot be done alone. We must stand together and help each other to move forward.

Our village is a community where we work and live, and that is why we should develop it

together, hand-in-hand.

It is also a fight against old and deep pessimistic views such as ‘poverty is our fate’ or ‘it is

impossible.’ It is a movement of getting over our pessimism, a movement of mental

reformation"5F6

Another reason why the Microfinance started so late in Korea is that there were several other

financial systems with similar role as microfinance and these systems worked normally until

recently. For example, “ gye” has been a kind of traditional private fund popular among Koreans,

whose members chip in a modest amount of money and take turns to receive a lump sum share.

Savings banks and mutual financial institutions carried out loans with a small amount of money

(usually less than $ 5,000). These loans have several something in common with microfinance;

they don’t require collateral and they are mostly used by the poor. But they have several different

aspects from microcredit. These loans are carried out to make a profit. Thus there is no restriction

with respect to users or the use of money. The interest rate charged for this loan was usually

much higher than the market level, because no collateral is required (Yoon Youngeun, 2011:p18).

After the foreign currency crises, many financial companies, whose fiscal stability and

profitability was poor, excluded from the market.

In the restructuring process after the foreign currency crises, many financial companies, whose

fiscal stability and profitability is poor, should be excluded from the market. It is needless to say

that many savings banks and mutual financial institutions with these loans no longer survived, as

the individuals with loans lost the ability to repay their loans and they don’t have any collateral to

cover the losses. so the microfinance institutions shaped in the Korea.

The most important microfinance institutions in Korea are as the below:

MFIP6 F

7P has roots in the Joyful Union (JOU) in 2000, concerns and interests of the government and

the public bore fruit with the establishment of the Microfinance Foundation (MIF) in 2008.

Besides the JOU and the MIF, the Social Solidarity Bank (SSB) and the Beautiful World Fund

(BWF) are representative MFIs.( Yoon Youngeun, 2011:p19).

١١

The Microfinance Foundation (MIF)

The MIF was established as a public foundation in March 2008, based on the Law of

Establishment of the Microfinance Foundation, which was enacted to regulate the establishment

and operating procedures of the MIF in August 2007.

The major projects of the MIF are as follows, (1) microcredit to help the poor to start new

businesses or to get new jobs; (2) micro insurance to support the poor to make contracts and to

maintain basic insurance; and (3) public welfare projects to relieve the burden of the expenses of

tuition and medical services for the children of low-income families. The actual projects are

conducted by different financial institutions that the MIF designates as agents and whose

behavior it controls on those projects. The MIF started microcredit and public welfare projects

right after it was established, but it started micro insurance only recently.( Yoon Youngeun,

2011:p20)

The Social Solidarity Bank

The Social Solidarity Bank (SSB) is a nongovernment organization (NGO) that was established

in December 2002 to aid poor people who were running, or planning to start, a microenterprise.

The SSB provides seed money for low-income families without collateral and provides assistance

in the form of training in management and marketing skills for their continuous growth. It has

sponsored by the Samsung Group and the Ministry of Gender Equality and Families. In terms of

business scope, the largest portion of the credit was used for the start-up of businesses. If

differentiated with respect to business types, the service sector (37%) is ranked first, followed by

the food sector (31%), the wholesale/retail sector (21%), the manufacturing sector (10%) and

agriculture (1%). Each person can get, at most, $20,000 in a loan over four years with an annual

interest rate of between 0% and 6%. Repayments are over equal installments for 42 months after

a six-month period of deferment. The repayment rate has been relatively high, namely 90% by

September 2006. The approval of loans usually takes three to four weeks, during which time the

SSB inspects basic documents and checks the proposed businesses, the repayment ability of the

applicants and their basic skills.( Yoon Youngeun, 2011:p21)

The Joyful Union

The JOU was established in June 2000 to help the poor who could not provide the collateral for

loans and, thus, by giving them seed money, enabled them to start up their businesses. The JOU

manages funds of about $1.5 million, sponsored by the City Group, the Munwha Broadcasting

Corporation (one of the major broadcasting companies) and donations from many individuals,

with 18 staff and volunteers. The JOU targets communities in rural areas, especially the low-

١٢

income group, which makes it different from the other MFIs. Since its establishment, the JOU has

advanced loans totaling $1 million to 73 communities by July 2007.

The maximum loan is $50,000 per community, with an annual interest rate between 2% and 4%.

Repayments are by one of two options: weekly base repayments over 200 weeks; or monthly base

repayments of equal installments over four years after a one-year period of deferment. The

repayment rate has been very high, namely 96% up to July 2006. The approval of loans is based

on inspecting basic documents, checking the place of business and interviewing. This process

usually takes around 60 days.( Yoon Youngeun, 2011:p22).

The Beautiful World Fund

The Beautiful World Fund (BWF) was established to support the start-up of businesses,

especially for families without male heads. Actually, the BWF is one of the funds in the Beautiful

Foundation, whose main purpose is to help the poor in various ways. Based on the bequest of an

owner of a conglomerate, this foundation has funds of $1.4 million, and the BWF supports

microcredit projects using the gains from its funds. Since its establishment, the BWF has

approved 15 loans amounting to $4.7 million, most loans being to help families without male

heads to start new businesses in Seoul.

The basic features of the BWF loans are that $30,000 is the maximum amount, and they have a

seven-year maturity with a 1% annual interest rate. Repayments of the loans are by equal

installments each month. The repayment rate has been very high (90.9% of loans). The approvals

of loans usually take six months and are based on inspections (Yoon Youngeun, 2011:p22)

Commercial Banks in Microcredit

In 2009, executives at the banks signed the donation agreement at the Korea Federation of Banks

office in central Seoul. The lenders will also invest 700 billion won from so-called “ dormant

deposits” - small accounts that have been idle for years - in the foundation until 2019.

The group of 18 banks includes four state-run institutions: Korea Development Bank, the

National Agricultural Cooperative Federation, the Export-Import Bank of Korea and the National

Federation of Fisheries Cooperatives and seven Seoul-based commercial banks - Hana Bank,

Shinhan Bank, Woori Bank, Korea Exchange Bank, Kookmin Bank, SC First Bank and Citibank

Korea - along with six regional banks - Daegu Bank, Busan Bank, Kyongnam Bank, Kwangju

Bank, Jeonbuk Bank and Jeju Bank will participate in this activity.7F8

١٣

The Hana Bank, which is ranked fifth among commercial banks in terms of magnitude of assets

in Korea, announced that it was going to participate in microcredit for profit. Compared with

other MFIs, its scheme is more aggressive and expansive. The Hana Bank gives not only

microcredit loans which can be used for starting up businesses but also additional synthetic

business consulting to help microcredit users survive in the long term. (Yoon Youngeun,

2011:p23).

The results of the above research showed that some strategies should be used to improving the

microfinance in South Korea such as bellow:

1. Introducing and enforcing group lending, because group lending can solve two major

problems in microfinance, adverse selection by assorted matching and moral hazard by

monitoring group members’ transactions.

2. Letting MFIs (Microfinance Institutions) carry out both micro saving and micro

insurance.

3. Establishing independent committees to mediate disputes regarding microcredit issues,

which can solve commitment problem.

4. Expanding microfinance services by letting MFIs handle housing microfinance and loans

for education and health care.

5. Encouraging social enterprise to help the poor overcome their state of poverty.( Yoon

Youngeun, 2011:p164).

The history of microfinance in Iran

Microfinance and microcredit in Iran against in South Korea, has a long history. The most

important institution which has paid small loans is Agriculture Bank of Iran (Bank Keshavarzi)

which has established in 1933. Furthermore there are some other institutions in Iran which pay

small loans to the poor people but the most important of them is Bank Keshavarzi.

Some other institutions such as ministry of Agriculture in Iran have some performance in micro

financing the poor specially women

As the Agriculture Bank of Iran is the most important institution in Iran which has microfinance

services, in this study the performance of this bank will be analysis.

١۴

Micro entrepreneurs

Macro entrepreneurs

Customers

Bank Keshavari

Microfinance

Microfinance Model in Agriculture Bank of Iran (Bank Keshavarzi(BK))

Bank Keshavarzi is the only bank in agriculture sector of Iran. It established in 80 years ago by

the goal of financing the agriculture sector and activities the bank has more than 1900 branches in

all over the country know and about 1000 of them are in the rural areas.

Amount of BK financial resources, distributed in the agriculture sector by March 20, 2013 is

more than RlsP8F

9P.160000 billion.

Many of agricultural users, who have been granted the bank financial facilities, are conducting

small economic businesses. More than 60 percent of the bank credits, in term of numbers, and

more than 30 percent in term of volume, have usually been categorized as loans, each equaling

less than Rls.50 million.

Above statistics shows that the more number of credits of the bank are in the micro scale. it is

important to know that more than 95 percent of the bank credits , in term of numbers and more

than 50 percent in term of volume are less than Rls.200 Million .

More ever BK has concern to the microfinance in some special schemes. Microfinance model in

BK has presented bellow as a conceptual model. As the bank is a development bank too, it has

concern to some factors such as empowerment of rural people, protecting environment and

creating job for customers too. BK also has some joint projects with international agencies such

as IFAD for micro financing.

The microfinance system in BK

٩ 1 Us$ is equal to Rls.24787

Saving

E-banking Environment protection

Iran Zeinab Fatima Scheme for agriculture

graduated joint project with IFAD

١۵

As it is presented above microfinance in BK involve the small credits and some special schemes.

Moreover, BK offers all banking services such as all kinds of saving services and E-banking, to

its customer in rural and urban areas. In this part ,the microfinance services of the bank will be

introduced.

Microfinance in BK Microfinance schemes in BK In microfinance schemes of BK,

The target customers are poor people, agriculture young graduated people and

women.

The goal of all schemes is too improving the economic customers' condition.

BK also concern to the saving, training and insurance services too.

BK concern to the customer and bank profits together in its microfinance strategies

Some more important microfinance schemes in BK are introduced as bellow:

1. The scheme for rural women head of households (Zeinab Scheme)

This scheme designed for women head of households in charge of managing their

families' living conditions.

This scheme has started in 1994.

The target customers are women

By this scheme BK has paid some small loans to the target customers which the

maximum amount of these loans are Rls.20 million

These loans pay to the target customers to creating a small business

The customers have been introduced to the bank by some of organization which

has enough information about the poor women in the rural areas.

These loans don’t need any collateral

There isn’t any interest rate for these kind of loans

2. The scheme for rural girls (Hazrat Fatima )

This scheme designed by the purpose of creating jobs for rural girls, orienting

rural girls with banking operations, and promoting their social positions.

The scheme has started at 2009

Target customers are rural girls

١۶

By this scheme the small loans have paid to the customers

The loans should use for creating the business

The plan is now implemented in two provinces, namely Yazd and Zanjan

The maximum amount of these loans are Rls.20 million

3. The scheme for all of the Iranian women (Iran scheme)

Target customers of this scheme all of the Iranian women in rural and urban areas

The scheme has started at 1999

The goal of the scheme is to offer the women some banking and loan services to

bankable them ,help them to creating some small business and offer them some

facilities to improve their life

This scheme is not limited to the economic activities

Some of the offered facilities are for help customers to buy their required goods

This scheme has extended in late years

In new Iran scheme by segmenting the customers, BK tries to offer more special

services to them

Now there are 4 kinds of customers( student women, housekeeper women,

employed women, unemployed girls)

4. The scheme for young graduate in agriculture

The scheme has started at 2001

The target groups are the agricultural educated young people

Some loans has offered to the customers to creating the job in agriculture sector

They should have saving in the bank too

5. A joint microfinance project of BK and IFAD

This is a joint project of BK and International Fund for Agricultural

Development (IFAD) and a NGO as implementing agency (TAK-international)

In this project, BK has supported the project by the credit line and cooperating in

the implementation process. IFAD has supported the project by grant

supplemented and technical assistance .TAK has supported the implementation

process.

The goal of the project is to expand the microfinance services in poor and

deprived regions of Iran by leveraging the resources and institutional capacity of

BK in partnership with civil society.

١٧

Microcredit

In BK

Kinds of Loans: Small and medium loans (60% in amounts and 90% in number)

Organizational structure

New technologies and protecting environment

The goals: paying for production

Paying for buying consuming goods

Target groups of the project are rural poor in general rural women and young

adults in specific. As a pilot project it has been implemented in seven provinces

(Ardebil, East Azerbaijan, West Azerbaijan, Kurdistan, Fars, Isfahan and

Charmahal Bakhtiai).

In this project the credits have been paid to the Self Help Groups instead of

individuals.

The projects' innovations are:

The cooperation of Bank, International agency (transferring their experiences)

and civil society.

Experience of linkage banking for the first time

Creating an intermediary between Bank and individual clients by supporting

group formation.

Decreasing the cost of transfer and workload of Bank’s staff.

Supporting people to take responsibility and learn working together

Microcredit in BK (A new paradigm)

Microcredit in BK is not just paying small loans to the poor people. BK has created some

changes in paying microcredit system to increasing the productivity. For this movement, BK

established a new office for microcredit by the goal of using new electronic systems in all phases

of the process.

١٨

In the last year, all phases of paying microcredit have been electronic and in all over the

rural and urban branches of the bank, the new approach in this field is implemented.

The achievements of the new approach:

1- Protecting the environment by using paperless systems

2- Creating an information microcredit customer bank

3- Creating a system for managing the Microcredit customers saving/deposit accounts

4- Creating a system for estimating unit cost of the activities systematically to

decreasing the costs of the projects

5- Decreasing the labor work in branches who managing the microcredit and using these

labors in other parts of the bank.

6- Increasing the human resource productivity by using the new web base method for

managing the microcredit

The Impact of BK Microcredit on economic indexes

In this part of the study an econometric equation is used to identifying the impact of BK

microcredit on value added of agriculture sector of Iran.

The data using in the study was panel data as bellow:

1. BK data of microcredit ( credit less than Rls. 50 million ) for 30 provinces of Iran from

2010-2013 ( the data was received from statistic department of BK)

2. Value added data of agriculture sector of Iran for 30 provinces of Iran from 2010-2013.

( The data was received from statistic center of Iran)

3. Labor force data of agriculture sector of Iran for 30 provinces of Iran from 2010-2013.

( The data was received from statistic center of Iran)

As in the microeconomic theories the production function is a function of factors such as capital,

labor, technologies,… and as one of the most popular functional form of the agriculture functions

is Cobb-Duglass, specially linier Cobb-D , in this study the linier kind of this function was used.

The dependent variable is value added in agriculture sector of Iran. the independent variables are

labor force of agriculture sector and BK microcredit which have been distributed in the sector .

The common form of the regression is:

The results:

١٩

(7.3) (7.1) (8.2)

As the regression is a log linier regression, the coefficients are the elasticties.

Interpretation of the coefficients:

The results showed that by if the microcredit amounts increase/decrease for 1 percent, the value

added in agriculture sector increase/decrease for 0.4 percent. Also, if the labor force of the

agriculture sector had increased/decreased for 1 percent, the value added of the sector would have

been increased/ decreased for 0.41 percent too.

The results showed that the role of BK microcredit is so important in creating value added of the

sector.

The impact of BK microfinance on customers' life

As I said before the BK microfinance services have divided in to some schemes for rural and

urban women, graduated young people in agriculture .to increasing the productivity of these

services ,the bank should knows the impact of them on its customer life. so some researches has

done in this field which the results of them are as bellow:

1. The pathology of Zeinab scheme in BK", 2007

The output of the research on the scheme for rural women headed householdsP9F

10P in four provinces

of the country in 2007 showed that some small loans have been used to buying the required

households goods and it couldn’t help them to have a small business. But in some cases the loans

have been applied to create a small business. by this research the reasons which caused some

women used the loans to buying the consumption goods were as bellow:

1. The little amount of the loans (in that time the amount of the loans were Rls.5 million).

2. The lack of supervisory

3. The lack of BK staff on the importance of this scheme

4. The lack of training programs for these kinds of customers

5. The lack of doing impact assessment to doing the scheme more productive

١٠ The research has been done by A.Farzin Motamed under the name of " The pathology of Zeinab scheme in BK" ,2007

٢٠

2. The impact assessment of the joint project of BK and IFADP10F

11

The research has been done to survey the impact assessment of the joint project of BK and IFAD

under the name of "Rural Microfinance Support Program (RMFSP) ".the output of this research

by focusing on women customers showed that:

Economic impacts:

Value RMFSP Kinds of usage RMFSP (%)

Family’s physical assets ($) 20’538 Agricultural production

5.17

Family’s income ($, annually) 1375 Buying livestock 26.53

No. of durable goods 5.02 Non-agri business 9.06

Monthly saving ($) 4.66 Production Purposes 40.76

Total saving ($) 324 Food & consumer goods

1.08

Health care 1.62

Child education 1.51

Other purposes 55.03

Reference: The Impact of Microfinance on Rural Women, Does Institutional Structure Matter?,Dr.Abbas ArabMazzarm,IWEE,2013

١١ the research has been done by Dr.Abbas Arab Mazzar, the Associate Prof. of Economics, Shahid Beheshti University,2010-2013 which the results of it have been presented in the first international seminar on women economic empowerment,Tehran,Iran,2013

٢١

Social impacts:

Social indexes RMFSP(%) Self confidence RMFSP(%)

Working in family business 49.84 Taking part in local activities Increased

Working in non-family business 28.7 Taking part in social activities increased

Child school enrollment 81.4 Financial dependency decreased

Reference: The Impact of Microfinance on Rural Women, Does Institutional Structure Matter?,Dr.Abbas ArabMazzarm,IWEE,2013

As the studies showed, the joint project of BK and IFAD has some positive social and economic impact but it was not enough for this project and the bank should have some program to improve the results of the project more and more.

VI. Conclusion

The purpose of this study was to introducing the microfinance in Iran and South Korea and compares them. As the required data about South Korean microfinance were not available, the author just tried to review the studies in this field and presented the results of those studies.

About microfinance in Iran, as one of the most important institution which has been pay microfinance is Agriculture bank of Iran, so the microfinance in this bank has been analyzed. For this goal at first the history of microfinance in the bank has been reviewed, then the microfinance system has been introduced and some important schemes in this field have been presented.

The impact of microfinance in the bank, has been analyzed by an econometric model and reviewing the previous studies in this field. The abstract of the results in this study has been presented below:

٢٢

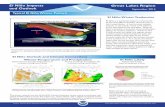

Compare the South Korea and Iran on Microfinance

Topics South Korea Iran The years history of microfinance 10 years 80 years

Number of the banks 18 commercial banks/SSB Bank Keshavarzi (Agriculture bank of Iran)

Complementary services Insurance/ saving (proposed) Saving/electronic banking services/insurance/training

Subsectors Food/wholesale/retail/agriculture/services Agriculture

problems Lack of enough saving /insurance services Lack of supervisory/ lack of permanent assessment/ lack of marketing for their productions/ not enough amounts of credit to starting a small business in Iran

As it can be seen from the results of this study, the banks have important roles in microfinance. But it seems that if they want to increase the productivity of their activities in this field, they should joint to some other organizations such as NGOs, International agencies…

By this way they can use their experiences in training the people, marketing their production, help them to learn about business skills, protecting environment ways, having saving, learning to use new electronic services, etc.

As it has been presented in the article, Agriculture Bank of Iran has been tried to create some changes in this field to improving the microfinance. But it seems it should have more trying in this field. It seems that BK and the South Korea banks which are active in this area can have some joint project and exchange their experiences to improving this kind of financial service in their countries.

the experience of BK shows that , we can have some new approach on microfinance. We can concern to the poor people and small business by some modern banking tools and help them to learn how they can participate in developing their country.

٢٣

References

1. ArabMazar,Abbas;" The Impact of Microfinance on Rural Women, Does Institutional

Structure Matter?," presented at the first international seminar on women economic

empowerment in Iran,Tehran,Iran,2013

2. Brau .James C," Microfinance: A Comprehensive Review of the Existing Literature",

Journal of Entrepreneurial Finance and Business Ventures, Vol. 9, Issue 1, 2004

3. Farzin Motamed,Arghavan : " The pathology of Zeinab scheme in BK" , an interior

report

4. Microfinance and the Millennium Development Goals A reader’s guide to the

Millennium Project Reports and other UN documents .2005

5. Nkamura, Peter:" introducing the microfinance" , web base article,2009:p4

6. YOON, YOUNGEUN," OPTIMAL STRATEGIES FOR THE DEVELOPMENT OF

MICROFINANCE IN KOREA AND THE IMPACT OF MICROFINANCE ",

Submitted in partial fulfillment of the requirements for the degree of Doctor of

Philosophy in Economics in the Graduate College of the University of Illinois at

Urbana-Champaign, 2010

7. Uhttp://www.businessdictionary.com/definition/microcredit.html

8. Uhttp://www.microfinancegateway.org/p/site/m/template.rc/1.26.12263/#2

9. Uhttp://www.globalenvision.org/library/4/1051

10. U and http://www.aboutmicrofinance.com/topics/history-of-microfinance

11. 2TUhttp://www.globalenvision.org/library/4/1051U2T

12. 2TUhttp://www.saemaul.or.kr/english/saemaulundong.aspU2T 13. Uhttp://www.syminvest.com/news/south-korea-18-banks-donate-for-

microcredit/2009/11/17/2158