Jpc weekly market view november 25 2015

-

Upload

jon-taubert -

Category

Economy & Finance

-

view

87 -

download

1

Transcript of Jpc weekly market view november 25 2015

JP Capital Perspective is everything November 25, 2015

Equities S&P falls 3.6% with the MSCI EAFE (developed markets index) falling 1.7%. Profit taking may be the culprit Fixed Income The 10-year Treasury yield fell 5 basis points to 2.27% revealing a cautious mood ahead of the expected rate tightening cycle in December Currencies The U.S dollar index (DXY) broke 100 for the first time since 2003 in anticipation of rate hike. The Euro headed below 1.06 in response Commodities WTI crude fell 8% to $40.70 per barrel while gold also fell 0.5% to $1,084 per ounce

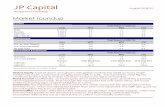

Market roundup

Source: Bloomberg, Spot returns. All data as of last Friday’s close. Past performance is no guarantee of future returns

EquitiesTotal Return in USD (%)

Level WTD MTD YTD

DJIA 17,245.2 -3.6 -2.2 -1.2Nasdaq 4,927.9 -4.2 -2.4 5.1S&P 500 2,023.0 -3.6 -2.6 0.1MSCI World 1,654.3 -2.9 -2.9 -1.6Fixed Income

Total Return in USD (%)Yield WTD MTD YTD

U.S. 10- Year Treasury 2.27 0.4 -1.1 0.6U.S. Corporate Master 3.52 0.2 -0.7 -0.2ML High Yield 7.98 -1.4 -1.7 -1.6Commodities & Currencies

Total Return in USD (%)Level WTD MTD YTD

Gold Spot 1,084 -0.5 -5.1 -8.5WTI Crude $/Barrel 40.7 -8.0 -12.6 -23.5

Current Prior Week End Prior Month End 2014 Year End EUR/USD 1.08 1.07 1.10 1.21USD/JPY 122.6 123.1 120.6 119.8

2 lorem ipsum :: [Date]

EQUITIES

Deflationary pressures

The real question from an equity investor’s viewpoint, is will we see the same reaction in the Eurozone markets from the ECB’s QE as we saw in the U.S market by the Federal Reserve?

There are however some key differences between the two policies that then relate to its effectiveness and thus outcomes. First, U.S QE was most effective in the early stage. By most effective we mean interest rates fell sharply via bond buying, which sent equity prices higher aided by a lower dollar. We have seen the Euro head sharply lower. In this regard it is similar, even though in the European case, QE was largely expected. Second, QE in the U.S started with long rates at circa 3%, not 40 basis points. Furthermore, everyone expects the Euro to plunge to parity by year-end if the Fed does indeed go for a small rate hike. One thing to bear in mind is that the Euro Is a sticky currency. The area is large and people still

Next- FX update: Peso pulls away

Exhibit 1: Debt dominates dividends

Source: BoAML

need to conduct business and hold Euros In banks. This could prevent the pair from going over 1:1. Assuming these comparisons, the European markets will likely track higher, but we don’t think to the same extent as we saw in the U.S. Although Europe remains a favored area due to the weaker Euro aiding export companies, we still favor Japan due to its ability to implement structural reforms and fiscal policies much quicker, relative to the paralysis we see in Eurozone governments today.

Our view on the U.S is that although it clearly is one of the leading growth stories globally, we must not get carried away. Firstly, even though the market is expecting a rate hike very soon, rates implied by the market are still historically low. This means deflation is everywhere and the U.S is not as closed as many assume.

3 lorem ipsum :: [Date]

FOREIGN EXCHANGE

Peso pulls away

Next- Commodities update: Gold heads lower

Exhibit 2: Price pressures defy the Peso

Source: Bloomberg data

U.S Dollar It seems that the story repeats itself on a weekly basis. However, this week it is different, the last time the greenback has been this close to parity was back in April. Indeed, for the first time in over 7 months, 1€ is currently worth $1.059. The dollar is obviously looking to get stronger than ever with the 16th of December being ever so close. Unsurprisingly it is not just the euro, which is affected, the greenback is currently standing at 1.5087 for a pound sterling, and the JPY is at 122.75 against a dollar. So, the USD is like a bulldozer and it is not stopping at anything, it is literally smashing the currency market. This may slow down against the pound sooner than the euro, simply because Governor Mark Carney will no doubt raise rates just after the US, and the UK is in a much better economic position than the EU. Mexican Peso We have not mentioned to Mexican peso recently, but something very interesting happened this week. In Mexico, as soon as the Peso depreciated in value, inflation rose. In fact, twenty years ago when the government devalued its currency, the inflation rate soared by 20% in the matter of months. However, over the last 12 months, the peso has devalued by 17% and yet inflation rate has decreased from 4.2% to 2.3%. Obviously we need to put things back into its context. At the moment, things are not going well with emerging markets; more specifically everything is becoming more and more expensive for them. Indeed, a lot of emerging markets base their economy on exports, and mainly commodity exportation, with the price of commodities decreasing, less revenue is being received and so reinvested in the economy. Adding on to that, the dollar is getting stronger each day, with a trading partner like the US, Mexico is spending a lot importing and not getting a lot from exporting.

4 lorem ipsum :: [Date]

COMMODITIES

Next- Bond update: What hike?

Source: Bloomberg

Iron ore- Yet another commodity, which is causing troublesome views. Iron ore, like most of the other commodities in our current climate, is experiencing an overwhelming amount of supply. The issue is that the demand mainly comes from China, and as we know China is not in its best place right now. So, why not just cut the production and let everything get back at an equilibrium level? The problem is much more complicated than just cutting production, effectively you have the biggest miners which, are betting that higher production will enable them to cut costs and raise market share while less efficient suppliers get squeezed. Yes you read that right, they are taking advantage of higher production costs to be more efficient and wipe out the competition. There is a sign that there may be progress going into next year as the China Iron & Steel Association, stated that Crude-steel output in China will drop 23 million tons to 783 million tons next year. We believe that with a potential rise in rates by year end, the prices will not get any higher for at least another months. Gold is not doing very well, and it has not been doing so for a while now. The year to date return on gold is now near the -10% territory, and again like in most dollar priced commodities, the potential rate hike will not improve the state of gold. Gold is currently priced at $1,074 per ounce; we are to the view that anything above $1,066 by the end of the year is unlikely. Oil- I spent a lot of time last week on the subject, so no need to go and explain what our view is on the famous commodity. WTI is currently priced at $42 a barrel, and crude is at $45 it is down by 2% today.

Exhibit 3: USD and commodities diverge

Gold loses its shine

5 lorem ipsum :: [Date]

FIXED INCOME

Cast your mind back to December 2013. The U.S economy was going great guns. Higher rates were almost a guaranteed proposition, yet when it came to the end of 2014, rates remained at record lows with no hike in sight. We enter a very similar phase. Yes, unemployment has fallen further, but that is just the headline number. Dig a little deeper into the employment report and you see long-term unemployment remaining stubbornly high along with youth unemployment. Inflation is low everywhere and given the U.S is an open economy, it will likely end up importing lower prices as no country wants to buy at higher levels. Although transitory, the oil price halving is causing inflation to remain low even if it is a technical ‘net net’ tailwind to the U.S economy. In a recent interview, Janet Yellen responded to some economists, who were not in agreement of keeping rates this low for this long. Her response, ‘if we had raised rates earlier, unemployment would have risen causing mass deflation. All we’ll say, is if the U.S can not handle a 25 basis rate move higher,

Exhibit 4: U.S uncertainty grows

No hike in sight

Source: BoAML

we suggest they implement more QE and buy treasuries and mortgage- backed securities like there is no tomorrow. The topic of discussion should be slashing rates negative, not moving higher; even if it does short- term impact pension funds and other institutions. That said the risk of moving too soon outweighs the risk of holding off. Or does it? If they wait, financial markets will remain in distorted values. Keeping rates lower allows for inefficient businesses to remain trading. Those firms will never hire anyone, keeping youth unemployment at the high rate. Raising rates allows for efficient decision making when resources are tighter. At present, the system is flush with liquidity. Liquidity is not the problem. It’s longer-term technological factors at play that prohibits unemployment and inflation from rising. Waiting is bad news. It is time.

6 lorem ipsum :: [Date]

JP Capital Perspective is everything

Jonathan Taubert FX and Commodities

Pete McCarthy Equities and Fixed Income

JP Capital Team

Going forward Euro area Q3 GDP rose 0.3% versus expectations of 0.4%. The ECB is likely going to ramp up its QE program as we begin 2016, however it is clear that Europe does not need more liquidity. Banking regulations tell banks to horde and build up capital, thus not lending. Yet European authorities implement QE to get banks to lend. That is one interesting policy mix. The weaker Euro will help European exporters and provide a boost to earnings, which in turn support the equity markets- standard result of money printing. Given that, we are optimistic on European equities even if the long-term economics don’t stack up. Remember John Maynard Keynes’ famous quote, ‘the markets will remain irrational, longer than you can remain solvent’. Whether markets are irrational is another debate, but certainly central banks are pushing investors into riskier assets in the hope to stimulate the wealth effect. Europe needs the same political backing as Spain. Spain it appears is the only country that has implemented structural reforms and are benefiting. If policy makers don’t implement polices, they are not doing their job. If one does not carry out their role, one is removed. Time for a Eurozone revival.