Fathom Overview Workshop on using Fathom in School Improvement Planning (SIP)

MARCH/APRIL 2014 RESOURCE MANAGEMENT WWW ... - FATHOM · Th e benefi ts manifested themselves soon...

Transcript of MARCH/APRIL 2014 RESOURCE MANAGEMENT WWW ... - FATHOM · Th e benefi ts manifested themselves soon...

RESOURCE MANAGEMENT | IRRIGATION

FINANCING AMI

TREATMENT OPTIONS

MANAGING ENERGY FOR WATER AND WASTEWATER: CASE STUDIES

T H E J O U R N A L F O R WAT E R R E S O U R C E MA N AG E M E N T

WATEREFFICIENCY

TT HH EE JJ OO UU RR NN AA LL FF OO RR WWAATT EE RR RR EE SS OO UU RR CC EE MMAA NN AAGG EE MM EE NN TTTT HH EE JJ OO UU RR NN AA LL FF OO RR WWAATT EE RR RR EE SS OO UU RR CC EE MMAA NN AAGG EE MM EE NN TT

STORAGE SHAPE, SIZE AND PLACEMENT

MARCH/APRIL 2014WWW.WATEREFFICIENCY.NET

10 WATER EFFICIENCY WWW.WATEREFFICIENCY.NET

T here are generally four barriers when it comes to financing an Advanced Metering Infrastruc-ture (AMI) system as part of an overall smart water technology

approach:1. A lack of understanding about the

business case2. A lack of funding3. A lack of political support4. Disparate products and solutions

Industry research indicates that many water utility managers are search-ing for ways to address these challenges; they are also outlined in a Sensus Meter-

ing Systems white paper on the topic, “Water 20/20: Bringing Smart Water Networks Into Focus.”

For water utilities, the question essentially becomes a matter of when—not if—it will be able to incorporate AMI technology due to several driving factors. According to Sensus, utilities worldwide are spending nearly $184 billion annually, of which $14 billion is spent on energy costs to pump water through the networks. Increases in energy prices, environmental impacts, and an aging infrastructure are the major challenges faced by the industry.

Smart technology that provides

critical data via remote operations can enable utilities to save up to 20% in labor, vehicle effi ciency, and produc-tivity; it streamlines and automates network operations and maintenance. Yet, while acknowledging the need for smarter infrastructure and technological investments, few utilities have embraced an end-to-end smart water network, which would also enhance customer service, according to Sensus.

In addition to their ability to remotely and continuously monitor and diagnose problems, preemptively pri-oritize and manage maintenance issues, and remotely control and optimize all aspects of the water distribution network using data-driven insights, such systems assist in maintaining regulatory com-pliance and other policy requirements having to do with water quality and con-servation, and provide water customers with information to make informed choices about their water usage.

A smart water network will consist of fi ve interconnected layers of function-ality, including:

1. Measurement and sensing devices, such as smart water meters and other smart endpoints to collect

Overcoming the Barriers to Financing AMIMany water utility managers are searching for ways to address the business case, the need for political support, and disparate products and solutions. By Carol Brzozowski

PHO

TOS:

SO

UTH

CA

ROLI

NA’

S C

HES

TERF

IELD

CO

UN

TY R

URA

L W

ATER

CO

MPA

NY

(CC

RWC

)

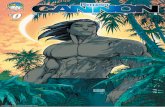

South Carolina’s Chesterfield County Rural Water Company deployed AMI in 2008 in its service area of more than 800-plus square miles.

MARCH/APRIL 2014 WATER EFFICIENCY 11

data on water fl ow, pressure, quality, and other critical parameters, such as potential leaks and abnormalities within the distribution system

2. Real-time communication chan-nels for two-way communications to instruct devices on what data to collect or which actions to execute, such as remote shutoff

3. Data management soft ware to process and aggregate collected data via basic network visualization tools and Geographic Information Systems, simple dashboards, or spreadsheets and graphs

4. Real-time data analytics and model-ing soft ware

5. Automation and control tools to enable water utilities to con-duct network management tasks remotely and automatically

Many utilities have existing SCADA (supervisory control and data acquisition) systems that can be integrated with smart water networks. Sensus’ paper makes the point that adoption of technologies

is tailored according to economic and non-economic utility circumstances, such as utility size, demographic and population shift s, and macroeconomic conditions. Smaller utilities lack in-house IT capabilities and indicate they are likely to favor technology provid-ers that off er “soft ware-as-a-service” solutions or cloud-based network and soft ware hosting.

Larger utilities prefer to keep data and soft ware onsite when possible and only use a third-party supplier for insight generation for highly complex data analytics. Large utilities also benefi t from economies of scale and larger bud-gets that enable them to invest in smart water network solutions, while smaller utilities may not be able to aff ord the large fi xed costs of meters and other advanced sensor networks. Non-eco-nomic factors aff ecting the design and deployment of smart water solutions include local topography, water scarcity levels, and regulatory conditions.

Without a compelling business case, there is little political appetite to

eliminate jobs and increase automa-tion in the distribution network via smart water network solutions, utilities indicated in the Sensus survey. Political support consistently emerged as a theme preventing the adoption of smart water networks, both internal to utilities, and external through municipalities as well as regulators, Sensus research notes.

Internally, key decision makers—particularly high-level utility execu-tives as well as regulators—need to be convinced of the potential for smart water network solutions. Many utilities indicated in the Sensus survey that a smart water network leader is needed within the organization.

Externally, political support of municipalities is needed, especially where utilities are publicly owned. Th at necessitates engaging city councils to understand the big picture as they retain the voting power on large investments.

Many regulatory policies fail to reward cost-conscious eff orts to upgrade or better manage networks, according to the Sensus white paper, which also

BUILDING & CONSTRUCTION CONDUIT SEWER & DRAINAGE ENERGY: OIL & GAS MUNICIPAL & INDUSTRIAL

Discussion ForumsInstallations & Applications Guidance

Technical ReportsEngineering Data

Software ProgramsDesign Tools

Model SpecificationsStandards Collaboration

To see why plastics are the best pipe choice visit: www.plasticpipe.org © 20

14 P

LAST

ICS P

IPE I

NSTI

TUTE

PPI - The industry's premier engineering and knowledge resource

12 WATER EFFICIENCY WWW.WATEREFFICIENCY.NET

makes the point that water conservation eff orts oft en result in lower utility revenues. Additionally, US utilities note that exist-ing regulations lacked “teeth” for reporting and compliance, providing little impetus to switch to new smarter approaches, the Sensus paper points out. Water utilities drew parallels with the Energy Act of 2005, which they pointed out became a driv-ing factor in the development of the electrical smart grid in the US, and suggested a similar approach would be needed to foster adoption in the water market.

To counteract the lack of political support, the point can be made that smart water solutions will help regulators, lawmakers, and municipalities achieve greater transparency into water quality and network safety by immediately calling attention to quality issues and potential contaminants. Th ey will also help to conserve water, deliver improved customer service, maintain price stability, and minimize community disruptions, according to Sensus.

RURAL DEVELOPMENT LOAN FUNDS AMI South Carolina’s Chesterfield County Rural Water Company (CCRWC) CEO Charlie Gray is well aware of the reluctance of decision-makers to embrace technology such as AMI. “I know there are a number of boards—some of them in South Caro-lina—that have been totally and completely opposed to this,” he says. “Like it or not, when you’re talking about reducing the labor force—even though we did it through attrition—there are a lot of boards and councils that are not in favor of that at all. Even if it costs more money, they’re not in favor of reduc-ing staff, and staff reduction is where the big savings are.”

CCRWC in 2008 deployed the Sensus FlexNet commu-nications network in its service area of more than 800-plus square miles of fruit, vegetable, and poultry farms and small towns, home to 22,000 residents. Th e service area contains more than 7,000 endpoints. It was not only the large geographical area that provided a challenge in meter reading, but the rolling terrain as well, which hosts a 700-foot elevation variance from the northwest to south-east corners. Envi-ronmental sensitivity is mandated as well, with 30% of the area being state and federal wildlife refuge lands.

Th e FlexNet system was deployed to active meters and worked inactive meters into the program to monitor unau-thorized water use and leaks, and to physically locate inactive meters. CCRWC partnered with the adjacent towns of Cheraw and Chesterfi eld for tower placement, using the towns’ water tanks for the antennas, with the two towns allowed to share the antennas and Tower Gateway Basestations (TGB).

On the wildlife refuge area, CCRWC leased land from a landowner to install an antenna and TGB, employing two

monopoles, as a typical tower would not meet wildlife require-ments. During installation, every meter was installed with a new customer-side shutoff valve at a cost of $11 each, enabling customers to have control when a leak occurs or they leave town for an extended period of time.

Th e CCRWC made its business case through a cost-benefi t analysis. “We were spending so much time and labor and fuel and vehicle costs reading our meters—it was taking us 13 days in some instances to read the meters with three trucks and two guys in a truck, and a day for return trips to recheck high or questionable readings of meters up to 30 miles away,” says Gray. “We now read all of our meters in less than two minutes.”

Th e benefi ts manifested themselves soon aft er the FlexNet deployment. CCRWC conserved vehicle use, fuel use and labor by eliminating reads, re-reads, and service starts and stops. Th e Workers Compensation insurance is reduced, as the meter readers were the highest indexed employees due to their exposure to accidents, injuries, and animal attacks. CCRWC achieved reductions in its carbon footprint and an increase in the time frame to detect leaks and unauthorized use of water—oft en in less than six hours.

Non-revenue water has virtually been eliminated, sav-ing CCRWC money when it purchases its water supply from another local water company that draws water from the Mid-dendorf Aquifer. CCRWC had previously employed six meter readers who used Sensus TouchRead handhelds for reading and billing. Now, all meters are read with 100% accuracy in less than two minutes from CCRWC offi ces—although essen-tially the meters can be read from anywhere CCRWC person-nel have a computer.

Th e political support for the AMI system was strong, Gray notes. “We did a great deal of research on this and were able to

justify to our board and our membership fairly easily based on the business case,” he says.

CCRWC chose FlexNet primarily for its 20-year battery life, as well as the fact that only 14 TGBs were required for FlexNet deployment, the licensed spec-trum, and the power output of the Smart-

Points, says Gray. CCRWC already had a history using Sensus technology, and he favored its reliability, customer service, and technology updates. As for challenges with disparate prod-ucts and solutions, Gray says the FlexNet system “is probably one of the most—if not the most—adaptable system to meter brands.

“We classifi ed our meters relative to age and brand, and whether they were able to be converted or not, and just saved those that needed to be saved anyway as part of this project,” he says. “You do run into some compatibility issues, but they’re more rare than you might think.”

“As you start to look at solving our infrastructure, water scarcity, and water quality issues from the

demand perspective, what you need is more and more data.”

MARCH/APRIL 2014 WATER EFFICIENCY 13

CCRWC has plans to further maximize the system by off ering prepay options and automated notifi cation when pre-set water usage is nearing depletion, and to replace drop boxes with kiosks to allow for real-time balance information, along with payments.

Th e water utility’s eff orts have captured the attention of federal rural development offi cials, he adds.

CCRWC, a not-for-profi t utility, fi nanced the system using a rural development loan from the US Department of Agriculture (USDA). “Th e cost justifi cations were such that the payback on the total project was fairly short,” says Gray. “We didn’t qualify for any grant money, but as far as getting a loan, we didn’t have any problem with that. We just had to jump through the same hoops that you normally jump through in any rural development project. Th ey looked at the cost-benefi t analysis and the payback period.” Gray says sev-eral utilities in South Carolina followed suit and were able to get fi nancing for AMI projects based on CCRWC’s experience.

CCRWC converted its fi nancing from the USDA to CoBank, a national cooperative bank that is a member of the Farm Credit System and provides loans, leases, export fi nanc-ing, and other fi nancial services to agribusinesses and rural power, water and communications providers in all 50 states. “Th ere’s a lot less paperwork and they are a lot more attractive in their interest rates and fi nancing options,” says Gray, add-ing that if he were to do anything diff erently, he would have started off by using CoBank. He is recommending CoBank

to other government entities interested in fi nancing an AMI system in the same manner as CCRWC.

“CoBank is very open to doing some very lucrative fi nanc-ing options,” he says. “Th ey’re guaranteed by the government.” CCRWC has downgraded its initial 13-year payback period estimate to 10 years, based on changing fuel and labor prices.

ARRA GRANT ALLOWS FOR DEPLOYMENT OF AMIThe lack of a strong business case to use smart water technol-ogies as an alternative to investing heavily in capital expendi-tures seems to predominate, with 65% of those surveyed by Sensus citing that as a challenge.

In an interview with 182 water utilities worldwide, Sensus identifi ed up to $12.5 billion in annual savings from a combi-nation of approaches.

One such approach is improved leakage and pressure management. According to Sensus research, water utilities lose an estimated $9.6 billion annually because of leaked water. Th e use of diff erent types of smart sensors to gather data and apply advanced analytics—such as pattern detection—could provide real-time leak location information in the network.

Strategic prioritization and allocation of capital expendi-tures is another approach. Employing dynamic asset manage-ment tools for such components as pipes can save 15% on cap-ital expenditures, which closes the gap between the required capital spending and the amount of fi nancing available.

Due to environmental concerns in Westwood, CA, the

To contact your nearest Singer Valve Solutions Specialist today, visit singervalve.com.

USA • Canada • UAE • Malaysia • China

THE SINGLE ROLLING DIAPHRAGM• Extremely stable low flow capability• Eliminates the need for low flow bypass• Smaller bonnets than traditional flat diaphragm valves • Takes up less space and safer for maintenance• Lower bonnet volumes means faster response times• Longer life expectancy than flat diaphragms

INNOVATION + EXECELLENCE

SRD – Lowest stable flow capability available.

14 WATER EFFICIENCY WWW.WATEREFFICIENCY.NET

business case for an AMI system was not the concern, but fi nancing options were. Westwood Community Services handles water, sewer, fi re, parks, and streetlights. Of the 900 residential homes in the one-mile square town, some 800 are billed for services, with 100 vacant houses and quite a few sea-sonal residents, notes Randy Buchanan, district manager.

Prior to its installation of an AMI system, Westwood had no meters; water users were charged a fl at rate. “We had extreme water waste,” says Buchanan. “We didn’t do it [install AMI] to increase our revenue per se; we did it because the pumps we used to pump water to town were running exces-sively just to keep up with the demand of water.”

During a particularly wet year, the sewer ponds over-fl owed. As a result, Westwood was issued a cease and desist order from the state of California. Westwood then engaged in a study to pinpoint the reasons why the sewer ponds overfl owed.

“One of the things we mentioned is that we used an excessive amount of water per capita, so water meters would greatly benefi t us and keep our sewer ponds from overfl ow-ing as much,” says Buchanan. “We were moving forward with putting water meters in, using a loan from the federal govern-ment. We had a shovel ready project and it just so happened that somebody from the state came through our offi ce one day and told our secretary that they had these ARRA grants available—those were for shovel ready projects. It was perfect timing for us.”

Yet the project was a tough sell to the community whose residents never had water meters.

“Th e ace we had in the hole was we already had a cease and desist from the state because the sewer pond was over-fl owing, and water meters were part of the solution for that,” says Buchanan. “Our hands were tied. We had a moratorium

Sensus Summarizes Solutions to ChallengesThe following solutions were taken from the Sensus White Paper “Water 20/20: Bringing Smart Water Networks Into Focus.”

• Utilities and municipalities can help technology providers pilot solutions, establish benefi ts of smart water networks, share data, and help innovators understand utility needs and mindsets.

• Utilities need to actively learn about smart water networks and how end-to-end solutions can holistically support improvement in key areas of their utility’s performance, and how such solutions could impact their budget for traditional capital spending on infrastructure improve-ment as well as their budget for operations and maintenance.

• Identify an internal smart water network champion who is willing to explore the business case for smart water networks and champion discussions on the topic with key decision-makers within the utility.

• Regulators can reward and incentivize improve-ments in operational effi ciency. Diverting savings captured by utilities to other municipal operations or reducing tariff s and price increases leaves little incentive for utilities to seek additional productiv-ity improvements.

• In areas of high water scarcity, regulators should prioritize favorable economic conditions and reward utilities that conserve water by imple-menting smart water network solutions.

• Regulators can leverage smart water technolo-gies to achieve higher water quality standards. If water utilities have the capability to monitor water quality on a real-time basis, regulators could consider defi ning new standards, which require more frequent reporting and testing.

• Investors can apply a results-driven investment approach to technologies across the industry. To achieve maximum impact, smart water networks will require innovative approaches and solutions in all aspects of the value chain, from ubiquitous, battery-powered measurement and sensing devices, to software with pattern detection and predictive analytic capabilities. Investors can off er fi nancial products, such as long-term, low-interest loans funded by payback from technology investments that enable utilities to realize up-front savings from major technology installation investments.

• Industry and utility associations can promote innovative solutions and publicly champion smart water networks in a market that is still in its infancy, much the same way such advocacy encouraged legislation needed to push adoption of electric smart grid solutions. Industry associations can reiterate the value of smart water network solutions to utilities and regulators by serving as a powerful outlet for promoting the business case for smart water technology and sharing successful case studies and results. They can also reiterate

the value that smart water networks deliver to consumers by creating fewer and shorter service interruptions, advancing water quality and improv-ing the availability and transparency of information that consumers need to manage their water consumption and associated costs.

• Technology providers can work with utilities in research and development and pilot phases to collaborate, develop, and adopt open standards and ensure interoperability of diff erent hardware and software off erings. Technology provid-ers should foster a collaborative “smart water ecosystem” that begins with advocacy and lobbying work with regulators to increase aware-ness around the opportunities for smart water networks, and they should encourage regulatory changes that could stimulate adoption. For the general public, technology providers should conduct public outreach to bolster awareness for smart water networks, leveraging the widespread use of electric smart meters and increased conservation eff orts.

• Academia can serve as a powerful forum to facilitate rigorous conversation, encourage partnerships and collaboration, and validate business cases. University research could serve as a launching pad for innovative smart water hardware and software technologies. Some universities are increasingly paying back the costs of their research by monetizing patents.

MARCH/APRIL 2014 WATER EFFICIENCY 15

on building in our community because of lack of responsibility on our part.”

Th e town was able to deploy a Neptune R450 AMI System in July of 2012 using a grant from the American Recovery and Reinvestment Act (ARRA) to fund the project. Th e two-way communications fi xed network system is designed to give users critical, timely data from the fi eld, including daily sys-temwide, time-synchronized midnight meter readings from all MIUs (meter interface units).

Utilities can remotely confi gure their system to send pri-ority alarms alerting key personnel to possible leak and reverse fl ow events. Additionally, utilities using the R450 System can eliminate off -cycle readings for high water bill complaints and/or move-ins and move-outs with access to hourly con-sumption data for time-of-use billing. Westwood Community Services’ fi xed based network utilizes a sole antennae erected near its building from which all meters are read.

Th e ARRA grant stipulated that the system had to be made in America. Th e contractor who won the bid had a rela-tionship with Neptune and used the company for the meters, the radios, the antennae, and other components.

CREATIVE WAYS TO GET THE BALL ROLLINGEven if there is a strong business case, a lack of funding impedes the process.

Many utilities currently manage visible leakage and pres-sure fl uctuations primarily on an ad-hoc and reactive basis, responding to leaks and bursts and repairing infrastructure as needed, which inevitably is cost- and time-consuming, in con-trast to the early identifi cation of leaks through smart water technology, according to the Sensus paper.

A Black & Veatch survey concludes 34% of US utilities indicate they will have insuffi cient funding for their capital infrastructure projects. It will take an estimated $1.7 trillion to repair and expand the US potable water infrastructure in the next 40 years, according to the American Water Works Association. Because of the constraints of insuffi cient public and private fi nancing for infrastructure improvements, utilities have been forced to seek creative sources of savings to fund capital expenditures.

Sensus research has found that while many utilities have integrated a GIS into their operations to map maintenance work orders, they oft en lack the ability to anticipate network deterioration and prioritize and properly time maintenance so that capital expenditures are used more effi ciently.

Th e company indicates that possible solutions to lower the fi nancial barrier to entry into smart water technology, such as AMI, include risk-sharing contracts to lower the upfront investment required and third-party suppliers who manage and analyze the data, a solution that’s now been undertaken by 20% of large and small utilities. Th e utility would pay a smaller fl at rate to a smart water network solutions provider and share a portion of their additional revenue or saved costs with that provider.

Sensus research shows utilities can save between $7.1 and $12.5 billion annually from implementing smart water solu-tions that reduce operational ineffi ciencies and optimize capital expenditures. For example, more than 5% of current operating

and capital budgets could be repurposed and reinvested in net-work upgrades or given back to water users in the form of lower rates and tariff s.

Recognizing that fi nancing a system upfront can be a signifi cant challenge to utilities, Aclara off ers an option to get the ball rolling faster, says Todd Stocker, director of product management for water and gas products. “When you’re look-ing at an AMI system, one of the challenges is traditionally you had to invest fi nancially in the system before you start realizing the benefi ts, so, for a while, you’re operating in the red until the system can pay for itself, which is in some later years,” he points out. “We’re looking at ways to be paying for the system once you’ve already started realizing benefi ts. An example of the way we’re doing that is in the Aclara network being off ered at no charge to the customer. We’ll go in and put in a Data Concen-trator Unit infrastructure on a commitment of purchasing the Meter Transmission Units in the system and deploying.”

As the utility purchases a meter end point and puts in out in the fi eld, “it’s already working for you to realize the benefi t of not having to go back and visit that, so you’re investing in your system as you’re rolling it out,” says Stocker. “It’s more of a drive-by model, where you’re putting out the endpoints as you need them and realizing the benefi ts immediately—you’re getting the fi xed network benefi t at the drive-by pricing model.”

Off erings around letting Aclara manage the network or maintain the infrastructure helps utilities manage the costs in a predictable way, Stocker points out.

Servicing both sides of the meter, nationwide.

MEANSLOST WATERLOST WATERLLLLOOOOSSSSTTTT WWWWAAAATTTTEEEERRRRLOST REVENUELOST REVENUE

Saving water and resources since 1974.Each office independently owned and operated.

AmericanLeakDetection.com

866. 570. 5325866. 570. 5325Toll Free:

Complete Leak Surveys Simplify distribution

Pipeline repair and maintenance.

Leak Correlation & Leak Locating Improve water conservation efforts

and reduce unaccounted-for water loss.

Acoustic Leak Detection increase usage efficiency & reduce water loss for sustainable water management

in older infrastructures.

16 WATER EFFICIENCY WWW.WATEREFFICIENCY.NET

A NATURAL RESOURCE AGENCY ZEROINTEREST LOAN Like Westwood, the town of Carolina Beach, NC, had a compelling business case for an AMI system. Also like West-wood, Carolina Beach faced financing challenges.

Th e metering system of Carolina Beach numbers 4,000, with some of the meters having been in place for decades. “One of our struggles was to gain good control on accuracy of water utilization,” says Gilbert DuBois, public utilities and capital projects director for Carolina Beach. “Many of the meters the town had purchased in years past were losing their effi ciency relatively rapidly, and there were others that had been in for a long time and still were pretty accurate up in the 90-plus range.”

Th e town attracts a good number of part-time residents whose homes may experience pipe ruptures or leaks that create substantial increases in their bills before they can return in a week or two to fi x them, DuBois points out.

Public works employees would review the bills and respond to calls as needed. It became apparent that human resources could be used in a more effi -cient manner if the town could adopt an AMI system.

DuBois and his team investigated the gains of systems deployed elsewhere and determined that by having one, “we would have the ability to spot leaks faster and more effi ciently than doing manual reads,” he says. “Aft er laying several things on the table as far as the utilization of personnel causing a reduction of man hours to go out and do reads and re-reads and proving the effi ciency with the AMI system, we had the full support of our community and the council was very, very positive.”

Th e system was fi nanced through a zero-interest loan from the North Caro-lina Department of Natural Resource’s Public Water Supply Loans and Grants program. “It was really overdue for this particular area,” says DuBois. “Th e propa-gation study allowed us to have redun-dant pickup with the use of three diff erent sites, two on water tanks and another point we’ll have to install, allowing us to cover our entire beach.” Carolina Beach is using an Aclara STAR Network AMI system and had expected to have the full

installation completed and up and active in early January.

Th e system is designed to deliver robust data communications on secure, licensed radio frequencies and provide timely data, accurate and timely billing, high/low consumption reporting, and non-revenue water loss detection. “Th ere are a couple of AMI systems in a few of the adjoining counties,” says DuBois. “Most of them have had very good suc-cess. A couple that have not had good success use a diff erent kind of meter than I’m currently using.”

DuBois advises other municipalities considering AMI systems to examine their “real” needs. “Everybody wants to do more with less,” he adds. “When I have three to four people I send out multiple times a month to read meters like we’re currently doing, it takes away from their assigned jobs.” In the past several months, he’s seen a signifi cant increase in con-struction and building, necessitating the need for the installation of water taps and sewer taps.

“I’m also struggling with maintain-ing an old and failing infrastructure,” says DuBois. “It would take man-hours away from the allocated people I have. It’s hard to get another person doing just the meter reading, so if we can do it with the AMI system, it would put those men back to work in the fi elds so I can get the taps installed, address the maintenance issues, and whatever I need to do, so I’m getting the most out of my personnel rather than just reading meters.”

WATER UTILITIES AND ECONOMIES OF SCALEGlobal Water Resources—which owns and operates regulated water and waste-water utilities—developed FATHOM Utility-To-Utility (U2U) Solutions, which includes the FATHOM AMI system.

Th e most eff ective business case to make for AMI is a comparison of one data point in a utility—the one obtained monthly from manual or mobile meter reading—with the hundreds of reads one would get hourly through an AMI system, says Jason Bethke, president and chief growth offi cer for FATHOM.

“Th e richness of that data and its abil-ity to be applied across the utility certainly makes this business case easy to make,” he says. “Th ere is a case for improved accounts receivable, fewer phone calls into

the call center, happier customers, and the function of having more information.

“If you look at what the utilities are spending on the verticals from water meters to AMI and then to data post-ing, analytics, billing, customer case, and then remittance management, today they’re spending $12 and $15 per house per month on that delivery of customer service,” he says, adding that “AMI system data can signifi cantly shave the costs.”

Th at means funding for AMI systems is in the existing budgets, Bethke says. “You just have to be innovative on how to access that line item of the budget.”

Funding issues can be a challenge, because water utilities operate on a diff er-ent economy of scale, Bethke says.

“Th ere are 52,000 water utilities in this sector, and none of us have any scale that would equate to what a Wells Fargo, Apple, or Facebook could achieve,” he says. “Because we operate on those diff erent economies of scale, if you can bring in some of these cloud technol-ogy components to the table and achieve some scale—which is really our business model—by achieving that scale, you can drive the cost down of these operations, and as a result, the business case for AMI becomes simpler.”

In FATHOM, Global Water Resources designed an off ering that could be deployed inside the existing budget line items of cities, Bethke says. “We basically did that as a utility, so we

MARCH/APRIL 2014 WATER EFFICIENCY 17

started renting those services to munici-palities. We have a scale where we’re less expensive. Th e result is then they can take the other revenue that would otherwise have been spent on the budget line item and fund AMI projects to increase the revenue in the cities.”

FATHOM put together a municipal lease tax-exempt fi nancing vehicle that allowed the cities to enter into a 15-year agreement that could fi nance the infra-structure, installation, and operation at a “fairly low rate,” notes Bethke.

“It has the advantage of being non-statutory, which means it doesn’t impact existing bond funding and could be underwritten in 30 days or so,” he says. “It allows cities to move quickly into AMI without impacting their existing bond structures. Th ey are fi nanceable because this business case we look at is self-funding.”

Political support is probably the toughest issue, Bethke says. “It’s diff erent from market to market, but my belief is we’re going to solve the water issues for the country and the world on the demand side, not necessarily the supply side,” he explains. “As you start to look at solving our infrastructure, water scarcity, and water quality issues from the demand perspective, what you need is more and

more data. What will ultimately drive the political components is we’re going to need more and more data to run more and more effi cient utilities.”

Utilities expressed concern in the Sensus research over perceived defi -ciencies in smart water technologies on the market, emphasizing that pro-prietary vendor solutions were diffi cult to integrate and diff erent vendors had diff erent strengths in their off erings. Th e lack of international open standards for devices poses an additional challenge. Also, technological solutions need to be user-friendly, especially for small utilities that have limited IT staff and don’t have the capacity to train multiple operators in data interpretation and analysis. Dispa-rate products is a “big problem” for the sector, says Bethke.

“We’re trying to lead the conversa-tion on open sourcing the product off er-ings and bringing them into common platforms, because without that we can’t achieve the economies of scale that we need to manage our businesses,” he says. “I think people are beginning to realize that a very important position to take is that this data belongs to the utilities, and, to the extent that it is confi ned inside pro-prietary elements, I think that’s bad for the sector. We all need to work together to say we need open source tools and technology for us to be able to integrate these things together.”

FATHOM’s meter data management platform currently homogenizes at least four meter manufacturers’ data to be able to provide a common platform for the billing systems, Bethke points out. FATHOM is designed for end users to deploy AMI to high-value commercial customers without concern of impact on the Customer Information System.

“Th at’s a function of opening up the standards and working with the manufacturers to provide a platform that integrates those components, and then doing it all in the cloud so we can achieve the scale,” says Bethke.

EMPOWERING CUSTOMERS WITH INFORMATIONTwo years ago, Covina, CA, deployed a Fathom system for a variety of reasons. “We were at a perfect storm,” points out Kalieh Honish, interim director of public works. “Our rates were way under mar-ket. Our infrastructure was failing, and

we needed a new billing system as well.”While Covina took an interest in

Fathom’s AMI system, “we found out they had other products—and as part of the process of realizing we needed a new rate structure, given California’s 20/2020 mandate (an overall reduction of urban water use by 2020)—for bringing our system into this tighter control,” says Honish. “Our rate study included the fact that we wanted to lease this equipment and upgrade our infrastructure. Before we had that, we didn’t have any GIS in our system. We had a few smart readers, but they were all drive-by reads, so we needed some major upgrades.”

Covina faced an “uphill battle” with residents in terms of the rate increase, Honish adds. “We implemented a tier rate structure to help with conservation needs that we needed to meet,” she says. “Other incentives were not working for us for conservation.” Th e Fathom system enabled Covina to empower customers with information to help them identify water usage and leak detection.

Fathom had been a one-stop shop for Covina, Honish states. “We were not looking for all of the system upgrades when they fi rst came to us. We had a billing problem at fi rst and they came to us to sell the other options, and we said, ‘OK, fi rst see if you can solve our billing soft ware issue,’ which they did. Th e AMI system was the second phase for us.” In the end, Fathom provided new billing soft ware, an AMI system, and a GIS system to Covina.

“Before they did any of that, they audited our system and found a bunch of waste and water loss, and poorly performing meters,” says Honish. “We also got auto-read soft ware as well. We can access our hourly reads. It came with a work order system and a mapping system.” WE

Carol Brzozowski specializes in topics related to resource management and technology.

for related articles: www.waterefficiency.net/AMR-and-AMI

A remote outdoor Tower Gateway Base used by Chesterfield County Rural Water Company.