Haivan Pass Tunnel Construction Project TUNNEL CONSTRUCTION.

Euro Tunnel

-

Upload

darkniight -

Category

Documents

-

view

156 -

download

20

description

Transcript of Euro Tunnel

Introduction

The Euro Tunnel, also known as 'Channel-tunnel', is a series of three tunnels (two

carrying, one service tunnel) linking the southern coast of England near Folkestone to

the northern coast of France outside Calais.

The tunnels are 50km long, with an undersea section of 39 km, making it the longest

undersea tunnel system in the world.

The Euro-tunnel project was privately financed and continues to be privately

operated.

Group Eurotunnel S.A. manages and operates the Channel Tunnel between Britain

and France. The Company operates the car shuttle services and earns revenue on other

trains (freight by DB Schenker and passenger services by Eurostar) passing through

the tunnel. It is listed both on the London Stock Exchange and Euronext Paris.

The idea of a Channel Tunnel was first explored by French mining engineer, Albert

Mathieu, who formulated early designs for Napoleon in 1802.

Page | 1

The first attempt to make a cross channel link was in 1880 when the Beaumont and

English tunnel boring machine began digging undersea tunnels on both sides of the

Channel. But the British military became increasingly concerned about national

security and the project was abandoned with no further attempts being made for

almost a century.

In 1974 work began again on the tunnel, but had to be abandoned shortly afterwards

due to financial problems.

Following announcements in 1981 by the French and British governments that a

cross-channel link would be explored, private companies were asked to tender for

contracts to construct and operate the tunnel link. In early 1986, Margaret Thatcher

and Francois Mitterrand announced that contracts had been finalized and work finally

began in mid 1986.

Page | 2

Contract Complexities

The Channel Tunnel proposal was originally conceived as a combination of two

functions: financing and construction, so it is natural that the two groups of promoters

were banks and construction companies. The construction side was handled by a

massive consortium of 10 contractors called TransManche Link or TML for short,

together with five banks, making 15 founder shareholders who put up the initial

equity of £47 million. The founder share-holders were evenly divided between

English and French, like almost everything else in this project. It is important to look

at the network of legal contracts that define the project because in the early days

Eurotunnel as a company did not exist. All there was, was a series of contracts and a

number of dedicated staff all of whom were on secondment from the interested

parties. The Construction Contract outlined without any great definition, most of the

engineering work not just in digging the tunnel but also in setting up the physical side

of the operations. This was a design and build contract between Eurotunnel and TML.

The Anglo-French Treaty and the Concession set the framework within which

Eurotunnel operates. The Channel Tunnel Link shall be financed without recourse to

government funds or to government guarantees of a financial or commercial nature.

This was the only basis on which British Prime Minister Margaret Thatcher would

accept the project. The Concession was originally for a period of 55 years but was

later extended to 65 years. It expires in 2052 and Eurotunnel then has to hand back

the system in good working order. The Treaty provided for the setting up of a bi-

national Intergovernmental Commission (IGC) and Safety Authority who monitor

Eurotunnel’s compliance with the Concession, and who have exercised considerable

power over Eurotunnel’s operations. The Railways Usage Contract provides

Eurotunnel’s only committed source of income. Under this Contract, Eurotunnel is

required to make half of the tunnel capacity available to the British, French and

Belgian railways for their Eurostar and freight trains. In return, the railways pay a

fixed charge and tolls based on the volume of traffic passing through the tunnel

together with a contribution to Eurotunnel’s operating costs. There is a minimum

Page | 3

charge level, a mechanism to ensure a guaranteed level of cash flow to Eurotunnel

over the first 12 years of operation. The Contract will provide 35%–40% of

Eurotunnel’s expected revenues. The Partnership and Corporate Structure Agreements

govern the relationship between the various subsidiaries within the Eurotunnel Group,

and provide for a Joint Board for the Group. The Maitre d’Oeuvre (MdO) is an

independent Consulting Engineer who ad- vises the IGC, the banks and Eurotunnel on

construction safety, etc. The Concession was awarded by the British and French

governments to Eurotunnel in January 1986. One of the features that led to the award

was the financing plan and the very early commitment in principle by 31 leading

banks to underwrite the debt part of the funding.

Page | 4

Financial & Economical Scenarios

The estimated £4.9 billion total cost of the tunnel turned out to be a serious

miscalculation, as the cost increased to almost £12 billion by the time it opened in

1994, more than double the original estimates. However, there were then delays,

disputes and spiralling costs until the project's completion in 1994.

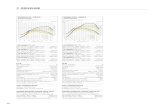

Shares of Eurotunnel were issued at £3.50 per share on 9 December 1987. By mid-

1989 the price had risen to £11.00. Delays and cost overruns led to the share price

dropping; during demonstration runs in October 1994 the share price reached an all-

time low value. Eurotunnel suspended payment on its debt in September 1995 to

avoid bankruptcy. In December 1997 the British and French governments extended

Eurotunnel's operating concession by 34 years to 2086.

Financial restructuring of Eurotunnel occurred in mid-1998, reducing debt and

financial charges. Despite the restructuring, The Economist reported in 1998

that to break even Eurotunnel would have to increase fares, traffic and market

share for sustainability. A cost benefit analysis of the Channel Tunnel indicated that

Page | 5

there were few impacts on the wider economy and few developments associated with

the project, and that the British economy would have been better off if the tunnel had

not been constructed.

In 1999 Eurostar posted its first ever net profits, having previously made a loss

of £925m in 1995.

In July 2003, a Eurostar train broke the record for the fastest train in the UK, reaching

208 mph during safety testing of Section One of the new Channel Tunnel Rail Link.

This section was completed ahead of schedule in December 2003.

However, plans to extend the routes followed by trains using the Channel Tunnel have

been slow to get off the ground.

Page | 6

Problem Statements and Findings

Problem-1:

Do Eurotunnel’s shareholders deserve to be compensated for their losses?

Solution-1:

Eurotunnel’s shareholder deserves to be compensated for their losses. But not all

shareholders proved to be worse off. Any shareholder who bought at the time of the

original Offer for sale or early 1988 and then sold in the first half of 1989 would have

realized substantial capital gains. But the vast majority of shareholders have

undoubtedly incurred substantial losses on their investment. The financial statements

provide a historical record, but it seems clear that the share price reacted to events

announced in the media, rather than to the financial statement. If the November 1987

Offer for sale document had reported the estimated project cost for each of the year

construction, shareholders might have been in a better position to compare estimated

and actual construction costs and appreciate earlier significant problems faced.

Problem-2:

Discuss the proposition that agents have an incentive to be optimistic when proposing

large capital projects.

Solution-2:

Management was arguably successful in achieving completion of the project and

therefore maintaining their employment.

The history of large capital projects suggests that almost invariably, agents tend to

underestimate capital cost and overestimate revenues. Including more detailed

estimates of the phasing of capital expenditure at the outset would have given the

principal an opportunity to monitor actual expenditures compared to predict

expenditure and this would have improved accountability.

Page | 7

Management incentives were determined at the beginning of the project and turned

out to be inappropriate, given the high construction costs.

Problem-3:

Which stakeholders were most adversely affected by Eurotunnel’s financial

difficulties?

Solution-3:

Among all the stakeholders, the shareholders potentially have the most to loss.

Shareholders were noticeably unsuccessful in terms of preventing the substantial

declines in net present value of their investments.

High construction costs did not provide sufficient incentives to protect the interests of

the shareholders.

Until the project opened a major uncertainty involved initial traffic volumes plus

growth rates. After operation had started the area of uncertainty reduced to growth

rates.

Eurotunnel is unable to service debt. There has also been uncertainty over the amount

of debt the banks will want to convert to equity. If the banks convert a relatively large

amount, interest charges will be lower but profit available for dividend will be

distributed over a large number of shares.

Problem-4:

Briefly outline the causes of Eurotunnel’s financial problems. Could, or should, these

problems have been foreseen?

Solution-4:

In 2004 Richard Shirrefs, chief executive of Eurotunnel, told BBC News that the

cross-channel rail industry was working on a "failed business model". He told Radio

Page | 8

4's Today programme that "you can't have a £25bn infrastructure which is not

generating enough traffic - this is a big structural problem".

Construction of the tunnel started in 1988, the project took approximately 20%

longer than planned (at 6 years vs. 5 years) and came in 80% over budget (at 4.6

billion pounds vs. a 2.6 billion pound forecast).

The issues that caused delay and financial problems later on resulted from

various factors:

Changed specifications for the tunnel, there were needs for air conditioning systems

to improve safety that were not included the initial design.

The communication between the British and French teams who were essentially

tunneling from the two different sides and meeting in the middle could have been

improved. These sorts of communication issues are relatively common in delayed

projects when tensions rise.

When the tunnel was built it was assumed that traffic levels would have grown

rapidly enough to generate a healthy income for Eurotunnel. 2003's 6.3 million

rail passengers, though, fell far short of original predictions of 16 million a year.

The 1.7 million tonnes of freight carried in 2003 can be set against an initial

forecast of an annual 7 million.

Another interesting aspect of the Channel Tunnel’s forecasts were that a lot of

revenue was projected to come from driving the existing ferry operators out of

business. Of course, these ferry operators were the main way to cross the English

Channel before the Channel Tunnel existed. However, this analysis ignored the

possibility that the ferries would react to the Channel Tunnel with improved

pricing and service, leading to them retaining market share. In addition the

creation of budget airlines providing cheap air travel between UK and France was not

foreseen. It is a good reminder that in making strategic forecasts of benefits or results

you should bear in mind how competitors will react to the project you are envisioning.

Page | 9

It should be noted that a great deal of the financial problems with the Channel

Tunnel were caused by overly optimistic revenue projections, on top of the

construction cost overruns, and those projections failed to anticipate that the set

of options for getting from Paris to London might change, both in reaction to the

tunnel and because of innovation in other areas such as the development of the budget

airline business model.

The tunnel wasn’t completely unprecedented. The Seikan Tunnel in Japan had similar

length and depth. Nonetheless, part of the reason for cost overrun was the absence

of many precedents and associated experience to base sound estimates off. It was

very difficult to predict accurately and complete the project in due time based on

initial estimates.

In fact, subsequently, the Channel Tunnel has been listed as one of the engineering

wonders of the world, which emphasizes its uniqueness.

Problem-5:

“Eurotunnel has been both a success and a disaster”. Discuss.

Solution-5:

Euro Tunnel is the finest engineering achievement of the 20th century as well as one

of the most expensive white elephants in the history.

Construction of the Eurotunnel was the realization of a centuries-old dream to connect

England and France. It is probably the most significant international transport project

since the Panama Canal, and the largest project ever paid for entirely by private

finance. Engineers have dreamed of building a Channel Tunnel for at least 250 years

which runs beneath the busiest shipping lane in the world. Between the dream and the

reality lay a dramatic and unimaginably complex engineering project.

In 1996 the American Society of Civil Engineers identified the tunnel as one of the

Seven Wonders of the Modern World. In 1999, Channel Tunnel was awarded first

Page | 10

prize amongst the top 10 construction projects of the 20th century by an international

construction panel in the United States.

The Channel Tunnel promotes the trading connection between UK and France and

improves living conditions by cheaper and faster transport for both sides. The

construction as well the tunnel operation improves employment in the respective

regions. For such a great advantage of it, the project can be considered as a success.

But if we focus on the financial performances, we cannot express the same opinion.

The tunnel cost two times more to build than the most pessimistic original estimate.

Together with additional finance charges caused by the delays in completion, which

meant that no income was received despite all the money having been spent, the

tunnel that should have cost £6 billion ended up to an estimated final cost of around

£12bn. That meant that the revenue needed to break even was two times more than

projected.

Eurotunnel’s financial results have of course proved extremely disappointing, way

below the documented expectations of 1987-94. Once the trials of late opening and

the November 1996 fire had been overcome, Eurotunnel achieved a turnover of

around £600 million a year over the period 1998-2008, and an operating margin of

around 55 per cent. But turnover was way below the prospectus forecasts and after

depreciation and financial charges; losses were severe, averaging £137 million a year,

1998-2004, before exceptional items.

The volume of traffic is a fraction of what projected. Passenger and freight trains

through the tunnel are running at about a fifth of the projected numbers. The vehicle

shuttles are running at about a third of the projected numbers.

The tunnel expected to gain substantial income from the sale of duty-free goods at the

terminals. Duty free sales of alcohol and tobacco had always been a tremendous

money spinner for the ferry companies, making up a substantial part of their profits.

But the advent of the European Single Market spelt the end of duty free sales on

Page | 11

journeys between two EU countries, so the duty free shops at each end of the tunnel

never provided the revenue that had been hoped for.

It was clearly a misfortune for Eurotunnel to embark on a long construction process

during a time of relatively high inflation, and then commence operating when the rate

of inflation fell and prices became more stable. In such a situation, the weight of the

debt burden remained stubbornly in place, creating difficulties for the owners of

capital as it became clear that revenues were likely to be insufficient to service the

debt.

With passenger and freight trains running at a fifth of the projected rate, passenger

and freight shuttles running at a third of the projected rate, duty free sales running at

zero, stuck with debts it could not afford to service and the capital cost of construction

running at two times that projected, the tunnel is an unmitigated financial disaster.

Page | 12