Global Climate Change Alliance: Intra-ACP Programme Training Module Climate Change Finance

description

Transcript of Global Climate Change Alliance: Intra-ACP Programme Training Module Climate Change Finance

An initiative of the ACP Group of States funded by the European Union

Global Climate Change Alliance: Intra-ACP Programme

Training ModuleClimate Change Finance

Module 5 – Introduction to the Voluntary Carbon Market

Ms Isabelle MamatySenior Expert

Climate Support Facility

Module Structure

Functioning of Voluntary carbon markets: VER concept

Voluntary carbon market project procedures: standards, registries …

Voluntary carbon market project types

Voluntary carbon market vs. CDM project

Voluntary carbon market opportunities in developing countries

2

What is the Voluntary Market ?

Companies and individuals take responsibility for offsetting their own emissions as well as entities that purchase “pre-compliance” offsets.

They co-exist with compliance markets that are driven by regulated caps on GHG emissions

There are two types of voluntary market: cap-and-trade and offset

3

Functioning of the Voluntary Carbone Market

Uses Carbon Credits Generated through a project based system Uses a Baseline – Project Emissions Similar to CDM procedures (many projects use

same methodologies) Additionality verified by independent third party

The volume of carbon credits transacted voluntarily in 2010 represents less than a 0.3% share of the global carbon markets

4

Voluntary Cap- and-Trade

Cap-and-Trade (a limit on emissions of countries, regions, sectors)

Successful mandatory cap-and-trade examples: SO2 (US), European Trading Scheme (EU ETS)

There are no voluntary cap-and-trade markets functioning at present but a number of countries and regions of the world are considering them • e.g. California, USA

5

What is being traded?

Emission reductions

Measured in tonnes of Carbon Dioxide (tCO2)

Also called offsets or

Verified or Voluntary Emission Reductions (VER)

6

VER Concept

Voluntary Emission Reduction (VER) is a type of carbon offset exchanged in the voluntary or 'Over-the-Counter' (OTC) market for carbon credits

VERs are usually created by projects which have been verified outside of the Kyoto Protocol.

1 VER = 1 tonne of CO2 emissions.

VERs may be developed and calculated in compliance with one of several VER standards. These set-out rules define how emission reductions are measured. Standards provider assurance for buyer of VERs. At a minimum, all VERs should be verified by an independent third-party.

7

Voluntary Carbon Market buyers (1)

Who buys carbon credits? Companies, NGOs and individuals

For? Offsetting activities and products (travel, books,

music festivals) Pre-compliance with mandatory schemes

Why? Competitive advantage: Public relations, Branding,

Corporate Social Responsibility Investment/Resale

8

Voluntary Carbone Market buyers (2)

Purely voluntary buyers: Organisations, companies or individuals not subject to mandatory emission reductions Purchase CO2 emission credits and remove them from the market In order to offset their own emissions Motivation = ethical thinking or corporate social responsibility (CSR)

Pre-compliance buyers:Companies buying credits in anticipation of a mandatory market being established in the future They expect that by buying now they will benefit from a lower price than will prevail once emissions reductions are mandatory

9

Voluntary Carbone Market Suppliers

Project Developers: Develop GHG emissions- reduction projects and sell the VERs

Wholesalers: Only sell offsets in bulk and often have ownership of a portfolio of credits

Retailers: Sell small amounts of credits to individuals or organizations, usually online, and might have ownership of a portfolio of credits

Brokers: Do not own credits, but facilitate transactions between sellers and buyers.

10

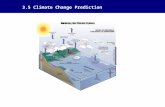

Emission reduction principle

11

GHG Emissions

Time

Project Emissions

Baseline Emissions

Emission Reductions

Projects that reduce or avoid carbon emissions are the source of credits in the voluntary carbon markets

Additionality

Similar to CDM projects: Additionality is a principal condition for the eligibility of any project in the voluntary carbon market.

Additionality is the requirement that the greenhouse gas emissions after implementation of a project activity are lower than those that would have occurred in the most plausible alternative scenario to the implementation of this project activity

12

Existing Standards and Methodologies

There are various standards, certification processes, and emissions registry services, but no standard is universally accepted.

However some standards are now widely recognized and accepted as a proof of credibility such as : the Voluntary Gold Standard; the GHG Protocol for Project Accounting; and the Climate, Community and Biodiversity Project Design Standards …

13

Existing Standards and Methodologies

Full-fledged Standards include accounting, monitoring and registrationo Gold Standardo Voluntary Carbon Standard 2007 (VCS 2007)o VER+o Chicago Climate Exchange (CCX)

Offset Standard Screens accept project under other standardso Voluntary offset Standard (VOS)

Bio-Sequestration Standards are sector specific standard (ex; forestry) o VCS AFOLU standardo Climate, Community &Biodiversity Standards (CDBS): CDM methodologies o Plan Vivo System

Offset Accounting Protocols provide definitions and procedures to account for GHG reductions from offset projects o GHG Protocolo ISO14064 14

Forest-based Standards

Plan Vivo: project specific methodologies CarbonFix BMV Standard Forest Carbon Standard International

Forest-specific standards made up one third of all active standards in 2010

15

Registries

Verified carbon reduction are converted to a saleable asset

Credits have unique ID Transferred from seller to buyer’s account Examples: Gold Standard Registry, VCS Registry,

Markit Registry, ACR, J-VER and others Many standards have their own registries

16

How to Develop a project

You have an idea for a project which reduces or avoids carbon emissions

1.The project requires some extra financing or needs some assistance to secure finance

2.It should contribute to the sustainable development of the local community

3.Get your partners together

4.Write a Project Idea Note (PIN)

5.Decide on a Standard to use

6.Present project to credit buyers

7.Get funding for your Project Design Document (PDD)

17

Different steps of Project Development Process

1. PROJECT IDEA AND PRELIMINARY ASSESSMENT

2. PROJECT DESIGN AND PLANNING

3. DEVELOPING A PROJECT DESIGN DOCUMENT

4. REVIEW PROJECT ACTIVITIES AND DEVELOP PROJECT IMPLEMNTATION STRATEGY

5. FINALISING FINANCING AND INVESTMENT ARRANGEMENTS

6. APPROVALS, VALIDATION AND REGISTRATION

7. IMPLEMENTATION AND MONITORING

8. VERIFICATION AND ISSUANCE

This process takes between 1 and 3 years or more…

Projects can generate income for 10 years or more

Voluntary Carbon Market: Project types

The top Three Voluntary Market Projects in 2010:

REDD / Avoided Conversion: 29%

Landfill methane: 16%

Wind: 11%

19

Other Voluntary market project types

Run-of-river hydro Agricultural soil Improved Forest management Livestock methane Energy efficiency Biomass

20

Price related to Project characteristics (1)

Project type is one of the most significant factors influencing price

Examples in 2010:o Two of the highest average prices: Solar ($16/tCO2e) and

biomass projectso Medium: (4-8/tCO2e) forestry, run-of- river hydro and landfill

o Lowest: large hydro ($1.7/tCO2e) and agricultural soil credits ($1.2/tCO2e)

21

Price related to Project characteristics (2)

Project location can also influence the price

Project environmental impacts

Contribution to local community – social impacts

Project size

Which Standard used e.g. Gold Standard or VCS for renewables, Plan Vivo for Forestry, SOCIALCARBON for projects with social benefits

22

Issues/ constraints for the Voluntary carbon market

Generally lower price than CDM (but not always) Quality assurance Transparency Many different buyers – market is changing Many standards and registries: can be confusing Market is still small – just 0.3% of the global

carbon market

23

Voluntary vs. Compliance (1)

Voluntary Compliance

Commodity VER CER

Price Variable accordingly with standard and project (typically around USD2-6)

Higher (around USD 11)

Coverage Voluntary/worldwide Annex 1 countries

Market size Smaller Larger

Volume 2009: 98 MtCO2 2010: 131 MtCO2

2009: 7,437 MtCO2 2010: 6,692 MtCO2

Regulation No Formal regulation UNFCC Executive Board (EB)

Methodologies CDM, Verified Carbon Standard (VSC), Gold Standard and Others

Approved by EB

Independent Third Party CDM DOEs and Others DOEs and EB

Voluntary vs. CDM (2)

Less bureaucratic / reduced transactions cost Cheaper to generate credits Flexibility and Innovation - niche/new sectors not

covered by CDM Can contribute more to sustainable development Value for co-benefits: environmental & social

contributions Easier to register forestry projects

25

Turning words into action Turning words into action

26

Discussion

Questions and answers Discussion and sharing of experiences

concerning the development of the voluntary carbon market projects

27

Have you ever developed a voluntary carbon market project in your sector or at your level ? what are the institutional and capacity needs in your organisation

to do so?

Where to get the information?

Site markit: http://www.markit.com/en/

Carbon Finance website of the World Bank: http://carbonfinance.org

28

Case studies

Presentation of case studies of projects relevant to the country needs.

29

• Thank you

• Contact: Dr. Pendo MARO, ACP Secretariat [email protected] or +32 495 281 494

www.gcca.eu/intra-acp