Market Imperfection Korea

Transcript of Market Imperfection Korea

-

8/14/2019 Market Imperfection Korea

1/40

Policy, e.earch, ndExtemal ffairsWORKING PAPERSFinancial olicyandSystems

CountryEconomics epartmentThe WorldBankApril1990WPS 409

Financial Policyand Corporate Investmentin ImperfectCapital Markets

The Caseof Korea

MansoorDailami

The vigorous expansion of corporatereal investment in Korea inthe 1980sdespite high real interest rates owes muchto the rapidgrowth of the stock market and its increasinglyimportant role insupplying equity capital to the corporate sector.

ThePolicy, Research, nd ExternalAffairs ComplexdisinbutesPREWo&tingPaperso disseminatehe indings of wo& in pngmnssiiid o encouragethe exchange f ideasamongBankstaffand all others ntersted in developmentssue. These apen carry he namesof theauthors,mflectotly their views, andshouldbe usedandcited accordingly. he findings, nterpretaticons,nd onclusions reheauthors' wn.They shouldnot be attnbutedo theWorld Bank, ts Board of Directors, ts management,r anyof its member ounies.

-

8/14/2019 Market Imperfection Korea

2/40

rPoMay,Resoroh,and Extmal Alhir

FinancialPolicy ndSystems

This paper -- a product ot' thc Financial Policy and Systems Division, Country Economics Departmcnt- is pan of a larger cf'fort in PRE to understand the role of capital markets in the growth and adjustmentprocess of developing countrics. Copies of this paper are available frec from the Wurld Bank, 1818 HStrect NW, Washington DC 20433. Pleasc contact Maria Raggambi, rrm N9-041, extension 37657 (47pages with tables).Dailamni'seconometric findings support three evident in the 1980s, when rapid growth of theconclusions about the relationship between cor- market has becn accompanied by vigorousporate finance and real investmenE n Korea: economic growth and a boom in corporatebusiness investment.

First, assuming that debt capital has beensubsidized through both taxation and regulatory Third, corporations in Korea have used low-intercst ratc policy, corporations have drawn on cost debt to finance investments in financialthe stock market to finance their marginal assets as well as in physical and productiveinvestment projects. assets. These financial assets - liquid assets(cash, bank deposits, and govemment securi-This reliance on new share issues as the ties), other companies' shares, and accountsmarginal source of financial capital is consistent receivable -- are known to account for relatively'with the observed relationship between stock more (42 6 pcrccnt) of total corporate assets inmarket price movements and corporate invest- Korea than in the United States (24.3 percent) orinent behavior. It also explains Daiiami's the United Kingdom (37.8 percent).inability to establish a statistically meaningfulrelationship bctwccn corporate investments and To the extent that extemal equity is theprofits - which would have been thc case had corporate sector's marginal source ol' funds,corporations funded their investments at thc what is relevant in determining incentives formargin through retained earnings. new investmcnt is what determines the cost ofequity (such as taxation of dividcnds and capitalThe marginal profitability of investment in gains) plus the procedure for pricing new shareKorca is higi, or has been shifting upward. issues.Otherwise it would be ditlicult to justify corpo-rate reliance on relatively costly extemal equity Policy should cater increasingly to theas a marginal sourcc of funds. requirement of developing equity markets,including measures to change the mcthod of'Second, the real aggregate stock market pricing new share issues from the prevailing par-price, rather than the average q, or even the value based system (or premiums thercol) to aaverage rate of profit, is the preferred proxy for system based on market forces. The existingthe theoretically appropriate - but unobserved par-value pricing procedure has evident!y becnmarginal q in explaining corporatc invest- an important factor behind the high cost ofment behavior. The link between stock market external equity capital in Korea and a potentialand real cconomic activity' has been particularly source of speculation.

The PRE Working Paper Series disscminates the findings of work under way in the Bank's Policy, Research, and ExternalAffairs Complex. An ohjective of the series is to get these findings out quickly, even if presentations are less than fullypolished. The findings, interpretations, and conclusions in these papers do not necessarily represent official Bank policy.Produced at the PRE Dissemination Center

-

8/14/2019 Market Imperfection Korea

3/40

la of ContanraI. Introduction . 2II. Theoretical ramework.. 2

1. The Model 22. Corporate Investment and MarginalSource of Funds 14III. 1. Empirical esults 172. Specification nd Data.17IV. Conclusion nd Policy Implications23Data Appendix 26References 30

List of Figures and TablFigure1 .15Table 1: Maximum-Likelihoodstimates f the Parameters f Equations(15. a) and (15.b).22Table A. 1.29

I would like to thankGerard Caprio, arceloGiugaleand PatrickHonohan forhelpfulcommentsand suggestions, nd InbomChoi for expertresearch ssis-tance.

-

8/14/2019 Market Imperfection Korea

4/40

I. Tntr6dua tion

Central to the effectiveness f financial oliciea geared towards promot-ing real business investment s the interaction etween corporations' inanc-ing and irvestment ecisions. The analysis f this interaction nd itsimplications or the role of finance in real economy has long been debated inthe field of both corporate inance nd investment heory.' In the former,the debate has centered on the determinants f optimal capital structure nthe capital market environment f industrialized ountries here the existenceof well developed ecurities arkets for pricing of various debt and equityclaims on corporate ssets are taken for granted. Within this context, neimportant oal of research as been to modify the implications f the originalModigliani-Miller 1958) leverage irrelevance heorem, y taking explicitaccount of the influences f taxes and costs of bankruptcy (Kraus nd Litzen-berger (1973), Scott (1976), im (1978)], he agency cost of debt (Jensen andMeckling (1976)] and the potential oss of non-debt tax shields, such asdepreciation llowances, De Angelo and Masulis (1980)] n the determinationof optimal financial everage. These studies have generally reated the cor-porate real investment ecisions s exogenous nd have focused on the financ-ing aspects of corporate nvestment ehavior. In contrast, here is theimportant trand of research n the neoclassical heory of private investmentbehavior hich, either in its original ontext [Jorgenson 1963), orgensonand Hall (1971)] or in its modified cost of adjustment ontext [Lucas (1967),

I See, for example, ickers (1970), hu and Meyer (1963), oen (1971), hrymesand Kurz (1967), and Ciccolo and Fromm (1979, 980).2 For recent empirical vidence n the simultaneous nfluence f these attrib-utes on optimal corporate apital structure n the U.S., see Bradley, arrelland Kim (1984); itman and Wessels (1988).

-

8/14/2019 Market Imperfection Korea

5/40

- 3 -

Gould (1968), readway (1969), ayashi (1982)], ssumes perfectcapital mar-kets and no uncertainty.3 In this case, it followsthat the firm'srealinvestment olicy is independent f how it is financed.

An important oint of co- ergencebetween theseseparate areasofresearchactivity n the theory of investment nd finance is the recentadvancesin the theory of imperfect apital marketsassociated ith, amongothers,Greenwald, tiglitz nd Weiss (1984), yers and Majluf (1984),Ber-nanke and Gertler (1989),Fazzari, ubbardard Petersen (1988); rossman andHart (1982). In an important eparture rom the traditional erfectcapitalmarket/full nformation ssumptions nderlying he Modigliani-Miller 1958)theorem--or he Jorgenson nvestment odel (1963)--this cw strandof litera-ture emphasizes he imperfections n capital marketsarising not only fromtaxes, ut also from asymmetry f information etween users and suppliers ffinance, nd shows how these imperfections ay create sndogenous inancingconstraints reventing irms from investing n projects with positive netpresent values. This possibility risesbecause of the additional remiumimposed on the supply of external inance, oth debt and equity, when inves-tors are less informed bout the firm's investment pportunities r its assetcharacteristics han insiders, .e.managers or stockholders. As aconsequence, he firm cannotcostlessly ubstitute xternal for internal undsin order to finance its desiredlevels of investment r dividend ayments.The upshot is that firms' financing, ividendand investment ecisions reinzerdependent, nd the nature of this interdependence s influenced y theinstitutional nd structural eatures f underlying apital market environ-ment.

3 For an extension f the neoclassical heoryof investment o include uncer-tainty,see Lucas and Prescott(1971), artman (1972); indyck (1982); ndAbel (1983).

-

8/14/2019 Market Imperfection Korea

6/40

.4-

Considering iperfections n capitalmarkets,the experience f develop-ing countries resents germane ground. In almostall thesecountrles apl-tal marketsare characterized y a high degree of segmentation, evereinformational symmetry, ncomplete arkets,weak prudential upervision, ndaboveall by pervasive overnront nterventions n the form of direct alloca-tion of credit,officialsettingof interest atesand tlghtregulatoryrestrictions n companies' ricingand offerings f new equityshare ssues.4These imperfections re, to a largeextent,structural, n the sense that theylmpose hlgher degreeof stringency n firas' financlng nd investment eci-sions than are Liplied y pure informational symetry presumedto exist lndeveloped ountries' apital arkets. The reformof these structuralimperfections s currently he focusof liberalizatloneasures dvocated ythe international inancial rganizations see,Cho (1986),Gelb and Honohan(1988), orld Bank (1989)].

The objectives f thispaper are two-fold: flrst,to developan inte-grated approacntowardsthe problemof optima)corporate eal investment ndfinancein the contextof a financial odel oE a developing conomycharacterized y creditrationing, controlled ankingsector,and an orga-nized equitymarket;and second,to apply the model to the non-financial or-porate sector of the Koreaneconomy. Korea presents n interesting xamplefor a number of reasons,including he government's raditionally ctive useof credit,interest ate and tax policy to stimulate nvestment; he existenceof relatively ell-developed nd broadbased equitymarkets;and the largesize of the corporate ector,accounting or about 60 percentof totaldomes-tic capital formation seeData Annex for background nformation on thesefeatures f the Korean economy]. In addltion, he tax treatment f incomefrom capitalin Korea, particularly t the personal evel, is very different

4 See, for example, elb (1989); ybout (1984); abi (1989); im (1989,andthe World Bank (1989).

-

8/14/2019 Market Imperfection Korea

7/40

- 5-

from that in he United States, 5 thereby providing n opportunity o analyzethe relationshil et ien capitaltaxation, orporate inanceand investment,issueswhic;h ave so far been explored nly in the contextof industrializedcountries ith mature securities arkets Miller (1977), oterbaand Summers(1983, 985);Bradley,arrelland Kim (1984)].

The remainder f the paper is organized s follows. In SectionI wedescribe ur theoretical odel of companies' ptimalinvestment nd financingbehavior, hich isbased on the familiar Tobin's " approachto the theoryofinvestment,ut extended o incorporate ome important ax and financial ea-tures of Korean economy. Specifically, n the model, there are three sourcesof funds: (i) retained arnings;(ii)debt capital; nd (iii,externalequity. Firms raise externalequity in the form of both initialpublic offer-ings (IPO's)4 nd seasonedissues f stocks, hile debt is placed only withthe financial nstitutions ncluding oth domestic nd foreign anks andnon-bank inancial nstitutions. There existsa well-functioning radingmar-ket in equity shareswhich price equity claimscompetitively, ut the interestrate on bank loans is administrativelyet and is treatedas a policyvariable. Capitalgains are exempt from personaltaxes,but dividendincomes

5 While there are important imilarities n the prevailing ax codes in Koreaand the United States in terms of corporate axation, here are importantdifferences n personaltaxation. One such difference, or example, is themuch lightertaxation f interest ncomerelative o equity income in Koreathan in the United States. Thanks to variousexemptions, he effective axi-mum tax rate on interestincome (including efense, ducation nd residencetaxes) in Korea is 18 percentcompared o 28 percentin the United States(afterthe tax reformof 1986). But incomefrom stocks is taxed much moreheavily in Korea;althoughcapitalgains are not subjectto personaltaxationthere,dividendincome is taxed at a rate as high as 70 percentfor wealthyindividuals, nce the defenseand residence axesare taken into account. Seedata Annex,Table A.1 for details.6 The amountof capitalraised throughIPO'sdependsof course on the numberof companies oing public,and this has varied considerably uring the pasttwo decades. In 1987, for instance, herewere 35 new listings nd one delis-ting. See Socuriti.. Market in Korea, the Korea Securities ealersAssoci-ation, 1988, for details.

-

8/14/2019 Market Imperfection Korea

8/40

*6-

are UkjO- to high marginal orsonal ax rates. Giventhese ax and finan-cial constraints,hefirm's ptimal ate f real investment s derived s afunction f wTobin's arginal ," (the ratio betweenthe market's valuation fan incremental nit of capital to its c;at of replacement), ax, and financialparameters haracterizinghe fLrm's arglnal ource f funds.

Section II discusses he estimationf the odel, lth annual ata from1963 to 1986. UsLng oth capital arket nd balance heet ata, everalmeasures of the valuatlon atio are providedand their relovance nd limXta-tion for explaining orporate eal investment ehavior in the Korean economyare discussed. Finally, ection IV concludes he paper with a briefdiscussion f some relevant olicy implications nd lessons.

II. Theorptieal FrAmovprk1. The Modal

We begin our analysis ith a description f the objectives hat a firm'smanagers ay pursue in formulating heir investment nd financing lans in thetax and financial nvironment f Korean economy.

Given the family-based tructure f corporate wnership nd control inKorea, it seems plausible o assume that managers act in the interest fexisting shareholders no seek o maximize the value of equity subject to aset of constraints. These ccnstraints re set by technolo& by imperfec-tions in capital arkets, by tax provisions, nd by 4nvestors' equiredreturnon equity. The returns required y equityholders depend on returns onalternative nvestment pportunities, hich in Korea (where apital marketshave until quite recently een virtually losed), re taken to be yields ongovernmerstonds.

7 This assumption lso applies to corporations ith diffused shareholdingbases under the conditions hat managers ave a share ownership take in thefirm [Jensen nd Heckling (1976), r when the firm is leveraged ith potentialthreat of bankruptcy (see Grossman and Hart (1982)].

-

8/14/2019 Market Imperfection Korea

9/40

We, thus, posit, -(I- )R, where p - required eturn oii equity; R -average ield on government onds, and xi - effective ersona, tax rate oninterest n government onds. Similarly, etting to be marginal personaltax rate on dividendincome, nd noting that capital gains in Korea are exemptfrom personal taxation, he firm's objective an be stated formallyas:

maxE.-f exp (-p1) [(1-m)d(t)-u(t)] dt (I)where d(t) and v(t) denote, respectively, he firm'sdividend paymentand newshare issues at time t, and E. is the present value of future stream of aftertax dividen' payments net of new stock issues.

The firm solves the maximization problem (1), subject to a set of con-straints. The first constraint tems from the legalrequirement andated ylaw [The Capital Market Promotior.ct of 19681, which obliges companies tomaintaina definedminimum stream of dividend payments regardless of theircash flow or tax consequences.' hus, we have

d(t) > di vtjme 2

whete d is an exogenously iven stream of dividend ayments.

Likewise, e constrain ew share issues to be non-negative r:

u(t) 2 0 Vtimn (3)

8 Note that such tax consequences re very severe in Korea where capital gainsare not subject to personaltaxation, hile dividend incomeis taxed at arelatively igh rate. In spiteof that, companies ave distributed sizeableportion of their earnings s dividends o shareholders, veraging 8 pe centfor the corporate ector as a whole over the 1975-1986 eriod. The tax costassociated ith this pay-out ratio, computed t an average dividendincome taxrate of 58 percent,amounts to 16.2 percent of corporate arnings or about 3.4percent of corporate ixed investment.

-

8/14/2019 Market Imperfection Korea

10/40

a8-

While there is no legal restriction n companies epurchasing heir shares,the strong need for funds induced y robust expans.on f corporate nvestmenteffectively recludes this option.

The third constraint efers to the firm's access to the official reditmarket, which is assumed to be limited. Specifically, e assume that banksare willing to lend only a fraction f each enterprise's ew investment eeds.This fraction is assumedto depend negatively n the company dAbt/capitalratio. A linear ersion of this restriction s expressed s,

b(t) S hP(t) l(t) + I P(t) K(t) - I, 8(t) (4)where (t) is the maximum lezel of bank credit extended at time t, B(t) is thestock of corporate ebt outstanding, (t) is the stock of real capital, (t)is gross corporate eal iiavesLment,(t) in the price of capital goods, and h,P and P2 are non-negative arameters f the underlying upply function ofbank credit,

The fourth constraint efers to the equality etween the use and sourcesof funds. The firm's sources of funds consist of three items: (a) after taxoperating rofits; net of interest aymkent ut including epreciationlllow-ances; (b) net borrowing; nd (c) net proceeds from new share issues. On theuse side, there are two main items: (a) payments f dividends nd (b)expenditures n new capital goods including osts of installation nd adjust-ment. Under these conditions, ash flow available or distribution o exis-ting share holders at time t are given by

d(t) - (I-Ti) [it(K(t)) - r B(t)] + b(t) - B(L) + (I-u) v(t)- P(t) C(I(t), K(t)) - P(t)( l- rz(t))l(t) (5)

where n(.) before interest nd tax profit, taken to be an increasing ndconcave function f K, i.e. " > 0 ,, 5 0, r - interest ate, p - amortiza-tion rate on debt, v - new share issues, - the average cost, consisting f

-

8/14/2019 Market Imperfection Korea

11/40

.9-

both transaction nd underpricing osts,per unit of capitalraised throughexternalequity issues,% - the corporate rofit tax rate, and C (.) anadjustment-cost unction assumedto be an increasing unction f I and K andz - presentvalue of depreciation llowance llowedfor tax purposes n oneunit of new investment.'

The cash flow constraint(5) is straightforward,lthoughthree featuresrequirecoomnt. First, it is noted that interest aymeats re treatedas taxceductible. This conformsto the prevailing ax regulation n many countriesincluding orea, where tax allowances re made for corporate nterest ay-ments. This, in effect,lowersthe cost of borrowing nd thus inducesfirmsto substitute ebt for equityfinancing. The limit to this processofsubstitution s determined itherby some legal>%ad nstitutional estraintson the debt financeavailable, r throughconsideration f varioasleverage-relatedcosts such as bankruptcy osts,costs due to agencyand asymmetricalinformation roblems r a lossof non-debttax shiel.ds seeDe AngeloandMasulis (1980); im (1982); oss (1985)]. Second,it is assumedthat externalequity financing s costly,and the cost is proportional o the gross proceedsfrom new share issuance, .e.uu(1).10 hus, the net proceedsfrom externalequity capitalare equal to (l-u)v, hich is includedin equation(5) as anadditionto the firm'scash flows. Third,we have included cost of adjust-ment item,C(I, K) in equation(5) to capturethe additional nstallation

9 Note that equation (5) excludes term for depreciation llowances llowedfor tax purposeson the existinglevel of capital. This term dependson pastinvestment nd has no influence n futureinvestment seeAbel (1983); ummers(1981)for details.]10 We recognize wo types of costs here: (i) transaction osts involvingunderwriters' ommissions nd legaland other relatedexpenses; nd (ii) theindirect osts associated ith the underpricing f new share issues ue pri-marily to the "par value"method of settingthe offerpr4-e at the par value.These indirect osts are very seriousin Korea,where ii .ial ublic offerings(IPOs)are traditionally ricedat, or very close to, par value. IPO'show-ever, accountfor only a smallproportion f total equity capitalraisedexternally; he dominant harecomes from seasonedissuance f stocksofferedto the existingshareholders n the form of rights issues.

-

8/14/2019 Market Imperfection Korea

12/40

10 -

expenses ssociated ith the process of investment. The rationale s based onthe models f Lucas (1967), Go.ild (1968) andTreadway (1969), here the costof adjustment as introduced n the neoclassical heory of investment oobtainan explicit solution for the firm's optimal ate of investment. Fur-thermore, his cost function is assumed o depend positively on Land specifi-cally o take he form:

C (1,K) - a/2 (K n-.)) x (6)where a a 0 is a constant parameter, and n(.) is a function to be specifiedlater and denotes the normal or long-term growth of fixed assets.

Two other constrai-ts %re he evolution of the firm's stocks of capitaland debt as given by:

JKt) - I(t) - 6 K(t) (7)B(t) - b(t) - 3 B(t) (8)

where is the rate of depeeciation f physical apital.

Equation (7) describes he familiar erpetual ethod of capital accumu-lation, herein real capital increases t the rate of gross investment essdepreciation ue to obsolescence nd wear and tear. The rate of depreciationis further taken as a constant raction f existing apital stock. In equa-tion (8) net flow of loans from the banking sector is defined as the diffe*-ence between new loans contracted nd the amortization ayment on the existingloanswhere the rate of amortizations assumed to remain unchanged ver time.

-

8/14/2019 Market Imperfection Korea

13/40

- 11 -

The maximization roblem facing the firm, stated formally, s to chooseb(t), I(t), and v(t) o maximize he present alue of its market equity, givenby equation (1), subject to the constraints 2), (3), (4), (5), (7) and (8)and given initial onditions, (o) and K(o). This problem can be solved bymeans of standard control techniques. Thus, we treat b(t), I(t) and v(t) ascontrol variables nd B(t) and K(t) as state variables nd formulate hecurrent-value amiltonian, , as,

H - (1-m) d-v + k (I - 6K) + p (b - 3B) (9)where k and p are the associated hadow prices of capital and debt, respec-tively.

Taking into account tae constraints 2), (3) and (4) and substituting ord from equation (5) into (9), we define the Lagrangian as:

L - (1-m.+lW 2 ) [(I -t) (n(K)-rB) - tB + b-P(1(1-tz)+C(1,K))] ((1-m.+i) (1-U) + I3-) V ip,(hPI + 1, PK -328 - b) (10)

where w,, 2 and i3 are the Lagrangian multipliers associated with constraints(4), (2) and (3) respeccively. The necessary onditions or an optimal solu-tion are the following:

_ (p + 6) X - (1-m+e 2 )) [(I -T) an P aK]- wi' (1l a)1i (p + 1) p + (1-m+, 2 ) CD + (1-t)r] + 12W (11.b)aL

ab (1-m.i4p 2 ) + p - VI 0 (I .c)-L (1 -m*V 2 P 1 --rZ * C) + . * -lp 0 (11.d)

-

8/14/2019 Market Imperfection Korea

14/40

- 12 -

d' (L -m.+)(-u) + 3 1 O (I 1), (10 .1)

Va (d-d) - 0 (11.g)

V3U (ll.h)

There are, A 2riorl,everal possible ptimllpaths or regimes corre-sponding o whether constraints 2), (3), and (4) are binding or not. Todetermine hese optimal paths, we rely on the assumption hat debt is cheaperthan equity financing n Korea, which would imply that firms have the incen-tive to resort to the maximun level of borrowing ossible. In this case,VI > 0 and from equations ll.b) and (ll.c) t follows that , _which is the capitalized ifference n the after tax cost of debt and equityper unit of debt capital, r the subsidy to the existing shareholders f thefirm's having access to low cost debt. To deriveformally the firm's optimalinvestment ule and its financing, e substitute orWi into equations(ll.d)and obtain,

(I- + )[I@ a/C - - z-h p + + 2]J q (12)where q is the familiar"Tobin's arginal " defined as the ratioof themarginal alue of an additional nit of capital(i.e. the shadowprice ofcapital), to the price of capital goods, P. [Abel (1979), Chirinko(1987)].Equation (12) describes he equilibrium ondition or the firm's optimumlevel of real investment. It states that an optimizing irm will continue oinvest ntil the marginal ost of an additional nit of investment s equal tothe marginal alue of that investment. The marginal ost of investmentdepends on the cost of the marginalsource of funds as well as on the net

-

8/14/2019 Market Imperfection Korea

15/40

- 13 -

marginal osts of acquiring apital. The latterterms involvethe sum ofpurchaseand marginal djustment osts less the tax savingsfrom depreciationallowances n one unit of investment n fixedassetsand less the leveragerelatedbenefitsto the existing hareholders f the availability f low costdebt. The availability f low cost debt implies lso that equity is themarginalsourceof financial apitalto the firm;and in this respectthereare two alternative ptimalinvestment ules,depending n whether the firmfinances ts investment t the marginby resorting o retainedearnings(i.e.internal quity),or by issuingnew shares,(i.e. externalequity). Thesealternatives orrespond, ormally, o whether V2- and V3>O), which implies!- + 2 1 -m; or whether *2>0 and Vs-0), hich from equation(ll. ) impliesthat 1-m.+42-,',. Substituting hesealternative alues for 1-m+W 2 in equa-tion (12), and solving it for the firm's optimal investment rate yields:

1 r 1 tz p-1-t)rl- a [(1r q _ (1- 'z-CZ)jh LP-(I- *n(.) (13.a)

which is the firm's optimal investment rate when the marginal source of fundsis retained earnings, and

I -Ia [(I-u) q - (1 -tz)]+ h [ nF.] (13_b)which is the corresponding nvestment quation hen the firm financesitsinvestment t the margin throughissuance f new equity.

-

8/14/2019 Market Imperfection Korea

16/40

14 -

2. CnMarat& Invaatm.nt And MArginI Sourte of FundsThese equations ffer some important nsights nto the relationship

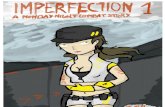

between the firm'soptimal investment nd its sourcesof equity financing. Tohighlight his relationship, t is convenient o abstract, or a moment, fromthe influence f debt subsidyand solve for the steady-state alues of mar-ginal q to obtain q6 1-(I-m)(I-xz) and qea-U=. These define,respectively,the threshold alues of q for marginal investment rojectsthat are financedby retained arningsand by issuing ew equity shares. For recentvalues ofm, c and T2 from the Koreaneconomy,it can be shown thatq2' >1> q,' hichimplies hierarchical rder in firms'financing ehavior,shown in Figure 1.In this figurethe horizontallinesSIand S2 correspond espectively o q -q*1 and q - q*2, and the relatively arge distance etween theselinesreflects he combinedinfluences f high taxation f dividend incomerelativeto capital gains and the directand indirect osts of issuingnew share equityin Korea. This high cost differential etween internal nd externalsourceofequity financeimpliesthat only firmswith relatively igh marginalprofit-ability of investment, s shownby demand schedule 2, resort to externalequity as theirmarginalsourceof funds. In contrast, irms with investmentprojects haracterized y demandschedule 1, rely on internalfundstofinance their marginalinvestments. This directrelationship etween firms'investment nd financing ecisions rovides useful device to motivatethediscussion f financial olicy. To the extentthat firms financetheirmar-ginal investment rojectsthroughissuance f new equity shares ratherthanthroughretentions f earnings, t is the stock market performance hatbearsinfluence n the incentives o invest. On the otherhand, for firmsthatretention f earnings is the marginalsourceof funds,one expects a closerelationship etweencorporate arnings nd investment. In practice, ach ofthese scenarios ay apply to some firms,but which one is predominant s thekey empirical uestionto be addressed n the next section. Given that our

-

8/14/2019 Market Imperfection Korea

17/40

- 15 -Figure 1

q

q-q 2 S2

D2

q-q I-DI

Investment

Figure 1: Marginal Source of Fundsand Investment Schedules.

-

8/14/2019 Market Imperfection Korea

18/40

16

data relates to the corporate ectoras a whole, we take a weightedaverage ofequations 13.a) and (13.b) ith the weight assignedto the former denoted bye, to obtain an aggregate nvestment quation:

1 I(1e \1-u+ I-z hp (1n-)r14l,l~( Il8(-uq ls a I P+0+0+ Iwhich provides the basis for our estimation. Note that the numerical aluethate takes is criticalto the identification f the marginalsources offunds to the corporate ector. A value of 0 0 implies that new share issueis the marginal sourceof funds; a value of e- 1, on the other hand, impliesthat the corporate ector relieson internally enerated unds to finance itsmarginal investment rojects.

-

8/14/2019 Market Imperfection Korea

19/40

- 17 -

III. Empsircal eults

III1. SRpecification nd Data

In this section e use annual data for the non-financial orporate ectorof the Korean economy over the period of 1963-1986 o estimate simultaneouslythe system of equatiorts 14) and (4). The starting oint is the modificationof these equations into some suitable mpirical orm. First, we specifyn(.), the long-tErm rowth in fixed capital in equation (14), as a function fthe long-term rowth in final demand, and distinguishing etween domestic ndexternal demandwo poeit: n(.) n'X,, where i'-(rI.,1l, n12, n,. I14. %, I1) is avector of parametersnd X,'-(I, X,, x,,,1, ,U2, x2,, 2,,, x21,2), where xi, ndx2, are, respectively, rowth rates of exports and domestic demand in year .Second, we extend equation (4) to account for the possibility hat bank creditmay be used to finance investments ther than those in fixed assets. Thus,denoting orporate investment n financial ssets by At, the basic equationsto be estimated, xpressed n discrete time, are:

l_ I [( -q,+(e-O)(1,)q,)1 - T,Z,S)] a (2 X (15Ea)

bK + h BIA ,2I + 133 K e2 (15.b)P, K, *P,K,K,where all terms in equation (15.b) re scaled by PK to conform to equation(15. ), El E2, are disturbance erms assumed to be normally distributed ithdefinite ariance co-variance atrix and zero means, and

-

8/14/2019 Market Imperfection Korea

20/40

.18

S,(,)piP-(l-l)rl

where is a given value of the rate of amortization aken to be 10 percentper year. Note that, for a given value of P2, St is empirically bservableand thus can be used as part of the data set.

To proceedwith estimation, e firstobtain an unbiasedestimate or 2by applyinginstrumental ariablesto equation(15.b), sing total corporateearnings s an instrument or investment, . This procedure s needed toovercome he simultaneity roblem associated ith the appearance f investmentas an Lndependent ariablein equation (15.b). Thus, using annualdata from1964 to 1986, the instrumental ariable stimateof A is given by 02 - 0.20with tandarderror 0.055 and t - statistic 3.71. Given this estimatef02,we next turn to the estimation f equations 15.a) nd (15.b). Oneobstacle, owever,remains. As emphasized riginally y Tobin and Brainard(1977), nd subsequently y Summers (1981), ayashi(1982), nd Chirinko(1987); q ln equation (15.a)is not directly bservable nd so this equationis not empirically perational. The standard pproach doptedin the empiri-cal work in the United States as been to use "average " definedas the ratioof the market valuation f existing apitalto its replacement ost (see,forinstance, on Furstenberg 1977);Summers(1981)]. The use of averageq isappealing rom a theoretical oint of view, since it providesa link betweensecurities arketsperformance nd corporate eal investment ehavior. Theproblemresides, owever, ith the empirical erformance f averageq inexplaining orporate nvestment. The experience n the United States revealsthat measuresof averageq are typically ery poor predictors f investment,and are statistically nferior o other proxiessuch as the real aggregatestock marketprice index [Barro (1989)]. Interestingly, ur findings ithKorean data confirmed hese findings n the United States. Experimenting ith

-

8/14/2019 Market Imperfection Korea

21/40

- 19 -

severalmeasures of average q11, we were not able to establish ny statis-tically eaningful elationship etween corporate nvestment nd average q.Instead, he use of real aggregate tock market price index proved to be muchsuperior, nd this providesthe basis for estimation esultsreported elow.

III. . atAMathnd and R-eultaThe system of investment quation (15.a) and the bank credit supply func-

tion (15.b) ere estimated imultaneously y full information aximum likeli-hood method, with annual data from 1964-1986. The data has already beendefined, ith details regarding ethodology, ources and construction eingreported in the Data Appendix.

Table 1 contains the estimation esults under two specifications fparameter , i.e ; (i) when G was not g Rriori restricted; nd (ii) when e wasrestricted o be zero. The table also shows the log likelihood alues underthese two specifications nd the implied likelihood atio statistic or test-ing the hypothesis - 0. This statistic s distributed 2(), with criticalvalues 3.84 (5% probability f type I error) and 6.63 (1%). Since thesevalues exceed the computed ikelihood atio statistic f 1.902, we accept thespecification - 0. This is an important inding, ince it means that thecorporate ector in Korea finances ts investment t the margin by issuing newequity shares, rather than by resorting o earning retention. This relianceon external quity as the marginal source of funds for financing nvestment sconsistent ith the observation hat investment n Korea is relatedto stockmarket price index but not to corporate arnings. The lack of strong rela-tionship etween investment nd earnings implies that investment as not beenconstrained y internal orporate esources.

11 These measures ere based on the ratio of market value of equity plus bookvalue of debt to the replacement ost of capital, here capital was definedeither broadly to include achinery, quipment, nd inventories, r narrowlyas only the sum of machinery nd equipment.

-

8/14/2019 Market Imperfection Korea

22/40

20

Given the weight of evidence n supportof the specification, - 0, wecontinueour interpretation f the resultsunder this specification, s con-tained in the secondcolumn of Table 1. Regarding hese results,they seemquite satisfactory, ince all have the right sign and all, with the exceptionof secondlags of growthof exportsand domesticdemand,are significantlydifferent rom zero at the 5 or 10 percentlevels,as marked in the table.The estimated alue for h is 0.43, indicating hat corporations n Koreauseabout half of their low-cost ank loans to financefixed investments, nd usethe rest to financeothers such as financial nvestments. This estimate sconsistent ith supplementary nformation n the observedshareof fixedassets in Koreancorporate alancesheetand its policy implications ill beelaborated elow. The estimates f other financial arameters, .e. 013,andE3 are all strongly ignificant, upporting he view that financial ndreal investment ecisions re interdependent n Korea. The implied alue forthe coefficient f cost of adjustment s a,2 - 22.4,which is high,but notunusual in the empirical iterature n the Q-approach o investment.2 Thepossibility, evertheless, emains that our estimate ay containan upwardbias due to errors in variables, r due to a specification"3roblemarisingfrom our use of the aggregate eal stockmarketprice indexas a proxy for the

12 Though not directly omparable, hirinko(1987) eportsestimatefor arangingfrom 536.62 to 558.7, hen ;heinfluence f demand is included, ndranging from 183.7 to 209.6, hen demandis excludedfrom his model of corpo-rate investment n the United States. Similarly, stimates eported y Fot-erba and Summers (1983)for the United Kingdomdata are much higher than ourestimatefor the Korean data.13 We also experimented ith the use of averagerate of profitsas a proxy formarginal , but the resultswere not satisfactory o warrant reporting. vi-dently,no singleproxycan capture fully the influence n -nvastmentf mar-ginal q. Hence, attention hould e given to consideration f severa'.roxiesand indicators. The methodology or estimating ultiploindicators n linearstructural odels is well developed[see,for instance, oreskogand Gold-berger (1975), entler (1983), igner,et. (1984) or estimation ssuesandTitman and Wessels (1988),for an interesting pplication o corporatefinance]. The extension nd application f this methodology o non-linearmodelswhich are typicalfeatures f the Q-approach o investment resentspromising rea of futureresearch.

-

8/14/2019 Market Imperfection Korea

23/40

21 -

theoretically ppropriate, ut not observable, arginalq. Fina ly, ourresultsconfirmthe sensLtivLty f business orporate nvestment n Korea tochanges in demand conditions, oth internal nd external. As shown in Table1, the contemporaneous nd laggedcoefficients f growth rates of both realexportsand domesticdemandare estimated t a high level of significance, ndlags of higher order do not seem to matter. Therefore, ur findings endfurthersupportto the relevance f accelerator erms in Q-wodelsof invest-ment behavior.

-

8/14/2019 Market Imperfection Korea

24/40

. 22 -

Table 1: Maximum-Likelihoodstimates f theParameters f Equations 15.a) nd (15.b),(Standard rrorsare in Parentheses)

Parameter r Unrestricted Restricted(0-0)Statisticno*^l 0.12 0.10(0.01) (0.01)a ^ 1 32.72 44.79(7.31) (12.80)h * 0.56 0.43(0.23.) (0.24)n u0.02 0.05(0.02) (0.02)

**

q2 ^- 0.01 0.04(0.03) (0.02)Th -0.03 -0.03(0.02) (0.02)Ti4 0.33 0.31(0.07) (0.07)Tns 0.29 0.34

(0.06) (0.06)n16 0.08 0.07(0.05) (0.06)13 0.05 0.07

(0.04) (0.04)13 0.76 0.74(0.17) (0.18)e -0.17 0.00(0.09)Log L 114.865 113.914a 1.902Noe: Sample period is 1964-1986; og L represents he log likelihood tatis-tic; a is the likelihood atio test statistic nder e- 0 hypothesis;*I significant t the 5 percent level.*I significant t the 10 percent level.

-

8/14/2019 Market Imperfection Korea

25/40

23

IV. Cnne1uuien Anil Poling, Impieattona

The econonometric indings resented in this paper support three conclu-sions regardingthe relationshipetween corporate finance and real invest-ment in Korea.

First, iven he reomise that debt capital as been subsidized hroughboth taxationand regulatory nterest ate policy, corporations ave drawn onthe stock arket o finance heir arginal nvestmentrojects. his relianceon new share ssues s he marginal ource f financial apital s consistentwith the observed elationshipetween tock arket rice ovements nd corpo-rate investmentehavior. It also accords ith our inability o establishstatisticallyeaningful elationshipetween orporate nvestment ndprofits, hich ould ave been the case ad corporationsunded heir nvest-ment at the margin hrough etained arnings. his conclusion lso uggeststhat he marginal rofitabilityf investment n Korea is high, r has beenshifting pwards. Without hat, t would e difficult o justify orporatereliance n relatively ostly xternal quity s their arginal ource ffunds.

Second, the real aggregate stock market price, rather than the average q,or even the average rate of profit, is the preferred roxy for the theoreti-cally appropriate--but unobserved--marginal q in explaining corporate invest-ment behavior. This conclusion is important, rot only because it supports thefindings of Barro (1989) and Fischer and Merton (1984) for the United States,but also because it draws attention to the important link between stock marketand real economic activity in the Korean economy. Such a link has been par-ticularly evident in the 1980s when the rapid growth of the market has beenaccompanied y a boom in corporate usiness investment s well as a vigorouseconomic growth. The 1980s have also seen other important acroeconomic ndpolicy changes in the Korean economy ircluding easures to reduce inflation,

-

8/14/2019 Market Imperfection Korea

26/40

- 24 -

large growth in household avingsand a sharp turn-around n the country'sbalanceof paymentpositionfrom deficitto surplusin 1986.1 These develop-ments highlightthe macro dimension f stock market performance n Korea,andin that respect, he relationship etweenstock market and investment slikelyto be an interactive ne. Thus, our approach f treating he stockmarket as exogenous s likelyto have introduced n upward simultaneity lasin the estimated oefficient , due to the simultanelty etweens*ock marketand corporate eal investment erformances,

Third, our findings ighlightthe extentto which corporations n Koreahave used low cost debt to flnanceinvestments n financial ssets,as opposedo physical nd productive ssets. These financial ssets,referring o liq-uid assets (cash, ank deposlts nd government ecurities), ther ccapanies'sharesand accounts eceivables re known to accountfor a relatively argershare of corporate otal assets in Korea than those in the United States orthe UnitedKingdom. Evldence rovided y Dailami(1989, ) on asset composi-tion of corporate alancesheetsin Korea and in a sample of developed oun-tries shows, for instance, hat financial ssetsaccounted n 1983, inaggregate, or about 42.6 percentof total assets in Korea as compared ith acorrespondIng atioof 24.3 percentin the United Statesand 37.8 percentinthe United Kingdom.

These conclusions, akentogether, ield important mplications or theconductof financial olicy in Korea. They suggestthat a narrow focus oninterest ate policy is likelyto be ineffective, ot only becauseof theimportant eight of financial ssets in corporate alancesheets,but alsobecauseof the increasingly mportant ole that the stock markethas played to

14 See Dailami (1989a); Dornbusch nd Park (1987); orbo and Nam (1986)forreview and analysis f macro economic valuation f Korean economyin the1980s.

-

8/14/2019 Market Imperfection Korea

27/40

25

supply equity capital to the corporate ector s To the extent that externalequity constitutes he marginalsource of funds to the corporate ector, it isthe consideration f the determinant f cost of equitysuch as taxationofdividends nd capital g&ins, as well as the procedure or pricing new shareissues, which are relevant n determining ncentives or new investment.16 nthis regard, olicy necds to cater increasingly o the requirement f develop-ment of equity markets,including easures to modify the prevailing ethod ofpricing of new share ssues at par rather than at market value. The existingpar-value ri'-ing rocedure as evidently een an important actor behind thehigh cost of external quity capital in Korea and a sourceof unhelthy specu-latior..

15 For the corporate ector as a whole, equity financing ccounted uring theperiod 1985-1987 or 23.7 percentof totalcorporate xternal inancing eeds,as comparedto 34.4 percent from traditional ank loans.16 There is also the argument gainstsubsidizing ebt capitalthat lends todistortions n resource llocation.

-

8/14/2019 Market Imperfection Korea

28/40

- 26 -

Da La AppendiA

The primary source for most of the data used in this study is the Eco_-nonIi *atiaties YaArbook (ESYB), ank of Korse, arious ssues.Two setofflow of funds tables,i.e. the Integrated ccounts f NationalIncome andFinancial ransactions, nd Financial ssets and Liabilities, ontained inthis publication ere utilized to generat. the necessary alance sheet datafor the total non-financial orporate ector for the years 1963.1986. Thesedata were supplemented, hen necesryaq, y drawing on several other sources,including ational ccounts (NA), Bank of Korea;KoreAn_Tax&iQn (KT), Minis-try of Finance; SanuritAeu S tatnea Ymarhook (SSYB), Korea Stock Exchange;and Securities arket n Korea (SMK), arious years, The Korea SecuritiesDealers ssociation.

The definitions f variables re as follows:1. I - gross real investment n machinery, quipment, tructures, nd inven-

tories, for non-residential, on-financial orporate ector at 1980 con-stant prices, based on (NA);

2. q - ratio of aggregate tock market price Index (Korea omposite tockPrice Index) to implicit rice deflator or capital goods (SSYB) and(NA);

3. b - gross borrowing onsisting f special and commercial ank loans,insurance nd trust loans and net foreign loans, (ESYB);

4. B - total corporate ebt consisting f total bank debt, foreign debt anddebt owned to insurance nd trust companies, ESYB);5. m - personal tax rate on dividend income, onstructed s the weighted

average of marginal personal tax rates on dividends or different lass

-

8/14/2019 Market Imperfection Korea

29/40

- 27 -

of stock holders, i.e. individuals, nstitutions, nd companies. Thesource of data is (KT) for tax rates and (SSYB) for stock ownership om-position;

6. p average yield on government onds; for the 1972-186 period and priorto that corporate ividend ield, (SSYB);

7. r - nominal lending rate, constructed s the simple average of rates ongeneral bank loans, export loans, loans from the Machinery Industry ro-motion rund; and loans from the National Investment und, (NA);

8. c corporate ncome tax rate. including efense and residence ax, (KT);9. z present value of standard epreciation llowances n new investment

in fixed assets (machinery nd equipment nd structures) llowed for taxpurposes and calculated nder a straight-line epreciation ormula andbased on an asset lifetime f 42.5 years for structures nd 10 years formachinery nd equipment, KT).

10. u - average cost per unit of gross proceeds from issuing ew equityshares, calculated s: u - (UPC+ tc) (RIPOS) (1-RIPOS) tc),where UPC - underpricing ost associated ith IPOS, taken from Kim andLee (1989); tc - transaction ost, taken from (SMK); IPOS ratio ofcapital raised through IPOS relative to total capital raised by issuanceof new equity shares, (SMK).

11. K - net capital stock, where capital is defined broadly to includemachinery nd equipment, tructures nd inventories; ixed assets werecalculated t replacement ost value, based on perpetual nventory alue,using an average depreciation ate of 0.091; and bench mark value for1962 obtained from Pyo (1988). Inventories ere measured at marketvalue, after adjustments or inflation nd inventory urnover are takeninto account (NA) and (ESYB).

12. A - corporate nvestment n non-fixed ssets, (ESYB).13. x - Annual growth rate of export volume (NA).

-

8/14/2019 Market Imperfection Korea

30/40

- 28 -

14. x2 - Annual growth ate of real domestic emand (NA).

-

8/14/2019 Market Imperfection Korea

31/40

- 29 -

Tnvastment, inancial nd Tax DAtas KoreanNon-financial orporate ector(Annual Average. for Selected Periods)(Percentage, unless indicated)

1963-69 70-74 75-78 79-81 82-861. Cor:prta- Fixed Invent-an

a. growthrate 25.7 10.5 21.3 -1.1 11.7b. percent of GDP 12.6 14.5 17.4 19.0 19.02. Iaon of TWCz,=fro Ca2ta

a. corporate income 29.4 26.7 35.4 41.1 40.5b. dividend income 11.3 15.8 57.i 61.6 57.6c. income earned on

interest on bankdeposits 13.5 19.0 6.3 10.2 17.8d. income earned on

interest from govern-ment bonds 0 0 0 4.3 17.8

3. ReaI Tnterent Rate -0.2 -5.8 -7.7 -3.5 6.44. Stock Market

a. Market Capitalization/GDP 2.7 5.5 11.1 7.1 8.4b. Real Aggregate Price

Index(1980-100) 166.8 230.0 216.5 117.4 121.85. Corporate Investment/

Total Domestic Investment 65.1 62.3 65.4 62.4 60.3

Noce and Sources: See previous section on definition and source of data.

-

8/14/2019 Market Imperfection Korea

32/40

* 30 -

REFERENCESAbel, A. B. (1979), alue Of Capital, Garland, ew York.

, (1983), "Optimal Investment Under Uncertainty," IhAAmerican Economic Ravi& , pp. 228-233.

Aigner,D., C. Hsiao, A. Kapteynand T. Wansbeck,(1984), Latent variableModels in Econometrics' n Z. Griliches nd H. D. Intriligator, ds.,Hndk9iL of Erconometrlc, ol. II, NorthHolland Publications, p.1321-1393.

Barro,R. I., (1989), "The Stock Market and Itnvestment,"ationalBureau ofEconomicResearch, orkingPaper, No. 2925.

Bentler, . M., (1983)."Simultaneous quation ystemsand Moment StructureModels," ournalof Econometrics, p. 13-42.

Bernanke, . and M. Gertler, (1989), "Agency osts, Net Worth, and BusinessFluctuations," he American Economic eview, pp. 14-31.

Bradley, ichael, GregoryJarrell and E. Han Kim (1984), "On the Existence fan Optimal Capital Structure: Theory and Evidence," ournal of Finance,39, 857-78.

Chirinko, . s., (1987), "Tobin's and Financial olicy," ournal of MonetaryEconomiA., pp. 69-87.

-

8/14/2019 Market Imperfection Korea

33/40

31

Cho, Yoon Jo, (1986),"Inefficienciesrom Financial iverbalization n theAbsence of Well-functioningquityMarkets," ournal of Money Creditand

aninak vo. 18, pp. 191-199.Ciccolo, . and G. Fromn, (1979),"'q' and the Theoryof Investment,"JEun&1

f Ftnance, May pp. 535-547.

(1980),"'q',Corporatenvestment, nd BalanceSheetBehavior," f Money nd RAnking, ol. 12, pp. 294-307.

Coon, R. M., (1971),"The Effectof Cash Flow on the Speed of Adjustment," nGary Fromm,ed., Tneentives And CApitA1 qgndfag, he BrookingsInstitute, p.

Corbo,V., and Sang-Woo am (1986),"The RecentMacroeconomic valuation fthe Republicof Korea: An overview," n V. Corbo and Sang-MokSuh, eds.,Structural AdJustment in a Newly Tndustrialized Countryi Lessons fromKorea, pp. 85-141.

Dailami, . (1989, ) "Korea: Adjustment rogressin the 1980s,"in V. Tho-mas, A. Chhibber, . Dailamiand J. deMelo,eds., Structural Adjustmantand the World Rank, (forthcoming).

Dailami,M. (1989, ), "Financial arket Structure nd Financing f BusinessInvestment: Issuesand PolicyChoicesfor the 1990s,"unpublished, orldBank.

-

8/14/2019 Market Imperfection Korea

34/40

32

DeAngelo,Harry and Ronald Hasulis (1980),"Opt'.malapitalStructure nderCorporate nd Personal axation," ourn&l of F*n0ncial Economics, ,3-30.

Dhrymes P. and M. Kurz, (1967),"Investment, lvidends, nd External FinanceBehaviorof Firms," in R. Ferber, ed., not&aminAnts of astmant Rahav.io, N.B.E.R., p.

Dornbusch, . and Y. C. Park (1987), "Korean rowth Policy."3xnkJ.nAi.sLAa*on Economir Activity, No. 2, pp. 389-444.

Fazzari, . M., R. C. Hubbard and B. C. Patersen (1988), "Financirtgon-straints and Corporate Investment," Brookinga Papers on Economic Activ-Jtv, no. 1, pp. 141-206.

Fischer, . and R. C. Merton,1984, "Macroeconomicsrd Finance: The Role ofthe Stock Market," in Essays on Macroeconomic Tmplications of Financialand Labor Markats and Political Procassas, K. Brunner and A. H. Meltzer(eds.), arnegie-Rochester onference erieson Public Policy, Vol. 21(Autumn), p. 57-108.

Gelb,A. (1989), "Financial olicies, rowth, and Efficiency," PPR, WorkingPaper, No. 202.

and P. Honohan (1989), "Financial Sector Reforms in AdjustmentPrograms", PR. Working Paper, No. 169.

-

8/14/2019 Market Imperfection Korea

35/40

- 33

Grossman, . J. and 0. D. Hart, (1982),"Corporate inancial tructure ndManagerial ncentive," n J. McCall, ed., The Economics f Tnformationand tlIeirtainty, niversity f Chicago Press, pp. 107-140.

Gould, J. P. (1968), "Adjustment osts in the Theory of Investment f theFirm," Reviaw of Economic Stud{en, pp. 47-55.

Greenwald, ., A. Weiss and J. E. Stiglitz (1984), Informational mperfec-tions in the Capital arkets and Macroeconomic luctuations," marifeanEconomic eview,pp. 194-200,

Hartman, . (1972),"The Effectsof Price and Cost Uncertainty n Investment,"Journal of Economic heory, pp. 258-266.

Hayashi, . (1982),"Tobin's arginalq and Average q: a Neoclassical nter-pretation," conometrica, anuary, pp. 213-224.

Jensen, M. and W. Meckling (1976),"Theory f the Firm: Managerial ehavior,Agency Costs and Ownership tructure," Journal of Financial conomics,pp. 305-360.

Joreskog, K. G., and A. S. Goldberger, (1975) "Estimation of a Model withMultiple Indicators and Multiple Causes of a Single Latent Variable,"JournAl of th1 American StAtistinal Acsociat{on, pp. 631-639.

Jorgenson, . W. and R. E. Hall, (1971),"Application f the Theory of OptimumCapital Accumulation," in G. Fromm, ed., Tax Tncentives and CapitalSpending, The Brookings nstitute, ashington), p. 9-60.

-

8/14/2019 Market Imperfection Korea

36/40

- 34 -

Jorgenson, . W. (1963),"Capital heoryand Investment ehavior,"AmiricanEconomic aview, (May), p. 247-259.

Kim, E. H. (1978),'A Mean-variance heoryof OptimalCapitalStructure,"Journal f Finanna,pp. 45-64.

(1982),"Miller's quilibrium, hareholder everageClien-telesand OptimalCapitalStructure," ournal f Finance, p. 301-318.

(1989), Financing orean Corporations: EvidenceandTheory,"in J. K. Kwon,ed., KoreanEconomicavelopment, GreenwoodPress.

and Lee, Young K. (1989),"Issuingtocks in Korea,"Research in Pa fic-Rasin Capital Market.,ElsevierSciencePublisherNorth Holland (forthcoming).

Kraus,A. and R. Litzenberger, 1973),"A StatePreference odel of OptimalFinancial everage," Journal of Finance, p. 911-922.

Kuh. and J. Meyer, (1963),"Investment, iquidity nd MonetaryPolicy,"inCommisston n Money and Credit: Impactsof MonetaryPolicy, pp. 339-474.

Lucas,R. E. (1967),"Adjustment ostsand the Theory of Supply," ournalofPolitinal conomy75, pp. 321-334.

and E. Prescott(1971),"InvestmentnderUncertainty,"PnonometricA, 9, pp. 659-681.

Miller,M. (1977), "Debtand Taxes,"Journalof Finance, o. 32, pp. 261-275.

-

8/14/2019 Market Imperfection Korea

37/40

. 35 -

Modigliani,. andH. Hiller (1958), The Cost of CapitalCorporate inance,and the Theory of Iraveutment,"merdcan Economimc Rcvie, no. 48, pp.261-297.

Myers, S. and N. MaJluf (1984). 'Corporate inancing nd Investment ecisionsWhen Firms Have Information nvestors o Not Have."JournAl of FinncrialLnonaue, 3, 187-221.

Nabi, J. (1989), "Investment n Segmented apital Markets," uArtegry JoirnAlgf Econom , pp. 453-462.

Pindyck, ., (1982), 'Adjustment osts, ncertainty nd the Behavior f theFirm,"Amrican Ecm ir Review, pp. 415-427.

Poterba, . and L. H. Summers, (1983)"Dividend axes, Corporate nvestment,and Q," Journalof Public Economics, p. 135-167.

(1985), The Economic Effects of Dividend Taxation," in E. I.Altman and M. C. Subrahmanyam eds.), ecentAdvances in CorporateFinance, Richard D. Irwin Publication.

Pyo, Hak-kil, (1988), Estimates f Capital stock and Capital/Output oeffi-cients by Tndustries or the Republic f Korea, (1953-1986), orkingPaper No. 8810, Korea Development nstitute, eoul,Korea.

Ross, S. A., (1985), "Debt and Taxes and Uncertainty," ournal of Finance, p.637-657.

-

8/14/2019 Market Imperfection Korea

38/40

36 -

Scott, . H., (1976), A Theory of OptimalCapitalStructure," l utruAoL.oonnomhes, pp. 33-54.

S-mmers, . H. (1981), "Taxation nd Corporate nvestment: A q TheoryApproach," Rrookina Pagers on Economic Activity, no. 1, pp. 67-127.

Titman,S. and R. Weasels; (1988),"The Determinants f CapitalStructureChoice," The Journ&l of Finance, pp. 1-19.

Tobin, J. and W. C. Brainard (1977), AssetMarkets and the Cost of Capital,"in R. Nelson and B. Balassa, ds., Economicrogreg= PrivAte Alue and

Publieolicy. EnayAS in lionor af wiliAm Folln, North-Holland,Amsterdam, p. 235-62.

Treadway, . B., (1967),"On RationalEntrepreneuriIalahviorand the Demandfor Investment," Reviev of Reonomie Studia., pp. 227-239.

Tybout,J. R. (1984), "Interest ontrols nd CreditAllocation n DevelopingCountries," ournalof Money. Credit and Banking, p. 474-487.

Vickers,D. (1970),"The Cost of Capitaland the Structure f the Firm,"Journalof Finance, arch, No. 1, pp. 35-46.

von Furstenberg, . (1977), "Corporate nvestment: Does Market Valuation at-ter in the Aggregate?" rookings ars on Economic gtivity,No. 2, pp.347-97.

World Bank, (1989), orld Development eport.

-

8/14/2019 Market Imperfection Korea

39/40

PEE Xfrikn r SetlideContactIWa AAba a0 forpapar

WPS388 The DistortionaryEffectsof Tariff FaezehForoutan March1990 S. FallonExemptins inArgentina 38009WPS389 MonetaryCooperationn the CFA PatrickHonohan March1990 WilaiPitayato-Zone nakam37666WPS390 PriceandMonetaryConvergence PatrickHonohan March1990 WilaiPitayato-in CurrencyUnions:The Francand nakarnRandZones 37666WPS391 WealthEffectsof VoluntaryDebt DanielOks April1090 S. King-WatsonReductionll LatinAmerica 31047WPS392 InstitutionalDevelopmentn World SamuelPaul April1990 E. MadronaBankProjects: A Cross-Sectional 37489ReviewWPS393 Debt-for-NatureSwaps MichaelOcchiolini March1990 S. Kiing-Watson31047WPS394 ThresholdEffects n International MarkM. Spiegel April1990 S. King-WatsonLending 31047WPS395 HowGambiansSave andWhat ParkerShipton April1990 C. SpoonerTheirStrategies mply or International 30464AidWPS396 StrategicTradePolicy: HowNew? Max CordenHowSensible?WPS397 AntidumpingRegulations r PatrickA. Messerlin April1990 S. TorrijosProcartelLaw? The ECChemical 33709CasesWPS398 AgriculturalExtensionor Women KatrineA. Saito April1990 M.VillarFarmersnAfrica C. leanWeidemann 33752WPS399 MacroeconomicAdjustment, AndresSolimano April1990 E. KhineStabilization, ndGrowth n 39361ReformingSocialistEconomies:AnalyticalandPolicy ssuesWPS400 MacroeconomicConstraintsor Andr6sSolimano April 1990 E. KhineMedium-TermGrowthandDistribution: 39361A Modelfor ChileWPS401 PolicingUnfair mports:The J.S. J. MichaelFinger March1990 N. ArtisExample TracyMurray 38010

-

8/14/2019 Market Imperfection Korea

40/40

PREWorki pner SerbsContactI~a A~bAA for&or

WPS402 The GATTas InternationalDiscipline J. MichaelFinger March 1990 Ik.ArtisOverTradeRestrictions:A Public 38010Choice Approach

WPS403 InnovativeAgriculturalExtension S. Tjip Walkerfor Women: A CaseStudyofCameroonWPS404 LaborMarkets n an Era of Luis A. RiverosAdjustment:The ChileanCaseWPS405 Investmentsn SoiidWaste CarlBartone April1990 S. CumineManagement:Opportunitiesor JanisBernstein 13735Environmentalmprovement FrederickWrightWPS406 Township,Villaga,and Private WilliamByrdIndustryn Chiia's Economric AlanGelbReformWPS407 PublicEnterpriseReform: AhmedGalal April 1990 G. Orraca-TettenA Challengeor theWorldBank 37646WPS408 Methodo'ogicalssues n Evaluating StijnClaessensDebt-ReducingDeals Ishac DiwanWPS409 FinancialPolicyand Corporate MansoorDailami April1990 M. RaggambiInvestmentn ImperfectCapital 37657Markets: TheCase of KoreaWPS410 The Cost of Capitaland Investment AlanAuerbach April 1990 A. Bhallain DevelopingCountries 37699WPS411 InstitutionalDimensions f Poverty Lawrence . SalmenReductionWPS412 ExchangeRate Policy n Developing W. Max CordenCountriesWPS413 SupportingSafe Motherhood: L. M. HowardA Reviewof FinancialTrendsWPS414 SupportingSafe Motherhood:A L. M. HowardReviewof FinancialTrends,ExecutiveSummaryWPS415 How Good (or Bad)are Country NormanHicks April 1990 IA. BergProjections? Michel Vaugeois 31058