For the period Nov 12, 2018 Nov 16, 2018 - BIPL Direct · Ghandhara to assemble Renault truc ks|...

Transcript of For the period Nov 12, 2018 Nov 16, 2018 - BIPL Direct · Ghandhara to assemble Renault truc ks|...

The Week in Review For the period Nov 12, 2018 – Nov 16, 2018

News This Week

Forex reserves fall to USD13.8bn

C/A deficit narrows 4.6% in July-Oct

FDI slips 46.4%YoY in July-October

Trade deficit shrinks to USD11.8bn

Overseas Pakistanis remit USD7.4bn in 4MFY19

Auto sales remain flat at 83,201 units in four months

ECC allows PKR36bn financing for circular debt

Steel re-rolling industry crisis deepens

Ghandhara to assemble Renault trucks

KA Hanteng Motor gets ‘Greenfield’ status

KSE-100 – Volatile week at bourse

Stock Market Overview

The outgoing week remained volatile as investors remained abreast with news flow regarding exclusion of certain stocks from MSCI

and developments on negotiations with IMF, where KSE100 index exhibited an increase of 0.7%WoW to 41,661pts. Additionally,

market participants remained dull during the week as evident from decline in ADT by 8.5%WoW while ADTV increased by 1.3%WoW.

Foreign investors continued to remain net seller, exhibiting an outflow of USD24mn.

GATI, CHCC, COLG, MUREB and GHGL were the major gainers while SEARL, SHFA, TRG, HCAR, and NESTLE were the major losers in the

benchmark KSE-100 this week.

REP 039 BIPL Securities Limited 5thFloor, Trade Centre, I.I. Chundrigar Road, Karachi 1

www.jamapunji.pk

Market Review

The outgoing week remained volatile as investors remained abreast with news flow regarding exclusion of certain stocks from MSCI and developments on negotiations with IMF, where KSE100 index exhibited an increase of 0.7%WoW to 41,661pts. Additionally, market participants remained dull during the week as evident from decline in ADT by 8.5%WoW while ADTV increased by 1.3%WoW. Foreign investors continued to remain net seller, exhibiting an outflow of USD24mn. During the week, PAMA released automobiles data for Oct’18 wherein auto sales grew by 6%YoY to 24,850 units, taking the cumulative sales to 83,201 units for 4MFY19, down 0.7%YoY. Additionally, ECC allowed the energy of ministry to secure PKR36bn in order to partially settle circular debt. Furthermore, lower demand emanating from the ban on the construction of high-rise buildings has resulted in shut down of some steel re-rolling mills in Sindh and Baluchistan provinces. On the macro front, SBP foreign exchange reserves declined by 3.0%WoW to USD7.5bn owing to external debt servicing and official payments. Pakistan’s current account deficit narrowed by 4.6% 4MFY19 on lower trade gap in goods, declining by 2.0% amid stronger exports, and higher remittance inflows (up 15%YoY). On the other hand, FDI fell by 46.4%YoY during the same period in the face of slowdown in Chinese investments for CPEC-related projects, as Chinese inflows for 4MFY19 dropped 52%YoY to USD334.9mn.

Outlook Investors are likely to closely track developments regarding IMF negotiations with government, scheduled to be completed by next week. Moreover, the prospective inflow from KSA on the agreed amount of USD3.0bn would be a key trigger to rebuild the investor’s confidence.

KSE-100 – Volatile week at bourse

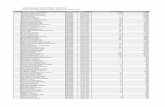

Date Open High Low Close Change Vol (mn)

12-Nov-18 41,414 41,572 41,053 41,096 -0.7% 178

13-Nov-18 41,112 41,202 40,761 41,152 0.1% 177

14-Nov-18 40,874 41,323 40,763 40,994 -0.4% 255

15-Nov-18 41,019 41,478 40,942 41,429 1.1% 255

16-Nov-18 41,536 41,805 41,429 41,661 0.6% 202

2 2

3

News This Week

Economic highlights & Data points

Forex reserves fall to USD13.8bn| (The News): Pakistan’s total liquid foreign reserves fell 1.7%WoW to USD13.8bn during the week ended on November 9, the central bank said on Thursday. Net reserves with the State Bank of Pakistan dropped 3% or USD196mn to USD7.5bn. C/A deficit narrows 4.6% in July-Oct| (The News): Pakistan’s current account deficit narrowed by 4.6% or USD232mn in 4MFY19 on lower trade gap in goods and higher remittance inflows, the central bank figures on Thursday. The current account deficit stood at USD4.8bn during 4MFY19, compared with USD5.1bn in the same period last year. FDI slips 46.4%YoY in July-October| (The News): Foreign direct investment into Pakistan fell 46.4% to USD600.7mn in 4MFY19 from the same period a year earlier, the central bank data showed on Wednesday. In October, Pakistan’s cross-border investments dipped to USD161.2mn, compared with USD354.6mn in the corresponding month last year, the State Bank of Pakistan (SBP) data showed. Trade deficit shrinks to USD11.8bn | (Dawn): The country’s trade deficit during 4MFY19 shrank by 1.97%YoY to USD11.8bn from USD12.0bn, according to latest data released by Pakistan Bureau of Statistics on Friday. Overseas Pakistanis remit USD7.4bn in 4MFY19| (The News): Overseas Pakistani workers remitted USD7.4bn in 4MFY19, compared with USD6.4bn received during the same period in the preceding year. During Oct’18, the inflow of worker’s remittances amounted to USD2.0bn, which is 37.7% higher than Sept’18 and 20.9% higher than Oct’17.

Sector and Corporate highlights

Auto sales remain flat at 83,201 units in four months| (The News): Sales of cars, jeeps and light commercial vehicles (LCVs) remained almost flat at 83,201 during the first four months of the current fiscal year as frequent price hikes and tax restriction stifled auto demand, a brokerage reported on Monday. ECC allows PKR36bn financing for circular debt| (The News): Government on Monday allowed the ministry of energy to secure around PKR36bn from a syndicate of banks to defray power sector’s outstanding payments that reawakened the energy woes. Steel re-rolling industry crisis deepens| (The News): The operations of almost all steel re-rolling mills in Sindh and Balochistan provinces have been shut down for an indefinite period, as a ban on the construction of high-rise and other buildings has deadened the demand. Ghandhara to assemble Renault trucks| (Dawn): Ghandhara Nissan Limited (GNL) has announced its plans to locally assemble Renault Trucks (RT) by end of 2019 at the manufacturing site in Port Qasim, according to a company release issued on Thursday. KA Hanteng Motor gets ‘Greenfield’ status| (BR): Government of Pakistan has awarded category-A Greenfield Investment status to KA Hanteng Motor Company Pvt Ltd, under automotive development policy 2016-21 which will bring an investment of about USD50mn in auto sector.

Sugar mills unwilling to start crushing amid ‘liquidity crunch’| (Dawn): The sugar industry has urged the government to fix sugarcane price in tandem with the selling price of sugar and asked for early payment of outstanding subsidies to come out of the woods.

4

Stock Market – Last week in pictorals

Chart 1: KSE-100 Index

Source: PSX

Chart 2: KSE Advance/Decline Ratio

Source: PSX

Chart 3: Pak Foreign Portfolio Flows (US$mn; US$=PKR130)

Source: NCCPL

Chart 4: KSE- Volumes & Values

Source: PSX

Chart 5: Price to Money Ratio

Source: NCCPL

Chart 6: Off market activity

Source: PSX

5

Economy Watch

Chart 7: Revenue Collection (PKRbn)

Source: SBP

Chart 8: Forex Reserves (US$mn)

Source: SBP

Chart 9: Import & Export (US$mn)

Source: SBP

Chart 10: Foreign Exchange Rate (PKR/US$)

Source: SBP

Chart 11: 6-mth T-Bill Yield (%)

Source: SBP

Chart 12: Yield Curve (%)

Source: SBP

Chart 13: KSE-100 Active Issues (ADTO-million shares)

Source: PSX

Chart 14: KSE-100 Least Traded Issues (ADTO- shares)

Source: PSX

Chart 15: KSE-100 Top Gainer (% change)

Source: PSX

Chart 16: KSE-100 Top Losers (% change)

Source: PSX

6

Stock Market Synopsis Last week This Week %Change 1M 3M 12M

Mkt. Cap (US $ bn) 61.4 61.5 0.0% 56.5 69.8 79.7

Avg. Dly T/O (mn. shares) 233.1 213.4 -8.5% 257.5 189.7 185.0

Avg. Dly T/V (US$ mn.) 71.1 72.0 1.3% 73.7 57.3 66.3

No. of Trading Sessions 5.0 5.0 0.0 24.0 62.0 247.0

KSE 100 Index 41,388.9 41,660.8 0.7% 36,663.4 41,960.8 40,813.3

KSE ALL Share Index 29,935.3 30,020.0 0.3% 27,319.8 30,422.0 29,152.0

Disclaimer

This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the

information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract. Information and opinions contained

herein have been compiled or arrived at by BIPL Securities Limited from publicly available information and sources that BIPL Securities Limited believed to be reliable. Whilst every care has been taken in

preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of BIPL Securities Limited gives or makes any representation, warranty or undertaking,

whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. Any responsibility or liability for any

information contained herein is expressly disclaimed. All information contained herein is subject to change at any time without notice. No member of BIPL Securities Limited has an obligation to update,

modify or amend this research report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or

subsequently becomes inaccurate, or if research on the subject company is withdrawn. Furthermore, past performance is not indicative of future results.

The investments and strategies discussed herein may not be suitable for all investors or any particular class of investor. Investors should make their own investment decisions using their own

independent advisors as they believe necessary and based upon their specific financial situations and investment objectives when invest ing. Investors should consult their independent advisors if they

have any doubts as to the applicability to their business or investment objectives of the information and the strategies discussed herein. This research report is being furnished to certain persons as

permitted by applicable law, and accordingly may not be reproduced or circulated to any other person without the prior written consent of a member of BIPL Securities Limited. This research report may

not be relied upon by any retail customers or person to whom this research report may not be provided by law. Unauthorized use or disclosure of this research report is strictly prohibited. Members of

BIPL Securities and/or their respective principals, directors, officers, and employees and their families may own, have positions or affect transactions in the securities or financial instruments referred

herein or in the investments of any issuers discussed herein, may engage in securities transactions in a manner inconsistent with the research contained in this research report and with respect to

securities or financial instruments covered by this research report, may sell to or buy from customers on a principal basis and may serve or act as director, placement agent, advisor or lender, or make a

market in, or may have been a manager or a co-manager of the most recent public offering in respect of any investments or issuers of such securities or financial instruments referenced in this research

report or may perform any other investment banking or other services for, or solicit investment banking or other business from any company mentioned in this research report. Investing in Pakistan

involves a high degree of risk and many persons, physical and legal, may be restricted from dealing in the securities market of Pakistan. Investors should perform their own due diligence before investing.

No part of the compensation of the authors of this research report was, is or will be directly or indirectly related to the specific recommendations or views contained in the research report. By accepting

this research report, you agree to be bound by the foregoing limitations.

BIPL Securities Limited and / or any of its affiliates, which operate outside Pakistan, do and seek to do business with the company(s) covered in this research document. Investors should consider this

research report as only a single factor in making their investment decision. BIPL Securities Limited prohibits research personnel from disclosing a recommendation, investment rating, or investment

thesis for review by an issuer/company prior to the publication of a research report containing such rating, recommendation or investment thesis.

BIPL Securities Limited endeavors to make all reasonable efforts to disseminate its publication to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax

and/or email. Nevertheless, not all clients may receive the material at the same time.

Disclaimers/Disclosures to US Investors

This investment research is distributed in the United States by BIPL Securities Limited (BIPLS), and in certain instances by Enclave Capital LLC (Enclave), a U.S.-registered broker-dealer, only to major U.S.

institutional investors, as defined in Rule 15a-6 promulgated under the U.S. Securities Exchange Act of 1934, as amended, and as interpreted by the staff of the U.S. Securit ies and Exchange Commission.

This investment research is not intended for use by any person or entity that is not a major U.S. institutional investor. If you have received a copy of this research and are not a major U.S. institutional

investor, you are instructed not to read, rely on or reproduce the contents hereof, and to destroy this research or return it to BIPLS or to Enclave. The analyst(s) preparing this report are employees of

BIPLS who are resident outside the United States and are not associated persons or employees of any U.S. registered broker-dealer. Therefore, the analyst(s) are not subject to Rule 2711 of the Financial

Industry Regulatory Authority (FINRA) or to Regulation AC adopted by the U.S. Securities and Exchange Commission (SEC) which among other things, restrict communications with a subject company,

public appearances and personal trading in securities by a research analyst. Any major U.S. institutional investor wishing to effect transactions in any securities referred to herein or options thereon

should do so by contacting a representative of Enclave. Enclave is a broker-dealer registered with the SEC and a member of FINRA and the Securities Investor Protection Corporation. Its address is 19

West 44th Street, Suite 1700, New York, NY 10036 and its telephone number is 646-454-8600. BIPLS is not affiliated with Enclave or any other U.S. registered broker-dealer.