Fm Assignment 0705114

Transcript of Fm Assignment 0705114

-

8/2/2019 Fm Assignment 0705114

1/18

Table of contents

Table of contents .................................................................................................... 1Unique selling proposition ....................................................................................... 2

Aims & objectives: ................................................................................................... 2

Key facts ................................................................................................................. 3

Competitive analysis ............................................................................................... 3

Market analysis summary .................................................................................... 3

SWOT analysis ........................................................................................................ 4

Funding requirements and company structure ........................................................ 8

Costing & pricing ..................................................................................................... 9

Breakeven analysis ............................................................................................... 10

Sensitivity analysis ................................................................................................ 12

Standard estimate .......................................................................................... 12

Best case scenario .......................................................................................... 13

Worst case scenario ........................................................................................ 14

-

8/2/2019 Fm Assignment 0705114

2/18

Unique selling proposition

The planned restaurant will be a Mediterranean themed restaurant named

Corrida situated in the city centre of Guildford. The restaurant aims to

distinguish itself from competitors through the provision of reasonably

priced high quality Mediterranean food (e.g. Spanish Tapas), drinks and

wine (e.g. Sherry and Port) as well as excellent customer service in a

pleasant and cozy servicescape that enhances the overall meal experience.

Since the level of service quality can make the difference between success

and failure, much emphasis will be placed on employee motivation and

development in order to attract and retain a skilled workforce. Even if this

entails high costs it doubtlessly plays a key role in satisfying and delighting

customers. Furthermore, the restaurant will implement sophisticated

information technology, such as Micros RES ePOS and ERP system

(Micros, 2011b), to enhance key value chain processes, improve decision-

making and reduce costs. Likewise, it will deploy customer relationship

management and integrated online and offline marketing initiatives to

create loyal and profitable customers. In this respect social media (e.g.

Facebook or Twitter) allow the restaurant to effectively communicate and

engage with guests and promote special offers online at low costs.

The restaurant aims to target a broad segment of customers aged 18-55+

as well as corporate customers who seek value for money. The restaurant

has a 20-seater function room which can be used for birthdays,

anniversaries, professional seminars and company events. The menu will be

adapted on a regular basis to provide seasonal dishes and cater for

customer preferences. Own events will be hosted throughout the year, such

as wine tastings or themed dinners.

Aims & objectives:

1) Provide an outstanding meal experience in a pleasant and cozyatmosphere

2) Gather regular feedback to ensure high guest and employeesatisfaction

3) Emphasize corporate social responsibility to satisfy key stakeholders4) Negotiate mutually beneficial contracts with suppliers to achieve high

gross margins

5) Maintain labor and food costs consistent with high ridge6) Enhance internal and external processes by implementing technology7) Increase annual sales revenues by 6% in 2015

-

8/2/2019 Fm Assignment 0705114

3/18

Key factsTotal capacity 100 seatsSeparate functionroom

20 seats

Opening hours Monday Sunday 12am-3pm, 6pm-

10.30pm

Competitive analysis

Market analysis summary

The Guildford area has 44 well-rated restaurants as listed by the Restaurant Guide (2011):

2 bar restaurants

1 American Bistro cuisine

1 Brasserie cuisine

1 Japanese Fast Food

1 Spanish cuisine

English, Gastropub, cuisine

3 Grill cuisines

Pub cuisines

2 French cuisines

14 Mediterranean Restaurants

2 Pizza & Pasta restaurants

casual and Traditional restaurants

There are only two direct competitors which offer similar meals (La Casita and Son

of Sombrero), yet lack quality customer service and an appealing atmosphere as

well as sophisticated technology. This provides a great opportunity to gain market

share and create loyal customers.

-

8/2/2019 Fm Assignment 0705114

4/18

SWOT analysis

Corrida

SWOTMatrix

Opportunities Threats

A new housingsociety is beingbuilt nearby.

The local counciloffers grant forregeneration ofunused area ifwe would like to

develop. Gain market

share

Create loyalcustomers

Deploytechnology toenhanceprocesses

Price competition

Local familyrestaurants withlover price.

Food priceincreases

Increase inoperating costs

Economic downturn

Strengths S-O strategies S-T strategies Our restaurant is

suitable foreveryone incommunity for alltype of purpose.

It is located intown centre.

We have goodchoice of itemsavailable in menu

for everyone. It offers private

area for anyfamily function orprofessionalmeetings.

Have take awayoptions forcustomers.

It is disabledfriendly

restaurant. Employee

satisfaction andwell-being

How can the restaurant

leverage strengths to benefit

from opportunities?

Ensure guest and employee

satisfaction

Establish mutually beneficial

relationships with suppliers

How can the restaurant usestrengths to minimise threats?

Increase cost-efficiency andimprove customer servicethrough technology

-

8/2/2019 Fm Assignment 0705114

5/18

Skilled employees

Sophisticatedtechnology

Weaknesses W-O strategies W-T strategies

Our restaurant isnew and notestablished.

We have limitedfunds available.

How can the restaurant

ensure that weaknesses do

not inhibit growth?

Develop sound marketing

strategy and integrate online

and offline initiatives

Allocate resources astutely to

ensure the highest possible

ROI

How can the restaurant fixweaknesses that can makethreats have a real impact?

Gain additional funding if

necessary

-

8/2/2019 Fm Assignment 0705114

6/18

Price comparison (food)

La casita Son of sombrero Olivo Corrida

Starter 5.1 4.95 6 5.14

Soup 3.45 2.95 4.4 3.45

Main dish 6.8 7.95 11.95 7.95

Dessert 5.1 4.95 7.1 5.95

Tapas

Cold tapas 1.60 1.95

Vegetariantapas

2.1 1.85

Fish tapas 4.5 3.27

Meat tapas 4.1 3.95

4 tapas meal 7.50 7.95

8 tapas meal 11.95 12.95

12 tapas meal 14.90 15.95

Price comparison (beverages)

La casita Son of sombrero Olivo Corrida

DrinksWater1000 ml

3.29 3.65 5.2 4.5

Beer 500 ml 3.3 3.1 3.9 3

Soft Drink 2.1 3 3.5 2.5

Fruit juices 3.1 3.5 5 3.42

Coffee 2.20 2.15 2.95 2.22

Tea 1.95 1.9 2.7 2.45

Wine White wine 10.95 11.2 15.5 13.4

Red wine 10.7 9.65 14.95 11.95

Sherry 3.4 4.15 5.2 4.83

Port 5.3 5.5 7.5 6.56

Sparkling wine 44.6 35.4 49.95 47.24

-

8/2/2019 Fm Assignment 0705114

7/18

-

8/2/2019 Fm Assignment 0705114

8/18

Funding requirements and company structureAn amount of 200,000 is needed to cover start-up costs and provide working

capital. Partners will contribute 40,000 at equal amounts and a Government

backed loan of 160,000 (at an Annual Interest Rate of 7.9% for a loan period of 10

years) provided by Natwest, 75% of which will be guaranteed by the UK

Department for Business Innovation and skills. This kind of loan allows borrowing

more money without having a large amount of security to back the borrowing

(Natwest, 2011). There is a 100 arrangement fee.

The structure of the restaurant will be a Limited Liability Partnership (LLP), which

requires partners to register at Companies HouseIn order to avoid possible

disagreement, an agreement will be written and approved by each member.

Moreover, each member needs to registers as self-employed at HM Revenue andCustoms (HMRC). In this kind of business, partners share the risks, costs,

responsibilities and profits of the business. However, liability is limited to the

amount of money that each partner has invested in the business and to any

guarantee they provided to secure the funding. This legal form is well adapted for a

restaurant which is not a big structure, but still provides some protection for the

partners if the business gets in trouble. In fact, this legal form allows different

people to work together without all the procedure constraint of a limited company.

The obligations are to produce annual self assessments returns for the business

and for each individual member to the Inland Revenue. Moreover, Limited liability

partnership must file accounts with Companies House. In this kind of business, thefour partners manage and support the business, but they can have employee. The

restaurants profits will be withdraw between the partners depending on the

agreement. Partners are taxed as individuals at normal rates on their share of

profits and need to pay their own National Insurance Contributions. In fact LLP

dont have to pay Corporation Tax (Business Link, 2011b)

-

8/2/2019 Fm Assignment 0705114

9/18

Costing & pricingIn terms of costing and pricing restaurants, in addition to tangible meals and

drinks, need to consider the intangible factors which complement the whole meal

experience, such as customer service and restaurant atmosphere (Cousins et al.,

2002). Likewise, perceived guest value, competition, price rounding and

traditional prices charged are further factors that influence the pricing decision

(Schmidgall et al., 2002, p. 196). Furthermore, given the perishability of inventories

it is crucial to carefully manage inventory levels. To facilitate both costing and

pricing the restaurant will use Micros RES system that maintains real-time

information on inventory levels, recipe ingredients and costs, competitive bids, as

well as actual versus theoretical reports (Micros, 2011a). The system also

facilitates adapting menus to cater for customer preferences and evaluate the

profitability of individual menu items through menu engineering, which is a toolused to determine the relative contribution margin and demand and make changes

if necessary (Jagels et al., 2007, p. 256).

A sample food and drinks menu has been created and costs of products and recipe

ingredients have been researched using ASDA online. Since all supplies will be

bought in bulk from hospitality suppliers, the contribution margin is expected to

slightly increase. The sample food menu comprises starters, soups, main dishes,

desserts and tapas, whereas the sample drinks menu comprises water, soft drinks,

beer, wine, coffee and tea. Deals are provided for lunch, dinner and tapas to

persuade guests to buy more. A marketing-orientated pricing approach has beenadopted in addition to cost-plus pricing to take account of key influencing factors

such as competitors (Jobber, 2010, p. 427). The selling prices are exclusive of the

current standard-rate of VAT (20%) which needs to be added (HM Revenue &

Customs, 2011; Business Link, 2011a).

Further information about the total costs and expenses can be found in the

financial statements.

-

8/2/2019 Fm Assignment 0705114

10/18

Breakeven analysisThe breakeven analysis is an essential tool in business planning to enhance

decision making, because the breakeven point shows the threshold from which abusiness turns profitable. Calculating the precise breakeven point for restaurants is

difficult as they offer a great variety of different meals and drinks. This is also

referred to as the menu mix (Jagels et al., 2007, p. 254). Cafferky et al. (2010)

therefore suggest using the Cost of Goods method to calculate the breakeven

point for restaurants. The estimated average check per guest (13) and costs of

goods rate excluding waste (30.33%) were used to calculate both variable costs

and contribution. The average fixed costs used are 891,615.85.

The breakeven analysis shows that the restaurant needs to make at least

1,281,376.16 in sales a year or 3,510.62 day and serve at least 270 customers aday to break even. The breakeven occupancy rate and seat turnover are 45% and

2.70 respectively.

Due to the dynamic nature of the hospitality industry breakeven analyses will be

conducted on a regular basis taking account of any changes in fixed and variable

costs and average check per guest (Cafferky et al., 2010).

Average fixed costs year 1-3891.615,8

5

Average check per guest 13,00

Average variable costs per checkyear 1-3 3,95

Average contribution per check 9,05

Breakeven sales level per year1.281.376,

16

Breakeven sales level per month106.781,3

5

Breakeven sales level per day 3.510,62

Breakeven occupancy rate 45,01%

Breakeven seat turnover 2,70

Breakeven guest count per year 98567Breakeven guest count permonth 8214

Breakeven guest count per day 270

-

8/2/2019 Fm Assignment 0705114

11/18

-

8/2/2019 Fm Assignment 0705114

12/18

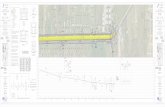

Sensitivity analysis

Sensitivity analysis is a useful tool to evaluate the potential risk of an investment (Atrill et al., 2010). Since in practice various input

values are having an influence on profitability a best and worst case scenario have been considered which include favorable and

unfavorable variations in the average check per guest, variable costs, fixed costs and capacity.

Standard estimate

Sensitivity Analysis Standard estimate

TimeGuests/Capacity

Averagecheck

Variablecosts

Contribution Fixed costs

Day 60 13,00 3,95 9,05 2.442,78

GuestsOccupancy Sales Variable cost

Contribution

Fixedcosts

Totalcosts Net income

0 0% 0,00 0,00 0,00 2.442,78 2.442,78 -2.442,78

60 10% 780,00 237,26 542,74 2.442,78 2.680,04 -1.900,04

120 20% 1.560,00 474,51 1.085,49 2.442,78 2.917,29 -1.357,29

180 30% 2.340,00 711,77 1.628,23 2.442,78 3.154,55 -814,55

240 40% 3.120,00 949,02 2.170,98 2.442,78 3.391,80 -271,80

300 50% 3.900,00 1.186,28 2.713,72 2.442,78 3.629,06 270,94

360 60% 4.680,00 1.423,53 3.256,47 2.442,78 3.866,31 813,69420 70% 5.460,00 1.660,79 3.799,21 2.442,78 4.103,57 1.356,43

480 80% 6.240,00 1.898,04 4.341,96 2.442,78 4.340,82 1.899,18

540 90% 7.020,00 2.135,30 4.884,70 2.442,78 4.578,08 2.441,92

600 100% 7.800,00 2.372,55 5.427,45 2.442,78 4.815,33 2.984,67

Breakeven guest count Breakeven Breakeven seat turnover Breakeven sales level

-

8/2/2019 Fm Assignment 0705114

13/18

per day occupancy rate per day

270 45,01% 2,70 3.510,62

Best case scenario

AssumptionsAverage check +

10%,Variable costs -5%,Capacity + 5%

Sensitivity Analysis Best case scenario

TimeGuests/Capacity

Averagecheck

Variablecosts

Contribution Fixed costs

Day 63 14,30 3,76 10,54 2.442,78

GuestsOccupancy Sales Variable cost

Contribution

Fixedcosts

Totalcosts Net income

0 0% 0,00 0,00 0,00 2.442,78 2.442,78 -2.442,78

63 10% 900,90 236,66 664,24 2.442,78 2.679,45 -1.778,55

126 20% 1.801,80 473,32 1.328,48 2.442,78 2.916,11 -1.114,31

189 30% 2.702,70 709,99 1.992,71 2.442,78 3.152,77 -450,07

252 40% 3.603,60 946,65 2.656,95 2.442,78 3.389,43 214,17

315 50% 4.504,50 1.183,31 3.321,19 2.442,78 3.626,09 878,41

378 60% 5.405,40 1.419,97 3.985,43 2.442,78 3.862,75 1.542,65

441 70% 6.306,30 1.656,63 4.649,67 2.442,78 4.099,42 2.206,88

504 80% 7.207,20 1.893,30 5.313,90 2.442,78 4.336,08 2.871,12

567 90% 8.108,10 2.129,96 5.978,14 2.442,78 4.572,74 3.535,36

630 100% 9.009,00 2.366,62 6.642,38 2.442,78 4.809,40 4.199,60

-

8/2/2019 Fm Assignment 0705114

14/18

Breakeven guest countper day

Breakevenoccupancy rate Breakeven seat turnover

Breakeven sales levelper day

232 36,78% 2,32 3.313,12

Worst case scenario

AssumptionsAverage check -10%Variable costs +10%

,Fixed costs +10%

Sensitivity Analysis Worst case scenario

TimeGuests/Capacity

Averagecheck

Variablecosts

Contribution Fixed costs

Day 60 11,70 4,35 7,35 2.687,06

GuestsOccupancy Sales Variable cost

Contribution

Fixedcosts

Totalcosts Net income

0 0% 0,00 0,00 0,00 2.687,06 2.687,06 -2.687,06

60 10% 702,00 260,98 441,02 2.687,06 2.948,04 -2.246,04

120 20% 1.404,00 521,96 882,04 2.687,06 3.209,02 -1.805,02

180 30% 2.106,00 782,94 1.323,06 2.687,06 3.470,00 -1.364,00

240 40% 2.808,00 1.043,92 1.764,08 2.687,06 3.730,98 -922,98

300 50% 3.510,00 1.304,90 2.205,10 2.687,06 3.991,96 -481,96

360 60% 4.212,00 1.565,88 2.646,12 2.687,06 4.252,95 -40,95

420 70% 4.914,00 1.826,86 3.087,14 2.687,06 4.513,93 400,07

480 80% 5.616,00 2.087,84 3.528,16 2.687,06 4.774,91 841,09

540 90% 6.318,00 2.348,83 3.969,17 2.687,06 5.035,89 1.282,11

600 100% 7.020,00 2.609,81 4.410,19 2.687,06 5.296,87 1.723,13

-

8/2/2019 Fm Assignment 0705114

15/18

Breakeven guest countper day

Breakevenoccupancy rate Breakeven seat turnover

Breakeven sales levelper day

366 60,93% 3,66 4.277,18

-

8/2/2019 Fm Assignment 0705114

16/18

-

8/2/2019 Fm Assignment 0705114

17/18

Atrill, P., McLaney, E. (2010) Accounting: An Introduction.

5th edn. Essex: Pearson Education Limited

Business Link (2011a) Rates of VAT on different goods and service.

Available at: http://www.businesslink.gov.uk/bdotg/action/layer?

topicId=1083088706&furlname=vatratesgoodsservices&furlparam=vatratesgoods

services&ref=&domain=www.businesslink.gov.uk

(Accessed: 6 May 2011).

Business Link (2011b) Set up and register a limited liability partnership (LLP).

Available at: http://www.businesslink.gov.uk/bdotg/action/layer?

r.l1=1073858805&r.l2=1085161962&r.s=tl&topicId=1073865702 (Accessed: 6

May 2011).

Cafferky, M., Wentworth, J. (2010) Breakeven Analysis: The Definitive Guide to

Cost-Volume-Profit Analysis. New York: Business Expert Press

Cousins, J., Foskett, D., Gillespie, C. (2002) Food and Beverage Management.

Essex: Pearson Education Limited.

HM Revenue & Customs (2011) VAT Catering and Take-Away Food.

Available at:

http://customs.hmrc.gov.uk/channelsPortalWebApp/channelsPortalWebApp.portal?

_nfpb=true&_pageLabel=pageLibrary_PublicNoticesAndInfoSheets&propertyType=

document&columns=1&id=HMCE_CL_000160#P176_17005 (Accessed: 6 May2011).

Jagels, M.G., Ralston, C.E. (2007) Hospitality management accounting.

New Jersey: John Wiley & Sons, Inc.

Jobber, D. (2010) Principles and Practice of Marketing.

6th edn. Maidenhead: McGraw-Hill Higher Education.

Micros (2011a) Micros RES Product Management.

Available at: http://www.micros.com/Products/RES/ProductManagement/

(Accessed: 1 May 2011).

Micros (2011b) MICROS RES: Back-Office, Guest Services, & Restaurant POS

Software.

Available at: http://www.micros.com/Products/RES/restaurant-pos-software.htm

(Accessed: 1 May 2011).

Natwest (2011) Government-backed loan.

Available at: http://www.natwest.com/business/products/borrowing/longer-

term/loans/government-backed-loan.ashx#tabs=section1

(Accessed: 1 May 2011).

-

8/2/2019 Fm Assignment 0705114

18/18

Schmidgall, R.S., Hayes, D.K., Ninemeier, J.D. (2002) Restaurant financial basics.

New Jersey: John Wiley & Sons, Inc.

![Assignment 6 With Solutions[2] Fm white](https://static.fdocuments.in/doc/165x107/56d6c0a01a28ab30169b2894/assignment-6-with-solutions2-fm-white.jpg)