Metaphors and the market: Consequences and preconditions ... · Metaphors and the market:...

Transcript of Metaphors and the market: Consequences and preconditions ... · Metaphors and the market:...

ARTICLE IN PRESS

www.elsevier.com/locate/obhdp

Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx

Metaphors and the market: Consequences and preconditionsof agent and object metaphors in stock market commentary

Michael W. Morris a,*, Oliver J. Sheldon b, Daniel R. Ames a, Maia J Young c

a Columbia University, New York, NY 10027, USAb Cornell University, USA

c University of California, Los Angeles, CA, USA

Received 23 March 2005

Abstract

We investigated two types of metaphors in stock market commentary. Agent metaphors describe price trajectories as volitionalactions, whereas object metaphors describe them as movements of inanimate objects. Study 1 examined the consequences of com-mentators’ metaphors for their investor audience. Agent metaphors, compared with object metaphors and non-metaphoric descrip-tions, caused investors to expect price trend continuance. The remaining studies examined preconditions, the features of a pricetrend that evoke agent vs. object metaphors. We hypothesized that the rate of agentic metaphors would depend on the trend direc-tion (upday vs. downday) and steadiness (steady vs. unsteady). Two archival studies tracked the metaphoric content in end-of-dayCNBC commentary as a function of daily price trajectories. As predicted, agent metaphors occurred more frequently on updaysthan downdays and especially so when the trends were relatively steady as opposed to unsteady. This held for both bull (Study2) and bear market periods (Study 3). Study 4 replicated these findings in a laboratory experiment where participants took the roleof stock market commentator.� 2006 Elsevier Inc. All rights reserved.

Keywords: Stock market; Metaphor; Agent; Attribution; Prediction; Media; Trajectory

Much recent research has sought clues about marketbehavior in the cognitive psychology of investors. Pat-terns of judgment and decision making that defyrational models have been elucidated by identifyingthe heuristics with which naı̈ve investors process finan-cial information (e.g. Barberis & Thaler, 2003; Camerer,1987; Fong & Wyer, 2003; Nelson, Bloomfield, Hales, &Libby, 2001). Yet investors do not make judgments in asocial vacuum. Recent behavioral finance evidence sug-gests they can be dramatically influenced by other peo-ple—friends who comment about the market (Hong,Kubik, & Stein, 2004) and also market commentatorsin newspapers (Huberman & Ragev, 2001; Liang,

0749-5978/$ - see front matter � 2006 Elsevier Inc. All rights reserved.

doi:10.1016/j.obhdp.2006.03.001

* Corresponding author.E-mail address: [email protected] (M.W. Morris).

1999) and on television (Busse & Green, 2002). This sug-gests that to understand market behavior we need tostudy the psychology of commentators in conjunctionwith that of investors.

The current research takes this approach by focusingon metaphor in market commentary. We use the term‘‘metaphor’’ in the broad Aristotelian sense of describ-ing an event in terms transferred from another domain(Heath, 1996). Whereas literary scholars focus on crea-tive metaphors that authors use for stylistic effect, cogni-tive scientists study conventional metaphors thatordinary people use when making sense of abstractevents in more concrete, familiar terms (Lakoff, 1993).Notwithstanding their moments of wit (e.g. ‘‘In latetrading, Caterpillar inched higher’’), market commenta-tors primarily traffic in conventional metaphors. Marketindices or stocks are explicitly compared to a charging

2 M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx

ARTICLE IN PRESS

bull, a falling brick, or a bobbing cork. Or the metaphoris conveyed implicitly through verbs phrases that rendermarket fluctuations in terms of movements from otherdomains (‘‘The S&P slipped downhill,’’ ‘‘the Nasdaqflirted with the 2000 mark,’’ ‘‘The Dow vaulted higher’’).In the prior literature, a few obscure linguistic studieshave identified metaphors in newspaper market com-mentary (Schmidt, 2002; Smith, 1995) in the traditionof analyzing the rhetoric of economic writing (McClos-key, 1985). These analyses suggest that certain kinds ofmetaphors, such as those that anthropomorphize themarket, occur across several languages and cultures;however, they do not probe the psychological questionsof what conditions spur commentators to generate suchmetaphors and how investors’ judgments are affected.

To develop a psychological model of how marketmetaphors operate in the minds of commentators andinvestors, we distinguish two types of market metaphorsthat reflect two basic causal schemas. Evidence fromvarious fields of cognitive science (Pinker, 1997) suggeststhat humans have particularly rich and accessible sche-mas for interpreting movements in two domains: (1)the actions of animals and people, and (2) the move-ments of inanimate objects such as rocks or tools. Whenimposed on price trajectories, these schemas give riserespectively to agent and object metaphors. Agent meta-phors describe price movements as action, as the voli-tional, internally-driven behavior of an animate entity.This type encompasses anthropomorphic descriptionas well as description of the market as like an animal.Some examples are ‘‘the Nasdaq climbed higher,’’ ‘‘theDow fought its way upward,’’ and ‘‘the S&P dove likea hawk.’’ Object metaphors describe price movementsas object trajectories, as events in which inanimateobjects are buffeted by external physical forces. Exam-ples of this second category are ‘‘the Nasdaq droppedoff a cliff,’’ ‘‘the Dow fell through a resistance level,’’and ‘‘the S&P bounced back.’’

We seek to identify the antecedent conditions andconsequences of these two types of market metaphors.What kinds of price movements tend evoke these typesof metaphoric description? How does exposure to thesemetaphors then affect investors’ judgments about futureprice trends? Hypotheses about these issues can bederived from the literature on the two underlying causalschemas. For instance, social psychologists have docu-mented that the schemas we use to attribute others’behavior (‘‘action schemas’’) lead us to exaggeratedexpectations that observed behavioral trends will contin-ue (Ross & Nisbett, 1991). Hence, given that agent met-aphors reflect these schemas, investors processing theday’s market trends in terms of agent metaphors shouldexhibit the same bias—exaggerated expectations oftrend continuance.

Before deriving the hypotheses more systematically, itis worth reviewing some basic features of the research

setting: the stock market, the journalists who cover it,and their audience of investors. After introducing thesetting, we develop our argument concerning the distinc-tive consequences of commentary featuring agent meta-phors as opposed to object metaphors or no metaphors.The next section then develops our argument concerningthe distinctive antecedents—the price trends that evokeeach type of metaphor.

The stock market setting

It is well established in economics that day-to-daytrends in the stock market follow a random walk, mean-ing that today’s trend does not predict tomorrow’s trend(Malkiel, 1996). Nevertheless, investors form expecta-tions about short term market trends and trade on them.Research tracking portfolios of investors finds that themore they trade actively—trying to time the buys andsells in relation to short-term trends—the worse theiroverall returns (Barber & Odean, 2000). If not the expe-rience of success, what then makes investors confidentthat they can interpret and predict short-term trends?One contributor, we suggest, may be marketcommentary.

Financial journalists, whether print or television, donot merely report market trends but also explain them.Consider, for instance, the tagline of the show CNBC

Marketwatch: ‘‘The story behind the numbers.’’ Underthis billing, reporters cannot merely report. The amountof increase or decrease or say ‘‘it was another randomwalk today.’’ They are supposed to provide their audi-ence with a story—an explanation of why the marketmoved the way it did. Of course, commentators eschewdirect ‘‘because’’ statements (which would be hard todefend). Instead they imply attributions indirectly, suchas by juxtaposing price trends with explanatory refer-ences to business conditions (e.g. ‘‘GM rose 3 pointstoday on news of a strike settlement.’’). These hintedexplanations undoubtedly make market reports moreengaging; however, they may lead the audience tounwarranted expectations about tomorrow’s trend.

Past research has examined the effect of commenta-tors’ attributions to business conditions. In a stock trad-ing game, Andreassen (1987) manipulated whether dailyprice trend information was accompanied by explanato-ry ‘‘news’’ about business conditions. He found thatnews led participants to perform worse. News-conditionparticipants bought (high) after updays and sold (low)after downdays, presumably because they tended toattribute the price trend to the changed business condi-tion and hence expected it to continue the next day.Recently, DiFonzo and Bordia (1997, 2002) found thesame effect from exposing investors to indefinite ‘‘ru-mors’’ rather than definite news, which ruled out alter-native accounts of the effect in terms of the

M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx 3

ARTICLE IN PRESS

information-value of news. Taken together, these studieshighlight that people seek to attribute price trends tostable causes, and they follow indirect attributional mes-sages in stock commentary.

Aside from explanatory references to business condi-tions, there may be other ways that commentators con-vey causal attributions. Even without hazarding areference to business conditions, commentators mayprovide hints about the causes of price trends throughmetaphoric language. Agent metaphors (‘‘The Nasdaqclimbed higher’’) imply that the observed trend reflectsan enduring internal goal or disposition and hence it islikely to continue tomorrow. By contrast, object meta-phors (‘‘The Nasdaq was pushed higher’’) do not implythat it reflects an internal force that will manifest itselfagain tomorrow. This is the crux of our argument–thatagent-metaphor descriptions affect investors differentlythan object-metaphor descriptions and non-metaphori-cal descriptions. To develop the argument in more detailwe turn now to the psychological literature on meta-phoric language and metaphoric encoding.

1 Why do people have this tendency if it leads to biased predictions?It may be that attributing properties of persons is necessary fornavigating the social world, and hence it becomes habitual from ayoung age, even though it leads to errors in many situations whereothers’ behavior does not primarily reflect their internal properties.Another answer, from evolutionary psychology, is that many schemasare hardwired into the brain because they were adaptive in the so-called environment of evolutionary adaptedness that existed through-out the Pleistocene era (Pinker, 1997). Attributing agency to predictfuture behavior may have enhanced survival chances in this environ-ment, and thereby evolved as an automatic response, even if themodern world presents many situations in which the resulting bias isproblematic.

Distinctive consequences

In considering the consequences of metaphors, it isworth distinguishing metaphoric description (usingterms from another domain to talk about an event) frommetaphoric encoding (using schemas from anotherdomain to think about an event). Psycholinguisticsresearch finds that a writer’s metaphorical descriptionscan prime his or her reader to engage in metaphoricalencoding (Galinsky & Glucksberg, 2000; Gibbs, Bogd-anovich, Sykes, & Barr, 1997; Slobin, 2003). For exam-ple, in one experiment exposure to particular metaphorsfor love (e.g. love is a journey) made participants morelikely to answer subsequent questions about love interms of the primed metaphoric schema (Gibbs, 1992).

It is perhaps not surprising that exposure to meta-phors shifts people’s subsequent descriptive language.But do metaphoric encodings also affect the way peoplemake practical judgments? Suggestive evidence that thisis the case comes from studies of people’s metaphoricthinking about technological devices. For instance, ahigh fraction of Americans believe that their home ther-mostat works like a gas pedal (they metaphorically mod-el it as a valve rather than a switch) and, accordingly,engage in the erroneous tactic of turning it to higher-than-desired temperatures when they want to heat thehouse quickly (Kempton, 1986). Consequences of meta-phoric encodings have also been documented in the rea-soning of experienced technicians: electricians makedifferent patterns of mistakes on wiring problemsdepending on which of two conventional metaphorsthey use when thinking about electricity in wires—flow-ing water in pipes, or teeming crowds in corridors (Gent-

ner & Gentner, 1983). The two metaphors imposedifferent schemas onto electricity problems, and eachschema carries its own distinctive biases.

Now let us return to agent vs. object metaphors formarket trends. Attribution theory (Heider, 1958) holdsthat schemas for physical object causality and personalaction causality differ in the primary locus of causation.Object causality schemas trace movements primarily toexternal forces, whereas action schemas trace move-ments to enduring internal properties. Hence actionschemas create a bias to expect that observed trends willcontinue. For example, when asked to forecast some-one’s future social behavior, people over-predict thedegree to which it will be consistent with the sample ofbehavior that they have observed (Ross & Nisbett,1991). Likewise, when judging sports performances,people trace observed trends (several baskets in a row)to internal properties of the actor (‘‘the hot hand’’)and over-predict the chances that the trend will continue(Gilovich, Vallone, & Tversky, 1985).1 As in social andsports judgments, we propose that action schemas giverise to this bias in stock market judgments. More for-mally, we propose

Hypothesis 1. The presence of agent metaphors incommentator descriptions of a price trend influencesthe judgments of their investor audience, making inves-tors more likely to expect that the given trend willcontinue than they would be otherwise.

The first hypothesis assumes that commentators’ met-aphoric descriptions beget corresponding metaphoricencodings in the minds of their investors. Yet are theresome conditions where investors are less susceptible tosuch encodings? Metaphor research, for instance, hasfound that people can inhibit activation of the literalmeanings of metaphors when they are made consciousthat figurative language is being used (Galinsky &Glucksberg, 2000). A possibility is suggested by Lakoff’s(1993) argument that the groundwork for many conven-tional metaphors is the mapping of abstract quantitiesinto spatial positions (e.g. more is up), so abstractionsbecome more like perceptions. Lakoff (1993) contendsthat the stock chart is an artifact that reifies a spatial

4 M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx

ARTICLE IN PRESS

mapping of price movements into trajectories, and thatrepresenting a trend as a spatial trajectory fosters itsinterpretation in terms of metaphors. Studies havefound that particular action concepts are associatedwith particular kinds of dynamic trajectories (Michotte,1946) and even with static trajectory-like diagrams(Richardson, Spivey, Barsalou, & McRae, 2003). Thissuggests that investors might be more likely to encodea price trend in terms of action schemas when theyreceive price information in the customary chart formatrather than in a table of numbers. Hence, a qualificationof the prior generalization is

Hypothesis 2. The effect of agent-metaphor commentaryon continuance judgments will be reduced when pricetrends are presented as a table of numbers rather than atrajectory-like graph.

2 Frog evolution ‘‘designed’’ its flytrap to detect features of flytrajectory, rather than color, size, or shape, because the trajectoryfeature is more useful in distinguishing flies from non-flies. At least thisis true in the frog’s natural ecology; in Lettvin’s lab, by contrast, frogslap in vain at abstract displays. As we shall see, people making sense ofstock charts may be in a predicament something like that of the frogsin Lettvin’s lab, victims of their automatized responses to trajectorycues.

Distinctive antecedent conditions

If agent and object metaphors produce different con-sequences, then it is important to identify the antecedentconditions that give rise to them. Our argument aboutthe eliciting conditions for these types of metaphors,again, turns on the premise that they reflect the activa-tion of two different causal schemas. A longstandingfinding is that specific trajectory features in stimulus dis-plays evoke processing in terms of schemas for animateaction (Heider & Simmel, 1944) as opposed to inanimatemechanics (Michotte, 1946). Some trajectory featuresautomatically evoke impressions of animacy, most likelybecause they are reliable cues to distinguishing animalsfrom objects in the environment. For instance, anascending trajectory is highly diagnostic of animacy,whereas a descending trajectory is somewhat diagnosticof inanimacy.

To consider what this suggests about the precondi-tions for metaphoric language about price trends, weturn to a pilot study by Andreassen (1987) that sampledprice changes in individual stocks in a Wall Street Jour-

nal column in selected years. Though not the focus of hisanalysis, Andreassen (1987, Table 1) presented thedescriptions of the 5 most positive and 5 most negativedaily price changes from his sample. In other words,these were days when a stock underwent a dramaticuptrend or a dramatic downtrend. The descriptions ofprice up-trends (date shown) were:

(6/3/1980) ‘‘Financial Federation leaped . . .’’(4/12/1960) ‘‘United Stores second preferred lead themarket in activity, advancing . . .(8/20/1965) ‘‘American South African Investorrose . . ..’’(11/3/1970) ‘‘In the glamour group, Telexclimbed . . .’’

(6/2/1980) ‘‘ERC Corp. stock soared . . .’’

The descriptions of down-trends, by contrast, were:

(11/20/1975) ‘‘Marine Midlands Banks slid . . .’’(6/20/1980) ‘‘City Investing was the Big Board’s mostactive stock, dropping . . .’’(4/1/1960) ‘‘Polaroid plummeted . . .’’(4/20/1960) ‘‘The most active stock was Ampex,which dropped . . .’’(11/4/1975) ‘‘A big casualty among blue chips wasUnited Technologies, which fell . . .’’

Notice first that there is a great deal of metaphoriclanguage in the description of these dramatic ups anddowns, some agent metaphors referencing internal force(‘‘leaped’’ and ‘‘climbed’’) and some object metaphorsreferencing external physical forces such as gravity(‘‘plummeted’’ and ‘‘fell’’). Yet more importantly, noticethat two metaphor types are not randomly distributedwith respect to vertical direction of the trend: agent met-aphors tend to be evoked by uptrends whereas objectmetaphors tend to be evoked by downtrends.

We propose that metaphors vary by trajectory direc-tion because upward trajectories are linked in people’sminds with animacy and action. How does this link orig-inate? One source is learning from direct experience inthe environment. Based on the law of cognitive structureactivation, action schemas would come to be activatedby the stimulus of an upward trajectory (Higgins,1996; Sedikes & Skowronski, 1991). In an example ofsuch a learned association, Schubert (2005) finds thatperceivers associate higher positions in space with socialstatus. Because of perceivers’ experience in a worldwhere height is diagnostic of status, height becomes astimulus feature that automatically activates conceptsfor status.

Alternatively, or in addition to learning from experi-ence, the link between ascending trajectories and anima-cy may reflect evolved neural mechanisms. Humanshave evolved to pick up regularities in the natural envi-ronment (Leslie, 1995). Responses to trajectories arehardwired in many species; the frog, for example, pro-trudes its tongue in response to stimulus displays thatresemble the zig-zagging trajectories of flies (Lettvin,Maturana, McCulloch, & Pitts, 1959).2 Increasing evi-dence suggests that humans are hardwired to distinguish

M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx 5

ARTICLE IN PRESS

animate, goal-directed movement from object move-ment. Stimulus displays in which a moving shapeascends over an obstacle are processed as action, evenby infants who have had little opportunity to learn fromexperience (see Scholl & Tremoulet, 2000). Mechanismsto recognize animates as opposed to inanimates basedon trajectories would have been highly adaptive for ear-ly human hunter-gatherers, so sensitivity to these trajec-tory features may be hardwired into our neural system.

Regardless of its source, this link means that peopleshould be more likely to have the impression of animacyand action from something ascending than somethingdescending. Uptrend stimulus trajectories should auto-matically trigger schemas for animate action and down-trends should trigger schemas for inanimate motion,regardless of whether the trajectories are encounteredon sand dunes or stock charts. Hence, uptrends shouldevoke agent metaphors, and downtrends should evokeobject metaphors.3 A main effect hypothesis about met-aphor evocation, then, is as follows:

Hypothesis 3. The more upward the direction of a pricetrend, the higher will be the rate of agent metaphors andthe lower the rate of object metaphors in marketcommentary.

Is direction the only relevant feature of trajectories indetermining which kind of schemas and metaphors theyevoke? In addition to the overall direction, another sali-ent feature of price charts is the steadiness of the trend.Unsteadiness can be defined as the degree to which thereare salient reversals along the way to the overall direc-tional trend. We propose that unsteadiness dampensthe impact of the overall trend direction. Again, ourrationale is that unsteadiness, in combination with direc-tion, is diagnostic of animacy in the naturalenvironment.

To see this, picture the contrast between two upwardtrajectories: something in the distance ascending steadilyfrom the ground into the sky, and something ascendingunsteadily, occasionally dropping downward beforeresuming upward. The former, steady trajectory givesa stronger impression of agency because it is pure ascent(like a raptor taking flight) whereas the second is a mixof ascending and descending movements (like a leafblowing in the wind). Now picture two more: somethingsliding steadily down a distant mountain slope, andsomething heading down a distant slope but with occa-sional uphill reversals. The latter, unsteady descentshows some sign of agency in its reversals (it could be

3 It is worth clarifying that metaphors of either sort are logicallypossible regardless of direction. An uptrend could be encoded as aclimbing hiker (agent) or as a leaf blowing in the wind (object); adowntrend could be seen as a diving raptor (agent) or a tumblingboulder (object). Yet psychologically, agent metaphors should beevoked by uptrends and object metaphors by downtrends.

a skier who turns uphill now and then) whereas thesteady descent shows no signs of life whatsoever (it isfalling like a rock). These examples, taken together, givethe intuition that the more unsteady a trend, the less itsoverall vertical direction determines impressions of ani-macy or agency. Spelling this out, we propose

Hypothesis 4. In the context of uptrends, unsteadinessshould decrease agent (and increase object) metaphorrates, whereas in the context of downtrends it shouldincrease agent (and decreases object) metaphor rates.

Overview of present studies

Our studies of consequences and preconditions ofmetaphors focused on market indices (Dow, Nasdaq,and S&P)4 rather than individual stocks. A skepticmight argue that agentic descriptions of individualstocks (e.g. ‘‘Apple picked up its pace’’) are referencesto actions of their CEOs or employees, not metaphorsfor the price change. Yet no one could argue thatdescriptions of a market index (‘‘the Nasdaq pickedup its pace’’) refer to coordinated actions by all theemployees of the hundreds of indexed firms. Hence,commentary about market indices, rather than aboutindividual stocks, is more unambiguouslymetaphorical.

Study 1 investigated the consequences of commenta-tor metaphors on investor expectancies of trend contin-uance. Participants took the role of investors andinterpreted daily price trends to predict the next day’strend. We manipulated whether or not they wereexposed to agent-metaphor descriptions of the currentday’s trend, and whether this trend was presented in astandard stock chart or in a table of numbers. Wefound, as hypothesized, that expectancies of trend con-tinuance were higher in the agent-metaphor conditionthan elsewhere, yet this effect of the commentator’s lan-guage was diminished when the price trends were pre-sented numerically instead of graphically.

The remaining studies investigated the conditionsthat give rise to agent and object metaphors. Study 2analyzed daily commentary about major indices in anend-of-market-day TV program on CNBC. By correlat-ing metaphor content with the indices’ daily financialperformance, we found support for the hypothesizedmain effect of price trend direction and its interaction

4 Three major indices dominate descriptions of market activity: theDow (the Dow Jones Industrial Average, a price-weighted average of30 major stocks traded on the New York Stock Exchange and theNasdaq), the Nasdaq (over 4000 stocks traded on the Nasdaqexchange, featuring many technology and Internet-related companies),and the S&P 500 (500 stocks covering all major areas of the USeconomy, also known as ‘‘the S&P’’).

6 M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx

ARTICLE IN PRESS

with a measure of price trend steadiness. Study 3 repli-cated these results in a different historical period. Study4 replicated these relationships in a laboratory experi-ment, which enabled direct manipulation of the pricetrajectories that participants (in the role of stock com-mentators) described.

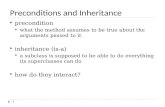

Study 1

Our first study investigated the consequences ofmetaphoric commentary on the investor audience.We predicted that agentic description would leadinvestors to encode price trends agentically and henceexpect trend continuance. Participants were given thetask of studying one day’s price activity and then pre-dicting the next day’s trend. They were presented withdetailed quantitative information about the priceactivity as well as a brief description of the trend bya market commentator. The primary experimentalmanipulation was the content of this commentary.We tested whether agent-metaphor content, comparedto object-metaphor content or non-metaphorical con-tent, would give rise to stronger expectancies of trendcontinuance.

A second manipulated factor was the format in whichthe quantitative price trend information was presented–chart or table. The standard chart format graphs priceactivity as a spatial trajectory and hence fosters encod-ing it in terms of action schemas. The table formatwas designed to convey precisely the same informationas in the chart, yet numerically rather than spatially.We predicted that the chart format would facilitateencoding of the price trend metaphorically. Hence, theformat factor should interact with the metaphoric con-tent factor.

This interaction-effect hypothesis is useful for dis-tinguishing our account from an alternative accountof why investors are affected by agent metaphors. Askeptic might argue that investors who read ‘‘the Nas-daq climbed higher’’ and then judge that the uptrendwill continue tomorrow are not encoding the eventmetaphorically (in terms of schemas for volitionalaction); rather these investors are merely taking thecommentator’s agentic language as a positive signalof the commentator’s conviction the trend is meaning-ful. If so then investors’ increased predictions of trendcontinuance, after hearing agentic metaphors, mightreflect a perfectly rational adjustment. However, ifinvestors’ response to agent metaphors reflects thisrational signal-reading process, the effect should occurequally in the graph and table conditions. It is onlyour account, in terms of metaphoric encoding, thatpredicts the effect should be stronger when the trendis presented spatially in a graph than numerically ina table.

Method

Participants

Subjects were 64 undergraduates at Cornell Universi-ty who participated in this study in exchange for $5compensation.

Procedure

Participants were given a questionnaire with instruc-tions on the cover page followed by 6 pages presentinginformation about the performance of the Nasdaqindex on a particular day, purportedly days drawn atrandom from the prior 5 years. The instructionsexplained that it was a study of predicting stock mar-ket trends. They would be given information aboutthe intraday price variation of a stock index, alongwith a description of the trend by a market commenta-tor on an end-of-day television program. They wouldbe asked three questions related to expectations abouttomorrow’s trend.

The three questions were designed to tap expectationsin different ways. Specifically, they were:

(1) What does the analyst think the market will do

tomorrow?

(2) What do people listening to his program guess that

the market will do tomorrow?

(3) What do you think the market will do tomorrow?

All three of questions were answered by rating theexpected next-day closing point on a scale relative tothe given day’s closing point (1 = much lower, 4 = thesame level, 7 = much higher). Continuance bias, the pri-mary dependent variable of interest, would appear onthis scale as above-midpoint ratings after updays andbelow-midpoint ratings after downdays. These are dis-tinct, non-synonymous measures of expectancies, sothey allow several tests of the hypotheses. By measuringthese separately, we can examine whether participants’judgments are driven by their perception of the com-mentator’s views.

All participants saw the same 6 stimulus days, in adifferent random order for each participant. Trenddirection was varied within-groups. Three uptrend stim-ulus patterns were designed based on randomly selectedNasdaq charts from the prior year, in which there wasan appreciable uptrend (between 40 and 80 points).Downtrend versions of each were created by invertingthe direction of variation within the given range, andthen introducing slight variations early in the day so thatthe inversion would not be transparent.

The between-groups manipulations were content andformat. The commentary content (agent-metaphor,object-metaphor, or no-metaphor) that appeared witheach stimulus pattern are listed in Appendix A. The for-mat manipulation held constant the information: in

9:30

AM

9:45

AM

10:0

0 A

M

10:1

5 A

M

10:3

0 A

M

10:4

5 A

M

11:0

0 A

M

11:1

5 A

M

11:3

0 A

M

11:4

5 A

M

12:0

0 PM

12:1

5 PM

12:3

0 PM

12:4

5 PM

1:00

PM

2160 2182 2189 2196 2188 2191 2174 2183 2192 2196 2179 2175 2171 2174 2184

Fig. 1. Graphs and Table formats for price trend information in Study 1 (for the Table format only half the day is shown here).

M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx 7

ARTICLE IN PRESS

both graphs and tables, price was presented at 15-minintervals and arrayed along the horizontal axis of thepage. An illustration of the varying formats and thecommentary content for a given stimulus day is provid-ed by Fig. 1.

Results

Hypothesis testing

To test our key hypotheses, we began by aggregatingacross the three stimulus days to reach upday and down-day summaries for each rating in each condition. As

Table 1Ratings of next day closing price as a function of direction, metaphor, and

Expectancy ratings Mean ratings

Updays

Graph Table

Commentator-focused

Agent metaphor 5.32 5.00Object metaphor 4.33 4.56No metaphor 4.30 4.58

Audience-focused

Agent metaphor 5.57 5.08Object metaphor 4.87 4.91No metaphor 4.69* 4.73

Self-focused

Agent metaphor 4.73 4.71Object metaphor 4.28 4.35No metaphor 4.37 4.53

Note. Cells show means (SD’s). Ratings >4 indicate expected uptrends; ratingindicate scores significantly different from 0.

may be seen in Table 1, participants generally expectedcontinuance after updays (ratings >4) and after down-days (ratings <4). To capture a participant’s overall ten-dency to expect continuance, we computed differencescores (upday–downday). As expected, this measure ofcontinuance bias tended to be stronger in the agent-met-aphor condition than in the other two conditions(object-metaphor condition and the non-metaphor con-dition), and these non-agent conditions did not differfrom each other.

Hence, to test hypotheses we pooled the two non-agentic conditions for a 2 · 2 · 2 mixed model ANOVA

format conditions (Study 1)

Difference score

Downdays

Graph Table Graph Table

2.81 3.42 2.51* 1.58*

3.80 3.67 .53 .89

3.83 3.76 .47 .82*

2.26 3.13 3.11* 1.95*

3.06 2.71 1.81* 2.20*

3.12 3.02 1.57* 1.71*

3.22 3.64 1.51* 1.05*

3.73 3.60 .55 .75

3.95 3.60 .42 .93*

s <4 indicate expected downtrends. Asterisks in difference score column

0.00

0.50

1.00

1.50

2.00

2.50

3.00

Agentic Non-agentic

Graph

Table

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

Agentic Non-agentic

Graph

Table

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

Agentic Non-agentic

Graph

Table

A

B

C

Fig. 2. The interactive effect of commentary content (agentic vs. non-agentic) and price information format (graph vs. table) in Study 1. (A)Commentator-focused expectancy rating. (B) Audience-focused expec-tancy rating. (C) Self-focused expectancy rating.

8 M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx

ARTICLE IN PRESS

with repeated measures on the Direction factor. That is,we submitted each of the three expectancy ratings to amodel that crossed Commentary Content (Betweengroups: agentic vs. non-agentic) · Format (Betweengroups: Graph vs. table) · Direction (Within groups:up vs. down) model. The only main effect observedwas that of Direction, which held for the commenta-tor-focused rating F(1,104) = 63.79, p < .001,g2

p ¼ :380, the audience-focused rating F(1,104)= 181.63, p < .05, g2

p ¼ :636 and the self-focused ratingF(1,104) = 45.76, p < .001, g2

p ¼ :306. This pattern indi-cating that ratings were generally higher after updaysthan downdays suggests that participants generallyexpected continuance rather than correction.

The influence of agent metaphors

The first hypothesis, that agent metaphors wouldgive rise to increased continuance expectancies, wastested by the Commentary Content · Direction interac-tion. That is, agentic descriptions of uptrends wereexpected to produce an upward bias and agenticdescriptions of downtrends were expected to producea downward bias. This was significant for the commen-tator-focused rating F(1,104) = 16.06, p < .001,g2

p ¼ :134, the audience-focused rating F(1,104) = 4.89,p < .05, g2

p ¼ :045, and the self-focused ratingF(1,104) = 4.66, p < .05, g2

p ¼ :043. Given the largereffect size for the commentator-focused rating, onemight wonder whether it mediated the effect on theself-focused rating. We followed the Judd, Kenny,and McClelland (2001) for testing mediation in designswith within-groups variables, which involves regressionanalysis on the difference scores that collapse the with-in-groups variable of Direction. Following the standardthree steps (Baron & Kenny, 1986), we regressed ourproposed mediator (commentator-focused score) anddependent variable (self-focused score) on the indepen-dent variables. Commentary content significantly pre-dicted both commentator (B = �2.00, p < .001) andself scores (B = �1.02, p < .001). We then carried outthe third step, regressing the self-focused score on theindependent variables while simultaneously controllingfor the commentator-focused score. Upon doing so,the previously significant effect of commentary contenton self score was reduced to nonsignificance (B = .207,p = .47), whereas the putative mediator (i.e., the com-mentator-focused score) remained significant(B = .613, p < .001). A Sobel test confirmed that theeffect of metaphor type on participants’ self-focusedexpectancy score was significantly reduced when theircommentator-focused expectancy score was enteredinto the model (z = �4.18, p < .001). This suggests thatmetaphoric content strongly influenced participants’perception of the commentator’s views and this ulti-mately influenced their own expectancies about themarket.

The moderating effect of format

The second hypothesis that the influence of agent met-aphors would be diminished when price trend informa-tion was presented numerically rather than graphicallywas tested by the Commentary Content · Direc-tion · Format interaction. The interaction effects weredirectionally present for all three ratings albeit notalways reliably: for the commentator-focused ratingF(1,104) = 3.56, p < .07, g2

p ¼ :033, for the audience-fo-cused rating F(1,104) = 4.89, p < .05, g2

p ¼ :045, and forthe self-focused rating F(1,104) = 1.93, p > .10. To illus-trate the interaction pattern, Fig. 2 shows differencescores (collapsing across Direction to measure overallcontinuance bias) as a function of Commentary Contentand Format. Planned contrasts on the difference scoresconsistently reveal that they are increased by agenticmetaphors in the graph condition (commentator-focusedrating t(1) = 4.57, p < .01; audience-focused ratingt(1) = 3.43, p < .01; and self-focused ratings t(1) = 2.75,

M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx 9

ARTICLE IN PRESS

p < .01), but not the table condition (commentator-fo-cused rating t(1) = 1.39, ns; audience-focused ratingt(1) = 0.00, ns; and self-focused ratings t(1) = .50, ns).

Discussion

Study 1 results support our proposal that commenta-tors’ metaphorical descriptions influence the investoraudience’s metaphorical encodings and ensuing judg-ments. Consistent with the H1, participants exposed toagent-metaphors responded with increased expectanciesthat today’s price trend would continue tomorrow.Moreover, the influence was moderated by the formatin which the price trend was presented to participants.Consistent with H2, there was greater influence in thegraph condition, where price trends were presented asspatial trajectories, than in the table condition, whereprice trends were presented in abstract numbers. Theinteraction effect is important because it cannot beexplained by alternative accounts of the influence ofcommentary content. For instance, if a participant’sresponse reflected a rational signal-reading process, thenit would be present regardless of the format condition.

Given the Study 1 findings that commentators’ meta-phorical descriptions have consequences for their audi-ence’s investment judgments, it is important to knowthe conditions under which commentators are mostlikely to generate certain kinds of metaphors. To theextent that particular kinds of price trends evoke agenticlanguage, these would be conditions where investorsmay be particularly vulnerable to continuance bias.

5 The network described the daily show as, ‘‘CNBC’s signatureevening business newscast live from the floor of the New York StockExchange. ‘Business Center’ co-anchors Sue Herera and Ron Insanareport on breaking news, the latest trends influencing the globaleconomy and review the day’s top business and financial headlines . . .’’The show’s anchors and reporters describe the day’s market activity,making frequent reference to individual stocks as well as the majormarket indices.

Study 2

The second study launched our investigation of theantecedent conditions that evoke agent and object meta-phors. We left the laboratory to study how real markettrends affect real market commentators. Transcripts ofan influential end-of-day television program were readto extract all references (metaphorical or non-metaphori-cal) to the day’s change in the three major market indices(i.e., Dow, Nasdaq, S&P). We sampled a historical period(January–June 2000) in which indices were volatile but notconsistently ascending or descending. Hence, there weremany updays, many downdays, and many sideways days.

We analyzed whether the rates of agent and objectmetaphors depend on features of the daily price trend,specifically its direction and steadiness. Our hypotheses,to review, were that price gain (vs. loss) would be asso-ciated with more agent (and less object) metaphors (H3),and that this relationship would be stronger when thedirectional trend resulted from a steady as opposed toan unsteady trajectory (H4). The steadiness of a trendis a gestalt variable that doesn’t correspond preciselyto any financial metric; however, one partial measure

of steadiness is the price range within the day. To illus-trate, when the daily range exceeds the overall rise orgain, this indicates unsteadiness in addition to the over-all directional trend.

Method

Procedures

Transcripts of the CNBC television program Business

Center were collected for January through June, 2000.This show aired on weeknights after the close of the pri-mary US markets (5 p.m., EST) and provided a reviewof the day’s market activity.5 All sentences or clauseshaving the Dow, Nasdaq, or S&P index as their subjectwere extracted for coding, resulting in a list of 1454descriptions (roughly four mentions per index per day).

A hypothesis-naı̈ve coder worked with the definitionsin Table 2 to sort each description into one of three cat-egories: non-metaphorical (N = 452), object-metaphor(N = 433), and agent-metaphor (N = 569). A secondresearch assistant coded half of the descriptors to checkreliability, yielding a satisfactory 79% agreement rate.

To compute the criterion variables, the number ofagent-, object-, and non-metaphorical descriptions wascounted for each of the 3 indexes for each day. Measuresof the proportional share of the daily description consti-tuted by agent- and object-metaphors, respectively, werecomputed by dividing these counts by the total count ofdescriptions for each index.

The predictor variables for trend direction and trendsteadiness were computed from the daily price informa-tion for each index. Trend direction was measured as thepercentage gain–the difference between an index’s dailyclosing price and that of the prior market day, as a per-centage of the prior closing value. Uptrends have a posi-tive value and downtrends a negative value. A measureof trend steadiness was the range (daily high–low) as apercentage of the prior closing value. Range, controllingfor the daily gain, picks up the degree to which therewere dramatic mid-day movements counter to the mainmovement of the day.

Results

An overview of the findings can be seen in the corre-lations between the financial measures of gain and rangeand the measures of metaphor rates–see Table 3. The

Table 2Content analysis coding scheme (Study 2)

Category Description Example

Non-metaphorical Describes price change as increase/decreaseor as closing up/down

The Dow today ended down almost 165 points, or 1 1/2 percent(May 17, 2000)

Object-causality metaphors Describes movement as trajectory of anobject affected by physical forces such asgravity, resistance, or external pressure

And as for the S&P 500, it also got caught in the downdraft.(February 25, 2000)

Agent-causality metaphors Describes movement as a volitional action The NASDAQ index jumped 122 1/3rd points. (February 10, 2000)

Table 3Correlations of financial measures with rates non-metaphor, object metaphor, and agent metaphor references to market movements (Study 2)

Count measures Proportion measures

Non-metaphor Object metaphor Agent metaphor Non-metaphor Object metaphor Agent metaphor

Overall (n = 348)

Gain .03 �.24** .19** .07 �.33** .27**

Range .18** .33** .32** �.11* .07 .05

Nasdaq (n = 121)

Gain �.03 �.28** .19* .01 �.30** .31**

Range .20* .24** .18* .01 .02 �.03

Dow (n = 120)

Gain .08 �.14 .27** .06 �.32** .24Range .03 .23* .27** �.15 .12 .05

S&P (n = 107)

Gain .24* �.50** .27** .21* �.51** .34**

Range .02 .02 .13 �.02 �.03 .05

Note: Gain measures trend direction and range measures trend variability.* p < .05.

** p < .01.

10 M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx

ARTICLE IN PRESS

overall results, pooling together data from the threemarket indices, appear in the top two rows. Lookingfirst at the raw count measures of commentary rate,we see that gain has the expected differential relation-ships to agent-metaphor rate and object-metaphor rate.Range, on the other hand, has a positive relationship tothe rate of all kinds of commentary (non-metaphoric,object metaphor, and agent metaphor), likely reflectingthat days with a wider range are simply more newswor-thy. Given this pattern, we focused on the proportionalmeasures which tap the relative frequency of particulartypes of commentary. With the proportion measures,the pattern of associations with gain remain the same–positive with agent metaphors, r(348) = .27, p < .01and negative with object metaphors, r(348) = �.33,p < .01. Range, by contrast, is uncorrelated with theproportional rate of agent r(348) = .05, and object met-aphors r(348) = .07. Notice that this configuration ofcorrelations in the overall pooled data is mirrored inthe results for each of the indices separately (Nasdaq,Dow, and S&P).

To test hypotheses, the proportional metaphor rateswere regressed on measures of trend direction (gain),trend unsteadiness (range), and their interaction.Agent-metaphor rate showed a main effect of trend

direction b = .57, p < .001, g2p ¼ :070; no effect of trend

variability b = .07, p < .10, g2p ¼ :004; and an effect of

their interaction b = �.32, p < .01, g2p ¼ :022; R2 = .11,

F(3,344) = 13.59, p < .001. Likewise, object metaphorsshowed a main effect of trend direction b = �.88,p < .001, g2

p ¼ :164; no effect of trend variabilityb = .08, p < .10, g2

p ¼ :007; and an effect of their interac-tion b = .64, p < .001, g2

p ¼ :090; R2 = .19,F(3,344) = 26.46, p < .001. To illustrate the interactioneffects, Fig. 3 plots metaphor rates for two sub-groups—updays (days that closed more than 1% up)vs. downdays (days that closed more than 1% down)as a function of unsteadiness (plotted at 1 SD belowand above the mean). As expected, the effect is an atten-uation of the difference between updays vs. downdays athigher levels of trend unsteadiness.

Discussion

Study 2 results showed that rates of agent and objectmetaphors in market commentary depend on the overalldirection of the daily trend (H3). Also, this effect oftrend direction was clearer when the trend was steadyas opposed to unsteady (H4). Hence the two hypotheseswere supported.

0

0.1

0.2

0.3

0.4

0.5

0.6

Agent metaphor

rate

Unsteadiness(SDs from mean)

+1-1

Down-days

Up-days

0

0.1

0.2

0.3

0.4

0.5

0.6

Object metaphor

rate

Unsteadiness(SDs from mean)

+1-1

Down-days

Up-days

Fig. 3. The interactive effect of trend direction and trend steadiness inStudy 2.

M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx 11

ARTICLE IN PRESS

However, alternative explanations for the main effectof direction can be raised. A critic might point out thatthe period sampled directly followed the greatest bullmarket in history; commentators conditioned by thisrecent experience may have had bullish expectations.Assuming that commentators have such time-laggedexpectations, agent metaphors may have been producedin response to updays simply because these days corre-sponded to commentators’ expectations, not becauseof anything inherent about upward trends. In our nextstudy we test this argument by sampling a later histori-cal period when time-lagged expectations would havebeen less bullish than in the period sampled in Study 2.

Study 3

Study 3 replicated the basic method of Study 2, yet inthe aftermath of bear rather than bull markets. Rates ofagent and object metaphors were tallied and regressedon the two general measures of price change–directionand steadiness—to test our hypotheses. Additionally,we explored more fine-grained relationships in thedependence of metaphors on trajectories. Agent andobject metaphors were divided into more fine-grainedcategories corresponding to frequently used verbs suchas ‘‘climbing,’’ ‘‘struggling,’’ ‘‘falling’’ and ‘‘bouncing.’’Also, price trajectories were coded into more specificpatterns than updays and downdays based on theirqualitative shapes on intraday price charts.

Method

Procedures

As in Study 2, electronic transcripts of CNBC Busi-

ness Center were collected, in this case for October 30,2000 through January 31, 2001. This yielded 774descriptions of the Nasdaq, Dow, and S&P 500 indices.Gain and range were computed from financial informa-tion as general measures of trajectory direction and var-iability. There was no overall direction of gain or loss inthe sample (average daily gain percentage for the threeindices was X = �0.0003, SD = 0.0265, n = 171).Descriptions were categorized at the general level asagent-metaphors (268), object-metaphors (150), ornon-metaphors (356) by a research assistant. An inde-pendent coding by another hypothesis-naı̈ve researchassistant on a randomly selected sample of one-fourthof these descriptions showed adequate reliability (84%agreement).

To explore more detailed patterns, the predictor var-iable of price trajectory was then coded at the level of 8prototypical trajectory types from intraday price chartsof each index (these were collected each business dayfrom www.BigCharts.com, though a few days are miss-ing due to clerical errors). Coders sorted charts into 8categories relying on a verbal definition as well assketches of stylized prototypes. Charts showing a salientprice change were categorized in terms of direction andsteadiness, resulting in the categories of steady upwards,unsteady upwards, steady downwards, and unsteadydownwards (these four types appear in the upper panelof Table 4). Charts without a salient directional changewere categorized into four types (shown in the lowerpanel of Table 4): calm (a relatively flat trend), chaotic(a trend with swings in both directions), fall-and-rise(a trend with one salient valley), and rise-and-fall (atrend with one salient peak). An independent hypothe-sis-naı̈ve coder coded a randomly selected third of thecharts, and the reliability was adequate (kappa = .76).

The criterion measures of metaphor rate were alsocoded at a more fine-grained level—subtypes of verbsrather than the general agent vs. object categories. Meta-phoric descriptions were tallied in terms of an emergentcoding scheme developed to capture different subtypesof agent and object metaphors. Each description was cod-ed as to which of the following verbs it most closelyresembled: jumped, climbed, struggled, rallied, followed,tested, edged, recovered, fell, slipped, tumbled, skidded,bounced, and reversed. An independent coding by anoth-er hypothesis-naı̈ve research assistant on half the descrip-tions showed adequate reliability (kappa = .82).

Results

The first purpose of Study 3 was to check whether theresults of Study 2 could be replicated in a different histor-

Table 4Most frequent verb subtypes evoked as a function of coded trajectory patterns (Study 3)

Visual prototype 1st 2nd 3rd

Price-change patterns (n = 92)

Steady uptrend Jumped 12.4% Climbed 10.0% Recovered 5.2%

Unsteady uptrend Climbed 9.9% Jumped 8.1% Rallied 7.6%

Steady downtrend Fell 31.4% Tumbled 16.0% Slipped 2.4%

Unsteady downtrend Fell 21.0% Tumbled 12.5% Struggled 4.7%

Non-change patterns (n = 92)

Calm Slipped 30.0% Followed 11.1% Climbed 11.1%

Chaotic Fell 10.7% Edged 9.8% Struggled 7.2%

Fall-and-rise Skidded 10.0% Fell 8.6% Bounced 7.1%

Rise-and-fall Slipped 12.0% Edged 7.6% Jumped 6.0%

12 M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx

ARTICLE IN PRESS

ical period. To this end, measures of the proportionalrate of agent and object metaphors were regressed ongain, range, and their interaction. For agent metaphors,there was as expected an effect of gain, b = .33, p < .05,g2

p ¼ :031; no effect of range, b = .067, p > .10; and theinteraction effect fell short of significance, b = �.23,p > .10; R2 = .035, F(2,167) = 2.03, p > .10. For objectmetaphors, results showed the expected an effect of gain,b = �.62, p < .01, g2

p ¼ :108; no effect of range, b = �.04,p > .10; and the expected interaction effect b = .414,p < .01, g2

p ¼ :046; R2 = .126, F(3,167) = 8.06, p < .01.In sum, there was strong support for the main effectand mixed support for the interaction effect hypotheses.

We also explored the relationship between price tra-jectories and metaphorical verbs at a more fine grainedlevel. Table 4 shows the most prevalent verbs evokedby each of the 8 trajectory types. In the top panel, manyof the most prevalent verbs are identical to those in theWSJ descriptions of major uptrends and downtrendsthat we listed from Andreassen’s (1987, pilot study) data.These epitomize our two types—actions by an agent(‘‘jumped’’ and ‘‘climbed’’) and object movements dic-tated by external forces such as gravity and resistance(‘‘fell’’ and ‘‘dropped’’). Not surprisingly, different verbsare evoked by the sideway trends in the lower panel,which seem to express primarily horizontal movement(e.g. ‘‘edged’’ or ‘‘skidded’’). Another type in both panelsseem to be verbs that describe tension between an agent’sinternal goals and external forces (e.g. ‘‘struggled’’ and‘‘rallied’’). Though the Ns are too small for significancetesting, these seem to be evoked by unsteady trajectories.

Discussion

Study 3 replicated the key main effect, that price gainis associated positively with agent-causality metaphorsand negatively with object-causality metaphors. The factthat these results were replicated in a historical period

following a sustained market downturn weighs againstthe alternative account in terms of commentators’ bull-ish expectations.

Finally, the interaction-effect involving unsteadinessfell short of significance on one of the two metaphor ratemeasures. The mixed results may reflect the fact that ourmeasure (range) captures only part of the overall gestaltof steadiness. Our final study was a laboratory experi-ment in which we could manipulate trend steadiness(rather than measuring it) to gain a clearer identificationof the effects.

Study 4

Our final study put student participants in the role ofstock market commentators. They were shown a seriesof charts representing daily trajectories of a marketindex, and they were asked to describe each day’s pricemovements into a microphone, descriptions that werecoded for metaphorical content. Later, participants rat-ed the metaphorical content of their descriptions. With-in the series of charts, trend direction and steadinesswere varied as within-groups manipulations.

A between-groups condition was introduced to testanother alternative interpretation of the direction effect.Motivated reasoning research suggests that people tendto apply a given schema to a problem if it supports theconclusions that they want to reach (Kunda, 1990). Ifcommentators generally wish for market uptrends, thenthey would be motivated to infer trend continuance afterupdays but not downdays. If so, our effect could reflectthat commentators apply action schemas to trends as afunction of whether the trends are desirable, and trenddirection is not the key factor. To investigate this, we var-ied the labeling of the charts across condition so that uptr-ends were clearly desirable for participants in onecondition and undesirable for them in the other condition.

M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx 13

ARTICLE IN PRESS

Method

Participants

Participants were 70 undergraduates at Stanford Uni-versity recruited by an offer of $10 to participate in ahalf-hour study concerning judgments about financialmarkets. They were run one at a time. Advertisementsemphasized that no expertise with financial marketswas required.

Procedure

Participants were told that they would be shown chartsof the intraday activity of a market index. The cover storydescribing the market index was varied between-groups.In the uptrend-desirable condition, participants were toldthey would see charts of the Nasdaq index, an indicator ofthe local (Silicon Valley) job market. In the uptrend-unde-sirable condition, participants were told they would seecharts of the ‘‘California Energy Futures index’’ index,an indicator of the energy shortages and blackouts thathad been recently hindering the region. Participants wereasked to paraphrase back the instructions, and they allcomprehended the valence of uptrends as opposed todowntrends in the two conditions.

The charts were presented to participants in bookletswith a separate page for each chart. Charts were labeledon the y-axis in terms of percent gain or loss and on thex-axis in terms of half-hours from 9:30 a.m. to 4:00 p.m.The charts were enumerated cryptically (e.g. Day #112,Day #37) and randomly ordered. The 5 charts weredesigned to represent the trend prototypes that wereferred to in the preceding study as steady-uptrend,unsteady-uptrend, steady-downtrend, unsteady down-trend, and chaotic. The goal was to test hypotheses con-cerning direction and variability, and the chaotic patternwas included as filler. The four focal charts were createdby starting with graphs of steady and unsteady decreas-es, then creating mirror images, and then slightly adjust-ing the mirror images so that the reversal was notobvious. The 5 were put in a random ordering: Half ofsubjects saw the graphs in this order and half in thereverse of this order. Upon being presented with thebooklet, subjects were asked to read the followinginstructions, which appeared on the cover-sheet of thebooklet:

These are charts of the Nasdaq (Energy Futures) index

activity on 5 days we’ve selected. For each chart we want

you to give an off-the-cuff description or interpretation of

the activity, as though you were describing it on the phone

at the end of the day to a group of friends.

Participants were then given a few minutes to studyeach chart, after which they spoke their description intoa microphone. These descriptions were tape recorded, sothat they could be later transcribed and contentanalyzed.

Once participants had finished describing the marketactivity for the five days, they were given a question-naire. On its 5 pages the graphs were repeated, alongwith several verb phrases describing the market index’sactivity. Participants were told that their task was to ratethe extent to which each captured their interpretation ofthe activity. Most important was a rating of agenticimpression; the extent to which they interpreted thatthe market was trying to do something.

Also there were specific items that varied for uptrendsas opposed to downtrends. These were used to explorewhether steadiness affects the metaphor subtypesevoked. The uptrend list included two of the most preva-lent uptrend verbs from Study 3, ‘‘jumped’’ and‘‘climbed.’’ Also we included one expected to be trig-gered with steady uptrends, ‘‘thrust,’’ and one expectedto be triggered with unsteady uptrends, ‘‘wandered.’’Likewise, the downtrend list included two prevalentverbs from Study 3, ‘‘fell’’ and ‘‘tumbled,’’ as well asone expected with steady downtrends, ‘‘dove,’’ andone expected with unsteady downtrends, ‘‘searched.’’Participants rated the extent to which each phraseresembled their interpretations on a 7-point scale(1 = not at all; 7 = very much).

Content analysis

Tapes of participants’ market commentary were tran-scribed. The overall description of each price chart wasrated by two hypothesis-naı̈ve graduate student coderson several abstract dimensions. Coders worked withthe paragraph-long transcriptions for each day’sdescription, without seeing the original charts. Unlikethe pithy phrases of market journalists (‘‘the Nasdaqjumped mid-day’’), participants rambled on in adjectivesand similes (e.g. ‘‘in the morning the Nasdaq was mel-low but then started some crazy surges . . .’’). To assessagentic description, coders rated the extent to whichthe market movement was described as active and inter-nally-driven. The agentic pole of the scale was illustratedby ‘‘the market climbed upwards,’’ whereas the non-agentic pole was illustrated by ‘‘the market was sweptupwards.’’ Also, to check an alternative account, codersrated the degree to which the market movement wasdescribed as dramatic or extreme.

Results

There were two sets of dependent measures—tran-script codings and participants’ scale-ratings. Thehypotheses were tested in a MANOVA with Direction(2: uptrend, downtrend) and Steadiness (2: steady,unsteady) as within-participants factors and Valence(2: uptrend-desirable, uptrend-undesirable) as abetween-participants factor. Overall, the results fit ourpredictions. There was a main effect of Direction andan interaction effect of Direction · Steadiness. More-

Fig. 4. Self-rated degree of agentic description as a function of trenddirection and steadiness in Study 4.

Table 6Endorsement of verbs as a function of trend steadiness (Study 4)

Trend steadiness

Steady Unsteady

Uptrend verbs

Jumped 3.09 3.00Climbed 3.43 4.29***

Thrusted 5.56 4.72***

Wandered 3.03 3.71**

Downtrend verbs

Fell 3.15 2.24***

Tumbled 3.48 3.34

Dove 3.22 2.65***

Searched 2.22 2.74***

Note: *p < .05, **p < .01, ***p < .005.

14 M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx

ARTICLE IN PRESS

over, no there were no effects of the Valencemanipulation.

The coded measures may be seen in Table 5. Foragentic description, there was a main effect of Direction,F(1,57) = 50.07, p < .001, g2

p ¼ :468, reflecting moreagentic description of uptrends M = 2.71 than downtr-ends M = 1.49. Agentic description also showed aninteraction of Direction · Steadiness F(1,57) = 11.799,p < .001, g2

p ¼ :171, reflecting that the difference betweenuptrends and downtrends was attenuated in theunsteady conditions relative to steady conditions. Fordramatic description, there were no effects of Direction,Steadiness, or their interaction. This suggests that theeffects on agentic descriptions are not simply a functionof which trajectories appear to be dramatic trends to thecommentators.

Turning to the scale-rating measures, the most impor-tant one was a general measure of agentic description.There was a main effect of Direction, F(1,57) = 116.05,p < .001, g2

p ¼ :671, and an interaction of Direc-tion · Steadiness, F(1,57) = 16.74, p < .001, g2

p ¼ :227.The MANOVA means are plotted in Fig. 4. Again wesee that uptrends were described more agentically thandowntrends and this effect was attenuated under thecondition of unsteadiness.

In addition to testing our hypotheses about generaltrajectory cues and agentic description, we also exploredpatterns at a more fine-grained level by asking partici-pants to rate the extent to which several specific verbscorresponded to their description. The means from theseratings may be seen in Table 6. For updays, ‘‘jumped’’was endorsed equally for the two trend directions.‘‘Climbed’’ was rated higher for unsteady than steadytrends, perhaps because it calls to mind traversing anuneven surface. As expected, ‘‘thrusted’’ upward wasendorsed more for the steady trend and ‘‘wandered’’upward for the unsteady trend. For downdays, ‘‘fell’’was endorsed more for steady trends but ‘‘tumbled’’was not. As expected, ‘‘dove’’ was endorsed more forthe steady trend and ‘‘searched’’ for the unsteady trend.In sum, these exploratory results suggest that distinctsubtypes of agent and object schemas may be evokedby steady and unsteady trajectories.

Table 5Transcript codings as a function of trend direction, steadiness, and valence

Valence condition Within-

Uptren

Steady

How agentic was the description?

Uptrend-desirable (‘‘Nasdaq Index’’) N = 39 2.94Uptrend-undesirable (‘‘Energy Futures Index) N = 19 2.67

How dramatic was the description?

Uptrend-desirable (‘‘Nasdaq Index’’) N = 39 3.37Uptrend-undesirable (‘‘Energy Futures Index) N = 19 3.22

Discussion

Results of Study 4 supported our hypotheses aboutthe preconditions of agent metaphors. Coded measuresfrom transcripts and participants’ scale ratings showedthe predicted main effect of trend Direction and the pre-dicted Direction · Steadiness interaction effect. Theselaboratory findings complement the early findings fromarchival analysis of field data.

Also Study 4 results ruled out two alternative expla-nations: that agentic descriptions are evoked by trendscongruent with motives, and that agentic description

condition (Study 4)

groups factors

d Downtrend

Unsteady Steady Unsteady

2.71 1.29 1.632.39 1.28 1.50

3.37 3.54 3.293.28 3.22 3.78

M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx 15

ARTICLE IN PRESS

are evoked by trends that are perceived to be dramatic.An experimental manipulation of the valence of uptr-ends had no effect on the rate of agentic description. Ameasure of dramatic description did not show effectsparallel to the measure of agentic description.

Finally, Study 4 explored differences in the verbs pre-ferred for steady vs. unsteady trends. Results were con-sistent with our intuitive predictions about verbs that fitsteady vs. unsteady downtrends and uptrends. Com-pared with steady trends, unsteady trends may be morelikely to evoke agentic verbs that posit complex forces ortensions between forces. Yet these findings are merelysuggestive; a systematic analysis of the verb subtypesassociated with steady and unsteady trajectories is a pro-ject for future research.

General discussion

In four studies we have found support for ourhypotheses concerning consequences and preconditionsof metaphors in stock commentary. Study 1 found, con-sistent with H1, that agent-metaphor commentaryincreased investor expectancies of trend continuance.Further, consistent with H2, the influence was strongerwhen price information was presented in graph ratherthan table format. Although alternative accounts maybe posited for the main effect of commentary content,only the metaphorical encoding account can explainwhy the influence is stronger in the graph than tablecondition.

The preconditions we investigated were features ofintraday price trajectories. Consistent with H3, wefound that agent metaphors occur more frequently indescriptions of updays than downdays. This held in ananalysis of CNBC transcripts from two time periods,following a bull market (Study 2) and a bear marketperiod (Study 3). It also held in an experiment that mea-sured commentaries of laboratory participants inresponse to manipulated trajectories (Study 4).

Finally there was mixed evidence for H4, that theeffect of direction would be attenuated when the trendis unsteady as opposed to steady. Unsteady trajectoriesinclude minor movements opposite to the overall direc-tion and hence send a mixed signal about animacy. Sup-port for this interaction effect was attained in our CNBCstudies (Study 2 and 3), significantly so in three of fourtests. The laboratory experiment (Study 4) used a moredirect manipulation of trend steadiness and found thepredicted interaction effect on both transcript-codedand self-rated measures of agentic interpretation (Study4).

Overall, the current studies found strong evidence forthe main effect hypotheses (H1 and H3). The evidencefor the interaction effect hypotheses (H2 and H4) wasless consistent across measures, and so further research

is necessary to explore these effects. To better under-stand the issue of boundary conditions on metaphoricencoding (H2), future studies could compare the con-ventional chart and tabular formats to other formatsfor presenting price trend information, such as horizon-tal bar graphs. Metaphorical encoding should be facili-tated only by graph formats that represent pricemovements as paths through a Euclidean space in whichhigher points correspond to higher prices.

Similarly, to explore the interactive effect of trendunsteadiness (H4), future experiments could examinedifferent components of unsteadiness to determinewhether one of them is most crucial in moderating theeffect of direction. We have defined unsteadiness as agestalt property–the degree to which there are salientreversals from the primary direction of a trend. It maybe that unsteadiness could be defined more objectivelyin terms of a combination of underlying features, suchas the number and magnitude of directional reversals.Future research focusing on these subfeatures mayenable a more precise understanding of the interactioneffect. In sum, trend steadiness should be regarded as aprovisional construct that may be refined or replacedin subsequent research.

Implications for the metaphor literature

The current findings contribute evidence for the ubiq-uity of metaphor in cognition and communication (Lak-off, 1993). The prevalence of metaphor in our studies isall the more striking considering that it is seen in com-munication about the stock market. Compared todomains like love in which metaphoric processing hasbeen previously studied (Gibbs, 1992), the stock marketis one where communicators strive for practical preci-sion rather than inspiring poetry. It also striking thatthe same types of metaphors are used by professionalcommentators (Studies 2 and 3) as well as novices (Stud-ies 4).

Yet more important than documenting the preva-lence of agent and object metaphors, the current studiesdemonstrate that these kinds of metaphors are evokedsystematically by specific types of price trends. As pre-dicted from the premise that trajectory-triggered sche-mas are involved, agent metaphors are evoked moreby uptrends, and object metaphors by downtrends.Our studies rule out a number of alternative interpreta-tions of the agent-uptrend link, such as that uptrends aremore expected, more desired, or more dramatic in theeyes of commentators. The interaction of direction andsteadiness, reflecting that the impact of vertical directionis stronger for steady as opposed to unsteady trends,provides further support for our interpretation. Notonly is this the first evidence about the eliciting condi-tions for stock market metaphors, it is the first evidence(to our knowledge) about stimulus conditions for meta-

16 M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx

ARTICLE IN PRESS

phors in any domain. Past metaphor research has beenrooted in linguistics, and so the issue of metaphor evo-cation has remained relatively unexplored.

Our findings concerning preconditions support the‘‘embodied cognition’’ view that metaphoric processinginvolves cannibalizing innate perceptually rooted sche-mas for conceptual tasks (Barsalou, 1999). Dennett(1995) argues this is a critical aspect of human cognition;only through ‘‘recycling’’ perceptual schemas that weovercome the ‘‘representational bottlenecks’’ that other-wise would limit our ability to model new domains.More specifically, cognitive theorists in several disci-plines (Boyer, 2001; Wegner, 2002) have argued thatpeople’s tendency toward anthropomorphic thinkingabout complex systems–such as the weather, the super-natural, and computers—reflects our application of thesame schemas we use to interpret personal actions. Yetthere has been little direct evidence. The current resultsconcerning trajectory features provide more direct evi-dence that perceptually rooted schemas underlie anthro-pomorphic metaphors.

This view does not assume that commentators con-sciously decide to cannibalize their action schemas pri-marily for market uptrends and their object schemasprimarily for downtrends. Rather two kinds of schemasare simply triggered by different stimulus features andcommentators apply whatever schemas have been trig-gered. An interesting issue, however, is the extent towhich the pattern is reinforced by the structure of theEnglish language itself or, at least, of contemporaryAmerican habits of speech. There may simply be moreagentic phrases for uptrends than downtrends in use.If so, then the agentic-uptrend correlation would beexhibited by commentators who just sample expressionsat random from the language or its stock of commonexpressions. To investigate the extent to which the asym-metry in commentators’ metaphors for uptrends vs.downtrends depends on trajectory perception or on lin-guistic sampling, future research could introduce manip-ulations of price information format (like that used inStudy 1) to the experimental paradigm used in Study 4.

A related question is whether metaphors producedmerely by parroting common expressions are ‘‘dead’’metaphors. Commentators may get so accustomed tohearing of ‘‘100-point leaps’’ that they form a conceptfor market leaps that is detached from their originalconcept for leaps and their broader schema for agenticaction. In such cases, it may be that commentators arenot mentally encoding the event metaphorically, justtalking in terms that originated in other domains. Thiscould be tested by examining whether such expressionsprime action schemas for financial commentators. Yeteven whether there is not metaphoric encoding underly-ing commentators’ metaphorical words, these wordsmay still strongly affect their audience. As Sartre said,‘‘Words are loaded pistols.’’ Speakers may offer them

merely as stylistic ornaments, but their audiences canstill get hurt. Particularly when experienced commenta-tors speak to naı̈ve investors, the speaker’s dead meta-phors may be metaphors the audience lives by, orinvests by.

Implications for investor judgment and decision making

The current research also contributes to the literatureexamining the content of stock market commentary andits influence on investor judgment. Andreassen (1987)found that pairing price change with explanatory refer-ences to news about business conditions leads investorsto expect continuance. DiFonzo and Bordia (1997,2002) found the same with explanatory references torumors. The current findings are more surprising in thatexpectancies are conveyed even when commentatorshave made no explanatory reference to plausibly causalbusiness conditions. Just describing price changes agen-tically (without explaining them) leads investors tobiased judgments about tomorrow’s trends.

A question for future research on judgment iswhether this bias would occur as much among expertsas among novices? Expert investors, who hold moreelaborated rules for making market judgments basedon quantitative indicators, may have an easier time sup-pressing their action schemas when exposed to agenticmetaphors. That is, experts may be better at ‘‘inhibitionof the literal’’ (Galinsky & Glucksberg, 2000). So thebiases ensuing from media metaphors may chiefly afflict‘‘Main Street’’ rather Wall Street investors. Yet somerecent findings reveal that even expert investors thinkof market sectors in terms of anthropomorphic imagery.MacGregor, Slovic, Dreman, and Berry (2000) foundthat measures of investors’ anthropomorphic imageryconcerning market sectors predicted their willingnessto invest even after measures of their quantitativeassumptions about financial issues were taken intoaccount. Hence the question of whether experts are sus-ceptible warrants empirical exploration.

The current findings are relevant to the debate inbehavioral economics over whether markets under-reactor over-react to recent price directions. Analyses ofsome markets show an over-reaction bias, consistentwith investors over-predicting continuance from the pasttrend (Offerman & Sonnemans, 2004). Yet there is also,in other cases, evidence for under-reaction (Forbes,1996). The current research suggests that one source ofover-reaction is interpretation in terms of agentic sche-mas. To the extent that different causal schemas are pre-valent or highly accessible in different financialcommunities, this may help to explain differences inreaction to price trends.

A related question is how precisely investors’ judg-ments about future trends determine their buy and selldecisions. Though obviously uptrend expectations gen-

M.W. Morris et al. / Organizational Behavior and Human Decision Processes xxx (2006) xxx–xxx 17

ARTICLE IN PRESS

erally lead to buying and downtrend expectations to sell-ing, other factors also come into play. For instance, the‘‘disposition effect’’ refers to a reluctance to sell ‘‘losing’’stocks but not ‘‘winning’’ stocks, independent of expect-ed future trends. Weber and Camerer (1998) found thatthat this comes from investors using their purchase priceas a reference point, then gambling on losses whileavoiding risk on gains. Hence, the relationship betweenuptrend expectancies and buy decisions may be weakerwhen purchase prices are salient.