Foreign To be accomplished by SEC Personnel conce · 2019-06-12 · Said bond was initially issued...

Transcript of Foreign To be accomplished by SEC Personnel conce · 2019-06-12 · Said bond was initially issued...

COVERSHEET

IAl 1 191917 1-1 1 13 11 1317 1 SEC Registration Number

P A M I ttlo RIZO N

( A n Op je n-End Mut lual IF u Comp a njy)

I I I I

I I I I I I I I I I

(Company's Full Name)

(Business Address: No. Street City/Town/Province)

Marissa P. Escala (Contact Person)

[ili] [iliJ Month Day

(Fiscal Year)

Dept. Requiring this Doc.

Total No. of Stockholders

I I 1 I 1 IQI (Form Type)

(Secondary License Type, If Applicable)

521-6300 (Company Telephone Number)

[DD] Month Day

(Annual Meeting)

Amended Articles Number/Section

Total Amount of Borrowings

~-~I '~-=---=-~ Domestic Foreign

To be accomplished by SEC Personnel concerned

I I I I I I I I I I I File Number LCU

I I I I I I I I I I I Document ID Cashier

STAMPS

Remarks: Please use BLACK ink for scanning purposes.

2

SECURITIES AND EXCHANGE COMMISSION

SEC FORM 17-Q

QUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17 (2) (b) THEREUNDER

01. For the fiscal year ended: March 31. 2017

02. SEC Identification Number: A199z1313z

03. BIR Tax Identification No.: 005-061-143-000

04. Exact name of registrant as specified in its charter: PAMI Horizon Fund. Inc.

05. Province, country or other jurisdiction of incorporation or organization: Philippines

06. Industry Classification Code: ______ (SEC use Only)

07. Address of principal office: 12/F. Philam Life Head Office. Net Lima Building, 5th Avenue corner 26th Street. Bonifacio Global City, Taguig 1634

08. Registrant's telephone number, including area code: (632) 521-6300

9. Fonner name, former address, and former fiscal year, if changed since last report: N/ A

10. Securities registered pursuant to Sections 4 and 8 of the RSA:

Tit)e of each class

Common voting stock

Number of Shares of Common Stock Outstanding

360,213,222

11. Are any of these securities listed on the Philippine Stock Exchange?

Yes () No(x)

®

3

PART I - FINANCIAL INFORMATION -· Item 1. Financial Statements

The following comparative financial statements are attached:

a. Statement of Assets and Liabilities as of March 31, 2017 and as of December 31, 2016 (with breakdown of Net Assets)

b. Statement of Operations for the 1st quarter of 2017 and 2016 c. Statement of Changes in Net Assets as of 1st quarter of 2017 and 2016 d. Statement of Cash Flows for 1st quarter of 2017 and 2016 e. Portfolio Valuation Report as of March 31, 2017

Item 2 : Management's Discussion and Analysis or Plan of Operation

Result of Operation for the 1st quarter of 2017 and Plan of Operation: Refer to attached Annex A - Fund Performance - 1st quarter of 2017

PART II- OTHER INFORMATION

Item 1. Disclosures not made under SEC Form 17-C

All information were disclosed in the submitted SEC Form 17-C

SIGNATURES

Pursuant to the requirements of the Revised Securities Act, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Registrant: PAMI HORIZON FUND, INC

By: PAMI-distributor

)WVfNI ~~;SSA P. ESCALA ~ad .=_-In~;tment Operations & Control

E~ Head - Finance

4

PAMI HORIZON FUND, INC

FUND PERFORMANCE - 1st QUARTER 2017

Fixed Income

Market Review: The BTr held a T-bill auction and two bond auctions in March. The T-bill auction on 13 March was partially awarded at higher average rates. In an English auction on 21 March, the 5-yr benchmark FXTN 5-74 was awarded at a higher average yield of 4.132% from the 4.03% average on its previous re-issuance in February. Said bond was initially issued on J anuary 26 at a coupon rate of 4.0%. Meanwhile, a week after the 5-year bond offer, the BTr officially set the coupon of its first RTB issue for 2017. The new 3-year RTB 3-8 was awarded at a coupon rate of 4.25%, the higher end of the indicative range and higher than FXTN 5-74, in an English auction held on 21 March. Demand for the said RTBs was overwhelming with PHP86.172 billion tenders but the BTr only accepted PHP70 billion. A public offering period commenced afterwards and was supposed to run until 6 April but the BTr capped the issue size at PHP175 billion, closing the offer period a day early.

The local secondary bond market yields opened higher in March after a pause in the previous month. Strong expectations of a Fed rate hike on 14-15 March FOMC meeting kept investors defensive, if not side lined. Locally, a weak peso amid anticipation of a Fed hike and local political uncertainties also contributed to weak investor sentiment. However, the FOMC meeting results on mid-month was deemed to be a dovish hike, providing relief to global markets. Peso bonds reversed its losses after having risen 2obps from February, which were toppish levels that essentially returned to yearend rates. Investors continued to prefer the short end of the curve though yields in that sector have already increased given the T-bill auction results. The 5-yr auction on the third week of the month did not generate enough interest though as whispers of a possible RTB issuance came about. As soon as the announcement came out, market players took profits and sold positions to make room for the RTB issuance. The week leading to the RTB announcement saw a cautious secondary bond market where yields rose on supply concerns. Fortunately, the BTr successfully issued RTB 3-8 at a very attractive coupon of 4.25%, at least 25bps higher than the benchmark 3-year bond in the secondary market. The market was initially caught off guard with the PHP70 billion award from the RTB auction against a PHP30 billion offer. But orders for the said bond turned out strong during the offer period. The BTr also released its 2Q17 auction schedule in the same week, which indicated a 7-, 10-, and 20-year issuance. The amount to be borrowed in 2Q17 is the same as the previous quarter at PHP180 billion. The new RTB has been capped at PHP175 billion despite more demand. With this successful issuance and favourable economic developments coupled with lower UST yields, we expect short term peso bond yields to rally to pre-RTB levels. A steeper yield curve is foreseen given supply in the long end.

The peso yield curve steepened in March with benchmark securities less than a year ris ing 52.2bps M/ m but the 1-2-yr benchmark yields declined 29.5bps M/m. The 3-yr benchmark yield rose 43.5bps M/m while the intermediate tenors rose 22.2bps M/m. The long end of the curve ended mix with the 10- and 25-yr benchmark yields rising 25.5bps and 35,4bps M/m, respectively, while the 20-y benchmark yield fell 24.8bps M/m.

Outlook: A domestically-driven demand for its goods and services implies that the stock market will weather the ups and downs of the global economy

Equities Market Review

Market Review: The PSEi was was back in the green in March, advancing by 1,4% to close at 7,312. This despite a continued lack of news flow and acceleration in net foreign selling to $251 million. Average daily value traded rose 11% month-on-month to P6.7 billion per day, though much of this increase was related to rebalancing in the PSEi and FTSE indices.

Economic News: Investors continue to await the passage of the first tax reform package, which is critical to the government's lofty infrastructure spend targets. Failure to pass this package will negatively impact GDP growth, interest rates and/or the Peso. March inflation inched up to a new multi-year high of 3.4%. The 10-year treasury yield rose 69 bps to 5.0554. The Peso held steady this time, appreciating 14bps to 50.2.

Corporate News: Gaming ( +13.2%) led all sectors, with BLOOM and MCP ( +8.0% and +32.0% respectively) showing impressive 2016 results. Construction/Cement (5.1%) lagged all sectors, as the threat of cement imports continues to be a headwind for the industry. ICT, TEL and GLO ( +18.3%, +12.7% and +11.2% respectively) led the Index, while MPI, DMC and MEG (-11.5%, -10.1% and -7.1% respectively) lagged it. Foreigners bought TEL the most ($17.5 million worth) and sold MPI the most ($60.9 million worth).

Outlook A domestically-driven demand for its goods and services implies that the stock market will weather the ups and downs of the global economy.

5

Fund Performance

The performance of the fund as of March 2017 as compared with December 2016 is mainly due to the market condition resulting to comparative financial indicators as follows:

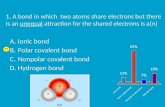

Market Indicator 31-Mar-17 31-Dec-16*/31-March-16 Inc/(Dec)

NAVPS* 3.6l1 ,, 3.511 0 .10

ROE (Year-on-Year) 2.81% 2-41r!I<"' 0-40%

EPS (Year-on-Year) 0.1016 0.0884 0.0132 -EBT (Year-on-Year) 38,021 36,696, 1,325

Expense Ratio (Year-on-Year) 0.59% 0.59% / 0.00%

NA VPS: NA VPS is computed by dividing the net assets over the outstanding shares. It represents the current value of each outstanding share.

Return on Equity (ROE): ROE is computed by dividing the net income of the current period over the Net Asset Value of the Fund. This represents the percentage of income earned out of the total NAV.

Earnings Per Share (EPS): The EPS is computed by dividing the earnings after tax by the outstanding shares. It indicates the amount of earnings represented by each outstanding share.

Earnings before Taxes (EBn: The EBT is computed by deducting the operating expenses from the gross income. It represents the amount of income the Fund has after deducting its operating expenses.

Expense Ratio: The expense ratio is computed by dividing the operating expenses by the average daily net asset value. It represents the percentage of net asset value that is used for operating expenses.

6

PAMI HORIZON FUND, INC

FUND PERFORMANCE - 1st QUARTER 2017

Assets

Total assets increased by Php17.69 million year to date. The movement is mainly due to the increase in the Fund's investment in Financial Assets at Fair Value through Profit or Loss together with the fund manager's strategy to maximize and capitalize growth of the local stocks and bonds.

Liabilities

The Fund's liabilities decreased by Php549 thousand from Php19.80 million in December 31, 2016 to Php19.25million in March 31. 2017. This is mainly due to the decrease in the Fund's payable to brokers as at reporting date.

Net Assets

The Fund's equity increased by Php18.24 million. This is brought by the volume of subscriptions from investors and increase in securities held as Financial Assets at Fair Value through Profit or Loss.

Gross Income

PAMI Horizon Fund, Inc. ended the first quarter of 2017 at PhP45.79 million of gross income. 66.31% of this amount comprises of unrealized gains amounting to Php30.36 million, 12.67% or Php5.80 million is interest income, 12.60% or Php5.77 million is realized gains and 8.41% or Php3.35 million is dividend income. The amount of current period's gross income is 1.30% higher than of the same period for the year 2016.

Operating Expenses

The operating expenses as compared year-on-year decreased by Php739 thousand due to lower AUM level. This further brought decreases in variable or AUM-based expenses such as management fees, Fund accounting fees, and transfer agency fees.

Net Investment Income

The net investment income of the Fund as compared to March 2017 increased by approximately Php1.41 million.

Investment in Foreign Securities

The Fund has no investment in foreign Securities as of March 31, 2017.

Fair Values of Assets and Gain/Loss for the Period

The comparison of the fair values as of March 2017 and as of December 2016 is reflected in the balance sheet while amounts of gains/losses for the periods are reflected in the income statement.

7

Fair Values of Assets and Gain/Loss for the Period

The comparison of the fair values as at March 31, 2017 and December 31, 2016 is reflected in the statement of assets and liabilities while amounts of gains/losses for the periods are reflected in the statement of operations.

Below is the summary:

(All amounts in thousands of Philippine Peso)

Unaudited as at Audited as at Increase/Decrease

31-Mar-2017 _31-Dec-2016 31 Mar 2017_ vs. 31 Dec 2016 All amounts in All amounts in

thousands of PHP thousands of PHP Amount % ASSETS

Cash & Cash Equivalents 61,721 70,839 -9,118 -12.87%

Financial Assets at Fair Value 774,373 741,584 32,789 4.42% through Profit or Loss

Available-for-Sale Investments 360,804 360,362 442 0.12%

Loans and Receivables Other Assets

121,989 128,755 -6,766 -5.25% 1081 739 ~42 46.28%

TOTAL ASSETS 1,319,968 1,302,279 17,689

Total assets increased by Php17.69 million year to date. The movement is mainly due to the increase in the Fund's investment in Financial Assets at Fair Value through Profit or Loss together with the fund manager's strategy to maximize and capitalize growth of the local stocks and bonds ..

B. REALIZED & UNREALIZED GAINS/ WSSES

For the Period Ended 31-March-2017 31-March-2016 All amounts in All amounts in

INVESTMENT INCOME/(WSS) Realized Gain/(Loss) on financial

thousands of PHP thousands of PHP

instruments 5,771 -1,927 Unrealized Gain/(Loss) on financial

30,362 34,607 instruments

Total Investment Income/(Loss) 36,133 32,680

PAMI Horizon Fund, Inc. ended the first quarter of 2017 at Php45.79 million of gross income. 66.31% of this amount comprises of unrealized gains amounting to Php30.36 million, 12.67% or Php5.80 million is interest income, 12.60% or Php5.77 million is realized gains and 8.41% or Php3.35 million is dividend income. The amount of current period's gross income is 1.30% higher than of the same period for the year 2016.

1.36%

8

Liabilities

The comparison ofliabilities as of March 2017 and as of December 2016 is reflected in the balance sheet and summarized below:

Unaudited as at Audited as at Increase/Decrease 31 March 2017vs. 31 Dec

31-March-2017 '.U-December-2016 2016 All amounts in All amounts in

thousands of PHP thousands of PHP Amount % LIABILmFS

Accounts Payable and Accrued Eimenses 17 021 17.620 -r:;oo -~.40% Due to Philam Asset Management, Inc. 2,220 2179 50 2.20% TOTAL LIABILITIES 19,250 19,799 -!,4Q -2,77%

The Fund's liabilities decreased by Php549 thousand from Php19.80 million in December 31, 2016 to Php19.25million in March 31. 2017. This is mainly due to the decrease in the Fund's payable to brokers as at reporting date.

9

PAMI HORIZON FUND, INC

FUND PERFORMANCE - 1st QUARTER 2017

Plan of Operation for the next 12 months

A. Distribution

The Fund will be distributed by Philam Asset Management, Inc. (PAM!) through licensed investment solicitors. PAM! will tap its existing distribution network of insurance and agents and third party distributors in order to inform as many retail and institutional investors about the advantages of mutual fund investments.

Training and promotional campaigns will be focused on the distribution networks. PAM! will commit resources and exert substantial effort to help future distributors acquire their licenses as mutual fund solicitors.

B. Use of Proceeds

The proceeds from the sale of PHFI shares will be used to build up its investment in equities of companies listed in the primary and secondary boards of the PSE. Likewise, proceeds will also be used to build up the investment in domestic fixed-income instruments including, but not limited to, treasury bills, Bangko Sentral ng Pilipinas' ("BSP") Certificates of Indebtedness, other government securities or bonds, and such other evidences of obligations issued by the BSP or guaranteed by the Philippine government.

C. Determination of Offering Price

The offering price is determined at Net Asset Value (NAV) per share computed for the current banking day, if payment is made within the daily cut-off time. Otherwise, the NAV per share on the following banking day will be used for payments made after the daily cut-off time. The daily cut-off time shall be 12:00 noon of a banking day. A banking day is defined as a day when commercial banks in Metro Manila are not required or authorized to close by law.

D. Material Events & Uncertainties

Liquidity

There are no demands, commitments, events or uncertainties which will impair the liquidity of the fund. The Fund is mandated by SEC, through Investment Company Act, to maintain at least 10% of its net assets to be invested at liquid assets (!CA Rule 35 - 1 p. d4). But since the Fund has a contingency liquidity plan, the liquid assets can be at a minimum of 5% of the Net Asset Value.

There are no events that triggered direct or contingent financial obligation that is material to the Fund.

Material Transactions

There are no material off-balance sheet transactions, arrangement, obligations and other relationships of the company with unconsolidated entities or other persons created during the period. There are no known trends, events or uncertainties that have had or that are reasonably expected to have a material, favorable or unfavorable, impact on net sales or revenues or income from continuing operations. PF! knows no events that will cause a material change in the relationship between costs and revenues.

The fund, being subjected to mark-to-market valuation, has significant dependency on the market value fluctuations oflisted stocks and securities held by it.

ANNBX1

PAMI HORIZON FUND, INC. (formerly GSIS MUTUAL FUND, INC.) (An Open-End Investment Company) 1.1 STATEMENT OF ASSETS AND LIABILITIES (All amounts in thousands of Philippine Peso)

ASSETS

Cash & Cash Equivalents

Financial Assets at Fair Value through Profit or Loss

Available-for-Sale Investments

Loans and Receivables

Other Assets

TOTAL ASSETS

LIABILITIES

Accounts Payable and Accrued Expenses Due to Philam Asset Management, Inc.

TOTAL LIABILITIE'S

NET ASSETS ATTRIBUTABLE TO UNITHOLDERS

EQUI1Y ATTRIBUTABLE TO UNITHOLDERS

Share Capital - Pt par value Authorized - 2,000,000,000 shares Issued and outstanding 365,272,697 shares as of December 31, 2016 and 360,213,222 shares as of March 31, 2017 Additional Paid-in Capital Retained Earnings Reserve for fluctuation on available-for-sale financial assets

EQUI1Y ATTRIBUTABLE TO UNITHOLDERS

NETASSETVALUEPERSHARE

For reference on the expense ratio computation AVERAGE NET ASSET VALUE January 1, 2017 - March 31, 2017 & January 1, 2016 - March 31, 2016

Unaudited Balances 31-Mar-2017

(PHP}

61,721

774,373

360,804

121,989

1081

1,319,968

17, 021

2,229

19,250

1,300,718

360,213 (111,804)

1,061,415 {9,106)

1,300,718

3.6110

1,307,8;.'i

Audited Balances lncreaseLDecrease 31-Dec-2016 31 Mar 2017 vs. 31 Dec 2016

{PHP} Amount %

70,839 (9,118) -12.81)6

741,584 32,789 4,42%

360,362 442 0.12%

128,755 (6,766) -5.25%

239 3~2 ~6.28%

1,302.279 17,689 1.36%

17,620 (599) -3.40% 2,179 0 2.29%

19,799 {~9) -2.~

1,282,480 18,238 1.42%

365,273 (5,060) -1.39% (98,578) (13,226) 13,42%

1,024,822 36,593 3.57% {9,037) {69) 0.00%

1,282,480 18,238 1;42%

3.5110 0.0999 2.85%

1~31,655 {123,830} -8.65%

ANNEXt

PAMI HORIZON FUND, INC. (formerly GSIS MUTUAL FUND, INC.) (An Open-End Investment Company) 1.2 STATEMENT OF OPERATIONS (All amounts in thousands of Philippine Peso)

INVFSI"MENT INCOME/(LOSS)

Interest Dividend Unrealized Gain/(Loss) on sale of securities at fair value through profit and loss Realized Gain/(Loss) on sale of securities at fair value through profit and loss

Total Investment lncome/(Loss)

OPERATING EXPENSES

Administration fees Directors' fees Custodian fees Legal and Audit Fees Bank charges Marketing Fees Postage and Mailing Other Expenses Transfer Agent Fees Documentary stamp tax Taxes and Llcenses Management fees

Total Operating Expenses

INVESTMENT INCOME BEFORE INCOME TAX

Provision for Income Tax

NET INVESTMENT INCOME/LOSS

Number of shares outstanding

Earnings per share (PHP)

11

For the Period Ended 31-Mar-2017 31-Mar-2016

(PHP} (PHP}

5,802 7,008 3,850 5,511

30,362 34,607

s,zz1 {1,222}

45,785 45,199

90 99 100 103 239 247 126 131 82 9 57 47

278 287 16 15

164 179 18 11

I 138 6,523 z,232

7,764 8,503

38,021 36.696

1,131 1,511

36,523 35,182

360,213,222 J22,s11,z10

PHPo.1016 PHPo.088~

For the 2!!arter Ended 31-Mar-2017 31-Mar-2016

(PHP} {PHP}

5,802 7,008 3,850 5,511

30,362 34,6o7

s,221 (1,222}

45,785 45,199

90 99 100 103 239 247 126 131 82 9 57 47

278 287 16 15

164 179 18 11

1. 138 6,523 z,2Jz

7,764 8,503

38,021 36,696

1,131 1,511

36,520 35,182

360,213,222 397,841,740

PHPo.1016 PHPo.088~

ANNEX 1

PAMI HORIZON FUND, INC. (formerly GSIS MUTUAL FUND, INC.) (An Open-End Investment Company) 1.3 STATEMENTS OF CHANGES IN NET ASSETS

ATIIBUTABLE TO UNITHOLDERS (All amounts in thousands of Philippine Peso)

NET ASSETS ATIRIBUTABLE TO UNITHOLDERS AT BEGINNING OF YEAR Net Investment Income Other Comprehensive Income

TRANSACTION WITH UNITHOLDERS Proceeds from issuance of units Payment from redemption of units Adjustments to Retained Earnings Net decrease from transactions with unitholders

NET INCREASE (DECREASE) IN NET ASSETS ATIRIBUTABLE TO UNITHOLDERS

NET ASSETS ATIRIBUTABLE TO UNITHOLDERS AT END OF YEAR

12

Unaudited For the Period Ended

31-Mar-2017 (PHP)

1,282,480 36,593

(69)

9,997 (28,283)

(18,286)

18,238

1,300,718

0

Unaudited For the Period Ended

31-Mar-2016 (PHP)

1,449,879 35,182

8,133

7,885 (40,030)

(32,145)

11,170

1,461,049

ANNEX 1

PAMI HORIZON FUND, INC. (formerly GSIS MUTUAL FUND, INC.) (An Open-End Investment Company) 1.4 STATEMENT OF CASH FLOWS (All amounts in thousands of Philippine Peso)

CASH FLOWS FROM OPERATING ACTIVITIES

lncome/(loss) before income tax Unrealized Gains/(Losses) - Investments Dividend income Interest income Operating loss before working capital changes Changes in operating assets and liabilities: (lncrease)ldecrease in assets:

Financial Assets at Fair Value through Profit or Loss Available-for-Sale Investments Loans and Receivables Other Assets

lncreasel(decrease) in liabilities: Accounts payable and accrued expenses Due to Phi/am Asset Management, Inc.

Net cash generated used in operations Interest received Dividend received Income Tax Net cash from operating activities

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from issuance of units Payment from redemption of units Net cash from (used in) Financing Activities NET DECREASE IN CASH AND CASH

EQUIVALENTS CASH AND CASH EQUIVALENTS, BEGINNING

CASH AND CASH EQUIVALENTS, END

13

Unaudited as at 31-Mar-2017

38,021 (30,362)

(3,850) (5,802) (1,993)

(2,102) (4,079) 8,734 (342)

(599) 50

(331) 9,132 1,798

(1,431 ) 9,168

9,997 (28,283) (18,286) (9,118)

70,839

61,721

Unaudited as at 31-Mar-2016

36,696 (34,607) (5,511) (7,008)

(10,430)

42,712 516.00

(35,620)

(10,281 ) 11 ,147 (1,956) 10,028 2,186

(1,514) 8,744

7,885 (40,030) (32,145) (23,401)

44,712

21,311

P'A.w,,crPLNDSGIIOUf'

P'AMI H0NZON RlfC). INC.

'°"TPOUO VALUA110H MP0f'1 Al AT

su•rorM.

.. __,.

l'W_CU9TP't• ACCIIIUIOCUSTOOIAII , ....

OUOTATIOM CCY

l"OflTfOUO CCY

-.... ----..., -,.., ''" ...... ,..,

---.... ---.... .... -----.... .... --.... --.... -------..... ---------.... .... -

•ACSYAUMI AV0 t00K Ali'SJIIAOC ...... -

IH,117110000

».1Hl60000

(IHM27tlXICOJ

(17C JU1.;JOC)Ol

(1JaOU9400DDI

00, 0000

C,&90t0COOO)

,._onoeCICO)

,xu.TI:

1 0000 1 000000

I 0000 1 000000

10000 1000000

1 0000 1 000000

1 0000 t 000000

10000 1 000000

1 0000 I 000000

I 0000 I 000000

1 0000 1 000000

1 0000 1000000

10000 1000000

1 0000 1000000

10000 I 000000

1 0000 1 000000

1 0000 1 000000

1 0000 I 000000

10000 1000000

10000 I 00000()

10000 1 000000

1 0000 1 000000

10000 1000000

IOCOO 1 000000

t OOOC 1 000000

1 0000 1 000000

1 0000 1 000000

1 0000 1 000000

10000 1000000

10000 1 000000

10000 1000000

1 0000 1 000000

10000 1 000000

10000 1 000000

I 0000 1 000000

I 0000 I 000000

10000 1000000

1 0000 1 000000

10000 1000000

10000 1000000

10000 1000000

1 0000 I 000000

10000 1000000

10000 ,000000

1 0000 I 000000

10000 1000000

I 0000 1 000000

I 0000 1 000000

10000 1000000

1 0000 1 000000

10000 1000000

I 0000 1000000

.... COi,

.... 112 71

..... , 1111

1,000,tlUI

t.OOl,1'1.71

t,OOl,.1U.11

:,000,1,1.,.

(170,)43 74)

(170,l&l 7 • J

(tlilO ..... }

(1 )1().ln.-e}

(1l71."7tl)

(1 771.1919))

00,

oo,

(14191)

(14'! 92)

(1101)

(21011

"'"'"' "-"'"'

(MS,ZH21)

tM5,_is.21 1

:,s_11$N

lS,1UM

.>n.11001

)12.11002

z.ooe.,u..,. 2.000, 111.11

..... .,. ....

1 000000 ,0000 ..... ,000000 10000

'""' 1 000000 1 0000

"'"' 1 000000 1 0000 .....

(1M.M9 21J 1000000 , .... , .... (121 .... 21)

{1'2,111 U') 1 000000 1 0000

l1U,11717J 1 0000

p2,s,ooo, 1 000000 , 0000

(J2.S1000) 10000

{11 1ttlt770, 1000000

111 Ul_)l1l'al

, .... , ....

\170,)4.J 14J 1 CODOOC 1 0000

(110.)4)74)

(1 JIO ..... ) ,000000 • 0000

1u,o.tN,..1 10000

1c.1,, u, 1 000000 1 0000

(«»tSU)t 10000

(127t,t97H) 1000000 , .... , .... (1 77t.N7n)

().7nlOJ IO'JOOOO 10000

{l,77?to, 1 0000

{1~ ..... ,SJ ,0000

001 , 000000 10000

001 10000

tt• t1) · 000000 1 0000 ,,..,2) 10000

(71 o,, '000000 1 0000

411011 10000

(lf,t~ ~ 1 000000 1 0000

(tf.94101 ..... (2.M'2)8J 1000000 10000

(1.Hl3iS) 10000

{4 1.)tl' tl) 1000000 10000

10,.>11 n1 , 0000

, .... ..... (2'f).'6i11 ) 1000000 , ....

'""' Qt).,t,5611)

1 000000 1 0000

,0000

(4e0,H741J 1000000 10000

, ... M'7..., 1 0000

""' .. °'' 1 000000 1 0000 , ....

M1,M401

..1 .... 0,

..... ,un

._.,nn

1.000.tlJ.H

t, ... ,,,1.11

1.-.,,u, t.000.162.H

(1'2,t17 17J

(11711117,

l11 .t91ll'10)

11Ull ll11GJ

(110,l4374 j

f110l43 1.f.l

(1_)90'6t .a)

(1,JIIU6141)

l\2,. H1 VJ) tUrt M 79l>

121011

(11 01)

(2>t1M)

{139136)

('J1)171DJ ,...,,,.,.,}

I MOnOI

1:M,OnOI

1514,lnot) ,... ... ..,

OOI

OOI

000

000

000

000

000

000

0.00 ... 000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

000

0 00

000

000

000

000

000

000

0 00

000

... om

000

om

~ .. ..,, ....

0.1$

,001)

/001)

000

ioo,,

""' 000

.,,.

000

000

""'

.,.,,

.....

000

""

00,

000

000

000

000

000

... 000

0 00

0000000

o"""'

0000000

0

o"""'

'"""' 0

0000000

o"""' 0

0000000

0

0000000

o"""'

0000000

o"""' 0

0000000

o"""'

0000000

o"""'

o"""'

....... 0 000000

0

'14_'Mff'MO""" 'MTMfOUIINO TAI rAY-... MAMOOtEfT flEU .... ()l».at5.)l0000f ..... ' 000000 ""-'"'"' (XQ,ffl3Z) ....... . .... (JOJ.MnJ 000 . .. 0000000 - ..... '000000 (J02,2M32) {>02.KS J )) ..... .,.,_,.,,,, 000 ~"' :"--

1"'".,..._ 'MfM10UIIHO TAXrAY.aa . P'fll'YMOHTH - {U ,)$4f'100001 ..... ....... (U,3$0~ j1 S,3.$4 92) '000000 , ooco (13.)SO?) 000 000 oooooco - ..... ....... ('1).3502) 11:1.~ 12) ..... j 1)~t2) 000 000 ,,._ __

~TMrAYAM.a, MtlaWnofit .... .,._ ..... '000000 "'"' """' ....... ..... "'"' 000 000 oooooco - ..... ....... "'"' """' ..... """' 000 000 0

l'M_WMf&HNal'ttf' ~ TM ,AYMLa . aHNtl"°'-DOlfn - (2.U2~ ..... ....... (l.1327't) (2.13271) ....... ..... (2U27t/ 000 000 oooooco ..... ....... (l.U2~ 12,1l21t) ,ooco (2.1)1711 ... 000 0

,.,._WKTI~ ~ T.U:rAYAa& , &TOClllallQIIUA - ..... ,.,... ..... ' 000000 I'"'"'> (1.-),q ' ...... ..... .. ... ,., 000 000 o ...... - ..... ....... (J,.U:M) ......... ..... , .... :,., 000 000

l"t4_WKT.UtrtW WITMfOI.CtNO TU r AYA.11..a. IUNC:~ ~ ... ..,..,, ..... (1.1110 .U) (UIIO .«) ....... ..... (2.190 44) 000 0 00 oooooco - ..... ....... (2.990 .U) (2.M "4) ..... (2,NO U ) 000 000

_,. TOTAL - 11'.rn.4;)1..., ( H.fTl..toUO, l1l,.IJ't.tt1.10t .... .... 111,119,tttMt ,,...,., ...... (IUTUot.Nt . .. ,, .... SUI TOTM.M.M •UAltlmlS .... (11.ffi,toUOJ ltl,f11.,.01.IO) 111.1,._I0110t .... .... 111.,,...., ... , .... ,., .. _., (11.IH,IOI ,~ 11.13)

IIIIIITOfM..\SsaTAHOUUIUTY~DCMT (17,171. ..... 1.., 111.,ffl.iMt,U J (11.111.441,1'1 .... - 111.tn,..S.1'1 111.17'1. ..... UI (17.171 • .Ul.t~ 000 11'1)

C4SH

- -- .,.,,..,Nl'fNOflROfi,...., ..CACCOIMT - 11100000IXl00 ..... ,000000 HJ.OOOCG ,,1.,000co ....... ..... 11100000 000 000 0000000 00000 0000000 111.CIJOOO 111,00000 ..... 111.00000 000 00, 0

l"tll'rhW\.Ctft,~ Cfflf'Hlll'l"IIMl~NJUNOINC, AeCOUHT 21GS1&0St0000 , .... , ...... ?1«a.1~,9 2lllOS,5.4)~ ....... ..... 21,Q_1,0M 000 000 0000000 .... 00000 0000000 21405,1,0st n ,tcS.S43» ..... 21<!$1,0S. 000 ,., --- 0. ... ,AMI HOIIQOM ,wiotNC ACCOUNT - 1)1 411~ ..... ....... u, ... , ... u, ... ,. .. . ...... ..... u,,,. .. 000 000 o ...... - 00000 0000000 U 7,C715ef UT,'7141 ..... ,n,11&1 000 00,

:::"'"'""'---- SCI !Haw) .r,c:(;OIJtrlT l'Nf> r""11 HOIUZOM ~NO t ..C .... 2'5.000000000 ..... ....... -n,00000 '25,00000 ....... ..... ,. ... ,. 000 000 0000000 .... 00000 o ...... ,. ...... ........ . .... ,. ..... 000 o .. 0

~ -11

- Y.ullOUaUH.CAC.COUllnS .... >21•360000 ..... '"""" )_?1•» :1.21, n , ...... ..... )?1'» 000 000 0000000 ..... o ...... ,.:z,, u l.21' li ..... ,,,.." 000 000 0

SUIT01'M. "'' 21,111,MUI H,1-.21&.» :u,MT,aou .... .... 2Ul1.Ml.U U.tllUH..Ja 21,111.,uM ... " ' SU.TOTA&. t,..., .. .., .. u ,,..,ta.M 2,,111 ......... u, .... 21,A7.,l,n.ll 2,.1-.m.ae 2, •• , ..... 11

SUITOT"'-t~ ''" 21,111,au.u M,t .. 2M.U 2, .• ..,, ....... .... 2',H7,SU .U U,t-.ne.,M 2, .. , .... , .. '·" U7

lat.mES ,....., ..... ..... ... _ ... aootm:IAIO(. IMC: •C:-••-• - )1016"000000 1011»1 ....... ,,m.,..,.,. ,u1,.acsq 11TIOOOOCI ..... ,,_.,,ucci 000 .. , . ...... - ,01us1 ....... ) 7120,WSC ,.,,, ..... ..... 0,11700CI 000 "' ... _ ... SANCO,THl.,._~. c-.. ....... .... ,.. .... 000000 .. ,... ....... ltN0,20162 ltoeG,101:n 1(1100000 ..... 29l,2»S1IIO 000 ... o ...... ,.,,., ltN0,20911 ltoeo.10121 ..... 29,1>06fUO 000 "' 0

~--' ,..,iltOf'OUfAN UHK& TIIUIT COMPANY .eo-a,w..-3417MIOOOIXX) 1311)9 ....... )OlU.IH730 11191..u1a ........ ..... n.•20440IO 000 .. , 0 000000 .... 7)9l)t ....... lO>H.9"17;JO ?1.ttt.427•.) , .... 21,QOMCIIO 0 00 '"

"'-'"'" 1-KUNTT ao\NK Cc«rooU.noH • C:-Sur• MtJOOOOOOO ,.,_ ....... 11.121,,...,1, ,,~1.c;i1 ..i '"""" ..... 17.!St SUIOC 000 .. , o ...... ..... ....... ....... 1U21.0"81t u ,ser.c:11 .- ..... 17.SU,7~00 000 '"

SUITOTM.a.uM& tl~N 1H,7u.a,&11 11,, . .... , .. ... - ,,.,........,. , .. ,u...._,. 11,,. .... , ... ... "" "'9 TOTM.N.t.HQAU .... ,,e,......._n , .. ., ........ 7' 111.nuor.eo 0.00

ttt,,M,NUS IOl,JU,S4 .. ,. ttl,1NM1.IO ... t .11

HOUllHC ......

- A'fAl.A~T1Clef.c-..., .. .... tl,000000000 TIM"81t ....... ,,.,, .. _.7205 T1,17'()_$12ct .,. ...... ..... 11.le&,OCIOOO 0 00 007 o ...... ,., ... 1, ....... n .11c,1n05, n,110.s120t ..... 706000000 ,oo ...

........ MOfflZaowT'VVDffUIIU, ,c..c.-.~ ~iu101000000 1tN7t >c.sn.eo"" J11!57.lllU ,._,.. ..... 36,,1)10$4,1' 0 00 ... . ...... ,, .. ,. ....... ,..,-,,.-,o ... l11~1_,.,N . .... ll .... os. 1• 000 ,.,

... .,. .. ~Oi.OM&.OAOUP • ..C.·C:-.,__ .... .,..,,.,000000 """ ....... 11, t01,1IIH n .tos.l<t ., ...... ..... 11,S:,7,0)t ... 00, . ...... - ,,..,. ....... ,1.10,,, .. lt 11.603.36318 ..... 11.UT,O>fM 000 OH 0

... _ .... OMCIMOlOINQe,INC.,C-IMrM .... T:Nl, 14$000000 u,,,, ....... t l7'SM21 ttt1.,2Not ........ ..... u•oo110 000 00, 0 000000 .... Ut11t ....... ll7t..SM~ t 5l1~ot ..... U<tll OOIJO 000 OU

Pk..•Tc:N OTCAl'l'TM.MC!UaMOa..: , C.-*"- .... 11,CM-4000000 1,2t) 1110 ....... n.,, .. , ... 2t,S31,11t,tl, , ,1,0000000 ..... 1, .... ,..212 00 000 000 .......

.......... JO....-.i'~IMC..-0...---

~l.TO LTQJtDUi,, INC,•00--ff

...,__ laTiltO~NNc;Ofl!"-~ .....

......... SM!Hvs.:lntfNTSCOAIIIOa.ATION·C-SN.l'N

IO•TOTM..

...,.TOTALM0l.09t0"""'5

INOUSTRW.S

COHSfftUCTIOH. !NIIVJTllltJCTUM I ALLE> SUMCH

MlOAWIOCCONtflWCTION CO,U,,.C- sa..-

..... ,oTM.COllllf'IIUC:noH..WMaTIIUCNQ&.-U.•o ........ rucTAJc:rTY, IN!EJtOY, POW'Ut & WA.Tat

... .,.

.........

"'·"""' MA*-AWATMCOM,A.H't, IHC ·C.-lfl•r"

.. _ .... auaTOTALm..KlllfCITY,ENDI.O't, l>OWaAAWATP

.. __

all TOTAL ,000, HVIMOI I TOIACCO

-•°"--"'·""'

au•TOTM.MNfolO & CML

-.... ----.... ....

--.... --.... .... -

---..... ---....

------------------

$21fi&,11000000 N297' ,000000

A7971 , 000000

HJ,:UC,000000 US&57 , 000000

UM.57 ,000000

4.211,moooooo ,..., , 000000 .... , , 000000

.,.s...000000 uoo,e ....... eouo '""""'

"' .. ,.000000 ti.SU I OOOOCO

114027 1 000000

1,...,. 1000000

•14').Y ,ocaxo

I 91 2315 000000 119(1.)2 1 000IXXJ

219602 1000000

JOIU)OOOOCIO ~0827 ,000000

U0627 ,000000

1791C26000000 ,._ ,000000

""' ,000000

n, .,,000000 lt71U ,000000

21 711) , 000000

14 7()000DIXIO men, '000000 27HIJU '""""'

"1l"OOOCIOO l046S3 , 000000 .... ., , 000000

~u,000000 ..... • 000000 ·- ,000000

31S II05000000 114070 ,000000

114010 ,000000

N.1'11000000 1 000000

,,,.t2~ ,000000

314 01000000 ,..,., , 000000

""" ,000000

... ,,1000000 D21&0CI ,000000 ., .... ,000000

111 sn.oooooo tl30t24 '""""' 18)0924 • 000000

1'60,111 .000000 ,,.,.70 1000000

1lll470 1000000

>5,YT,55611

>1Nt.ffl17

1111.smm

1.111.,ooeo

2'1N,l12 ...

ll, 1M,212 M

tU,M2,ztUI

:rn,M:a..._.

1.011 .... 1,

1 ,087,401

O:t1,S71!8

•n1.s11~

1>101,8UCO

1),01,UIOO

11•1,231,2

11et'\.Z:,7$2

1 11t,875C<I , .,..,,c.

, 11:>.ce,!a , 1,o.~11111

.. ,"1,0111

...... ,,4311 1

!]41,510'7

,,,,.s:io.a1

tt71l,217IO

197e).21?90

,,.,.005 .. ,,,,.oas ..

)1*.211'7

) 1 900,:t'lt 47

.,,...,,._n ... , .. , .... 111 ... 1,140..M

111.Nl ,7'0,M

1t,l6S,_.P

,.,lQ.""fl ,,._ .. ,,_..

>S.flJ, ... 13 '13"°°°° 10000

lS1'21,.-U

7,0A.11017 IIC00000 1 0000

7.0M.17Ql7

11.,01.,tt:NI

ll,101,111:M

• 0000

8020000 1 0000

• 0000

,.,_m,.2•os n,000000 10Q00 $>.on.2• os , 0000

ffl,ltUC.N

211,DUAJM

t.0110,6108'

t ,OII0."801S

-,s_o,,n C!S,047:H

U21,S716ll

4 221,$71&1

1.117 .... .41

1.111, .....

'"'""' ,0000

• 0000

........ '"" ,0000

'""""' ,0000

,0000

11.~oo•> , , 100000 , 0000

11.IKM.-001) 1 00.,0

tl?0.21011

s,o,.,,,., ,Ot50000 1 0000

s ,01.12.iru

<1 057."'731 ] 1)200000 10000

4Jl:5t."'1 )1 I 0000

1,17t,US04 lOIOOOOO 10000

1,119,17SO<I

1110000 10000

10000

52lO,tA7U KMOOOO 1 0000

!UC,, .... 721

,, ~,.,n.. ,., ,oocoo , 0000

11 «17,512M t()OOC

J,-MS:U 'l~ 10000

)7ft.,9$5:1J

6,«11.*2t 102000000 1 0000

1,.:lt.C&lM 1ooc:o

n.ni..iu:n a.,,.n.,1.u.n

19,Jt2,0)8M H7l00000 10000

tt.J12,031M 10000

,._. 1..-.--, • .an. ... • 1"'2,0N.N

... ,,0,.00 N.111.01100

..,,.0,*47.4t IN.IIO,Mt.•t

... ,.~, ... ., .. .Mt ...

un.,.,,_.. l ,IH, .... M

,,.a,.cn,o 12,6~G21,0

,,110121,U,

4,110JJ11U

1.IM, t2720

119t121XI

l .MO!S2 11

).140H111

n.e••.•n.M >7 ... 1,111.H

Sl7SO!ill0

5)75Mll0

17,f9710$10

11,897.&08 10

7,029SJ400

7,1'29$)400

2t.w1onoo ,., .. 702200

... , .. ,., .. ..., .. ,., .. ,..,,,.,en,• ,oa,110,m .•

-.ro:a. ...... ··--

000 0.00

000

000

000

000

000

0.00

0.00

u, ...

0.00

000

000

000

000

000

.... . .. 000

000

000

000

000

000

000

000

000

000

•00

000

.... ... 000

000

000

000

"" 000

000

000

000

000

... .... o ... ...

0 .00

000 ... ... ... ....

001 0000000 .,, OU 0000000

on

o .. 0000000

"' 0

00, 0000000 .,,

.....

... ,.

000 0000000

001

001 0000000

oo,

000 0000000

0)5

. ... 000 0000000

OM

00, 0000000

013

003 0000000

"' 000 0000000

0.,

000 0000000

o,s

000 '""""' '" 0

Ln

"' 0000000

o ..

0000000

000 0000000

o ..

"" 0000000

0 "

001 0000000 ,,. 0

u,

"' 0000000

, .. , ... , ...

'"-"'°

IUI TOTAL

........,. ... au• TOTAL w , QfW.HION 1'lCHNOLOO'f'

.. , ... ,UMQOI.C J>NCI ClUl,~c .• eom- s u, ..

IUI TOTAL M'TM

......... o

,,._,k

TIU.NSPOfltTATK>H SEMCES

INT'L CONTAJHUI: TltMHL Slil.V'CS, INC.• C.- .ll'INtt

W.uuu.N'TS,PHL DEl"OStT RECEPTS, ETC

_,I TOTAL

MtlroTM.IIQUITIH

""'°"'"'''" C~Tl!UCUMl! S

CON'ORATI 80NDS

Ll'M.>(:0411 Cl~7...,.0WJIH'll11

,,.... .. ,.,.. o\'l'A&.A~I.Sft01J UUOU

...._.._, CII .uomz -,n"Y WlffUllU I.ONl'llo DUI' OU.l,IO:d

"'-'"''""' o\'l'A&.AL.MOINCI.Mlft0'70CT10.U

.. .,..,....,. ca A4.I......., oue ~

-..... ....

.... .... -.....

-...., -.... -.... .... -.....

--

-...... --''" '"'

'"' '"'

-..... -.... -.... --

'~-~000000 .,,.., ,.,.,., ,,,..,

'"""" 2,103.GJOOOOOOO , .... "''0000 , .... , 000000

MOtNOOCIOCIO '""' '"""" """ , 000000

1,4'1.'31000000 211'14 , 000000

lt~H ,000000

19,QI 1000000

, ... 1, 1000000

• 4l•:U 1000000

,.4l•2J IOCOOI))

122000000 113'17M 1000000

1IM17N I OIXIODO

•.~000000 1)87011M 1000000

13610114 1000000

6 100.000 000000 !OO H.a '""" 100 1..cl '""" 1.J.!I00.000.000000 """" ,000000

100 0000 0000000

1.000.000.000000 , .. 0000 '"""" ,000000 , 000000

2,.aoo.000000000 ,000000 , 000000

,000000 '000000

<1,00Cl,000000000 ,000000 ,000000

t,16),M,40)

1,M).1*40,

U ,Cl&t,"911

» .~1.,89111

tOl,Olt,IM•

10I.Ol1, IM.Jt

1o.lM1,&M.Jt ...... ,_,.

l'Ol ..... ot .,.. .... . .......... ... ...._.

, .... ,,,n ,..,.u,u

1 141, .. 1$6' ,_,.,_.,, ..

11 , 1 ... 0lOil

214U,'llC•

.. ,....,._a __ ,,...

Slll,)ttS)

5,111.,1•"

1.>.,00,00000

t).500.00000

S.000,00000

5.000.00000

:N.,SC0.00000

,,.soo.oooco

, 000.oooco

•.k1,'tl0.. 33050000 I 0000

7.!100,j(},)t) ) 3'0000 10000

7,500,5031) 10000

1.222,tltto ?2IOOOCIO 10000

9,111,tlllO

,1.au.m~ nnoooo 10000 4t.Ml,t)'l4$ ,oc.:io

, ...... , .. ,. 1N,ta, t OO.M

174,NJ!2

H4,N U J

114 ... U1

.1130.77717 4l&;ioooo 10000

lleS,7'717 1 0000

,.,. , •• ,... 71900000 10000

10,IU,,.HJ',"1

10.I M ,10.al

'0000

t .5tt,N,&tS 1,moooooo 10000

15"t"'ts ICXIJO

14.2,U.JNal

14,24&,7'0.M

,"51.•SIW Jl9:ICOOO

,..,,.<l)IQt 10000

, iot.°'909 11900000 10000

,,c..o.w 10000

:,.111.ns.• a.,11s,,K.N

442.uo 2• a 000000 , moo "'l,.)102<1 10000

............ ,, ........ MUI

S.Wl. >11 a, 100 1._.,a 1 0000

S,10l,ll1S, 10000

ll,,00.00000 100000000 10000

U,S00.00000 I 0000

S,000.000 00 100000000 1 0300

5.ooo.ooo co 10000

"21.500,00000 IIXlO'XIOQO

11.,S00.00000 '"" 4,000,00000 10)000000 10000

1,10.,2'1.tl)

7,1118.24141)

•U,Ml,923 ,0

41,Ml,'n,0

, ... n.Yft.N

tOl,S14.INI.N

151.191 ..

151,'92 11

1'1,NLtl

HI.Mt. ti

,u.._190,. ·-~-1,110.30'00

1,UO XMOO

111211., ,000

15,2'19•1000

11.-."Ju.oo , . .... 114.00

......... _. ,.ott.nuo

,i.on.n:u• n .en.,u..•

.,.,HJoo «7.>0>00

,n,:auM M7,JN.00

'-'°'311 S1 5,109.311 5'

1),~0:,000

1),500.00000

s.ooo.eoooo S.000.00000

,,.sm.00000

,,,~.00000

41,<X>0.00000

000

000

"" 0 ...

o .. 000

000

o ..

.... uo . .. ...

000

000

... ... 0 ..

0 ..

000

000

... ... 0 ..

000

000

000

... 000

000

000

000

.... . ..

... , ...

000

000

'·" ... u o , ...

,,nooo n.nooo

,:u....,oo 1n •oo

>1,n1a, ,.,,n:n

oll>\•11U

..... ,.,10

4.3\1 11

00, 0000000

'" 00, 0000000

065

00, 0000000

o ..

001 0000000

"' L21

u ,

00, 0000000

00, 0

u ,

o .. 0000000

0 ..

000 0000000

0,, 0

'·"

000 0000000

0"

000 0000000

....

000 0000000 ... 000 0000000

0,0

..,.

,..,

000 0000000

00,

o ...

, ... .....

000 0000000

O,O ,. 0 .. 0000000

" ' . .. 000 0000000

o .. '·"' 0000000 ... "''

000 0000000

~_FU200UJ c• ,U UM7<4 OUE 20 AUQ 20H

SUI TOTAL CORl'Ofl.ATI 10fll0$

1\11 TOTAL COAIOAATI HCUIUTIH

GOVE RM ENT INTRUMEN1S

FIXED AATIE TREASURY NOTE$

~M_Jt0171

FJ:TN 2M ,t.aff)kOtt t.lU'II, OUI l~OH

.SUI TOTAL ,tJUI lllAH TRDSUllV NOT"aa

REP\JBUC ()jll THE PHU PPfNES

RETAl_l TREASURY80N05

~_ttoS41

~_JJJ011

11/STOTALIIIETAIL~IIOHOS

.sue TOTAL flX.IED 1NCOA.:

FUNOOf P:UNOS

OANKS

IUI TOTAL.IMKa

------.... -.... -.... ....

--.... ----""'

-... ... -

-

1000000 1000000

10,000,00000000I) iiC214 1 000000

t9 C274 1 000000

1,540000000000 1000000 100!Xl00

1000000 1000000

&.000,000_000000 119913,J 1000000

9999'33 100000:,

5,000,000000000 1005104 1 000000

100$104 1000000

20.000.000000000 1001111 1 000000

1002111 1 000000

10,00Cl.000.000000 10715241 1 000000

,01~4 1 000000

7,700,000000000 100 0000 1 000000

100000C 1000000

501;00000.000000 101! ~S3 I 000000

11M5965l 1000000

50000,000000000 IXl4214 1000000

99 •29• 1000000

50000,00000000C 1191870 1 000000

!Nl7S10 1000000

11l000000000000 1000000 I 000000

1000000 1000000

41l,000,D00000000 1l5l\60 1000000

llSll.tO 100000)

:5000Cl000000000

lOOOll,000000000 t)ll4832 1 000000

1304132

50000,000000000 991111 1 000000

9!11117 1 000000

S000,000000000 114 1431 1 000000

114 M39 1000000

50,000,000000000 tO~ JS)7 1 000000

11)2li32 1000000

25000,00CIOOOOOC 1102719 100000:I

1101719 1000000

3'4,Get .11200 l t1«lN

111«:IM 1000000

4.000,00000

1,'42,4"01

l ,l,C,2,ffl01

1,5'60.00000

0,$$0,00000

l0.1'-ll,H2••

2tl.8"il,Nl411

,o,n2,2lloo 10,772.2HOO

1,100,00000

7,100,00000

117,710,0ltM

117,170,081. ..

117,ffl,OII N

117,710,0II.N

Y,1121,502$7

S1t12t.50,s1

..,,S.-S.11S'1

C9S4$,11S91

.t9,t61,9D0 17

~.1161,9111)11

10,000,00000

10000,00000

d.5el,2f0 30

OM).2'030

271~11060

i11SO.ll1ll40

.,-..,.oaa2 4t9QJ_431 8 2

MJ,ff'l",IN.N

i.lJ.171,MUf

5,180,0.)472

5,1S0.03472

l,1IIO,OU..T2

1,190,CR:4.n

5-2.4le,"9900

51 431 ,4)900

11.,,1,1nis

21,417,112,S

H~7UI

n .1U,.,1.u

•21.11,., ... n • a,111.,w4,n

'47,lt1., .... 1t

U7,2*1.4't.12

4t,ke,ffll.2:t

4,000,00000 ,0000

ll.kl,742 83 114214M 10000

9.9'Q.7f2&l 10000

, .seo.00000 ·00000000 10000

ueo,00000 10000

4.9111.M.3 U 11191:)218 1 0000

4,9",S&l 12 1 0000

S,021,51001 10(U10.t01

S,021.,$1007

'0000

'0000

20,CQ,:UOO$ 'I00211~ 1 000C

20C'-2,2100S 1 C000

10761,41970 107124797

10.Ml,47970

,0000

,0000

7,100,00000 ,ocooocoo 1 0000

1 .100,000 00 1 0000

111,1u,H1.M

117,1'4,NJ,M

117,1"4,t t1.lk

111,144,NJ.M

Sl, 492,131,Afl 1oe18ll6, 10000

Sl,492.S31141 10000

,, 11<1,&rs 47 g1111494 , 0000

•t 71 <t,ltS 47 1 0000

ot9U3,S74 C3 97J05696 10000

"9Ml,S24 C)

10,000,00000 r.!5.l114l 1 0000

10000,00000 1 0000

S4, 12S,8 1l7S 121.SSSSl

S•11M1117S

u,..,,nsr• 17t5M5e

44l.t9,1'S7•

,0000

,0000

' 0000

'0000

21 091,l)lto ll1&<1l108 1 0000

21 0H,1)8&.) 10000

•990\,Ull7S ~43$6131

4911m,Ull7S ICOOO

"'·* ·71Jfl )Jf,JU ,l1J.n

5)"2,1 i6C) 1130275'7

s .1•2.1~0,

1 ,70,IM.02

l,142.1H.CR:

S1,179,609 7S 1()2 211270 1 0000

S1,171,tol7S

27,5f7,IIIS7S 111M<t:s1 1 000(l

l7, 5f7.~7S 10000

fl,74',116.IG

11., ...........

IH,OCIO,I01U

"9,000,II01.1.

42,t.Ml,11447 111131500

' l .116t,1H41

u,...,,u.4, •i.na,nu,

' 0000

'0000

4,000,00000

1 ,SS0,00000

9,590,00000

$,021,520Cl1

S,O'M,S20Cl7

20.(M2,2100&

20,0422100$

10,762,47170

10,7Gl,41'870

7,1'00,00000

1,100,00000

117,144,Nl.M

117, t44,N1.M

117,14',N7.lk

117,U4.N1.M

SUll.1131 00

Sl,lllJlJ1 0C1

41,tiJ, 7•700

41,llil,74700

9,153,114 '20

9,25J, t14 20

43.911,92100

0 .917,92100

47,111 ,41S:50

c 7,1tl,41S5ll

5,1$51 ,31lJS

S,S5l ,J7tM

1,,111 ,Ut.H

, ... 1,111.11

51,10111l500

51,10\l,'35 00

27.M.80775

21,'99,I011S

41U$1.M1.to

41UU.ll'P.IO

Q.,059,9"57

4J.05Sl,t3lS7

4,311 11

1N,nl .U

liS, 7119'

42,361.11

42,lll.11

l0,503.4.l

30,$0)0

297,Cllll

297,0U "

1•• .110e.

l « ,170.!14

, ... ,., ... 11

1,..,.,IM,ZI

, ... , ,, .... 71

,,...,,, ... 21

..,..,oo 84000000

50_l.t12l

!,0 ~1 2)

141,l19•S

U1,319•S

l,OH,Gn.lt

2,0fol,N'.l.12

N.14021

M.14021

H,M0.211

M ,140.2:t

, ..... 2:.14

, ...... ..

4,1H.CM1M

01l,,.041 ...

000

0.00

... 000

on

,.,

"'

,,.

O<l

"' ,,,

00)

00)

000

000

000

000

000

'"' o"""" .... 00)0000 .,., 00)0000 .... 00)0000

, .... 000000) ,.,

'"0000 ... .,,.,.,

'·""

"""' , ... • 515000

, .... 4 1(i000

s.n>

0000000 .. ,. ... ,.., ..... ,, .....

1,5ei3

S180097 ....

'"'"' ,.,

"""" 7,512

0000000

--.......

~ -"-- ••"' CHl!i.UN«T1Ne~TACOOUHT'"-'AMI0 .. 1Cl f0t Pf,4fl

IUI TOTAL nuo OO'O• Ta

IUtTOTALtAHK&

INT PUT I :HYIOf"HO l!ICIJVAllU

TOTM.NAV

.... -.... ..... .... -'"' -...

'"'

tO.ocn,9"".450000 100000C 1 000000

1000000 t 000000

l0Cl1.01)1CIOOO t OOOOOO 1 000000

1000000 t 000000

)0031,0UtM

l0.0>1.01:1 ..

1,2U, IM.Oll! •

10001 ..... 4$ 100000000 10000

10_00,,N,11,6$ 10000

30,0)1,013.. 100000000 10000

JOo.>t .013.. tOXO

ff,OU,Mf.M

... on .MUI

41,0lt,tM.lt

H .N2.NI.M

t ,t1t,.ollt ,17&.N

lO,Oll,OUM

30.0)t,OU ..

... OH, IM..M'

... , u .......

4, :II0,1N.H

2.103.ULU

,.-,.111.N1.n

, ,aoo,11, .111.n

MU1Utt.OI

... ~ .. , ...

104111

1 ,0011

t .OM,11

1.-....,,

1,NUI

2,0M '1

• ,SI0,12LM

0000000

0000000

'

PAMI HORIZON FUND, INC.

NOTES TO FINANCIAL STATEMENfS As of the Quarter ended March 31, 2017

Note 1 - General information

14

PAMI Horizon Fund, Inc. (the "Fund") is an open-end mutual fund company organized to acquire and sell, transfer or otherwise dispose of securities of all kinds including sale of its shares of stock, the proceeds of which are invested in equity and fixed income investments. As an open-end mutual fund company, its outstanding shares of stock are redeemable anytime based on the net asset value ("NAV") per unit at the time of redemption.

The Fund is registered with the Securities and Exchange Commission ("SEC") on August 8, 1997 under the Corporation Code of the Philippines. The SEC approved the registration of the Fund under the Investment Company Act (Republic Act No. 2629) and the Revised Securities Act on June 18, 1998. The Fund started commercial operations on July 1, 1998. The table below shows the Fund's track record of registration of securities under the SRC (in absolute amount).

SEC approval date August 8, 1997

December 17, 2007

Number of shares 1,000,000,000 1,000,000,000

Par value Php1 Php1

On January 18, 2013, the SEC approved the change in the name of the Fund from GSIS Mutual Fund, Inc. to PAMI Horizon Fund, Inc.

The Fund's registered office address, which is also its principal place of business, is located at 17F Philam Life Head Office, Net Lima Building, 5th Avenue comer 26th St., Bonifacio Global City, Taguig 1634, Philippines.

The Fund has no employees. Philam Asset Management, Inc. ("PAMI"), a wholly-owned subsidiary of The Philippine American Life and General Insurance Company ("Philamlife"), acts as the Fund manager. PAMI also serves as adviser, administrator and distributor of the Fund and provides management, distribution and all required operational services.

The Fund is designed to seek above average return from income and long-term capital appreciation through investments in listed equities and fixed income securities of Philippine and international companies including debt obligations of the Republic of the Philippines and its instrumentality as well as those of foreign governments.

From July to September 2011, GSIS redeemed its 1,042,963,168 shares from the Fund and the proceeds were transferred to an investment management account with PAM!.

Note 2 • Summary of significant accounting policies

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied to all years presented, unless otherwise stated.

2.1 Basis of preparation

The financial statements of the Fund have been prepared in accordance with Philippine Financial Reporting Standards ("PFRS"). The term PFRS, in general, includes all applicable PFRS, Philippine Accounting Standards ("PAS") and interpretations of the Philippine Interpretations Committee ("PIC"), Standing Interpretations Committee ("SIC") and International Financial Reporting Interpretations Committee ("IFRIC") which have been approved by the Financial Reporting Standards Council ("FRSC") and adopted by the SEC.

The financial statements have been prepared under the historical cost convention, as modified by the revaluation of financial assets at fair value through profit or loss ("FVTPL ").

The preparation of financial statements in conformity with PFRS requires the use of certain critical accounting estimates. It also requires management to exercise its judgment in the process of applying the

Fund's accounting policies. The areas involving a higher degree of judgment or complexity significant to the financial statements are disclosed in Note 4.

Changes in accounting policy and disclosures

(a) New and amended standards adopted by the Fund

15

The following amendments to existing standards have been adopted by the Fund effective January 1, 2017:

• PAS 1 (Amendment), 'Presentation of financial statements' Disclosure initiative. The amendments provide clarifications on a number of issues, including (a) materiality- an entity should not aggregate or disaggregate information in a manner that obscures useful information. Where items are material, sufficient information must be provided to explain the impact on the financial position or performance. (b) Disaggregation and subtotals- line items specified in PAS 1 may need to be disaggregated where this is relevant to an understanding of the entity's financial position or performance. There is also a new guidance on the use of subtotals. (c) Notes- confirmation that the notes do not need to be presented in a particular order. (d) OCI arising from investments accounted for under the equity method- the share of OCI arising from equity-accounted investments is grouped based on whether the items will or will not be subsequently reclassified to profit or loss. Each group should then be presented as a single line item in the statement of other comprehensive income. The amendments did not have significant effect on the Fund's financial statements.

Other standards, amendments and interpretations which are effective for the financial year beginning on January 1, 2017 are not material to the Fund.

(b) New standards, amendments and interpretations not yet adopted

A number of new standards and amendments to standards and interpretations are effective beginning after January 1, 2017, and have not applied in preparing the financial statements. None of these is expected to have a significant effect on the financial statements, except the following set out below:

• PFRS 9, Financial Instruments. This new standard addresses the classification, measurement and recognition of financial assets and financial liabilities. The complete version of PFRS 9 was issued in July 2014. It replaces the guidance in PAS 39 that relates to the classification and measurement of financial instruments. PFRS 9 retains but simplifies the mixed measurement model and establishes three primary measurement categories for financial assets: amortized cost, fair value through OCI and fair value through P&L. The basis of classification depends on the entity's business model and the contractual cash flow characteristics of the financial asset. Investments in equity instruments are required to be measured at fair value through profit or loss with the irrevocable option at inception to present changes in fair value in OCI without recycling. There is now a new expected credit losses model that replaces the incurred loss impairment model used in PAS 39. For financial liabilities there were no changes to classification and measurement except for the recognition of changes in own credit risk in other comprehensive income, for liabilities designated at fair value through profit or loss. PFRS 9 relaxes the requirements for hedge effectiveness by replacing the bright line hedge effectiveness tests. It requires an economic relationship between the hedged item and hedging instrument and for the 'hedged ratio' to be the same as the one management actually use for risk management purposes. Contemporaneous documentation is still required but is different to that currently prepared under PAS 39. The standard is effective for accounting periods beginning on or after January 1, 2018. Early adoption is permitted. The Fund is currently assessing the impact of PFRS 9 on its financial statements.

There are no other standards, amendments and interpretations that are not yet effective that would be expected to have a material impact on the Fund's financial statements.

2.2 Cash and cash equivalents

Cash and cash equivalents include deposits held at call with banks and other short-term highly liquid investments with original maturities of three months or Jess from date of acquisition.

2.3 Financial instruments

Date of recognition

Financial instruments are recognized in the statements of financial position when the Fund becomes a party to the contractual provisions of the instrument. Purchases or sales of financial assets that require delivery of assets within the time frame established by regulation or convention in the marketplace are recognized on the trade date.

Initial recognition of financial instruments

Financial instruments not carried at FVf PL are initially recognized at faii: value plus transaction costs. Financial instruments carried at FVTPL are initially recognized at fair value, and transaction costs are recognized as expense in profit or loss.

16

Day1 profit

Where the transaction price in a non-active market is different from the fair value from other observable current market transactions in the same instrument or based on a valuation technique whose variables include only data from observable market, the Fund recognizes the difference between the transaction price and fair value (a "Day 1"

profit) in profit or loss unless it qualifies for recognition as some other type of asset. In cases where variables are made of data which are not observable, the difference between the transaction price and model value is only recognized in profit or loss when the inputs become observable or when the instrument is derecognized. For each transaction, the Fund determines the appropriate method of recognizing the Day 1 profit amount.

Classification of financial instruments

The Fund classifies its financial assets in the following categories: (a) financial assets at FVfPL, (b) held-tomaturity, (c) loans and receivables and (d) available-for-sale. The Fund classifies its financial liabilities at FVfPL or as other financial liabilities at amortized cost. The classification depends on the purpose for which the financial instruments were acquired or incurred and whether they are quoted in an active market. Management determines the classification of the Fund's financial instruments at initial recognition. The Fund does not hold any financial assets under categories (b) and (d) during and at the end of each reporting period. The Fund does not hold any financial liabilities at FVTPL during and at the end of each reporting period.

Financial assets or .financial liabilities at FVI'PL

This category consists of financial assets or financial liabilities that are held for trading or designated by management as at FVfPL on initial recognition. Derivatives instruments, except those covered by hedge accounting relationships (none as at reporting dates), are classified under this category.

Financial assets or financial liabilities classified in this category are designated by management on initial recognition when the following criteria are met:

• The designation eliminates or significantly reduces the inconsistent treatment that would otherwise arise from measuring the assets or liabilities or recognizing gains or losses on them on a different basis;

• The assets and liabilities are part of a group of financial assets, financial liabilities or both which are managed and their performance evaluated on a fair value basis, in accordance with a documented risk management or investment strategy; or

• The financial instrument contains an embedded derivative, unless the embedded derivative does not significantly modify the cash flows or it is clear, with little or no analysis, that it would not be separately recorded.

Financial assets at FVTPL are recorded in the statements of financial position at fair value, with changes in the fair value recorded in profit or loss, included under Fair value gains Oosses). Interest earned is recorded in Interest income, while dividend income on equity instrument is recorded in profit or loss under Dividend income when the right of the payment has been established. Gains or losses realized from the sale of financial assets at FVf PL are recorded in Fair value gains (losses) in profit or loss.

Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They are not entered into with the intention of immediate or short-term resale and are not classified as financial assets held for trading, designated as available-for-sale or FVTPL. This accounting policy applies to cash and cash equivalents and accrued income.

After initial measurement, loans and receivables are subsequently measured at amortized cost using the effective interest method, less allowance for impairment, if any. Amortized cost is calculated by taking into account any discount or premium on acquisition and fees that are an integral part of the effective interest rate. The amortization is included in Interest income in profit or loss. The losses arising from impairment of such loans and receivables are recognized in Provision for impairment losses in profit or loss.

Other financial liabilities at amortized cost

Issued financial instruments or their components, which are not designated as financial liabilities at FVfPL are classified as other financial liabilities, where the substance of the contractual arrangement results in the Fund having an obligation either to deliver cash or another financial asset to the holder, or to satisfy the obligation other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the Fund's own equity shares.

17

After initial measurement, other financial liabilities are subsequently measured at amortized cost using the effective interest method. Am01tized cost is calculated by taking into account any discount or premium on the issue and fees that are an integral part of the effective interest rate.

This accounting policy applies to accounts payable and accrued expenses (excluding taxes payable) and due to PAMI.

Impairment of financial assets

The Fund assesses at each reporting date whether a financial asset or group of financial assets is impaired.

A financial asset or a group of financial assets is deemed to be impaired if, and only if, there is objective evidence of impairment as a result of one or more events that has occurred after the initial recognition of the asset (a "loss event") and that loss event (or events) has an impact on the estimated future cash flows of the financial asset or the group of financial assets that can be reliably estimated. Evidence of impairment may include indications that the debtor or a group of debtors is experiencing significant financial difficulty, default or delinquency in interest or principal payments, the probability that they will enter bankruptcy or other financial reorganization and where observable data indicate that there is a measurable decrease in the estimated future cash flows, such as changes in arrears or economic conditions that correlate with defaults.

Loans and receivables

For loans and receivables which are carried at amortized cost, the Fund first assesses whether objective evidence of impairment exists individually for financial assets that are individually significant, or collectively for financial assets that are not individually significant. If the Fund determines that no objective evidence of impairment exists for an individually assessed financial asset, whether significant or not, it includes the asset in a group of financial assets with similar credit risk characteristics such as type of borrower, collateral type, past-due status and term, and collectively assesses for impairment. Assets that are individually assessed for impairment and for which an impairment loss is, or continues to be, recognized are not included in a collective assessment for impairment. The criteria that the Fund uses to determine that there is objective evidence of an impairment loss include:

• Delinquency in contractual payments of principal or interest; • Cash flow difficulties experienced by the borrower; • Breach ofloan covenants or conditions; • Initiation of bankruptcy proceedings; • Deterioration of the borrower's competitive position; and • Deterioration in the value of collateral.

If there is objective evidence that an impairment loss has been incurred, the amount of the loss is measured as the difference between the asset's carrying amount and the present value of the estimated future cash flows. The carrying amount of the asset is reduced through use of an allowance account and the amount of loss is charged to profit or loss. If, in a subsequent period, the amount of the estimated impairment loss decreases because of an event occurring after the impairment was recognized, the previously recognized impairment loss is reversed. Any subsequent reversal of an impairment loss is recognized in profit or loss, to the extent that the carrying value of the asset does not exceed its amortized cost had the impairment not been recognized at the reversal date.

The present value of the estimated future cash flows is discounted at the financial asset's original effective interest rate. Time value is generally not considered when the effect of discounting is not material. If an instrument has a variable interest rate, the discount rate for measuring any impairment loss is the current effective interest rate, adjusted for the original credit risk premium. The calculation of the present value of the estimated future cash flows of a collateralized financial asset reflects the cash flows that may result from foreclosure less costs for obtaining and selling the collateral, whether or not foreclosure is probable.

For the purpose of a collective evaluation of impairment, financial assets are grouped on the basis of such credit risk characteristics as type of debtor, past-due status and term.

Derecognition of financial assets and liabilities

Financial asset

A financial asset (or, where applicable, a part of a financial asset or part of a group of similar financial assets) is derecognized where:

18

• The right to receive cash flows from the asset has expired; • The Fund retains the right to receive cash flows from the asset, but has assumed an obligation to pay them in

full without material delay to a third party under a 'pass-through' arrangement; or • The Fund has transferred its right to receive cash flows from the asset and either (a) has transferred

substantially all the risks and rewards of the asset, or (b) has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset.

Where the Fund has transferred its right to receive cash flows from an asset and has neither transferred nor retained substantially all the risks and rewards of the asset nor transferred control of the asset, the asset is recognized to the extent of the Fund's continuing involvement in the asset.

Financial liability

A financial liability is derecognized when the obligation under the liability is discharged, or cancelled or has expired.

Where an existing financial liability is replaced by another from the same lender on substantially different terms, or the terms of an existing liability are substantially modified, such an exchange or modification is treated as a derecognition of the original liability and the recognition of a new liability, and the difference in the respective carrying amounts is recognized in profit or loss.

Offsetting of financial instruments

Financial assets and financial liabilities are offset and the net amount is reported in the Fund's statements of financial position if, and only if, there is a currently enforceable legal right to offset the recognized amounts and there is an intention to settle on a net basis, or to realize the asset and settle the liability simultaneously.

2.4 Fair value measurement

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The fair value of a non-financial asset is measured based on its highest and best use. The asset's current use is presumed to be its highest and best use.

The fair value of financial and non-financial liabilities takes into account non-performance risk, which is the risk that the entity will not fulfill an obligation.

There are no significant non-financial assets as at March 31, 2017 and December 31, 2016.

The fair value for financial instruments traded in active markets at the reporting date is based on their quoted market price or dealer price quotations, without any deduction for transaction costs. When current bid and ask prices are not available, the price of the most recent transaction provides evidence of the current fair value as long as there has not been a significant change in economic circumstances since the time of the transaction.

For all other financial instruments not listed in an active market, the fair value is determined by using appropriate valuation techniques. Valuation techniques include net present value techniques, comparison to similar instruments for which market observable prices exist, option pricing models, and other relevant valuation models.

PFRS 13 specifies a hierarchy of valuation techniques based on whether the inputs to those valuation techniques are observable or unobservable. Observable inputs reflect market data obtained from independent sources; unobservable inputs reflect the Fund's market assumptions. These two types of inputs have created the following fair value hierarchy:

Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities. This level includes listed equity securities and debt instruments on exchanges (for example, Philippine Stock Exchange, Inc., Philippine Dealing and Exchange Corp., etc.).

Level 2 - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e., as prices) or indirectly (i.e., derived from prices).

Level 3 - Inputs for the asset or liability that are not based on observable market data (unobservable inputs). This level includes equity investments and debt instruments with significant unobservable components.

19

The Fund's classification of its financial assets based on the above fair value hierarchy is presented in Note 3 to the financial statements.

2.5 Share capital

The Fund issues shares, which are redeemable at the holder's option and are classified as equity in accordance with PAS 32, Financial instruments: Presentation. Each share has the following features which support the equity classification:

• · It entitles the holder to a pro rata share of the Fund's net assets in the event of the entity's liquidation; • The share has no priority over other claims to the assets of the entity on liquidation, and it does not need to be

converted into another instrument before it is classified as such; and • All shares have an identical contractual obligation for the Fund to deliver a pro rata share of its net assets on

liquidation.

In addition, the Fund has no other financial instrument or contract that has:

• total cash flows based substantially on the profit or loss, the change in the recognised net assets or the change in the fair value of the recognised and unrecognised net assets of the Fund (excluding any effects of such instrument or contract); and

• the effect of substantially restricting or fixing the residual return to the shareholders.

Should the redeemable shares' terms or conditions change such that they do not comply with the strict criteria as mentioned above, the redeemable shares would be reclassified to a financial liability from the date the instrument ceases to meet the criteria. The financial liability would be measured at the instrument's fair value at the date of reclassification. Any difference between the carrying value of the equity instrument and fair value of the liability on the date ofreclassification would be recognized in equity.

Redeemable shares can be put back to the Fund at any time for cash equal to a proportionate share of the Fund's trading NAV calculated in accordance with the Fund's regulations. Redeemed shares are not cancelled and may be reissued in the future.

Share premium

Sales of shares are recorded by crediting Share capital at par value and Share premium for the amount received in excess of the par value; redemptions are recorded by debiting those accounts. In the event that the Share premium balance is exhausted as a result of redemptions, the Retained earnings account is reduced by redemptions in excess of par.

2.6 Revenue recognition

Dividend income

Dividend income on equity instrument is recognized when the Fund's right to receive the payment is established.

Interest income

Interest income is presented gross of final tax and recognized on a time-proportion basis using the effective interest method. When a receivable is impaired, the Fund reduces the carrying amount to its recoverable amount, being the estimated future cash flows discounted at original effective interest rate of the instrument, and accretes the discount as interest income. Interest income on impaired financial asset carried at amortized cost is recognized using the original effective interest rate.

Other income

Other income is recognized when earned and the Fund's right to receive payment is established.

2.7 Expenses

Expenses are recognized in the year in which they are incurred.

2.8 NAV per share

NAV per share is computed by dividing net assets attributable to shareholders (total assets less total liabilities) by the total number of shares issued and outstanding at the reporting date.

20

2.9 Earnings per share

Basic earnings per share is calculated by dividing the profit attributable to shareholders of the Fund by the weighted average number of shares outstanding during the year.

Diluted earnings per share is calculated by adjusting the weighted average number of shares outstanding to assume conversion of all dilutive potential shares. The number of shares calculated as above is compared with the number of shares that would have been issued assuming the exercise of the share options.

As at March 31, 2017, there are no dilutive potential shares.

2.10 Taxation

The Fund is domiciled in the Philippines. Under the existing tax laws of the Philippines, a documentary stamp tax, included under Taxes, licenses and other fees in profit or loss, is payable by the Fund on original issue and subsequent sale or transfer of its redeemable shares.

The Fund has interest income from bank deposits and government securities which is subject to final withholding tax. Such income is presented at gross amount and the related final tax is presented as part of Income tax expense in profit or loss.

2.11 CUITent and deferred income tax

Income tax expense for the period comprises current and deferred tax. Tax is recognized in profit or loss, except to the extent that it relates to items recognized in other comprehensive income or directly in equity, in which case, the tax is also recognized in other comprehensive income or directly in equity, respectively.

Current tax assets or liabilities comprise those claims from, or obligations to, fiscal authorities relating to the current or prior reporting period, that are uncollected or unpaid at the end of reporting period. They are calculated using the tax rates and tax laws applicable to the fiscal periods to which they relate, based on the taxable profit for the year. All changes to current tax assets or liabilities are recognized as a component of income tax expense in profit or loss.

Deferred income tax ("DIT") is provided, using the liability method on temporary differences at the end of the reporting period between the tax bases of assets and liabilities and their canying amounts for financial reporting purposes. Under the liability method, with certain exceptions, DIT liabilities are recognized for all taxable temporary differences and DIT assets are recognized for all deductible temporary differences and the carry-forward of unused tax losses (net operating loss carry over or NOLCO) and unused tax credits ( excess of minimum corporate income tax or MCIT) to the extent that it is probable that taxable profit will be available against which the DIT asset can be utilized. Deferred income tax liabilities are recognized in full for all taxable temporary differences, except to the extent that the deferred tax liability arises from the initial recognition of good'A~ll.