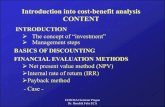

Introduction to Cost Analysis

Transcript of Introduction to Cost Analysis

page 2

Executive Summary

Effect of Crude Oil Pricing – The recent decline in crude oil pricing is affecting the

viability of higher-cost oil extraction for shale plays

Hedging and Price Exposure – Producers have varying degrees of exposure to the

recent decline based on financial hedges

Covenant Violations – Producers funding operations through credit revolvers are at

risk of violating covenants with crude oil priced below $50 per bbl.

Future Outlook – Most producers are scaling back capital spending and growth to

weather the current environment of low pricing—some producers are likely to default on

financial obligations and will not be able to generate cash from oil production

page 3

Producer Review

Producer Comments Risk

Assessment

Whiting

Petroleum

Low amount of production hedged. Likely to violate

lending covenant of 4.0 EBITDAX to Debt ratio

Critical

Emerald Oil Significant hedges through Q2 2015, but likely to violate

lending covenant

Critical

Continental

Resources

Monetized 100% of hedge position in Q3 2014 at

$90 per bbl. leaving the rest of production exposed.

Moderate

Oasis

Petroleum

Significant hedges through 2015, but likely to violate

interest coverage of 2.5X covenant on credit revolver

Moderate

Northern Oil

& Gas

Significant hedges through 2016 protect credit and

capital budget

Low

page 4

Producer Financial Benchmark Producers are positioned differently to handle the current WTI environment.

CLR WLL EOX OAS NOG

2015 Cash Requirement ($1,806,013,788) ($970,535,673) ($44,277,215) ($382,859,925)

Requirement as a percent of Cash and Credit 77% 31% 23% 24% 0%

Average Hedged Revenue per BBL 2015 $51.21 $51.56 $65.33 $68.34 $76.06

Hedge Asset Value percent of Market Cap 0% 2% 36% 25% 49%

WTI Break-even $45.31 $47.11 $47.23 $45.68 $45.88

Minimum Interest Coverage Ratio 2015 2.63 2.41 3.52 2.48 6.28

Maximum Debt to EBITDA 6.53 5.20 4.70 6.52 3.38

Days of Cash on Hand 118.3 10.6 103.5 64.1 0.0

Estimated Credit Default Q4 2015 Q4 2015 Q1 2016

page 5

2015 Hedge Profile Hedge positions improve crude oil selling price as much as $30 above spot.

Hedge Profile (Net $/bbl)

EOX

CLR, WLL, WTI

OAS

NOG

$0.00

$10.00

$20.00

$30.00

$40.00

$50.00

$60.00

$70.00

$80.00

$90.00

$100.00

Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

CLR WLL EOX WTI OAS NOG

Impact above spot

Producer per bbl.

CLR $ 0.00

WLL $ 0.37

EOX $ 12.22

OAS $ 18.32

NOG $ 30.03

page 6

Production Cost Analysis WTI Needs to stay above $45-$47 for Bakken producers to cover costs.

$0.00

$10.00

$20.00

$30.00

$40.00

$50.00

$60.00

$70.00

$80.00

CLR WLL EOX OAS NOG

DD&A

Marketing Differential

Interest

G&A

Taxes

Production Expense

Hurdle

Growth cannot be sustained unless WTI is above $70 per bbl.

page 7

Company Report – Whiting Petroleum (WLL) Diagnostics

Whiting Petroleum has a credit line covenant

not to exceed a Debt to EBITDA ratio of 4.0

Based on current expenditures, Whiting will

violate that covenant in Q4 2015 and could

trigger default

Q1 2015 will be challenging for Whiting

Petroleum for Interest Coverage. Although

not a covenant, low interest coverage is a

sign of financial distress

0.0

1.0

2.0

3.0

4.0

5.0

6.0

Q42014

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Debt to EBITDA

0.0

2.0

4.0

6.0

8.0

10.0

Q42014

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Interest Coverage

page 8

Company Report – Whiting Petroleum (WLL) Liquidity Report

Whiting Petroleum utilizes a mostly

untapped credit revolver as the primary

source of liquidity

Whiting can maintain a capital plan at 75%

of 2014 expenditure by utilizing the revolver

Debt to EBITDA coverage covenants could

restrict access to the credit revolver and

trigger a default

$0

$500,000,000

$1,000,000,000

$1,500,000,000

$2,000,000,000

$2,500,000,000

$3,000,000,000

$3,500,000,000

page 9

Company Report – Emerald Oil (EOX) Diagnostics

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

Q42014

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Debt to EBITDA Ratio

0.0

5.0

10.0

15.0

20.0

25.0

Q42014

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Interest Coverage

Emerald Oil’s credit revolver has a covenant

that Debt to EBITDA must remain below

4.0:1.0. At expected crude pricing, Emerald

will violate this covenant in Q4 2015.

Although not a credit covenant, Emerald Oil

should be able to maintain an interest

coverage ratio above 4 even with lower

crude prices

page 10

Company Report – Emerald Oil (EOX) Liquidity Report

With the current capital plan to spend $62 -

$81 million in 2015, Emerald Oil will require

access to their line of credit to operate in

2015.

If Emerald Oil violates the credit covenant of

a debt to EBITDA ratio of 4.0, access to the

credit line may be suspended

$0

$20,000,000

$40,000,000

$60,000,000

$80,000,000

$100,000,000

$120,000,000

$140,000,000

$160,000,000

$180,000,000

$200,000,000

Cash Credit Q42014

Q12015

Q22015

Q32015

Q42015

page 11

Company Report – Continental Resources (CLR) Diagnostics

Although not a liquidity covenant,

Continental Resources will struggle with a

high Debt to EBITDA ratio for much of 2015

and 2016

Q1 2015 will be challenging for Continental

Resources for Interest Coverage. Although

not a covenant, low interest coverage is a

sign of financial distress

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

Q42014

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Debt to EBITDA

0.0

2.0

4.0

6.0

8.0

10.0

Q42014

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Interest Coverage

page 12

Company Report – Continental Resources (CLR) Liquidity Report

Continental Resources monetized the value

of their hedges at the end of Q3 2014 at an

average WTI price of $90 per bbl. This

generated $433 million in cash for the

company.

With the current capital plan to spend

$2,700,000,000 in 2015, Continental

Resources will need to rely heavily on their

$1.75 BUSD credit revolver

$0

$500,000,000

$1,000,000,000

$1,500,000,000

$2,000,000,000

$2,500,000,000

$3,000,000,000

page 13

Company Report – Oasis Petroleum (OAS) Diagnostics

Oasis is highly leveraged with a EBITDA

ratio beyond safe ranges

Oasis Petroleum will violate debt covenants

in Q1 2016 that could default on the credit

revolver

0.02.04.06.08.0

10.012.014.0

Q42014

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Debt to EBITDA

0.0

1.0

2.0

3.0

4.0

5.0

Q42014

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Interest Coverage

page 14

Company Report – Oasis Petroleum (OAS) Liquidity Report

Oasis’ primary source of liquidity is cash

from operations and their credit revolver

There should be ample cash for operations

unless the interest coverage covenant is

triggered for default

$0

$200,000,000

$400,000,000

$600,000,000

$800,000,000

$1,000,000,000

$1,200,000,000

$1,400,000,000

$1,600,000,000

$1,800,000,000

page 15

Company Report – Northern Oil & Gas (NOG) Diagnostics

Northern Oil & Gas will maintain a safe debt

to EBITDA ratio well into 2016

Northern Oil & Gas won’t feel pressure from

Interest Coverage until the end of 2016 due

to the extent of previous hedged positions

0.0

1.0

2.0

3.0

4.0

5.0

Q42014

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Debt to EBITDA

0.0

2.0

4.0

6.0

8.0

10.0

Q42014

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Interest Coverage

page 16

Company Report – Northern Oil & Gas (NOG) Liquidity Report

With a large portion of volume hedged,

Northern Oil & Gas will continue to generate

cash from operations while still deploying the

capital plan.

$0

$50,000,000

$100,000,000

$150,000,000

$200,000,000

$250,000,000

$300,000,000

$350,000,000

$400,000,000

page 17

For more information contact:

Tom Bokowy, Partner (208) 610-0032

Cost & Capital Partners LLC