Industrial Finance Corporation of India IFCI Ltd.

-

Upload

sunny10119 -

Category

Documents

-

view

118 -

download

0

description

Transcript of Industrial Finance Corporation of India IFCI Ltd.

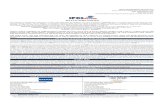

AProject Report

On

IFCI(Industrial Financial Corporation of India)

Session (2007-09)

Submitted To: Submitted By:

Mrs. Bhoomika Desai Mst. Sunny ShindeFaculty: Banking & Insurance. FYB/I Roll No. A50

SIES (NERUL) COLLEGE OF ARTS,SCIENCE & COMMERCE

Sri Chandrasekarandra Saraswathy VidyapuramPlot 1-C,Sector V,Nerul,Navu Mumbai-400706

CONTENTS

About IFCI Liberalization Conversation into Company IFCI is Economic Contribution Corporate Strategy Board of Directors Product & Services IT Services Strength and Experience Corporate Advisory Project Advisory & Finance IFCI Venture Capital Funds Ltd.

ABOUT IFCI

At the time of independence in 1947, India’s capital

market was relatively under-developed. Although there

was significant demand for new capital, there was a

dearth of providers. Merchant bankers and underwriting

firms were almost non-existent. And commercial banks

were not equipped to provide long-term industrial finance

in

any significant manner.

It is against this backdrop that the government

established The Industrial Finance Corporation of India

(IFCI) on July 1, 1948, as the first Development Financial

Institution in the country to cater to the long-term finance

needs of the industrial sector. The newlyestablished DFI

was provided access to low-cost funds through the

central bank’s Statutory Liquidity Ratio or SLR which in

turn enabled it to provide loans and advances to

corporate borrowers at concessional rates.

LIBERALISATION - CONVERSION INTO COMPANY IN 1993

This arrangement continued until the early 1990s when it

was recognized that there was need for greater flexibility

to respond to the changing financial system. It was also

felt that IFCI should directly access the capital markets

for its funds needs. It is with this objective that the

constitution of IFCI was changed in 1993 from a statutory

corporation to a company under the Indian Companies

Act, 1956. Subsequently, the name of the company was

also changed to "IFCI Limited" with effect from October

1999.

FOCUS

IFCI has fulfilled its original mandate as a DFI by providing

long-term financial support to all segments of Indian

Industry. It has also been chiefly instrumental in

translating the Government’s development priorities into

reality. Until the establishment of ICICI in 1956 and IDBI

in 1964, IFCI remained solely responsible for

implementation of the

government’s industrial policy initiatives. Its contribution

to the modernization of Indian industry, export

promotion, import substitution, entrepreneurship

development, pollution control, energy conservation and

generation of both direct and indirect employment is

noteworthy. Some sectors that have directly benefited

from IFCI’s disbursals include:

Consumer goods industry (textiles, paper, sugar);

Service industries (hotels, hospitals);

Basic industries (iron & steel, fertilizers, basic

chemicals,cement);

Capital & intermediate goods industries (electronics,

synthetic fibers, synthetic plastics, miscellaneous

chemicals); and

Infrastructure (power generation, telecom services).

IFCI's ECONOMIC CONTRIBUTION

IFCI’s economic contribution can be measured from the

following:

Cumulatively, IFCI has sanctioned financial

assistance of Rs 462 billion to 5707 concerns and

disbursed Rs 444 billion since inception.

In the process, IFCI has catalyzed investments worth

Rs 2,526 billion in the industrial and infrastructure

sectors.

By way of illustration, IFCI’s assistance has been

helped create production capacities of :

· 6.5 million spindles in the textile industry

· 7.2 million tons per annum (tpa) of sugar production

· 1.7 million tpa of paper and paper products

· 18.5 million tons tpa of fertilizers

· 59.3 million tpa of cement

· 30.2 million tpa of iron and steel

· 32.8 million tpa of petroleum refining

· 14,953 MW of electricity

· 22,106 hotel rooms

· 5,544 hospital beds

· 8 port projects, 66 telecom projects and 1 bridge

project.

The direct employment generated as a result of its

financial assistance is estimated at almost 1 million

persons.

IFCI has played a pivotal role in the regional

dispersal

of industry, 47% of IFCI’s assistance has gone to

2,172

units located in backward areas, helping to catalyse

investments worth over Rs1,206 billion.

IFCI’s contribution to the Government exchequer by

way of taxes paid is estimated at Rs9 billion.

IFCI has promoted Technical Consultancy

Organizations (TCOs), primarily in less developed

states to provide necessary services to the

promoters of small- and medium-sized industries in

collaboration with other banks and institutions.

IFCI has also provided assistance to self-employed

youth and women entrepreneurs under its

Benevolent Reserve Fund (BRF) and the Interest

Differential Fund (IDF).

IFCI has founded and developed prominent

institutions like:

Management Development Institute (MDI) for

management training and development ICRA for

credit assessment rating

Tourism Finance Corporation of India (TFCI) for

promotion of the hotel and tourism industry

LIC Housing Finance Ltd.

GIC Grih Vitta Ltd., and

Bio-tech Consortium Ltd. (BCL).

IFCI has also set up Chairs in reputed educational/

management institutions and universities. A major

contribution of IFCI has been in the early assistance

provided by it to some of today’s leading Indian

entrepreneurs who may not have been able to start

their enterprises or expand without the initial support

from IFCI.

CORPORATE STRATEGY

IFCI has been able to achieve a financial turnaround

with the consistent support and cooperation of all its

stakeholders and is now endeavouring to re-position

itself .

As a part of its organizational strategy, IFCI plans to

induct strategic investor(s) who may provide

besides funds support, business know-how,

marketing techniques, technology, clientele, brand

name etc. to achieve scale and scope economies

and provide expansion of the capital and resources

base. In the interim period, IFCI plans to enhance

organizational value through better realization of its

Non-performing Assets (NPAs) and unlocking of

value of its investment port-folio including unquoted

investments as well as real estate assets.

The present business strategy of IFCI envisages (a)

retaining and enhancing its core competence in long

term lending to industrial and infrastructure sectors

and (b) expanding fee-based businesses to

capitalize opportunities in Corporate Advisory Services.

BOARD OF DIRECTORS

Shri Atul Kumar Rai, , Chief Executive Officer &

Managing Director is B.A. (Hons.) Economics from

University of Delhi and hold postgraduate

qualification in Economics from Jawahar Lal Nehru

University. Shri Rai has rich experience of over 20

years and had held various posts in the Government

of India, including as Director in DDA, Banking

Division in Ministry of Finance. He is presently also

on the Board of Directors of Tourism Finance

Corporation of India Ltd., GIC Housing Finance Ltd.,

IFCI Financial Services Ltd., IFCI Venture Capital Fund

Ltd., Assets Care Enterprise Ltd., IIBI and Haldia

Petrochemicals Ltd

Smt Sukriti Likhi nominee Govt. of India

Shri R.C. Razdan, Chief General Manager in

IDBI Bank Ltd., is Post Graduate in Marketing

Management. He has rich experience of over 30

years in Commercial and Development Banking in

various capacities. He is IDBI nominee on the Board

of Bhandari Exports Ltd.

Shri S. Ravi is a practicing Chartered

Accountant and founder member of Ravi Rajan &

Co. He is on the Board of Corporation Bank, IDBI

Capital Market Services Limited, Batiliboi Limited,

Mahindra Ugine Steel Co. Ltd., Spectrum Power

Generation Ltd. Gujarat Pipavav Port Ltd., LIC

Housing Finance Ltd, IDBI Home finance Limited,

Kudremukh Iron Ore Company Ltd., Hindustan

Aeronautics Ltd., Management Development Institute

(MDI), UTI Trustee Company Pvt. Ltd.

PRODUCTS AND SERVICES

AREAS OF OPERATIONS

The lending policies of IFCI have evolved over the last five

decades of operations. These policies have sought to

achieve the primary objective of providing medium and

long-term financial assistance to mainly manufacturing

concerns and to fulfill the overall goals of industrial and

economic development in India. The principal activities of

IFCI include:

· Project finance

· Financial services

· Non-project specific assistance

· Corporate Advisory Services

i. Project finance involves providing credit and other

facilities to green-field industrial projects (including

infrastructure projects) as well as to brown-field

projects,

viz., expansion, diversification and modernization of

existing industrial concerns through various types of

assistance that are tailored to the borrowers’ needs.

ii. Financial services covers a wide range of activities

wherein assistance is provided to existing concerns

through various schemes for the acquisition of assets,

as

part of their expansion, diversification and

modernization programs. These schemes are also

extended to equipment which could be directly got

fabricated by the actual user, or procured from

domestic

suppliers, or imported. Tailor-made schemes to suit the

individual borrower's requirements have been

designed

to provide quick funds after a need-based appraisal.

The

interest rate and rentals (in case of equipment leasing)

are competitive and determined on the basis of the risk

perception about individual concerns.

iii. Non-project specific assistance is provided mainly in

the

form of corporate / short-term loans, working capital,

bills discounting, etc to meet expenditure, which is not

specifically related to any particular project.

IT SERVICESIFCI has been evolving over the years to meet the needs

of its customers and has been taking the help of

technology to move forward. With this aim IFCI set up its

full-fledged IT department in the year 1985. The core

team of professionals in the department has helped IFCI

adapt to various technologies and enabled IFCI to become

one of the top 100 IT Users in the country (MIS Dec. 99).

With this vast in-house experience, IFCI has now started

providing total IT solutions to various Business

Houses/Financial Institutions and also its Subsidiaries &

Associates.

MISSIONTo be among the leading IT solution providers in the

country. To share the expertise gained in operation and

continue to develop new competencies in emerging

technologies so as to come up with mutually beneficial

solution to customers.

GOAL To provide innovative and cost effective solutions to

clients with a blend of traditional and latest

technologies maximising value at the least cost..

To provide maximum service at least cost and

shorter turnaround times.

To develop long term relationship with our clients

OUR TEAMIFCI's strength has always been its People and the

convergence of their minds. They are highly skilled

developers comprising Software Technologists, Finance &

Domain Specialists, selected with great care and located

over 12 offices of the Company all over the country. They

are dedicated Software Specialists, fully equipped to

provide total support to the customers.

STRENGTHS AND EXPERTISE

Over the years IFCI's IT Group has gained considerable

knowledge and expertise in the following areas in IT

domain as well as in the financial domain being part of

the premier financial Institution · Complete IT solutions

using state-of-the-art technologies for multifaceted

business environments.

Complete IT strategy planning for large

geographically

dispersed organisations.

Web-enabling of applications for

users/customers/citizens direct access to the

information.

Application Systems suitable for

financial/manufacturing sector using latest

technologies.

Planning of Computing Environment, Sizing of

Hardware

Evaluation and Selection of Database Engines

Creation of LAN of computers.

WIDE Area Networking of Computer Systems (WAN),

Virtual Private Networking (VPN) Structured Cabling

Systems.

Operations Management, LAN, WAN & ORACLE

Database (DBA) Administration.

Knowledge Management Migration from client server

computing to server based computing through

CITRIX Metaframe Software - Installation &

Administration

Setting up of Corporate email facility, post-office

protocols - Installation & Administration.

Web Designing, Administering Servers & Installation.

CORPORATE ADVISORY

With its traditional core competence in project finance,

and coupled with its expanding expertise in investment

banking and corporate finance & advisory services, IFCI

aims to be a provider of total financial solutions for any

aspiring or existing business entity. With its traditional

core competence in project

finance, and coupled with its expanding expertise in

investment banking and corporate finance & advisory

services, IFCI aims to be a provider of total financial

solutions for any aspiring or existing business entity.

PROJECT ADVISORY & FINANCE

At a time when India is throwing up investment avenues

in newer sectors and projects, there is a critical need to

provide specialized advisory services to the Indian

Corporate Sector in their efforts towards Industrial

Advancement.As a catalyst of Industrial growth, IFCI

provides the following project Advisory Services:

Investment appraisal of Navratna (most valued

public

Sector companies) Companies

Project Conceptualization and related services,

including Guidance in relation to Selection of

Projects, Preparation of feasibility studies, DPR,

Capital Structuring, Techno economic Feasibility,

Financial Engineering, Project Management Design

etc.

Credit Syndication including preparation of

Information Memorandum, Syndication of

domestic/foreign loans, post sanction Follow-up,

assistance in Legal Documentation etc

INFRASTRUCTURE ADVISORY

Assets available for Sale

Where Sale Notices have been issued

(i) by Official Liquidator

(ii) by Recovery Officer

(iii) Under Securitisation Act 2002

(iv) by other Institutions

Where

(i) Recovery Certificates have been issued By DRTs

(ii) Liquidation Proceeding is Pending

This section has two parts. Part A gives the names of

Companies where Sale Notices have been issued by the

Official Liquidators attached to the High Courts and / or

by the Recovery Officers attached to Debt Recovery

Tribunals (DRTs) and / or under Securitisation Act 2002.

Part B gives the names of cases where execution

proceedings before Recovery Officers of DRTs are

pending and/or cases where liquidation proceedings

before Official Liquidators attached to High Courts are on.

To peruse the notices published in respect of cases of

Part-A and to get the details of Company Profile in

respect of cases of Part– B, interested buyers may click

the name of the 'Company' listed below.

IFCI VENTURE CAPITAL FUNDS LTD.(IVCF)

IFCI Venture Capital Funds Ltd. (IVCF) was originally set

up by IFCI as a Society by the name of Risk Capital

Foundation (RCF) in 1975 to provide institutional support

to first generation professionals and technocrats setting

up their own ventures in the medium scale sector, under

the Risk Capital Scheme. In 1988, RCF was converted

into a company, Risk Capital and Technology Finance

Corporation Ltd. (RCTC), when it also introduced the

Technology Finance and Development Scheme for

financing development and commercialisation of

indigenous technology. To reflect the shift in the

company’s activities, the name of RCTC was changed to

IFCI Venture Capital Funds Ltd. (IVCF) in February 2000.

Over the years, IVCF has provided financial assistance to

new ventures, supported commercialisation of new

technologies.