Marginal 2

-

Upload

karan-khatri -

Category

Documents

-

view

5 -

download

0

description

Transcript of Marginal 2

PROJECT ON COST ACCOUNTS

INDEXSR.NO.PARTICULARSPAGE. NO.

1.INTRODUCTION5

2.FEATURES OF MARGINAL COST6

3.TYPES OF COST7

4.ADVANTAGES OF MARGINAL COST9

5.MARGINAL COST EQUATION10

6.IILUSTRATIONS11

7.BREAK-EVEN ANALYSIS12

8.P/V RATIO14

9.PRATICAL APPLICATION OF MARGINAL COSTING TECHNIQUES AND DECISION MAKING20

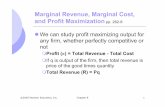

MARGINAL COSTINGINTRODUCTIONMarginal Costing is a technique which also divides costs into two categories, but of somewhat different nature. In this case costs are identified as being either fixed or variable, relative to the quantity of output:Total Cost = Variable Costs + Fixed CostsMarginal Costing Definition: Marginal costing distinguishes between fixed and variable costs as conventionally classified. The marginal cost of a product is its variable cost. This is normally taken to be; direct labour, direct material, direct expenses and the variable part of overheads. Marginal costing is formally defined as: The accounting system in which variable costs are charged to cost units and fixed costs of period are written off in full against the aggregate contribution. Its special value is in recognizing cost behavior and hence assisting in decision-making. The term contribution mentioned in the definition is the term given to the difference between Sales and Marginal Cost. ThusMarginal Cost = Variable Cost = Direct Labour + Direct Material + Direct Expenses + Variable OverheadsContribution = Sales - Marginal CostThe term marginal cost sometimes refers to the marginal cost per unit and sometimes to the total marginal costs of a department or batch or operation. The meaning is usually clear from the context. Marginal costing involves ascertaining marginal costs. Since marginal costs are direct cost, this costing technique is also known as direct costing; In marginal costing, fixed costs are never charged to production. They are treated as period charge and is written off to the profit and loss account in the period incurred; Once marginal cost is ascertained contribution can be computed. Contribution is the excess of revenue over marginal costs. The marginal cost statement is the basic document/format to capture the marginal costs.FEATURES OF MARGINAL COSTING (1) All elements of costs are classified into fixed and variable costs.(2) Marginal costing is a technique of cost control and decision making.(3) Variable costs are charged as the cost of production.(4) Valuation of stock of work in progress and finished goods is done on the basis of variable costs.(5) Profit is calculated by deducting the fixed cost from the contribution, i.e., excess of selling price over marginal cost of sales.(6) Profitability of various levels of activity is determined by cost volume profit analysis.

Types of costs

Fixed Cost and Variable costFixed costs are expenses that do not change in proportion to the activity of a business, within the relevant period or scale of production. For example, a retailer must pay rent and utility bills irrespective of sales. Variable costs by contrast change in relation to the activity of a business such as sales or production volume. In the example of the retailer, variable costs may primarily be composed of inventory (goods purchased for sale), and the cost of goods is therefore almost entirely variable. In manufacturing, direct material costs are an example of a variable cost. An example of variable costs is the prices of the supplies needed to produce a product.A company will pay for line rental and maintenance fees each period regardless of how much power gets used. And some electrical equipment (air conditioning or lighting) may be kept running even in periods of low activity. These expenses can be regarded as fixed. But beyond this, the company will use electricity to run plant and machinery as required. The busier the company, the more the plant will be run, and so the more electricity gets used. This extra spending can therefore be regarded as variable.Along with variable costs, fixed costs make up one of the two components of total cost. In the most simple production function, total cost is equal to fixed costs plus variable costs.It is important to understand that fixed costs are "fixed" only within a certain range of activity or over a certain period of time. If enough time passes, all costs become variable. In retail the cost of goods is almost entirely a variable cost; this is not true of manufacturing where many fixed costs, such as depreciation, are included in the cost of goods.Although taxation usually varies with profit, which in turn varies with sales volume, it is not normally considered a variable cost.Variable costs are expenses that change in proportion to the activity of a business. Along with fixed costs, variable costs make up the two components of total cost. Direct Costs, however, are costs that can be associated with a particular cost object. Not all variable costs are direct costs, however; for example, variable manufacturing overhead costs are variable costs that are not a direct costs, but indirect costs. For example, a manufacturing firm pays for raw materials. When activity is decreased, less raw material is used, and so the spending for raw materials falls. When activity is increased, more raw materials is used and spending therefore rises. Average cost per unitAverage cost is equal to total cost divided by the number of goods produced.Total cost/outputIt is also equal to the sum of average variable costs (total variable costs divided by Output) Marginal costMarginal cost is the change in total cost that arises when the quantity produced changes by one unit. In general terms, marginal cost at each level of production includes any additional costs required to produce the next unit. So, the marginal costs involved in making one more wooden table are the additional materials and labour cost incurred.Absorption CostingAbsorption costing is also termed as Full Costing or Total Costing or Conventional Costing. It is a technique of cost ascertainment. Under this method both fixed and variable costs are charged to product or process or operation. Accordingly, the cost of the product is determined after considering both fixed and variable costs.Absorption Costing Vs Marginal Costing: The following are the important differences betweenAbsorption Costing and Marginal Costing:(1) Under Absorption Costing all fixed and variable costs are recovered from production while under Marginal Costing only variable costs are charged to production.(2) Under Absorption Costing valuation of stock of work in progress and finished goods is done on the basis of total costs of both fixed cost and variable cost.While in Marginal Costing Valuation of stock of work in progress and finished goods at total variable cost only.(3) Absorption Costing focuses its attention on long-term decision making while under Marginal Costing guidance for short-term decision making.(4) Absorption Costing lays emphasis on production, operation or process while Marginal Costing focuses on selling and pricing aspects.

Advantages of Marginal CostingThe following are the important decision making areas where marginal costing technique is used:(I) pricing decisions in special circumstances:(a) Pricing in periods of recession;(b) Use of differential selling prices.(2) Acceptance of offer and submission of tenders.(3) Make or buy decisions.(4) Shutdown or continue decisions or alternative use of production facilities.(5) Retain or replace a machine.(6) Decisions as to whether to sell in the export market or in the home market.(7) Change Vs status quo.(8) Whether to expand or contract.(9) Product mix decisions like for example:(a) Selection of optimal product mix;(b) Product substitution;(c) Product discontinuance.(10) Break-Even Analysis.Marginal Cost EquationThe Following are the main important equations of Marginal Cost:Sales = Variable Cost + Fixed Expenses Profit I Loss(Or)Sales - Variable Cost = Fixed Cost Profit or Loss(Or)Sales - Variable Cost = ContributionContribution = Fixed Cost + ProfitThe above equation brings the fact that in order to earn profit the contribution must be more than fixed expenses. To avoid any loss, the contribution must be equal to fixed cost.ContributionThe term Contribution refers to the difference between Sales and Marginal Cost of Sales. It also termed as "Gross Margin." Contribution enables to meet fixed costs and profit. Thus, contribution will first covered fixed cost and then the balance amount is added to Net profit. Contribution can be represented as:Contribution = Sales - Marginal CostContribution = Sales - Variable CostContribution = Fixed Expenses + ProfitContribution - Fixed Expenses = ProfitSales - Variable Cost = Fixed Cost + ProfitC=S-V.CC=F.C+PS-V.C=F.C+PC-F.C=PIllustration: 1(Or)Where:C = ContributionS = SalesF=Fixed CostP = ProfitV = Variable Cost

From the following information, calculate the amount of profit using marginal cost technique:Solution:Fixed cost Rs. 3, 00,000Variable cost per unit Rs. 5Selling price per unit Rs. 10Output level 1, 00,000 units.Solution:Contribution = Selling Price - Marginal Cost(1, 00,000 x 10) - (l, 00,000 x 5)10, 00,000 - 5, 00,000Rs.5, OO, OOOFixed Cost + Profit3, 00,000 + ProfitContribution - Fixed CostRs. 5, 00,000 - Rs. 3, 00,000Rs. 2, 00,000

Break-Even Analysis:Break-Even Analysis is also called Cost Volume Profit Analysis. The term Break-Even Analysis is used to measure inter relationship between costs, volume and profit at various level of activity. A concern is said to break-even when its total sales are equal to its total costs. It is a point of no profits no loss. This is a point where contribution is equal to fixed cost. In other words, the break-even point where income is equal to expenditure {or) total sales equal to total cost.The break-even point can be calculated by the following formula:Break-Even Point in Units(1) Break-Even Point in Units = Total Fixed cost Contribution per unit

Break-Even Point in Sales Volume Break-Even Sales = Fixed Cost x Sales Sales - Variable CostOr Break-Even Sales = Fixed CostP I V RatioProfit Volume Ratio (PI V ratio) = Contribution x 100Sales

Illustration: 2From the following particulars find out break-even point:Fixed Expenses Rs. 1.00.000Selling price per unit Rs. 20Variable cost per unit Rs. 15Solution:Break-Even Point in Units = Total Fixed cost Contribution per unit Contribution per unit = Selling Price per unit - Variable Cost per unit= Rs. 20 - Rs. 15 = Rs. 5B E P (in units) = 1, 00,0005= 20.000 unitsBE P in Sales= 20,000 x Rs. 20 = Rs. 4, 00,000

Profit Volume Ratio is also called as Contribution Sales Ratio (or) Marginal Income Ratio (or) Variable Profit Ratio. It is used to measure the relationship of contribution, the relative profitability of different products, processes or departments.The following formula for calculating the P I V ratio is given below:(I) PI V Ratio = Contribution x 100 SalesOrPI V Ratio = S-V x 100SWhere S = Sales V = Variable costOrPI V Ratio = F+P x 100SWhere F = Fixed CostP = ProfitS = SalesIllustration: 3From the following information calculate:(I) P I V Ratio(2) Break-Even Point(3) If the selling price is reduced to Rs. 80, calculate New Break-Even Point:Total salesRs. 5, 00,000Selling price per unitRs. 100Variable cost per unitRs. 60Fixed costRs. 1, 20,000Solution:PI V Ratio = Contribution x 100 SalesContribution = Sales - Variable CostTotal Sales = Rs. 5, 00,000Selling price per unitRs. 100Sales in units = 5, 00,000 = 5000 units 100Contribution = Rs. 5, 00,000 - (5000 x 60)Rs. 5, 00,000 - Rs. 3, 00,000 = Rs. 2, 00,000PI V Ratio = Rs. 2, 00,000 x 100 Rs. 5, 00,000=40%Break-Even Point in sales = Fixed Cost P I V Ratio = 1, 20,00040% = Rs. 3, 00,0003) If the Selling price is reduced to Rs. 80:Sales = 5, 00,000 X 80100 =Rs. 4, 00,000Break-Even Sales = Fixed Cost x Sales Sales - Variable Cost = Rs. 1, 20,00080-50= Rs. 4,000 unitsBreak-Even Point in Sales = 4,000 units x Rs. 80= Rs. 3, 20,000Illustration: 4Sales Rs. 2, 00,000Profit Rs. 20,000Variable Cost 60%You are required to calculate(1) P I V Ratio(2) Fixed Cost(3) Sales volume to earn a profit of Rs. 50,000Solution:Sales = Rs. 2, 00,000Variable Cost = 60%Variable Cost= 60 x 2, 00,000 100 = Rs. 1, 20,000

(1) P / V Ratio == Sales - Variable Cost x 100 Sales= 200,000-1, 20,000 x 100 2, 00,000= 80,000 x 100 2, 00,000= 40%(2) Contribution = Fixed Cost + Profit(Or) Contribution = Sales - Variable Cost Rs. 2, 00,000 - Rs. 1, 20,000 = Rs. 80,000 Contribution = Fixed Cost + Profit 80,000 = Fixed Cost + Rs. 20000Fixed Cost = Rs. 80,000 - Rs. 20,000 = Rs. 60,000(2) Sales volume to earn a profit of Rs. 50,000Sales = fixed cost + desired profitP/V Ratio= Rs. 60,000 + Rs. 50,000 40%= 1, 10,000 40%= Rs.2, 75,000Illustration: 5From the following particulars, calculate:(a) P / V Ratio (b) Profit when sales are Rs. 40,000, and(c) New break-even point if selling price is reduced by 10%Fixed cost = Rs. 8,000Break-even point = Rs. 20,000Variable cost = Rs. 60 per unitSolution:(a) Break-Even Point = Fixed Cost P I V RatioFixed costBreak-Even Point= 8,000 x 100 20,000= 40%(b) Profit when sales are Rs. 40,000Profit = Sales x P I V Ratio - Fixed Cost = 40,000 x 40% - 8,000 = Rs. 16,000 - Rs. 8,000 = Rs. 8,000(c) New break-even point if the selling price is reduced by 10%. If the selling price is Rs. 100, nowit is reduced by 10%, i.e., it will be Rs. 90 (100 - 10)Variable Cost = Rs. 60 per unitNew P/V Ratio = = Selling Price - Variable Cost x 100Selling price= 90-60 x 100 60=33.33%(c) New Break-Even Point = Fixed Cost P I V Ratio = 8,000 33.33% =Rs. 24,002.40New Break-Even Point = Rs. 24,002.40PRACTICAL APPLICATIONS OF MARGINAL COSTING TECHNIQUE 1) Key or limiting Factors analysis: Marginal costing can be used in budgeting to help management to determine what the profit maximizing budget. Plan should be made when one or more factors of production or other business resources are in short supply. Marginal costing really shows its merit when scarce resources are being considered. Examples of resource restrictions which may apply are as follows: a) Limit to the availability of a particular grade of labor. b) Shortage of raw materials. c) Limit to machine capacity. d) Shortage of cash to finance production. If labour supply , materials availability , machine capacity or cash availability limit production to less than the volume which could be achieved ,management is faced with the problem of deciding what to produce and what not to produce , because there are insufficient resources to make everything. The limiting factor is often sales demand itself in which the business should produce enough goods or services to meet the demand in full, provided that sales of the goods earn a positive contribution towards fixed costs and profits. However, when the limiting factor is a production resource, the business must decide which part of sales demand it should meet, and which part must be left unsatisfied. Marginal costing analysis can be used to indicate the profit-maximizing. a) Analysis when only one limiting factor: If fixed costs are constant, regardless of the level of output and sales within a relevant range of output, marginal costing principles should lead us to the conclusion that profits will be maximized if total contribution is maximized. If there is a shortage of one particular production resource, it is inevitable that all the available supply of that resource will be used up. For example, if a business has a chronic shortage of skilled manpower, it will plan to use all the skilled manpower that it does have available.

Total contribution will be maximized if the maximum possible contribution is obtains per unit of that scarce resource. In other words, a business should get the best possible value out of the scarce resources that it uses up. In dealing with a limiting factor problem, the steps to be taken care are as follows: Identify the possibility that there are may be a limiting factor other than sales demand. There may be the maximum availability of one or (more) resources, so that sales demand cannot be met. This is done quite simple as follows:

i) Calculate the volume of resources required to produce enough unit to satisfy sales demand. ii) Calculate the volume of resources available. iii) Compare the two totals. If (i) exceed (ii) there is a limiting factor. If there is only one such limiting factor, the next step is to calculate the contribution earned by each product per unit of the scarce resource. The products with the highest contribution per unit of scarce resource should receive priority in the allocation of the resource in the production budget.

2) Profit Planning: The behavioral study of costs in marginal costing technique helps the management in profit planning exercise. Constant development in science and technology makes the long run situation more uncertain and highly unpredictable. Long-run consists of a series of short-runs and one must aim at maximizing contribution in each short-run which will lead to profit maximization in long-run. Profit figure is planned and activity level is determined to achieve that planned profit. It helps in doing sensitivity analysis by observing different cost and revenue situations and its resultant impact on profit and guides in the determination of activity level to achieve target profit. The profit of a business concern can be improved in the following ways: 1. by increasing volume 2. By increasing selling price 3. By decreasing variable costs, and 4. By decreasing fixed costs.

3) Contribution analysis: The analysis of the contribution per unit each product makes towards fixed or current period costs and profit leads to the preparation of statements showing the total contribution each product class has made towards the recovery of period costs. These statements may be further refined by deducting any discretionary or separable period costs (i.e., costs such as annual tooling and product advertising) which should be avoided if the product line were dropped.

4) Make or buy decisions: Make or buy decision is simply the choice between making a part or article within the company or purchasing it from outside. The following considerations apply when taking a make or buy decision: The capability of the company to make the item in terms of the capacity (people, plant and space) available and the ability to achieve required quality standards. The availability of outside suppliers who can deliver the item in the quantities, quality and time required. The differential cost of making or buying the item. This means that consideration has to be given to these conditions:

-If items which are currently purchased are manufactured, what additional or incremental costs will be incurred and how do these compare with the costs being saved? - If items are purchased which could be manufactured, what costs will be avoided and how do these compare with the costs will be incurred? The opportunity cost of using existing capacity to manufacture alternative items which would make a greater contribution to profit and fixed costs than the item under consideration. A make or buy decision is often essentially about how best to utilize existing facilities. The impact of a decision to make the item on aggregate volumes, an increase in which should contribute to overhead recovery and facilitate the balancing of demand and operations capacity overtime.

3. By decreasing variable costs, and 4. By decreasing fixed costs.

3) Contribution analysis: The analysis of the contribution per unit each product makes towards fixed or current period costs and profit leads to the preparation of statements showing the total contribution each product class has made towards the recovery of period costs. These statements may be further refined by deducting any discretionary or separable period costs (i.e., costs such as annual tooling and product advertising) which should be avoided if the product line were dropped. 4) Make or buy decisions: Make or buy decision is simply the choice between making a part or article within the company or purchasing it from outside. The following considerations apply when taking a make or buy decision: The capability of the company to make the item in terms of the capacity (people, plant and space) available and the ability to achieve required quality standards. The availability of outside suppliers who can deliver the item in the quantities, quality and time required. The differential cost of making or buying the item. This means that consideration has to be given to these conditions:

-If items which are currently purchased are manufactured, what additional or incremental costs will be incurred and how do these compare with the costs being saved? - If items are purchased which could be manufactured, what costs will be avoided and how do these compare with the costs will be incurred? The opportunity cost of using existing capacity to manufacture alternative items which would make a greater contribution to profit and fixed costs than the item under consideration. A make or buy decision is often essentially about how best to utilize existing facilities. The impact of a decision to make the item on aggregate volumes, an increase in which should contribute to overhead recovery and facilitate the balancing of demand and operations capacity overtime. The level of variable overheads which are charged to the part or article.

Procedure: The procedure for taking a make or buy decision is as follows: Produce a precise specification of the item and define the quantities required, the timing of deliveries and the maximum acceptable unit cost. Analyze existing capacity to find out if the item can be made in accordance with specifications for quality, quantity and delivery dates. Analyze tenders made by outside suppliers to find out which ,if any , can best satisfy requirements for quality, cost limits and delivery. Calculate the incremental cost of making the item that is, the full accounting cost of the labour and direct materials used to make it. The incremental cost will equal marginal cost if, and only if, factory capacity is sufficiently under-utilised before the make or buy decision is take to render all fixed costs irrelevant to the decision. Calculate the cost to buy, which is the purchase cost invoiced by the supplier (total cost less any trade discount), plus any delivery and inspection costs and costs of buying (office-staff time). Assess the opportunity cost of making the component as measured by the total contribution that would have been earned by using the resources required to make the item to manufacture instead of an alternative more profitable product. Weigh the results of the various assessments listed above. A thorough make or buy analysis, as outlined above , will ensure that all the capacity , capability, differential cost and opportunity cost factors will have been taken fully into consideration before the choice is made. 5) Price fixation: Under this method fixed costs are ignored and prices are determined on the basis of marginal cost. A firm seeks to fix its prices so as to maximize its total contribution. Marginal cost is the change in total costs that results from production of additional unit of a product or service. Marginal costing is more effective than full cost pricing for the following reasons: Prevalence of multi-product, multi-process and multi-market concerns makes the absorption of fixed costs into product costs is difficult. Constant development in science and technology makes the long run situation more uncertain and highly unpredictable. Long-run consists of a series of short runs and we must aim at maximizing contribution in each short run which will lead profit maximization in the long-run.

6) Accept or reject new order and sub-contracting: In times of taking decisions to accept or reject new order or in sub-contracting, the contribution analysis us made as to whether it is profitable to accept or reject new order or in sub-contracting.

2