Jpc weekly market view november 5, 2015

-

Upload

jon-taubert -

Category

Economy & Finance

-

view

73 -

download

0

Transcript of Jpc weekly market view november 5, 2015

JP Capital Perspective is everything

November 5, 2015

Equities S&P slightly declines after a blockbuster return after the summer sell off Fixed Income BoE maintains its ultra low interest rate policy as concerns over China and the strength of the Eurozone weigh on MPC sentiment Currencies The U.S dollar gains on rate expectations as ECB signals dovish signals Commodities Gold remains unchanged and oil may have touched a new bottom, potentially supporting oil companies going forward

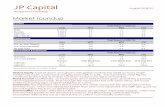

Market roundup

Source: Bloomberg, Spot returns. All data as of last Friday’s close. Past performance is no guarantee of future returns

EquitiesTotal Return in USD (%)

Level WTD MTD YTD

DJIA 17,646.7 2.6 8.5 0.9Nasdaq 5,031.9 3.0 8.9 7.2S&P 500 2,075.2 2.1 8.2 2.5MSCI World 1,706.6 1.4 8.0 1.4Fixed Income

Total Return in USD (%)Yield WTD MTD YTD

U.S. 10- Year Treasury 2.08 -0.5 -0.1 2.1U.S. Corporate Master 3.34 0.0 0.9 0.8ML High Yield 7.47 0.6 2.8 0.2Commodities & Currencies

Total Return in USD (%)Level WTD MTD YTD

Gold Spot 1,165 -1.1 4.4 -1.7WTI Crude $/Barrel 44.6 -5.6 -1.1 -16.3

Current Prior Week End Prior Month End 2014 Year End EUR/USD 1.10 -2.91 -1.42 -8.93USD/JPY 121.5 1.7 1.3 1.4

2 lorem ipsum :: [Date]

EQUITIES

BoJ holds back

The Bank of Japan refrained from adding more stimulus at its last meeting, but that doesn’t alter our view on the region. With structural reforms, in particular corporate governance and gender labour market reform expected to be implemented over the coming months, in conjunction with a weaker yen providing a tail wind to earnings, the Nikkei looks poised to track higher. Japan should outperform the U.S in 2016. Emerging markets continue to be under pressure from slowing Chinese demand, in particular in the ASEAN manufacturing sector (shown via softer PMI’s). We remain optimistic in the E.U even though the economics are not exactly stellar, but multiple expansion should do the trick to the Dax, Cac etc.

Next- FX update: Euro plummets

Exhibit 1: Euro falls as spreads widen On the flipside, the probability of the U.S slipping into recession, dragged down by its trading partners rose in October to circa 20%, up from 15% in April f this year. Likewise, the Eurozone and Japan and Latin America have recession likelihoods increase. Latin America was primarily a result of the Brazilian economy and softening growth indicators and trade volumes prompted such estimates. The Bank of England has expressed its views on the plausibility of ‘Brexit’, not surprisingly with a view to stay within the Euro regime. If however the U.K does decide to leave, expect gilts to move sharply higher, as investors price in the risk and widening deficit. Bonds as an asset class continue to exhibit lofty valuations and with the speculation about higher rates in the states, price risk remains a key factor to keep in mind.

Source: MS GIC

Information technology lead the way this week, rising 4.6% and Financials also benefiting from speculation over a rate rise, up around 2.5%. Euro area PMI came in at 54.0 beating expectations and up MoM from 53.4. GDP in the U.S for the quarter is expected to be up 1.2%, significantly lower than Q2’s blockbuster result. Culprits include a stronger dollar, causing a widening in the trade deficit. Consumer sentiment is expected to increase to 92.5 from 92.1, showing spending and animal spirits are standing firm amid a rate rise environment. Emerging markets year to date are down 7% and could be in for a tough 2016. Granted, conditions and financial market infrastructure has been improved since the taper tantrum in the summer of 2013 but are by no means immune to market forces.

3 lorem ipsum :: [Date]

FOREIGN EXCHANGE

Euro resilience

Next- Commodities update: Oil stalls

Exhibit 2: Sterling sterilisation

Source: Bloomberg data

GBP- So we talked about the pound last week, as some important figures came out, but this Thursday, there will be the decision from the B of E to see whether there will be a rate rise. It is highly unlikely that a rise will occur in the UK before it occurs in the US, however, there a few things to consider. First of all, the fourth quarter actually looks fairly good, PMI and manufacturing has accelerated and things have calm down in terms of global volatility. Another important thing to consider is that inflation is low, and annual pay rise has actually overtaken inflation, which means more purchasing power for the nation. However, pound is fairly strong, and this squeezes inflation (chart below). The issue here, is that inflation is very important for the BoE and if they do decide to raise rates then sterling will get even stronger, which would make it even harder for inflation to creep towards its 2% target. All in all, we are not to the opinion that a raise will occur. It is important to flag that a few economists actually believe that one more member of the MPC will join Mr McCafferty in wanting a raise. EUR/USD/JPY- Important news came out with the confirmation that Draghi would be looking to boost stimulus if needed. Further to that, you have the Fed looking more and more likely to raise rates in December. When you combine the two factors together, you tend to have the sell euro buy dollar view. Nomura and Société Générale, both agree with the fact that you should sell the euro, and buy yen. EUR/JPY is standing around 132.7, and SG is predicting that it will hit the 126 mark within the next three months. Regarding EUR/USD, it is currently standing at 1.0906, down from 1.0967 from the start of today.

4 lorem ipsum :: [Date]

COMMODITIES

Exhibit 3: Oil bottoming?

Next- Bond update: Spreads narrow

Oil rally over?

Source: Bloomberg

Gold is not doing anything positive in the last week, at this time last week gold was sitting in themed $1,160, and today you can take nearly $50 from that price tag. It is currently priced at $1,119, which is an increase of 0.15% on the day. This is most likely a repercussion of the Fed looking to raise rates by the end of the year, again the market is adjusting itself to the potential rate rise, and so a decrease in gold is just a natural effect of this potential rise. Adding on to that the greenback is pretty strong against other major currencies, and as gold is priced in dollars, it also has an impact of the price. Effectively, there is a lot of headwind for gold, and there is no real reason to suggest that gold is actually a commodity to buy right now. Some economists believe that gold can go below the $1,100 by the end of the year, which is pretty tough to say, we are not necessarily convinced that this will be the case. If this is the case then the question would be to wonder how low gold can actually go? Oil is continuing to be very interesting but not for the same reasons as the last few weeks. Indeed, in October oil has increased by over 2%, does that mean that it is the end of the oil rally? Well, it all depends on the next few months. Oil ministers from OPEC have decided that they need until next months to really confirm whether or not this is the end of the oil rally. Further, they have established that if it is not the end, then the production

Exhibit 4: Oil bounces off low

5 lorem ipsum :: [Date]

FIXED INCOME

We still sit in a world where all eyes are on the Federal Reserve’s rate decision. Whatever the outcome, the end result and trajectory will be shallow; so were told by Mrs Yellen repeatedly. Friday’s sessions should provide some insight into the direction of markets after a choppy earnings season. In Canada we get the building permits figure with an expected number of around 1.4% M.o.M, up from 3.7% in September. A little closer to home is the German industrial production; gain the market forecasts a slight rise of 0.7% up from negative 3.7% M.o.M. However, the most important set of figures is the United States’ employment metric, the non-farm payrolls. Consensus is for 179,000 jobs to be added, up from 1420,000 previously. A solid number gives the Fed a conundrum as markets will expect a rate move in December, which in turn will U.S borrowing costs higher. Expect a dollar rally and Euro in the single digits if we get lift off.

Exhibit 4:

Great expectations

Source: Blackrock

European bonds look expensive as the ECB continues to buy them at a clip of €60bn per month. French debt looks unattractive as does Italian and Spanish. In terms of Euro area debt, the U.K looks to be positioned after a rate hike but until then, we would wait on the sidelines for a fall in prices. High yield, although dominated by the energy sector, looks reasonable, simply because everything else is so overly valued. Cash looks good as it gives optionality and with inflation near record lows, the risks are few and far between.

6 lorem ipsum :: [Date]

JP Capital Perspective is everything

Jonathan Taubert FX and Commodities

Pete McCarthy Equities and Fixed Income

JP Capital Team

Going forward The Federal Reserve it appears does not care now about international events, after playing them down and referencing a rate rise in December is ‘live’. After the ECB announced their dovish statement, the Euro headed sharply lower. If we get a rise at the end of the year, lower could be an understatement. The 2-year treasury rose to its highest level in half a decade amid speculation of a move higher in rates. We can’t see inflation heading higher anytime soon, which means the ECB will continue to have their peddle to the metal throughout 2016. EUR/ GBP made an 11- week low to hit 0.7043 as the Bank of England’s policy committee continue to see a stronger domestic economy with some members expected to have aching of tune with regards to holding off on a rate rise. The chances are the BoE will wait for the Fed to go first then follow suit at the next meeting. Furthermore, the U.K’s biggest trading partner is still slacking, preventing the MPC of going for gold sooner than most think it should.