FINS5530 Lecture 3 Capital Adequacy

description

Transcript of FINS5530 Lecture 3 Capital Adequacy

-

Lecture 3: Capital Adequacy

Dr Lixiong Guo

Semester 2 ,2014

1

-

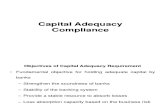

Functions of Capital

To absorb unanticipated losses with enough margin to inspire

confidence and enable the FI to continue as a going concern.

To protect uninsured depositors, bondholders, and creditors in

the event of insolvency, and liquidation.

To protect FI insurance fund and the tax payers.

To protect the FI owners against increases in insurance

premium.

To fund the branch and other real investments necessary to

provide financial services.

2

-

DIFFERENT DEFINITIONS OF CAPITAL

Part I

3

-

The Market vs Book Value of Capital

The Market Value of Capital

The difference between the market value of assets and the market value of liabilities. This is also called the net worth of an FI.

The Book Value of Capital

The difference between the book value of assets and the book value of liabilities.

Even though trading assets are carried at fair value, significant amount of assets and liabilities are carried at amortized costs.

Capital requirements are based on regulators definition of capital, which is neither the market value of capital nor the book

value of capital.

The objective of regulators is to require FIs to hold a large enough buffer to protect depositors and insurance fund against losses.

4

-

How is a $12 million market value loan loss reflected in a

market value balance sheet?

5

-

How may a $12 million market value loan loss reflected in

a book value balance sheet?

6

-

Under book value accounting, FIs have greater discretion in

recognizing loan loss on their balance sheet both in terms of the

amount of the loss and the timing of when it is recognized.

If an FI were closed by regulators before its book value of capital became zero, liability holders and deposit insurance fund may still

suffer a loss.

Market value accounting is advocated by many academics and

analysts because the capital value under market value

accounting presents a more accurate picture of the net worth of

the FI, and thus, its ability to absorb losses before liability holders

do.

If an FI were closed by regulators before its economic net worth became zero, neither liability holders nor deposit insurance fund

would stand to loose.

Market Value vs. Book Value Accounting

7

-

Arguments Against Market Value Accounting

It can be difficult to implement when a FI hold a large amount of

non-traded assets.

Market value accounting introduces an unnecessary degree of

variability into an FIs earnings and thus capital because paper gains and losses on assets are passed through the FIs income statements.

In many cases, the paper gains and losses never realize when the FI hold loans and other assets to maturity.

Regulators may be forced to close the banks too early under the prompt corrective action (PCA) requirement imposed by the FDICIA.

FIs would be less willing to accept long-term asset exposures

under market value accounting.

Long-term assets are more sensitive to interest rate changes than short-term assets.

8

-

Mark-to-Market Accounting Rules in the U.S.

In 2007, FAS 157 went into effect which specified a hierarchy of

valuation techniques to determine fair value.

Level 1 Quoted prices for identical instruments in active markets.

Level 2 Quoted prices for similar instruments in active markets or model-derived valuations based on observable market inputs.

Level 3 Model-derived valuations based on one or more unobservable inputs.

During the financial crisis, under pressure from the U.S.

Congress, FASB eased its position on FAS 157 and allowed the

banks to use significant judgment when valuing illiquid assets, such as MBS.

Example: Citigroup has $1.6 billion losses in 2008, under the new guidance, this loss would be erased.

9

-

Mark-to-Market Accounting Rules in the U.S. (cont.)

In 2010, FASB proposed to mark loans to market.

In 2011, FASB withdrew the proposal under strong opposition.

This brings the FASB in line with ISAB which follows the book

value approach on valuing loans on the balance sheet.

10

-

BASEL III OVERVIEW

Part II

11

-

Capital Ratio

12

=

Q1: How is capital defined?

Q2: How are assets measured? Especially, how are

assets adjusted for credit risk?

-

The Basel Agreement or Accord

The Basel Committee on Banking Supervision (BCBS) was

formed in 1974 by banking authorities from the G-10 nations to

strengthen the soundness and stability of the international banking system while maintaining sufficient consistency that

capital adequacy regulation will not be a significant source of

competitive inequality among internationally active banks.

While the Basel Committee develops global capital and

regulatory guidelines, the government of each participating

nation are responsible for local adoption, implementation, and

enforcement of the guidelines.

In Australia, APRA makes and enforces the capital adequacy rules for Australian authorized depository institutions (ADIs).

13

-

Basel I and II

The first Basel agreement was fully implemented on January 1,

1993, now known as Basel I.

Explicitly incorporate the different credit risks of assets into capital adequacy measures.

Risk weights depend on the broad categories of borrowers.

Both on- and off-balance-sheet assets are considered in the calculation of credit risk-weighted assets (RWA).

Market risk was incorporated in a 1998 revision.

The Basel Agreement of 2006 (known as Basel II) used a wider

differentiation of credit risk weights than Basel I and added a

capital charge for operational risk. It consists of three pillars.

14

-

15

-

Basel II Framework of Calculating Minimum Capital

16

-

Basel III

On 16 December 2010, the BCBS released the final text of the

Basel III capital framework. The framework was revised in June

2011.

Raised the quality and quantity of capital with a focus on common equity.

Introduced an internationally harmonized leverage ratio to serve as a backstop to the risk-based capital requirements.

Introduced additional capital surcharge for systemically important institutions.

Introduced capital buffers which should be built up in good times or during periods of excess credit growth.

Introduced minimum global liquidity standards to improve banks resilience to acute short term stress and to improve long term

funding.

17

-

Implementation of Basel III in Australia

Australias risk-based capital adequacy guidelines are generally consistent but not completely aligned with the approach agreed

upon by the Basel Committee on Banking Supervision (BCBS).

APRA has exercised its discretion in applying the Basel

framework to Australian ADIs, resulting in a more conservative

approach than the minimum standards published by the BCBS.

APRA also introduced the new standards from 1 January 2013

with no phasing in of higher capital requirements as allowed by

the BCBS. The application of these discretions act to reduce

reported capital ratios relative to those reported in other

jurisdictions.

18

-

Basel III Capital Requirements

19

1 = 1

4.5%

1 = 1

6%

= 1 + 2

8%

1 = 1

( + ) 3%

-

Basel III: Tier 1 Capital

Common Equity Tier 1 Capital (CET1)

Common shares and stock surplus.

Retained earnings.

Accumulated other comprehensive income and other disclosed reserves.

Common shares issued by consolidated subsidiaries of the bank and held by third parties (i.e. minority interests).

Less goodwill.

Regulatory adjustments applied in the calculation of CET1.

Basically, it includes the book value of common equity plus

minority equity interests held by the DI in subsidiaries minus

good will.

20

-

Basel III: Tier 1 Capital (cont.)

Additional Tier 1 Capital

This include other options to absorb losses of the bank beyond common equity.

Tier 1 capital is the sum of

Common Equity Tier 1 Capital (CET1)

Additional Tier 1 Capital.

Overall, Tier 1 capital is the capital that is available to absorb

losses on a going-concern basis or capital that can be depleted without placing the bank into insolvency or liquidation. It is the

primary capital of the DI.

21

-

Basel III: Tier 2 Capital

Tier 2 capital is a broad array of secondary equity-like capital resources. It is capital that can absorb losses on a "gone-

concern" basis, or capital that absorbs losses in insolvency prior

to depositors losing any money.

It mainly includes:

Convertible and subordinated debt instruments.

Allowances for loan and lease losses not exceeding 1.25 percent of the banks total credit risk-weighted assets.

General loan-loss reserves held against future, presently unidentified losses are freely available to meet losses which subsequently

materialize and therefore qualify for inclusion within Tier 2.

Provisions ascribed to identified losses should be excluded.

Regulatory adjustments applied to calculation of Tier II capital.

22

-

Basel III Capital Requirements (cont.)

Capital Conservation Buffer

In good times, DIs are required to build up a capital conservation buffer of greater than 2.5% of total risk-weighted assets (RWA).

The capital conservation buffer must be composed of CET1 capital and is held separately from the minimum risk-based capital

requirements.

Countercyclical Capital Buffer

A buffer between 0% to 2.5% of total risk-weighted assets (RWA) may be declared by any country when experiencing excess

aggregate credit growth.

This buffer must be met with CET1 capital, and DIs are given 12 months to adjust to the buffer level.

23

-

Basel III Capital Requirements (cont.)

Leverage ratio

A simple, non-risk based leverage ratio of Tier 1 capital to total exposure (on- and off-balance-sheet) to serve a backstop to the

risk-based capital ratios.

Initially set at a 3% minimum. Final adjustment in 2017.

Globally systemically important banks

Global systemically important banks (G-SIBs) must have higher loss absorbency capacity than other FIs because their failure

would cause significant disruption to the wider financial system

and economic activity.

Additional CET1 capital surcharge of 1% to 3.5% to be held above the 7% minimum CET1 plus conservation buffer requirement.

The initial list include 29 G-SIBs in 12 countries. The sample of banks to be assessed will be reviewed every three years.

24

-

25

-

Prompt Corrective Actions (PCA) in the U.S.

Besides meeting the minimum capital ratios, a DIs capital adequacy is also monitored based on its place in one of five

capital target zones by regulators under the FDIC Improvement

Act (FDICIA) of 1991.

FDICIA requires regulators to take specific actions prompt corrective actions when a DI falls outside the zone 1, or well-capitalized, category.

A receiver must be appointed when a DIs tangible equity (Tier 1

+ Non-Tier 1 perpetual preferred stock) to total assets falls to 2

percent or less.

The idea of PCA is to limit the ability of regulators to show

forbearance to the worst capitalized DIs.

26

-

27

-

28

-

CALCULATING CAPITAL RATIOS USING

BASEL III STANDARDIZED APPROACH

Part III

29

-

Credit Risk-Adjusted On-Balance-Sheet Assets

Under the Standardized Approach of Basel III:

= ($)

=1

Cash assets have a risk weight of zero.

Commercial loans and consumer loans are in the 100% risk

category.

Residential 1-4 family mortgages are first separated into two

categories.

Category 1 includes traditional, first-lien, prudently underwritten mortgage products. Category 2 includes junior liens and non-

traditional mortgage products.

The risk weight assigned to the residential mortgage exposure then depends on the mortgages loan-to-value ratio.

30

-

Credit Risk-Adjusted On-Balance-Sheet Assets (cont.)

Risk weights for sovereign exposures are determined using

OECD risk classifications (CRCs).

Countries are classified into one of eight risk categories (0-7).

Categories 0-1 have the lowest possible risk and are assigned a risk weight of 0%, while category 7 is assigned a risk weight of

150%.

A 150% risk weight is assigned to a sovereign exposure immediately after an event of sovereign default or if a sovereign

default has occurred during the previous 5 years.

Risk weights on exposures to foreign banks are also based on

the CRCs for the banks home country.

31

-

Credit Risk-Adjusted Off-Balance-Sheet Assets

A DIs off-balance-sheet (OBS) activities represent contingent rather than actual claims against the DI.

Regulations require that capital be held not against the full face

value of these items, but an amount equivalent to any eventual

on-balance-sheet credit risk these securities might create for a

DI.

To calculate the credit risk-adjusted asset values for these OBS

items, we first convert them into credit equivalent amounts amounts equivalent to an on-balance-sheet item.

We then assign the OBS credit equivalent amount to an

appropriate risk category to calculate the credit risk-adjusted of

these items.

32

-

Contingent Guaranty Contracts

The calculation of the credit equivalent amounts depends on the

type of the OBS items.

Contingent guaranty contracts (e.g. SLCs, loan commitment).

Derivative contracts (e.g. interest rate forward, option and swap contracts.)

For guaranty contracts,

Conversion factors are provided (Table 20-10) based on the guaranty type, one simply multiplies the amount of the OBS

guaranty contract by the conversion factor to arrive at the Credit

Equivalent Amount.

Credit risk weights for the OBS guaranty contracts are the same as that for on-balance-sheet credit risk exposures to the same

party.

33

-

Conversion Factors for OBS Guaranty Contracts

34

-

Derivative Contracts

Derivative contracts expose DIs to counterparty credit risk.

This is the risk that counterpart will default when suffering large actual or potential losses on its position.

Such default means the DI would have to go back to the market to replace such contract at (potentially) less favorable terms.

A major distinction is made between exchange-traded derivatives

and over-the-counter (OTC) derivatives.

The credit or default risk of exchange-traded derivatives is approximately zero because when a counterparty defaults on its

obligations, the exchange itself adopts the counterpartys obligations in full.

Most OBS futures and options positions have virtually no capital requirement for a DI.

35

-

Derivative Contracts (cont.)

The credit equivalent amount of OBS derivatives is divided into a

potential exposure and a current exposure.

The potential exposure reflects the risk if the counterparty to

the contract defaults in the future.

Calculated by multiplying the notional amount of the contract by some given conversion factor (Table 20-11)

The current exposure reflects the cost of replacing a contract if

a counterparty to the contract defaults today.

This equals to the replacement cost when it is positive.

If the contracts replacement cost is negative, regulations require the replacement cost to be set to zero.

Under Basel III, the risk weights for OCT derivatives is generally

1.0 or 100%.

36

-

Conversion Factors for Calculating Potential Exposure

37

-

38