GHANDHARA NISSAN LIMITED · Quarterly Report March 2018 04 Directors’ Report Your Directors are...

Transcript of GHANDHARA NISSAN LIMITED · Quarterly Report March 2018 04 Directors’ Report Your Directors are...

Quarterly ReportMarch 31, 2018(Un-audited)

GHANDHARA NISSAN LIMITED

Contents

CompanyProfile

02 04Directors'Report(English)

Directors'Report(Urdu)

05 06CondensedInterim Statementof Financial Position

08CondensedInterim Statementof Cash Flows

09CondensedInterim Statementof Changes inEquity

10Notes to theCondensed InterimFinancialInformation

Directors' Report onConsolidatedCondensed InterimFinancial information (English)

Directors' Report onConsolidatedCondensed InterimFinancial information (Urdu)

16 17

18ConsolidatedCondensed Interim Statement of FinancialPosition

19 20ConsolidatedCondensed InterimStatement ofCash Flows

ConsolidatedCondensed InterimStatement of Changes in Equity

21 22Notes to theConsolidated Condensed InterimFinancial Information

07Condensed InterimStatement of Profit &Loss account & othercomprehensive income

Consolidated CondensedInterim Statementof Profit & Loss account& other comprehensive income

Company Profile

Board of Directors

Mr. Raza Kuli Khan Khattak ChairmanLt. Gen. (Retd.) Ali Kuli Khan Khattak President Mr. Ahmed Kuli Khan Khattak Chief Executive OfficerMr. Mushtaq Ahmed Khan (FCA) Mr. Jamil A. Shah Mr. Syed Haroon Rashid Mr. Mohammad Zia Mr. Muhammad Saleem Baig Mr. Polad Merwan Polad

Company Secretary

Mr. Muhammad Sheharyar Aslam

Registered Office

F-3, Hub Chowki Road, S.I.T.E., Karachi

Bankers of the Company

National Bank of Pakistan Faysal Bank Limited Habib Bank Limited Allied Bank Limited United Bank LimitedSoneri Bank Limited MCB Bank Limited The Bank of Tokyo – Mitsubishi, Ltd. Industrial & Commercial Bank of China Summit Bank Limited The Bank of Punjab The Bank of Khyber

Chief Financial Officer

Mr. Muhammad Umair

Factory

Truck / Car Plants Port Bin Qasim, Karachi

Audit Committee

Mr. Mohammad Zia ChairmanLt. Gen. (Retd.) Ali Kuli Khan Khattak MemberMr. Jamil A. Shah MemberMr. Polad Merwan Polad Member

Human Resource & Remuneration Committee

Lt. Gen. (Retd.) Ali Kuli Khan Khattak ChairmanMr. Ahmed Kuli Khan Khattak MemberMr. Muhammad Zia MemberMr. Jamil A. Shah MemberAskari Commercial Bank Limited

Meezan Bank LimitedBank Al Habib Limited Bank Alfalah IslamicAl Baraka Bank (Pakistan) LimitedJS Bank Limited

Quarterly Report March 2018

02

Quarterly Report March 2018

03

Auditors

M/s. Shinewing Hameed Chaudhri & Co. M/s. Junaidy Shoaib AsadChartered Accountants Chartered Accountants5th Floor, Karachi Chambers 1/6, Block-6, P.E.C.H.S, Mohtarma LaeeqHasrat Mohani Road Begum Road, Off Shahrah-e-Faisal

Near Nursery Flyover, Karachi ihcaraK

Legal & Tax Advisors

Ahmed & Qazi AssociatesAdvocates & Legal Consultants404 Clifton Centre, CliftonKarachi

Shekha & MuftiChartered AccountantsC-253, P.E.C.H.S., Block 6Off Shahrah-e-FaisalKarachi

Share Registrars

T.H.K. Associates (Pvt.) Ltd.

NTN:

0802990-3

Sales Tax Registration No:

12-03-8702-001-46

1st Floor, 40-C,Block-6, P.E.C.H.SKarachi-75400

Quarterly Report March 2018

04

Directors’ ReportYour Directors are pleased to present the report alongwith the condensed interim �nancial information of Ghandhara

Nissan Limited for the Nine months period ended March, 31, 2018.

In terms of value, the Company’s net turnover was Rs. 1,740.4 million as compared to Rs. 4,035.2 million during the same

period of last year. The decrease is mainly due to discontinuation of UD Trucks. The Company has started CKD operations

of JAC Trucks which earlier received an overwhelming market response in CBU condition. In addition to this, the regular

Dongfeng CBU business together with contract assembly has also contributed signi�cantly in company’s performance.

The operational pro�t of your Company for the nine months was Rs 330.8 million as compared to Rs. 614.8 million in the

corresponding period of last year. Pro�t after tax for the nine months was Rs. 242.8 million. This pro�t translates into

earnings per share of Rs. 5.40 as against Rs. 9.71 during the corresponding period of last year.

The company has been awarded “Category-B Brown�eld Investment Status” by the Ministry of Industries and Production

under the Automotive Development Policy 2016-21, for the assembly of Datsun passenger cars.

To meet the �nancing needs of the growing operations, the Directors have granted approval for issuance of Right shares.

This, in addition to the funds generated from the partial divestment of shares in an Associated Company, will facilitate in

strengthening the �nancial health of the company.

Further, the company has signed Importer Agreement with Renault Trucks SAS, France for heavy commercial vehicles. By

virtue of that Agreement, few units have been imported from France in CBU condition primarily for “test & trial” purpose.

Related Party Transactions

All transactions with related parties have been executed at arm’s length and have been disclosed in the condensed interim

�nancial information.

The directors are also grateful to the Principals, customers, vendors, bankers and other business associates for their

continued patronage and support.

For and on behalf of the Board of Directors

Karachi Dated: April 24, 2018

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad ZiaDirector

Quarterly Report March 2018

05Karachi Dated: April 24, 2018

� �ہ � وا� �� � � �رچ � � �� ��� �ن ��را �� � � �� � �ز

� �ڈا��� آپ

�۔ �� ِ�� �� ��ت �� ��� �رى

��� ر�رٹ

312018

1,740.4

JAC CBU

Dongfeng CBU

UD TrucksJAC Trucks 4,035.2

330.8 614.8

242.8 9.71

5.40

“Category-B Brown�eld Investment Status” ۔� �ازہ � ����� � �رى ���� �

���

� �اون � “ز�ہ۔ ” � �

د� � ��ے � درآ�ات �� � ،�ا� �� ��ر� � �ں �ڑ�� �� �ى � �� � � �وہ � اس

درآ� �� � � �ا� �� �� � (� �� � �) ��� آز�� � � �ر �دى �

��� �

���� �

��� � ��ہ اس � �� ��

۔ � �� � ر �

“RENAULT”SAS

CBU

� ��ت ��� ��� �رى � �ہ � �۔ � �� �

��� �� � ا�ر � � د�� � �� �رو�رى

�

“DATSUN”2016-21 ڈا�

�و� ��وى �� ��� س اورا

Quarterly Report March 2018

06

Condensed Interim Statement of Financial PositionAs at March 31, 2018

Note

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

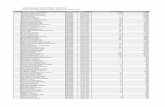

----------- Rupees ‘000 -----------ASSETS Non current assets Property, plant and equipmentIntangible assetsLong term investmentsLong term loans Long term deposits Due from Subsidiary Company Current assets Stores, spares and loose toolsStock-in-tradeTrade debts Loans and advancesDeposits and prepaymentsOther receivables Accrued interest / mark-upTaxation - net Bank balances

Non current asset classi�ed as held for sale Total assetsEQUITY AND LIABILITIESShare capital and reservesAuthorised capital 80,000,000 (June 30, 2017: 80,000,000) ordinary shares of Rs.10 eachIssued, subscribed and paid-up capital 45,002,500 (June 30, 2017: 45,002,500) ordinary shares of Rs.10 eachShare premiumUnappropriated pro�tEquity without surplus on revaluationSurplus on revaluation of �xed assetsTotal equity with surplus on revaluationLiabilities Non current liabilitiesLiabilities against assets subject to �nance leaseLong term depositsDeferred gain on sale and lease back of transactionDeferred taxation

Current liabilitiesTrade and other payablesAccrued mark-up on running �nances Running �nances under mark-up arrangementsCurrent portion of liabilities against assets subject to �nance lease Taxation - net Unclaimed dividend Total liabilitiesContingencies and commitmentsTotal equity and liabilities

The annexed notes 1 to 14 form an integral part of this condensed interim �nancial information.

2,044,591 2,933

242,630 8,315

20,110 391,073

2,709,652

92,268 489,777 498,759

58,825 36,516 57,430 14,930

4,847 150,934

1,404,286 -

4,113,938

800,000

450,025 40,000

1,352,113 1,842,138

967,844 2,809,982

49,051 9,611

3 287,377 346,042

694,104 6,338

233,445

13,179 -

10,848 957,914

1,303,956

4,113,938

1,983,445 50

242,630 9,546

19,266 313,140

2,568,077

86,474 277,690 181,088

49,773 16,625 18,082

7,669 -

514,390 1,151,791

137,909 3,857,777

800,000

450,025 40,000

1,313,543 1,803,568

988,570 2,792,138

53,699 9,611

6 282,527 345,843

621,077 347

-

18,474 72,166

7,732 719,796

1,065,639

3,857,777

5

6

7

8

9

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad UmairChief Financial Officer

Muhammad ZiaDirector

For the nine months period ended March 31, 2018

Note

Revenue

Cost of sales

Gross pro�t

Distribution cost

Administrative expenses

Other income

Other expenses

Pro�t from operations

Finance cost

Pro�t before taxation

Taxation

Pro�t after taxation

Other comprehensive income

Total comprehensive income

Earnings per share - basic

and diluted

The annexed notes 1 to 14 form an integral part of this condensed interim �nancial information.

10

March 31,2018

March 31,2017

----------------------------- Rupees ‘000 -----------------------------

Quarter ended

725,887

(603,702)

122,185

(13,123)

(53,089)

22,419

(7,055)

71,337

(8,365)

62,972

(17,170)

45,802

-

45,802

1.02

1,385,559

(1,098,694)

286,865

(9,959)

(57,902)

17,119

(16,147)

219,976

(2,106)

217,870

(62,480)

155,390

-

155,390

3.45

March 31,2018

March 31,2017

Nine months period ended

1,740,435

(1,381,484)

358,951

(35,091)

(144,587)

175,378

(23,814)

330,837

(14,014)

316,823

(73,966)

242,857

-

242,857

5.40

4,035,234

(3,268,072)

767,162

(30,821)

(175,723)

99,376

(45,137)

614,857

(5,834)

609,023

(172,011)

437,012

-

437,012

9.71

Quarterly Report March 2018

07

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad UmairChief Financial Officer

Muhammad ZiaDirector

Condensed Interim Statement of Profit and Loss Accountand other Comprehensive Income (Unaudited)

----------------------------- Rupees --------------------------------

March 31,2018

March 31,2017

Quarterly Report March 2018

08

Condensed Interim Statement of Cash Flows (Un-audited) For the nine months period ended March 31, 2018

----------- Rupees ‘000 -----------

Nine month period ended

CASH FLOWS FROM OPERATING ACTIVITIES Pro�t before taxationAdjustments for non cash charges and other items: Depreciation and amortisation Provision for gratuity Interest income Dividend income Gain on disposal of property, plant and equipment Amortization of gain on sale and lease back of �xed assets Finance cost Net exchange loss / (gain)Operating pro�t before working capital changes (Increase) / decrease in current assets: Stores, spares and loose tools Stock-in-trade Trade debts Loans and advances Deposits and prepayments Other receivables

Increase / (decrease) in trade and other payablesCash (used in) / generated from operations Gratuity paid Long term deposits Long term loans - net Finance cost paid Taxes paid Net cash used in operating activities CASH FLOWS FROM INVESTING ACTIVITIES Payments for �xed capital expenditure and intangibles Proceeds from disposal of property, plant and equipment / non current asset classi�ed as held for sale Interest received Interest bearing advance (to) / from subsidiary - net Dividend income Net cash generated from investing activitiesCASH FLOWS FROM FINANCING ACTIVITIES Lease �nances - net Running �nances - net Dividend paid Net cash used in �nancing activitiesNet decrease in cash and cash equivalents Cash and cash equivalents - at beginning of the period Cash and cash equivalents - at end of the period The annexed notes 1 to 14 form an integral part of this condensed interim �nancial information.

316,823

78,650 5,762

(33,445) (77,493) (36,509)

(3) 14,014

310 268,109

(5,794) (212,087) (317,671)

(9,052) (19,891) (39,348)

(603,843)80,382

(255,352) (13,427)

(844) 1,231

(8,023) (146,129) (422,544)

(133,891)

177,913 26,184

(77,933) 77,493 69,766

(22,226) 233,445

(221,897) (10,678)

(363,456) 514,390 150,934

609,023

68,236 8,653

(30,198) (51,662)

(3,689)

(3) 5,834 (532)

605,662

(1,858) (39,236) (26,750) (41,885)

4,163 58,369

(47,197) (462,650)

95,815 (40,425)

(1,737) (1,510) (5,490)

(109,165) (62,512)

(36,753)

5,853 29,041

140,739 51,662

190,542

(10,967) -

(222,051) (233,018) (104,988) 375,408 270,420

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad UmairChief Financial Officer

Muhammad ZiaDirector

Balance as at July 1, 2016 (Audited) Transaction with owners recognised directly in equity Final dividend for the year ended June 30, 2016 at the rate of Rs.5.00 per share Total comprehensive income for the nine months period ended March 31, 2017 Pro�t for the period Other comprehensive income Transfer from surplus on revaluation of �xed assets on account of incremental depreciation - net of deferred taxation Balance as at March 31, 2017 (Un-audited) Balance as at July 1, 2017 (Audited) Transaction with owners recognised directly in equity Final dividend for the year ended June 30, 2017 at the rate of Rs.5.00 per share Total comprehensive income for the nine months period ended March 31, 2018 Pro�t for the period Other comprehensive income Transfer from surplus on revaluation of �xed assets on account of incremental depreciation - net of deferred taxation Balance as at March 31, 2018 (Un-audited)

The annexed notes 1 to 14 form an integral part of this condensed interim �nancial information.

Condensed Interim Statement of Changes in Equity (Un-audited) For the nine months period ended March 31, 2018

-------------------------------------- Rupees ‘000 --------------------------------------

Quarterly Report March 2018

09

Issued,subscribed

and paid-upcapital

450,025

-

-

- -

-

450,025

450,025

-

-

- -

-

450,025

Share premium(Capitalreserve)

40,000

-

-

- -

-

40,000

40,000

-

-

- -

-

40,000

Unappro-priated pro�t

(Revenuereserve)

1,111,191

(225,013)

437,012

- 437,012

21,820

1,345,010

1,313,543

(225,013)

242,857

- 242,857

20,726

1,352,113

Equitywithout

surplus onrevaluation

1,601,216

(225,013)

437,012

- 437,012

21,820

1,835,035

1,803,568

(225,013)

242,857

- 242,857

20,726

1,842,138

Surplus onrevaluation of

�xed assets(Capital reserve)

1,017,664

-

-

- -

(21,820)

995,844

988,570

-

-

- -

(20,726)

967,844

Total equitywith surplus

onrevaluation

2,618,880

(225,013)

437,012

- 437,012

-

2,830,879

2,792,138

(225,013)

242,857

- 242,857

-

2,809,982

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad UmairChief Financial Officer

Muhammad ZiaDirector

Quarterly Report March 2018

10

Notes to the Condensed Interim Financial Information (Un-audited) For the nine months period ended March 31, 2018

1. THE COMPANY AND ITS OPERATIONS Ghandhara Nissan Limited (the Company) was incorporated on August 8, 1981 in Pakistan as a private limited company and subsequently converted into a public limited company on May 24,1992. The registered o�ce of the Company is situated at F-3, Hub Chauki Road, S.I.T.E., Karachi. Its manufacturing facilities are located at Port Qasim, Karachi. The Company's shares are listed on Pakistan Stock Exchange Limited. The principal business of the Company is assembly / progressive manufacturing of Nissan passenger Cars, UD Trucks & buses and JAC trucks, import and marketing of Nissan vehicles, import and sale of DongFeng and JAC Complete Built-up Trucks and assembly of other vehicles under contract agreement. The Company is a subsidiary of Bibojee Services (Private) Limited which holds 62.32% (June 30, 2017: 62.32%) of issued, subscribed and paid-up capital of the Company. 2. BASIS OF PREPARATION This condensed interim �nancial information has been prepared in accordance with the accounting and reporting standards as applicable in Pakistan for interim �nancial reporting. The accounting and reporting standards as applicable in Pakistan for interim �nancial reporting comprise of: - International Accounting Standards (IAS) 34, Interim Financial Reporting, issued by the International Accounting Standards Board (IASB) as noti�ed under the Companies Act, 2017 (the Act); and - Provisions of and directives issued under the Act. Where the provisions of and directives issued under the Act di�er with the requirements of IAS 34, the provisions of or directives issued under the Act have been followed. 3. ACCOUNTING POLICIES The signi�cant accounting policies and the methods of computation adopted in the preparation of this condensed interim �nancial information are consistent with those applied in the preparation of audited annual �nancial statements for the year ended June 30, 2017. There are certain new International Financial Reporting Standards (standards), amendments to published standards and interpretations that are mandatory for the �nancial year beginning on July 1, 2017. These are considered not to be relevant or to have any signi�cant e�ect on the Company's �nancial reporting and operations and are, therefore, not disclosed in this condensed interim �nancial information.

4. ACCOUNTING ESTIMATES AND JUDGEMENTS

The preparation of this condensed interim �nancial information in conformity with the approved accounting standards requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the Company's accounting policies. Estimates and judgements are continually evaluated and are based on historical experience and other factors, including the expectation of future events that are believed to be reasonable under the circumstances. Actual results may di�er from these estimates. During the preparation of this condensed interim �nancial information, the signi�cant judgements made by management in applying the Company's accounting policies and the key sources of estimation and uncertainty were the same as those that applied to the audited annual �nancial statements of the Company for the year ended June 30, 2017.

5.1 Operating �xed assets Net book value at beginning of the period / year Additions during the period / year Disposals, costing Rs.6,379 thousand (June 30, 2017: Rs.9,669 thousand) - at net book value Assets classi�ed as held for sale costing Rs.Nil (June 30, 2017: Rs. 162,724 thousand) - at book value Depreciation charge for the period / year Net book value at end of the period / year 5.2 Additions to operating �xed assets, including transfer from capital work-in-progress, during the period / year were as follows: Leasehold land Building on free hold land Plant and machinery Furniture and �xtures Vehicles - owned - leased Other equipment O�ce equipment Computers

Quarterly Report March 2018

11

Notes to the Condensed Interim Financial Information (Un-audited) For the nine months period ended March 31, 2018

Note

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

----------- Rupees ‘000 -----------

5.1

5.2

1,940,286

104,305 2,044,591

1,920,332

63,113 1,983,445

5. PROPERTY, PLANT AND EQUIPMENT Operating �xed assets Capital work-in-progress

1,920,332

102,002

(3,495)

-

(78,553)

1,940,286

-

44,751

18,259

256

9,075 12,283

12,314

4,338

726

102,002

1,846,454

309,256

(2,294)

(137,909)

(95,175)

1,920,332

207,980

-

39,442

14,710

4,300 32,523

6,188

3,042

1,071

309,256

Quarterly Report March 2018

12

Notes to the Condensed Interim Financial Information (Un-audited) For the nine months period ended March 31, 2018

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

----------- Rupees ‘000 -----------

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

----------- Rupees ‘000 -----------

149,995

92,635

1,875

(1,875)

-

242,630

149,995

92,635

1,875

(1,875)

-

242,630

6. LONG TERM INVESTMENTS Subsidiary Company - at cost

Ghandhara DF (Private) Limited

14,999,500 (June 30, 2017: 14,999,500) ordinary shares of Rs.10 each Equity held: 99.99% (June 30, 2017: 99.99%) Break-up value per share on the basis of latest �nancial statements is Rs. 33.11(June 30, 2017: Rs.24.05) Associated Company - at cost Ghandhara Industries Limited 5,166,168 (June 30, 2017: 5,166,168) ordinary shares of Rs.10 each Equity held: 24.25% (June 30, 2017: 24.25%) Fair value: Rs.4,312.045 million (June 30, 2017: Rs.3,358.577 million)

Others - available for sale Automotive Testing & Training Center (Private) Limited 187,500 (June 30, 2017: 187,500) ordinary shares of Rs.10 each - cost Provision for impairment

7. DUE FROM SUBSIDIARY COMPANY - Unsecured and interest bearing

The Company has an aggregate cash limit of Rs. 800 million that can be provided as loan to Ghandhara DF (Private) Limited (Subsidiary company) for its working capital requirements. This advance is unsecured and has been granted for a period of three years. It carries mark-up at rate of six months KIBOR+3.00% and is receivable on quarterly basis.

8. BANK BALANCES Cash at banks on: - current accounts - deposits accounts - term deposits receipts Provision for doubtful bank balances

62,329 10,517 82,000

154,846 (3,912)

150,934

202,785 10,517

305,000 518,302

(3,912) 514,390

Quarterly Report March 2018

13

Notes to the Condensed Interim Financial Information (Un-audited) For the nine months period ended March 31, 2018

Note

10.1

10. COST OF SALES Finished goods at beginning of the period Cost of goods manufactured Purchases - trading goods Finished goods at end of the period 10.1 Cost of goods manufactured Raw materials and components consumed Factory overheads

March 31,2018

March 31,2017

139,276

141,387

527,970

669,357

808,633

(204,931)

603,702

8,124

133,263

141,387

148,259

1,002,751

229,642

1,232,393

1,380,652

(281,958)

1,098,694

855,161

147,590

1,002,751

213,001

401,067

972,347

1,373,414

1,586,415

(204,931)

1,381,484

8,124

392,943

401,067

113,586

3,046,058

390,386

3,436,444

3,550,030

(281,958)

3,268,072

2,572,314

473,744

3,046,058

March 31,2018

March 31,2017

------------------------------ Rupees ‘000 --------------------------------

Quarter ended Nine months ended--------------------------------(Un-Audited)--------------------------------

9. CONTINGENCIES AND COMMITMENTS

9.1 There is no change in status of the contingencies as disclosed in note 28.1 of the audited annual �nancial statements of the Company for the year ended June 30, 2017.

9.2 Commitment in respect of irrevocable letters of credit as at March 31, 2018 aggregate to Rs.44.153 million (June 30, 2017: Rs.34.80 million).

9.3 Guarantees aggregating Rs.4.951 million (June 30, 2017: Rs.15.787 million) are issued by banks of the Company to various government and other institutions. Further, the Company has issued corporate guarantees aggregating Rs.609.141 million (June 30, 2017: Rs.259.443 million) to the commercial banks against letters of credit facilities utilised by the Subsidiary Company.

Quarterly Report March 2018

14

Notes to the Condensed Interim Financial Information (Un-audited) For the nine months period ended March 31, 2018

11. TRANSACTIONS WITH RELATED PARTIES 11.1 Signi�cant transactions with related parties are as follows:

----------- Rupees ‘000 -----------

March 31,2018

Name Nature oftransaction March 31,

2017

(i) Holding Company Bibojee Services (Private) Limited - 62.32% shares held in the Company

(ii) Subsidiary Company Ghandhara DF (Private) Limited 99.99% shares held by the Company

(iii) Associated Companies Ghandhara Industries Limited 24.25% shares held by the Company

The General Tyre and Rubber Company of Pakistan Limited Gammon Pakistan Limited Janana De Malucho Textile Mills Limited (iv) Others UD Trucks Corporation, Japan

Staff provident fund Staff gratuity fund Key management personnel

Corporate office rentDividend

Contract assembly chargesPurchase of partsSale of partsLong term advances given - net Long term advances recovered - net Interest incomeInterest receivedGuarantee commissionReimbursement of expenses

Contract assembly chargesHead office rentBody fabricationSale of partsPurchase of partsDividend incomeReimbursement of expenses Purchase of tyres Office rent Reimbursement of expenses

RoyaltyDividendPurchases of complete knock down kitsContribution madeContribution madeRemuneration and other benefits

4,500 140,232

102,896

75 52,105

77,933

- 33,066 26,043

4,872

-

579,337 1,980

- 6

16 77,493

1,003

72

2,250

1,256

- 18,235

- 6,058

13,427

55,820

7,350 140,232

31,491 1,520 2,221

-

140,739 26,994

- 3,094

246

292,839 1,320

676 1,056

8 51,662

356

41,308

2,250

763

11,312 18,235

2,009,252 5,446

40,425

53,153

Un-audited --Nine Months ended--

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad UmairChief Financial Officer

Muhammad ZiaDirector

12. FINANCIAL RISK MANAGEMENT

The Company's activities expose it to a variety of �nancial risks: credit risk, liquidity risk and market risk (including foreign exchange risk, interest rate risk and other price risk). The condensed interim �nancial information does not include all �nancial risk management information and disclosures required in the audited annual �nancial statements and should be read in conjunction with the audited annual �nancial statement for the year ended June 30, 2017. There has been no change in Company's sensitivity to these risks since June 30, 2017 except for general exposure to �uctuations in foreign currency and interest rates. There have been no change in the risk management policies during the period. There have been no signi�cant changes in the business or economic circumstances during the period that would have a�ected the fair values of the �nancial assets of the Company. Further, no re-classi�cations in the categories of �nancial assets have been made since June 30, 2017. 13. CORRESPONDING FIGURES In order to comply with the requirements of International Accounting Standard 34 - 'Interim Financial Reporting', the condensed interim statement of �nancial position has been compared with the balances of audited annual �nancial statements of the Company for the year ended June 30, 2017, whereas, the condensed interim statement of pro�t and loss account and other comprehensive income, condensed interim statement of cash �ows and condensed interim statement of changes in equity have been compared with the balances of comparable period of condensed interim �nancial information of the Company for the nine months period ended March 31, 2017. In order to ful�ll the requirements of the Act, following corresponding �gures have been rearranged and reclassi�ed for better presentation:

However there is no impact of above reclassi�cations on total assets and pro�t of the Company, therefore statement of �nancial position as at July 1, 2016 has not been presented.

14. DATE OF AUTHORIZATION FOR ISSUE

This condensed interim �nancial information was authorized for issue on April 24, 2018 by the Board of Directors of the Company.

Quarterly Report March 2018

15

Notes to the Condensed Interim Financial Information (Un-audited) For the nine months period ended March 31, 2018

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

----------- Rupees ‘000 -----------

June 30,2017

-- Rupees ‘000 --

1,100 45,210

821 708 864

7,528

39,445

11.2 Period / year end balances are as follows: Receivables from related parties Long term loans Trade debts Loans and advances Deposits and prepayments Other receivables Accrued interest / mark-up Payable to related parties Trade and other payables

Reclassi�ed from component Surplus on revaluation of �xed assets (out of equity) Unclaimed dividend (trade and other payables)

Reclassi�ed to component

with in equity (included as part of total equity as capital reserve) as separate line item on the face of statement of �nancial position

988,570

7,732

650 126,911

600 2,840 1,757

14,552

39,023

Quarterly Report March 2018

16

Directors’ ReportThe directors are pleased to present their report together with consolidated condensed interim �nancial information of Ghandhara Nissan Limited (GNL) and its subsidiary Ghandhara DF (Pvt.) Limited (GDFPL) for the nine months period ended March, 31 2018.

The Company has annexed consolidated un-audited condensed interim �nancial information alongwith its standalone un-audited condensed interim �nancial information.

The consolidated un-audited condensed interim �nancial information shows turnover ofRs. 3,728.7 million, gross pro�t of Rs. 615.4 million and pro�t after tax of Rs. 562.1 million for the nine months period ended March, 31 2018.

Dongfeng business has remained a major contributor in the consolidated performance of the company during the current period. This has been achieved as a result of incredible e�orts made by GDFPL in promoting the Chinese brand throughout the Country.

For and on behalf of the Board of Directors

Karachi Dated: April 24, 2018

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad ZiaDirector

Quarterly Report March 2018

17

اس ��� � �د��� �۔�

��

ر�رٹ � رچ312018 � �ہ �� ��ت� ��� �رى

�� رچ312018 3,728.7

۔ � 562.1 615.4

ر�رٹ � �ہ �

� � � �� �� � � �۔�� ر� ر دا ا� �ا� �� �ر�د� �� � ن � دورا � �ت ہ ر ��د �رو�

۔ � �� � �� �� �� � �� �� � ��ں � �

��� ��� ذر�� � �� ا �

��� ا ى ڈ � ��

�د�� � �وغ (GDFPL)�ا�

�� ��ت ��� �رى ا�ادى � ��ت �� ��� �رى

Karachi Dated: April 24, 2018

Quarterly Report March 2018

18

Consolidated Condensed Interim Statement of Financial PositionAs at March 31, 2018

Note

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

----------- Rupees ‘000 -----------ASSETS Non current assets Property, plant and equipmentIntangible assets Long term investments Long term loans Long term deposits Current assets Stores, spares and loose tools Stock-in-trade Trade debts Loans and advances Deposits and prepayments Other receivables Taxation - net Cash and bank balances Non current asset classi�ed as held for saleTotal assets EQUITY AND LIABILITIES Share capital and reservesAuthorised capital 80,000,000 (June 30, 2017: 80,000,000) ordinary shares of Rs.10 each Issued, subscribed and paid-up capital 45,002,500 (June 30, 2017: 45,002,500) ordinary shares of Rs.10 each Share premium Items credit directly in equity by an Associate Unappropriated pro�t Equity without surplus on revaluation attributable to shareholders of the Holding Company Surplus on revaluation of �xed assets Equity with surplus on revaluation attributable to shareholders of the Holding CompanyNon-controlling interestTotal equity Liabilities Non current liabilities Liabilities against assets subject to �nance lease Long term deposits Deferred gain on sale and lease back transaction Deferred taxation Current liabilities Trade and other payables Accrued mark-up on running �nances Running �nances under mark-up arrangements Current portion of liabilities against assets subject to �nanace lease Taxation - net Unclaimed dividend Total liabilities Contingencies and commitmentsTotal equity and liabilities The annexed notes 1 to 14 form an integral part of this consolidated condensed interim �nancial information.

1,992,030 258

857,012 9,546

19,266 2,878,112

86,474 699,540 516,167

51,235 31,372 89,761

- 573,693

2,048,242 137,909

5,064,263

800,000

450,025 40,000 68,426

1,818,045

2,376,496 1,389,904

3,766,400 26

3,766,426

92,194 9,611

6 282,843 384,654

862,747 347

-

38,313 4,044 7,732

913,183 1,297,837

5,064,263

6

7

8

9

2,051,888 3,089

1,040,242 8,315

20,110 3,123,644

92,268 1,367,808 1,443,823

66,741 82,587

125,980 134,565 154,257

3,468,029 -

6,591,673

800,000

450,025 40,000 69,859

2,175,844

2,735,728 1,367,745

4,103,473 40

4,103,513

77,546 9,611

3 287,693 374,853

1,458,906 7,618

610,685

25,250 -

10,848 2,113,307 2,488,160

6,591,673

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad UmairChief Financial Officer

Muhammad ZiaDirector

Quarterly Report March 2018

19

For the nine months period ended March 31, 2018

Revenue Cost of sales Gross pro�t Distribution cost Administrative expenses Other income Other expenses Pro�t from operations Finance cost Share of pro�t of an Associate Pro�t before taxation Taxation Pro�t after taxation Other comprehensive income Total comprehensive income Attributable to: - Shareholders of the Holding Company - Non-controlling interest

Earnings per share - basic and diluted

The annexed notes 1 to 14 form an integral part of this consolidated condensed interim �nancial information.

Note

9

March 31,2018

March 31,2017

----------------------------- Rupees ‘000 -----------------------------

Quarter ended

-------------------------------- Rupees --------------------------------

1,384,911

(1,181,043)

203,868

(16,060)

(58,249)

7,597

(7,055)

130,101

(10,083)

120,018

109,215

229,233

(31,197)

198,036

-

198,036

198,031

5

198,036

4.40

2,000,715

(1,614,270)

386,445

(12,608)

(60,782)

8,440

(16,147)

305,348

(2,199)

303,149

59,997

363,146

(87,551)

275,595

-

275,595

275,591

4

275,595

6.12

March 31,2018

March 31,2017

Nine months period ended

3,728,686

(3,113,312)

615,374

(42,562)

(161,203)

61,723

(23,814)

449,518

(15,884)

433,634

260,723

694,357

(132,257)

562,100

-

562,100

562,086

14

562,100

12.49

5,326,509

(4,357,792)

968,717

(40,686)

(182,227)

19,159

(45,137)

719,826

(6,408)

713,418

162,206

875,624

(220,322)

655,302

-

655,302

655,295

7

655,302

14.56

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad UmairChief Financial Officer

Muhammad ZiaDirector

Consolidated Condensed Interim Statement of Profit and Loss Accountand other Comprehensive Income (Unaudited)

Quarterly Report March 2018

20

Consolidated Condensed Interim Statement of Cash Flows (Un-audited)

For the nine months period ended March 31, 2018

March 31,2018

March 31,2017

----------- Rupees ‘000 -----------CASH FLOWS FROM OPERATING ACTIVITIESPro�t before taxationAdjustments for non-cash charges and other items: Depreciation and amortisation Interest income Finance cost Gain on disposal of property, plant and equipment Net exchange gain Amortization of gain on sale and lease back transaction Share of pro�t of an Associated Company Provision for gratuityOperating pro�t before working capital changes(Increase) / decrease in current assets: Stores, spares and loose tools Stock-in-trade Trade debts Loans and advances Deposit and prepayments Other receivables

Increase / (decrease) in trade and other payablesCash (used in) / generated from operations Gratuity paid Long term loans-net Long term deposits Finance cost paid Taxes paidNet cash (used in) / generated from operating activitiesCASH FLOWS FROM INVESTING ACTIVITIES Payment for �xed capital expenditure and intangibles Proceeds from disposal of property, plant and equipment / non current asset classi�ed as held for sale Interest income received Dividend incomeNet cash generated from investing activitiesCASH FLOWS FROM FINANCING ACTIVITIES Lease �nances - net Running �nances-net Dividend paidNet cash generated from / (used) in �nancing activitiesNet decrease in cash and cash equivalentsCash and cash equivalents - at beginning of the periodCash and cash equivalents - at end of the period

The annexed notes 1 to 14 form an integral part of this consolidated condensed interim �nancial information.

694,357

79,990 (25,214) 15,884

(36,509) (992)

(3) (260,723)

5,762 472,552

(5,794) (668,268) (927,656)

(15,506) (51,215) (36,219)

(1,704,658) 604,816

(627,290) (13,427)

1,231 (844)

(8,613) (266,016) (914,959)

(133,891)

177,913 25,214 77,493

146,729

(39,994) 610,685

(221,897) 348,794

(419,436) 573,693 154,257

875,624

69,898 (3,240) 6,408

(3,692) (1,200)

(4) (162,206)

8,653 790,241

(1,858) 177,038 (93,889) (45,411)

8,021 115,281 159,182

(557,277) 392,146 (40,425)

(1,510) (1,737) (6,064)

(168,115) 174,295

(36,805)

5,853 3,240

51,662 23,950

(10,968) -

(222,051) (233,019)

(34,774) 394,789 360,015

Nine months period ended

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad UmairChief Financial Officer

Muhammad ZiaDirector

Consolidated Condensed Interim Statement of Changes in Equity (Un-audited)

For the nine months period ended March 31, 2018

-------------------------------------------------------- Rupees ‘000 --------------------------------------------------------

Balance as at July 1, 2016 (Audited)

Transaction with owners recognised directly in equity

Final dividend for the year ended June 30, 2016 at the rate of Rs.5.00 per shareTotal comprehensive income for the nine months period ended March 31, 2017 Pro�t for the period Other comprehensive income

Transfer from surplus on revaluation of �xed assets on account of incremental depreciation - net of deferred taxationE�ect of item directly credited in equity by an Associated CompanyBalance as at March 31, 2017 (un-audited)Balance as at July 1, 2017 (Audited)Transaction with owners recognised directly in equity Final dividend for the year ended June 30, 2017 at the rate of Rs.5.00 per share

Total comprehensive income for the nine months period ended March 31, 2018 Pro�t for the period Other comprehensive income

Transfer from surplus on revaluation of �xed assets on account of incremental depreciation - net of deferred taxationE�ect of item directly credited in equity by an Associated Company

Balance as at March 31, 2018 (un-audited)

The annexed notes 1 to 14 form an integral part of this consolidated condensed interim �nancial information.

Item credited directly

in equity byan Associate

(Capitalreserve)

Quarterly Report March 2018

21

450,025

-

- - -

-

- 450,025 450,025

-

- - -

-

-

450,025

1,863,095

(225,013)

655,295 -

655,295

21,820

1,646 2,316,843 2,376,496

(225,013)

562,086 -

562,086

20,726

1,433

2,735,728

1,421,841

-

- - -

(21,820)

- 1,400,021 1,389,904

-

- - -

(20,726)

(1,433)

1,367,745

3,284,936

(225,013)

655,295 -

655,295

-

1,646 3,716,864 3,766,400

(225,013)

562,086 -

562,086

-

-

4,103,473

Non-controlling

interest

11

-

7 - 7

-

- 18 26

-

14 -

14

-

-

40

40,000

-

- - -

-

- 40,000 40,000

-

- - -

-

-

40,000

66,516

-

- - -

-

1,646 68,162 68,426

-

- - -

-

1,433

69,859

1,306,554

(225,013)

655,295 -

655,295

21,820

- 1,758,656 1,818,045

(225,013)

562,086 -

562,086

20,726

-

2,175,844

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad UmairChief Financial Officer

Muhammad ZiaDirector

Issued,subscribed

and paid-upcapital

Share premium(Capitalreserve)

Unappro-priatedpro�t

(Revenuereserve)

Equitywithoutsurplus

onrevaluation

Surplus onrevaluation of

�xed assets(Capital-reserve)

Totalequity

with surpluson

revaluation

Quarterly Report March 2018

22

Notes to the Consolidated Condensed Interim Financial InformationFor the nine months period ended March 31, 2018

1. THE GROUP AND ITS OPERATIONS

The Group consists of Ghandhara Nissan Limited (the Holding Company) and Ghandhara DF (Private) Limited (the Subsidiary Company). 1.2 Ghandhara Nissan Limited Ghandhara Nissan Limited (the Holding Company) was incorporated on August 8, 1981 in Pakistan as a private limited company and subsequently converted into a public limited company on May 24, 1992. The registered o�ce of the Holding Company is situated at F-3, Hub Chuki Road, S.I.T.E., Karachi. Its manufacturing facilities are located at Port Qasim, Karachi. The Holding Company's shares are listed on Pakistan Stock Exchange Limited. Bibojee Services (Private) Limited is the ultimate holding company of the Group. The principal business of the Holding Company is assembly / progressive manufacturing of Nissan passenger Cars, UD trucks & buses and JAC, and sale, import and marketing of Nissan vehicles, import and sale of DongFeng and JAC Complete Built-up trucks and assembly of other vehicles under contract agreement. 1.3 Ghandhara DF (Private) Limited Ghandhara DF (Private) Limited (the Subsidiary Company) was incorporated on June 25, 2013 in Pakistan as a private limited company. The registered o�ce of the Subsidiary Company is situated at F-3, Hub Chuki Road, S.I.T.E., Karachi. The principal business of the Subsidiary Company is to carry-out CKD operations of Dongfeng vehicles. It has outsourced assembly of the vehicles to the Holding Company. 2. BASIS OF PREPARATION 2.1 This consolidated condensed interim �nancial information has been prepared in accordance with the accounting and reporting standards as applicable in Pakistan for interim �nancial reporting. The accounting and reporting standards as applicable in Pakistan for interim �nancial reporting comprise of:

- International Accounting Standards (IAS) 34, Interim Financial Reporting, issued by the International Accounting Standards Board (IASB) as noti�ed under the Companies Act, 2017 (the Act); and - Provisions of and directives issued under the Act. Where the provisions of and directives issued under the Act, 2017 di�er with the requirements of IAS 34, the provisions of or directives issued under the Act have been followed.

3. PRINCIPLES OF CONSOLIDATION

These consolidated �nancial statements include the �nancial statements of Holding Company and its Subsidiary Company. The Holding Company's direct interest in the Subsidiary Company is 99.99% as at March 31, 2018 ( June 30, 2017: 99.99%).

Consolidated �nancial information combines like items of assets, liabilities, equity, income, expenses and cash �ows of the Holding Company with those of its Subsidiary, o�set (eliminate) the carrying amount of the Holding Company's investment in Subsidiary and the Holding Company's portion of equity of Subsidiary and eliminate in full intragroup assets and liabilities, equity, income, expenses and cash �ows relating to transactions between entities of the Group. Non-controlling interest is equity in the Subsidiary Company not attributable, directly or indirectly, to the Holding Company.

6.1 Operating �xed assets

Book value at beginning of the period / year Additions during the period / year

Disposals costing Rs.6,379 thousand (June 30, 2017: Rs.9,669 thousand) - at book value Assets classi�ed as held for sale costing Rs.Nil (June 30, 2017: Rs. 162,724 thousand) - at book value Depreciation charge for the period / year Book value at end of the period / year

Notes to the Consolidated Condensed Interim Financial InformationFor the nine months period ended March 31, 2018

4. ACCOUNTING POLICIES

The signi�cant accounting policies and the methods of computation adopted in the preparation of this condensed interim �nancial information are consistent with those applied in the preparation of audited annual consolidated �nancial statements for the year ended June 30, 2017.

There are certain International Financial Reporting Standards, amendments to published standards and interpretations that are mandatory for the �nancial year beginning on July 1, 2017. These are considered not to be relevant or to have any signi�cant e�ect on Group's �nancial reporting and operations and are, therefore, not disclosed in the consolidated condensed interim �nancial information.

5. ACCOUNTING ESTIMATES AND JUDGEMENTS

The preparation of this consolidated condensed interim �nancial information in conformity with the approved accounting standards requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the Group's accounting policies. Estimates and judgements are continually evaluated and are based on historical experience and other factors, including the expectation of future events that are believed to be reasonable under the circumstances. Actual results may di�er from these estimates.

During the preparation of this consolidated condensed interim �nancial information, the signi�cant judgements made by management in applying the Group's accounting policies and the key sources of estimation and uncertainty were the same as those that applied to the audited annual consolidated �nancial statements of the Group for the year ended June 30, 2017.

Quarterly Report March 2018

23

Note

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

----------- Rupees ‘000 -----------

6.1

6.2

1,947,583

104,305

2,051,888

1,928,917

63,113

1,992,030

1,928,917

102,002

(3,495)

-

(79,841)

1,947,583

1,857,185

309,256

(2,294)

(137,909)

(97,321)

1,928,917

6. PROPERTY, PLANT AND EQUIPMENT

Operating �xed assets

Capital work-in-progress

Quarterly Report March 2018

24

Notes to the Consolidated Condensed Interim Financial InformationFor the nine months period ended March 31, 2018

6.2 Additions to operating �xed assets, including transfer from capital work-in-progress, during the period / year were as follows:

Leasehold land

Building on free hold land

Plant and machinery

Furniture and �xtures

Vehicles - owned - leased

Other equipment O�ce equipment Computers

7. LONG TERM INVESTMENTS

Associate - equity accounted investment

Others - available for sale

7.1 Associated Company - equity accounted investment

Ghandhara Industries Limited

Balance at beginning of the period / year

Share of pro�t / OCI for the period / year

Share of revaluation during the period / year

Dividend received during the period / year

Balance at end of the period / year

-

44,751

18,259

256

9,075 12,283

12,314

4,338

726 102,002

1,040,242

- 1,040,242

857,012

260,723

-

(77,493)

1,040,242

207,980

-

39,442

14,710

4,300 32,523

6,188

3,042

1,071 309,256

857,012

- 857,012

647,079

210,784

50,811

(51,662)

857,012

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

----------- Rupees ‘000 -----------

7.1.1 Investment in Ghandhara Industries Limited (GIL) represents 5,166,168 (June 30, 2017: 5,166,168) fully paid ordinary shares of Rs.10 each representing 24.25% (June 30, 2017: 24.25%) of its issued, subscribed and paid-up capital as at March 31, 2018. GIL was incorporated on February 23, 1963 and its shares are quoted on Pakistan Stock Exchange Limited. The principal activity of GIL is the assembly, progressive manufacturing and sale of Isuzu trucks and buses.

7.1.2 The value of investment in GIL is based on un-audited condensed interim �nancial information of the investee company as at December 31, 2017.

7.1.3 The market value of investment as at March 31, 2018 was Rs.4,312.045 million (June 30, 2017: Rs.3,358.577 million).

Note

7.1

7.2

9.1 Contingencies

9.1.1 There is no change in status of the contingencies as disclosed in note 26.1 of the audited annual �nancial statements of the Group for the year ended June 30, 2017.

9.1.2 Guarantees

Guarantees issued by banks on behalf of the Group Corporate guarantee's issued by Holding Company to the commercial banks against letters of credit facilities utilised by the Subsidiary Company

9.2 Commitment

Commitments in respect of capital expenditure, raw materials and components through con�rmed letters of credit

Notes to the Consolidated Condensed Interim Financial InformationFor the nine months period ended March 31, 2018

7.2 Others - available for sale

Quarterly Report March 2018

25

Note

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

----------- Rupees ‘000 -----------

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

----------- Rupees ‘000 -----------

1,875

(1,875)

-

1,875

(1,875)

-

Automotive Testing & Training Centre (Private) Limited 187,500 (June 30, 2017: 187,500) ordinary shares of Rs.10 each - cost Provision for impairment

8. CASH AND BANK BALANCES Cash in hand Cash at banks on: - current accounts - deposit accounts - term deposit receipts Provision for doubtful bank balances 9. CONTINGENCIES AND COMMITMENTS

1

65,651 10,517 82,000

158,168 (3,912)

154,257

1

262,087 10,517

305,000 577,604

(3,912) 573,693

5,557

609,141

154,593

15,787

259,443

294,243

Notes to the Consolidated Condensed Interim Financial InformationFor the nine months period ended March 31, 2018

Quarterly Report March 2018

26

Name

(i) Ultimate Holding Company Bibojee Services (Private) Limited - 62.32% shares held in the Holding Company (ii) Associated Companies The General Tyre and Rubber Company of Pakistan Limited Ghandhara Industries Limited - 24.25% shares held by the Holding Company

Janana De Malucho Textile Mills Limited

Gammon Pakistan Limited (iii) Others UD Trucks Corporation, Japan

Sta� provident fund Sta� gratuity fund Key management personnel

Rent Dividend Purchase of tyres Contract assembly charges Body fabrication Sale of parts Purchase of parts O�ce rent Dividend income Reimbursement of expenses Reimbursement of expenses

O�ce rent Royalty Dividend Purchases of complete knock down kits Contribution made Contribution made Remuneration and other short term bene�ts

9,000 140,232

24,687

579,337 - 6

16 1,980

77,493 1,003

1,256

2,250

- 18,235

- 6,058

13,427

58,520

10,380 140,232

53,278

292,839 676

1,056 8

1,320 51,662

356

763

2,250

11,312 18,235

2,009,252 5,446

40,425

55,799

Nature of transaction

----------- Rupees ‘000 -----------

March 31,2018

March 31,2017

Un-audited --Nine months period ended--

Note

10.1

10. COST OF SALES Finished goods at beginning of the period Cost of goods manufactured Purchases - trading goods

Finished goods at end of the period

10.1 Cost of goods manufactured Raw materials and components consumed Factory overheads

11. TRANSACTIONS WITH RELATED PARTIES

11.1 Signi�cant transactions with related parties are as follows:

March 31,2018

March 31,2017

358,586

709,488

475,790 1,185,278 1,543,864

(362,821)

1,181,043

645,550 63,938

709,488

346,775

1,442,573

226,497 1,669,070 2,015,845

(401,575) 1,614,270

1,277,407 165,166

1,442,573

302,797

2,253,169

920,167 3,173,336 3,476,133

(362,821) 3,113,312

1,843,386 409,783

2,253,169

165,813

4,206,008

387,546 4,593,554 4,759,367

(401,575) 4,357,792

3,706,140 499,868

4,206,008

March 31,2018

March 31,2017

------------------------------ Rupees ‘000 --------------------------------

Quarter ended Nine months period ended--------------------------------(Un-Audited)--------------------------------

Notes to the Consolidated Condensed Interim Financial InformationFor the nine months period ended March 31, 2018

11.2 Period / year end balances are as follows:

Receivables from related parties

Long term loans Trade debts Loan and advances Deposits and prepayments Payable to related parties Trade and other payables These are in the normal course of business and are settled in ordinary course of business.

12. FINANCIAL RISK MANAGEMENT The Group's activities expose it to a variety of �nancial risks: credit risk, liquidity risk and market risk (including foreign exchange risk, interest rate risk and other price risk).

The condensed interim �nancial information does not include all �nancial risk management information and disclosures required in the audited annual �nancial statements and should be read in conjunction with the audited annual consolidation �nancial statement for the year ended June 30, 2017.

There has been no change in Group's sensitivity to these risks since June 30, 2017 except for general exposure to �uctuations in foreign currency and interest rates. There have been no change in the risk management policies during the period.

There have been no signi�cant changes in the business or economic circumstances during the period that would have a�ected the fair values of the �nancial assets of the Group. Further, no re-classi�cations in the categories of �nancial assets have been made since June 30, 2017.

Quarterly Report March 2018

27

Note

(Un-Audited)March 31,

2018

(Audited)June 30,

2017

----------- Rupees ‘000 -----------

650

50,555

600

10,105

39,240

1,100

28,578

821

708

40,785

Notes to the Consolidated Condensed Interim Financial InformationFor the nine months period ended March 31, 2018

13. CORRESPONDING FIGURES

In order to comply with the requirements of International Accounting Standard 34 - 'Interim Financial Reporting', the consolidated condensed interim statement of �nancial position has been compared with the balances of audited annual �nancial statements of the Company for the year ended June 30, 2017, whereas, the consolidated condensed interim statement of pro�t and loss account and other comprehensive income, consolidated condensed interim statement of cash �ows and consolidated condensed interim statement of changes in equity have been compared with the balances of comparable period of consolidated condensed interim �nancial information of the Company for the nine months period ended March 31, 2017. In order to ful�ll the requirements of the Act, following corresponding �gures have been rearranged and reclassi�ed for better presentation:

However there is no impact of above reclassi�cations on total assets and pro�t of the Company, therefore balance sheet as at July 1, 2016 has not been presented. 14. DATE OF AUTHORIZATION

This consolidated condensed interim �nancial information was authorized for issue on April 24, 2018 by the Board of Directors of the Holding Company.

Quarterly Report March 2018

Reclassi�ed fromcomponent

Reclassi�ed tocomponent

June 30, 2017----------- Rupees ‘000 -----------

Surplus on revaluation of �xed assets (out of equity) Unclaimed dividend (trade and other payables)

with in equity (included as partof total equity as capital reserve) as separate line item on the face of statement of �nancial position

1,389,904

7,732

Ahmed Kuli Khan KhattakChief Executive Officer

Muhammad UmairChief Financial Officer

Muhammad ZiaDirector

28

Notes

Ghandhara Nissan Limited

F-3, Hub Chowki Road, S.I.T.E., Karachi-75730Tel: 021-32556901 - 10 UAN: 111-190-190 Fax: 021-32556911 - 12Email: [email protected] Web: www.ghandharanissan.com.pk