Jpc weekly market view 2 december 2015

-

Upload

jon-taubert -

Category

Economy & Finance

-

view

128 -

download

2

Transcript of Jpc weekly market view 2 december 2015

JP Capital Perspective is everything

December 2, 2015

Equities The S&P 500 barely budged rising only 0.1% in the past week with the markets closed for a U.S holiday, while the developed market index was down 0.5% Fixed Income Bonds were flat with the yield on the ML high yield index rising 10 basis points and the benchmark U.S Treasury falling 4 basis points to 2.22% Currencies The dollar broke through the 100 level on the trade weighted index (DXY) in anticipation of a rate hike, however with the U.S now in contractionary territory, this may be a false dawn Commodities Gold continues its slide falling almost 2% to $1,057 per ounce while oil rebounded marginally to hit $41.7 per barrel

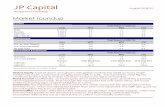

Market roundup

Source: Bloomberg, Spot returns. All data as of last Friday’s close. Past performance is no guarantee of future returns

EquitiesTotal Return in USD (%)

Level WTD MTD YTD

DJIA 17,798.5 -0.1 1.1 2.2Nasdaq 5,127.5 0.5 1.6 9.5S&P 500 2,090.1 0.1 0.8 3.5MSCI World 1,700.3 -0.1 -0.2 1.3Fixed Income

Total Return in USD (%)Yield WTD MTD YTD

U.S. 10- Year Treasury 2.24 0.4 -0.6 1.1U.S. Corporate Master 3.49 0.2 -0.3 0.2ML High Yield 8.07 -0.1 -2.4 -2.3Commodities & Currencies

Total Return in USD (%)Level WTD MTD YTD

Gold Spot 1,057 -1.9 -7.4 -10.8WTI Crude $/Barrel 41.7 3.3 -10.5 -21.7

Current Prior Week End Prior Month End 2014 Year End EUR/USD 1.06 -0.50 -3.75 -12.44USD/JPY 122.8 0.0 1.8 2.5

2 lorem ipsum :: [Date]

EQUITIES

Plummeting PMI

Over the long term, equities rise for one thing and one thing only: economic growth. The purchasing managers index (PMI) provides insights into economic growth prospects and are highly accurate measurements of upcoming activity or financial performance of equity markets. The latest U.S PMI came in 48.6, down from the expansionary reading of 50.1 month over month. A reading below 50 indicates bearish business prospects, while above 50, bullish. Within the machinery sector of the U.S economy, a weak Eurozone and a slowing China is causing the major headaches, while in the Metals sector, they site a strong dollar is impacting sales to China as “they can buy in Europe”. If the Federal Reserve does indeed go for a rate rise in December, the greenback will continue to appreciate, causing further downward pressure on U.S demand. Last week, Jon touched upon the Mexican peso and the strange divergence between the inflation rate and the peso. Even though those market factors are causing headline panic, the economy still posted a PMI reading of 53.0, unchanged from October, but more importantly, Mexico has recorded an expansionary figure for the 26th consecutive month.

Amid all the turmoil from a lower oil price and a widening trade balance, Mexican manufactures remain bullish on domestic demand which then begs the question: are there equity investment opportunities in Mexico?

Next- FX update: Draghi’s dilemma

Exhibit 1: Robust Mexican domestic demand

Source: Markit

Year to date, the main Mexican stock index has returned 1.97%; 4.17% on a year on year basis. We remain cautious on Mexico because of the degrading sentiment towards emerging markets and with companies such as América Móvil (AMóvil), Axtel, Alfa, TV Azteca and ICA all having large debt piles denominated in U.S dollars, they will be under pressure as the U.S begins its tightening cycle. Over the last five years, the external debt held by Mexico’s private businesses (in pesos) has increased by 86%. In nominal terms, the total amount has reached 1.69 trillion pesos (roughly $105 billion), 117% more than at the beginning of 2010. In the second quarter of 2015, the debt in dollar terms of América Móvil and Axtel exploded by 37% and 48% respectively. Ironic that as the Fed loads up, Mexican corporates are continuing on the dollar debt binge.

3 lorem ipsum :: [Date]

FOREIGN EXCHANGE

Draghi’s dilemma

Next- Commodities update: Oil heads lower

Exhibit 2: Draghi surely won’t disappoint…

Euro How much in a pickle is Mario Draghi in? Quite a big one to be honest. Inflation is near zero percent; the CPI was expected to grow by 0.2% and has only grown 0.1%. If you think about it, it is not that bad, we just missed by 0.1%. However, let’s not forget that the target inflation rate is 2%, and that target was established in order to have a stable currency. This is becoming quite a bit of a problem for M. Draghi, because he does not know what else to do. The figures are coming home every week lower than expected, and it does not seem to be getting any better at all. The USD and even the yen are getting stronger by the minute against the euro, and this does not seem to help. A survey shows that there is now a 65% chance that Mario Draghi will increase his €60bn of asset purchases and a near 80% chance that the QE programme will go past the September 2016 due date. We absolutely agree with this view, if this is the case, and we have Janet Yellen increasing the rates in two weeks, well it just promises to be a bad day for the euro. Even if that is too happen we don’t believe that the parity will happen before the end of the year, and maybe even until the end of January 2016. A lot depend on what Draghi will say tomorrow; if he is as dovish as he normally is, then it could potentially be a disaster for the euro. Yuan On a more optimistic note, the yuan has passed the test to become part of the IMF reserve currency. It does not mean a lot for us as individuals, but it really shows that China is including themselves a little bit more as part of our global economy, they are now less closed, and that is good, it really confirms the importance that China has on our global market.

4 lorem ipsum :: [Date]

COMMODITIES

Next- Bond update: What hike?

Source: Bloomberg

Oil- Yes, I know, we are talking about oil again, but it is important, it always is. Ok so what happened this week, well aside from the fact that oil keeps depreciating in value and all, the OPEC ministers have met in Vienna. That is pretty exciting, especially that our worst fear has been confirmed. Effectively, they all met to agree that they will increase production. That is right. The supply of oil is already outrageously large, so why are they doing it? Well this could be more political than anything, but they argue that they want to extend their market share as the US is slowly reducing their production. The problem is that an increase in supply only means one thing that the price will go down further; it is as simple as that. This is what was said at the meeting “Iran, Iraq, Libya and several of the other OPEC members are going to increase production substantially during the coming years”. Worst than that, Iran, which are the fifth largest producer of the OPEC group, have decided that within a week of the US sanctions dropping, they will increase production by 500,000 a day, and by 1million a day within the next 6 months. Adding on to that, the very strong dollar is pushing the price of oil further down. If someone tells you the price will go back to $55 or so soon, don’t listen to them! Gold- Next few coming weeks are not looking good for gold at all. The Fed is expected to raise rates, and so push the dollar to a strong finish for the year. This means that investors are selling more and more gold. The commodity is being seriously impacted by the strong dollar, and there is not a lot it can do about it at the moment. The commodity is currently valued at $1,067 an ounce. A Bloomberg survey shows that investors sold 49.3 metric tons in November, which is about three times as much as they bought in the previous three months combined. Last week gold even touch a five-year low. It seems that the commodities market is still stuck, and can’t find a way out, or at least the dollar is not letting them grow.

Exhibit 3: Still no sign of bottoming

Saudi signal’s surge

5 lorem ipsum :: [Date]

FIXED INCOME

Shinzo Abe came to power late 2012. Since then, the Nikkei has gifted extraordinary returns and the country has under gone a revolution. It is one thing as a leader to promise results and reforms, but Mr Abe has delivered in his monetary stimulus, fiscal stimulus and the longer-term structural reform agenda. More women have entered the labour force, which over time will fundamentally change the labour dynamics in Japan. In terms of business investment from the manufacturing sector, the PMI for November came in at 52.6, up from 52.4 in October. This is significant. When many economies around the world are contracting in PMI terms, Japan remained robust amid a low growth environment. This clearly means domestic demand is holding up and driving the economy forward, which has implications for policy going forward and thus Japanese rates. The 10 year Japanese Government bond sits at a low 30 basis points (0.3%), with the 2 year in negative territory at -0.02%. It is no wonder the GPIF has rotated its allocation to equities, due to the pretty dismal returns/ loss in domestic debt.

Exhibit 4: Abenomics absolute return

The man from Japan

Source: Nikkei

The big question is where does Japan go from here? The equity scene will likely benefit from continued loose policy, in both monetary and fiscal, with the Japanese yen likely to depreciate further relative to the U.S, as policy diverges into 2016. Fiscal wise, Japan’s debt ratio is very high. The policy needs to achieve two things. Provide the right business conditions, while at the same time, tighten and restore some of the loose fiscal position that has been built up over time. It is a fine balancing act, but Shinzo Abe seems the right man to kick start Japan. For the Japanese debt market, monetary policy will remain the key driver. That should continue into 2016 with no sign of a taper in the Bank of Japan’s statements. Assuming this is the case, yields will remain at these historic low levels, with the Goldilocks scenario continuing for equity markets, that is multiple expansion, weaker currency tailwinds and low yielding assets elsewhere.

6 lorem ipsum :: [Date]

JP Capital Perspective is everything

Jonathan Taubert FX and Commodities

Pete McCarthy Equities and Fixed Income

JP Capital Team

Going forward Eurozone M3 money supply rose 5.3% year on year, versus 4.9% in October. M3 is a very accurate predictor of recessionary periods and expansionary phases. Such methods should be employed rather than the traditional inflation targeting measures in many central banks today. The U.S third quarter GDP was revised up to 2.1% (seasonally adjusted), from a prior reading of 1.5%. The University of Michigan Consumer Sentiment Index (UMCSI) came in 91.3, from 93.1 in October. This coupled with contractions in manufacturing sector expectations, will likely result in a weak U.S economy over the next 6-12 months. Even given those comments, the Fed will feel pressured to raise interest rates, causing further upward pressure on the dollar. These factors do not put the U.S in our favored region for both equity and bond investments. That said, the currency will be hard to predict. A rising interest rate environment points towards a stronger dollar, but the weaker fundamentals in the economy may prompt the authorities to implement a looser stance going forward, or at least refrain from the impending tightening, limiting the upward move in the dollar index. On the flipside, U.S strength should help the Eurozone, currency wise, but also giving the struggling region a stronger export market.