Issue of securities

-

Upload

hammad-abid -

Category

Business

-

view

113 -

download

0

Transcript of Issue of securities

• Shall be used only for projects that are specified

under objects in the offer document.

• The issuers shall maintain a bank account in which

the amount raised from the issue shall be

transferred immediately after the closure of the

issue and such amount shall only be utilized for

specific project(s)

• The issuer shall disclose the schedule of

implementation of the project in the offer

document in a tabular form and the funds raised

by the issuer shall be utilized in accordance with

the said schedule.

• The issuer shall establish a separate project implementation

cell and designate a project officer who shall not be below the

rank of deputy commissioner, who shall monitor the progress of

the project(s) and shall ensure that the funds raised are

utilised only for the project(s) for which the debt securities

were issued.

• Issuer’s contribution for each project shall not be less than

twenty per cent. of the project costs, which shall be

contributed from their internal resources or grants.

WHAT DOES SECURITIES

INCLUDE

As per sec2(81) companies act

2013 securities means the

securities as defined in sec2(h)

securities contracts regulation act:

It includes-shares, scripts, stocks,

bonds, debentures, or other

maretable securities of a like

nature in any incorporated

company or other body corporate.

MEANING OF SHARE

Capital of a company termed as share

capital, is divided into units. Each unit is

called share.

Nature of Share –According to section 44 of

the companies act shares of any member in

a company is movable property, transferable

in the manner provided by the articles of

the company.

KINDS OF SHARES Equity shares-under this a)With voting rights b)With differential rights

Preference Shares

Rules for Issuing preference Shares-1)Issue of such shares should be authorized by passing a SR in the general meeting of the company.

2)Explanatory statement attached to the notice of meeting for passing SR should include size of the issue, and number of preference shares to be issued and nominal value of each share, nature of shares, objectives of the issue etc

3)The company at the time of issue of preference shares should not have any subsisting defaults

4)Register of members required to be maintained under section 88 must contain all the particulars in respect of such preference issue

5)A company intending to list its preference shares on a recognized stock exchange shall issue such shares in accordance with the regulations made by the SEBI

PRIVATE PLACEMENT OF SHARES According to sec 81 (1a) of the companies act,1956 private placement of

shares implies issue and allotment of shares to a selected group of persons such as UTI,LIC

Preferential allotment: It is one that is made at a predetermined price to the preidentified people who wish to take a stake in the company such as promoters, venture capitalists, Financial institutions, buyers of companies products or its suppliers

Employee Stock Option Plan: In order to retain high caliber employees or to give them a sense of belonging , companies may offer their equity shares to be purchased at their will. Characteristics of this scheme:

1)ESOP implies the right but not an obligation

2)The Employee has a right to exercise the option of purchase of shares within the vesting period.

3)Any share issued under the scheme of ESOP shall be locked in for a minimum period of one year from the date of allotment.

Right shares-Under sec 81 of the companies act the

existing shareholders have a right to subscribe in their

existing proportion to the fresh issue of capital or to

reject the offer or sell their rights. The existing

shareholders can authorize the company by passing a

special resolution to offer such shares to the public

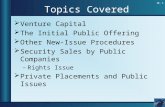

Public

Company

Through prospectus

i.e. public offer

Private Placement

Right or Bonus Issue

Issue of

securities

Meaning-Book building is essentially a process used

by companies raising capital through public

offerings either IPOS or FPOS to aid price and

demand discovery

Book Building

Method

CHARACTERISTICS OF BOOK

BUILDING Price Band-

Floor Price-

Tendering process-

Intermediaries involved in a book building process are:

The Issuer /Company

The Book Running Lead Manager who is a merchant banker registered with

SEBI

The syndicate members who are registered with SEBI

Bid-

Allotment-

Participants-

A)Retail Individual Investors-RII is an investor who applies for securities for

a value of not more than 200000.

B)Non Institutional Investors-NII are referred to as high net worth

individuals.

C)Qualified Institutional Buyers- QIB are institutional investors who possess

the expertise and funds to invest in the securities market.

BOOK BUILDING

PROCESS Nominate Book Runner

Form Syndicate of Brokers, Arrangers, Underwriters, Financial

Institutions

Submit Draft offer Document to SEBI Indicating the price band

(without mentioning the price of the issue)

Circulate Offer Document among the syndicate members

Ask for bids on price (within the price Band)

and Quantity of securities

Aggregate and forward all offers to BRLM

Run the Book to maintain a record of subscribers, their offer price

and orders

Consult with issuer and BRLM to determine the final issue price

based on the offers received

Firm up Underwriting Commitments

Issue Final Prospectus specifying the price and size of the offer

Allot Securities to the successful Bidders/syndicate members

Securities issued and listed

LIMITATIONS

It is appropriate for mega issues only

It is Suitable only for the issuer companies which are fundamentally strong and well known to the investors

It works very well in matured market conditions

It works where the investors are aware of the various parameters affecting the market price of the securities.

DIFFERENCE BETWEEN BOOK

BUILDING AND NORMAL PUBLIC

ISSUEFixed Price Process

Price at which the securities are

offered/allotted is known in

advance to the investor

Demand for the securities offered

is known only after the closure of

the issue

Payment is made at the time of

subscription wherein refund is

given after allocation

Book Building Process

Price at which securities will be

offered is not in advance to the

investor. Only an indicative price

range is known.

Demand for the securities

offered can be known everyday

as the book is built

Payment is made only after

allocation