GOLD Magazine Issue 48

-

Upload

inbusiness -

Category

Documents

-

view

248 -

download

0

description

Transcript of GOLD Magazine Issue 48

30 st

rateg

ic

proposals

to re

store

cyprus

as a

n int

erna

tional

busin

ess c

entre

the international investment, finance & professional services magazine of cyprus529

1295

0005

77

00001>

529

1295

0005

77

00001>

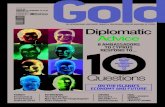

ISSUE 48MARCH 14 - APRIL 13, 2015PRICE €4.95

PowEREd by:

INTERVIEwSMarc de Panafieu Constantinos HerodotouTheo Paphitis

SURVEyCEoconfidencegrows in Cyprus

PLUS: MoNEy / bUSINESSECoNoMyTAX & LEGALLIFESTyLE / oPINIoN

GREECEwhy the‘Grexit’won’t happen

HARRIS GEORGIADES

‘The Worst Is Now Behind Us’

+ yARoN bLooM, GEoRGE MoUSKIdES, EMILy yIoLITIS

4 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

22| ACTIONS SPEAK LOUDER THAN WORDSConstantinos Herodotou, Commissioner for Privatisations, on why he took the job and why he is absolutely determined to see it through.

25 | NICOSIA ECONOMIC CONGRESS 2015A preview of the biggest annual financial/economic event to be held in the capital.

26 | WHY THE ‘GREXIT’ WON’T HAPPENThose who think that Greece should be ‘allowed to fail’ do not realise the extent of the geopolitical shocks and the unfavour-able social and economic consequences of such an event on the rest of the eurozone, says Dr. Savvas Savouri.

30 | THE MULTIMILLIONAIRE SHOPKEEPERTheo Paphitis returns to Cyprus with a

6 814

Issue 48March 14- April 13, 2015

EDITORIALUP FRONTFIVE MINUTES WITH...

74 {money}

78 {business}

82 {economy}

84 {tax & legal}

86 {lifestyle}

FEATURES

68 | NO REGRETSGeorge Mouskides, Director of FOX Smart Estate Agency, has been through both the good and the bad times of the real estate sector but, he says, he has no regrets or complaints about his career choices.

few words for his homeland’s politicians

48 | EY CYPRUS INAUGURATES NEW NICOSIA OFFICESPhotos of the event.

50 | GOING IT ALONEThe partners in a relatively new legal firm have some fascinating suggestions regarding what can be done to revive the economy and allow Cyprus to regain its favoured position as an international finance centre of choice.

52 | OIL PRODUCERS OVER A BARRELWhat caused last year’s dramatic decline in oil prices and when – if ever – may we see a return to 2013 levels?

54 | CEO CONFIDENCE GROWS IN CYPRUSThe results of PwC Cyprus’ fourth country-specific survey, which sets out the views of more than 80 CEOs.

BEHIND US”

“THE WORSTIS NOW

HARRIS GEORGIADES

Harris Georgiades looks back over his 23 months as Finance Minister and confirms his optimism about

the country’s future.

16

26 30

SPECIAL ADVERTISING

SUPPLEMENTS33 | CYPRUS CITIZENSHIP GUIDE7 companies present their services and express their views on the success of the ‘Citizenship Through Investment’ scheme. 57 | OIL & GAS SERVICES IN CYPRUS5 companies present their services. 71 | RE-PROFESSIONALISING BANKING TOGETHERGlobaltraining is the exclusive education partner for the Chartered Banker MBA in Cyprus, Greece, Russia, Romania and Eastern Europe.

33

5722

52

MANAGEMENT CONSULTINGPEOPLE & CHANGE SERVICES

2014 KPMG Compensation and

Benefits Survey

KPMG’s People and Change Services successfully

published for the fourth time since 2008 the results of

the 2014 KPMG Compensation and Benefits Survey.

The 2014 KPMG Compensation and Benefits Report

presents compensation and benefits policies and

data of 90 prominent companies. The information

refers to 104 generic positions and 77 industry

specific positions and presents data from 6522

professionals.

The Survey’s results provide companies with

insight to design their compensation strategy

with a competitive edge. The 2014 KPMG

Compensation and Benefits has been

established as the best known and most

comprehensive Survey in Cyprus due to

its excellent sample and the fieldwork

methodology implemented.

For more information, and to purchase

a copy of the Report, please contact

us:

Marios Papalazarou

Associate

People & Change Services

T: 22 209107

Elli Foulli

Assistant Manager

People & Change Services

T: 22 209107

www.kpmg.com.cy

©2015 KPM

G Lim

ited, a Cyprus lim

ited liability company and m

ember of the KPM

G netw

ork of independent mem

ber firm

s affiliated with KPM

G International C

ooperative (”KPMG

International”), a Swiss entity. A

ll rights reserved.

EDITORIAL

John Vickers,Chief Editor

Back to the Future

It’s often said that everything has to do with timing and here at Gold, we discovered the truth of this exactly two years ago when we published our March 14, 2013 is-sue. Containing the first interview with newly elected President Nicos Anastasiades, the cover bore his photo and the optimistic title “Cyprus Means Business”. Twenty-four hours later, the Eurogroup proposed the infamous bail-in to save the island’s

banks…I mention this simply to make the point that the timing of that particular cover story was somewhat unfortunate. I cannot help wondering, however, what excuse the island’s political establishment and most of the Greek-language media have for obsessing with the same story virtually every day for the past two weeks. Supposedly ‘secret’ documents are being presented by various parties that allegedly prove that the idea of bailing-in depositors in the country’s banks was first brought up months before the fateful Eurogroup meeting, as if this is actu-ally going to change anything. The only thing it achieves is to enable so many of the island’s publicity-seekers to get another 15 minutes of fame instead of having to behave sensibly and contribute to the efforts being made to stabilise the economy. You can be sure that, one year from now, the subject will still be monopolising the media as the parliamentary election cam-paign reaches its climax.

One is tempted to imagine that there is some kind of informal code of practice that all would-be politicians in Cyprus have to sign before they are allowed to address the media. It means that they constantly have to revisit past events in an effort to lay the blame on the shoulders of their opponents, while at the same time, failing to come up with any proposals whatsoever that might contribute positively to moving the island forward. We saw it when President Anastasiades decided to restart reunification talks after insisting on having a joint declaration of intent by both sides, and we saw it when he decided to halt those very same talks in the face of Turkey’s decision to send a seismic exploration vessel into Cyprus’ Exclu-sive Economic Zone. Eleven years have passed since the twin referenda on the UN Plan to reunite the island and still barely a week goes by without some MP or media columnist bring-ing it up.

Whatever our political affiliations, we should all be grateful to President Anastasiades for appointing Harris Georgiades as Minister of Finance two years ago. A real breath of fresh air in our past-obsessed political establishment, he is a straight talker who recognises the mistakes of the past but understands the futility of blaming whoever may have been responsible and shows remarkable (for Cyprus) self-control in not attacking previous administrations with anything like the acrimony they deserve. Faced with a House of Representatives that has frequently appeared to be bent on destroying the country’s chances of recovery for its own petty interests, he chooses to focus on the occasions when opposition MPs have sided with the Government and even thanks them for their support and cooperation (see this issue’s Cover Story).

Above all, Georgiades stands out from many of his colleagues because he has his sights fixed firmly on the future, not on the past, refusing to let populism and rhetoric deflect him from his mission to do what is best for Cyprus. This is why we decided that, as everyone else tries to take advantage of the second anniversary of Cyprus’ very own ‘Black Friday’ (15 March 2013), we would make the Minister of Finance only the second politician ever, apart from the President, to feature on the cover of Gold. Read his interview and you’ll understand why.

We are not suggesting that the mistakes and sins of the past should be buried or ignored. On the contrary. But we do believe that, for the sake of the country and coming generations, we urgently need to get back to the future in our discussions.

6 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

MANAGING DIRECTOR George Michail

GENERAL MANAGER Daphne Roditou Tang

MEDIA MANAGERElena Leontiou

EDITOR-IN-CHIEF John Vickers

JOURNALISTSEffy Pafitis, Chloe Panayides

CONTRIBUTORS TO THIS ISSUE Fred Balm, Andrew Lumley-Holmes,

Dr. Savvas Savouri

ART DIRECTION Anna Theodosiou

SENIOR DESIGNERAlexia Petrou

PHOTOGRAPHY Jo Michaelides

MARKETING EXECUTIVE Kevi Chishios

SALES & BUSINESS DEVELOPMENT EXECUTIVE

Phivos KarayiannisADVERTISING EXECUTIVES

Irene Georgiou, Christopher ConstantinouOPERATIONS MANAGER

Voulla NicolaouSUBSCRIPTIONSMyria Neophytou

PRINTERS Cassoulides Masterprinters

CONTACT5 Aigaleo St., Strovolos 2057, Nicosia, Cyprus

Mailing address: P.O.Box 21185, 1503, Nicosia, Cyprus

Tel: +357 22505555, Fax: +357 22679820e-mail: [email protected]

subscriptions: [email protected]

ISSN 1986 - 3543PUBLISHED BY IMH

INTERVIEWSMichael DobbsTim PotierColin Wright

INVESTMENTRecord-breaking sales for alternative assets

PLUS: MONEY / BUSINESSECONOMYTAX & LEGALLIFESTYLE / OPINION

BANKINGBank of CypruslaunchesPremier Club

+ DAI LINGYUN, SAVVAS SAVOURI, GEORGE & ALEXIS TSIELEPIS

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

ISSUE 45 DECEMBER 14, 2014 - JANUARY 13, 2015PRICE €4.95

POWERED BY:

LET’S SEE

ACTION!

529

1295

0005

77

0000

1>

SPECIAL OFFERSubscribe today for just €90 and get an annual subscription to both Gold & IN Business

Call us on (+357) 22505555

OFFER INCLUDES

FREE ACCESS TO

DIGITAL EDITIONS

UP FRONT

Director of CIM, told Gold. “It is Cyprus’ leading Marketing & Management event, attracting a high-calibre audience from Cyprus, the Middle East and Russia. In the past 7 years, more than 2,000 executives have attended the Summit, which is growing every year.” CIM has been Cyprus’ leading Business School since 1978 and, Hadjiyiannis said, it considers the annual Summit as a way of ‘giving back’ to the Cyprus business world which has supported its operations over the past 37 years.

“Apart from interactive sessions with the acclaimed speakers, the Summit provides an excellent platform for networking and for maintaining relationships with CIM alumni and associates. The fact that, on a Saturday morning, more than 300 senior executives choose to attend and 15 leading firms support the event through sponsorships, is sound evidence of the recognition that it enjoys. The CIM Summit is being upgraded every year and I can assure you that it’s here to stay!”

CIM SUMMIT 2015SATURDAY 28 MARCH, 8:30-14:00, BANK OF CYPRUS HEADQUARTERS (AYIA PARASKEVI), NICOSIAADMISSION IS FREE (REGISTRATION ESSENTIAL)

8 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

In a new book by

the Turkish Cypriot academic Niyazi Kizilyurek, the former President of Cy-

prus discusses a host of subjects, includ-ing his early life, studies and employment, his decision to run for the presidency in

the EU and subsequent membership of the

longstanding Cyprus Problem as essential if the island is to make use of its full poten-tial to grow and prosper. The book, which has also been published in Greek and

was translated by John Vickers, Chief Edi-tor of Gold.

NEW BOOK ABOUT EX-PRESIDENT

VASSILIOU

0,

The 2015 CIM Sum-mit takes

place at the Bank of Cyprus HQ in Nicosia at 9am on Saturday 28 March. The Summit is be-ing organised for the 8th consecutive year (admission is free) and the purpose is to inform local executives about the latest trends affect-ing the way they run their businesses. Every year, world-renowned academics and professionals are invited to share their knowledge

and experience; this year, Prof. Jack Lang (University of Cambridge), David Chaffey (CEO, SmartInsights) and Jonathan Gabay (ac-claimed consultant and author) will ad-dress the theme The Digital Era for Busi-ness, shedding light on new technologies that affect the busi-ness world and pro-vide opportunities for growth. “The Summit is highly on-hands and case study-focused,” Yangos Hadjiyannis, Deputy

CORRECTIONIn last month’s cover story, a number of the figures quoted were incorrect, due to printing errors. With regard to cdbbank, the figure for deposits should have been €395 million (not billion), for net loans €345 million (not billion), and assets €531.7 million (not billion). For Hellenic Bank, the the figure for deposits should have been €6.1 billion (not €61), for net loans €3.3 billion (not €33) and for assets €6.9 billion (not €69). For USB Bank, the figure for deposits should have been €621 million (not billion) and in the case of Piraeus Bank the corresponding figure should have been 1.2 billion (not million).We apologise for any confusion and inconve-nience caused.

CYPRUS-SOUTH AFRICA BUSINESS ASSOCIATION HOLDS FIRST NETWORKING EVENTT

he recently-founded Cyprus-South Africa Business Association will hold its first networking event on March 18. Speakers include Association President Maria Zav-rou, Antonis Mavrides,

Trade Officer at the South African Embassy in Cyprus, Angelos Gregoriades, President of the Cyprus Investment Funds Associa-tion, and Bert Pijls, CEO of Hellenic Bank. The Cyprus-South Africa Business Associa-tion operates under the auspices of the Cy-prus Chamber of Commerce and Industry, which supports it in its efforts to reinforce commercial and economic relationships between the two countries.

nMinPrrou

de Officer at the Soutyprus A

The Cyprus Institute (CyI) has been awarded a European Re-search Area (ERA) Chair grant of €2.5 million in the field of Solar Thermal Energy (STE).

Following what is described as a highly competi-tive process, CyI secured one of the 13 grants awarded out of the 88 proposals submitted from 15 countries. The grant – which constitutes recognition for the successful research work being pursued at the Institute – is intended to allow CyI to develop excellence on a European level in the relevant field.

Part of the European Commission’s Horizon 2020 research funding programme, the ERA Chairs are intended to support research or-ganisations in countries with low research and development investment, such as Cyprus, to attract and maintain high quality scientists from across the European Union and implement the structural changes necessary to achieve excel-lence in specific fields of research. The secured European funding will enhance and upgrade the Institute’s existing substantial activity in solar energy, aiding its strategic objec-tive of becoming an innovation hub for Cyprus, the Eastern Mediterranean and the Middle East.

Prominent Cyprus real estate and development firm Aristo Developers has further expanded its global reach through the

establishment of a new Head Office in Zhujiang New Town, Guang-zhou, China, marking another milestone in its broadening Asian operations. Tony Antoniades will be heading the company’s new China office, along with an established network of Satel-lite Offices in Beijing, Shanghai and Chengdu.“The new office, which has been established in line with our custom-er-oriented strategy, is bolstered with experienced professionals to meet customer needs,” commented Theodoros Aristodemou, CEO and Managing Director of Aristo Devel-opers.“We believe there is still tremendous opportunity to be tapped. Our en-hanced presence will further enable us to position ourselves as a leader in the Cyprus property industry, bringing us closer to our existing and potential clients, and our network of associates across China and beyond,” he concluded.

Aristo Unveils New China

Head Office

Cyprus Institute Secures €2.5m

European Research Area

Grant

CIPA SIGNS MoU WITH RUSSIAN INVESTMENT AGENCY

Within the framework of President Nicos An-astasiades’

to Moscow on February 24-25,

Agency (CIPA) signed a Memoran-dum of Understanding (MoU) with

-

President Nicos Anastasiades, his --

Angastiniotis and the Chairman of

cooperation and the exchange of information between the two

During the signing ceremony, Angastiniotis referred to the strong economic ties between Cyprus

cooperation between business-

“The signing of the Memoran-dum of Understanding sends a

ties between Cyprus and Russia and the deep friendship between

-eration with strategic partners

-

of the country, Angastiniotis

the Eastern Mediterranean an e le East.

g itsation hub for

d th Middln and the Middle E

CYPRUS- RUSSIA AGREEMENTS

President Anastasiades an d Russian President Vladimir Putin met in Moscow last month for

private talks and, later, the signing of a number of agreements. The two leaders signed the Joint Action Programme between the Republic of Cyprus and the Russian Federation for 2015-2017, which constitutes an umbrella document, covering

numerous areas of cooperation between the two countries. A Memorandum of Understanding (MoU) was signed between the Cypriot Ministry of Finance and the Russian Ministry of Education and Sciences on cooperation in the fields of research and technology.

The Protocol of the 8th Cyprus-Russia Intergovernmental Commit-tee for Economic Cooperation was

also signed, as was an MoU between the Ministries of Defence of the two countries for cooperation in the naval field. An agreement on military coopera-tion was also signed by the coun-tries’ Foreign Ministers. Moreover, the two countries agreed to cooperate in the fight against drugs smuggling and on combating terrorism.

UP FRONT

10 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

T H E F I R S T N A M E I N L O N G - T E R M L O Y A L T Y

M A R I A

We are one of the world’s largest independent providers of trust, fund and corporate administration services.

We are committed to helping our clients protect, nurture and grow their wealth.

Above all, we are a people business.

To find out more about our services and to get to know us better, visit

www.firstnames.com

THE 10 HIGHEST-EARNING FOOTBALL CLUBS

T he 18th edition of the Deloitte Football Money League, which looks at the high-est earning clubs in the world’s most popular sport, is the most contempo-

rary and reliable analysis of the clubs’ relative fi-nancial performance. It reveals that Manchester United and Real Madrid are currently the only

clubs to earn over €500m in a season but notes that “such is the pace of growth seen at the largest clubs, it is possible that in next year’s edition, all of the top five Money League clubs will be generating in excess of half a billion euros for the 2014/15 season.” Below are the Ten Highest-Earning Foot-ball Clubs in the world.

1(1)

2(4)

3(3)

4(2)

5(5)

6(6)

7(7) 9(12)

8(8) 10(9)

)) 2)2))2)

12 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

UP FRONT

1. REAL MADRID 2014 REVENUE: €549.5M 2013 REVENUE: €518.9M DOMESTIC LEAGUE POSITION 2013-14: 3RDAVERAGE LEAGUE MATCH ATTENDANCE: 70,739

2. MANCHESTER UNITED 2014 REVENUE: €518M 2013 REVENUE: €423.8M DOMESTIC LEAGUE POSITION 2013-14: 7TH AVERAGE LEAGUE MATCH ATTENDANCE: 75,203

3. BAYERN MUNICH 2014 REVENUE: €487.5M 2013 REVENUE: €431.2M DOMESTIC LEAGUE POSITION 2013-14: 1STAVERAGE LEAGUE MATCH ATTENDANCE: 71,131

4. FC BARCELONA2014 REVENUE: €484.6M 2013 REVENUE: €482.6M DOMESTIC LEAGUE POSITION 2013-14: 2NDAVERAGE LEAGUE MATCH ATTENDANCE: 71,988

5. PARIS SAINT-GERMAIN 2014 REVENUE: €474.2M 2013 REVENUE: €398.8M DOMESTIC LEAGUE POSITION 2013-14: 1STAVERAGE LEAGUE MATCH ATTENDANCE: 45,420

6. MANCHESTER CITY2014 REVENUE: €414.4M 2013 REVENUE: €316.2M DOMESTIC LEAGUE POSITION 2013-14:1STAVERAGE LEAGUE MATCH ATTENDANCE: 47,166

7. CHELSEA 2014 REVENUE: €387.9M 2013 REVENUE: €303.4M DOMESTIC LEAGUE POSITION 2013-14: 3RDAVERAGE LEAGUE MATCH ATTENDANCE: 41,474

8. ARSENAL 2014 REVENUE: €359.3M 2013 REVENUE: €284.3M DOMESTIC LEAGUE POSITION 2013-14: 4THAVERAGE LEAGUE MATCH ATTENDANCE: 60,014

9. LIVERPOOL2014 REVENUE: €305.9M 2013 REVENUE: €240.6M DOMESTIC LEAGUE POSITION 2013-14: 2NDAVERAGE LEAGUE MATCH ATTENDANCE: 44,831

10. JUVENTUS2014 Revenue: €279.4M 2013 Revenue: €272.4M DOMESTIC LEAGUE POSITION 2013-14: 1STAVERAGE LEAGUE MATCH ATTENDANCE: 35,564

14 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

INTERVIEW

better value for consumers.

Gold: What would you propose in order to modernize and update the Cypriot FMCG sector, especially in terms of the way suppliers and supermarkets oper-ate?Y.B.: Based on my experience, the best way for retailers and suppliers to win during challenging times is to improve collaboration and focus on joint value creation. Collaboration should focus on both improving the shopping experience and optimizing the supply chain. A strong collaboration will enable both retailers and suppliers to provide the best service and value for money to the Cypriot consumer

Gold: What are your future plans for the Cyprus market? Can we assume that you are here to stay?Y.B.: We are indeed here to stay! We be-lieve in the Cyprus market.Over the past three years we have managed to build a great local team – I’m the only non-native employee in the company – that has enabled us to successfully establish a healthy business and to consistently grow the business year after year, despite all the challenges we are facing in the market. We strongly believe that the combination of a highly-skilled local team and Diplomat’s unique global capabilities and expertise give us a competitive advantage, which will eventually lead to us becoming the leading distribution company in Cyprus.

Gold: Give us a brief his-tory of Diplomat and how it has developed into the huge global organisation it is today.

Yaron Bloom: Diplomat actually started as a razor blade manufacturer in 1963. Diplomat Distributors Ltd was established In 1968 to distribute locally produced razor blades and imported personal care products. A very significant milestone in Diplomat’s history was 1994, when it was appointed as the ex-clusive distributor of Procter & Gamble products in Israel. In 2005, the company started to distribute also food products and it is currently exclusively distribut-ing global brands in Israel such as Heinz, Milka, Toblerone, Oreo, Kellogg’s, Kikkoman, Pringles and more. In 2008, Diplomat expanded globally, establishing operations in Georgia, followed by South Africa in 2010 and Cyprus in 2011. All began operations as the official and ex-clusive Distributor of Procter & Gamble, later expanding into other FMCG cat-egories such as food, representing Nestle and Mondelez.

Gold: What was behind the decision to set up Diplomat in Cyprus?Y.B.: It was taken at the request of Procter & Gamble, who asked Diplomat to build a fast operation in a new market, based on Diplomat’s proven best prac-tices and experience, adapted to differ-

ent market structures and needs and, of course, on its long-term partnership with the company.

Gold: What is your view of the fast-moving consumer goods (FMCG) sec-tor in Cyprus?Y.B.: Overall, I would say that the Cypriot market behaves in a similar way to other developed FMCG markets. Cyprus’ FMCG sector, consisting of hypermarkets and su-permarkets which account for 70% of the total FMCG sector turnover, is a developed and concentrated market in which the Top 5 retailers represent 70% of total FMCG sales. One difference between the Cypriot market and other markets that I have had the chance to work in relates to the large number of tour-ists compared to the size of the local Cypriot population, and they have different shopping needs and expectations.

Gold: What are your forecasts for the sec-tor in 2015?Y.B.: Our assumption is that, overall, the market will stay flat compared to 2014 but there will be differences in which categories do well (as happened last year) and we will face similar challenges to those faced in 2014. Cypriot consumers will continue to look for the best value-for-money proposition, not necessarily the cheapest. We also think that suppliers will look for ways to leverage synergy and scale, in order to reduce costs and improve efficiency. It will enable them to provide a better service to retailers as well as

five minutes with...

Yaron BloomCEO, Diplomat Cyprus

.

C O N G R E S S

5 t h N I C O S I A

16 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

HARRIS GEORGIADES

BEHIND US”

“THE WORSTIS NOW

By John Vickers, Photography by Jo Michaelides

EXACTLY TWO YEARS SINCE THE ECONOMY OF CYPRUS FOUND ITSELF ON THE VERGE OF COLLAPSE AND THE NEWLY ELECTED GOVERNMENT OF NICOS ANASTASIADES WAS FORCED TO TAKE DECISIONS THAT CONTINUE TO REVERBERATE TO THIS

DAY, AN OPTIMISTIC HARRIS GEORGIADES LOOKS BACK OVER HIS 23 MONTHS AS

FINANCE MINISTER.

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS Gold 17

Gold: When you were appointed Min-ister of Labour & Social Insurance in March 2013, I am sure you saw it as a challenge. But how did you feel a month later when the President asked you to be-come Minister of Finance, given the state of the economy and the banking sector?Harris Georgiades: Although we had been quite optimistic about the outcome of the Febru-ary presidential election, we were also aware of the very difficult situation that we would face as a new administration. When I took over as Minister of Labour, I was perfectly aware

that unemployment had soared from 3.5% to an all-time high of 15.5% and I ex-pected that it would continue its upward course and climax somewhere between 20% and 25%. I am very glad that we

have been able to stabilize unemployment and it’s now more or less where it was two

years ago and showing the first signs of de-escalation.

My appointment as Minister of Finance came just days after the collapse of one systemic bank, the near-col-

lapse of another bank and with the public coffers almost empty.

I AM VERY OPTIMISTIC ABOUT THE

CYPRIOT ECONOMY

COVER STORY

18 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

COVER STORY

On my first day in the job, I was informed that we only had reserves for another 30 days or so. I admit that the severity of the situation far exceeded what I personally and the Government had expected to inherit.

Gold: Did you ever doubt your ability to cope in such a vital post?H.G.: No, because ultimately it wasn’t my ability that was being called into question but rather the ability and resilience of the economy and its key productive sectors. As a Government, we did our best to offer support to those sectors, essentially by taking con-trol of the situation, agreeing swiftly on a support programme and getting down to work in several different directions at once, in the context of a broader effort. So it was not my personal ability but rather the fact that we were able to establish conditions of stability, combined with the resilience of our productive sectors, that spared us the worst.

Gold: Your success in formulating and overseeing the imple-mentation of the government’s policies is reflected in the Troi-ka’s reports, the upgrades by the credit rating agencies and the statistics that point to a faster return to growth than predicted. So how do you feel when the opposition is constantly ques-tioning your abilities?H.G.: I fully respect the role of the opposition and I have to ex-press my appreciation for its positive stance during these two years because we have had strong support regarding most of the difficult decisions that we have had to take. Let me remind you that during the latter years of the previous administration, my party was in op-position but it was consistently demonstrating a readiness to take difficult but necessary decisions, essentially pushing the Govern-ment of the time to do so. For the last two years, Cyprus has had a Government which does not need pushing. It is a Government that is absolutely ready to take the lead in implementing those dif-ficult but unavoidable decisions, And so far, I have to acknowledge that the House of Representatives, despite what may sometimes be seen as a critical stance, has been supportive. I am hopeful that this constructive approach will continue. We have come a long way. Together, the Government and the House have taken decisions which have enabled the economy to achieve much-needed stability and to secure growth prospects. We can still be constructive even when we disagree and we should always ensure that differences of opinion do not endanger the effort to fully secure the recovery of the country.

Gold: Knowing what has happened with the foreclosures leg-islation, I think you’re being very diplomatic but, as someone who has been involved in party politics from quite a young age, you know how these things work. Do you believe that, were your party (DISY) in opposition rather than in govern-ment, it would have reacted differently from your opponents in the House of Representatives?H.G.: I think our record as an opposition party is there for eve-ryone to evaluate. We were actually more ready and willing than the Government to take difficult decisions. You say that I’m being diplomatic but my attitude is actually a very deliberate attempt

not to burn our bridges of cooperation with the House. I am willing to accept criticism and to listen to different opinions and I’m not suggesting that everyone should agree with my own policy choices or with the economic policy of the Government. But something more important is at stake here and we should all be able to behave responsibly and sensibly, irrespective of whether we are

ON MY FIRST DAY IN THE JOB, I WAS

INFORMED THAT WE ONLY HAD RESERVES

FOR ANOTHER 30 DAYS OR SO

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS Gold 19

in opposition or government. We need to ensure that day-to-day politics do not jeopardize what our fellow citizens have achieved and what the productive sectors of the economy have achieved. We’ve at last been able to breathe easy after the unprecedented climax of the crisis two years ago and we ought to make the best use of the posi-tion we are now in, which should essentially be interpreted as a vote of confidence in our efforts and our future prospects and encourage us to continue the effort.

Gold: Presumably you have seen for yourself the truth of the old saying that it is easier to be in opposition than in government?H.G.: It is definitely easier but we have shown that we’re up to the challenge. I believe that my party has always been a party of respon-sibility. That was the hallmark of its founder and I think that we are continuing this political tradition of being the voice of responsibility and reason in Cypriot politics. As a nation we have paid the price over the years for failing to follow the course of rationality and rea-son. I try not to take emotional decisions and, as Finance Minister, I certainly can’t base my actions on whether they will be popular. When we were in opposition, we always recognised that we needed to encourage the Government to act. Delaying or postponing deci-sions always makes things more difficult and, regrettably, many dif-ficult decisions have had to be taken during the past two years but, as a result of them, I believe that our future now lies entirely in our own hands. If we continue the present effort, if we work together, if the Government and opposition both behave responsibly and we don’t go back to the practice of postponing and delaying decisions, we will definitely succeed. I am very optimistic about the Cypriot economy. There will always be external factors and risks but it is now up to us to ensure that we not only overcome the crisis – one that we basically caused through our own failings – but we lay the foundations for a much more viable and healthy growth model with-out the excesses and the imbalances of the past.

Gold: Doesn’t it disappoint you when the other political par-ties reject your calls for a unified front in order to deal with the country’s problems?H.G.: I don’t let such things affect me. It’s not personal. It has to do with the future of this country. As Winston Churchill said, “If you’re going through hell, keep going” and that’s my motto. I don’t give up in the face of adversity. I believe in what we’re doing and I believe in the prospects for Cyprus. If there are political difficulties,

let’s try and deal with them. I know that we are on the right course and I am determined to do the job.

Gold: Do you feel that, within the Eurogroup for example, you are considered an equal by your counterparts from the other eurozone countries? Or is there a view that the smaller countries are less important in the process?H.G.: Theoretically we are all equals but, at the same time, one has to understand that the influence of a larger member state will be more significant than that of a smaller one. What a smaller state can do in order to be considered as a credible participant around the table is to show a constructive attitude. Our approach is one of con-structive participation; it is a positive stance and definitely not one of entrenchment and self-imposed isolation, nor is it based on rhetoric for domestic consumption. Such an approach would not deliver any influence or add anything to our role within bodies such as the Eu-rogroup. We need to be aware of the realities of the situation and, at the same time, feel confident that, by maintaining a credible stance, we not only cater for our own best interests but also participate ac-tively in the common endeavour of the European people.

Gold: You were forced to carry out a rather delicate balancing act recently of being seen to support the new Greek government (which is very anti-Troika) while believing that, in the case of Cyprus at least, implementation of the Memorandum of Under-standing (MoU) to the letter is the correct policy. How did that feel?H.G.: Ultimately there was no dilemma. We have a very clear in-terest in ensuring that Greece remains a member of the eurozone and stays on the path to economic recovery. This is exactly why we were perfectly able to support what was eventually the Eurogroup’s unanimous decision to offer a four-month extension to the Greek programme. It was offered because the new government in Athens undertook a clear commitment to continue with the implementa-tion of a very ambitious reform and consolidation programme. That commitment, which the Greek Finance Minister conveyed to the Eurogroup, includes a balanced budget with a primary surplus, an acceptance of privatisation as a very useful tool that will attract investment, a commitment in favour of reforming the public admin-istration, the taxation and welfare systems. And, of course, all these are meant to ensure the continuing participation of the country in the eurozone. There isn’t a single issue with which I disagree; in fact, the pil-

WE NEED TO ENSURE THAT DAY-TO-DAY POLITICS DO NOT JEOPARDIZE WHAT OUR FELLOW

CITIZENS HAVE ACHIEVED

20 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

lars which were presented by the Greek government are exactly the same pillars that constitute our own programme of economic reform and consolidation. Ultimately, what I and the other ministers supported was what the Greek government presented: a com-mitment in to fiscal consolidation, economic reform and a continued presence in the eurozone.

Gold: The MoU with the Troika will expire this time next year. Will Cyprus be ready to go it alone by then?H.G.: Inevitably, we must re-establish sustainable access to the international capital markets if we want to do away with the Troika and the Memorandum.

This will not be achieved with words, slogans, rhetoric or vocal opposition but by credible actions that facilitate the re-establishment of such market access and I think this is a perfectly achievable objec-tive. It was a huge step in the right direction that we were able to tap the markets only a year after the commencement of the effort and we stand ready to repeat the exercise. We also need to see some confi-dence in our domestic political process.

Gold: But the end of the MoU will certainly not mean an end to the country’s obligations, regard-ing issues such as privatisation, etc?H.G.: It will definitely not signal the end of pru-

COVER STORY

I CHOOSE TO SEE

THE GLASS HALF FULL

RATHER THAN HALF

EMPTY

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS Gold 21

dently managing our public finances. I think that, by now, we should all have learned a very simple lesson: just like a household or a business, an economy cannot keep spending more than it earns. So even without the Troika, our ambitious plan of structural reforms to bring positive changes to the administration and to the way that the state interacts with the private sector will continue. Economic policy – and primarily the effort to maintain a competitive edge – is a never-ending process and I can assure you that we shall continue to implement much-needed reform and ensure fiscal consolidation until the very last day of our administration.

Gold: How difficult is it for you, as Finance Minister, to per-suade ordinary people that things are bound to improve if we follow the policies advocated by the Troika, which the opposi-tion and much of the media are happy to demonise?H.G.: I choose to see the glass half full rather than half empty. I know that many of our fellow citizens and many local businesses are going through difficult times and it is clear that some have been worse hit than others. At the same time, I believe that there is now a general recognition that it was our own mistakes that led us into this difficult situation and that our own actions and our determination to continue this effort will get us out of it. I repeat that I do not expect everyone to agree fully with each and every policy stance that we, as a Government, are promoting. But I think that, despite a range of dif-fering opinions that may exist, we do have the consent of our fellow citizens to continue and complete this effort.

Gold: Looking back over your two years in this post, are there things you would have done differently?H.G.: I have to be honest and say that I am not entirely satisfied with what we have achieved. I wish we had done more during the first two years of our administration. We have done enough but there is more to do and I only wish we had been able to do things more quickly. One has to realise that the executive branch of govern-ment is not alone in the decision-making process so, inevitably, some issues are going to take more time. Despite our occasional frustration and our desire to move faster, I think that we have to acknowledge certain realities and to do our best under the circumstances.

Gold: How optimistic are you that Cyprus will complete the programme of reforms? Aren’t you worried that domestic poli-tics will affect your plans in the run-up to the 2016 parliamen-tary elections?H.G.: I would be less than truthful if I told you that I don’t have any concerns. I do and whilst expressing my appreciation for the constructive stance of the parliamentary parties so far, I would em-phasise strongly that this needs to continue. But let me also say that the really difficult decisions are now behind us. We are not going to propose any new taxes or, indeed, anything that will burden house-holds and businesses. There is no possibility of a repetition of the unprecedented decisions that affected our banking sector two years ago. So the decisions that lie ahead are very positive ones, which do not justify political or social opposition because they favour changes that we desperately need. I don’t think there is anyone in Cyprus who disagrees over the need to reform the public administration, the welfare system or the healthcare system, or the need to take the step – as one of the last countries in Europe – to implement very limited and specific privatisations. Even on such a sensitive issue, we are absolutely ready to ensure the rights and benefits of the employees so if that is established, as is our intention, there should be no grounds for opposition, either ahead of a parliamentary election or not. I hope that we shall continue to have the support of the public and the political parties when it comes to the promotion of a very posi-tive reform agenda.

Gold: When future historians are looking back at this period, how would you like to be remembered?H.G.: To tell you truth I would not object if I am not really remem-bered! If a Finance Minister is remembered, there is always a risk that it’s not for a good reason! What I definitely wish is to be able to leave office with a clear conscience and a sense that I did my bit as a member of the Government of President Anastasiades in fac-ing up to a very difficult situation that was regrettably allowed to escalate and playing a part in creating conditions of stability and good future prospects for the country. If I am able to say that to myself, then I think that my venture into politics will have meant something.

AS A NATION WE HAVE PAID THE PRICE OVER THE YEARS FOR FAILING TO FOLLOW

THE COURSE OF RATIONALITY AND

REASON

I BELIEVE IN WHAT WE’RE DOING AND I BELIEVE IN THE PROSPECTS FOR CYPRUS

PRIVATISATION

22 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

ACTIONS SPEAKLOUDERTHAN WORDS

Constantinos Herodotou, Commissioner for Privatisations, knew that he would face plenty of opposition when he took the job but he is absolutely determined to see it through.

By John Vickers Photograph by Jo Michaelides

In March 2013, Constan-tinos Herodotou was a successful investment banker in London, doing the job to which he had dedicated most of his professional life. When he became aware of the details of the Memo-randum of Understand-ing with the Troika of international lenders, he decided that he ought to try and do something to help.

“It was a sense of knowing that I could do the job and so be use-ful at a crucial time for Cyprus,” he recalls. “All the Cypriots I know who were living abroad at the time of the bail-in were emotionally affected by what had happened, as I was, and when the post of Commissioner for Privatisations came up, I knew that, hav-ing done a lot of these transactions and advised on more than €47 bil-lion, I was in a position to make a contribution. From a career perspec-tive or for financial rea-sons it didn’t make sense at all!”

Having spent his en-tire professional career abroad, there was obvi-ously a risk involved in returning to Cyprus and being responsible for such an important project – one facing

considerable popular opposition, it should be noted. Despite lots of sleepless nights (“I’m not exaggerating when I say that when I was made the offer I couldn’t sleep at night. Once I had accepted it, things got worse.”), and an aware-ness of the huge respon-sibility he would shoul-der, Herodotou took the big step and moved to Cyprus, determined to get the best possible outcome for the semi-government corporations that had been earmarked for privatisation.

“I came here to ensure that certain things are done in the best way possible and to maximize the chances of a very good outcome,” he says. “That’s the only way to deal with such transac-tions. I knew from the start that a huge part of the population might be against it or they may not understand the rea-son why I came here.”

He agrees that his lack of any evident ties with the establishment in Cyprus is an advantage. “I think it makes it easier for people to accept and understand that there is nothing else behind my being here,” he says. “It adds to the credibility of my true motivation for coming.”

Is it safe to assume that the Commissioner for Privatisations is in favour of the transfer of ownership from the pub-lic to the private sector in every instance? He is doubtless familiar with examples – including some in the UK – where the process has been viewed by some as a failure.

“I don’t think we should generalize when

it comes to privatisa-tions, or any type of investment for that mat-ter,” he explains. “You have to look at each case on its own merits and it requires a complicated analysis. You’re right that there are good examples and bad ex-amples and that’s how it works. Having the knowledge, or the advi-sors with the knowledge, you have to look at prec-edents – that’s the basis of any financial transac-tion – and see what has worked and what hasn’t, what applies and what doesn’t, and then decide how to manage it ac-cordingly.”

The idea of replacing inefficient state-con-trolled practices with a more streamlined man-agement makes sense to most people, but in the case of a profit-making organisation such as Cyta (selected as the first to be privatised), isn’t there something to be said for the idea of making it more ef-ficient while keeping those profits for the state rather than a private company?

The two things are not mutually exclusive, he says. “If you bring in the right investors, the valuation of the com-

pany today will be on its future profitability, which should include the contribution of the more agile management that will be brought in. So you will get that enhanced profitability as a lump sum today. Moreover, whether in the form of dividends going forward or tax on higher profitability, the Government will always receive a contribution.”

On the basis of the Privatisations Law, a number of objectives are to be achieved through privatisation, of which value maximization is only one. Others in-clude bringing more products to consumers at better prices, bringing foreign investment into the country and creat-ing new employment positions. Although the timing of the intermedi-ate deliverables of the original timetable has changed, the final target date remains and, Hero-dotou says, is achievable without compromising. “We have now brought in the advisors [Citi-group, PwC, Antis Tri-antafyllides & Sons LLC in a consortium with Shearman & Sterling LLP, and Roland Berg-er] which is a critical first step,” he explains,

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS Gold 23

A NUMBER OF OBJECTIVES ARE TO BE ACHIEVED THROUGH PRIVATISATION, OF WHICH VALUE MAXIMISATION IS ONLY ONE

24 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

PRIVATISATION

“because having the right advi-sors with the relevant experi-ence and a global footprint is necessary for the analysis to be carried out in a proper way and in order to instill confidence in the type of investors we want to see in Cyprus – and in Cyta. We have to look at it from their point of view. They need to see that this is a proper serious process so it’s a win-win situation on both sides. It doesn’t guarantee us the end result but if we start on that basis we have a good chance of getting there. So we are now working on the preparation of the transaction and we’re work-ing with the management of Cyta to make all our analyses and prepare everything before launching the process towards the investors. That will happen in a couple of months’ time, with the idea of finalising be-fore the end of 2015. That was the original deadline and it has not changed.”

Although Herodotou has stated publicly that he intends to have the employees of the organisations that have been chosen for privatisation in-volved at every step, the staff unions at Cyta were complain-ing not long ago that they were being kept in the dark. This is not true, says the Commis-sioner, noting that a couple of months after his arrival on the island he invited all five unions to a meeting to update them. “I explained the processes and I promised them that I would update them whenever there was news. Last month, once we had the advisors on board, we had another meeting. The truth is that between those two meetings there wasn’t much else to say but now the process is starting, we’ll be meeting much more regularly.”

Herodotou adds that he has held meetings with Cyta’s Board of Directors and the top management of the organisa-tion. In fact there are now weekly calls with the manage-ment. He has also met once with all the political parties and will soon have another round of talks with them. “There has been a real effort to be all-inclusive and transparent, so that everybody knows what we’re doing and how we’re ap-proaching it. The whole point is to achieve the best possible outcome for Cyta; we are now working with the management in this preparation phase and they will be involved in the transaction execution phase. They have already identified a core team to work with the advisors, so things are progress-ing.”

Given the power of the trade unions and the fact that, for various reasons, the opposition parties in parliament seem bent on fighting the process every step of the way, is he optimistic that he can get a deal with the employees and management? He admits to being concerned but the reason is that, on the basis of the Privatisations Law, issues concerning employee benefits, status, etc will be dealt with by the unions and the Joint Advisory Committee, and not the Privatisation Unit. “The law is also clear that the issue has to go through parlia-ment and I think that’s the right thing to do as it affects everyone in the country,” he says. “My approach has been to show that the process is being carried out in the best way pos-sible; it’s open and transparent and it has clear objectives; they are receiving constant informa-tion on that level. That’s as much as I can do. The rest will

be up to the elected representa-tives of the people.”

At present there is no specific model for the type of company that will be created in the place of each of the semi-government corporations. There will first be expressions of interest, at which stage various entities will be fil-tered out. “Everyone will have to fulfil the same criteria and that stage will be fully transpar-ent so that everyone knows how the filter works,” Herodo-tou points out. “Those proceed-ing further will then have to sub-mit their plans for the organisa-tion and also reveal their financial capability for implementing and delivering those plans. That’s why it’s a complicated process. It’s not a single option with just one cri-terion – price. There will be a list of criteria, which will form part of the analysis and the evaluation that the advisors will carry out.”

It has already been decided that Cyta will not be broken up, meaning that its landline, mobile and broadband services will stay together. “There is no question of the operations of the company being split up and I have told the management, unions and em-ployees that they have no reason to fear that,” he says, elaborating that “The process is all about how to enhance the organisation versus the competition vis-à-vis market share, bringing new products, enhancing revenue and profit lines. It’s not about breaking up or doing something different with Cyta.”

Constantinos Herodotou’s vision for the new Cyta is of an organisation that is even big-ger than today, more agile and competitive not only locally but regionally which, by implication, means a bigger product range, possible new business divisions and new employment positions. “Let’s not forget that there are

connections between Cyprus and the rest of Europe that can give further upside and, if we end up with an investor that has a re-gional presence, you can imagine how things may come together. Hopefully that’s the picture we will see a few years from now.’

Does he think that the ma-jority of Cypriots will ultimate-ly share his view that, thanks in part to his work, the future Cyta will be providing a much better service than today?

“This is a key objective,” he admits, but he adds that to have a chance of achieving it, a lot of work and coopera-tion will be needed among all stakeholders – the Privatisation Unit, the advisors, the manage-ment, Board and employees of Cyta, the Government, the House of Representatives. “So many people need to be pull-ing in the same direction but I believe that it can be done,” he says.

He thus remains undaunted by the task and the noisy op-position to it. “I have worked on complex and demanding transactions in the past,” he notes, “and hopefully people will see more than mere good intentions and recognise what we have done so far and the way we are approaching the issue in order to obtain the best possible result for Cyta. That’s what gives me comfort and keeps me going. This is just the first step and there’s a long way to go. We will be criticized – there is no financial transac-tion out there that will not have some criticism – and that is something I am prepared for but, at least in terms of the big deliverables, I believe that we’ll eventually have something that everybody is happy with. Hopefully actions speak louder than words.”

THE LAW IS CLEAR THAT THE ISSUE HAS TO GO THROUGH PARLIAMENT AND I THINK THAT’S THE RIGHT THING TO DO

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS Gold 25

NICOSIAECONOMICCONGRESS 2015

Last year’s autumn fore-cast by the European Commission stated that the recession in Cyprus had been milder than anticipated and a mod-

est economic recovery is expected to begin in 2015 and strengthen in 2016, in line with the rest of the EU. Cyprus’ public finances are forecast to improve significantly as a result of the govern-ment’s efforts and improvements in the economy. Inflation was close to zero in 2014, due to weak domestic cost pres-sure; however, it is expected to increase gradually in 2015.

Organisers: Gold Magazine and the Institute of

Main sponsor:Sponsor:Communication sponsors:

Coordinator: IMHFor further information, contact IMH: Tel: e-mail: Website:

THE NICOSIA ECONOMIC CONGRESS HAS ESTABLISHED ITSELF AS THE BIGGEST FINANCIAL/ECONOMIC EVENT IN THE CAPITAL

The Government has stated its determination to continue with the strict implementation of the programme of reforms for the complete restoration of Cyprus’ economy and reputa-tion as a regional business centre. It is generally believed that the recession has completed its cycle; unemployment is finally declining after several years, public finances are under control and Cyprus can now look to the future with optimism.

THE CONGRESSNow in its 5th year, the Nicosia Economic Congress – organised by Gold Magazine and the Institute of Certified Public Accountants of Cyprus (ICPAC) – is the meeting place for senior business executives, economists, financi-ers, policy- and decision-makers and govern-ment officials, who will discuss the European Economic Outlook for 2015-2016, the state of the Cyprus economy two years after the Eurogroup’s decisions of March 2013, the restructuring of the banking sector, the road

to privatisation, measures to tackle unemploy-ment and the future of the Cooperative Bank-ing system in Cyprus.The Nicosia Economic Congress has estab-lished itself as the biggest financial/economic event in the capital. A key objective is to pro-vide members of the Institute of Certified Public Accountants of Cyprus (ICPAC) and the broader business world with comprehensive information on the latest economic trends and developments in Cyprus and around the world. Hosting distinguished international speakers who will analyze and give their own forecasts for the economy and markets; it addresses all owners and managers of companies and organisations who are actively involved in the decision-making process. This one-day event will bring together influ-ential and innovative minds in the finance and accounting sectors as well as economic deci-sion- and policy-makers. Among the confirmed keynote speakers are:

• Harris Georgiades, Minister of Finance of the Republic of CyprusThe State and Prospects of the Cyprus Economy• Constantinos Petrides, Under-Secretary to the President Redeveloping the Growth Model for Cyprus• Constantinos Herodotou, Commissioner for PrivatisationsThe Cyprus Privatisation Process • Enam Ahmed, Director, Western European

team of the sovereign group, Fitch Ratings, UK How Credit Rating Agencies View the Prospects for the Economy of Cyprus

Other presentations will deal with The Eco-nomic Outlook for Greece and the Next Steps, The State of Banking in Cyprus, The Prospects for the Cyprus Economy as Viewed by Foreign Institutions such as the European Commission and the European Central Bank, and Economic Forecasts for the Next Two Years.There will also be a panel discussion featuring the CEOs of the largest audit firms in Cyprus.

CONFERENCE

THURSDAY 21 MAY 2015, HILTON PARK HOTEL NICOSIA

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS Gold 25

GREECE

26 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS26 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

WHY THE ‘GREXIT’

WON’T HAPPEN

THOSE WHO THINK THAT GREECE SHOULD BE ‘ALLOWED TO FAIL’ DO NOT REALISE THE

EXTENT OF THE GEOPOLITICAL SHOCKS AND THE UNFAVOURABLE SOCIAL AND

ECONOMIC CONSEQUENCES OF SUCH AN EVENT ON THE REST OF THE EUROZONE.

By Dr Savvas Savouri

History is peppered with milestone events which have had an impact far out of proportion to the number of those directly involved. After all, just think of Winston Churchill’s honouring of the RAF after the Battle of Britain with the words “never was so much owed by so many to so few”. Now reflect on a Greek population of eleven million – representing barely 3% of the overall population of the eurozone – with a national debt of €360 billion. For Greece one might well cry, “Never was so much owed by so few to so many.”

The ancient Greeks had a tradition of small numbers doing things far out of proportion.

The most famous instance of this was when three hundred Spartans fended off a vastly superior force at Thermopylae, defending the pass long enough for the battle against Xerxes of Persia to turn in favour of Greece. In many ways, the story of those Spartans contains ele-ments that are relevant to where Greeks col-lectively stand today. For just as the Spartans formed a bulwark protecting all of ancient Greece, so do modern Greeks stand between the rest of Europe and economic catastrophe.

It is universally accepted that, had the 300 Spartans not put up such a valiant defence at

Thermopylae, the city states – whose federa-tion was, in effect, ancient Greece – would have succumbed. As it was, Greece survived until its next challenge. We should be no less confident that, if Greece were to exit the euro-zone sometime in 2015, economic and social contagion would sweep throughout the federa-tion which is the EU.

Let me be very clear. Those who claim that Greece should be “allowed to fail” so as to be held up as an example to others of to behave – as a sacrificial lamb or a scapegoat, as it were – fail to appreciate the epidemic which a “Grexit” would trigger. Of course, Brussels would endeavour to contain Greece by expel-ling it from the EU in an effort to deny it ac-cess to crucial export markets, while removing the freedom of its nationals to work across the EU’s Single Labour Market. However, the idea the EU could hermetically seal Greece, making it some sort of North Korean-style autarky, is nonsense. If Greece were to be expelled from, or exit the eurozone, this could not fail in the first instance to negatively hit its immediate neighbours.

In the wake of a “Grexit”, Greek people and products would find whatever means they could to evacuate. For the likes of Cyprus (within the euro area), Bulgaria and Croatia (outside it but very much within the EU), and Serbia and FYROM (just outside the EU but keen to join and with currencies closely “pegged” to the euro), the consequences of Greece being expelled from the EU would be severe economic pressures created by the escap-ing of people and goods from the country.

There would also be serious social and ethnic unrest across a Balkans region which, in all too recent memory, has been the stage for bitter deadly conflict.

Were the contagion from Greece to be simply confined to the Balkans, the cost to the EU would be high enough. My fear, however, is that it would be impossible for the effect of a “Grexit” to be isolated to just a handful of its neighbours. The reality is that neighbours have other neighbours and the resulting domino ef-fect would see a Greek crisis spread all the way to Iberia and the Baltic. Let me be very clear

on something else: it is inconceivable that a “Grexit” would not trigger Russian involve-ment in the crisis. Moscow would almost cer-tainly take the chance to offer rescue capital to Athens in return for “concessions”, quite possibly including a commitment that Greece leave NATO and provide Russia with a Med-iterranean base (we might well be seeing the beginnings of something similar in Cyprus). Remember that with Montenegro and Ser-bia, Russia is not short of sympathetic nations across the region. The standoff between the EU and Russia in Ukraine could easily see the opening up of another confrontational front were a “Grexit” to go ahead. Is this far-fetched? Make no mistake, a “Grexit” would trigger geopolitical shocks as well a unfavour-able social and economic consequences.

In short, European nations, seemingly safe because of their distance from Greece, would not be safe at all; they would not be safe from the economic consequences of a “Grexit,” nor from the adverse social implications. As for trying to quantify or estimate in some clinical accounting way the “cost” of a “Grexit”, this is impossible to calculate because it is unprec-edented and because the cost would not be confined to a loss of value in property and other assets but would involve the destruction of social infrastructures and communities.

As much as I believe that a “Grexit” would trigger an extremely unpleasant domino effect across Europe, I am not convinced that this is the mainstream view in Berlin. To explain the consequences of Athens and Berlin seeing things so differently, let me spend a moment

considering game theory, in which Yanis Varoufakis, Greece’s new Finance Minister, is a specialist.

Because Varoufakis is so perfectly aware of the negative “externalities” (the technical phrase for the really nasty side-effects which spread outwards when a shock happens) that would result from a “Grexit”, he believes that Berlin is also aware of these. And because he is convinced that Germany is “wise”, he also believes Berlin would cooperate with Athens to avoid Greece, the eurozone and indeed the wider EU all entering into a “prisoner’s trap”

IF GREECE WERE TO EXIT THE EUROZONE SOMETIME IN 2015, ECONOMIC AND SOCIAL CONTAGION WOULD SWEEP THROUGHOUT THE FEDERATION WHICH IS THE EU

28 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

problem – or certainly the problem as Berlin sees it – is that, having got what it wanted, Athens could simply renege on its promises. So the Greece problem would simply return when its next tranche of bailout capital had been exhausted – or as Germany sees it, frittered away in inefficiency and excess. For many in Germany (and indeed elsewhere across “Hard Europe”), the “Greek boil” needs to be lanced now, or to mix our metaphors, the Greek can must not be kicked down the road.

Let me now return to my rather glib apho-rism that, in the case of Greece, “Never was so much owed by so few to so many”. There are two issues which we need to reflect on here. For one, the debt is barely €40,000 per Greek, equivalent to the price of a good German-made car. And on the issue of German cars, we must not forget that during its period of “debt fuelled growth”, Greece was a voracious importer of a great many German-made cars. Indeed, Greece was an importer of German-made kitchen appliances, German-made home electronics and German-made machinery. So too was Spain and so was Portugal. In fact, many of the eurozone nations, which the Ger-

mans are hounding to introduce more thrifty spending habits, spent a great deal of money on German goods and, in so doing, indebted themselves whilst enriching Germany.

Since the Germans have insisted that we look at Greece very clinically with numbers I will keep to this numerical rule in what fol-lows. The data in Chart 1 shows that since joining what was known as the European Eco-nomic Community (EEC) in 1981, Greeks have spent $100 billion more on German goods than Germans have spent on Greek imports. In Chart 2 we see much of the $100 billion surplus that Germany has earned from Greece was amassed relatively recently (since 2000). Sticking with numbers, of its overall debt obligation of $360 billion, Greece is accountable to Germany for just over $70 billion. According to my simple arithmetic, the net balance of what Greeks have spent on German goods over what Germans have spent on Greek imports, puts Germany up $30 bil-lion. It makes one think just who has exploited who? So what then is my outlook?

Where we are can be summarised as the three ”fors”: whilst the Greeks want debt for-giveness many in Germany want to foreclose on Greece. The compromise is debt forbear-ance. And this is the outcome that I genuinely expect will be reached. The Greek funding requirement will be bridged long enough, I believe, not only for other eurozone nations to elect anti-austerity governments but for Germany to realise that the austerity it has imposed on others has sent its own economy into recession.

GREECE

(what game theorists call an outcome that is the worst option for all players as opposed to what it could have been if they had cooper-ated). I, however, am far from convinced that Berlin appreciates the consequences of a “Grexit”. Instead, I see the Germans viewing their position relative to the Greeks and others across “Soft Europe” as a “master-servant” one. In this context, Berlin believes that if it were to compromise with Athens, this would un-dermine its authority over other nations with similarly bad fiscal habits.

Quite simply, Germany believes that were it to compromise with Greece, it would create an entirely different set of negative externali-ties. Berlin, moreover, sees the risk of “moral hazard”: forgive the Greeks and you will only encourage them to misbehave again. Sticking to the terminology of game theory, the Ger-mans see the situation as if it were an “implicit bad faith model”. Let me try to explain.

Suppose Berlin gives the Greeks the debt forgiveness they are pleading for, in return for promises from Athens that it will improve its fiscal housekeeping by restructuring the civil service and be better at tax collection. The

1981 1986 1991 1996 2001 2006 2011

14

12

10

8

6

4

2

0

Billio

ns, U

SD X

10

Value of Exports (FOB) Value of Imports (CIF)

CHART 1: GREEK TRADE WITH GERMANY, $BN

Source: IMF – Direction of trade statistics

1981 1986 1991 1996 2001 2006 2011

1009080706050403020100

Billio

ns, U

SD

CHART 2: GERMANY’S CUMULATIVE TRADE SURPLUS WITH GREECE

THE AUSTERITY THAT

GERMANY HAS IMPOSED

ON OTHERS HAS SENT ITS

OWN ECONOMY INTO RECESSION

info: Dr. Savvas Savouri is a Partner and Chief Economist of Toscafund.

By John Vickers

30 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

INVESTMENT

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS Gold 31

heo Paphitis is one of the UK’s most popular entrepreneurs, thanks in part to his participation in the popular BBC TV se-ries Dragons’

Den from 2005-2012 as one of the five “Dragons” – venture capitalists willing to invest their own money in business ideas in exchange for equity in the companies. By the time he became a TV celebrity, he had already gained a reputation for turning fail-ing companies into highly successful and profitable businesses. As a result of some of them, he was reported last year to have an estimated net worth of £210 million.

ends. Cyprus is an independent nation, one that’s very proud and hugely capable; one that punches way above its weight outside Cyprus but, unfortunately, way below what it could be achieving inside Cyprus.”

If the blame for Cyprus’ misfortunes is to be laid at someone’s feet, it is the island’s politicians who need to take a good look at themselves, Paphitis says.

“Nobody in their right mind is going to invest in Cyprus until the politicians put the right laws in place to protect people’s investments. You can have as many confer-ences as you like but you can’t insult the intelligence of sophisticated investors. No matter how much they like the projects, they will do serious due diligence and if they can’t secure their investment, why should they invest in us?”

The UK, where most of Paphitis’ busi-nesses are based, is currently enjoying positive economic results and he acknowl-edges that with unemployment now under control and interest rates low, people have started to feel more confident. “Bearing in mind that so much of the UK’s GDP is consumer-driven, as long as that continues, things will be looking good for the present government with an election coming up in May”.

David Cameron has promised to hold a referendum on Britain’s place in the EU. Does Paphitis foresee any possibility of the British people voting to leave the European Union?

“I’d be very surprised,” he says. “When

INVESTMENT

32 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

push comes to shove, I would expect that a more practical, logical decision will be taken. I think the EU has overstepped the mark in many ways and it needs to reform. There’s a bunch of politicians sitting in Brussels and taking decisions without con-sidering the feelings of the people. They need to realize that there is some very strong anti-Europe feeling around and to temper some of the powers and activities that the EU exerts on sovereign nations.”

In Paphitis’ view, the EU is already “far too close to a federalist relationship, which was never the intention” and he cites this as the reason why many people in the UK are unhappy with how the Union func-tions. “Being part of a common market or an economic union is undoubtedly the best thing for the United Kingdom,” he says, adding, “But each country should be re-sponsible for its own political decisions.”

For Theo Paphitis himself, business is booming. His highly successful ventures now include stationery chain Ryman, the homeware specialist chain Robert Dyas and lingerie retailer Boux Avenue. The com-bined group currently comprises 349 stores with 3,600 employees who serve over 28 million customers a year.

“2014 was a good year with record profits,” he enthuses, “and Boux Avenue is expanding overseas. We’ve just opened up in Dubai, Abu Dhabi and North Africa and we’re planning for Saudi Arabia so it’s a pretty big expansion in this area of the world. We’ve got some structural issues that need to be dealt with first but there’s no reason why Cyprus shouldn’t be the next stage.”

Most people know Theo Paphitis thanks to his seven years on Dragons’ Den, from which he ‘retired’ at the end of the 2012 series. “I missed it at first but I’m doing other things now, including a regular slot on The One Show on BBC1 so that keeps my ‘thespian hobby’ going,” he says but, despite the wealth, the public profile and the fame that TV invariably brings, he has a very clear picture of what he is:

“Ultimately I’m a shopkeeper. That’s what I do for a living and I never want to forget it.”

Last month he was back in his birth-place – Limassol – for the Cyprus Investors Summit at the Four Seasons Hotel, which is where he talked to Gold. Although real estate is not his usual investment area, he was interested to see what kind of projects were being pitched to the forty or so fund managers and investors attending the event. As someone who is proud to be a Cypriot (“I shout it from the rooftops,” he says), he has always kept a close watch on what’s happening on the island – indeed, he owns a number of companies here – and he is acutely aware of its good points... and its failings.

“There are some fantastic efforts being made to get the country back on a sound footing,” he says. “This is an incredible island and it should never have failed in the first place. And it certainly has no reason to fail going forward. But I know what Cypri-ots can be like – I am one myself! You’ve heard the saying about ‘snatching defeat from the jaws of victory’ and that is exactly what we’ve managed to do single-handedly. I just hope that we don’t continue to do that.”

Paphitis recognises that “there are people doing some great work to try and get this economy back on its feet” and he repeats that “Cyprus should never have found itself in this position” but he is aware that the island is perceived in a very negative light by many outsiders.

“When I meet people and we talk about Cyprus, I often hear remarks about there being no financial probity here, about cor-ruption, recklessness, laziness and more and I get very upset about this because such a description of the Cypriots is not one that I recognize.”

Traditional links with Greece, during what has been a critical time since the gov-ernment of Alexis Tsipras came to power, are also causing confusion about Cyprus among foreign observers, Paphitis believes. “I was very pleased to hear [Bank of Cyprus CEO] John Hourican’s comment about not allowing the ‘noise’ that’s going on in Greece to affect us,” he notes, adding that, “Of course we have cultural links and a common language but that’s where it

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS Gold 33

SPECIAL SUPPLEMENT

34 | Bybloserve Management Limited

36 | Christos Patsalides LLC

38 | Deloitte

40 | Der Arakelian-Merheje LLC

42 | EY Cyprus

44 | KPMG Ltd

46 | Savva & Associates

CONTENTS

CYPRUSCITIZENSHIP

GUIDET

he Government’s “Citizenship through Invest-ment” scheme, or to use its of-

-

-

-

34 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

he Firm’s clientele comprises a respectable volume of High Net Worth Corporations and Individuals around the globe. An assembled multilingual team of highly skilled and experienced professionals – including lawyers, accountants, tax advisors and ad-ministrators – allows us to quote “professional excellence”. The diversified composition of our team, and its close affiliation with the law firm I.Frangos & Associ-ates LLC, allows us to provide a wide range of services, not limited within the boundaries of merely corporate and fiduciary matters. The Council of Ministers decision dated 19/03/2014, by virtue of which amendments were made to the Scheme for Naturalization of Investors in Cyprus by Exception, as intended by the Government, has proved to be attractive to for-eign investors. Consequently, the interest expressed by both existing and new clients regarding the

aforesaid has increased substan-tially over the past year. This is firstly, due to the benefits attached to Cyprus citizenship including but not limited to free move-ment within the European Union and secondly, the attractiveness and flexibility offered by the said scheme. The most significant highlights of the scheme are as follows:• There are no Greek language proficiency requirements.• There is no requirement to re-side in Cyprus.• The timeframe for the comple-tion of the examination process is merely 3 (three) months.• Cyprus citizenship may also be acquired by the family members of the investor, without any fur-ther financial requirements.• The acquisition of Cyprus citizenship does not require the renouncement of existing citi-zenship, which may thereby be retained.• A combination of investments is available, thus allowing the inves-tor to spread investment risks. • Investments are required to be maintained for no longer than 3 (three) years from the date of ap-proval of the application by the Council of Ministers.• There is the option of apply-ing under a Major Collective Investment Scheme, whereby 5 (five) or fewer investors may col-lectively invest the total amount

BYBLOSERVE MANAGEMENT LTD IS A LICENSED FIRM AUTHORIZED TO PROVIDE, INTER ALIA, SPECIALIZED CORPORATE MANAGEMENT, TRUST AND FIDUCIARY SERVICES.

T

CONTACT DETAILS BYBLOSERVE MANAGEMENT LTD. Address: 10, Patron Street, CY-6051, Larnaca | Tel: (+357) 24812575 Fax: (+357) 24812583 | e-mail: [email protected] | Website: http://bybloserve.com/

BYBLOSERVE MANAGEMENT LIMITED

Iosif FrangosAdvocate (LLB, LLM)

Executive PartnerBybloserve Management Ltd.

“HOW SUCCESSFUL HAS THE CITIZENSHIP THROUGH INVESTMENT SCHEME BEEN? WHAT AMENDMENTS, IF ANY, WOULD YOU MAKE TO ITS PRESENT TERMS AND CONDITIONS?”“Improvements could be