Fm assignment

-

Upload

saira-arshad -

Category

Economy & Finance

-

view

765 -

download

0

Transcript of Fm assignment

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

MANAGERIAL OPTIONS IMPLICATION

NAME;SAIRA ARSHAD

TUTOR:M.YAMIN SATTI

ROLL NUMBER;AH5315371

SUBJECT:FINANCIAL MANGEMENT

1 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

Table of contents:

1 Comparison with standard techniques 2 Valuation

o 2.1 Valuation inputs o 2.2 Valuation methods

3 Limitations o 3.1 Organizational considerations o 3.2 Technical considerations

4 History

Case study

Unilever

Recommendation

Conclusion

SWOT analysis

References

2 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

MANAGERIAL OPTIONS:Management flexibility to make future decisions that affect a project's expected cash flows, life, or future acceptance.

Managerial options — Valuation implicationsUp to now, we have assumed that cash flows in a capital budgeting project occurred out to some horizon and then were discounted to obtain their present value. However, investment projects are not necessarily set in stone once they are accepted. Managers, can, and often do, make changes that affect subsequent cash flows and/or the life of the project. Slavish devotion to traditional discounted cash flow (DCF) methods often ignores future managerial flexibility that is, the flexibility to alter old decisions when conditions change.

Valuation implications

The presence of managerial, or real, options enhances the worth of an investment project. The worth of a project can be viewed as its net present value, calculated in the traditional way, together with the value of any option(s).

Project worth = NPV + Option(s) value ——–Equation 1

The greater the number of options and the uncertainty surrounding their uses, the greater the second term in equation 1, and the greater the project€™s worth. For now, it is sufficient to say that the

3 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

greater the uncertainty, the greater the chance that an option will be exercised, and hence, the greater the optional€™s value.

The types of managerial options available include,

1. Option to expand (or contract) — An important option is one that allows the firm to expand production if conditions become favorable and to contract production if conditions become unfavorable.

2. Option to abandon — if a project has abandonment value, this effectively represents a put option to the project€™s owner.

3. Option to postpone — For some projects there is the option to wait and thereby to obtain new information.

Sometimes these options are treated informally as qualitative factors when judging the worth of a project. The treatment given to these options may consist of no more than the recognition that “if such and such occurs, we will have the opportunity to do this and that�.

Managerial options are difficult to value than are financial options; you will find that the formulas for financial options taken up. Often do not work when applied to managerial options. Rather, we must resort to less precise approaches such as decision trees (i.e. diagrams of decision problems) and simulations.

Real options valuation, also often termed Real options analysis, (ROV or ROA) applies option valuation techniques to capital budgeting decisions. A real option itself, is

4 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

the right — but not the obligation — to undertake some business decision; typically the option to make, abandon, expand, or contract a capital investment. For example, the opportunity to invest in the expansion of a firm's factory, or alternatively to sell the factory, is a real call or put option, respectively.

Real Options, as a discipline, extends from its application in Corporate Finance, to decision making under uncertainty in general, adapting the techniques developed for financial options to "real-life" decisions. For example, R&D managers can use Real Options Valuation to help them determine where to best invest their money in research; a non business example might be the decision to join the work force, or rather, to forgo several years of income to attend graduate school. It thus forces decision makers to be explicit about the assumptions underlying their projections, and for this reason ROV is increasingly employed as a tool in business strategy formulation.

Comparison with standard techniques

ROV is often contrasted with more standard techniques of capital budgeting, such as discounted cash flow (DCF) analysis / net present value (NPV).

Using a DCF model, only the most likely or representative outcomes are modelled, and the "flexibility" available to management is "ignored"; see Valuing flexibility under Corporate finance. The NPV framework (implicitly) assumes that management is "passive" with regard to their Capital Investment once committed. Analysts usually account for this uncertainty by adjusting the discount rate (e.g. by increasing the cost of capital) or the cash flows (using

5 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

certainty equivalents, or applying (subjective) "haircuts" to the forecast numbers). These methods normally do not properly account for changes in risk over a project's lifecycle and fail to appropriately adapt the risk adjustment.

By contrast, ROV assumes that management is "active" and can modify the project as necessary. ROV models consider "all" future outcomes and management's response to these contingent scenarios. Because management responds to each outcome - i.e. the options are exercised - the possibility of a (large) negative outcome is reduced (or even eliminated), and /or greater profit is achieved. Risk is therefore reduced or "eliminated" under ROV, and uncertainty is accounted for using the techniques applied to financial options. Here the approach is to risk-adjust the probabilities - as opposed to the discount rate, as for NPV - and the cash flows can then be discounted at the risk-free rate. This technique is known as the certainty-equivalent or martingale approach, and uses a Risk-neutral measure. For technical considerations here, see below.

Given these different treatments, the real options value of a project is typically higher than the NPV - and the difference will be most marked in projects with major flexibility, contingency, and volatility. (As for financial options higher volatility of the underlying leads to higher value).

[edit] Valuation

From the above it is clear that there is an analog between the modelling of real options and financial options:

6 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

“First, you must figure out the full range of possible values for the underlying asset.... This involves estimating what the asset's value would be if it existed today and forecasting to see the full set of possible future values... [These] calculations provide you with numbers for all the possible future values of the option at the various points where a decision is needed on whether to continue with the project... ”

However, ROV is distinguished from these approaches in that it takes into account uncertainty about the future evolution of the parameters that determine the value of the project, and management's ability to respond to the evolution of these parameters. It is the combined effect of these that makes ROV technically more challenging than its alternatives. When valuing the real option, the analyst must consider the inputs to the valuation, the valuation method employed, and whether any technical limitations may apply.

] Valuation inputs

Given the similarity in valuation approach, the inputs required for modeling the real option correspond, generically, to those required for a financial option valuation. The specific application, though, is as follows:

The option's underlying is the project in question - it is modelled in terms of:

7 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

o spot price : the starting or current value of the project is required: this is usually based on management's "best guess" as to the gross value of the project's cash flows and resultant NPV;

o volatility : uncertainty as to the change in value over time is required: the volatility in project value is generally used, usually derived via monte carlo

simulation; sometimes the volatility of the first period's cash flows are preferred; project NPV is often difficult to estimate, and some analysts therefore substitute a listed security as a proxy, using either the volatility of the price of the security (historical volatility), or, if options exist on this security, their implied volatility.

See further under Corporate finance for a discussion relating to the estimation of NPV and project volatility.

Option characteristics: o Strike price : this corresponds to the investment outlays, typically the prospective costs

of the project. In general, management would proceed (i.e. the option would be in the money) given that the present value of expected cash flows exceeds this amount;

o Option term : the time during which management may decide to act, or not act, corresponds to the life of the option. Examples include the time to expiry of a patent, or of the mineral rights for a new mine. See Option time value.

Option style . Management's ability to respond to changes in value is modeled at each decision point as a series of options:

o the option to contract the project (an American styled put option);

8 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

o the option to abandon the project (also an American put);o the option to expand or extend the project (both American styled call options);o switching options , composite options or rainbow options which may also apply to the

project.

Valuation methods

The valuation methods usually employed, likewise, are adapted from techniques developed for valuing financial options. Note though that, in general, while most "real" problems allow for American style exercise at any point (many points) in the project's life and are impacted by multiple underlying variables, the standard methods are limited either with regard to dimensionality, to early exercise, or to both. In selecting a model, therefore, analysts must make a trade off between these considerations; see Option (finance): Model implementation. The model must also be flexible enough to allow for the relevant decision rule to be coded appropriately at each decision point.

The most commonly employed are Closed form solutions—often modifications to Black Scholes—and binomial lattices. The latter are probably more widely used due to their flexibility, particularly given that most real options are American styled, although cannot readily handle high dimensional problems.

Specialized Monte Carlo Methods have also been developed and are increasingly applied particularly to high dimensional problems, although for American styled real options, this application is somewhat more complex.

9 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

When the Real Option can be modelled using a partial differential equation, then Finite difference methods for option pricing are sometimes applied. Although many of the early ROV articles discussed this method, its use is relatively uncommon today—particularly amongst practitioners—due to the required mathematical sophistication; these too cannot readily be used for high dimensional problems.

Various other methods, aimed mainly at practitioners, have been developed for real option valuation. These typically use cash-flow scenarios for the projection of the future pay-off distribution, and are not based on restricting assumptions similar to those that underlie the closed form (or even numeric) solutions discussed.

] Limitations

The relevance of Real options, even as a thought framework, may be limited due to organizational and / or technical considerations. When the framework is employed, therefore, the analyst must first ensure that ROV is relevant to the project in question. These considerations are as below.

Organizational considerations

Real options are “particularly important for businesses with a few key characteristics”, and may be less relevant otherwise. At the same time the market in question must be one where "change is most evident", and the "source, trends and evolution" in product demand and supply, create the volatility and contingencies discussed above.

10 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

In overview:

1. The business must be positioned such that it has appropriate information flow, and opportunities to act. This will often be a market leader and / or a firm enjoying economies of scale and scope.

2. Management must understand options, be able to identify and create them, and appropriately exercise them. (This contrasts with business leaders focused on maintaining the status quo and / or near-term accounting earnings.)

3. The financial position of the business must be such that it has the ability to fund the project as required (i.e. issue shares, absorb further debt and / or use internally generated cash flow); see Financial statement analysis. Management must also have appropriate access to this capital.

Technical considerations

Limitations as to the use of these models arise due to the contrast between Real Options and financial options, for which these were originally developed. The main difference is that the underlying is often not tradable - e.g. the factory owner cannot easily sell the factory upon which he has the option. Additionally, the real option itself may also not be trade able - e.g. the factory owner cannot sell the right to extend his factory to another party, only he can make this decision (some real options, however, can be sold, e.g., ownership of a vacant lot of land is a real option to develop that land in the future). Even where a market exists - for the underlying or for the option - in most cases there is limited (or no) market liquidity.

11 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

The difficulties:

1. As above, data issues arise as far as estimating key model inputs. Here, since the value or price of the underlying cannot be (directly) observed, there will always be some (much) uncertainty as to its value (i.e. spot price) and volatility (further complicated by uncertainty as to management's actions in the future).

2. It is often difficult to capture the rules relating to exercise, and consequent actions by management: Some real options are proprietary (owned or exercisable by a single individual or a company) while others are shared (can be exercised by many parties). Further, a project may have a portfolio of embedded real options, some of which may be mutually exclusive.

3. Theoretical difficulties, which are more serious, may also arise.[19]

Option pricing models are built on rational pricing logic. Here, essentially: (a) it is presupposed that one can create a "hedged portfolio" comprising one option and "delta" shares of the underlying. (b) Arbitrage arguments then allow for the option's price to be estimated today; see Rational pricing: Delta hedging. (c) When hedging of this sort is possible, since delta hedging and risk neutral pricing are mathematically identical, then risk neutral valuation may be applied, as is the case with most option pricing models. (d) Under ROV however, the option and (usually) its underlying are clearly not traded, and forming a hedging portfolio would be difficult, if not impossible.

Standard option models: (a) Assume that the risk characteristics of the underlying do not change over the life of the option, usually expressed via a constant volatility assumption. (b) Hence a standard, risk free rate may be applied as the discount rate at each decision point, allowing for risk neutral valuation. Under ROV, however: (a)

12 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

managements' actions actually change the risk characteristics of the project in question, and hence (b) the Required rate of return could differ depending on what state was realized, and a premium over risk free would be required, invalidating (technically) the risk neutrality assumption.

These issues are addressed via several interrelated assumptions:

1. As discussed above, the data issues are usually addressed using a simulation of the project, or a listed proxy. Various new methods - see for example those described above - also address these issues.

2. Specific exercise rules can often be accommodated by coding these in a bespoke binomial tree;.

3. The theoretical issues:

To use standard option pricing models here, despite the difficulties relating to rational pricing, practitioners adopt the "fiction" that the real option and the underlying project are both traded (the so called, Marketed Asset Disclaimer (MAD) approach). Although this is a strong assumption, it is pointed out that, interestingly, a similar fiction in fact underpins standard NPV / DCF valuation (and using simulation as above).

To address the fact that changing characteristics invalidate the use of a constant discount rate, some practitioners use the "replicating portfolio approach", as opposed to Risk neutral valuation, and modify their models correspondingly. Under this approach, we "replicate" the cash flows on the option by holding a risk free bond and the underlying in the correct proportions. Then, since the value of the option and the

13 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

portfolio will be identical in the future, they may be equated today, and no discounting is required.

History

Whereas business managers have been making capital investment decisions for centuries, the term "real option" is relatively new, and was coined by Professor Stewart Myers of the MIT Sloan School of Management in 1977. It is interesting to note though, that in 1930, Irving Fisher wrote explicitly of the "options" available to a business owner (The Theory of Interest, II.VIII). The description of such opportunities as "real options", however, followed on the development of analytical techniques for financial options, such as Black–Scholes in 1973. As such, the term "real option" is closely tied to these option methods.

Real options are today an active field of academic research. Professor Lenos Trigeorgis (University of Cyprus) has been a leading name for many years, publishing several influential books and academic articles. Other pioneering academics in the field include Professors Eduardo Schwartz and Michael Brennan (UCLA Anderson). An academic conference on real options is organized yearly (Annual International Conference on Real Options).

Amongst others, the concept was "popularized" by Michael J. Mauboussin, then chief U.S. investment strategist for Credit Suisse First Boston.[8] He uses real options to explain

14 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

the gap between how the stock market prices some businesses and the "intrinsic value" for those businesses. Trigeorgis also has broadened exposure to real options through layman articles in publications such as The Wall Street Journal.[7] This popularization is such that ROV is now a standard offering in postgraduate finance degrees, and often, even in MBA curricula at many Business Schools.

Recently, real options have been employed in business strategy, both for valuation purposes and as a conceptual framework.[3][4] The idea of treating strategic investments as options was popularized by Timothy Luehrman in two HBR articles: "In financial terms, a business strategy is much more like a series of options, than a series of static cash flows". Investment opportunities are plotted in an "option space" with dimensions "volatility" & value-to-cost .

unilever

15 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

What UniLever is? Unilever is dedicated to meeting the everyday needs of people everywhere. Around the world UniLever foods and home and personal care brands are chosen by many millions of individual consumers each day. Earning their trust, anticipating their aspirations and meeting their daily needs are the tasks of UniLever local companies. They bring to the service of their consumers the best in brands and both UniLever’s international and local expertise.For more than 70 years Unilever has been providing consumers with quality products and services. UniLever has a portfolio of global, regional and local brands. Some, such as Bertolli, Dove, Hellmann’s, Lipton, Lux, Magnum, Omo and Vaseline, are popular around the world. Others are the first choice for consumers in particular countries. As traditional structures and lifestyles around the world are being rapidly transformed, Unilever continues to respond to consumers’ present needs and, at the same time, to anticipate their future ones. Our strength lies in the deep understanding we have of local culture and markets. Unilever’s strategy is to focus research and development and marketing on our top performing brands, that is, those that are most in demand from consumers. Through our extensive knowledge of trends identified today, we will continue to develop our brands to meet the needs of our consumers tomorrow. , feel and smell great.UniLever products are at home everywhere: favorites with consumers throughout the world, from the emerging markets of Asia and Latin America to the developed economies of Western Europe and North

16 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

America.UniLever meets the needs of consumers around the world, in both new and established markets. Consumers vary from country to country in their preferences and habits and UniLever adapt many of its brands to suit local tastes. For example, among UniLever’s many teas, it produces around 20 separate brands of black tea specifically tailored for consumption in over 20 different countries and UniLever is constantly sharpening the flavors to suit all its local markets. In some societies, consumers have traditionally washed up by sponging ash, sand or detergent onto their dishes, before rinsing. Learning from these established practices, we developed our Vim dish wash bar, to bring improved cleaning to existing washing routines. Shopping habits also vary and the availability of our brands is a key concern of local managers. UniLever adapt the distribution of its brands to suit local realities. In Europe, customers benefit from swifter, easier dispatch through online ordering of frozen foods. While, in Tanzania, UniLever has piloted bicycle delivery of products to villages inaccessible to motor transport. Building on a presence that in places stretches back nearly a century, it keeps closely in tune with local consumers. UniLever is, in every sense, a multi-local multinational.Unilever’s research and development teams help to anticipate and meet consumer needs. UniLever’s research and development expertise allows to anticipate the evolving needs of consumers and to create the innovations to meet them. Internet technology is improving the way UniLever share best practice and innovation around the world.UniLever’s R&D activity is focused on six major laboratories and a network of innovation centers

17 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

around the world. Recent successes have demonstrated UniLever’s practical ability to respond to consumers and bring innovations to the marketplace. They include laundry tablets, which it has rolled out in more than 30 countries; Lipton Cold Brew tea bags, which take away the need to boil water when making ice tea; and its cholesterol-owering spreads, which have been widely rolled out under the Take Control, Becel and Flora brands. UniLever continues to look for new innovation opportunities. For instance, UniLever research into the human genome means they can now decode the make-up of skin. This can reveal such secrets as an individual’s tendency for dryness or their skin protein mix. Such knowledge forms the foundation for new, more personal products.UniLever’s global IT system helps them to share information around the business and to use their scale and scope to meet consumer needs and reduce their costs. UniLever drives to provide better value for customers and consumers, they have always valued the sharing of information across product sectors and geographical locations. IT has boosted this knowledge-sharing culture, allowing us to make the most of the vast amount of Information held by our people around the world. UniLever’s computer networks provide over 90,000 employees worldwide with common tools for sharing information –allowing them to deal with millions of electronic messages every working day. They also have a Unilever Intranet, which helps them to manage innovation and best practice around the world. Global teams, for example, pool information, marketing success stories and knowledge via dedicated sites, making this knowledge available to UniLever’s people locally, wherever they are.UniLever is committed to doing business in a responsible and sustainable way. In partnership with

18 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

organizations around the world, UniLever works to reduce their impact on the environment and to act as a responsible corporate citizen.Unilever believes in sustainable development – meeting the needs of the present without compromising resources for future generations. This commitment begins and ends with their consumers. UniLever believes that by constantly evolving to meet their changing needs, they can continue to develop their business in both a profitable and an environmentally sustainable way. In working towards sustainable development, they focus on three areas that are directly relevant to their business. These are fish conservation, clean water stewardship and sustainable agriculture. An example of their work in the area of fish conservation is the Fish Sustainability Initiative, which aims to meet their objective of sourcing all supplies from sustainable fisheries by 2005. Filegro, an Alaskan salmon-based dish, was our first product to come from a sustainable fishery, as certified by the Marine Stewardship Council. In clean water stewardship, as in other areas, UniLever joins with partners to achieve maximum impact. For example, through their sponsorship of the Global Nature Fund’s Living Lakes initiative, they work with a network of private and government organizations to help communities better manage their local lakes and wetlands. In sustainable agriculture, UniLever has set up of an expert external advisory board. Its task is to advise and inform its business and suppliers on new sustainability standards.Unilever’s commitment to corporate social responsibility is an integral part of their operating tradition. It is outlined in their Corporate Purpose and in their Code of Business Principles. It finds practical expression in the worldwide standards they have set their selves: to ensure the health and

19 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

safety of Unilever people at work, to secure the quality and safety of products and to minimize the environmental impact of their operations. UniLever aims to be as professional in their management of its social responsibilities as they are in any other area of business. UniLever recognize the need to be explicit about what their social commitment means in practice: to articulate their policies, and to demonstrate its performance. UniLever reports on their approach and progress in its Social Review. Unilever has a tradition of support for the local community wherever it operates, in particular in the areas of education, environment and health. For example, in India access to oral care is limited, with few dentists per head of population. In 2000, UniLever’s oral health and hygiene education programmed brought advice and care to over 2.5 million schoolchildren. In China, Unilever has sponsored Qinghai province’s first Art Hope School. In a region where few can afford the cost of basic schooling, it offers the opportunity of a general education and free tuition in traditional dance, music and modern art. Internet technology is providing a two-way communication channel, helping UniLever to get to know its consumers better.Competition in markets is intense. To further develop their relationships with consumers and communicate the benefits of their brands, UniLever uses a variety of media, not only highly creative television advertising campaigns but also new one-to-one communication via the internet. UniLever brand communication has always made the news. In the 1950s, they produced the first ever television commercial in the UK. As the 21st century began, they screened the UK’s first interactive TV commercials, marketing their Colman’s and Olivio brands.

20 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

Lever Brothers Pakistan Limited Lever Brothers Pakistan Limited is largest fast moving consumer Products Company in Pakistan. Lever Brothers Pakistan Limited is a part of UniLever- a global company. Lever Brothers Pakistan Limited is producing more than 50 brands in Pakistan.

Mission Statements 1: We are the leading consumer product company in Pakistan, a multinational with deep root in country.2: We attract and develop high talented people who are excited, empowered and committed to deliver double digit growth.3: We serve every day needs of all consumers every where for food, hygiene and beauty through brands products and service that deliver the best quality and value.4: We strive to remain and every simple and enterprising business.5: We use our superior consumer understanding to products breakthrough innovation in brand and channel.6: Our brands capture the hearts of consumer through outstanding communication. 7: Through managing a responsive supply chain we maximize value from supplier to customer.8: We are exemplary through our commitment to business ethics, safety, health, environment and involvement in the community

21 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

LOCATIONLocation is the process of determining a geographical site for a firm’s operation. Organizations must weigh many factors when assessing the desirability of a particular site that can beProximity to customersProximity to suppliersLabor costsTransportation costLBPL Rahim Yar Khan Factory is situated in the middle of the city. It was established in 1948. The main reason for choosing this location for the factory was:

The land for the factory was donated by the NAWAB of the Bahawalpur State. It was the ideal location to cover the Indo-Pak border areas. It was the central location of Pakistan so it was a convenient location from the distribution

point of view. Availability of the cotton seeds because south Punjab is cotton area. Government tax free area Availability of inexpensive labor

PROXIMITY TO MARKETSThe site of R.Y. Khan Plant was chosen in 1948. The main reason was its central location. This location is the middle of Lahore and Karachi that were the main markets at that time. So the company can easily cover whole market fro Karachi to Lahore.

22 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

PROXIMITY TO SUPPLIERS AND RESOURCESAt that time the company was only producing oil for which cotton area was suitable. This site was suitable for processing the raw material that was cotton and R.Y. Khan was main cotton area.TAXES AND REAL ESTATE COSTIt was the tax-free area. The land was gifted by the ABBASI family, so there was no real estate cost.TRANSPORTATION COSTSTransportation cost is also a major determinant, which directs the location decision. Transportation cost is a major factor not only in terms of the raw material but also in terms of raw material. As R.Y Khan is situated at the center of Pakistan, the movement of finished goods cost minimum here across Pakistan. R.Y. Khan Railway Station is situated along with the factory so transportation through rail is very easy. AVAILABILITY OF UTILITIESThe factory is facilitated with electricity, natural gas and telephone.

History

Unilever Unilever was formed in 1930 when the Dutch Margarine Company Margarine Unie merged with British soap maker Lever Brothers. Both companies were competing for the same raw materials, both were involved in large-scale marketing of household products and both used similar distribution channels. Between them, they had operations in over 40 countries.Margarine Unie grew through mergers with other margarine companies in the 1920s. Lever

23 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

Brothers was founded in 1885 by William Hesketh Lever. Lever established soap factories around the world. In 1917, he began to diversify into foods, acquiring fish, ice cream and canned foods businesses.In the Thirties, Unilever introduced improved technology to the business. The business grew and new ventures were launched in Latin America. The entrepreneurial spirit of the founders and their caring approach to their employees and their communities remain at the heart of Unilever's business today.Unilever NV and Unilever PLC are the parent companies of what is today one of the largest consumer goods businesses in the world. Since 1930, the two companies have operated as one, linked by a series of agreements and shareholders that participate in the prosperity of the whole business. Unilever's corporate centers are London and Rotterdam

Lever Brothers Pakistan Limited (Rahim Yar Khan Factory) The factory site was selected in 1946. The construction of the factory started in 1949. First of all factory started the production of the Edible Oil by establishing the Edible Fats Plant in 1952. The factory started the production of soap n soapry unit in 1954. Then the company expand the business by establishing the Animal Feed Plant in 1960. Company decided to enhance the product range and establish the Personal Product Plant in 1981. Non Soap Detergent (NSD) based on sulphonic acid, instead of conventional manufacturing of soap base on Tallow, started in 1983. Then the company decided to expansion in soapry plant in 1991. Company

24 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

installed sulphonation in 1992.

Management Activities in Lever Brothers Pakistan Limited

Path to Growth Introduced in 2000, path to growth is UniLever’s corporate strategic agenda which aims to double the size of the business in seven years and to grow profits faster than the competition, thereby ensuring that we are the leaders in similar type companies in providing top value to our shareholders.Six Strategic ThrustsThe six strategic thrusts that make up the path to growth are1. Reconnect with ConsumerBy having real insights into consumer needs, preferences and future needs. This means knowing and understanding consumers’ lifestyles, habits and attitudes and creatively adapting brands to their changing needs.2. Brand FocusGrow their leading international brands by concentrating our resources behind them while still supporting ‘golden’ regional brands and local jewels. Innovation will be the keystone to ensuring our brands are attuned to consumers’ future needs.3. Pioneer New ChannelsWiden their means of ‘going to market’ i.e. reaching consumers and customers. This means

25 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

developing new channels such as direct selling, home-vending, fashion outlets, travel, food service and out-of home.4. World Class Supply ChainTo close the gap to global world class within three years by establishing brand synergies, superior logistics and supply chain and by establishing a world program. 5. SimplifyEverything that they do by reducing complexity, duplication and by making the best use of I.T. to provide high quality information once.6. Enterprise CultureBy creating a culture which shapes the mindset and actions among all employees towards winning in the market-place by building an organization fit for growth.

TPM Total productive maintenance is global standard of efficient production, which cuts waste, save money and make factories safer places to work. It gives machine operators the knowledge and confidence to investigate and eliminate root causes of machine error or breakdown as well as the chance to work in teams with managers to achieve improvements on product lines.UniLever started introducing TPM sometimes known as Total Perfect Management or Total People Motivation in Japan in 1989 ahead of global roll-out program. Today, around 200 sites are using TPM techniques. The level one ‘excellent’ award applies simply to the factory floor, ‘consistently

26 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

excellent’ is for sustained performance and the ‘special’ award, much harder to achieve, also includes innovation, manufacturing, sourcing and distribution.

5 S’s of Workplace Organization. The 5 S’s are a group of techniques to promote workplace organization, ensure adherence to standards and foster the spirit of continues improvement.The 1st S: SortObjective: To get rid of unwanted items. Decide what is needed to be kept, and what is not needed and to be discarded. The 2nd S: Set Location and LimitsObjective: To locate a specific place for specific items of a specific quantity, where needed. Determine addresses for materials and equipment. Put them in that place and keep them there.The 3rd S: Shine and SweepObjective: To use cleaning to identify abnormalities and areas for improvement. Clean the workplace and at the same time visually sweep for abnormalities or out or control conditions.The 4th S: Standardize Objective: To consolidate the first 3 S’s by establishing standard procedures. Determine the best work practices and find ways of ensuring everyone does it the same “best” way.The 5th S: SustainObjective: To sustain improvements and make further improvements by encouraging effective use

27 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

of the ‘Check-Act-Plan-Do’ cycles. Keep all current improvements in place and develop an environment for future improvements.

Managerial Hierarchy of Lever Brothers Pakistan Limited (Rahim Yar Khan Factory)

28 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

Operations of Lever Brothers Pakistan Limited (Rahim Yar Khan Factory)

Material Store

Material store is a place where raw material is store. My period of internship is spent in material store, where I learn the different function of material store and stock maintenance. The management structure of material store is as follows:

Staff of material store is as follows.Assistant Manager Mr.Jaffar MedhiJoiner Manager (Oil & Fat) Mr.Raza

29 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

Joiner Manager (Raw and Packing) EmptySOA (On receipt of material) Mr.HashimSOA (On issue of material) Mr.AsgarMr.Hashim is working on the seat of joiner manager (Raw and Packing) on temporary basis. Material Store Department consists of two hangers and one perfume store. Total area of each hanger is 256 x 107 feet. Material store has an over flow depot outside the factory.Material Store Department handles near about 650 items of raw material. Function of Material Store:Two main functions of material stores are1. Receipt of Material2. Issue of Material 1. Material Receipt Process:Material store receive two type of materialOil and Fat, DFA, Liquid Caustic Packing and Raw Material The process of receiving these materials is different from each other. We will discuss

30 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

these processes one by one.(a). Receipt of Oil and Fat, DFA, Liquid Caustic:The process of receiving Oil and Fat includes following steps.Step 1: Weigh Bridge:First step in material receipt system is weigh bridge where vehicles reach. Capacity of weigh bridge is 80 tons. There are two operators on the weigh bridge.The Function of weigh bridge in goods receipt process is as follows.Truck or other type of vehicle driver come on weigh bridge and gives truck invoice to weigh bridge operator which is issue by the supplier of material. The weigh bridge operator check the type of material load on truck and note the truck number and its timing of arrival. If material is packing and raw then it is sent to material store for unloading. If material is Oil and Fat tankers are sent to sampling point. Lab assistant takes sample from tanker. Operator of weigh bride makes a sample chit and then this chit is sent with sample of material to lab for inspection. Sample chit consists of date, sample no, indent no, supplier name, quality, quantity, and truck no. The operator is informed by telephone from lab that sample is ok. Then operator on weigh bridge take the first weight of loaded tanker and feed data in system with the help of software Weighbridge which includes serial number, supplier name, truck number, material

31 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

name, sample no and first weight. Print of this data is attached to truck invoice. Then operator makes a weigh bridge slip and give it to driver and send driver to unloading point. Weigh bridge slip contains date, party name, truck no, material name, and signature of weigh bridge operator. One portion of weigh bridge slip is filled by the operator on weigh bridge and other part is filled by the operator on receipt on material. The part of weigh bridge slip which is filled by the operator on receive contains received, material name, truck no, and tank no where material is unloaded.After unloading tankers come back to weigh bridge. Driver gives back the weigh bridge slip to operator and unloaded tankers are weighted. The operator feed this weight in Weighbridge software and calculates net weight. Then print of data is attached to truck invoice. Operator checks the difference between net weight and weight written on truck invoice. If it is minor difference than it is ignored. If it is major difference than it is mentioned on truck goods receipt which operator makes after second weight. Two copies of TGR are given to driver and two for office. Truck good receipt contains following data. Supplier name, date of receipt, city name, date of sending, quantity, packing type, description of goods and truck no.Operator feed this data is daily sheet, which is made in excel. Daily sheet contains data about date of receipt, arrival time, truck no, TGR no, indent no, item code, supplier,

32 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

commodity, sample no, dispatch weight, received weight, difference, out time, system posted(yes/no), remarks, weigh bridge operator. After it, the operator feed this data in MFG Pro.

FORECASTINGDemand Forecasting“A forecast is the prediction of future events used for the planning purposes”.Forecasting TechniquesThere the three forecasting techniques are available for the purpose of the forecasting of the demand, which are as under.

Judgmental Method. Causal Method. Time Series Method.

The usage of these techniques depends upon the availability of the data about the past.Forecasting at LBPLThe forecasting technique, which is being followed by LBPL, is the qualitative technique.Sales Force EstimateSales force estimate of forecasts compiled by the members of the company’s sales force (their dealers in each region) about the future demand of the product. They are using this technique because they believe that their estimates are correct since the dealers are much near to the

33 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

market. Marketing Department is actually involved much in forecasting. They observe the trend of the market and they set their target of sale then they tell to the production that what is their target then production department make productions according to the target set by marketing department.Time SeriesDemand for the future periods is also determined by the time series method. Historical data about the past demand is the basis for the time series. The data is used for the demand projection for the coming periods.Marketing ResearchMarketing research is also conducted by the firm. Data obtained is used to determine the customer demand pattern, and trends.Effective CapacityIt is the maximum output that a process or firm can economically sustain under normal conditions. When operating close to peak capacity, a firm can make minimal profits or even lose money despite high sales levels.Operations manager must examine the three dimensions of capacity before making capacity decisions:

Sizing capacity cushions Timing and sizing expansion Linking capacity and other operating decisions

34 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

The capacity cushion is the amount of reserve capacity that a firm maintains to handle sudden increases in demand or temporary loses of production capacity it measures the amount by which the average utilization falls below 100 percent.CAPACITY CUSHION = 100% - UTILIZATION RATE (%)Another issue of capacity strategy is when to expand and by how much there are two extreme strategies:The Expansionist Strategy, which involves large infrequent jumps in capacity. In this strategy organization remains ahead-of-demand.The Wait and See Strategy could be to follow the leader, expanding when others do. Management may choose one of these two strategies or one of closely linked to strategies operate between these extremes. Capacity decision should be considered throughout the organization. When managers make decisions about location, resource flexibility and inventory, they must consider the impact on capacity cushions.Capacity cushion buffer the organization against uncertainty as do resource flexibility, inventory and longer customer lead times. If a system is well balanced and a change is made in some other

decision area, then the capacity cushion may need changes to compensate.The categories and sizes of the soaps manufactured at RF are given below:Hard SoapLIFEBUOY( Red & White) 140gms.n a year four Times capitalization procedure is completed. At The end of each quarter

35 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

capitalization of Capital Proposal is done by the Capital Proposal Account Department. For various head of accounts, Company has mentioned various numbers of Capital Proposal just like as 91/L/10192/L/30193/L/30694/L/308.Working capital:To know the financial position of the business each month of the financial year “working Capital report” is prepared. With the help of Working Capital Report, company knows how much capital is circulated in business. And also know that how many accounts receivable, accounts payable and inventories exist.Two copies of Working Capital report are prepared. One is sent to head office monthly basis while second is for office use.Over Head Expenditure report:To control the repair expenses of the factory “Over Head Expenditure Report” is prepared on monthly basis. All locations mentioned in workshop, for example Worker Administration Department, for their salary, traveling expense, building of the workshop administration department all revenue expenditures are Called overhead Expenditure

36 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

report.After obtaining this report one JV Is passed by Accounts Department according to various a/c # and locations.Month End Work Order report:This report is received from R.F. Engineering Department. It shows the detail of that work done on repair and maintenance, in other words those expenses which incurred on repairs and maintenance up to at the end of each month. This final report is send by Engineering Department to Accounts department. Against this report Accounts Department prepares two JVs; one for Capital Proposal Administration Department while second against various locations. ReconciliationReconciliation functions are also performed in financial section. Following Reconciliation Statements are prepared in this department.

Reconciliation Statement Between Wall’s Ice cream and Rahim Yar Khan Factory Reconciliation Statement Between Engineering stores & Payment section Reconciliation Statement between Karachi Tea Factory (KTF) Reconciliation Statement between Karachi edible oil The & Ghee Factory Reconciliation Statement between Head office and R.F

Reconciliation Statement between Brook Bond And R.F37 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

OBJECTIVES· OFI – Opportunity For Improvement· Always looking for improvement.· The continuous improvement of all services through total involvement of all employees.· The developing and the strengthening of partnership with external and internal customers and suppliers.· Providing innovative and higher quality products and services to achieve total customer satisfaction by understanding their requirements and anticipating their future expectations or needs.FUNCTIONS· Monitoring annual targets for quality improvements in all areas.· Creating a culture of customer focus striving to become the lowest cost producer through agreed annual cost reduction program.· Value people by understanding and drawing upon their strength i.e. abilities and knowledge and make efforts for their training and development.

38 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

STAGES

RAW MATERIAL:When raw material is received the quality of raw material is inspected according to the standards. According to these standards if the personnel of receiving department will inspect according to the standards. If there are a lot of 500 and they choose 13 samples from the whole lot then they select the sample from the upper and lower and right and left side of the whole packet. It means that they select the sample by way of diversifying the area. If the 2 units of the sample are rejected then the whole lot will be rejected and if the lot is rejected then they call back the vendors and vendor check that lot again. If the lot is very much needed by the production department then they place a

39 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

written request. The 100% inspection is done on it. In this case, they call the vendors or their inspectors and they check it on 100% basis. But this happens in very rare cases.On the other hand if the lot is accepted then it is remarked as GRL (good received lot) and sent to the store. While four copies of GRL are made and sent to the following four departments: 1. Purchase Department2. Quality Control Department3. Store4. For computer entry

Financial analysis:Financial Highlights

Six months ending

40 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

Reference

30.6.01 31.12.00 30.6.00 31.12.99 30.6.99

Sales Rs.'000s 1 9,642,559 10,790,801 9,717,415

9,426,775 9,939,479

Profit after tax Rs.'000 2 623,270 843,209 495,905 415,168 348,792

Dividends Rs.'000 3 498,520 1,103,869 438,698 332,586 332,347

Shareholders' equity (or Net assets) Rs.'000 4 1,383,352 1,258,602 1,517,879

1,538,483 1,451,690

Number of shares 000s 5 13,294 13,294 13,294 13,294 13,294

Key Financial Benchmarks

Sales per share (Rs) 6=1/5 725.33 811.70 730.96 709.10 747.67

Net profit margin (%) 7=1/2 6.46% 7.81% 5.10% 4.40% 3.51%

Eps (Rs) 8=2/5 46.88 63.43 37.30 31.23 26.24

Dividend per share (Rs) 9=3/5 37.50 83.00 33.00 25.00 25.00

Dividend payout (%) 10=3/2 79.98% 130.91% 88.46% 80.11% 95.29%

Book-value per share (Rs) 11=4/5 104.06 94.67 114.18 115.73 109.20

41 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

Return on equity (%) 12=2/4 45.06% 67.00% 32.67% 26.99% 24.03%

EXPANSION PROGRAMMES:

They are now deciding to add more products in their product list for expansion as below :

Ketchup and other processed food

Soups Sauces Frozen food Beans Pasta meals and pasta sauces Infant food

Unilever abandoned short term market for long term viability:

42 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

After a difficult start in the first quarter of 2009, with volume sales down 1.8%, we accelerated volume growth continuously, culminating in a 5% growth over the October-December quarter: well ahead of global market growth. From one-third of our total business growing share at the beginning of last year, we finished the year with two-thirds growing share, reversing a 10 year declining trend. Growth was broad based with all regions growing volume market share, especially strong was the Asia region under Harish Manwani's leadership. Even some of the tougher geographies grew market share, like Western Europe, under Doug Baillie's leadership, and Japan. Currently, all of the 11 major categories in which we compete are growing again, as are all of our Multi Country Operations and 12 of our top 13 brands. At the same time we improved operating margin by 20 basis points and cash flow by

over €1.4 billion, reflecting strong savings programmers, accelerated restructuring and tight control of working capital. More importantly, we were able to achieve these results whilst investing a record €400 million more behind our brands in advertising and promotion to support the

increased stream of innovation. These results have allowed us to significantly strengthen our balance sheet which should be reassuring to all of us in these challenging times. Not surprisingly these were good results – and the shareholders thought so as well. Our share price was up more than 50% over the 12 months to the end of April, and Total Shareholder Return (TSR) was in the top tercile of our peer group.

43 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

Around €20 billion was added to our overall market capitalization which, for respective, is equal to the total market capitalization of some of our competitors.

Managing the short term alone is not enough:

We have had good years before and then under delivered thereafter. We are well aware of the need to create sustainable top and bottom line growth, which is why we launched what we call 'the Compass' in 2009.

The Compass is an energizing vision and strategy to bring the company back to sustainable growth. It puts growth, based on a passion for the consumer and customer, firmly back on the agenda. We appreciate the input and support of the Board as we developed the new strategy.

Years of restructuring and savings have undoubtedly changed and improved the business. However, it is clear that you cannot save your way to prosperity. Responsible, profitable growth is at the root of long term value creation.

The vision we set ourselves is to double the business and outperform market growth, whilst at the same time reducing our overall environmental impact. With our portfolio significantly streamlined over the past few years and the divestiture of many non strategic businesses, we have started to re-ignite growth across the board.

44 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

Most of this will come from emerging markets behind the growth in population – two billion over the next 40 years – and from improvements in living standards. We have strong positions in many developing markets to capitalize on this trend, but still need to close the gap – especially in China and Russia – where we are behind.

Market development continues to be an equally big opportunity in both developed and developing markets. For example, just bringing the consumption of shampoo in D&E markets to the level of developed markets would add €2.7 billion to our business. And, as living standards improve and demands for better hygiene grow, we also see a €1 billion opportunity to build our household care business in the emerging world.

We have the opportunity to globalize more fully our portfolio, introducing our brands into more and more countries. Products like Ponds or Lipton are currently sold in only 47 and 71 countries respectively. Filling these gaps is a big opportunity.

Sustainability:

Achieving the growth objectives while decoupling growth from environmental impact is a bold but challenging vision. Not many companies have yet taken it on. But I believe it is the only viable vision, one that builds on Unilever's long-term heritage and achievement.

According to the World Wildlife Fund – WWF – if everyone consumed at the levels of the British or the Dutch then we would need the resources of three planets.

45 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

We cannot go on borrowing or stealing from future generations. International institutions and governments have increasingly failed us. Consumers are taking charge and, more and more, will reward those brands and companies that not only deliver good quality products at affordable prices, but do so in a responsible way. Not surprisingly, our employees are very energized by this vision, and so are the key retailers who increasingly see this as a critical area of focus. And, I am happy to say, more and more of the financial community are showing an interest in fast growing ethical funds.

Being the number one company on the Dow Jones Sustainability Index for our industry for eleven consecutive years and our strong record of reducing waste, and using less water and CO2, gives us the confidence that we can deliver. We have, for example, already moved Lipton to Rainforest certified tea and are actively committed to sourcing only sustainable palm oil by 2015.

Growing sustainably goes beyond material use. It also includes an ethical supply chain and labor practices. We are setting high standards here in many places and I am glad that we have found solutions in the last year for even our most challenging situations, such as in Pakistan and India. But the Compass vision and strategy does more. It also aligns the organization around a few key priorities we all need to deliver to win.

Postponed or Sustainable work:

46 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

In 2010, Unilever Pakistan signed the Green Office agreement with WWF which aims to reduce carbon emissions and eliminate waste at the head office. Previously initiatives such as the optimization of cooling temperature, replacement of halogen lamps with energy savers, awareness drives and encouraging inter employee energy saving contacts has resulted in a decreases of 50 Tons of CO2 footprint reduction, with an overall 16% reduction as measured from 2007, the baseline year.

Cash flows:Another important factor (not detailed in above table because of space limitations) is that the company has recorded significant cash earnings after a long time, which is good news for its shareholders. As a result, the overdrawn balance has gone down by Rs. 166 m, from Rs. 194 in 2H00 to Rs. 28 m in 1H01, which is no mean achievement. The half-yearly accounts of 2001 also show that Rs. 1 billion is payable by the company in the next twelve months, which will be a drain on its cash resources but given the ability of the company to borrow funds at reasonable financial charge from elsewhere, this too will pass. The company as a fast mover of consumer goods needs to carry heavy inventory but gladly it has been able to control its inventory, and receivables properly. The role of creditors as a source of financing is also significant. Creditors etc have balloned considerably by Rs. 719 m from Rs. 2,353m at 2H00 to Rs. 3,072 m in 1H01. Creditors etc are almost 150% of the net assets and it sure is an indication of over-trading. The level of creditors etc needs to be bought down

47 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

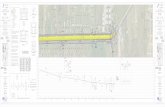

Stock Chart

.

RECOMMENDATION:

I recommend them that they should have to be flexible in their cash flows and about the expansion and future planning of their organization .They must have to be clear about their future planning and its implication in their routine life of their organization because their flexibility gives a way them to the successful future plans.

Conclusion :In unilever every thing is preplanned and there is a very little scope of flexibility of future planning so they have to take care of their planning and also have to be very much concerned about it

48 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

too .So in the conclusion I want to appreciate them about other planning and financial assessment and also about their all departments to be so efficient .

SWOT Analysis

Strengths

Largest producing company of consumer products in Pakistan Enjoying economies of scale Good will in the market Strong financial position Some of its brands have become the generic name for those products as Dalda in ghee & surf

in detergents Market leader in tea industry with Lipton & Brook Bond Capture 70 percent market share of ice cream industry Highly sales brands in skin care i.e. Ponds and Fair & Lovely Have Strong distribution channel in Pakistan Wide product line in home wash

Weakness

High rates of skin care products Ratio of success of new product is low Huge inventory stocks of raw material and finished goods Few new products are introduce in the market

49 Financial management 562 Roll #AH 531929

Digit 09 [MANAGERIAL OPTIONS IMPLICATION

Opportunities

Capturing food industry by acquiring Raffan Best Foods Wide scope of confectionery business for LBPL LBPL is looking to acquire Tapal tea

Threats

Facing tough competition in Ghee and Cooking Oil Facing tough competition in ice cream. LBPL is facing a very tough competition in personal care and detergents by P&G There is very tough competition in detergents and soap markets High inflation rate is increasing the cost of imported raw material day by day

Refferences:

Internet

Unilever

50 Financial management 562 Roll #AH 531929