For personal use only · Atlas Group Holdings Limited – H1 Results Presentation (28 February...

Transcript of For personal use only · Atlas Group Holdings Limited – H1 Results Presentation (28 February...

1

Atlas Group Holdings Limited – H1 Results Presentation (28 February 2007)

Full Year Results - FY 07August 2007

Competency, consistency, and growth

For

per

sona

l use

onl

y

2Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Headline Results

• Revenues $423.2m (up 9%)

• EBIT $12.0m, underlying EBIT $16.5m

• NPAT $1.0m (loss), underlying NPAT $6.1m

• Working capital impacted by metal prices / mill deliveries

– Inventory $154.1m

– Net Debt $141.8m

• Operating cash outflow $48.8m

• Underlying EPS 6.0c

• Final dividend 1.5 cps (unfranked)

• Full year dividend 3.0 cps (unfranked)For

per

sona

l use

onl

y

3Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Highlights

• Bisalloy completes expansion by adding second shot blaster– Record annual production, significant capacity increase

• Market conditions positive in second half FY07

• Improved performance at Australian distribution meeting profit expectations for the period

• Key actions taken to improve performance in New Zealand and Project Services

– New management appointments and operations being streamlined

• Group Supply and procurement restructured to reduce costs

• Substantially higher metal prices result in increased inventory for the full year

• Volatile market conditions since year end (metal pricing, exchange rates)

For

per

sona

l use

onl

y

4Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Group Profit

-(2.5)- Write-off NZ Tax Losses

(4.0)(4.5)- One-off Costs

(7.4)(0.1)- Discontinued Operations

3.0c(4.4c)(1.4c)EPS - Basic

(1.2c)7.2c6.0cEPS - Underlying

(4.4)(1.4)Net Profit / (Loss) After Tax

(1.0)(1.0)- Taxation

(9%)18.216.5EBIT (underlying *)

(18%)7.46.1NPAT (underlying *)

(9.8)(9.4)- Net Financing Costs

7.8c

(0.4)

FY06

(4.8c)3.0cDividend per share **

(0.4)- Minority Interests

Chg%FY07($m)

* continuing operations excluding one-off costs. ** FY06 fully franked, FY07 unfranked

For

per

sona

l use

onl

y

5Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Restructuring Costs(Continuing Operations / Before Tax)

0.4Project Services debtor provision

0.5Technip settlement

0.9Non-cash FX hedge fair value adjustment

0.4CDC (distribution network) restructuring

0.2Provision for insurance deductible (FY03)

4.5Total Restructuring Costs

1.1NZ restructuring, write offs and provisions

1.0Redundancies

FY07($m)

For

per

sona

l use

onl

y

6Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Balance Sheet

(28.4)(59.5)(88.0)Payables & Provisions

12%60%72%Gearing (ND / ND+Eq.)

57.484.4141.8Net Debt52.9142.5195.4Funds Employed(3.9)6.82.9Net Discontinued

(4.5)58.153.6Equity

1.110.511.6Other Assets-28.928.9Property Plant & Equipment

64.189.9154.1Inventory65.8

Jun0620.185.9ReceivablesVar.Jun07($m)

For

per

sona

l use

onl

y

7Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

FY07

0

1

2

3

4

5

6

Jul-0

3

Jul-0

4

Jul-0

5

Jul-0

6

Jul-0

7

Stai

nles

s St

eel (

US$

/kg)

0

10

20

30

40

50

60

Nic

kel (

US$

/kg)

Metal Prices / Group Inventory

Nickel

Stainless Steel

• Market volatility since year end*

– Nickel down ~20%

– Aluminium down ~10%

– Stainless Steel down various

– USD-AUD up 4%

• Increased mill deliveries

• Inventory $154.1m– Tonnes up 20%

– Avg. Cost up 40%

Metal Prices (to Jul 07)

yoy

* period from June 30 2007 to 22 August 2007

For

per

sona

l use

onl

y

8Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Cash Flow

(23.9)61.0- Debt Proceeds / (Repayments)

(0.9)

(31.2)

(1.4)

(6.0)

-

(6.4)

36.7

FY06

(1.6)- Other

2.8

87.1

(1.2)

(85.5)

Var.

1.9Net Cash Increase / (Decrease)

55.9Net Financing Activities

(3.5)- Dividends (net)

-- Share Issues (net)

(5.2)Net Investing Activities

(48.8)Net Operating Cash Flow

FY07($m)

For

per

sona

l use

onl

y

9Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

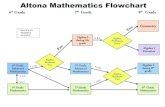

The Atlas Group

Aust. / NZ

• Metals distribution- 19 branches

• Metals processing- sheet & coil facility- bar mill- Durinox- plasma cutting

• Technical support

Aust. / NZAust. / NZ

• Metals distribution- 19 branches

• Metals processing- sheet & coil facility- bar mill- Durinox- plasma cutting

• Technical support

Asia

• Metals distribution- Thailand- Indonesia

• Represent. Office- Vietnam

AsiaAsia

• Metals distribution- Thailand- Indonesia

• Represent. Office- Vietnam

Manufacturing

• Bisalloy (NSW)- Q&T plate facility

• NZ Tube Mills- stainless & mild steel

tube mills

ManufacturingManufacturing

• Bisalloy (NSW)- Q&T plate facility

• NZ Tube Mills- stainless & mild steel

tube mills

Project Services

• Project-specific distribution business

• International focus / customer base

• Services- sourcing- procurement- logistics- warehousing- materials mgmt

Project ServicesProject Services

• Project-specific distribution business

• International focus / customer base

• Services- sourcing- procurement- logistics- warehousing- materials mgmt

DistributionDistributionDistribution

Group Services / Corporate(incl. Finance, Supply Chain, Human Resources, Information Management)

Group Services / CorporateGroup Services / Corporate(incl. Finance, Supply Chain, Human Resources, Information Manag(incl. Finance, Supply Chain, Human Resources, Information Management)ement)

For

per

sona

l use

onl

y

10Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Distribution - Australia / New Zealand

Australia• Operations performed strongly in the second half• Focus on improving WA performance• Costs associated with poorly performing warehouse operations

were disappointing• Warehouse operations have been streamlined with cost

savings anticipated in H1 FY08

New Zealand• Distribution operations had a poor year but significant

restructuring has been completed and cost savings expected • Performance in the final quarter of FY07 showed significant

improvementFor

per

sona

l use

onl

y

11Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Executive / Management Changes

AppointedRoleName

GM – Human Resources

GM – NZ Distribution

GM – Atlas Processing Ops.

GM – Group Supply

GM - Sales & Operations

Chief Financial Officer

CEO & Managing Director

Jun 07Mr John McGrath

Jul 07Mr Dave Stampa

Jul 07Mr Mark Connolly

Apr 07Mr Richard Spall

Feb 07Mr Andrew Luxton

Feb 07Mr John Reid

Feb 07Mr Kym Godson

For

per

sona

l use

onl

y

12Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Product Development

Rail Wagon Sheet / Plate• 3 year collaboration - JFE & Tokyo Boeki

– product development / certification

• Australian market ~10,000tpa

• Continued contract success

Durinox• Stainless steel re-enforcing bar• Atlas acquisition of processing facility• Life-cycle cost benefits v carbon steel• Coastal construction and infrastructure

projects• Atlas sole processor in Aust.-NZ

Coal wagons (Queensland Rail).

Wharf fender constructed from Durinox.

For

per

sona

l use

onl

y

13Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Distribution - Asia

Population ~400mGDP Growth 5-8%pa

Population 24mGDP Growth 2-3%pa

Current Situation• Established and profitable position

– Thailand / Indonesia• Attractive ROCE• Limited product portfolio

Opportunity• Low risk organic growth• Product diversification• Strong regional economies

Thailand Diversification• Engineering steels (new product)• Stainless Steel (established customer

relationships)• Leverage off existing infrastructure

Vietnam• Applied for a Representative Office

License• Plans to establish a JV

For

per

sona

l use

onl

y

14Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Project Services

• History– domestic focus– material procurement and supply– attractive ROCE

• New Business Model– target selected global blue-chip clients– focus on projects with Atlas operating synergies– service offering extended to include supply chain

and logistics management (where applicable)– resourced to understand and manage risk

• Recent Actions– new business manager appointed (Jan 07) and cost structure reduced– Contract wins include rail wagons, Caltex, Inco– responsibility for domestic projects reverts to state and regional management to gain

greatest leverage from established infrastructure / systems

For

per

sona

l use

onl

y

15Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

0

10

20

30

40

50

60

FY01 FY02 FY03 FY04 FY05 FY06 FY07

kt p

a

Bisalloy

Q&T Market• Demand strong

– y-o-y growth continues• Resource sector exposure• Multiple end-user applications

– OEM / R&M

Bisalloy• Record FY07 production (42,800t)• Expansion project completed

– $2m capex– 30% capacity increase– high IRR

• ROCE attractive

Q&T Demand - Australia

New shot blaster

For

per

sona

l use

onl

y

16Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Bisalloy Outlook

• FY08 production target 50kt– 47.5kt Q&T plate

– 2.5kt toll treatment

• Greenfeed supply flexibility– domestic v. import options

• Regain domestic market share

• Capitalise on strong export

demand, especially armour plate

• Capacity for further expansion subject to market demand

100

120

140

160

180

200

Q2-06 Q3-06 Q4-06 Q1-07 Q2-07 Q3-07 Q4-07

Ave

rage

tonn

es p

er d

ay

Production Ramp-up (tpd)

For

per

sona

l use

onl

y

17Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Summary - FY07

• Record Bisalloy production, capacity for further expansion subject to market demand

• Market conditions positive in second half FY07

• Australian distribution improved performance meeting profit expectations for the period

• Restructuring completed for Group Supply, New Zealand and Project Services

• New experienced senior management appointments completed

• Normalised full year EBIT $16.5m

• Full year dividend 3.0cps (unfranked)For

per

sona

l use

onl

y

18Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Focus for FY08

• Cost reduction program in our Warehouse and Administration operations

• Continued expansion and progressive improvement in Bisalloy

• Increased market share for WA operations• Continued improvement in NZ operations as a result of

restructuring• Diversification of the NZ Tube Mills product range• Growth and delivery of shareholder value by maintaining a

strategic focus on:– Expanding the revenue base– Broadening geographic coverage– Participating in down-stream value added processing

For

per

sona

l use

onl

y

19Atlas Group Holdings Limited – FY07 Full Year Results Presentation (August 2007)

Outlook

• Distribution businesses to have a difficult first half– Margins / revenue to be suppressed as declining global metal

prices flow through the supply chain

– Management review of cost base to mitigate this impact

• Bisalloy outlook is for strong results

– Increased capacity

– Ongoing domestic demand

– Increased export orders

For

per

sona

l use

onl

y

20

Atlas Group Holdings Limited – H1 Results Presentation (28 February 2007)

Competency, consistency, and growth

For

per

sona

l use

onl

y

21

Atlas Group Holdings Limited – H1 Results Presentation (28 February 2007)

• Website www.atlasgroup.com.au

• Head Office Lynch RoadAltona North, VIC 3025Tel: (03) 9272 9999Fax: (03) 9272 9965

• Managing Director / CEO Kym [email protected]

• Company Secretary David [email protected]

ContactsF

or p

erso

nal u

se o

nly