level 1 intro to exam JMaz9194.vo.msecnd.net/pdfs/110801/04_Handout.pdf · 2011-10-18 · ©2011...

Transcript of level 1 intro to exam JMaz9194.vo.msecnd.net/pdfs/110801/04_Handout.pdf · 2011-10-18 · ©2011...

NAEA

NATIONAL TAX PRACTICE INSTITUTE™

LEVEL 1 Introduction to Examination

August 8, 2011

Jennifer MacMillan, EA Jennifer MacMillan, EA owns a practice in Santa Barbara, California, specializing in representation and individual income tax services. Jennifer speaks and writes regularly on a variety of tax and marketing topics for NAEA, the California Society of Enrolled Agents (CSEA), and Spidell Publishing, Inc. She is a past president of CSEA, and a current member of NAEA’s Government Relations Committee and the California Tax Education Council (CTEC) Board. MacMillan is an NTPI Fellow and an instructor for Levels 1, 3, Tax Prep/Practice Management “Build Your Business.”

NAEA

©2011 Jennifer MacMillan, EA i Intro to Exam, NTPI

Introduction to Examination Contents Course Objectives ........................................................................................................................... 1

Types of Examinations ................................................................................................................... 1

Types of Examiners ........................................................................................................................ 2

Audit Trends ................................................................................................................................... 2

IRS Examination Statistics ............................................................................................................. 3

Correspondence Audits ................................................................................................................... 4

Corresponding with Taxpayers ....................................................................................................... 5

National Taxpayer Advocate 'Tells It Like It Is' ............................................................................. 9

Authorities..................................................................................................................................... 10

The Internal Revenue Manual ....................................................................................................... 10

Interim Guidance .......................................................................................................................... 11

Other IRS Guidance Through the Tax Professionals Tab ............................................................ 11

IRS e-services ............................................................................................................................... 12

Taxpayer Rights ............................................................................................................................ 12

Privilege ........................................................................................................................................ 14

The Ten Deadly Sins ..................................................................................................................... 15

Office and Field Exam .................................................................................................................. 16

The Audit Process: Office Exam and Field Exam ........................................................................ 16

Audit Selection.............................................................................................................................. 16

IRS Examination Priorities ........................................................................................................... 17

Examination Procedures in the IRM ............................................................................................. 17

The Representative's Audit Process .............................................................................................. 21

Managing Client Expectations ...................................................................................................... 21

Audit Meeting Preparation ............................................................................................................ 22

IRS Examination Techniques ....................................................................................................... 23

The Audit Meeting According to the IRS ..................................................................................... 23

4.10.3.3.1 (03-01-2003) Authority to Conduct Tours of Business Sites ...................................... 24

The QuickBooks Data Dilemma ................................................................................................... 26

Bypass of Power of Attorney ........................................................................................................ 27

NAEA

©2011 Jennifer MacMillan, EA ii Intro to Exam, NTPI

Minimum Income Probes and The Cash-T ................................................................................... 27

Creating the Cash-T ...................................................................................................................... 28

4.10.4.3.7 Minimum Income Probes: E-Commerce Income ....................................................... 31

4.10.4.3.7.6 (05-27-2011) Third Party Record Keepers ............................................................... 31

4.10.4.4 (05-27-2011) Results of Minimum Income Probes ........................................................ 32

4.10.4.6 (05-27-2011) Formal Indirect Methods of Determining Income .................................... 32

Audit Technique Guides and Market Segment Specialization Program ...................................... 33

Statute of Limitations .................................................................................................................... 33

Extending the ASED ..................................................................................................................... 33

The Audit Reconsideration Process .............................................................................................. 33

Appendix A – Electronic Reading Room Links ........................................................................... 35

Appendix B – IRS Sources of Information ................................................................................... 36

Appendix C - Audit Techniques Guides (ATGs) ......................................................................... 39

Appendix D – PPC Sample Questions and Work Program .......................................................... 45

NAEA

©2011 Jennifer MacMillan, EA 1 Intro to Exam, NTPI

Introduction to Examination

Representing taxpayers under examination requires special skills and knowledge, as well as patience and flexibility. Understanding the IRS examiners' priorities and techniques is crucial in defending taxpayers under audit, and managing client expectations plays an important role as well. Providing competent audit representation can be one of the most gratifying aspects of our profession; defending the positions and rights of taxpayers who would otherwise be defenseless in the quagmire of tax law can be exhilarating and lucrative. The overriding objective of the representative in an IRS audit, as with all representation, is to protect taxpayers' rights. The only way to accomplish that end is to know what those rights are, and of course, stand firm (yet professional) in defending them. Representatives also have rights as do IRS employees, and when everyone plays nicely together, it is likely all parties will get the best results possible.

Course Objectives The purpose of this course is to provide the tools necessary to begin, or strengthen, the practitioners' abilities when representing clients before the Examination Division of the Internal Revenue Service (IRS). The teaching objectives are to familiarize practitioners with every step of the audit process; IRS selection and classification, pre-audit communications, essential research, records and preparation, the role of the audit/audit manager, as well as managing client expectations. Students will gain the practical knowledge to confidently and vigorously defend their clients' returns and their rights. Upon completion of this course, you will be able to:

◘ Identify areas of greatest exposure in an exam ◘ Be a competent advocate of your clients' taxpayer rights ◘ Present a thorough and effective case to defend a client's tax return

Types of Examinations

Audits come in all shapes and sizes, but generally fall into one of four categories:

◘ Document Matching CP2000s or Automated Underreporter (AUR) Automated Substitute for Return (ASFR)

◘ Correspondence Audits Service Center or "Campus" Audits; Mail requests for substantiation

◘ Office Audits In-person meeting at an IRS office (Post of Duty)

◘ Field Exam Auditor comes to taxpayer's or representative's location

NAEA

©2011 Jennifer MacMillan, EA 2 Intro to Exam, NTPI

The level of complexity dictates which type of audit the IRS will utilize for the case. Limited issues are appropriate for correspondence exams, with field exams being employed for the most complex cases.

Types of Examiners The differing exam functions require a broad range of expertise on the part of the IRS. The vast majority of IRS examinations are performed by employees in one of the three most common exam positions:

Tax Examiners handle Document Matching and Correspondence audits in the Campuses (Service Centers). These employees are not required to have extensive knowledge of tax law or accounting, but generally understand the limited issues inherent in those exams, such as filing status verifications and limited Schedule A substantiation. Tax Compliance Officers (TCOs) perform the Office Exam function and are limited in their ability to expand audits and generally do not delve into income probes and complex issues. Revenue Agents (RAs) are the highest level auditors and typically conduct Field Examinations. They have more latitude to use judgment than TCOs, and typically have an accounting degree.

Caution Do NOT confuse Revenue Agents with Revenue Officers: Revenue Officers (ROs) are part of the Collections branch of the IRS. Revenue Agents are examiners/auditors. Both ROs and RAs may get slightly annoyed, or downright indignant, if you use the wrong term for their position.

Numerous other types of employees within the IRS also perform audits, but they are typically specialized situations.

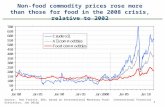

Audit Trends In case there was any doubt about the trends in IRS exam, it is certainly a growth area for the IRS and tax practitioners.

NAEA

©2011 Jennifer MacMillan, EA 3 Intro to Exam, NTPI

IRS Examination Statistics

Audit coverage of individuals (including Schedule C filers) has nearly doubled over the past ten years while the number of Revenue Agents has remained relatively constant. The overall trend then, appears to be mainly due to the sharp increase in correspondence audits as well as better selection techniques. The clear trend in the breakdown by income level is, in part, the result of exam reengineering created from data gleaned out of the National Research Program (NRP). Started in 2002, the NRP is an ongoing series of audit programs designed to obtain data for future audit planning. In the initial phase of the NRP, a large-scale sample of taxpayers were subjected to massive comprehensive audits (but not nearly as burdensome as a Taxpayer Compliance Measurement Program (TCMP) audit; the horrendous, line-by-line audits of the 1980's), these newer behemoth audits told the IRS what practitioners had known for years:

◘ Wealthy taxpayers have the motivation & wherewithal to hide income ◘ Taxpayers who want to cheat will start by over-reporting cash charitable contributions ◘ Schedule C Filers overstate expenses and underreport gross income

NAEA

©2011 Jennifer MacMillan, EA 4 Intro to Exam, NTPI

Correspondence Audits The rapid increase in Correspondence Audits is likely attributable to a number of factors:

◘ Increased IRS matching capabilities as reporting compliance and magnetic media filing have steadily increased,

◘ Lower level IRS employees have been reallocated from data entry positions due to e-file, ◘ NRP data/exam reengineering have helped to pin-point areas with error rates, ◘ Appears to be improving compliance, since many taxpayers just "sign and pay," rather

than respond, or, their response is lost or ignored and they do not fight the assessment.1

Regardless of the reason, correspondence audits (including CP2000s and SFRs) have become a staple of exam representation work. The following bullet points are adapted from the IRS 2010 outreach efforts, and hence represent the IRS perspective on the Correspondence Exam process.

Role of Correspondence Examination

Criteria for a correspondence examination: ◘ Defined scope: single or limited audit issues ◘ Focus on recordation to substantiate tax return entries ◘ Limited potential for a face-to-face interview or discussion with the taxpayer or their

representative/preparer

Inventory Selection Returns are selected that are deemed to have a questionable deduction, expense, or credit

◘ Use data to identify returns with high potential for a tax adjustment ◘ Third party information ◘ Potentially inconsistent line items on the tax return ◘ Referrals from Criminal Investigation and preparer /promoter actions

Primary Audit Issues Addressed via a Correspondence Examination

◘ Earned Income Credit (EIC or EITC)2 ◘ Certain Non-filing Conditions ◘ Schedule A Issues ◘ Employee Business Expenses (EBE) ◘ Charitable Contributions ◘ Emerging Issues (e.g. First Time Home Buyer’s Credit)

1 According to TIGTA's 2009 audit of "The Discretionary Examination Program" (synonymous with correspondence exam), the statistics IRS uses to validate the success of the program are flawed and overstate results. 2 Usually these are Pre-Refund examinations based on likelihood of denial. When that is case, the EIC portion of the refund is held but the non-EITC amount will be refunded to the taxpayer. A letter will generate to alert the taxpayer that the refund is being held pending an examination.

NAEA

©2011 Jennifer MacMillan, EA 5 Intro to Exam, NTPI

Corresponding with Taxpayers Initial Contact Letters (ICL) vs. “Combo” Letters There are two types of letters used to begin a correspondence examination:

◘ An Initial Contact Letter (ICL) is used to notify a taxpayer of the opening of an audit without proposing a balance due. These letters are used on all EITC examinations and when IRS is questioning a general deduction or credit.

◘ A Combo Letter includes an examination report with the notification of the audit. We use combo letters on issues where there is reasonable certainty of the potential liability.

In a 2010 Phone Forum, the IRS said (without apology, yet also, without snickering): Combo letters:

◘ Significantly reduce the audit cycle; and, ◘ Present the taxpayer with a clearer understanding of our proposed changes.

Examination Workflow

◘ Use of automation Audit contacts with no-response are systemically advanced through the audit

process Receipt of mail precludes subsequent notices from being issued

◘ Telephone contact is encouraged ◘ Tax examiners use judgment when evaluating responses

Practitioner Concerns about the correspondence examination process

In answer to the primary concerns of:

◘ Premature issuance of the Statutory Notice of Deficiency ◘ No acknowledgement or disregard of submitted documentation

IRS says they promptly addressed these concerns with the following: ◘ Acted to ensure consistency ◘ Modified our processes ◘ Revised and clarified our procedures ◘ Initiated studies on taxpayer behavior and process performance ◘ Initiated Outreach forums

Other problematic issues with the program stem from:

◘ Assignment is based on written response (the process is entirely automated until the IRS realizes there has been a response submitted)

◘ Cases are often reassigned ◘ There are barriers to call backs

NAEA

©2011 Jennifer MacMillan, EA 6 Intro to Exam, NTPI

NAEA

©2011 Jennifer MacMillan, EA 7 Intro to Exam, NTPI

NAEA

©2011 Jennifer MacMillan, EA 8 Intro to Exam, NTPI

NAEA

©2011 Jennifer MacMillan, EA 9 Intro to Exam, NTPI

National Taxpayer Advocate 'Tells It Like It Is'

The mail delivery and routing within the IRS has been cited by the Taxpayer Advocate, Nina Olson, as one of the "Most Serious Problems" in her 2010 report to Congress. She reports in the Executive Summary:

"The IRS receives more than 11 million pieces of taxpayer correspondence each year. It Is critical that taxpayer correspondence be timely processed, because delays can lead to erroneous tax assessments, improper collection actions, and additional penalties and interest for taxpayers or additional refund interest costs to the government. Yet taxpayers and practitioners express frequent complaints about processing delays, and in one study, the IRS found that more than 75 percent of mail addressed to two campus collection sites took longer to process than the 14-day goal. In fact, nearly 40 percent of this correspondence took more than 30 days to process. Despite this strong evidence of significant processing delays, the IRS does not measure the accuracy or timeliness with which it handles taxpayer correspondence, and it lacks any comprehensive, reliable data to help it understand the sources or causes of misrouted mail. Moreover, because the IRS does not measure the time between first receipt of correspondence and its receipt by the correct technical operation or function, the IRS does not know whether the taxpayer response timeframes built into automated processes are sufficient."

In her Analysis, she concludes: "...because the IRS cannot timely process taxpayer responses and associate documents with a taxpayer’s case, taxpayers and their practitioners receive premature notices of deficiency. The IRS must change its automated systems and explore ways to improve mail routing in order to prevent severe downstream consequences for both taxpayers and the IRS."

Practitioner Solutions As we anticipate steadily increasing work within this system, it is obvious we will run into obstacles. The best advice is:

◘ Respond as quickly and thoroughly as possible ◘ Return the original IRS Notice/Letter ON TOP of your documentation and any

correspondence you include (any "cover letter" should go right behind the IRS Notice) ◘ Staple the entire packet together (or otherwise fasten the pages so they cannot be

accidentally disassembled) ◘ Manage your client's expectations by giving them the likely scenarios and realistic

timelines ◘ If things go awry, Audit Reconsideration may be your best option

IRM 4.19.10 contains the rules of engagement for correspondence exams. Because it is written as an instruction manual for the Service Center employees who maintain the function, it is full of helpful basic information, such as:

◘ What substitute documentation is considered acceptable as substantiation ◘ Acronyms for nearly every baffling cryptic code used in the course of an audit ◘ The cycle-time; schedule of deadlines and correspondence mailing dates

NAEA

©2011 Jennifer MacMillan, EA 10 Intro to Exam, NTPI

Authorities Authorities, in short, are the references you may rely upon to make your case to the IRS. The weight accorded an authority depends on its relevance, persuasiveness and the type of document providing the authority. Treas. Reg. § 1.6662-4(d)(3)(ii). The hierarchy of authoritative documents is shown in the table below:

1. Applicable provisions of the Internal Revenue Code and other statutory provisions; 2. Proposed, Temporary and Final Regulations construing such statutes; 3. Revenue Rulings and Revenue Procedures; 4. Tax Treaties and Regulations there under, and Treasury Department and other official

explanations of such treaties; 5. Court Cases; 6. Congressional intent as reflected in committee reports, joint explanatory statements of

managers included in conference committee reports, and floor statements made prior to enactment by one of a bill's managers;

7. General Explanations of tax legislation prepared by the Joint Committee on Taxation (the Blue Book);

8. Private Letter Rulings and Technical Advice Memoranda issued after October 31, 1976; 9. Actions on decisions and General Counsel Memoranda issued after March 12, 1981 (as

well as general counsel memoranda published in pre-1955 volumes of the Cumulative Bulletin);

10. Internal Revenue Service information or press releases; and 11. Notices, Announcements, and other administrative pronouncements published by the

Service in the Internal Revenue Bulletin.

Resources

A vast number of resources are available to assist representatives in preparation for an audit.

The Internal Revenue Manual The number one, greatest tool in your audit arsenal is the Internal Revenue Manual (IRM). The entire IRM (with the exception of some highly sensitive secrets) is available at:

Website http://www.irs.gov/irm/index.html

This gem is the policy manual, employee handbook, and complete instructions on everything the IRS can, and must, do in every situation. Note in the preceding table, the IRM is not an Authority, but the IRS must follow its every word, while practitioners are not bound by its rules.

NAEA

©2011 Jennifer MacMillan, EA 11 Intro to Exam, NTPI

Part 4 of the IRM is entirely devoted to Examination, but note that there are numerous other sections that may also be pertinent to any given situation. Other areas of the IRM that frequently pertain to audits are:

• Part 1: Contains general IRS policies and Resource Guide for managers • Part 8: Appeals Division functional capacity, rules, and authority • Part 20: Penalties, including non-assertion

Interim Guidance

The IRS publishes updates to policies and procedures prior to their inclusion in the IRM as Interim Guidance. This is a crucial place to check when relying on content from the IRM to hold the IRS to account, lest you have obsolete policies. Interim Guidance sorted by IRM section can be found at:

Website http://www.irs.gov/foia/content/0,,id=134931,00.html

Other areas of the IRS website also contain a wealth of other resources if you know where to look. Under the Tax Professionals tab, the "Basic Tools for Tax Professionals" section has an extensive list of resources. The box below shows some of the excellent material available at:

Website http://www.irs.gov/newsroom/article/0,,id=98257,00.html

Other IRS Guidance Through the Tax Professionals Tab

.

IRS Guidance in Plain English This is a starting point for understanding some of the basic guidance issued by the IRS. Internal Revenue Bulletins (after June 2003) (after June 1995 - PDF only) The Internal Revenue Bulletin (IRB) is the authoritative instrument of the IRS for announcing all substantive rulings necessary to promote a uniform application of tax law. Issues after June 2003 are available in both HTML and PDF formats; earlier issues are in PDF only. Advance Notices The IRS sometimes releases Rulings, Procedures and other technical items in advance of publishing them in the Internal Revenue Bulletin. The full text of these advance notices is available in PDF format. This list’s filenames are based on the items’ designations — for example, Announcement 2003-40 is “a-03-40,” Notice 2003-30 is “n-03-30,” Revenue Procedure 2003-50 is "rp-03-50” and Revenue Ruling 2003-60 is "rr-03-60." Tax Regulations In addition to the regulations that interpret the tax laws, there are links to various technical resources.

NAEA

©2011 Jennifer MacMillan, EA 12 Intro to Exam, NTPI

Internal Revenue Code The codified collection of U.S. laws on income, estate and gift, employment and excise taxes, plus administrative and procedural provisions. IRS Written Determinations Rulings or determinations issued by the IRS, including Technical Advice Memoranda and Chief Counsel Advice. Sorted by most recent publication number, the listing may also be sorted by Uniform Issue List codes. Electronic Reading Room A collection of links to published guidance, rulings, administrative manuals, and other items.

NOTE: The complete menu for the Electronic Reading Room is in Appendix A.

IRS e-services Another helpful tool for exam strategy is e-services. Although the registration is cumbersome and the program can be a bit finicky or slow, the Transcript Delivery System is definitely worth accessing for information the IRS has about your client, including:

◘ Transcripts provide dates of filing and assessment to calculate Statute of Limitations ◘ Payor Information; W-2s, 1099s, 1098s, K-1s 5498s, etc. ◘ Record of Account: contains most data from original tax return, plus account history

Note that the Electronic Accounts Resolution (EAR) function CANNOT assist with issues relative to Correspondence Audits; only the controlling units (i.e. AUR or ASFR) may access these taxpayer accounts relative to these specific exams.

Taxpayer Rights Taxpayer Rights are the essence of our work. As a Circular 230 representative, the duty to vigorously defend your client is always framed in the context of the rights afforded them by law. A thorough understanding those rights therefore, is crucial in dealing with the IRS. The IRM gives the following guidance to auditors: 4.10.1.6 (05-14-1999) Taxpayer Rights

1. Examiners have the ongoing responsibility to ensure that all taxpayer rights are protected and observed, whether these rights are mandated by statute or provided as a matter of policy.

2. Examiners should be aware of all the rights provided by the IRC, Taxpayer Bill of Rights I & II, the IRS Restructuring and Reform Act of 1998 (RRA 98) and IRS policies.

NAEA

©2011 Jennifer MacMillan, EA 13 Intro to Exam, NTPI

3. The rights specifically covered in this subsection are not all inclusive, but rather are mentioned here to provide special emphasis or to highlight some of the new rights provided in RRA 98.

4. The taxpayer rights covered in the subsections below are as follows:

A. Representation/Power-of-Attorney Requirements (1.6.1) B. Confidentiality Privileges—Accountant/Client Privilege (1.6.2) C. Notification of Appeal Rights (1.6.3) D. Innocent Spouse Relief (1.6.4) E. Interest Abatement (1.6.5) F. Consideration of Collectibility (1.6.6) G. Early Referrals to Appeals (1.6.7) H. Separate Notices for Joint Filers (1.6.8) I. Providing Taxpayers with Employee Contact Information (1.6.9) J. Confidentiality of Taxpayer Information/Privacy (1.6.10) K. Unauthorized Access (UNAX) Requirements (1.6.11) L. Third Party Contacts (1.6.12)

IRC § 7521 (b) (2) Right of consultation If the taxpayer clearly states to an officer or employee of the Internal Revenue Service at any time during any interview (other than an interview initiated by an administrative summons issued under subchapter A of chapter 78) that the taxpayer wishes to consult with an attorney, certified public accountant, enrolled agent, enrolled actuary, or any other person permitted to represent the taxpayer before the Internal Revenue Service, such officer or employee shall suspend such interview regardless of whether the taxpayer may have answered one or more questions. (a) Representatives holding power of attorney

Any attorney, certified public accountant, enrolled agent, enrolled actuary, or any other person permitted to represent the taxpayer before the Internal Revenue Service who is not disbarred or suspended from practice before the Internal Revenue Service and who has a written power of attorney executed by the taxpayer may be authorized by such taxpayer to represent the taxpayer in any interview described in subsection (a). An officer or employee of the Internal Revenue Service may not require a taxpayer to accompany the representative in the absence of an administrative summons issued to the taxpayer under subchapter A of chapter 78. Such an officer or employee, with the consent of the immediate supervisor of such officer or employee, may notify the taxpayer directly that such officer or employee believes such representative is responsible for unreasonable delay or hindrance of an Internal Revenue Service examination or investigation of the taxpayer. (d) Section not to apply to certain investigations This section shall not apply to criminal investigations or investigations relating to the integrity of any officer or employee of the Internal Revenue Service.

NAEA

©2011 Jennifer MacMillan, EA 14 Intro to Exam, NTPI

Privilege IRC §7525. Confidentiality privileges relating to taxpayer communications (a) Uniform application to taxpayer communications with federally authorized practitioners

(1) General rule With respect to tax advice, the same common law protections of confidentiality which apply to a communication between a taxpayer and an attorney shall also apply to a communication between a taxpayer and any federally authorized tax practitioner to the extent the communication would be considered a privileged communication if it were between a taxpayer and an attorney. (2) Limitations Paragraph (1) may only be asserted in—

(A) any noncriminal tax matter before the Internal Revenue Service; and (B) any noncriminal tax proceeding in Federal court brought by or against the United States.

(3) Definitions For purposes of this subsection—

(A) Federally authorized tax practitioner The term “federally authorized tax practitioner” means any individual who is authorized under Federal law to practice before the Internal Revenue Service if such practice is subject to Federal regulation under section 330 of title 31, United States Code. (B) Tax advice The term “tax advice” means advice given by an individual with respect to a matter which is within the scope of the individual’s authority to practice described in subparagraph (A).

The privilege may be asserted in any noncriminal tax matter before the IRS and in any noncriminal tax proceeding in Federal court and may be asserted to the extent such communication would be considered privileged communication if it were between a taxpayer and an attorney. The privilege may not be asserted with respect to written communication made in connection with the promotion of the direct or indirect participation of a corporation in any tax shelter. The Service must allow taxpayers to assert the confidentiality privilege in communications with a Federally authorized tax practitioner. The taxpayer must assert the confidentiality privilege, it does not arise automatically. Revenue Agents are instructed that the procedures below apply to this provision: Employees may continue to seek information as before. Use information in LRG 57(16)662.72 for guidance on attorney-client privilege. The information relating to accountant-client privilege in LRG 57(16)662.73 has been superseded by this provision. Seek counsel advice on specific issues relating to tax advice, communication, and other issues such as, under what circumstances the taxpayer waive or lose the ability to assert the privilege.

NAEA

©2011 Jennifer MacMillan, EA 15 Intro to Exam, NTPI

It is crucial to remember that the privilege belongs to your client. Only the client may assert privilege and waive privilege. You absolutely may not disclose any communications your client has identified as confidential within the scope of your representation. IRC § 7605 (b) Restrictions on examination of taxpayer No taxpayer shall be subjected to unnecessary examination or investigations, and only one inspection of a taxpayer’s books of account shall be made for each taxable year unless the taxpayer requests otherwise or unless the Secretary, after investigation, notifies the taxpayer in writing that an additional inspection is necessary. IRC § 7602(e) Limitation on examination on unreported income The Secretary shall not use financial status or economic reality examination techniques to determine the existence of unreported income of any taxpayer unless the Secretary has a reasonable indication that there is a likelihood of such unreported income. Misconduct The Taxpayer Bill of Rights II defines three elements of misconduct:

◘ An employee violated a law, regulation, or rule of conduct (these cases are worked and reported by Treasury Inspector General for Tax Administration (TIGTA).

◘ An IRS system failed to function properly or within proper time frames (these cases are worked as Taxpayer Advocate Service cases).

◘ An IRS employee treated a taxpayer inappropriately in the course of official business. For example, rudeness, over zealousness, excessive aggressiveness, discriminatory treatment, and intimidation. - (These cases will be worked/handled by management within the employee's function.)

RRA98 §1203(b) requires the IRS to terminate an employee for certain proven violations committed by the employee in connection with the performance of official duties.

The Ten Deadly Sins

IRS has a zero-tolerance policy for retaliation and has had a written non-retaliation policy in place since 1998. This feature of RRA98 §1203 is sometimes referred to as the ten deadly sins as it calls for the termination of any employee of the Internal Revenue Service if there is a final administrative or judicial determination that the employee willfully committed any act or omission described below:

◘ Failing to obtain required approval signatures when making a seizure ◘ Providing a sworn false statement in a "material matter " concerning a taxpayer ◘ Violating the constitutional rights of or discriminating against taxpayers or employees ◘ Falsifying or destroying documents to cover a mistake concerning a taxpayer ◘ Receiving a criminal conviction or civil judgment for assault or battery on a taxpayer or

employee

NAEA

©2011 Jennifer MacMillan, EA 16 Intro to Exam, NTPI

◘ Violating the Internal Revenue Code, IRS regulations or policies to retaliate against or harass taxpayers or employees

◘ Misusing Internal Revenue Code section 6103 to conceal information from Congressional inquiry

◘ Failing to file a federal tax return on or before its due date, unless it is due to reasonable cause

◘ Understating federal tax liability, unless it is due to reasonable cause ◘ Threatening an audit for personal gain

Office and Field Exam

The Audit Process: Office Exam and Field Exam

The face-to-face examination process is much like a dance between a taxpayer/representative and the IRS. Both have their own assortment of information, documentation, and ideas of how to interpret the Internal Revenue Code. Making the most of the set available to you, the representative, involves extensive preparation. When a taxpayer is initially notified that their return has been selected for audit, the letter will likely include a vague description of the issues. Enclosed will be an Information Document Request (IDR), which lists the records and substantiation the auditor wants to see. He has already done a "classification" on the return and has identified the issues he deems worthy of investigation. The auditor has numerous techniques and resources at his disposal...but so do you, and you have the taxpayer. Guiding principles in exams are:

◘ Know as much about the client as they know about themselves ◘ Know more than the auditor knows about your client ◘ Know what the auditor will say, do, think, wonder, and ask.

Audit Selection

Returns are selected for Office and Field exam using a variety of methods, including:

◘ Discriminant Index Function (DIF) and Unreported Income DIF (UIDIF) scoring ◘ Random selection and computer screening - some returns are selected based solely on a

statistical formula. ◘ Related examinations - returns may be selected for audit when they involve issues or

transactions with other taxpayers, such as business partners or investors, whose returns were selected for audit.

Classification is the process of determining whether a return should be selected for examination, what issues should be examined, and how the examination should be conducted. DIF (Discriminant Function) is a mathematical technique used to score income tax returns as to examination potential. These formulas were developed based on available NRP data. Each return

NAEA

©2011 Jennifer MacMillan, EA 17 Intro to Exam, NTPI

measured under DIF receives a DIF score. Generally, the higher the score, the greater the audit potential. The highest scored returns are made available to Examination upon request. All returns are identified for assignment to a Revenue Agent (RA) or a tax compliance officer (TCO). For revenue agent or tax compliance officer, assignment will be based upon the complexity of the issues involved and the degree of accounting and auditing skills required to conduct a quality examination. Non-DIF returns are manually classified to select returns that contain significant issues likely to result in tax changes or that require examination to achieve voluntary compliance by an identifiable group of taxpayers. Corporation returns having no balance sheet or assets under $10,000,000 are computer scored under the DIF System. Formula numbers are used to identify the asset classes when ordering corporate returns. High asset returns, are not DIF scored and are delivered automatically to Classification at the Ogden LMSB Campus.

IRS Examination Priorities Activities the IRS has determined are of such importance, time must be allocated to them before resources are committed to other activities. Examples of these programs are:

◘ National Research Program ◘ Abusive Tax Avoidance Transaction (ATAT) Promoters ◘ Offshore Credit Card (Credit Card Project - OCCP) ◘ Abusive Tax Avoidance Transactions (Offshore ATAT and Domestic ATAT) ◘ High Income Taxpayers (HITS) ◘ High Income Non Filers (HINF) ◘ Special Enforcement Program (SEP)

Examination Procedures in the IRM

The following sections are taken directly from the IRM, which is updated constantly, so care should be taken to always check for updates (this is especially important if you believe a Revenue Agent has circumvented the rules or you plan to enumerate his/her obligations). 4.10.2.6 (04-02-2010) Pre-Contact Planning of Examination Activities If the in-depth analysis and evaluation of audit potential indicate that a return should be examined, then examiners should begin planning the examination. Field cases: The planning process begins with the accomplishment of the steps and audit techniques listed on the mandatory lead sheets that are applicable at this stage of the examination. Office examination cases: The planning process consists of the following:

NAEA

©2011 Jennifer MacMillan, EA 18 Intro to Exam, NTPI

A. Review the tax return and classification sheet to ensure that the most egregious issues are correctly classified;

B. Prepare and review the case building materials; C. Assess the risk of potential issues and revise the scope as warranted; D. Office examiners should verify tax return information on RGS, Report Generating

System; E. If the case is not on the LAN, Local Area Network, the examiners should input and verify

tax return information into RGS, enter all issues (classified and new issues added during pre-audit),

F. Ensure RGS information matches IDRS, Integrated Data Retrieval System, G. Prepare case file documentation lead sheets, H. Develop a forecast. 3 I. Develop a focused Form 4564 Information Document Request, (IDR). J. Prepare an appointment letter. See IRM 4.10.2.7.3.2 regarding appointment letters to use.

NOTE: Internal and external sources used by the IRS in their pre-audit case building are

listed in the Appendix B. Examiners are expected to examine all large, unusual and questionable items (LUQ). However, it is not intended that examiners should consider every possible issue. For instance, it is not proper for examiners to make a detailed analysis of a specific account unless the potential adjustment will materially affect the tax liability or will be important from a compliance viewpoint. Examiners are expected to adequately explain the items which are examined and the large, unusual, and questionable items which are accepted without examination. The case file and workpapers will clearly indicate the scope of every examination, the depth of the examination, and the reasons for the decisions. The examiner is expected to complete their workpapers contemporaneously. The examiner should prepare to the extent possible, the mandatory lead sheets and issue specific lead sheets as they progress through the examination. The examiner should add comments where the lead sheets indicate that comments are required or where in the examiner’s professional judgment, comments are needed for clarification. 4.10.2.6.1 (04-02-2010) Determining the Scope of an Examination Determining the scope of an examination is the process by which an examiner selects issues warranting examination. Examiners should select issues so that, with reasonable certainty, all items necessary for a substantially proper determination of the tax liability have been considered.

3 A forecast is the amount of time the examiner should estimate for the initial interview with the taxpayer and the time to close the case.

NAEA

©2011 Jennifer MacMillan, EA 19 Intro to Exam, NTPI

Examiners must assess the facts and apply judgment in determining the scope of the examination. Office examination: The scope of the examination of a return is prescribed on a classification check sheet during the classification process. However, the scope of an examination should not be limited to the classified issues if other significant issues are revealed during the examination. Whenever possible, tax examiners should consult with their manager before raising new issues. Field examination: The scope of the examination will be determined by the examiner. Examiners are expected to continually exercise judgment throughout the examination process to expand or contract the scope as needed. If during the course of the examination, the scope of the examination is expanded to include another tax period(s), the taxpayer should be notified in writing of the expansion. If the taxpayer has a power of attorney and it does not cover the tax period(s) being picked up for examination, the taxpayer must be given time to secure a power-of-attorney for the additional tax period(s). Also, the examiner must allow the taxpayer time to submit records on the newly added year. Examiners should use the appropriate appointment confirmation letter. See IRM 4.10.2.7.3.1 for field letters and IRM 4.10.2.7.3.2 for office letters. 4.10.2.6.1.1 (04-02-2010) Limiting the Scope of an Examination The scope of an examination may be limited under conditions, as described in this subsection. Any limitations placed upon the scope of the examination should be documented in the case workpapers. The scope of an examination of a return may be limited to one or two issues if no other items appear worthy of examination. For example, it may be necessary to examine a claim because the issue is highly technical and requires factual development. If there are no other issues meriting development, then the exam should be limited to the claim issue. If a taxpayer is contacted with regard to an information document program item, the scope of the examination is generally limited to resolving differences between items reported by the taxpayer and items reported on the information returns. Emphasis should be placed on determining why the income was omitted and whether the omission occurred in more than one year. When it appears that a material amount of income may not have been reported, and there has not been a prior audit, an examination should be initiated. If a return is selected due to an issue arising from an agency-investor relationship, or identified as an Information Returns Program (IRP), and no other issues on the return appear worthy of examination, the scope of the examination may be limited to the identified issues. When a Schedule K–1 is inspected to determine that the flow through items have been reported correctly, the taxpayer and/or representative should be advised that the inspection does not constitute an examination and the taxpayer’s distributions from the related entity may be adjusted later if the related entity is examined.

NAEA

©2011 Jennifer MacMillan, EA 20 Intro to Exam, NTPI

Generally, short-term timing issues should not be examined. Timing issues with long term, indefinite or permanent deferral features should be examined. Unplanned timing issues which arise as correlative adjustments during an examination of non-timing issues should be made if it is cost effective to do so. The scope of the examination may be limited due to collectibility. A collectibility determination should be made when the taxpayer has no ability to pay or expectation of a future ability to pay. See IRM 4.20.1, General Collectibility Procedures. See IRM 4.10.2.4.1.2 through IRM 4.10.2.4.1.2.2 for a discussion of scope limitation and examiner documentation requirements. 4.10.2.6.1.2 (04-02-2010) Expanding the Scope of an Examination Expanding the scope of the examination is based on the examiner’s judgment. If, while completing the required filing checks, an examiner discovers that a taxpayer has not complied with a filing requirement or that an audit potential exists, they should expand the examination scope if warranted. See IRM 4.10.5, Required Filing Checks, for guidance. Office Examination: If it appears that a related entity warrants examination and the examiner feels they cannot conduct the examination, the examiner should discuss the possible reassignment of the case with their group manager. The examiner should secure a copy of the related entity return and prepare the case file for transfer. If the group manager agrees that the case warrants transfer to another examiner, the manager should:

◘ Reassign the case to a more experienced examiner in office examination. ◘ If the related case is outside the examination scope of office examination, the manager

should contact a field examination group manager to assess the case’s audit potential. ◘ If the group manager determines the case does not warrant examination, this decision

should be documented in the case file by either the examiner or the manager. 4.10.2.4.1.1 (08-01-2007) Value Added Decision Making at the Mid Audit Decision Point (1) At the mid point of the examination, using risk analysis, the examiner should determine whether the remaining classified/identified issues should be examined. This decision should be based on the facts and circumstances, evaluation of internal controls (in business examinations) and the examiner’s judgment. For example, the resulting additional tax is not expected to be material, or the time to develop additional issues is not justified, based on the potential for more tax. (2) The mid-point of the examination could be determined based on the number of issues classified/identified or the number of hours expended. (3) Examiners are expected to use their professional judgment to determine if it is in the government’s best interest to continue the examination. If it is not in government’s best interest to continue the examination, the examiner must document their decision on the Risk Analysis Workpaper as described below.

NAEA

©2011 Jennifer MacMillan, EA 21 Intro to Exam, NTPI

The Representative's Audit Process Your client, or better yet a Turbo-Tax wielding friend of your client, comes to you with an Audit Letter from the IRS. They indicate they need representation and you sit down with them. Now what?

McKenzie's Three Rules of Representation: 1. Get the fee first. 2. Be nice. 3. Who's your boss?

Rule #1: Getting a retainer is a must, since clients may be reluctant to pay you later (or might ask for a fee reduction) if they are disappointed in the outcome of the exam. With the prospect of an assessment never out of the question, it is not difficult to imagine the client resentful that they must pay the IRS and pay your fee. An estimate of time and fees is usually a prevalent question in the client's mind. Unfortunately, at this point, you will likely not be able to project the course of the exam with much certainty. The rule of thumb is to take your best guess at the hours the audit will consume, and double it. Be clear in advising the client that this is not any kind of guarantee or maximum (unless you want to structure it that way). In all audit work, an engagement letter is crucial, even with clients you know well and trust. An understanding of the terms, risks, and expectations is vital for you and the client, since you have limited control over the outcome, with the countless variables that could arise during the audit. You will also need to obtain a Power of Attorney (POA), IRS Form 2848. Both spouses must sign if you are representing them on a joint return, but you can speak to the auditor if only one spouse is available to sign initially. Simply prepare a second POA for the signing spouse and use it temporarily, but be sure to obtain Form 2848 with both spouses' signatures as soon as possible. Once a valid Power of Attorney has been signed, fax it to the auditor and place a call to introduce yourself, set the appointment, and ask what their main issues are. They'll likely tell you, point-blank, their concerns and give additional guidance about the items on the IDR they want to see. During this, and every subsequent exchange with the auditor, keep "Rule #2 – Be Nice" as the guiding factor for this relationship. Any hint of antagonism will earn zero cooperation, even if the auditor takes an argumentative tone, NEVER let down your shield of courtesy and professionalism. Managing Client Expectations One of the biggest mistakes made by tax practitioners is the failure to manage client expectations from the start. Clear communication is the key to smoothing out the bumps in the road and the occasional ugly surprises that come with exam representation. Warnings of the multiple potential hazards and hearing about the "worst case scenario" may make a client very uncomfortable (especially when they are already in a mild panic because they are under audit),

NAEA

©2011 Jennifer MacMillan, EA 22 Intro to Exam, NTPI

but providing a reality check can alleviate many future problems. Representatives must be watchful and gently dash any high-hopes that the client (or that they themselves) may have about how well the audit "should" go. Even in seemingly simple cases, everyone needs to expect the unexpected; be confident, but avoid sounding overly optimistic. During the initial discussion with the client to review the IDR (with or without their source documents), some issues may be obvious and should be explained to the client, but again, not in any definite terms. The concept is to instill the client with confidence in your abilities to get the best possible outcome, but avert their natural inclination to hope that being represented means they will automatically "win big".

Practice Tips • A helpful tactic for early in the audit process is to qualify any preliminary advice with

phrases such as, "just from a cursory glance, it appears" and finish sentences with, "but that will depend on how the records tie out."

• It is not unusual for the taxpayer to discover additional deductions and receipts which were

not claimed in the audit year. They often assume (some with a great deal of certainty) they will come out of the audit with a refund. It is wise to affirm for them that you can use those additional to offset anything the auditor wants to deny.

• When the client provide minimal or sketchy documentation, limiting the scope of the audit

may be the best thing you can do; utilizing your "worst case scenario" estimate, you can give them a sense of how much worse it might be.

From there, your subsequent research (in preparation for meeting with the auditor) will illuminate where the traps and risks lie. An audit checklist and list of questions the auditor is likely to ask, along with the audit engagement checklist is in Appendix D. These excellent tools are included here, courtesy of PPC's "Guide to Dealing With the IRS."

Audit Meeting Preparation The importance of preparation prior to an examination cannot be overstated. A two-hour office audit should require at least five times that for preparation. Prior to meeting with the auditor to present substantiation, the representative must research:

◘ The Internal Revenue Manual sections pertinent to the specific exam ◘ Any applicable Audit Technique Guides (ATGs or MSSPs) ◘ Code and Regulations pertaining to any issues of interpretation of the law ◘ Court Cases, Opinions, Tax Court Memorandums with similar circumstances ◘ Other available guidance (Pubs, Private Letter Rulings, which are NOT Authorities) ◘ Web resources: Discussion Forums (TaxAlmanac, Accountant'sWorld,

NAEA

©2011 Jennifer MacMillan, EA 23 Intro to Exam, NTPI

IRS Examination Techniques 1. The following Examination techniques used to gather evidence are discussed in IRM 4.10.3:

◘ Interviews, (3.2) ◘ Tours of Business Sites and Inspection of Residences, (3.3) ◘ Evaluation of the Taxpayer’s Internal Controls, (3.4) ◘ Examining the Taxpayer’s Books and Records, (3.5) ◘ Analyzing Schedules M–1 and M–2, (3.6) ◘ Bank Record Reconciliations, (3.7) ◘ Balance Sheet Analyses, (3.8) ◘ Testing Gross Receipts or Sales, (3.9) ◘ Testing Expenses: Cost of Goods Sold, (3.10) ◘ Testing Expenses: Operating Expenses, (3.11) ◘ Sampling Techniques, (3.12)

The Audit Meeting According to the IRS

4.10.3.2 (03-01-2003) Interviews: Authority and Purpose

1. An interview is defined as a meeting between two persons and usually includes holding a formal consultation for the purpose of resolving or exploring issues.

2. Interviews are used to obtain leads, develop information, and establish evidence. The testimony of witnesses and the confessions or admissions of alleged violators are major factors in resolving tax cases. Cases are presented to a jury through the testimony of witnesses. Therefore, it is the agent's duty to interview the taxpayer and every witness connected with the case. The record of such interviews will usually take one of the following forms: Transcript of interview or question-and-answer statement, affidavit, memorandum of interview, or recording (wire, tape, wax, etc.).

3. Internal Revenue Code Section 7602 authorizes the Secretary or a delegate to examine books and records and to take testimony under oath.

4. Interviews provide information about the taxpayer’s financial history, business operations, and books and records. Interviews are used to obtain information needed to reach informed judgments about the scope/depth of an examination and the resolution of issues. Interviews are used to obtain leads, develop information, and establish evidence.

5. Oral testimony is a significant factor in resolving tax cases. Oral testimony can: A. provide information not otherwise available from physical documentation, B. corroborate return information, C. provide relevant information not reflected on the return, and D. establish the taxpayer’s intent.

6. At initial interviews, examiners should inform the taxpayer of the existence of the Taxpayer Bill of Rights II, as well as the examination and the appellate processes.

NAEA

©2011 Jennifer MacMillan, EA 24 Intro to Exam, NTPI

4.10.3.3 (03-01-2003) Tours of Business Sites

1. The physical observation of the taxpayer’s operation, or tour of business site, is an integral part of the examination process. Viewing the taxpayer’s facilities and observing business activities is an opportunity to:

A. Acquire an overview of the business operation, B. Establish that the books and records accurately reflect actual business operations, C. Observe and test internal controls, D. Clarify information obtained through interviews, and E. Identify potential audit issues.

4.10.3.3.1 (03-01-2003) Authority to Conduct Tours of Business Sites

1. Regulation 301.7605–1(d)(3)(iii) states: "regardless of where an examination takes place, the Service may visit the taxpayer’s place of business or residence to establish facts that can only be established by direct visit, such as inventory or asset verification. The Service generally will visit for these purposes on a normal workday of the Service during the Service’s normal tour of duty hours."

4.10.3.3.5 (03-01-2003) Inspection of a Taxpayer’s Residence

1. An examiner may consider inspecting the taxpayer’s residence. Due to privacy issues and the intrusiveness of such inspections, their use should be limited. The purpose of inspecting the taxpayer’s residence includes (but is not limited to):

A. Determining the validity of deductions for an office or business located in the residence.

B. Determining the taxpayer’s financial status.

4.10.3.3.5.1 (03-01-2003) Inspection of a Business in the Home

1. When determining the validity of office in the home deductions, the office or business should be toured as any other business site. In order for any portion of a personal residence to qualify, it must be used exclusively for business purposes. This can only be determined by inspecting the business portion of the residence.

4.10.3.3.5.2 (03-01-2003) Other Inspections of the Taxpayer’s Residence

1. When determining the taxpayer’s financial status, an inspection of the interior of the home is not required. The following techniques are suitable alternatives:

A. Ownership, sales price and mortgage information can be obtained from public records.

NAEA

©2011 Jennifer MacMillan, EA 25 Intro to Exam, NTPI

B. The examiner can drive through the taxpayer’s neighborhood to estimate the taxpayer’s standard of living.

2. These activities should be completed early in the examination process. Coordination with the taxpayer is not necessary.

4.11.55.2.1.1 (04-20-2010) Taxpayer's Presence Required?

1. IRC section 7521(c) permits a representative authorized by a taxpayer to represent that taxpayer at any interview. A taxpayer may not be required to accompany a representative in the absence of an administrative summons.

2. RRA 98, section 3502, requires taxpayers to be clearly informed of their rights to be represented at interviews and to have the interview suspended if the taxpayer wishes to consult with a person authorized to practice before the IRS. Publications 1, Your Rights as a Taxpayer, and Publication 3498, The Examination Process, have been revised to reflect this.

3. Examiners must ensure that they do not violate or give the perception of violating the taxpayer's right to representation.

4. Although a request for the taxpayer's voluntary presence should be made through his/her representative, the taxpayer's presence will not be mandated as long as the person being interviewed:

A. Has firsthand knowledge of the taxpayer's business, business practices, bookkeeping methods, accounting practices and the daily operation of the business;

B. Provides factual, reliable information to questions asked by the examiner; C. Timely provides follow-up information for any questions that could not be

answered at the time of the initial interview; and D. Has a properly executed Form 2848 or Form 8821. See IRM 4.11.55.1.7.

5. If the taxpayer is not available for the initial interview, or if the representative is resolute in not having the taxpayer present at the initial interview, the examiner should attempt to conduct the initial interview with the taxpayer's representative.

6. If the examiner determines that the representative does not have sufficient knowledge of the taxpayer and his/her business to provide factual information, the examiner should request an interview with the individual who possesses that information. Note: The examiner should not conduct the audit with someone who will merely serve as a courier, shuttling questions and answers between the examiner and the taxpayer. This type of arrangement obstructs the flow of the examination.

7. In many cases, the taxpayer will be the only one who has the information necessary for the examiner to determine the accuracy of the books and records. This has a direct bearing on the ultimate scope and depth of the examination.

8. If the taxpayer's representative does not comply with the request to interview someone more knowledgeable, including the taxpayer, the examiner should consider management involvement and/or an administrative summons.

NAEA

©2011 Jennifer MacMillan, EA 26 Intro to Exam, NTPI

The QuickBooks Data Dilemma A huge issue in today's audit environment is the IRS' use of QuickBooks to mine taxpayers' business data. Some inherent problems immediately come to mind; some even sending shivers down a representative's spine.

1. The "Audit Trail" function allows the auditor to view the date and other details of every entry, including any "late" journal entries and adjustments made in preparation for the audit.

2. Even if "Closed" in QuickBooks, other years are easily accessible, creating more concerns: a. Auditors could review details of all other years and decide to expand to other years b. Practitioners could be violating their due diligence requirements if giving sensitive client data to

the IRS without a thoroughly reviewing it. This policy is based on Revenue Procedure 98-25, which outlines requirements for making records available to the IRS, as required in IRC §6001. Books or records required by §6001 must be kept available at all times for inspection by authorized internal revenue officers or employees, and must be retained so long as the contents thereof may become material in the administration of any internal revenue law. In April 2011, the Commissioner of the SB/SE Division of the IRS clarified their position on QuickBooks data files in a letter to the AICPA:

"Similar to paper records, it is important an exact copy of the original electronic data file be provided to the examiner and not an altered version. Only an exact copy of the original file includes the unaltered metadata which allows examiners to properly consider the integrity and veracity of the electronic files through use of such means as reports generated by the software program that may help to identify deleted or altered entries. For example, the original data file may provide the date a transaction was originally created, dates of subsequent changes, what changes were made, and the username of the person who entered or changed that transaction. This type of information is directly relevant to the evaluation of the taxpayer's internal controls."

Section 5.02 of Rev. Proc 98-25 says: .02 DBMS4.

(1) A taxpayer has the discretion to create files solely for the use of the Service. For example, a taxpayer that uses a DBMS may satisfy the provisions of this revenue procedure by creating and retaining a sequential file that contains the transaction-level detail from the DBMS and otherwise meets the requirements of this revenue procedure. (2) A taxpayer that creates a file described in section 5.02(1) of this revenue procedure must document the process that created the sequential file in order to establish the relationship between the file created and the original DBMS records.

4 DBMS is the format of QuickBooks data files.

NAEA

©2011 Jennifer MacMillan, EA 27 Intro to Exam, NTPI

Bypass of Power of Attorney 4.11.55.3.3 (04-20-2010) Procedures for By-Passing a Representative

1. If the representative delays or refuses to provide the information requested after repeated attempts, a by-pass request should be prepared for the territory manager's signature.

2. The decision to seek a by-pass rests with the employee and group manager. In taking such an action, the following items must be considered:

A. It is imperative that the case file be properly documented with the efforts made by the employee to obtain the information and the actions (or lack thereof) of the representative. It is suggested that when the employee first suspects uncooperative behavior all appointments and document requests should be confirmed in writing.

B. As previously mentioned, prior to initiating the by-pass procedures, the group manager should contact the representative in writing and advise him of his responsibilities under Circular 230 and explain the consequences of his continued conduct.

C. The permission to by-pass must be obtained from the territory manager. A letter to the representative from the territory manager should be prepared. Letter Letter 4020-C, Final Bypass Letter, should be used for this purpose. The letter should outline the facts and circumstances which constitute the basis for the by-pass. The letter is prepared by the employee with the assistance of the area return preparer coordinator, as needed. This letter should be routed through the examiner's group manager and the area return preparer coordinator to the territory manager for signature.

D. The employee may not circumvent the representative until the territory manager approves the by-pass by signing and issuing the letter in (c) above to the representative.

3. The by-pass permits the employee to contact the taxpayer directly. The practitioner can continue to represent the taxpayer, if accompanied by the taxpayer. The representative will be afforded the courtesy of being advised of the time and place for future appointments with the taxpayer.

Note: Employees will not use by-pass procedures routinely or simply to interview the taxpayer.

Minimum Income Probes and The Cash-T The Taxpayer Bill of Rights and RRA98 which codified most of the most precious rights that taxpayers and representatives enjoy today, specifically forbade the IRS from "economic reality" audits...unless they had reason to suspect unreported income. This law does not seem to have any effect on precluding these audits, as the IRM references the acceptability and encourages use of these techniques and methods throughout. The suspicion of hidden gross income is, apparently, universally applied.

NAEA

©2011 Jennifer MacMillan, EA 28 Intro to Exam, NTPI

4.10.4.3 (05-27-2011) Minimum Requirements For Examination of Income

1. All examiners will consider gross income during the examination of all income tax returns.

2. Minimum income probes will be completed regardless of the type of return filed by the taxpayer. The minimum income probes are designed as a set of analytical tests intended to determine whether the taxpayer accurately reported income. If the taxpayer is underreporting income, the probes should result in the identification of at least a portion of the understatement.

A. The minimum income probes vary depending upon the type of return (nonbusiness or business) and the method of the examination (office audit or field examination).

B. The minimum income probes are not subject to IRC 7602(e) governing the use of financial status audit techniques.

C. Internet use and e-commerce activities will be audited as part of the minimum income probes for all business returns. See IRM 4.10.4.3.7 for detailed discussion.

D. All minimum income probes will be completed regardless of whether the taxpayer maintains a double-entry set of books.

3. Minimum income probes must be addressed in no show/no response cases. See IRM 4.10.4.3.6.

Creating the Cash-T The Cash-T is not only a valuable tool for demonstrating to the IRS "what the taxpayer lived on," but also gives context to the practitioner's own understanding of a taxpayer's overall financial picture. In the most basic terms, beginning with what the taxpayer had at the start of the year, adding and subtracting ALL cash and debt that came in and went out, and finally comparing the actual cash and debt at the year-end, any difference indicates unaccounted cash. The following example uses the Cash-T Analysis module in CFS TaxTools:

Example Penny Zahn-Adahler started the year with: Cash/Checking of $2,300 and credit card debt of $14,000. She collected child support of $24,000 and received an inheritance & gifts of $40,000. At the end of the year she had cash and bank account balances totaling $15,250 and had paid off her credit card debt. Other cash in was $20,000 in gross revenues in her business and proceeds from a stock sale of $5,000 which resulted in a taxable loss. Penny also had $8,000 of business expenses, $5,400 for daycare, $800 of Schedule A deductible expenses, and $47,964 of personal living expenses (taken straight from the National Standards that IRS applies to Collections cases as "allowable living expense").

NAEA

©2011 Jennifer MacMillan, EA 29 Intro to Exam, NTPI

NAEA

©2011 Jennifer MacMillan, EA 30 Intro to Exam, NTPI

4.10.4.2.7 (05-27-2011) Specific Item Method

1. The specific item method involves the use of direct evidence to determine the tax liability based on omitted income, overstated expenses, or both. For example, funds from known sources are tracked to deposits made to a taxpayer's bank account rather than analyzing bank deposits to identify unreported income from likely sources.

2. Direct evidence is evidence from which only one logical conclusion can be reached. Direct documentary evidence is generally regarded as having the greatest value and, when possible, examiners should ask to see the original documents when there is reason to believe they exist. Documentary evidence should not be relied upon to the exclusion of facts established through oral testimony or other techniques, such as a tour of the business site.

3. The specific item method is appropriate when the taxpayer maintains books and records, adjustments are due to technical issues (such as timing or character of funds), or the potential sources of unreported income are limited (such as an insurance agent who underwrites for several companies).

4. The specific item method is not useful if the taxpayer's gross receipts are generated from numerous sources or in small amounts, such as a grocery store.

5. See IRM 4.10.7.3, Evaluating Evidence, for complete discussion. 4.10.4.2.8 (05-27-2011) Indirect Method

1. The indirect method involves the use of circumstantial evidence to determine the tax liability based on omitted income, overstated expenses, or both. Circumstantial evidence is evidence from which more than one logical conclusion can be reached. To support adjustments for additional taxable income, both the credibility of the evidence and the reasonableness of the conclusion must be evaluated before the determination of tax liability is made.

2. Analytical reviews and testing of the taxpayer's books and records, as required by the minimum income probes may result in the identification of additional taxable income based on circumstantial evidence from which an inference can be made. The financial status analysis and bank account analysis are not prohibited by IRC 7602(e), Limitation on the Use of Financial Status Audit Techniques, simply because an adjustment to taxable income supported by indirect (circumstantial) evidence may be the result.

Example: The minimum income probes for an individual business return include a bank account analysis. There is an identifiable potential source of additional taxable income. The records used for the analysis are the bank account statements, which are prepared by a third party, and are credible evidence. The characterization of excess funds as additional taxable income is reasonable because deposits of nontaxable funds are identified and eliminated. See IRM 4.10.4.3.3.7, Bank Account Analysis (Individual Business Returns).

4.10.4.2.9 (05-27-2011) Formal Indirect Method

1. The formal indirect methods are audit techniques used to determine the tax liability based on the amount of unreported income.

NAEA

©2011 Jennifer MacMillan, EA 31 Intro to Exam, NTPI

A. IRM 4.10.4.6.3, Source and Application of Funds Method B. IRM 4.10.4.6.4, Bank Deposit and Cash Expenditures Method C. IRM 4.10.4.6.5, Markup Method D. IRM 4.10.4.6.6, Unit and Volume Method E. IRM 4.10.4.6.7, Net Worth Method

2. The formal indirect methods are also known as financial status audit techniques. See IRM 4.10.4.6.1 for additional discussion. They are distinguishable from other audit techniques by the following characteristics:

A. Reliance on indirect evidence of income, B. In-depth analysis of actual costs that requires the extensive collection of detailed

information, and C. Subject to IRC 7602(e), which states, "the Secretary shall not use financial status

or economic reality examination techniques to determine the existence of unreported income of any taxpayer unless the Secretary has a reasonable indication that there is a likelihood of such unreported income."

3. Formal indirect methods are appropriate when the taxpayer's books and records are missing, incomplete, or irregularities are identified; or the financial status analysis indicates a material imbalance of cash flows after consideration of other adjustments identified during the examination. See IRM 4.10.4.6.2 and IRM 4.10.4.3.3.1.

4.10.4.3.7 Minimum Income Probes: E-Commerce Income 4.10.4.3.7.6 (05-27-2011) Third Party Record Keepers

1. Banks and other financial institutions that previously maintained account information such as signature cards, loan applications, and account activity in hard copy may now do so electronically. There are online banks that only do business on the Internet. Taxpayers can maintain accounts with banks across the country or even overseas, rather than with banks in close proximity to their physical location.

2. The Internet has resulted in new third party record keepers whose information may be of help in resolving tax issues. These new third party record keepers may be able to supply information regarding website ownership, related websites owned by the taxpayer, location of the business, contact information, and the taxpayer's bank accounts. Examples include:

A. Internet Domain Name Registrars

B. Internet Hosting Providers

C. Internet Access Provides (IAP)

D. Internet Service Providers (ISP)

E. Application Service Providers (ASP)

F. E-Payment Providers, e.g., PayPal

NAEA

©2011 Jennifer MacMillan, EA 32 Intro to Exam, NTPI

4.10.4.4 (05-27-2011) Results of Minimum Income Probes

1. After completion of the minimum income probes, the examiner must evaluate the information collected to this point and determine the scope of the examination of income, using the following criteria:

IF THEN The results show that the taxpayer reported all taxable income from known sources, the books and records can be reconciled to the tax return, all financial activities are in balance, and the bank deposits do not exceed reported income.

The examination of income may be limited to the Minimum Income Probes. The results and conclusions reached should be documented in the examination workpapers.

The results indicate the potential of unreported income due to inaccurate reporting of taxable income from known sources, the books and records cannot be reconciled to the tax return, a material imbalance in the financial status analysis that cannot be reconciled, excess unexplained bank deposits, or inadequate internal control.

A more in-depth examination of income is warranted. See IRM 4.10.4.5 below for suggested guidelines for an in-depth examination of income.

4.10.4.6 (05-27-2011) Formal Indirect Methods of Determining Income

1. The formal indirect methods used to determine tax liabilities involve the development of circumstantial proof of income through the use of bank deposits, source and application of funds, ratio analyses, or changes in net worth.

2. The purpose of this section is to provide guidance for examiners when using formal indirect methods of reconstructing income. The five basic formal indirect methods of reconstructing income discussed are:

A. Source and Application of Funds Method B. Bank Deposits and Cash Expenditures Method C. Markup Method D. Unit and Volume Method E. Net Worth Method

3. IRM 4.10.4.6, Formal Indirect Methods of Determining Income, is organized into the subsections listed below. Key court decisions which allow for the use of formal indirect methods, when to use a specific method, formulas, and examples are included in the discussions of the different methods. Common defenses which an examiner may encounter in cases where a formal indirect method is used are also discussed.

IRM Reference

Title

IRM 4.10.4.6.1 Authority to Use Formal Indirect Methods IRM 4.10.4.6.2 Using Formal Indirect Methods to Reconstruct Income IRM 4.10.4.6.3 Source and Application of Funds Method IRM 4.10.4.6.4 Bank Deposits and Cash Expenditures Method IRM 4.10.4.6.5 Markup Method

NAEA

©2011 Jennifer MacMillan, EA 33 Intro to Exam, NTPI

IRM Reference

Title

IRM 4.10.4.6.6 Unit and Volume Method IRM 4.10.4.6.7 Net Worth Method IRM 4.10.4.6.8 Potential Taxpayer Defenses Against Formal Indirect Methods of Computing Income

Audit Technique Guides and Market Segment Specialization Program Audit Technique Guides (ATGs) are the IRS’ instruction manuals used in examinations of particular industries or issues. New ATG’s (previously called Market Segment Specialization Program or MSSP guides) have been issued for the ‘Wine Industry’ and for ‘Cash Intensive Businesses’ activities in the past year. When beginning an audit engagement, always check for the current list of available ATGs. The IRS website has them in the electronic reading room and under the "Basic Tools for Tax Professionals." A list of the currently available ATGs and MSSPs is in Appendix C.

Statute of Limitations