ASIAN DEVELOPMENT BANK IND:34262 · 2014-09-29 · IDBI – Industrial Development Bank of India...

Transcript of ASIAN DEVELOPMENT BANK IND:34262 · 2014-09-29 · IDBI – Industrial Development Bank of India...

ASIAN DEVELOPMENT BANK IND:34262

REPORT AND RECOMMENDATION

OF THE PRESIDENT

TO THE

BOARD OF DIRECTORS

ON

PROPOSED LOANS TO

INFRASTRUCTURE LEASING AND FINANCIAL SERVICES LIMITED

AND

INDUSTRIAL DEVELOPMENT BANK OF INDIA

AND

PROPOSED TECHNICAL ASSISTANCE GRANT

TO INDIA

FOR THE

PRIVATE SECTOR INFRASTRUCTURE FACILITY

AT STATE LEVEL PROJECT

November 2001

CURRENCY EQUIVALENTS(as of 1 October 2001)

Currency Unit – Rupee/s (Re/Rs)Re1.00 = $0.0209

$1.00 = Rs47.82

ABBREVIATIONS

ADB – Asian Development BankAP – Andhra PradeshBOT – build-operate-transferGDP – gross domestic productICICI – ICICI Ltd.IDFC – Infrastructure Development Finance Company Ltd.IDBI – Industrial Development Bank of IndiaIFCI – Industrial Finance Corporation of IndiaIL&FS – Infrastructure Leasing and Financial Services Ltd.KfW – Kreditanstalt für WiederaufbauLIBOR – London interbank offered rateMORTH – Ministry of Road Transport and HighwaysMW – megawattNHAI – National Highways Authority of IndiaPFI – participating financial institutionPTC – pass-through certificatePSIF II – Private Sector Infrastructure Facility at State Level ProjectRBI – Reserve Bank of IndiaSEB – state electricity boardSERC – State Electricity Regulatory CommissionSEZ – special economic zoneSPV – special purpose vehicleTA – technical assistance

NOTES

(i) The fiscal year (FY) of the Government of India, the Gujarat government, theAndhra Pradesh government, the Karnataka government, and the MadhyaPradesh government ends on 31 March. FY before a calendar year denotes theyear in which the fiscal year ends e.g., FY2002 begins on 1 April 2001 and endson 31 March 2002.

(ii) In this report, "$" refers to US dollars

CONTENTS

Page

LOAN AND PROJECT SUMMARY ii

I. THE PROPOSAL II

II. INTRODUCTION 1

III. BACKGROUND 2A. Sector Description 2B. Government Policies and Plans 10C. External Assistance to the Sector 14D. Lessons Learned 15E. ADB’s Sector Strategy 17F. Policy Dialogue 17

IV. THE PARTICIPATING FINANCIAL INSTITUTIONS 17A. Infrastructure Leasing and Financial Services Limited 18B. Industrial Development Bank of India 18

V. THE PROPOSED ASSISTANCE 19A. Proposed Financing 19B. Rationale 19C. Mechanics of the Facility 20D. Main Terms and Conditions 30E. Cofinancing 34F. Social and Environmental Aspects 35G. Risks and Safeguards 38H. Technical Assistance 39

VI. ASSURANCES 39

VII. RECOMMENDATION 40

APPENDIXES 41

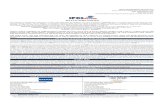

LOAN AND PROJECT SUMMARY

Borrowers

Guarantor

Project Description

Infrastructure Leasing and Financial Services Ltd. (IL&FS)and Industrial Development Bank of India (IDBI).

India

The proposed Private Sector Infrastructure Facility at StateLevel (PSIF II) consists of two components (i) twoseparate loans to the participating financial institutions(PFIs) in equal amounts and on identical terms foronlending to infrastructure projects in specifiedinfrastructure sectors in four selected Indian states:Andhra Pradesh, Gujarat, Karnataka, and MadhyaPradesh; and (ii) technical assistance to the four selectedIndian states that will receive PSIF II financing, to enhanceprivate sector participation in infrastructure development intheir respective states.

Incorporated in the PSIF II design are components toaddress the key constraints of infrastructure developmentat the state level in India.

The PSIF II is focused to provide assistance only to fourselected Indian states that are generally consideredreform-oriented and that provide an environmentconducive to private investments. It aims to demonstratehow constraints at the state level may be addressed basedon the collective experiences of these four states and onbest practice. It also aims to underscore state performanceas a key factor in (i) lending and investing by financialinstitutions in India; (ii) providing a Government of Indiaguarantee to enable performance-based lending; (iii)catalyzing the flow of resources into performing states,starting with the four selected states; and consequently,(iv) establishing an appropriate incentive structure for otherIndian states to improve performance.

To address identified gaps in capacity at the state level,the PSIF II seeks to partner national PFIs with stategovernments to undertake infrastructure projects thatcould be offered for private sector participation, particularlyfor structuring, developing, and engineering the financingof projects.

To strengthen the public-private interface and facilitate theprocessing of infrastructure projects, the PSIF II supportsthe adoption of formal legislation, sector policies andregulatory frameworks that address private sectorconcerns, the organization of formal structures withstatutory mandates at the state level, and operationalmechanisms for dealing with the private sector.

iii

Finally, the PSIF II will provide the anchor loans, withmaturities that more appropriately fit the long gestation andpayback periods of infrastructure projects, which pose thegreatest financial risk to these projects. Parallel initiativesare to be undertaken to meet related risks in undertakingprivate investments in infrastructure projects.

Subloans The PSIF II is also targeted to support reform efforts inidentified infrastructure sectors where reforms are beingundertaken by providing financing to projects in thesesectors, including power transmission and distributionprojects for privatization and those that may be set up byprivate sponsors; modernization and upgrading of privatepower generation plants; minor ports under privateconcessions; state roads on build-own-operate, build-operate-transfer, and similar arrangements; optic fibercable connections for privately owned telecommunicationsfacilities; airports under private management; urban masstransit systems that will be privately run; water supply andsewerage services under private concession; cyberparks;and special economic zones where private sectorcompanies are to operate.

Classification Economic growth

Environmental Assessment Category B. Environmental impact assessments or initialenvironmental examinations will be undertaken forsubloans to be financed.

Rationale The anticipated demand for private infrastructureinvestments has not materialized as few infrastructureprojects are reaching financial closure. Several reasonsaccount for this: (i) reforms have not been progressing asfast as anticipated, (ii) present governance structures arenot suited for the broad participation by the private sectorin infrastructure envisaged in a liberalized environment, (iii)the public/private interface needs substantialstrengthening, and (iv) it remains difficult to disaggregateand allocate risks in the domestic capital market. Theseconstraints are particularly pronounced at the state level.

The PSIF II, in its design, attempts to help Indian statesaddress these constraints by providing a policy andoperational framework for attracting private participation ininfrastructure; establishing an appropriate incentivestructure to reward performance and penalizenonperformance; and through various initiatives,addressing risks associated with the financing ofinfrastructure projects.

iv

Loan Amount and Terms Two loans of $100 million each to IL&FS and IDBI will beprovided under the LIBOR-based lending facility of theAsian Development Bank (ADB). The loans will have a 20-year term, including a grace period of 5 years; an interestrate determined in accordance with ADB's LIBOR-basedlending facility; a commitment charge of 0.75 percent perannum; a front end fee of 1.0 percent; conversion optionsthat may be exercised in accordance with the terms of thedraft Loan Agreements, the Loan Regulations, and ADB'sConversion Guidelines; and such other terms andconditions set forth in the draft Loan Agreements.

Relending Terms At prevailing market rates for Indian rupees tosubborrowers. The ADB loans are to be hedged againstforeign exchange risk by the PFIs and relent in rupees.

Instrumentation The PFIs will purchase marketable securities fromsubborrowers as evidence of their loans.

Utilization of Loan Proceeds

The loan proceeds will be used to finance the direct andindirect foreign exchange costs of equipment and services,including civil works. Subject to sectoral limits, loanproceeds may be utilized to finance local currency costs ofeligible projects. To facilitate the timely implementation ofprojects, up to 10 percent of the loan proceeds may beused to finance eligible expenditures incurred 180 daysprior to the date the loans become effective.

Subloan Size 25 percent of the total project cost or the single exposurelimit of the PFI whichever is lower, but in no case toexceed a maximum absolute amount of $75 million.

Procurement For contracts for the supply and installation of equipmentvalued at $10 million or more, and for civil works of $20million or more, international competitive biddingprocedures in accordance with the ADB Guidelines forProcurement will be followed. In the case of a build-operate-transfer project and variants, the project sponsoror engineering, procurement, and construction contractor ifselected through competitive bidding among internationalentities in accordance with procedures acceptable to ADB,may apply its own procedures for procurement providedthat such procurement is for goods and works suppliedfrom, or produced by ADB member countries.

Benefits and Beneficiaries The PSIF II will benefit the state sector by promotingprivate participation in infrastructure at the state level. Byhelping to identify and resolve gaps in the policyenvironment, operating framework, and institutionalcapacity, the PSIF II aims to facilitate infrastructure projectdevelopment in the four selected states. By promotinginfrastructure development at the state level, the PSIF II isensuring that appropriate policies are in place to mitigate

v

against the possible social and environmental risks ofinfrastructure development, and protect the localpopulation, particularly the affected segments of society.The PSIF II will catalyze a larger flow of resources to thefour selected states and make much needed infrastructureservices more accessible. The four states haveconsiderable potential for industrial development that canonly be realized with adequate infrastructure support; bystimulating economic growth, poverty reduction will beenhanced. By emphasizing state performance as a keyfactor for project financing, the PSIF II aims to promotestate reforms by redirecting credit flows to deserving statesand by establishing an appropriate performance basedincentive structure. The PSIF II also encourages the cross-fertilization of ideas among states. States are veryinterested in finding out how their counterparts areaddressing specific difficulties in infrastructuredevelopment. Selected states, among themselves, are nowlearning from their collective and individual experiencesand innovative approaches to developing theirinfrastructure sectors. The Government of India will alsobenefit in terms of reduced assistance needed because ofincreased private provision for infrastructure, and savingsfrom improved efficiencies arising out of structural reformsand private sector management based on commercialprinciples.

Risks Lack of commitment and cooperation on the part of theselected states could undermine the objectives of the PSIFII. However, the four selected states are acutely aware ofthe need to establish an environment conducive to privateinvestment and to compete for scarce resources, and havebeen closely watching the progress of neighboringcountries; thus, their relative advances in reforming theirrespective states and promoting infrastructuredevelopment. Furthermore, the PSIF II is designed topromote competition. States able to develop suitableinfrastructure projects for financing can access the facility.The four selected states are also aware that other Indianstates have expressed strong interest in participating in thePSIF II.

Infrastructure projects typically have long gestation andpayback periods. Project preparation is difficult in thecurrent environment due to the myriad agencies involvedand in dealing with cumbersome procedures. To facilitateproject preparation and processing, the PSIF II issupporting the development of formal structures withstatutory mandates at the state level to deal with theprivate sector, to essentially serve as one-stop facilities.Moreover, to enhance project preparation and buildownership, the PSIF II seeks to partner the PFIs with stategovernments. The PFIs could provide the project

vi

development and financial engineering expertise requiredto bring projects to financial closure. With close stategovernment involvement and immediate feedback onproblems, project preparation is expected to accelerate,and problems that arise, addressed more promptly. Longpayback periods, and the uncertainty associated with it,can be covered by matching long-term financing that thePSIF II will provide. Other risks could be covered throughinnovative instruments that the PFIs will design to meetthe risks of infrastructure financing. State guarantees areto be targeted more appropriately to meet noncommercialrisks and allow disaggregation of risks and proper riskallocation in the Indian environment.

Technical Assistance Technical assistance is proposed to be provided to thefour selected states to assist them in addressing specificconstraints in the development of the enablingenvironment for private sector participation in infrastructureto make the effort sustainable and to facilitate theprocessing of eligible projects within these selected statesfor PSIF II financing.

Experts will be fielded to identify priority areas in eachselected state that require assistance and provide theneeded advisory assistance to enable the selected state tomeet pre-agreed measures with ADB for broadeningprivate sector involvement in infrastructure development.

I. THE PROPOSAL

1. I submit for your approval the following Report and Recommendation on (i) twoproposed loans, one to Infrastructure Leasing & Financial Services Limited (IL&FS), and theother to Industrial Development Bank of India (IDBI), each to be guaranteed by India, for thePrivate Sector Infrastructure Facility at State Level Project (PSIF II); and (ii) proposed technicalassistance (TA) for Enhancing Private Sector Participation in Infrastructure Development atState Level.

II. INTRODUCTION

2. Ongoing reviews of the development of India’s infrastructure sectors and experiencegained under the Asian Development Bank (ADB)-funded Private Sector Infrastructure Facility(PSIF I)1, noted that the private sector was not responding as expected to earlier initiatives.Consequently, as part of an ADB TA,2 state constraints to infrastructure development andfinancing were examined and possible ADB responses considered. The state focus wasappropriate as state governments are fully responsible for reforms that are key to determiningthe nature and extent of state infrastructure development. Progress in infrastructuredevelopment appears to have stalled due to waning private sector interest as difficulties indeveloping infrastructure projects started to emerge. National policy is a critical considerationonly in the case of the national road network, railways, the major ports, andtelecommunications. Consequently, this report does not focus on these areas.

3. The PSIF I considered the supply of funds to be the main constraint, to infrastructuredevelopment given the enormous potential demand. Consequently, the PSIF I was targeted atenhancing financial intermediation and developing the domestic capital market. However, todayfew infrastructure projects are actually materializing, despite the continuing large demand forinfrastructure and relative availability of domestic funds.3

4. The February 2001 Reconnaissance Mission4 examined possible approaches to assistIndian states address emerging infrastructure bottlenecks. After consultations within India andADB, the Fact-Finding Mission5 was fielded in April 2001. During fact-finding, the measures forstrengthening the enabling environment for private sector participation in state infrastructuredevelopment; the possible partnership arrangements between the selected states andparticipating financial institutions (PFIs); and the design, scope, and mechanics of the projectfacility were defined and discussed in detail. Subsequently, the August 2001 Preappraisal

1 Loan 1480-IND: Private Sector Infrastructure Facility to ICICI Ltd. (ICICI), for $150 million, approved on 7

November 1996; and Loan 1481-IND: Private Sector Infrastructure Facility to the Industrial Finance Corporation ofIndia Ltd. (IFCI), for $100 million, approved on 7 November 1996.

2 TA5882-REG: Assessing Financial System Vulnerabilities in Selected Noncrisis Affected Economies (India, Nepal,and Viet Nam), for $600,000, approved on 20 December 1999. In connection with the formulation of a suitablefinancial sector development strategy for India and as an important aspect of India’s reform priorities, a review ofsate-level constraints to infrastructure finance and Asian Development Bank Strategy was conducted, at thesuggestion of the Government of India.

3 Banking institutions report current holdings of some $2.0 billion in excess statutory liquidity reserves. However,available debt funds in the domestic funds market are short to medium-term in character, ranging from 5 to 7 years.Maturities of 10 years and beyond are still rare.

4 The Mission comprised R. M. Limjoco, Mission Leader; and V.V. Subramanian, Investment Officer, INRM.5 The Mission comprised R. M. Limjoco, Mission Leader and Lead Financial Sector Specialist; W.McCarten, Public

Resource Management Specialist; Y. Elhan, Economist; and V. V. Subramanian, Financial Economist. F. Polman,Resident Representative, INRM; and T. Kumar, Senior Investment/Programs Officer, INRM joined the wrap-upmeeting.

2

Mission followed by the Appraisal Mission in October 2001 continued discussions and confirmedthe commitments from the selected states to undertake specified measures to strengthen theenabling environment for the private sector, agreed with the PFIs on the terms and conditions oftheir participation under the PSIF II, and secured the commitment of the Government of India(the Government) to extend its guarantee to the PFIs under the PSIF II. The project frameworkis shown in Appendix 1.

III. BACKGROUND

A. Sector Description

1. Private Sector Participation in Infrastructure Development

5. State government finances deteriorated throughout the 1990s. The combined fiscaldeficit of all states in India increased from 2.3 percent of gross domestic product (GDP) inFY1994 to 4.3 percent in FY1999, and 4.6 percent in FY2000;6 but narrowed down to 4.3percent in FY2001 due to a higher growth in receipts compared with expenditures. Theoutstanding debt of the states is estimated to exceed 23 percent of GDP in FY2001, from just18.6 percent in FY1994. In FY2001, the fiscal deficit of the national Government and the statestaken together decreased, but remained high at 9.1 percent from 9.4 percent in FY2000.7

6. This deterioration in fiscal health of state governments over the years directly contributesto inadequate public investments. Insufficient investments in both public and privateinfrastructure, on the other hand, constrain industrial growth. In particular, the failure of stategovernments to provide basic infrastructure severely undermines the long-term growth potentialof the economy as it is prevented from obtaining the full benefits of market reforms andliberalization. Moreover, with rising deficits, the states are forced to cut back not only on capitalexpenditures but on expenditures in essential social sectors, impacting on the drive to reducepoverty.

7. ADB has therefore been providing assistance for public sector resource management atthe state level.8 However, public resources are clearly inadequate for meeting infrastructureneeds. Greater private sector participation, including foreign investments, will be needed ifIndia’s targeted economic growth rate of 8-9 percent per year is to be achieved. Moreimportantly, well-regulated private management is needed to improve efficiency and productivityin the provision of infrastructure and eliminate much of the waste associated withnoncommercial operation of basic infrastructure services.

2. Limited Response in Provision of Infrastructure

8. Accounting for inflation, only about 30 percent of projected financing for infrastructurefrom private sources has actually materialized since 1994/95 based on the assessments earlier

6 Despite efforts at fiscal consolidation, the present level of the Government's fiscal deficit is 5.9 percent (7.0 percent

under the old definition that includes small savings collections passed on to the states), slightly higher than the 5.6percent registered in the previous year.

7 Reserve Bank of India. 2001. Annual Report 2000/01. Mumbai.8 Loan 1506-IND: Gujarat Public Sector Resource Management Program, for $250 million, approved on 18

December 1996; and Loan 1717-IND: Madhya Pradesh Public Resource Management Program, for $250 million,approved on 14 December 1999. The World Bank has been encouraging fiscal reform in individual states (likeAndhra Pradesh, Karnataka, Orissa, Rajasthan, and Uttar Pradesh) and is providing financial support for fiscalreform programs now in process in Andhra Pradesh and Karnataka.

3

made by the Expert Group on the Commercialisation of Infrastructure Projects (the ExpertGroup).9

9. In the power sector, new generating capacity during the Eighth Five-Year Plan (1992/97)fell short of target by almost 50 percent, principally due to inadequate investments by the states.Of this, independent power, including captive power, producers contributed barely 1,430megawatt (MW) of the total 16,422 MW in additional capacity. The Ninth Plan (1997/2002),originally estimated that 40,425 MW of power would be added with about 44 percent of this tobe privately produced. This has been revised during the midterm review to 28,097 MW, andfurther, based on a more recent update, to 20,891 MW with the private sector expected to takeup 32 percent of the capacity augmentation. Under the Ninth Plan up to December 2000, a totalof 14,227 MW was completed with the private sector contributing 3,915 MW (about 27.5percent). However, in the immediately preceding year, FY1999/2000, private sectorparticipation declined sharply with only 553 MW added by private producers. Under the 10th and11th plan periods, the Central Electricity Authority projects capacity augmentation of 55,000 MWand 51,500 MW, of which the private sector is expected to take up about 40 percent.

10. Similarly, for the road sector, only $3.2 billion has been provided for state and majordistrict roads, against the requirement of $5.5 billion under the Eighth Plan. Of this, about $211million has been undertaken with private sector participation, mainly bridges and bypasses. TheExpert Group estimated the total requirements for state highways from 1996/2006 to be about$10.2 billion.10 The private sector was expected to contribute about $1.3 billion.

11. For ports, projected requirements are $5.3 billion11 to meet the expected increase indemand and cargo handling capacity to 400 million tons by 2000/01 and to 650 million tons by2005/06. However, the plan allocation during 1990/97 was only $905 million. Under the NinthPlan, an additional 122 million tons capacity is envisaged at an estimated cost of Rs175 billion(about $3.7 billion). However, only 46 percent of the requirement is expected to be met by themajor ports through borrowings and internal generation. About 11.5 percent is to be raised fromexternal sources including multilateral agencies. The balance is proposed to be met through thedevelopment of minor state ports and investments in captive facilities by user industries and theprivate sector. Thus far, port projects from private sector/captive users of about Rs39 billion($816 million) have been approved and are at various stages of construction.

12. The Airports Authority of India manages 92 airports, of which 5 are internationalgateways.12 Presently, the various airlines are operating from only 61 airports. The rest areunutilized, handling occasional aircraft. Given the volume of air traffic,13 the need for newinternational airports is not immediate, although forecasts by different organizations reflect anincrease in domestic passenger traffic of 8.5 percent and international passengers by 6.0percent annually from now until 2004/05.14 However, in 1998/99, 51 percent of airport trafficwas handled at Delhi and Mumbai. The apparent need is to reduce congestion and upgradeairport services. For this purpose, the Airport Authority proposed an expenditure of Rs34.2billion ($715 million) under the Ninth Plan for airport infrastructure. A large proportion of this isexpected to be raised from the private sector. Thus far, one airport has been inaugurated under

9 Ministry of Finance. 1996. The India Infrastructure Report. Government of India, New Delhi.10 At 1996 prices.11 1995/96 prices.12 Chennai, Delhi, Kolkata, Mumbai, and Thiruvananthapuram.13 During 1995/99, growth was not significant although cargo and international passenger traffic have increased.14 Based on a study of the Foundation for Aviation and Sustainable Tourism.

4

private sector sponsorship, the Cochin International Airport Limited at Nedumbassery, with 26percent equity participation by the Kerala state government.

13. For water supply and sewerage, the Planning Commission estimates that to make up forthe huge need in the next 10 years, investments of approximately $3.2 billion per year will berequired. Under the Eighth Plan, $1.2 billion was provided. To cover the resource gap, theGovernment resorted to build-operate-transfer (BOT) schemes with the private sector for bulkwater supply. However, inefficiencies in water distribution made new investments in the watersector unviable and led to the failure of most of the private sector participation schemes. Underthe Ninth Plan, investments of $6.1 billion for urban water and $9.3 billion for rural water supplyare envisaged. Funding will be a crucial issue.

3. Reasons Behind Weak Private Sector Response

14. At the root of the difficulty is the slow development of an enabling environment for theprivate sector. More specifically, why the response by the private sector to the liberalization ofIndia’s infrastructure sectors, particularly at the state level, fell below expectations may beattributed to the confluence of several major factors: (i) the progress of reforms has been slowerthan earlier anticipated; (ii) governance structures are not suited for the broad participation bythe private sector in infrastructure in a liberalized environment, (iii) the public/private interfacerequire substantial strengthening, and (iv) inability to unbundle and allocate risk in the domesticcapital market (Appendix 2).

a. Progress of Reforms Not as Fast as Anticipated

15. Power . In the power sector, the impaired financial condition of most state electricityboards (SEBs), the major purchasers of power, has resulted in the marked slowdown of privateinvestments in power generation.15 The poor financial state of SEBs, on the other hand, is dueto several major causes: (i) revenue losses16 arising from subsidies to the agriculture sector andother domestic users, not compensated for by the state; (ii) high level of leakages,17 particularlyfrom distribution mainly due to theft, and inaccurate metering; and (iii) poor collection ofreceivables.18

16. This poor state of SEBs is also hampering privatization. When a SEB is privatized, thestate government has to bear the up-front costs of reform. If the SEB has raised loans with astate guarantee, the cost of meeting these commitments can be formidable. Other costs includeunfunded pension liabilities; contractual obligations, such as unpaid dues to suppliers; voluntaryretirement schemes for reducing excess staff to place the SEB on commercially viable terms;and environmental liabilities, if any.

15 To cover the risk of nonpayment by SEBs, financial institutions resorted to escrow arrangements appropriating

cash flows coursed through an escrow account for payment of power purchases. However, estimates show that thecurrent escrowable capacity is no longer sufficient to cover commitments under signed power purchaseagreements or awarded projects. State guarantees have also been provided. For large fast-track projects,sovereign guarantees have been given.

16 To illustrate the order of magnitude, the ratio of tariff to cost was about 74 percent in 1999/2000.17 Official estimates of transmission and distribution (T&D) losses put them at 21 to 25 percent. However, in states

starting to implement power reform, actual T&D losses are being found to be much higher. For example, in Orissa,the increase was from 23 percent to 51 percent. In Haryana, a recent World Bank study revealed that the actuallevel of T&D losses is about 47 percent instead of 36 percent. Moreover, recent analyses of power utilizationpatterns in Andhra Pradesh, Gujarat, and Haryana indicate that a substantial portion of power consumptionattributed to farmers has actually been utilized by unauthorized nonagricultural users.

18 Average receivables position of SEBs is about 30 percent of revenues.

5

17. Among the states, only Orissa, with World Bank support, has separated power intogeneration, transmission, and distribution, and subsequently privatized generation anddistribution.19 Furthermore, only nine states have complied with an agreement reached fouryears ago among state chief ministers to charge a minimum tariff of Rs0.50 to the agriculturesector. This was to be raised to 50 percent of the average cost of supply within three yearsending in 1999.20 Little progress on this has apparently been made.21 Worse, many stategovernments are not compensating SEBs for the subsidies extended to agricultural anddomestic users.22 However, the implementation of more comprehensive structural reforms withassistance from bilateral and multilateral aid agencies suffered significant delays due toapprehensions by countries extending financial assistance over the uncertainty that cloudedIndia’s nuclear policy. In Gujarat, power sector reforms had to be moved back about two and ahalf years from what was originally planned; while in Andhra Pradesh (AP), power sectorreforms were initiated about one and a half to two years behind schedule.

18. In addition, of total energy generated, only about 55 percent is billed while only 41percent is actually collected, and of the unbilled accounts, theft accounts for 20 percent andcommercial losses for 4 percent. Stopping theft and improving billing and collection couldeliminate the current SEB losses. Losses from generation and high voltage transmission areestimated to be 12–13 percent while losses stemming from distribution operations are about40–45 percent.23 Consequently, serious consideration is now being given to privatizing powerdistribution, an area that has been relatively neglected.

19. Roads . An immediate problem is lack of reliable demand estimates. Precise estimatesof demand are difficult particularly for new toll roads where alternative slower but toll-free routesare available. Without reliable traffic projections, determining the commercial viability of tolledroads is difficult. Moreover, the acceptable level of tolls and willingness to pay have yet to beestablished. Consequently, only small bridges and bypasses have been privately financed.

20. Furthermore, in developing a road project, particularly with a component for commercialland development, apart from the Ministry of Road Transport and Highways (MORTH)24 and itsarm, the National Highways Authority of India, numerous other agencies are involved, such asurban planning authorities, local municipalities, and zoning and state revenue authorities.25 TheDelhi-Noida toll bridge project took six years to bring to financial closure. The Vadodara-Halolroad project took four years to commission.

21. However, the governments recognize that private sector participation in roaddevelopment would provide sound project management. Furthermore, professional

19 Andhra Pradesh is in the process of privatizing its distribution companies.20 The low tariff for agriculture is cross-subsidized leading to exorbitant rates for commerce and industry. As a result,

industries are either moving to captive power generation or changing states.21 Gujarat has raised agricultural tariffs by more than 400 percent and average tariff levels for other consumer

categories by 15 percent.22 Andhra Pradesh recently reimbursed its Transmission Company for the tariff subsidy as determined by its

regulatory agency.23 From the Agenda Notes of the Conference of Chief Ministers/Prime Ministers, 3 March 2001.24 A previous key ministry, Ministry of Surface Transport, was reorganized in November 2000 into two ministries:

MORTH, and Ministry of Shipping and Ports (MOSP). MORTH's duties relate to the development and maintenanceof national highways, and policies on road transport. In addition, it coordinates state roads and issues guidelines onhighway planning, design, and construction. MOSP is responsible for major ports, inland water transport, andshipping.

25 National highways are administered by the central Government. All other roads, i.e., state highways, and districtand village roads, are within the responsibility of the state and local bodies.

6

management could also contribute significantly to improving road repair and maintenance, asidefrom raising service levels, for example, for emergency assistance for accidents and stalledvehicles, as well as for road safety.

22. Ports . Amendments to the Indian Ports Act, 190826 to enable privatization, and theMajor Ports Trust Act, 196327 to facilitate corporatization have been identified but are yet to bepassed.28 The port sector is governed by a plethora of acts. In addition to the two preceding actsare the Dock Workers’ Act (1948) and the Merchant Shipping Act (1958). Investors arecompelled to examine these and other acts in detail, raising the complexity and riskiness ofdealing with port projects.

23. There is a patent need to develop an integrated plan for capacity development by thecentral and state governments to facilitate private initiatives in port development. For example,eight coastal states have announced plans to develop minor ports in their respective areas.However, these minor ports are in close proximity to each other and to some major ports.Mapping out regional growth patterns and cargo trends to forecast required investments thattake into account possible buildup of excess capacity as well as connectivity requirements andhinterland development would facilitate and mitigate risks for private sector participation in ports.

24. The labor issue needs to be addressed. Existing labor contracts and laws29 still do notpermit termination of labor except through prohibitive voluntary retirement schemes.30 The costof overstaffing is a serious deterrent to private sector involvement. Moreover, the terms ofemployment are quite rigid with wages and job classifications highly specified. Attempts to linkwages to productivity have had limited success. Consequently, ports that have been offered tothe private sector are principally new ports.

25. Ports targeted for development need associated infrastructure that the private sector, byitself, would be unable to provide, such as connecting roads, railway linkages, power facilities,container yards, and customs administration.

26. The main problem for Indian ports is low productivity leading to an average turnaroundtime of 5.9 days.31 This is due to congestion and poor multimodal interface infrastructure. Threeof the oldest ports (Chennai, Kolkata,32 and Mumbai) are located in city centers. They need tobe decongested by developing additional ports that provide needed berthing capacity and easiermodal interface access. Moreover, container-handling costs are comparatively much higherthan in other countries in the Asian region. For example, the India Infrastructure Report 200133

26 This governs the operations of 148 intermediate and minor ports that are administratively under the state

governments.27 This governs the operations of India’s 11 major ports for which responsibility rests with the central Government

through the Ministry Of Shipping and Ports.28 Existing provisions in the Major Ports Trust Act permit private sector participation in ports based on an opinion laid

down by the Ministry of Law and Justice, Department of Legal Affairs. This is to be clarified in the law.29 Dock Labour Board Act and conditions under the contract of the Port Trusts.30 Almost all major ports are believed to have excess labor. Some estimates place excess labor at Mumbai at about

35,000, at Kolkata 13,000, and at Chennai 11,000.31 Against a benchmark of two days at international ports; turnaround time in Singapore is about 6 to 8 hours.32 Formerly Calcutta.33 Raghuram. G. 2001. Integrating Coastal Shipping with the National Transport Network. In India Infrastructure

Report 2001. Edited by Sebastian Morris. New Delhi: Oxford University Press.

7

notes that in Mumbai, container-handling charges can be as high as $530 per twenty- footequivalent units versus $281 in Singapore.34

27. Airports . The policy adopted in December 1997 endorsing private sector participationmust now be implemented. New private sector airports at Bangalore in Karnataka, Hyderabad inAP, and Panaji in Goa have been sanctioned. Approval has also been given to privatizingairport services at Chennai, Delhi, Kolkata, and Mumbai. However, as exemplified by theattempt to build a new airport in Bangalore, difficulties are anticipated. As part of the conditions,the private sector parties stipulated closure of the existing airport. After initial agreement andmuch wrangling, the state government refused to carry this out. The process has since beenrevived. The Karnata Government has rebid the airport project, selected a new partner; andagreed to close the existing airport to all civil aviation flights. The policy on airports must beconsidered in conjunction with the policy framework for the entire civil aviation sector. Furtherliberalization of civil aviation could have a palpable impact on air travel in India. The public hasresponded favorably to the decision to privatize Air India and Indian Airlines

28. Water Supply and Sewerage . Urban water supply and sewerage services areadministered by water supply boards in various states. Water supply is generally considered asocial obligation and is subsidized. Consequently, this approach has introduced systemicinefficiencies relating to wastage, theft, high leakage rates, and poor collection. To attractprivate sector investment, pricing will need to be rationalized. Subsidies that may be provideddue to affordability issues should be reimbursed by the state through budgetary support. Thepresent differential in tariff structures among Indian cities ranges from $0.10 to $2 per kiloliter.Local governments usually revise water tariffs every five years. The imposed price increasesare consequently large and typically are resisted by consumers. Nonetheless, certain state havehad some success in this area. The AP state government revised the water tariffs for houseservice connection recently from $0.47 US to a minimum charge of $1.00 per month. This 100percent increase was imposed after seven years. A more pragmatic approach was taken byKerala, which successfully established a program of automatic annual water tariff increases ofup to 15 percent.

29. Inefficiencies in water supply distribution need to be addressed, including high waterleakage. Water loss through distribution systems is estimated to range from 20 to 40 percent ofthe total flow. Furthermore, although most large towns have meters, in certain cases up to 50percent of all meters operate poorly. In many areas, the existing infrastructure is poor due to lowpriority usually accorded to system maintenance resulting from lack of finances; inadequatedata, designs, and survey plans; inadequate training of personnel; and lack of propermonitoring. The sewerage situation is even worse, with many cities not having seweragesystems.

b. Unsuitable Governance Structures

30. As an offshoot of past policies, the operation and development of infrastructure havebeen the responsibility of the central and state governments. Consequently, the governmentshave been the policymakers, regulators, and operators all rolled into one. Services providedwere basically considered public goods, and thus, stakeholders were rarely involved, nor didstakeholders ask to be involved if the services were provided at affordable cost, even if thequality of the service and long-term sustainability were in question. Public dialogue was seldom

34 Yet in Gujarat, ports under the Gujarat Maritime Board charge slightly less than $140 per twenty-foot unit. The

variance in cost compared with Mumbai apparently points to a difference in efficiency levels.

8

held on critical economic issues or on the promulgation of formal policy. Moreover, withregulation also the responsibility of the operator, the level of accountability was low.

31. However, with liberalization and the drive to attract private sector participation ininfrastructure operation and development, past philosophies have been gradually changing.This past role is now being reexamined in the different infrastructure sectors with a view toseparating this monolithic structure into various roles to ensure predictability, instituteappropriate checks and balances, promote fair competition and more effective regulation andsupervision, and address most of the uncertainties that often discourage broader private sectorparticipation — all crucial factors for sustainable private sector engagement. More importantly,shifting infrastructure operation and development to a market orientation would promoteefficiency and productivity, both crucial to the long-term soundness and sustainability of India’sinfrastructure sectors. However, this process is still evolving.

32. Few states have adopted formal policies for private sector participation or defined therules and terms under which private sector entry and participation would be allowed and withwhat incentives. Moreover, while the Expert Group’s early recommendations considered theneed for separate autonomous regulatory agencies for the various infrastructure sectors,recognition of this need has been slow.

33. For instance, in the power sector, the Electricity Regulatory Commissions Act waspassed only in 1998 enabling states to set up their own regulatory agencies, the state electricityregulatory commissions (SERCs). This was intended to bring about power tariff rationalization inan objective manner and make government subsidy policies transparent. Of 28 states35, 15have set up SERCs, of which 12 are now functional but only 8 have issued tariff orders.

34. No separate national or state regulators exist for roads. The uncertainty for privatebidders is increased by the multiplicity of agencies that may invite tenders for the same route.With the same ministry responsible for licensing and operating road projects also regulating thesector, the possibility of the private sector not receiving fair and equal treatment vis-à-vis publicoperators remains a concern. The regulatory framework for ports also lacks clarity without aseparate dedicated regulator. For instance, no standards are in place for measuringproductivity, and tariffs are not anchored on economic costs. Prudential norms for port trusts,which manage the major ports, vary considerably. Major ports are covered by the tariffrestrictions imposed by the Tariff Authority for Major Ports, while minor ports are at liberty todetermine their tariff levels.

35. For airports, the central Government formulated a policy on airport infrastructuredevelopment in 1997 to permit up to 74 percent foreign equity participation on automaticapproval and up to 100 percent with special dispensation. It also proposed an independentregulatory board. Regulations, thus, are still to evolve. Accordingly, economic andenvironmental considerations have yet to be addressed concerning questions about locationand connectivity to urban centers, land acquisition and local resistance, pricing of services,performance norms, time and space allocations, and noise and emission standards, amongothers. Similarly for water and sewerage, regulatory bodies are needed at the state/municipallevel to facilitate private sector participation by overseeing the various concession agreementsand setting standards for quality and performance.

35 The three new states of Chhattisgarh, Jharkhand, and Uttaranchal were created only in November 2000 as a result

of the bifurcation of the existing states of Madhya Pradesh, Bihar, and Uttar Pradesh, respectively.

9

c. Need to Strengthen Public-Private Interface

36. With the absence of formal or enunciated state policy on private sector participation, fewstates are organized to deal with the private sector and privatizations, as they lack appropriateinstitutional structures and processes, established systems and procedures, and capablededicated staff. Delays are common in (i) seeking approvals for projects; (ii) obtaining permitsand clearances; (iii) processing, negotiating, and finalizing contracts; and (iv) bringinginfrastructure projects to financial closure. Due to inexperience, capacity for promoting anddeveloping infrastructure projects is limited. Thus, priority areas for private sector participationare not identified early and feasible projects are not developed for bidding. Lack of adequateaccess to required data is a serious constraint. For example, developing a pipeline of bankableprojects for private sector investments in roads against a defined plan rather than dealing withprojects on an individual stand-alone basis has proved to be a more cost-effective approach.Furthermore, under its enunciated policy, the central Government, as well as the states, agreedto provide support for preparing detailed feasibility studies, identifying land for right-of-way andenroute facilities; and providing land, as well as environmental clearances including relocation ofutilities and resettlement and rehabilitation of affected people/establishments. Equally importantis the need to develop bankable projects. Lack of financial engineering expertise posesdifficulties in packaging projects that could be successfully offered for financing. Projectdevelopment is proving to be a very risky and costly exercise.

37. Invariably, infrastructure projects attract public interest litigation. Many are avoidable ifconsumers are appropriately sensitized to user charges and to the positive effects ofprivatization. The recent privatization of the Bharat Aluminium Company located in Chhattisgarhis a case in point. At the outset, the privatization met with strong labor resistance and objectionsfrom the state government. Since India is undertaking privatization in a systemic fashion, theimpacts of privatization on all affected parties need to be identified early, and ways by whichsuch impacts are to be mitigated determined. Experience shows that obtaining environmentalclearances from various national and state bodies has led to avoidable delays, arising from localresistance and cost overruns.

38. Moreover, the absence of credible mechanisms for settling disputes and well-definedbases for settling disputes also contribute to protracted debates over terms of agreements.Standard concession agreements have been prepared to guide negotiations for a fewinfrastructure sectors. Model concession agreements have been drafted recently for roads andlargely address lenders concerns. However, they have yet to be tested for bigger projects.Moreover, at the state level, the bankability of concession agreements is an issue since themodel concession agreement is not being used, rather standard construction contracts arefrequently utilized. Similarly, bidding procedures need to be streamlined and enhanced to bringthem in line with international practices. For roads, for example, the eligibility criteria forawarding projects on a BOT basis do not seem to depart significantly from regular road workscontracts. As a result, even small poorly capitalized firms can bid for contracts leading to lengthyselection processes.

d. Inability to Disaggregate and Allocate Risk

39. One of the major constraints to private infrastructure financing in India is the inability ofproject sponsors to identify separately and allocate risk of infrastructure projects. Availablesources of supplemental equity (in addition to sponsors’ funds) and long-term debt that canmatch the long gestation and payback periods of most infrastructure projects are limited, despite

10

a large stock market. Thus, domestic financial institutions risk large mismatches in their booksto finance large-scale infrastructure projects, facing both liquidity as well as interest rate risks.Risk from foreign exchange exposure is also difficult to hedge due to a still relatively thin swapmarket. As recourse to available collateral is limited, innovative credit enhancementmechanisms, instruments, and arrangements need to be developed. Escrows have reached thelimits of available cash flows from SEBs, while states have restricted issuances of stateguarantees because of a Reserve Bank of India (RBI) cap on such guarantees.

40. Domestic financial institutions view the risks and costs during construction as majordeterrents. Insurance companies in India are just starting to liberalize and finance infrastructureprojects, and still do not provide insurance cover for a variety of risks such as nonperformanceon technical contracts or risks during construction. For foreign sponsors, sovereign riskparticularly at the state level remains a major consideration.

B. Government Policies and Plans

41. Recognizing the precipitous slide in the growth of infrastructure36 and the need for animmediate response, the Government constituted the Special Subject Group (Subject Group) onInfrastructure within the Prime Minister’s Council on Trade and Industry to suggest ways toenhance investments in infrastructure in the quickest way possible. The summaryrecommendations and composition of the Subject Group are given in Supplementary AppendixA.

42. In general, the recommendations follow two general principles: (i) infrastructure servicesmust be offered in the most efficient, low-cost manner to best meet community needs, and (ii)users must pay for actual costs of infrastructure services plus a reasonable return oninvestment. To accomplish these, six major common policy actions are identified for eachinfrastructure sector: (i) separate the regulator from the operator; (ii) corporatize existinggovernment operating entities to provide better autonomy to these entities and have themoperate along commercial lines; (iii) privatize, where appropriate, corporatized entities (exceptstrategic assets); (iv) promote competition in sectors that are not natural monopolies; (v)establish enabling regulations e.g., for rights-of-way and environmental clearances; and (vi)implement full cost recovery for infrastructure services, e.g., tariff for agriculture sector andresidential consumers, tariff for local calls in the telecommunications sector, and water chargesin cities.

43. Power . An electricity bill introduced in Parliament, will: (i) mandate state governments toreplace SEBs with separate generation, transmission, and distribution companies or generationand combined transmission and distribution companies with a proviso to create moredistribution companies if the state government so decides; (ii) raise the agricultural tariff to aminimum of Rs0.50 per unit, and in not more than three years, raise this again to 50 percent ofthe cost of supply of power as in earlier agreements; (iii) require states that have not set upelectricity regulatory commissions to set one up within three months; and (iv) require strictenforcement of metering equipment as stipulated by the Central Electricity Authority. The view isto consider private distribution of power as an independent economic activity rather than as alicensed operation on terms determined by the SEBs. This will help create a more predictableinvestment environment.

36 Growth in infrastructure slowed to 5 percent of GDP in FY2001, from 8 percent in FY1999.

11

44. As an incentive, the Government has offered a one-time settlement of SEB dues tocentral public sector undertakings of approximately Rs260 billion ($5.4 billion) in return for atime-bound program of reforms. Memorandums of understanding between the central andconcerned state governments were signed in March 2001 to this effect. Except for the states ofPunjab and Tamil Nadu, all others agreed to charge a minimum agricultural tariff of Rs0.50 perunit. The governments also agreed that all states would achieve commercial viability of theirSEBs within two years. Each state may follow different routes, but essentially will create profitcenters with full accountability and may choose to hand over local distribution to the privatesector. A consultative group37 recently completed its study formulating a strategy for the capitalrestructuring of SEBs. Incentives for restructuring of about Rs15 billion ($314 million) to SEBsare provided in the current budget and are expected to be provided on an annual basis underthe Accelerated Power Development Programme with an enhanced allocation of power fromcentral sector power companies, along the lines agreed to by the central and various stategovernments.

45. Transmission projects, which are a government monopoly, have traditionally beenfinanced from internal accruals and state budgets. For the past decade or so, developmentfinance institutions such as the Power Finance Corporation and multilateral agencies havefinanced the sector. The Power Finance Corporation has identified transmission and distributionas a high priority sector for financing. However, funding sources have proven inadequate, moreso with the SEBs not being financially equipped to execute projects on their own. To overcomethese constraints, private participation in the sector has been invited with the amendment of theElectricity Supply Act, 1948, to enable private investment in the sector. However, so far noprivate sector enterprise has invested. Karnataka and Madhya Pradesh were among the firststates to invite private participation in the transmission sector. Karnataka formed a joint venturewith National Grid of the United Kingdom to evacuate power from two power generation projectsproposed to be set up at Mangalore. However, with both generation projects encounteringdifficulties, the transmission project has not made any progress. Madhya Pradesh also hadplans to set up over 20 private transmission projects, mainly to evacuate power from the manyindependent power producers proposed in the state. With the independent power producersembroiled in disputes on availability of escrow cover from the SEB, the transmission projectshave been delayed. Demand for private sector participation is expected to improve with theresolution of the generation issues and implementation of independent power producers.

46. In April 2001, the Power Grid Corporation of India also announced plans to tender $2.6billion in six transmission projects under international competitive bidding norms38 using a tariff-based formula intended to select the bidder with the lowest tendered tariff. These projects willbe developed on a build-own-operate-transfer basis.

47. The states of AP, Delhi, Haryana, Karnataka, Orissa, Rajasthan, and Uttar Pradeshhave enacted their respective electricity reform acts. The Madhya Pradesh legislative assemblyhas passed an electricity reform bill. A similar electricity reform bill has been drafted by Gujaratand is awaiting approval by the legislative assembly.39 Average power tariffs have increased by5 to 20 percent in several states (AP, Gujarat, Haryana, Karnataka, Madhya Pradesh,

37 Headed by M.S. Ahluwahlia, former finance secretary.38 ADB is assisting Power Grid Corporation to prepare bidding documents to invite the private sector to implement

transmission projects and to select suitable developers under TA 3380-IND: Private Sector Participation inElectricity Transmission, for $600,000, approved on 28 December 1999.

39 Loans 1803/1804-IND: Gujarat Power Sector Development Program, for $350 million, approved on 13 December2000.

12

Maharashtra, and Orissa) following tariff orders by their SERCs. The states of AP, Delhi,Karnataka, and Rajasthan, are scheduled to initiate the process of privatization of distribution in2001/02, with Haryana likely to follow.

48. Roads . The Central Road Fund Ordinance, 2000 was promulgated on 1 November2000. An amount of Rs25 billion ($523 million approximately) was appropriated from the cesson diesel fuel to invest in rural connectivity, while Rs9.6 billion (about $201 million) is being setaside from the cess on diesel and petrol to develop state roads. To facilitate private sectorparticipation, model concession agreements for major projects costing more than Rs1 billionand for projects below Rs1 billion to be undertaken on a BOT basis have been finalized.

49. The total outlay for the road sector was enhanced by 93 percent to Rs87.3 billion (about$1.8 billion). The National Highway Authority is setting up wholly owned special purposevehicles for implementing certain projects on a nonrecourse or partial recourse basis, such asthe Ahmedabad-Vadodara Expressway, Moradabad Bypass, and Palset-Panagarth Roadproject. A 10-year tax holiday during the first 20 years of operation is proposed for roaddevelopment.

50. Ports . While privatizations have yet to be implemented, Ministry Of Shipping and Portshas issued guidelines for inviting private sector participation in defined areas. These include (i)lease of existing assets; (ii) construction/creation and operation of additional assets such ascontainer terminals, multipurpose and specialized cargo, berths, and container freight stationsand storage facilities; (iii) pilotage; and (iv) captive facilities for port-based industries. Somestate governments have begun formulating BOT and similar arrangements for private sectorentry and participation. States such as AP, Gujarat, Maharashtra and Orissa have issuedtenders/ awards for the development of select minor ports.

51. A 10-year tax holiday is also proposed for ports development. It can be availed of withinthe first 15 years of operation. The rates of depreciation for ships and inland water vessels havebeen increased from 20 to 25 percent per annum.

52. Airports . One of the earliest areas to be liberalized in India was civil aviation. Evenbefore a policy on airline infrastructure had been formulated, private participation in domesticairlines was already permitted. Private airlines today provide stiff competition to Indian Airlines,capturing an estimated more than 40 percent of domestic air traffic. The current policy permits40 percent ownership by foreign investors in domestic airlines.40 Fares and schedules havebeen deregulated, but domestic airlines are required to service smaller city routes under thepolicy. Cargo traffic is fully accessible in both domestic and international routes. Privatechartered planes have also been allowed to operate freely, offering services to tourists andentrepreneurs.

53. Water and Sewerage . At the national level, the Ministry of Water Resources isresponsible for laying down policy guidelines and programs for the development of the country’swater resources. The recommended strategy under the Ninth Plan for improving urban watersupply and sewerage is to decentralize water production and distribution systems by devolvingresponsibility to municipal governments including promoting inter-municipal coordination andenhancing the role of civil society associations. The strategy also seeks to promote privatizationand greater community participation in managing and maintaining services, and leveragingpublic resources and exploiting innovative ways to improve access to finance. Currently, the

40 For unclear reasons, foreign airlines are not allowed to have any ownership in these domestic airlines.

13

main sources of financing for this sector are budgetary allocations from national, state, and localgovernments (about 70 percent), loans and grants from bilateral and multilateral agencies, andinstitutional lending by Life Insurance Corporation of India and the Housing and UrbanDevelopment Corporation.

54. Under the 74th Constitutional Amendment passed in 1992, service provision for waterand sewerage is to be decentralized to the various municipalities based on greater powersdelegated to local governments. However, the municipal laws required to bring them in line withthe constitutional provisions are yet to be enacted. In practice, implementing decentralizationfaces many constraints. The World Bank identified these as including, lack of standardinstitutional arrangements between the states and municipal bodies for providing water andsanitation services; lack of arrangements for the transfer of resources from the state to themunicipalities; considerable political interference in operations, decision making, and tariffsetting; weak capacity at the municipal levels; fragmentation of municipal functions, lack ofpublic service orientation; limited creditworthiness due to nontransparent financial andaccounting systems, and weak treasury management. Given the systemic nature of theseproblems, the World Bank proposes that the central Government in partnership with the statesand their cities undertake systematic institutional, fiscal, and financial reforms to developcreditworthy cities in line with urbanization and the devolution of political and economic powers.

55. Fiscal Responsibility Act . Concerned about the burgeoning fiscal imbalances and therapid buildup in public debt, the Government constituted the Committee on Fiscal Responsibilityin January 2000 to look into the various aspects of the fiscal system and to draft legislation onfiscal responsibility. This was followed by a pronouncement in the 2000/01 budget to bring thelegislative proposal forward and adopt concrete mechanisms to implement its provisions.Accordingly, the Fiscal Responsibility and Budget Management Bill 2000 was introduced inParliament in December 2000 and subsequently referred to the Parliamentary StandingCommittee.

56. The proposed law binds the Government itself to observe prudent guidelines, achievespecified targets in the conduct of fiscal policy, and thereby promote greater macroeconomicstability. The proposed Fiscal Responsibility and Budget Management Bill will provide a legaland institutional framework to reduce the fiscal deficit, contain the growth of public debt, andstabilize debt as a proportion of GDP over the medium term. It binds future governments to aprespecified path of fiscal consolidation. This covers only the finances of the centralGovernment. The matter regarding similar legislation at the state level will be pursued by therespective state governments. The bill proposes to eliminate the revenue deficit andprogressively reduce the fiscal deficit to not more than 2 percent of GDP within five yearsfollowing the promulgation of the law. It will also contain public indebtedness by specifying thatwithin 10 years, the total liabilities (including external debt at current exchange rate) will notexceed 50 percent of GDP. The Government will also cease any form of direct borrowing fromRBI after three years except in specified emergencies. The Government will also not extendguarantees to projects beyond 0.5 percent of GDP in any given financial year. Fiscal reform willhave crucial implications for the sustainability of infrastructure development in the country.

57. Labor Reform. Labor concern is one of the major constraints to privatization andgreater private sector participation in infrastructure and industry in India, but is being givenserious attention apparently only now. The finance minister, in a recent speech, noted thatlabor market rigidity needs to be addressed in order to promote industrial investments.Consequently, the scope for permitting termination of workers is to be expanded by allowing

14

employers of specified industrial establishments with 1,000 or more employees, instead of theearlier 100, to lay off, retrench, or effect business closure following a prescribed proceduresubject to prior Government approval. In parallel, the separation compensation is to beincreased from 15 days to 45 days for every completed year of service. Furthermore, use ofcontract labor is being liberalized by allowing unrestricted outsourcing of activities. Inexchange, protection will be extended to workers by defining compensation for health, safety,welfare, and social security, including larger compensation for retrenchment based on lastdrawn wages for every year of service. In March 2001, the Prime Minister stated that, althoughdifficult, the Government will push for the proposed labor reforms in the Union Budget as themajority of the people desire it. The proposed amendments to the labor laws are expected tobe introduced in Parliament. Labor market reforms have favorable implications for increasedprivate sector activity and expansion.

C. External Assistance to the Sector

58. India is the World Bank’s single largest borrower. The World Bank’s cumulative lendingto India as of June 2000 was over $47 billion in market-based loans from the International Bankfor Reconstruction and Development and development credits from the InternationalDevelopment Association. Of its existing portfolio of 79 ongoing projects amounting to $11.5billion, infrastructure, including energy, projects comprise 20 percent.

59. Japan and Germany are the other major contributors in the sector. Official developmentassistance loan commitments by Japan have steadily increased since 1990. Japan hasemerged as the largest source of bilateral assistance to India. However, due to economicmeasures in place since May 1998, only one new loan has been committed for the BakreswarThermal Power Station Unit–3 Extension Project, an extension of the ongoing project. As ofMarch 2000, a total of 143 official development assistance loans had been committed by theJapan Bank for International Cooperation for a total of Y1,642 billion (about $13.7 billion).41

Infrastructure support comprises about 61 percent of total commitment, with power and gas asthe main beneficiaries.

60. The Kreditanstalt für Wiederaufbau (KfW) has extended DM14 billion (about $6.5billion)42 to India; India has become the largest partner for German financial cooperation funds.KfW’s investments in infrastructure include assistance to SEBs for power sector reforms, IndianRailways, and minor irrigation schemes. Lending to the power sector totals DM1,383 million(about $631 million). For the environment, KfW has assisted the Indian Renewable EnergyDevelopment Agency Ltd. with financing of renewable energy projects.

61. The United Kingdom's. Department for International Development is cofinancing theWorld Bank’s Economic Restructuring Program in AP and is looking at ADB’s Public ResourceManagement Program in Madhya Pradesh for possible cofinancing. Sweden’s assistance toinfrastructure is through a combination of grants and loans comprising $70 million for onehydropower project and $100 million for a transmission line project. Dutch developmentassistance in infrastructure has been mainly for port development, water supply and sanitation,pollution, and sewerage treatment facilities. Currently, assistance is being provided to threestates in India: AP, Gujarat, and Kerala.

41 $1=¥ 119.74 as of 1 October 2001.42 $1=DM2.1486 as 1 October 2001.

15

62. The United States Agency for International Development's Financial institutions Reformand Expansion Project includes an element to enhance debt markets for municipal finance and,in this regard, provided TA for the issuance of municipal bonds to some municipal governments.The International Finance Corporation recently issued a guarantee for the local currencyborrowings of the privatized distribution companies in Orissa.

D. Lessons Learned

63. The PSIF I was ADB's first facility established for private sector infrastructure financingand development through Indian financial institutions.43 Much of the analyses and findings inthis report were gathered from feedback and dialogue with the participating and other financialinstitutions in India engaged in infrastructure financing.

64. Through this intervention, financial intermediaries involved were anticipated to developcapacity to undertake the financing of infrastructure projects, help mobilize resources forinfrastructure development, develop innovative instruments and mechanisms for mitigating risksin infrastructure financing, and thereby facilitate private sector participation in infrastructureprojects in India.

65. Among Indian financial institutions, the two financial institutions involved under the PSIFI, ICICI and IFCI, together with the Industrial Development Bank of India (IDBI) emerged as thelargest financiers of infrastructure in India since 1994, with the most rapid growth occurringbetween 1996 and 1998. Total disbursements during 1994/99 were approximately Rs206 billion(about $4.3 billion), of which power projects accounted for 65 percent, roads and ports for 20percent, and telecommunications projects for 15 percent.44

66. The PSIF I has been 96 percent committed for eight ICICI projects (three in power, threein telecommunications, one in ports and one in roads) and for five IFCI projects (four in powerand one in ports). Of the projects financed by ICICI, five have been completed, while three arein progress. For IFCI, three have been commissioned, while two are under implementation.

67. As required under the PSIF I, both ICICI and IFCI have set up separate dedicated unitsfor infrastructure. The one for ICICI was set up in 1996 and focuses on projects in power,telecommunications, transport, and urban infrastructure. It has about 33 professionals in thesesectors now undertaking various functions.

68. Today, these infrastructure groups provide a complete range of financial services, fromproject identification to the structuring of complex project finance transactions. Aside fromlending, they help arrange and provide advice to infrastructure projects. They conduct duediligence over projects to be financed, and help identify and mitigate project risks. Beyondproject financing, they carry out policy dialogue with the central and state governmentsregarding issues affecting the various infrastructure sectors. ICICI,45 in particular, was

43 The World Bank also provided a credit line under its Private Infrastructure Finance (IL&FS) Project for $200 million

in March 1996 for financing private urban infrastructure (water supply and sanitation and roads) projects. Out of thetotal line, only $30 million was reportedly disbursed. A number of reasons appear to account for this: (i) the limitednumber of eligible infrastructure sectors; (ii) more difficult environment for water supply and sanitation and the latereforms in roads, particularly the difficulty with land acquisition and long gestation period involved; and (iii) the morerigid structure of the credit line, as it can only be used as a loan, and all loans were subject to prior World Bankapproval including requests for proposals.

44 World Bank. 2000. Report on India Financial Market Assessment for Private Infrastructure Investments.45 ICICI was one of the members of the original Expert Group.

16

instrumental in drafting the model National Highway Authority concession agreement for roadprojects. It is also assisting several state governments undertake the privatization of their powerdistribution companies. ICICI was actively involved in preparing the NationalTelecommunications Policy 1999. ICICI also set up special purpose vehicles in Kerala and WestBengal to help develop infrastructure projects in partnership with the state governments but withunfavorable results.46

69. The PSIF I was to be used to finance debentures issued by infrastructure projects toencourage the development of an active secondary market for infrastructure securities. Allfinanced eligible projects under the PSIF I have issued debentures. However, a market for thesesecurities cannot be created until the infrastructure projects attain stable commercial operations.The underlying securities of start-up infrastructure projects have to undergo “seasoning” prior tomarket distribution. The existing secondary market in debt securities in India are primarily forAAA or at least AA+ rated securities at this time (a rating these infrastructure securities are notlikely to obtain at this stage as they are still perceived to be high risk). Furthermore, unratedpapers are required to carry a 20 percent additional spread in the market in accordance with thestipulation of the Fixed Income Money Market and Derivatives Association based on theirvaluation guidelines. Nonetheless, ICICI has been able to sell the debentures of some assistedinfrastructure projects47 utilizing pass-through certificates (PTCs) issued by a special purposevehicle configured as a trust, typically used in securitization arrangements. Nonetheless, astipulation is included in ICICI and IFCI’s loan agreements requiring infrastructure projectsfinanced to list their debentures at the stock exchanges within two to three years from the startof regular commercial operations.

70. ICICI is today active in the corporate debt market. It has a trading desk with anaggregate turnover of Rs37 billion from April 2000–March 2001 and average outstanding ofRs4.6 billion. It has been engaged in constructive dialogue with various government agenciesand has provided representation in various committees dealing with issues on capital marketdevelopment.

71. However, India’s long-term debt market remains underdeveloped and suffers from anumber of impediments. It is still characterized by a small number of players, with very limitedparticipation by long-term market participants such as provident funds and insurancecompanies;48 weak secondary market,49 hence relatively illiquid market; absence of abenchmark yield curve; and inadequate support infrastructure.

72. Given current market imperfections, weak capacity and lack of the regulatory andinstitutional structures, and standardized systems and processes at the state level, a project-to-project approach to infrastructure development is not likely to advance private sectorparticipation significantly, certainly not to the extent that present Government plans envision.

46 Many believe this outcome was the result of poor choice of states. Both Kerala and West Bengal had, at that time,

communist-led governments with probably the least conducive environments for private sector investments.47 Jindal Tractabel Power Company Ltd., for Rs650 million and for Nandi Highway Developers Ltd., two issues for

Rs324 million and Rs100 million.48 ADB is providing TA for development of provident funds and insurance systems under TA 3367-IND: Reform of

the Private Pension and Provident Funds System and the Employees’ Provident Fund Organization, for$1,000,000, approved on 26 December 1999; and TA 3460-IND: Policy and Operational Support and CapacityBuilding for the Insurance Regulatory and Development Authority, for $800,000, approved on 22 June 2000.

49 A study is also being undertaken by ADB under TA 3473-IND: Development of Secondary Debt Market, for$600,000, approved on 28 July 2000.

17

E. ADB’s Sector Strategy

73. India’s economic success over the medium term will depend in large part on theGovernment’s ability to address structural weaknesses, particularly in the infrastructure sectorand in public finances. In key areas of the economy, particularly in power, roads, and transport,investments have failed to keep pace with economic need and their apparent lack is impedingthe transition to a more sustainable and poverty reducing growth path. Given the considerableresource requirement in infrastructure and the significant recurring drain on public finances ofinefficient public structures in various infrastructure sectors, the central and state governmentswill need to (i) promote greater private sector involvement and encourage commercialization byevolving the long-term framework and policy incentive mechanism for private initiatives andinvestment, (ii) strengthen policy coordination among government agencies, and (iii) enhancethe availability of long-term domestic funding. The objectives and design of the PSIF II areconsistent with ADB’s sector strategy. ADB assistance in infrastructure to India is shown inAppendix 3.

F. Policy Dialogue

74. Policy dialogue has been active in all areas of infrastructure sector involvement by ADB,both at the national and state levels. This is carried out by various missions and ADB’s IndiaResident Mission. State operations have allowed ADB to interact closely with state governmentsin pursuing reforms and in bringing ADB’s cross-cutting concerns to the forefront. Periodicreviews have been carried out under PSIF I and the results of these missions have beendiscussed with the financial institutions involved and the Government. Concerns by ICICI andIFCI relating to policy and public-private interface issues discussed with ADB arising out of theirinfrastructure operations and capital market activities have been relayed to and discussed withthe Government.

75. In particular, ADB’s role in capital market development has led to its close involvement inimportant areas of capital market operations, such as provident funds reform and insurancesector liberalization; in the recent past, these were highly protected areas.