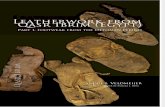

LEATHER AND FOOTWEAR IN MÉXICO - UNEP · 2008-03-14 · MARKET INFORMATION – FOOTWEAR AND...

Transcript of LEATHER AND FOOTWEAR IN MÉXICO - UNEP · 2008-03-14 · MARKET INFORMATION – FOOTWEAR AND...

INSTITUTO MEXICANO DE NORMALIZACIÓN Y CERTIFICACIÓN IMNC – PARTNER IN MÉXICO

Founded in 1993 as an organism for standardization andcertificaction. IMNC´s main objective is to strenghten industry, commerce and services national, regional and internationalcompetitiveness. IMNC Board of Director´s is integrated by:

Industry - Confederación de Cámaras Industriales de los Estados Unidos Mexicanos (CONCAMIN)Agriculture - Consejo Nacional Agropecuario (CNA)Services - Confederación de Cámaras Nacionales de Comercio, Servicios y Turismo (CONCANACO-SERVYTUR)Confederación de Asociaciones de Agentes Aduanales de la República Mexicana (CAAAREM)Commerce - Cámara Nacional de Comercio (CANACO)Academy - Universidad Nacional Autónoma de México (UNAM)Government - Secretaría de Economía (SE)Consumers - Procuraduría Federal del Consumidor (PROFECO)

IMNC ACTIVITIES

IMNC is supported by national outstanding experts in the field ofstandardization, certification and training. We are very active in the following national and international forums:

• ISO International Organization for Standardization• IAF International Acreditation Forum• ILAC International Laboratory Acreditation Cooperation• COPANT Cooperación Panamericana de Normas Técnicas• IAAC Interamerican Acreditation Cooperation• CNN Comisión Nacional de Normalización

IMNC ACTIVITIES

• Verification• Commercial information• Restaurants quality

• Standardization• Quality assessment• Tourism• Metrology• Environmental assessment• Graphic Arts• Health and Safety• Autoparts• Cranes

• Certification• SYSTEMS: QUALITY, ENVIRONMENT AND HEALTH AND SAFETY• PRODUCTS: INDUSTRY, SPA AND AGRICULTURE

MARKET INFORMATION – FOOTWEAR AND LEATHER MEXICO

• In Mexico several efforts to improve the competitiveness of the leather and footwear sector have been carried out since 2003 with the implementation of programs and funds for this purpose.

• The Ministry of Economy has stated that the average competitiveness of the sector is low, but nevertheless there is a group of companies with high levels of competitiveness in the international scale and a group in transition; both groups mark a trend for the other companies to become more competitive.

• The competitiveness studies carried out by the Ministry of Economy show that the population size of the country reveals a great potential for the national leather and footwear national industry, since the estimates on footwear consumption per person (now of 1.8 pairs) could increase to three.

MARKET INFORMATION Mexico footwear exports per country in thousands of USD 1999-2002

1999 2000 2001 2002 (Jan -Ju n ) C ountries

(usd) % (usd) % (usd) % (usd) %

T O T AL 426.9 100.0 405.1 100.0 356.6 100.0 148.3 100.0

U S A 371.0 86.9 368.4 91.0 332.6 93.3 139.0 93.7

P U E R T O R IC O

5.9 1.4 4 .9 1 .2 5 .3 1.5 3 .0 2 .0

C A N A D A 14.6 3.4 5 .2 1 .3 3 .8 1.1 1 .3 0 .9

IT A LY 0.3 0.1 0 .5 0 .1 0 .7 0.2 0 .7 0 .5

G U A T EM A LA 2.2 0.5 2 .1 0 .5 1 .7 0.5 0 .7 0 .5

C O S T A R IC A 4.1 1.0 1 .8 0 .4 1 .1 0.3 0 .5 0 .3

C U B A 3.7 0.9 3 .6 0 .9 2 .6 0.7 0 .4 0 .3

G E R M A N Y 2.4 0.6 1 .1 0 .3 0 .6 0.2 0 .4 0 .3

E l S A LV A D O R

1.1 0.3 1 .3 0 .3 0 .5 0.2 0 .3 0 .2

JA P A N 0.5 0.1 0 .3 0 .1 0 .2 0.1 0 .2 0 .2

O TH E R S 21.1 4.9 15.9 3.9 7 .4 2.1 1 .8 1 .2

Source: Ministry of Economy

Destiny of the Mexican footwear exports in thousands of USD (2002-2004)

COUNTRIES 2002 2003 2004 PARTICIPATION % (2003)

OTHERS 328.68 318.42 290.41 100

USA 306.58 296.07 272.61 92.98

CANADA 3.065 3.033 2.93 0.95

SPAIN 0.32 0.52 1.79 1.17

PUERTO RICO

6.33 4.32 1.68 1.36

GUATEMALA 1.67 2.23 1.27 0.7

ITALY 1.94 1.61 1.26 0.51

UNITED KINGDOM

0.18 0.186 1.16 0.06

DOMINICAN REPUBLIC

0.332 2.14 1.09 0.67

COSTA RICA 1.00 0.96 0.98 0.3

GERMANY 0.92 1.24 0.83 0.39

Source: Ministry of Economy

Foreign investment in the leather-footwear sector in Mexico (per country), 2001

Country Number of companies Thousands of USD

Total 117 88294

USA 57 60366

KOREA 12 851

ITALY 8 524

SPAIN 8 7914

UNITED KINGDOM 4 86

TAIWAN 41 970

URUGUAY 3 2049

FRANCE 3 610

OTHERS 18 13924

Source: Ministry of Economy

Main data of exports to Europe

• Main products (77.3% of total export to Europe in 2001)• footwear for men (15.3% )• women's footwear (11.7%)• footwear parts (11.5%) • footwear with plastic sole (11.1%)

• To have a more competitive sector Mexico need to focus in three market niches: a) the domestic market in a context of international competitiveness b) North America c) European Union.

Mexico footwear exports to European Union in thousands of USD.

1999 2000 2001 Description

(usd) % (usd) % (usd) %

TOTAL 10791 100 6378 100 3583 100

Selected products 8500 78.7 4755 74.6 2771 77.3

Men footwear 731 6.8 1042 16.3 547 15.3

Women footwear 1249 11.6 384 6.0 421 11.7

Footwear parts 100 0.9 164 2.6 411 11.5

Plastic sole footwear 1586 14.7 442 6.9 399 11.1

Plastic sole footwear that covers ankle

237 2.2 379 5.9 249 6.9

Cuts of leather (outfront) 2126 19.7 665 10.4 194 5.4

Children footwear 766 7.1 1028 16.1 166 4.6

Other varieties with plastic sole 1428 13.2 433 6.8 163 4.5

Other varieties for men 166 1.5 147 2.3 128 3.6

Sports footwear for men 111 1.0 71 1.1 93 2.6

OTHERS 2297 21.3 1623 25.4 812 22.7

Main data of exports to Europe

The Mexico – European Union Business Center, as part of the Ministry of Economy Integral Program to support small and medium size enterprises (PIAPYME) launched the program “Technology for the design and forms of footwear for exportation to European Union” in 2003 and 2004 coordinated by COFOCE, the Coordinator of Foreign Commerce of the State of Guanajuato, with workshops in 22 companies focused in the improvements of design.

Main stakeholders in the value chain

• The main stakeholders in the value chain of footwear in Mexico were identified from information of the production-consumption chains in the states of Jalisco and Guanajuato. At this point of the project contacts are in a beginning stage but this exercise has been very useful for this near future purpose of involving them in different steps of the ecolabellingproject.

Figure 2. Mexico’s leather footwear production-consumption chain stakeholders.

Leather Tannering andfinishing

Manufacturing ofleather footwear

Wholesale

Retail and shoestores

Exports

Manufacturing ofsoles and heels

Footwear 100% leather

Leather footwearwith synthetic sole

Plastic footwearwith synthetic sole

Fabric (textile) footwear withsynthetic sole

SUPPLIER

ANPIC (Leather, machinery and other materials) National Association of Suppliers of the FootwearIndustry

ANPICUR National Association of Products for theTanning Industry

CANALCUR National Chamber of the Tanning industry

ANCU National Association of the tanners

CICUR National Association of the Tanning industry in Guanajuato

CRIC Regional Association of the Tanning industry in Jalisco

Association of Chemists and Technicals of Leather in Leon and Jalisco

PRODUCTION

CICEG Chamber of the FootwearIndustry of Guanajuato and CICEJ, Chamber of the Footwear Industry in Jalisco

CANAICAL, National Chamber of theFootwear Industry

COSEC Coordinator of the leather andfootwear sector

COMMERCIALIZATION

COFOCE Coordinator of exports of theState of Guanajuato

National Bank of Foreign CommerceBANCOMEXT

NAFIN National Finance Program

FAIRS: INMODA/MODAMA./ANPIC/

CALZATECNIA/SAPICA

Chart compiled fro data of the productive chain of footwear and leather in Jalisco and the productive chain of footwear in León, Guanajuato. Sources: Jalisco State Program of Science and Technology, page. 3 and Ortiz andMartínez, Competitive factors in footwear chain in León, 2000, page 566. Ministry of Economy, Program for the competitiveness of the leather andfootwear sector, 2003, page. 61.

RESEARCH AND DEVELOPMENT

CIATEC RESEARCH AND CONSULTANCY CENTER IN LEATHER AND FOOTWEARCEJALDI JALISCO DESIGN CENTERCADIS CENTER FOR LCA AND SUSTAINABLE DESIGNUNIVERSITIEs

Commercialization

• The commercialization channels for footwear in the internal market are dominated by the relationship manufacturer-independent retailer, following shoe stores and chains and wholesalers (with less importance).

• The specialized shoe stores are the dominant sales channel, with a tendency to expand mainly because of factors of fashion and the variety of products that are offered to the consumer.

• It is very important for the manufacturer to dominate the channels of commercialization, according to CECIC:

• In general the shoe stores are more important• The stores of the National Department and

Supermarket Association (ANTAD) mark 60% Catalogue sales approximately 40 to 50% with the advantage of credit sales

• 30% goes to wholesalers and 130% is over the cost of manufacturing.

Commercialization

• The financial support is provided by NAFIN (National Finance organization) that established a program of financial support for industrial subcontracts. These credits allow obtaining bank credits with NAFIN as a guarantee.

• The promotion of exports is provided by the National Bank of Foreign Commerce (BANCOMEXT). This bank plays an important role because it provides financial and non financial services to exporting companies. The benefits that it offers are not only exclusive to this industry. The promotional programs and those of technical formation and assistance are the most important for the footwear industry.

• There is an Integral Program to support of SMEs, Mexico-European Union Business Center.

Commercialization - FAIRS

SAPICA– National Fair of Leather • MODAMA – Footwear fashion exposition,

to promote and disseminate national footwear designs.

• ANPIC International Fair of Suppliers, Machinery and Fashion for the footwear industry.

• CALZATECNIA 2007 “Proposals of Value in Real Time" will take place in Leon, Guanajuato, Mexico, on August 17 and 18, 2007

A presentation about the ecolabellingproject in this event is expected.

Research and Development

• The Center for Research and Consultancy of Leather and Footwear CIATEC is an important partner in this project with whom we have already signed a project agreement. The center supports the areas of process engineering, manufacturing, materials development and certification. It is a valuable center for the companies.

• The Mexican Association of Footwear Design (AMDICAM)

Eco-labeling status in México

• In Mexico, the green products market is a niche; there is lack of information and awareness about these products. The most successful example of certification of a green product is organic labeling, that responds to the increasing demand of the developed countries and benefits from premium prices in the international market. In the Federal District only a Green Organic Label has been established.

• The National Institute of Standards and Certification (IMNC) offered a workshop on eco-labeling in 2005 with around 60 companies attending, and so far there have been 75 sales of the standards related to eco-labeling (product declarations) for ISO 14020:2000 –NMX-SAA-14020-IMNC-2004, 73 for ISO 14021:1999 - NMX-SAA-14021-IMNC-2004, and 76 for ISO 14024:1999 – NMX-SAA-14024-IMNC-2004.

PROJECT TEAM

IMNC

MANUFACTURING

CIATEC group leader fortraining and activities withmanufacturing industries (agreement signed)Ing. Gustavo Alvarado

GOVERNMENT

Ministry ofEnvironment –Ministry´s Advisor Office. Ing. Arturo Rodríguez

DESIGN

Mexican Associationfor Footwear Designand Biodesign(agreement to be signed).M.D. Josefina Pernett

Dr. Nydia Suppen

Eng. Angélica Contla

Staff