INTERNATIONAL BANK FOR RECONSTRUCTION AND … · 2016. 8. 26. · EADB's Director General is...

Transcript of INTERNATIONAL BANK FOR RECONSTRUCTION AND … · 2016. 8. 26. · EADB's Director General is...

RESTRICTED

Report No. DB-87a

This report is for official use only by the Bank Group and specifically authorized organizationsor persons. It may not be published, quoted or cited without Bank Group authorization. TheBank Group does not accept responsibility for the accuracy or completeness of the report.

INTERNATIONAL BANK FOR RECONSTRUCTION AND DEVELOPMENT

INTERNATIONAL DEVELOPMENT ASSOCIATION

APPRAISAL OF

THE EAST AFRICAN DEVELOPMENT BANK

June 6, 1972

Development Finance Companies Department

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

CURRENCY EQUIVALENTS

7.14 Shillings (Shs.) - US$ 1. -Shs. 1 million = US$ 140,000.-

ABBREVIATIONS

CDC Commonwealth Development Corporation (U.K.)EADB East African Development BankICDC Industrial and Commercial Development Corporation (Kenya)IPS Industrial Promotion ServiceNDC National Development Corporation (Tanzania)SIDA Swedish International Development AuthorityTIB Tanzania Investment BankUDC Uganda Development Corporation

This report is based on the findings of a mission which visitedEast Africa in September 1971, composed of Mr. C. Loganathan (Chief),Mr. K. Nougaim and Mr. J. C. Kendall.

APPRAISAL OF

TIE EAST AFRICAN DEVELOPMENT BAiK

Table of Contents

Page

BASIC DATA .... ..........................................SUMMARY .............................-----.--... ill

1. INTRODUCTION ........ 1...............................1

II. TIE EiNVIRONMENT .................................... 2

The Industrial Sector .............................. 2Government Policy Towards Industry ................ . 2Financial Institutions ............................ . 4

III. 'niE EAST AFRICAN DEVELOPMENT BANK .................. 6

Shareholders .... 6Objectives ........................................ . 6

Resources .......................................... 7The Board of Directors ...... ....................... 8 Policies ........................................... 8The Director General ....... ..................... . 9Personnel and Organization ...... ................... 9Project Promotion . . ............... , 11Operating Procedures .......... . ....... o ............ 11

IV. OPERATIONS AND FItNANCIAL PERFORMANCE ...... ......... 13

Operations ......................................... 13Financial Structure .............. ..... ............. 1zlInvestments ........................................ 14Profitabilitv ...........y........................ 15Auditors ........................................ 15

V. PROSPECTS .......................................... 16

EADB's Role in the East African Community .... ...... 16Projections ......... .................. .............. 16Resource Requirements .............................. 17Projected Financial Results .......... .. ............ 18

VI. CONCLUSIONS AN) RECOMMENDATIONS .................... 18

The Bank, E.ADB and National Institutions ... ........ 18Recommendations . ... .......... 19

List of Annexes

1. Summarized Data on East African Development Institutions

2. Resources Available for Commitment as of December 31, 1971

3. Statement of Operating Policies

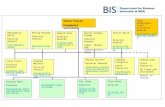

4. Organization Chart

5. Summary of Operations 1969-1971

6. Projects Approved and Committed to December 31, 1971

7. Summarized Balance Sheets 1968-1971

8. Summarized Income Statements 1968-1971

9. Projected Approvals, Commitments and Disbursements 1972-1976

10. Projected Cash-Flow 1972-1976

11. Projected Balance Sheets 1972-1976

12. Projected Statements of Income 1972-1976

13. Projection Assumptions

14. Selected Data on Kenya, Tanzania and Uganda and Total East Africa

Location of Projects Approved to December 31, 1971

- i -

EAST AFRICAN DEVELOPMENT BANK

BASIC DATA

Date of Formation: December 1, 1967

Date of Which Started Operations: July 1, 1968

Operating Performance (in Shs. millions):

a) Loans and Guarantees (Years ending December 31)1969 1970 1971 Total

Approvals 36e9 35.5 UT. 119.2Commitments 8.5 35.6 27.2 71.3Disbursements 3.9 14 .2 37.4 55.5

b) Equity Investments

Approvals - 3.8 - 3.8Commitments _ 3.8 - 3.8Disbursements - o.6 2.0 2.6

c) Country Distribution of Total Investments (%)I/

Approvals Commitments Disbursements

Kenya 29 46 37Tanzania 33 33 39Uganda 38 21 24

100 100 100

Financial Performance:

a) Summarized Balance Sheets (Shs. million)

1968 1969 1970 .971

Current assets 74.5 101.3 121.4 86.4Loans (net) - 3.9 18.0 55.2Equity investments - - 0.6 2.6Fixed assets (net) 0.7 2.4 4.5 11.2Total Assets - Liabilities n 107.6 TIM4 TM 4Short + medium term liab. -7.7 37.7 46 1Net Worth 72.8 103.9 139.9 145.4Overall Debt/Equity ratio ./1 o. a 6 7Reserves + Provisions as % ofloan and equity portfolio - 141 63 30

1/ To December 31, 1971 except disbursements which to February 28, 1972.

2/ Unaudited.

- ii -

b) Summarized Income Statements (Shs. million):

1968 1969 1970 1971E/

Total Income 2.1 7.2 10.1 10.5Total Expenses 1.3 2.6 3.9 4.9

Operating Profit 0.8 4.6 6.2 5.6

plus non-recurring profit lges losses - - - 0.1less provisions - - 0.1 0.2

Total ProfiV2 0.8 4.6 6.1 5.5

Operating profit, before provisions,as % of average net worth 3.5 5.3 5.1 3.9

Total profit, after provisions,as % of average net worth 3.5 5.3 5.0 3.8

Resources Posltion (as of December 31, 1971):(Shs. million)

Called-up Capital and Reserves 146 .8Borrowings, medium term 7.4

Total Resources 154.2

less:

Loans and equity investments outstanding (net) 57.8Undisbursed commitments 15.7Fixed assets (net) 1.2

Uncommitted Resources 69.5

Interest Rates and Other Charges

Interest rate: 8% - 9% p. a.Commitment fee: NoneEvaluation fee: 1% of investment

Z/ Unaudited.Y/ Tax exempt.

-iii.

SUMMARY

i. The East African Development Bank (EADB) is one of the institutionsof the East African Community. It was created in 1967 when the Treaty forEast African Co-operation was signed by Kenya, Tanzania and Uganda. EADB isspecifically charged with helping to redress industrial imbalances betweenPartner States, and hence must invest its resources so as to favor Tanzaniaand Uganda.

ii. Though East Africa is still in the initial stages of industrializa-tion, investment in manufacturing has increased and industrial output hasgrown at a satisfactory, though not spectacular, rate. The outlook for fur-ther industrialization is favorable. Both ideology and lack of African entre-preneurs have led the three governments to assume a major, though varying,role in the industrial sector. Partly because of their differing approaches,there has been friction between Partner States of the Community, but its in-stitutions and the Common Market have shown an ability to survive, and theirvalue is recognized by the Partner States.

iii. Though there are development finance institutions within eachPartner State, EADB has a significant role to play in financing industrialdevelopment in the region, alone and in co-operation with other developmentinstitutions. EADB can provide larger amounts of financing for individualprojects than development finance companies not owned by the governments;it is in a better position than government-owned development institutionsto appraise projects impartially; and it is in a unique position to evaluateregional projects.

iv. EADB's highest authority in most matters is its Board of Directorswhich makes all decisions on operations. The present Board is appointed bythe three Partner States, though there is provision for appointment of addi-tional directors to represent other shareholders once ownership is morediversified. The Charter specifies that Partner States will own at least51% of EADB's shares at all times; their present holding is over 90%. EADB'sCharter also contains general operating guidelines and limitations which arereasonable and prudent; they have been complemented, at the Bank's suggestion,by a Statement of Policies which will further serve to safeguard EADB's fi-nancial position.

v. EADB's Director General is appointed by the Community Authority. 1/The present Director General is competent and has the stature for this posi-tion. Expatriate staff have been retained to assist in the more technicaltasks of development banking. Continued expatriate assistance will be re-quired while East African staff - which is academically well-qualified, butlacks experience - develops its own capabilities. EADB's appraisal methodsand operating procedures are adequate but need improving in some respects,particularly in evaluating clients' procurement procedures and the economicimpact of projects.

1/ Consisting of the three Presidents of the Partner States.

- ir

vi. A major proportion of EADB's commitments to date have been made inprojects sponsored by parastatal enterprises, and EADB has co-operated closelywith other development institutions in the region. Its approvals have shownan encouraging tendency to increase, although commitments and disbursementshave lagged.

vii. EADB's financial position is good and it is creditworthy. It anti-cipates a substantial increase in its business and requires additional resour-ces to meet its forecast commitments. A gap of US$13.7 million, to meet theimport component of projects EADB expects to commit itself to up to the endof 1973, is projected. A Bank loan of US$8.0 million is recommended. Con-sidering EADB's short span of existence and relatively low level of opera-tions and profitability to date, it should receive concessional treatmentin respect of the commitment charge applicable to the Bank loan. EADB'sinitial free limit per sub-loan would be US$300,000 equivalent, with an ag-gregate free limit of US$2.4 million. Other loan conditions would be thosenormal for Bank loans to development finance companies.

APPRAISAL OF

THE EAST AFRICAN DEVELOPMENT BANK

I. INTRODUCTION

1.01 The East African Community, of which Kenya, Tanzania and Ugandaare the Partner States, was created on December 1, 1967 on the recommenda-tion of a Commission appointed to review previous regional agreements amongthe three countries. For several decades there had been extensive regionalco-operation. However, because of favorable location and climate, and acomparatively large expatriate community, Kenya's industrial sector haddeveloped much further by the mid-1960's than those of Tanzania and Uganda.The latter two countries felt that they should be provided opportunities tocatch up with Kenya, so the Treaty for East African Co-operation, which es-tablished the East African Community, was designed to redress imbalancesin industrial development, as well as to strengthen ties among the threePartner States. The Treaty provided for a Common Market with a common ex-ternal tariff, a uniform system of taxation and fiscal incentives, and thecontinued operation of four jointly owned Corporations to provide commonservices (post and telecommunications, railways, harbors and an airline).The headquarters of the Community was established at Arusha, in Tanzania.

1.02 Several provisions of the Treaty are aimed at compensating for in-dustrial imbalances. First there is a system for sharing equally among thePartner States 20% of i* ncome tax collected from manufacturing and finan-cial enterprises within the Community. Second, fiscal incentives to indus-trial investment are to be harmonized. Third, there is a system of transfertaxes by which a Partner State having a negative trade balance in manufac-Lure'd goods with another Partner State may impose (subject to various limit-ations) a transfer tax on imports of goods from the state with a positivetrade balance, provided the state imposing the tax manufactures, or plansto manufacture, the goods in question. This tax can amount to up to hialfthe value of the common external tariff. Since, at the time the Treaty wassigned, Kenya had a positive balance of trade in manufactured good- w'ithits two partners, and Uganda a positive balance with Tanzania, this provi-sion has protected a number of industries in Tanzania, and a somewhatsmaller number in Uganda.

1.03 The fourth and most direct means by which the signatories of theTreaty sought fri redress imbalances in industrial development was the creationof the East African Development Bank (EADB), which is charged with allocatingits investments to favor Tanzania and Uganda, thus assisting them to catch upwith their more industralized partner.

1.04 The World Bank Group established close relations with EADB evenbefore it made its first commitments in 1969. From time to time thereafter,Bank personnel has visited EADB's headquarters in Kampala to advise on orga-nization, personnel and operating policies. In November, 1970, EADB indicatedthat it might need long-term resources from the World Bank by the beginning of1972. A Bank mission headed by Mr. C. Loganathan and including Mr. K. Nougaim

- 2 -

and Mr. J. C. Kendall accordingly visited East Africa, from August 30 toSeptember 17, 1971, to appraise EADB.

II. THE ENVIRONMENT 1/

The Industrial Sector

2.01 East Africa is still in the initial stages of industrialization.The population of the region, totalling approximately 33 million, is over-whelmingly engaged in agriculture, mostly on a subsistence basis. About160,000 people are employed in industry, and manufacturing accounts forabout 10% of the three countries' combined GDP. About half the regionalvalue of manufactures are produced by Kenya, while Uganda's industrial pro-duction is sdk6what greater than Tanzania's. Manufactures accounted forabout 60% of'to-tal trade within the Community in 1968. Agricultural proc-essing accounts for 45-50% of industrial output, and other consumer goodsfor most of the remainder.

2.02 Dur'ing the 1960's manufacturing output expanded at an average rateof about 6.5% per annum in Uganda and Kenya and 12.0% in Tanzania. The pacein Uganda and Kenya slowed in the latter years of the decade. Data on indus-trial investment since 1965 is summarized below:

(in millions of Shs.)1965 1966 1967 1968 1969 1970

Kenya 152 190 298 218 168 262Tanzania 70 150 181 226 171 314Uganda 95 67 108 n.a. n.a. n.a.

Total 317 407 i587 ! -

2.03 Up to May 1970, the currencies of all three Partner States circu-lated freely within the region, and were convertible at par. Since then,Uganda has prohibited the import and export of its bank notes, and Tanzaniahas done the same. All three countries now have exchange controls but pay-ments on current account are normally made without difficulty or delay.

Government Policy Towards Industry

2.04 Most East African industries enjoy a fairly high level of protec-tion, though not as high as in many other developing countries. Nominal du-ties on consumer goods from outside the region range from 30% to 50%. In-

1/ Detailed information is given in the following reports:

(a) Economic Development in East),Africa (five volumes), June 28, 1971,Report No. AE-16a.

(b) Industrial Development in EaSt Africa: Progress, Policies, Prob-lems and Prospects (four volufii'), April 16, 1971, Report No.AE-12.

-3-

termediate goods are subject to duties of around 30%, but thiese may be re-mitted wholly or in part when the goods are processed within the country.Other protective devices are also employed at times, including quantitativeimport restrictions, licensing requirements to manufacture or import, anddiscriminatory purchasing by state trading corporations.

2.05 Beside protection, other incentives are available. These includea 20% investment credit (by which 120% of the value of an investment may bedepreciated), duty free import of machinery and equipment, and loss carry-forward allowances for tax purposes (without time limitation). Export in-dustries are favored by a remission of sales taxes and duties on importedinputs. The corporate tax rate is a moderate 40% of profits. Finally, le-gislation in effect in the three countries provides that profits and invest-ments may be repatriated, and that there will be full, fair and prompt set-tlement in case of expropriation.

2.06 Commerce and industry have largely been controlled by Europeansand Asians resident in East Africa, and by foreign firms. During the pastfive years trade licensing laws have been enacted to Africanize retail dis-tribution, which has been mostly in the hands of Asians. Some of the Asiansforced out of commerce have reinvested in light manufacturing, while othershave left East Africa with their capital.

2.07 Both ideology and the lack of indigenous entrepreneurs have in-fluenced all three Partner States to assume a major, though varying, rolein the industrial sector. In Kenya, many new industrial projects are jointventures of foreign private firms and the Government, the latter holding aminority share. In Tanzania, Government policy since 1967 requires major-ity State ownership of all industries considered to be basic to the economy.A number of total or partial nationalizations have taken place, giving theGovernment a controlling interest in most important industrial concerns.In Uganda, jthe previous Government passed an Act in 1970 under which it wasto acquire a 60% interest in Uganda's major industrial enterprises; however,the present Government, which came into power early in 1971, has not imple-mented this Act and has announced a policy of welcoming foreign priv_ . in-vestment.

2.08 Differences among the Partner States in 1971 gave rise to some un-certainty about the future of the Common Market, and many investors hesitatedto base investment decisions on the assumption of permanent access to theregional market. However, efforts to pursue a regional approach to industrialinvestment continue and the Community has undertaken to study three industriesthat require a regional market - motor vehicles, chemicals and steel. Incooperation with other Community organizations, EADB may have an importantrole to play in implementing these plans.

2.09 East Africa has substantial potential for continued and acceleratedindustrial development. The Common Market and the Community have survivedboth the stresses of the post-independence years and the political divergencesof the Partner States. The growth rate of the regional economy has been sa-tisfactory, although not spectacular, and the prospects for further expansion

are favorable. One may expect a fairly rapid rise in agricultural output, anexpansion of activity in other fields such as tourism and trade, as well as anextension of the money economy -- all of which will support an increasingly ef-ficient and varied industrial sector.

Financial Institutions

2.10 EADB is the only development finance institution which operates ona regional basis in the Community, but there are a number of national develop-ment banks. In each Partner State there is a government-owned developmentcorporation; a development company owned by British, German and Dutch publicinstitutions together with the national government of each country; and asmall private development company. Annex 1 contains some comparative data onthese institutions.

2.11 The three national development corporations serve as instruments ofgovernment policy in the development field. The Industrial and CommercialDevelopment Corporation (ICDC) of Kenya was mainly concerned with providingassistance to small African traders and industrialists up to the late 1960's.More recently ICDC has invested in a number of medium and large scale indus-trial projects sponsored by foreign investors. The National Development Cor-poration (NDC) of Tanzania was chiefly geared to the promotion of new enter-prises since it started operations in 1965, and has played a major rolesince the nationalization act of 1967 as the holding company for state-ownedcorporations. The Uganda Development Corporation (UDC) is also more a promo-tion and holding company than a banking institution. UDC has had a majorrole in the development of Ugandats industrial sector. It wholly owns a num-ber of the largest enterprises in Uganda, and has also entered into jointventures with private investors. In general, government-owned developmentcorporations have experienced management and financial problems with theirnumerous subsidiaries. The development corporations themselves often havetrouble in obtaining resources from their governments for further invest-ments, and in two cases (NDC and UDC) liquidity problems exist.

2.12 The second group of development institutions in the Partner States ofthe Community are the three multinational development finance companies. Theywere started in the early 1960's at the initiative of the British Government'sCommonwealth Development Corporation (CDC), which has an equal share withGerman and Dutch Government organizations, and the national development cor-porations of Kenya, Tanzania and Uganda. 1/ Each development finance companyhas a manager seconded by CDC. These companies take minority shareholdingsand provide term loans to industrial projects, usually with foreign sponsors.National partners are also sought, and these are often the national develop-ment corporations, sometimes in association with local private capital. Interms of the number of projects supported these development finance companies

1/ The Dutch have not yet invested in the Uganda Company.

have performed quite well, though the size of their individual investments islimited by their comparatively small capital.

2.13 The Industrial Promotion Services (IPS) group, sponsored by HisUighness the Aga Khan, established a small development company in each ofthe three Partner States in 1963. They provide medium and long-term loansand equity financing to projects sponsored by the Ismaili Community andsometimes by other groups. So far IPS's impact has been minor. In Kenya,at least one other investment company (Africindo) has been formed, witheven smaller capabilities and results.

2.14 In addition to the foregoing, Tanzania has recently establishedthe Tanzanian Investment Bank (TIB) to complement NDC. The Governmentwants to separate the promotion of industrial projects from their appraisaland financing. NDC will continue to be a promoter and a controlling share-holder of industrial enterprises, while TIB is expected to provide long-term loans and to take minority shareholdings after subjecting investmentproposals to an objective examination.

2.15 Commercial banks in East Africa engage in term lending to indus-trial projects only in exceptional cases. Some foreign-owned banks in Kenya,however, have accumulated idle resources since exchange controls were putinto effect, and have undertaken to finance a considerable share of the ca-pital requirements of some industrial projects.

2.16 Interest rates in the three countries have been maintained at simC? I

ilar levels, but vary considerably to different borrowers. The commercialbank rate to prime customers is a minimum of 7% per annum, while most cus-tomers are charged between 8.0% and 9.5%. Rates for crop financing arelower than the prime commercial rate because of special central bank redis-counting Facilities. In Tanzania, parastatal enterprises 1/ have borroweddirectly from the Treasury at rates below commercial levels.

I2.17 There are no developed capital markets in East Africa. Kenya lhasanembryonic stock market, but trading is mostly in shares of a few .,ll-known

-enterprises. Long-term financing from institutional investors, other thanlevelopment banlls, is also scarce. Though many international insurance com-panies operate in E-ast Africa, none have made significant investments in theindustrial sector to date.

2.18 The availability of term loans for industrial projects in EastAfrica depends in large part on the type of project. Parastatal enterprisesin Tanzania and Uganda have generally been financed by the government-owneddevelopment corporations, although the latter have not had sufficient localand foreign currency resources to support as many projects as they desired.

1/ i.e., majority government-owned enterprises.

- 6 -

Small, privately owned industrial and service enterprises, on the other hand,have obtained support from the CDC-sponsored development finance companies.There remains a gap in sources of credit for medium and large-scale enter-prises of mixed national and foreign ownership, which EADB is in an excellentposition to fill alone or in cooperation with other financial institutions.EADB can supply larger amounts of credit to each project than the CDC-sponsored development finance companies, it is in a better position toappraise impartially projects sponsored by parastatal entities than thegovernment-owned development corporations; and lastly, it is uniquelyequipped to evaluate regional projects.

III. THE EAST AFRICAN DEVELOPMENT BANK

Shareholders

3.01 EADB's Charter provides that the three Partner States should eachsubscribe to 20% of EADB's authorized capital, and maintain equal proportionsin future subscriptions. Further provisions stipulate that the Partner Statesshall at no time jointly own less than 51% of subscribed capital, though otherinstitutions may make subscriptions provided they are approved by a majorityof EADB's Board of Directors and by the East African Authority (which consistsof the Presidents of the three Partner States).

3.02 EADB's shareholders as of June 30, 1971 were as follows:

Amount paid-in % of Paid-in(Shs. millions) Capital

Government of Kenya 40.0 31.20Government of Tanzania 40.0 31.20Government of Uganda 40.0 31.2nAfrican Development Bank 3.5 2.71National and Grindlays Bank 2.4 1.87Yugoslav Consortium 1.4 1.11Commercial Bank of Africa 0.5 0.39Barclays Bank International Ltd. 0.2 0.16Standard Bank 0.2 0.16

128.2 100.00

3.03 The sale of shares to institutions other than the Partner Stateshas not gone as well as was initially expected. No large subscriptions fromnew shareholders are expected in the near future.

Objectives

3.04 The Charter states that EADB's main objective is to promote in-dustrial development in Partner States by providing technical and financial

- 7 -

assistance. In so doing, it must give priority to the relatively less de-veloped Partners so as to reduce industrial imbalances. At the same time, itmust endeavour to increase the extent to which Partner States complement oneanother in the industrial field. In fulfilling these objectives, it mustsupplement the activities of national development agencies and co-operate withother development organizations, whether public, private, national or inter-national. Industry is defined to mean manufacturing, assembling and process-ing industries. Building, transport and tourism are specifically excluded.

3.05 EADB's Charter requires that peIr periods of five years*of opera-tion it make, as nearly as possible, 22.5% of its investments in Kenya and38.75% each in Tanzania and Uganda. The distribution is to be reviewed atthe end of EADB's first ten years of operation. 1/ The main consequence ofthis differential formula is that EADB's overall investment activities maybe inhibited by the lack of investment opportunities in any one Partner State;this would mean that EADB would have to promote investments in the laggingcountry to increase its investments in the others,

Resources

3.06 EADB's authorized capital is Shs. 400 million (US$56.0 million) ofwhich Shs. 259.2 (US$36.3 million) have been subscribed by the member share-holders shown in paragraph 3.02. Half the subscribed capital had been paid-inas of June 30, 1971 and the other half is callable only to repay borrow-ings or to honour guarantees. Callable capital is therefore an indirectguarantee given by EADB's shareholders to its creditors.

3.07 The Charter denominates capital in units of account equivalentto 0.124414 grams of fine gold, corresponding to the then par value of thethree East African currencies. Partner States disbursed half their paid-incapital subscriptions in foreign currencies and half in their national cur-rencies. The Charter specifies that, in the event that the currency of anyPartner State should be devalued, that Partner must increase its subscriptionso as to restore the original value to the extent that the original capitalpayments have not been disbursed or converted into other currencies.

3.08 EADB has not yet entered into any significant borrowing agreements,as shown in Annex 2. However, a loan has been negotiated with the AfricanDevelopment Bank for US$2.0 million equivalent, at 6.5% interest per annum,with repayment in fixed amortizations over a period of 15 years. Ten percentof the loan may be available for local currency procurement purposes.

3.09 A significant proportion of loans so far granted by EADB havebeen in local currencies, and these operations have been financed out ofits equity capital. In order to continue to provide its customers with

1/ ThIe Charter is not clear on whether these proportions are to be achiievedon an approval, commitment or clisbursement basis.

- 8 -

local currency financing, EADB should seek new sources of funds in shillings.The Charter empowers it to borrow within the territories of Partner Stateswith the approval of the governments concerned, and EADB is giving thought toways of obtaining additional local currency resources.

The Board of Directors

3.10 EADB's highest authority is its Board of Directors, except forcertain matters 1/ which must be decided by the Community Authority in con-sultation with the Board. The Board is composed of three directors, eachappointed by a Partner State. The Charter also provides that two addition-al directors may represent non-government shareholders. Non-governmentshareholders are not yet represented, however, as their individual and jointshare subscriptions are too small, although National and Grindlays Bank andthe Consortium of Yugoslav Banks are normally invited to send observers toboard meetings, and do so.

3.11 Board meetings are convened and chaired by the Director General.According to the Charter, meetings must be held at least every three months,and the practice has been to hold them at these intervals. All operationaltransactions must be presented by the Director General to the Board forapproval. Voting power is determined by the number of shares directorsrepresent. The Director General does not vote. Resolutions are carriedby a simple majority of the votes represented by the directors.

3.12 Membership of the Board is for a three--year period, though PartnerStates may change their directors at will and reappoint them. Tanzania andKenya have been represented by officials of the Ministries of Commerce andIndustry, and Finance and Economic Planning, respectively, while the UgandanDirector is from the private sector. Board membership was fairly stable dur-ing the first two years of operation, but several changes were made by Kenyaand Tanzania during 1970 and 1971.

Policies

3.13 EADB's Charter states that EADB will be guided by sound bankingprinciples and that it shall finance only economically sound, technicallyfeasible and properly appraised projects. It is prohibited from engaging inrefinancing operations. It is required to supervise its investments and tomake certain that its funds are used with due attention to economy and effi-ciency.

3.14 In addition to general guidelines, the Charter contains a numberof operating limitations designed to safeguard EADB's financial soundness.These limitations are reasonable and prudent. They were complemented, at

1/ These include: the appointment of the Director General, increases inauthorized capital, Charter amendments and admission of new members(shareholders).

-9-

the Bank's suggestion, by a Statement of Operating Policies, approved byEADB's Board on May 4, 1972, which will help guide Management on day-to-daydecisions regarding EADB's exposure to investments in a single enterprise.The Statement also provides that EADEi will protect itself against foreignexchange risks in its operations and that its Management and auditors willcritically review the investment portfolio at least yearly so as to estab-lish the adequacy of provisions. A copy of the Statement may be found inAnnex 3.

3.15 The Charter contains two operating limits which seem unduly re-strictive: neither EADB's total equity investments nor its total guaran-tees can exceed 10% of net worth. Though these limits have not restrictedoperations so far, they could do so in future. The limit on equity invest-ments, in particular, could hamper EADB's promotional role. EADB's Manage-ment is seeking an amendment to the Charter which will enable EADB to in-vest a greater proportion of its net worth in shares of other companies.

The Director General

3.16 The Director General is appointed by the East African Authorityfor a period of five years. The Director General is EADB's Chief Executiveand legal representative. His main responsibilities are to interpret policy,set objectives for operations, formulate long-term plans, structure EADB'sorganization and develop its management. Mr. Iddi Simba, a Tanzanian, hasbeen EADB's only Director General. He had previously been an Alternate Ex-ecutive Director of the World Bank, Acting Permanent Secretary of Planning,and Assistant Commissioner of Planning in the Government of Tanzania. Hehas the stature and administrative competence required for his job and hasretained advisors to help him perform the more technical functions satisfac-torily.

3.17 Friction between Tanzania and Uganda early in 1971, resulted inthe temporary expulsion of several Community organization officials fromthe territories of both countries. The Director General was one of theofficials affected but he was permitted to return to Kampala, where EADB'sheadquarters are located, in November 1971 after differences between thetwo Partner States had been overcome. The Director General carried outhis functions from Nairobi and Dar-es-Salaam during his five-month absencefrom Kampala.

Personnel and Organization

3.18 The Director General has considerable freedom in selecting seniorstaff. Partner States expect, however, that as many senior staff positionsas possible will be filled by East Africans and that appointments will bedistributed more or less evenly among the three countries. In the shortperiod of EADB's existence, the Director General has recruited some 22 young,well educated East Africans to staff the organization. Most are universitygraduates in engineering, economics, or business administration and have twoor three years business experience. Their average tenure at EADB is about

- 10 -

two years. Their inexperience has been compensated for by obtaining theservices of six expatriate advisors, some of whom also have management re-sponsibilities. Most of them have been seconded from variou* external aidorganizations which pay their salaries. (See organization chart in Annex 4.)The expatriate staff play an important role in EADB, both in ensuring effi-cient operations and in providing on-the-job training to East African staff.Expatriate advisors will probably be required in some functions for at leastfive years more.

3.19 The Deputy Director General, Mr. J. G. Shamalla, is a lawyer whopreviously served in the Kenyan Civil Service. He has been with EADB forabout 2 years. The Deputy Director General oversees the legal, secretarial,and treasurer's functions. He could also usefully include long-term plan-ning and mobilization of resources in his functions.

3.20 Mr. M. S. Gujarathi, an Indian who has only been with EADB asTreasurer for less than one year, is an experienced commercial banker. Histask at EADB is a challenging one. Accounting systems need upgrading toprovide management with adequate information on operations as EADB grows.Long-term financial planning should be emphasized and more attention paidto the securing of local currency resources. The Deputy Director Generaland Treasurer should jointly improve planning in this area.

3.21 The Chief of Operations is responsible for all EADB's term invest-ment activities. He reports directly to the Director General and supervis,--project promotion, appraisal and investment follow-up. lie also supervisesEADB's recently opened regional offices in Nairobi and Dar-es-Salaam. Thepresent Chief of Operations is Mr. L. Berring, a Swedish national secondedby SIDA 11, who has been with EADB since 1969. He has extensive commercialbanking experience. Mr. Berring is due to finish his contract with EADB inJuly 1972, and will be replaced by Mr. T.E. Ericson, an experienced manage-ment consultant recommended to EADB by SIDA, which has offered to pay forhis salary. It is expected tHat Mr. Ericson will emphasize project promotionduring his two-year assignment to EADB.

3.22 The Project Appraisal division within the Operations Departmentis headed by Mr. M. B. Ngatunga, a Tanzanian graduate in economics, who hasbeen with the EADB for almost four years. He has under him seven E1astAfrican project officers with backgrounds in economics, engineering or busi-ness administration. A team of three people of different specialties is nor-mally assigned to project appraisals. For the time being, two such teamsare sufficient for EADB's requirements, but the aim is eventlally to havethree teams in the Project Appraisal division.

3.23 The Project Supervision division, also responsible for disbursementcontrol, is under Mr. I. 0. Baruti, a Tanzanian graduate in business adminis-tration, who has been with EADB for almost four years. He has three project

1/ Swedish International Development Authiority.

- 11 -

officers under him. Since EADB's operational portfolio is being built up,this group is still in the process of organizing its work and establishingworking relations with customers. It has sometimes had to borrow project of-ficers from the Appraisal division to do supervision work.

3.24 The Technical Advisor to the Operations Department participates inproject appraisals and advises on technical matters when required. The ex-patriate who has filled this position has recently left, and hlr. H. Nathan,an experienced British industrial engineer seconded by UNIDO who now heads1.ADB's Research and Planning Department, will be named to this position.

Project Proinotion

3.25 The recently created Project Preparation and Promotion division isheaded by Mr. !E. Rebeling, 38, a Swedish specialist in management accounting,who reports to tlhc Chief of 0-perations. The function of this group will beto identify and develop investment onoortunities, but its modus operandi hasnot been clearly established yet.

3.26 The Researchi and Planning Department is also concerned with projectdevelopment, but more in macro-economic terms. Tt completed an overall studyof the East African economy in November 1970 which identified several indus-trial fields for possible investment projects. The Department is now prepar-ing pre-feasibility studies on fourteen of these industries. It is headed byMr. N>athan who is supported by another UNIDO expatriate and a local officer.

3.27 EADB's efforts in project development have so far not resulted inany investments; a reorganization and reorientation of this activity seemscalled for. The Project Preparation and Promotion Division and the Researchand Planning Department might advantageously be merged into a single depart-ment, with terms of reference clearly de-emphasizing the more abstract macro-economic studies prepared in the past. It should also be discouraged fromgetting too involved in the detailed planning of projects; such responsibi-lities should be undertaken by sponsors with appropriate knowledge of theindustry concerned. In order to find sponsors for the projects it identifies,EAD]B should develop contacts with the business world both within and withoutEast Africa, and should use its branch offices in Nairobi and Dar-es-Salaamto a greatpr extent for this purpose. The Director General is currently con-sidering the respective roles of these two units, and it is likely that theywill be reorganized when Mr. Nathan assumes hiw new responsibilities as Tech-nical Advisor.

Operating Procedures

3.28 Detailed manuals on all important aspects of operations have beenDrepared by the expatriate advisors with a view to training staff and alsoestablishing sound operating procedures. The manuals cover the marketing,technical, financial and economic aspects of project appraisals. The cover-age of the financial and economic aspects is somewhat confusing as a numberof techniques are prescribed, not all of which seem relevant. EADB's ap-praisals follow these guidelines fairly closely and therefore, although com-

- 12 -

plete in their coverage, tend to be over-elaborate in some respects, whilemajor issues are not always examined in depth. Despite these shortcomings,appraisals are carefully prepared and usually present a good description ofthe project. EADB is considering moving towards a more straightforwardeconomic rate of return test in analyzing the economic merits of projects.

3.29 EADB's procedures to check on its client's procurement needimprovement. Appraisal teams often do not question the suitability andcost of equipment or the choice of process. In some cases, clients relyunduly on feasibility studies prepared by suppliers of equipment and l.ADBmakes too little effort to check on the objectivity of these studies. Theappointment of Mr. Nathan, who has experience in industrial management indeveloping countries, to the position of Technical Advisor, can be expectedto substantially improve EADB's perfornance in procurement evaluation.

3.30 Each draft appraisal report is considered by a Staff AppraisalCommittee, chaired by the Chief of Operations and including the 'Tanagersof the Promotion, Project Appraisal and Project Supervision divisions aswell as the Director of Research and Planning, the Technical Advisor andthe Legal Officer. The project is presented by the appraisal team leaderand critically examined by all participants. Once a project is approvedby the Staff Appraisal Committee, it is sent to the Management AdvisoryCommittee, a smaller group of EADB's Department heads chaired by the Di-rector General. Most recommendations to the Board on investment termsand conditions are formulated by the Director General and the Chief ofOperations.

3.31 The Supervision division has been in existence only a few monthsand has not yet had an opportunity to implement the follow-up proceduresoutlined in the operations manual. The procedures, as outlined, are ade-quate. A full report on each customer is called for once a year, afteraudited financial statements have been received. Quarterly reports are re-quired from each client. Project supervision probably depends too heavilyon data supplied by clients, some of whom do not yet have the managementreporting systems needed to produce the information requested by EADB.Brief monthly reports are prepared which will complement EADB's annual re-views. Supervision visits are scheduled whenever required. In the caseof projects under construction, disbursements are often preceded by visitsto verify progress made in plant construction.

3.32 One of EADB's normal conditions of investment is that it be re-presented on the client's board of directors. Most clients accept this, soEADB's Management is able to follow their progress through board meetingsas well as through supervision reports. Since EADB does not have too manycustomers its staff has been able to attend to Board representations, buteventually this may become a burden. EADB will then have to select theclients on whose board it will be represented. In the meantime, it isgaining a broader understanding of the East African business communitythrough board representations.

- 13 -

3.33 EADB has clearly laid down disbursement procedures which requirecustomers to present evidence that approved investments are actually beingmade. These procedures, if supported by checks on the performance of con-tractors in terms of quantity and quality, would be adequate for the purpose.Each individual disbursement is approved by at least three senior staff mem-bers.

IV. OPERATIONS AND FINANCIAL PERFORMANCE

Operations

4.01 EADB's yearly operations up to December 31, 1971 are summarizedin Annex 5. Total approvals were Rs 123.0 million on that date while com-mitments where only Rs 75.1 million. This lag has been due to delays inobtaining complementary financing for some projects and to management diffi-culties in implementing others. In some cases, EADB may have approved projectsbefore they were mature for implementation. Disbursements also lagged up tothe middle of 1971 but have improved since then. Total disbursements wereequivalent to 78% of commitments at the end of 1971.

4.02 A large proportion of EADB's clients are parastatal (i.e. majoritygovernment-owned) enterprises. They sponsored 6 out of the 16 investmentscommitted to the end of 1971. Somewhat over 40% of the total financing com-mitted by EADB up to then was granted to such enterprises. The remaining 60%was for projects sponsored by resident Asian and European investors (some ofthem East African citizens) or by foreigners.

4.03 The country distribution of approved investments on December 31,1971 was: Kenya 29%, Tanzania 33% and Uganda 38%. This distribution, onan approval basis, is reasonably close to the differential formula. On acommitment basis operations in Uganda have lagged, and the distributionwas Kenya 46%, Tanzania 33% and Uganda 21%. As stated earlier (see foot-note to paragraph 3.05), the Charter does not clearly indicate whether thedifferential formula is to be met on an approval, commitment or disburse-ment basis; the matter will probably not be clarified until the end ofEADB's first five years of operation, in July 1973.

4.04 About 53% of the total cost of projects financed by EADB was inforeign exchange. New equity contributions financed about 29% of total proj-ect costs, suppliers' credits about 24%, EADB about 13% and other sources 29%.

4.05 EADB had committed only two equity investments up to the end of1971, representing only 5% of its portfolio and 2.5% of net worth. Thissmall equity portfolio reflects, to some extent, inhibitions imposed by theCharter limit on such operations. Only one guarantee transaction has beenundertaken, for She. 1.3 million, or 1.7% of commitments. A guarantee com-mission of 1% p.a. is charged.

4.06 A list containing summarized information for all projects approvedand committed by EADB up to the end of 1971 is at Annex 6. The location ofEADB's projects are shown on the map. EADB's financing has tended to go toindustries engaged in the production of intermediate and basic goods. Thus,

- 14 -

as of the end of 1971, 30% of the value of commitments were to the metal pro-ducts industry, and another 30% to the paper and packaging industry. Indus-tries producing consumer goods received another 20% of total investments andthe processing of agricultural products for export received 15%. So far mostof EADB's projects have been aimed at national rather than regional or exportmarkets. Several of the projects will have sufficient capacity to serve theregional market as well, however; and EADB hopes to increase its support forregional projects.

4.07 EADB has committed a Government guaranteed loan to ICDC of Kenyafor Shs. 5.2 million, to enable it to finance six investments in mediumsized industries. Each project financed was reviewed by EADB. ICDC hasagreed to repay EADB's loan over 12 years, including 4 of grace.

4.08 EADB's average repayment period for loans has been 9-1/2 years.The median size of investment is Shs. 4.7 million and the largest invest-ment in a single project amounted to 8% of EADB's paid-in capital and re-serves. Most loans granted by EADB to date are secured by a first chargeon fixed assets. EADB has also obtained guarantees from sponsors for 35%of its loan commitments.

4.09 Interest rates have been negotiated in each individual case, rang-ing from 8.0% to 9.0% per annum. EADB's management is now considering theuse of a single interest rate for all loan investments, which is expected tobe 9%. A 1% commitment fee is charged on amounts not disbursed according toa client's projected loan disbursement schedule. EADB plans to institute a1% commitment fee on the undisbursed amount of approved loans.

4.10 About 20% of EADB's loans have been denominated in foreign exchange,the remainder in Shillings.

4.11 EADB has co-operated closely with other financial institutions inthe region, especially government-owned development corporations. Of its 24approved investments, half are being financed jointly with national develop-ment corporations, four with CDC - sponsored development finance companies,and three with IPS. EADB has also had a joint financing with the AfricanDevelopment Bank and with IFC.

Financial Structure

4.12 Summarized balance sheets up to December 31, 1971 are shown inAnnex 7. EADB's newness is reflected in its financial structure. Short-term investments were 1.4 times loan and equity investments outstanding onDecember 31, 1971. Borrowings were insignificant.

Investments

4.13 Short-term investments are well managed. They are mostly in theform of call and time deposits with commercial banks and yielded 8.4%, onaverage, in 1971. The bulk of these deposits is with foreign banks. EADBholds large foreign currency balances because half the capital contributions

- 15 -

made by Partner States were denominated in foreign currencies. Managementhas thought it convenient to maintain these balances in foreign currenciesuntil required for operational purposes because of higher returns in Europeanshort-term money markets and to avo4d exchange risks.

4.14 Since grace periods granted by EADB on its project loans haveaveraged about two and a half years, no part of its portfolio has yet becomedue, and it is too early to judge its quality.

Profitability

4.15 Summarized income statements up to December 31, 1971, m,Iay be foundin Annex 8. During 1971 profit from operations was equivalent to 3.7% ofaverage net worth. (EADB is tax exempt.) This low return is the result oflow leverage and high administrative expenses, which were 3.1% of averageassets in 1971. The main profit and loss account items, as a percentageof average assets, have evolved as follows since EADB started operations:

(She. million)1968 1969 1970 1971

Gross Income 5.5 7.9 8.0 7.0Financial Expenses - - 0.2 0.2

Administrative Exp. /1 3.3 2.8 2.9 3.1

Operatirg Profit 2.2 5.1 4.9 3.7

/1 Including depreciation.

EADB's profitability should increase as its leverage improves, provided itslending rates are maintained at least at the level of its earnings on short-term investments, and its administrative expenses are kept in check.

4.16 No dividends have been paid to date and no dividend policy has yetbeen established. It is probable that the Partner States will not requiredividenids from EADB, but some of its other shareholders will expect a returnon their investment. No dividend payments are planned in the near future.

Auditors

4.17 The Charter provides that EADB shall have an internal auditor, whohas not been appointed yet. The accounting system is simple, and does notprovide for automatic checks on its day-to-day operations. Some improvementscould be made to meet the needs of EADB as its volume of business increases.

4.18 Peat, Marwick, Mitchell and Company has been appointed as EADB'sexternal auditors. A short-form audit is prepared once yearly. The auditorsexpressed no reservations concerning EADB's accounts. EADB has agreed torequest its auditors to prepare long-form audit reports.

- 16 -

V. PROSPECTS

EADB's Role in the East African Community

5.01 EADB has an important role to play in the East African Community.It is the only regional financial institution in a position to gauge overalldemand and be up-to-date on competitive circumstances in all three PartnerStates. Its primary function should, therefore, be to support regional in-vestment projects, not only by providing finance, but also by bringing to-gether foreign and local investors. As stated earlier, EADB may play animportant role in financing and helping implement Community sponsored proj-ects in the motor vehicle, chemical and steel industries.

5.02 Apart from its own investments in regional projects EADB may beable, through its knowledge of regional markets, to convince its clients tocomplement rather than compete with manufacturers in other Partner States,thus realizing economies of scale and minimizing duplication of investment.

5.03 EADB can also act as an impartial appraiser of projects. ManiyEast African industrial projects are promoted by national development cor-porations; they are often part of a government-determined development plan,and the national corporations sponsor them with little regard to financial,technical or economic criteria. EADB, though an entity of the three PartnerStates, is not controlled by any single government, and thus can better in-sist on sound criteria for its investments.

Projections

5.04 In considering the possible effect of the differential investmentformula on EADB's operations, it seems that Uganda may constitute a con-straint to EADB's level of operations, as its market is the smallest of thethree. The estimated level of manufacturing investment in Uganda is Shs.150 million in 1972, increasing by about 10% per annum thereafter. On theassumption that EADB will finance approximately 18% of this total, based inpart on EADB's knowledge of industrial projects now being prepared, EADB'scommitments in 1972 would amount to Shs. 27 million each in Uganda andTanzania and Shs. 16 million in Kenya, for a regional total of Shs. 70 mil-lion. Total commitments are projected to increase to Shs. 90 million in 1973.

5.05 EADB's five-year projections of operations shown in Annex 9 assumethat the annual level of commitments will double over the average of 1970and 1971. Though this is an optimistic forecast, EADB has a large number ofprojects under study and a backlog of approved but not committed projects ofSh. 48 million.

5.06 In order to cope with the larger volume of forecast business, EADBplans to take on six additional East African professionals for the OperationsDepartment in 1972, three in 1973, and two each in 1974 and 1975, as well asnew professional staff in the Legal and Secretary's Office. These appoint-ments, plus the present number and quality of expatriate and local staff,should be sufficient to handle EADB's expected volume of business.

- 17 -

5.07 In the past 80% of the value of EADB's loans was in shillings, butpart of these amounts were used by EADB's clients to purchase foreign exchangeto finance imported (i.e. extra-regional) goods and services. EADB's manage-ment forecasts that 70% of commitments from 1972 on will be to finance im-ported goods and services.

Resource Requirements

5.08 At the end of 1971 EADB had uncommitted resources of Sh. 69.5 mil-lion (see Annex 2). To the end of 1973 EADB is expected to commit Sh. 160million, of which Sh. 112 million (equivalent to US$15.7 million) is expectedto be for the import component of projects, as shown in the following table:

(Shs. million)

of which:Total Import Component Local Component

Available, end 1971 69.5 - 69.5

less commitments 1972 (70.0) (49.0) (21.0)plus cash generation 1972 10.4 10.4

Available, end 1972 9.9 (49.0) 58.9

less commitments 1973 (90.0) (63.0) (27.0)plus cash generation 1973 13.8 13.8

Available, end 1973 (66.3) (112.0) 45.7(in U.S. $ million equivalent) (9.3) (15.7) 6.4

Since EADB has not yet developed new sources of finance for the local com-ponent of projects, wise management of its resources requires that it limitthe use of its paid-in capital and local currency cash generation to finan-cing such requirements. These resources will be sufficient to meet the localcomponent cost of projects up to the end of 1973 but in the meantime EADBwill require US$15.7 million to finance the import component of projects.

5.09 EADB obtained a $2 million loan from the African DevelopmentBank early in 1972. It wishes to meet the remaining gap of US$13.7 mil-lion for the foreign component of projects by loans from SIDA and the Bank.SIDA appraised EADB at the same time as the Bank; a $5.2 million loan hasbeen negotiated and is due to become effective during the second semester of1972. One half of the loan may be used to finance the local component ofprojects. Repayment is to be made over 25 years with 10 years of grace;the interest charge is 2% per annum and a provision of the agreement will bethat gross income in excess of 4% per annum derived by EADB from the proceedsof thie loan, will be set aside in a special fund which is to be used to fi-nance foreign technical assistance to EADB for project preparation, promotionand appraisal, technical assistance to African-owned enterprises and loans

- 18 -

or other forms of assistance to small-scale industries. EADB will still re-quire $8.0 million to finance the import component of projects, over andabove the SIDA loan.

Projected Financial Results

5.10 EADB's projected cash-flow statements, balance sheets and incomestatements up to December 31, 1976 are shown in Annexes 10, 11 and 12. An-nex 13 contains a summary of the assumptions on which they are based.

5.11 Administrative expenses, as a percentage of average assets, areexpected to decrease from 3.1% per annum in 1971 to 2.0% per annum in 1974and 1.3% per annum in 1976. Yearly provisions for bad investments were cal-culated so as to bring the total of such provisions to 5% of the outstandingportfolio; this level seems adequate. EADB's management is taking steps toapply a single lending rate of 9% p.a., instead of individually negotiatedrates ranging from 8% to 9%. Nevertheless, the margin between borrowing andlending rates remains quite narrow; and return on share capital, after pro-visions, is expected to be no greater than 5.9% per annum in 1976. This isnot an unacceptably low return on share capital for a predominantly government-owned bank such as EADB. While some further increase in its lending rate,perhaps to 9.5%, would be reasonable, it is probably not feasible in the im-mediate future in view of competitive conditions in East Africa.

VI. CONCLUSIONS AND RECOMMENDATIONS

The Bank, EADB and National Institutions

6.01 EADB is a regional financial institution established and largelyowned by the Partner States of the East African Community. It is an integralpart of the structure of the Community and has been assigned an impor tantrole in carrying out its purposes. Its role in promoting industrial develop-ment in the region can be very important if the Community functions as in-tended by its founders. If the Community arrangements and relations shoulddeteriorate, EADB could still make a substantial constribution to the indus-trial development of the region.

6.02 The Government of all three Partners of the East African Communityhave recently requested that the Bank consider lending to existing or new de-velopment institutions in their respective countries. These national DFCscompete to some extent with EADB, but their operations should also be comple-mentary (see paras. 5.01 - 5.03). Hence there is no reason why the Bankshould not consider, on the merits, lending both to EADB and to the nationalinstitutions.

- 19 -

Recommendations

6.03 The Bank has been in close contact with EADB since it started op-erations and has lent advice and assistance on several occasions. EADB iscreditworthy; it has developed its organization and its capabilities as afinancial institution, though further improvement should be expected. Itis recommended that a loan of US$8 million be extended to EADB so that itmay finance the import requirements of industrial projects to the end of1973, passing on the exchange risk to its clients. A free limit ofUS$300,000 is recommended, which would enable the Bank to monitor the ma-jority of EADB's investments during its first few years of operation; theaggregate free limit should be 30% of the Bank's loan, or US$2.4 million.

6.04 Since EADB has only been in operation for a comparatively shortperiod of time and has not had a chance to build up its portfolio and reachan acceptable level of profitability, it is recommended that EADB be grantedconcessional treatment with respect to the Bank's commitment fee.

Annex 1

EAST AFRICAN DEVELOPMENT BANK

Summarized Data on East African Development Finance Institutions

(to December 31, 1970)

Year 1/ Number of CommitmentsStarted Portfolio_. Number of Projects during 1970

operation (Sh million) Subsidiaries_. Supported (Sh million)

Government-ownedDevelopment Corporations

ICDC (Kenya)4/ 1955 80.7 8 39 308-'NDC (Tanzania) 1965 296.9 22 63 76. 4

UDC (Uganda) 1952 317.8 23 39 3l.1:

Majority Foreign-ownedDevelopment FinanceCompanies

DFCK (Kenya) 1963 48.6 - 28 3.0

TDFL (Tanzania) 1962 30.0 38 104

DFCU (Uganda) 1964 35.7 _ 26 1.4

IPS GroupW 1963 18.2 2 38 6/

Regional Institutions

EADB 1968 18.7 - 16 39.4

1/ Loan and equity portfolios.

2/ More than 50 percent owned.

3/ Projects assisted with term loans, guarantees or equity investments, including

subsidiaries.

4/ Data to June 30, 1970.

5/ Increase in portfolio.

6/ Disbursements.

DFCDFebruary 1, 1972

Annex 2

EAST AFRICANI DEVELOPMNT BANK

Resources Available for Commitment

as of December 31, 1971

(in million of Shs.)

Called-up capital 129.6

Reserves and retained earnings 17.2

Borrowings in shillings, medium term 7.4

Total Resources Available 154.2

Investments Outstanding:

Loans (net) 55.2

Equity investments 2.6

Total Investments 57.8

Undisbursed Commitments 15.7 -

Fixed Assets 11.2

Total Commitments 8L.7

Uncommitted Resources 69.5 -

154.2

1/ Excluding guarantees for 9hs.1.3 million

DFCD

June 1972.

Annex 3

EAST AFRICAN DEVELOPMENT BANK

Statement of Operating Policies

(Approved by the Board of Directors on May 4, 1972)

i) EADB's investments in any single enterprise, whetherin the form of equity, loan or guarantee, will notnormally exceed 20% of its own paid-in capital andfree reserves;

ii) EADB's investment in an enterprise, whether in theform of equity investment, loan or guarantee, willnot normally exceed 50% of the total net assets ofthe enterprise;

iii) In making equity investments, EADB will avoid havinga controlling interest and the responsibility ofmanaging an enterprise. EADB will not normally sub-scribe to more than 25% of an enterprise's sharecapital;

iv) EADB will adequately protect itself against foreignexchange risks in its borrowing and lending operations;

v) EADB loans will not normally be granted for periodsexceeding fifteen years;

vi) EADB's Management and auditors shall criticallyexamine EADB's portfolio at least once yearly, andrecommend to the Board what amounts should be addedto provisions for bad and doubtful investments.

DFCD

May 1972

EAST AFRICAN DEVELOPMENT BANKORGANIZATION CHART

SEPTEMBER 1971

BOARD OF DIRECTORS

DIRECTOR - GENERAL _(I. Simba)

DEPUTY DIRECTOR - GENERAL(J. G. Shomolla)

SECRETARY TREASURER LEGAL OFFICER CHIEF OF OPERATIONS TECHNICAL ADVISOR(H. KaIura) (M. Gujarathi*) (D. Mulira) (L. Berring*) (R. Lotz*)

ACCOUNTANT MANAGER PROJECT REGIONAL MANAGER RESEARCH PBI EAINPREPARATION AN D MANAGER PROJECT MANAGER PROJECT MANAGERS AND PLANNING PBI EAIN

(J. Wamunza) PROMOTION APPRAISAL SUPERVISION (W Mada (H.Nathan*) OFFICER

(E. Rebeling*) (M. Ngatunga) (I. Baruti) (S. Kosozi) (A.Monte;ro*) (D. Selbukirna)

ADMINISTRATIVE ACCOUNTS OFFICERS PROJECT OFFICERS PROJECT OFFICERS SENIOR PROJECTPERSONNEL AND CLERKS (7) (3) OFFICER

z*Expatriate Z

World Bank-6206(2R)

EAST AFRICAN DEVELOPMENT BANK

Summary of Operations 1969-1971(millions of Shs.)

Equity T O T A LLoans Investments Guarantees No. Amount

1969

Approved 36.9 - - 10 36.9

Committed 8.5 _ _ 3 8.5

Disbursed 3.9 - - 2 3.9

1970

Approved 34.2 3.8 1.3 7 39.3

Committed 35.6 3.8 - 7 39.4

Disbursed 14.2 0.6 _ 6 14.8

1971

Approved 46.8 - - 7 46.8

Committed 25.9 - 1.3 6 27.2

Disbursed 37.4 2.0 - 7 39.4

Total to 12/31/71

Approved 117.9 3.8 1.3 24 123.0

Committed 70.0 3.8 1.3 16 75.1

Disbursed 55.5 2.6 - 15 58.1

DFCD

June 1972

ZAST 'FI"Lhui DEVELOPMEVIT BUIK

Projects Approved and Committed to December 31, 1971

TermsGrace + Dat.es Other

Instru- Amount Inter- Repayment Approval InstitutionalProJect ment (Shs.- T.) est (Years) Commitment Sponsor Investors

KENYA

1. Industrial & Commercial Development 5orp. Loan 5.2 86 4+ Pi 3/69 2/71-for onlending to (guar-a. Resins Sh.O.6 Mn anteed) Foreignb. Hamd tools Sh.2.0 Mn Foreignc. Plastic tableware Sh.O.l Mn Foreignd. Metal containers Sh.1.4 Mn Foreigne. Ceramics Sh.0.4 Mn Foreignf. Groundnut Processing Sh.0.7 Mn Resident Expatriate

2. Metal lox Co. (7eatal containers) Loan 6.o 8.rj 2+ 5 12/69 2/70 Foreign

3.Panafrican Paner Mills (pulpand Paper) Loan 7.1 9% 2+12 4/70 9/70 Foreign IF'C,ADB,

&Quity 3.6 DFCK,ICDC

Total 10.7

4.Plastic & Rubber Industries (Shoec) Loan 1.0 8.5/ 1+ It 4/70 12/70 IPS.Equity .2

Total 1.2

5.EMCO Steelworks (hot rolled steel Loan 6.o 9% 3+ 7 9/70 3/71 Resident Expatriateproducts) !/

6.Kenya Toray Mills (Synthetic textiles) Loan 4.8 8- 3+ 7 3/71 6/71 Foreign(guaran- V ¢

Total Commitmensf / teed) Total Approvrals` 3309 0%

1/ &xcluding Guarantee of'Sh. 1.3 !4n.

TermsGrace+ Dates Other

Instru- imount :nter-Repayment ipproval Institutional*iProject ment (Jhs.Mn) est (Years;) ommitment 6ponsor Investors

T U G?AIfl)A\

1 -J riean C 3rarnmCl L,o-n 2.0 P1l 1.5+ 5 2/69 1/70 IJDC IID,IPS(0.r75 Guaranteed) DFCIJ

2.Agricultuiral Enterprisec Loan(Tea Factory) (G,uar.lJteed) 4.5 WI 3+ 7 3/69 12/69 UDC 1DB

3.Ugma Steel (Agricultural Implements) Loan 1.5 9% 2+ 5.5 2/69 3/69 Resident Expatriate DFCIJ

4.TTganda Tea Growers Association Loan(Thro tea factories) (Guaranteed) 3.2 8ib 5+ 7 3/69 11/69 Uganda Tea Growlers UK,Coffee D1--

*4ssociation versif.Fund

5.Musicraft (Radio Assembly) Loan(0.3 G'iuaranteed) 1.0 9% 2.5+ 6 9/69 11/69 Resident Expatriate

6.1JDC (Small industries) Loar 1.5 8% ? 6/70 - UDC(Guaranteed)

7.Stteel, Corp. Loan 20.0 9% 3+ 7 3/71 - Resident Expatriate ITDC

8.Papeo (paper) L.an(3,uaranteed) 3.2 8% 3+ 8 2/71 5/71 Resident Expatriate IJDC

9.TTv-Lnda Bottlers (Soft DrinkF) Loan 5.5 9% 3+ 7 11/71 - Resident Expatriate

il.Mpanga Tea Factory Loan 3.6 8]e 4+ 8 11/71 - Uganda Tea GrowersAssociation

11.0hgastat (envelopes) Loan 0.97 9% 0.5+4.5 11/71 - IPS 0N

Trotal Commitments 1540Total Approvals 46.97

TermsGrace+ Dates Other

Instru- Amolmt Inter-Repayment -Approval Institutional

-Project ment (Shs.Mn.) est (Years) Commitment Sponsor Investors

T!INZANIA

I.Raleigh Cycles Loan(0.35 Guaranteed) l.75 8% 2+ 5 2/69 - NDC

2.General Tyre Loan 10.0 8% 2+ 5 3/69 11/70 NTDC

3 .Mafi.a Coconut Doan 1.9 8% 4+ 8 9/69 6/70 Resident TDFL, 1111FCOExpatriate

4.Fiberboard Loan 6.0 8% 4+ 8 6/70 - TTNICO(2.4~ Gulara:eed)

5.Tanzania Bag Loan 7.6 8% 3+10 9/70 12/70 NDC(3.0 Guaranteed)

6 .Aluminum Africa (Steel pipes) Loan 5.0 9% 2+ 5 11/70 6/71 ResidentExpatriate

7.Wyan-a Salt Yines Loan 8.6 84 3+10 3/71 - N1DC

Total Commitments 24.5oTotal Aprrnvals 40.85

East African Total

Oommitmnnts 1/ 73.80

CtD\

1/ Excluding guarantee of S0h.1.3 Min

DFCDF-br1ary 1, 1972

Annex 7

EAST AFRICAN DEVELOPMENT BANK

Summarized Balance Sheets 1968 - 1971

(in miUions of Shs.)

19682/ 196 2/ 19702/ 19713

ASSETS

Cash and Banks 0.3 0.4 1.0 1.1Short-Term InvestmentsDeposits 52.5 78.3 97.0 72.0Government Securities 20.5 20.0 20.2 9.6

Loans - 3.9 18.1 5-Equity Investments - - 0.6 2.6Special Reserves (Provisions for bad investments)- - (0.1) (0.3)Sundry Debtors and Accrued Earnings 1.2 2.6 3.2 3.7Fixed Assets (net) 0.7 2.4 4.5 11.2

Total Assets 75.2 107.6 144.5 155.4

LIABILITIES AND NET WORTH

Sundry Creditors + Accrued Charges 0.2 0.3 0.5 0.6Loans in Local Currencies 2.2 3.4 4.1 9.4Loans in Foreign Currencies - - - -

Total Liabilities 2.4 3.7 4.6 10.0

Paid-in Capital 72.0 98.4 128.2 128.2Revenue Reserves 0.8 5.5 11.7 17.2

Net Worth 72.8 103.9 139.9 145,4

Total Liabilities and Net Worth 75.2 107.6 144.5 154.4

Contingent Liabilities - - 1.3 1.3

Overall Debt/Equity Ratio: 0o03/1 0.o4/1 0.o4/1 o.o6/1

1/ Year ending December 31.2/ Audited.

U/ Unaudited.

DFCD

June 1972

Annex 8

EAST AFRICAN DEVELOPMENT BANK

Summarized Income Statements 1968-1971 V(in '000 Shs.)

1968 1969 1970 19712/

INCOME

From Investments 2,079 7,248) 10,072 (10,043Other, including comndssions -- -- -- 477

Total Income 2,079 7,248 10,072 10,520

Less:

Financial Expenses -- 81 183 226Administrative Expenses 1,212 2,427 3,448 4,o60Depreciation 44 112 240 668

Total Expenses 1,256 2,620 3,871 4,954

Profit from Operation 823 4,628 6,201 5,566Non-recurring profits less losses -- -- -- 1 ,Total Profit 3/before Provisions 823 4,628 6,9201 5,676

Provisions -- -- 81 189

Total Profit after Provisions 823 4,628 6i120 5,487

Operating Profit before Provisionson Average Net Worth 3.5% 5.3% 5.1% 3.9%

Total Profit after Provisionson Average Net Worth 3.5% 5.3% 5.0% 3.8%

1/ Year ending December 31.T/ Unaudited.37 Tax Free.

DFCD

June 1972

Annex g

EAST AFRICAN DEVELOPMENT BANK

Projected Approvals. Commitments and Disbursements!/ 1972 - 1976

(in millions of Shs.)

1972 1973 1974 1975 1976

APPROVALS: Domestic Currency: Loans 22.0 28.0 34.0 40.0 46.0Equity 2.0 2.0 2.0 2.0 2.0

TOTAL 24.0 30.0 36.o 42.0 48.0

Foreign Currency Loans 56.0 70.0 84.o 98.0 112.0

TOTAL APPROVALS 8.0 100.0 120.0 140.0 160.0= = -~~~~~~~~

COMMITMENTS: Domestic Currency: Loans 19.0 25.0 31.0 37.0 43.0t Equity 2.0 2.0 2.0 2.0 2.0

TOTAL 21.0 27.0 33.0 39.0 45.0

Foreign Currency : Loans 49.0 63.0 77.0 91.0 105.0

TOTAL COMMITMENTS 7040 90.0 110.0 130.0 150.0

DISBURSEMENTS: Domestic Currency: Loans 21.2 22.5 28.o 34.0 40.0"'t " Equity 2.0 2.0 2.0 2.0 2.0

TOTAL 23.2 24.5 30.0 36.o 42.0

Foreign Currency: Loans 44.7 56.0 70.0 84.o 98.0

TOTAL DISBURSEMENTS 67.9 80.5 100.0 120.0 140.0

I/ See :Mnnex 13 for main assumptions made

DFCDFebrioary 1, 1972

EAST AFRICAN DEVELOPMENT BANK

Projected Cash-Flow 1972-1976(in millions of shillings)

Sources 1972 1973 1974 1975 1976

Loan recoveries 0.6 2.6 10.0 19.4 30.7Profit before provisions 7.1 8.1 9.7 12.6 15.7Depreciation 0.7 1.1 1.1 1.0 1.0New share capital 1.9 2.0 2.0 2.0 2.0Loans in shillings 2.2 1.1 - - -Foreign currency loans 23.2 55.5 85.0 100.5 119.0

Total Resources 35.7 70.4 107.8 135.5 168.4

Applications

Loan disbursements: shillings 21.2 22.5 28.0 34.0 40.0foreign currencies 44.7 56.0 70.0 84.0 98.0

Equity investments 2.0 2.0 2.0 2.0 2.0Short-term investments and cash (37.7) (15-1) 3.2 7.7 1601Fixed assets 4.9 4.5 0.2 - 0.2Repayment of borrowings 0.6 0.5 4.4 7.8 12.1

Total Applications 35.7 70.4 107.8 135.5 168.4

DFCDApril 1972

EAST AFRICAN DE V&PMENT BANK

Projected Balance Sheets 1972-1976(in millions of Shildlngs)

1971 1972 1973 1974 1975 1976

Assets (actual)-

Cash and short-term investments 82.7 42.9 27.8 31.0 38.7 54.8

Loans 55.5 120.5 196.4 284.4 383.0 490.3Provisions (0.3) (6.1) (10.1) (14-5) (19.4) (24.7)

Equity investments 2.6 4.6 6.6 8.6 10.6 12.6

Sundry debtors, accrued earnings 3.7 3.7 3.7 3.7 3.7 3.7

Fixed assets (net) 11.2 15.5 18.9 18.0 17.0 16.2

Total assets 155.4 181.1 243.3 331.2 433.6 552.9

Liabilities

&unxry creditors and accrued charges o.6 0.2 0.2 0.2 0.2 0.2

Loans: shillings 9.4 11.0 11.6 8.4 5.8 3.9

foreign currencies - 23,2 78.7 162.5 257.8 366.6

Paid-in capital 128.2 130.1 132.1 134.1 136.1 138.1

Reserves 17.2 16.6 20.7 26.0 33.7 44.1

Net worth I14.W7 I 1 6 ". I8g.

Total liabilities 155.4 181.1 243.3 331.2 433.6 552.9

Term debt/equity ratio 0.06/1 0.2/1 0.6/1 1.1/1 1.6/1 2.0/1

1/ Unaudited.

DFCDJur 3 1972

EAST AFRICAN DEVELOPMENT BANK

Projected Statements of Income 1972-1976(in millions of Shillings)

1971 1/ 1972 1973 1974 1975 1976(actual)

Income from operations

Short-term investments ( 3.8 1.9 1.4 1.5 2.8Loans (10.0 8.8 15.1 22.8 31.7 40.0Commissions, other charges and dividends B 0.5 1.8 2.0 2.6 3.0 3.3

Gross income 10.5 14.4 19.0 26.8 36.2 46.1

less:Financial expenses 0.2 2.h 5.7 11.2 17.3 23.7Administrative expenses 4.0 4.2 4.1 4.8 5.3 5.7Depreciation 0.7 0.7 1.1 1.1 1.0 1.0

Profit before provisions 5-6 7TI 1.9.7 1. ig7Provisions 0.2 5.8 4.0 4.4 4.9 5.3

Net profit from operations 5.4 -/ 1.3 4.1 5.3 7.7 l0.4

Profit before provisions, on average net worth (%) 3.9 4.9 5.4 6.2 7.6 8.9

Profit after provisions, on average net worth (%) 3.8 0.9 2.7 3.4 4.7 5.9

I/ Unaudited.

2/ Not including non-recurring profits, less losses, of Shs. 0.1 million.

DFCD

June 1972

Annex 13

EAST AFRICAN DEVELOPMENT BANK

Projection Assumptions

1. Projected Approvals, Commitment and Disbursements - (Annex 9)

- Half the amounts approved in one period will be cormmitted in the sameperiod, the other half during the following period.

- Disbursements are assumed to take place as follows: 1/4 during year ofapproval, 1/2 during the following year and 1/4 the third year.

- Equity investments: Shs. 2 million per year.

- Rate of approval growth: Shs. 20 million per annum,

2. Projected Balance Sheets (Annex 11)

- Average period of loans granted: 10 years including 2 of grace.

- Provision for bad investments to be 5% of portfolio at the end of eachperiod.

- Increase in fixed assets up to 1974 due to improvements in office buildingin Kampala.

- Lending operations in local currencies are to be financed out of internalsources only.

- Average period of foreign loans obtained: 10 years including 2 of grace.

- No dividends to be paid.

3. Projected Statements of Income (Annexl2)

- Income from short-term investments projected at 6.5% p.a.

- Income from long-term loans projected at 9.0% p.a.

- Financial expenses estimated at 7 1/4% p*a. interest cost and commitmentcharges of 0.75% p. a.

- Administrative expenses remain at budgeted level of about Shs. 4.2million p.a. until 1973, thereafter increasing by about 10% p.a.

DFCDFebruary 1, 1972

Annex 14

EAST AFRICAN DEVELOPMENT BANK

Selected Data on Kenya, Tanzania and Uganda

and Total East Africa

Kenya Tanzania Uganda East Africa

Area ('000 sq. kms.) 583 937 236 1,756

Population (millions, 1970) 11.1 12.5 9.8 33.4

Current population growth rate(% p. a. ) 3.3 2.7 3.1 3.0

Annual per capita income($ equivalent, 1969) 132 95 118 112

GDP growth rate (% p.a.) 6. / 5.4-/ 5.6 5.8 4

Manufacturing contributionto GDP (%, 1970) 11.0 7.9 8.7 - 10.0

Manufacturing sector growth rate 1/ 2/ 6 8(% p. a.) 7.5- 12.9 6.0 8.6

Employment in manufacturing 56('000) 70 - 33- 48 -151

Balance of intra EAC tradein manufacturing d/

Kenya - 205 117 322Tanzania (205) - (11) (216)Uganda (117) 11 - (106)

1/ 1965-19692/ 1964-19703T/ 1961-19691i/ Approximation&/ 1968g/ 19667/ Approximation, 1970F/ 1970, millions of Shs.

s u D A .. ETHMDPDA

.*. , .... LAKE* V RB/DOE F

o ! .Aruo EAST AFRICAN DEVELOPMENT BANKt .Okocllo t .Location of Projects AppovedPokea* ch' s;IroRra to December 31, 1971

TE64+ .A Po kwoch vXcr°Evo >8qK PA EADB headquarters

a LAdKE A LEEfi>T * * McSLnA S SMLL I-DUSPRIES * EADB offices-3 LAKEALBERT Masids IG o AI01S1L

M*......... International Boundaries

- .. IIIIIIIRailways

KITALE -- 4 3 ( PLA PP Railways under considerationWom I -L,,~~~ras ANt PAPER ____ _Ro ads5

XK22s C' Eseru _______ Lake services

444 Is tN.tA a~' EDORET at

PEoTE E LO . WBLTERE 0a 0 1a3 THOMSON'S

a ~~~~~~ a SUMLI ~~~~~~~~~~~~FALLS 0Meru

4

* LAKE EOWARo , 0 L Gilg'l KEmbu METAL CO ITAINERS

* A0 Mba°ra ACRICOLLTSL tsoosho

~~~~~~~~~~~~~~~.. .. :.X; ........ K - EA I Y A*-- * *-- *, ~ ~~~BUK1OBi, Cro *.NAIRO%s PATC CTAR

BKOBA\ - Ar Musomc SMA 1 HOT ROLLED STEEL

R WA MDA *embon'KLAKEI /Vt

....... 'MWANZA rL.orron *-. tZ tA

%.' G~~~~~~~~~~~~~~~~~~~~~LAII~~~~~~A-E-SLA

To Capper Belt S~~L'* Cy

P .. FEROR\W SLCr Us/ na/rU,u,

pnuubrn rarpo tt s/ero A

7)~~~~~~~~~~~~~~4

|ILOMRTE9S -.VA S A -AL 8AGSM.E5 t* CYCLES TIRES

.NUA 972 irR Ko,doo 7Isl _ 8s B O R A \,,,, 8e,<K,T.o ODR

r * W > Jg e Korogwet . } ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~PEM8A 1.

^ * - > c} 1 D~ ~ ~ ~~~~~ ~ ~~~~~~~~~~~~~~~DOOO?- DZANZBARC) s_ I Mpo,Ida'

L~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~s -E_S-Uvne5 XSALAAM

**tfi ~~~~ ~~LAKE | 4 IRINGAJ K,d.tu}sEu

/ / ~~~~~~~~~~~~~~IfokooO_e 14AfiA t,

, -e"" 9 ~~~~~~~~~~~~~~kongolos, rf0° >Cr~

e~~~~~~~~~~~~~~~~~~~~~ Mpuuu*., .#^|s pngo

T . Copp.;S, Porlt1<>rsN