In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation...

Transcript of In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation...

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 1

2015 WL 751783 (Del.Ch.) (Trial Motion, Memorandum and Affidavit)Chancery Court of Delaware.

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation.

No. 8885-VCL.February 18, 2015.

Plaintiff's Opening Brief to Approve the Settlement, Recertify the Class,Approve the Fee Application, and Approve the Special Award to Plaintiff

Joel Friedlander (#3163), Jeffrey M. Gorris (#5012), Fredlander & Gorris, P.A., 222 Delaware Avenue, Suite 1400, Wilmington,Delaware 19801, (302) 573-3500, Co-lead Counsel.

Of Counsel: Lawrence P. Eagel, Jeffrey H. Squire, Bragar Eagel & squire, PC, 885 Third Avenue, Suite 3040, New York, NewYork 10022, (212) 308-5858, Co-Lead Counsel.

Jessica Zeldin (#3558), Rosenthal, Monhait & Goddess, PA., 919 Market Street, Suite 1401, Wilmington, Delaware 19801,(302) 656-4433, Delaware Liaison Counsel.

REDACTED/PUBLIC VERSION

FILED ON: February 18, 2015

DATED: February 11, 2015

TABLE OF CONTENTSTABLE OF AUTHORITIES ................................................................................................................... iiiPRELIMINARY STATEMENT .............................................................................................................. 1STATEMENT OF FACTS ...................................................................................................................... 6A. Only Pacchia Sued Based on a Section 220 Demand ........................................................................ 6B. Plaintiff Achieved Early Procedural Victories .................................................................................... 12C. Plaintiff Filed Amended Pleadings that Withstood Motions to Dismiss ............................................. 13D. Plaintiffs Counsel Expended Significant Resources While Motions to Dismiss Were Pending ......... 17E. Plaintiffs Counsel Built a Liability Case that Relied on Extensive Documentary Analysis and ManyFact Depositions .......................................................................................................................................

20

1. Vivendi Pushes For Liquidity .............................................................................................................. 222. BKBK Push for a Self-Interested Transaction Structure ..................................................................... 26a. BKBK Plotted Secretly for Months ..................................................................................................... 27b. Nobody Negotiated BKBK's Investment Terms .................................................................................. 29c. The Special Committee Did Not Determine that the ASAC Transaction Structure Was Superior toAlternative Structures ...............................................................................................................................

31

d. BKBK's and ASAC's Ultimate Investment Terms Are Extraordinary ................................................ 33F. The Parties Served Expert Reports and Completed Expert Discovery ................................................ 34G. The Parties Mediated the Dispute with Former United States District Court Judge Layn PhillipsAmidst Pre-Trial Preparations ..................................................................................................................

41

ARGUMENT ............................................................................................................................................ 44I. THE SETTLEMENT IS FAIR, REASONABLE AND ADEQUATE ................................................ 44A. Analysis of the $275 Million Payment to Activision ......................................................................... 481. Restitution ............................................................................................................................................ 482. Damages to Activision ......................................................................................................................... 50

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 2

3. Damages to Public Stockholders ......................................................................................................... 51B. Analysis of the Corporate Governance Changes ................................................................................ 53II. RECERTIFICATION OF THE CLASS IS PROPER ........................................................................ 55III. THE NEGOTIATED FEE APPLICATION OF $72.5 MILLION IS REASONABLE ..................... 55A. The Sliding Scale ................................................................................................................................ 56B. The Benefits Conferred ....................................................................................................................... 59C. Plaintiffs Counsel Assumed True Contingent Risk Expending Intense Effort and Over $1.1 Millionon a Factually Complex Matter ...............................................................................................................

61

IV. PLAINTIFF'S TIME AND EFFORT MERIT A SPECIAL AWARD .............................................. 65CONCLUSION ......................................................................................................................................... 66

TABLE OF AUTHORITIESCASEAm. Mining Corp. v. Theriault, 51 A.3d 1213 (Del. 2012) ................................ 57, 62, 64Bomarko, Inv. v. Int'l Telecharge, Inc., 794 A.2d 1161 (Del. Ch. 1999) ........... 48Brinckerhoff v. Texas E. Prods. Pipeline Co., LLC, 986 A.2d 370 (Del. Ch.2010) ...................................................................................................................

65

Dow Chemical Co. v. Reinhard, 2007 WL 2780545 (E.D. Mich. Sept. 20,2007) ...................................................................................................................

47

Dow Jones & Co. v. Shields, 1992 WL 44907 (Del. Ch. Mar. 4, 1992) ............. 61Forsythe v. ESC Fund Mgmt. Co., 2012 WL 1655538 (Del. Ch. May 9, 2012) . 56, 59, 65Ginsburg v. Phila. Stock Exch., Inc., C.A. No. 2202-CC (Del. Ch. July 2,2008) (Order) ......................................................................................................

65

In re Abercrombie & Fitch Co. S'holders Deriv. Litig., 886 A.2d 1271 (Del.2005) ...................................................................................................................

55

In re Am. Int'l Gp., Inc. Consol. Deriv. Litig., 965 A.2d 763 (Del. Ch. 2009) ... 47In re Am. Int'l Group, Inc. Cons. Deriv. Litig., C.A. No. 769-VCS, tr. (Del.Ch. Jan. 25, 2011) ..............................................................................................

58

In re Best Lock Corp. S'holders Litig., C.A. No. 16281-CC, tr. (Del. Ch. Oct.16, 2002) .............................................................................................................

59

In re Clear Channel Outdoor Holdings Inc. Deriv. Litig., C.A. No. 7315-CS,tr. (Del. Ch. Sept. 9, 2013) ................................................................................

64

In re CNX Gas Corp. S ‘holders Litig., C.A. No. 5377-VCL (Del. Ch. Aug.23, 2013) .............................................................................................................

59

In re Del Monte Foods Co. S'holders Litig., 2011 WL 2535256 (Del. Ch. June27, 2011) .............................................................................................................

62

In re Emerson Radio S ‘holder Deriv. Litig., 2011 WL 1135006 (Del. Ch.Mar. 28, 2011) ....................................................................................................

57

In re Gardner Denver, Inc. S'holder Litig., C.A. No. 8505-VCN, tr. (Del. Ch.Sept. 3, 2014) .....................................................................................................

63, 64

In re Genentech, Inc. S ‘holder Litig., C.A. No. 3911-VCS, tr. (Del. Ch. July9, 2009) ...............................................................................................................

64

In re Google Inc. Class C S'holder Litig., Cons. C.A. No. 7469-CS, tr. (Del.Ch. Oct. 28, 2013) ..............................................................................................

60

In re Orchard Enters., Inc. S'holders Litig., 2014 WL 4181912 (Del. Ch. Aug22, 2014) .............................................................................................................

57, 58

In re Phila. Stock Exch., Inc., 945 A.2d 1123 (Del. 2008) ................................ 46In re Plains Res., Inc. S'holders Litig., 2005 WL 33281 (Del. Ch. Feb. 4,2005) ...................................................................................................................

59, 61

In re Rural/Metro S'holders Litig., C.A. No. 6350-VCL (Del. Ch. Nov. 19,2013) ...................................................................................................................

58

In re Sauer-Danfoss Inc. S'holders Litig., 65 A.3d 1116 (Del. Ch. 2011) .......... 56In re TD Banknorth S'holders Litig., C.A. No. 2557-VCL, tr. (Del. Ch. June25, 2009) .............................................................................................................

59

In re TeleCommunications, Inc. S'holder Litig., C.A. No. 16470-CC, tr. (Del.Ch. Jan. 30, 2007) ..............................................................................................

59

In re Telecorp. PCS, Inc. S'holder Litig., C.A. No. 19260-VCS, tr. (Del. Ch.Aug. 20, 2003) ....................................................................................................

59

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 3

In re Topps Co. S'holders Litig., 924 A.2d 951 (Del. Ch. 2007) ....................... 56In re Triarc Companies, Inc., 791 A.2d 872 (Del. Ch. 2001) ............................ 45In re UnitedGlobalCom, Inc. S'holders Litig., C.A. No. 1012-VCS (Del. Ch.May 16, 2008) (Order) .......................................................................................

59

In re Yahoo! S'holders Litig., C.A. 3561-CC, let. op. (Del. Ch. Mar. 6,2009) ... 60Kurz v. Holbrook, C.A. No. 5019-VCL, tr. (Del. Ch. July 19, 2010) ................ 62, 63Loral Space & Commc'ns. Inc. v. Highland Crusader Offshore Partners, L.P.,977 A.2d 867 (Del. 2009) ..................................................................................

56

Minneapolis Firefighters' Relief Assoc. v. Ceridian Corp., C.A. No. 2996-CC(Del. Ch. Mar. 24, 2008) (Order) .......................................................................

61

Minneapolis Firefighters' Relief Assoc. v. Ceridian Corp., C.A. No. 2996-CC,tr. (Del. Ch. Feb. 25, 2008) ...............................................................................

60

Oliver v. Boston Univ., 2009 WL 1515607 (Del. Ch. May 29, 2009) ................ 65Parnes v. Bally Entm't Corp., 722 A.2d 1243 (Del. 1999) ................................ 47Polk v. Good, 507 A.2d 531(Del. 1986) ............................................................ 44Prezant v. De Angelis, 636 A.2d 915 (Del. 1994) ............................................. 55Raider v. Sunderland, 2006 WL 75310 (Del. Ch. Jan. 4, 2006) ........................ 66Reis v. Hazelett Strip-Casting Corp., 28 A.3d 442 (Del. Ch. 2011) .................. 47Rome v. Archer, 197 A.2d 49 (Del. 1964) ......................................................... 44Ryan v. Gifford, 2009 WL 18143 (Del. Ch. Jan. 2, 2009) ................................. 44, 45Schultz v. Ginsburg, 965 A.2d 661 (Del. 2009) ................................................. 46Seinfeld v. Coker, 847 A.2d 330 (Del. Ch. 2000) .............................................. 59Sugarland Indus., Inc. v. Thomas, 420 A.2d 142 (Del. 1980) ............................ 56OTHER AUTHORITIESLeo E. Strine, Jr., Documenting the Deal: How Quality Control and CandorCan Improve Boardroom Decision-Making and Reduce the Litigation TargetZone 8 (draft Oct. 2014) ....................................................................................

47

“Jean-Rene and myself we appreciated your discreet but efficient taking care of us. Thanks for that.”

Email from Vivendi CEO Jean-Francois Dubos to Activision CEO Bobby Kotick, July 25, 2013 1

PRELIMINARY STATEMENT

This case challenged a transaction put together at the highest levels of global business. A year before the announcement ofthe transaction, industry participants learned that troubled French conglomerate Vivendi S.A. (“Vivendi”) wanted to sell eitherActivision Blizzard, Inc. (“Activision” or the “Company”) or Vivendi's 61% stake in Activision as part of a deleveragingeffort and major shift in Vivendi's strategic direction. Vivendi's senior managers worked with French and American advisors atGoldman Sachs & Co. and Barclays about how to monetize an asset worth as much as $10 billion for which there was no buyer.Activision's co-founders and highly compensated senior executives, CEO Robert A. Kotick and Co-Chairman Brian G. Kelly(collectively, “BKBK”), devised their own plan. They directed a cast of corporate advisors, personal advisors, institutionalinvestors, a local private equity firm, and corporate strategic partners with the objective of negotiating a deal in which BKBKwould personally invest $100 million, obtain voting control of Activision, and potentially gain $1 billion within four years.

More than a year of plotting, posturing, negotiating, and threatening by Vivendi, BKBK, and, eventually, a special committeeof Activision outside directors (the “Special Committee”) culminated in the announcement of a unique transaction that servedthe interests of BKBK and Vivendi (the “Transaction”). Activision paid $5.83 billion to repurchase shares from Vivendi at adiscount to the market price, and BKBK rounded up outside investors willing to compensate BKBK as if they were privateequity fund managers. BKBK's fund, ASAC II LP (“ASAC”), paid $2.34 billion to buy from Vivendi a 25% block of Activisionshares at the same discounted price per share. Vivendi pocketed over $8 billion and kept the upside on its remaining 12% stakein Activision. The Transaction was well received in the marketplace, and equity analysts swooned at how BKBK engineered

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 4

a highly accretive transaction that freed Activision from the shackles of an over-leveraged Vivendi. As expected, Activision'sstock price rose significantly upon announcement of the Transaction.

Stockholder Plaintiff Anthony Pacchia (“Plaintiff” or “Pacchia”) was upset that BKBK had obtained the opportunity to investin Activision shares at a discount to the market price. He made a Section 220 demand and filed a stockholder derivative actioninformed by Activision's document production. Another stockholder litigated a contractual claim on an expedited basis andsought to settle before and after obtaining preliminary injunctive relief. Defendants perceived so little risk from stockholderlitigation filed in Delaware and California that on the eve of oral argument in the Delaware Supreme Court defendants declined tosign a settlement their lawyers had negotiated. The Delaware Supreme Court reversed, the Transaction closed, and Activision'sstock price rose again.

Defendants were represented by seven premier law firms who hired preeminent financial economists as testifying experts.The litigation proceeded in the forum favored by defendants. Nevertheless, barely thirteen months after the closing of theTransaction, defendants agreed to a $275 million settlement, reportedly the largest cash settlement of stockholder derivativeclaims in U.S. history and the largest cash settlement in the history of this Court. BKBK also agreed to the appointment of twoadditional independent directors - creating a board majority of directors unaffiliated with them or ASAC - and a reduction oftheir own voting power from 24.9% to 19.9%.

Why did parties so proud of their handiwork in the summer of 2013 concede so much in November 2014? The answer is thatdefendants feared the consequences of an impending two-week trial in December 2014. Plaintiff's counsel pled the correctclaims, pursued the right litigation strategy, put the case on an aggressive schedule, diligently pursued multi-track fact discovery,prevailed in motion practice, and served an expert report explaining how a finding that there existed superior feasible alternativetransaction structures could translate into large damages and/or restitution. In preparing for trial, Plaintiffs counsel accumulatedabundant evidence about how Vivendi misused its power as a controlling stockholder, how BKBK misused corporate resources,relationships and information to negotiate a below-market side deal, and how the Special Committee failed to protect Activisionand its public stockholders.

The proposed settlement is fair and reasonable. We believe it approximates what Activision and the class stood to recover attrial. Such a full recovery was achievable through settlement, we believe, because of the probability of a finding of actionableself-dealing, the wide range of potential post-trial monetary and equitable remedies, and the severity of the potential collateraleffects on the defendants.

This case stands at the pinnacle of what entrepreneurial counsel have ever achieved when settling breach of fiduciary dutyclaims. Plaintiff seeks approval of the proposed settlement and an award of attorney's fees and expenses of $72.5 million,which Activision negotiated and defendants agreed not to oppose. Out of that amount, Plaintiff seeks approval of a specialaward of $50,000 for his time and effort overseeing the litigation. Future dealmakers should advise their clients that meritoriousclaims against fiduciaries of Delaware corporations may be pursued to a highly successful, prompt conclusion in this Court bystockholder counsel who are incentivized to do so.

STATEMENT OF FACTS

A. Only Pacchia Sued Based on a Section 220 Demand

The Transaction was announced on July 25, 2013. Activision disclosed that a special committee of independent directors advisedby Centerview Partners (“Centerview”) and Wachtell, Lipton, Rosen & Katz had negotiated and evaluated the Transaction onbehalf of Activision, and Activision had been separately advised by J.P. Morgan Securities LLC (“JP Morgan”) and Skadden,Arps, Slate, Meagher & Flom LLP. (Friedlander Ex. 2 Ex. B.)

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 5

Vivendi sold 428,676,471 Activision shares to Activision and 171,968,042 Activision shares to ASAC for $13.60 per share, a10% discount to Activision's closing stock price on July 25 of $15.18 per share. Following announcement of the Transaction,Activision's stock price rose, closing at $17.46 per share on July 26, and at $18.27 per share on Monday, July 29. (Id. Ex. D.)Equity analysts identified many positive aspects of the Transaction, such as: (i) earnings accretion due to Activision's favorablepurchase price; (ii) elimination of Vivendi's majority stake and the associated “overhang”; (iii) the signaling effect of BKBK andActivision's Chinese strategic partner Tencent Holdings Limited (“Tencent”) investing in Activision; (iv) Activision's loweredcost of capital from issuing debt; and (v) Activision's eligibility for inclusion in the S&P 500. (Friedlander Ex. 3 Ex. B at 7.)There was no commentary about whether BKBK or ASAC were being inappropriately enriched or empowered.

Pacchia was disturbed that BKBK had created an entity to buy a large block of shares at a discount, which he considered a“usurpation of corporate opportunity and a breach of their duty as highly compensated executives.” (Pacchia 81-82.) Pacchiawas the only stockholder of Activision who promptly made a Section 220 demand and filed suit for breach of fiduciary duty.

The first suit was filed on August 1, 2013, by Todd Miller, who filed a stockholder derivative complaint in California state courtalleging breach of fiduciary duty, waste, and unjust enrichment. Miller's complaint was not informed by a Section 220 demand.

Pacchia made a Section 220 demand on August 9, 2013. Plaintiffs counsel signed a confidentiality agreement on August 28,2013, promptly analyzed the documents, and prepared a complaint. Plaintiff filed his stockholder derivative complaint underseal on September 11, 2013. The sealed complaint contained the explosive allegation that Kotick vetoed a transaction structurebeing negotiated by the Special Committee and Vivendi whereby shares not sold to Activision would be sold by Vivendi in asecondary offering. In particular, the complaint alleged that the Special Committee felt it necessary to abandon the secondaryoffering structure and go forward instead with the ASAC structure because Kotick's support was necessary for a successfulsecondary offering and Kotick had repeatedly voiced his opposition to a secondary offering and threatened to resign. Plaintiffscomplaint further alleged that the Board dissolved the Special Committee on June 8, 2013, after which BKBK negotiated aterm sheet directly with Vivendi.

On September 11, 2013, Douglas Hayes publicly filed a complaint. Count I asserted an individual and class claim allegingthat the Transaction violated Activision's Certificate of Incorporation because no stockholder vote was contemplated. Count IIasserted an individual and class claim based on the allegation that the class of stockholders who held their shares though closing“were not afforded the same opportunity to acquire Activision common stock at a favorable price.” Hayes sought injunctiverelief as to Count I. Pacchia did not support Hayes's request for a temporary restraining order. Pacchia's counsel believed thatno stockholder vote was required and that stockholders would benefit from the closing of the Transaction, given that Activisionwas repurchasing a huge number of its shares at a favorable price.

Milton Pfeiffer, who owned two shares of Activision common stock, made a Section 220 demand on September 18, 2013. He didnot file a Section 220 action until November 12, 2013, and he later abandoned it and did not file a breach of fiduciary duty action.

Hayes pursued a settlement in the form of a special dividend days before the hearing on his motion for a temporary restrainingorder on his voting rights claim and before obtaining any discovery. (Friedlander Ex. 4.) Hayes obtained a preliminary injunctionon his voting rights claim. Defendants appealed. On October 7, 2013, Hayes's counsel invited Pacchia's counsel to participatein a proposed settlement. On October 8, Hayes's counsel circulated a proposed emergency motion to consolidate the Hayesand Pacchia actions that Hayes's counsel proposed to file the next day, which would appoint Hayes's counsel as lead counselin order to facilitate a prompt settlement with financial terms purportedly “in excess of $85 million” and “relegate Pacchia toobjector status.” (Friedlander Ex. 5 Mot. ¶¶ 7, 8.) In fact, the monetary consideration in the proposed settlement was only worth

approximately $41 million to the public stockholders. 2 Pacchia declined to support the proposed settlement at that time.

On October 9, the day before oral argument in the Delaware Supreme Court, Hayes's counsel implored Pacchia's counsel toreconsider and support the proposed settlement, saying defendants refused to sign it without Pacchia's support and reasoningas follows:

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 6

If we lose this [oral] argument, the settlement will be off, our leverage will dissipate, and we will moveforward with the litigation. If we win this argument, the settlement will be off, the company will holda shareholder vote, and we believe the shareholders may well approve the transaction. This will givedefendants a potential ratification defense in the litigation moving forward, and we believe will make itvery hard to extract any consideration through settlement or trial.

(Friedlander Ex. 6.) Hayes's counsel stated that they would seek to be appointed lead counsel that day, with the power to litigatethe case going forward even if the settlement did not happen. (Id.)

Pacchia reluctantly signed the settlement stipulation that afternoon, believing it to be at the low end of the range ofreasonableness. (Eagel Aff. of 11/22/14) (D.I. 68). Pfeiffer did not participate in the proposed settlement.

According to Hayes's counsel, “Pacchia's counsel essentially sat in the bleachers booing the underdog until the 9 th inning,when they reached over the fence to prevent a potential game-winning home run.... As a result of the delay and opposition byPacchia and the refusal of Pfeiffer's counsel, the settlement did not proceed, the preliminary injunction was overturned, and anoptimal opportunity to achieve an outstanding result for Activision's public stockholders was lost.” (Friedlander Ex. 7 at 4-5.)

In fact, Defendants chose not to sign the stipulation. They instead went forward with the appellate argument and prevailed.Defendants could have signed the proposed settlement on October 9 if they each believed the settlement amount was less thanthe sum of (i) the nuisance value of a potential delay in the closing of a $8+ billion transaction and (ii) the expected value ofthe damages claims. Presumably, one or more defendants believed the Transaction would soon close and all litigation wouldbe disposed of post-closing at a significantly lower cost than the $41 million proposed settlement.

From the perspective of Pacchia's counsel, the closing of the Transaction and the resolution of the leadership hearing onDecember 3, 2013, created an optimal opportunity to achieve an outstanding result. The absence of a stockholder vote eliminated

potential defenses to the Transaction. The prompt closing of the Transaction locked in immediate unrealized gains 3 and newvoting power for BKBK and ASAC, plus additional influence for them through the appointment of new directors Peter Nolanand Elaine Wynn. Nolan was managing partner of ASAC investor affiliate Leonard Green & Partners, L.P. (“LGP”), and Kotickhad a longstanding close friendship with Elaine Wynn. Those facts on the ground created the potential for significant finalequitable relief. Additionally, our analysis of the Section 220 documents and publicly available information led us to believethat factual questions existed about the independence or loyalty of all three groups of director defendants: BKBK; the Vivendidesignees; and the members of the Special Committee. We only had to accomplish what defendants did not expect, what noother stockholder aimed to do, and what no commentator suggested - make the case that the Transaction was the product ofbreaches of fiduciary duty and that BKBK or ASAC were not entitled to control over the Company or their unrealized gains.

B. Plaintiff Achieved Early Procedural Victories

Immediately after the leadership hearing, Plaintiff filed a Verified Second Amended Class and Derivative Complaint thatelaborated on allegations respecting demand futility. Plaintiff also served document requests and subpoenas and proposed entryof a scheduling order that would allow the case to be tried in 2014 and decided in advance of the 2015 annual meeting ofstockholders, which is typically held in early June.

Two disputes with defendants soon arose. All defendants proposed a schedule under which trial would not occur until April2015, at the earliest. Vivendi argued that its electronic documents were exempt from discovery.

In January 2014, Plaintiff sought entry of his proposed scheduling order and filed a motion to compel against the VivendiDefendants. The Court entered Plaintiff's proposed scheduling order on January 23, 2014. On February 21, 2014, after full

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 7

briefing and oral argument, the Court issued an opinion granting Plaintiffs motion to compel and rejecting the VivendiDefendants' objections based on a French blocking statute and a French data protection act. In re Activision Blizzard, Inc.S'holder Litig., 86 A.3d 531 (Del. Ch. 2014).

These two rulings allowed the case to proceed on a quick schedule. Substantial completion of document productions fromall defendants was due by March 31, 2014, fact discovery was scheduled to conclude by July 31, 2014, and trial was set forDecember 8-12, 2014. Plaintiffs counsel expended intense effort to stick to those deadlines and never requested an extension.

C. Plaintiff Filed Amended Pleadings that Withstood Motions to Dismiss

On January 31, 2014, all defendants filed motions to dismiss supported by opening briefs. No defendant moved pursuant toCourt of Chancery Rule 23.1.

On February 10, 2014, Plaintiff filed a motion for leave to file an amended complaint that incorporated information gleanedfrom core documents produced by defendants in January 2014. The proposed pleading also asserted new counts for breach ofcontract. Plaintiff alleged that Kotick' s involvement in the appointment to the Board of Peter Nolan and Elaine Wynn uponthe closing of the Transaction breached a standstill restriction in the Stockholders Agreement between Activision and ASACthat limited ASAC's board representation to BKBK.

All defendants filed motions to dismiss and supporting briefs on March 3, 2014. Plaintiff's opposition brief identified legaldoctrines that could support a judgment that the pleaded facts gave rise to a breach of the duty of loyalty:

• citing Guth v. Loft, Inc., 5 A.2d 503 (Del. 1939), and Agranoff v. Miller, 1999 WL 219650 (Del. Ch. Apr. 12, 1999),Plaintiff argued that BKBK seized a corporate opportunity belonging to Activision to facilitate a transaction whereby Vivendi'sActivision shares not repurchased by Activision could be distributed sufficiently widely so as to effectuate a transfer of controlfrom Vivendi to public stockholders (and not to BKBK);

• citing McMullin v. Beran, 765 A.2d 910 (Del. 2000), and In re Dairy Mart Convenience Stores, Inc., 1999 WL 350473 (Del.Ch. May 24, 1999), Plaintiff argued that the Transaction was subject to entire fairness and was not entirely fair because majoritystockholder Vivendi used threats of a special dividend to extract desired liquidity on an otherwise unavailable scale and becauseBKBK used threats of non-cooperation with a secondary offering to receive voting control and an extraordinary immediate gain;

• citing Louisiana Municipal Police Employees Retirement System v. Fertitta, 2009 WL 2263406 (Del. Ch. July 28, 2009), andIn re Dairy Mart Convenience Stores, Plaintiff argued that the non-Vivendi directors failed to defend appropriately againstthreats made by Vivendi to corporate policy and effectiveness, and the non-BKBK directors failed to defend appropriatelyagainst threats made by BKBK not to cooperate in a secondary offering; and

• citing Alidina v. Internet.com Corp., 2002 WL 31584292 (Del. Ch. Nov. 6, 2002), Plaintiff argued that the Special Committeedirectors knowingly acquiesced to self-interested conduct by Vivendi and BKBK.

Plaintiff did not allege or argue that Activision's public stockholders were entitled to participate in any particular alternativetransaction, such as a rights offering.

On June 6, 2014, after full briefing and oral argument, the Court denied defendants' motions to dismiss the breach of fiduciaryduty claims and aiding and abetting claims. The Court granted ASAC's motion to dismiss the derivative claim for breach of theStockholders Agreement, but allowed plaintiff to re-plead it.

On June 20, 2014, Plaintiff filed an amended complaint that re-pled the breach of contract claim, based largely on the nominationand election of Nolan and Wynn to new terms in 2014. ASAC briefed a motion to dismiss the breach of contract claim.

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 8

ASAC subsequently requested permission to brief a motion for summary judgment directed to the breach of contract claim.ASAC's counsel withdrew that request after Plaintiff responded with citations to the discovery record. ASAC's motion to dismissremained sub judice at the time of the proposed settlement of this action.

On September 23, 2014, plaintiff filed an unopposed motion for leave to file a further amended complaint that clarified certainfactual allegations based on information learned in discovery and identified potential “class damages” based on alternativetransaction structures discussed in plaintiffs expert report and allegations that BKBK had foreclosed potential alternativetransactions with better financial terms. Following oral argument on class certification on October 13, 2014, defendants accededto a class definition that included all holders of Activision shares since announcement of the Transaction on July 25, 2013.

D. Plaintiff's Counsel Expended Significant Resources While Motions to Dismiss Were Pending

In order to keep the case on schedule for trial in December 2014, and prepare for depositions in June and July 2014, it wasincumbent on Plaintiff's counsel to undertake a significant investment in the case while defendants were pressing their motionsto dismiss in the first half of 2014.

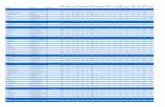

Plaintiffs counsel obtained and reviewed in excess of 800,000 pages of documents from all parties and numerous non-parties:

Activision Blizzard, Inc.

220,325

Allen & Company

12,410

ASAC II LP

4,479

Bank of America Merrill Lynch

967

Barclays Bank PLC

59,357

Centerview

60,327

Covington & Burling LLP (counsel to Tencent)

4,708

Davis Selected Advisors

7,974

FMR LLC

16,039

Goldman Sachs & Co.

74,903

JP Morgan

156,733

Brian Kelly

2,419

Robert Kotick

9,195

LGP

13,137

Special Committee

18,569

Vivendi

151,303

Obtaining, reviewing and analyzing these documents required significant effort.

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 9

Extensive follow-up communications were required to ensure timely and comprehensive productions of electronic documentsby defendants and non-parties. Defendants objected to a follow-up round of document requests propounded in May 2014 asuntimely, but ultimately relented. All defendants asserted attorney-client privilege and generated mammoth privilege logs,requiring follow up inquiries by Plaintiffs counsel.

We initially served a subpoena in Massachusetts upon an affiliate of non-party FMR, LLC (“Fidelity”) that objected to producingthe documents and filed an emergency motion to quash. Plaintiff's counsel withdrew that subpoena and served a new subpoenaon Fidelity in Delaware. Fidelity objected to that subpoena, requiring Plaintiff to file a motion to enforce the subpoena. Thatmotion was resolved when Fidelity relented and agreed to produce all responsive, non-privileged documents.

After initially resisting production, Vivendi produced numerous documents written in French. This necessitated a sustainedeffort by Plaintiff's counsel to identify those documents warranting unofficial and official translation.

Document review was a substantial undertaking. Piecing together a chronology of what happened required mixing and matchingdocuments from multiple vantage points, such as each ASAC investor and each adviser. Kotick and Kelly routinely deletedemails and electronic files prior to the litigation. (Kelly 47-48; Kotick 91.) Kotick often preferred receiving documents by faxrather than email and considers it “good business” to vet documents orally before they are sent to him. (Kotick 93.) Extensiveanalyses of document productions were needed to understand what happened, given the wholesale assertions of privilege andthe contemporaneous destruction of documents.

To assist with the document review and eliminate the complications of multi-district litigation, Plaintiff's counsel enlisted theassistance of Robbins Arroyo LLP, which represented Todd Miller and was facing motions to stay filed by defendants inCalifornia.

Plaintiff's counsel moved quickly to retain J.T. Atkins of Cypress Associates LLC (“Cypress”), an investment banking firm thatprovides litigation consulting services. We believed it essential to consult an investment banker early in the litigation, beforedepositions began, and we decided to hire J.T. Atkins before any defendant did so.

While defendants' motions to dismiss were pending, Plaintiff's counsel opposed a motion by plaintiff Mark Benston forappointment of his counsel as additional co-lead counsel. Benston wanted to pursue a claim under Brophy v. Cities ServiceCo., 70 A.2d 5 (Del. Ch. 1949), which Plaintiff had not pled and which Plaintiffs counsel believed to be meritless giventhat the Transaction was negotiated by Activision fiduciaries (i.e., BKBK and Vivendi) with equivalent access to confidentialinformation.

The prosecution of the case by co-lead counsel Friedlander & Gorris, P.A. (“F&G”) and Bragar Eagel & Squire, PC (“BE&S”)was a largely undiversified, entrepreneurial risk. F&G and BE&S are both small firms, with two partners and three partnersrespectively. Two partners from each firm were intimately involved in all stages of the litigation and took or defended all ofthe depositions. Both firms necessarily had limited ability to work on other cases or turned away potential new business. Inaddition, F&G recapitalized itself effective April 30, 2014. In order to effect that transaction and ensure that the firm was ableto finance this litigation and maintain the flexibility necessary to operate regardless of its outcome, F&G took out a five-yearloan secured by personal guarantees from its two partners. A partner of BE&S took out a personal loan due to the litigationexpense of this case. (Squire Aff ¶ 4.)

E. Plaintiff's Counsel Built a Liability Case that Relied on Extensive Documentary Analysis and Many FactDepositions

Following the denial of Defendants' motions to dismiss on June 6, 2014, Plaintiffs counsel deposed twenty-three fact witnesseson the following dates:

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 10

Name

Organization

Date/Time

Joseph Tuite

Brian Kelly's family office

June 11, 2014

Danton Goei

Davis Selected Advisors

June 18, 2014

Andrew Boyd

Fidelity

June 20,2014

Kris Galashan

LGP

June 25, 2014

Mark Fiteny

JP Morgan

July 1, 2014

Jean-Francois DuBos

Director Defendant

July 2, 2014

Frederic Crepin

Director Defendant

July 3, 2014

Robert Pruzan

Centerview

July 8, 2014

Richard Sarnoff

Director Defendant

July 9, 2014

Regis Turrini

Director Defendant

July 9, 2014

Robert J. Corti

Director Defendant

July 15, 2014

Brian Kelly

Director Defendant

July 15, 2014

Gregory Dalvito

Barclays Bank PLC

July 16, 2014

Robert Morgado

Director Defendant

July 17, 2014

Robert Kotick

Director Defendant

July 22, 2014 & Sept. 12, 2014

Jean-Rene Fourtou

Vivendi

July 23, 2014

Nancy Peretsman

Allen & Company, LLC

July 24, 2014

Philippe Capron

Director Defendant

July 24, 2014

Michael Ronen

Goldman Sachs & Co.

July 29, 2014

Anwar Zakkour

Former JP Morgan

July 31, 2014

Peter Nolan

LGP

July 31, 2014

Jonathan Mattern

Centerview

August 7, 2014

Ian Teh

Centerview

August 8, 2014

Plaintiffs counsel created a discovery record bearing out (i) Vivendi's desire for liquidity and its threat to take unilateral action toobtain liquidity through a special dividend if its demands were not met, (ii) BKBK's plotting for months to advance a transactionstructure in which they would personally invest $100 million and obtain voting control and profits far outstripping the extentof their investment, and (iii) the Special Committee's willingness in the face of threats by Vivendi and Kotick to approve atransaction negotiated directly between Vivendi and BKBK that served those parties' mutual self-interests, without regard forsuperior alternative transaction structures. Certain aspects of the discovery record are summarized below.

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 11

1. Vivendi Pushes For Liquidity

Vivendi's desire for liquidity was a constant backdrop to the evolution of the Transaction. Vivendi was willing to pay hugesums to BKBK to facilitate a liquidity-generating transaction, and Vivendi repeatedly threatened to obtain liquidity through thealternative means of declaring a special dividend.

In March 2012, Kotick entered into an employment agreement with Activision entitling him to receive a “Change of ControlSuccess Bonus” of between $30 million and $45 million if a person or group acquired either Activision or Vivendi's controlblock. (Friedlander Ex. 9 § 10.) In June 2012, Kelly entered into an employment agreement with Activision entitling him toreceive a “Change of Control Success Bonus” of 50% of the amount paid to Kotick. (Friedlander Ex. 10 § 10.) Kotick testifiedthat Vivendi requested inclusion of these bonus provisions. (Kotick 76, 82.)

In July 2012, Kotick and the new Chairman of Vivendi's Supervisory Board, Jean-Rene Fourtou, met with potential buyers ofActivision at the Allen & Co. media conference in Sun Valley. Fourtou soon discovered that no one was interested in buyingActivision. (Fourtou 26-27.) Kotick and Kelly testified that Fourtou suggested that BKBK put together a group to either buyActivision or buy Vivendi's stake. (Kotick 94; Kelly 114-15.) Fourtou denied giving any such direction to Kotick. (Fourtou37-39.)

In late 2012, Vivendi proposed that the Board consider declaring a $3 billion special dividend in 2013. A translated internalVivendi email chain discussed how fear of the fiscal cliff was prompting companies to declare special dividends in 2012,since dividends paid in 2013 would have a comparatively negative tax effect on individual shareholders. Vivendi wouldsuffer no such burden, and a Vivendi official noted: “Of course this will not dissuade us from asking for a dividend paymentin 2013.” (Friedlander Ex. 11 at VIV0130456.) A January 16, 2013 presentation book by JP Morgan, written on behalf ofActivision and presented at a meeting with Vivendi, stated that “a large special dividend will almost certainly destroy significantvalue to shareholders” and “Reinforces potential concerns about diverging interests of [Activision] and [Vivendi], underscoredby a decision to implement a special dividend shortly after the fiscal cliff.” (Friedlander Ex. 12 at 1.)

In the spring of 2013, Vivendi revived a special dividend as an alternative to a negotiated repurchase. Vivendi recognized that alarge special dividend would be viewed by Activision as less desirable than a repurchase, and therefore a prod to negotiations. Atranslated June 5, 2013 internal Vivendi email explains: “We will put some more pressure on explaining that we are consideringALL options - I'll take Brian [Kelly] to the side to explain to him what that means. This should restart negotiations.” (FriedlanderEx. 13 at VIV 0029239.)

Notes taken at a May 30, 2013 Special Committee meeting reflect how Kotick understood that Vivendi needed liquidity, SpecialCommittee financial advisor Robert Pruzan posited that Vivendi might lever up the Company to a great extent in the absenceof a deal, and Kotick threatened to resign if Vivendi did so:• Bobby's thought on [Vivendi]

• “They are done!”

• Desire to get out of the video game industry

• Extremely cash-strapped, and so really need to get a capital return

• But Robert [Pruzan]'s point - [Vivendi] will put $6.0bn+ debt on the Company, which will be worse than what we're tryingto accomplish now with the Special Committee

• Bobby said - Fine, if too much debt insisted by [Vivendi], Management will leave!

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 12

• Won't let them get pushed around by the French

• Pruzan's scenario

• Lever up the Company, give out a very large special dividend

• Bobby claims they won't do that! - he and management would resign

• Would the independent directors resign as well?

(Friedlander Ex. 14 at CV00055088-89.)

When deal negotiations conducted through the Special Committee fell apart, Vivendi continued to threaten the declaration of alarge special dividend. Activision Chairman and Vivendi CFO Phillipe Capron sent a June 20, 2013 email to Activision's non-Vivendi directors stating: “the adequate amount [of an extraordinary dividend] seems to me to be significantly in excess of the$3Bn figure mentioned in the management proposal.” (Friedlander Ex. 15 at ATVI000180522.)

[Text redacted in copy.]

[Text redacted in copy.] A translated internal Vivendi email sent by Capron on July 13, 2013, confirms that Vivendi keptthreatening to declare a special dividend as a means to improve Vivendi's negotiation position: “Also, let's not forget that theobjective is to reach an agreement on the transaction. Plan B is only there to keep the pressure on.” (Friedlander Ex. 17 atVIV0029877.)

2. BKBK Push for a Self-Interested Transaction Structure

Shortly after the Sun Valley conference in July 2012, BKBK conceived of and began pursuing a transaction structure in whichthey would participate in buying out Vivendi. Four aspects of their efforts deserve special emphasis: (i) BKBK plotted secretlyfor months before proposing a transaction structure on the heels of Vivendi threatening a special dividend; (ii) no one negotiatedwith BKBK over the terms of BKBK's investment in ASAC's general partner (“ASAC GP”); (iii) ASAC's terms were not testedagainst alternative transaction structures; and (iv) BKBK and ASAC invested on extraordinary terms.

a. BKBK Plotted Secretly for Months

In August 2012, BKBK prepared a draft presentation book outlining their plan to organize a $2-3 billion investment fund thatwould purchase the portion of Vivendi's stake not repurchased by Activision, given the fund's 38-44% ownership of Activision.(Friedlander Ex. 18 at 6.) BKBK contemplated investing $100 million in the general partner of a limited partnership that wouldcharge limited partners an incentive fee and an annual management fee. (Id. at 23.) [Text redacted in copy.] [Text redacted incopy.] BKBK also met with Warren Buffett, who advised them to be patient because Vivendi would likely need to sell assets.(Kotick 249-50; see Friedlander Ex. 19.)

On June 7, 2012, JP Morgan had delivered a presentation to the non-Vivendi directors about various means by which Activisionand Vivendi could arrange for the purchase of that portion of Vivendi's stake not immediately repurchased by Activision.(Friedlander Ex. 20 at ATVI0026.) Rather than schedule a follow-up meeting, BKBK waited several months to tell the SpecialCommittee Defendants and Vivendi about their own plan. In late January 2013, Kotick and Kelly presented their buyout planto Vivendi as an alternative to Vivendi's threatened special dividend. BKBK both testified that they kept the Special CommitteeDefendants in the loop about their plans in 2012. (Kelly 28-30; Kotick 244-45.) The Special Committee defendants testified

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 13

that they did not become aware of management's interest until December 2012 or January 2013. (See Morgado 65-69; Sarnoff6-8, 19-20; Corti 60-69.)

Kotick arranged for Activision's two rival licensees in mainland China, Tencent and NetEase, Inc., to sign non-disclosureagreements in January 2013. (Friedlander Ex. 21; Friedlander Ex. 22.) BKBK pitched them in China in April 2013 to invest inASAC, even though both had raised questions about why they were being asked to invest through a management-led vehicle(see Friedlander Ex. 8 at 17-18), and even though Activision's Code of Conduct instructs all corporate employees and officersto “avoid situations that create an actual or potential conflict of interest” and “avoid any direct or indirect business connectionwith our ... licensees ... except on our behalf.” (Friedlander Ex. 23 at 3.)

b. Nobody Negotiated BKBK's Investment Terms

BKBK proposed the terms of their investment in ASAC GP. Nobody negotiated against BKBK over ASAC GP's share ofASAC's returns.

The Vivendi director designees uniformly testified that it was not their responsibility to learn about, much less negotiate over,the terms of BKBK's investment in ASAC. A Vivendi in-house lawyer and director designee who served on Activision'scompensation committee and governance committee and worked on the transaction testified: “I didn't really pay any time tothat, and I don't think I should have. That was not part of my duties.” (Crepin 22-24.)

[Text redacted in copy.]

That goal was no secret. The original return model that BKBK's advisers prepared for prospective limited partners in ASAC inApril 2013 projected that BKBK would be distributed over $1 billion on their $100 million investment upon exit in three years,while the return on investment capital for the limited partners would be 2.5x. (Friedlander Ex. 26.)

The Special Committee Defendants made no effort to negotiate the terms of BKBK's investment in ASAC. The SpecialCommittee was provided with BKBK's proposed investment terms and their return model, and the Special Committee's financialadvisor calculated the magnitude of BKBK's prospective returns. (Friedlander Ex. 27; Friedlander Ex. 28 at 63-65.) The SpecialCommittee did not use that information to negotiate for improved price terms for Activision at the expense of ASAC or BKBK.Activision and ASAC both paid $13.60 per share to Vivendi, even though ASAC's below-market investment opportunity wasonly available because Activision was putting up more than $5.8 billion and BKBK were senior executives of Activision.

c. The Special Committee Did Not Determine that the ASAC Transaction Structure Was Superior to AlternativeStructures

At the January 16, 2013 meeting between Activision and Vivendi, JP Morgan presented on behalf of Activision an outline fora three-part transaction structure that did not contemplate any investment by management:1. Redemption of shares by Activision using cash and debt

2. Marketed secondary offering of stake to institutional shareholders

3. “Investment by ‘patient,’ long term investor(s) supportive of management team,” which JP Morgan described as a “UniquePIPE opportunity to invest in leading management and interactive franchises without ‘capped’ upside; levered returns; playon possible industry recovery”

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 14

(Friedlander Ex. 12 at 11.) JP Morgan stated that it “thoroughly analyzed this opportunity and is ‘highly confident’ in itsfeasibility.” (Id.) JP Morgan's lead banker testified that the PIPE opportunity had “a lot of characteristics that would beinteresting to financial investors.” (Zakkour 65-66.) No one asked JP Morgan to find potential financial investors. (Id. 83.)

Centerview's lead banker testified that the Special Committee determined it was not “particularly logical” for the SpecialCommittee to raise equity financing in competition with BKBK. (Pruzan 78.) He further explained why the Special Committeecould not direct Kotick to raise money on behalf of Activision:The special committee had a proposal from Bobby to buy the company. The special committee determined at various points intime that having the existing management lead the company into the future was important for the success of the company. Thespecial committee worked hard to attempt to influence the form and monitor the fundraising of Mr. Kotick, but Mr. Kotick'steam was not particularly interested in having the special committee actively involved in his fundraising process.

[The games industry] was a people business. Keeping that people business intact, producing games, producing product wasimportant for the success of the business. Therefore, Mr. Kotick had a rather long leash, if you will, as a CEO in terms ofhow he did stuff. Okay? And that was important for the board and the committee recognized the importance of Bobby andhis team in the deal....

(Id. 78-80.)

Vivendi proposed selling a portion of its stake through a secondary offering, rather than selling the shares to ASAC. On May25, 2013, the Special Committee determined it was not actionable to pursue the secondary offering alternative, in light ofKotick's opposition to it, his importance to the Company, the need for his support and cooperation in order for a debt or equityoffering to succeed, and the possibility that Kotick might leave “if the Company were to agree to a transaction without [Kotick's]support.” (Friedlander Ex. 29 at 2.) The Special Committee decided “they would have to find a way for BKBK to be includedin the transaction.” (Id.)

d. BKBK's and ASAC's Ultimate Investment Terms Are Extraordinary

ASAC paid Vivendi $13.60 per share for shares that were expected to trade, and did trade, approximately $4 per share higherimmediately after announcement of the Transaction. (Friedlander Ex. 8 Ex. C at 8; Friedlander Ex. 30.)

BKBK invested $100 million in ASAC GP. Under ASAC's limited partnership agreement, the returns to ASAC GP are tied tothe overall gains on ASAC's $2.3 billion investment in Activision. ASAC's immediate unrealized gain at closing was $712.8million, of which BKBK's share was $178 million. (Friedlander Ex. 8 Ex. C at 29.) Over the potential four-year life span ofASAC, BKBK had great upside on their investment in ASAC GP and a protected downside:• BKBK double their money if Activision's stock price remains at the post-announcement price of $17.46 per share;

• BKBK make nine times their money if Activision's stock price doubles from the post-announcement price to $35 per share;

• BKBK lose nothing if Activision's stock price declines by 20% from its post-announcement price.

(Friedlander Ex. 3 Ex. B at 4.)

For a $100 million investment in ASAC GP, BKBK also obtained the power to vote all of ASAC's Activision shares, and toexercise 24.9% of the stockholders' total voting power. Mutual fund complexes Fidelity and Davis, which are affiliated withlimited partners in ASAC, owned an additional combined 12% of Activision's shares. (Friedlander Ex. 8 Ex. C at 6.)

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 15

F. The Parties Served Expert Reports and Completed Expert Discovery

Plaintiff's expert, investment banker J.T. Atkins of Cypress, prepared a lengthy opening report. His report supported Plaintiffsclaims for liability and identified different rationales for monetary recoveries against each set of defendants.

A central analytical section of the opening report was devoted to identifying feasible alternative transaction structures.(Friedlander Ex. 8 at 29-32 & Ex. C at 9-27.) These alternatives were mutually exclusive, they presented different questionsabout feasibility, and they implied different potential forms of recovery.

The first alternative (described as an “Over-the-Wall Transaction”) was for Activision (rather than ASAC) to solicit largedirect equity investments, use the funds to repurchase additional shares from Vivendi at $13.60 per share, and sell those newlyrepurchased shares to the direct investors in a simultaneous closing at a higher price per share. Atkins opined that investorsshould be willing to pay Activision significantly more than $13.60 per share, and perhaps as much as $17 per share, because (i)Activision's stock price was expected to rise above $17 per share upon announcement; (ii) limited partners in ASAC deemedmid-teen internal rates of return to be satisfactory; (iii) limited partners in ASAC effectively paid more than $13.60 per share,given that a portion of ASAC's returns went to ASAC GP; and (iv) Activision could demand a higher effective price per sharethan could ASAC, because limited partners in ASAC had to lock up their shares for four years. (Id. at 29-30.)

Atkins identified precedents for an Over-the-Wall Transaction. Perhaps most similarly, in late 2012, Alibaba Group repurchaseda block of its shares from Yahoo! at $13.54 per share, financed in part by the sale of new common shares to a group of investorsat $15.50 per share. (Id. at 30 & Ex. C at 13, 53.) Atkins also identified recent PIPE transactions in which private investors paida premium to the market price to buy a block of stock in a public company. (Id. at 30 & Ex. C at 14-17.)

A second alternative was series of secondary offerings and block trades by Vivendi, similar to what Vivendi had proposed.Activision would not profit from this alternative, but public stockholders would benefit, since Vivendi's control block wouldbecome widely dispersed, instead of control passing to BKBK. (Id. at 30 & Ex. C at 19.)

A third alternative was a hybrid between an Over-the-Wall Transaction and secondary offerings, consistent with the three-parttransaction structure outlined by JP Morgan on January 16, 2013. Activision would solicit direct investment for some sharesand facilitate a smaller series of secondary offerings by Vivendi. Atkins opined that the hybrid structure would reduce pressureon Activision's stock and decrease execution risk as compared to the secondary offering alternative. (Id. at 31 & Ex. C at 25.)

A fourth alternative was a backstopped rights offering to Activision's then-public stockholders. Atkins opined that a rightsoffering at $13.60 per share would be fully subscribed, and new stockholders would enjoy the benefits of the expected stockprice increase. (Id. at 31 & Ex. C. at 27.)

Additionally, Atkins opined that Activision could have safely incurred an additional $500 million in debt to purchase additionalshares from Vivendi at $13.60 per share, which would have increased the EPS accretion for Activision and thus the pro formastock price. (Id. at 31-32.) Atkins calculated how an additional $500 million of indebtedness would affect the damages flowingfrom pursuit of the Over-the-Wall Transaction, the hybrid alternative, and the rights offering alternative. (See id. at 34-37.) Thepremise for this form of damages was that Activision's stock rise would rise higher than it otherwise would, due to an increasein earnings per share. (Id. Ex. C at 57.)

Various potential remedies could flow from a finding that certain defendants disloyally pursued the Transaction and foreclosedone or more superior feasible transaction structures. One such remedy was the disgorgement of ASAC's gains or BKBK's gains.Atkins calculated the gains of ASAC and BKBK as of closing and as of the date of his opening report, which reflected asubsequent run-up in Activision's stock price. (Id. Ex. C. at 29.) Atkins also calculated the present value of BKBK's interestin ASAC GP under different scenarios. (Id. at 30.)

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 16

Another potential remedy was damages to the Company, to the extent it was feasible to resell shares in an Over-the-WallTransaction at a higher price per share. Atkins calculated damages under different rationales for estimating the price at whichActivision could re-sell Vivendi's Activision shares to third party investors, such as assumptions that (i) a mid-teens IRR fordirect investors would be sufficient (id. at 33), (ii) direct investors would pay Activision a premium equivalent to what ASACGP got (id. at 34), or (iii) direct investors would pay the then-market price of Activision's common stock (id. at 35).

For purposes of the rights offering alternative, Atkins calculated gains to the exercising right holders, under the assumptionsthat (i) Activision granted rights to buy Activision stock at $13.60 per share and (ii) the stock price would rise to the same levelit did upon announcement of the Transaction. (Id. at 38.)

In a public filing, Activision interpreted Atkins' opening expert report as expansively as possible: “Pacchia's expert's reportsallege damages to the Company in excess of $540 million and to the purported class in excess of $640 million, in additionto disgorgement claims, which could, in theory, exceed $1 billion.” (Friedlander Ex. 31 at 52.) Atkins' opening report didnot aggregate monetary claims. It actually suggested that certain potential forms of recovery practically foreclosed others.Activision could not simultaneously pursue an Over-the-Wall Transaction and a rights offering for the same number of shares.

Daniel Fischel served an opening expert report opining that the Transaction was beneficial to Activision and its stockholders andwas superior to Vivendi's proposal of a large secondary offering. Professor Fischel opined that BKBK's investment in ASACbetter aligned senior management's interests with those of Activision and signaled management confidence in Activision'sprospects. (Friedlander Ex. 2 ¶¶ 9, 16-18.) Professor Fischel's rebuttal report raised questions about the feasibility of the variousalternatives identified by Atkins. (Friedlander Ex.32.)

Kenneth Lehn served an opening expert report on behalf of the Vivendi Defendants disputing whether a pro rata special dividendposed a threat to Activision and its stockholders. (Friedlander Ex. 33.)

Paul Gompers served an opening expert report opining that BKBK's potential returns from their investments in ASAC GP arenot excessive relative to the returns made by general partners in the private equity industry. (Friedlander Ex. 34 ¶ 28.)

Bradford Cornell served a rebuttal expert report on behalf of defendants that focused on the claimed damages arising fromActivision borrowing an additional $500 million for the purpose of buying additional shares from Vivendi at $13.60 per share.Professor Cornell opined that increased indebtedness would not necessarily translate into greater stockholder wealth, becauseActivision's cost of equity would also rise. Professor Cornell also opined that it was speculative whether Activision wouldhave received a provisional BB+ bond rating on its debt if Activision had approached the credit ratings agencies prior to theannouncement of the Transaction, and he noted that the bond rating was not the only factor driving the Special Committee'srecommendation about how much debt to raise. (Friedlander Ex. 35.)

Atkins served a rebuttal report that focused on Professor Fischel's reliance on contemporaneous analyst reports, scholarlycitations, and an empirical study by Professor Fischel suggesting that BKBK's participation in the Transaction explained thestock price increase. Atkins examined the multitude of positive factors identified by various analysts about the Transactionunrelated to BKBK's investment. He discussed how analysts were unaware of key terms of BKBK's investment. Atkins alsodiscussed how ASAC's and ASAC GP's interests were not aligned with Activision's interests, given the limited duration ofASAC. Atkins further discussed how scholarly articles did not support the proposition that BKBK's interests were aligned withstockholders, and how Fischel's analysis of other repurchase transactions did not support the conclusion that Activision's stockprice increase was attributable to ASAC's participation in the Transaction. (Friedlander Ex. 3.)

Plaintiffs counsel deposed Professor Fischel on October 17, 2014, Professor Lehn on October 20, 2014, and Professor Cornellon October 29, 2014. Plaintiffs counsel declined to depose Professor Gompers. (Defendants subsequently omitted him fromtheir witness list.) Defendants deposed Atkins on October 21, 2014.

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 17

G. The Parties Mediated the Dispute with Former United States District Court Judge Layn Phillips Amidst Pre-TrialPreparations

The proposed settlement arose out of a mediation conducted by former United States District Court Judge Layn Phillips.

The first mediation session was held in Newport Beach, California on July 11, 2014, after the ruling on defendants' motionto dismiss, the production of documents by parties and non-parties, and several depositions. Plaintiffs counsel had not yetundertaken any damages analysis, but knew the extent of ASAC's immediate and subsequent gains. The parties exchangedmediation statements on June 23, 2014, and on July 1, 2014. From the perspective of Plaintiff's counsel, the purpose of theinitial mediation session was to make clear that Plaintiffs counsel had no intention of settling early and cheaply, notwithstandingthe unfortunate history of the pre-closing settlement negotiations, when Plaintiff had signed a proposed settlement agreementnegotiated by Hayes's counsel that Plaintiffs counsel valued at approximately $41 million.

The mediation did not resume until months later. On October 24, 2014, Plaintiffs counsel submitted a mediation statementin connection with a mediation session in Newport Beach on October 28, 2014, in which Plaintiff's counsel did not directlyparticipate. Plaintiff's counsel submitted a supplemental mediation statement on October 31, and a reply mediation statement onNovember 3, in anticipation of an all-party mediation session in New York on November 6, with a potential follow-up sessionon Saturday, November 8. Defendants also submitted mediation statements.

The November 6 mediation session ended without sufficient progress toward a global resolution to justify the follow-up sessionon November 8. We did not expect any future mediation sessions before trial, since Judge Phillips' calendar was booked.Plaintiff's counsel continued with pre-trial preparations. We had circulated to defense counsel a draft pre-trial order and draftjoint trial exhibit list on October 31. We compiled additional trial exhibits, finished preparing deposition designations, andbegan screening video clips of deposition testimony for use at trial. We also continued working on the pre-trial brief due Friday,November 14.

On Monday, November 10, Judge Phillips initiated a series of telephonic follow-up sessions about a potential global resolution.At his suggestion, the parties agreed to defer the filing of simultaneous pre-trial briefs until Monday, November 17. On theevening of November 12, each set of defendants served a markup of the pre-trial order. On the evening of November 13, theparties agreed to the principal terms of a global settlement. Plaintiffs counsel and Activision publicly disclosed basic terms of the

proposed settlement after the markets closed on November 19, 2014. Activision's stock price rose significantly the next day. 4

There are three elements to the settlement consideration: (i) payment of $275 million to Activision ($67.5 million from Vivendi;some portion from insurers; the remainder (at least $150 million) from ASAC); (ii) expansion of the board by two spots to befilled by individuals independent of and unaffiliated with ASAC, BKBK, or any limited partner of ASAC; and (iii) reductionof BKBK's voting power from 24.9% to 19.9%. (Settlement Stip. §§ 2.1-2.3.) The payments by Vivendi and the insurers willbe made within fifteen days after entry of a judgment approving the settlement. (Id. § 2.1 (a), (b).) The reduction of BKBK'svoting power will take effect within ten days after entry of judgment. (Id. § 2.3.) The expansion of the Board will occur on orbefore July 31, 2015. (Id. § 2.2.) ASAC's payment to Activision, however, will not be made until ten business days after the“Effective Date,” which does not occur until the resolution of any appeals following an objection to the proposed settlement(other than an objection directed solely to an award of attorneys' fees and costs). (Settlement Stip. §§ 1.5, 1.9, 2.1(b).)

ARGUMENT

I. THE SETTLEMENT IS FAIR, REASONABLE AND ADEQUATE

Delaware law has long favored the voluntary settlement of contested claims. Ryan v. Gifford, 2009 WL 18143, at *5 (Del. Ch.Jan. 2, 2009); Rome v. Archer, 197 A.2d 49, 53 (Del. 1964). In reviewing a proposed settlement of a class or derivative action,

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 18

the Court must determine, using its business judgment, whether the settlement terms are fair, reasonable, and adequate. Ryan,2009 WL 18143, at *5. Factors to be considered are “(1) the probable validity of the claims, (2) the apparent difficulties inenforcing the claims through the courts, (3) the collectibility of any judgment recovered, (4) the delay, expense and trouble oflitigation, (5) the amount of the compromise as compared with the collectibility of a judgment, and (6) the views of the partiesinvolved, pro and con.” Polk v. Good, 507 A.2d 531, 536 (Del. 1986).

By any standard, the proposed settlement warrants approval. The cash component far outstrips the next-largest cash settlement

of a stockholder derivative action; 5 the governance changes put control of the Board in the hands of independent directorsand control of the Company in the hands of public stockholders; the proposed settlement was the product of intense litigationthat extended to pre-trial preparation and a protracted mediation conducted by a highly respected former United States DistrictCourt Judge. See Ryan, 2009 WL 18143, at *5 (“The Settlement was reached after ... hard fought motion practice before thiscourt, and ... a mediation session with Judge Weinstein. The diligence with which plaintiffs' counsel pursued the claims and thehard fought negotiation process weigh in favor of approval of the Settlement.”).

As discussed below, the settlement consideration approximates what plaintiff could expect to recover at trial. The proposedsettlement does not compensate class members who sold their shares, but there is nothing controversial about not compensatingclass members with weak claims in the context of a class and derivative settlement that provides for (i) a huge payment to thecorporation, which benefits all current stockholders, and (ii) significant corporate governance changes that remedy the principalalleged harms to public stockholders. This Court has found it “fair and reasonable to release” weak class claims “in the contextof a proposed settlement that provides substantial recovery on behalf of the corporation and, indirectly, its stockholders.” In reTriarc Companies, Inc., 791 A.2d 872, 878 (Del. Ch. 2001). A reasonable plan of allocation of settlement proceeds in a classaction “may consider the relative values of competing claims.” Schultz v. Ginsburg, 965 A.2d 661, 667 (Del. 2009). Indeed,“it is commonplace for the Court of Chancery to include persons having weak claims in a settlement class, but to allocate littleor none of the proceeds to them.” In re Phila.Stock Exch., Inc., 945 A.2d 1123, 1140 n.31 (Del. 2008) (gathering cases). Thathappened here.

Plaintiffs counsel was highly confident we could establish at trial that the Transaction was not entirely fair and that BKBKusurped a corporate opportunity for Activision to negotiate a superior feasible alternative transaction. Our optimism wastempered by awareness of the risks. Articulate witnesses, skilled counsel, and polished experts would contend that (i) theTransaction was highly beneficial to Activision and its stockholders, (ii) BKBK's personal investment of $100 million wasinstrumental to putting a deal together and the positive stock price reaction, (iii) it was beneficial to take the stock in ASACoff the market for one to four years, (iv) the secondary offering proposed by Vivendi was not viable, was presented for tacticalreasons, and posed the risks that Vivendi might retain a large stake or the stock price might not increase as much as it did, (v)it was unreasonable to negotiate an alternative transaction structure given the billions of dollars needed to eliminate Vivendi'scontrolling stake, and (vi) any hypothetical alternative structure is too speculative to credit. Even so, we believed the Court

would find fault with, among other things, (a) Vivendi threatening a special dividend to improve its negotiation position, 6 (b)

BKBK responding by pushing their secretly planned ASAC proposal, 7 and (c) the Board approving a below-market side deal

to an otherwise favorable transaction. 8

We thought it highly uncertain what remedy the Court might award. We were also highly concerned about the impact of aCourt-imposed equitable remedy on the Company and its public stockholders. These subjects are discussed below in connectionwith the relief obtained in the proposed settlement.

A. Analysis of the $275 Million Payment to Activision

Plaintiff articulated three forms of potential monetary remedies - restitution, damages to Activision, and damages to publicstockholders. For purposes of exerting settlement pressure, we thought it made sense to identify multiple forms of significantmonetary relief that could potentially be awarded against differently situated defendants. When expert discovery was completed

In re: ACTIVISION BLIZZARD, INC., Stockholder Litigation., 2015 WL 751783 (2015)

© 2015 Thomson Reuters. No claim to original U.S. Government Works. 19

and it came time to prepare our case for trial and make decisions about settlement, we believed a $275 million payment toActivision approximated the relief we could realistically obtain after trial, as either restitution against BKBK or damages to

Activision. 9 We believed that a damages award to past or present public stockholders was not a realistic prospect.

1. Restitution

Restitution may have been the easiest form of monetary remedy to establish, because it did not require proving damages. Weconsidered the realistic extent of a disgorgement award - whether it would encompass ASAC as well as BKBK, and whether itwould extend to the full immediate unrealized gain, or also extend to post-Transaction gains.

We thought disgorgement of ASAC's gains was unlikely, because third-party equity capital was a necessary component of arepurchase transaction, the limited partners in ASAC were logical people to solicit investment from, they incurred risk, andthey were each kept at a distance from the deal negotiations. We believed the odds of a restitution award against BKBK werevery different. We thought Activision did not need their equity capital, and that BKBK lacked a strong equitable claim to theirgains, especially their “carry” on ASAC's gains.

BKBK's immediate unrealized net profit was $178 million, and the present value of ASAC GP's projected gains after fouryears (assuming a 9.0x trading multiple) was $253.1 million (after deducting BKBK's initial investment of $100 million andwithout considering BKBK's entitlement to interest). (Friedlander Ex. 8 Ex. C at 29-30.) We thought both forms of disgorgementremedies were logical and plausible, but we were deeply concerned that an order requiring disgorgement of BKBK's gains,perhaps accompanied by a disbandment of ASAC, could lead to the dissipation of those gains. A final judgment against BKBKfor loyalty breaches might imperil their positions with Activision and lead to great uncertainty about the disposition of ASAC'sshares, which could result in a reduced stock price and a reduction in BKBK's disgorged gains. The $275 million settlementpayment compared favorably to this outcome.

2. Damages to Activision

We believed the logical appeal of an Over-The-Wall Transaction warranted a damages award to Activision. The operativequestion was what price the Court would find an equity investor would pay to buy a large block of Activision share in advanceof the public announcement of a repurchase transaction by Activision at $13.60 per share. We believed the most plausibleoutcome was a finding that outside investors would pay the then-current market price of $15.18 per share, which translated into

a damage award of $271.7 million. (Friedlander Ex. 8 Ex. C at 35.) 10

We came to believe it unlikely that the Court would award additional damages on the theory that Activision should have incurredadditional debt of $500 million in conjunction with an Over-The-Wall Transaction. The amount of debt incurred was basedon the recommendation of the disinterested Special Committee. We believed Professor Cornell made a strong argument aboutthe uncertain impact of additional debt on the Company's cost of equity. We also did not expect the Court to find that Kotickbreached his fiduciary duties by not consulting the ratings agencies in advance of a public announcement.

3. Damages to Public Stockholders