Future of Upstream - Petrotech Papers/TS - 4- Upstream.pdf · These trends will define the future...

Transcript of Future of Upstream - Petrotech Papers/TS - 4- Upstream.pdf · These trends will define the future...

Future of UpstreamA Techno-Managerial Challenge

Kaustav Mukherjee, Rahool Panandiker, Akshaya Gulhati

November 2016

2 Oil Price Volatility

AT A GLANCE

Cash flows and margins of upstream companies have been under pressure for several years, even during periods when oil prices exceeded $100/bbl. This trend points to deteriorating industry fundamentals primarily driven by two factors—re-source complexity, which is forcing producers to spend more for proportionally much less return, and project complexity, which is leading to larger and more costly projects.

The recent oil price decline has exacerbated this pressure and forced upstream players to focus on short-term austerity and cost control measures. Both capital and operation expenses have been aggressively targeted to bring costs under control.

In addition to short-term measures, upstream players are coming to terms with new industry realities and trends that will persist and characterize the industry over the long haul. Four main trends have been highlighted: First, a strong drive towards increasing project efficiency; second, collaboration among industry stakeholders to focus on gains and synergies as well as risk sharing; third, a portfolio revolution to ensure focus on core competence and cash generation; and lastly the need to work with governments to reduce their take which is currently the largest cost for E&P companies.

These trends will define the future of upstream and players would structurally and fundamentally need to redefine their business model to align with these trends in order to grow and restore value.

The Boston Consulting Group 3

These are trying times for upstream oil and gas companies. Following more than a decade of strong financial returns, up-

stream companies have suffered sharp reductions in free cash flows over several years which have been exacerbated by the oil price fall in late 2014. Profit margins have also been under pressure with average profit margins for Big Oil companies turning negative in FY 2015 (See Exhibit 1).

0

10

-5

5

Net profit margin (%)

2015

2014

2013

2012

2011

2010

2008

2009

2007

2006

100

50

0

150

Weekly Brent spot price ($/bbl)1

EXHIBIT 1 | Cash Flows and Net Profit Margin Trends for Big Oil Companies

Sources: FCF and Profit Margins: BCG ValueScience, BCG analysis; Brent spot price: Thomson Reuters.Note: Free cash flow = Operating cash flow-Expenses-Taxes-Changes in NWC-Changes in investments; FCF and Profit Margin calculated for 'Big Oil' companies. Big oil includes: Chevron, ExxonMobil, Shell, Total, BP, ConocoPhilips, Statoil, Eni, Repsol.

-40,000

-80,000

-120,000

0

80,000

40,000

120,000

2006

2012

2011

2010

2007

2008

2009

2015

2013

2014

Free cash flow ($mm)

0

50

100

150

Weekly Brent spot price ($/bbl)

Cash flow on a downward trajectory even during high oil prices...

Enterprise FCF

Brent (spot, $ / bbl)

Margins also under pressuredropped 48% (2011-14) while oil >$100

-48

Net profit margin

Brent (spot, $ / bbl)

4 Oil Price Volatility

Deteriorating FundamentalsThis downward trajectory of cash flows and falling profit margins even during times when oil prices were above $100 per barrel, points to de-teriorating industry fundamentals. The upstream industry has been facing inherent pressure from two distinct intrinsic complexities:

Resource ComplexityExploration results are not hitting the mark despite high E&P spend-ing. A more than six fold increase in E&P spending has not even been able to double production over the last fifteen years (See Exhibit 2).

Exhibit 2 | Production Cost Trend for Big Oil Companies

60

20

0

40

0

15

30

45

boe (bn)($bn)

2010

2013

2011

2014

2015

2012

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

Liquid volumes (Bn boe)

Gas volumes (Bn boe)

Exploration spend ($Bn)

Sources: LHS: IHS 2016; RHS: UBS Global Oil and Gas Analyser (Sep, 2015).Note: LHS graph for all active companies (371 companies); RHS graph for Big Oil companies: Chevron, ExxonMobil, Shell, Total, BP, ConocoPhilips, Statoil, Eni, Repsol.

20

15

10

5

020102000 2005 2015

Production Cost ($/boe)

TOTAL

Statoil

RD/Shell

Repsol

ExxonMobil

Eni

ConocoPhillips

Chevron

BP

The Boston Consulting Group 5

For conventional players, this is largely due to the steady shift towards less accessible resources—for example, further from shore, towards deep and ultra-deep fields.

Project ComplexityAs companies pursue increasingly complex resources, the development of those resources also increases in complexity. Projects grow larger, and the teams managing them grow bigger, incorporating more people from more companies. This increases the number of contracts / con-tractors and makes the project supply chain more intricate.

Increased project complexity has inevitably led to cost and schedule overruns. An analysis1 of projects by oil major companies from 2005-2014 shows that 49 percent of total projects in this period faced cost overruns with a median budget overrun of $2,700 million while 52 per-cent of the projects faced schedule overruns with median delay of 3.25 years. For example, ~71 percent of the projects by one of the Oil Ma-jors faced a schedule overruns of more than a year; 9 out of 15 projects completed by another Oil Major between 2005 and 2014 exceeded their budget by more than $100 million.

It is this combination of increasing resource and project complexity further exacerbated by the recent and persistent low oil price that has adversely impacted E&P companies’ performance in ways unseen in previous decades.

Austerity MeasuresGiven these deteriorating industry dynamics and the low oil price envi-ronment, upstream players have responded with austerity and cost control as immediate measures. There has been a sharp drop in up-stream spending with an aim to improve cash flows. Global oil majors reduced their exploration spend by 12 percent from 2013 to 2015 and have taken a 10-30 percent reduction in total capital expenditure in 20152.

To tide over the crisis, companies have also reviewed their operational costs incisively to reduce expenses. Manpower costs have been ratio-nalized, for example, Statoil announced 1,600 to 1,900 job cuts in early 2014 (including ~20 percent technical staff ) and then an additional 500 job cuts in late 2014. Similar action has been taken at the other Ma-

Upstream players have responded to the deteriorating industry fundamentals and low price environment by reducing capex, manpower costs as well as renegotiating their supplier contracts.

6 Oil Price Volatility

jors, for example, Shell, ConocoPhillips, Chevron have all made an-nouncements regarding manpower reduction.

Many of the top upstream players have also reduced costs by renegoti-ating their contracts with suppliers, for example, Petrobras obtained 13 percent cost savings in contract renegotiation in 2015, Statoil renegoti-ated about 500 contracts starting from 2014 till March 2016, Chevron targeted >$1.5 billion in Capex reduction through renegotiations, and Total renegotiated with contractors to secure up to 30 percent reduc-tions in costs of offshore rigs by September 2015.

Emerging TrendsIn addition to short-term measures, upstream players are coming to terms with new industry realities and trends that will persist and char-acterize the industry over the long haul. The four trends emerging in the industry are: improving project efficiency, industry collaboration, portfolio rationalization and renegotiating government take.

Project EfficiencyThe industry has started to develop a razor like focus on improving project efficiency. Multiple operational levers are being pulled to achieve efficiency objectives. The three key levers most commonly de-ployed are:

• ‘Factory-model’ Operations: Factory-model execution improves predictability and speed of execution by reducing downtimes, eliminating waste in processes and ensuring continuous flow of processes. A recent example of this is the Total Kaombo Angola project which achieved 20 percent reduction in cost of a $20 billion project by adopting lean solutions at the design stage as well as identifying mechanisms to reduce required man-hours.

• Standard Design and Execution: Standardized design guidelines in equipment, design and material, combined with informed and empowered decision-making helps in cost reduction and faster project execution. For example, Statoil drilled three wells at Snorre B platform at an average cost of $21 million compared to $61 million for previous projects by adopting standard design and components.

Lean operations, standardization and

basin specific solutions are key levers being

used to enhance efficiency

The Boston Consulting Group 7

• Basin-specific Expertise: In some cases, basin-specific ‘fit for purpose’ customization to designs and specifications also has a large impact on costs. For example, Shell Appomattox GOM saved ~20 percent in cost mainly driven by design improvements and technical advancements.

Industry CollaborationCollaboration is already common in many other capital-intensive in-dustries that have faced rapid change and fierce competition, such as the automotive, telecommunications, and transportation industries. The objective of any industry collaboration is to align the goals of the operators and contractors around a shared objective, in which compa-nies jointly invest in an activity, provide resources and capabilities, and share the risks and potential returns—all while remaining indepen-dent. The benefits that each partner receives should be greater than those gained by working individually. Done properly, collaboration on capital projects in the oil and gas industry can result in one or more of the following three tangible benefits:

• Efficient Project Delivery: Reduced sourcing effort (no need to tender new work within an existing collaboration), standardized contracts and call-off procedures and competitive prices in return for stable work; all contribute to an improvement in project deliv-ery efficiency.

• Effective Project Delivery: Project delivery can be made more effective in an alliance. First, there is greater contractor involve-ment in the concept design stage when the ability to influence cost / value creation is greatest; and second, there is continuity of personnel committed across multiple projects within the alliance, which ensures that knowledge is not lost and continuous improve-ment opportunities can be realized.

• Enhanced Capabilities: Collaborations provide access to a wider resource pool with shared standards, processes, and tools that enable the use of repeatable capabilities across projects. New technology development is also possible through focused alliance capability initiatives.

Realizing these benefits strengthens competitive positioning as the ability to deliver projects more efficiently / effectively is enhanced. In

Collaboration in the oil and gas industry can result in efficient and effective project delivery as well as enhanced capabilities.

8 Oil Price Volatility

addition, there is reduced risk and resource commitment in project de-liveries as well as increased resilience to address adverse market con-ditions.

Players have started to realize these benefits and multiple examples of collaboration experiments can be seen in the industry:

• Statoil: Statoil in collaboration with Kongsberg, has signed an agreement with Eelume to accelerate technology to reduce subsea maintenance cost. In addition, Statoil has initiated a a US$100 million joint industry program with ABB for the development of subsea power systems to reduce cost and to enable development at remote oil and gas field locations, located far away from other infrastructure.

• BG Group: In early 2015, BG formed an alliance with KBR under which KBR will provide engineering services, project management expertise, and technical support across BG’s global upstream portfolio. The alliance is intended to minimize BG’s fixed costs.

Portfolio RationalizationUpstream players have been quick to realize that portfolio rationaliza-tion is prudent under the current market environment. The industry has seen various ramifications of this trend from Shell / BG and ExxonMobil focusing on Natural gas / LNG, to Suncor focusing on oil sands, BP on deepwater and Total stepping back on exploration to focus on develop-ment. Players are quickly abandoning the “a little bit of everything” phi-losophy to focus their portfolio on their core competence, areas of syner-gy and potential cash generation.

Renegotiating Government Take Government take averaged 52 percent of revenues from 2009 to 2014. Upstream companies are taking a fresh look at how this can be re-cali-brated to reflect current market conditions. Simultaneously govern-ments are also reviewing their policies in order to ensure continued long-term investment in the sector. The level of government take can be re-calibrated by adjusting two levers:

• Tax Reform: This is the first lever that can be deployed and has been successfully adjusted in multiple instances:

Upstream players are focussing their portfolio

on their core compe-tence, areas of synergy

and potential cash generation.

The Boston Consulting Group 9

ǟ Adjustment of tax / royalty terms by field type or size: In 2013, Malaysia lowered taxes on marginal fields with reserves of less than 30 million Barrel of Oil Equivalents (BOE) or 500 billion cubic feet of gas to stimulate exploration activities.

ǟ Modification of tax regulations: Norway allows operators to accumulate losses and use them to offset taxes indefinitely in offshore plays. It also gives a tax refund of as much as 78 percent of a company’s exploration costs in the year it incurs a loss. These regulations have created strong incentives for operators to invest in exploration despite the emerging maturity of the Norwegian continental shelf.

• Contract Structure Revision: Deploying this lever involves a more radical intervention; despite this, countries have effectively evolved and / or revised contracts structures.

ǟ Iran has replaced its 1990s buyback contracts (a short-term service contract) with more attractive “integrated petroleum contracts” that have similar characteristics to other regional Production Sharing Agreements (PSAs).

ǟ India adopted revenue sharing contracts for all hydrocarbon explorations in March 2016, in view of the structural failures of the then existing fiscal regime based on production sharing contracts.

ǟ Brazil uses relatively attractive concession licenses for onshore projects, and it uses PSAs for the exploration of the pre-salt basins, such as the Santos Basin.

Future of UpstreamThe four emerging trends discussed above are actively shaping the fu-ture of the new upstream world.

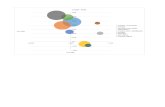

Growth in the new world will require upstream players to shift to a fundamentally new model. The new growth model for upstream com-panies rests on five levers (See Exhibit 3). Deploying these levers will allow upstream companies to undergo a structural shift towards restor-ing value once again.

Companies & govern-ments are taking a fresh look at how government take can be re-calibrated to reflect current market conditions.

10 Oil Price Volatility

ConclusionThe upstream industry is undergoing a transformation. The structural stress, which steadily built over a decade, driven by resource and project complexity combined with the more recent oil price decline has put in-dustry players through a crucible. Not only have players taken a series of short-term measures to stabilize their financial situation but they have also started to experiment with new ways to add value and / or save costs. Four trends, namely, project efficiency, identifying new sources of industry collaboration, portfolio rationalization and re-calibrating gov-ernment take, would drive the future of upstream. Companies would need to embrace a new operating model and structurally align with these trends in order to drive sustainable value going forward.

• Implicit profitability assumption

• Allowed non-monetary aspects to enter decision-making

• Large investments, bigger plays and longer-term bets

• Best in class and bespoke solutions

• Capital and resource deployed freely

• Focus on building in-house capability

• Extreme focus on cost versus value across all aspects (from selection of resource to production operations to relationships with stakeholder, including the government)

• More focus on risk mitigation, financial and natural hedging and optionality

• Extreme focus on continuous improvement both in process and technology

• Customization and standardization deployed appropriately for optimal / low cost solutions

• Collaborate to share risks and find new sources of value

• Develop capability for strategic advantage

Old World New World

Big Gambles

TopNotch

Go Solo

Focus on Volume

Focus on Value

Cautionary Approach

Frugal Efficiency

Seek Out Synergies

The Boston Consulting Group 11

Notes:

1. IHS, BCG analysis.2. Exploration spend: IHS Upstream Competition Service; Capex reduction: Goldman Sachs, company information.

Exhibit 3 | Five Levers of New Growth Model for Upstream Companies

Operating processes and organization setup to be driven by the specifics of the assets and a relentless focus on lean

operations

Physical Infrastructure (PI)

design consulting for data centers

Operating ModelTransformation

Value Creation

A

B

C

D

E

Renegotiating government take to have a transparent,

stable, and constructive framing

Portfolio focus on specific plays and roles aligned with core competency

to ensure sustained cash

generation

Redesigning the approach (processes and organization) to build trust via supplier engagements

A culture that instills cost focus and continuous

improvements as priorities

12 Oil Price Volatility

The Boston Consulting Group (BCG) is a global management consulting firm and the world’s leading advisor on business strategy. We partner with clients from the private, public, and not for profit sectors in all regions to identify their highest-value opportunities, address their most critical chal-lenges, and transform their enterprises. Our customized approach com-bines deep insight into the dynamics of companies and markets with close collaboration at all levels of the client organization. This ensures that our clients achieve sustainable competitive advantage, build more capable or-ganizations, and secure lasting results. Founded in 1963, BCG is a private company with 85 offices in 48 countries. For more information, please visit bcg.com.

The PETROTECH series of International Oil and Gas Conference and Exhi-bition is a biennial platform for national and international experts in the oil and gas industry to exchange views and share knowledge, expertise and experiences. Being held for the last over two decades with growing partici-pation, PETROTECH-2016 is the 12th edition of the flagship event of the Indian hydrocarbon sector.

The Boston Consulting Group 13

About the AuthorsKaustav Mukherjee is a Senior Partner and Managing Director in the New Delhi office of the Boston Consulting Group.

Rahool Panandiker is a Partner and Managing Director in the Mumbai of-fice of The Boston Consulting Group.

Akshaya Gulhati is a Principal in the Energy practice area at The Boston Consulting Group and is currently based in the New Delhi office.

AcknowledgmentsWe gratefully acknowledge the contribution of all team members of BCG’s Center for Energy Insight for their industry input as well as that of Umesh Sharma and Abhishek Kapoor in BCG‘s New Delhi office in writing this re-port. In addition, we also gratefully acknowledge the contributions of Sonal Tripathy and Sunny Sharma in the firm‘s New Delhi office for supporting analysis.

Special thanks to Jamshed Daruwalla, Pradeep Hire and Zaufer Sadiq for their contributions to the editing, de sign and production of this report; Jas-min Pithawala and Maneck Katrak for managing the market ing process.

For Further ContactIf you would like to discuss this report, please contact one of the authors.

To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcgperspectives.com.

Follow bcg.perspectives on Facebook and Twitter.

© The Boston Consulting Group, Inc. 2016. All rights reserved.11/16