l U.S. GOVERNMENT ACCOUNTABILITY OFFICE Buccaneer selling ...

Transcript of l U.S. GOVERNMENT ACCOUNTABILITY OFFICE Buccaneer selling ...

l F I N A N C E & E C O N O M Y

l E X P L O R A T I O N & P R O D U C T I O N

l E X P L O R A T I O N & P R O D U C T I O N

page4

Q&A: Guttenberg sees benefits,risks, in equity in gas project

Vol. 19, No. 1 • www.PetroleumNews.com A weekly oil & gas newspaper based in Anchorage, Alaska Week of January 5, 2014 • $2.50

U.S

. G

OV

ERN

MEN

T A

CC

OU

NTA

BIL

ITY

OFF

ICE

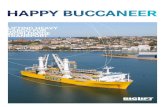

Buccaneer selling spreeSelling stakes in Cosmopolitan and its jack-up rig to finance operations

By ERIC LIDJIFor Petroleum News

Buccaneer Energy Ltd. is selling its interest inthe Cosmopolitan field and the Endeavour

jack-up drilling rig to strengthen its balance sheet,the company announced on Jan. 1.

The Australian independent is selling its 25 per-cent stake in the offshore Cosmopolitan field toBlueCrest Energy Inc. for $41.25 million. The pri-vately held Fort Worth independent currently holdsthe majority interest in the oil and gas field offAnchor Point.

Buccaneer is also selling its equity stake inKenai Offshore Ventures LLC to Teras InvestmentsPte. Ltd. for $23.95 million. The joint venture

Kenai Offshore Ventures owns the jack-up rigthrough a deal partially funded by the AlaskaIndustrial Development and Export Authority.Under the terms of the financing arrangement,AIDEA must approve the sale before it can befinalized, according to Buccaneer.

By keeping its wholly owned subsidiary Kenai

By keeping its wholly owned subsidiaryKenai Drilling LLC, Buccaneer said it

would still be the rig operator once thosesales are finalized, thus keeping a

revenue source.

see BUCCANEER SELL-OFF page 13

Shell responds to BOEMFills in some additional details for company’s Chukchi Sea exploration plan

By ALAN BAILEYPetroleum News

Shell has responded to a request from theBureau of Ocean Energy Management, or

BOEM, for additional information relating to thecompany’s latest Chukchi Sea exploration plan.The company, with hopes of restarting its ChukchiSea drilling campaign in the summer of 2014, hadfiled a revised exploration plan in early November.BOEM subsequently sent the company a list ofadditional information it needs before deeming theplan complete and ready for release for publiccomment.

Peter Voser, the company’s CEO, has recentlysaid that Shell is preparing to drill in the Chukchi

in 2014 or 2015 but has not yet made a finaldrilling decision.

Permits neededShell has said that it wants to drill in 2014, but

that the drilling would be contingent on the com-pany obtaining all of the necessary permits for the

Alaska in NWT dreamsIndustry Minister Ramsay encouraged by Alaska, Yukon, Alberta, NWT relationship

By GARY PARKFor Petroleum News

Northwest Territories IndustryMinister Dave Ramsay is increas-

ingly pinning hopes on Alaska as an out-let for his region’s stranded oil and natu-ral gas at a time when interest in devel-oping those resources is gathering pace.

A series of meetings over the last yearwith Alaska legislators, along with theYukon and Alberta, have pointed to the emergenceof a “regional perspective” on energy developmentas the jurisdictions continue their discussionsunder the umbrella of the Pacific North WestEconomic Region, he said.

“The Alaskans have been receptive” toproposals that could see crude from theAlberta oil sands and northern Canadafed into the underutilized Trans AlaskaPipeline System and delivered to Valdezfor export, Ramsay said, adding: “We’refooling each other if we’re not thinkingon a regional basis.”

The “northern option” is getting afresh look as pipelines such asTransCanada’s Keystone XL and Energy

East, Enbridge’s Northern Gateway and KinderMorgan’s Trans Mountain expansion face poten-tially crippling political, aboriginal and environ-mental opposition.

Shell has said that it wants to drill in2014, but that the drilling would be

contingent on the company obtaining allof the necessary permits for the fleet ofsome 30 vessels that it plans to deploy.

see SHELL DRILLING page 14

DAVE RAMSAY

see ALASKA DREAMING page 16

Interior mulling higher royaltiesfor new onshore federal leases

The U.S. Department of the Interior plans to seek publiccomment on whether and how to change the fiscal system foronshore oil and natural gas development on federal lands.

The federal land manager is preparing an Advance NoticeOf Proposed Rulemaking on changes to the fiscal system thatwould ensure the public gets a fair return for its resources,according to a report from the U.S. GovernmentAccountability Office.

A backlog of higher priority rulemaking projects — includ-ing regulations for hydraulic fracturing — will likely keep theInterior Department from releasing the proposed rulemakingfor some time, but any changes would greatly impact Alaska,where North Slope development is beginning to creep into theNational Petroleum Reserve-Alaska.

UAF to help test drones; crafthave appeal for AK oil industry

The University of Alaska is among six public entities theFederal Aviation Administration has chosen nationally todevelop and operate test sites for unmanned aircraft systems,or drones.

The congressionally mandated test sites will conductresearch for safely integrating drones into the national air-space over the next several years, the FAA said Dec. 30.

Remote controlled aircraft, including miniature planes andhelicopters, present significant safety questions, including therisk of collisions with regular air traffic. Privacy is anotherconcern with drones, the use of which generally has beenrestricted to government agencies and the military.

In recent years, momentum has built for broader use ofdrones for commercial or other purposes.

Alaska has been on the forefront of commercial efforts. In

New York financial firm bringssuit against Miller, Texas bank

A New York City firm that helped Miller Energy ResourcesInc. acquire its oil and gas assets in Alaska’s Cook Inlet is nowsuing Miller.

Vulcan Capital Corp. filed suit Dec. 10 in federal court forthe Southern District of New York. The suit names Miller andPlainsCapital Bank as defendants.

The complex suit alleges the defendants acted wrongfullyto take control of Vulcan’s warrants to buy Miller stock at cer-tain prices.

Miller and PlainsCapital Bank had not yet answered thesuit at press time.

Miller, based in Tennessee, operates in Alaska through itssubsidiary, Cook Inlet Energy LLC. Miller is listed on the

see FISCAL CHANGES page 15

see DRONE TESTING page 13

see MILLER LAWSUIT page 13

2 PETROLEUM NEWS • WEEK OF JANUARY 5, 2014

Petroleum News North America’s source for oil and gas news

FINANCE & ECONOMY

NATURAL GAS

contents6 Parker denies hiring discrimination

4 Potential Alaska state and federal oil and gas lease sales

6 Parnell seeks to advance gas project

6 Enstar still wants customer switch notice

7 EPA terminates Shell’s drilling air permits

10 AOGCC OKs field contractions, expansions

11 US drilling rig count down by 11 to 1,757

EXPLORATION & PRODUCTION8 Using a compass to steer a drill bit

The critical importance of accurately steering a directionaldrilling operation places high demands on magnetic field measurement

9 A power tool for teachers, researchers

U.S. Energy Information Administration packs facts into updated energy profile of Alaska; state remains a top-tier oil producer

8 Crude oil price most sensitive variable

Department of Revenue price forecast group finds FY 2014 consensus in $100-$110 per barrel range, but not for FY 2015 and beyond

Interior mulling higher royaltiesfor new onshore federal leases

UAF to help test drones; crafthave appeal for AK oil industry

New York financial firm bringssuit against Miller, Texas bank

Buccaneer selling spree

Selling stakes in Cosmopolitan and its jack-up rig to finance operations

Shell responds to BOEM

Fills in some additional details for company’s Chukchi Sea exploration plan

Alaska in NWT dreams

Industry Minister Ramsay encouraged by Alaska, Yukon, Alberta, NWT relationship

ON THE COVER

GOVERNMENT4 Guttenberg sees benefits, risks, in equity

Fairbanks Democrat believes industry would treat state as weak partner; ensure it bore most of risks in LNG equity partnership

5 Seeking a social license

Canadian government, pipeline companies, LNGproponents short on time to sell megaproject economic benefits to aboriginal communities

LAND & LEASING

PIPELINES & DOWNSTREAM7 Flint Hills still challenging Resid

Despite a FERC investigation into the Quality Bankmethodology, the refiner wants its original complaint to be reheard

U I C U M I A Q . C O M

D I V E R S I F I E D D E V E L O P M E N T A N D S U P P O R T S E R V I C E S I N T H E A R C T I C & B E Y O N D

Ph| 907-644-4522Fx| 907-644-4523

[email protected] Silverado Way, Ste. I

Anchorage, AK 99518

• Custom Web & DesktopApplications

• IT Requirements Analysis• Database Design & Modeling

• Server 2003/2008 Configuration& Maintenance

• SQL Server DatabaseAdministration

• Network Design & Security Administration

• POS Applications

WE OFFER THE FOLLOWING SOLUTIONS TO PUBLIC AND

PRIVATE SECTORS

SIDEBAR, Page 14: Shell explains its contractor management

PETROLEUM NEWS • WEEK OF JANUARY 5, 2014 3

Rig Owner/Rig Type Rig No. Rig Location/Activity Operator or Status

Alaska Rig StatusNorth Slope - Onshore

Doyon DrillingDreco 1250 UE 14 (SCR/TD) Prudhoe Bay OWDW-C, workover BPDreco 1000 UE 16 (SCR/TD) Prudhoe Bay MPK-05, workover BPDreco D2000 Uebd 19 (SCR/TD) Alpine CD4-290 ConocoPhillipsAC Mobile 25 Prudhoe Bay Y-10 BPOIME 2000 141 (SCR/TD) Kuparuk 1C-151 ConocoPhillips

Kuukpik 5 Waiting on Ice Road to Linc Energy Operations Inc. Umiat 23H

Nabors Alaska DrillingTrans-ocean rig CDR-1 (CT) Prudhoe Bay StackedAC Coil Hybrid CDR-2 Kuparuk 2F-18 ConocoPhillipsDreco 1000 UE 2-ES (SCR-TD) Prudhoe Bay Available Mid-Continental U36A 3-S Prudhoe Bay AvailableOilwell 700 E 4-ES (SCR) Prudhoe Bay AvailableDreco 1000 UE 7-ES (SCR/TD) Kuparuk ConocoPhillipsDreco 1000 UE 9-ES (SCR/TD) Will begin operation in Kuparuk ConocoPhillips

January 1, 2014Oilwell 2000 Hercules 14-E (SCR) Prudhoe Bay AvailableOilwell 2000 Hercules 16-E (SCR/TD) Prudhoe Bay Available Oilwell 2000 17-E (SCR/TD) Prudhoe Bay StackedEmsco Electro-hoist-2 18-E (SCR) Prudhoe Bay StackedEmsco Electro-hoist Varco 22-E (SCR/TD) Prudhoe Bay StackedTDS3Emsco Electro-hoist Canrig 27-E (SCR-TD) Prudhoe Bay Available 1050EEmsco Electro-hoist 28-E (SCR) Prudhoe Bay StackedOilwell 2000 33-E Prudhoe Bay Available Academy AC Electric CANRIG 99AC (AC-TD) Prudhoe Bay AvailableOIME 2000 245-E (SCR-ACTD) Oliktok Point ENIAcademy AC electric CANRIG 105AC (AC-TD) Deadhorse Available

Nordic Calista ServicesSuperior 700 UE 1 (SCR/CTD) Prudhoe Bay Drill Site 15-45C BPSuperior 700 UE 2 (SCR/CTD) Milne Point F-53 BPIdeco 900 3 (SCR/TD) Kuparuk Well 2N-308 ConocoPhillips

Parker Drilling Arctic Operating Inc. NOV ADS-10SD 272 Prudhoe Bay DS 18 BPNOV ADS-10SD 273 Prudhoe Bay DS W-59 BP

North Slope - OffshoreBPTop Drive, supersized Liberty rig Inactive BP

Doyon DrillingSky top Brewster NE-12 15 (SCR/TD) Spy Island 14-N6 ENI

Nabors Alaska DrillingOIME 1000 19AC (AC-TD) Oooguruk ODSN-02 Pioneer Natural Resources

Cook Inlet Basin – Onshore

Kenai Land Ventures LLC (All American Oilfield Associates, labor Contract)Taylor Glacier 1 Kenai Loop Drilling Pad #1 Buccaneer Energy Ltd.

All American Oilfield AssociatesIDECO H-37 AAO 111 Kenai Yard Available

Aurora Well ServicesFranks 300 Srs. Explorer III AWS 1 D&D yard in Sterling, Available

doing winter maintenance

Doyon DrillingTSM 7000 Arctic Fox #1 Doyon Yard, Mobilization Contracted to ConocoPhillips

Winter of 2013/2014

Nabors Alaska DrillingContinental Emsco E3000 273E Kenai AvailableFranks 26 Kenai StackedIDECO 2100 E 429E (SCR) Kenai AvailableRigmaster 850 129 Kenai AvailableAcademy AC electric Heli-Rig 106-E (AC-TD) Kenai Available

SaxonTSM-850 147 Ninilchik Unit, Bartolowits pad Hilcorp Alaska

drilling Frances #1TSM-850 169 Swanson River Hilcorp Alaska

Cook Inlet Basin – Offshore

XTO EnergyNational 110 C (TD) Idle XTO

Spartan Drilling Baker Marine ILC-Skidoff, jack-up Spartan 151 Furie

Upper Cook Inlet KLU#1Cook Inlet EnergyNational 1320 35 Osprey Platform RU-1, workover Cook Inlet Energy

Hilcorp Alaska LLC (Kuukpik Drilling, management contract)Monopod A-17RD, workover Hilcorp Alaska LLC

Patterson UTI Drilling Co LLC 191 West McArthur River Unit #8 Cook Inlet Energy

Kenai Offshore VenturesLeTourneau Class 116-C, Endeavor Port Graham Buccaneer Energy Ltd. jack-up

Mackenzie Rig StatusCanadian Beaufort Sea

SDC Drilling Inc.SSDC CANMAR Island Rig #2 SDC Set down at Roland Bay Available

Central Mackenzie Valley

AkitaTSM-7000 37 Racked in Norman Well, NT Available

Alaska - Mackenzie Rig ReportThe Alaska - Mackenzie Rig Report as of December 31, 2013.

Active drilling companies only listed.

TD = rigs equipped with top drive units WO = workover operations CT = coiled tubing operation SCR = electric rig

This rig report was prepared by Marti Reeve

Baker Hughes North America rotary rig counts*Dec. 27 Dec. 20 Year Ago

US 1,757 1,768 1,763Canada 263 398 204Gulf 59 59 48

Highest/LowestUS/Highest 4530 December 1981US/Lowest 488 April 1999Canada/Highest 558 January 2000Canada/Lowest 29 April 1992

*Issued by Baker Hughes since 1944

The Alaska - Mackenzie Rig Report is sponsored by:

JUDY

PAT

RICK

4 PETROLEUM NEWS • WEEK OF JANUARY 5, 2014

Kay Cashman PUBLISHER & EXECUTIVE EDITOR

Mary Mack CEO & GENERAL MANAGER

Kristen Nelson EDITOR-IN-CHIEF

Susan Crane ADVERTISING DIRECTOR

Bonnie Yonker AK / NATL ADVERTISING SPECIALIST

Heather Yates BOOKKEEPER & CIRCULATION MANAGER

Shane Lasley IT CHIEF

Marti Reeve SPECIAL PUBLICATIONS DIRECTOR

Steven Merritt PRODUCTION DIRECTOR

Alan Bailey SENIOR STAFF WRITER

Eric Lidji CONTRIBUTING WRITER

Wesley Loy CONTRIBUTING WRITER

Gary Park CONTRIBUTING WRITER (CANADA)

Rose Ragsdale CONTRIBUTING WRITER

Ray Tyson CONTRIBUTING WRITER

Judy Patrick Photography CONTRACT PHOTOGRAPHER

Mapmakers Alaska CARTOGRAPHY

Forrest Crane CONTRACT PHOTOGRAPHER

Tom Kearney ADVERTISING DESIGN MANAGER

Renee Garbutt CIRCULATION SALES

Ashley Lindly RESEARCH ASSOCIATE

Dee Cashman RESEARCH ASSOCIATE

Petroleum News and its supple-ment, Petroleum Directory, are

owned by Petroleum Newspapersof Alaska LLC. The newspaper ispublished weekly. Several of theindividuals listed above work forindependent companies that con-

tract services to PetroleumNewspapers of Alaska LLC or are

freelance writers.

ADDRESSP.O. Box 231647Anchorage, AK 99523-1647

NEWS [email protected]

CIRCULATION 907.522.9469 [email protected]

ADVERTISING Susan Crane • [email protected]

Bonnie Yonker • [email protected]

FAX FOR ALL DEPARTMENTS907.522.9583

OWNER: Petroleum Newspapers of Alaska LLC (PNA)Petroleum News (ISSN 1544-3612) • Vol. 19, No. 1 • Week of January 5, 2014

Published weekly. Address: 5441 Old Seward, #3, Anchorage, AK 99518(Please mail ALL correspondence to:

P.O. Box 231647 Anchorage, AK 99523-1647)Subscription prices in U.S. — $98.00 1 year, $176.00 2 years

Canada — $185.95 1 year, $334.95 2 years Overseas (sent air mail) — $220.00 1 year, $396.00 2 years“Periodicals postage paid at Anchorage, AK 99502-9986.”

POSTMASTER: Send address changes to Petroleum News, P.O. Box 231647 Anchorage, AK 99523-1647.

www.PetroleumNews.com

• Field Heat Trea ng• NDE/NDT and Inspec ons • Leak Repair • Hot Tap • Line Freeze • Field Machining • Technical Bol ng • Valve Repair • Emissions Control • Valve Inser on • Engineering and Manufacturing • Turnkey Tank Program • Isola on Test Plugs • Line Stop • Fitness for Service

Combining the exper se,

innova on and technology

that keep your facili es online and in produc on.

Team’s Alaska loca on specializes in NDT Services and Field Heat Trea ng

42730 Kenai Spur Hwy. Kenai, AK907-335-1446

8141 Diamond Hook Anchorage, AK907-336-1446

Mountain Work • Sling Load Operations

Crew Haul • Aerial Survey

Aerial Filming • Offshore Operations

Ph: 907-246-3554 Fx: 907-246-3654Web: www.egliair.com

Serving Alaska since 1982

LAND & LEASINGPotential Alaska state and federal

oil and gas lease salesAgency Sale and Area Proposed Date

DNR Cook Inlet Areawide Spring 2014

DNR Alaska Peninsula Areawide Spring 2014

DNR Beaufort Sea Areawide fall 2014

DNR North Slope Areawide fall 2014

DNR North Slope Foothills Areawide fall 2014

BLM NPR-A fall 2014

BOEM Chukchi Sea May 2016

BOEM Cook Inlet (special interest) November 2016

BOEM Beaufort Sea May 2017

Agency key: BLM, U.S. Department of the Interior’s Bureau of Land Management, manages leasing inthe National Petroleum Reserve-Alaska; BOEM, U.S. Department of the Interior’s Bureau of Ocean

Energy Management (formerly Minerals Management Service), Alaska region outer continental shelfoffice, manages sales in federal waters offshore Alaska; DNR, Alaska Department of Natural Resources,Division of Oil and Gas, manages state oil and gas lease sales onshore and in state waters; MHT, Alaska

Mental Health Trust Land Office, manages sales on trust lands.

l G O V E R N M E N T

Guttenberg seesbenefits, risks, in state equityFairbanks Democrat believes industry would treat state as weakpartner; ensure it bore most of risks in LNG equity partnership

By STEVE QUINNFor Petroleum News

R ep. David Guttenberg says the inter-im has provided good news on the

state’s resource front.The Regulatory Commission of

Alaska chose municipal utility InteriorGas Utility to deliv-er gas to North Poleand other areas ofthe Interior.

The state learnedthat taking an equitystake in a large-diameter line couldbe prudent inadvancing a project.

But some issuesremain unresolved.A referendum torepeal the newly minted oil tax goesbefore voters in August.

Referendum critics say Gov. SeanParnell’s Senate Bill 21 needs to remainif the oil and gas industry is to be confi-dent in a regime.

Guttenberg says SB 21 will do noth-ing to stem annual declinein North Slope productionand pipeline throughout;calls arguments pushing thatpoint disingenuous.

The Fairbanks Democrat,now in his sixth term, dis-cussed his thoughts on resource develop-ment issues facing the state as theLegislature is a few weeks away fromreturning to Juneau for another 90-daysession.

Petroleum News: Let’s start with newsclose to home. The RCA picked IGU todistribute natural gas throughout theFairbanks North Star Borough. Do yousee this as progress?

Guttenberg: In many ways, all ofthese issues — oil or gas — it just seems

like you’re in a loggerhead until some-thing happens and then it becomesmomentum. I’m glad IGU has got it.They are the only ones committed toactually having a distribution system thatreaches as many people as possiblebecause that’s their goal. It’s not a profitdriven company. Its goal is to get gas tothe residents.

Petroleum News: What would you liketo see next as far as a timetable goes?

Guttenberg: You need to get anchortenants for gas. You need to get commit-ments to building a facility on the NorthSlope — or wherever the gas comesfrom. Whether it’s getting gas from northcoming south or the south coming north,or wherever the gas comes from.

The next step for some of the anchortenants: Golden Valley, the bases, themines — people committing to a systemthat builds the economic structure forgas.

Tower Hill has a huge mine prospectin Livengood and the one factor that thestate can effect and make it economicalis driving the cost of power down.

That’s the answer to all the economicsin the Fairbanks area isthe cost of living here, thecost of heating your homeand to turn your power on.We would have a vibrantplace and it would be sig-

nificant to cleaning the air problem thatwe have. It speaks to quality of life.

Petroleum News: Is it going to take agreater financial commitment, like anappropriation or a tax break? Or is it aresources commitment like a particularadministrative office such as AIDEA(Alaska Industrial Development andExport Authority)?

Guttenberg: The guy on the streetdoesn’t care. The guy heating his home,

REP. DAVIDGUTTENBERG

see GUTTENBERG Q&A page 10

PETROLEUM NEWS • WEEK OF JANUARY 5, 2014 5

Anchorage Honolulu Los Angeles

• Commercial Diving• Marine Construction Services• Platform Installation, Maintenance and Repair• Pipeline Installation, Maintenance and Repair• Underwater Certified Welding• NDT Services• Salvage Operations• Vessel Support and Operations

• Environmental Services• Oil-Spill Response, Containment and Clean-Up• Hazardous Wastes and Contaminated Site Clean-

Up and Remediation• Petroleum Vessel Services, e.g. Fuel Transfer• Bulk Fuel Oil Facility and Storage Tank

Maintenance, Management, and Operations

American MarineServices Group

6000 A Street, Anchorage, AK 99518

907-562-5420Deadhorse, AK

907-659-9010www.amarinecorp.com • www.penco.org

By GARY PARKFor Petroleum News

The Canadian petroleum industry enters 2014 facedwith needing to make a complete and credible about-

face in its dealings with First Nations.Failure to act could sidetrack Enbridge’s Northern

Gateway project beyond the point where it can remain eco-nomically viable.

And, unless industry leaders and governments can per-suade the bulk of aboriginal communities that they stand tobenefit from energy megaprojects without disruption totheir lifestyles, Kinder Morgan’s Trans Mountain expan-sion, TransCanada’s Energy East push to Canada’s Atlanticcoast and any number of LNG export plans could be in trou-ble.

When a federal government Joint Review Panel condi-tionally endorsed Northern Gateway on Dec. 18 it was noordinary approval.

“It is the most important regulatory decision we haveseen in modern times in this country,” said Jim Prentice, aformer senior cabinet minister under Prime MinisterStephen Harper and now a leading bank executive. “That’sbecause the issues associated with West Coast access are soimportant to our future.”

Diana McQueen, Alberta’s newly appointed energy min-ister, welcomed the Northern Gateway report as “good forAlberta, British Columbia and the entire country” by settingthe stage for accessing offshore markets.

Enbridge’s efforts salutedTo the delight of some and the surprise of many, the JRP

saluted Enbridge’s efforts to tackle the key challenges fac-ing Northern Gateway, notably the preparation of a marinespill response plan and its engagement with First Nations.

It said that in some cases Enbridge went beyond whatwas required under present legislation. But, in the eyes ofmost Native leaders, that was nowhere near far enough and,for many of them, nothing Enbridge can offer will ever winthem over.

The options before the federal cabinet are to accept orreject the JRP’s 209 conditions, or, as it did with theMackenzie Gas Project ask the National Energy Board tomake additions or deletions to the list.

But Enbridge and the industry have to assume that thecabinet will reach a decision within the required 180 days ofthe JRP’s report being made public — in other words, bymid-June.

Prentice said the JRP has clearly laid out a path for theCanadian government and Enbridge to “build a sociallicense” for Northern Gateway, notably ensuring that FirstNations “are meaningful participants in the economic ben-efits.

Issue sidesteppedWhat the JRP sidestepped was an overriding issue — the

lack of progress on aboriginal land rights and title in BritishColumbia.

Enbridge Chief Executive Officer Al Monaco has made

no attempt to downplay the realities, observing that “the factpeople see Gateway as controversial is not necessarily a badthing. It has really helped the landscape because peopleunderstand what is at stake.”

His pledge to make an immediate start on building a newlevel of trust with First Nations came on the heels of arecent survey by the University of Calgary School of PublicPolicy that showed how fast the cloud of aboriginal opposi-tion to Canada’s energy megaprojects is accumulating.

The concern among governments who count on the oiland natural gas sector for a large percentage of their rev-enues and the petroleum industry, which urgently needs topost a victory in the struggle to open new markets, iswhether they have left it too late to reach an accommodationwith First Nations.

The university survey, which canvassed the views of 300Natives, showed 30 percent have “zero” trust in oil and gascompanies, energy executives and the CanadianAssociation of Petroleum Producers, CAPP.

Study co-author Andre Turcotte said a “lot of resources... have been put into trying to change the image of theindustry,” but the results “show that whatever the industry isdoing is not really working.”

The “zero trust” number means that aboriginal commu-nities are “not ready to engage in a conversation, so it’s areal obstacle to start a dialogue,” Turcotte.

He said the obstacle faced by the industry is “inevitable”given that where future energy production will occur andwhere aboriginals live “is a fact you can’t overcome.”

However, Turcotte said aboriginals are prepared toaccept resource development and pipelines being near theircommunities when the proposals are linked to benefits.

The economic benefits are “where you start the conver-sation,” he said.

Blunt receptionBut Ann Marie Sam, a councillor with the Nak’azdli

First Nation, a member of the Yinka Dene Alliance in north-western British Columbia, gave a blunt reception to the JRPverdict, underscoring that some aboriginals are not willingto talk under any circumstances.

“The message we want to send out from the Yinka Deneis that the Northern Gateway pipeline is banned from ourterritories,” she declared.

Gordon Christie, an associate professor of law and aFirst Nations legal expert at the University of BritishColumbia, said that view is shared by dozens of FirstNations along the pipeline right of way, belief that thepipeline has “pretty far-reaching consequences.”

The burden on the Canadian government and Enbridgeis “fairly onerous,” said Christie, questioning whether the

government has enough time to meet the Supreme Court ofCanada’s requirement for “meaningful consultation.”

Merie Alexander, an aboriginal law specialist theVancouver firm of Gowlings, said the deep distrust withinFirst Nations over projects like Northern Gateway couldalso “create a movement” against Kinder Morgan’s plan totriple capacity on its Trans Mountain system to Vancouverand Washington state.

Ellis Ross, chief councillor of the Haisla Nation in theKitimat area, said mitigation will not satisfy the concernsabove remediation in the event of an oil spill.

“We’ve already seen what happened in Prince WilliamSound” where the Exxon Valdez hit an undersea reef in1989, dumping about 260,000 barrels of crude into theocean.

“You cannot remediate an oil spill if it happens in a saltwater environment,” he said.

CAPP understandsDave Collyer, president of CAPP, told the Globe and

Mail his organization understands both the nuance and theneed to move quickly.

He said a recent report by Douglas Eyford, who wasappointed by Harper to gather First Nations’ views onresource development, presents some workable approachesfor fostering inclusion of Native people in economic devel-opment.

“A lot of it is founded on relationships and trust and thathas to be built over a period of time. One can certainly takethe view that the foundation is not where we’d like it to beat the moment,” Collyer said.

“But I think it really does come down to the right people— government and industry and importantly First Nations— trying to see if there is a pragmatic way through this.”

Those looking for positives can find shreds in the LNGsector where the Haisla Nation is positioned to share own-ership of the BC LNG Co-operative, the smallest of theprovince’s projects, while the Fort McKay First Nation inAlberta has profited from business partnerships in the oilsands.

Ross views the BC LNG deal as the first stepping stoneto advance the Haisla from a depressed economy to perma-nent, skilled jobs, such as pipefitters, electricians and mill-wrights, in the Shell and Chevron LNG projects and therestructuring of the Rio Tinto aluminum smelter in theKitimat area.

To that end he has organized an employment summit ofFirst Nations, training institutes, governments, industriesand labor unions to ensure the opportunities do not passwithout long-term benefits.

He may have spoken for more than just the Haisla andprovided industries with their best chance of closing thegulf with First Nations.

“If we don’t get enough people trained for jobs, thecompanies are going to have no choice but to look out-side the region, outside the province and outside thecountry. We need a bigger strategy,” Ross said. l

l G O V E R N M E N T

Seeking a social licenseCanadian government, pipeline companies, LNG proponents short on time to sell megaproject economic benefits to aboriginal communities

The university survey, which canvassed theviews of 300 Natives, showed 30 percent have“zero” trust in oil and gas companies, energyexecutives and the Canadian Association of

Petroleum Producers, CAPP.

6 PETROLEUM NEWS • WEEK OF JANUARY 5, 2014

Alaska’sOil and GasConsultants

GeoscienceEngineeringProject ManagementSeismic and Well Data

3601 C Street, Suite 1424Anchorage, AK 99503

(907) 272-1232(907) 272-1344

Alaska’s Premier Motorola DealerProviding Alaskans with two way radio and wireless communications.

The future of two-way radio.

NORTH SLOPETELECOM, INC.

907.751.8200 | www.nstiak.com

MOTOTRBOTM PROFESSIONALDIGITAL TWO-WAYRADIO SYSTEM.

l N A T U R A L G A S

Parnell seeks toadvance gas project

By BECKY BOHRERAssociated Press

Gov. Sean Parnell’s administration islooking to get out from under a 2007

law as it seeks to further advance a majornatural gas pipeline project in Alaska.

Specifics on how that might happen,though, have yet to be decided, NaturalResources Commissioner Joe Balash said inmid-December.

The law, known asthe Alaska GaslineInducement Act, wasaimed at encouragingconstruction of apipeline to moveNorth Slope gas tomarket.

C a n a d a - b a s e dTransCanada Corp., apipeline company, won an exclusive licenseto pursue it in 2008, with the state promis-ing up to $500 million to cover reim-bursable expenses. ExxonMobil Corp. laterjoined TransCanada’s effort.

Significant changesSince then, the project has changed sig-

nificantly. It’s no longer focused on a linethat would extend into Canada and serveNorth America markets but rather on a liq-uefied natural gas project — supported bythe North Slope’s three major players,ExxonMobil, BP and ConocoPhillips —that would allow for exports to Asia.

ConocoPhillips and BP opposed provi-sions of the 2007 law and pursued a rivalline of their own before ditching it in 2011and ultimately joining TransCanada andExxonMobil in pursuing the liquefied natu-ral gas option.

AGIA office eliminatedParnell’s budget plan for next year would

eliminate the state’s Alaska GaslineInducement Act office, which is responsiblefor license monitoring and compliance. Thebudget plan says gas commercializationefforts are expected to transition out ofAGIA by the start of the next fiscal year,July 1.

Balash said the hope is that getting outfrom under AGIA will allow more freedomfor the state and companies to come toterms on advancing a line.

He said the AGIA license contemplates aproject sponsor — one — in this case,TransCanada. But he said the project nowbeing pursued is more akin to a joint ven-ture. With a joint venture, he said the licenseholder can only be responsible for its ownactions.

“The AGIA license isn’t really built well— the specific statutory framework — for ajoint venture,” he said. “And so we expect totransition away from that.”

What shape that takes remains to be seenand depends on the type of progress thecompanies make, he said.

Options for withdrawalBalash said the parties could mutually

agree to move away from AGIA or one ofthem could declare the project uneconomic,which he called a sort of “brute forcemethod.” That could lead to arbitration or, ifthe other side agrees, effectively killing thelicense.

Balash estimated costs and reimburse-ments to TransCanada at about $280 millionor so, so far.

The federal coordinator for Alaska gaspipeline projects, Larry Persily, said theadministration putting its effort intoaddressing fiscal terms seems more impor-tant to the overall project than fighting overthe remaining reimbursable costs, whichcould happen in arbitration.

A TransCanada spokesman said byemail only that his company continues towork with the oil companies and state toadvance the project.

The administration has floated the ideaof taking a multibillion-dollar equity stakein the project as a way to protect its interestsand help make the long-hoped-for project areality. And Parnell has said he wants to see“demonstrable progress” on a line beforeintroducing any gas-tax legislation.

“Ultimately what we’re looking for aresome key terms that drive tariffs lowerand result in higher royalty values andproduction tax values,” Balash said. l

Parnell’s budget plan for next yearwould eliminate the state’s Alaska

Gasline Inducement Act office,which is responsible for license

monitoring and compliance.

GOV. SEAN PARNELL

FINANCE & ECONOMYParker denies hiring discrimination

Parker Drilling Co. is asking a court to throw out a lawsuit alleging it discrim-inated against a vision-impaired job applicant in Alaska.

In September, the Equal Employment Opportunity Commission sued the com-pany in Alaska federal court on behalf ofKevin McDowell.

The EEOC is an agency that enforcesthe Americans with Disabilities Act.

The suit said Parker discriminatedagainst McDowell in 2010 when it failedto hire him for a toolpusher positionbecause of his disability — blindness inhis left eye.

“Mr. McDowell is qualified for theposition as he had previously performed all of the essential functions of similarjobs successfully and without any accommodation,” the suit said.

In an answer to the suit, lawyers for Parker deny the allegation that the compa-ny discriminated against McDowell.

The company says McDowell applied for a “driller” position, submitted to aphysical exam, and was deemed “not to be medically qualified for the position.”

Parker is asking the court to dismiss the case.—WESLEY LOY

Enstar still wants customer switch noticeEnstar Natural Gas Co. has refiled for tariff revisions that could hamper the

ability of direct gas marketers to compete for commercial customers.Enstar originally filed for the tariff revisions in late November, but the

Regulatory Commission of Alaska rejected the filing for technical reasons.The agency invited Enstar to reorganize and resubmit its filing, and the com-

pany did so on Dec. 19.Enstar is the main gas utility serving the greater Anchorage area.The company is asking the RCA to approve a requirement for commercial cus-

tomers to provide at least a year’s notice when switching from Enstar to a directgas marketer, or vice versa.

Enstar says the “unpredictable coming and going” of customers can harm allEnstar customers in the form of higher gas prices.

The one-year notice, however, could draw formal opposition from alternativesuppliers using Enstar’s distribution system.

One local gas producer, Cook Inlet Energy LLC, has said it aims to market gasdirectly to commercial customers for space heating.

—WESLEY LOY

NATURAL GAS

The suit said Parkerdiscriminated against McDowell

in 2010 when it failed to hirehim for a toolpusher positionbecause of his disability —

blindness in his left eye.

By ERIC LIDJIFor Petroleum News

Flint Hills Resources Alaska LLC is asking federalregulators to reconsider their decision to dismiss a

complaint about the quality bank formula on the trans-Alaska oil pipeline.

The Federal Energy Regulatory Commission recentlydismissed the complaint, saying Flint Hills missed astatute of limitations. The refiner believes its complaintwas timely.

The FERC decision started counting a two-year statueof limitations from when Flint Hills discovered an allegeddiscrepancy in the quality bank methodology. Flint Hillsbelieves each payment under the methodology should insome sense start the clock over.

Flint Hills filed the complaint against BP Pipelines(Alaska) Inc., ConocoPhillips Transportation Alaska Inc.and ExxonMobil Pipeline Co., the three owners of the800-mile pipeline from the North Slope to Valdez. BPasked FERC to uphold its ruling.

The quality bank is a system for compensating oil pro-

ducers for the varying qualities of crude oil shippedthrough the pipeline. Producers shipping oil valued belowthe pipeline average pay into the bank to compensate pro-ducers shipping oil valued above the average. The systemis currently based on the value of seven petroleum by-products.

Investigation under wayThe spat about the complaint comes amid a larger

investigation into the quality bank.When FERC dismissed the Flint Hills complaint, it

also launched a separate investigation into the mattersraised in the complaint. Specifically, the investigation willconsider whether the quality bank methodology underval-ues Resid, or the residual product that is left behind afterall the lighter petroleum products have been distilled fromcrude oil.

The investigation is in the discovery phase. FERCAdministrative Law Judge H. Peter Young has scheduleda hearing for February 2014 and a decision by early May.

The quality bank has often been a source of contention.A 1984 methodology used gravity to determine the

value of oil, but some shippers believed increasing natu-ral gas liquids deliveries were throwing off this measure-ment.

A 1993 ruling established the current method of deter-mining value based on distillation, but a lawsuit over thepast decade challenged the ruling, particularly in regardsto Resid.

The current methodology determines the value ofResid based on coking, which splits the product intoasphalt and a lighter fuel. Each of those products is valuedseparately.

The Flint Hills complaint argued that since 2009 thepublished price of Alaska North Slope crude oil has beenhigher than the combined value of the products extractedfrom the stream. Flint Hills blames the valuation of Residfor this apparent discrepancy.

Flint Hills also brought the matter before state regula-tors, but the Regulatory Commission of Alaska is wait-ing until Jan. 15, 2014, to decide whether it will hear thecase. l

PETROLEUM NEWS • WEEK OF JANUARY 5, 2014 7

www.lynden.com 1-888-596-3361

At Lynden, we understand that plans change but deadlines don’t. That’s why we proudly offer our exclusive

Dynamic Routing system. Designed to work around your unique requirements, Dynamic Routing allows you

to choose the mode of transportation — air, sea or land — to control the speed of your deliveries so they

arrive just as they are needed. With Lynden, you only pay for the speed you need!

Only pay for the speed you need... Dynamic Routing!SM

l P I P E L I N E S & D O W N S T R E A M

Flint Hills still challenging ResidDespite a FERC investigation into the Quality Bank methodology, the refiner wants its original complaint to be reheard

GOVERNMENTEPA terminatesShell’s drillingair permits

The Environmental ProtectionAgency, or EPA, has terminated the airpermits for Shell’s use of the NobleDiscoverer drillship and the floatingdrilling platform, the Kulluk, forexploratory drilling in Alaska’sChukchi and Beaufort seas. With theBureau of Ocean EnergyManagement, or BOEM, taking overArctic outer continental shelf air per-mitting from EPA, Shell had notifiedEPA of its intent to obtain air emis-sions authorizations from BOEM andhad requested EPA to terminate thepermits. EPA has agreed to thatrequest.

Shell is in the process of seekingauthorization from BOEM for emis-sions from the Noble Discoverer fordrilling in the Chukchi Sea. Ratherthan approving an air emissions per-mit, BOEM will review the emissionsas part of the approval process for arevised Chukchi Sea exploration planthat Shell has submitted to the agency.That plan contains comprehensiveestimates of air emissions from Shell’sproposed Chukchi Sea activities.

In addition, Noble Drilling Inc., onbehalf of Shell, has made some sub-stantive modifications to the NobleDiscoverer since EPA issued the airpermit for the vessel. EPA says that theair permit is no longer consistent withShell’s planned future explorationactivities. But, with EPA no longerhaving the authority to issue air per-mits for the Chukchi Sea, the agencycannot issue a revised permit, thusmaking permit cancellation the appro-priate action to take, the agency says.

And, with the agency not havingthe authority to take permitting actionswith respect to the Kulluk, followingpermit compliance issues and ground-ing-related damage associated withthat vessel, EPA says that it is alsoappropriate to cancel the Kulluk per-mit.

—ALAN BAILEY

By KRISTEN NELSONPetroleum News

A changed forecast for the price ofAlaska North Slope crude oil is the

most “influential contributor” to changesin forecast unrestricted revenue betweenits spring and fall forecasts, the AlaskaDepartment of Revenue said in its Fall2013 Revenue Sources Book.

“The future price of crude oil is themost sensitive variable in the revenueforecast and is also the most prone touncertainty,” the department said.

The spring 2013 forecast had pegged

the Alaska North Slope crude oil price at$109.61 per barrel for the current fiscalyear, FY 2014, which ends June 30. Butthe fall forecast, issued in December,reduced the ANS forecast for FY ’14 to$105.68, which the department said wasless than the forecast for the last severalyears.

How is the price forecast?The department said in the Revenue

Sources Book, or RSB, that by regulationit uses several different reporting andassessment services to estimate the “pre-vailing value” for ANS crude oil. There isno spot market for ANS crude oil and it is

not traded on an exchange, so it isassessed “based on purchases of crude oilin the West Coast markets, where it is soldprimarily to Washington State andCalifornia refiners,” the department said.

In fiscal year 2013 the average prevail-ing value was $107.57 per barrel.

Change in valuationANS crude oil was formerly valued

against West Texas Intermediate, thedepartment said, but “since the WTIbenchmark has decoupled from ANS andother crude markers,” ANS is now morecomparable to waterborne crude oil such

as Brent. Since 2012, the department has fore-

cast the ANS crude oil price directly,rather than forecasting WTI and then cre-ating an ANS-WTI differential.

For the fall 2013 ANS price forecastthe department “considered various oilprice forecasts of WTI and Brent oil …and relied on a panel of experts in deter-mining the price path expectations forANS.”

Short-term variablesThe department said several short-term

variables influence oil prices, including:inventory levels; infrastructure; geopoli-tics; natural disasters; warfare; action byOPEC, the Organization of the PetroleumExporting Countries; and financial markettrends and speculation.

These factors have all influenced theprice of oil over the last 10 years.

“Without knowledge of when and ifthese events will occur, it is not possible toforecast a particular path for oil priceswith any certainty. Furthermore, the sys-tem is dynamic and the impact of the sameevent can bring about different outcomesat different times,” the department said.

In the longer term the oil price is driv-en by supply and demand.

“Ultimately,” the department said,“predicting future price requires an under-standing of demand growth and the avail-able future supply of petroleum products.”

Forecasting methodologyThe department uses a day-long price

forecasting session held in early Octoberwith participants from state government,the private sector and academia. In 2013there were 39 participants, each of whomwas asked to forecast the price of ANScrude oil at the end of the session. The

8 PETROLEUM NEWS • WEEK OF JANUARY 5, 2014

l E X P L O R A T I O N & P R O D U C T I O N

Using a compass to steer a drill bitThe critical importance of accurately steering a directional drilling operation places high demands on magnetic field measurement

By ALAN BAILEYPetroleum News

The use of the Earth’s magnetic field to make direc-tional measurements, a technique that goes back

many centuries in the form of the magnetic compass,remains a key to precisely steering a drill bit throughsubsurface rock strata during oil well drilling, accordingto an article in the fall 2013 issue of Oilfield Review.

But, given the high level of accuracy required todirect a well through thousands of feet of the subsurfaceand thread the well through thin layers of oil bearingrock, the space-age compass technology for drilling hasorders of magnitude greater precision than the type ofdevice used by, say, a hiker navigating a backcountrytrail. And, at the levels of precision required for drilling,it becomes essential to take into account small-scale andsometimes fleeting variations in the Earth’s magneticfield, resulting from factors such as magnetic stormscaused by disturbances in the solar wind, the flow ofatomic particles from the sun.

Deadhorse observatoryCarol Finn, co-author of the Oilfield Review article

and leader of the U.S. Geological Survey GeomagnetismGroup, explained that at high latitudes, such as in north-ern Alaska, the Earth’s geomagnetic field can be partic-

ularly active and can change quite rapidly. On the NorthSlope a partnership between the U.S. Geological Survey,or USGS, and oil services company Schlumberger oper-ates a geomagnetic observatory at Deadhorse, continu-ously providing precise information about the local mag-netic field to drillers on the Slope. The Deadhorse obser-vatory is one of a network of 14 similar USGS observa-tories in the United States and its territories.

“Drill-bit positioning requires directional accuracy ofa fraction of a degree, and this can be accomplished withadvanced technology and expert understanding of theEarth’s dynamic magnetic field,” Finn said. “USGS oper-ational systems measure the magnetic field on a contin-uous basis. These data are provided as a service toresearch scientists, civilian and defense governmentagencies, and to customers in the private sector, includ-ing the oil and gas drilling industry.”

Precision magnetometersModern directional drilling commonly uses a tech-

nique called measurement while drilling, or MWD, toprovide a continuous flow of information from near thedrill bit to the drilling team at the surface. According tothe Oilfield Review article, directional information forthe well generally comes from a high-precision instru-ment called a magnetometer that acts as a compass,measuring the orientation of the downhole tool assembly

relative to the local magnetic field. The magnetometertypically works in conjunction with a device for measur-ing the local gravitational field, the Oilfield Review arti-cle says. There are several different designs of magne-tometer: One design, for example, uses the tendency ofatomic nuclei with a magnetic spin to orient along thedominant magnetic field, the article says.

As with a compass used by a hiker, a user of a down-hole magnetometer must adjust directional measure-ments to allow for the slowly changing deviationbetween the Earth’s magnetic north and true north. But adriller must also accommodate the local geomagneticeffects resulting from the local geology and possiblyfrom the effect of magnetic materials in nearby oil wells.The driller must also calibrate the magnetometer read-ings to allow for the magnetic properties of the drillstring and bottom hole drilling equipment. And thenthere are those relatively rapid fluctuations in the mag-netic field that are reported by the geomagnetic observa-tory — on the North Slope, disturbance to the magneticfield from a magnetic storm can cause short term varia-tions of several degrees in the magnetic declination, aswell as significant changes in the strength of the mag-netic field, the Oilfield Review article says. l

l F I N A N C E & E C O N O M Y

Crude oil price most sensitive variableDepartment of Revenue price forecast group finds FY 2014 consensus in $100-$110 per barrel range, but not for FY 2015 and beyond

see CRUDE PRICE page 9

By WESLEY LOYFor Petroleum News

The U.S. Energy InformationAdministration has updated its state

energy profile for Alaska.The profile provides a concise

overview of the state’s energy resourcesand consumption, and features handytools to compare Alaska with other states.

What’s more, the profile offers anassortment of fun facts.

Did you know Alaska has 212 stationsthat sell motor gasoline?

Or that 3,146 alternative-fuel vehicleswere in use in the state as of 2011?

Or that Alaska’s energy demand perperson is almost three times higher thanthe U.S. average?

Find the profile at www.eia.gov/state.

Staying abreast of trendsThe Energy Information

Administration, or EIA, is the statisticaland analytical agency within the U.S.Department of Energy.

EIA said the energy sectors in eachstate are changing rapidly with increasedoil and gas production, new renewableelectricity generation and shifting fuelprices. With these trends in mind, theagency has updated its energy profiles forall 50 states, the District of Columbia andfive U.S. territories.

Users can find details on energy pro-duction, consumption and prices, plusstate rankings for key energy statistics.

EIA’s state energy portal also offersusers a multilayer mapping function toshow views of fossil and renewable ener-gy resources, oil refineries, pipelines,power plants, transmission lines and otherenergy infrastructure.

No. 2 for crudeThe Alaska energy profile states what

most locals already know: “The oil andgas industry dominates Alaska’s econo-my.”

It goes on, however, to frame theindustry’s importance in ways you mightnot have imagined.

“Based on the value of the major oiland gas reserves found in Alaska’s NorthSlope and Cook Inlet basins, and the roy-alties paid on that production, the UnitedStates has earned back many times morethan the $7.2 million it paid Russia forAlaska in 1867. The North Slope containsmore than a dozen of the 100 largest oilfields in the United States and several ofthe 100 largest natural gas fields. ItsPrudhoe Bay field is the largest oil fieldin the country, although production hasfallen to less than 300,000 barrels per dayfrom its peak of 1.6 million barrels perday in 1988.”

When federal offshore areas areexcluded, Alaska’s crude oil production ofabout 600,000 barrels per day in 2011ranked second among the states, afterTexas, the EIA says.

As for natural gas, Alaska is the sec-ond-leading producer in terms of grosswithdrawals. But most of the state’s pro-duction doesn’t go to market, as volumesfar exceed local demand and no pipelineexists to move the enormous North Slopereserves.

Large volumes of gas are extractedduring oil production on the Slope. Mostof the gas is injected back undergroundwhere it serves a useful purpose in pro-viding reservoir pressure, which helpsmaintain oil production rates.

“Thus far, it has not been consideredcommercially feasible to build a pipelinelinking natural gas produced in Alaska’sNorth Slope with markets in the Lower 48states, especially with natural gas pricesdeclining in recent years,” the EIA profilesays.

More energy factsThe energy profile offers lots of other

facts that set Alaska apart from otherstates.

Until 2012, Alaska had the only termi-nal in the United States authorized toexport liquefied natural gas.ConocoPhillips, the operator of the CookInlet facility, in December applied to theDepartment of Energy to resume theLNG exports.

Alaska has a great deal of coal, butonly one operating surface coal mine, theUsibelli mine in the Interior.

Unlike most other states, Alaska is notconnected to the nation’s electricity grid.The state has its own internal grid thatlinks the more populated areas fromFairbanks to south of Anchorage.

Natural gas accounts for just over halfof Alaska’s electricity generation. Thestate also has more than 50 hydroelectricpower plants. Many remote villages burndiesel to make power.

In 2012, Alaska was one of only eightstates generating some electricity fromgeothermal sources.

Alaska has no nuclear power plants.In terms of natural gas prices,

Alaskans apparently have a good deal. InSeptember, Alaska had a residential rateof $9.03 per thousand cubic feet com-pared to the national average of $15.65,the EIA reports. l

PETROLEUM NEWS • WEEK OF JANUARY 5, 2014 9

Providing Clients

The Advantage

One Mile at a Time

department said it used the medianprice for each time period for its fall2013 forecast.

There was consensus at theOctober forecasting session that theaverage ANS price for FY 2014would be in the $100 to $110 per bar-rel range, the department said, but“there was lack of consensus amongoil price forecasts in the long term.”

Some experts believe the oil pricewill rise, but the department saidthere isn’t widespread support ofmuch higher prices, but a view thatmuch higher prices would make newresources economic and result in fuelswitching.

The department said that in thefuture it “plans to incorporate proba-bility and statistical confidence in itsprice forecast.” l

continued from page 8

CRUDE PRICES

l E X P L O R A T I O N & P R O D U C T I O N

A power tool for teachers, researchersU.S. Energy Information Administration packs facts into updated energy profile of Alaska; state remains a top-tier oil producer

Safety Quality Experience Leadership Resources

A Doyon Limited and Anvil Corpora on Joint Venture

Oil & Gas Services in Alaska and the Lower 48Upstream | Midstream | Downstream

Anchorage, AK doyonanvil.com 907.276.2747

turning on the lights and burning fire-wood, doesn’t care who does it or whogets it done. He just wants it (naturalgas) here. You know we have beenchurning this forever. Every time youturn around and there are more peoplewho express interest in doing something.There’s always a but ... ‘I need some-thing.’

One of the things they need is a com-mitment to have the gas here. If you had

the commitment to have the gas here,then everything else would fall intoplace; the gas would come here. Youhave to have the customer, but the cus-tomer has to have the ability of the gas.It’s been an ongoing dog-and-ponyshow. Now that you’ve got IGU, theywill figure out exactly how much theycan use, how much the citizens ofAlaska can use. If the state can coordi-nate things well, whether it’s gas storageor a facility on the North Slope, thepublic doesn’t care. They just want ithere. It’s been a long time coming.There have been a lot of forecasts that

have been on the horizon for manyyears, saying that we need to get it here,not just the Interior.

If you look at the economy for therest of the state outside the Railbelt —Fairbanks is suffering considerably —but if you look out at all of the commu-nities off the road system, some ofwhich I now represent, they are strug-gling, they are struggling really bad.

Look at Nome. They are havingproblems keeping police officers inNome because of the high cost ofeverything. You talk about keeping peo-ple at home and building a vibrant com-munity, that doesn’t mean the Railbelt.It means the whole state. Those commu-nities outside from here in the Interiorto the coast, it’s really problematic. Howcan we build an economy? How can webuild a state? We lose jobs. People can’tafford to stay there.

I always feel strongly about ourfounding fathers and what Congresssaw at the time. The state was toosprawled, too diverse, too spread out inorder to sustain an economy so theygave us subsurface rights. Before it wasoil and gas, it was fish, timber, miningand fur. They said take this and build astate. We need to do a better job ofdoing that.

Petroleum News: Still on natural gas,there has been interim movement on theLNG, large-diameter line. One is therecommendation from a consultant thatthe state have an equity interest in anLNG line. The other is a migration awayfrom AGIA. Let’s take the first one. Whatare your thoughts on an equity stake?

Guttenberg: I love an equity interestin a gas line because it puts us at thetable when they are talking about costsand projects and delivering something.At the end of the day, we need to makesure that it works for Alaskans.

Look at what would have happened ifwe had an equity stake in TAPS. I thinka lot of these things would have beendifferent. Personally, I think we wouldhave cheaper oil and gas prices here inthis state because of that. The problemwith the equity is the risk. You’ve gotrewards; you’ve got the risks.

I think the state has a lot of equityinto the system right now. If we put allof our resources on the table and addedthem up, it would be considerable. Iknow they (producers) put billions ofdollars into development into projects.

The state also has $500 million commit-ted for TransCanada, the reimbursables.That’s a commitment. Look at all of thework of our employees for permitting.

The problem is, everybody loves theupside, but the risk and the downsidethat’s considerable also. The state has anobligation to itself — and personally Idon’t think we’ve done to maximizeupside and minimize the loss, which iswhat everybody else does.

If we go into an equity situation thatwe are not as nimble on our feet as therest of the industry is, and they will setus up to take a fall if things go bad.That’s what you do with a weak partner.This is a cutthroat business. I thinkthat’s the way the industry sees thestate.

We need to be very, very careful. Ilove the concept of being an equitypartner. It’s the downside — price ofgas dropping, cost overruns, changes inthe market — all of those things matter.The state needs to be very concerned ofthose downsides. You’ve got to act likea responsible partner. The industry seesthe state as a weak partner and they willdo their best to put most of the burdenof the downsides on us. That’s what theydo now on the oil side of the equation.That’s capitalism. That’s how you dothese partnerships. You try to minimizeyour downside and maximize yourupside. The state hasn’t been very goodat that.

Petroleum News: The prospects ofmoving further away from AGIA. Is thata policy call or a reflection of the dras-tic change in the market?

Guttenberg: TransCanada’s TonyPalmer said after they got the contractthere will be no gas line until Exxon ispart of a gas line project. When Exxondecides there is a gas line project, BPwill decide and Conoco will decide thatit’s time to start moving gas. The privatesector could have come and built one ifthey like and do it without AGIA. AGIAwas not the only avenue to build a gasline and get gas to market.

What you are seeing is when they allmove together — and apparently theyare and they are doing it quietly — butthere is enough noise out there for theobservers of the process to say some-thing is happening and that it’s time.

AGIA was an attempt to get thingsgoing. That’s why I supported it. Thestate needs to kick start something.AGIA was a competitive bid.TransCanada was not an exclusive bid.Outside of AGIA, you could alwayshave built something. It’s evolving.

Petroleum News: What would youlike to see next from the executivebranch or the Legislature as the sessionapproaches, or is there nothing that canbe done and it’s up to the industry tomake the next move?

Guttenberg: I think we are going tohave to set up gas taxes. I think we aregoing to have to separate oil from gastaxes. I think that’s something they aregoing to want. But I don’t think there isan urgent need for that because theyhaven’t made the commitment down theroad to start doing something. When wetalked with the consultants, there is a

10 PETROLEUM NEWS • WEEK OF JANUARY 5, 2014

• Catering and Cleaning Services•Equipment Rental

Kenai, Alaska | (907) [email protected]

www.fivestaroilfieldservices.com

WORK IS BETTER WHEN YOU’RE FED GOOD.

continued from page 4

GUTTENBERG Q&A

see GUTTENBERG Q&A page 11

EXPLORATION & PRODUCTIONAOGCC OKs field contractions, expansions

The Alaska Oil and Gas Conservation Commission has approved contractionsin two oil pools at the Prudhoe Bay unit on the North Slope, with the contractionareas — plus additional acreage — added to a third oil pool. The approvals, datedDec. 18, are for contractions of the West Beach and Niakuk oil pools and expan-sions of the Point McIntyre oil pool.

Prudhoe Bay unit operator BP Exploration (Alaska) Inc. told the commissionin a Sept. 19 letter that BP, as unit operator, had received approval from the AlaskaDepartment of Natural Resources for corresponding changes in the participatingareas.

The expansion request for the Point McIntyre pool was “based on new wellinformation and new seismic interpretation that extends the field limits based onthe area capable of contributing to production,” BP said. There are two PointMcIntyre expansion areas — one of the north and one to the southeast — with thenorthern expansion the larger at some 2,588 acres and the southeast expansion at560 acres.

The southeast expansion area at Point McIntyre includes contractions from thewestern edge of the Niakuk oil pool (320 acres) and the northern edge of the WestBeach pool (240 acres).

In its orders the commission said the West Beach oil pool was discovered in1976 and regular oil production began in April 1993 and continued through July2001. Small amounts of oil have been produced since, with the last reported WestBeach production in 2009.

First test of the Niakuk oil pool was in April 1985; regular production began in1994 and is ongoing.

Point McIntyre was discovered in 1988; regular oil production began in 1993and is ongoing.

—KRISTEN NELSON

“We compare ourselves to NorthDakota. We are cursing somebody

else’s success. Those are newtechnologies in North Dakota, not

the same old drillingtechnologies.”

—Rep. David Guttenberg, D-Fairbanks

timeline when all of these things needto be done. I think we have to under-stand gas taxes better than we do oiltaxes because we don’t understand oiltaxes very well, either. We had a push afew years ago of separating oil from gastaxes and we need to have stronger dia-logue about that. We need to keep theinfrastructure in place. If they are com-ing down to Cook Inlet, then is thatwhat do we need to do to make surethose things happen? Those things canbe part of an equity share also.

I’ve been sitting and listening tothese guys for a decade. What you needto do is listen to the things they are say-ing that is different or letting loose out-side the normal parameters. Those arethe things we need to pay attention to.

Petroleum News: Could advancing alarge-diameter line interfere with theshort-term solutions you folks are push-ing throughout the Interior?

Guttenberg: Not at all. The timelinesare completely different. One of the bigthings the Interior needs to do is buildout a distribution system. That’s whatIGU is for. The timeline for a large-diameter gas line is years away — adecade away, possibly more. Once youhave a distribution system in place, thenyou have to have price. You have tohave competition. You have to bring thegas into town. The distribution is a keypart of the component. It doesn’t inter-fere with trucking or the large-diameterline or anything else. You still have tohave the distribution system.

Petroleum News: On to oil taxes,which remains a hot-button issuebecause of the referendum. What areyour thoughts on the referendum andhow this might drive an industryresponse?

Guttenberg: Well, this is part of theworld of listening to industry and whatthey say. All of the sudden there areprojects going on. What’s significant isyou hear the same old talking points.The state has not done a great job onunderstanding the nature of oil and gas.The things I heard during the passage ofSB 21 were not all relevant to what weshould be doing. They were talkingpoints from the industry. They didn’tlike people asking questions.

We still don’t understand how thisthing works. We don’t have access towhat’s going on. I think the industrydoes a really good job of maximizingtheir profits. We are so far behind onour audits. We don’t understand the ris-ing costs of operations and maintenancethat are being deducted. I think the ref-erendum is a good thing.

The opposition I’m hearing from hasjust talking points and has little to dowith what actually happened with thedecision-making process. Over and overagain we heard the industry come inwith one thing and the consultants comein with another thing and in the end, weknow the tax structure is just a smallpart of it. The best place for the indus-try to increase their profit is by takingmore money from the state.

They are admitting it. Going back tothe constitution and the foundingfathers who built this state, we are obli-gated by the constitution of gettingmaximum benefit for our people, andwe are giving that away. That’s a majorconcern for me. SB 21 was designed tocut the budget by decreasing taxes, nomatter what else they say. We know it’snot going to increase production. We

know it’s not going to slow down thedecline. The industry knew that 30years ago. They are manipulating theprocess and political environment tomaximize their return from the state.That’s their job. The state is not defend-ing itself. The state is not standing upfor Alaska. That’s their job.

Petroleum News: One of the argu-ments for the change is that during thehigh-price climate Alaska missed out onthe kind of investment other regions sawand that was because of ACES. Whatare your thoughts on that?

Guttenberg: That’s poppycock. Wecompare ourselves to North Dakota. Weare cursing somebody else’s success.Those are new technologies in NorthDakota, not the same old drilling tech-nologies. When you look at the flowcurve of production, (the industry)knew about this during ELF (PPT pred-ecessor, Economic Limit Factor). Theyweren’t reinvesting then. They weren’tputting up millions of dollars to makeup for the loss. They were payingalmost nothing in taxes. They weren’treinvesting here.

That’s why they could reinvest inother places. They were taking the prof-its they were making in Alaska and put-ting them in other places. Alaska hasalways been a cash cow. They havealways taken money from Alaska andput them in other places where the mar-gins might be different, there might bean economic environment where theyhave a smaller window for, and it meansmore dividends for their shareholders.They argument doesn’t bear out. Evenback then, the production curve wasdoing down. They weren’t investingmoney back then. They weren’t payinganything in taxes; they took money andput it in other places. Now they are cry-ing wolf. I’m sorry. It’s crocodile tearsto me. I worked on the North Slope.Those jobs are critical to Alaska. Iwould do a lot to make sure we havethose jobs. But cutting the state budgetby $2 billion is what the state wanted.They wanted to cut taxes and decreasethe size of government. They shouldhave taken that money and put it intothe Permanent Fund if they wanted todo that and do something that is muchmore productive for the state.

If you take the Norway model — it’ssomething we would never do — itmeans taking control of its resourcesand the industry becomes your partner.We become the CEO of all of our stateresources. That’s something that would-n’t be acceptable to a lot of people. Ithink we need to use some of thatmodel. It hasn’t worked for us to beabsent partners and sitting on the side-lines watching. The state doesn’t actlike a sovereign. These are ourresources. We need to stand up forAlaska. Now the industry sees us as avery weak partner. l

PETROLEUM NEWS • WEEK OF JANUARY 5, 2014 11

®Providing integrated environmental and engineering solutions for the oil and gas industry

continued from page 10

GUTTENBERG Q&A EXPLORATION & PRODUCTIONUS drilling rig count down by 11 to 1,757

Oilfield services company Baker Hughes Inc. says the number of rigs drillingfor oil and natural gas in the U.S. fell by 11 the week ending Dec. 27 to 1,757.

The Houston company said in its weekly report that 1,382 rigs were drilling foroil and 374 for gas. One was listed as miscellaneous. A year ago there were 1,763active rigs.

Of the major oil- and gas-producing states, Alaska gained two rigs andLouisiana and Pennsylvania each gained one.

Texas declined by 10 rigs, West Virginia was down by four and Oklahoma bytwo. Arkansas, California, Colorado, Kansas, New Mexico, North Dakota, Ohio,Utah and Wyoming were unchanged.

The U.S. rig count peaked at 4,530 in 1981 and bottomed at 488 in 1999.— ASSOCIATED PRESS

Crowley consolidates liner and logistics teamsCrowley Maritime Corp.’s Panama

liner and logistics teams have relo-cated to a new, shared location inthe heart of the country’s capital,just minutes from Panama City’smajor highways, airport and seaport.The facility offers triple the ware-house and distribution space andmakes Crowley the first bonded facil-ity in the heart of the capital city,and the only company with the abili-ty to serve both bonded and nation-alized cargo in the same warehouse.

Crowley customers now have access to a fully Customs-bonded, 25,300-square-foot ware-house with eight dock doors, increasing the company’s efficiency in receiving and deliveringcargo; a 38,426-square-foot container yard; and a business office staffed with knowledgeableCrowley representatives who can serve as a single point of contact for shippers and con-signees who are importing to and exporting from the country. The facility also offers dedicated

capacity for both bonded and non-bonded cargo, integrated communication and data inter-change systems, along with a permanent fire and security system. For more information visitwww.crowley.com.

CGG wins contract for PDO subsurface imaging centerCGG announced it has been awarded a further contract by Petroleum Development Oman

to provide seismic imaging services at its dedicated center in Muscat, Oman.CGG has been operating the PDO dedicated center since 1994 and the contract will run for

another four years from January 2014. The center provides the full range of subsurface imag-ing services for PDO’s onshore data and specializes in large, high-density wide-azimuth proj-ects. As part of this contract CGG will also expand its onsite training facilities and increase itssupport to Sultan Qaboos University.

Jean-Georges Malcor, chief executive officer of CGG, said: “CGG is delighted that PDO hasconfirmed its confidence in our advanced subsurface imaging technology, expertise and serviceexcellence by extending this contract on the eve of the dedicated center’s twentieth anniver-sary. Throughout this time we have consistently shown our commitment to developing thepeople and seismic industry of Oman and have transformed the traditional contractor-client

12 PETROLEUM NEWS • WEEK OF JANUARY 5, 2014

ADVERTISER PAGE AD APPEARS ADVERTISER PAGE AD APPEARS ADVERTISER PAGE AD APPEARS

Companies involved in Alaska and northern Canada’s oil and gas industry

All of the companies listed above advertise on a regular basis with Petroleum News

Oil Patch Bits

AAcuren USAAECOM EnvironmentAggreko LLCAir LiquideAircaft Rubber Mfg. (ARM-USA)Alaska Air CargoAlaska Analytical LaboratoryAlaska Dreams . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8Alaska Frontier ConstructorsAlaska Marine Lines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7Alaska Rubber Alaska Steel Co.Alaska TextilesAlaska West Express . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7All Pro AlaskaAlpha Seismic CompressorsAmerican Marine . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5Arctic ControlsArctic FoundationsArctic Slope Telephone Assoc. Co-op.Arctic Wire Rope & SupplyARCTOSArmstrongAspen HotelsASRC Energy ServicesAT&TAvalon Development

B-FBaker HughesBald Mountain Air ServiceBattelle AnchorageBombay DeluxeBrooks Range SupplyCalista Corp.Canadian Mat Systems (Alaska)Canrig Drilling TechnologyCarlile Transportation ServicesCCI Industrial Services LLCCGGCH2M HillClearSpan Fabric StructuresColville Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9Computing Alternatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2CONAM ConstructionConocoPhillips AlaskaConstruction Machinery IndustrialCook Inlet Energy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3Craig Taylor EquipmentCrowley SolutionsCruz ConstructionDelta LeasingDenali Industrial

Dowland-Bach Corp.Doyon Anvil . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9Doyon DrillingDoyon LTDDoyon Universal ServicesEgli Air Haul . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4Engineered Fire & SafetyEra AlaskaERA HelicoptersExpro Americas LLCExxonMobilF. Robert Bell and AssociatesFairweatherFive Star Oilfield Services . . . . . . . . . . . . . . . . . . . . . . . . . .10Flowline AlaskaFluorFoss MaritimeFugro

G-MGBR EquipmentGCI Industrial Telecom . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9Global Diving & SalvageGMW Fire ProtectionGolder AssociatesGreer Tank & WeldingGuess & Rudd, PCHawk Consultants . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13HDR AlaskaIFR WorkwearInspirationsIronclad Co.Jackovich Industrial & Construction SupplyJudy Patrick PhotographyKakivik Asset Management LLCKenworth Alaska . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11Kuukpik Arctic ServicesLast Frontier Air VenturesLister IndustriesLittle Red Services, Inc. (LRS) . . . . . . . . . . . . . . . . . . . . . . . .14Lounsbury & Associates . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5LW SurveyLynden Air Cargo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7Lynden Air Freight . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7Lynden Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7Lynden International . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7Lynden Logistics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7Lynden Transport . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7MagTec AlaskaMapmakers of AlaskaMAPPA TestlabMaritime HelicoptersM-I SwacoMotion Industries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13

N-PNabors Alaska DrillingNalcoNANA WorleyParsons . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15NASCO Industries Inc.Nature Conservancy, TheNEI Fluid TechnologyNordic CalistaNorth Slope Telecom . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6Northern Air CargoNorthern Electric Inc.Northrim BankNorthwest Technical ServicesOil & Gas SupplyOpti Staffing GroupPacWest Drilling SupplyPENCO . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5Pebble PartnershipPetroleum Equipment & ServicesPND Engineers Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11Polyguard ProductsPRA (Petrotechnical Resources of Alaska) . . . . . . . . . . . . . .6Price Gregory InternationalResource Development Council

Q-ZSAExplorationSecurity Aviation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .16Seekins FordShell Exploration & ProductionSophie Station SuitesSourdough Express Inc.STEELFAB . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10Stoel RivesTaiga VenturesTanks-A-LotTEAM Industrial Services . . . . . . . . . . . . . . . . . . . . . . . . . . . .4The Local PagesTire Distribution Systems (TDS)Total Safety U.S. Inc.TOTE-Totem Ocean Trailer ExpressTotem Equipment & SupplyTTT EnvironmentalUdelhoven Oilfield Systems ServicesUMIAQ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2Unique MachineUnivar USA URS AlaskaUsibelliVigor AlaskaWeston Solutions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11

CO

URT

ESY

CR

OW

LEY

see OIL PATCH BITS page 15

Drilling LLC, Buccaneer said it wouldstill be the rig operator once those salesare finalized, thus keeping a revenuesource.

The sales are designed help Buccaneerpay down previous debt, but the companyis also pursuing a series of loans, creditfacilities and rights issues totaling some$116.3 million, according to the compa-ny. If those financing agreements andboth sales are ultimately executed,Buccaneer said it “will have working cap-ital and will be essentially debt free.”

Cosmo minorityThe two sales are designed to free

Buccaneer from the responsibility ofowning assets in the Cook Inlet basin,while allowing the company to makemoney from those assets.

The Cosmopolitan deal keepsBuccaneer in place as rig operator.