July Wisconsin Professional Agent

-

Upload

professional-insurance-agents-of-wisconsin -

Category

Documents

-

view

224 -

download

0

description

Transcript of July Wisconsin Professional Agent

What’s Inside?

Convention Highlights ...........7

Meet the 2012 Board ..............16 Nominees

ISO Commercial ..................21 Property Changes

New CIC's ...........................25

2011-2012 Wisconsin ........... 27 Legislative Wrap-Up

Reduce Your E&O ...............32 Exposure

Classifieds ...........................34

YPC Scholarship Photos .....35

Coming Events ....................38

w w w . p i a w . o r g

p r o f e s s i o n a l a g e n t

Potawatomi State Park boat rental canoe dock — Sturgeon Bay

j u l y | 2 0 1 2

Milwaukee Branch: 855.495.1800 | Home Office: Des Moines, IA www.emcins.com

© Copyright Employers Mutual Casualty Company 2011 All rights reserved

I’m celebrating our 100th year by planning for our next 100 years.

Jason Bogart, CPCU, ARM, Vice President of Branch Operations

Our future will be marked by the relationships we forge with you—the independent insurance agents who represent us. You’re the reason we’ll continue to investigate new market opportunities. Why we’ll develop competitive products. Why we’ll maximize the use of new technologies. Why we’ll emphasize ongoing professional development for our staff. By helping you profitably and efficiently grow your agency, EMC Insurance Companies will continue to serve you and your customers today and in the future.

6914_EMC_AD_Jason_WiscProff 7.75x10.25.indd 1 1/12/12 3:48 PM

Thank you very much!

Al Breitenfeldt, CIC — President, PIA of Wisconsin

Wow, it’s hard to believe that my year as President of this awesome organization is almost over. By the time you read this the convention will be almost here and my year will be completed. It has been a pleasure to serve the PIA of Wisconsin and its members for the past year. I have had the pleasure of meeting many of our members and thank all of you for taking the time to say hello and give us some input on what you would like to see from your association. In the past year the organization has grown it membership base and made strides to provide additional exciting benefits for our members. With our new President Tracy, our association will continue to grow and strengthen. We are currently the third largest PIA association in the nation! You can be very proud of what that means on a National level.

I began my year with two themes that you may be tired of hearing but “no one can do everything but everyone can

do something.” We have accomplished a lot as your asso-ciation this year and by having more members participate in our various functions I truly believe that everyone has done something! Thank you very much for that.

A man named Lombardi once said “the achievements of an

organization are the direct result of the combined efforts

of each individual.” The PIA of Wisconsin is not able to achieve anything without you its members. While we get great leadership from Ron and support from our super

staff of Brenda, Becca, Darcy, Mandy and Heather, we can’t do anything without the support and input from you the members. Your elected board members Tracy, Jeff, LouAnn, Dennis K, Mary, Trey, Dennis R, Steve, Rick, Kori, and Brian

have done a super job of guiding this organization this year.

In addition the support we get from all of our company

partners allows us to do so much for our members at a very

affordable price. When you see your company people make

sure to take the time to thank them for their support.

I am not outlining the accomplishments from the last year;

you will have to attend the business meeting at the conven-

tion to get all those details. I hope to see you all at our 63rd

Annual Convention. It promises to be a fun and informa-

tion filled event. Please remember to collect those old cell

phones and bring them to the convention!

As I conclude my last few words I do wish to thank some

very special people that have made this year very special.

Ron, thank you very much for your support and advice not

only this year but for all you have done for our organization!

Members of the PIA staff, Brenda, Becca, Darcy, Mandy and

Heather, thanks for your dedication to your jobs! Members

of the Executive Committee and Board—thank you again so

much for your support this year and for your contributions

to our association and profession! It is truly over and above

the norm. Committee members and company partners—we

cannot do it without you. Thanks for your contributions!

Lastly all our members—thank you so much for all you do

not only for your industry but your communities! Thank

you all so much—“the achievement of this organization

are the direct result of the combined effort of all these

individuals!” Everyone did something! Thank you so

much, have a great month and see you at the convention!

From the President

JULY 12 3

GERMANTOWN MUTUAL INSURANCE COMPANY W209 N11845 Insurance Place PO Box 1020 Germantown, WI 53022-8220 Phone (262) 251-6680 Fax (262) 623-3130 www.gmic.comSERVING POLICYHOLDERS AND INDEPENDENT AGENTS IN WISCONSIN SINCE 1854

Ron Von Haden, CIC — Executive Vice President, PIA of Wisconsin

4 JULY 12

Certificates of Insurance

WE HAVE DISCUSSED AD NASEUM that agents cannot prepare false or misleading Certificates of Insurance. Even when badgered by lenders or customers, an agent (or anyone associated with an agent) who violates Wisconsin law runs the risk a fine and of losing their license if they intentionally prepare certificates that do not reflect exact policy provisions. Section 628.34 (1) (a) of the Wisconsin State Statutes stated:

“Conduct Forbidden. No person who is or should be licensed under chs. 600 to 646, no employee or agent of any such person, no person whose primary interest is as a competitor of a person licensed under chs, 600 to 646, and no person on behalf of any of the foregoing persons may make or cause to be made any communication relating to an insurance contract, the insurance business, any insurer, or any intermediary which contains false or misleading information, including information misleading because of incompleteness. Filing a report and, with intent to deceive a person examining it, making a false entry in a record or willfully refraining from making a proper entry, are “communications” within the meaning of this paragraph…. ”

The Commissioner of Insurance has made it very clear in previous bulletins to agents that they will be severely punished for violating this section of the law. The National Association of Insurance Commissioners, National Confer-ence of Insurance Legislators, State Legislatures and agent associations, including PIA National and PIAW, have been grappling with ways to strengthen and clarify the laws regarding Certificates, for the protection of agents. Some proposals and new laws have gone as far as imposing huge fines on someone who requests that an agent prepare a false or misleading Certificate. Some have made it a felony to

request or issue such a Certificate.

Here in Wisconsin, a simplified version of that clarification is now in place. Under 2011 Wisconsin Act 224, enacted April 6, 2012, chapter 628.34 (1) (a) was amended by a couple minor wording changes and more importantly, the addition of a sentence at the end of the section. The newly added sentence says:

“No intermediary may provide a misleading certificate of insurance.”

I understand the intent of the addition and maybe it will give agents something to provide to customers, bankers or other requestors to make them understand that an agent can’t simply type something on a certificate that is not included the policy. But it’s more like saying “we told you before that you really can’t do that and now we’re saying you really, really, really can’t do that.”

The bottom line…you couldn’t issue false or misleading certificates before and you can’t do it now. Enough said!

AGENCY VALUATION is always a concern when you are considering buying or selling an agency. It is a common question fielded at the association office. A new report may help you understand the process of valuation. Agency Consulting Group, a respected nationwide provider of information to the insurance industry, has a free report on their web site titled “The Standards & Guidelines For Appraising Insurance Agencies/Brokerages”, recently published by the American Association of Insurance Management Consultants. Go to www.agencyconsulting.com, then click on “Seminars” and scroll down to the title of the report.

AND REMEMBER…..Whatever your lot in life, build some-thing on it.

Memos from Madison

JULY 12 5

Dennis Kuhnke, CIC — Director, PIA of Wisconsin

Hello everyone. Since this is the last magazine article you will be reading from me, I wanted to somehow tie it in with my first article, The “Convention Virgin.” Like many other agents, for some reason I had never taken the time to attend our association’s main event of the year—the convention. When at last I did go, I was so impressed that I wrote an article on all of the positive things I observed.

Since then, of course, many conventions have come and gone but my appreciation of what they bring to our membership has only increased.

As with all conventions we’ll provide our fair share of fun for all with the fabulous Family Opening Party featuring the Rhythm Kings; President Al “Wally” Breitenfeldt will host a cocktail reception for all prior to our awards dinner. After dinner the fun continues with comedian Vic Henly.

If you are interested in a little boat ride (since we are on Lake Geneva) you can sign up for the US Mailboat ride and learn a little about the homes and history of the lake (a small additional cost is required).

Do you like to golf? The YPC along with Wisconsin Mutual and the Hanover Group will sponsor the 9th Annual YPC Scholarship Golf Outing on Wednesday August 1st. Last year the proceeds allowed PIA to give $15,000.00 in scholarships to young people who are interested in joining our industry!

We take care of business as well with our PIAW annual meeting to elect new board members and review our finances. We hold a CIC, CISR, CRM and CPIA conferment ceremony (proving once again we are the education association); we honor our Agent of the Year, Field Rep of the Year and present the Stony

Steinbach Achievement Award; we hold a President’s Panel featuring John Barbagallo – Group President of Progressive Insurance, Richard Keith – President/CEO of IMT Group, Rick Parks – President/CEO of Society Insurance and Dave Pauly – CEO of Capitol Insurance. Please bring along your questions for these industry leaders.

Our company representatives and industry partners will be holding a great Trade Show which not only allows you to visit with them, but also offers many opportunities to win great prizes (did I mention the PIA money machine will also be fully stocked with $).

Friday’s breakfast is an absolute “do not miss” event as Colonel Mark W. Tillman, pilot and Air Force One Commander from 2001 to 2009 reveals his first hand stories of flying President Bush on 9-11 and into Baghdad for Thanksgiving dinner with our troops.

Speaking of our troops, don’t forget to bring along your Cell Phones for Soldiers—the PIAW charity of this year.

As you can tell, we have a sterling lineup for you this year thanks to the efforts of our convention committee, Brenda and the rest of the PIA staff.

I am as excited now about this terrific lineup we have for our members as I was for my first convention. If you have not attended in awhile, this is the one to come back for and attend. If you, like I was at one time, are a convention virgin, I encourage you to “take the plunge” and sign up. You will be forever glad you did.

Thank you – it has been my pleasure to serve.

Don't be a Convention Virgin!

From the Boardroom

6 JULY 12

With Continental Western Group® in your backyard, you have the comfort of knowing we are responsive to your needs and the confidence of knowing we are dedicated to our partnership! Call Fritz Weitendorf, our Wisconsin Representative at 1-877-643-0219 ext 3828.

www.cwgins.com

Right in your backyard!

JULY 12 7 JULY 12 7

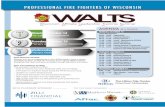

GOLD SpONSORS

Colonel Mark W. TillmanAir Force One – Moments in History

Chosen as the nation’s 12th Presidential pilot, retired Colonel Tillman served as pilot and commander of Air Force One from 2001-2009. He will keep you on the edge of your seat discussing

his firsthand account of flying President Bush on September 11, 2001 and later transporting the commander in chief into the war zone of Baghdad, Iraq to have Thanksgiving dinner with the

troops. An engaging story teller, Col Tillman will take you behind the scenes of AF-1.

HOTEL

$179.00 + 8.5% tax Rooms WILL go fast! Please make your reservations today, rate guaranteed based on availability

through July 10th.

For reservations call 1-800-558-3417 and identify that you are with the Professional Insurance Agents.CO

MpA

NY

pRES

IDEN

T’S

pAN

EL

Dave Pauly, CIC CEO

Capitol Insurance Companies

Richard Keith President & CEO The IMT Group

Rick Parks President & CEO

Society Insurance

John Barbagallo Group President

Commercial Lines & Agency Operations

Progressive Insurance Group

What is the status of the market? Will rates remain stable? What are the hot issues facing companies and agents? These questions and more will be addressed during this lively exchange of information and ideas. These Gold Sponsors have shown a strong commitment to professional independent agents and we look forward to seeing you at this important convention event.

For More Information and Registration Options Visit www.piaw.org or Call 1-800-261-7429.

Madison, WI—OCI has taken the following administrative actions. In many of these cases the respondent denied the allegations but consented to the action taken. Any forfeitures paid in these administrative actions are deposited in the Common School Fund which is administered by the Board of Commissioners of Public Lands. The earnings from this fund are distributed to all public K-12 schools in Wisconsin and are used by school libraries to purchase books. Copies of the administrative action orders may be viewed online at https://ociaccess.oci.wi.gov/OrderInfo/OrdInfo.oci.

OCI is responsible for overseeing the operations and marketing of insurance companies and agents in Wisconsin. OCI encourages anyone with a question or a complaint regarding an insurance company or agent to contact the office at this toll-free telephone number: 1-800-236-8517.

AllegAtions And Actions AgAinst Agents

8 JULY 12[continued on page 10]

Dorothy Ann Angeli, 3300 Business Park Dr., Stevens Point, WI 54482, had her insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Sarah M. Barton, 1502 N. 56th St., Superior, WI 54880, had her insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Michael James Bennett, 800 Nebraska St., Oshkosh, WI 54902, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Brian Blackley, 225 Prospect Ave., Pewaukee, WI 53072, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Charles H. Brown, 10932 75th St. Apt. 107, Kenosha, WI 53142, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Jaquieta Monique Brown, 5659 N. 36th St., Milwaukee, WI 53209, had her insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Robert Brown, W329N4320 Lakeland Dr., P.O. Box 76, Nashotah, WI 53058, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and failing to pay Wisconsin delinquent taxes due.

Terrence Carlino, 1300 Jez Rd., Ladysmith, WI 54848, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and a criminal conviction which may be substantially related to insurance marketing type conduct.

John F. Cotter, 419 E. Forest Dr., Neenah, WI 54956, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Neil Demant, 1313 Yorkville Ave., Union Grove, WI 53182, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Michael B. Dermody, 222 S. Golden Lake Ln., Oconomowoc, WI 53066, was ordered to pay a forfeiture of $15,000.00 within 31 days and was ordered to pay restitution to a consumer in the amount of $3,717.36. The application for the reinstatement of his intermediary's license was denied and he is prohibited from reapplying for an intermediary's license for a period of five years. These actions were taken based on allegations of selling annuities after license revocation, misrepresenting information to OCI, and making multiple misrepresentations to consumers regarding the features of annuities sold.

Perry S. Dlugie, 1203 Walden Ln., Deerfield, IL 60015, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Michael Leonard Gartman, 1228 Alcott Ave., Howards Grove, WI 53083, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

David A. Glaser, 1033 S. East St., Appleton, WI 54915, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Claudia Gonzalez, 445 State St., Fremont, MI 49412, had her application for an insurance license denied. This action was taken based on allegations of a criminal conviction which may be substantially related to insurance marketing type conduct and for failing to pay fines as required.

Joshua Griffin, 2351 Rainbow Dr., Plover, WI 54467, had his

Ted Nickel — Commissioner of the Office of Insurance

OCI Administrative Actions

JULY 12 9

10 JULY 12

OCI Administrative Actions

[continued from page 8]

application for an insurance license denied for 31 days. This action was taken based on allegations of failing to disclose a criminal conviction on a licensing application.

Shawn P. Hammes, 2130 South Ave. Apt. 310, La Crosse, WI 54601, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Peter Hannah, 250 Cliff Alex Ct., Apt. 3, Waukesha, WI 53189, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and not being eligible to hold a variable line of authority.

Christopher Harris, 118 W. Bell St., Apt. 202, Neenah, WI 54956, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI, failing to disclose criminal convictions on a licensing application, and having a criminal conviction which may be substantially related to insurance marketing type conduct.

Scott Harris, 4793 Hillsboro Cir., Santa Rosa, CA 95405, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and failing to provide evidence of a resident surplus lines license.

Jason Hebert, 5817 N. 41 St., Milwaukee, WI 53209, had his application for an insurance license denied for 31 days. This action was taken based on allegations of failing to disclose a criminal conviction on a licensing application.

Mark Hiller, 7992 Paton Rd., Saint Germain, WI 54558, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Diandra D. Holloway, 4512 W. Martin Dr. Apt. 5, Milwaukee, WI 53208, had her insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Adriana Jaime, 12238 Silicon Dr. Ste. 150, San Antonio, TX 78249, had her application for an insurance license denied. This action was taken based on allegations of a criminal conviction which may be substantially related to insurance marketing type conduct and an administrative action taken by the state of Wisconsin.

Steve James Kass, P.O. Box 1071, Hayward, WI 54843, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Neda Keshani, 3800 Citigroup Center, FI-9, Tampa, FL 33610, had her application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and failing to provide evidence of a resident surplus lines license.

Alan Thomas Krajcir, 1227 N. Milwaukee St. Apt. 23, Milwaukee, WI 53202, had his insurance license revoked. This action

was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Blaise B. Krautkramer, 482 Edelweiss Dr., Green Bay, WI 54302, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Jay M. Kufahl, 412 Weston Ave., Wausau, WI 54403, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Morrison Lamb, 1032 S. Kernan Ave., Appleton, WI 54915, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and having a criminal conviction which may be substantially related to insurance marketing type conduct.

Albert Lambert, 4601 Corporate Dr. Ste. 115, Concord, NC 28027, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and failing to provide required documentation on a licensing application.

Song Lee, 1401 Park Cir., Sun Prairie, WI 53590, had his application for an insurance license denied for 31 days. This action was taken based on allegations of failing to disclose a criminal conviction on a licensing application.

Paula J. Matteson, 2301 W. Jackson St. Apt. 19, Merrill, WI 54452, had her insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Whitney Morgan, 3700 S. Stonebridge Dr., McKinney, TX 75070, had her application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and a criminal conviction which may be substantially related to insurance marketing type conduct.

Martin J. Panczak, 214 Wildflower Way, Lake Mills, WI 53551, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Hiram Perez, 6777 S. 17th St., Milwaukee, WI 53221, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and failing to complete required prelicensing education.

Cory J. Peterson, 249 N. Water St. Apt. 407, Milwaukee, WI 53202, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Sandra K. Proksch-Troope, 2114 Farnam St., La Crosse, WI 54601, had her insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

[continued on page 12]

JULY 12 11

12 JULY 12

OCI Administrative Actions

[continued from page 10]

[continued on page 14]

Terry Reed, One Haven for Hope Way, San Antonio, TX 78207, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and failing to provide proof of current child support payments or an approved child support repayment plan.

Scott A. Rupnow, 18 N. 4th St., P.O. Box 331, Winneconne, WI 54986, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Andy Schaefer, 502 Plaza Dr., Apt. 216, Madison, WI 53719, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and failing to complete fingerprinting requirements.

Rodger G. Schneider, 2017 Almond Dr., Delavan, WI 53115, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Grant Ludwig Schultz, N977 Shore Dr., Marinette, WI 54143, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Ryan Sepnafski, 1800 W. Glendale Ave., Appleton, WI 54914, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and a criminal conviction which may be substantially related to insurance marketing type conduct.

James F. Stein, 213 Emily Way, Hortonville, WI 54944, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Jennifer Strouf, 1306 N. 28th St., Sheboygan, WI 53081, had her application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and failing to complete prelicensing education requirements.

Franklin D. Thompson, 3014 N. 41st St., Milwaukee, WI 53210, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Marvin J. Tick, 11642 N. Riverland Rd., Mequon, WI 53092, agreed to have his insurance license suspended for 30 days. This action was taken based on allegations of violation of s. 628.34 (1), Wis. Stat., in the marketing and sale of a life insurance product.

Beauryan Tway, 8025 County Rd. M, Evansville, WI 53536, had his application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and failing to complete fingerprinting requirements.

Benjamin A. Villa, 2618 S. 50th St., Milwaukee, WI 53219, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Kevin James Weidman, 401 S. Marietta St., Apt. 3, Verona, WI 53593, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Kim Marie Weller, E13949A Hein Rd., Baraboo, WI 53913, had her insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Mark Wilkie, W2464 Hwy. 63, Springbrook, WI 54875, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

David L. Williams, 4604 Ripple Dr., West Jordan, UT 84088, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Paul D. Zeier, 1000 N. Cambridge Ct., Waunakee, WI 53597, had his insurance license revoked. This action was taken based on allegations of failing to pay Wisconsin delinquent taxes due.

Attention CiCs!Exciting update options.

CIC Graduate Ruble Seminar

December 11 & 12, 2012 | Crowne Plaza – Milwaukee, WIFebruary 12 & 13, 2013 | Radisson – Green Bay, WI

16 WI CE (4 are optional Ethics)

visit www.piaw.org or call PIA at 1-800-261-7429

Your customers put all they have into their businesses. And it’s worth every long day and late

night. So don’t let them skimp on their insurance coverage.

With a policy from West Bend, they’ll have peace of mind knowing the business is well protected.

Our insurance professionals have the knowledge and experience to create the right insurance

program for hundreds of businesses, from antique stores to veterinarians.

Our reputation for fair and prompt claim service, as well as our financial strength, is known

throughout the Midwest.

If it’s worth insuring, it’s

worth insuring well.

West Bend’s SMARTbusiness™ insurance program makes sense. Because if

it’s worth insuring, it’s worth insuring well.

14 JULY 12

OCI Administrative Actions

[continued from page 12]

Affirmative Insurance Company, P.O. Box 9030, Addison, TX 75001, was ordered to pay a forfeiture of $500.00, was ordered to promptly reply to OCI, and was ordered to pay a required appointment fee. These actions were taken based on allegations of failing to respond promptly to inquiries from OCI and failing to pay a required fee.

Balboa Life Insurance Company, 400 Robert St. N., St. Paul, MN 55101, was ordered to pay a forfeiture of $500.00, was ordered to reply promptly in writing to OCI, and was ordered to pay a required appointment fee. These actions were taken based on allegations of failing to respond promptly to inquiries from OCI and failing to pay a required fee.

Guggenheim Life & Annuity Company, 2711 Centerville Rd. Ste. 400, Wilmington, DE 19808, was ordered to pay a forfeiture of $500.00, was ordered to promptly reply in writing to OCI, and was ordered to promptly pay a required appointment fee. These actions were taken based on allegations of failing to respond promptly to inquiries from OCI and failing to promptly pay a required fee.

Health Tradition Health Plan, 1808 E. Main St., Onalaska, WI 54653, was ordered to pay a forfeiture of $500.00, was ordered to promptly reply in writing to OCI, and was ordered to pay a required appointment fee. These actions were taken based on allegations of failing to respond promptly to inquiries from OCI and failing to pay a required fee.

Indymac Financial Services, 888 E. Walnut St., Pasadena, CA 91101, had its insurance license revoked. This action was taken

based on allegations of failing to pay Wisconsin delinquent taxes due.

Medco Containment Life Insurance Company, 100 Summit Ave., Montvale, NJ 07645, was ordered to pay a forfeiture of $500.00, was ordered to promptly provide requested information to OCI, and was ordered to pay a required appointment fee. These actions were taken based on allegations of failing to respond promptly to inquiries from OCI and failing to pay a required fee.

North American Elite Insurance Company, 650 Elm St., Manchester, NH 03101, was ordered to pay a forfeiture of $2,000.00, was ordered to promptly reply in writing to OCI, and was ordered to pay a required appointment fee. These actions were taken based on allegations of failing to respond promptly to inquiries from OCI and failing to pay a required fee.

North American Specialty Insurance Company, 475 N. Martingale Rd. Ste. 850, Schaumburg, IL 60173, was ordered to pay paid a forfeiture of $500.00, was ordered to promptly provide requested information to OCI, and was ordered to pay a required appointment fee. These actions were taken based on allegations of failing to respond promptly to inquiries from OCI and failing to pay a required fee.

Strategic Company, LLC, 2404 Edenborn Ave., Metairie, LA 70001, had its application for an insurance license denied. This action was taken based on allegations of failing to respond promptly to inquiries from OCI and failing to provide required documentation on a licensing application.

AllegAtions And Actions AgAinst compAnies

JULY 12 15

15, 2012

CPIA 3 - Sustain Success

This program focuses on fulfilling the implied promises contained in the insuring agreement. Students will review methods of providing evidence of insurance coverage; will discuss policies and procedures for controlling errors and omissions including policy review and delivery, endorse-ments, claims-processing, and handling of client complaints. This course includes a review of the Professional Expectations; the Law of Agency; and Legal and Ethical Standards.

WISCONSIN PIA IS A PROUD SPONSOR OF THE CPIA DESIGNATION PROGRAM

The PIA of Wisconsin is a proud sponsor of the Certified Professional Insurance Agent (CPIA) professional designation program. The CPIA designation is comprised of a series of Insurance Success Seminars. These three, one-day workshops teach practical "before", "during", and "after" the sale techniques for insurance producers, sales managers, account managers and company marketing representatives.

Participants leave with ideas that will produce increased sales results immediately. In fact, The Insurance Success Seminars are guaranteed: Implement the principles covered in these sessions and experience a 20% increase in personal production within six months, or your registration fee will be refunded!

To maintain the CPIA designation, CPIA’s must fulfill an update every two years by attending an Agency Management Boot Camp, or attend one of the core Insurance Success Seminars, or attend a Pro-to-Pro Retreat, or maintain an active membership in the AIMS Society.

The The AIMS SocietyAIMS Society is a national organization dedicated to providing is a national organization dedicated to providing

interactive marketing and sales training, ongoing resources and interactive marketing and sales training, ongoing resources and

networking opportunit ies to insurance professionals.networking opportunit ies to insurance professionals.

You can attend the CPIA courses in any order. No Test. Approved for 7 Wisconsin CE credits.

CPIA 1 - November 9, 2011 CPIA 2 - February CPIA 3 - August 1, 2012 Radisson Paper Valley Hotel Marriott Madison West Grand Geneva Resort Appleton, WI Middleton, WI Lake Geneva, WI

8:30 – 4:30 p.m. Fee Per Course (does not include lunch): PIA Member $155.00 / Non Member $190 Register at www.piaw.org or call PIA at 1-800-261-7429

CPIA 1 - Position for Success

During this program, participants are encouraged to focus on internal and external factors affecting the development of effective business development plans. Factors discussed include a review of the state of the insurance marketplace; analysis of competitive pressures; necessary insurance carrier underwriting criteria; and consumer expectations and understanding.

CPIA 2 – Implement for Success

During this session participants will be provided with specific tools for analyzing consumer needs; will learn to utilize risk identification techniques to gather pertinent prospect information; will develop skills necessary to assimilate information gathered into a customized protection program; and will participate in exercises designed to promote effective delivery of proven solutions.

CPIA 1Fall 2012 Dates to be Announced

CPIA 3 – August 1, 2012 CPIA 1 – January 16, 2013 CPIA 2 – May 1, 2013 CPIA 3 – September 11, 2013Grand Geneva Resort Wisconsin Mutual Ins. Co. Radisson Kelmann Corporation Lake Geneva, WI Madison, WI Green Bay, WI Wauwatosa, WI

16 JULY 12

JULIEt ULsEt, Grams Insurance Agency LLC, Edgerton, WI. Julie has been in the insurance business for 16 years. She is a high school graduate and has taken various college courses , including business and insurance courses. She is a member of the Edgerton Rotary, Edgerton PTA, Chamber of Commerce, MACCIT and the Diabetes Association. Principal companies: West Bend, Auto-Owners and General

Casualty. Julie has served on the YPC committee for several years.

KatHLEEN mULDER, Nolan Insurance Agency, LLC, Brandon, WI. Kathy has been in the insurance business for 22 years. She is a high school graduate and has taken insurance education classes her entire career. She is involved in the local food pantry, June Diary Days, Day on the Farm, Local fairs and community events. Principal companies: Hastings Mutual, General Casualty and Integrity Mutual.

Kathy served on the Automation Committee for three years.

WaYNE DaLLmaN, Dallman Insurance Agency, LLC, Greenwood, WI. Wayne has been in the insurance industry for 12 years. He graduated from the UW-Eau Claire in 2003. He is an active member and Secretary of the Thorp Jaycees and is active in the Muskybucks charity group. Principal Companies: Mutual of Wausau, Partners Mutual and Hastings Mutual. Wayne has not yet served on a PIAW

committee.

tREY NEHER, CIC, CIsR, THZ Insurance Group, Appleton, WI. Trey has been in the insurance business for 34 years. He has a Bachelors Degree from Illinois Wesleyan University in Business Administration and has attained the CIC and CISR designations. He is on the Board of the Downtown Appleton Rotary, member of the 1st United Methodist Church Finance Committee, Northside Business Association and Fox Cities Chamber of Commerce. Principal Companies: West Bend, SECURA and Frankenmuth. Trey has served on the Convention Committee, Membership Committee and Investment Task Force. He has

served on the PIA Board of Directors for the past three years.

JoHN KLINZINg, CIC, Affiliated Insurance Agencies of WI, LLC, Madison, WI. John has been in the insurance business for 33 years. He has an Associate Degree in Applied Science in Insurance and has attained the CIC designation. He is Vice President of the Monona Chamber of Commerce and a Past President of that group, member of the Monona Grove Optimists, Madison TIP Club and the Monona Festival Committee. Principal companies: West bend, Society and ACUITY. John has served on the

Membership and Education Committees for several years.

ANNUAL MEETING NOTICE and Nominations Committee ReportThe Annual Meeting of the Professional Insurance Agents of Wisconsin, Inc. will be held at 11:15 a.m. on Thursday, August 2, 2012 at the Grand Geneva Resort, Lake Geneva, Wisconsin. At that meeting, the Nominations Committee will place the following names in nomination for election to the Board of Directors. In accordance with PIA procedures, we are publishing photos and a brief biography of each nominee. Nominations will be accepted from the floor at the annual meeting and each nominee will speak on their own behalf prior to the election. Each director elected will serve a three year term beginning at

the installation ceremony that evening.

pROpOSED BY LAWS CHANGE — NOTICE TO MEMBERS

At the Annual Business meeting on August 2, 2012, a proposed By Laws change will be brought before the members for a vote. The purpose of this change is to include the PIAW National Director as a member of the Executive Committee.

Currently the PIAW National Director does not serve as a member of the Executive Committee.

Current: ARTICLE VI-COMMITTEES, Section 2: An Executive Committee shall be formed composed of President, Vice-President, Treasurer, Secretary and immediate Past President.

Proposed: ARTICLE VI-COMMITTEES, Section 2: An Executive Committee shall be formed composed of President, Vice-President, Treasurer, Secretary, immediate Past President and National Director.

For more information go to: www.cellphonesforsoldiers.com or www.piaw.org.

PIAW ASKS YOU TO HELP OUR TROOPSCALL HOME! JUST SET UP A DONATION BOX!

To a military family, aphone call is priceless.But the costs to callhome can be as much as$7 to $8 per minute.Some soldiers just can’tafford to make the calls.

Cell Phones for Soldiersraises money to providesoldiers with FREE pre-paid calling cards. Since,2004, more than 500,000pre-paid cards have beendistributed to soldiersserving overseas.

We need your help! All you need to do is collect unneeded cell phones.These phones will either be re-used or recycled and all proceeds go topurchasing calling cards. Simply place a collection box in your lobby,reception area or any high-traffic area. We will even send you the box!

Just email PIAW’s public relations firm at [email protected] orcall them at (262) 789-1565 and ask for Leslie. We’ll be sure you get abox sent to you.

The insurance agency and carrier that submit the most phoneswill be recognized at the PIAW Annual Convention! So get yourfriends and family involved and collect phones through July!

Then, bring your phones to the Convention in August. If you won’t beattending, we will try to arrange for a pickup or you can simply shipyour donations--at no charge to you. It’s all FREE. Complete information is available on the PIAW website.

18 JULY 12

®

JULY 12 19

Tired of Walking Away from Business?We Can Help!

The Midwest’s Premier Cluster Group * 100% Retained Ownership * Increased Markets-Over 30 Represented * Knowledgeable Support Staff

Commercial Assistance - Placement * Increased and More Stable Contingencies * Comparative Rater Provided * Retain 90% of Commission * Reduced Cost of Applied Management System * Preferred Agency Contracts

Check out our website at www.iaanetwork.comFor more information call Mike Sabourin 866-789-9712

AIA Tired PC BACK 11_9_11:AIA 02.10.10 PC BACK 11/16/11 1:35 PM Page 1

For more information and registration visit www.piaw.org or call (800) 261•7429.

MARCH 12 21

On-Line educatiOn OppOrtunities thrOugh piaW

For The New Employee (MERG) – no CE• New Agency Employee Orientation• Delivering Quality Service• Personal Lines Coverage Basics• Commercial Lines Coverage Basics

CISR OnLine – 8 WI CE• Insuring Personal Residential Property• Insuring Personal Auto Exposures• Insuring Commercial Property• Insuring Commercial Casualty Exposures• Agency Operations

Pre-Licensing • Insurance • Securities

William T. Hold Seminars – 4 WI CE• Variety of Topics

Flood – 4 WI CE• NFIP Approved

Ethics – 4 WI CE

Open tO

AnyOne[ [

Help Build Your Family’s Financial Future With

PIA Trust Insurance PlansINSURANCE PLANS DESIGNED WITH LOCAL AGENTS IN MIND

As a PIA Member* serving Main Street America, you and your employees have access to a variety of high-

quality, competitively priced insurance plans.

Plans available include:

> Basic Term Life**> Voluntary Term Life> Dependent Term Life> Hospital Indemnity > Long Term Disability> Short Term Disability

> Business Overhead Expense> Accidental Death & Dismemberment

PIA SERVICES GROUPINSURANCE FUND

For additional information about PIA Trust Insurance Plans, please contact your local PIA Affi liate or call the Plan Administrator at 1-800-336-4759. Additional information is also available on-line at www.piatrust.com.

Policies or provisions may vary or be unavailable in some states. Policies have exclusions or limitations which may aff ect any benefi ts payable.Underwritten by Unimerica Insurance Company, Portland, ME. Administered by Lockton Risk Services.

*PIA National membership, when required, must be current at all times.**Only available if 100% employer paid and if the employer and 100% of the employees enroll.

No medical underwriting necessary up to guaranteed issue limits.

20 JULY 12

JULY 12 21

[continued on page 22]

T

ProgramThe ISO

Gets a Tune-Upby Dan Corbin, CIC, CPCU, LUTC

The Insurance Services Office Inc. is in the process of introducing its new 2011 Commercial Property Program in all jurisdictions with a multistate forms filing, a rules filing and a loss-costs filing. Forms and endorsements affected by the filing will carry an edition date of October 2012. The proposed effective date of the program will not take place until 2013, which gives you plenty of time to digest the changes.

To give you an idea of the scope of the forms filing, there are 17 changes to the policy forms, where many of these changes have been made to multiple forms. There are 28 changes to the endorsements portfolio, which result in 12 new endorsements; 38 revised endorsements; and one withdrawn endorsement.

As is common in past filings, many of these changes do not affect the intent of coverage, but merely fine tune the language in response to case law or some stakeholder’s suggestion. Even many of the substantive changes likely will not alter the typical conversation you have with policyholders. In this article I have selected 20 of the items most likely to interest you, though your clients ultimately may be incurious.

NO. 1–DEBRIS REMOVAL. The commercial property forms have an additional coverage for debris removal expense not to exceed 25 percent of the direct damage plus the deductible. To supplement this amount, the forms make available an additional $10,000 when certain conditions are met. This amount is increasing to $25,000. Further, coverage for debris removal expense will apply to the property of others on the described premises, as well as covered property. However, if covered property has not been damaged, a new limit of $5,000 applies to the property of others. For example, this broadening of coverage would apply when a tornado or windstorm has deposited debris from a neighboring building onto the insured’s premises.

NO. 2–ExTENDED BIC. Although the period of restoration ends on the date when damaged property should be restored according to the business income coverage forms, there is an additional coverage that prolongs that date by 30 consecutive days. This extended period of indemnity is being increased to 60 days.

NO. 3–COVERAGE RADIUS. Despite the territory definition stated in the Commercial Property Conditions CP 00 90 form (i.e., U.S., Puerto Rico and Canada), basic coverage of the commercial property forms does not apply to business personal property located more than 100 feet of the described premises. In

order to accommodate the insured who has a described premises (e.g., a suite) within a larger building, this radius description is being changed. Coverage now will apply to business personal property located “within 100 feet of the building or within 100 feet of the premises described in the declarations, whichever distance is greater.”

NO. 4–pROpERTY IN STORAGE. A new coverage extension is being introduced for business personal property temporarily located in a portable storage unit (as opposed to “in the open” or “in a vehicle”) within 100 feet of the described premises. An aggregate sub-limit of $10,000 applies to this property and coverage expires 90 consecutive days after storage of the property began, or when the unit was made available for storage.

NO. 5–ELECTRONIC DATA. Electronic data is excluded as covered property under the coverage forms, except the insured’s stock of prepackaged software and the limited electronic data covered under the additional coverage. A welcome exception is introduced for electronic data that “is integrated in and operates or controls the building’s elevator, lighting, heating, ventilation, air conditioning or security system.” Modern buildings have expensive environmental control systems that represent a significant loss exposure. These costs are reflected in building replacement cost values and policyholders expect coverage for them when a loss is incurred.

NO. 6–NEWLY ACqUIRED pROpERTY. No longer will there be a $100,000, 30-day coverage extension for newly acquired business personal property at the described premises. However, this coverage will continue to apply when the business personal property is located at some other newly acquired building or location.

NO. 7–WEAR AND TEAR. Various perils (e.g., wear and tear, mechanical breakdown, discharge of pollutants, collapse, fungus, etc.) interact with “specified causes of loss” in the

Commercial Property

22 JULY 12

ISO Commercial Property [continued from page 21]

Causes Of Loss–Special Form (CP 10 30). Water damage is one of the “specified causes of loss” defined in the form, and presently includes an accidental discharge of systems or appliances located on the described premises. This description is being expanded to include systems or appliances located off the described premises if the breaking or cracking is caused by wear and tear, but only if unassisted by causes otherwise excluded under the terms of the water exclusion.

NO. 8–pROpERTY AWAY fROM pREMISES. A new Specified Business Personal Property Temporarily Away From Premises (CP 04 04) endorsement is introduced as an option to cover the insured’s portable office equipment while off the described premises; particularly, when in the care of an employee. A limit must be chosen for this coverage and it is subject to many restrictive conditions.

NO. 9–EqUIpMENT BREAkDOWN. A new Equipment Breakdown Cause Of Loss (CP 10 46) endorsement is introduced as an option to add equipment breakdown as a peril only when special form perils are provided by the policy. To compliment this coverage, a new Suspension Or Reinstatement Of Coverage For Loss Caused By Breakdown Of Certain Equipment (CP 10 47) endorsement also is introduced.

NO. 10–DEDUCTIBLES BY LOCATION. A new Deductibles By Location (CP 03 29) endorsement is introduced as an option to designate selected deductibles at each location that sustains loss or damage, affording maximum flexibility in the application of deductibles.

NO. 11–ROOf LIMITATIONS. A new Limitations On Coverage For Roof Surfacing (CP 10 36) endorsement is introduced to provide options for covering roof surfacing at actual cash value instead of replacement cost, and for excluding cosmetic damage to roofs. A similar endorsement already exists in the homeowners and dwelling programs.

NO. 12–CONSTRUCTION COST INfLATION. A new Increase In Rebuilding Expenses Following Disaster (CP 04 09) endorsement is introduced as an option to supplement building limits when increased costs of construction are incurred due to the high demand and low supply that typically follows widespread catastrophe losses. A specified percentage of the building limit is chosen for the maximum limit of this additional coverage and it is applied on an aggregate basis.

NO. 13–DEpENDENT pROpERTY. Because of loss to the insured’s property, there is a need for business interruption coverage. ISO has a coverage for that. What if the insured’s supplier or recipient of materials or services suffers loss to its property? ISO has a coverage for that dependency on a business partner. But, what if the business depended upon by the insured’s supplier or recipient has a loss to its property? ISO didn’t have a coverage for that secondary dependency. However, now it has this option built into its dependent property endorsements.

NO. 14–fLOOD COVERAGE. Besides adding an underlying insurance waiver “by location” to the flood coverage schedule, the flood coverage endorsement is revised to waive the 72-hour waiting period under conditions that avoid adverse selection. In addition, drains and sumps now are included with sewers for back-up and overflow coverage.

NO. 15–SEWER DISCHARGE. A new Discharge From Sewer, Drain or Sump (CP 10 38) endorsement is introduced as an option to cover the discharge of water or waterborne material from a sewer, drain or sump. The limitations in this endorsement give reason to be cautious when you explain its purpose to the insured. It does not cover discharge due to flood conditions and it does not cover discharge due to power failure, unless the policy is endorsed to cover power failure.

NO. 16–THEfT Of BUILDING MATERIALS. A new Theft Of Building Materials And Supplies (CP 10 44) endorsement is introduced as an option to cover the theft of building materials and supplies located on or within 100 feet of the premises, provided the property is intended to become a permanent part of the building or structure. The policy should have special form perils without a theft exclusion and it should be other than a builders risk policy (a separate endorsement is currently available for this policy).

NO. 17–pAYROLL LIMITATION. What previously was the Ordinary Payroll Limitation Or Exclusion (CP 15 10) endorsement now omits the word “ordinary” in its title. This is because the endorsement is revised to permit the limitation or exclusion of payroll expense for any individual or category of employee, not just those without managerial duties.

NO. 18–DEDUCTIBLE LOSS ASSESSMENT. Under the current optional coverages endorsement, a unit-owner is restricted to a $1,000 sub-limit for loss assessments resulting from a deductible in the policy purchased by the condominium association. Options for higher sub-limits are being introduced for selection by the unit-owner policyholder.

NO. 19–pROTECTIVE SAfEGUARDS. The interline Protective Safeguards (IL 04 15) endorsement is being replaced by the commercial property Protective Safeguards (CP 04 11) endorsement. The provisions are not much different except for the addition of a symbol and description for hood-and-duct fire extinguishing systems.

NO. 20–fOOD CONTAMINATION. A new Food Contamination (CP 15 05) endorsement is introduced as an option to cover business income and extra expense losses caused by food contamination. Covered expenses include the cost of cleaning equipment, replacing food, medical testing and vaccination and advertising (separate limit).

Corbin is PIACT, PIANH, PIANJ and PIANY’s director of research. —Reprinted with permission from PIA Management Services Inc.—

Includes copyrighted material of Insurance Services Office Inc. with its

permission. Copyright, Insurance Services Office Inc. 2011.

JULY 12 23

www.sheboyganfallsinsurance.com

24 JULY 12

The Worry-Free Bucket

West Des Moines, IA 800.274.3531 www.imtins.com

We are seeking quality agency appointments to become part of our “Worry Free” family. Simply bundle your customer’s auto, home and business insurance into IMT’s “Worry Free” bucket, and you will be worry free too.

BucketBucketBucketBucket

IMT TradeAdHalfPage.indd 1 10/20/11 4:02 PM

Insurance underwritten by Auto Club Insurance Association or Auto Club Group Insurance Company.

Join AAA’s Team of Independent Insurance Agents.AAA brings a powerful difference to your insurance carrier line-up. That’s because we’re a club, not just another company – offering your customers more than a sense of security, but a sense of belonging.

Here’s your opportunity to share in AAA’s brand strength, while enjoying a competitive commission structure, outstanding contingency program and innovative co-op advertising resources.

For current opportunities, contact Heidi Nienow at 608-828-2614 or [email protected]

Power Your Insurance Business With A Great Brand.

JULY 12 25

Log on to SPOT, our online rating tool at:www.ericksonlarseninc.com

We have been solving specialty insurance puzzles with excellence

since 1980. Call us for the right �t.

Erickson-Larsen, Inc. • 800-442-3168Bjornson/Sentinel – E&L • 800-284-0965

Erickson-Larsen, Inc. – WI • 888-249-6050

THE RIGHTPIECE.

Excellence & Leadership

NEWCICsThe Certified Insurance Counselors (CIC) Program has been the insurance industry’s premier, proven source for practical, real-world education since 1969. For insurance professionals everywhere, the 20 hour Institutes represent a thoroughly rewarding learning experience, led by accomplished insurance and risk management speakers. Are you ready to challenge yourself?

Joel Christ, CIC, CpCUWest Bend - A Mutual Insurance Co.

West Bend, WI

Christina Hewitt, CICHNI Risk Services, LLC

New Berlin, WI

Leonard Indovina, CIC, AUQBE

Sun Prairie, WI

Marcy Lindner, CIC, CISRThe Riverbank Insurance Center

Hudson, WI

John Miller, CIC, CpCUWest Bend Mutual/NSI

Middleton, WI

Michael peterson, CICBaer Insurance Services, LLC

Madison, WI

Nicole Wish, CIC, AU, AIS, AINSContinental Western Group

Middleton, WI

Dana Young, CICSchwarz Insurance Agency, Inc.

Prairie du Sac, WI

www.piaw.org

26 JULY 12

JULY 12 27

[continued on page 28]

T

Our state has one of the longest, if not the longest, legislative session of any of the 50 states—an on again off again process that extends over a 16-month period every two years. So, summarizing the just concluded action of the Wisconsin Legislature of 2011-2012, even from just the perspective of insurance-related issues, can be a bit of a challenge. Other states, like Kentucky and Montana, approach legislating very differently. The legislatures in these two states meet only for a few weeks every two years. There are bugs with longer life spans than the Kentucky legislative session.

Wisconsin

By Attorney Ron Kuehn, Legaland Government Relations Consultant to theProfessional Insurance Agents of Wisconsin

A Brief History of the

The PIA Government Affairs Committee has my detailed 24 page report on the PIA’s legislative activity from the just concluded session that is in three parts: (1) The final “Tracking Memo” that reports on the final status of 45 bills of substantial interest to PIA agents and their insurance clients; (2) A “Supplement” report on State Budget insurance-related issues (and a few other bills that did not make the Tracking Memo list) that numbers an additional 39 initiatives, and; (3) A list of 33 healthcare-related issues that PIA worked on in alliance with the Wisconsin Association of Health Underwriters (WAHU).

So, adjusting for just a bit of overlap between the 24 pages of these three reports, there were over 100 insurance-related pieces of legislation that we worked on during the Session that concluded with the end of the final veto session on May 3, 2012.

Let’s distill all that down a bit and look back over the last year and a half to examine some of the legislative and political highlights and lowlights:

1. The Political Setting—Results of the 2010 November Election

The big surprise that came out of the 2010 November elections was not the win by Governor-elect Walker, nor was it the 59 seat dominance of the Assembly elections by the Republicans. What no one saw coming was a transfer of Senate majority control from the Democrats to the Republicans. In one day in November, we went from having a Democratic Governor, and both houses controlled by Democrats to Republicans in control of the entire state government.

Who would have expected that a candidate from Wausau, with no prior political experience would beat the Senate Democratic Majority Leader in the fall elections? Along with a couple

of other surprising Republican wins in the State Senate, the November 2010 election gave Governor Walker-elect a very unexpected Republican control of the State Legislature that set the stage for the passage of historic “Act 10”.

2. The “Early Days” of the Session—January and March 2011

There were some remarkable insurance governance achievements attained by the new state government in the first sixty days of the session. No time was wasted in addressing really big insurance-related issues of tort reform, the deductibility of contributions to health savings accounts and anti-stacking laws. At the request of Governor Walker these bills were introduced and promptly passed as 2011 WI Acts 1, 2 and 14, respectively.

After dealing with three really significant insurance issues, the Administration and the Legislature also made good on their pledge to do their part to stimulate job growth. Although the PIA legislative program is all about insurance, we have long recognized that pro-business development programs that assist our insurance customers are often equally important to the growth of our member agents and agencies. So early passage of laws that expanded small business tax credits (Act 5), and relocated business tax credits (Act 3) to stimulate business growth were welcomed. These pro-business initiatives were, later in the session built upon with the passage of legislation that expanded tax credit enhanced Enterprise Zones from 12 to 20 statewide (Act 26), additional jobs tax credits (Act 88), and income tax relief amounting to over $300 million for partnership-taxed-businesses that either manufacture products or grow agricultural products. Some of our business customers did very well during the last session!

2011–2012

Legislative Session(January 7, 2011 to May 3, 2012)

28 JULY 12

A Brief History [continued from page 27]

Selective has been a trusted provider of insurance solutions since 1926.

Working with our elite group of agents, we focus on providing the businessand personal insurance solutions that best meet our customers’ needs.

Get to know us today.

©2012 Selective Ins. Group, Inc. (Branchville, NJ). “Selective” insurers include Selective Ins. Co. of America, Selective Ins. Co. of New England, Selective Ins. Co. ofN.Y., Selective Ins. Co. of South Carolina, Selective Ins. Co. of the Southeast, Selective Way Ins. Co. and Selective Auto Ins. Co. of N.J. Insurers and productsavailable vary by jurisdiction. SI-12-077

West & Central [email protected]

Metro [email protected]

Green Bay/Fox [email protected]

3. Then Came the Storm—March through June, 2011

The heady success of insurance and business development reforms of early 2011 made it seem that reform and enhancement of business and insurance-related opportunities were unlimited under this new government. Then came the incredible scene that erupted in and around the State Capitol building with the passage of Act 10 changing the public employee union laws. If you only saw the scene at the Capitol in the late winter, spring and early summer of 2011 on TV, then you really can’t appreciate what it was like to view it, daily, up close and personal. The ability of the Legislature to function was severely affected by the daily demonstrations (15,000-30,000 people daily was common) and the police presence (sometimes several hundred officers a day engaged in rotating shifts).

Somehow, the Legislature managed to pass a State Budget during this unprecedented period of turmoil. The remainder of the legislative process was almost overwhelmed by the noise of the public demonstrations and the shock of preparing for Senate recall elections in July and August. (These recalls, when combined with prior recalls in Wisconsin history, made Wisconsin the undisputed leader in all recalls held in U.S. history. After the conclusion of the recalls set for June 2012, about 40% of all recall elections ever held in the US – both state and federal – will have occurred in Wisconsin!)

Some insurance-related matters managed to pass during this period of turmoil, and most of it appeared in the State Budget Bill. Some examples: service contract enforcement by OCI; Group Insurance Board reforms; adjustment of the independent review process for health insurers; the always popular lapsing of “excess” funds collected from agent licensing and insurance companies to the general fund. (OCI is a moneymaker for the Wisconsin taxpayer.)

On the health insurance front the PIA continued to work with their insurance agent friends of the Wisconsin Association of Health Underwriters (WAHU) on many issues. But, with limited exceptions, most of the initiatives so important to controlling healthcare costs (rather than the unfortunate focus on healthcare insurance reform created by the federal PPACA) failed to pass. Wisconsin legislative initiatives addressing transparency of PPACA costs, checks and balances on PPACA implementation, small business wellness programs and agent value-added recognition were already showing signs of insufficient legislative support that would result in their ultimate failure to pass during the remainder of the session.

4. The “Second Half” of the Session—July 2011 through May 3, 2012

Although this period of 10 months represents more than half of the 16 months of the legislative session, once the Budget Bill is passed in July, we are clearly in the late stage of any session. A nearly $60 billion bill, of many hundreds of pages, getting the State Budget passed is a monumental undertaking for any Legislature. To have gotten the bill finished by June, with no significant tax increases, in an unprecedented period of political turmoil was a remarkable achievement for this new government.

In this second half of the session we saw a return to some semblance of order in the Wisconsin Legislature – although the tension between elected officials of each competing political party remained at Defcon 3. Most bills that the insurance community opposed, uniformly failed to pass in this period, including: limitations on the use of credit reports in P&C underwriting; health insurance mandated coverages; auto insurance repair shop selection prohibitions; other limitations on P&C underwriting (i.e., acts of nature). One bill, insurance on portable electronics sold by unlicensed business agents, passed, but with a coverage limitation successfully initiated at the request of the PIA.

Summary

Despite the political turmoil of the just concluded legislative session, some significant P&C insurance and insurance customer business reforms were passed. Real healthcare cost reform continues to be shuttled aside by a misguided, nationwide focus on health insurance reform. This was nevertheless a Legislature (and an Administration) that took insurance-related issues very seriously and usually acted on them in a very constructive manner.

The PIA has always been very strong on P&C issues. Now, after a full session of working with our health care cost reform allies in WAHU, the PIA is, more than ever, covering the full spectrum of insurance legislative issues in a very effective manner.

JULY 12 29

Certified insuranCe CounselorEach Approved for 20 Wisconsin CE Credits

PERSONAL LINESAugust 14-16, 2012

Marriott Madison West–Middleton, Wi608-831-2000

$109 room rate through 7/13/12 includes internet

• PERSONAL RESIDENTIAL COVERAGES Mary LaPorte CIC, CPCU

•PERSONALAUTOMOBILECOVERAGES • WATERCRAFT Monte Giddings, CIC, ARM

•PERSONALUMBRELLA/EXCESSCOVERAGES • PERSONALLINESCASESTUDY John Dismukes, CIC, CPCU, AAI, AIS

COMMERCIAL PROPERTYSeptember 26-28, 2012

Metropolis Resort–eau Claire, Wi 888-861-6001

$79 room rate through 8/26/12 (includes hot continental breakfast)

• COMMERCIALPROPERTYCOVERAGES •COMMERCIALPROPERTYCAUSEOFLOSSFORMS • COMMERCIALPROPERTYENDORSEMENTS Sheldon Hansen, CIC, CRM, CPIA

•TIMEELEMENTCOVERAGES John Dismukes, CIC, CPCU, AAI, AIS

• COMMERCIALINLANDMARINECOVERAGES • BUSINESSOWNERSPOLICIES • CRIME Bernie Neff, CIC, CPCU

New WI CE CoursE # 66245 New WI CE CoursE # 66246

Day one: 8:00 – 5:15 Day two: 8:00 – 5:00 Day three: 8:00 – noon, optional exam 2:00 – 4:00New Format in 2012!

$390.00 per institute. Register at www.piaw.org or call 800-261-7429.

PEOPLE WHO EARNED THIS ALSO EARNED MORE

30,900 MORE OF THESE PER YEAR.If you’re looking to jump start a new career or make more with the one you are in, education is your best investment. Now, more than ever, it is important to invest in your greatest assets—yourself and your people. According to The National Alliance Producer Profile, commercial lines producers with the Certified Insurance Counselor (CIC) designation earn 30% more than those without the designation. To learn more about the CIC Program, call or visit us on the web.

The most successful training programs for insurance professionals Register at www.piaw.org or call 1-800-261-7429

30 JULY 12

© 2011 Vertafore, Inc. Vertafore, the Vertafore logo and design, Unleash your potential, and the Vertafore trademarks listed are owned by Vertafore, Inc.

Through a new partnership with Vertafore, PIAW is offering FREE access to Sircon online licensing and continuing education management services.

USING SIRCON SERVICES, YOU CAN: • APPLY FOR A LICENSE• RENEW YOUR LICENSE• LOOK UP AVAILABLE COURSES • CHECK LICENSE RENEWAL STATUS• CHECK LICENSE APPLICATION STATUS• REQUEST A LETTER OF CERTIFI• REQUEST A LETTER OF CERTIFICATION• UPDATE YOUR NAME OR ADDRESS• FIND YOUR LICENSE NUMBER/NPN• CHECK YOUR STATUS WITH A STATE• MAINTAIN YOUR FIRM ASSOCIATION• UPDATE YOUR ADDRESS• UPDATE YOUR EMAIL ADDRESS • PRINT • PRINT YOUR LICENSE

Login to: www.piaw.organd get started today!

Attention UticA e&o Policy Holders:

The following PIAW education classes are approved for Utica’s premium discount.

Please contact Darcy at PIA for details. 1-800-261-7429 or [email protected]

•AnyCICUpdate

•CICAgencyManagement

•CISRAgencyOperations

•DynamicsofService

•PIAWEthicsandE&OSeminars

•PIAWConductedIn-HouseSeminars

Education Schedule: www.piaw.org or 1-800-261-7429

Maple Valley Mutual’s vision is to be the best smaller

mutual insurance carrier in northeastern Wisconsin.

This means providing exceptional service and top-notch

products to our Agents and Policyholders/Owners

while maintaining the Company’s excellent financial

condition and A.M. Best Rating of A- (EXCELLENT).

• Well Established, Competitive Farmowners Program

• Comprehensive Modern Homeowners Program

• Competitive BOP & Commercial Programs

• Unique Quotation System for New Business

• Above Average Commissions

For more information Contact

Al Schuettpelz, President, at: [email protected] | 800-23MAPLE | www.maplevalleymutual.com

Writing Territory

Northeastern Wisconsin

MAPLE VALLEY MUTUAL Insurance Company

“The Promise You Can Trust”

2505 Court StreetPekin, IL 61558800-322-0160

Extension 2394 www.pekininsurance.com

AUTO

HOME

BUSINESS

LIFE

HEALTH

Offering some of the most innovativeproducts available inthe industry today,we strive to be theeasiest company todo business with. Learn more.

• Roadside Rescue • Replacement Cost Coverage • Enhanced Coverage for Rental Cars • Pet Coverage • No Deductible on Glass Claims • Accidental Death Coverage• Tire Protection Coverage

• Identity Fraud Coverage with Resolution Service • Equipment Breakdown Coverage • Pet Health Insurance • Replacement Cost Coverage (Home and Contents)• Water Back-Up of Sewers & Drains • Personal Injury• Water & Sewer Line Breakage

• Employment Practices Liability Insurance • Employee Benefit Liability Coverage • Water Back-Up of Sewers & Drains • Workers Compensation Claim Specialists• Employee Wage Expense Continuation • Loss Control Services• Equipment Breakdown Coverage

• E-App for Most Life Products • Long Term Care Endorsement • Term Insurance Guaranteed Conversion Program• Access to Life Insurance Planning Specialists• Children’s Single Premium Term Plan

• Personal Customer Service • Extensive PPO & Transplant Facility Networks• Benefits Paid Faster than Industry Average• Online Access to Claim Information • TPA Services

Our coverage enhancements and endorsements goBeyond the expected.®

JULY 12 31

Certified insuranCe serviCe representative Open to Anyone!

8 WI CE Credits Course #66249

Sept 11 • MosineeSept 12 •MadisonSept 13 • Brookfield

Course instruCtor PattiGardner

CIC,CRM,CPCU ACUITY

• Essentials of Legal Liability

• CommercialGeneralLiabilityInsurance

• BusinessAutoPolicy

• Workers Compensation

INSURINGCOMMERCIALCASUALTYEXPOSURESThis course strengthens your ability to have productive, assured interactions with your commercial customers. You will improve your cross-selling skills by understanding essential commercial coverages.

$145 Per Course

Register at www.piaw.org

or call 800-261-7429

CLASSSCHEDULEInstruction 8:00a.m. – 3:45p.m.GroupLunch 12:00p.m. – 12:45p.m.OptionalExam 4:15p.m. – 5:15p.m.

32 JULY 12

MMany carriers are reporting an increase in Errors & Omissions claim frequency compared to 2011. One of the biggest increases deals with the cause code failure to provide the proper coverage. One carrier reports that close to 60 percent of its E&O claims are from this one cause code.

Often when this cause code is discussed, a significant part of the dialogue concerns the upfront identification of exposures a customer presents. Failure to identify these exposures and subsequently offering insurance proposals to address them has caused, and continues to cause, a significant number of E&O claims.

MAkE SURE THE CUSTOMER kNOWSThere is, however, another significant issue resulting in a sizeable number of E&O claims. This concerns the “Mirror Test” or, more precisely, the failure to perform it. Over the last several years, with soft market conditions and the economy, many agencies have found it necessary to remarket their personal and commercial accounts to additional carriers in the hope of getting a degree of premium relief. It is fairly likely if an agent remarketed an account to three additional carriers, the potential exists for differences between the incumbent carrier and these additional markets.

In an effort to reduce insurance expenses, a customer might request that coverage be replaced with a new carrier due to the premium savings. While this may appear fine on the outside, what if the coverage with the new carrier is deficient in some areas compared to the incumbent carrier? Maybe the sub-limits are less in some areas or the definition of “who is an insured” is more limited.

For example, say you move the account to another carrier and the insured suffers a loss that would have been covered by company A, but is not covered by the new carrier with which you placed the account. When the customer faces an uninsured loss and was not aware of the coverage differences, you may very well be questioned on why the coverage was moved. Practically speaking, if you don’t advise the customer of the differences when you move the account, what would the customer probably think? In all likelihood, the customer would believe the coverage was the same because if it was less, you would have indicated that up front.

Bottom line, there is a good chance the customer will say moving the account wouldn’t have been approved if the sacrifice in coverage was mentioned. The key, when you look to move the account to a new carrier, is to identify any coverage differences, bring them to the customer’s attention and seek the customer’s direction.

HIGHLIGHT THE DIffERENCESDifferences between various proposals can be significant. This can involve sub-limits, the coverage grant, specific endorsements,

definitions for areas such as “who is an insured,” what is excluded on one policy compared to another, and the carrier’s rating.

An E&O claim developed in recent years where the agent moved the account from a carrier where the premium was handled via an account current bill to one where the premium was paid on a direct-bill basis. The agent was unaware of the change and, thus, the customer was unaware. The account was cancelled for non-pay, a loss occurred and the carrier denied coverage because the policy had been cancelled. Guess who paid?

The highly recommended approach is taking all of the carriers you are considering and putting the details on a spreadsheet, noting all of the pertinent issues – limits, sub-limits, coverage grants, etc. Share this spreadsheet with the customer and bring to their attention the detail the customer needs to be aware of. This enables your client to make an educated decision – and that’s the key: the customer sees the differences and decides. At a minimum, bring to the client’s attention the differences between the expiring policy and the other carriers you are considering.

You must get the customer’s written approval regardless of the final decision. This will be crucial if an underlying claim later occurs and the customer then learns they didn’t have the coverage they thought. If your client chooses the lower price with the lesser coverage, that’s fine – just get it in writing that they realized they were giving up some coverage.

This issue may still be a concern even if you keep the account with the same carrier. This is probably more common or more of an issue with Excess & Surplus Lines business because E&S carriers are not required to provide a conditional renewal notice if they want to add an exclusion on the renewal. In this situation, the important thing (again) is for your office to identify the differences on the renewal policy, bring them to the customer’s attention and get the customer’s sign-off. Due to the nature of E&S, it is best to do this review with the client before binding the coverage, in case the customer subsequently decides they don’t want the coverage.

While this detailed comparison is important on all coverages, there are probably more things to consider if you write professional liability and/or D&O. Because no two policies are the same, an issue as subtle as an exclusion on one policy that was not on the other (the expiring) has resulted in a claim being denied, subsequently triggering an E&O claim – all because the customer alleged they were unaware of the difference.

Perform the “Mirror Test.” Communicating this analysis and comparison of the differences to the customer and getting a sign-off are vital if your agency wants to truly minimize its potential for an E&O claim.

Exposureperform the "Mirror Test"

Take a Chunkout of your E&O

Curtis M. Pearsall, CPCU, AIAF, CPIA President, Pearsall Associates Inc. and Special Consultant to the Utica National E&O Program

JULY 12 33

Imperium Insurance Company Houston Specialty Insurance Company

Oklahoma Specialty Insurance Company Great Midwest Insurance Company

AllcarriersareratedA–orbetterbyAMBest.

HOUSTON INTERNATIONAL INSURANCE GROUP

800Gessner,Suite600⋅Houston,TX77024⋅713.935.7400

Certified insuranCe serviCe representative Open to Anyone!

8 WI CE Credits Course #66251

SEPTEMBER25 • EAUCLAIRE

Course instruCtor JohnDismukes