Market Report - Cushman & Wakefield/media/reports/united... · 2011 2012 2013 2014 2015 2016 2017...

Transcript of Market Report - Cushman & Wakefield/media/reports/united... · 2011 2012 2013 2014 2015 2016 2017...

cushmanwakefield.com

Market ReportNorthern Virginia | 2nd Quarter 2017

Cushman & Wakefield | 2

DC Metropolitan Area Overview..............................................................................3

Northern Virginia & Map........................................................................................4-6

Alexandria ........................................................................................................................7

RB Corridor.......................................................................................................................8

Crystal City/Pentagon City .......................................................................................9

Tysons Corner....................... .......................................................................................10

Reston/Herndon ...........................................................................................................11

50-66.................................................................................................................................12

Route 28 South/Chantilly..........................................................................................13

Loudoun County ..........................................................................................................14

Appendix..........................................................................................................................15

Tables..........................................................................................................................15-24

Methodology & Definitions......................................................................................25

About Cushman & Wakefield.................................................................................26

Contents

cushmanwakefield.com | 3

Washington, DC Metropolitan Area

WASHINGTON, DC METRO

Economic IndicatorsQ2 16 Q2 17 12-Month

Forecast

DC Metro Employment 3.23M 3.28M

DC Metro Unemployment 3.8% 3.6%

U.S. Unemployment 4.9% 4.4%

Market IndicatorsQ2 16 Q2 17 12-Month

Forecast

Overall Vacancy 17.9% 17.5%

Net Absorption 830K 600K

Under Construction 6.76M 9.79M

Deliveries 2.19M 432K

Average Asking Rent (FS) $36.19 $39.63

Continued Musical ChairsFollowing a record start in the first quarter of the year, the Washington, DC metropolitan region’s (DC Metro) economy continued to grow in the second quarter of 2017. The Bureau of Labor Statistics (BLS) reported nearly 20,000 net new jobs from January through June 2017, and will easily surpass the Washington region’s historical average of 36,000 annual net new jobs. Cushman & Wakefield forecasts an annualized 52,000 net new nonfarm jobs by year-end 2017. Suburban Maryland led the region with 10.100 net new jobs since January, 1,480 of which were in the office-using sectors, followed by Northern Virginia, which recorded 6,100 net new jobs (2,000 in office -using sectors) and Washington, DC with 3,400 net new jobs (with office-using employment contracting by 500 jobs.). Overall, education and healthcare, retail, construction, and professional and business services lead job growth with 12,580, 5,315, 2,870, and 2,610 jobs, respectively.

Across the region, the headline-making story has been the development pipeline. With a wave of construction expected to kick-off in downtown Bethesda, and new and renovated development already well-underway in the District of Columbia and Northern Virginia, the development pipeline is expected to bring a total of 15.0 million square feet (msf) of Class A product to the DC Metro by 2021. At the close of the second quarter, 44.4% of the pipeline was preleased, leaving a number of large blocks available for tenants. The overall vacancy rate for existing product in the DC Metro area closed the second quarter of 2017 at 18.1%, which is expected to continue to climb as new product is delivered to the market.

While the bulk of new leasing activity was comprised of existing tenants shifting within the market, the DC Metro did have a number of green shoots during the first half of 2017, particularly from non-traditional office users. Marriott officially executed its lease to relocate the hotelier’s headquarters to 7750 Wisconsin Avenue in downtown Bethesda. Nestle’s announced plans to relocate its headquarters from California to Northern Virginia and its subsequent expansion, has helped to chip away at vacancy in Rosslyn . In the District of Columbia, a confidential technology firm committed to nearly 74,000 square feet (sf) at Terrell Square (575 7th Street, NW), expanding the company’s existing footprint in DC by nearly 20,000 square feet (sf). Overall, new leasing activity for the DC Metro closed the quarter at 6.4 msf of year-to-date leasing, the bulk of which occurred in the District of Columbia (3.0 msf), followed by Northern Virginia (2.4 msf), and then Suburban Maryland (1.0 msf).

For the region, year-to-date net absorption remained positive for the DC Metro region, though down from the second quarter of 2016. Overall net absorption for the first half of 2017 closed the second quarter of 2017 at 600,401 sf, a 26.9% decline since the same period last year as tenants continue to seek out efficiencies on their relocations.

Though year-over-year absorption slipped and long-term vacancy rates are expected to rise, asking rents continued to hold across the region and were bolstered as landlords continued to offer peak concession rates in a bid to incentivize tenant relocations in lieu of dropping rates. On average, tenants can expect to receive an average of 1 month abatement per year of term, and generous tenant improvement allowances across the DC Metro. With the wave of deliveries expected to hit the market, landlords are expected to continue to face stiff competition as tenants continue their flight to quality and efficiency in a round of musical chairs.

Net Absorption/Asking Rent 4Q TRAILING AVERAGE

Washington, DC Metropolitan Area NET ABSORPTION - DELIVERIES - VACANCY

0%

4%

8%

12%

16%

20%

-6

-4

-2

0

2

4

6

8

10

05 06 07 08 09 10 11 12 13 14 15 16 17

Vac

ancy

Rat

e

MS

F

Net Absorption Deliveries Vacancy Rate

$36

$37

$37

$38

$38

$39

$39

-1,000-800-600-400-200

0200400600800

1,0001,2001,400

2011 2012 2013 2014 2015 2016 2017

Net Absorption, SF (thousands) Asking Rent, $ PSF

Cushman & Wakefield | 4

Northern Virginia

Overall Vacancy

Large Blocks of Contiguous Space

Net Absorption/Asking Rent 4Q TRAILING AVERAGE

$28

$29

$30

$31

$32

$33

$34

-800

-600

-400

-200

0

200

400

2011 2012 2013 2014 2015 2016 2017Net Absorption, SF (thousands) Asking Rent, $ PSF

Market IndicatorsQ2 16 Q2 17 12-Month

Forecast

Overall Vacancy 21.60% 20.80%

Net Absorption 371k 650k

Under Construction 3.1M 4.7M

Deliveries 160K 0K

Average Asking Rent $32.70 $32.16

10%

12%

14%

16%

18%

20%

22%

24%

2011 2012 2013 2014 2015 2016 2017

0 20 40 60 80

Alexandria

Arlington

Tysons Corner

Reston/Herndon

50/66

Springfield/Newington

Route 28 South

Loudoun County

# of Blocks

25-50k SF

50-100k SF

100-150k SF

150-200k SF

200k+ SF

EconomyThe Washington, DC metropolitan region continues to experience strong job growth, adding a total of 50,100 net new nonfarm payroll jobs between May 2016 and May 2017 . Northern Virginia (NoVA) accounted for 20,400 of those new jobs – 41% of the total. In addition, 69% of the office-using employment growth in the region – 11,840 of 17,190 total jobs – took place in Northern Virginia.

Market OverviewThanks to 650,000 SF of absorption in Q2 2017 – NoVA’s largest quarterly figure in over five years – the market’s vacancy rate dipped to 20.8%. That is the lowest vacancy rate since the third quarter of 2014. Its impact has been felt across the office spectrum as all three building classes saw vacancies decrease over the past few years. Class A product alone experienced 425,472 SF of absorption in the second quarter, and currently maintains a 19.0% vacancy rate.

Positive absorption for the quarter can be attributed to a number of large move-ins: Ellucian, CDW, and Volkswagen occupied a combined 160,000 SF at 2003 Edmund Halley Drive; Applied Predictive moved into 98,000 SF at 4250 North Fairfax Drive; and WeWork took 92,000 SF at 1775 Tysons Boulevard. Rental rates for all classes have remained relatively unchanged over the past few years, as the decrease in rates due to lease-up of expensive Class A and new construction product counteracts rent increases in Silver Line hot spots and in certain Rosslyn-Ballston Corridor buildings.

Nestle’s market-moving 206,000-SF first-quarter 2017 lease was bested in the second quarter by Amazon Web Services’ (AWS)* 400,000-SF blockbuster deal at 13200 Woodland Park in Herndon—space formerly occupied by Booz Allen Hamilton. This deal represents significant net new growth in the Toll Road market, as AWS augments its current 230,000-SF footprint at 12900 Worldgate Drive. AWS and its Fortune 12 tech-company parent have been active in the data center space in Loudoun County, but the new deal signals a desire to bolster AWS’s digital presence with a physical one. Renewals again figured prominently in the second quarter of 2017, accounting for 12 of the top 15 leases of the quarter, with contractors and GSA users accounting for the top ten renewals.

No new buildings broke ground or were completed in the second quarter, as delivery of Marymount’s project at 1000 North Glebe Road was pushed back to the third quarter of this year. With the number of large blocks decreasing in Silver Line-walkable buildings, the build-versus-hold debate may be hitting a tipping point.

OutlookAWS’s 400,000-SF lease in Herndon represents the largest private-sector deal in a non-owner-occupied building since CEB Inc. signed for 625,000 SF in Rosslyn’s Waterview building in 2004. A recent expansion by another West Coast tech behemoth in downtown Washington, DC represents an increase in the industry’s ties to government and growing lobbying activities, and a handful of additional well-known technology firms are in the market for the first time. Northern Virginia’s formula of highly educated workers, pro-business policies, and affordable real estate compared to tech hubs San Francisco, Boston, and New York, may further accelerate this tech industry growth, bolstered by potential contract dollars related to the upgrade of legacy federal computer systems.

*According to public media reports

cushmanwakefield.com | 5

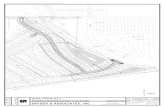

Northern Virginia Office SubmarketsNorthern Virginia Office Submarkets

HERNDON

RESTON

LOUDOUN

AL GONK IAN PARKWAY

LOUDO

UN COU

NTY

FAIR

FAX

COUN

TY

POTOMACRIVER

MARYL

AND

DISTR

ICT OF

COLU

MBIA

VIRGINIA

VIRGINIA

MARYLAND

WASHINGTONDULLES

INTERNATIONALAIRPORT

395

95

123

123

7

7

29

1

29

29

50

50

50 50

236

28

28

FAIRFAX COUNTYPRINCE WILLIAM COUNTY

ARLINGTO

N COUNTY

FAIRFA

X COUNTY

VIENNA

RONALDREAGAN

WASHINGTON NATIONALAIRPORT

495

66

metro

metro

metro

metro

metro

6666

metro

PENTAGON

COURT HOUSE

CLARENDON

BALLSTONVIRGINIA SQUARE - GMU

metro

KING STREET

metro

metro

metro

metro

ROSSLYN

metro

metro

metro

286

267

495

metro

metrometrometro

267

267metro

metro

metro

286

metro

WASHINGTON, DC

FAIRFAX COUNTY

LOUDOUN COUNTY

PRINCE WILLIAM COUNTY

ARLINGTON COUNTY

metro

metro

metro

metro

FRANCONIA/SPRINGFIELD

VAN DORNSTREET

EISENHOWERAVENUE

EAST FALLSCHURCH

WEST FALLSCHURCH

DUNN LORING/MERRIFIELD

TYSONSCORNER

SPRINGHILL

WIEHLE - RESTONEAST

RESTON TOWNCENTER

HERNDON

PHASE I

INNOVATIONCENTER

DULLESAIRPORT

ROUTE 606

ROUTE772

PHASE II2016

MCLEANGREENSBORO

NATIONALAIRPORT

MARYLAND

CRYSTAL CITY

OLD TOWNALEXANDRIA

TYSONS

MERRIFIELD

FAIRFAX CENTERROUTE 28 SOUTH

RESTON

HERNDON

LOUDOUN

EISENHOWERAVENUE

SPRINGFIELD/NEWINGTON

I-395 CORRIDOR

R-B CORRIDOR

Cushman & Wakefield | 6

Northern Virginia Office MarketInventory and Vacancy by Submarket, Second Quarter 2017

Top Transactions

Northern Virginia Office MarketNet Absorption - Deliveries - Vacancy, Second Quarter 2017

0%

5%

10%

15%

20%

25%

-3,000

-2,000

-1,000

0

1,000

2,000

3,000

4,000

5,000

07 08 09 10 11 12 13 14 15 16 17

Va

can

cy R

ate

Sq

ua

re F

ee

t, 0

00

’s

Net Absorption Deliveries Vacancy Rate

0%

5%

10%

15%

20%

25%

30%

0

5

10

15

20

25

30

Alexandria RB Corridor Crystal City Tysons Reston/Herndon 50/66 Rte. 28 South Loudoun

Va

can

cy R

ate

MS

F

Leased Vacant Vacancy Rate

Key Sales Transactions Q2 2017

Key Lease Transactions Q2 2017

PROPERTY SF TENANT TRANSACTION TYPE SUBMARKET

13200 Woodland Park Drive 400,000 Amazon Web Services* New Lease Reston/Herndon

1320 Braddock Place 131,000 GSA - USDA New Lease Old Town

4050 Legato Road 92,000 Accenture/ASM Research Renewal Fairfax/Oakton/Vienna

PROPERTY SF SELLER / BUYER PRICE / $PSF SUBMARKET

1919 North Lynn Street - Waterview Tower 634,000 Paramount Group / Morgan Stanley $459,250,000 / $724 Rosslyn

1801 North Lynn Street 350,000 Morgan Stanley / GSA $240,000,000 / $686 Rosslyn

7901 Jones Branch Drive - Shenandoah Building 197,000 TIAA-CREF / Rockpoint Group $55,250,000 / $281 Tysons

cushmanwakefield.com | 7

Alexandria

0%

5%

10%

15%

20%

25%

30%

-600

-400

-200

0

200

400

600

800

07 08 09 10 11 12 13 14 15 16 17

Vaca

ncy

Rat

e

Squ

are

Fee

t, 00

0’s

Net Absorption Deliveries Vacancy Rate Old Town Vacancy Rate

Vacancy in Old Town is 9.2%, and for Greater Alexandria (Old

Town, Eisenhower and I-395 submarkets) 23.9%—both rates

unchanged from one year ago. Old Town boasts the lowest

vacancy rate of any Northern Virginia submarket, with Clarendon

the second tightest at 15.7%. Class A vacancy in Old Town stands

at a very healthy 7.2%, a rate also unchanged from one year ago.

There were no leases recorded in the Eisenhower submarket and

only 8,357 square feet (sf) of leasing activity in the I-395 Corridor.

However, Old Town captured Northern Virginia’s second-largest

lease of the quarter (behind Amazon’s 400,000-sf lease in

Herndon) as the GSA/U.S. Department of Agriculture (USDA)

signed for 131,000 sf at Braddock Metro Center 2. Two other

notable leases were Wyndham Resort’s renewal of 14,140 sf at 1737

King Street and National Association of Drug Court Professionals’

(NADCP) new lease for 10,442 sf at 625 N Washington Street.

Move-in and move-out activity among tenants occupying greater

than 15,000 sf was light in the second quarter of 2017. Alexandria’s

asking rents have remained steady in the $31-$33 per square foot

(psf) range on a full-service basis over the past five years. Class

A asking rents in Old Town declined 4.2% from the first quarter

of the year, mainly due to a price reduction at 1900 Duke Street.

Alexandria experienced a flurry of sales activity in the second

quarter, as Monday Properties purchased a five-property,

290,000-sf portfolio from Duke Realty for $25.9 million ($89/sf).

Buildings in the sale included 1500, 1600, 1800, 1900 and 2000

North Beauregard Street. Monday Properties has stated it intends

to complete extensive enhancements to amenities, common areas

and landscaping of those buildings originally built in the 1970s.

There were two other second-quarter sales: Kassabian Realty

purchased the National School Boards Association Building

(1980 Duke Street) from Normandy Real Estate Partners for $19.0

million ($404/sf), and JER Partners sold 1701 North Beauregard

Street to Alexandria City Public Schools for $15.0 million ($126/sf)

which desires to convert this office building and adjacent parking

garage into a school and playground.

Outlook

As construction on the fully leased 3000 Potomac Avenue office building adjacent to the future Potomac Yard Metro station continues, and with the National Science Foundation set to move into its 700,000-sf headquarters building in the Eisenhower submarket by the end of this year, these periphery sections of Alexandria will bring an influx of office workers and daytime spenders to the market.

Market Indicators*Arrows = Current Qtr Trend

Asking Rent

Net Absorption – Deliveries – Vacancy

New Leasing Activity

0.00

0.20

0.40

0.60

0.80

1.00

1.20

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

MS

F

Q1 Q2 Q3 Q4

$25

$27

$29

$31

$33

$35

$37

$39

2012 2013 2014 2015 2016 2017

Ful

l Ser

vice

PS

F

Class A Class B

Asking Rent$31.22 FS

Net Absorption10,865 SF

Vacancy23.9%

Deliveries0 SF

Under Construction720,000 SF

Cushman & Wakefield | 8

RB Corridor

0%

5%

10%

15%

20%

25%

-800-600-400-200

0200400600800

1,000

07 08 09 10 11 12 13 14 15 16 17

Vac

ancy

Rat

e

Squ

are

Fee

t, 00

0’s

Net Absorption Deliveries Vacancy Rate

The Rosslyn-Ballston (RB) Corridor began 2017 with a strong 80,372 square feet (sf) of positive absorption in the first quarter followed by an even stronger 262,063 sf in the second. Ballston accounted for 147,000 sf of that absorption, with Applied Predictive occupying 98,000 sf at 4250 North Fairfax Drive, DRT Strategies taking 14,000 sf at 4401 North Fairfax Drive, and Systems & Technology Research moving into 10,000 sf at 901 North Stuart Street. After hitting a 10-year high of 21.7% in the second quarter of 2016, Ballston’s vacancy continues to decrease, declining to 17.2% at the end of Q2 2017. The largest physical occupancy was that of Regus Spaces, which took 44,000 sf at 1101 Wilson Boulevard in Rosslyn.

Leasing activity in the RB Corridor was a lower-than-average 76,154 sf during the second quarter, as the top three deals were all renewals: GSA/U.S. Department of Homeland Security renewed for 77,000 sf at 4601 North Fairfax Drive, Raytheon/BBN Technologies re-committed to 43,277 sf at 1300 North 17th Street and Language Associates extended its 41,364-sf lease at 1901 North Fort Myer Drive. The largest new deal of the quarter was that of Insight Global which signed for 24,346 sf at 1001 North 19th Street in Rosslyn.

From 2015 to 2016, direct rental rates in the RB Corridor declined 7.0%, as the corridor had to contend with an extended period of high vacancy. However, rental rates rose 4.1% in the first two quarters of 2017, to $42.53 per square foot (psf) on a full-service basis —a healthy bucking of the previous trend. Concessions in the RB Corridor have increased steadily over the past five years and are currently at all-time highs, but declining vacancy may halt this trend over the next six to twelve months.

The most significant sales transaction of the quarter was Morgan Stanley’s purchase of Waterview Office Tower (1919 North Lynn Street) from Paramount Group REIT for $459.3 million ($724/sf). About half of the 647,000-sf building is due to be vacated in January 2018 as Gartner (formerly CEB) moves into its under-construction future headquarters building at 1201 Wilson Boulevard. Rosslyn captured the other major office sale of the quarter, as the GSA purchased 1801 North Lynn Street from Morgan Stanley and JBG for $240 million ($686/sf). The Bureau of Diplomatic Security currently occupies the entire building.

Market Indicators*Arrows = Current Qtr Trend

Asking Rent

Net Absorption – Deliveries – Vacancy

New Leasing Activity

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

MS

F

Q1 Q2 Q3 Q4

$32$34$36$38$40$42$44$46$48$50

2012 2013 2014 2015 2016 2017

Full

Serv

ice P

SF

Class A Class B

Asking Rent$42.40 FS

Net Absorption262,093 SF

Vacancy21.0%

Deliveries0 SF

Under Construction862,729 SF

OutlookOne of Northern Virginia’s most significant leases of the past several years transpired in the first quarter of 2017: Nestlé USA announced plans to relocate its headquarters from Los Angeles to Rosslyn, and will move into 206,000 sf at 1812 North Moore Street. This development spurred interest from some larger regional tenants in the market, many of which are taking a closer look at the submarket as Nestlé diversifies the primary tenant base away from consultancies, and as Central Place Plaza and its retail delivers.

cushmanwakefield.com | 9

Crystal City/Pentagon City

0%

5%

10%

15%

20%

25%

30%

-2,000

-1,500

-1,000

-500

0

500

1,000

07 08 09 10 11 12 13 14 15 16 17

Vaca

ncy

Rate

Square

Feet, 0

00’s

Net Absorption Deliveries Vacancy Rate

Over the past five years, Class A product has registered 819,000 square feet (sf) of positive absorption. Class B product registered 607,000 sf of negative absorption during the same time period, as tenants have expressed a preference for new and renovated buildings. The overall vacancy rate currently stands at 22.0%, equal to the five-year running average. However, Class A vacancy is a healthier 17.2%, much lower than its five-year running average of 22.7%.

The most significant deal of the quarter was Raytheon’s 70,000-sf renewal and 16,000-sf expansion at 2450 Crystal Drive. There were a handful of smaller leases: the Cobalt Company and Mission1st Group signed new leases of 9,600 sf and 5,000 sf, respectively, at 2511 Jefferson Davis Highway, and Trident Maritime Systems signed a 5,500-sf new lease at 2001 Jefferson Davis Highway.

There were no notable physical moves or significant office sales transactions in the second quarter of 2017, and rental rates for all classes remained virtually unchanged from Q1 2017.

Market Indicators*Arrows = Current Qtr Trend

Asking Rent

Net Absorption – Deliveries – Vacancy

New Leasing Activity

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

1.00

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

MS

F

Q1 Q2 Q3 Q4

$32

$34

$36

$38

$40

$42

$44

2012 2013 2014 2015 2016 2017

Full

Serv

ice P

SF

Class A Class B

Asking Rent$36.71 FS

Net Absorption(25,534 SF)

Vacancy22.0%

Deliveries0 SF

Under Construction100,000 SF

Outlook

The completed merger of Vornado Realty Trust and JBG into JBG Smith is bringing a new set of development professionals to the Crystal City submarket. JBG Smith executives have labeled the submarket a “top priority” as they plan to be proactive with a new set of demolition and redevelopment.

Cushman & Wakefield | 10

Tysons Corner

0%

5%

10%

15%

20%

25%

-800

-600

-400

-200

0

200

400

600

800

1,000

07 08 09 10 11 12 13 14 15 16 17

Va

can

cy R

ate

Sq

ua

re F

ee

t, 0

00

’s

Net Absorption Deliveries Vacancy Rate

Tysons’ vacancy rate ticked up to 21.6% in Q2 2017, up from 21.5% in the first quarter. The high velocity of move-ins and move-outs in the second quarter were nearly evenly matched, resulting in a negative 31,000 square feet (sf) of absorption. Mitre vacated the entire 152,000 sf at 1550 Westbranch Drive, and is now in the market for swing space as its existing four-building campus is at capacity. Grant Thornton vacated 28,000 sf at 2010 Corporate Drive in a move to Rosslyn’s Twin Towers. Ernst & Young relocated from 110,000 sf at 8484 Westpark Drive to 124,000 sf at Tysons’ newest office building—1775 Tysons Boulevard—while WeWork moved into its 92,000-sf space in that same building.

Year-to-date leasing activity in Tysons stands at 375,000 sf, slightly below the five-year running average. The largest leasing transactions of the second quarter of 2017 included: BAE, which renewed for 30,000 sf at 8201 Greensboro Drive; The Media Trust, which signed a 26,000-sf sublease at 1660 International Drive; DMI, which leased 23,000 sf at 1600 International Drive; and Executive Office Suites, which took over 19,000 sf of Carr Workplaces’ former space at 8200 Greensboro Drive.

Asking rental rates for all classes have remained relatively unchanged over the past few years, as the decrease in rates due to lease-up of expensive Class A and new construction product has offset rent increases in the Hill/Greensboro Drive minimarket.

The submarket was home to several significant sales transactions in the second quarter. Rockpoint Group continued to add to its Tysons portfolio, purchasing the three-building Tysons Dulles Plaza complex for $130.3 million ($270/sf) from KBS REIT, as well as the Shenandoah Building (7901 Jones Branch Drive) for $55.3 million ($281/sf) from TIAA-CREF. Westport Capital purchased the virtually empty 2000 Corporate Ridge for $24.5 million ($96/sf) from LNR Partners, and plans for an extensive renovation.

Market Indicators*Arrows = Current Qtr Trend

Asking Rent

Net Absorption – Deliveries – Vacancy

New Leasing Activity

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

MS

F

Q1 Q2 Q3 Q4

$25

$30

$35

$40

$45

$50

2012 2013 2014 2015 2016 2017

Ful

l Ser

vice

PS

F

Class A Class B

Asking Rent$31.94 FS

Net Absorption(31,055 SF)

Vacancy21.6%

Deliveries0 SF

Under Construction1,555,419 SF

OutlookWith Rockpoint Group purchasing four more Tysons office buildings in the second quarter, this Boston-based real estate private equity firm now owns nine office buildings in Tysons. PS Business Parks also owns nine office buildings, followed by Meridian Group with seven, and Lerner with six. This attraction of laser-focused private equity money could be a good bellwether for the attractiveness of this evolving submarket.

cushmanwakefield.com | 11

Reston/Herndon

0%

5%

10%

15%

20%

25%

-500

0

500

1,000

1,500

2,000

2,500

07 08 09 10 11 12 13 14 15 16 17

Vaca

ncy

Rate

Square

Feet, 0

00’s

Net Absorption Deliveries Vacancy Rate

Vacancy in the Reston/Herndon submarket is 16.6%, unchanged from one year ago, although the rate is slightly below the five-year average of 17.0%. The submarket’s sublet vacancy rate—at 2.1%—is the second-highest in Northern Virginia (after that of the Route 28 South submarket), a factor which provides opportunity for value-conscious tenants and also competition for landlords with direct space on the market.

Amazon Web Services (AWS) signed a 400,000-square-foot (sf) blockbuster, widely reported lease at 13200 Woodland Park in Herndon—space formerly occupied by Booz Allen Hamilton. This represents the largest private-sector lease in a non-owner-occupied building in Northern Virginia in over 10 years, as AWS augments its current 230,000-sf footprint at 12900 Worldgate Drive. AWS and its Fortune 12 tech-company parent have been active in the data center space in Loudoun County, but the new deal signals a desire to bolster this digital presence with a physical one. The next-largest deals of the quarter in Reston/Herndon were Micropact’s 42,000-sf renewal at 12901 Worldgate Drive, the GSA’s 20,000 sf renewal at 12825 Worldgate Drive, and Penn State University’s 19,700-sf new lease at 1850 Centennial Park Drive.

One location captured three move-ins during Q2 2017: Ellucian (97,000 sf), CDW (32,000 sf) and Volkswagen (32,000 sf) occupied 2003 Edmund Halley Drive. Other notable move-ins included Iron Bow taking over 46,000 sf at 2303 Dulles Station Boulevard and SAP occupying 26,000 sf at 2355 Dulles Corner Boulevard. Cox relocated from 94,000 sf at 3080 Centreville Road to less than half that footprint at 13900 Lincoln Park Drive, and K12 put 33,000 sf of sublet space on the market at 13241 Woodland Park Drive. Rents in all classes remained virtually unchanged from a year ago.

Market Indicators*Arrows = Current Qtr Trend

Asking Rent

Net Absorption – Deliveries – Vacancy

New Leasing Activity

0.00

0.50

1.00

1.50

2.00

2.50

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

MS

F

Q1 Q2 Q3 Q4

$20

$22

$24

$26

$28

$30

$32

2012 2013 2014 2015 2016 2017

Ful

l Ser

vice

PS

F

Class A Class B

Asking Rent$27.99 FS

Net Absorption65,067 SF

Vacancy16.6%

Deliveries0 SF

Under Construction354,913 SF

OutlookThe Reston/Herndon submarket’s makeup of highly educated workers, technology and contractor firms, exposure to private business and public contracts, and affordable real estate—compared to downtown Washington, DC, San Francisco, Boston, and New York—are all factors which may add further fuel to the fire of tech industry growth.

Cushman & Wakefield | 12

Route 50/66

0%

5%

10%

15%

20%

25%

30%

-800

-600

-400

-200

0

200

400

07 08 09 10 11 12 13 14 15 16 17

Va

can

cy R

ate

Sq

ua

re F

ee

t, 0

00

’s

Net Absorption Deliveries

Merrifield Vacancy Rate Fairfax/Oakton/Vienna Vacancy Rate

The Merrifield submarket’s vacancy rate declined from 21.9% in Q1 2017 to 20.3% in the second quarter, mainly due to Inova’s 42,000-square-foot (sf) expansion at 8111 Gatehouse Road. Still, the current vacancy rate is still above the five-year running average of 18.5%.

The Fairfax/Oakton/Vienna submarket’s vacancy rate moved the other direction, experiencing a slight uptick from 23.8% in Q1 2017 to 24.3% in Q2 2017. The increase was due primarily to Siemens vacating 38,000 sf at 4401 Fair Lakes Court as the company consolidates into other offices in Crystal City and Reston. This submarket’s current vacancy rate is well above its five-year running average of 18.7% and nearly matches the 10-year high of 24.7% registered in the fourth quarter of 2016.

The five largest deals of the quarter were all renewals: Accenture/ASM renewed for 92,000 sf at 4050 Legato Road, CGI for 42,500 sf at 11325 Random Hills Road, Leidos for 39,000 sf at 2650 Park Tower Drive, Serco for 32,000 sf at 11781 Lee Jackson Highway, and New Editions for 10,000 sf at 103 West Broad Street. The largest new lease was signed by ASRC Federal for 10,000 sf at 2941 Fairview Park Drive.

One notable sales transaction of the quarter was the purchase of 11320 Random Hills Road by Boyd Watterson from Colony Realty Partners for $23.5 million ($169/sf). This is a significant discount from the $40.5 million price that Colony Realty Partners paid for its original purchase of the property in November 2005. Several other properties traded in the second quarter at significant discounts, including 6910 Richmond Highway ($7.1 million, a 71.2% discount from the Q4 2006 sales price), 3076 Pender Drive ($5.6 million, a 39.4% discount from the Q1 2007 sales price), and 3702 Pender Drive ($5.6 million, a 63.8% discount from the Q4 2006 sales price).

Market Indicators*Arrows = Current Qtr Trend

Asking Rent

Net Absorption – Deliveries – Vacancy

New Leasing Activity

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

MS

F

Q1 Q2 Q3 Q4

$22

$24

$26

$28

$30

$32

$34

2012 2013 2014 2015 2016 2017

Ful

l Ser

vice

PS

F

Merrifield/Route 50 Fairfax/Oakton/Vienna

Asking Rent$26.84 FS

Net Absorption61,665 SF

Vacancy22.6%

Deliveries0 SF

Under Construction385,000 SF

OutlookIt should be noted that most of these properties were purchased at the top of the investment cycle, and the discounts were significant. This may indicate lagging investor demand for buildings in the I-66 corridor that lack walkable retail amenities.

cushmanwakefield.com | 13

Route 28 South/Chantilly

0%

5%

10%

15%

20%

25%

30%

-600

-400

-200

0

200

400

600

800

1,000

1,200

07 08 09 10 11 12 13 14 15 16 17

Va

can

cy R

ate

Sq

ua

re F

ee

t, 0

00

’s

Net Absorption Deliveries Vacancy Rate

Absorption in the Route 28 South submarket was strong in the second quarter—totaling 239,000 square feet (sf). Vacancy declined further to 17.7%, a year-over-year decrease of 640 basis points (BP) and its lowest level since the third quarter of 2012. This positive absorption can be attributed to a 160,000-sf, full-building move-in at 4870 Stonecroft Boulevard, a 44,000-sf move-in by SOC at 3975 Virginia Mallory Drive, and a 42,000-sf move-in by Cox Communications at 13900 Lincoln Park Drive.

Leasing activity for the second quarter came in at a moderate 69,000 sf, mainly due to three leases: L3 Technologies signing for 21,000 sf at 14100 Park Meadow Drive, AbleVets for 21,000 sf at 15049 Conference Center Drive, and Intergraph for 17,000 sf at 14291 Park Meadow Drive. There were also two large renewals, as the DEA re-committed to 72,000 sf at 14560 Avion Parkway, and Fulcrum IT renewed for 61,000 sf at 5870 Trinity Parkway. Direct asking rental rates in the submarket have remained virtually unchanged over the past three years, and currently stand at $25.84 per square foot (psf) on a full service basis for all classes and $27.55 psf for Class A space.

Colony Realty Partners sold Vencore’s headquarters building—Stonegate II (15052 Conference Center Drive)—to Gramercy for $27.8 million ($197/sf), a 37.0% discount from the original Q3 2007 sales price of $44.0 million.

Market Indicators*Arrows = Current Qtr Trend

Asking Rent

Net Absorption – Deliveries – Vacancy

New Leasing Activity

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

MS

F

Q1 Q2 Q3 Q4

$18

$20

$22

$24

$26

$28

$30

2012 2013 2014 2015 2016 2017

Ful

l Ser

vice

PS

F

Class A Class B

Asking Rent$25.56 FS

Net Absorption221,595 SF

Vacancy17.7%

Deliveries0 SF

Under Construction665,000 SF

Outlook

President Trump’s proposed Defense budget marks an increase in funding from that proposed by the Obama administration. The proposed Defense budget saw further increases from the House Armed Services Committee and those increases garnered initial passage by the full House of Representatives. These addition Defense dollars could benefit the multiple federal agencies and associated contractors in the Route 28 South submarket. Final passage of the budget has yet to take place, but the indicators are bullish.

Cushman & Wakefield | 14

Loudoun County

0%

5%

10%

15%

20%

25%

-100

0

100

200

300

400

500

600

07 08 09 10 11 12 13 14 15 16 17

Vaca

ncy

Rate

Square

Feet, 0

00’s

Net Absorption Deliveries Vacancy Rate

The Loudoun County submarket began 2017 with a strong 68,411 square feet (sf) of positive absorption in the first quarter, followed by 34,285 sf of absorption in the second. Small-to-medium sized tenants accounted for the majority of move-ins in the second quarter. The submarket’s vacancy rate hit 14.7% in the second quarter of 2017—the lowest rate in over 10 years. Class A vacancy declined from 15.9% a year ago to 12.2% at the end of Q2 2017, as tenants expressed a preference for newer and higher-quality buildings. This Class A vacancy is extremely healthy, and is the third-lowest in Northern Virginia after Old Town and Ballston.

The largest lease of the quarter was that of DRS Technologies, which signed for 40,000 sf at 21345 Ridgetop Circle, followed by Epsilon Data Management, which signed for 12,000 sf at 19775 Belmont Executive Plaza.

Rental rates for all classes remained virtually unchanged from both the first quarter of the year as well as the second quarter of 2016. The most significant sales transaction of the quarter was Kaiser Permanente’s purchase of its Ashburn Medical Center at 43480 Yukon Drive for $14.1 million ($236/sf) from The Lenkin Company.

Market Indicators*Arrows = Current Qtr Trend

Asking Rent

Net Absorption – Deliveries – Vacancy

New Leasing Activity

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

MS

F

Q1 Q2 Q3 Q4

$16

$18

$20

$22

$24

$26

$28

2012 2013 2014 2015 2016 2017

Ful

l Ser

vice

PS

F

Class A Class B

Asking Rent$23.85 FS

Net Absorption34,285 SF

Vacancy14.7%

Deliveries0 SF

Under Construction72,000 SF

Outlook

Many active tenants in the Loudoun County submarket have indicated a preference for Class A office space with retail amenities, leading to lease-up in office projects in and adjacent to One Loudoun, Loudoun Station and other walkable projects. With Class A vacancy declining, some medium-to-large tenants have expressed difficulty in finding blocks of space in amenity-rich sections of the submarket.

cushmanwakefield.com | 15

Appendix

Table Summaries

Metro Washington Office Market Summary15

Employment Data15

Office Availability, Vacancy, and Net Absorption16

Trailing 12-Month Data17

Historical Year-End Data18

Market Statistics by Class19-20

Survey of New Office Space by Submarket21-24

Methodology & Definitions25

Metro Washington Current Employment Data

Metro Washington Office Market Summary: Second Quarter 2017p

SOURCE: U.S. Bureau of Labor Statistics (Not seasonally adjusted)* Average per year to datep - preliminary

Inventory Total Vacant Space

Vacancy Rate

Q2 2017 Absorption

Year to Date Absorption

Washington, DC 108,148,369 13,346,910 12.3% 215,354 258,710

Northern Virginia 130,274,770 27,140,899 20.8% 650,110 455,553

Suburban Maryland 59,443,704 11,763,916 19.8% -199,232 -113,862

Regional Totals 297,866,843 52,251,725 17.5% 666,232 600,401

Nonfarm Employment

(Jan-Jun 2016)

Nonfarm Employment

(Jan-Jun 2017p)

Jobs Added/ Lost* Percent Change

Washington, DC 780,867 789,117 8,250 1.1%

Northern Virginia 1,433,750 1,459,700 25,950 1.8%

Suburban Maryland 987,383 1,011,600 24,217 2.5%

Regional Totals 3,218,750 3,270,567 51,817 1.6%

Cushman & Wakefield | 16

AppendixO

ffice

Ava

ilab

ility

, Vac

ancy

, and

Net

Ab

sorp

tio

n, S

eco

nd Q

uart

er 2

017

p

Tota

l Inv

ento

ryN

ew/R

elet

Spa

ce

Avai

labl

eS

uble

t Spa

ce

Avai

labl

eTo

tal S

pace

Av

aila

ble

Vaca

ncy

Rat

eN

ew/R

elet

A

bsor

ptio

nS

uble

t A

bsor

ptio

nTo

tal N

et

Abs

orpt

ion

Ros

slyn

8,63

8,62

3 2,

286,

828

83,5

24

2,37

0,35

2 27

.4%

59,9

84

(5,1

82)

54,8

02

Cou

rtho

use/

Cla

rend

on/V

irgin

ia S

quar

e5,

531,

747

815,

577

53,5

26

869,

103

15.7

%56

,938

2,

998

59,9

36

Bal

lsto

n7,

095,

248

1,17

9,28

5 44

,380

1,

223,

665

17.2

%15

7,76

9 (1

0,41

4)14

7,35

5

Cry

stal

City

/Pen

tago

n C

ity10

,677

,069

2,

330,

514

22,2

20

2,35

2,73

4 22

.0%

(41,

436)

15,9

02

(25,

534)

Arli

ngto

n C

ount

y31

,942

,687

6,

612,

204

203,

650

6,81

5,85

4 21

.3%

233,

255

3,30

4 23

6,55

9

RB

Cor

ridor

21,2

65,6

18

4,28

1,69

0 18

1,43

0 4,

463,

120

21.0

%27

4,69

1 (1

2,59

8)26

2,09

3

Old

Tow

n7,

991,

666

676,

100

62,8

40

738,

940

9.2%

(332

)1,

621

1,28

9

I-395

Cor

ridor

6,05

8,05

0 2,

336,

401

5,16

2 2,

341,

563

38.7

%13

,724

2,

000

15,7

24

Hun

tingo

n/Ei

senh

ower

2,42

3,70

9 82

7,18

8 28

,839

85

6,02

7 35

.3%

1,86

9 (8

,017

)(6

,148

)

City

of A

lexa

ndria

16,4

73,4

25

3,83

9,68

9 96

,841

3,

936,

530

23.9

%15

,261

(4

,396

)10

,865

Insi

de th

e B

eltw

ay48

,416

,112

10

,451

,893

30

0,49

1 10

,752

,384

22

.2%

248,

516

(1,0

92)

247,

424

Ann

anda

le/B

aile

ys1,

369,

626

373,

405

12,5

84

385,

989

28.2

%38

5 0

385

Mer

rifiel

d/R

oute

50

6,60

8,19

4 1,

279,

350

59,5

30

1,33

8,88

0 20

.3%

82,7

88

27,2

38

110,

026

Fairf

ax/O

akto

n/Vi

enna

9,50

9,46

7 2,

206,

239

104,

658

2,31

0,89

7 24

.3%

(44,

566)

(3,7

95)

(48,

361)

Tyso

ns C

orne

r22

,920

,597

4,

831,

842

126,

789

4,95

8,63

1 21

.6%

(62,

679)

31,6

24

(31,

055)

Res

ton/

Her

ndon

24,2

30,8

37

3,49

8,91

9 51

2,04

2 4,

010,

961

16.6

%80

,673

(1

5,60

6)65

,067

Rt 2

8 S/

Cha

ntill

y8,

675,

922

1,34

3,00

7 19

6,46

1 1,

539,

468

17.7

%22

9,59

5 (8

,000

)22

1,59

5

Sprin

gfiel

d3,

268,

420

1,05

8,47

4 8,

421

1,06

6,89

5 32

.6%

50,7

44

0 50

,744

Fairf

ax C

ount

y76

,583

,063

14

,591

,236

1,

020,

485

15,6

11,7

21

20.4

%33

6,94

0 31

,461

36

8,40

1

50-6

6 C

orrid

or16

,117

,661

3,

485,

589

164,

188

3,64

9,77

7 22

.6%

38,2

22

23,4

43

61,6

65

Loud

oun

Cou

nty

5,27

5,59

5 71

1,13

9 65

,655

77

6,79

4 14

.7%

42,0

91

(7,8

06)

34,2

85

Out

side

the

Bel

tway

81,8

58,6

58

15,3

02,3

75

1,08

6,14

0 16

,388

,515

20

.0%

379,

031

23,6

55

402,

686

No

rthe

rn V

irg

inia

130

,274

,770

25

,754

,26

8

1,38

6,6

31

27,14

0,8

99

20

.8%

627

,54

7 22

,56

3 6

50,11

0

1 Th

e R

oss

lyn/

Bal

lsto

n (R

/B)

corr

ido

r is

co

mp

rise

d o

f R

oss

lyn,

Cla

rend

on/

Co

urth

ous

e, V

irg

inia

Sq

uare

, and

Bal

lsto

n su

bm

arke

ts.

2 In

sid

e th

e B

eltw

ay is

co

mp

rise

d o

f A

rlin

gto

n C

oun

ty a

nd A

lexa

ndri

a/O

utsi

de

the

Bel

tway

is c

om

pri

sed

of

Fair

fax

and

Lo

udo

un C

oun

ties

3

The

50/6

6 c

orr

ido

r is

co

mp

rise

d o

f M

erri

fiel

d, V

ienn

a, O

akto

n, F

airf

ax C

ente

r, an

d F

airf

ax C

ity

sub

mar

kets

.

****

New

Sp

ace

Ava

ilab

le a

nd N

ew S

pac

e A

bso

rpti

on

bas

ed o

n b

uild

ing

s d

eliv

ered

20

05

to p

rese

nt

P -

Pre

limin

ary

cushmanwakefield.com | 17

AppendixTr

ailin

g 1

2-M

ont

h D

ata

Tota

l Offi

ce In

vent

ory

Offi

ce V

acan

cy R

ate

Tota

l Offi

ce A

bsor

ptio

n

3rd

Qtr

20

164t

h Q

tr

2016

1st Q

tr

2017

2nd

Qtr

20

173r

d Q

tr

2016

4th

Qtr

20

161s

t Qtr

20

172n

d Q

tr

2017

3rd

Qtr

20

164t

h Q

tr

2016

1st Q

tr

2017

2nd

Qtr

20

17

Ros

slyn

8,63

8,62

38,

638,

623

8,63

8,62

38,

638,

623

27.8

%27

.7%

28.1

%27

.4%

(10,

550)

6,01

2 (3

1,82

1)54

,802

Cou

rtho

use/

Cla

rend

on/

Virg

inia

Squ

are

5,53

1,74

75,

531,

747

5,53

1,74

75,

531,

747

18.1

%18

.7%

16.8

%15

.7%

2,30

3 (3

1,83

9)10

6,79

2 59

,936

Bal

lsto

n7,

095,

248

7,09

5,24

87,

095,

248

7,09

5,24

8 19

.4%

19.4

%19

.3%

17.2

%10

6,08

2 (1

,437

)5,

401

147,

355

Cry

stal

City

/Pe

ntag

on C

ity10

,945

,402

10,6

77,0

6910

,677

,069

10,6

77,0

69

22.3

%23

.1%

21.8

%22

.0%

140,

289

(269

,571

)14

4,52

9 (2

5,53

4)

Arli

ngto

n C

ount

y32

,211

,020

31,9

42,6

8731

,942

,687

31,9

42,6

8722

.4%

22.8

%22

.1%

21.3

%23

8,12

4 (2

96,8

35)

224,

901

236,

559

RB

Cor

ridor

21,2

65,6

1821

,265

,618

21,2

65,6

1821

,265

,618

22

.5%

22.6

%22

.2%

21.0

%97

,835

(2

7,26

4)80

,372

26

2,09

3

Old

Tow

n7,

991,

666

7,99

1,66

67,

991,

666

7,99

1,66

6 8.

4%9.

1%9.

3%9.

2%67

,124

(5

7,70

6)(1

0,85

6)1,

289

I-395

Cor

ridor

6,05

8,05

06,

058,

050

6,05

8,05

06,

058,

050

38.7

%38

.0%

38.9

%38

.7%

(52)

46,1

97

(56,

187)

15,7

24

Hun

tingt

on/

Eise

nhow

er2,

423,

709

2,42

3,70

92,

423,

709

2,42

3,70

9 34

.6%

34.5

%35

.1%

35.3

%(1

4,14

1)1,

827

(13,

778)

(6,1

48)

City

of A

lexa

ndria

16,4

73,4

2516

,473

,425

16,4

73,4

2516

,473

,425

23.4

%23

.5%

24.0

%23

.9%

52,9

31

(9,6

82)

(80,

821)

10,8

65

Insi

de th

e B

eltw

ay48

,684

,445

48,4

16,1

1248

,416

,112

48,4

16,1

12

22.8

%23

.0%

22.7

%22

.2%

291,

055

(306

,517

)14

4,08

0 24

7,42

4

Ann

anda

le/B

aile

ys1,

369,

626

1,36

9,62

61,

369,

626

1,36

9,62

6 29

.5%

30.1

%31

.2%

28.2

%(7

,771

)(7

,853

)(1

5,97

3)38

5

Mer

rifiel

d/R

oute

50

6,60

8,19

46,

608,

194

6,60

8,19

46,

608,

194

19.0

%17

.5%

21.9

%20

.3%

(104

,618

)96

,690

(2

92,6

62)

110,

026

Fairf

ax/O

akto

n/Vi

enna

9,50

9,46

79,

509,

467

9,50

9,46

79,

509,

467

23.1

%24

.7%

23.8

%24

.3%

(96,

712)

(157

,072

)87

,193

(4

8,36

1)

Tyso

ns C

orne

r23

,055

,893

22,9

20,5

9722

,920

,597

22,9

20,5

97

20.7

%21

.7%

21.5

%21

.6%

118,

512

(204

,201

)(1

5,53

2)(3

1,05

5)

Res

ton/

Her

ndon

24,2

30,8

3724

,230

,837

24,2

30,8

3724

,230

,837

16

.6%

16.2

%16

.7%

16.6

%(3

1,50

0)10

0,59

2 (1

27,9

90)

65,0

67

Rt 2

8 S/

Cha

ntill

y8,

675,

922

8,67

5,92

28,

675,

922

8,67

5,92

2 21

.6%

21.0

%19

.8%

17.7

%24

6,98

1 52

,326

18

,003

22

1,59

5

Sprin

gfiel

d3,

268,

420

3,26

8,42

03,

268,

420

3,26

8,42

0 32

.3%

32.4

%34

.2%

32.6

%17

,106

(1

,848

)(6

0,08

7)50

,744

Fairf

ax C

ount

y76

,718

,359

76,5

83,0

6376

,583

,063

76,5

83,0

63

20.3

%20

.5%

20.8

%20

.4%

141,

998

(121

,366

)(4

07,0

48)

368,

401

50-6

6 C

orrid

or16

,117

,661

16,1

17,6

6116

,117

,661

16,1

17,6

6121

.4%

21.8

%23

.0%

22.6

%(2

01,3

30)

(60,

382)

(205

,469

)61

,665

Loud

oun

Cou

nty

5,12

1,79

55,

121,

795

5,06

6,59

55,

275,

595

18.2

%18

.2%

16.0

%14

.7%

9,93

5 (3

,527

)68

,411

34

,285

Out

side

the

Bel

tway

81,8

40,1

5481

,704

,858

81,6

49,6

5881

,858

,658

20.2

%20

.3%

20.5

%20

.0%

151,

933

(124

,893

)(3

38,6

37)

402,

686

Nor

ther

n Vi

rgin

ia21

.1%21

.3%

21.3

%20

.8%

44

2,9

88

(4

31,4

10)

(19

4,5

57)

650

,110

1 Th

e R

oss

lyn/

Bal

lsto

n (R

/B)

corr

ido

r is

co

mp

rise

d o

f R

oss

lyn,

Cla

rend

on/

Co

urth

ous

e, V

irg

inia

Sq

uare

, and

Bal

lsto

n su

bm

arke

ts.

2

Insi

de

the

Bel

tway

is c

om

pri

sed

of

Arl

ing

ton

Co

unty

and

Ale

xand

ria/

Out

sid

e th

e B

eltw

ay is

co

mp

rise

d o

f Fa

irfa

x an

d L

oud

oun

Co

unti

es.

3 Th

e 50

/66

co

rrid

or

is c

om

pri

sed

of

Mer

rifi

eld

, Vie

nna,

Oak

ton,

Fai

rfax

Cen

ter,

and

Fai

rfax

Cit

y su

bm

arke

ts.

4 T

he I-

395

and

Sp

ring

fiel

d/N

ewin

gto

n su

bm

arke

ts w

ere

upd

ated

in t

he s

eco

nd q

uart

er o

f 20

12 w

ith

add

itio

nal i

nven

tory

. p

- p

relim

inar

y

Cushman & Wakefield | 18

AppendixH

isto

rica

l Yea

r-E

nd D

ata

Tota

l Offi

ce In

vent

ory

Offi

ce V

acan

cy R

ate

Tota

l Ann

ual A

bsor

ptio

n

2015

2016

2017

p20

1520

1620

17p

2015

2016

2017

p

Ros

slyn

8,61

3,04

38,

638,

623

8,63

8,62

329

.1%

27.7

%27

.4%

159,

209

9,47

0 22

,981

Cou

rtho

use/

Cla

rend

on/

Virg

inia

Squ

are

5,53

1,74

75,

531,

747

5,53

1,74

721

.7%

18.7

%15

.7%

(81,

594)

(7,2

56)

166,

728

Bal

lsto

n7,

076,

618

7,09

5,24

87,

095,

248

18.9

%19

.4%

17.2

%12

7,31

6 60

,792

15

2,75

6

Cry

stal

City

/Pen

tago

n C

ity10

,945

,402

10,6

77,0

6910

,677

,069

21.3

%23

.1%

22.0

%34

6,22

8 (4

62,1

46)

118,

995

Arli

ngto

n C

ount

y32

,166

,810

31,9

42,6

8731

,942

,687

22.9

%22

.8%

21.3

%55

1,15

9 (3

99,1

40)

461,

460

RB

Cor

ridor

21,2

21,4

08

21,2

65,6

18

21,2

65,6

18

23.7

%22

.6%

21.0

%20

4,93

1 63

,006

34

2,46

5

Old

Tow

n8,

191,

666

7,99

1,66

67,

991,

666

10.2

%9.

1%9.

2%(8

2,12

0)(5

5,87

7)(9

,567

)

I-395

Cor

ridor

6,05

8,05

06,

058,

050

6,05

8,05

037

.3%

38.0

%38

.7%

(227

,461

)13

6,18

4 (4

0,46

3)

Hun

tingo

n/Ei

senh

ower

2,74

2,70

72,

423,

709

2,42

3,70

942

.3%

34.5

%35

.3%

(17,

885)

(11,

038)

(19,

926)

City

of A

lexa

ndria

16,9

92,4

2316

,473

,425

16,4

73,4

2525

.0%

23.5

%23

.9%

(327

,466

)69

,269

(6

9,95

6)

Insi

de th

e B

eltw

ay49

,159

,233

48

,416

,112

48

,416

,112

23

.6%

23.0

%22

.2%

223,

693

(329

,871

)39

1,50

4

Ann

anda

le/B

aile

ys1,

358,

705

1,36

9,62

61,

369,

626

30.4

%30

.1%

28.2

%(9

7,36

7)12

,058

(1

5,58

8)

Mer

rifiel

d/R

oute

50

6,60

8,19

46,

608,

194

6,60

8,19

420

.2%

17.5

%20

.3%

(106

,447

)11

2,72

5 (1

82,6

36)

Fairf

ax/O

akto

n/Vi

enna

9,50

5,60

39,

509,

467

9,50

9,46

717

.4%

24.7

%24

.3%

5,92

1 (4

77,1

61)

38,8

32

Tyso

ns C

orne

r23

,240

,699

22

,920

,597

22

,920

,597

19

.1%

21.7

%21

.6%

67,3

79

(76,

977)

(46,

587)

Res

ton/

Her

ndon

24,6

90,8

3724

,230

,837

24,2

30,8

3716

.4%

16.2

%16

.6%

268,

104

266,

554

(62,

923)

Rt 2

8 S/

Cha

ntill

y9,

242,

182

8,67

5,92

28,

675,

922

24.8

%21

.0%

17.7

%41

,794

43

1,90

6 23

9,59

8

Sprin

gfiel

d3,

268,

420

3,26

8,42

03,

268,

420

35.1

%32

.4%

32.6

%73

,408

(2

8,25

0)(9

,343

)

Fairf

ax C

ount

y77

,914

,640

76,5

83,0

6376

,583

,063

19.7

%20

.5%

20.4

%25

2,79

2 24

0,85

5 (3

8,64

7)

50-6

616

,113

,797

16

,117

,661

16

,117

,661

18

.5%

21.8

%22

.6%

(100

,526

)(3

64,4

36)

(143

,804

)

Loud

oun

Cou

nty

5,12

1,79

55,

121,

795

5,27

5,59

520

.3%

18.2

%14

.7%

74,7

54

40,0

04

102,

696

Out

side

the

Bel

tway

83,0

36,4

35

81,7

04,8

58

81,8

58,6

58

19.7

%20

.3%

20.0

%32

7,54

6 28

0,85

9 64

,049

No

rthe

rn V

irg

inia

132,

195,

66

813

0,12

0,9

7013

0,2

74,7

7021

.2%

21.3

%20

.8%

551,2

39

(49

,012

)4

55,5

53

1 In

sid

e th

e B

eltw

ay is

co

mp

rise

d o

f A

rlin

gto

n C

oun

ty a

nd A

lexa

ndri

a/O

utsi

de

the

Bel

tway

is c

om

pri

sed

of

Fair

fax

and

Lo

udo

un C

oun

ties

2 Th

e R

oss

lyn/

Bal

lsto

n (R

/B)

corr

ido

r is

co

mp

rise

d o

f R

oss

lyn,

Cla

rend

on/

Co

urth

ous

e, V

irg

inia

Sq

uare

, and

Bal

lsto

n su

bm

arke

ts.

3

The

50/6

6 c

orr

ido

r is

co

mp

rise

d o

f M

erri

fiel

d, V

ienn

a, O

akto

n, F

airf

ax C

ente

r, an

d F

airf

ax C

ity

sub

mar

kets

.

4

The

I-39

5 an

d S

pri

ngfi

eld

/New

ing

ton

sub

mar

kets

wer

e up

dat

ed in

the

sec

ond

qua

rter

of

2012

wit

h ad

dit

iona

l inv

ento

ry.

cushmanwakefield.com | 19

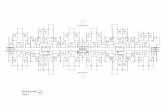

Northern Virginia – 2nd Quarter 2017 Market Statistics

BuildingsTotal

Inventory(SF)

New/Relet Vacancy

(%)

Sublet Vacancy

(%)

Total Vacancy*

(%)

Net Absorption

Current QTR(SF)

Under Construction

(SF)

Average Asking Rent

(FS)

Alexandria

Class

A 46 7,855,196 20.0% 0.6% 20.7% 393 720,000 $34.16

B 64 6,746,020 31.1% 0.4% 31.5% (2,817) $28.91

C 27 1,872,209 9.1% 1.0% 10.1% 13,289 $24.88

TOTAL 137 16,473,425 23.3% 0.6% 23.9% 10,865 720,000 $31.22

RB Corridor

Class

A 49 12,757,247 17.9% 1.2% 19.0% 172,268 862,729 $44.25

B 35 6,227,522 21.8% 0.4% 22.2% 87,753 - $41.64

C 19 2,280,849 28.2% 0.5% 28.7% 2,072 - $35.43

TOTAL 103 21,265,618 20.1% 0.9% 21.0% 262,093 862,729 $42.40

Crystal City/Pentagon City

Class

A 25 7,794,322 16.9% 0.2% 17.2% (24,465) 100,000 $38.91

B 13 2,882,747 35.1% 0.1% 35.2% (1,069) $34.13

C - 0 0.0% 0.0% 0.0% - N/A

TOTAL 38 10,677,069 21.8% 0.2% 22.0% (25,534) 100,000 $36.71

Tysons

Class

A 52 13,255,289 20.5% 0.6% 21.1% (27,886) 1,555,419 $38.09

B 61 7,622,416 22.8% 0.5% 23.4% (21,841) $29.58

C 29 2,042,892 18.5% 0.1% 18.6% 18,672 $24.77

TOTAL 142 22,920,597 21.1% 0.6% 21.6% (31,055) 1,555,419 $31.94

Reston/Herndon

Class

A 106 17,967,174 14.3% 2.3% 16.6% 44,001 354,913 $29.86

B 63 5,589,260 15.1% 1.7% 16.8% 1,913 $25.15

C 15 674,403 12.5% 0.3% 12.8% 19,153 $18.03

TOTAL 184 24,230,837 14.4% 2.1% 16.6% 65,067 354,913 $27.99

* Vacancy Current - the vacancy rate is calculated using the combined total of vacant direct, sublease and new space.

Market Statistics

Cushman & Wakefield | 20

Northern Virginia – 2nd Quarter 2017 Market Statistics

Market Statistics

BuildingsTotal

Inventory(SF)

New/Relet Vacancy

(%)

Sublet Vacancy

(%)

Total Vacancy*

(%)

Net Absorption

Current QTR(SF)

Under Construction

(SF)

Average Asking Rent

(FS)

Merriield/Route 50

Class

A 20 3,616,798 27.4% 1.0% 28.4% (9,258) - $31.99

B 15 1,566,456 12.1% 1.4% 13.4% 100,292 $26.49

C 20 1,424,940 7.1% 0.0% 7.1% 18,992 $22.31

TOTAL 55 6,608,194 19.4% 0.9% 20.3% 110,026 - $29.91

Fairfax/Oakton/Vienna

Class

A 25 4,365,706 17.3% 0.3% 17.6% (5,808) 385,000 $30.07

B 47 4,410,647 28.5% 2.1% 30.6% (42,861) $23.89

C 12 733,114 26.2% 0.0% 26.2% 308 $23.22

TOTAL 84 9,509,467 23.2% 1.1% 24.3% (48,361) 385,000 $24.71

Route 28 South

Class

A 49 6,127,730 13.5% 1.2% 14.7% 233,540 665,000 $27.32

B 27 2,548,192 20.2% 4.9% 25.1% (11,945) $23.31

C - 0 0.0% 0.0% 0.0% - N/A

TOTAL 76 8,675,922 15.5% 2.3% 17.7% 221,595 665,000 $25.56

Loudoun County

Class

A 40 3,867,941 11.1% 1.1% 12.2% 33,434 72,000 $25.64

B 18 1,407,654 19.9% 1.8% 21.7% 851 $21.38

C - 0 0.0% 0.0% 0.0% - N/A

TOTAL 58 5,275,595 13.5% 1.2% 14.7% 34,285 72,000 $23.94

Northern Virginia

Class

A 427 79,919,628 17.9% 1.1% 19.0% 425,472 4,715,061 $34.96

B 350 39,611,961 23.9% 1.1% 25.0% 142,181 $29.82

C 143 10,743,181 18.6% 0.3% 19.0% 82,457 $28.08

TOTAL 920 130,274,770 19.8% 1.1% 20.8% 650,110 4,715,061 $32.16

* Vacancy Current - the vacancy rate is calculated using the combined total of vacant direct, sublease and new space.

cushmanwakefield.com | 21

Nor

ther

n Vi

rgin

ia S

urve

y of

Offi

ce S

pace

Und

er C

onst

ruct

ion/

Und

er R

enov

atio

n

Alex

andr

ia

BU

ILD

ING

AD

DR

ESS

OW

NER

/DEV

ELO

PER

REN

TAL

RAT

EST

ATU

SD

ELIV

ERY

DAT

ER

ENTA

BLE

B

UIL

DIN

G A

REA

AVAI

LAB

LE

SPAC

EPE

RC

ENT

PREL

EASE

D

MAJ

OR

TEN

ANTS

2401

Eis

enho

wer

Ave

nue

Nat

iona

l Sci

ence

Fou

ndat

ion

HQ

US

AA

N/A

U/C

3Q17

720,

000

010

0%N

atio

nal S

cien

ce F

ound

atio

n

Tota

l 7

20,0

00

-

100%

Cry

stal

City

BU

ILD

ING

AD

DR

ESS

OW

NER

/DEV

ELO

PER

REN

TAL

RAT

EST

ATU

SD

ELIV

ERY

DAT

ER

ENTA

BLE

B

UIL

DIN

G A

REA

AVAI

LAB

LE

SPAC

EPE

RC

ENT

PREL

EASE

D

MAJ

OR

TEN

ANTS

3000

Pot

omac

Ave

nue

Nat

iona

l Ind

ustri

es fo

r the

Blin

dN

/AU

/C2Q

1810

0,00

00

100%

Nat

iona

l Ind

ustri

es fo

r the

Blin

d,

Kai

ser P

erm

anen

te

Tota

l 1

00,0

00

-

100%

Fairf

ax/O

akto

n/Vi

enna

BU

ILD

ING

AD

DR

ESS

OW

NER

/DEV

ELO

PER

REN

TAL

RAT

EST

ATU

SD

ELIV

ERY

DAT

ER

ENTA

BLE

B

UIL

DIN

G A

REA

AVAI

LAB

LE

SPAC

EPE

RC

ENT

PREL

EASE

D

MAJ

OR

TEN

ANTS

4097

Mon

umen

t Cor

ner D

rive

Pet

erso

n C

ompa

nies

N/A

U/C

3Q17

150,

000

32,0

0079

%A

pple

Fed

eral

Cre

dit U

nion

1041

Ele

ctric

Ave

nue

Nav

y Fe

dera

l Cre

dit U

nion

Nav

y Fe

dera

l Cre

dit U

nion

N/A

U/C

3Q17

235,

000

010

0%N

avy

Fede

ral C

redi

t Uni

on

Tota

l 3

85,0

00

32,

000

92%

Res

ton/

Her

ndon

BU

ILD

ING

AD

DR

ESS

OW

NER

/DEV

ELO

PER

REN

TAL

RAT

EST

ATU

SD

ELIV

ERY

DAT

ER

ENTA

BLE

B

UIL

DIN

G A

REA

AVAI

LAB

LE

SPAC

EPE

RC

ENT

PREL

EASE

D

MAJ

OR

TEN

ANTS

1900

Res

ton

Met

ro P

laza

Com

stoc

k P

artn

ers

N/A

U/C

4Q17

354,

913

354,

913

0%N

/A

Tota

l 3

54,9

13

354

,913

0%

Stat

usO

pera

ting

Expe

nse

and

Rea

l Est

ate

Tax

Bas

eU

/C =

Und

er C

onst

ruct

ion

FS

= F

ull S

ervi

ce

NN

= P

lus

Ele

ctric

& C

har

N/A

= N

o S

pace

Ava

ilabl

eU

/R =

Und

er R

enov

atio

nN

=

Plu

s E

lect

ric

NT

= P

lus

Taxe

s

N

NN

= N

et o

f all

Ope

ratin

g E

xpen

ses

and

Taxe

s

Cushman & Wakefield | 22

Nor

ther

n Vi

rgin

ia S

urve

y of

Offi

ce S

pace

Und

er C

onst

ruct

ion/

Und

er R

enov

atio

n

RB

Cor

ridor

BU

ILD

ING

AD

DR

ESS

OW

NER

/DEV

ELO

PER

REN

TAL

RAT

EST

ATU

SD

ELIV

ERY

DAT

ER

ENTA

BLE

B

UIL

DIN

G A

REA

AVAI

LAB

LE

SPAC

EPE

RC

ENT

PREL

EASE

D

MAJ

OR

TEN

ANTS

1201

Wils

on B

oule

vard

CE

B T

ower

Mon

day

Pro

perti

esN

/AU

/C4Q

1752

1,00

019

5,00

063

%C

EB

2311

Wils

on B

oule

vard

Car

r Pro

perti

esN

/AU

/C3Q

1717

5,00

075

,262

57%

Opo

wer

, Bea

n K

inne

y &

Kor

man

, A

HR

I

1000

Nor

th G

lebe

Roa

dM

arym

ount

Uni

vers

ityN

/AU

/C3Q

1716

6,76

756

,631

66%

Mar

ymou

nt U

nive

rsity

Tota

l 8

62,7

67

326

,893

62

%

Rou

te 2

8 So

uth

BU

ILD

ING

AD

DR

ESS

OW

NER

/DEV

ELO

PER

REN

TAL

RAT

EST

ATU

SD

ELIV

ERY

DAT

ER

ENTA

BLE

B

UIL

DIN

G A

REA

AVAI

LAB

LE

SPAC

EPE

RC

ENT

PREL

EASE

D

MAJ

OR

TEN

ANTS

1475

7 C

onfe

renc

e C

ente

r Driv

eC

OP

TN

/AU

/C4Q

1724

0,00

00

0%G

SA

/Con

tract

or

1390

0 A

ir an

d S

pace

Mus

eum

P

arkw

ayP

eter

son

Com

pani

esN

/AU

/C1Q

1842

5,00

00

0%G

SA

/Con

tract

or

Tota

l 6

65,0

00

-

100%

Tyso

ns C

orne

r

BU

ILD

ING

AD

DR

ESS

OW

NER

/DEV

ELO

PER

REN

TAL

RAT

EST

ATU

SD

ELIV

ERY

DAT

ER

ENTA

BLE

B

UIL

DIN

G A

REA

AVAI

LAB

LE

SPAC

EPE

RC

ENT

PREL

EASE

D

MAJ

OR

TEN

ANTS

Cap

ital O

ne T

ower

Cap

ital O

neN

/AU

/C4Q

1897

5,00

00

100%

Cap

ital O

ne83

50 B

road

Stre

etM

erid

ian

Gro

upN

/AU

/C1Q

1943

6,81

333

1,80

024

%Te

gna

1640

Bor

o P

lace

Mer

idia

n G

roup

N/A

U/C

1Q19

143,

606

143,

606

0%N