Hdfc Amc Project Report Final

-

Upload

hanishdhillon -

Category

Documents

-

view

950 -

download

3

Transcript of Hdfc Amc Project Report Final

A Summer Internship Project Report on

“Dynamics of Mutual Fund Distribution”

Submitted in partial fulfillment of the requirements for the degree of

Post Graduate Diploma in Management (Marketing)

By

HANISH DHILLON(Roll No. ISBS M 48)

Under the guidance of

Mr. Dilraj SinghManger Banking & Corporate Channel-HDFC AMC Ltd

A Study Conducted for HDFC AMC Ltd

AtIndira School of Business Studies,

Tathawade, Pune 411033

(2008-10)

1

CONTENTS

Chapter/Sub

Headings

Particulars Page No

1 Acknowledgements 4

2 Executive Summary 5

3 Objectives 8

4

4.1

4.2

4.3

4.4

4.5

4.6

4.7

4.8

4.9

4.10

Introduction-

- Mutual Funds

- History of Mutual Funds

- Current state of Mutual Funds

- Key Characteristics

- Advantages of Investing in Mutual Funds

- Disadvantages of Investing in Mutual Funds

- Risks Associated with Investing in Mutual Funds

- Categories of Mutual Funds

- Snapshot of Various funds

- Risk Hierarchy of Different Mutual Funds

10

11

12

14

16

20

22

23

25

28

29

5 Company Profile- HDFC AMC 30

6

6.1

6.2

6.3

6.4

6.5

6.6

6.7

6.8

6.9

Research Study

- Introduction

- Review of Literature

- Type of Research

- Data collection Technique

- Scope of the Study

- Data sources

- Sampling procedure

- Sample Size

- Techniques for Analysis

41

42

42

42

42

43

43

43

43

43

2

6.10

6.11

- Data presentation tools

- Limitations

44

44

7

7.1

7.2

7.3

7.4

7.5

7.6

7.7

7.8

7.9

Data Analysis

- Bar Graph 7.1

- Bar Graph 7.2

- Bar Graph 7.3

- Bar Graph 7.4

- Bar Graph 7.5

- Bar Graph 7.6

- Bar Graph 7.7

- Bar Graph 7.8

- Bar Graph 7.9

45

46

48

49

51

53

55

57

58

8 Research Conclusions 60

9 Recommendations 62

10 Annexure and Bibliography 65

3

ACKNOWLEDGEMENTS

I take this opportunity to express my deep sense of gratitude to all those who have

contributed significantly by sharing their knowledge and experience in the completion of

this project work.

I am greatly obliged to, for providing me with the right kind of opportunity and facilities

to complete this venture. My first word of gratitude is due to Mr. Dilraj Singh –

Manager Banking & Corporate Channel, HDFC Mutual Fund, My corporate guide, for

his kind help and support and his valuable guidance throughout my project. I am

thankful to him for providing me with necessary insights and helping me out at every

single step.

I am highly thankful to Prof. Bidyut Gogoi – My internal faculty guide under whose able

guidance this project work was carried out. I thank him for his continuous support and

mentoring during the tenure of the project.

Finally, I would also like to thank all my dear friends for their cooperation, advice and

encouragement during the long and arduous task of carrying out the project and

preparing this report.

4

2. EXECUTIVE SUMMARY

5

EXECUTIVE SUMMARY

The Indian mutual fund industry has witnessed significant growth in the past few years

driven by several favorable economic and demographic factors such as rising income

levels and the increasing reach of Asset Management Companies (AMCs) and

distributors. However, after several years of relentless growth, the industry witnessed a

fall of 8 percent in the assets under management in the financial year 2008-09 that has

impacted revenues and profitability.

Recent developments triggered by the global economic crisis have served to highlight

the vulnerability of the Indian mutual fund industry to global economic turbulence and

exposed our increased dependence on corporate customers and the retail distribution

system. It is therefore an opportune time for the industry to dwell on the experiences

and develop a roadmap through a collaborative effort across all stakeholders, to achieve

sustained profitable growth and strengthen investor faith and confidence in the health

of the industry. Innovative strategies of AMCs and distributors, enabling support from

the regulator SEBI, and pro-active initiatives from the industry bodies CII and AMFI are

likely to be the key components in defining the future shape of the industry.

Total Investment scenario is changing, in past people were not interested in investment

because there were no good options available for investment. Now there are many

options available for investment like life Insurance, Mutual fund, Equity market, Real

asset, etc.

The basic objective of any financial services company would be to provide an absolute

tailor made products and services to the customer and to advocate them, enrich them

and finally retain them into the organization.

The underlying difference or core competence that can help any AMC outperform

others is by providing differentiated services that are tailor made as according to the

customers need and objective of investing money in a Mutual Fund.

This project involves study of mutual fund Industry and evaluating and suggesting

measures to improve the services provided by the various Banking Channels of HDFC

6

AMC and also to identify the strong and the weak points so that an appropriate sales

pitch can be developed.

The sales pitch highlighted features like HDFC being the pioneer in terms of AUM, its

huge distributor base, returns being independent of the market ups and downs, etc.

During the Internship I mainly worked with two of the highest revenue generator

Banking Channels mainly HDFC Bank, Boat Club Road and DBS Bank, Dhole Patil Road.

Initially Cold Calls were made to different customers (Retail) from company‘s database

and appointments were sought. Thereafter a brief questionnaire was filled up by them

regarding their perception about HDFC AMC.

The need for this research is to emphasize and understand the expectations of

customers of mutual funds and how the company can be more customers centric

instead of Product Centric.

This report summarizes the current state of the Indian mutual fund industry highlighting

the key challenges and issues. We have also presented the ‘Voice of Customers’ to

understand their needs and priorities.

I acknowledge the inputs received from AMCs, distributors, customers and service

providers for this report.

7

3. PROJECT OBJECTIVES

8

OBJECTIVES OF THE PROJECT

As the title of the project suggests, the objective of the project is to find out the

satisfaction level of different Banking Channels with respect to the services & overall

quality provided by the AMC. The following are the sub objectives of the project:

• To understand the different investment options provided by HDFC mutual funds through its mutual fund schemes.

• To know the investors’ expectations on mutual funds offered by HDFC AMC.

• Find out there preference parameters for selling a particular fund.

• Understanding the competition for the service provided by different mutual fund companies.

• Finding out ways and means to improve on the services by HDFC Mutual Fund.

• Understanding the different ratios & portfolios so as to tell the Banks about these terms, by this, managing the relationship with the Banks.

• Understanding the attitude and behavior of the distributors and channel partners towards HDFC AMC.

• To identify and over come the gap between the management perception and the customers expectation.

• To come up with strategies to maintain better business relationships with our banking channels.

9

4. INTRODUCTION

10

4.1 MUTUAL FUNDS

A mutual fund is a professionally-managed firm of collective investments that pools

money from many investors and invests it in stocks, bonds, short-term money market

instruments, and/or other securities, it is a trust registered with the Securities and

Exchange Board of India (SEBI), which pools up the money from individual / corporate

investors and invests the same on behalf of the investors /unit holders, in equity shares,

Government securities, Bonds, Call money markets etc., and distributes the profits.

The value of each unit of the mutual fund, known as the net asset value (NAV), is mostly

calculated daily based on the total value of the fund divided by the number of shares

currently issued and outstanding. The value of all the securities in the portfolio in

calculated daily. From this, all expenses are deducted and the resultant value divided by

the number of units in the fund is the fund’s NAV.

NAV= Total value of the fund

________________________________________ No. of shares currently issued and outstanding

11

Invest their Money

Profit/Loss from portfolio of Investments

Profit/Loss from Individual Investments

Invest in Variety of Stocks/ Bonds

MUTUAL FUND SCHEME

MARKET

INVESTORS

4.2 HISTORY OF INDIAN MUTUAL FUND INDUSTRY

The mutual fund industry in India started in 1963 with the formation of Unit Trust of

India, at the initiative of the Government of India and Reserve Bank. The history of

mutual funds in India can be broadly divided into four distinct phases.

First Phase – 1964-87

Unit Trust of India (UTI) was established on 1963 by an Act of Parliament by the Reserve

Bank of India and functioned under the Regulatory and administrative control of the

Reserve Bank of India. In 1978 UTI was de-linked from the RBI and the Industrial

Development Bank of India (IDBI) took over the regulatory and administrative control in

place of RBI. The first scheme launched by UTI was Unit Scheme 1964. At the end of

1988 UTI had Rs.6, 700 crores of assets under management.

Second Phase – 1987-1993 (Entry of Public Sector Funds)

1987 marked the entry of non- UTI, public sector mutual funds set up by public sector

banks and Life Insurance Corporation of India (LIC) and General Insurance Corporation

of India (GIC). SBI Mutual Fund was the first non- UTI Mutual Fund established in June

1987 followed by Can bank Mutual Fund (Dec 87), Punjab National Bank Mutual Fund

(Aug 89), Indian Bank Mutual Fund (Nov 89), Bank of India (Jun 90), Bank of Baroda

Mutual Fund (Oct 92). LIC established its mutual fund in June 1989 while GIC had set up

its mutual fund in December 1990.At the end of 1993, the mutual fund industry had

assets under management of Rs.47, 004 crores.

Third Phase – 1993-2003 (Entry of Private Sector Funds)

1993 was the year in which the first Mutual Fund Regulations came into being, under

which all mutual funds, except UTI were to be registered and governed. The erstwhile

Kothari Pioneer (now merged with Franklin Templeton) was the first private sector

mutual fund registered in July 1993.

The 1993 SEBI (Mutual Fund) Regulations were substituted by a more comprehensive

and revised Mutual Fund Regulations in 1996. The industry now functions under the

12

SEBI (Mutual Fund) Regulations 1996. As at the end of January 2003, there were 33

mutual funds with total assets of Rs. 1, 21,805 crores.

Fourth Phase – since February 2003

In February 2003, following the repeal of the Unit Trust of India Act 1963 UTI was

bifurcated into two separate entities. One is the Specified Undertaking of the Unit Trust

of India with assets under management of Rs.29, 835 crores as at the end of January

2003, representing broadly, the assets of US 64 scheme, assured return and certain

other schemes

The second is the UTI Mutual Fund Ltd, sponsored by SBI, PNB, BOB and LIC. It is

registered with SEBI and functions under the Mutual Fund Regulations. Consolidation

and growth. As at the end of September, 2004, there were 29 funds, which manage

assets of Rs.153108 crores under 421 schemes.

13

4.3 CURRENT STATE

The Indian mutual fund industry has evolved from a single player monopoly in

1964 to a fast growing, competitive market on the back of a strong regulatory

framework.

AUM GrowthThe Assets under Management (AUM) have grown at a rapid pace over the past

few years, at a CAGR of 35 percent for the five-year period from 31 March 2005

to 31 March 2009. Over the 10-year period from 1999 to 2009 encompassing varied

economic cycles, the industry grew at 22 percent CAGR. This growth was despite two

falls in the AUM - the first being after the year 2001 due to the dotcom bubble

burst, and the second in 2008 consequent to the global economic crisis (the first

fall in AUM in March 2003 arising from the UTI split.

AUM Base and Growth Relative to the Global Industry

India has been amongst the fastest growing markets for mutual funds since

2004; in the five-year period from 2004 to 2008 (as of December) the

Indian mutual fund industry grew at 29 percent CAGR as against the global

average of 4 percent3. Over this period, the mutual fund industry in mature

markets likes the US and France grew at 4 percent, while some of the

emerging markets viz. China and Brazil exceeded the growth witnessed in the

Indian market. However, despite clocking growth rates that are amongst the

highest in the world, the Indian mutual fund industry continues to be a

very small market; comprising 0.32 percent share of the global AUM of USD

18.97 trillion as of December 20084.

Share of Mutual Funds in Household Financial Savings

Investment in mutual funds in India comprised 7.7 percent of the gross

household financial savings in FY 2008, a significant increase from 1.2

percent in FY 2004. The households in India continue to hold 55 percent of

14

their savings in fixed deposits with banks, 18 percent in insurance and 10

percent in currency as of FY 2008. In 2008, the UK had more than thrice

the investments into mutual funds as a factor of total household savings (26

percent), than India had in the same time period. As of December 2008, UK

households held 61 percent of the total savings in bank deposits, 11.6

percent in equities and 1 percent in bonds.

Profitability

The increase in revenue and profitability in the Indian mutual fund industry

has not been commensurate with the AUM growth in the last 5 years. The

AUM grew at 35 percent CAGR in the period from March 2005 to 2009,

while the profitability of AMCs - which is defined as PBT as a percentage

of the AUM - declined from 24 bps in FY 2004 to 14 bps in FY 2008.

During FY 2004 and FY 2008, the investment management fee as a percent

of average AUM was in the range of 55 to 58 bps (small increase to 64

bps in FY 2006) due to the industry focus on the underlying asset mix

comprising relatively low margin products being targeted at the institutional

segment. The operating expenses, as a percentage of AUM, rose from 41 bps

in FY 2004 to 113 bps in FY 2008 largely due to the increased spend on

marketing, distribution and administrative expenses impacting AMC margins.

Rising cost pressures and decline in profitability have impacted the entry

plans of global players eyeing an Indian presence. The growth in AUM

accompanied by a decline in profitability necessitates an analysis of the

underlying characteristics that have a bearing on the growth and profitability

of the Indian mutual fund industry.

15

4.4 THE INDIAN MUTUAL FUND INDUSRTY KEY- KEY CHARACTERISTICS

Customers

The Indian mutual fund industry has significantly high ownership from the

institutional investors. Retail investors comprising 96.86 percent in number

terms held approximately 37 percent of the total industry AUM as at the

end of March 200811, significantly lower than the retail participation in the

US at 82 percent of AUM as at December 2008. Out of a total population

of 1.15 billion, the total number of mutual fund investor accounts in India

as of 31 March 2008 was 42 million (the actual number of investors is

estimated to be lower as investors hold multiple folios). In the US, an

estimated 92 million individual investors owned mutual funds out of a total

population of 305 million in 2008.

In the last few years, the retail investor participation, in particular, in Tier 2

and Tier 3 towns, has been on the rise aided by the buoyant equity

markets.

Products

The Indian mutual fund industry is in a relatively nascent stage in terms of

its product offerings, and tends to compete with products offered by the

Government providing fixed guaranteed returns. As of December 2008, the

total number of mutual fund schemes was 1,002 in comparison to 10,349

funds in the US. Debt products dominate the product mix and comprised 49

percent of the total industry AUM as of FY 200915, while the equity and

liquid funds comprised 26 percent and 22 percent respectively. Open-ended

funds comprised 99 percent of the total industry AUM as of March 2009.

While traditional vanilla products dominate in India, new product categories

viz. Exchange Traded Funds (ETFs), Gold ETFs, Capital Protection and Overseas

Funds have gradually been gaining popularity 2008.

16

Markets

While the mutual fund industry in India continues to be metro and urban

centric, the mutual funds are beginning to tap Tier 2 and Tier 3 towns as

a vital component of their growth strategy. The contribution of the Top 10

cities to total AUM has gradually declined from approximately 92 percent in

2005 to approximately 80 percent currently.

Distribution Channels

As of March 2009, the mutual fund industry had 92,499 registered

distributors as compared to approximately 2.5 million insurance agents. The

Independent Financial Advisors (IFAs) or Individual distributors, corporate

employees and corporates comprised 73, 21 and 6 percent respectively of

the total distributor base.

Banks in general, foreign banks and the leading new private sector banks in

particular, dominate the mutual fund distribution with over 30 percent AUM

share. National and Regional Distributors (including broker and dealers) together

with IFAs comprised 57 percent of the total AUM as of 2007. The public

sector banks are gradually enhancing focus on mutual fund distribution to

boost their fee income.

Industry Structure

The Indian mutual fund industry currently consists of 38 players that have

been given regulatory approval by SEBI. The industry has witnessed a shift

has changed drastically in favour of private sector players, as the number of

public sector players reduced from 11 in 2001 to 5 in 2009. The public

sector has gradually ceded market share to the private sector. Public sector

mutual funds comprised 21 percent of the AUM in 2009 as against 72

percent AUM share in 2001.

17

The mutual fund houses based on product portfolio and distribution strategy,

the key elements of competitive strategy, can be segmented into three

categories:

• The market leaders having presence across all product segments

• Players having dominant focus on a single product segment - debt or

equity

• Players having niche focus on an emerging product category or distribution

channels.

The market leaders have focused across product categories for a more

diversified AUM base with an equitable product mix that helps maintain a

consistent AUM size. Although the Indian market has relatively low entry

barriers given the low minimum networth required to venture into mutual

fund business, existence of a strong local brand and a wide and deep

distribution footprint are the key differentiators.

Operations

The Indian mutual fund industry while on a high growth path needs to

address efficiency and customer centricity. AMCs have successfully been using

outsourced service providers such as custodians, Registrar and Transfer Agents

(R&T) and more recently, fund accountants, so that mutual funds can focus

on core aspects of their business such as product development and

distribution. Functions that have been outsourced are custody services, fund

services, registrar and transfer services aimed at investor servicing and cash

management. Managing costs and ensuring investor satisfaction continue to be

the key goals for all mutual funds today.

However, there is likely to be scope for optimizing operations costs given

the trend of rising administrative and associated costs as a percentage of

AUM.

18

Regulatory Framework

The Indian mutual fund industry in terms of regulatory framework is believed

to match up to the most developed markets globally. The regulator, Securities

and Exchange Board of India (SEBI), has consistently introduced several

regulatory measures and amendments aimed at protecting the interests of

the small investor that augurs well for the long term growth of the

industry. The implementation of Prevention of Money Laundering (PMLA)

Rules, the latest guidelines issued in December 2008, as part of the risk

management practices and procedures is expected to gain further momentum.

The current Anti Money Laundering (AML) and Combating Financing of

Terrorism (CFT) measures cover two main aspects of Know Your Customer

(KYC) and ‘suspicious transaction monitoring and reporting’.

The regulatory and compliance ambit seeks to dwell on a range of issues

including the financial capability of the players to ensure resilience and

sustainability through increase in minimum net worth and capital adequacy,

investor protection and education through disclosure norms for more

information to investors, distribution related regulations aimed at introducing

more transparency in the distribution system by reducing the information gap

between investors and distributors, and by improving the mechanism for

distributor remuneration. The success of the relatively nascent mutual fund

industry in India, in its march forward, will be contingent on further evolving

a robust regulatory and compliance framework that in supporting the growth

needs of the industry ensures that only the fittest and the most prudent

players survive.

19

4.5 ADVANTAGES OF MUTUAL FUND

Diversification of Risk Helps diversifying risk by investing money in a Basket of Assets. Diversification reduces

risk of loss, as compared to investing directly in one or two shares or debentures or

other instruments. When an investor invests directly, all the risk of potential loss is his

own. This risk reduction is one of the most important benefits of a collective investment

vehicle like mutual fund.

Reduction of Transaction CostMutual Funds provide the benefit of cheap access to expensive stocks. A direct investor

bears all the cost of investing such as brokerage and custody of security. When going

through a fund, he has the benefits of economies of scale; the funds pay a lesser costs

because of larger volumes, benefits passed on to its investors.

Convenience and Flexibility Being institutions with good bargaining power in markets, mutual funds have access to

crucial corporate information, which individual investors cannot access. Mutual fund

management companies offer many investor services that a direct market investor

cannot get. Investors can easily transfer their holdings from one scheme to the other;

get updated market information, and so on.

Liquidity An investor can liquidate the investment, by selling the units to the fund if open-end, or

selling them in the market if the fund is close-end, and collect funds at the end of each

period specified by the mutual fund or the stock market.

Choice of SchemesThe Investor gets choice from varied Funds in accordance to his Needs and Objectives.

Lucidity

You get regular information on the value of your investment in addition to disclosure on

the specific investments made by the mutual fund scheme.

20

Professional Management

Most mutual funds pay topflight professionals to manage their investments. These

managers decide what securities the fund will buy and sell.

Regulatory Over-sight

Mutual funds are subject to many government regulations that protect investors from

fraud. Securities Exchange Board of India (“SEBI”), the mutual funds regulator has clearly

defined rules, which govern mutual funds. These rules relate to the formation,

administration and management of mutual funds and also prescribe disclosure and

accounting requirements. Such a high level of regulation seeks to protect the interest of

investors.

21

4.6 DISADVANTAGES OF MUTUAL FUND

No GuaranteesNo investment is risk free. If the entire stock market declines in value, the value of

mutual fund shares will go down as well, no matter how balanced the portfolio.

Investors encounter fewer risks when they invest in mutual funds than when they buy

and sell stocks on their own. However, anyone who invests through a mutual fund runs

the risk of losing money.

Fees and commissionsAll funds charge administrative fees to cover their day-to-day expenses. Some funds also

charge sales commissions or "loads" to compensate brokers, financial consultants, or

financial planners. Even if you don't use a broker or other financial adviser, you will pay

a sales commission if you buy shares in a Load Fund.

TaxesDuring a typical year, most actively managed mutual funds sell anywhere from 20 to 70

percent of the securities in their portfolios. If your fund makes a profit 34 on its sales,

you will pay taxes on the income you receive, even if you reinvest the money you made.

Management riskWhen you invest in a mutual fund, you depend on the fund's manager to make the right

decisions regarding the fund's portfolio. If the manager does not perform as well as you

had hoped, you might not make as much money on your investment as you expected.

Of course, if you invest in Index Funds, you forego management risk, because these

funds do not employ managers.

DilutionIt’s possible to have too much diversification. Because funds have small holdings in so

many different companies, high returns from a few investments often don’t make much

difference on the overall return. Dilution is also the result of a successful fund getting

too big. When money pours into funds that have had strong success, the manager often

has trouble finding a good investment for all the new money.

22

4.7 RISKS ASSOCIATED WITH MUTUAL FUNDS

Market Risk

Market risk relates to the market value of a security in the future. Market prices

fluctuate and are susceptible to economic and financial trends, supply and demand,

and many other factors that cannot be precisely predicted or controlled.

Political Risks

Changes in the tax laws, trade regulations, administered prices, etc are some of the

many political factors that create market risk. Although collectively, as citizens, we

have indirect control through the power of our vote individually, as investors, we have

virtually no control.

Inflation Risk

Interest rate risk relates to future changes in interest rates. For instance, if an investor

invests in a long-term debt Mutual Fund scheme and interest rates increase, the NAV

of the scheme will fall because the scheme will be end up holding debt offering lower

interest rates.

Business Risk

Business risk is the uncertainty concerning the future existence, stability, and

profitability of the issuer of the security. Business risk is inherent in all business

ventures. The future financial stability of a company cannot be predicted or

guaranteed, nor can the price of its securities. Adverse changes in business

circumstances will reduce the market price of the company’s equity resulting in

proportionate fall in the NAV of the Mutual Fund scheme, which has invested in the

equity of such a company.

23

Economic Risk

Economic risk involves uncertainty in the economy, which, in turn, can have an

adverse effect on a company’s business. For instance, if monsoons fail in a year, equity

stocks of agriculture-based companies will fall and NAVs of Mutual Funds, which have

invested in such stocks, will fall proportionately.

24

4.8 CATEGORIES OF MUTUAL FUNDS

Mutual funds can be classified as follow:

Based on their structure

Open-ended funds: Investors can buy and sell the units from the fund, at any point of time.

Close-ended funds: These funds raise money from investors only once.

Therefore, after the offer period, fresh investments can not be made into the

fund. If the fund is listed on a stocks exchange the units can be traded like stocks

(E.g., Morgan Stanley Growth Fund). Recently, most of the New Fund Offers of

close-ended funds provided liquidity window on a periodic basis such as monthly

or weekly. Redemption of units can be made during specified intervals.

Therefore, such funds have relatively low liquidity.

25

Based on their investment objective:

• Equity funds: These funds invest in equities and equity related instruments. With

fluctuating share prices, such funds show volatile performance, even losses.

However, short term fluctuations in the market, generally smoothens out in the

long term, thereby offering higher returns at relatively lower volatility. At the

same time, such funds can yield great capital appreciation as, historically,

equities have outperformed all asset classes in the long term.

• Balanced fund: Their investment portfolio includes both debt and equity. As a

result, on the risk-return ladder, they fall between equity and debt funds.

Balanced funds are the ideal mutual funds vehicle for investors who prefer

spreading their risk across various instruments. Following are balanced funds

classes:

Debt-oriented funds -Investment below 65% in equities.

Equity-oriented funds -Invest at least 65% in equities, remaining in debt.

• Debt fund: They invest only in debt instruments, and are a good option for

investors averse to idea of taking risk associated with equities. Therefore, they

invest exclusively in fixed-income instruments like bonds, debentures,

Government of India securities; and money market instruments such as

certificates of deposit (CD), commercial paper (CP) and call money. Put your

money into any of these debt funds depending on your investment horizon and

needs.

– Liquid funds

These funds invest 100% in money market instruments, a large portion

being invested in call money market.

– Gilt funds ST

26

They invest 100% of their portfolio in government securities of and T-

bills.

– Floating rate funds

Invest in short-term debt papers. Floaters invest in debt instruments

which have variable coupon rate.

– Arbitrage fund

They generate income through arbitrage opportunities due to mis-pricing

between cash market and derivatives market. Funds are allocated to

equities, derivatives and money markets. Higher proportion (around 75%)

is put in money markets, in the absence of arbitrage opportunities.

– Gilt funds LT

They invest 100% of their portfolio in long-term government securities.

– Income funds LT

Typically; such funds invest a major portion of the portfolio in long-term

debt papers.

– MIPs

Monthly Income Plans have an exposure of 70%-90% to debt and an

exposure of 10%-30% to equities.

– FMPs

Fixed monthly plan invest in debt papers whose maturity is in line with

that of the fund.

27

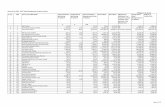

4.9 SNAPSHOT OF MUTUAL FUND SCHEMES

The following table summarizes different types of mutual fund schemes, their objective, where do they invest and their suitability

Mutual Fund Type

Objective Risk Investment Portfolio

Who should invest

Investment horizon

Money Market

Liquidity + Moderate Income +

Reservation of Capital

Negligible Treasury Bills,

Certificate of Deposits,

Commercial Papers, Call

Money

Those who park their funds in current

accounts or short-term

bank deposits

2 days - 3 weeks

Short-term Funds

(Floating - short-term)

Liquidity + Moderate

Income

Little Interest Rate

Call Money, Commercial

Papers, Treasury Bills, CDs,

Short-term Government

securities.

Those with surplus

short-term funds

3 weeks - 3 months

Bond Funds

(Floating - Long-term)

Regular Income

Credit Risk & Interest Rate

Risk

Predominantly

Debentures, Government

securities, Corporate

Bonds

Salaried & conservative

investors

More than 9 - 12 months

Gilt Funds Security & Income

Interest Rate Risk

Government securities

Salaried & conservative

investors

1 year and more

Equity Funds

Long-term Capital

Appreciation

High Risk Stocks Aggressive investors with long

term outlook

> 3 years

28

Index Funds

To generate returns that

are commensurat

e with returns of respective

indices

NAV varies with index

performance

Portfolio indices like BSE, NIFTY

etc

Aggressive investors

> 3 years

Balanced Funds

Growth & Regular Income

Capital Market Risk and Interest

Rate Risk

Balanced ratio of

equity and debt funds to ensure

igher returns at lower risk

Moderate & Aggressive

> 2 years

4.10 RISK HEIRARCHY OF DIFFERENT FUNDSThus, different mutual fund schemes are exposed to different levels of risk and investors

should know the level of risks associated with these schemes before investing. The

graphical representation hereunder provides a clearer picture of the relationship

between mutual funds and levels of risk associated with these funds

29

30

5. COMPANY PROFILE

VISION

“To be a dominant Player in the Mutual Fund space recognized for its higher levels of

ethical and professional conduct and a commitment towards enhancing Investor

Interests”.

HDFC Asset Management Company Ltd. has a vision of being a leading player in the

Mutual Fund business and has achieved significant success and visibility in the market.

Growth and visibility is adhered to Good Conduct in the marketplace. At HDFC AMC, the

implementation and observance of ethical processes and policies has helped them to

stand up to the scrutiny of the domestic and international investors.

MANAGEMENT

The management at HDFC AMC is committed to good Corporate Governance, which

includes transparency and timely dissemination of information to its investors and unit

holders. The HDFC AMC Limited Board is a professional body, including well-experienced

31

and knowledgeable Independent Directors. Regular Audit Committee meetings are

conducted to review the operations and performance of the company.

HDFC MF

HDFC Mutual Fund is one of the largest mutual funds and well-established fund house in

the country with consistent and above average fund performance across categories

since its incorporation on December 10, 1999. While our past experience does make us

a veteran, but when it comes to investments, we have never believed that the

experience is enough.

HDFC Asset Management Company Ltd (AMC) was incorporated under the Companies

Act, 1956, on December 10, 1999, and was approved to act as an Asset Management

Company for the HDFC Mutual Fund by SEBI vide its letter dated June 30, 2000.

In terms of the Investment Management Agreement, the Trustee has appointed the

HDFC Asset Management Company Limited to manage the Mutual Fund. The paid up

capital of the AMC is Rs. 25.161 crore.

INVESTMENT PHILOSOPHY

The single most important factor that drives HDFC Mutual Fund is its belief to give the

investor the chance to profitably invest in the financial market, without constantly

worrying about the market swings. To realize this belief, HDFC Mutual Fund has set up

the infrastructure required to conduct all the fundamental research and back it up with

effective analysis. HDFC lays strong emphasis on managing and controlling portfolio risk

avoids chasing the latest “fads” and trends.

OFFERINGS

HDFC believes, that, by giving the investor long-term benefits, they have to constantly

review the markets for new trends, to identify new growth sectors and share this

knowledge with their investors in the form of product offerings. They have come up

32

with various products across asset and risk categories to enable investors to invest in

line with their investment objectives and risk taking capacity. Besides, they also offer

Portfolio Management Services.

ACHIEVEMENTS

HDFC Asset Management Company (AMC) is the first AMC in India to have been

assigned the ‘CRISIL Fund House Level – 1’ rating. This is its highest Fund Governance

and Process Quality Rating which reflects the highest governance levels and fund

management practices at HDFC AMC. It is the only fund house to have been assigned

this rating for third year in succession. Over the past, HDFC has won a number of awards

and accolades for their performance.

PRODUCTS

Equity/ Growth Fund

– HDFC mid Cap Opportunities Fund.

– HDFC Prudence Fund.

– HDFC Index Fund- Nifty Plan.

– HDFC Capital builder Fund.

– HDFC Infrastructure Fund.

– HDFC Long term advantage Fund.

– HDFC Index Fund- Sensex plus Plan.

– HDFC Core and Satellite Fund.

– HDFC Growth Fund.

– HDFC top 200 Fund.

– HDFC Index Fund- Sensex plan.

– HDFC Balanced Fund.

– HDFC Long term Equity Fund.

– HDFC Equity Fund.

– HDFC Premiere Multi-cap Fund.

33

– HDFC Arbitrage Fund.

– HDFC Tax saver (ELSS).

Children’s Gift Fund

– HDFC Children’s Gift Fund Savings Plan.

– HDFC Children’s Gift Fund Investment Plan.

HDFC Liquid Fund

– HDFC Cash Management Fund- Savings Plan.

– HDFC Liquid Fund Premier Plus Plan.

– HDFC Liquid Plan.

– HDFC Cash Management Fund- Call Plan.

– HDFC Liquid Fund Premier Plan.

Debt/Income Funds

– HDFC Floating rate Income Fund- Long term Plan.

– HDFC High Interest Fund- Short term Plan.

– HDFC Multiple Yield Fund- Plan 2005.

– HDFC Cash Management Fund- Treasury Advantage Fund.

– HDFC Gilt Fund- Short term Plan.

– HDFC Income Fund.

– HDFC Multiple Yield Fund.

– HDFC Short term Plan.

– HDFC Floating rate Income Plan- Short term Plan.

– HDFC MF Monthly Income Plan- Long term Plan.

– HDFC High Interest Fund.

– HDFC Gilt Fund- Long term Plan.

HDFC Quarterly Income Fund

HDFC Fixed Maturity Fund

34

MEASURING AND EVALUATING PERFORMANCE

Every investor investing in the mutual funds is driven by the motto of either wealth

creation or wealth increment or both. Therefore it’s very necessary to continuously

evaluate the funds’ performance with the help of factsheets and newsletters, websites,

newspapers and professional advisors. If the investors ignore the evaluation of funds’

performance then he can loose hold of it any time. In this ever-changing industry, he can

face any of the following problems:

– Variation in the funds’ performance due to change in its management/ objective.

– The funds’ performance can slip in comparison to similar funds.

– There may be an increase in the various costs associated with the fund.

– The funds’ ratings may go down in the various lists published by independent

rating agencies.

– It can merge into another fund or could be acquired by another fund house.

Performance measures

35

Equity funds- The performance of equity funds can be measured on the basis of: NAV

Growth, Total Return; Total Return with Reinvestment at NAV, Annualized Returns and

Distributions, Computing Total Return (Per Share Income and Expenses, Per Share

Capital Changes, Ratios, Shares Outstanding), the Expense Ratio, Portfolio Turnover

Rate, Fund Size, Transaction Costs, Cash Flow, Leverage.

Debt fund- The performance of debt funds can be measured on the basis of: Peer Group

Comparisons, The Income Ratio, Industry Exposures and Concentrations, NPAs, besides

NAV Growth, Total Return and Expense Ratio.

Liquid funds- The performance of the highly volatile liquid funds can be measured on

the basis of: Fund Yield, besides NAV Growth, Total Return and Expense Ratio.

DISTRIBUTION CHANNELS

Mutual funds posses a very strong distribution channel so that the ultimate customers

doesn’t face any difficulty in the final procurement. The various parties involved in

distribution of mutual funds are:

Direct marketing by the AMCs: The forms could be obtained from the AMCs directly.

The investors can approach to the AMCs for the forms. Some of the top AMCs of India

are; Reliance ,Birla Sun life, Tata, SBI magnum, Kotak Mahindra, HDFC, IDFC, ICICI, LIC,

AXIS etc. whereas foreign AMCs include: Standard Chartered, Franklin Templeton,

Fidelity, JP Morgan, HSBC, DSP Merill Lynch, etc.

Broker/ sub broker arrangements: The AMCs can simultaneously go for broker/sub-

broker to popularize their funds. AMCs can enjoy the advantage of large network of

these brokers and sub brokers.

Individual agents, Banks, NBFC: Investors can procure the funds through individual

agents, independent brokers, banks and several non- banking financial corporations too,

whichever he finds convenient for him.

36

COSTS ASSOCIATED

Expenses

AMCs charge an annual fee, or expense ratio that covers administrative expenses,

salaries, advertising expenses, brokerage fee, etc. A 1.5% expense ratio means the AMC

charges Rs1.50 for every Rs100 in assets under management. A fund's expense ratio is

typically to the size of the funds under management and not to the returns earned.

Normally, the costs of running a fund grow slower than the growth in the fund size - so,

the more assets in the fund, the lower should be its expense ratio

Loads

Entry Load/Front-End Load (0-2.25%) - It’s the commission charged at the time of

buying the fund to cover the cost of selling, processing etc however the RBI has waived

off this charge w.e.f 1 Aug 2009.

Exit Load/Back- End Load (0.25-2.25%) -It is the commission or charged paid when an

investor exits from a mutual fund; it is imposed to discourage withdrawals. It may

reduce to zero with increase in holding period.

37

WHY HAS IT BECOME THE LARGEST AND ATTRACTIVE INVESTMENET INSTRUMENT?

If we take a look at the recent scenario in the Indian financial market then we can find

the market flooded with a variety of investment options which includes mutual funds,

equities, fixed income bonds, corporate debentures, company fixed deposits, bank

deposits, PPF, life insurance, gold, real estate etc. All these investment options could be

judged on the basis of various parameters such as- return, safety convenience, volatility

and liquidity. Measuring these investment options on the basis of the mentioned

parameters, we get this in a tabular form:

Return Safety Volatility Liquidity Convenienc

e

Equity High Low High High Moderate

Bonds Moderate High Moderate Moderate High

Co.

Debentures

Moderate Moderate Moderate Low Low

Co. FDs Moderate Low Low Low Moderate

38

Bank

Deposits

Low High Low High High

PPF Moderate High Low Moderate High

Life

Insurance

Low High Low Low Moderate

Gold Moderate High Moderate Moderate Gold

Real Estate High Moderate High Low Low

Mutual

Funds

High High Moderate High High

We can very well see that mutual funds outperform every other investment option. On

three parameters:

– It scores high whereas it’s moderate at one.

– Comparing it with the other options, we find that equities gives us high returns

with high liquidity but its volatility too is high with low safety which doesn’t

makes it favorite among persons who have low risk- appetite.

– Even the convenience involved with investing in equities is just moderate.

Now looking at bank deposits, it scores better than equities at all fronts but lags badly in

the parameter of utmost important i.e.; it scores low on return , so it’s not an

appropriate option for person who can afford to take risks for higher return. The other

option offering high return is real estate but that even comes with high volatility and

moderate safety level, even the liquidity and convenience involved are too low. Gold

have always been a favorite among Indians but when we look at it as an investment

option then it definitely doesn’t gives a very bright picture. Although it ensures high

safety but the returns generated and liquidity are moderate. Similarly the other

investment options are not at par with mutual funds and serve the needs of only a

specific customer group. Straightforward, we can say that mutual fund emerges as a

clear winner among all the options available. The reasons for this being:

39

Mutual funds combine the advantage of each of the investment products

Mutual fund is one such option which can invest in all other investment options. Its

principle of diversification allows the investors to taste all the fruits in one plate. Just by

investing in it, the investor can enjoy the best investment option as per the investment

objective.

Dispense the shortcomings of the other options

Every other investment option has more or les some shortcomings. Such as if some are

good at return then they are not safe, if some are safe then either they have low

liquidity or low safety or both, likewise, there exists no single option which can fit to the

need of everybody. But mutual funds have definitely sorted out this problem. Now

everybody can choose their fund according to their investment objectives.

Returns get adjusted for the market movements

As the mutual funds are managed by experts so they are ready to switch to the

profitable option along with the market movement. Suppose they predict that market is

going to fall then they can sell some of their shares and book profit and can reinvest the

amount again in money market instruments.

Flexibility of invested amount

Other then the above mentioned reasons, there exists one more reason which has

established mutual funds as one of the largest financial intermediary and that is the

flexibility that mutual funds offer regarding the investment amount. One can start

investing in mutual funds with amount as low as Rs. 500 through SIPs and even Rs. 100

in some cases.

40

41

RESEARCH STUDY

RESEARCH DESIGN

42

6.1 Introduction The project consisted of working mainly two Banking Channels HDFC Bank and DBS Bank in

Pune, chosen for the survey. The reason for choosing these two particular Banking Channel

is that they have lot of potential and were amongst the highest revenue generator for

HDFC AMC. It consisted of three stages:

Stage 1: Gathering data from the company and plan schedule to meet the concerned

person.

Stage 2: Collecting the data by survey method, on the basis of questionnaire.

Stage 3: Analyzing and interpreting the primary data collected.

6.2 Review of Literature Study Literature given from the company was studied in order to gain an insight of past

market and future prospects of mutual fund industry. Also the requirements of various

concepts were understood using the help of internet and various other books.

6.3 Type of Research It is a framework or blueprint for conducting the marketing research project. The research

design used here is Descriptive Research Design which is used for description of

something. Here it is used to describe the characteristics of Existent and Potential

Customers with respect to the services expected HDFC AMC.

6.4 Data Collection Technique

The survey method of collecting data is based on the questioning of respondents. They

were asked variety of questions regarding their behavior, intensions, attitude, awareness

and motivations. In Structured data collection, a formal Questionnaire is prepared thus

the process is direct. The questionnaire designed for this project consists of questions

based on various parameters which a relationship manager would consider before selling a

mutual fund. Each question is based on different variables like investment decisions, selling

decisions, company policies, serving issues etc.

6.5 Scope of the study

43

The research was carried on in the Pune Region of Maharashtra. It is restricted to Pune

where it has got its head office at Shivaji Nagar and operates or sells its products through a

large network of Distribution Channels. I have visited people randomly while pitching for

products and also existing customers of HDFC and DBS (Development Bank of Singapore).

6.6 Data sources

Research is totally based on primary data. Secondary data can be used only for the

reference. Research has been done by primary data collection, and primary data has been

collected by interacting with various people. The secondary data has been collected

through various journals and websites and some special publications of HDFC AMC.

6.7 Sampling procedure

The sample is selected in a random way, irrespective of them being investor or not or

availing the services or not. It was collected through mails personal visits to the known

persons, by formal and informal talks at HDFC Bank and DBS Bank and through filling up

the questionnaire prepared. The data has been analyzed by using the measures of central

tendencies like mean, median, mode. The group has been selected and the analysis has

been done on the basis statistical tools available.

6.8 Sample size

The sample sizes of my project is limited to 100 only and have got questionnaires filled

only with the ones who invest in various other and HDFC AMC’s however have taken

different opinions as to why certain people or respondents are not Investing in the current

Market Scenario.

6.9 Technique of analysis

44

Percentage analysis was used to analyze the data collected.

6.10 Statistical tools used for Data presentation

Data has been presented with the help of bar graph, pie charts, line graphs etc.

6.11 Limitations

– Time limitation.

– Research has been done only at Pune.

– Some of the persons were not so responsive.

– Possibility of error in data collection.

– Possibility of error in analysis of data due to small sample size.

7. DATA ANALYSIS

45

7.1 Have you ever invested/ interested to invest in mutual funds?

YES 100

NO 0

YES

NO

Graph 7.1DATA INTERPRETATIONAnalysis is carried on only for those respondents who are already Investing in Mutual Funds and the reasons for not Investing( Non Investors) citied while filling or while interacting with the respondents were

Lack of Knowledge about Mutual Funds.

Enjoy Investing in other financial instruments.

Its benefits are not that lucrative or better than other instruments.

No trust over the schemes.

No trust over the Fund manager or AMC.

Current Market scenario.

Complex KYC procedure.

PAN Card a Mandate.

7.2 In which of the following type funds you have invested?

46

Equity 18

Debt 23

Balanced 29

ELSS 30

Gilt 0

Graph 7.2

DATA INTERPRETATION18% of the respondents have Invested in Equity Funds, 23% have invested in Debt

Schemes while 29% and 30% have invested in Balanced and ELSS schemes respectively.

FINDINGS Respondents in the Current market scenario have Invested mostly in Balanced schemes

which give leverage to their investments and have switched their investments to balances

or debt schemes in the recession period because it helps them to accumulate more Units

as the NAV’s are low.

Respondents who have invested in Tax saving schemes have a Lock in period of 3 years so

they still are continuing to invest in Recession period as it gives them leeway in terms of

47

saving Tax over a period of time.

7.3 Preferred Investment Period?

Less than 1 Year 2

48

1 to 3 years 42

3 to 5 years 41

More than 5 years 15

Graph7.3DATA INTERPRETATION

42% prefer to stay invested for a period of 1-3 years, while 41% for the period of 3-5 years

and 15 % for more than 5 years and only 2% stay invested for less than a year.

FINDINGS

It was found out that most Respondents have either invested for a time spam of 1 to 3

years or more than 5 years. Investment period purely and solely depends on the

Investment Objective and the Schemes thus chosen. Respondents who have invested in

Equity diversified funds have invested for a time spam of 1-3 years and Debt schemes

customer usually invest for a period of 3 to 5 years and ELSS customers have to invest in a

lock in period of 3 years so they opt for 3 year Investment strategy.

7.4 AMC in which money is Invested?

Kotak 6

49

Reliance 8

HDFC 36

SBI 16

DSP Black Rock 5

DSP M Lynch 6

ICICI 15

Religare 6

IDFC 2

Graph 7.4

DATA INTERPRETATION

36% have Invested with HDFC AMC, 16% with SBI and 15% with ICICI Securities, 8% have

invested with Reliance AMC and the rest 6%, 5%, 6% and 2% have invested with other

AMC’s such as DSP, Kotak, Religare, IDFC etc.

FINDINGS

50

It was found out that Respondents have not invested in a particular AMC or their

Portfolio is managed by single AMC. They have simultaneously invested in two AMC’s

and the ones which are popular are HDFC and ICICI and the others have got place in the

reckoning.

7.5 Which according to you are the factors important while investing in Mutual Funds?

51

Risk factor 8

Returns 9

Tax savings 9

Performance if the particular Fund 9

NAV 10

AMC 10

Safety 11

Ratings of a particular fund 11

Portfolio of the Fund 11

Profile of the Fund Manager 12

Graph 7.5

DATA INTERPRETATION

52

12% say that profile of Fund manager is an important element, 11% prefer safety,

portfolio and Ratings of the fund to be an Important factor,while 10% say services by the

AMC and the NAV value play an Important role and rest of them prefer investing to safe

tax and look at returns over a short period of time.

FINDINGSDifferent Investors have different needs for Investment purposes. However people if

Investing in Equtiy Instruments would look for better returns in a short spam of time as

it carries equal risk.

And other factors which are considerate with the investement purposes would be

Performance or Rating of a Particular Fund and Fund manager also plays a important

role as generally people invest in funds keeping in mind the profile of the Fund Manager

and for Instance Prashant Jain who is a pass out of IIT and has done is MBA from IIM

having over 14 years of experience in Equity research market has lot of funds in his Kitty

to manage.

7.6 Preferred Channels through which Investments are made?

53

Directly through AMC 27

Through Distributor 40

Broker/ Sub Broker 33

Graph 7.6

DATA INTERPRETATION

27% dodge entry load and prefer to invest directly through AMC, while 33% prefer to

Invest through a Sub- broker who can manage their portfolio’s and 40% invest it through

authorized Distributors.

FINDINGS

It was found out that most Investors usually invest through Brokers or Distributors

because they get the advantage of having statements on timely basis and also switching

or redeeming of funds becomes an ease as they are just a phone call away.

They can easily review they portfolio and seek Investment recommendation in order to

suffice their short term needs and also to manage their assets.

However all of this comes with a charge which is usually known as Commission charged

in the form of Entry Load which is usually between 0-2.5% for retail customers and there

54

are few who manage their own portfolio and invest directly through the AMC’s and the

entry load or the commission charge is weaved off for those Investors.

7.7 Have you invested in the current Recession period?

55

YES 38

NO 62

Graph 7.7

DATA INTERPRETATION62% say no that they rather prefer to stay out the stock markets during Recession and

38% want to enjoy the benefit of Rupee cost averaging that’s why they haven’t

redeemed their Units.

FINDINGSIt was observed that people are not investing the current market scenario as it is hard of

them to believe that the market is facing a U shaped recovery mode where in the

positivity will be reflected in the Market over the period of time as per the new Changes

and Amendments bought in by the new UPA Govt. However Existing customers have

also redeemed or switched their funds as they lost a lot of money in the year 2008.

However there are some Investors who are positive about the Market and have

Switched to Balanced funds because that helps them fetch more units as the NAV is low

and have Invested money in the NFO’s that were out in the market for e.g. Reliance

Infrastructure fund and DSP Black Rock World Energy Fund.

56

7.8 In the recession period which type of funds are the best option?

Equity Diversified 4

57

Debt 8

Balanced 60

Tax Saving Schemes 28

Graph 7.8

DATA INTERPRETATIONIn recession period 60% of the respondents prefer to stay invested with Balanced

schemes while 28% are with ELSS schemes and 8% have invested in Debt Schemes while

only 4% have Invested in Equity schemes.

FINDINGSIt is observed that most of the Investors during the recession period have taken a step

back in terms of Investments in Mutual Funds as the share market saw an Impeccable

down fall last year and had lost a lot of money last year.

However what is more promising is the confidence amongst these Investors who are

betting on an attitude that shows a sign of recovery for the market right now and have

kept their fingers crossed in terms of Promises by the Congress.

So either balanced schemes are the one’s for a safe bet right now or else tax saving

schemes have always given investors a leeway under Section 80©.

58

7.9 Other Financial Instruments that are a safe bet right now?

Bank FD’s 14

59

NBFC’s 17

PPF 19

NSC’s 21

ULIP 29

Graph 7.9DATA INTERPRETATION14% prefer to park their money with FD’s, 29% prefer to stay connected with ULIP’s as

that gives them benefit of saving tax and 21% prefer to invest in NSC’s and 19% and 17%

prefer to Invest with PPF’s and NBFC’s.

FINDINGSBank FD’s are one of the means for the different banks to get NTB’s and helps investors

to park their money for a spam of 1-2 years in attractive FD’s thus offered. However

after maturity is the main Game Plan through which Banks anticipate to invest the same

in the Equity markets after they take a respectable position. It scores better than

equities at all fronts but lags badly in the parameter of utmost important i.e.; it scores

low on returns. ULIP schemes have sustainably taken a peek in the recession period

60

where in they not only provide leverage to one’s investment in debt and equity market

but also insurance for a life time.

61

RESEARCH CONCLUSIONS

62

At the survey conducted upon approx 100 people, most of them are already

mutual fund investors or are interested to invest in future and the remaining are

not interested in it. So there is enough scope for the advisors to convert those

leads into potential investors through their offerings and services.

Now, when people were asked about the reason for not investing in mutual

funds, then most of the people held their ignorance responsible for that. They

lacked knowledge and information about the mutual funds. Whereas just few

people enjoyed investing in other option. For few people, the benefits arousing

from these investments were not enough to drive them for investment in MFs

and few of them expressed no trust over the fund managers’ decision. Again the

financial advisors can tap upon these people by educating them about mutual

funds.

Out of the people who already have invested in mutual funds/ are interested to

invest, only few have sound knowledge of MFs, and few have a sound knowledge

of the mutual funds and its operations and thereby prefer to Invest it directly

through the AMC’s and maintain their own Portfolio’s. However it is important to

realize that a lot of investors are aware of the schemes and the operations of the

Indian Market but prefer a Financial Advisor to cater to their Investment

Objectives as they are well versed with the markets and are qualified advisors to

recommend them on Investment strategies with minimal Commission co-

responding to the portfolio managed.

When asked about the most alluring feature of MFs during the current market

conditions, most of them opted for diversification, followed by reduction in risk,

helps in achieving long term goals and helps in achieving long term goals

respectively and also helps them in terms of Tax saving benefits.

The other financial instruments that are a lucrative option for the Investors in

the recession are ULIP plans, NSC’s, Bank FD’s however are not in the same

reckoning of Mutual funds in terms of returns.

63

RECOMMENDATIONS

64

The most vital problem spotted is of ignorance. Investors should be made aware

of the benefits and the current status of Economy. Nobody will invest until and

unless he is fully convinced of the future of one’s Investments. Investors should

be made to realize that ignorance is no longer bliss and what they are losing by

not investing.

Mutual funds offer a lot of benefit which no other single option could offer. But

most of the people are not even aware of what actually a mutual fund is? They

only see it as just another investment option. So the advisors should try to

change their mindsets. The advisors should target for more and more young

investors. Young investors as well as persons at the height of their career would

like to go for advisors due to lack of expertise and time.

The advisors may try to highlight some of the value added benefits of MFs such

as tax benefit, rupee cost averaging, and systematic transfer plan, rebalancing

etc. These benefits are not offered by other options single handedly. So these

are enough to drive the investors towards mutual funds. Investors could also try

to increase the spectrum of services offered.

Now the most important reason for not availing the services of Banking Channel;

was being expensive. The advisors should try to charge a nominal fee at the

beginning. But if not possible then they could go for offering more services and

benefits at the existing rate. They should also maintain their Banking Channels

should try to attract more and more persons and turn them into investors and

finally their clients.

With the globalize economy and immense competition among countries for

faster development of their respective economies, the significance of Mutual

Funds and Foreign investment has taken manifold. With a buoyant vibrant and

experienced stock market, India today is looking ahead to surpass China in terms

of foreign Investment and growth prospects. Stock exchange being the

barometer of the economy plays a vital role in showcasing growth of an

economy and luring investment.

65

While studying the role of Mutual fund and FIIs in Stock Market, I discussed with

a few persons who are into stock broking business. And the information they

have provided shows that though the investment and participation of domestic

investors are rising, still, they have not been able to prove themselves to be as

influential as mutual funds and FIIs.

Importance and the role of Mutual funds and FIIs play in the Indian stock market

can be seen from the fact that the recent surge in Sensex and NIFTY is attributed

to the active Participation of FIIs in the Stock Market. Despite being aware of the

Asian economic crisis where FIIs role was of a major concern, the importance of

foreign capital in the development of economy can not be undermined in

anyway so the people more emphasis on mutual fund to earn more return

increasing our benefit .

66

ANNEXURE

67

Exhibit 1

QUESTIONNAIRE

1. Have you ever invested in mutual funds?a. Yesb. No

2. In which of the following type funds you have invested?a. EQUITYb. DEBTc. BALANCEDd. GILTe. TAX SAVING SCHEMES

3. What is your preferred investment period?a. Less than 1 yrb. 1 yr—3yrc. 3 yr—5yrd. more than 5 yr

4. Which AMC you have invested in? Please specify

5. Rank according to importance the factor you look for while investing in MF(1 being the most important and 5 the least important)

a. Risk factor b. Return c. Tax saving d. Performance e. NAV f. AMC g. Safety h. Ratings of the fund i. portfolio of fund j. Profile of the Fund manager

68

6. How have you invested in MF?a. Directlyb. Through Distributorc. Through Sub-brokers/Brokers.

7. Have you invested or would you like to invest in the current period?a. Yesb. No

8. If yes then rank in 1-5 (with 1 being best and 4 being worst) of the following optionsa. Mutual funds are no doubt the best investment option in spite of the

current economic slowdown b. I am getting more units as NAV is low, so I will definitely earn profit when

market goes up. c. Mutual fund are still giving better return for longer period( 5yrs) than

other investment option d. Despite all the slowdown, I will prefer MF as it gives me tax benefit

9. If yes in which kind of fund you will prefer to invest now?a. Equityb. Debtc. Balancedd. Tax saverse. ETFs

10. Which is your preferred mood of investment in mutual fund?a. Lump sum b. SIP (Systematic Investment Plan)

11. Rank the option which u think best describe your views ( 1 being the best & 5 being worst)

i. I will better invest in FDs of Banks in this condition as it is the safest ii. I will invest in FDs of NBFC as they give better interest

iii. I will go for PPF iv. I will invest in NSC v. I will put my money in ULIPs because it will give me insurance cover.

69

Bibliography

Websiteswww.the-finapolis.comwww.mutualfundsindia.comwww.valueresearchonline.comwww.moneycontrol.comwww.morningstar.comwww.yahoofinance.comwww.theeconomictimes.comwww.rediffmoney.comwww.bseindia.comwww.nseindia.comwww.investopedia.com

Journals & other referencesHDFC AMC manualThe Economic TimesBusiness StandardThe TelegraphBusiness IndiaFact sheet and statements of various fund houses

70