LONDON MARKETS - Gerald Eve · Battersea Power Station Palace of Westminster Canary Wharf...

Transcript of LONDON MARKETS - Gerald Eve · Battersea Power Station Palace of Westminster Canary Wharf...

LONDON MARKETSThe definitive guide to London’s office markets

Summer 2019

geraldeve.com

3.6MILLION SQ FT

Q2 2019TAKE-UP

4.9%AVAILABILITY

RATE

£115PER SQ FT

WEST ENDPRIME RENT

30%GRADE A

AVAILABILITY

£72.50PER SQ FT

MIDTOWNPRIME RENT

11.3MILLION SQ FT

UNDER CONSTRUCTION

£68.50PER SQ FT

CITYPRIME RENT

18.9%TENANTSPACE

2 LONDON MARKETS

Occupier confidence remains despite slow start to the year

Following a slow start to the year, leasing activity picked up during the second quarter, where 3.6 million sq ft was taken, which is in line with the five year average.

Despite the uncertainty surrounding Brexit, and the threat of a “no-deal” scenario increasing, the finance & banking sector displayed its confidence in the London market and accounted for 29% of acquisitions over the last six months. Notably the European Bank for Reconstruction and Development signed a pre-let to take 365,000 sq ft at 5 Bank Street in Canary Wharf, whilst in the City, Brewin Dolphin & Co took 114,000 sq ft at 25 Cannon Street. The demand from this sector has overwhelmingly been driven by lease events, however the Fintech sector is increasingly becoming an area of growth for financial service firms across London.

Media & Technology occupiers have also been active and continue to be one of the main drivers of occupier demand across the capital, accounting for 19% of deals in 2019 so far. The largest deal from this sector was by G-Research, which signed the first pre-let at One Soho Place, taking 103,000 sq ft. Derwent’s development only began construction in Q1 2019, highlighting the strong occupier demand for new space. The ability to recruit and retain the best talent has led to occupiers targeting high quality office space and over the last 12 months, 48% of lettings were for new space, compared to the five year average of 39%.

Serviced office providers accounted for 14% of activity in the first half of the year, with WeWork particularly active taking 255,000 sq ft across the capital. The increase in offering from serviced office providers has lured smaller firms that might previously have signed conventional deals elsewhere, and as a result, the availability rate for smaller offices has gradually increased since 2015.

Premiums paid on larger floor plates due to limited grade A availability

The high volume of leasing activity, as well as some conversion of office stock to other uses, has led to a fall in the availability rate to 4.9%. In 2019, the availability rate fell in 9 of our 15 markets, and as a result, occupiers are having to pay a premium on larger floor plates where available.

The development pipeline will help ease the supply squeeze with 11.4 million sq ft currently under construction. However 43% of this space has already been let, and the majority of the remaining available space is expected to be taken as the developments move nearer to completion. A large increase in London’s availability rate is therefore unlikely.

EXECUTIVE SUMMARY

Canary WharfEastWest

SouthbankFive year average

Q2

2016

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

0

2.5

3.0

1.5

2.0

0.5

1.0

3.5

4.0

4.5

5.0

Million sq ft

Source: Gerald EveQuarterly take-up by region

Cana

ry W

harf

Shor

editc

h

Farri

ngdo

n &

Cle

rken

wel

l

May

fair

& S

t Jam

es’s

Vict

oria

City

Cove

nt G

arde

n

Padd

ingt

on

Mid

tow

n

King

’s Cr

oss &

Eus

ton

Mar

yleb

one

Fitz

rovi

a

Knig

htsb

ridge

Sout

hban

k

Soho

Lond

on

0

5

6

3

4

1

2

7

8

9

10

%

Source: Gerald EveAvailability rate by market

Completed

Under construction availableUnder construction let

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

0

3

4

2

1

5

6

7

8

Million sq ft

Source: Gerald EveDevelopment pipeline

EXECUTIVE SUMMARY 3

REPURPOSING RETAIL – OXFORD STREET

4 LONDON MARKETS

10 of top 24TfL’s pedestrian collision hot spots are on Oxford Street

60 millionEstimated increase in footfall per annum with opening of Elizabeth Line

500,000pedestrians through Oxford Circus per day

270buses per hour

15,000taxi pick up/set downs per day

HistoryDebenhams – 1870John Lewis – 1864House of Fraser – 1879Selfridges – 1909Marks & Spencer – 1930

5REPURPOSING RETAIL – OXFORD STREET 5

Value as single-let retail block

Value of re-geared retail – with offices

5th

4th

1st

2nd

3rd

Ground

Basement

5th

4th

1st

2nd

3rd

Ground

Basement

5th

4th

1st

2nd

3rd

Ground

Basement

5th

4th

1st

2nd

3rd

Ground

Basement

OFFICES£85 per sq ft

+ 4.25%

£1,870 psf

RETAIL£70 per sq ft

+ 3.00%

£2,200 psf

5th

4th

1st

2nd

3rd

Ground

Basement

5th

4th

1st

2nd

3rd

Ground

Basement

5th

4th

1st

2nd

3rd

Ground

Basement

5th

4th

1st

2nd

3rd

Ground

Basement

ALL RETAIL£25 per sq ft

+ 3.25%

£720 psf

Potential impact on value The retail and casual dining sector is under pressure, with news of store closures and CVAs getting strong publicity. Retaining current rental income is difficult with many tenants demanding that landlords accommodate additional flexible payment plans or reductions. With a lack of new operators ready to occupy any vacant units, landlord options are somewhat limited. Such a negative outlook has placed retail at the bottom of most investor wish lists, although the release of surplus retail space, particularly on upper floors, could present opportunities for alternative uses.

16%of all transactionsare now online

-6.0%Average annual capital value decline for high street retail over the next three years

326%increase in online transactions since 2008

20%reduction in floorspace expected by West End retailers in the next decade

53%increase in CVAs in 2018

2.6%office availability rate in Marylebone

TO LET

LIFE SCIENCES IN LONDON

6 LONDON MARKETS

The Francis Crick Institute, King’s Cross & Euston

Bringing together 1,500 scientists and support staff, with a focus on finding new ways to treat, diagnose and prevent a range of illnesses.

Imperial College London’s Campus, White City

Co-locating researchers, businesses and higher education partners on a 25-acre site, White City Place is fast becoming the centre of the emerging life science cluster in West London.

The Cube, East London

A post-incubator scientific research & development facility in Dagenham, East London.

Key life sciences locations across London

7 LIFE SCIENCES IN LONDON 7

London has a long history as a centre for advancement in medicine and biology and together with Oxford and Cambridge, forms the Golden Triangle, a global hub for life sciences. The Mayor of London has given his support to different sectors working together to solve healthcare challenges, including exploring the safe use of health data for research, supporting increased investment to allow innovative life sciences firms to grow, and enabling new life science developments to expand across London.

Advances in medicine and global demographic trends point to an overall expansion of the life sciences industry. Global healthcare expenditure is expected to have increased by 24% between 2015 and 2020. At the same time, the pace of change driven by technology, big data and personalised therapies creates unprecedented opportunities in life sciences. The strength of these fundamentals implies increasing demand for life sciences space.

With a unique ecosystem combining a rich network of world-class universities, renowned research centres, healthcare providers, medical charities, innovative small businesses and global industry players, London is highly attractive for investment in life sciences. London’s life sciences sector now has over 1,300 companies, employs over 60,000 and has an annual turnover of £14.4 bn. This covers biotech R&D, healthcare, medical and optical equipment and pharmaceutical manufacture.

In early 2019, the British Library signed a development agreement with Stanhope plc and Mitsui Fudosan UK Ltd to develop plans to build a 100,000 sq ft extension to the Grade I listed building. The agreement is the next stage in the Library’s plans to develop its 2.8 acre site to the north of the Library at St Pancras, next door to the Francis Crick Institute, which will house a new headquarters for the national institute for data science and artificial intelligence, The Alan Turing Institute.

This development will be facilitated by the construction of extensive commercial space for organisations and companies seeking to locate in the heart of the Knowledge Quarter, an area supported by MedCity and at the intersection of learning, data science and biomedical research.

There are also new plans proposing the creation of a thriving life sciences centre at the heart of Whitechapel. The presence of a life sciences cluster would be a powerful incentive for attracting new start-ups and other innovative and dynamic enterprises to the area.

Post-Brexit, the life science sector is set to become increasingly more important to economic growth in the UK leading to a greater demand for space. At the end of 2018, GammaDelta Therapeutics became the latest life sciences company to take space at White City Place, joining pharmaceutical giant Novartis, which recently announced plans to locate their UK headquarters to the site.

GammaDelta Therapeutics will be taking approximately 12,000 sq ft of office and lab space, joining fellow innovators Autolus and Synthace in White City Place and OpenCell, Rebelbio, and Blenheim Chalcot. Other tenants at White City Place include the Yoox Net-a-Porter technology centre and the pioneering tech ‘scale-ups’ Attention Seekers and Arts Alliance Media.

With a unique ecosystem combining a rich network of world-class universities, renowned research centres, healthcare providers, medical charities, innovative small businesses and global industry players, London is highly attractive for investment in life sciences.

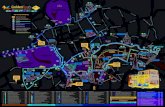

LONDON OFFICE RENTS

NationalTheatre

London South Bank University

Tower Bridge

Tower of London

30 St Mary Axe

City Hall

Tate Modern

Whitechapel Gallery

London Stadium

Bank of England

Mansion House

Somerset House

St Paul’sCathedral

Barbican Centre

London Eye

Sadler’s Wells

Geffrye Museum

The Old Truman Brewery

Brick Lane MarketOld Spitalfields Market

Scala

The British Library

The WallaceCollection

BBC

Buckingham Palace

Selfridges

Kensington Palace

Science Museum

Royal Albert Hall

The National Gallery

Royal Opera House

V&A

Harrods

Southbank Centre

Imperial War Museum

The Oval

Westminster Abbey

Westminster Cathedral

Battersea Power Station

Palace of Westminster

Canary Wharf

Regent’s Park

Lincoln’sInn Fields

SouthwarkPark

Tower HamletsCemetery Park

Hyde Park

Green Park

St James’s Park

Victoria Park

Rent Free 21 months

Grade A

£85.00

FITZROVIA

Rent Free 24 months

Grade A

£80.00

KING’S CROSS & EUSTON

Rent Free 18 monthsGrade A

£72.50

FARR

INGDON & CLERKENWELL

Rent Free 21 months

Grade A

£72.50

MIDTOWN

Rent Free 24 months

Grade A

£87.50

MARYLEBONE

Rent Free 24 months

Grade A

£80.00

PADDINGTON

Rent Free 21 months

Grade A

£115.00

MAYFAIR & ST JAMES’S

Rent Free 21 months

Grade A

£75.00

VICTORIA

Rent Free 24 months

Grade A

£85.00

KNIGHTSBRIDGE

Rent Free 24 months

Grade A

£90.00

SOHO

Rent Free 21 months

Grade A

£80.00

COVENT GARDEN

Rent Free 21 months

Grade A

£67.50

SOUTHBANK

Rent Free 18 months

8 LONDON MARKETS

NationalTheatre

London South Bank University

Tower Bridge

Tower of London

30 St Mary Axe

City Hall

Tate Modern

Whitechapel Gallery

London Stadium

Bank of England

Mansion House

Somerset House

St Paul’sCathedral

Barbican Centre

London Eye

Sadler’s Wells

Geffrye Museum

The Old Truman Brewery

Brick Lane MarketOld Spitalfields Market

Scala

The British Library

The WallaceCollection

BBC

Buckingham Palace

Selfridges

Kensington Palace

Science Museum

Royal Albert Hall

The National Gallery

Royal Opera House

V&A

Harrods

Southbank Centre

Imperial War Museum

The Oval

Westminster Abbey

Westminster Cathedral

Battersea Power Station

Palace of Westminster

Canary Wharf

Regent’s Park

Lincoln’sInn Fields

SouthwarkPark

Tower HamletsCemetery Park

Hyde Park

Green Park

St James’s Park

Victoria Park

Grade A

£72.50

SHOREDITCH

Rent Free 24 months

Grade A

£68.50

CITY

Rent Free 24 months

Grade A

£50.00

Canary Wharf

Rent Free 24 months

LONDON OFFICE RENTS 9

The uncertainty surrounding Brexit has had a negative impact on the investment market, with investors delaying decisions until the UK’s relationship with the EU becomes clearer. As a result, investment fell significantly in the first half of the year with both Q1 and Q2 below the five year average.

With Brexit delayed until October, investment activity is expected to increase slightly in Q3, although overall volumes in 2019 are expected to be low. Those that are looking to buy have moved away from core assets due to the lack of potential rental growth, and instead are targeting value-add opportunities.

The largest transaction of the year occurred in Canary Wharf where Citigroup purchased its headquarters, 25 Canada Square, for £1.1 billion. Citigroup has been in the building for 19 years and also occupies 33 Canada Square next door. The latter will house staff while the tower is refurbished. The work is to start early next year to create a state-of-the-art interior, and include an open-plan layout for all staff, as is the case in the bank’s New York headquarters, which Citigroup also bought recently.

The recent hesitancy in the London investment market is largely coming from vendors, and as a result there is little stock available to buy. The transactions that did take place in H1 2019, were mostly down to investors under some pressure to sell. There has also been a notable increase in off-market transactions, with vendors reluctant to market their assets due to a lack of confidence.

There has also been a drop in demand from overseas investors, which have previously been dominant in the London office market since the referendum in 2016. Overseas investors, particularly from the Far East, have been sensitive to periods of uncertainty. However, pricing concerns are also playing an important role in holding back investment.

The occupational market remains strong with high demand for new space. This combined with a lack of good quality grade A space should lead to continued grade A rental growth in both the West End and the City, albeit not as strong as previous years. However, this growth will be offset by negative yield movements over the forecast period, leading to a slight decline in capital values in 2019 and 2020.

In July, the Bank of England’s Financial Stability Report highlighted a potential risk to the commercial property market, suggesting that in a no-deal Brexit scenario, net outflows from open-ended property funds could be almost as large as after the EU referendum vote in 2016. Over the past six months, heightened uncertainty has seen average net outflows of around £100m, compared to average net inflows in 2018 of £20m. If a Brexit deal is secured, outflows are likely to reduce. However, in the event of a no-deal, heavier outflows than have been seen over the past six months can’t be ruled out.

ContactLloyd DaviesMobile +44 (0)7767 [email protected]

CENTRAL LONDON INVESTMENT

Capital growthIncome returnTotal return

2016

2017

2018

2019

2020

2021

Sources: Gerald Eve, MSCI

-4

0

-2

2

4

6

8

10

%

Central London O�ce forecasts

Canary WharfCity

West End

SouthbankFive year average

Q1 2

016

Q2

2016

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q1 2

019

Q4

2018

Q3

2018

Q2

2019

Sources: Property Data, Gerald Eve

0

1

2

3

4

5

6

£ billion

Central LondonO�ce investment volumes

Monthly totalSix month average

2013

2014

2015

2016

2017

2018

2019

Sources: Investor Association, Capital Economics

-1200

-900

-600

-300

0

300

600

£ million per month EU referendum

Net flows into open-ended property funds

10 LONDON MARKETS

Hyde Park

Edgware Road

Paddington

Lancaster Gate

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

50

100

150

200

250

300

000s sq ft

DemandQuarterly take-up and five year average

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

100

200

300

400

500

600

30

40

50

60

70

80

90

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

50

100

150

200

250

300

350

400

450

000s sq ft

SupplyAvailability by grade

Despite the lack of leasing activity in Q2 2019, occupiers continue to be drawn to Paddington from other parts of London, attracted by the quality of its new developments, improvements to the public realm and the upcoming arrival of Crossrail, boosting the market’s connections with Heathrow Airport and other parts of London.

Recent developments in the market have proved particularly popular, namely the Brunel Building where the entire 238,000 sq ft was committed to ahead of its completion in Q3 this year. Sony Pictures and the FA Premier League signed significant pre-lets at the Brunel Building, relocating from Soho and Marylebone respectively. As a result, the availability rate has dropped to 4.4%, which is close to its historical low.

The positive momentum in the leasing market, with four of the last five quarters exceeding the five year average, is encouraging developers. Sellar Property Group will soon begin the construction of Paddington Square (355,000 sq ft) on a speculative basis, which will become Paddington’s largest office building upon delivery in H1 2022.

Invesco is also expected to start its redevelopment and extension of 50 Eastbourne Terrace following its recent acquisition of the property, with the new scheme likely to deliver 95,000 sq ft.

In the longer term, British Land have begun a consultation process on its plans for the final stage of the Paddington Central campus. Five Kingdom Street will include 440,000 sq ft of offices as well as extensive community, leisure and cultural development.

PADDINGTON

ContactPatrick RyanMobile +44 (0)7792 [email protected]

7.6%Tenant Space

29,000 sq ftUnder Offer

4.4%Availability Rate

194,000 sq ftUnder Construction

Grade AGrade BGrade C

12 month take-up by grade

44%56%

LONDON MARKETS 11

£80.00Prime Rent

65%Corporate take-up

The Wallace Collection

Marylebone

Edgware Road

Baker Street

Marble Arch

Bond Street

Cavendish Square

Portman Square

After a sluggish Q1, leasing activity bounced back in the second quarter with 102,000 sq ft taken, 11% above the five year average. The most significant deal was signed by Union Bancaire Privee, which took all 15,900 sq ft at the recently refurbished Seymour Mews House.

The increase in take-up combined with a lack of deliveries brought about a drop in Marylebone’s availability rate over the last 12 months to 2.6%, the second lowest across central London. Over the last five years, the market has actually lost space with around 200,000 sq ft delivered since 2015, whilst over 250,000 sq ft has been lost to demolitions or conversions.

Vacancies will remain low throughout the remainder of 2019 given the lack of development, and as a result, occupiers looking for larger lot sizes will find it increasingly difficult. However, this could change in 2020 as a few large developments near completion.

There remains a strong demand for high quality office space within the submarket, evidenced by Portman Estate’s 1–9 Seymour Street (55,000 sq ft), the largest delivery in 2018, which was fully let upon completion.

This occupier activity will encourage developers, with a number of schemes expecting to complete next year. The largest is Almacantar’s 5 Marble Arch Place, delivering 91,000 sq ft of Grade A office space. Native Land and Portman Estate’s 136 George Street (43,000 sq ft), is also set to complete by Q3 2020 after construction began on the mixed-use scheme during 2018. The Howard de Walden Estate will also deliver 18,500 sq ft of refurbished office space at 2 Cavendish Square over the next 6-12 months with Gerald Eve appointed on leasing.

MARYLEBONE

ContactRhodri PhillipsMobile +44 (0)7768 [email protected]

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q2

2019

Q4

2018

Q1 2

019

Source: Gerald Eve

0

50

100

150

200

250

300

000s sq ft

DemandQuarterly take-up and five year average

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

100

200

300

50

150

250

350

400

450

30

40

50

60

70

80

100

90

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

50

100

150

200

250

300

350

400

000s sq ft

SupplyAvailability by grade

27.9%Tenant Space

78,000 sq ftUnder Offer

2.6%Availability Rate

185,000 sq ftUnder Construction

£87.50Prime Rent

37%Finance & Banking take-up Grade A

Grade BGrade C

12 month take-up by grade

44%

49%

7%

12 LONDON MARKETS

MAYFAIR & ST JAMES’S

Hyde Park

Green Park

St James’s Park

Bond StreetOxford Circus

Hyde Park Corner

Piccadilly Circus

Marble Arch

Occupier demand has remained strong in Mayfair & St James’s, with take-up volume exceeding 500,000 sq ft in the first half of the year. Demand has been particularly strong in bigger, newer buildings, with the market’s recent deliveries having all performed well.

The finance & banking sector continues to dominate the market, and in the first half of the year accounted for 40% of deals; Cinven Partners took 51,000 sq ft at 21 St James’s Square, Shore Capital Stockbrokers leased 14,000 sq ft at 57 St James’s Street, and Triton Investment Advisers took 18,250 sq ft at The Crown Estate’s new build scheme, The Marq, which completed in May.

Due to the high level of leasing activity, the availability rate has fallen to 5.1%. The market has also lost space in recent years through conversions to other uses, particularly residential. However as high-end residential prices have cooled, this should be less relevant going forward.

The availability rate is predicted to rise over the next 12 months with a number of schemes currently under construction. Over the next 12 months, 446,000 sq ft will be delivered, including the markets largest construction since 2010, 18-19 Hanover Square (130,000 sq ft). The building is scheduled to complete in 2020 and recently signed its first tenants, Kohlberg Kravis Roberts and Glencore, leaving just one floor available.

Great Portland Estates commenced construction on 65 Davies Street which will deliver 65,000 sq ft in Q3 2020. Grosvenor Estates have also announced plans to redevelop a two-acre site which will increase the height and density of buildings opposite Claridge’s on Brook Street.

ContactPatrick RyanMobile +44 (0)7792 [email protected]

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

50

100

150

200

300

250

350

400

000s sq ft

DemandQuarterly take-up and five year average

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

100

200

300

400

500

600

30

40

50

60

70

90

130

110

80

120

100

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

200

400

600

800

1,000

1,200

1,400

1,600

000s sq ft

SupplyAvailability by grade

5.6%Tenant Space

335,000 sq ftUnder Offer

5.1%Availability Rate

446,000 sq ftUnder Construction

£115.00Prime Rent

40%Finance & Banking take-up Grade A

Grade BGrade C

12 month take-up by grade

38%

57%

5%

LONDON MARKETS 13

KNIGHTSBRIDGE

Hyde Park Green Park

Victoria

Sloane Square

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

10

20

30

40

60

50

70

80

000s sq ft

DemandQuarterly take-up and five year average

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

10

30

50

70

90

20

40

60

80

30

40

50

60

70

90

100

80

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

50

100

150

200

250

000s sq ft

SupplyAvailability by grade

Leasing activity has been relatively subdued over the last 18 months with falling demand from the private banks and investment houses that traditionally drive demand here. However a number of lettings in Q2 2019 drove the leasing volume to 74,000 sq ft, the market’s highest in three years. Motcomb Estates, advised by Gerald Eve, has leased 19,000 sq ft to Maybourne Hotels Group at 27 Knightsbridge, whilst Liberty Commodities took 39,000 sq ft at 40 Grosvenor Place.

The increase in leasing activity resulted in a further fall in the availability rate from 4.5% in December to 3.3% in June 2019. A loss of office stock to luxury residential development has also been responsible with a small demolition occurring in Q1 2019.

There’s been a lack of office development over the last five years, however, new high-quality space is on the way; Chelsfield Partners LLP have begun development of The Knightsbridge Estate, which will deliver a much needed 67,000 sq ft of new high-quality space to the market, within a wider mixed-use scheme.

Adhara Property Holdings have also begun construction on another mixed-use scheme; 55–91 Knightsbridge, which will deliver 18,000 sq ft of new office space in 2020.

Despite the lack of recent leasing activity, Knightsbridge’s low availability and its prestigious location means properties here still command high rents.

ContactSophie O’SullivanMobile +44 (0)7880 [email protected]

33.2%Tenant Space

33,000 sq ftUnder Offer

3.3%Availability Rate

85,000 sq ftUnder Construction

Grade AGrade BGrade C

12 month take-up by grade

37%

48%

15%

14 LONDON MARKETS

£85.00Prime Rent

66%Corporate take-up

Green ParkHyde Park

Palace of Westminster

Victoria

Pimlico

St James’s Park

Hyde Park

Westminster

Green Park

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

100

50

150

200

250

350

300

400

450

000s sq ft

DemandQuarterly take-up and five year average

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

100

300

500

700

200

400

600

30

40

50

60

70

90

80

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

300

400

100

200

500

600

700

800

900

1,000

000s sq ft

SupplyAvailability by grade

Recent improvements to Victoria’s retail and leisure offering, combined with the availability of high-quality office space, have persuaded a larger pool of occupiers to consider taking space here. This is reflected in the fact that of the 1.6 million sq ft of new office space delivered over the last five years, less than 5% remains available.

406,000 sq ft was leased in the first half of the year, notably The House of Commons took 96,000 sq ft at the recently refurbished 64 Victoria Street, and 52,000 sq ft at 21 Dartmouth Street.

Due to the strong demand for space from occupiers, the availability rate has fallen significantly, from 7% in December 2018 to 4.7% in June 2019. However, whilst the overall availability rate has fallen, vacancies for offices smaller than 20,000 sq ft has increased significantly as SMEs and start-ups increasingly gravitate towards serviced offices.

Victoria has become a key target for serviced office providers seeking to expand in London over the past couple of years, with notable lettings to The Office Group (84 Eccleston Square); London Executive Office (Nova); Spaces (25 Wilton Road); and WeWork (123 Buckingham Palace Road).

Landsec, a major owner in Victoria, also chose Victoria as the destination for its own venture into the co-working market, taking 36,000 sq ft at 123 Victoria Street (under the Myo brand) in Q1 2019.

There will be no new space coming to the market until 2022 when Northacre’s 10 Broadway (116,000 sq ft) completes. However Landsec announced plans in Q1 2019 to develop another office building at Nova, to be known as Nova East, and submitted a planning application for the 136,500 sq ft office building. Also GAW Capital Partners plans to create an additional 103,000 sq ft at 123-151 Buckingham Palace Road by Q1 2022.

VICTORIA

ContactRhodri PhillipsMobile +44 (0)7768 [email protected]

27.8%Tenant Space

181,000 sq ftUnder Offer

4.7%Availability Rate

116,000 sq ftUnder Construction

£75.00Prime Rent

80%Associations take-up Grade A

Grade BGrade C

12 month take-up by grade

39%

46%

15%

LONDON MARKETS 15

SOHO

Soho Square Gardens

Golden Square

Oxford Circus

Tottenham Court Road

Piccadilly Circus Leicester Square

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

40

20

60

80

100

140

120

160

180

000s sq ft

DemandQuarterly take-up and five year average

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

50

150

250

350

100

200

300

30

40

50

60

70

110

90

100

80

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

50

100

150

200

250

300

350

400

000s sq ft

SupplyAvailability by grade

Leasing activity has been strong in Soho, supported by infrastructure improvements, particularly along the eastern end of Oxford Street where Crossrail will arrive in 2021. In the first half of 2019, leasing volume totalled 214,00 sq ft, exceeding the five year average.

The media and technology sector continues to dominate the market and accounted for 60% of deals over the last six months. Notably G-Research signed the first pre-let at One Soho Place, taking 103,000 sq ft. Derwent’s development only began construction in Q1 2019, highlighting the strong occupier demand for new space in the market with Apollo Global Management understood to be negotiating on the remainder.

The recent high level of leasing activity has led to a fall in the office availability rate to 3.3%, one of the lowest across central London. However, there are a number of developments currently under construction which will ease the supply squeeze. Over the next 18 months, 201,000 sq ft will be delivered across six schemes. Notably Soho Estates’ Ilona Rose House will deliver 163,000 sq ft in 2020, the majority of which is currently available.

Landsec will shortly commence speculative development of 1 Sherwood Street (behind the Piccadilly Lights) to deliver 107,000 sq ft by Q2 2022.

ContactSophie O’SullivanMobile +44 (0)7880 [email protected]

30.5%Tenant Space

194,000 sq ftUnder Offer

3.3%Availability Rate

226,000 sq ftUnder Construction

£90.00Prime Rent

60%Media & Tech take-up Grade A

Grade BGrade C

12 month take-up by grade

58%

40%

2%

16 LONDON MARKETS

RIBA

British Museum

University College London

Great OrmondStreet Hospital

Wigmore Hall

Russell Square

Goodge Street

Holborn

Tottenham Court RoadOxford Circus

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

50

150

100

200

250

000s sq ft

DemandQuarterly take-up and five year average

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

200

100

400

600

800

300

500

700

30

40

50

60

70

100

90

80

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

50

150

100

200

250

300

350

400

450

500

000s sq ft

SupplyAvailability by grade

Occupier sentiment remains positive in Fitzrovia with leasing activity totalling 349,000 sq ft in the first half of the year and exceeding the five year average. The arrival of Crossrail at Tottenham Court Road will continue to lure in more occupiers. The high level of leasing activity has led to a further fall in the availability rate to 2.5%, making Fitzrovia the most restricted in terms of availability.

Over the last 12 months, buildings of different sizes have performed differently. Recent activity has largely been driven by several large occupiers taking big chunks of space. However, the availability rate in smaller offices, below 20,000 sq ft, has increased significantly, due to the migration of SME’s and start-ups towards serviced offices.

Fitzrovia has seen a number of serviced office providers locate in the market, namely Regus and Fora have each taken 25,000 sq ft in the past two years. Spaces took 16,000 sq ft at 307-317 Euston Road at the end of 2018, and The Wing have recently taken 11,000 sq ft at 14-16 Great Portland Street in Q1 2019.

Whilst Derwent’s 80 Charlotte Street (321,000 sq ft) is fully let (allowing for future options), there are other schemes currently under construction which will deliver new space to the market. Great Portland Estates’ 1 Newman Street will deliver 80,000 sq ft in Q4 2020.

FITZROVIA

ContactRhodri PhillipsMobile +44 (0)7768 [email protected]

18.6%Tenant Space

116,000 sq ftUnder Offer

2.5%Availability Rate

411,000 sq ftUnder Construction

£85.00Prime Rent

54%Corporate take-up Grade A

Grade BGrade C

12 month take-up by grade

50%46%

4%

LONDON MARKETS 17

COVENT GARDEN

Lincoln’sInn Fields

River Thames

Leicester Square

Charing Cross

Covent Garden

Embankment

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

150

250

350

50

100

200

300

000s sq ft

DemandQuarterly take-up and five year average

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

200

100

150

50

300

400

500

250

350

450

30

40

50

60

70

100

90

80

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

100

200

300

400

500

600

700

800

000s sq ft

SupplyAvailability by grade

Leasing activity remained subdued in Covent Garden with both quarters in 2019 falling below the five year average. The media and technology sector continued to be the main driver behind occupier demand and accounted for 26% of lettings in the first half of the year. Notably data company ComplyAdvantage took 21,000 sq ft at 90 Long Acre, whilst a number of companies took sub 10,000 sq ft including Love Productions Ltd at 15 Macklin Street, and Invenica at Berkshire House on High Holborn.

Encouragingly, many firms are moving to Covent Garden from other submarkets or expanding into new offices, with new or refurbished space especially popular, and in Q1 2019, insurer Rothesay Life took 49,000 sq ft at the recently completed Post Building, relocating from the City.

The Post Building, which at 263,000 sq ft was the market’s largest development in a decade, is nearly 100% let upon completion with McKinsey & Co (relocating from Mayfair & St James’s) also pre-letting space. The remaining space in the building has now let in Q3 2019, highlighting the demand for good quality space in this location.

Across all sizes, the availability rate remains at a historical low level of 4.1%. However, like other markets in central London, buildings smaller than 20,000 sq ft have seen a rise in their availability rate as a result of increased competition from serviced office providers. In recent years, WeWork and Regus have each taken significant space in Covent Garden.

ContactSophie O’SullivanMobile +44 (0)7880 [email protected]

14.4%Tenant Space

182,000 sq ftUnder Offer

4.6%Availability Rate

225,500 sq ftUnder Construction

£80.00Prime Rent

26%Media & Tech take-up Grade A

Grade BGrade C

12 month take-up by grade

40%

54%

6%

18 LONDON MARKETS

MIDTOWNMuseum of London

Leicester Square

King’s Cross

Farringdon

Blackfriars

Euston

Picadilly Circus

Chancery Lane

Russell Square

Holborn

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

400

800

1,200

200

600

1,000

30

35

45

55

80

75

65

40

50

70

60

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

Midtown has been one of the most active markets in central London over the last couple of years, and a further 383,000 sq ft was leased in the first half of 2019. The market’s close proximity to the Crossrail station at Farringdon, has also helped it lure occupiers from other parts of London. Almost all of the new space from recent development completions have been fully let, many before completion, highlighting the high occupier demand for new space.

Professional services have been the most active business sector in 2019 so far, and in particular the legal sector. Law Business Research acquired 41,000 sq ft at Meridian House, 34-35 Farringdon Street, whilst Haynes and Boone took 13,000 sq ft at 1 New Fetter Lane.

Despite the strong occupier demand and tight supply of new/refurbished space, the overall availability rate has increased over the last six months to 4.1%. This could increase further with the delivery of a number of developments currently under construction, combined with a couple of large occupiers relocating to other London markets. Freshfields Bruckhaus Deringer recently signed a large pre-let deal at 100 Bishopsgate in the City, and will be leaving its current headquarters at 65 Fleet Street in 2021. Also The Competition & Markets Authority will be vacating Victoria House (80,000 sq ft) to move to Canary Wharf.

The next major development commencing in Midtown is likely to be Ivanhoe Cambridge and Greycoat’s 1 Stonecutter Court, which received planning permission for a 239,000 sq ft office redevelopment scheme in Q1 2019. The developer is considering whether to refurbish the existing building (150,000 sq ft) or develop the consented new scheme, with a decision likely by Q4 2019.

ContactAmy BryantMobile +44 (0)7551 [email protected]

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

200

400

600

100

300

500

000s sq ft

DemandQuarterly take-up and five year average

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

200

400

600

800

1,000

1,200

1,400

000s sq ft

SupplyAvailability by grade

7.5%Tenant Space

288,000 sq ftUnder Offer

4.1%Availability Rate

373,000 sq ftUnder Construction

£72.50Prime Rent

56%Professional Services take-up Grade A

Grade BGrade C

12 month take-up by grade

35%

62%

3%

LONDON MARKETS 19

Mornington Crescent

King’s Cross

Euston

Camden Road

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

200

400

800

100

300

600

700

500

000s sq ft

DemandQuarterly take-up and five year average

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

400

800

1,400

1,200

200

600

1,000

30

90

80

60

40

70

50

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

50

100

150

200

250

300

350

000s sq ft

SupplyAvailability by grade

King’s Cross & Euston continues to be one of the most sought-after markets across central London. In the first half of the year, leasing activity totalled 398,000 sq ft, with Sony Music signing the largest deal, pre-letting 125,000 sq ft at S1 Handyside. The company will join sports manufacturer Nike, which pre-let 68,000 sq ft in 2018, when the building completes in 2021.

The market has been dominated in recent years by a number of large pre-lets, and significantly all of the buildings that have been delivered since 2014 are fully occupied, with the media and technology sector the main occupier. Havas Media, Universal Music, and Facebook have taken large amounts of space, and in particular Google, which has taken more than 1.6 million sq ft in recent years.

As a result of the high leasing activity, the overall availability rate remains one of the lowest across central London at 3.5%, with almost no grade A space remaining. This isn’t likely to change over the next 18 months as all the significant buildings that will complete during that time are fully pre-let or under offer.

In 2021, more space could become available with the completion of Lazari’s The Lantern, 75 Hampstead Road, delivering 147,000 sq ft of new space, all of which is currently available.

Other schemes within the King’s Cross Central development are likely to begin soon. In the longer term, development might start to shift to the western end of the submarket around Euston, where regeneration is likely as the HS2 project gets underway.

KING’S CROSS& EUSTON

ContactPatrick RyanMobile +44 (0)7792 [email protected]

67.0%Tenant Space

75,000 sq ftUnder Offer

3.5%Availability Rate

1,244,000 sq ftUnder Construction

£80.00Prime Rent

86%Media & Tech take-up Grade A

Grade BGrade C

12 month take-up by grade

88%

9% 3%

20 LONDON MARKETS

Farringdon

Chancery Lane

Barbican

Old Street

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

400

500

700

1,000

900

200

300

100

600

800

30

80

75

55

35

65

45

70

50

60

40

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

Farringdon and Clerkenwell continues to attract a high level of occupier demand with 542,000 sq ft leased in the first half of 2019.

The market attracts firms from a variety of industries but particularly those within the media and technology sector where demand has proved resilient post-referendum. So far, this sector has been the most active and accounted for 33% of deals with football magazine WSC taking 15,000 sq ft Petersham House, and Incubeta taking 11,000 sq ft at The Tower - The Bower, 207-211 Old Street.

Firms within the education sector have also taken space in the market. Three notable deals so far in 2019 were by the Open Society, which leased 29,000 sq ft at Herbal House; the University of Chicago Booth School of Business, which leased 43,000 sq ft at 1 Bartholomew Close; and UCL Mechanical Engineering, which leased 12,000 sq ft at 44 Wicklow Street.

Many of the larger lettings over the last 18 months have taken place near Farringdon Station, which is set to be one of the busiest stations in Europe when Crossrail arrives in 2020. Occupiers are realising the benefits of Farringdon’s future connectivity, with reduced commuter times and larger capacity trains, and this has led to heightened demand and rental growth in this market.

A number of development completions in the first half of the year led to an increase in the overall availability rate from 3.1% in December to 5.4% in June. The availability rate will likely remain high, compared to other London markets, as the area continues to be a development hot-spot with 1.3 million sq ft currently under construction. However, 33% of this space has already been leased and, with more pre-letting activity expected, a significant rise in the availability rate is unlikely.

FARRINGDON& CLERKENWELL

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

200

400

900

800

100

600

300

700

500

000s sq ft

DemandQuarterly take-up and five year average

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

200

400

600

800

1,000

1,200

1,400

000s sq ft

SupplyAvailability by grade

ContactAmy BryantMobile +44 (0)7551 [email protected]

11.4%Tenant Space

409,000 sq ftUnder Offer

5.4%Availability Rate

1,708,000 sq ftUnder Construction

£72.50Prime Rent

33%Media & Tech take-up Grade A

Grade BGrade C

12 month take-up by grade

43%

49%

8%

LONDON MARKETS 21

SHOREDITCH Brick Lane Market

Old Spitalfields Market

Shoreditch High Street

Liverpool Street

Old Street

Whitechapel

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

200

250

350

500

450

100

150

50

300

400

0

80

70

50

60

40

20

30

10

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

Occupier sentiment continues to be positive in Shoreditch despite a lower level of leasing activity so far in 2019. 260,000 sq ft has been taken in the first half of the year, with both quarters below the five-year average. The second half of the year looks more encouraging however, with 147,000 sq ft currently under offer.

Larger floorplates are in limited supply and thus, Shoreditch has become the natural home for SMEs and start-ups in London and has been a particular beneficiary of the clustering effect. This was reflected in 2019 with the media and technology sector accounting for 45% of deals. Notably Usborne Publishing Limited took 25,000 sq ft at 1 Frying Pan Alley.

The atmosphere around Shoreditch High Street continues to be a draw. For example, serviced office provider Fora recently acquired a second Shoreditch location; taking 33,000 sq ft at Arnold, 21-33 Great Eastern Street in one of the market’s largest deals so far this year. The area to the south of Shoreditch, around Aldgate and Whitechapel, is also becoming increasingly popular to occupiers, driven by the near arrival of the Whitechapel Crossrail station in 2020 and the significant investment into development in this area.

The overall availability rate has risen recently and could increase further with a number of schemes currently under construction. A few smaller schemes have also started construction on a speculative basis recently, which is indicative of developer confidence in the Shoreditch market.

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

100

350

300

200

50

250

150

000s sq ft

DemandQuarterly take-up and five year average

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

200

100

300

400

500

600

700

000s sq ft

SupplyAvailability by grade

23.5%Tenant Space

147,000 sq ftUnder Offer

6.7%Availability Rate

681,000 sq ftUnder Construction

£72.50Prime Rent

45%Media & Tech take-up Grade A

Grade BGrade C

12 month take-up by grade24%

69%

7%

22 LONDON MARKETS

ContactJessica NuttMobile +44(0)7788 [email protected]

CITY

Liverpool Street

Cannon Street

Farringdon

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

1,000

1,500

2,500

4,000

3,500

500

2,000

3,000

30

75

55

35

65

45

70

50

60

40

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

The high levels of leasing activity we’ve seen in recent years in the City has continued in 2019 despite the political and economic uncertainty surrounding Brexit. The leasing volume totalled 2.2 million sq ft in the first half of the year, with both quarters exceeding the five year average. This looks set to continue in the second half of the year with a further 1.1 million sq ft currently under offer.

The City continues to attract occupiers from the finance and banking sector, which have accounted for 34% of deals so far this year. Brewin Dolphin & Co signed the largest deal, taking 114,000 sq ft at 25 Cannon Street. The lease will be for 15 years and is expected to commence in August 2021 with relocation to the new premises happening in July 2022.

Elsewhere Smith & Williamson agreed to take 87,000 sq ft at Gresham St Paul’s, 40 Gresham Street, a new development due to complete Q3 2020 and only a few minutes’ walk from its current home at 25 Moorgate, in 2022. In addition, Quilter signed for 94,000 sq ft at Senator House, EC4.

WeWork continue to be a substantial occupier in the City. In H1 2019, they have acquired 46,000 sq ft at 133 Houndsditch, 50,000 sq ft at 2 Minster Court, 30,000 sq ft in 12 Moorgate and 30,000 sq ft in Dixon House, 1 Lloyd’s Avenue.

As a result of this strong occupier demand, the availability rate has fallen from 5.3% in December to 4.6% in June. This could increase over the next few years with 4 million sq ft of new space currently under construction. However, 30% of this space has already been leased, and with pre-letting activity expected to continue, the impact of these developments once completed is unlikely to cause a significant increase in the availability rate.

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

400

1,600

1,400

1,000

1,200

800

200

600

000s sq ft

DemandQuarterly take-up and five year average

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

2,000

1,000

4,000

6,000

3,000

5,000

000s sq ft

SupplyAvailability by grade

ContactFergus JaggerMobile +44 (0)7787 [email protected]

20.0%Tenant Space

1,121,000 sq ftUnder Offer

4.6%Availability Rate

4,037,000 sq ftUnder Construction

£68.50Prime Rent

34%Finance & Banking take-up Grade A

Grade BGrade C

12 month take-up by grade

48%50%

2%

LONDON MARKETS 23

WaterlooLondon Bridge

Embankment

Elephant and Castle

Tate ModernOxo Tower

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

400

500

700

1,000

900

200

300

100

600

800

30

75

55

35

65

45

70

50

60

40

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

Leasing activity across Southbank has been slightly subdued in 2019, with 410,000 sq ft taken, and both quarters below the five year average. However, the second half of the year looks set to perform better with a further 325,000 sq ft currently under offer.

Serviced office providers continue to hold a strong presence in the market and have been the main driver of occupier demand in 2019, accounting for 25% of all deals in the first half of the year. Notably Sustainable Workspaces took 33,000 sq ft at 25 Lavington Street.

WeWork, which currently occupies over 550,000 sq ft across Southbank, opened its largest London location at Two Southbank Place earlier this year, and in June announced that HSBC had signed on for 1,135 desks, likely more than 100,000 sq ft. The deal indicates the shifting type of occupier for serviced offices away from just small businesses, to larger companies.

Elsewhere in the market, retailer The Body Shop signed for the 24,000 sq ft at 155 Tooley Street, where the company will move its head office in Q3 2019. The move marks the company’s return to the submarket, and London Bridge specifically, where it was located before moving to Croydon in 2016.

The availability rate in Southbank increased slightly to 3.5% over the last 6 months. Whilst this is still relatively low compared to other London markets, its unlikely to rise much further in the next two years with 72% of development space currently under construction already leased.

SOUTHBANK

13.4%Tenant Space

325,000 sq ftUnder Offer

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

100

600

500

300

400

200

000s sq ft

DemandQuarterly take-up and five year average

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

2,000

1,000

5,000

9,000

3,000

7,000

4,000

8,000

6,000

000s sq ft

SupplyAvailability by grade

ContactFergus JaggerMobile +44 (0)7787 [email protected]

3.5%Availability Rate

416,000 sq ftUnder Construction

£67.50Prime Rent

25%Serviced Offices take-up Grade A

Grade BGrade C

12 month take-up by grade

44%

53%

3%

24 LONDON MARKETS

Canary Wharf

Blackwall

South Quay

Poplar

East India

CANARY WHARF

CompletedUnder construction letUnder construction availablePrime rent (RHS)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Source: Gerald Eve

0

400

600

1,000

1,600

1,400

200

800

1,200

30

55

50

40

45

35

000s sq ft £ sq ft

DevelopmentPipeline and prime rent

Occupier activity increased dramatically in the second quarter of the year with the volume of take-up reaching 413,000 sq ft. This level of activity looks set to continue in the second half of the year, with 633,000 sq ft currently under offer.

Firms are moving to Canary Wharf from other parts of London or expanding into new space. Notably in Q2 2019 the European Bank for Reconstruction & Development (EBRD) signed a 365,000 sq ft pre-let at Five Bank Street, moving from One Exchange Square in the City. Société Générale will also move staff from the City when it occupies 280,000 sq ft at the same building later this year, after having pre-let the space in 2014.

Serviced office providers have also begun to target Canary Wharf having previously been drawn to more central locations, and in Q1 Spaces leased 71,000 sq ft at 25 Cabot Square. Also

WeWork agreed to take over the European Medicines Agency’s 266,000 sq ft lease at 25 Churchill Place in July 2019, ahead of the EU agency’s departure to Amsterdam.

Following the success of Five Bank Street, which is 91% occupied prior to completion later this year, The Canary Wharf Group have begun developing 20 Water Street, a 240,000 sq ft speculative office building, which will complete in Q3 2020. Together with neighbouring 15 Water Street, a 178,000 sq ft building fully let to Ennismore, TOG & NoCo and due to complete Q2 2021, it forms part of the mixed-use Wood Wharf scheme, with offices largely aimed at the media and technology sector. Elsewhere, Blackstone is set to complete its refurbishment of Cargo, 25 North Colonnade (340,000 sq ft in Q4 2020) next year.

Take-upFive year average

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

100

600

500

300

400

200

000s sq ft

DemandQuarterly take-up and five year average

NewRefurbishedUnrefurbished

Q3

2016

Q4

2016

Q1 2

017

Q2

2017

Q3

2017

Q4

2017

Q1 2

018

Q2

2018

Q3

2018

Q4

2018

Q1 2

019

Q2

2019

Source: Gerald Eve

0

500

1,500

2,500

1,000

2,000

000s sq ft

SupplyAvailability by grade

31.2%Tenant Space

633,000 sq ftUnder Offer

ContactJessica NuttMobile +44(0)7788 [email protected]

9.9%Availability Rate

356,000 sq ftUnder Construction

£50.00Prime Rent

70%Finance & Banking take-up Grade A

Grade BGrade C

12 month take-up by grade3%

58%

42%

LONDON MARKETS 25

The current position for rent reviews is shown in the table. Notwithstanding the identified growth, the evidence continues to show a cooling in the uplifts being experienced compared with previous editions. That cooling reflects the sharply rising rents being experienced five years ago, and it is that historic rental growth that will mitigate the impact of such increases as can be reasonably forecast for the next two to three years. Rental growth over the last five years must also be seen in the context of increasing rent free periods over the same timeframe, which show no real sign of contracting. The treatment of these rent frees at rent review continues to have a significant impact on rent review settlements.

Many leases now contain break clauses and such leases often include an additional period of rent free if the break clause is not exercised by the tenant. The treatment of these break clauses, with their associated rent frees or penalties, and indeed whether or not the break clause is deemed to be included in the hypothetical lease, is an issue we see being routinely debated. The drafting of rent review clauses does not yet appear to have developed to allow for this trend, and is an issue that parties entering into a new lease would be wise to consider.

The impact of rent free periods means that larger increases are generally found on bigger buildings, and/or prime buildings experiencing their second rent review. The valuation assumptions in both these cases work to minimise the impact of the market rent free periods and the effect of this can, for second rent reviews, be seen in the right hand column in the table. These are, in percentage terms, well ahead of those predicted for the first rent review in a lease.

Rents vary quite widely even within the individual locations we are reporting on and any particular rent review can therefore differ from this general analysis. A good example of this is the market for ‘trophy floors’, usually being the top floor in a building with outside space. The rents being achieved for such floors have generally grown faster over the last five years than the rents for more typical floors, so as a result uplifts at rent review are higher for such space than those being experienced for non-trophy floors.

June

201

4 he

adlin

e re

nt

June

201

9 he

adlin

e re

nt

June

2019

Re

nt fr

ee m

onth

s

Impl

ied

net

effec

tive

rent

Pred

icted

upl

ift

first

revi

ew

Pred

icted

upl

ift

seco

nd re

view

Paddington £57.50 £80.00 21 £68.00 18% 33%Marylebone £82.50 £87.50 24 £72.20 0% 0%Mayfair & St James's £107.50 £115.00 21 £97.80 0% 2%

Knightsbridge £90.00 £85.00 24 £70.10 0% 0%

Victoria £70.00 £75.00 24 £61.90 0% 4%

Soho £85.00 £90.00 21 £76.50 0% 4%Fitzrovia £67.00 £85.00 24 £70.10 5% 17%

Covent Garden £70.00 £80.00 21 £68.00 0% 9%

Midtown £57.50 £72.50 24 £59.80 4% 22%King's Cross & Euston £62.50 £80.00 18 £70.00 12% 26%

Farringdon& Clerkenwell £44.00 £72.50 21 £61.60 40% 57%

Shoreditch £45.00 £72.50 24 £59.80 33% 58%City £60.00 £68.50 24 £56.50 0% 12%

Southbank £52.50 £67.50 18 £59.10 13% 31%

Canary Wharf £40.00 £50.00 24 £41.30 3% 39%

London Average £66.07 £78.73 22 £66.18 9% 21%

CENTRAL LONDON RENT REVIEWS

Subject to the not insignificant challenges of political uncertainty and Brexit, rental growth can for many locations reasonably be forecast for the next few years given the restricted development pipeline. However this expected growth is, we consider, unlikely to see any material pick-up in the increases being experienced at rent review in most locations.

0%

80%

40%

10%

20%

30%

50%

60%

70%

May

fair

/ S

t Jam

es’s

Soh

o

Vic

toria

Cov

ent G

arde

n

Pad

ding

ton

Kni

ghts

brid

ge

Kin

g's

Cro

ss &

Eus

ton

Fitz

rovi

a

Mar

yleb

one

Mid

tow

n

City

Farr

ingd

on &

Cle

rken

wel

l

Sho

redi

tch

Can

ary

Wha

rf

Sou

thba

nk

Paddington0%

40%

10%

20%

30%

Marylebone0%

10%

Mayfair &St James’s

0%

10%

Knightsbridge0%

10%

Fitzrovia0%

10%

20%

Victoria0%

10%

Covent Garden

0%

10%

Soho0%

10%

Midtown0%

10%

20%

30%

King’s Cross& Euston

0%

10%

20%

30%

Farringdon & Clerkenwell

0%

40%

10%

20%

30%

50%

60%

Shoreditch0%

40%

10%

20%

30%

50%

60%

Southbank0%

40%

10%

20%

30%

Canary Wharf

0%

40%

10%

20%

30%

City0%

10%

20%

Predicted uplift

Uplift if effect of rent free periods disregarded

0%

80%

40%

10%

20%

30%

50%

60%

70%

May

fair

/ S

t Jam

es’s

Soh

o

Vic

toria

Cov

ent G

arde

n

Pad

ding

ton

Kni

ghts

brid

ge

Kin

g's

Cro

ss &

Eus

ton

Fitz

rovi

a

Mar

yleb

one

Mid

tow

n

City

Farr

ingd

on &

Cle

rken

wel

l

Sho

redi

tch

Can

ary

Wha

rf

Sou

thba

nk

Paddington0%

40%

10%

20%

30%

Marylebone0%

10%

Mayfair &St James’s

0%

10%

Knightsbridge0%

10%

Fitzrovia0%

10%

20%

Victoria0%

10%

Covent Garden

0%

10%

Soho0%

10%

Midtown0%

10%

20%

30%

King’s Cross& Euston

0%

10%

20%

30%

Farringdon & Clerkenwell

0%

40%

10%

20%

30%

50%

60%

Shoreditch0%

40%

10%

20%

30%

50%

60%

Southbank0%

40%

10%

20%

30%

Canary Wharf

0%

40%

10%

20%

30%

City0%

10%

20%

Predicted uplift

Uplift if effect of rent free periods disregarded

Predicted uplift first reviewPredicted uplift second review

ContactTony GuthrieMobile +44 (0)7717 [email protected]

26 LONDON MARKETS

GERALD EVE IN THE MARKET

27 Knightsbridge, SW1On behalf of Motcomb Estates Gerald Eve have leased 20,000 sq ft to Maybourne Hotels. The luxury hotels group, owner of Claridge's, The Connaught and The Berkeley, will occupy the newly refurbished 6th, 4th and lower ground floors on a 10 year lease.

30 St Mary Axe, EC3Acting on behalf of Swiss Re we have let Level 12 of 30 St Mary Axe to RFIB.

One Angel Lane, EC4Acting on behalf of Nomura we have let the 7th and part 8th floors of One Angel Lane to Mastercard.